商业发票制作

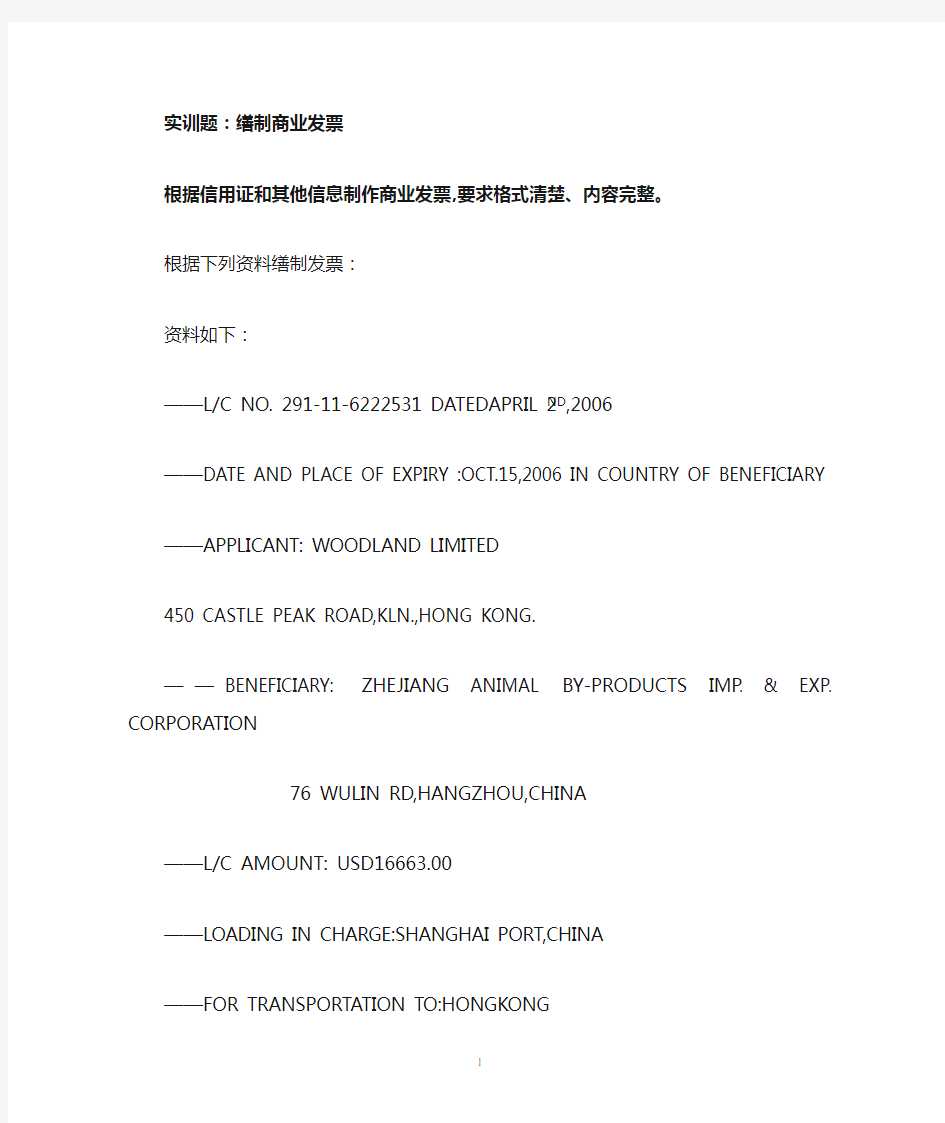

实训题:缮制商业发票

根据信用证和其他信息制作商业发票,要求格式清楚、内容完整。

根据下列资料缮制发票:

资料如下:

——L/C NO. 291-11-6222531 DATEDAPRIL 2ND,2006

——DATE AND PLACE OF EXPIRY :OCT.15,2006 IN COUNTRY OF BENEFICIARY ——APPLICANT: WOODLAND LIMITED

450 CASTLE PEAK ROAD,KLN.,HONG KONG.

——BENEFICIARY: ZHEJIANG ANIMAL BY-PRODUCTS IMP. & EXP. CORPORATION

76 WULIN RD,HANGZHOU,CHINA

——L/C AMOUNT: USD16663.00

——LOADING IN CHARGE:SHANGHAI PORT,CHINA

——FOR TRANSPORTATION TO:HONGKONG

——LATEST DATE OF SHIP:060930

——DESCRIPTION OF GOODS: 42500 PIECES OF STUFFED TOY AS PER SALES CONTRACT

03ZA16IA0019 DATED 06.03.13

STYLE NO. QUANTITY UNIT PRICE

-----------------------------------------------------------------

ZEAPEL01 7000PCS USD0.345/PC

ZEAPEL02 500PCS USD0.65/PC

ZEAPEL04 5000PCS USD1.10/PC

ZEAPEL05 30000PCS USD0.31/PC

CIFC5 HONGKONG AS PER INCOTERMS 2000 ——DOCUMENTS REQUIRED:+ COMMERCIAL INVOICE IN 1 ORIGINAL AND 3 COPIES LESS 5%

COMMISSION AND HANDSIGNED BY BENEFICIARY.

+ --------------

——ADDITIONAL COND.: +PACKING IN CARTONS OF 50 PCS EACH.

