Horngren-financial accounting(9e)-solutions-7

CHAPTER 7

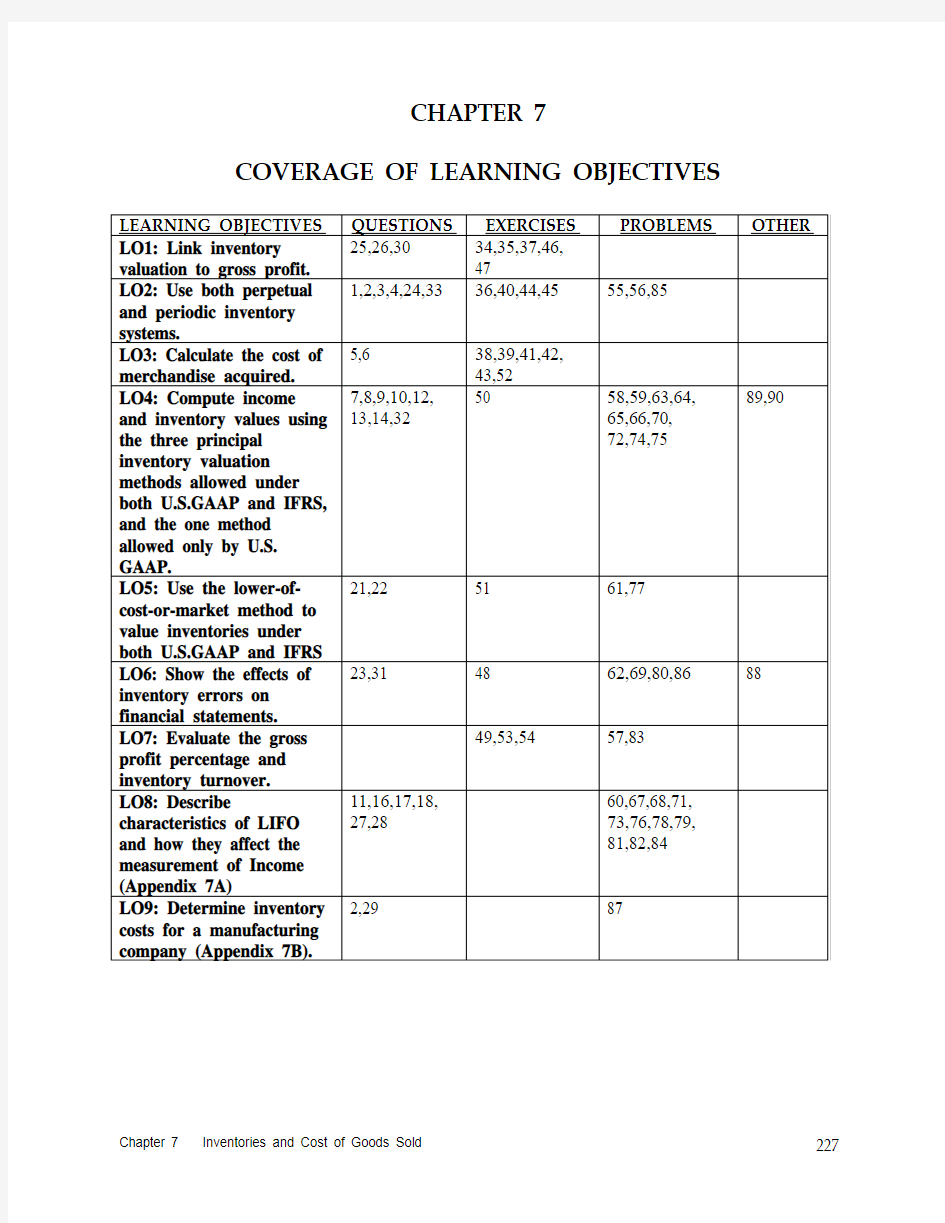

COVERAGE OF LEARNING OBJECTIVES

Chapter 7 Inventories and Cost of Goods Sold 227

CHAPTER 7

7-1 Sales transactions are accompanied by recording of the cost of goods sold (or cost of sales). This is literally true under the perpetual system and conceptually descriptive under the periodic system.

