最全面的财会英语,对有志考过ACCA的筒子们大有益处.

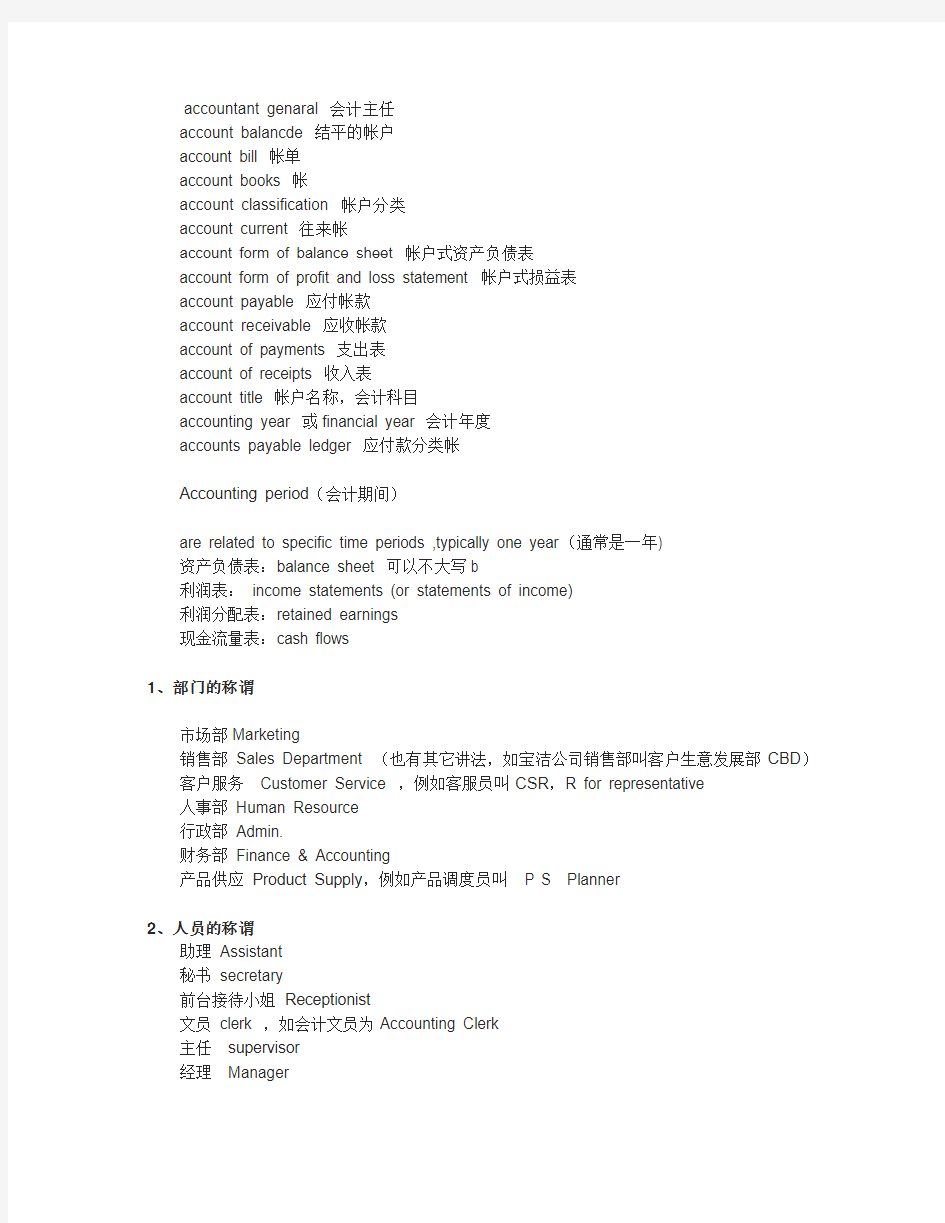

accountant genaral 会计主任

account balancde 结平的帐户

account bill 帐单

account books 帐

account classification 帐户分类

account current 往来帐

account form of balance sheet 帐户式资产负债表

account form of profit and loss statement 帐户式损益表

account payable 应付帐款

account receivable 应收帐款

account of payments 支出表

account of receipts 收入表

account title 帐户名称,会计科目

accounting year 或financial year 会计年度

accounts payable ledger 应付款分类帐

Accounting period(会计期间)

are related to specific time periods ,typically one year(通常是一年)

资产负债表:balance sheet 可以不大写b

利润表:income statements (or statements of income)

利润分配表:retained earnings

现金流量表:cash flows

1、部门的称谓

市场部Marketing

销售部Sales Department (也有其它讲法,如宝洁公司销售部叫客户生意发展部CBD)客户服务Customer Service ,例如客服员叫CSR,R for representative

人事部Human Resource

行政部Admin.