+CARTONS TO BE MARKED WITH:Z.J.A.B

HONGKONG

C/NO.1-

+--------------

Issuing bank: HSBC, HONGKONG.

1

商业发票格式

商业发票格式,商业发票样本 什么是商业发票? 商业发票(Commercial Invoice)对外贸易中简称发票, 是出口公司对国外买方开立的载有货物名称、规格、数量、单价、总金额等方面内容的清单, 供国外买方凭以收货、支付货款和报关完税使用,是所装运货物的总说明,虽然发票不是物权凭证, 但如果出口单据中缺少了发票,就不能了解该笔业务的全部情况。 商业发票的内容一般包括: ⑴商业发票须载明“发票”(INVOICE)字样; ⑵发票编号和签发日期(NUMBER AND DATE OF ISSUE); ⑶合同或定单号码(CONTRACT NUMBER OR ORDER NUMBER); ⑷收货人名址(CONSIGNEE’S NAME AND ADDRESS); ⑸出口商名址(EXPORTER’S NAME AND ADDRESS); ⑹装运工具及起讫地点(MEANS OF TRANSPORT AND ROUTE); ⑺商品名称、规格、数量、重量(毛重、净重)等(COMMODITY,SPECIFICATIONS,QUANTITY,GROSS WEIGHT,NET WEIGHT,ETC.);

⑻包装及尺码(PACKING AND MEASUREMENT); ⑼唛头及件数(MARKS AND NUMBERS); ⑽价格及价格条件(UNIT PRICE AND PRICE TERM); ⑾总金额(TOTAL AMOUNT); ⑿出票人签字(SIGNATURE OF MAKER)等。 在信用证支付方式下,发票的内容要求应与信用证规定条款相符,还应列明信用证的开证行名称和信用证号码。在有佣金折扣的交易中,还应在发票的总值中列明扣除佣金或折扣的若干百分比。发票须有出口商正式签字方为有效。 商业发票格式,商业发票样本,商业发票形式如下:

商业发票.

第 5 次课:周: 4 学时数:2课时课题:商业发票 教学目的:了解商业发票的形式 掌握商业发票的内容 主要教学内容:商业发票作用的讲解 信用证结汇方式下商业发票的实例讲解 教学重点难点:商业发票内容分析 信用证结汇方式下商业发票的实例讲解 教学方法:讲授法、案例分析法 教具:计算机、投影仪

商业发票 (一)商业发票简介 1、商业发票是对已装运货物的详细说明,是货款价目总清单。 2、商业发票无统一格式 3、商业发票的内容要符合信用证或合同的要求 (二)商业发票的内容 1.首文部分 出口商名称及地址单据名称:有时包括电传、电话号码等。该项目必须与货物 买卖合同的签约人及信用证受益人的描述一致, 一般表示为“beneficiary: ×××”通常出口 商名称及地址都已事先印好。 单据名称:商业发票上应明确标明“INVIOCE”或“COMMERCIAL INVOICE”。 在信用证项下,为防止单、证不符,发票名称应与信用证保持一致。发票的抬头:发票抬头一般缮制为开证申请人(APPLICANT)或托收的委托人。信用证中一般表示为“FOR ACCOUNT OF × × × ” “APPLICANT: × × × ”或“BY THE ORDER OF ×××”中“× ××”部分 商业发票编号:商业发票编号可以代表整套单据的编号,一般由出口商按统一规律自定。 发票日期:发票日期最好不要晚于提单的出具日期,而且要在信用证规定的议付期之前。一般在货物离开出口商的监管时,出口商就应该开立商 业发票。 合同号信用证号等:因发票是证明出口商履行合同或订单条款情况的文件,因 此,必须要注明,一笔交易若有多个合同号应分别列出。 若信用证有要求,还须注明信用证号码。 装运港、目的港:一般只简单地表明运输路线及运输方式, 如FROM ×××TO ×××BY SEA/AIR 开证行:若信用证有要求则需注明。 支付方式:根据实际情况填写该票货物的付款结算方式,可以填写一种及以上支付方式。 2.本文部分 货物描述:包括货物的品名、规格、等级、尺寸、颜色等,一般用列表的方式将同类项并列集中填写。内容必须与信用证规定的货物描述完全一 致,必要时要照信用证原样打印,不得随意减少内容,否则有可能 被银行视为不符点。但有时信用证中货物描述非常简单,此时按信 用证打印完毕后,再按合同要求列明货物具体内容。若信用证对此 部分有开错的应将错就错,或用括号将正确的描述注明。如信用证 规定品名为:“药物”,实际出口货物是“安乃近”,发票可表示“安 乃近”。但最好的表示方法是按照信用证规定表示“药物”,然后再 表示具体的名称“安乃近”。 唛头:商业发票的内容及缮制说明—本文部分一般出口商自行选用,若合同和信用证规定了唛头,则须按规定。若无唛头,应注明:“N/M”。 数量:货物数量的描述受到信用证和提单的两项约束不能有出入。故在信用

