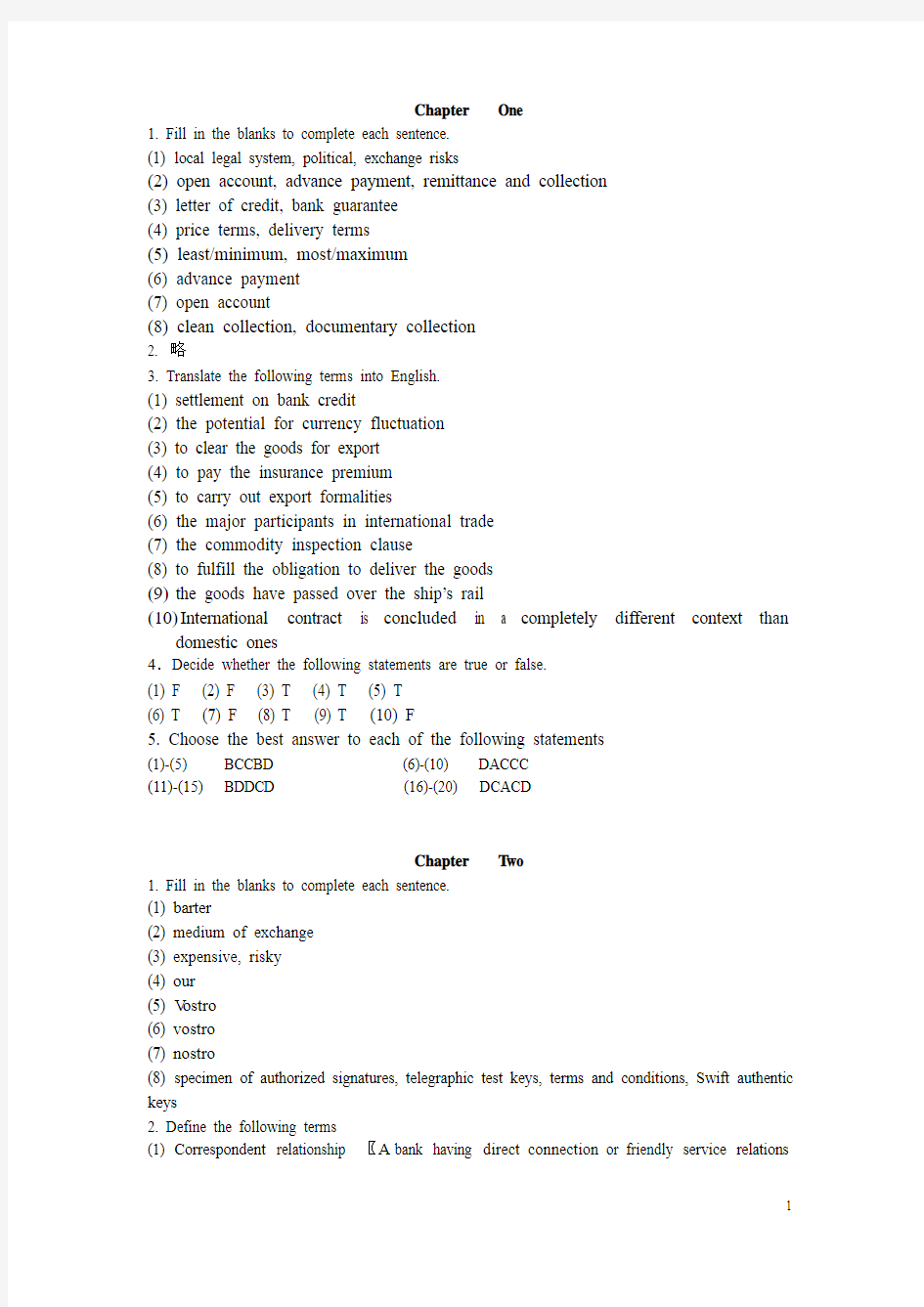

《国际支付与结算》(修订版)王益平 课后答案

Chapter One

1. Fill in the blanks to complete each sentence.

(1) local legal system, political, exchange risks

(2) open account, advance payment, remittance and collection

(3) letter of credit, bank guarantee

(4) price terms, delivery terms

(5) least/minimum, most/maximum

(6) advance payment

(7) open account

(8) clean collection, documentary collection

2. 略

3. Translate the following terms into English.

(1) settlement on bank credit

(2) the potential for currency fluctuation

(3) to clear the goods for export

(4) to pay the insurance premium

(5) to carry out export formalities

(6) the major participants in international trade

(7) the commodity inspection clause

(8) to fulfill the obligation to deliver the goods

(9)t he goods have passed over the ship’s rail

(10)I nternational contract is concluded in a completely different context than

domestic ones

4.Decide whether the following statements are true or false.

(1) F (2) F (3) T (4) T (5) T

(6) T (7) F (8) T (9) T (10) F

5. Choose the best answer to each of the following statements

(1)-(5) BCCBD (6)-(10) DACCC

(11)-(15) BDDCD (16)-(20) DCACD

Chapter T wo

1. Fill in the blanks to complete each sentence.

(1) barter

(2) medium of exchange

(3) expensive, risky

(4) our

(5) V ostro

(6) vostro

(7) nostro

(8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys

2. Define the following terms

(1) Correspondent relationship 〖A bank having direct connection or friendly service relations

with another bank.〗

(2) International settlements〖International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 〗

(3) V isible trade〖The exchange of goods and commodities between the buyer and the seller across borders.〗

(4) Financial transaction〖International financial transaction covers foreign exchange market transactions, government supported export credits, syndicated loans, international bond issues, etc.〗(5). V ostro account〖V ostro account is an account held by a bank on behalf of a correspondent bank.〗

3. Translate the following terms into English.

(1) commercial credit

(2) control documents

(3) account relationship

(4) cash settlement

(5) financ ial intermediary

(6) credit advice

(7) agency arrangement

(8) credit balance

(9)reimbursement method

(10) test key/code

4.Decide whether the following statements are true or false.

(1) T (2) F (3) F (4) T (5) F

5. Choose the best answer to each of the following statements

(1)-(5) BCDAD (6)-(10) BBDAB

Chapter Three

1. Define the following Terms:

(1) Negotiable instrument〖“A negotiable instrument is a chose in action, the full and legal title to which is transferable by delivery of the instrument (possibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.” 〗

(2) Bill of exchange〖A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer. 〗

(3) Check〖A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer. 〗

(4) Documentary bill〖It is a bill with shipping documents attached thereto. 〗

(5) Crossing〖A crossing is in effect an instruction to the paying bank from the drawer or holder to pay the fund to a bank only. 〗

2. Translate the following terms into English.

(1) 一般划线支票〖generally crossed check〗

(2) 特殊划线支票〖specially crossed check〗

(3) 过期支票〖a check that is out of date〗

(4) 未到期支票〖post dated check〗

(5) 大小写金额〖amount in words〗

(6) 白背书〖blank endorsement〗

(7) 特别背书〖special endorsement〗

(8) 限制性背书〖restrictive endorsement〗

(9) 跟单汇票〖documentary bill〗

(10) 即期汇票〖sight draft〗

(11) 远期汇票〖usance/term bill〗

(12) 承兑汇票〖acceptance bill〗

(13) 可确定的未来某一天〖determinable future date〗

(14) 光票〖clean bill〗

(15) 流通票据〖negotiable instrument〗

(16) 贴现行〖discounting house 〗

(17) 商人银行〖merchant bank〗

(18) 无条件的付款承诺〖unconditional promise of payment〗

(19) 负连带责任〖jointly and severally responsible〗

(20) 出票后90天付款〖payable 90 days after date〗

3. Decide whether the following statements are true or false.

(1) T (2) F (3) T (4) T (5) T

(6) F (7) T (8) T (9) T (10) T

(11) F (12) T (13) T (14) F (15) T

(16) T (17) T (18) F (19) F (20) F

4. Choose the best answer to each of the following statements

(1)-(5) CACBC (6)-(10) BACBB

(11)-(15) BDCCC (16)-(20) BBAAC

5-7 略

Chapter Four

1. Fill in the blanks to complete each sentence.

(1) beneficiary

(2) payment order / mail advice / debit advice

(3) the remittance amount is large / the transfer of funds is subject to a time limit / test key

(4) sell it to his own bank for crediting his account

(5) debits / credits

(6) demand draft

(7) act of dishonor

(8) swiftness / reliability / safety / inexpensiveness

(9) debiting remitting bank’s nostro account

(10) delivery of the goods

2. Define the following Terms.

(1) International remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the remitting bank’s overseas branch or its correspon dent with a nostro account.