7-2 The two steps are obtaining (1) a physical count and (2) a cost valuation.

7-3 Perpetual systems provide continuous inventory and cost of goods sold records. Periodic systems rely on taking a physical inventory to calculate and record cost of goods sold at the end of the period.

7-4 It is true that the periodic method requires a physical count to measure cost of goods sold and the perpetual method does not. However, for control purposes, it is important to undertake at least annual physical counts of inventory under the perpetual method, as well.

The difference between what the accounting records show and the physical count will be due to theft, spoilage, or other unrecorded changes.

7-5 F.O.B. destination means the shipper pays the freight bill. F.O.B shipping point means the customer bears the cost of the freight bill. F.O.B. stands for ―free on board.‖The terms also describe whether the seller or buyer ―owns‖ the goods while they a re in transit.

7-6 Freight out is not shown as a direct offset to sales. Unlike sales discounts and returns, freight out is not a part of gross revenue that never gets collected. Instead, it is an expense, entailing ordinary cash disbursements.

7-7 The four methods are:

1. Specific identification – charges the actual cost of the specific item sold.

2. FIFO – items purchased first are assumed to be sold first.

3. LIFO – items purchased most recently are assumed to be sold first.

4. Weighted average –the average cost of all items available is charged for each

item sold.

7-8 The specific identification method is normally used for low volume, high value items.

Therefore, we would expect this to be used for a, b, d, and f.

7-9 Yes. Under FIFO the oldest costs are assigned to the cost of goods sold first, so the same cost of goods sold arises whether the costs are assigned at year end or as the sales occur. 7-10 The good news is that LIFO reduces taxes in times of rising prices. The bad news is that reported profit is lower.

7-11 Yes. Purchases under LIFO can affect income immediately, because the unit costs of the latest purchases in the period are assigned to units sold even if the purchases occur after the sales.

228

7-12 No. The weighted average must take into account the number of units purchased at each price. For Gamma Company, the weighted average unit cost of inventory is: [(2 × $4.00) + (3 × $5.00)] 5 = $4.60.

7-13 Ending inventory is lower under LIFO in a period of rising prices and constant or growing inventory. FIFO produces the higher ending inventory value.

7-14 Falling prices reverse the normal relation, so FIFO produces higher cost of goods sold and, therefore, lower net earnings. This helps explain why computer and electronics firms typically use FIFO in order to lower their taxes.

7-15 Consistency requires the maintaining of constant accounting methods from period to period. Switching accounting methods hinders comparisons of current results to those of preceding periods.

7-16 Companies have adopted LIFO primarily because it saves income taxes during times of rising prices by reporting higher cost of goods sold and lower profits.

7-17 An inventory profit is fictitious because, for a going concern, it represents an amount necessary for replenishing inventory and is therefore not ―available‖ in the form of cash for distribution as dividends. It arose from change in unit costs of the products purchased, not from the company’s value-added activities.

7-18 LIFO inventory valuations can be absurd because inventory valuation is based on older and older costs as the years pass.

7-19 Conservatism does result in lower immediate profits, but higher profits are then shown in later periods.

7-20 This convention is called conservatism.

7-21 Under IFRS the market price is the net realizable value – the net amount the company expects to receive for the inventory. Under U. S. GAAP it is usually the current replacement cost – what it would cost to buy the inventory item today.

7-22 The inconsistency is the willingness of accountants to have replacement costs used as a basis for write-downs below historical costs, even though a market exchange has not occurred, but their unwillingness to have replacement costs used as a basis for write-ups above historical costs.

