国际结算重点名词英文全称

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

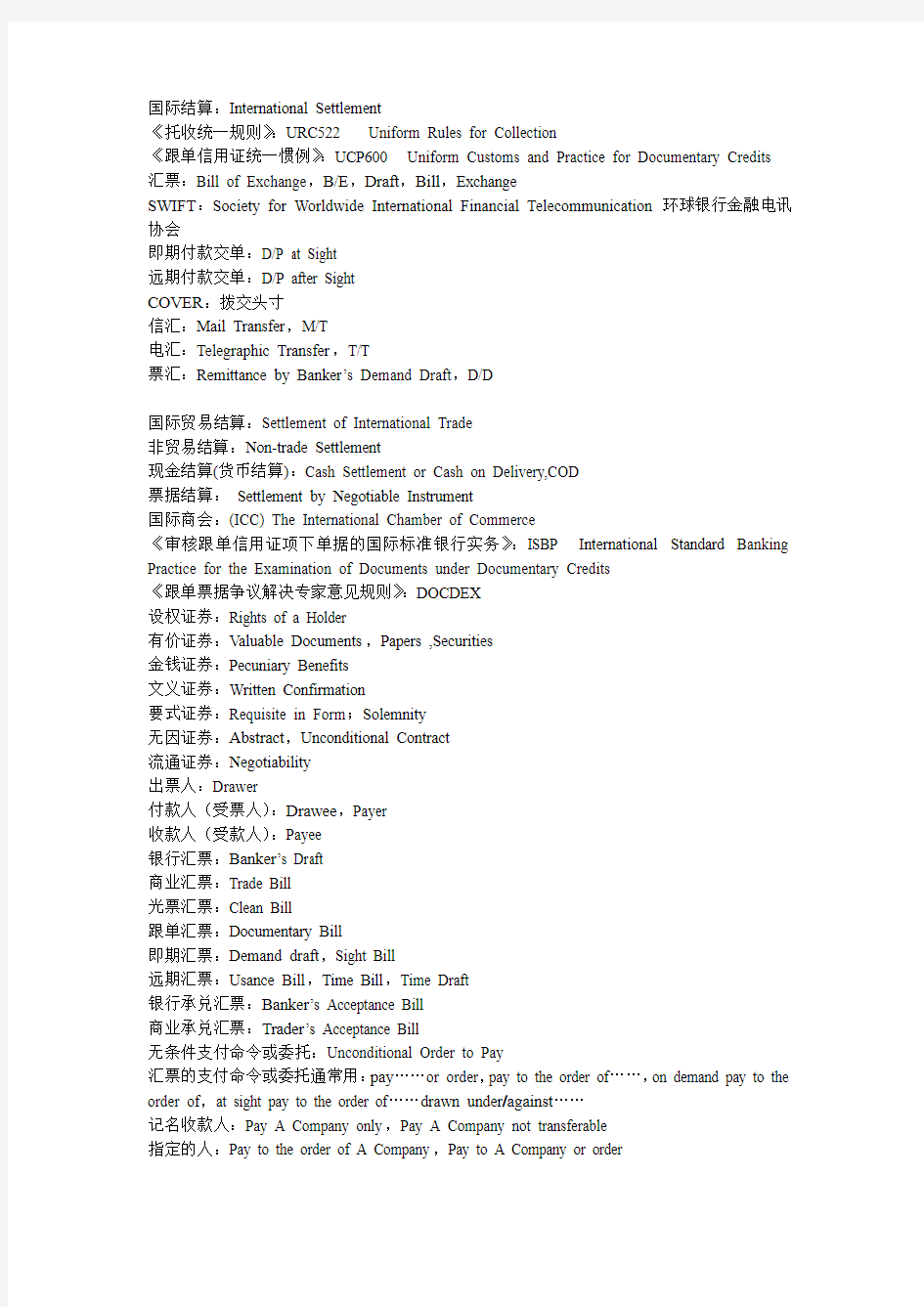

国际结算:International Settlement

《托收统一规则》:URC522 Uniform Rules for Collection

《跟单信用证统一惯例》:UCP600 Uniform Customs and Practice for Documentary Credits 汇票:Bill of Exchange,B/E,Draft,Bill,Exchange