制商业发票

① 题目要求和说明 ISSUE OF DOCUMENTARY CREDIT TO: BANK OF CHINA GUANGZHOU BRANCH IRREVOCABLE DOCUMENTARY CREDIT NO.97-34985 FOR THE ACCOUNT OF A.B.C. TRADING CO., LTD., HONGKONG.312 SOUTH BRIDGE STREET, HONGKONG. DEAR SIRS, WE OPEN AN IRREVOCABLE DOCUMENTARY CREDIT IN FAVOUR OF GUANGDONG FOREIG FOREIGN TRADE IMP. AND EXP. CORPORATION, 267 TIANHE ROAD GUANGZHOU, CHINA. FOR A SUM NOT EXCEEDING HKD 1000000.00 (SA Y HONGKONG DOLLARS ONE MILLION ONLY.) AVAILABLE BY THE BENEFICIARY’S DRAFT(S) AT SIGHT DRAWN ON APPLICANT BEARING THE CLAUSE” DRAWN UNDER NANYANG COMMERCIAL BANK LTD., HONGKONG. DOCUMENTARY CREDIT NO. 97-34985 DTAED IST MARCH, 1997.” ACCOMPANIED BY THE FOLLOWING DOCUMETNS: (1) MANUAL SIGNED COMMERCIAL INVOICE IN TRIPLICA TE. ALL INVOICES MUST SHOW FOB SEPARA TELY. (2) 3/3 ORIGNAL + 3NN COPIES CLEAN ON BOARD BILL OF LADING MADE OUT TO ORDER MAR KED FREIGHT COLLECT. (3) CERTIFICA TE FO ORIGIN ISSUED BY GUANGZHOU IMPORT AND EXPORT COMMODITY INSPECTION BUREAU OF THE PEOPLE’S REPUBLIC OF CHINA IN TRIPLICA TE. EVIDENCING SHIPMENT OF THE FOLLOWING MERCHANDISE: AIR CONDITIONER (HUALING BRAND), 500PCS KF-23GW AND 500 PCS KF-25GW, PACKING: IN CARTON BOX, 50 KILOS NET EACH CARTON,1PC/CARTON,@HKD1000.00,FOBC2% DUBAI VIA HONGKONG, PARTIAL SHIPMENT PERMITED. TRANSSHIPMENT PERMITED. LA TEST DATE FOR SHIPMENT: 30TH APRIL, 1997. EXPIRY DA TE: 15TH MAY, 1997. IN PLACE OF OPENER FOR NEGOTIA TION.

制作商业发票(答案)

案例:制作商业发票 根据以下相关信息制作商业发票: IRREVOCABLE DOCUMENTARY CREDIT NO.: 211LC200116 DATED: 18FEB2005. DA TE AND PLACE OF EXPIRY: 17 APR. 2005 IN BENEFICIARY’S COUNTRY BENEFICIARY: ANHUI CHEMICALS IMP. & EXP. CO. LTD. JIN AN MANSION 306 TUNXI ROAD, HEFEI, ANHUI, CHINA A/C NO.: 6018090000-185 APPLICANT: HOP TONG HAI (PTE) LTD. BLK 15, NORTH BRIDGE ROAD #04-9370 BARCELONA SPAIN 100032 FAX: 2953397 AMOUNT: USD37850.00 UNITED STA TES DOLLARS THIRTY SEVEN THOUSAND EIGHT HUNDRED AND FIFTY ONL Y. PARTIAL SHIPMENT: NOT ALLOWED TRANSHIPMENT: ALLOWED SHIPMENT FROM CHINA TO BARCELONA W/T A T HONG KONG LATEST SHIPMENT DA TE: 7 APR. 2005 THIS CREDIT IS A V AILABLE WITH THE ADVISING BANK BY NEGOTIATION AGAINST PRESENTATION OF THE DOCUMENTS DETAILED HEREIN AND BENEFICIARY’S DRAFT(S) AT 30 DAYS AFTER SIGHT DRAWN ON ISSUING BANK FOR FULL INVOICE V ALUE. DOCUMENTS REQUIRED (IN THREE-FOLD UNLESS OTHERWISE STIPULATED): 1. SIGNED COMMERCIAL INVOICE; 2. SIGNED PACKING LIST; 3. CERTIFICATE OF CHINESE ORIGIN; 4. INSURANCE POLICY/CERTIFICATE ENDORSED IN BLANK FOR 110% CIF VALUE, COVERING ALL RISKS AND WAR RISK; 5. FULL SET OF CLEAN ‘ON BOARD’OCEAN BILLS OF LADING MADE OUT TO ORDER OF BANK OF CHINA, BARCELONA MARKED FREIGHT PREPAID AND NOTIFY APPLICANT. 6. SHIPMENT ADVICE SHOWING THE NAME OF THE CARRYING VESSEL, DATE OF SHIPMENT, MARKS, AMOUNT AND THE NUMBER OF THIS DOCUMENTARY CREDIT TO APPLICANT WITHIN 3 DAYS AFTER THE DATE OF BILL OF LADING. EVIDENCING SHIPMENT OF: 1300 DOZENS 100% COTTON OVERALLS, SHIRTS & SINGLETS AS PER S/C NO.

