《管理者会计课程2》

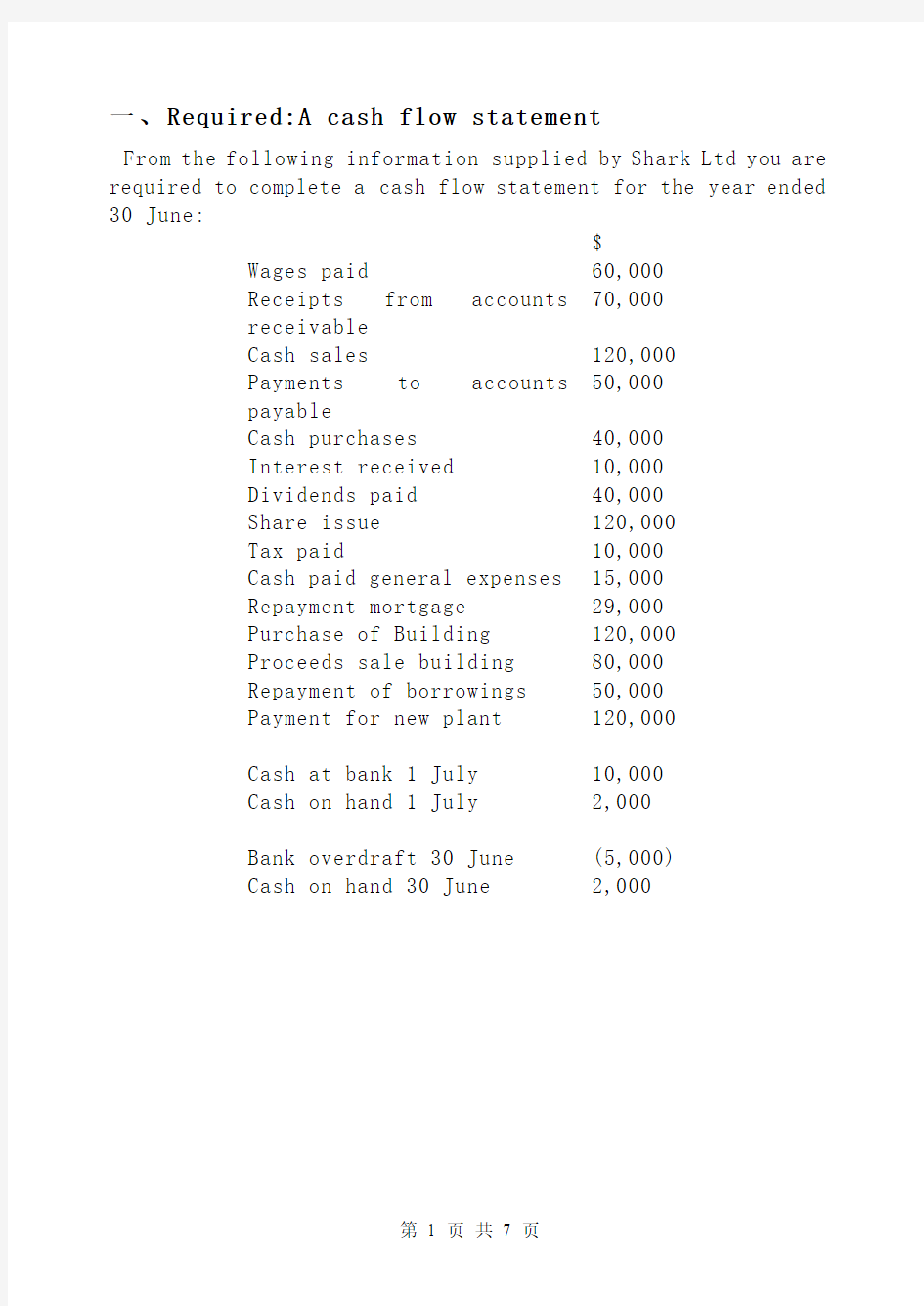

一、Required:A cash flow statement

From the following information supplied by Shark Ltd you are required to complete a cash flow statement for the year ended 30 June:

$

Wages paid 60,000

70,000

Receipts from accounts

receivable

Cash sales 120,000

50,000

Payments to accounts

payable

Cash purchases 40,000

Interest received 10,000

Dividends paid 40,000

Share issue 120,000

Tax paid 10,000

Cash paid general expenses 15,000

Repayment mortgage 29,000

Purchase of Building 120,000

Proceeds sale building 80,000

Repayment of borrowings 50,000

Payment for new plant 120,000

Cash at bank 1 July 10,000

Cash on hand 1 July 2,000

Bank overdraft 30 June (5,000)

Cash on hand 30 June 2,000

二、Calculate

The following annual data relates to Qi Ltd .

Unit selling price $60

$40

Variable cost per

unit

Annual fixed costs $480,000

Plant capacity 35,000

units

Current production 34,000

units

Required: Calculate (showing all workings)

a) Break-even point in units

b) Break-even point in $

c) Break even point in units if selling price increases to $75 per unit

d) Profit at sales of 30,000 units per year

三、Calculate the Net Present Value of the equipment

Gao Ltd is considering the purchase of large machi nery worth $350,000.

The machinery would have a 5 year life and a resale value of $150,000.

The new project would produce a net increase in cash inflows of $75,000 each year.

The company has a cost of capital of 12%.

Required:

Calculate the Net Present Value of the equipment. (Use the

FACTORS FOR CALCULATING THE PRESENT VALUE OF $1

四、Calculation

1.For a particular period, a manufacturer has the following costs:

Variable factory overhead $30,000

Financial expenses $16,400

Depreciation of factory plant & equipment $20,000

Direct materials used $70,500

Variable selling expenses $32,000

Direct labour $60,000

Fixed selling expenses $30,400

Factory rent $32,000

Calculate the following amounts:

a) Total product costs

b) Total variable product costs

c) Total fixed product costs

d) Total conversion costs

e) Total period costs

f) Prime cost

五、Trial Balanc

Using the Trial Balance for Charlie Tan you are required to prepare:

1.A classified Income Statement for the year ended 30th June 2009.

2.A classified Balance Sheet as at 30th June 2009.

A stock-take at 30th June 2009 revealed closing stock of $14,000. Vehicles are used exclusively by the sales staff.

All equipment is maintained in the office.