信用证修改练习题

信用证修改练习

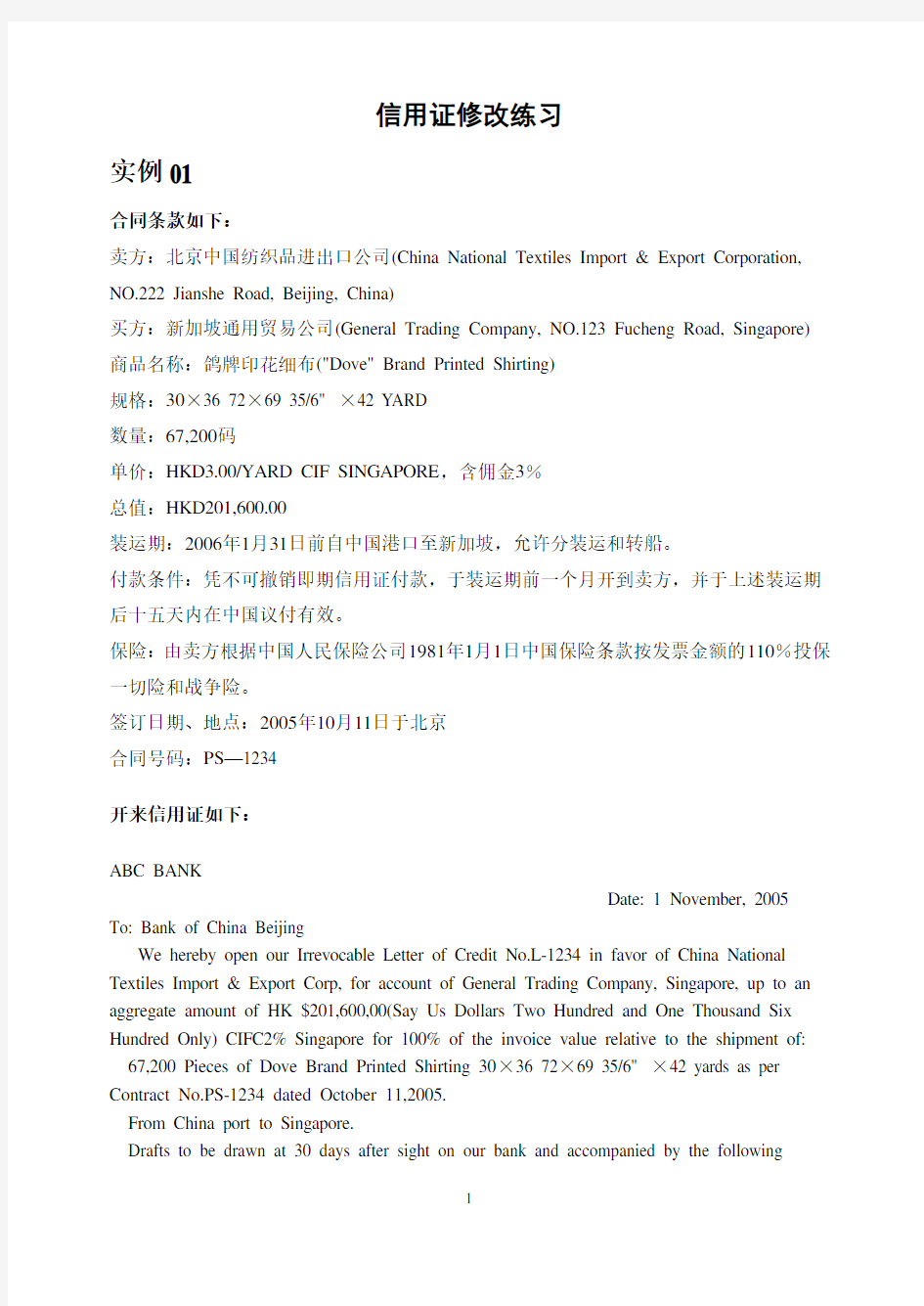

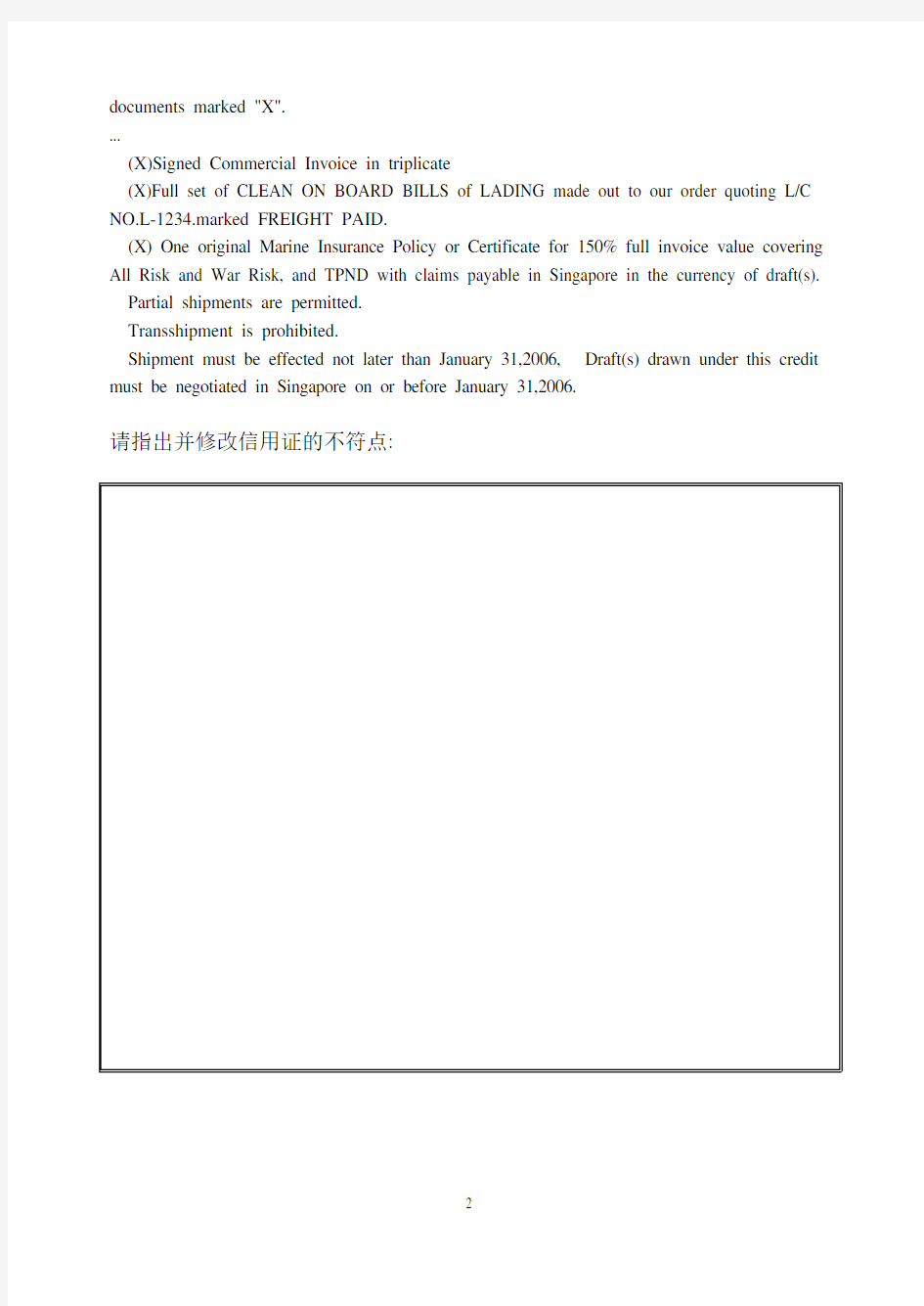

实例01

合同条款如下:

卖方:北京中国纺织品进出口公司(China National Textiles Import & Export Corporation, NO.222 Jianshe Road, Beijing, China)

买方:新加坡通用贸易公司(General Trading Company, NO.123 Fucheng Road, Singapore) 商品名称:鸽牌印花细布("Dove" Brand Printed Shirting)

规格:30×36 72×69 35/6" ×42 Y ARD

数量:67,200码

单价:HKD3.00/YARD CIF SINGAPORE,含佣金3%

总值:HKD201,600.00

装运期:2006年1月31日前自中国港口至新加坡,允许分装运和转船。

付款条件:凭不可撤销即期信用证付款,于装运期前一个月开到卖方,并于上述装运期后十五天内在中国议付有效。

保险:由卖方根据中国人民保险公司1981年1月1日中国保险条款按发票金额的110%投保一切险和战争险。

签订日期、地点:2005年10月11日于北京

合同号码:PS—1234

开来信用证如下:

ABC BANK

Date: 1 November, 2005 To: Bank of China Beijing

We hereby open our Irrevocable Letter of Credit No.L-1234 in favor of China National Textiles Import & Export Corp, for account of General Trading Company, Singapore, up to an aggregate amount of HK $201,600,00(Say Us Dollars Two Hundred and One Thousand Six Hundred Only) CIFC2% Singapore for 100% of the invoice value relative to the shipment of: 67,200 Pieces of Dove Brand Printed Shirting 30×36 72×69 35/6" ×42 yards as per Contract No.PS-1234 dated October 11,2005.