制作商业发票学生练习

学习情境二制作商业发票和装箱单操作 一、学习目标 能力目标:能读懂L/C 条款和/或合同条款品名条款、价格条款,能根据L/C 条款和/或合同条款准确填写商业发票和装箱单相关栏目的内容。 知识目标:熟悉发票的分类和作用,熟悉UCP600 中关于商业发票的条款,熟悉包装单 据的种类。 二、工作项目 2008 年2 月25 日,外贸业务员董斌采纳了外贸单证员陈红的合理改证建议,当天给SIK 贸易有限公司发改证函。SIK 贸易有限公司同意改证要求,向汇丰银行迪拜分行提出改证申 请。2008 年 2 月28 日,杭州市商业银行通知浙江金苑进出口有限公司外贸单证员陈红,汇 丰银行迪拜分行的信用证修改书(Amendment to a documentary credit)已到。信用证修改书 的内容如下: MT 707 SENDER RECEIVER SENDER’S REFERENCE AMENDMENT TO A DOCUMENTARYCREDIT HSBC BANK PLC,DUBAI, U.A.E. HANGZ HOU CITY COMMERCIAL BANK, HANGZ HOU, CHINA 20:FFF07699 RECEIVER’S REFERENCE21:NON DATE OF ISSUE NUMBER OF AMENDMENT BENEFICIARY(BEFORE THIS AMENDMENT) NEW DATEAND PLACE OF EXPIRY DECREASE OF DOCUMENTARYCREDIT AMOUNT NEW DOCUMENTARY CREDIT AMOUNTAFTER AMENDMENT PERCENTAGE CREDIT AMOUNT TOLERANCE 31C:080228 26E:01 59:Z HEJIANG JINYUAN IMPORT & EXPORT CO., LTD. 118 XUEYUAN STREET, HANGZ HOU, P.R.CHINA 31E:DATE 080510 PLACE IN CHINA 33B:CURRENCY USD AMOUNT 450.00 34B:CURRENCY USD AMOUNT54000.00 39A:05/05

商业发票答案77

分类: 制商业发票 题号: DZ0077 说明: 制单结汇 基本要求: 根据合同、信用证及下述提供资料,制作商业发票,要求格式清楚、内容完整。 相关说明: 2003年8月12日,南京蓝星贸易公司填制编号为2003SDT009的商业发票。 相关附件: 售货确认书.doc ,信用证.doc 正确答案: 南京蓝星贸易公司 NANJING LANXING CO., LTD. ROOM 2501, JIAFA MANSTION, BEIJING WEST ROAD, NANJING 210005, P.R.CHINA TEL: 025-******* 025-******* FAX: 025-******* COMMERCIAL INVOICE To :EAST AGENT COMPANY 3-72,OHTAMACHI,NAKA-KU,YOKOHAMA,J APAN231 Invoice No .:2003SDT009 Invoice Date :2003-08-12 S/C No .:03TG28711 S/C Date : 2003-07-22 From : NANJING Letter of Credit No. :LTR0505457 To : AKITA Date : 2003-07-27 Mark s and Numbers V.H LAS PLAMS C/NO.1-180 CFR DAMMAM PORT, SAUDI ARABIA ABOUT 180 CARTONS H6-59940BS GOLF CAPS 1800 DOZS USD8.10 USD14580.00 TOTAL : 1800DOZS USD14580.00 SAY TOTAL: U.S.DOLLARS FOURTEEN THOUSAND FIVE HUNDRED AND EIGHTY ONLY.

国际结算题库及答案

一、单选 1.不可撤销保兑信用证的鲜明特点是(A)。第7章 A. 给予受益人双重的付款承诺 B. 有开证行确定的付款承诺 C. 给予买方最大的灵活性 D. 给予卖方以最大的安全性 2.国际贸易结算是指由(C)带来的结算。第1章 A.一切国际交易 B. 服务贸易 C. 有形贸易 D. 票据交易 3.信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是(C)。第6章 A. 打包放款 B. 汇票贴现 C. 押汇 D. 红条款信用证 4.信用证能否转让给二个以上的第二受益人取决于(C)。第8章 A. 信用证上面是否标明“transferable”字样 B. 受益人与转让行之间的协议是否规定 C. 信用证是否规定了分批转运 D. 第一受益人与第二受益人商议决定 5 . 一份信用证如果未注明是否可以撤销,则是(B)的。第6章 A. 可以撤销的 B. 不可撤销的 C. 由开证行说了算 D. 由申请人说了算 6.信用证业务中,三角契约安排规定了开证行与受益人之间权责义务受(A)约束。第6章 A. 销售合同 B. 开证申请书 C. 担保文件 D. 跟单信用证 7 . 以下属于顺汇方法的支付方式是(A)。第3章

A. 汇付 B. 托收 C. 信用证 D. 银行保函 8 . 以下关于海运提单的说法不正确的是(C)。第9章 A. 是货物收据 B. 是运输合约证据 C. 是无条件支付命令 D. 是物权凭证 9 . 背书人在汇票背面只有签字,不写被背书人名称,这是(D)。第2章 A. 限定性背书 B. 特别背书 C. 记名背书 D. 空白背书 10 . 信用证业务特点之一是:银行付款依据(A)。第6章 A. 信用证 B. 单据 C. 货物 D. 合同 11 . 对于出口商而言,承担风险最大的交单条件是(C)。第4章 A. D/P at sight B. D/P after at sight C. D/A after at sight D. T/R 12 . 远期信用证中开证行会指定一家银行作为受票行,由它对远期汇票做出承兑,这家银行应该是(C)。第6章 A. 议付行 B. 付款行 C. 承兑行 D. 偿付行 13 . 下列关于信用证的说法正确的是(B)。第6章 A. 单证相符时,开证行或保兑行应独立的履行其付款承诺。除了受买方申请人制约,不应受其他当事人干扰 B. 信用证是独立文件,与销售合同分离 C. 信用证作为一种结算工具,其是否有效执行,取决于该笔交易是否得到银行认可 D. 采用信用证方式,银行不仅处理单据,还要监管货物 14 . 银行审核单据的合理时间是不超过收到单据次日起的(C个工作日。第11章 A. 1 B. 3 C. 7 D. 5 15 . 信用证的议付行与付款行的本质区别在于:(C)。第6章 A. 付款行是开证行的付款代理人,而议付行不是