Chapter 7 Inventories and Cost of Goods Sold 229

7-23 Many inventory errors do counterbalance. For example, an ending inventory that is overstated will overstate current income. But the same overstated inventory becomes the beginning inventory the next year; hence, next year’s income will be understated. To show this you might use the following schematic:

Year 1 Year 2

BI OK

+ Purchase OK

Goods Available OK

– Ending Inventory Too Large

Cost of Goods Sold Too Small

This exercise stresses the fact that the ending inventory of one year becomes the

beginning inventory of the subsequent year and the errors correct themselves.

7-24 Cost of goods sold = Beginning inventory + Purchases – Ending inventory.

7-25 Past gross profit percentages are sometimes applied to current revenue as interim

estimates of gross profit for a month or quarter. Thus, the time and cost of taking

physical inventories can be saved.

7-26 Grocery stores have a low profit margin. If the profit margin is 2%, a savings of $100 in

shrinkage would be equivalent to a $5,000 increase in sales.

7-27 The inventory holding gain is an increase in the value of inventory due to price changes

that occur while the inventory is held.

7-28 When LIFO layers are liquidated, older, generally lower cost items are reflected in cost of

goods sold and high profits are reported in the income statement. In other words, the

inventory holding gains are realized.

7-29 Manufacturing companies have raw material, work in process, and finished goods

inventories. The size of the various inventories will vary from industry to industry and

from season to season in many industries. Most often finished goods will be the largest

inventories and work in process will be the smallest inventories.

7-30 Your boss has a point. This is a cost benefit question. If the company does not give the

discount, it may lose customers to competitors that treat them better. But if it is not

currently a custom in the industry, the company may not have to do it. If offering the

discount does not cause customers to buy more, it is giving money away. However, if it

is not an industry custom and it attracts new customers, this may lead to a different

conclusion. Compare how much your operating income would rise from newly attracted

customers versus the discounts received by existing customers.

230

7-31 Phar Mor overstated its assets by overstating inventories. This means that either liabilities or stockholders’ equity must also be overstated (to keep the balance sheet equation in balance). Most likely Phar Mor used a periodic inventory method, so that overstating ending inventory would reduce cost of goods sold and increase pretax profit.

If the company used a perpetual inventory system, management must have made inappropriate credits to cost of goods sold or some other expense account to offset the additional debits to the inventory account.

7-32 Under the FIFO method, the cost of sales will be based on old acquisition costs. Under the LIFO method, the cost of sales will be based on the most recent acquisition costs.

Thus, under LIFO, if additional units are acquired on the last day of the year, the cost of those units will be included in cost of sales. Thus, under LIFO, additional purchases would produce higher cost of goods sold in this instance and lower evaluations for the purchasing officer. Thus, under LIFO he would be less likely to purchase additional oil on the last day of the year.

7-33 There are many advantages to a perpetual inventory system. It allows a continuous tracking of inventories, allowing better control of inventory. This could include tracking of sizes, colors, and other product characteristics, which could help manage production.

Its biggest disadvantage is cost; a periodic inventory system is simpler and less costly.

However, with the use of optical scanning and computers, the cost of a perpetual inventory system has come down quickly. If the Zen Bootist is willing to invest in a system that codes each individual product and tracks its progress through the inventories, then many advantages of a perpetual inventory system can be achieved.

7-34 (10–15 min.)

GOODMAN’S JEWELRY WHOLESALERS

Schedule of Gross Profit

For the Year Ended December 31, 20X8

(In Thousands)

Gross sales $995 Deduct: Sales returns and allowances $ 50 Cash discounts on sales 5 55 Net sales 940 Cost of goods sold:

Inventory, December 31, 20X7 $103

Add: Gross purchases $650

Deduct: Purchase returns and allowances $27

Cash discounts on purchases 6 33

Net purchases 617

Add Freight-in 50

Cost of merchandise acquired 667

Cost of goods available for sale 770

Deduct: Inventory, December 31, 20X8 185

Cost of goods sold 585 Gross profit $355 Chapter 7 Inventories and Cost of Goods Sold 231

7-35 (20 min.)

