Chapter 9 Nontariff trade barrier (07-06-20)

Chapter 9 Nontariff Trade Barriers and

the New Protectionism

1. Introduction

There are many other types of trade barriers, such as import quotas, voluntary export restraints, and antidumping actions.

Section 9.2 examines the effect of an import quota and compares them to those of an import tariff.

Section 9.3 deals with other nontariff trade barriers and includes a discussion of voluntary export restraints and other regulations, as well as trade barriers resulting from international cartels, dumping, and export subsidies. 3. 非关税壁垒的分类

z Import quotas

z Voluntary export restraints

z Antidumping actions

z Other types of trade barriers

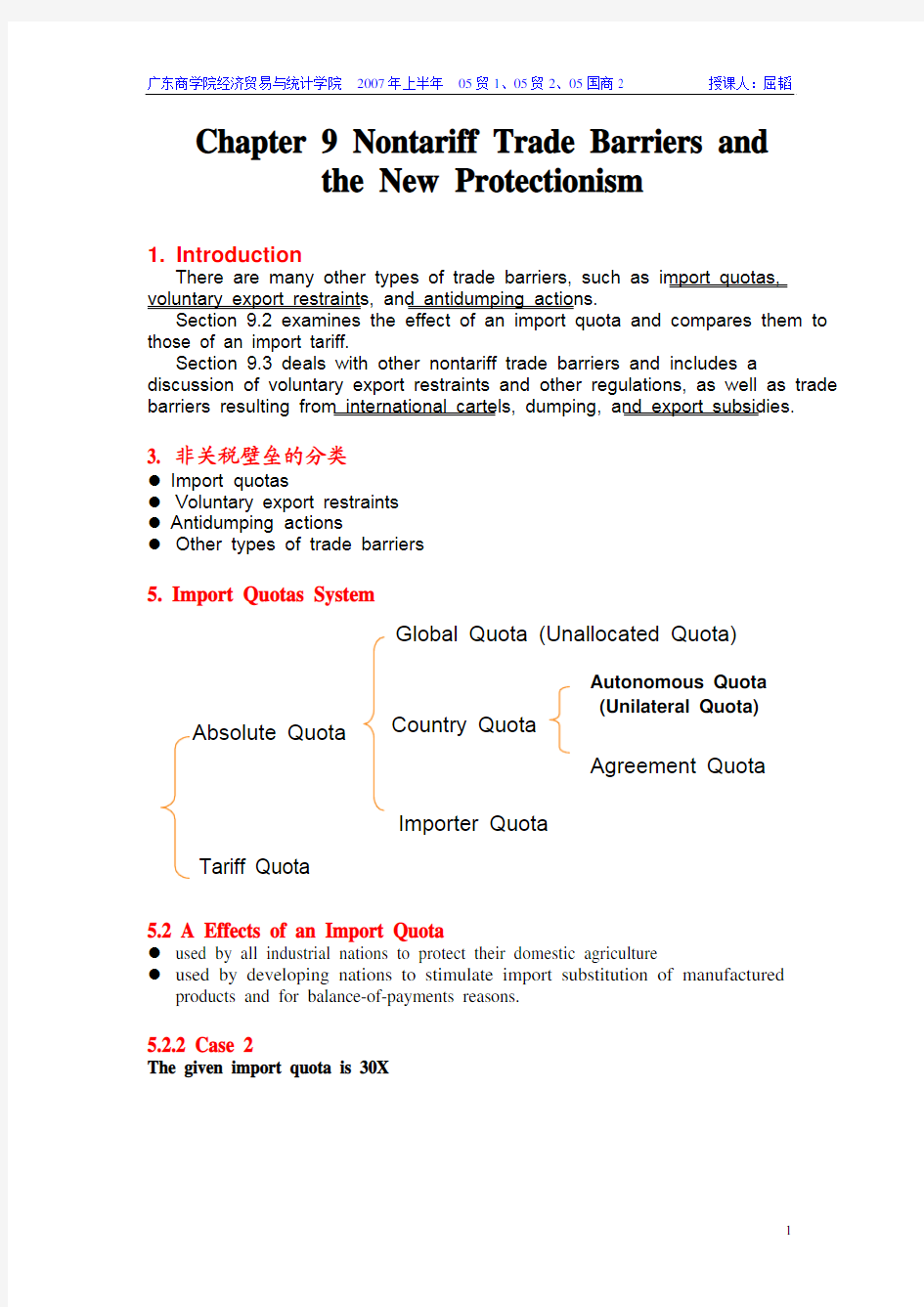

5. Import Quotas System

Absolute Quota Tariff Quota Global Quota (Unallocated Quota)

Country Quota

Agreement Quota Importer Quota

Autonomous Quota

(Unilateral Quota)

5.2 A Effects of an Import Quota

z used by all industrial nations to protect their domestic agriculture

z used by developing nations to stimulate import substitution of manufactured products and for balance-of-payments reasons.