商业发票制单要点

商业发票制单要点 (1)出票人名称、地址等描述必须醒目、正确。如是采用信用证方式收汇的,必须与信用证上受益人的名称、地址等完全一致。同时要注意与其他单据上显示的出口商的名称地址的一致性。如果信用证已被转让,银行也可接受由第二受益人出具的发票。 发票的出票人有两种表示方式:一是发票的信头直接显示受益人名称;二是由受益人在发票上进行签署。在实务中,如果发票的出票人是受益人下属的某个部门(例如ABC Co.Ltd., Export Dept.),根据国际商会专家小组的意见,这是不允许的。 例:信用证条款如下: APPLICANT:XYZ COMPANY,ANYTOWN BENEFICIARY:ABC COMPANY NANJING DOCUMENTS REQUIRED:COMMERCIAL INVOICE IN 6 COPIES。 发票的出具人应为:ABC COMPANY NANJING (2) 出票日期及出票的基础信息方面必须注意事项: ① 出票日期不能迟于装运日。有的商品,如矿砂、煤等散装货物,必须装完后才能根据装货实际重量制作商业发票。如信用证有规定,不能早于信用证的开证日;

② 如果发票的货物涉及不止一个合约的,发票上显示合约号必须包括全部合约。在信用证方式下,必须标明该笔交易中的信用证号码。 (3)在显示发票抬头人时,必须注意做成信用证的申请人名称、地址。 如果信用证有指定其他抬头人的,按来证规定制单。如果信用证已被转让,则银行也可接受由第二受益人提交的以第一受益人为抬头的发票。托收项下,一般填写合同买方的名称和地址。 TO: 例:信用证条款如下: APPLICANT: MIDDLEMAN COMPANY,HONGKONG BENEFICIARY:ABC COMPANY, NANJING DOCUMENTS REQUIRED: FULL SET OF CLEAN ON BOARD OCEAN B/L MADE OUT TO ORDER AND BLANK ENDORSED MARKED FREIGHT PREPAID NOTIFYING XYZ COM PANY, NEW YORK, USA COMMERCIAL INVOICE IN 6 COPIES MADE OUT TO ABOVE NOTFY PARTY.

商业发票制作

实训题:缮制商业发票 根据信用证和其他信息制作商业发票,要求格式清楚、内容完整。 根据下列资料缮制发票: 资料如下: ——L/C NO. 291-11-6222531 DATEDAPRIL 2ND,2006 ——DATE AND PLACE OF EXPIRY :OCT.15,2006 IN COUNTRY OF BENEFICIARY ——APPLICANT: WOODLAND LIMITED 450 CASTLE PEAK ROAD,KLN.,HONG KONG. ——BENEFICIARY: ZHEJIANG ANIMAL BY-PRODUCTS IMP. & EXP. CORPORATION 76 WULIN RD,HANGZHOU,CHINA ——L/C AMOUNT: USD16663.00 ——LOADING IN CHARGE:SHANGHAI PORT,CHINA ——FOR TRANSPORTATION TO:HONGKONG ——LATEST DATE OF SHIP:060930 ——DESCRIPTION OF GOODS: 42500 PIECES OF STUFFED TOY AS PER SALES CONTRACT 03ZA16IA0019 DATED 06.03.13 STYLE NO. QUANTITY UNIT PRICE ----------------------------------------------------------------- ZEAPEL01 7000PCS USD0.345/PC ZEAPEL02 500PCS USD0.65/PC ZEAPEL04 5000PCS USD1.10/PC ZEAPEL05 30000PCS USD0.31/PC CIFC5 HONGKONG AS PER INCOTERMS 2000 ——DOCUMENTS REQUIRED:+ COMMERCIAL INVOICE IN 1 ORIGINAL AND 3 COPIES LESS 5% COMMISSION AND HANDSIGNED BY BENEFICIARY. + -------------- ——ADDITIONAL COND.: +PACKING IN CARTONS OF 50 PCS EACH. +CARTONS TO BE MARKED WITH:Z.J.A.B HONGKONG C/NO.1- +-------------- Issuing bank: HSBC, HONGKONG. 1