Sales $71,200 Sales returns 2,300 Net sales $68,900 Cost of goods sold:

Inventory, January 1* x = $39,864

Cost of goods purchased:

Purchases $54,000

Purchase returns 1,000

Net purchases $53,000

Freight in 500 53,500 Cost of goods available for sale $93,364

Inventory, January 15 41,000

Cost of goods sold, .76 × $68,900 52,364 Gross margin, .24 × $68,900 $16,536 * $52,364 + $41,000 – 53,500 = $39, 864

or:

Cost of goods sold (.76 × 68,900) $52,364 Cost of goods purchased 53,500 Inventory increase $ 1,136 Ending Balance = Beginning Balance + Increase (or – decrease) =

$41,000 = Beginning Balance – $1,136

Beginning Balance = $39,864 7-36 (5 min.) Amounts are in millions of dollars.

Perpetual Periodic Accounts receivable* 19 Accounts receivable 19 Sales revenue 19 Sales revenue 19 Cost of goods sold 16 No entry

Merchandise inventory 16

* Could be a debit to cash if sales were for cash.

232

Cost of Goods Available = £19,400

(6,000 + 4,200 + 4,400 + 2,300 + 2,500)

LIFO Ending Inventory = (3,000 @ £2) + (1,500 @ £2.10) = £9,150

FIFO Ending Inventory = 1,000 @ £2.50 = £ 2,500

1,000 @ £2.30 = 2,300

2,000 @ £2.20 = 4,400

500 @ £2.10 = 1,050

4,500 £10,250 Weighted average = £19,400/9,000 = £ 2.16 per unit

Ending inventory 4,500 @ £2.16 = £9,720*

* With no rounding error on the unit cost this would be £9,700.

Cost of Goods Sold Calculation:

Weighted

LIFO FIFO Average Cost of goods available £19,400 £19,400 £19,400 Less Ending Inventory (9,150) (10,250) (9,720) Cost of Goods Sold £10,250 £ 9,150 £ 9,680* * Or £9,700 with no rounding error.

7-38 (10–15 min.)

This is straightforward. Answers are in Swiss francs.

Aug. 2 Purchases 350,000

Accounts payable 350,000 Aug. 3 Freight-in 16,000

Cash 16,000 Aug. 7 Accounts payable 32,000

Purchase returns and allowances 32,000 Aug. 11 Accounts payable 318,000

Cash discounts on purchases 6,360

Cash 311,640 Chapter 7 Inventories and Cost of Goods Sold 233

1. Invoice price $195,000

Add: Freight-in 10,000

Deduct: Purchase allowance (10,000)

Deduct: Cash discount (3,700)*

Total cost of steel acquired $191,300

*2% × ($195,000 – $10,000)

2. Purchases (or Inventory)* 195,000

Accounts payable 195,000 *The debit is to Purchases under the periodic inventory method and to Inventory under the perpetual inventory system.

Freight-in 10,000

Accounts payable (or cash) 10,000

Accounts payable 10,000

Purchase returns and allowances 10,000

Accounts payable 185,000

Cash discounts on purchases 3,700

Cash 181,300 234

7-40 (15 min.) Amounts are in thousands of dollars.

See Exhibit 7-40 for the balance sheet equation. Although not required, the balance sheet equation provides a good framework for understanding.

Journal Entries

Perpetual System

a. Gross purchase: Inventory 950

Accounts payable 950

b. Returns and allowances: Accounts payable 70

Inventory 70

c. As goods are sold: Cost of goods sold 890

Inventory 890 d1. and d2. No entry

Periodic System

a. Gross purchase: Purchases 950

Accounts payable 950

b. Returns and allowances: Accounts payable 70

Purchase returns

and allowances 70

c. As goods are sold: No entry

d1. Transfer to cost of goods sold: Cost of goods sold 990

Purchase returns

and allowances 70

Purchases 950

Inventory 110 d2. Recognize ending inventory: Inventory 100

Cost of goods sold 100 Chapter 7 Inventories and Cost of Goods Sold 235

EXHIBIT 7-40

Entries are in thousands of dollars.