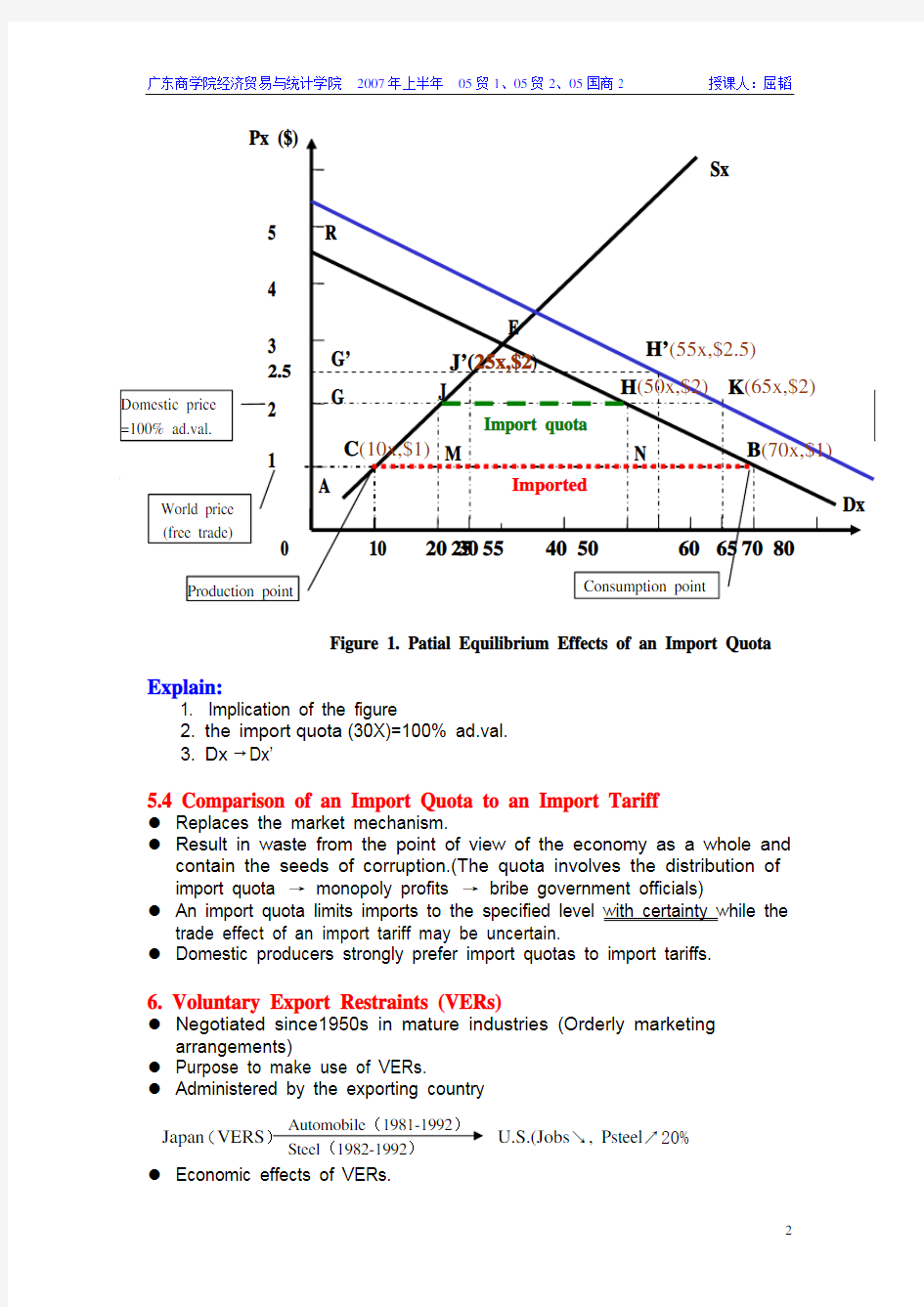

5.2.2 Case 2

The given import quota is 30X

Explain: 1. Implication of the figure

2. the import quota (30X)=100% ad.val.

3. Dx →Dx’

5.4 Comparison of an Import Quota to an Import Tariff

z Replaces the market mechanism.

z Result in waste from the point of view of the economy as a whole and

contain the seeds of corruption.(The quota involves the distribution of import quota → monopoly profits → bribe government officials)

z An import quota limits imports to the specified level with certainty while the

trade effect of an import tariff may be uncertain.

z Domestic producers strongly prefer import quotas to import tariffs.

6. Voluntary Export Restraints (VERs)

z Negotiated since1950s in mature industries (Orderly marketing

arrangements)

z Purpose to make use of VERs.

z

Administered by the exporting country

z Economic effects of VERs.

z VERs were less effective in limiting imports than import quotas.

7. Import License System

8. Foreign Exchange control

9. State Monopoly (State trade)

10. Discriminatory Government Procurement Policy

11. Internal Taxes

13. Advanced Deposit

14. Customs Procedures

15. Technical Administrative, and other Regulations

z Safety regulations for automobile and electrical equipment.

z Health regulations for the hygienic production and packaging of imported food products.

z Labeling requirements showing origin and contents.

z Government procurement policy

z Border taxes

15.1 技术性贸易壁垒的分类

z technical standard

z health and sanitary regulation

z packing and labeling regulation

17. International Cartels

17.1 Organization

z OPEC (Petroleum)

z IATA (Air)

z No cartel in minerals, agricultural products.

An international cartel is more likely to be successful if there are only a few international suppliers of an essential commodity for which there are no close substitutes.

17.2 Characteristic:

z The power of a cartel lies in its ability to restrict output and exports

z Being inherently unstable

z Behaving exactly as a monopolist

18. The Political Economy of Protection

? Fallacious and Questionable Arguments for Protection;

?The Infant-Industry and Other Qualified Arguments for Protection;

? Who Gets Protected?

18.1 Fallacious and Questionable Arguments for Protection

?Trade protections are needed to protect domestic labor against cheap foreign labor (fallacious);

?The scientific tariff (fallacious); (No price differences, no trade).

?Protection is needed to

(1) reduce domestic unemployment and

(2) cure a deficit in the nation’s balance of payment (questionable)

Substitute of domestic products, while at the expenses of other nation

→ beggarthy-neighbor

→ All lose

18.2 The Infant-Industry and Other Qualified Arguments

18.2.1 The infant-industry argument

?General comment: may be correct;

?More justified for developing nation

?Protection, once given, is difficult to remove

?Difficult to identify infancy industry;

?Production subsidy to the infant industry can do better.

?The protection costs vs the future return;

?Empirical experiences: negative

The return in the grown-up industry must be sufficiently high also to offset the higher prices paid by domestic consumers of the commodity during the infancy period.

One way to encourage the industry and confer greater external economies on society would be to restrict imports. This stimulates the industry, but it also increases the price of the product to domestic consumers. A better policy would be to provide a direct subsidy to the industry, which would stimulate the industry without the consumption distortion and loss to consumers (P288).

A direct tax would be better than a tariff to discourage activities (such as automobile travel) that giver rise to external diseconomies (pollution).