(作业)请根据下列信用证制作商业发票及装箱单

练习一:请根据下列信用证及相关资料制作商业发票及装箱单。 (一)信用证条款 SEQUENCE OF TOTAL :27:1/1 SWIFT700的开证格式,即全部只有一页,没别的意思 FORM OF DOCUMENTARY CREDIT :40A:IRREVOCABLE DOCUMENTARY CREDIT NUMBER :20:LC12465 DATE OF ISSUE :31C:001228 DATE AND PLACE OF EXPIRY :31D:010320 CHINA APPLICANT BANK: : 51A:BANK OF GOOD COLOMBO APPLICANT :50:ELECTRADE CO.,LTD ! THE FIRST STREET,COLOMBO, SRI LANKA BENEFICIARY :59:ZHENGCHANG TRADING CO.,LTD XUESHI ROSD, HUZHOU, ZHEJIANG, CHINA CURRENCY CODE,AMOUNT :32B: AVAILABLE WITH….BY… :41D:BANK OF CHINA,HUZHOU BRANCH DRAFTS AT…. :42C:AT SIGHT DRAWEE :42D:BANK OF GOOD COLOMBO PARTIAL SHIPMENT :43P:NOT ALLOWED TRANSHIPMENT :43T:NOT ALLOWED LOADING FROM :44A:SHANGHAI, CHINA FOR TRANSPORTION TO :44B:COLOMBO, SRI LANKA @ LATEST DATE OF SHIPMENT :44C:010228 DESCRPT OF GOODS :45A: COMMODITY :CIRCUIT BREAKER ITEM NO:WS1020 3000PCS PC WT1041 2500PCS PC ZT3050 2500PCS PC TOTAL VALUE:CIF COLOMBO, SHIPPING MARKS: HZ0114 COLOMBO C/ DOCUMENTARY REQUIRED :46A: 1.' 2.SIGNED COMMERCIAL INVOICE IN TRIPLICATE CERTIFYING THAT GOODS ARE IN ACCORDANCE WITH CONTRACT NO. ZC1212. 3.PACKING LIST IN TRIPLICATE SHOWING THE TOTAL WEIGHT AND MEASUREMENT. 4.CERTIFICATE OF ORIGIN IN ONE ORIGINAL AND TWO COPIES ISSUED BY CHINA COUNCIL FOR PROMOTION OF INTERNATIONAL TRADE. 5.3/3 SET OF CLEAN ON BOARD MARINE BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED,MARKED FREIGHT PREPAID NOTIFY THE APPLICANT. 6.INSURANCE CERTIFICATE COVERING ALL RISKS FOR 110% INVOICE VALUE SUBJECTED TO

制作商业发票制作

制作商业发票操作(一) 请根据以下信用证中的相关内容缮制商业发票: …… DOC. CREDIT NUMBER *20: 6764/05/12345B DATE OF ISSUE 31C: 120216 EXPIRY *31D: DATE 120216 PLACE CHINA APPLICANT *50: THOMAS INTERNATIONL COMPANY LIMITED 1/F WINFUL CENTRE, SHING YIN STREET KOWLOON, HONG KONG BENIFICIARY *59: FENGYUAN LIGHT INDUSTRIAL PRODUCTS IMP. AND EXP. CORP. P. O. BOX 789, SHANGHAI, CHINA AMOUNT *32B: CURRENCY USD AMOUNT 10560.00 …… PARTIAL SHIPMENTS 43P: NOT ALLOWED TRANSSHIPMENT 43T: ALLOWED LOADING IN CHARGE 44A: CHINA PORT FOR TRANSPORTATION TO 44B: ANTWERP LATEST DATE OF SHIPMENT 44C: 120515 DESCRIPIT OF GOODS 45A: APPLICANT’S ITEM NO. HW-045 WOODEN HANGER, 66000PCS, THE PACKING IS 100PCS PER STRONG EXPORT CARTON OF 3.00 CUFT @ USD16.00 PER CARTON CIF ANTWERP INCLUDING 3 PCT COMMISSION AS PER SALES CONFIRMATION NO. 484LFVS15783 SHIPPING MARKS: GH -1904-001(IN A DIAMOND) C/NO: DOCUMENTS REQUIRED 46A: *SIGNED COMMERCIAL INVOICE IN QUADRUPLICATE 其他资料: Port of Loading: Shanghai Port of Transshipment: Hong Kong S.S.: TONGMEI V. 155/FARROR Date of B/L: MAY. 2, 2012 Invoice No.: 2012C8K4897

商业发票实训1

商业发票实训 根据以下实际业务情况,缮制一份商业发票。 广东XX进出口公司出口一批货物到英国,货品名是学生书包(School Bag),进口方是ABC CORP. OF LONDON,66/66A COMMERCIAL STR., LONDON。运输方式是直达海运,从上海至伦敦港。 具体资料如下: 发票号码:2006999 发票日期:2006年6月26日 合同号码:2006888 货物明细单: 货号数量(PCS)毛重(KGS)净重(KGS)尺码 AWT33 100CTNS/3600PCS 28 26 27X29X46cm AWT55 200CTNS/4800PCS 29 27 42.5x32x40cm 单价:每个1.00美元CIF LONDON 支付方式:T/T 唛头:ABC LONDON C/NO.1-300

INVOICE TO: Invoice No.: __________________ Date: __________________ S/C No.: __________________ From To L/C No. Issued by Marks & Numbers Quantities & Description Unit Price Amount ********************************************************************* ************** TOTAL: SAY AS PER