From China port to Singapore.

Drafts to be drawn at 30 days after sight on our bank and accompanied by the following

documents marked "X".

...

(X)Signed Commercial Invoice in triplicate

(X)Full set of CLEAN ON BOARD BILLS of LADING made out to our order quoting L/C NO.L-1234.marked FREIGHT PAID.

(X) One original Marine Insurance Policy or Certificate for 150% full invoice value covering All Risk and War Risk, and TPND with claims payable in Singapore in the currency of draft(s). Partial shipments are permitted.

Transshipment is prohibited.

Shipment must be effected not later than January 31,2006, Draft(s) drawn under this credit must be negotiated in Singapore on or before January 31,2006.

请指出并修改信用证的不符点:

实例02

合同条款如下:

卖方:中国粮油食品公司(China National Cereals, Oils & Foodstuffs Corp.)

买方:温哥华加拿大食品公司(Canada Food Corp., Vancouver)

商品名称:长城牌草莓酱(Gread wall brand strawberry jam)

规格:340克听装。

数量:1000箱(每箱50听)。

单价:CIF温哥华,每箱30加元。

总值:30,000加元。

包装:纸箱装。

保险:由卖方按发票金额110%投保一切险。

装运期:1988年8月

装运港:中国港口

目的港:温哥华

唛头:由卖方选定

支付条款:凭不可撤销、可转让即期信用证付款。信用证须不迟于装运月份前30天到达卖方。有效期应为最后装运期后15天在中国到期。

签订日期、地点:1988年5月4日于北京

合同号码:SC-3

开来信用证如下:

Date: 1 June, 1988

To: Bank of China, Beijing

We hereby open our Irrevocable Letter of Credit No.9876543 in favour of Canada Food Corp., Vancouver for account of China National Cereals, Oils & Foodstuffs Corp. up to an amount of CA$ 3,000.00 CIF Vancouver (Say Canadian Dollars Three Thousand Only), for 110% of the invoice value relative to the shipment of: Canned Strawberry Jam 100 cartons (each 50 cans). As per Contract SC-3, from Vancouver, Canada to China port

Drafts to be drawn at sight on our bank and accompanied by the following documents, marked

"X": ......

Partial Shipments permitted.

Transshipment permitted.

Shipment must be effected not later than 31 August 1988. This L/C is valid at our counter until 5 September 1988. For Bank A

请指出并修改信用证的不符点:

实例03

合同条款如下:

卖方:中国粮油食品公司(China National Cereals, Oils & Foodstuffs Corporation)

买方:温哥华香港食品公司(Hong Kong Food Company, Vancouver)

商品名称: 长城牌草莓酱(Great Wall Brand Strawberry Jam)

规格:340克听装

数量:50,000听

单价:CFR 温哥华每听2.50加元,含佣3%

总值:125,000加元

装运期:1992年11月自中国港口运往温哥华,允许转船和分批装运

付款条件:凭不可撤销的即期信用证付款。信用证议付有效期应为最后装运期后第15天在中国到期

合同号码:92/8712

COMMERCIAL BANK OF THATTOWN

Date: Oct. 5, 1992

To: China National Cereals, Oils & Foodstuffs Corporation,

Beijing, China

Advised through Bank of China, Beijing

No. BOC 92/10/05

DOCUMENTARY LETTER OF CREDIT IRREVOCABLE

Dear Sirs:

You are authorized to draw on Hong Kong Food Company, Vancouver for a sum not exceeding CAN $ 120,000 (SAY CANADIAN DOLLARS ONE HUNDRED AND TWENTY THOUSAND ONL Y) available by draft drawn on them at sight accompanied by the following documents:

──Full set of Clean on Board Bills of Lading made out to order and blank endorsed, marked "freight to collect" dated not later than November 30, 1992 and notify accountee.

──Signed Commercial Invoice in quintuplicate.

──Canadian Customs Invoice in quintu plicate.

──Insurance Policies (or Certificates) in duplicate covering Marine and War Risks. Evidencing shipment from China port to Montreal, Canada of the following goods:

50,000 tins of 430 grams of Great Wall Brand Strawberry Jam, at CAN $ 2.50 per tin CFRC 3% Vancouver, details as per your S/C No. 92/8712.

Partial shipments are allowed.

Transshipment is allowed.

This credit expires on November 30, 1992 for negotiation in China. 请指出并修改信用证的不符点:

实例04

1992年8月3日签订的第92/1234号合同主要条款:

卖方:广州服装进出口公司

买方:Messrs. J. Handerson & Co, New York City, USA.

商品名称及数量:1,000打丝织女式衬衫

单价:每打52.50美元成本加保险加运费到纽约市,含佣3%

总金额:52,500美元

交货期:1992年11月份由中国港口装运可转运但不可分批装运

交付条款:不可撤销、即期信用证付款,议付有效期为最后装船期后15天内在中国到期开来信用证如下:

THE STANDARD CHARTERED BANK

NEW YORK, USA

NO.10/1375

DA TE: 18 October, 1992

DOCUMENTARY LETTER OF CREDIT

IRREVOCABLE

To: Guangzhou Garments

Imp. & Exp. Corp.

Guangzhou, China

Advising Bank: Bank of China, Guangdong Branch, Guangzhou China

Dear Sirs,

You are authorised to draw on Messrs.J.Handerson & Co. for a sum not exceeding US$ 51,500 (SAY US DOLLARS FIFTY-ONE THOUSAND FIVE HUNDRED ONL Y) available by draft drawn in duplicate on them at 60 days after sight, accompanied by the following documents: 1. Full set of Clean on Board Bills of Lading made out to order and blank endorsed, marked "FREIGHT PREPAID" covering 1,000 dozen silk blouses.

2. Signed Commercial Invoice in triplicate, indicating S/C No.92/1234 dated 3 August, 1992.

3. One original insurance Policy/Certificate.

Shipment from China port to New York City, USA.

Shipment is to be effected before November 30,1992,with partial shipments and transshipment prohibited.

This credit expires on December 10,1992 in China. 请指出并修改信用证的不符点:

实例05

销货合同主要条款如下:

合同号码:28KG603

卖方:辽宁纺织品进出口公司

买方:J. Brown & Co., 175 Queen?s Way, Hong Kong

商品名称及数量:羊毛衫S105 50打

M107 60打

L109 70打

单价: S105 每打成本加运费香港120美元

M107 每打成本加运费香港150美元

L109 每打成本加运费香港180美元

金额: 27,600美元

交货期: 1995年11月,不允许分批装运,可转运。

付款条件:不可撤销的见单后90天付款的信用证,效期为装运后15天在中国到期。

开来信用证如下:

HUA CHIAO COMMERCIAL BANK LTD.

88-89 Des V oeux Road, Central, Hong Kong

Irrevocable Documentary Credit No. F--07567

Date and place of issue: 95/09/28 Hong Kong

Date and place of expire:95/11/30 Hong Kong

Applicant: J. Brown & Co., 175 Queen?s Way, Hong Kong

Beneficiary: Liaoning Textiles I/E Corp., Dalian, China

Advising Bank: Bank of China, Liaoning Branch, Dalian

Amount: USD26,700.---(SAY UNITED STA TES DOLLARS TWENTY-SIX THOUSAND SEVEN HUNDRED ONL Y)

Partial shipments and transshipment are prohibited.