(2) Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.

(3) A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.

(4) Demand draft transfer is a remittance method using a bank demand draft. It is a negotiable instrument drawn by one bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.

(5) Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.

3. Translate the following terms into English.

(1) 汇款通知单remittance advice (2) 汇出汇款outward remittance (3) 国际汇款单international money order (4) 往来账户current account

(5) 自动支付系统automated payment system (6) 作为偿付in cover

(7) 赔偿保证书letter of indemnity (8) 信汇通知书 mail advice

(9) 汇票的不可流通副本non-negotiable copy of draft (10) 首期付款down payment

4. Choose the best answer to each of the following statements

(1)-(5) BCABD (6)-(10) BBBAA

Chapter Five

1. Fill in the blanks to complete each sentence.

(1) presenting bank

(2) title documents / pays the draft / accepts the obligation to do so

(3) legal / the exchange control authorities

(4) the payment is made

(5) open account / advance payment

(6) Inward collection

(7). the remitting bank

(8) trust receipt

(9) D/P at sight

(10) documents, draft, and collection order

2. Define the following terms

(1) Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.

(2) The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in

the collection.

(3) Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.

(4) Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer. (5) Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.

3. Translate the following terms into English.

(1) 承兑交单acceptance against documents (2) 商业承兑汇票 trade acceptance

(3) 需要时的代理人case of need (4) 出口押汇export bill purchased

(5) 物权单据 title document (6) 以寄售方式on consignment

(7) 直接托收direct collection (8) 货运单据shipping documents

(9) 付款交单documents against payment (10) 远期汇票time/ tenor/term/ usance draft

4. Choose the best answer to each of the following statements

(1)-(5) ABCAB (6)-(10) ACAAD

Chapter Six

1. Define the following terms:

(1) Letter of credit 〖The Documentary Credit or letter of credit is an undertaking issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with. 〗

(2) Confirmed letter of credit 〖A credit that carries the commitment to pay by both the issuing bank and the advising bank. 〗

(3) Revolving credit 〖A credit by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. 〗(4) Confirming bank 〖A bank, usually the advising bank, which adds its undertaking to those of the issuing bank and assumes liability under the credit.〗

(5) Applicant of the credit〖The applicant is always an importer or a buyer, who fills out and signs an application form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.〗2. Translate the following terms or sentences into English.

(1) 未授权保兑〖silent confirmation 〗

(2) 有效地点为开证行所在地的柜台〖to expire at the counters of the issuing bank 〗

(3) 凭代表物权的单据付款〖to pay against documents representing the goods〗

(4) 信用证以银行信用代替了商业信用。〖A credit places a bank’s credit instead of commercial credit.〗

(5) 信用证独立于它所代表的商业合同。〖A credit stands independent of the sales contract.〗3. Decide whether the following statements are true or false.

(1) F (2) F(3) T (4) F (5) T

(6) F (7) F (8) T (9) F (10) F

(11) T (12) T (13) F (14) F (15) T

4. Choose the best answer to each of the following statements

(1)-(5) BCDBA(6)-(10) DDCCC

(11)-(15) DDADB (16)-(20) DDDAB

Chapter Seven

1. Fill in the blanks to complete each sentence.

(1) completeness, correctness, consistency

(2) underlying transaction

(3) authorized signatures, test key

(4) comply with

(5) ISO currency code

2. Translate the following terms or sentences into English.

(1) 信用证表面的真实性〖the apparent authenticity of the credit 〗

(2) 标准国际银行惯例〖international standard banking practice〗

(3) 信息交换系统〖data communication network 〗

(4) 有足够的资金来支付信用证〖to have sufficient funds to cover the credit〗

(5) 买方考虑自己的要求也同样的重要〖It is equally important that the buyer’s own requirements be taken into account.〗

3. Decide whether the following statements are true or false.

(1) F (2) F(3) F (4) T (5) T

(6) T (7) F (8) T (9) F (10) T

4. Choose the best answer to each of the following statements

(1)-(5) CDCBC (6)-(10) CAADD

(11)-(15) ADDAB

Chapter Eight

1. Define the following terms:

(1) Commercial invoice 〖The commercial invoice is the key accounting document describing the commercial transaction between the buyer and the seller. It is a document giving details of goods, service, price, quantity, settlement terms and shipment. 〗

(2) Export license 〖An export license is a document prepared by a government authority of a nation granting the right to export a specific quantity of a commodity to a specified country. 〗(3) Bill of lading 〖A bill of lading is a document issued by a carrier to a shipper, signed by the captain, agent, or owner of a vessel, providing written evidence regarding receipt of the goods, the conditions on which transportation is made, and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading. 〗

(4) Inspection certificate 〖A document issued by an authority indicating that goods have been inspected prior to shipment and the results of the inspection. 〗

(5) Consular invoice 〖A consular invoice is an invoice covering a shipment of goods certified in the country of export by a local consul of the country for which the merchandise is destined. 〗II. Translate the following into English:

(1) 战略产品〖strategic commodity〗

(2) 普惠制〖General System of Preference〗

(3) 有预订的泊位〖with reserved berth〗

(4) 多式联运提单〖multi-modal transport bill of lading〗

(5) 抽样方式〖sampling methodology〗

3. Decide whether the following statements are true or false.

(1) F (2) F(3) T (4) T (5) F

(6) F (7) F (8) T (9) T (10) F

4. Choose the best answer to each of the following statements

(1)-(5) ABDAC (6)-(10) CCCDA

(11)-(15) DDAAA(16)-(20) ABACD

Chapter Nine

1. Fill in the blanks to complete each sentence.

(1) acceptable accounts receivable / non-recourse and notification

(2) collection as well as the risk of credit losses

(3) the level of sales

(4) changes in the world economic structure

(5) growing demands

(6) purchasing the client’s accounts receivables

(7) financial and administration

(8) the invoice date / the customer makes his payment

(9) market conditions and his assessment of the risks involved in a particular transaction

(10) fluctuations in the exchange rate / in the status of the debtor

2. Define the following terms

(1) Factoring is a form of trade financing that allows sellers to sell their products to overseas buyers essentially on an open account basis. In simple terms, factoring is the purchase of claims, arising from sales of goods, by a specialized company known as factoring company or factor. Factoring is in fact a three-party transaction between the factor and a business entity, i.e. the exporter selling goods or providing services to foreign the importer.

(2) Forfaiting is the term generally used to denote the purchase of obligations falling due at some future date, arising from deliveries of goods and services--mostly export transactions--without recourse to any previous holder of the obligation. Simply speaking, forfaiting is the business of discounting medium-term promissory notes or drafts related to an international trade transaction.

3. Translate the following terms into English.

(1)或有负债contingent liability (2)信用额度credit limit

(3)卖方信贷supplier credit (4)无追索权的without recourse

(5)信用审定credit approval (6)资本货物capital goods

(7)买方信贷担保buyer credit guarantee (8)福费廷融资便利forfaiting facility (9)贸易壁垒trade barrier (10)大宗采购折扣bulk purchase discount 4. Choose the best answer to each of the following statements

(1) B (2)A(3) D (4) C (5) D

Chapter 10

1. Fill in the blanks to complete each sentence.

(1) secure mechanism for payment / default instrument

(2) party tendering / the contract has been awarded

(3) presentation of the beneficiary’s demand and stipulated documentation

(4) issue a guarantee directly to the beneficiary

(5) Unconditional bonds

(6) withdraw its bid / accept the award of contract in its favor / between 2% and 5%

(7) UCP for documentary credits / Uniform Rules for Demand Guarantee.