商业发票实训答案: 广东XXX 进出口公司 GUANGDONG XXX IMPORT & EXPORT CORPORATION 6TH FLOOR FOREIGN TRADE BUILDING ZHAN QIAN ROAD GUANGZHOU CHINA INVOICE TO: ABC CORP.OF LONDON Invoice No.: 2006999 66/66A COMMERCIAL STR, Date: JUNE. 26, 2006 LONDON S/C No.: 2006888 From SHANGHAI, CHINA To LONDON L/C No. Issued by T/T Marks & Numbers Quantities & Description Unit Price Amount ABC 300 CARTONS OF SCHOOL BAGS LONDON CIF LONDON C/No.1-300 ART. NO. QTY. AWT33 3600PCS USD 1.00/PC USD 3600.00 AWT55 4800PCS USD 1.00/PC USD4800.00 ********************************************************************* ************** TOTAL: 8400PCS USD 8400.00 SAY U.S.DOLLARS EIGHT THOUSAND AND FOUR HUNDRED ONLY. AS PER S/C NO. 2006888 GUANGDONG XXX IMPORT& EXPORT CORPORATION 公司经理签名或盖章

根据信用证制作商业发票、装箱单、装船通知.doc

16.3.1根据信用证缮制结汇单据 : 商业发票、装箱单、装船通知 (一)信用证资料 BANK OF KOREA LIMITED, BUSAN SEQUENCE OF TOTAL*27: 1/1 FORM OF DOC. CREDIT*40A: IRREVOCABLE DOC. CREDIT NUMBER*20: S100-108085 DATE OF ISSUE31C: DATE AND PLACE OF EXPIRY*31D: DATE PLACE CHINA APPLICANT*50: JAE & SONS PAPERS COMPANY 203 LODIA HOTEL OFFICE 1546, DONG-GU BUSAN, KOREA BENEFICIARY*59: WONDER INTERNATIONAL CO., LTD. NO. 529, QIJIANG ROAD, NANJING, CHINA. AMOUNT*32B: CURRENCY USD AMOUNT (10% MORE OR LESS ARE ALLOWED) AVAILABLE WITH/BY *41A: ANY BANK IN CHINA BY NEGOTIATION DRAFTS AT42C: 90 DAYS AFTER B/L DATE FOR FULL INVOICE COST DRAWEE42A: BANK OF KOREA LIMITED, BUSAN PARTIAL SHIPMENTS:43P: ALLOWED TRANSHIPMENT43T: ALLOWED LOADING IN CHARGE44A: MAIN PORTS OF CHINA FOR TRANSPORTATION TO 44B: BUSAN, KOREA LATEST DATE OF SHIPMENT 44C: DESCRIPT OF GOODS45A: COMMODITY: UNBLEACHED KRAFT LINEBOARD UNIT PRICE: MT TOTAL: 100MT+10% ARE ALLOWED PRICE TERM: CFR BUSAN KOREA COUNTRY OF ORIGIN : P. R. CHINA PACKING: STANDARD EXPORT PACKING SHIPPING MARK: ST05-016 BUSAN KOREA https://www.360docs.net/doc/2311305247.html,MERCIAL INVOICE IN 3 COPIES INDICATING LC NO.&CONTRACT NO. ST05-016 2.FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED MARKED FREIGHT PREPAID AND NOTIFYING APPLICANT 3.PACKING LIST/WEIGHT LIST IN 3 COPIES INDICATING QUANTITY/GROSS AND NET WEIGHTS 4.CERTIFICATE OF ORIGIN IN 3 COPIES 5.SHIPPING ADVICE SHOWING THE NAME OF THE CARRYING VESSEL, DATE OF SHIPMENT, MARKS, QUANTITY, NET WEIGHT AND GROSS WEIGHT OF THE SHIPMENT TO APPLICANT WITHIN 3 DAYS AFTER THE DATE OF BILL OF LADING.

商业发票练习

题目要求和说明

售货确认书 SALES CONFIRMATION 卖方(Sellers):Contract No.:03TG28711 NANJING LANXING CO.,LTD Date:JULY,22,2003 ROOM 2501, JIAFA MANSTION, BEIJING WEST ROAD, NANJING 210005, P.R.CHINA Signed at:NANJING 买方(Buyers): EAST AGENT COMPANY 3-72,OHTAMACHI,NAKA-KU,YOKOHAMA,JAPAN231 This Sales Contract is made by and between the Sellers and Buyers, whereby the sellers agree to sell and the buyers agree to buy the under-mentioned goods according to the terms and conditions stipulated below: 10% more or less both in amount and quantity allowed TOTAL USD 14580.00 Packing:10 DOZS PER CARTON Delivery :From NANJING to AKITA Shipping Marks:V.H LAS PLAMS C/NO.1-180 Time of Shipment:Within 30 days after receipt of L/C. allowing transshipment and partial shipment. Terms of Payment:By 100% Irrevocable Letter of Credit on favor of the Sellers to be available. By sight draft to be opened and to reach China before JULY 30, 2003 and to remain valid for negotiation in China until the 15th days after the foresaid Time of Shipment. L/C must mention this contract number L/C advised by BANK OF CHINA NANJING BRANCH. TLX: 44U4K NJBC, CN. ALL banking Charges outside China (the mainland of China) are for account of the Drawee. Insurance:To be effected by Sellers for 110% of full invoice value covering F.P.A up to AKITA To be effected by the Buyers.