财务部Finance & Accounting

产品供应Product Supply,例如产品调度员叫P S Planner

2、人员的称谓

助理Assistant

秘书secretary

前台接待小姐Receptionist

文员clerk ,如会计文员为Accounting Clerk

主任supervisor

经理Manager

总经理GM,General Manager

入场费admission

运费freight

小费tip

学费tuition

价格,代价charge

制造费用Manufacturing overhead

材料费Materials

管理人员工资Executive Salaries

奖金Wages

退职金Retirement allowance

补贴Bonus

外保劳务费Outsourcing fee

福利费Employee benefits/welfare

会议费Coferemce

加班餐费Special duties

市内交通费Business traveling

通讯费Correspondence

电话费Correspondence

水电取暖费Water and Steam

税费Taxes and dues

租赁费Rent

管理费Maintenance

车辆维护费Vehicles maintenance

油料费Vehicles maintenance

培训费Education and training

接待费Entertainment

图书、印刷费Books and printing

运费Transpotation

保险费Insurance premium

支付手续费Commission

杂费Sundry charges

折旧费Depreciation expense

机物料消耗Article of consumption

劳动保护费Labor protection fees

总监Director

总会计师Finance Controller

高级Senior 如高级经理为Senior Manager 营业费用Operating expenses

代销手续费Consignment commission charge

运杂费Transpotation

保险费Insurance premium

展览费Exhibition fees

广告费Advertising fees

管理费用Adminisstrative expenses

职工工资Staff Salaries

修理费Repair charge

低值易耗摊销Article of consumption

办公费Office allowance

差旅费Travelling expense

工会经费Labour union expenditure

研究与开发费Research and development expense

福利费Employee benefits/welfare

职工教育经费Personnel education

待业保险费Unemployment insurance

劳动保险费Labour insurance

医疗保险费Medical insurance

会议费Coferemce

聘请中介机构费Intermediary organs

咨询费Consult fees

诉讼费Legal cost

业务招待费Business entertainment

技术转让费Technology transfer fees

矿产资源补偿费Mineral resources compensation fees

排污费Pollution discharge fees

房产税Housing property tax

车船使用税Vehicle and vessel usage license plate tax(VVULPT) 土地使用税Tenure tax

印花税Stamp tax

财务费用Finance charge

利息支出Interest exchange

汇兑损失Foreign exchange loss

各项手续费Charge for trouble

各项专门借款费用Special-borrowing cost

帐目名词

一、资产类Assets

流动资产Current assets

货币资金Cash and cash equivalents

现金Cash

银行存款Cash in bank

其他货币资金Other cash and cash equivalents

外埠存款Other city Cash in bank

银行本票Cashier''s cheque

银行汇票Bank draft

信用卡Credit card

信用证保证金L/C Guarantee deposits

存出投资款Refundable deposits

短期投资Short-term investments

股票Short-term investments - stock

债券Short-term investments - corporate bonds

基金Short-term investments - corporate funds

其他Short-term investments - other

短期投资跌价准备Short-term investments falling price reserves

应收款Account receivable

应收票据Note receivable

银行承兑汇票Bank acceptance

商业承兑汇票Trade acceptance

应收股利Dividend receivable

应收利息Interest receivable

应收账款Account receivable

其他应收款Other notes receivable

坏账准备Bad debt reserves

预付账款Advance money

应收补贴款Cover deficit by state subsidies of receivable

库存资产Inventories

物资采购Supplies purchasing

原材料Raw materials

包装物Wrappage

低值易耗品Low-value consumption goods

材料成本差异Materials cost variance

自制半成品Semi-Finished goods

库存商品Finished goods

商品进销差价Differences between purchasing and selling price

委托加工物资Work in process - outsourced

委托代销商品Trust to and sell the goods on a commission basis

受托代销商品Commissioned and sell the goods on a commission basis 存货跌价准备Inventory falling price reserves

分期收款发出商品Collect money and send out the goods by stages

待摊费用Deferred and prepaid expenses

长期投资Long-term investment

长期股权投资Long-term investment on stocks

股票投资Investment on stocks

其他股权投资Other investment on stocks

长期债权投资Long-term investment on bonds

债券投资Investment on bonds

其他债权投资Other investment on bonds

长期投资减值准备Long-term investments depreciation reserves

股权投资减值准备Stock rights investment depreciation reserves

债权投资减值准备Bcreditor''s rights investment depreciation reserves

委托贷款Entrust loans

本金Principal

利息Interest

减值准备Depreciation reserves

固定资产Fixed assets

房屋Building

建筑物Structure

机器设备Machinery equipment

运输设备Transportation facilities

工具器具Instruments and implement

累计折旧Accumulated depreciation

固定资产减值准备Fixed assets depreciation reserves

房屋、建筑物减值准备Building/structure depreciation reserves

机器设备减值准备Machinery equipment depreciation reserves

工程物资Project goods and material

专用材料Special-purpose material

专用设备Special-purpose equipment

预付大型设备款Prepayments for equipment

为生产准备的工具及器具Preparative instruments and implement for fabricate 在建工程Construction-in-process