Shipment from Dalian, China to Hong Kong, latest 95/11/30 Credit available against presentation of the documents detailed herein and of your draft at 90 days …sight for full inv oice value.

----Signed commercial invoice in quadruplicate.

----Full set of clean on board ocean Bills of Lading made out to order of HUA CHIAO COMMERCIAL BANK LTD. marked freight prepaid.

----Insurance certificate or policy endorsed in blank for full invoice value plus 10%, covering All Risks and War Risk.

Covering 50 doz. woolen sweaters, S105, @USD 120 per doz.

CFR Hong Kong

60 doz. woolen sweaters, M107, @USD 150 per doz. CFR Hong Kong

70 doz. woolen sweaters, L109, @USD180 per doz. CFR Hong Kong

As per Contract No. 28KG063

请指出并修改信用证的不符点:

实例06

合同如下

Shanghai Light Industrial Products I & E Corporation

Sales Confirmation

To: Abdular Company NO.:253

P.O.Box789 DATE: Sep.15, 1999

Kuwait

We hereby confirm having sold to you the following goods on terms and conditions as stated below.

Name of Commodity and Butterfly Brand Sewing Machine JA-1 Specification: 3 Drawers Folding Cover(三折叠式蝴蝶牌缝纫机) Packing: Packed in wooden cases of 1 set each.

Quantity: Total 55000sets

Unit price: USD64.00per set CIF3% Kuwait

Total amount: USD352000.00

(Say US Dollars three hundred and fifty two thousand only.)

Shipment: During Oct./Nov. 1999 from Shanghai to Kuwait with

partial shipments and train shipment permitted Incurrence: To be covered by the seller for 110$% of total invoice value

against all risks and war risks as per the relevant ocean

marine cargo clauses of the people?s Insurance Company

of China dated1/1/1981.

Payment: The buyer should open through a bank acceptable to the

seller an irrevocable Letter of Credit at 30days after sight

to reach the seller 30days before the month of shipment

valid for negotiation in China unit the 15th day after the

date of shipment.

Remarks: Please sign and return one copy for our file.

The buyer: The seller:

Abdular Company Shanghai Light Industrial Products _____________________ I & E Corporation

THE HABIB BANK LIMITED KUWAIT

Advised though : bank of china , NO .CN3099 / 714

Shanghai Branch DA TE: Oct .2, 1999 Kuwait

To: Shanghai Light Industrial Products Import & Export Corp.

Dear sirs :

We are pleased to advise that for account of Abdular Company ,Kuwait(企业名称) ,we hereby open our L/C.NO CN3089/714 in your favor for a sum not exceeding about US $330000.00(Say US Dollars There Hundred Thirty Thousand only) available by your drafts On the Habib Bank Ltd., New York Branch at 30 days after date accompanied by the following documents:

1.Singed commercial invoice in 6 copies

2.Full set of (3/3) clean on board B/L issued to our order notify the above mentioned

buyer and marked “freight to collect” dated not later than October 31 1999

3.Insurance policy in 2 copies covering C. I. C for 150% invoice value

4.Certificate of Origin in 2 copies

Covering shipments of :

5. 500 sets Sewing Machine Art. No. JA-1 packed in wooden cases or cartons each

At US$ 64.00 CIF Kuwait

Partial shipments are allowed. Transshipment is not permitted.

Drafts drawn under this credit must be marked “drawn under Habib Bank, Ltd., Kuwait bearing the number and date of this credit. .

We undertake to honour all the drafts drawn in compliance with the terms of this Credit if such drafts to be presented at our counter on or before Oct. 31 1999.

For and on behalf of

THE HABIB BANK LTD. KUWAIT

实例07

Sales Confirmation No:0003916

Date:Sep.30,2005 Seller:Ningbo Huadu Textile International Trade Corp.

Buyer:Sunny Men Corporation,P.O.Box No.6789 Toronto,Canada.

Commodity and Specifications:

Polo brand full cotton men?s shirt 15,000pcs ,5%more or less at seller's option

Packing:In cartons of 20pcs each,containerized

Unit Price:US$1.20 Per Piece CFR Toronto

Total value:US$18,000.00(U.S.Dollars Eighteen Thousand only)

Time of shipment:

During Nov./Dec.2005 In two equal monthly lots,from China to Toronto,allowing transshipment。

Insurance:To be covered by the Buyer

Terms of Payment:

By Irrevocable Sight Letter of Credit to reach the Seller 15 days before the month of shipment and remained valid for negotiation in China until the 15th days after date of shipment。

IRREVOCABLE DOCUMENTARY CREDIT

NO. 051086

Oct.12,2005 TO;BANK OF CHINA

NINGBO,CHINA

FROM:THE ROYAL BANK OF CANADA

WE OPEN IRREVOCABLE DOCUMENTARY CREDIT NO. 051086

BENEFICIARY: NINGBO HUADU TEXTILE IMP. AND EXP. Co. LTD.

Jiefang south road 111,Ningbo,China

APPLICANT:sunny men corporation P.O.BOX NO.6789 Toronto, Canada

AMOUNT:US $18000.00(Say U.S. Dollars eighteen thousand Only.)

This credit is available by beneficiarys draft at 30days after sight for 100% of invoice value

drawn on the royal bank of canada.Accompained by the following doccuments::

1.Signed commercial invoice in 3copied.

2.Full set of clean on board bill of lading made out to order and blank endored marked freight prepaid and notify appliant..

3.Insurance policy duplicate copied for 110% of invoice value. Covering all risks and war risk subject to CIC dated JAN.1ST,1981.

4.Certificate of origin in duplicate issed bu china internation chamber of commerce or other government authorities.

5.Inspection certificate of quality issued by applicant covering:

Polo brand full cotton men?s shirt 15,000pcs at US$1.20 per piece CFRC3% Toronto as per S/C NO. 0003916 dated SEP.30,2005.

LATEST SHIPMENT:NOV.30,2005 from ningbo to toronto.

PARCIAL SHIPMENTS: Allowed

TRANSHIPMENT: Prohibited

The goods shall be containerized, the documents must be presented within 8days after the date of the B/L,but within the vaildity of the credit.

THE ROYAL BANK OF CANADA

实例08

SALES CONFIRMATION

S/C NO:BDY666

Date:AUG.20,2005

The Seller:DAYA FOREIGN TRADE CORP The Buyer:PITY IMP AND EXP CO Address:88 XINFENG ROAD,NINGBO,CHINA Address:NO.555,A.C STREET,LONDON,BRITISH

The Sellers Agree to Sell And The Buyers Agree to Buy The Undermentl0ned Goods According to The Terms And Conditions as Stipulated Below:

Shipment:Within 45days of receipt of letter of credit and not later than the month of October 2005. With partial shipments and transshipment allowed, from any Chinese port to London ,British.

Insurance:to be effected by seller for 110%of CIF invoice value covering all risks only as per China Insurance Clause.

Payment:By 100% confirmed Irrevocable Letter of Credit of 45 days after B/L opened by the Buyer.

Confirmed by :

The Seller: DAYA FOREIGN TRADE CORP The Buyer: PITY IMP AND EXP CO 李环清Steven Jam

General Manager Dept. Manager

DOCUMENTARY LETTER OF CREDIT

FROM:BRITISH LOYAL BANK,LONDON .

SEQUENCE OF TOTAL 27: 1/1

FORM OF DOCUMENTARY CREDIT: 40A:IRREVOCABLE

L/C NO. 20: BB555

DA TE OF ISSUE: 31C:SEP.10,2003

EXPIRY DATE AND PLACE 31D:OCT.31,2005, LONDON

APPLICANT 50:PITY IMP AND EXP CO.

NO.555,A.C STREET,LONDON,BRITISH. BENEFICIARY 59:DAYA FOREIGN TRADE CORP.