(8) An advance payment

(9) borrower (the principal) / the lender (the beneficiary)

(10) counter indemnity

2. Define the following terms

(1) A bank guarantee is an instrument for securing performance or payment especially in international business. It is a written promise issued by a bank at the request of its customer, undertaking to make payment to the beneficiary within the limits of a stated sum of money in the event of default by the principal. It may also be defined as an independent obligation where the guarantor has to make a special agreement with its customer, ensuring that it will be refunded by him for any payment to be effected under the contract of guarantee.

(2) A beneficiary is the party in whose favor the guarantee is issued. He is secured against the risk of the principal’s not fulfilling his obligations towards the beneficiary in respect of the underlying transaction for which the demand guarantee is given. He will not obtain a sum of money if the obligations are not fulfilled.

(3) An indirect guarantee is a guarantee where a second bank, usually a foreign bank located in the beneficiary’s country of domicile, will be requested by the initiating bank to issue a guarantee in return for the latter’s counter-guarantee.

(4) A performance bond is an undertaking given by the guarantor at the request of a supplier of goods or services or a contractor to a buyer or beneficiary, whereby the guarantor undertakes to make payment to the beneficiary within the limit of a stated sum of money in the event of default by the supplier or the contractor in due performance of the terms of a contract between the principal and the beneficiary.

(5) A standby letter of credit is a clean letter of credit that generally guarantees the payment to be made for an unfulfilled obligation on the part of the applicant. It is payable on presentation of a draft together with a signed statement or certificate by the beneficiary that the applicant has failed to fulfill his obligation.

3. Translate the following terms into English.

(1)履约保函performance bond (2)担保书,保函letter of guarantee

(3)反赔偿counter indemnity (4)附属保函accessory guarantee

(5)备用信用证stand-by letter of credit (6)工程承包engineering contracting

(7)基础交易underlying transaction (8)见索即付保函demand guarantee

(9)延期付款保函deferred payment bond (10)反担保counter guarantee

4. Choose the best answer to each of the following statements

(1)-(5) BAADC (6)-(10) BCDBA

Chapter 11

1. Fill in the blanks to complete each sentence.

(1) collection operations for drafts and for documentary collections

(2) all collections / collection instruction

(3) all Documentary Credits / Credit

(4) all Bank-to-Bank Reimbursements / Reimbursement Authorization.

(5) any demand guarantee and amendment thereto / Guarantee or any amendment thereto.

(6) documents / goods / terms and conditions

(7) codification of rules / banking practice regarding documentary credits

(8) international finance, trade, transportation and computer technology

(9) quite different from the practice of guarantee / banking and commercial

(10) bank-to-bank reimbursements

2. Translate the following terms into English.

(1)索偿reimbursement claim

(2)仲裁书arbitral award

(3)银行委员会banking commission

(4)多式联运multi-model transport

(5)偿付保证reimbursement undertaking

(6)银行惯例banking practices

(7)集装箱运输containerized traffic

(8)非转让运输单据non-negotiable waybill

(9)远期托收提示tenor collection presentation

(10)国际商会International Chamber of Commerce

4. Choose the best answer to each of the following statements.

(1) B (2) D (3) C (4) A(5) D

Chapter 12

1. Fill in the blanks to complete each sentence.

(1) payment information / transfer value

(2) confirmation number / confirmation help and notification

(3) for procedures and message formats / computer readable

(4) information / value / net amount

(5) high speed and accuracy

(6) access to the system for the settlement of international money transfers

(7) faster, more reliable communication / lower transmission costs

(8) the international clearing house

(9) standardized formats

(10) Clearing House Automated Payment System / CHIPS

2. Define the following terms

(1) A payment system is the means whereby cash value is transferred between a payer’s bank account and a payee’s bank account.

(2) SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) is a computerized international telecommunications system which, through standardized formatted messages, rapidly processes and transmits financial transactions and information among its members around the world.

(3) CHIPS (Clearing House Inter-bank Payment System) is a pseudo-wire system in New Y ork City that handles an enormous volume of cash flow between local financial institutions. CHIPS is a settlement system involving primarily about 135 New Y ork City financial institutions and is operated by the New Y ork Clearing House Association.

(4) Clearing House Automated Payments System (CHAPS) is a system of sending and clearing payments on a same-day basis that is available nationwide in Britain and is operated by a number of settlement banks that communicate directly through computers.

(5) Fed Wire is a fund-transfer system operated nationwide in the USA by the Federal Reserve System (the Fed, Central Bank of the USA) that handles transfer from one financial institution to another with an account balance held with the Fed.

3. Translate the following terms into English.

(1) 现金头cash positions

(2) 簿记入账bookkeeping entry

(3) 金融中介financial intermediary

(4) 客户汇款customer transfers

(5) 账目核对account reconciliation

(6) 联储银行支付系统Fed Wire

(7) 非结算银行non-settlement bank

(8) 资金调拨系统fund transfer system

(9) 次支付体系secondary payment system

(10) 储备余额账户reserve balance account

(11) 自动票据交换所automated clearing house

(12) 银行头寸调拨financial institution transfers

(13) 非盈利性合作协会non-profit cooperative society

(14) 外汇买卖和存放款foreign exchange deal and loan

(15) 票据交换所银行同业清算系统Clearing House Inter-bank Payments System

4. Decide whether the following statements are true or false.

(1) T (2) T (3) F (4) T (5) F

5. Choose the best answer to each of the following statements.

(1) B (2)A(3)D (4) B (5) C

Chapter 13

1. Fill in the blanks to complete each sentence.

(1) purchaser or the holder / replaced

(2) clerk or the teller / a small commission

(3) the initial signature / the countersignature

(4) banking instruments / retailing

(5) (assigned) merchant

(6) annual income and the credit standing

(7) issuance, application and clearing

(8) consumer’s credit / current account

(9) separate listing of their cheque numbers

(10) paying the bill in full / drawing revolving credit

2. Define the following terms

(1) A traveler’s cheque is a specially printed form of cheque issued by a financial inst itution, leading hotels, and other agencies in preprinted denominations for a fixed amount to a customer for use when he is going to travel abroad. A traveler’s cheque is actually a draft of a bank or other agency, which is self-identifying and may be cashed at banks, hotels, etc., either throughout the world or in particular areas only.

(2) A paying agent is one that undertakes by arrangement with the issuer to pay the latter’s traveler’s cheques when presented by the holder.

(3) Credit cards are instruments issued by banks to carefully selected customers with a line of credit ranging from several hundred to several thousand dollars based on the latter’s financial status for use in obtaining, on credit, consumer goods, services and other things when necessary.

(4) A cardholder is the customer who has a current account with the card-issuing bank and whose credit is good, and who based on his financial status can obtain, on credit, consumer goods, services and other things when necessary.

(5) A merchant is a store, hotel or restaurant that is bound to have a pre-arrangement with the card-issuing bank and is willing to accept the credit card for payment of commodities sold or services rendered

3. Translate the following terms into English.

(1) 初签initial signature

(2) 入会费entrance fee

(3) 销售代理selling agent

(4) 商户assigned merchant

(5) 旅行支票traveler’s cheque

(6) 购货收据purchase receipt

(7) 往来账户current account

(8) 签购单,购物单sales slip

(9) 兑付代理人paying agent

(10) 会员费membership dues/fee

(11) 消费者信贷consumer’s credit

(12) 签字印鉴authorized signature

(13) 美国运通卡American Express Card

(14) 非贸易结算non-trade settlement

(15) 零售银行业务retailing banking business

4. Decide whether the following statements are true or false.

(1) T (2)F (3)T (4) T (5)F

5. Choose the best answer to each of the following statements.

(1) B (2) D (3) A(4) C (5) B

Chapter 14

1. Fill in the blanks to complete each sentence.

(1) medium of high-speed digital transactions

(2) business-to-business commerce / its breadth of coverage and ease of use

(3) Putting up a Web site / luring online shoppers in

(4) “e-cash”, “cyber-money”

(5) stored-value products and access products (such as a bank A TM card)

(6) transfer of financial value

(7) advertising purposes

(8) phone orders and credit card orders

(9) digital signatures

(10) debit card account.

2. Define the following terms

(1) Electronic commerce is the ability to purchase goods and services electronically over the Internet from around the world at any time of day or night.