安装工程Erection works

在安装设备Erecting equipment-in-process

技术改造工程Technical innovation project

大修理工程General overhaul project

在建工程减值准备Construction-in-process depreciation reserves

固定资产清理Liquidation of fixed assets

无形资产Intangible assets

专利权Patents

非专利技术Non-Patents

商标权Trademarks, Trade names

著作权Copyrights

土地使用权Tenure

商誉Goodwill

无形资产减值准备Intangible Assets depreciation reserves

专利权减值准备Patent rights depreciation reserves

商标权减值准备trademark rights depreciation reserves

未确认融资费用Unacknowledged financial charges

待处理财产损溢Wait deal assets loss or income

待处理财产损溢Wait deal assets loss or income

待处理流动资产损溢Wait deal intangible assets loss or income

待处理固定资产损溢Wait deal fixed assets loss or income

二、负债类Liability

短期负债Current liability

短期借款Short-term borrowing

应付票据Notes payable

银行承兑汇票Bank acceptance

商业承兑汇票Trade acceptance

应付账款Account payable

预收账款Deposit received

代销商品款Proxy sale goods revenue

应付工资Accrued wages

应付福利费Accrued welfarism

应付股利Dividends payable

应交税金Tax payable

应交增值税value added tax payable

进项税额Withholdings on VAT

已交税金Paying tax

转出未交增值税Unpaid VAT changeover

减免税款Tax deduction

销项税额Substituted money on VAT

出口退税Tax reimbursement for export

进项税额转出Changeover withnoldings on VAT

出口抵减内销产品应纳税额Export deduct domestic sales goods tax 转出多交增值税Overpaid VAT changeover

未交增值税Unpaid VAT

应交营业税Business tax payable

应交消费税Consumption tax payable

应交资源税Resources tax payable

应交所得税Income tax payable

应交土地增值税Increment tax on land value payable

应交城市维护建设税Tax for maintaining and building cities

payable

应交房产税Housing property tax payable

应交土地使用税Tenure tax payable

应交车船使用税Vehicle and vessel usage license plate

tax(VVULPT) payable

应交个人所得税Personal income tax payable

其他应交款Other fund in conformity with paying

其他应付款Other payables

预提费用Drawing expense in advance

其他负债Other liabilities

待转资产价值Pending changerover assets value

预计负债Anticipation liabilities

长期负债Long-term Liabilities

长期借款Long-term loans

一年内到期的长期借款Long-term loans due within one year

一年后到期的长期借款Long-term loans due over one year

应付债券Bonds payable

债券面值Face value, Par value

债券溢价Premium on bonds

债券折价Discount on bonds

应计利息Accrued interest

长期应付款Long-term account payable

应付融资租赁款Accrued financial lease outlay

一年内到期的长期应付Long-term account payable due within one year 一年后到期的长期应付Long-term account payable over one year

专项应付款Special payable

一年内到期的专项应付Long-term special payable due within one year 一年后到期的专项应付Long-term special payable over one year

递延税款Deferral taxes

三、所有者权益类OWNERS'' EQUITY

资本Capita

实收资本(或股本) Paid-up capital(or stock)

实收资本Paicl-up capital

实收股本Paid-up stock

已归还投资Investment Returned

公积

资本公积Capital reserve

资本(或股本)溢价Cpital(or Stock) premium

接受捐赠非现金资产准备Receive non-cash donate reserve

股权投资准备Stock right investment reserves

拨款转入Allocate sums changeover in

外币资本折算差额Foreign currency capital

其他资本公积Other capital reserve

盈余公积Surplus reserves

法定盈余公积Legal surplus

任意盈余公积Free surplus reserves

法定公益金Legal public welfare fund

储备基金Reserve fund

企业发展基金Enterprise expension fund

利润归还投资Profits capitalizad on return of investment

利润Profits

本年利润Current year profits

利润分配Profit distribution

其他转入Other chengeover in

提取法定盈余公积Withdrawal legal surplus

提取法定公益金Withdrawal legal public welfare funds

提取储备基金Withdrawal reserve fund

提取企业发展基金Withdrawal reserve for business expansion

提取职工奖励及福利基金Withdrawal staff and workers'' bonus and welfare fund

利润归还投资Profits capitalizad on return of investment

应付优先股股利Preferred Stock dividends payable

提取任意盈余公积Withdrawal other common accumulation fund

应付普通股股利Common Stock dividends payable

转作资本(或股本)的普通股股利Common Stock dividends change to assets(or stock)