588 XINFENG ROAD,NINGBO,CHINA CURRENCY CODE,AMOUNT 32B:USD20,000.00

A V AIABLE WITH-/BY 41D:WITH ANY BANK BY NEGOTIATION IN CHINA

DRAFT AT 42C:AT 45 DAYS AFTER SIGHT

DRAWEE(PAYING BANK)42D:OURSELVES

PARTIAL SHIPMENT 43P:NOT ALLOWED

TRANSHIPMENT 43T: ALLOWED

LOADING AT/FROM 44A:ANY CHINESE PORT

FOR TRANSPORTATION TO 44B:LONDON,BRITISH

THE LATEST DATE OF SHIPMENT 44C:OCT.23,2005

DESCRIPTION OF GOODS 45A:

100%FULL WOOLEN SWEATER AS PER S/C NO.BD666 DD.AUG.20,2005

STYLE 7681000 PCS USD12.00/PC

STYLE 769800 PCS USD10.00/PC

TERMS OF DELIVERY: CIF LONDON

DOCUMENTS REQUIRED 46A :

1.SIGNED COMMERCIAL INVOICE IN 4 COPIES SHOWING THAT THE QUALITY OF SHIPMENT IS IN ACCORDANCE WITH THE STIPULATION OF S/C.

2.PACKING LIST IN 3 COPIES

3.2/3 OF CLEAN ON BOARD MARINE BILLS OF LADING MADE OUT OT ORDER AND ENDORED IN BLANK SHOWING FREIGHT PREPAID AND NOTIFYING APPLICANT.

4.BENEFICIARY?S CERTIFICATE CERTIFYING THAT 1/3 O RIGINAL B/L AND ONE SET OF NON-NEGOTIABLE DOCUMENTS HA VE BEEN SENT TO APPLICANT AFTER SHIPMENT IMMEDIATELY.

5.INSURANCE POLICY I N DUPLICATE FOR 120% OF INVOICE VALUE COVERING

ALL RISKS AND WAR RISK SUBJECT TO CIC DATED JAN.1ST,1981.

ADDITIONAL CONDITIONS 47A:

PLS NOTE IF DOCS PRESENTED CONTAIN DISCREPANCY, A FEE OF USD30 WILL BE DEDUCETED.

PERIOD FOR PRESENTA TION: 48:

DOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER SHIPMENT DATE BUT WITHIN L/C V ALIDITY-------END----------------------------------------------- CONFIRMATION 49:WITHOUT

CHARGES 71B: ALL BANKING COMMERCIAL CHARGES OUTSIDE OF NEW YORK ARE FOR THE BENEFICIARY?S ACCOUNT.

CONFIRMATION INSTRUCTIONS 49:WITHOUT

实例09

Sales Contract

No.:ss03

Date:May 20.2006 Seller: Shanghai stationery and sporting goods Imp. and Exp. Corp.

Address : 5-15 mansion 1230-1240 Zhongshan road, shanghai

Buyer: Smith Co. Ltd. ,

Address :The Jane street ,Kong zone , London , England

This contract is made by and between the buyers and the sellers, whereby the buyers agree to buy and the sellers agree to sell the undermentioned commodity according to the terms and conditions stipulated below:

Name of commodity: men?s gloves

Specification: Model No. 5

Quantity: 2000dozens

Unit Price : CFR Amsterdam USD 45.00 Per dozen

Amount : USD90 000.00( Say U.S. Dollars Ninety Thousand Only)

Shipment : From Shanghai , China To Amsterdam, Holland Not Later Than July 30, 2006 with transshipment and partial shipment not allowed

Packing: By Seaworthy cartons(CTNS)

Insurance: To be covered by buyers

Terms of Payment: By irrevocable letter of Credit at Sight

Shipping Marks: At sellers? option

Letter of Credit

CREDIT NUMBER: A2B9600463

DATE OF ISSUE: 060618

ADVISING BANK:BANK OF CHINA ZHONGSHAN DONG YI LU 23

SHANGHAI CHINA

FORM OF DOCUMENTARY CREDIT: IRREVOCABLE

DATE AND PLACE EXPIRY: 060830/ON ISSUING BANK?S COUNTERS APPLICANT:SMITH CO. LTD. ,

THE JANE STREET, KONG ZONE, LONDON , ENGLAND

BENEFICIARY:SHANGHAI STATIONERY AND SPORTING GOODS

IMP.AND EXP.CORP.

5-15 MANSION 1230-1240 ZHONGSHAN ROAD,SHANGHAI

CURRENCY CODE, AMOUNT:USD 90 000.00

AVAILABLE WITH...BY...:ANY BANK IN ADVISING BANK'S

COUNTRY BY NEGOTIATION AT 30 DAYS SIGHT DRAFT(S)

DRAWN ON:ABN AMRO BANK NV, LONDON

PARTIAL SHIPMENTS:PERMITTED

TRANSSHIPMENT :PROHIBITED

LOADING ON BOARD /DISPATCH/TAKING IN CHARGE AT/FROM:SHANGHAI PORT

FOR TRANSPORTATION TO :AMSTERDAM PORT

SHIPMENT PERIOD: NOT LATER THAN 060630

DESCRIPTION OF GOODS: 2000 DOZENS MEN'S GLOVES CFR AMSTERDAM AT USD 45.00 EACH

…………………….

实例10

中国国际纺织品进出口公司江苏分公司

CHINA INTERNATIONAL TEXTILES I/E CORP. JIANGSU BRANCH

20 RANJIANG ROAD ,NANJING,JIANGSU,CHINA

销售确认书编号NO.:CNT0219

SALES CONFIRMATION 日期DATE:MAY 10,2004 OUR REFERENCE:IT123JS

买方BUYERS:TAI HING LOONG SDN, BHD, KUALA LUMPUR.

地址ADDRESS:7/F, SAILING BUILDING, NO.50 AIDY STREET, KUALA LUMPUR,MALAYSIA

电话TEL:060-3-74236211 传真FAX:060-3-74236212 兹经买卖双方同意成交下列商品,订立条款如下:

The undersigned sellers and buyers have agreed to close the following transaction according to the terms and conditions stipulated below:

Description of goods Quantity Unit price AMOUNT

CIF SINGAPORE

100% COTON GREE LAWN 300,000 YARDS @HKD3.00PER YARD HKD900,000.00

装运SHIPMENT:during june/july,2004 in transit to malaysia

付款条件PAYMENT:irrevocable sight l/c

保险INSURANCE:T o be effected by sellers covering wpa and war risks for 10%

over the invoice value

买方(签章)THE BUYER 卖方(签章)THE SELLER TAI HING LOONG SDN, BHD, KUALA LUMPUR.中国国际纺织品进出口公司江苏分公司

CHINA INTERNATIONAL TEXTILES I/E CORP.

JIANGSU BRANCH

买方开来的信用证如下所示:

From bangkok bank LTD., Kualalumper

Documentary credit NO.:01/12345,Date:JUNE 12,2004

Advising bank: Bank of china , Jiangsu Branch

APPLICANT: TAI HING LOONG SDN, BHD., P.O.B.666 KUALA LUMPUR Beneficiary:CHINA INT?L TEXTILES I/E CORP., BEIJING BRANCH

信用证练习(有答案)

信用证练习 一、单选题 1、所谓“信用证严格相符”的原则,是指受益人必须做到()。 A.信用证和合同相符 B.信用证和货物相符 C.信用证和单据相符 答案:C 解析:在信用证业务中,实行的是凭单付款的原则,开证银行只根据提交的单据与信用证相符,即要求“单证一致”、“单单一致”。 2、信用证的基础是买卖合同,当使用证与买卖合同规定不一致时,受益人应要求()。 A.开证行修改 B.开证申请人修改 C.通知行修改 答案:C 3、在信用证业务中,银行的责任是:() A、只看单据,不看货物 B、既看单据,又看货物 C、只管货物,不看单据 答案:A 4、信用证上如未明确付款人,则制作汇票时,受票人应为()。 A.开始申请人 B.开证银行 C.议付行 D.任何人 答案:B 5、根据国际商会《跟单信用统一惯例》的规定,如果信用上未注明“不可撤消”的字样,该信用证应视为: A.可撤消信用证 B.不可撤消信用证 C.远期信用证 D.由受益人决定可撤消或不可撤消 答案:B 6、在合同规定的有效期,()负有开立信用证的义务。 A. 卖方 B. 买方 C.开证行 D.议付行 答案:B 解析: 考点为开立信用证的要求。买方负有开立信用证的义务,要求开证行开立的有条件的承诺付款的书面文件。 7、在交易金额较大,对开证行的资信有不了解时,为保证货款的及时收回,买方最好选择()。 A.可撤销信用证 B.远期信用证 C.承兑交单 D.保兑信用证 答案:D