(2) Cyber-payment means the methods that have been implemented to transfer money, new methods of financial transactions as today banks already can transfer money with computers. (3) SET is a single technical standard for safeguarding credit (and in the near future debit) card purchases made over the open networks of the Internet. It is an international protoc ol that details how credit card (and debit card) transactions on the Internet will be secured using encryption technology and digital certification.

(4) A digital signature is a way to encrypt a message so that the recipient can decode it and be certain of the authenticity of the transaction.

(5) Smart cards are micro- processor-equipped cards that work with card readers installed in the computers of consumers.

3. Translate the following terms into English.

(1) 电子支付cyber-payment

(2) 电子现金e-cash

(3) 信用额度line of credit

(4) 数字化货币digital currency

(5) 电子钱包electronic wallet

(6) 自动出纳机automated teller machine

(7) 商务的全球化globalization of commerce

(8) 个人身份识别号personal identification number

(9) 微芯片埋置式灵通卡microchip-embedded smart card

(10) 电子交易安全标准Secured Electronic Transactions Standards

(11) 电子商务electronic commerce

(12) 加密的磁条encoded magnetic stripe

(13) 存取设备access device

(14) 借记卡debit card

(15) 虚拟指纹virtual fingerprint

4. Decide whether the following statements are true or false.

(1) F (2) T (3) T (4) F (5)T

(6) T (7) T (8) F (9) F (10) F

5. Choose the best answer to each of the following statements.

(1) A(2) B (3) C (4) D (5) D (6) C (7) B (8) A(9) D (10) B

测量平差复习题及答案

测量平差复习题及答案 一、综合题 1.已知两段距离的长度及中误差分别为cm m 5.4465.300±及cm m 5.4894.660±,试说明这两段距离的真误差是否相等?他们的精度是否相等? 答:它们的真误差不一定相等;相对精度不相等,后者高于前者。 2.已知观测值向量 ???? ??=2121 L L L 的权阵为? ??? ????=32313132 LL P ,现有函数21L L X +=, 13L Y =,求观测值的权 1 L P , 2 L P ,观测值的协因数阵XY Q 。 答:12/3L P =;22/3L P =;3XY Q = 3.在下图所示三角网中,A .B 为已知点,41~P P 为待定点,已知32P P 边的边长和方位角 分别为 S 和 0α, 今测得角度1421,,,L L L 和边长21,S S ,若按条件平差法对该网进行平差: (1)共有多少个条件方程?各类条件方程各有多少个? (2)试列出除图形条件和方位角条件外的其它条件方程(非线性条件方程不要求线性化) 答:(1)14216,6,10n t r =+=== ,所以图形条件:4个;极条件:2个;边长条件:2个;基线条件:1个;方位角条件:1个 (2)四边形14ABPP 的极条件(以1P 为极) : 34131 241314????sin()sin sin 1????sin sin sin() L L L L L L L L +??=+ 四边形1234PP P P 的极条件(以4P 为极) : 101168 91167????sin()sin sin 1????sin sin sin() L L L L L L L L +??=+