未分配利润Undistributed profit

四、成本类Cost

生产成本Cost of manufacture

基本生产成本Base cost of manufacture

辅助生产成本Auxiliary cost of manufacture

制造费用Manufacturing overhead

材料费Materials

管理人员工资Executive Salaries

奖金Wages

退职金Retirement allowance

补贴Bonus

外保劳务费Outsourcing fee

福利费Employee benefits/welfare

会议费Coferemce

加班餐费Special duties

市内交通费Business traveling

通讯费Correspondence

电话费Correspondence

水电取暖费Water and Steam

税费Taxes and dues

租赁费Rent

管理费Maintenance

车辆维护费Vehicles maintenance

油料费Vehicles maintenance

培训费Education and training

接待费Entertainment

图书、印刷费Books and printing

运费Transpotation

保险费Insurance premium

支付手续费Commission

杂费Sundry charges

折旧费Depreciation expense

机物料消耗Article of consumption

劳动保护费Labor protection fees

季节性停工损失Loss on seasonality cessation

劳务成本Service costs

五、损益类Profit and loss

收入Income

业务收入OPERATING INCOME

主营业务收入Prime operating revenue

产品销售收入Sales revenue

服务收入Service revenue

其他业务收入Other operating revenue

材料销售Sales materials

代购代售

包装物出租Wrappage lease

出让资产使用权收入Remise right of assets revenue 返还所得税Reimbursement of income tax

其他收入Other revenue

投资收益Investment income

短期投资收益Current investment income

长期投资收益Long-term investment income

计提的委托贷款减值准备Withdrawal of entrust loans reserves 补贴收入Subsidize revenue

国家扶持补贴收入Subsidize revenue from country

其他补贴收入Other subsidize revenue

营业外收入NON-OPERATING INCOME

非货币性交易收益Non-cash deal income

现金溢余Cash overage

处置固定资产净收益Net income on disposal of fixed assets 出售无形资产收益Income on sales of intangible assets