SWIFT:Society for Worldwide International Financial Telecommunication 环球银行金融电讯协会

即期付款交单:D/P at Sight

远期付款交单:D/P after Sight

COVER:拨交头寸

信汇:Mail Transfer,M/T

电汇:Telegraphic Transfer,T/T

票汇:Remittance by Banker’s Demand Draft,D/D

国际贸易结算:Settlement of International Trade

非贸易结算:Non-trade Settlement

现金结算(货币结算):Cash Settlement or Cash on Delivery,COD

票据结算:Settlement by Negotiable Instrument

国际商会:(ICC) The International Chamber of Commerce

《审核跟单信用证项下单据的国际标准银行实务》:ISBP International Standard Banking Practice for the Examination of Documents under Documentary Credits

《跟单票据争议解决专家意见规则》:DOCDEX

设权证券:Rights of a Holder

有价证券:Valuable Documents,Papers ,Securities

金钱证券:Pecuniary Benefits

文义证券:Written Confirmation

要式证券:Requisite in Form;Solemnity

无因证券:Abstract,Unconditional Contract

流通证券:Negotiability

出票人:Drawer

付款人(受票人):Drawee,Payer

收款人(受款人):Payee

银行汇票:Banker’s Draft

商业汇票:Trade Bill

光票汇票:Clean Bill

跟单汇票:Documentary Bill

即期汇票:Demand draft,Sight Bill

远期汇票:Usance Bill,Time Bill,Time Draft

银行承兑汇票:Banker’s Acceptance Bill

商业承兑汇票:Trader’s Acceptance Bill

无条件支付命令或委托:Unconditional Order to Pay

汇票的支付命令或委托通常用:pay……or order,pay to the order of……,on demand pay to the order of,at sight pay to the order of……drawn under/against……

记名收款人:Pay A Company only,Pay A Company not transferable

指定的人:Pay to the order of A Company,Pay to A Company or order

来人或持票人:Pay bearer,Pay to A Compan or bearer

出票日期:Date of Issue

出票人签字:Signature of the Drawer

相对必要记载事项:Relative Requisites for a B/E

出票地:Place of Issuing

付款地:Place of Payment

到期日:Tenor

汇票的出票:Issue

汇票的背书:Endorsement

汇票的承兑:Acceptance

汇票的保证:Guarantee

汇票的付款:Payment

汇票

No.由出票人自行编号填入

Exchange for 货币缩写和用阿拉伯数字表示金额小写数字at ____sight... 付款期限

Pay to the Order of 受款人,也称“抬头人”或“抬头”

the sum of 汇票金额填大写金额

Drawn under 支付行

L/C No. 信用证号码

Dated 开证日期

To 被出票人

For 出票人,即出口商签字,填写公司名称

汇付:Remittance

汇款人(付款人):Remitter

汇出行:Remitting Bank

支付授权书:Payment Order,P.O.

汇入行(解付行):Paying Bank

汇款的偿付:Reimbursement of Remittance of Cover

信汇委托书:M/T Advice

密押:Test Key

预付货款:Payment in Advance

货到付款:Payment after Arrival of the Goods

托收:Collection

商业信用:Commercial Credit

委托人:Principal

托收行:Remitting Bank

代收行:Collection Bank

提示行:Presenting Bank

托收指示:Collection Instruction

光票托收:Clean Bill for Collection

跟单托收:Documentary Bill for Collection

付款交单:Documents against Payment,D/P

承兑交单:Documents against Acceptance,D/A

承付:Honour

商业信用证:Commercial Credit

光票信用证:Clean Credit

跟单信用证:Documentary Credit

开证申请人:Applicant

开证行:Issuing Bank;Opening Bank,Establishing Bank

通知行:Advising Bank;Notifying Bank

受益人:Beneficiary

议付行:Negotiating Bank;Negotiation Bank

保兑行:Confrming Bank

商业发票:Commercial Invoice

海关发票:Customs Invoice

领事发票:Consular Invoice

税务发票:Tax Invoice

最终发票:Final Invoice

厂商发票:Manufactures Invoice

出票人:Issuer

发票名称:Commercial Invoice

收货人:To

发票号:Invoice No.

发票日期:Date

信用证号、合同号:L/C No. and S/C No.

运输标志和件号(唛头和件号):Shipping Marks and Numbers 汇票的期限:Tenor

提单:Bill of Lading,B/L

托运人:Shipper