平狄克微观经济学课后习题答案-第7-8章

第七章 复习题 1.显性成本 2.她自己做其他事时会得到的最高收入 3.多用资本,少用工人 4.完全竞争价格给定,即斜率不变 5.不意味 6.意味着递增 7.AVC 第七章附录 练习题 1、我们考查规模报酬时可由F(aK,aL)与aF(K,L)之间的关系判断 当F(aK,aL)>aF(K,L),表明是规模报酬递增; 当F(aK,aL)=aF(K,L),表明是规模报酬不变; 当F(aK,aL) ones表示1矩阵 zeros表示0矩阵 ones(4)表示4x4的1矩阵 zeros(4)表示4x4的0矩阵 zeros(4,5)表示4x5的矩阵 eye(10,10)表示10x10的单位矩阵 rand(4,5)表示4x5的伴随矩阵 det(a)表示计算a的行列式 inv(a)表示计算a的逆矩阵 Jordan(a)表示求a矩阵的约当标准块rank(a)表示求矩阵a的秩 [v,d]=eig(a)对角矩阵 b=a’表示求a矩阵的转置矩阵 sqrt表示求平方根 exp表示自然指数函数 log自然对数函数 abs绝对值 第一章 一、5(1) b=[97 67 34 10;-78 75 65 5;32 5 -23 -59]; >> c=[97 67;-78 75;32 5;0 -12]; >> d=[65 5;-23 -59;54 7]; >> e=b*c e = 5271 11574 -11336 664 1978 3112 (2)a=50:1:100 二、1 、x=-74; y=-27; z=(sin(x.^2+y.^2))/(sqrt(tan(abs(x+y)) )+pi) z = -0.0901 2、a=-3.0:0.1:3.0; >> b=exp(-0.3*a).*sin(a+0.3) 3、x=[2 4;-0.45 5]; y=log(x+sqrt(1+x.^2))/2 y = 0.7218 1.0474 -0.2180 1.1562 4、a*b表示a矩阵和b矩阵相乘 a.*b表示a矩阵和b矩阵单个元素相乘A(m,n)表示取a矩阵第m行,第n列 A(m,:)表示取a矩阵第m行的全部元素A(:,n)表示取a矩阵的第n列全部元素 A./B表示a矩阵除以b矩阵的对应元素, B.\A等价于A./B A.^B表示两个矩阵对应元素进行乘方运算 A.^2表示a中的每个元素的平方 A^2表示A*A 例:x=[1,2,3]; y=[4,5,6]; z=x.^y z= 1 3 2 729 指数可以是标量(如y=2).底数也可以是标量(如x=2) 5、a=1+2i; >> b=3+4i; >> c=exp((pi*i)/6) c = 0.8660 + 0.5000i d=c+a*b/(a+b) d = 1.6353 + 1.8462i 第二章 二、4、(1) y=0;k=0; >> while y<3 k=k+1; y=y+1/(2*k-1); end >> display([k-1,y-1/(2*k-1)]) ans = 计算题 1、如图,图中已知A 、B 两点坐标,C 、D 、E 为待定点,观测了所有内角,试用条件平差的方法列出全部条件方程并线性化。 解:观测值个数 n =12,待定点个数t =3,多余观测个数r =n -2t =6 ① 图形条件4个: )180(0 )180(0 )180(0 )180(0 121110121110987987654654321321-++-==-++-++-==-++-++-==-++-++-==-++L L L w w v v v L L L w w v v v L L L w w v v v L L L w w v v v d d c c b b a a ② 圆周条件1个: )360(0963963-++-==-++L L L w w v v v e e ③ 极条件1个: ρ''--==----++)sin sin sin sin sin sin 1(0 cot cot cot cot cot cot 8 52741774411885522L L L L L L w w v L v L v L v L v L v L f f 3、如图所示水准网,A 、B 、C 三点为已知高程点, D 、E 为未知点,各观测高差及路线长度如下表所列。 用间接平差法计算未知点D 、E 的高程平差值及其中误差; C 3、解:1)本题n=6,t=2,r=n-t=4; 选D 、E 平差值高程为未知参数2 1??X X 、 则平差值方程为: 1 615142322211?????????????X H h H X h H X h H X h H X h X X h A A B A B -=-=-=-=-=-= 则改正数方程式为: 6165154143232221211???????l x v l x v l x v l x v l x v l x x v --=-=-=-=-=--= 取参数近似值 255.24907.2220221011=+==++=h H X h h H X B B 、 2014年分析化学课后作业参考答案 P25: 1.指出在下列情况下,各会引起哪种误差?如果是系统误差,应该采用什么方法减免? (1) 砝码被腐蚀; (2) 天平的两臂不等长; (3) 容量瓶和移液管不配套; (4) 试剂中含有微量的被测组分; (5) 天平的零点有微小变动; (6) 读取滴定体积时最后一位数字估计不准; (7) 滴定时不慎从锥形瓶中溅出一滴溶液; (8) 标定HCl 溶液用的NaOH 标准溶液中吸收了CO 2。 答:(1)系统误差中的仪器误差。减免的方法:校准仪器或更换仪器。 (2)系统误差中的仪器误差。减免的方法:校准仪器或更换仪器。 (3)系统误差中的仪器误差。减免的方法:校准仪器或更换仪器。 (4)系统误差中的试剂误差。减免的方法:做空白实验。 (5)随机误差。减免的方法:多读几次取平均值。 (6)随机误差。减免的方法:多读几次取平均值。 (7)过失误差。 (8)系统误差中的试剂误差。减免的方法:做空白实验。 3.滴定管的读数误差为±0.02mL 。如果滴定中用去标准溶液的体积分别为2mL 和20mL 左右,读数的相对误差各是多少?从相对误差的大小说明了什么问题? 解:因滴定管的读数误差为mL 02.0±,故读数的绝对误差mL a 02.0±=E 根据%100?T E = E a r 可得 %1%100202.02±=?±= E mL mL mL r %1.0%1002002.020±=?±=E mL mL mL r 这说明,量取两溶液的绝对误差相等,但他们的相对误差并不相同。也就是说,当被测定的量较大时,测量的相对误差较小,测定的准确程度也就较高。 4.下列数据各包括了几位有效数字? (1)0.0330 (2) 10.030 (3) 0.01020 (4) 8.7×10-5 (5) pKa=4.74 (6) pH=10.00 答:(1)三位有效数字 (2)五位有效数字 (3)四位有效数字 (4) 两位有效数字 (5) 两位有效数字 (6)两位有效数字 9.标定浓度约为0.1mol ·L -1 的NaOH ,欲消耗NaOH 溶液20mL 左右,应称取基准物质H 2C 2O 4·2H 2O 多少克?其称量的相对误差能否达到0. 1%?若不能,可以用什么方法予以改善?若改用邻苯二甲酸氢钾为基准物,结果又如何? 解:根据方程2NaOH+H 2C 2O 4·H 2O==Na 2C 2O 4+3H 2O 可知, 需H 2C 2O 4·H 2O 的质量m 1为: 《误差理论与测量平差基础》课程试卷A 2010-06-27 11:30:49 来源:《误差理论与测量平差基础》课程网站浏览:4次 武汉大学测绘学院 2007-2008学年度第二学期期末考试 《误差理论与测量平差基础》课程试卷A 出题者课程小组审核人 班级学号姓名成绩 一、填空题(本题共20个空格,每个空格1.5分,共30分) 1、引起观测误差的主要原因有(1)、(2)、(3)三个方面的因素,我们称这些因素为(4)。 2、根据对观测结果的影响性质,观测误差分为(5)、(6)、(7)三类,观测误差通过由于(8)引起的闭合差反映出来。 3、观测值的精度是指观测误差分布的(9)。若已知正态分布的观测误差落在区间的概率为95.5%,则误差的方差为(10),中误差为(11)。 4、观测值的权的定义式为(12)。若两条水准路线的长度为、,对应的权为2、1,则单位权观测高差为(13)。 5、某平差问题的必要观测数为,多余观测数为,独立的参数个数为。若,则平差的函数模型为(14)。若(15),则平差的函数模型为附有参数的条件平差。 6、观测值的权阵为,的方差为3,则的方差为(16)、 的权为(17)。 7、某点的方差阵为,则的点位方差为(18)、误差曲线的最大值为(19)、误差椭圆的短半轴的方位角为(20)。 二、简答题(本题共2小题,每题5分,共10分) 1、简述观测值的精度与精确度含义及指标。 在什么情况下二者相同? 2、如图1所示,A、B、C、D为已知点,由A、C分别观测位于直线AC上的点。观测边长、及角度、。问此问题的多余观测数等于几?若采用条件平差法计算,试列出条件方程式(非线性方程不必线性化)。 图1 三、(10分)其它条件如上题(简答题中第2小题)。设方位角,观测边长,中误差均为,角度、的观测中误差为 。求平差后点横坐标的方差(取)。 四、(10分)采用间接平差法对某水准网进行平差,得到误差方程及权阵(取 ) (1)试画出该水准网的图形。 (2)若已知误差方程常数项,求每公里观测 平狄克第八版课后答案 【篇一:平狄克微观经济学课后习题答案-第7-8章】> 1.显性成本 2.她自己做其他事时会得到的最高收入 3.多用资本,少用工人 4.完全竞争价格给定,即斜率不变 5.不意味 6.意味着递增 7.avcac mc递增mc=avc最低点 mc=ac最低点 8.l形 9.长期扩展线为把等产量线簇上斜率相同点连起来,此时它改变了斜率 10.规模经济基础是内在经济,针对一种产品 范围经济基础是同时生产高度相关的产品. 练习题 1.avc=1000 ac=1000+1000/q 非常大,最后为1000 2.不对,除非工人只可以在这里找到工作 3.见书后 4.见书后 5.见书后 6.每个均衡点斜率更小 7不同意,应按不同时段定价,如不可,则同意 8.见书后 9.tc=120000+3000(q/40)+2000 ac=75+122000/q mc=75 ac随q减小 2个劳动组,1600元 1/4, 更大的生产能力 11.190万元 53元 53元 19元 第七章附录 练习题 1、我们考查规模报酬时可由f(ak,al)与af(k,l)之间的关系 判断 当f(ak,al)af(k,l),表明是规模报酬递增; 当f(ak,al)=af(k,l),表明是规模报酬不变; 当f(ak,al)af(k,l),表明是规模报酬递减; (a)规模报酬递增;(b)规模报酬不变;(c)规模报酬递增。 2、根据已知条件,资本价格r=30,设劳动价格为w,则成本函数 c=30k+ wl 联立(1) ,(2), (3)可得k=(w/3) 1/2 ,l=(300/w) 1/2 , 此时成本最小,代入成本函数c=30k+ wl,得c=2(300w)1/2 联立(1) ,(2), (3)可得k/l=3/4 , 此时成本最小,即生产既定产出的成本最小化的资本和劳动的组合 为资本/劳动=3/4。 4、(a)已知q=10k0.8(l-40)0.2 , 得 mpl=2(k/ (l-40))0.8 , mpk=8( (l-40) / k)0.2 , 在最小成本点有: mpl/ mpk=w/r 即2(k/ (l-40))0.8/8( (l-40) / k)0.2=w/r, k/(l-40)=4 w/r ,l- 40=kr/4w, 0.80.20.2q=10k(l-40)=10 k(r/4w), 最小需求为:k=q/10(r/4w)0.2,l=40+ q (r/4w)0.8/10 总成本函数为:tc=10q+kr+lw=10q+ q/10((4w)0.2r0.8+(r/4)0.8w0.2)+40w (b)当r=64,w=32时tc=10q+ (2*20.2+0.50.8)32 q/10+1280 tc=1280+10q+91.84 q/10=1280+19.184q 该技术呈现规模递减。 (c)当q=2000时,l=40+ q (r/4w)0.8/10≈155,即需要劳动力为:155/40=3.875 0.2k= q/10(r/4w)≈230,即需要机器为:230/40=5.75 产出边际成本为:19.184美元/件;平均成本为:(1280+19.184q)/q=19.824 美元/件。 22 第八章 复习题 1.厂商关闭的条件是pac,但当avcpac,厂商虽亏损,但不仅能 弥补全部的可变成本,尚可弥补部分的固定成本。 第一章质点运动学 1、(习题1.1):一质点在xOy 平面内运动,运动函数为2 x =2t,y =4t 8-。(1)求质点的轨道方程;(2)求t =1 s t =2 s 和时质点的位置、速度和加速度。 解:(1)由x=2t 得, y=4t 2-8 可得: y=x 2 -8 即轨道曲线 (2)质点的位置 : 2 2(48)r ti t j =+- 由d /d v r t =则速度: 28v i tj =+ 由d /d a v t =则加速度: 8a j = 则当t=1s 时,有 24,28,8r i j v i j a j =-=+= 当t=2s 时,有 48,216,8r i j v i j a j =+=+= 2、(习题1.2): 质点沿x 在轴正向运动,加速度kv a -=,k 为常数.设从原点出发时速 度为0v ,求运动方程)(t x x =. 解: kv dt dv -= ??-=t v v kdt dv v 001 t k e v v -=0 t k e v dt dx -=0 dt e v dx t k t x -?? =0 00 )1(0 t k e k v x --= 3、一质点沿x 轴运动,其加速度为a = 4t (SI),已知t = 0时,质点位于x 0=10 m 处,初速度v 0 = 0.试求其位置和时间的关系式. 解: =a d v /d t 4=t d v 4=t d t ? ?=v v 0 d 4d t t t v 2=t 2 v d =x /d t 2=t 2 t t x t x x d 2d 0 20 ?? = x 2= t 3 /3+10 (SI) 4、一质量为m 的小球在高度h 处以初速度0v 水平抛出,求: (1)小球的运动方程; (2)小球在落地之前的轨迹方程; (3)落地前瞬时小球的 d d r t ,d d v t ,t v d d . 解:(1) t v x 0= 式(1) 2gt 21h y -= 式(2) 201 ()(h -)2 r t v t i gt j =+ (2)联立式(1)、式(2)得 2 2 v 2gx h y -= (3) 0d -gt d r v i j t = 而落地所用时间 g h 2t = 所以 0d -2g h d r v i j t = d d v g j t =- 2 202y 2x )gt (v v v v -+=+= 21 20 212202)2(2])([gh v gh g gt v t g dt dv +=+= CXXXCCZ 中国矿业大学2008~2009学年第 二 学期 《 误差理论与测量平差 》试卷(B )卷DDDDDEF2WT AW34CQ2 考试时间:100 分钟 考试方式:闭 卷 一、填空题 (共20分,每空 2 分) 1、如下图,其中A 、B 、C 为已知点,观测了5个角,若设L 1、L 5观测值的平 差值为未知参数2 1??X X 、,按附有限制条件的条件平差法进行平差时,必要观测个数为 ,多余观测个数为 ,一般条件方程个数为 ,限制条件方程个数为 A B C D E L 1L 2L 3 L 4 L 5 2、测量是所称的观测条件包括 、观测者、 3、已知某段距离进行了同精度的往返测量(L 1、L 2),其中误差cm 221==σσ,往返测的平均值的中误差为 ,若单位权中误差cm 40=σ,往返测的平均值的权为 4、已知某观测值X 、Y 的协因数阵如下,其极大值方向为 ,若单位权中误差为±2mm ,极小值F 为 mm 。 ??? ? ??--=0.15.05.00.2XX Q 二、已知某观测值X 、Y 的协因数阵如下,求X 、Y 的相关系数ρ。(10分) ??? ? ??--=25.015.015.036.0XX Q 三、设有一函数2535+=x T ,6712+=y F 其中: ? ? ?+++=+++=n n n n L L L y L L L x βββααα 22112211 αi =A 、βi =B (i =1,2,…,n )是无误差的常数,L i 的权为p i =1,p ij =0(i ≠ j )。(15分) 1)求函数T 、F 的权; 2)求协因数阵TF Ty Q Q 、。 四、如图所示水准网,A 、B 、C 三点为已知高程点, D 、E 为未知点,各观测高差及路线长度如下表所列。(20分) 用间接平差法计算未知点D 、E 的高程平差值及其中误差; C 《 误差理论与测量平差 》试卷(D )卷 考试时间:100 分钟 考试方式:闭 卷 一、填空题 (共20分,每空 2 分) 1、观测误差产生的原因为:仪器、 、 2、已知一水准网如下图,其中A 、B 为已知点,观测了8段高差,若设E 点高程 的平差值与B 、E 之间高差的平差值为未知参数2 1??X X 、,按附有限制条件的条件平差法(概括平差法)进行平差时,必要观测个数为 ,多余观测个数为 ,一般条件方程个数为 ,限制条件方程个数为 C B 3、取一长度为d 的直线之丈量结果的权为1,则长度为D 的直线之丈量结果的权为 ,若长度为D 的直线丈量了n 次,则其算术平均值的权为 。 4、已知某点(X 、Y)的协方差阵如下,其相关系数ρXY = ,其点位方差为2 σ= mm 2 ??? ? ??=00.130.030.025.0XX D 二、设对某量分别进行等精度了n 、m 次独立观测,分别得到观测值 ),2,1(,n i L i =,),2,1(,m i L i =,权为p p i =,试求: 1)n 次观测的加权平均值] [] [p pL x n = 的权n p 2)m 次观测的加权平均值] [] [p pL x m = 的权m p 3)加权平均值m n m m n n p p x p x p x ++=的权x p (15分) 三、 已知某平面控制网中待定点坐标平差参数y x ??、的协因数为 ??? ? ??=2115.1??X X Q 其单位为()2 s dm ,并求得2?0''±=σ ,试用两种方法求E 、F 。(15分) 四、得到如下图所示,已知A 、B 点,等精度观测8个角值为: 第5章 不确定性与消费者行为 一、单项选择题 1.下列函数中,( )是可能来自一个风险偏好者的效用函数。 