固定资产盘盈Fixed assets inventory profit

罚款净收入Net amercement income

支出Outlay

业务支出Revenue charges

主营业务成本Operating costs

产品销售成本Cost of goods sold

服务成本Cost of service

主营业务税金及附加Tax and associate charge

营业税Sales tax

消费税Consumption tax

城市维护建设税Tax for maintaining and building cities

资源税Resources tax

土地增值税Increment tax on land value

5405 其他业务支出Other business expense

销售其他材料成本Other cost of material sale

其他劳务成本Other cost of service

其他业务税金及附加费Other tax and associate charge

费用Expenses

营业费用Operating expenses

代销手续费Consignment commission charge

运杂费Transpotation

保险费Insurance premium

展览费Exhibition fees

广告费Advertising fees

管理费用Adminisstrative expenses

职工工资Staff Salaries

修理费Repair charge

低值易耗摊销Article of consumption

办公费Office allowance

差旅费Travelling expense

工会经费Labour union expenditure

研究与开发费Research and development expense

福利费Employee benefits/welfare

职工教育经费Personnel education

待业保险费Unemployment insurance

劳动保险费Labour insurance

医疗保险费Medical insurance

会议费Coferemce

聘请中介机构费Intermediary organs

咨询费Consult fees

诉讼费Legal cost

业务招待费Business entertainment

技术转让费Technology transfer fees

矿产资源补偿费Mineral resources compensation fees

排污费Pollution discharge fees

房产税Housing property tax

车船使用税Vehicle and vessel usage license plate tax(VVULPT) 土地使用税Tenure tax

印花税Stamp tax

财务费用Finance charge

利息支出Interest exchange

汇兑损失Foreign exchange loss

各项手续费Charge for trouble

各项专门借款费用Special-borrowing cost

营业外支出Nonbusiness expenditure

捐赠支出Donation outlay

减值准备金Depreciation reserves

非常损失Extraordinary loss

处理固定资产净损失Net loss on disposal of fixed assets

出售无形资产损失Loss on sales of intangible assets

固定资产盘亏Fixed assets inventory loss

债务重组损失Loss on arrangement

罚款支出Amercement outlay

所得税Income tax

以前年度损益调整Prior year income adjustment

财务管理专业英语 句子及单词翻译

Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. 财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。 Decisions involving a firm’s short-term assets and liabilities refer to working capital management. 决断涉及一个公司的短期的资产和负债提到营运资金管理 The firm’s long-term financing decisions concern the right-hand side of the balance sheet. 该公司的长期融资决断股份资产负债表的右边。 This is an important decision as the legal structure affects the financial risk faced by the owners of the company. 这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。 The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors). 董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。 Maximization of shareholder wealth focuses only on stockholders whereas maximization of firm value encompasses all financial claimholders including common stockholders, debt holders, and preferred stockholders. 股东财富最大化只集中于股东,而企业价值最大化包含所有的财务债券持有者,包括普通股股东,债权人和优先股股东。 Given these assumptions,shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run。 根据这些假设,从长期来看,股东财富最大化与利益相关者和社会的最好利润是相一致的。 No competing measure that can provide as comprehensive a measure of a firm’s standi ng. Given these assumptions, shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run. 没有竞争措施,能提供由于全面的一个措施的一个公司的站。给这些臆说,股东'财富最大化一贯不比任何人差项目干系人项目利益相关者的利益,社会从长远说来。 In reality, managers may ignore the interests of shareholders, and choose instead to make investment and financing decisions that benefit themselves. 在现实中,经理可能忽视股东的利益,而是选择利于自身的投资和融资决策。 Financial statements are probably the important source of information from which these various stakeholders(other than management) can assess a firm’s financial health. 财务报表可能是最重要的信息来源,除管理者以外的各种利益相关者可以利用这些报表来评估一个公司的财务状况。 The stockholders’ equity section lists preferred stock, common stock and capital surplus and accumulated retained earnings. 股东权益列示有优先股,普通股,资本盈余和累积留存收益。 The assets, which are the “things” the company owns, are listed in the order of decreasing liquidity, or length of time it typically takes to convert them to cash at fair market values, beginning with the firm’s current assets. 资产,也就是公司拥有的东西,是按照流动性递减的顺序或将它们转换为公允市场价值所需要的时间来排列的,通常从流动资产开始。The market value of a firm’s equity is equal to the number of shares of common stock outstanding times the price per share, while the amoun t reported on the firm’s balance sheet is basically the cumulative amount the firm raised when issuing common stock and any reinvested net income(retained earnings). 公司权益的市场价值等于其发行在外的普通股份数乘以每股价格,而资产负债表上的总额则主要是公司在发行普通股以及分配任何再投资净收益(留存收益)时累积的数额。 When compared to accelerated methods, straight-line depreciation has lower depreciation expense in the early years of asset life, which tends to a higher tax expense but higher net income. 与加速折旧法相比,直线折旧法在资产使用年限的早期折旧费用较低,这也会趋向于较高的税金费用和较高的净收入。 The statement of cash flows consists of three sections:(1)operating cash flows,(2)investing cash flows, and(3)financing cash flows. Activities in each area that bring in cash represent sources of cash while activities that involve spending cash are uses of cash. 该声明现金流量表包含三个部分:(1)经营现金流,(2)投资的现金流,(3)融资现金流。在每个地区活动带来现金来源的现金而代表活动涉及到花钱是使用现金 Financing activities include new debt issuances, debt repayments or retirements, stock sales and repurchases, and cash dividend payments. 筹资活动,包括发行新债券,偿还债务,股票销售和回购,以及现金股利支付。 Not surprisingly, Enron’s executives had realized some $750 million in salaries, bonuses and profits from stock options in the 12 months before the company went bankrupt. 毫不奇怪, 公司破产前的十二个月里,安然的高管们实现了7.5亿美金的工资、奖金和股票期权利润。First, financial ratios are not standardized. A perusal of the many financial textbooks and other sources that are available will often show differences in how to calculate some ratios. 首先,财务比率不规范。一个参考的许多金融教科书及来源,可将经常表现出差异如何计算一些率。 Liquidity ratios indicate a firm’s ability to pay its obligations in the short run. 流动性比率表明公司的支付能力在短期内它的义务。 Excessively high current ratios, however, may indicate a firm may have too much of its long-term investor-supplied capital invested in short-term low-earning current assets. 当前的比率过高,然而,可能表明,一个公司可能有太多的长期 investor-supplied资本投资于短期low-earning流动资产 In an inflationary environment, firms that use last-in, first-out(LIFO)inventory valuation will likely have lower current ratios than firms that use first-in, first-out(FIFO). 在一个通货膨胀的环境下,企业选择使用后进先出法对存货计价的公 司比采用先进先出法的公司有一个低的流动比率。 The cash ratio is too conservative to accurately reflect a firm’s liquidity position because it assumes that firms can fund their current liabilities with only cash and marketable securities. 流动比率太稳健不能正确反映一个公司的流动性状况,因为在这一比率假定公司仅仅用现金和有价证券就可以偿还流动负债。 Debt management ratios characterize a firm in terms of the relative mix of debt and equity financing and provide measures of the long-term debt paying ability of the firm. 描述一个公司债务管理比率从相对的混合的债务和股权融资的措施, 提供长期偿债能力的公司。 Total capital includes all non-current liabilities plus equity, and thus excludes short-term debt. 资本总额包括所有非流动负债加上股本,从而排除短期贷款。 Net profit margins vary widely by the type of industry. 有着很大的不同,其净利润为典型的产业。 Note that earnings before interest and taxes, rather than net income, Is used in the numerator because interest is paid with pre-tax dollars, and the firm’s ability to pay current interest is not affected by taxes. 注意,分子中用的是息税前利润而不是净收入,这是因为利息是税前支付的,公司支付现金利息的能力不受税收的影响。 Managers should analyze the tradeoff between any increased sales from a more lenient credit policy and the associated costs of longer collection periods and more uncollected receivables to determine whether changing the firm’s credit sales policy could increase shareholder’s we alth. 管理者应该分析权衡增加的销售从一个更为宽松的信贷政策和相关费用较长的周期和更多的应收账款收集来决定是否改变公司的信用销售的政策可能会增加股东的财富。 If the receivables collection period exceeds a firm’s credit terms this may indicate that a firm is ineffective in collecting its credit sales or is granting credit to marginal customers. 如果应收账款采集时间超过公司的信用条款这也许说明了企业信用销售收集它无效或给予客户信用边缘。 A low, declining ratio may suggest the firm has continued to build up inventory in the face of weakening demand or may be carrying and reporting outdated or obsolete inventory that could only be sold at reduced prices, if at all. 一个低税率、下降率可能显示这个公司已经持续不断地加强库存面对需求不断减弱或可能携带和报告过期或过时的库存,只能减价出售。Thus, the operating profit margin, which indicates the operating profit generated per dollar of net sales, measures t he firm’s operating profitability before financing costs. 因此,经营利润,预示着美元营业利润产生的净销售额,公司的经营利润措施在融资成本。 If the firm’s fixed assets are old and have been depreciated to a low book value, and the assets have not lost their productive ability, the low figure in the denominator will inflate ROA. 如果公司固定资产比较旧,分母的减少会是ROA折旧到低的账面价值,但是资产并没有失去生产能力。 Return on common equity(ROCE) focuses on just the return to common shareholders and is computed by removing the dividends to preferred shareholders from net income and dividing by the capital provided by common shareholders. 普通股权益报酬率仅仅关注普通股股东的报酬率,用净收入扣除优先股股利除以普通股股东提供的资本计算得到。 Dividend yield represents parts of a stock’s total return; another part of a st ock’s total return is price appreciation. 代表部分股息率的股票总回报;另一部分是一个股票的总回报价格上涨。 In fact, of all the concepts used in finance, none is more important than the time value of money, also called discounted cash flow(DCF) analysis. 事实上,财务上所有的概念中,货币时间价值是最重要的,也称作是折现调整现金流量折价分析。