The best way the correct a domestic distortion is with domestic policies rather than with trade policies.

Direct production subsidies are generally better than tariff protection.

18.3 The Strategic Trade Policy

?View point: a nation can create a comparative advantage in high-tech fields and other industries that are deemed crucial to future growth and

the nation can reap the large external economies;

?Examples: steel industry in 1950’s and semiconductors in 1970’s ~80’s in Japan;

?Concorde and airbus in 1970’s in Europe

?It may cause retaliation.

18.3.1 Difficulties in carrying out:

Extremely difficult to pick winners and devise appropriate policies to successfully nurture them.

The potential benefits to each may be small.

Other countries are likely to retaliate.

18.3.2 Conclusion:

Free trade is still the best policy, after all. That is, free trade may be suboptimal

in theory, but it is optimal in practice.

18.3.4 Strategic trade and Industrial Policies with Game Theory

Suppose:

z Both Boeing and Airbus are deciding whether to produce a new aircraft.

z Because of the huge cost of developing the new aircraft, a single producer would have to have the entire world market for itself to earn a profit, say, of

$100 million.

z Boeing enters the market first and earns a profit of $100 million (100,0).

Table: Game theory figure

Airbus (Europe)

Produce

Produce Don’t

(100,0) Produce (-10,-10)

Boeing(U.S.)

Don’t Produce (0,100) (0,0)

Then:

If Airbus enter→(-10,-10)

If Airbus enter and is subsidized for 15→(-10,5)→Boeing out

18.3.5 Shortcoming:

z Very difficult to accurately forecast the outcome of government industrial and trade policies

z Extremely difficult to correctly carry out this type of analysis.

18.4 Who Gets Protected?

? Producers;

?Labor-intensive industries in developed countries. The most highly protected industry in the U.S. today is the textiles and apparel industry.

?Natural resource- intensive, capital-intensive and technology-intensive industries in developing countries.

?Highly organized industry (such as the automobile industry) receive more trade protection than less organized industries.

?Industries that produce consumer products generally are able to obtain more protection than industries producing intermediate products.

?More protection seems to go to geographically decentralized industries that employ a large number of workers than the industries that operate in only some regions and employ relatively few workers.

?Trade policies are biased in favor of maintaining the status quo.

?Protection seems to be more easily obtained by those industries that compete with products from developing countries.

18.5 The U.S. Response to Foreign Industrial Targeting and Strategic Trade Policies

z Direct federal support for civilian technology

z Take unilateral steps to force foreign markets to open more widely to U.S.

exports

z Retaliate with restrictions of its own against nations that fail to respond.

z Opening the entire Japanese distribution system more widely to U.S. firms z Demanded a sharp reduction in subsidies granted to Airbus Industrie and to agriculture

z Remove excessive restrictions against specific U.S. exports

z Protection for its intellectual property

z The EU’s restrictions of banana imports

z Ban on imports of American beef

z Imposed antidumping duties on steel imports

z Subsidies to agriculture and to some high-tech products, such as commercial aircraft.

19.History of U.S. Trade Policy (from 1934 to present)

?1930’s: high tariff rates up to 59% by U.S. and followed by retaliation of others resulting in a collapse in world trade later on (trade war);

?The establishment of GATT resulted in a sharp decrease in tariff in U.S.

and other countries (by 35%) ;

?Kenney and Tokyo Rounds: resulting in a tariff reduction by 27%~28%;

?Uruguay Round (1986~1993):trade dispute between U.S. & EU in the field of agricultural Products;

?Doha Round (going on): the conflicts between U.S. & developing countries

19.1 During the early 1930s, world trade in general and U.S. exports in particular fell sharply because of:

Depression

Great

z The

Act.

Tariff

z The

Smoot-Hawley

z GATT(1947)

z The 1962 Trade Expansion Act

? Background

? Main ideas

9Authorizing president to tariff-negotiate

9 Providing TAA

z The trade Reform Act(1974)

z The U.S. Trade and Tariff Act (1984)

z The omnibus Trade and Competitiveness Act (1988)