A = L + SE

Purchase

Returns and Accounts Retained

Inventory Purchases Allowances Payable Earnings PERPETUAL SYSTEM

Balance, 12/31/X7 +110 = + 110

a. Gross purchases +950 = + 950

b. Returns and allowances – 70 = – 70

c. As goods are sold –890 = –890 [Increase Cost of

Goods Sold] Closing the accounts at end of period:

d1. No entry

d2. No entry ____ ____

Ending balances, 12/31/X8 +100 = +990 –890

PERIODIC SYSTEM

Balance, 12/31/X7 +110 = + 110

a. Gross purchases +950 = + 950

b. Returns and allowances –70 = – 70

c. As goods are sold (no entry)

Closing the accounts at

end of period:

d1. Transfer to cost of goods sold –110 –950 +70 = – 990 [Increase Cost of

Goods Sold] d2. Recognize ending inventory +100 = + 100 [Decrease Cost of

___ ___ ___ Goods Sold] Ending balances, 12/31/X8 +100 0 0 = +990 – 890

236

7-41 (10 min.)

This is straightforward.

1. Purchases 900,000

Accounts payable 900,000

2. Accounts payable 50,000

Purchase returns and allowances 50,000

3. Freight-in 74,000

Cash 74,000

4. Accounts payable 850,000

Cash 832,000

Cash discounts on purchases 18,000 7-42 (10 min.)

The entries could be compounded.

Accounts receivable (or Cash) 1,250,000

Sales 1,250,000 Cost of goods sold 977,000

Purchase returns and allowances 50,000

Cash discounts on purchases 18,000

Purchases 900,000

Freight-in 74,000

Inventory 71,000

Inventory 120,000

Cost of goods sold 120,000 Chapter 7 Inventories and Cost of Goods Sold 237

Compound entries could be prepared. (Amounts are in millions.)

Purchases 140

Accounts payable 140 Accounts receivable 239

Sales 239 Sales returns and allowances 5

Accounts receivable 5 Accounts payable 6

Purchase returns and allowances 6 Freight-in 14

Cash 14 Accounts payable 134

Cash discounts on purchases 1

Cash 133 Cash 226

Cash discounts on sales 8

Accounts receivable 234 Cost of goods sold 162

Purchase returns and allowances 6

Cash discounts on purchases 1

Inventory 15

Purchases 140

Freight-in 14 Inventory 45

Cost of goods sold 45 Other expenses 80

Cash (or other accounts) 80 7-44 (5 min.) Amounts are in millions of dollars.

Beginning inventory $ 346

Purchases (or production costs) 21,497

Cost of goods available 21,843

Ending inventory (509)

Cost of goods sold $21,334

238

This problem develops familiarity with the gross profit section. The answer, $53,760, is computed by filling in the gross profit section and solving for the unknown, or: $192,000 – (54% × $256,000) = $53,760

Gross sales $280,000 Deduct: Sales returns and allowances 24,000 Net sales $256,000 Cost of goods sold:

Inventory, December 31, 20X7 $38,000

Gross purchases $159,000

Deduct: Purchase returns

and allowances $7,000

Cash discounts

on purchases 2,000 (9,000)

Net purchases 150,000

Inward transportation 4,000

Cost of goods acquired 154,000

Cost of goods available for sale 192,000

Inventory, May 3, 20X8* x = 53,760

Cost of goods sold,

54% of $256,000 138,240 Gross profit, 46% of $256,000 $117,760

* Calculated as the difference between cost of goods available for sale, $192,000, and cost of goods sold, $138,240.

7-46 (15 min.)

Sales $200,000 Cost of goods sold:

Inventory, January 1 $65,000

Purchases $190,000

Purchase returns and allowance 10,000

Net purchases $180,000

Freight-in 15,000 195,000

Cost of goods available for sale $260,000

Inventory, March 9* x = 100,000

Cost of goods sold, 80% of $200,000 160,000 Gross margin, 20% of $200,000 $ 40,000 * The answer, $100,000, is obtained by filling in the schedule of cost of goods sold and solving for the unknown, or: $260,000 – 80%($200,000) = $260,000 – $160,000 = $100,000.