会计专业英语模拟试题及答案

《会计专业英语》模拟试题及答案 一、单选题(每题1分,共 20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost. 2) In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? $8 500 Dr $8 500 Cr $14 000 Dr $14 000 Cr Should dividends paid appear on the face of a company’s cash flow statement? Yes No Not sure Either Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? Weighted Average cost First in first out (FIFO) Last in first out (LIFO) Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position? (1) plant, equipment, and property (2) company car (3) €4000 cash (4) €1000 cheque A. (1), (3)

财务管理外文翻译

财务风险管理 尽管近年来金融风险大大增加,但风险和风险管理不是当代的主要问题。全球市场越来越多的问题是,风险可能来自几千英里以外的与这些事件无关的国外市场。意味着需要的信息可以在瞬间得到,而其后的市场反应,很快就发生了。经济气候和市场可能会快速影响外汇汇率变化、利率及大宗商品价格,交易对手会迅速成为一个问题。因此,重要的一点是要确保金融风险是可以被识别并且管理得当的。准备是风险管理工作的一个关键组成部分。 什么是风险? 风险给机会提供了基础。风险和暴露的条款让它们在含义上有了细微的差别。风险是指有损失的可能性,而暴露是可能的损失,尽管他们通常可以互换。风险起因是由于暴露。金融市场的暴露影响大多数机构,包括直接或间接的影响。当一个组织的金融市场暴露,有损失的可能性,但也是一个获利或利润的机会。金融市场的暴露可以提供战略性或竞争性的利益。 风险损失的可能性事件来自如市场价格的变化。事件发生的可能性很小,但这可能导致损失率很高,特别麻烦,因为他们往往比预想的要严重得多。换句话说,可能就是变异的风险回报。由于它并不总是可能的,或者能满意地把风险消除,在决定如何管理它中了解它是很重要的一步。识别暴露和风险形式的基础需要相应的财务风险管理策略。 财务风险是如何产生的呢? 无数金融性质的交易包括销售和采购,投资和贷款,以及其他各种业务活动,产生了财务风险。它可以出现在合法的交易中,新项目中,兼并和收购中,债务融资中,能源部分的成本中,或通过管理的活动,利益相关者,竞争者,外国政府,或天气出现。当金融的价格变化很大,它可以增加成本,降低财政收入,或影响其他有不利影响的盈利能力的组织。金融波动可能使人们难以规划和预算商品和服务的价格,并分配资金。 有三种金融风险的主要来源: 1、金融风险起因于组织所暴露出来的市场价格的变化,如利率、汇率、和大宗商品价格。 2、引起金融风险的行为有与其他组织的交易如供应商、客户,和对方在金融衍生产品中的交易。 3、由于内部行动或失败的组织,特别是人、过程和系统所造成的金融风险。 什么是财务风险管理? 财务风险管理是用来处理金融市场中不确定的事情的。它涉及到一个组织所面临的评估和组织的发展战略、内部管理的优先事项和当政策一致时的财务风险。企业积极应对金融风险可以使企业成为一个具有竞争优势的组织。它还确保管理,业务人员,利益相关者,董事会董事在对风险的关键问题达成协议。金融风险管理组织就必须作出那些不被接受的有关风险的决定。那些被动不采取行动的战略是在默认情况下接受所有的风险,组织使用各种策略和产品来管理金融风险。重要的是要了解这些产品和战略方面,通过工作来减少该组织内的风险承受能力和目标范围内的风险。 风险管理的策略往往涉及衍生工具。在金融机构和有组织的交易所,衍生物广泛地进行

《财会专业英语》期末试卷及答案

《财会专业英语》期终试卷 I.Put the following into corresponding groups. (15 points) 1.Cash on hand 2.Notes receivable 3.Advances to suppliers 4. Other receivables 5.Short-term loans 6.Intangible assets 7.Cost of production 8.Current year profit 9. Capital reserve 10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payroll II.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the account receivable A.assets increase B.assets do not change C.owner’s equity d ecreases D.liabilities decrease 2. A balance sheet report . A. the assets, liabilities, and owner’s equity on a particular date B. the change in the owner’s capital during the period C. the cash receipt and cash payment during the period D. the difference between revenues and expenses during the period 3. The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below: 20 x 1 20 x 2 Assets $ 75,000 $ 90,000 Liabilities 36,000 45,000 how much the owner’sequity at the end of 20 x 2 ? A.$ 4,500 B.$ 6,000 C.$ 45,000 D.$ 43,000