A.x1/2 B.lnx C.x2 D.ax 【答案】C 【解析】风险偏好者的预期效用函数是一个凸函数,即d2U/dx2>0,只有C项符合这一特点。 2.假定某投资者面对两个投资项目A和B。项目A报酬为(x0+h)的概率为1/2,报酬为(x0-h)的概率为1/2,h∈[0,x0]。项目B的报酬固定为x0。该投资者选择了项目B。那么,该投资者为( )。 A.风险厌恶者 B.风险偏好者 C.风险中性 D.不确定 【答案】A 【解析】由题意可知,(x0+h)/2+(x0-h)/2=x0,即投资者投资项目A的期望值等于无风险条件下可以持有的固定报酬。投资者在这种前提下选择了项目B,表明他认 为无风险条件下持有固定财富的效用大于项目A的期望效用,因此是风险厌恶者。 3.假设你去买一张彩票,而且你知道将以0.1的概率得到2500元,0.9的概率得到100元。假设你的效用函数为U(w)=w1/2,那么你从所购买的彩票中得到的期望效用为( )。 A.360 B.14 C.46 D.1300 【答案】B 【解析】期望效用的计算公式为 U(g)=π1U(w1)+π2U(w2) 其中,π1,π2为两种自然状态w1,w2发生的概率。将U(w)=w1/2以及 π1=0.1,w1=2500,π2=0.9,w2=100代入期望效用计算公式,可得期望效用为14。 4.假设一个消费者的效用函数为U(w)=w2,那么该消费者是( )。 A.风险规避的 B.风险中性的 C.风险偏好的 D.都不是 【答案】C 【解析】消费者的效用函数为U(w)=w2,边际效用为MU(w)=2w,边际效用 平狄克《微观经济学》(第8版)笔记和课后习题详解完整版>精研学习?>无偿试用20%资料 全国547所院校视频及题库全收集 考研全套>视频资料>课后答案>往年真题>职称考试 第1篇导论:市场和价格 第1章绪论 1.1复习笔记 1.2课后复习题详解 1.3课后练习题详解 第2章供给和需求的基本原理 2.1复习笔记 2.2课后复习题详解 2.3课后练习题详解 第2篇生产者、消费者与竞争性市场 第3章消费者行为 3.1复习笔记 3.2课后复习题详解 3.3课后练习题详解 第4章个人需求和市场需求 4.1复习笔记 4.2课后复习题详解 4.3课后练习题详解 第4章附录需求理论——一种数学的处理方法 第5章不确定性与消费者行为 5.1复习笔记 5.2课后复习题详解 5.3课后练习题详解 第6章生产 6.1复习笔记 6.2课后复习题详解 6.3课后练习题详解 第7章生产成本 7.1复习笔记 7.2课后复习题详解 7.3课后练习题详解 第7章附录生产与成本理论——一种数学的处理方法 第8章利润最大化与竞争性供给 8.1复习笔记 8.3课后练习题详解 第9章竞争性市场分析 9.1复习笔记 9.2课后复习题详解 9.3课后练习题详解 第3篇市场结构与竞争策略 第10章市场势力:垄断和买方垄断 10.1复习笔记 10.2课后复习题详解 10.3课后练习题详解 第11章有市场势力的定价 11.1复习笔记 11.2课后复习题详解 11.3课后练习题详解 第11章附录纵向联合厂商 第12章垄断竞争和寡头垄断 12.1复习笔记 12.2课后复习题详解 12.3课后练习题详解 第13章博弈论与竞争策略 13.1复习笔记 13.2课后复习题详解 13.3课后练习题详解 第14章投入要素市场 14.1复习笔记 14.2课后复习题详解 14.3课后练习题详解 第15章投资、时间与资本市场 15.1复习笔记 15.2课后复习题详解 15.3课后练习题详解 第4篇信息、市场失灵与政府的角色第16章一般均衡与经济效率 16.1复习笔记 16.2课后复习题详解 16.3课后练习题详解 第17章信息不对称的市场 17.1复习笔记 17.2课后复习题详解 17.3课后练习题详解 第18章外部性和公共物品 18.1复习笔记 18.2课后复习题详解 5-10 某线性调制系统的输出信噪比为20dB ,输出噪声功率为9 10W ,由发射机输出端到解调器输 入端之间总的传输损耗为100dB ,试求: (1)DSB/SC 时的发射机输出功率; (2)SSB/SC 时的发射机输出功率。 解:设发射机输出功率为S T ,解调器输入信号功率为Si,则传输损耗K= S T /Si=100(dB). (1)DSB/SC 的制度增益G=2,解调器输入信噪比 相干解调时:Ni=4No 因此,解调器输入端的信号功率: 发射机输出功率: (2)SSB/SC 制度增益G=1,则 解调器输入端的信号功率 发射机输出功率: 6-1设二进制符号序列为 1 1 0 0 1 0 0 0 1 1 1 0,试以矩形脉冲为例,分别画出相应的单极性码波形、双极性码波形、单极性归零码波形、双极性归零码波形、二进制差分码波形及八电平码波形。 解:各波形如下图所示: 6-8已知信息代码为1 0 1 0 0 0 0 0 1 1 0 0 0 0 1 1,求相应的AMI码及HDB3码,并分别画出它们的波形图。 解: 6-11设基带传输系统的发送滤波器、信道及接收滤波器组成总特性为H(ω),若要求以2/Ts 波特的速 率进行数据传输,试检验图P5-7各种H(ω)是否满足消除抽样点上码间干扰的条件? (a ) (c ) (d ) 解:无码间干扰的条件是: ??? ??? ?> ≤=???? ? ?+=∑s s i s s eq T T T T i H H π ωπ ωπωω02)( (a ) ??? ? ?? ?> =≤=s s T B T H π ωππ ωω021)( 则 s T B 21= ,无码间干扰传输的最大传码率为:s s B T T B R 212max <= = 故该H (ω)不满足消除抽样点上码间干扰的条件。 (b ) ??? ? ?? ?> =≤=s s T B T H π ωππ ωω0231)( 则 s T B 23= ,无码间干扰传输的最大传码率为:s s B T T B R 232max >= = 虽然传输速率小于奈奎斯特速率,但因为R Bmax 不是2/T s 的整数倍,所以仍然不能消除码间干扰。故该H (ω)不满足消除抽样点上码间干扰的条件。 (c ) 如下图所示,H (ω)的等效H eq (ω)为: 第16章一般均衡与经济效率 16.1课后复习题详解 1.为什么反馈效应能使一般均衡分析与局部均衡分析存在很大的不同? 答:可以通过一个例子来分析反馈效应能使一般均衡分析与局部均衡分析发生很大的差异的原因。考察录像带租赁和影剧院门票这两个竞争市场。这两个市场有紧密的联系,是因为录像机的普遍拥有使大多数顾客可以选择在家而不是去影剧院看电影。影响某一市场的价格政策变动也会影响另一个市场,而该市场的变化又会对第一个市场产生反馈效应。现在假定政府对购买每一张电影票征收1美元的税。这一税收的局部均衡效应就是使对电影的需求曲线向上提高1美元。电影税会影响录像市场是因为电影和录像是替代品。局部均衡分析会低估税收对电影票价格的影响。录像市场受到影响后,又通过反馈效应影响电影票价格,结果必然同时决定电影和录像两者的均衡价格和均衡数量。 2.解释埃奇沃思盒形图中的一点是如何同时代表两个消费者所拥有的商品配置的。 答:假定两种产品分别为X和Y,其既定数量为X′和Y′,两个消费者分别为A和B,如图16-1所示的埃奇沃思盒形图,盒子的水平长度表示整个经济中的第一种产品X的消费量X′,盒子的垂直长度表示第二种产品Y的数量Y′,O A表示第一个消费者A的原点,O B 表示第二个消费者B的原点,从O A水平向右测量消费者A对第一种商品X的消费量X A,垂直向上测量它对第二种商品Y的消费量Y A;从O B水平向左测量消费者B对第一种商品X 的消费量X B,垂直向下测量消费者B对第二种商品Y的消费量Y B。现在考虑盒中的任意一点D,对应于消费者A的消费量(X a,Y a)和消费者B的消费量(X b,Y b),这样,X a+X b 《误差理论与测量平差》课程自测题(1) 一、正误判断。正确“T”,错误“F”。(30分) 1.在测角中正倒镜观测是为了消除偶然误差()。 2.在水准测量中估读尾数不准确产生的误差是系统误差()。 3.如果随机变量X和Y服从联合正态分布,且X与Y的协方差为0,则X与Y相互独立()。4.观测值与最佳估值之差为真误差()。 5.系统误差可用平差的方法进行减弱或消除()。 6.权一定与中误差的平方成反比()。 7.间接平差与条件平差一定可以相互转换()。 8.在按比例画出的误差曲线上可直接量得相应边的边长中误差()。 9.对同一量的N次不等精度观测值的加权平均值与用条件平差所得的结果一定相同()。 10.无论是用间接平差还是条件平差,对于特定的平差问题法方程阶数一定等于必要观测数()。 11.对于特定的平面控制网,如果按条件平差法解算,则条件式的个数是一定的,形式是多样的()。 12.观测值L的协因数阵Q LL的主对角线元素Q ii不一定表示观测值L i的权()。13.当观测值个数大于必要观测数时,该模型可被唯一地确定()。 14.定权时σ0可任意给定,它仅起比例常数的作用()。 15.设有两个水平角的测角中误差相等,则角度值大的那个水平角相对精度高()。 二、用“相等”或“相同”或“不等”填空(8分)。 已知两段距离的长度及其中误差为300.158m±3.5cm; 600.686m±3.5cm。则: 1.这两段距离的中误差()。 2.这两段距离的误差的最大限差()。 3.它们的精度()。 4.它们的相对精度()。 三、选择填空。只选择一个正确答案(25分)。 1.取一长为d的直线之丈量结果的权为1,则长为D的直线之丈量结果的权P D=()。 