解析:信用证的选择问题,ABC收回货款的风险大。采用保兑信用证,是指一家银行开立的信用证,由另一家银行加以保证兑付,保兑行在信用证下也承担了第一付款责任。 8、关于信用证的有效期,除特殊规定外,银行将拒绝接受迟于运输单据出单日期()天后提交的单据。 A.20 B.30 C.25 D.21 答案:D 解析:本题是关于信用证的有效期与银行交单的关系。银行拒绝接受迟于运输单据出单日期21天后提交的单据(出单日期指提单签发日期,即货物装船完毕日期) 9、按照《跟单信用证统一惯例》的解释,在信用证中如未注明是可以撤销,则该证为: A.可撤销信用证 B.不可撤销信用证 C.由双方协商决定 答案:B 解析:根据《跟单信用证统一惯例》规定,信用证上未注明是可撤销信用证或不可撤销信用证时,视为不可撤销信用证。 10、某外贸公司的工作人员因为在审证过程中粗心大意,未能发现合同发票上的公司名称与公司印章的名称不一致,合同发票上的是ABC Corporation ,而印章上则是ABC,仅一词之差,此时又恰逢国际市场价格有变,在这种情况下: A.外商有权拒绝付款 B.责任在外商 C.外商应按规定如期付款 答案:A 解析:题中某外贸公司应审核开证申请人的名称和地址,以防错发运。受益人的名称和地址也必须正确无误,而且前后要一致,否则,会影响收汇。一词之差,外商完全可以以“单单不符”拒付。 11、海运提单的签发日期是() A.货物开始装船的日期; B.货物装船完毕的日期; C.船只到达装运港的日期; D.船只离开装运港的日期 答案:B 解析:海运提单的签发日期货物装船完毕的日期,如提单上有“装船批注”以装船批注上的ON BOARD日期为装船日期。 12、采用信用证与托收相结合的支付方式时,全套货运单据应() A.随托收部分汇票项下 B.随信用证的汇票项下 C.直接寄往进口商 D.留在卖方 答案:A 13、保兑信用证的保兑行其付款责任是() A.在开证行不履行付款义务时履行付款义务

实训十一 信用证的审核与修改

实训十一信用证的审核与修改 实训目的与要求: 1.能够审核信用证 2. 能够修改信用证 重点: 能够审核并修改信用证 难点:能够审核并修改信用证 实训项目:根据背景资料审核并修改: http://10.99.36.252/icd3 实训指导: 要求说明: 请根据审证的一般原则和方法对收到的信用证进行认真细致的审核,列明信用证存在的问题并陈述要求改证的理由。 提示: 1.审核L/C 的商品货号是否与合同不一致。 2.审核金额(大写/小写)是否与合同不一致。 3. L/C 条款是否与合同相应条款不符。(例如:保险条款在合同中写明All Risks as perC.I.I dated 1/1/1982. 但L/C 显示War Risk and All risks. ) 4.付款方式是否不符合同要求。(例如:合同中为by sight L/C, 而信用证中为draft at 30days' sight. ) 注意:信用证本身常出现的问题: 1.注意L/C 的到期地点。 2.信开本信用证应写明"subject to UCP 600"。 3.注意信用证"三期",即:有效期、装运期和交单期。 4.L./C 中的"软条款"。(例如:要求卖方提交客检证书;正本B/L 全部或部分直寄客户。) 修改信用证应注意: --对信用证修改内容的接受或拒绝有两种表示形式: --收到信用证修改后,应及时检查修改内容是否符合要求,并分别情况表示接受或重新提出修改 ---对于修改内容要么全部接受,要么全部拒绝;部分接受修改中的内容是无效的; ---有关信用证修改必须通过原信用证通知行通知才算真实、有效;通过客户直接寄送的信用证修改申请书或修改书复印件不是有效的修改 ---明确修改费用由谁承担,一般按照责任归属来确定修改费用由谁承担

信用证修改练习题

信用证修改练习 实例01 合同条款如下: 卖方:北京中国纺织品进出口公司(China National Textiles Import & Export Corporation, Jianshe Road, Beijing, China) 买方:新加坡通用贸易公司(General Trading Company, Fucheng Road, Singapore) 商品名称:鸽牌印花细布("Dove" Brand Printed Shirting) 规格:30×36 72×69 35/6" ×42 YARD 数量:67,200码 ~ 单价:YARD CIF SINGAPORE,含佣金3% 总值:HKD201, 装运期:2006年1月31日前自中国港口至新加坡,允许分装运和转船。 付款条件:凭不可撤销即期信用证付款,于装运期前一个月开到卖方,并于上述装运期后十五天内在中国议付有效。 保险:由卖方根据中国人民保险公司1981年1月1日中国保险条款按发票金额的110%投保一切险和战争险。 签订日期、地点:2005年10月11日于北京 合同号码:PS—1234 - 开来信用证如下: ABC BANK Date: 1 November, 2005 To: Bank of China Beijing We hereby open our Irrevocable Letter of Credit -1234 in favor of China National Textiles Import & Export Corp, for account of General Trading Company, Singapore, up to an aggregate amount of HK $201,600,00(Say Us Dollars Two Hundred and One Thousand Six Hundred Only) CIFC2% Singapore for 100% of the invoice value relative to the shipment of: 67,200 Pieces of Dove Brand Printed Shirting 30×36 72×69 35/6" ×42 yards

信用证实训

一、根据下列信用证回答问题 TO: BANK OF CHINA SHANGHAI BRANCH FROM: THE HONGKONG AND SHANGHAI BANKING CORPORATION NEW YORK BRANCH LC NO:1678 APPLICANT:HOME TEXTILES CO.LTD. 220 HILL STREET ,NEW YORK,NY.,U.S.A. BENIFICIARY: SHANGHAI TEXTILE IMP AND EXP CORPORATION 27 ZHONGSHAN ROAD SHANGHAI.P.R. CHINA. DATE OF ISSUE: 30 FEB 1997 EXPIRY DATE AND PLACE: 30 APR 1997 SHANGHAI AMOUNT: USD 64,500 (SAY U.S. DOLLARS SIXTY FOUR THOUSAND AND FIVE HUNDRED ONLY) AVAILABLE BY NEGOTIATION WITH ANY BANK AGAINST BENEFICIARY'S DRAFT AT 30 DAYS SIGHT DRAWN ON US SHIPMENT FROM SHANGHAI TO NEW YORK NOT LATER THAN 15 APR 1997 PARTIAL SHIPMENTS ALLOWED TRANSHIPMENT NOT ALLOWED DOCUMENTS REQUIRED: --COMMERCIAL INVOICE IN DUPLICATE --FULL SET CLEAN ON BOARD BILLS OF LADING MADE OUT OUR ORDER MARKED FREIGHT PREPAID NOTIFY APPLICANT --INSURANCE POLICY/CERTIFICATE COVERING W.A. AND W.R. AS PER CIC 1/1/1981 COVERING:10,000 METER 100 PCT COTTON PRINT 54/56" AT USD 6.45 PER METER CIF NEW YORK SHIPPING MARKS:

《国际结算》习题集

1.出票包括(填写票据、签字并在被追索时承担票据责任) 2.汇票的付款期限的下述记载方式中,(at X days after sight) 3.退票行为是由(受票人)做出的 4.下列四种汇票中,注明(Pay to Johnson Co. only)是不可转让的 5.票据经过付款后,应由(D.付款人)收存 6.跟单汇票所指的“单”,是指(货运单据) 7.根据我国的票据法,当票据上金额的大小写不一致时(票据无效)。 8.支票(是以银行为付款人的即期汇票),是对支票的正确描述。 9.银行承兑汇票的出票人应是(工商企业)。 10.由出口商签发的、要求银行在一定时间内付款的汇票,不可能是(即期汇票) 11.根据下列的汇票记载,可判定记载为(Pay to Tom Co. or order the sum of two thousand US dollars)的汇票为有效汇票。 12.注明“At three months after sight pay to …”的汇票(应提示承兑) 13.某平年1月31日出具的汇票上写明“At one month after date pay to …”, 该汇票的到期日为当年(2月28号) 14.以(限制性记名)为抬头人的汇票为不可转让的汇票。 15.承兑是(受票人)对远期汇票表示承担到期付款责任的行为。 16.若汇出汇款为付款地货币,且汇出行在解付行有该货币账户,则这两地银行 之间的头寸拨付采取(解付行付讫,借记汇出行账户)。 17.(票汇)方式下,汇入行不负通知收款人到银行取款之责。 18.票汇结算的信用基础是汇款人与收款人之间的商业信用,但办理中使用的是 (银行即期)汇票。 19.在汇款业务中,若汇出行给汇入行的汇款通知中指示“In cover, please debit our account with you”,则表明(汇出行在汇入行开设有该笔汇款业务所使用货币的账户)。 20.在托收业务中,若代收行在托收行有该笔托收业务的货币账户,则两行间的 头寸拨付方式是(代收行收妥后授权托收行借记其账户)。

信用证审核和修改

单证实务段考 班级:学号:姓名:根据以下销售合同审核国外开来的信用证,指出信用证中存在的10个问题并说明应如何修改。(100分) Sales Confirmation No:0003916Date:Sep.30,2006Seller:Ningbo Huadu Textile International Trade Corp. Buyer:Sunny Men Corporation,P.O.Box No.6789 Toronto,https://www.360docs.net/doc/439115487.html,modity and Specifications: Polo brand full cotton men’s shirt 15,000pcs,5%more or less at seller'soption Packing:In cartons of 20pcs each,containerized Unit Price:US$1.20 Per Piece CFR Toronto Total value:US$18,000.00(U.S.Dollars Eighteen Thousand only) Time of shipment:During Nov./Dec.2006 In two equal monthly lots,fromChina to Toronto,allowing transshipment。 Insurance:To be covered by the Buyer Terms of Payment:By Irrevocable Sight Letter of Credit to reach the Seller15 days before the month of shipment and remained valid for negotiation inChina until the 15th days after date of shipment。 IRREVOCABLE DOCUMENTARY CREDIT NO. 051086Oct.12,2006FROM:THE ROYAL BANK OF CANADA TO:BANK OF CHINA,NINGBO,CHINA WE OPEN IRREVOCABLE DOCUMENTARY CREDIT NO. 051086 BENEFICIARY:NINGBO HUADU TEXTILEIMP. AND EXP. CO. LTD.(1)

信用证案例分析 含答案

二十三、信用证开证行的付款责任 一、我某公司向外国某商进口一批钢材,货物分两批装运,支付方式为不可撤销即期信用证,每批分别,由中国银行开立一份信用证。第一批货物装运后,卖方在有效期内向银行交单议付,议付行审单后该行议付货款,中国银行也对议付行作了偿付。我方在收到第一批货物后,发现货物品质不符合合同规定,要求开证行对第二份信用证项下的单据拒绝付款,但遭到开证行拒绝。 问:开证行拒绝是否有道理? 答:1、开证行拒绝是有道理的。 2、分析提要: 在本案中,开证行是按信用证支付原则,还是按买方要求,这是本案分析的焦点,根据“单单相符,单证一致”的信用证支付原则,开证行依信用证规定的支付原则行事是合法、合理的,这也是分析本案开证行拒绝买方要求的关键。 3、理由:本案货物买卖的支付方式为不可撤销即期信用证。根据《跟单信用证统一惯例》规定,信用证一经开出,在有效期内不经受益人或有关当事人同意,开证行不得单方加以修改或撤销信用证,即银行见票即付。因为信用证开出以后就成了独立于买卖合同的另一个交易关系,银行只对信用证负责,只要卖方提交符合信用证规定的单据,在单单一致,单证一致的条件下,银行承担无条件付款的义务。为此,开证行拒绝我某公司提出对第二份信用证项下的交易所拒绝付款的要求是合法、合理的,因为开证行只依信用证,而不看重双方买卖合同的规定。

二、上海A出口公司与香港B公司签订一份买卖合同,成交商品价值为418816美元。A公司向B公司卖断此批产品。合同规定:商品均以三夹板箱盛放,每箱净重10公斤,两箱一捆,外套麻包。香港B公司如期通过中国银行香港分行开出不可撤销跟单信用证,信用证中的包装条款为:商品均以三夹板箱盛放,每箱净重10公斤,两箱一捆。对于合同与信用证关于包装的不同规定,A公司保证安全收汇,严格按照信用证规定的条款办理,只装箱打捆,没有外套麻包。“锦江”轮将该批货物5000捆运抵香港。A 公司持全套单据交中国银行上海银行办理收汇,该行对单据审核后未提出任何异议,因信用证付款期限为提单签发后60天,不做押汇,中国银行上海分行将全套单据寄交开证行,开证行也未提出任何不同意见。但货物运出之后的第一天起,B公司数次来函,称包装不符要求,重新打包的费用和仓储费应由A公司负担,并进而表示了退货主张。A公司认为在信用证条件下应凭信用证来履行义务。在这种情况下,B公司又通知开证行“单据不符”,A公司立即复电主张单据相符。 问:本案应如何处理?为什么? 答:在本案中,双方争执的焦点是其成交合同与信用证的规定不相符合,处理本案争执的关键是依合同还是依据信用证。根据《跟单信用证统一惯例》(UCP500)的规定,信用证“单单相符、单证一致”的支付原则,卖方上海A公司依据信用证行事是合法、合理的,应给予支持。因为在给付时,开证行和受益人只依据信用证行事,而不看重合同的规定,而对买方香港B公司的主张证据不足,不予支持,因为本案处理是依据信用而不依据合同。

修改信用证实训

信用证实训 一、根据下列合同审核并修改信用证 SALES CONFIRMATION S/C NO.:SPT-211 DATE: Jan.8, 2015 The Seller: SHANGHAI SPORTING GOODS IMP. & EXP. CORP Address: 215 HUQIU ROAD SHANGHAI CHINA The Buyer: PETRRCO INTERNATIONAL TRADING CO. Address: 1100 SHEPPARD AVENUE EAST SUITE406 PORT OF LOADING AND DESTINATION: From Shanghai to Vancouver with transshipment and partial shipment allowed. TIME OF SHIPMENT: During Mar. 2015 TERMS OF PAYMENT: The buyer shall open through a bank acceptable to the seller an irrevocable letter of credit at sight to reach the seller 30 days before the month of shipment valid for negotiation in Vancouver until the 15th day after the date of shipment. INSURANCE: To be covered by the seller for 110% of the invoice value against All Risks and War Risks as per the relevant ocean marine cargo clauses of the People’s Insurance Company of China dated 01/01/1981. REMARKS: 1.The Buyer shall have the covering letter of credit reach the seller 30 days before shipment, falling which the Seller reserves the right to rescind without further notice, or to regard as still valid whole or any part of this contract not fulfilled by the Buyer, or to lodge a claim for losses thus sustained, if any. 2.In case of any discrepancy in Quality/Quantity, claim should be filed by the Buyer within 130 days after the arrival of the goods at port of destination; while for quantity discrepancy, claim should be filed by the Buyer within 150 days after the arrival of the goods at port of destination. 3.For transactions concluded on C.I.F. basis, it is understood that the insurance amount will be for 110% of the invoice value against the risks specified in the Sales Confirmation. If additional insurance amount or coverage required, the Buyer must have the consent of the Seller before Shipment, and the additional premium is to be borne by the Buyer. 4.The Seller shall not hold liable for non-delivery or delay in delivery of the entire lot or a portion of the goods hereunder by reason of natural disasters, war or other causes of Force Majeure. However, the Seller shall notify the Buyer as soon as possible and furnish the Buyer within 15 days by registered airmail with a certificate issued by the China Council for the Promotion of International Trade attesting such event(S). 5.All disputes arising out of the performance of, or relating to this contract, shall be settled through negotiation. In case no settlement can be reached through negotiation, the case shall arbitration in