财务管理专业财务管理和财务分析大学毕业论文外文文献翻译及原文

毕业设计(论文) 外文文献翻译 文献、资料中文题目:财务管理和财务分析 文献、资料英文题目: 文献、资料来源: 文献、资料发表(出版)日期: 院(部): 专业:财务管理 班级: 姓名: 学号: 指导教师: 翻译日期: 2017.02.14

外文翻译原文 Financial Management and Analysis is an introduction to the concepts,tools, and applications of finance. The purpose of this textbook is to communicate the fundamentals of financial management and financial analysis.This textbook is written in a way that will enable students who are just beginning their study of finance to understand financial decision-making and its role in the decision-making process of the entire firm. Throughout the textbook, you’ll see how we view finance.We see financial decision-making as an integral part of the firm’s decision-making, not as a separate function. Financial decision-making involves coordination among personnel specializing in accounting, marketing, and production aspects of the firm. The principles and tools of finance are applicable to all forms and sizes of business enterprises, not only to large corporations. Just as there are special problems and opportunities for small family-owned businesses(such as where to obtain financing), there are special problems and opportunities for large corporations (such as agency problems that arise when management of the firm is separated from the firm’s owners). But the fundamentals of financial management are the same regardless of the size or form of the business. For example, a dollar today is worth more than a dollar one year from today, whether you are making

财务管理术语中英文对照

财务管理术语表 Absorptioncosting吸收成本法: TotalCostMethods全部成本法:将某会计期间内发生的固定成本除以销售量,得出单位产品的固 定成本,再加上单位变动成本,算出单位产品的总成本。 Accounting会计:对企业活动的财务信息进行测量和综合,从而向股东、经理和员工提供企业活动的信息。请参看管理会计和财务会计。 Accountingconvention会计原则:会计师在会计报表的处理中所遵循的原则或惯例。正因为有了这些原则,不同企业的会计报表以及同一企业不同时期的会计报表才具有可比性。如果会计原则在实行中发生了一些变化,那么审计师就应该在年度报表附注中对此进行披露。 Accounts会计报表和账簿:这是英国的叫法,在美国,会计报表或财务报表叫做Financial Statements,是指企业对其财务活动的记录。Chieffinancialofficer Accountspayable应付账款:这是美国的叫法,在英国,应付账款叫做Creditors,是指公司从供应商处购买货物、但尚未支付的货款。 Accountsreceivable应收账款:这是美国的叫法,在英国,应收账款叫做Debtors,是指客户从公司购买商品或服务,公司已经对其开具发票,但客户尚未支付的货款。 Accrualaccounting权责发生制会计:这种方法在确认收入和费用时,不考虑交易发生时有没有现金流的变化。比如,公司购买一项机器设备,要等到好几个月才支付现金,但会计师却在购买当时就确认这项费用。如果不使用权责发生制会计,那么该会计系统称作“收付制”或“现金会计”。Accumulateddepreciation累计折旧:它显示截止到目前为止的折旧总额。将资产成本减去累计折旧,所得结果就是账面净值。 Acidtest酸性测试:这是美国的叫法,请参看quickratio速动比率(英国叫法)。 Activityratio活动比率:资产周转率,即销售收入除以净资产(或总资产)。它表明企业在销售过程中利用资产的效率,而不考虑资本的来源。零售业和服务业的活动比率通常比较高。制造业通常是资本密集型的,固定资产的流动资产较多,因此其活动比率也就比较低。 Allcationofcosts成本的分配:将成本分配给“拥有”它们的产品或分部,比如用某产品的广告成本抵减该产品的收入。 Amortization摊销:将资产或负债价值的逐渐减少记录在各期费用里。通常是指商誉、专利或其他无形资产,或者债券的发行费用。 Assets资产:企业所拥有的财产,可能包括固定资产、流动资产和无形资产。 Assetturnover:资产周转率 Auditing审计对公司账簿和会计系统进行检查,从而确认公司的会计报表是否真实、公正地披露其财务状况的过程。 Auditors’report审计报告:根据法律规定,有限公司每年都应当公布一份会计报表,同时审计师应当出具意见,以确认公司是否对其商业活动进行了真实、公正的披露。为了确认这一点,审计师需要检查公司的会计报表。如果他们对报表不满意,他们就会出具“保留意见”,提了同报表中他们认为错误或不确定的项目。审计师出具的保留意见可能会对公司的公众形象和股票价格产生灾难性的影响。 Authorizedcapital核定资本:经过核定允许发行的实收资本额。在核定资本的时候,公司需要支付

会计英语试题及复习资料

会计英语试题及答案 会计专业英语是会计专业人员职业发展的必要工具。学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。 一、单选题 1. ? 1) . 2) . 3) . 4) , a . A 1 3 B 1 4 C 3 D 2 3 2. $5 500 2010. 31 2010 $55 000 $46 500 . 31 2010? A. $8 500 B. $8 500 C. $14 000 D. $14 000 3. a ’s ? A. B. C. D. 4. a ? A. B. () C. () D. 5. a ’s ? (1) , , (2) (3) 4000 (4) 1000 A. (1), (3) B. (1), (2) C. (2), (3) D. (2), (4)