商业发票填制规范

商业发票是出口商开给进口商的出口货物清单,是买卖双方交接货物和结算货款的主要依据,也是全套出口单据的核心。现将其各项内容和制作方法介绍如下: 1 发票的抬头——即在“Sold to Messrs”或“TO”之后,必须填开证申请人。若开证人为ABC CO,但来证要求发票抬头改为他人也可照办,例如来证要求,INVOICE TO BE MADE IN THE NAME OF L.L.E.CO.或要求在ABC CO 之后加注“ON BEHALF OF L.L.CO.”或要求加注“FOR ACCOUNT OF L.L.E. CO”均可照办。如为托收,发票抬头应填进口人。 2 发票上的品名、规格、数量、包装以及唛头等项目——所填写的内容必须与信用证上所规定的完全一致,不能有任何省略或改动,即使证上有错字、漏字,也只能将错就错。如来证的品名用的是法文或德文,而合同上用的是英文也应按来证的文字,但可在其后加括号注明英文。如来证没有规定详细品质或规格,则不要加注,如必须加注时,可按合同上的规定加注某些内容,但不能与来证规定有所抵触。如:来证为“70 PERCENT”而不能改为70%。 3 价格——应按信用证上的规定在发票上表现出来。如来证价格为“CIF HAMBURG LINER TERMS”,则在发票上对价格的描述不能省去“LINER TERMS。 4 发票上的总金额——除非信用证另有规定,一般不得超过信用证上的总金额并须与汇票上的金额相一致。 5 信用证上如规定超额运费或超额保险费或选港费由买方负担且信用证金额已包括上述费用者,或信用证金额虽不包括上述费用,但规定可在信用证项下支取者(MAY BE DRAWN UNDER THIS CREDIT 或ADDITIONAL INSURANCE PEREMIUM MAY DRAWN IN EXCESS OF L/C AMOUNT),则可连同贷款一并列在发票的总值内。 例如: 锰铁PET M/T USD500 CIF NEW YORK TOTAL AMOUNT USD40000 PLUS ADDITIONAL FREIGHT USD1400 TOTAL PROCEEDS USD41400。 如信用证金额不包括上述费用,或未规定可在信用证项上支取,则上述费用不能在发票上出现,应将这些费用另制汇票进行光票拖收。 例如:信用证上有“CONGESTION ADDITIONAL INSURANCE PREMIUM,OPTIONAL CHARGES ARE TO BE BORN BY THE BUYERS OUR SIDE THIS CREDIT”字样,则上述费用就不能在信用证的金额项下支取。如信用证上这一规定与合同规定相悖,则应要求对方改证。 6 如来证的总金额是按CIFC计算的,则发票汇票上的总额也应按CIFC总额计算,不要减佣。待收汇后再把佣金回付给买方。 如来证单价为CIFC,但总额已预扣佣金,则在发票CIFC总金额之下要减去佣金(LESS X%),以CIF值作为发票、汇票的最高金额。 如合同中规定的CIF价含有佣金百分之五并双方事先言明是暗佣,事后国外来证上的CIF总金额是含暗佣金额百分之五的,则在发票上不应减佣。 7 如来证规定单价中含有佣金(INCLUDING COMMISSION)应在发票上照写,而不能用折扣(DISCOUNT)字样代替。如来证中有现金折扣(CASH DISCOUNT)字样,则在发票上照列,而不能写成“商业折扣”(TRADE DISCOUNT)或者相反。按“CASH DISCOUNT”是卖方鼓励买方早日付款用的,即在规定付款之日前提前付款,则在价格上给以一定的折扣。例如,60 DAYS NET,2% DISCOUNT FOR CASH 即60天按净价付款,减收2%。 8 如来证要求出“收讫发票”(RECEIPTED INVOICE)则应在发票上加注“RECEIPTED INVOICE”或“RECEIVED INVOICE”字样,并应在发票的正中空白处加注“PAYMENT RECEIPTED AGAINST XX BANK L/C NO.XX DATED XX”字样,或加注“PAYMENT RECEIVED”字样。 9 如来证要求出“证实发票”(CERTIFIED INVOICE)则应在发票上加注“CERTIFIED INVOICE”字样,并应在发票正中空白处加注“WE HERBY CERTIFY THA T THE CONTENTS DESCRIBED HERE IN ARE TRUE AND CORRECT”字样,同时要将发票上印就的“有错当查”(E&O.E)字样划去。 10 南美一些国家的商人往往在来证上要求出“宣誓发票”(SWORN INV.)则应在发票上加“SWORN INVOICE”字样,并要在发票正中空白处加注“WE SWEAR THAT THE CONTENTS OF THE V ALUE OF THIS INVOICE ARE TRUE AND CORRECT IN EVERY RESPECT”字样,同时要将发票上印就的E&O.E字样划掉。 11 如来证要求出详细发票(DETAILED INVOICE)则应在发票上加注“DETAILED INVOIC”字样,并要在发票内详细列明货名、规格、数量等内容。 12 如来证要求提供“中性发票”(NEUTRAL INVOICE)则在发票上不能显示出口人的名称、地址、所以不能用公司本身的发票,而应用白纸打制,并应以“TO WHOM IT MAY CONCERN”作为发票抬头。 13 如开征信用证的金额为20000美元,而发票金额为20005.50美元,可采取抹零的办法,即在发票金额栏内加注“5.50美元不计”字样,总金额即为20000美元,即“WRITTEN OFF USD5.50,NET PROCEEDS USD 20000”。这样便可使单证一致,而不致因微小金额要求对方改证。 如信用证金额为20000美元而发票金额为20055.50美元,可先行减去55.5采取以后解决的办法(即另行要求外