信用证练习题

第一章信用证一、练习题 (一)中英文术语、短语互译 1. 不可撤销信用证 2. 开证日期 3. 电汇索偿 4. 一切银行费用 5. 佣金 6. 出票根据 7. 正本单据 8. 通知行 9. 账户 10 保兑行 1. Applicant 2. Beneficiary 3. Negotiation Bank 4. Drawee Bank

5. Expiry Date 6. Documentary Credit 7. Documents Required 8. Special Conditions 9. Up to an Aggregate Amount of 10. The Full Name and Address of the Openers 二单项选择题 1.不可撤销信用证在信用证的有效期内,未经()的同意,开证行或开证人不得撤销或修改。 A. 受益人 B. 开证人 C. 开证行 D. 受益人 2.根据《UCP600》的规定,若信用证没有注明()字样,则认为该信用证为不保兑信用证。 A. Confirmed B. Revocable C. Revolving D. Transferable 3.在进料加工贸易中,经常先向外商购买原材料或配件,我方加工成品后再卖给该外商。为了避免上当受骗,我方应采用()比较稳妥。 A.保兑信用证 B. 可转让信用证 C. 预支信用证 D. 对开信用证 4.下列对信用证有效期的描述,属于直接写明具体日期的是()

A. Documents must be presented for negotiation within 10 days after the on board date of bill of lading B. Negotiation must be on or before the 15th day of shipment C. This L/C is valid for negotiation in China until Oct. 1. 2002 D. Documents to be presented to negotiation bank within 15 days after shipment. 5.根据《UCP600》的规定,如使用“于或约于”之类的词语限定装运日期,银行将视为在所述日期前后各()内装运,起讫日包括在内。 A. 3天 B. 5天 C. 7天 D. 10 天 6.下列词组中,表示“议付行”的是()。 A. Confirming Bank B. Opening Bank C. Negotiation Bank D. Advising Bank 7.根据《UCP600》的规定,若信用证没有特别说明,则信用证()。 A. 未注明“Transferable”字样或条款,即为可转让信用证。 B. 未注明“Irrevocable”字样,即为可撤销信用证。 C. 未注明“Confirmed”字样,即为不保兑信用证。

信用证修改

信用证修改 Sales Contract The seller:China National Cereals, Oils & Foodstuffs Corporation The buyer:Hong Kong Food Company, Vancouver Name of Commodity:Great Wall Brand Strawberry Jam Specification:340 gram each tin Quantity:50000 tins Unite Price:CAN$ 2.50 PER TIN CFRC3% V ANCOUVER Total Amount:CAN$ 125,000 Shipment:shipment from China port to Vancouver during Nov.2003,partial shipment are allowed and transshipment is allowed. Payment:Irrevocable L/C at sight. Documents must be presented within 15 days after date of issuance of the bills of lading but within the validity of the credit. COMMECIAL BANK OF V ANCOUVER TO: China National Cereals, DATE: Oct.5, 2003 Oils & Foodstuffs Corporation Beijing, China Advised Through Bank of China, Beijing NO.BOC 03/10/05 IRREVOCABLE DOCUMENTARY LETTER OF CREDIT Dear Sirs: We open this by order of Hong Kong Food Company, Vancouver for a sum not exceeding CAN$120,000(SAY CANADIAN DOLLARS ONE HUNDRED AND TWENTY THOUSAND ONLY) available by drafts drawn on us at sight accompanied by the following documents: —Full set of clean on board bill of lading made out to order and blank endorsed, marked “Freight Collect” dated not later than November 30, 2003 a nd notify applicant. —Signed commercial invoice in quintuplicate. —Canadian customs invoice in quintuplicate. —Insurance policies (or certificates) in duplicate covering marine All Risks and war risks subject to P.I.C.C. dated Jan.1st,1981. Evidencing shipment from China port to Montreal, Canada of the following goods: 5000 tins of 430 grams of Great Wall Strawberry Jam, at CAN$2.50 per tin CFR3% Vancouver, details as per your S/C No.94/8712 Partial shipment are allowed. Transshipment is allowed. This Credit expires on November 30, 2003 for negotiation in China.

信用证题目及答案

信用证题目及答案 一、单项选择题(单项选择题的答案只能选择一个,多选不得分) 1.根据《UCP600》的规定,开证行的合理审单时间是收到单据次日起的(A)个工作 日之内。 A.5 B.6 C.7 D.8 2.“单单一致”的纵审时,以(B)为中心。 A 保险单 B 商业发票C.海运提单D.装箱单 3.下列哪项不属于“正确”制单要求的“三相符”(B) A.单据与信用证相符B.单据与货物相符 C.单据与单据相符D.单据与贸易合同相符 4.当L/C 规定INVOICE TO BE MADE IN THE NAME OF ABC…,应理解为(D)。 A.一般写成××(中间商)FOR ACCOUNT OF ABC(实际购货方,真正的付款人)B.将受益人ABC 作为发票的抬头人 C.议付行ABC 作发票的抬头 D.将ABC 作为发票的抬头人 5.根据联合国设计推荐使用的用英文字母表示的货币代码,如下表示不正确的是(C) A.CNY89.00 B.GBP89.00 C.RMB89.00 D.USD89.00 6.在托收项下,单据的缮制通常以(C)为依据。A.信用证B.发票

C.合同D.提单 7.一份信用证规定有效期为2008 年11 月15 日,装运期为2008 年10 月,未规定装运日 后交单的特定期限,实际装运货物的日期是2008 年10 月10 日。根据《UCP600》规 定,受益人应在(B)前向银行交单。 A.2008 年11 月15 日B.2008 年10 月31 日 C.2008 年10 月15 日D.2008 年10 月25 日 8.信用证支付方式下,银行处理单据时不负责审核(C)。 A.单据与有关国际惯例是否相符 B.单据与信用证是否相符 C.单据与国际贸易合同是否相符 D.单据与单据是否相符 9. 在信用证业务中,有关当事方处理的是(C)。 A.服务 B.货物 C.单据 D.其他行为 10.在信用证支付方式下,象征性交货意指卖方的交货义务是(C)。 A.不交货 B.仅交单 C.凭单交货 D.实际性交货 11.假如在一笔交易中,提单日期为2009 年7 月15 日,信用证有效期为2009 年8 月15 日。按《UCP600》,受益人最迟向银行交单的期限为(B)。 A.2009 年7 月15 日 B.2009 年8 月5 日 C.2009 年8 月15 日 D.2009 年8 月6 日 12.某开证行2010年3月1日(周一)收到A公司交来的单据,根据《UCP600》规定,最迟的