第8章利润最大化和竞争性供给 8.1课后复习题详解 1.为什么一个发生亏损的厂商选择继续进行生产而不是关闭? 答:一个发生亏损的厂商选择继续进行生产而不是关闭的原因在于:此时的价格仍然大于平均可变成本,但小于平均成本。具体来讲: (1)厂商发生亏损是指总收益TR小于总成本TC,此时,如果总收益TR仍然大于可变成本VC,厂商继续生产将会弥补VC,并且可以弥补一部分的固定成本FC,弥补量是 ,从而使损失最小化,因此在短期内,厂商不会关闭而是继续生产。 TR VC (2)停止营业点是指一个已经投入生产的企业,在生产中总有这样一点,当根据利润最大化原则确定的产量大于这一点所代表的产量时,仍可以继续生产,小于这一点所代表的产量时,就只好关闭。 一个已经投入生产的企业是否必须关闭的条件不在于它是否盈利,而在于它关闭后的亏损与生产时的亏损哪种情况更大。如果关闭后的亏损比生产时的亏损更大,则应继续生产;如果生产时的亏损比关闭后的亏损更大,则必须关闭。实际上关闭后也是有亏损的,其亏损就是固定成本。因此,是否关闭就视生产时的亏损是否大于固定成本而定,若不大于,就可继续生产,若大于,就必须停止营业。企业的停止营业点可用图8-1说明:图中N点即平均可变成本最低点就是企业停止营业点。 图8-1停止营业点 (3)当市场决定的价格为 P时,均衡产量为2Y,恰好等于N点所表示的产量。这时, 2 总亏损为面积BFJN,即等于总固定成本。此时,厂商的平均收益AR等于平均可变成本AVC,厂商可以继续生产,也可以不生产,也就是说,厂商生产或不生产的结果都是一样的。这是因为,如果厂商生产的话,则全部收益只能弥补全部的可变成本,不变成本得不到任何弥补。如果厂商不生产的话,厂商虽然不必支付可变成本,但是全部不变成本仍然存在。由于在这一均衡点上,厂商处于关闭企业的临界点,所以,该均衡点也被称作停止营业点或关闭点。 2.解释为什么行业长期供给曲线不是行业长期边际成本曲线。 答:(1)供给曲线是指每一可能的价格下厂商将生产的产量。供给曲线有短期和长期之分。 (2)在完全竞争条件下,单个厂商是价格接受者。在短期,企业生产规模固定不变,厂商通过选择产量水平以实现利润最大化。厂商将增加产量直到价格等于边际成本,但如果价格低于平均可变成本,它则会不生产。因此一个厂商的短期供给曲线是短期边际成本曲线(位于最小平均可变成本点之上的部分)。 分析化学第五版习题答案详解(下) 第五章配位滴定法 思考题答案 1.EDTA与金属离子的配合物有哪些特点? 答:(1)EDTA与多数金属离子形成1?1配合物;(2)多数EDTA-金属离子配合物稳定性较强(可形成五个五原子环); (3)EDTA与金属配合物大多数带有电荷,水溶性好,反应速率快;(4)EDTA与无色金属离子形成的配合物仍为无色,与有色金属离子形成的配合物颜色加深。 2.配合物的稳定常数与条件稳定常数有何不同?为什么要引用条件稳定常数? 答:配合物的稳定常数只与温度有关,不受其它反应条件如介质浓度、溶液pH值等的影响;条件稳定常数是以各物质总浓度表示的稳定常数,受具体反应条件的影响,其大小反映了金属离子,配位体和产物等发生副反应因素对配合物实际稳定程度的影响。 3.在配位滴定中控制适当的酸度有什么重要意义?实际应用时应如何全面考虑选择滴定时的pH? 答:在配位滴定中控制适当的酸度可以有效消除干扰离子的影响,防止被测离子水解,提高滴定准确度。具体控制溶液pH值范围时主要考虑两点:(1)溶液酸度应足够强以消去干扰离子的影响,并能准确滴定的最低pH值;(2)pH值不能太大以防被滴定离子产生沉淀的最高pH值。 4.金属指示剂的作用原理如何?它应该具备那些条件? 答:金属指示剂是一类有机配位剂,能与金属形成有色配合物,当被EDTA等滴定剂置换出来时,颜色发生变化,指示终点。金属指示剂应具备如下条件:(1)在滴定的pH范围内,指示剂游离状态的颜色与配位状态的颜色有较明显的区别;(2)指示剂与金属离子配合物的稳定性适中,既要有一定的稳定性K’MIn>104,又要容易被滴定剂置换出来,要求K’MY/K’MIn ≥104(个别102);(3)指示剂与金属离子生成的配合物应易溶于水;(4)指示剂与金属离子的显色反应要灵敏、迅速,有良好的可逆性。 5.为什么使用金属指示剂时要限定适宜的pH?为什么同一种指示剂用于不同金属离子滴定时,适宜的pH条件不一定相同? 答:金属指示剂是一类有机弱酸碱,存在着酸效应,不同pH时指示剂颜色可能不同,K’MIn不同,所以需要控制一定的pH值范围。指示剂变色点的lgK’Min应大致等于pMep, 不同的金属离子由于其稳定常数不同,其pMep也不同。金属指示剂不象酸碱指示剂那样有一个确定的变色点。所以,同一种指示剂用于不同金属离子滴定时,适宜的pH条件不一定相同。 6.什么是金属指示剂的封闭和僵化?如何避免? 答:指示剂-金属离子配合物稳定常数比EDTA与金属离子稳定常数大,虽加入大量EDTA也不能置换,无法达到终点,称为指示剂的封闭,产生封闭的离子多为干扰离子。消除方法:可加入掩蔽剂来掩蔽能封闭指示剂的离子或更换指示剂。指示剂或指示剂-金属离子配合物溶解度较小, 使得指示剂与滴定剂的置换速率缓慢,使终点拖长,称为指示剂的僵化。消除方法:可加入适当有机溶剂或加热以增大溶解度。 测量平差复习题及答案 一、综合题 1.已知两段距离的长度及中误差分别为cm m5.4 465 . 300±及cm m5.4 894 . 660±,试说明这两段距离的真误差是否相等他们的精度是否相等 答:它们的真误差不一定相等;相对精度不相等,后者高于前者。 ` 2.已知观测值向量 ?? ? ? ? ? = 2 1 21L L L 的权阵为 ? ? ? ? ? ? ? ? = 3 2 3 1 3 1 3 2 LL P ,现有函数2 1 L L X+ =, 1 3L Y=,求观测值的权1L P ,2L P ,观测值的协因数阵XY Q。 答: 1 2/3 L P=; 2 2/3 L P=;3 XY Q= 3.在下图所示三角网中,A.B为已知点,4 1 ~P P为待定点,已知3 2 P P 边的边长和方位角分别为0 S 和0 α ,今测得角度14 2 1 , , ,L L L 和边长 2 1 ,S S,若按条件平差法对该网进行平差: 、 (1)共有多少个条件方程各类条件方程各有多少个 (2)试列出除图形条件和方位角条件外的其它条件方程(非线性条件方程不要求线性化)答:(1)14216,6,10 n t r =+===,所以图形条件:4个;极条件:2个;边长条件:2个;基线条件:1个;方位角条件:1个 (2)四边形 14 ABPP的极条件(以 1 P为极): ~ 34131 241314 ???? sin()sin sin 1 ???? sin sin sin() L L L L L L L L + ??= + 四边形 1234 PP P P的极条件(以 4 P为极): 101168 911 67????sin()sin sin 1????sin sin sin() L L L L L L L L +??=+ 边长条件(1?AB S S - ):1 23434??????sin()sin() AB S S L L L L L = +++ 边长条件(12 ??S S - ):112 1314867 ???sin ?????sin()sin sin()S L S L L L L L ?= ++ ] 基线条件(0AB S S - ): 02 101191011?????sin()sin() S S L L L L L =+++ 4.A .B .C 三点在同一直线上,测出了AB .BC 及AC 的距离,得到4个独立观测值, m L 010.2001=,m L 050.3002=,m L 070.3003=,m L 090.5004=,若令100米量距的权为单位权,试按条件平差法确定A .C 之间各段距离的平差值L ?。 答:?[200.0147,300.0635,300.0635,500.0782]T L = ( 5.在某航测像片上,有一块矩形稻田。为了确定该稻田的面积,现用卡规量测了该矩形的 长为cm L 501=,方差为22136.0cm =σ,宽为cm L 302=,方差为2 2236.0cm =σ,又用求积 仪量测了该矩形的面积 2 31535cm L =,方差为 4 2336cm =σ,若设该矩形的长为参数1? X , 宽为参数2? X ,按间接平差法平差: (1)试求出该长方形的面积平差值;(2)面积平差值的中误差。 答:(1)令0111?X X x =+,0222 ?X X x =+,011X L =,022X L =,误差方程式为: 1122312??305035 v x v x v v v ===+- >matlab课后答案解析完整版

测量平差练习题及参考答案

分析化学课后作业答案解析

测量平差题目及答案

平狄克第八版课后答案

大学物理课后习题答案详解

测量平差试卷E及答案200951

《测量平差》试卷D及答案(-5-1)

平狄克《微观经济学》(第9版)章节题库-第5章 不确定性与消费者行为【圣才出品】

平狄克《微观经济学》(第8版)笔记和课后习题详解复习答案

通信原理习题答案解析

平狄克《微观经济学》(第8版)配套题库(下册)-课后习题-一般均衡与经济效率【圣才出品】

误差理论和测量平差试卷及答案6套试题+答案

平狄克《微观经济学》(第7版)课后习题详解 第8章~第9章【圣才出品】

分析化学第五版习题答案详解下

测量平差复习题及答案