6. a ’s ? (1) (2) . (3) . (4) A (1), (2) (3) B (1), (2) (4) C (1), (3) (4) D (2), (3) (4) 7. 30 2010 : $992,640 $1,026,480 , , ? 1. $6,160 . 2. $27,680 a . 3. $6,160 a . 4. $21,520 . A 1 2 B 2 3 C 2 4 D 3 4 8. . (1) (2) (3) (4) ? A (1), (3) (4) B (1), (2) (4) C (1), (2) (3) D (2), (3) (4) ( = [])({ : "u3054369" }); 9. ? (1) , (2) a (3) , A. 2 3 B. C. 1 2 D. 3 10. ? (1)

财务管理专业英语翻译

1、Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. 财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。 2、Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-hold forms to large publicly-traded corporations. 做财务决策对于所有形式和规模的商业组织,无论是小型私人公司还是大型股份公开交易的公司来说,都是不可分割的一部分。 3、In today’s rapidly changing environment, the financial manager must have the flexibility to adapt to external factors such as economic uncertainty, global competition, technological change, volatility of interest and exchange rates, changes in laws and regulations, and ethical concerns. 在当今瞬息万变的环境中,财务经理必须具备足够的灵活性以适应外部因素,如经济的不确定性、国际竞争、技术变革、利息波动、汇率变动、法律法规变化以及商业道德问题。 4、The financial manager makes investment decisions about all types of assets-items on the left-hand side of the balance sheet. 财务经理要做出关于所有形式的资产—即资产负债表左侧所列示项目的投资决定。 5、For example, a firm must repay debt with interest over a specific period without typically sharing control with the lender. 例如,一个公司在偿还债务时必须还要偿付特定期间内的利息,而通常不用与债权人分享控制权。 6、When you examine a set of financial statements, you should keep in mind that a physical reality lies behind the numbers, and you should also realize that the translation from physical asset to “correct”numbers is far from precise. 当你检查一组财务报表的时候,你应该牢记:真实的东西是隐藏在数字背后的,并且你还应该意识到,把物理资产转换为数据是很难做到精确的。 7、The qualitative characteristics of accounting information include relevance, timeliness, reliability, consistency ,and comparability. 会计信息的质量特征包括相关性、及时性、可靠性、一致性和可比性。 8、The assets, which are the “things”the company owns, are listed in the order of decreasing liquidity, or length of time it typically takes to convert them to cash at fair market values, beginning with the firm’s current assets. 资产,也就是公司拥有的东西,是按照流动性递减的顺序或将它们转换为公允市场价值所需要的时间来排列的,通常从流动资产开始。

财务管理专业英语

财务管理专业英语business 企业商业业务 financial risk 财务风险 sole proprietorship 私人业主制企业 partnership 合伙制企业 limited partner 有限责任合伙人 general partner 一般合伙人 separation of ownership and control 所有权与经营权分离claim 要求主张要求权 management buyout 管理层收购 tender offer 要约收购 financial standards 财务准则 initial public offering 首次公开发行股票

private corporation 私募公司未上市公司closely held corporation 控股公司board of directors 董事会 executove director 执行董事 non- executove director 非执行董事chairperson 主席 controller 主计长 treasurer 司库 revenue 收入 profit 利润 earnings per share 每股盈余 return 回报 market share 市场份额 social good 社会福利

financial distress 财务困境 stakeholder theory 利益相关者理论 value (wealth) maximization 价值(财富)最大化common stockholder 普通股股东 preferred stockholder 优先股股东 debt holder 债权人 well-being 福利 diversity 多样化 going concern 持续的 agency problem 代理问题 free-riding problem 搭便车问题 information asymmetry 信息不对称 retail investor 散户投资者

财务管理专业英语

财务管理专业英语 financial management 财务管理decision-making 决策,决策的acquire 获得,取得publicly traded corporations 公开上市公司公众 vice president of finance 财务副总裁 chief financial officer 首席财务官 chief executive officer 首席执行官 balance sheet 资产负债表 capital budgeting 资本预算 working capital management 营运资本管理 hurdle rate 最低报酬率 capital structure 资本结构 mix of debt and equity 负债与股票的组合 cash dividend 现金股利stockholder 股东 dividend policy 股利政策dividend-payout ratio 股利支付率 stock repurchase 股票回购stock offering 股票发行tradeoff 权衡,折中common stock 普通股current liability 流动负债current asset 流动资产marketable security 流动性资产,有价证券 inventory 存货 tangible fixed assets 有形固定资产 in tangible fixed assets 无形固定资产 patent 专利 trademark 商标 creditor 债权人stockholds’ equity股东权益 financing mix 融资组合risk aversion 风险规避 volatility 易变性不稳定性 allocate 配置 capital allocation 资本配置 business 企业商业业务financial risk 财务风险 sole proprietorship 私人业主制企业 partnership 合伙制企业 limited partner 有限责任合伙人 general partner 一般合伙人separation of ownership and control 所有权与经营权分离claim 要求主张要求权management buyout 管理层收购tender offer 要约收购financial standards 财务准则initial public offering 首次公开发行股票 private corporation 私募公司未上市公司