信用证_综合制单实训

实训:综合制单 练习:根据下列国外来证及有关信息缮制发票、装箱单、原产地证书、提单、保单、汇票等 单据。AWC-23-522号合同项下商品的有关信息如下:该批商品用纸箱包装,每箱装10 盒,每箱净重为75公斤,毛重为80公斤,纸箱尺寸为113×56×30CM,商品编码为 6802.2110,货物由“胜利”轮运送出海。 FROM: HONGKONG AND SHANGHAI BANKING CORP., HONGKONG TO: BANK OF CHINA, XIAMEN BRANCH, XIAMEN CHINA TEST: 12345 DD. 010705 BETWEEN YOUR HEAD OFFICE AND US. PLEASE CONTACT YOUR NO. FOR VERIFICATION. WE HEREBY ISSUED AN IRREVOCABLE LETTER OF CREDIT NO. HKH123123 FOR USD8,440.00, DATED 040705. APPLICANT: PROSPERITY INDUSTRIAL CO. LTD. 342-3 FLYING BUILDING KINGDOM STREET HONGKONG BENEFICIARY: XIAMEN TAIXIANG IMP. AND EXP. CO. LTD. NO. 88 YILA ROAD 13/F XIANG YE BLOOK RONG HUA BUILDING, XIAMEN, CHINA THIS L/C IS AVAILABLE WITH BENEFICIARY’S DRAFT A T 30 DAYS AFTER SIGHT DRAWN ON US ACCOMPANIED BY THE FOLLOWING DOCUMENTS: 1.SIGNED COMMERCIAL INVOICE IN TRIPLICATE. 2.PACKING LIST IN TRIPLICATE INDICATING ALL PACKAGE MUST BE PACKED IN CARTON/ NEW IRON DRUM SUITABLE FOR LONG DISTANCE OCEAN TRANSPORTATION. 3.CERTIFICATE OF CHINESE ORIGIN IN DUPLICATE. 4.FULL SET OF CLEAN ON BOARD OCEAN MARINE BILL OF LADING MADE OUT TO ORDER AND BLANK ENDORSED MARKED “FREIGHT PREPAID” AND NOTIFY APPLICANT. 5.INSURANCE POLICY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK FOR THE VALUE OF 110 PERCENT OF THE INVOICE COVERING FPA/WA/ALL RISKS AND WAR RISK AS PER CIC DATED 1/1/81. SHIPMENT FROM: XIAMEN, CHINA .SHIPMENT TO: HONGKONG LATEST SHIPMENT 31 AUGUST 2004 PARTIAL SHIPMENT IS ALLOWED, TRANSSHIPMENT IS NOT ALLOWED. COVERING SHIPMENT OF: COMMODITY AND SPECIFICATIONS QUANTITY UNIT PRICE AMOUNT CIF HONGKONG. 1625/3D GLASS MARBLE 2000BOXES USD2.39/BOX USD4,780.00 1641/3D GLASS MARBLE 1000BOXES USD1.81/BOX USD1,810.00 2506D GLASS MARBLE 1000BOXES USD1.85/BOX USD1,850.00 SHIPPING MARK: P.7. HONGKONG NO. 1-400 ADDITIONAL CONDITIONS:

第一章信用证练习题

第一章信用证 一、练习题 (一)中英文术语、短语互译 1. 不可撤销信用证 2. 开证日期 3. 电汇索偿 4. 一切银行费用 5. 佣金 6. 出票根据 7. 正本单据 8. 通知行 9. 账户 10 保兑行 1. Applicant 2. Beneficiary 3. Negotiation Bank 4. Drawee Bank

5. Expiry Date 6. Documentary Credit 7. Documents Required 8. Special Conditions 9. Up to an Aggregate Amount of 10. The Full Name and Address of the Openers 二单项选择题 1.不可撤销信用证在信用证的有效期内,未经()的同意,开证行或开证人不得撤销或修改。 A. 受益人 B. 开证人 C. 开证行 D. 受益人 2.根据《UCP600》的规定,若信用证没有注明()字样,则认为该信用证为不保兑信用证。 A. Confirmed B. Revocable C. Revolving D. Transferable 3.在进料加工贸易中,经常先向外商购买原材料或配件,我方加工成品后再卖给该外商。为了避免上当受骗,我方应采用()比较稳妥。 A.保兑信用证 B. 可转让信用证 C. 预支信用证 D. 对开

信用证 4.下列对信用证有效期的描述,属于直接写明具体日期的是() A. Documents must be presented for negotiation within 10 days after the on board date of bill of lading B. Negotiation must be on or before the 15th day of shipment C. This L/C is valid for negotiation in China until Oct. 1. 2002 D. Documents to be presented to negotiation bank within 15 days after shipment. 5.根据《UCP600》的规定,如使用“于或约于”之类的词语限定装运日期,银行将视为在所述日期前后各()内装运,起讫日包括在内。 A. 3天 B. 5天 C. 7天 D. 10 天 6.下列词组中,表示“议付行”的是()。 A. Confirming Bank B. Opening Bank C. Negotiation Bank D. Advising Bank

信用证修改申请书

信用证修改申请书 信用证修改申请书一: 编号: 申请 日期:年月日 银行: 我单位申请对在规行开立的____号信用证做第____次修改。 本次信用证修改通知方式:信开通知□ 电开通知□ 原证金额:_____ 原证受益人:_____ 我单位业务编号:_____ 我单位和同号:_____ 本次修改包括以下内容: (1)、 (2)、

(3)、 (4)、 (5)、 (6)、 (7)、 原证其他条款不变。 联系人: 电话: 申请人签章 注:本申请书一式三联,第一联受理回单;第二联修改依据;第三联修改存查。用途及联次应分别印在信用证修改申请书右端括弧内和括弧与编号之间。 信用证修改申请书二: 编号:年字号

致:中国银行股份有限公司行 现我司因业务需要,依据我司与贵行签署的编号为________ ___ __的□《授信额度协议》/□《授信业务总协议》及其附件1:用于开立国际信用证和编号为的《开立国际信用证申请书》/□《开立国际信用证合同》,向贵行申请修改由贵行开立的编号为的信用证。由于此产生的权利义务,均按照前述协议及其附件/合同、申请书和本申请书的约定办理。 第一条信用证的修改内容 信用证的修改内容见随附英文。 第二条增加保证金 我司将通过以下第种方式向贵行交付本笔业务下增加的保证金: (1)、在本申请书被贵行接受之日起个银行工作日内通过交纳。(2)、授权贵行直接从我司账户(账号:)中扣收。 (3)、其他方式:。 保证金补交金额为(币种) (大写) ,(小写) 。 第三条费用 我司将按时向贵行支付因本申请书项下信用证修改而产生的有

关费用,该费用的计收依据、标准和方式等按贵行有关规定执行。 我司将通过以下第种方式支付上述费用: (1)、在本申请书被贵行接受之日起个银行工作日内通过交纳。 (2)、授权贵行直接从我司账户(账号:)中扣收。 (3)、其他方式:。对于提交此申请书时不能预见、在信用证修改后发生的应由我司承担的费用(包括受益人拒绝承担的银行费用),我司将以与上述相同的方式向贵行支付。 申请人:有权签字人:年月日 担保人意见:(备注:适用于因修改而加重申请人债务的情形,若不适用则删除) 我司同意上述申请人即就该信用证向贵行提出的修改,并兹确认在该信用证修改后继续依据编号为的《合同》的约定向贵行承担担保责任。 担保人:有权签字人:年月日 银行意见:有权签字人/ 经办人:年月日 信用证修改申请书三:

信用证修改答案

SMT006-1参考答案 修改信用证 2013 MAR29 08:17:21 MT: H.S.700 ISSUE OF DOCUMENTARY CREDIT FUNC FJQZOOTQ UMR10732456 APPLICATION HEADER 0 700 1635 060328 CZNBSBAXXX 5913 287523 060328 1536 N ? KOOKMIN BANK ? PUSAN USER HEADER SERVICE CODE 103 BANK PRIORITY 113 INFO.FROMC1211: SEQUE NCE OF TOTAL ? 27: 1/2 FORM OF DOC. CREDIT ? 40:IRREVOCABLE DOC. CREDIT NUMBER ? MKC478632 DATE OF ISSUE ? 31C:20130428 EXIPRY ? 31D: DATE 20130610IN OUR COUNTRY 20130627IN CHINA APPLICANT ? 50: D.D. TRADING COMPANY BENEFICIARY ? 59: WENZHOU SMART INTERNATIONAL COMPANY 189 YANDANG ROAD 18 WENZHOU CHINA AMOUNT ? 32B: CURRENCY USD AMOUNT 31920.00 32376.00 A VAILABLE WITH/BY ? 4 ID: BANK OF CHINA, WENZHOU BRANCH BY NEGOTIATION DRAFTS AT... ? 42C: DRAFTS AT 30 DAYS' SIGHT A T SIGHT DRAWEE ? 42A: CZNBSBAXXX KOOKMIN BANK PUSAN PARTIAL SHIPMENTS ? 43P: ALLOWED TRANSHIPMENT ? 43T: PROHIBITED ALLOW LOADING IN CHARGE ? 44A: SHIPMENT FROM CHINESE PORT (S) FOR TRANSPORT TO ? 44B: PUSAN, KOREA LATEST DATE OF SHIP ? 44C: 2013051020130612 DESCRIPT.OF GOODS ? 45A: TENDENCY SHOE767 2280 PAIRS UNIT PRICE: USD 14.00 PER PAIR USD 14.20 PRICE TERM: CIF PUSAN CIFC5%