Chapter 7 Inventories and Cost of Goods Sold 239

Beginning inventory $ 55,000

Purchases 200,000

Cost of goods available for sale $255,000

Less estimated cost of goods sold:

75%* of $300,000 225,000 Estimated ending inventory $ 30,000

*100% – 25% = 75%

The difference between $30,000 and the amount of inventory remaining is an estimate of the amount missing.

7-48 (10–15 min.)

1 & 2. To calculate the effect use the following approach:

20X5 20X6

Beginning inventory OK

Too low $10,000

+ Purchases OK OK

Goods available OK Too low $10,000 Ending inventory Too low $10,000 OK

Cost-of-goods sold Too high $10,000 Too low $10,000 Cost-of-goods sold is too high by $10,000 in 20X5 so taxable income will be too low by $10,000. Taxes will be too low by $4,000 so net income and retained earnings will be too low by $6,000. Taxable income for 20X6 will be overstated by $10,000 and taxes will be $4,000 too high. Net income in 20X6 will be too high by $6,000 and retained earnings will be correct again at December 31, 20X6.

240

1. Inventory turnover = cost of goods sold* ÷ average inventory

= $1,080,000 ÷ $1,000,000

= 1.08

*Cost of goods sold = $2,400,000 – $1,320,000 = $1,080,000

2. The gross profit would increase from $1,320,000 to $1,500,000, so a change in pricing

strategy would be desirable for Custom Gems. The current 20X3 data follow:

Inventory turnover 1.08

Gross profit percentage:

$1,320,000 ÷ $2,400,000 55% This percentage is not unusual.

If prices are cut 10 percent in 20X4 without affecting inventory turnover, new sales would be .9 ×$2,400,000 = $2,160,000. Cost of goods sold on those sales would still be $1,080,000. Therefore Mr. Siegl would be reducing his gross profit from $1,320,000 to $2,160,000 –$1,080,000 = $1,080,000 and its gross profit percentage to 50% [($2,160,000 $1,080,000) ÷ $2,160,000].

However, an increase in inventory turnover to 1.5 would produce the following:

Sales, $2,160,000 × ($1,500,000 ÷ $1,080,000)* $3,000,000

Cost of goods sold, $1,000,000 × 1.5 1,500,000

Gross profit $1,500,000

* This could also use the ratio of the turnover ratios: $2,160 × (1.5 ÷1.08)

Gross profit would be $180,000 above the 20X3 level.

Chapter 7 Inventories and Cost of Goods Sold 241

1. LIFO Method:

Inventory shows: 1,100 tons on hand at July 31.

Costs: 1,000 tons @ $ 9.00 $ 9,000

100 tons @ $10.00 1,000 July 31 inventory cost $10,000 FIFO Method:

Inventory shows: 1,100 tons on hand at July 31.

Costs: 800 tons @ $12.00 $9,600

300 tons @ $11.00 3,300 July 31 inventory cost $12,900

2. Purchases:

5,000 tons @ $10 $50,000

1,000 tons @ $11 11,000

800 tons @ $12 9,600

Total purchases $70,600

Beginning inventory:

1,000 tons @ $ 9 9,000

LIFO FIFO Cost of goods available for sale $79,600 $ 79,600 $ 79,600 Less ending inventory (10,000) (12,900) Cost of goods sold $ 69,600 $ 66,700 Sales $102,000 $102,000 Cost of goods sold 69,600 66,700 Gross profit $ 32,400 $ 35,300

242

U. S. GAAP: The inventory would be written down from $200,000 to $185,000 on December 31, 20X1. The new $185,000 valuation is ―what’s left‖ of the original $200,000 cost. In other words, the $185,000 is the unexpired cost and may be thought of as the new cost of the inventory for future accounting purposes. Thus, because subsequent replacement values exceed the $185,000 cost, and write-ups above ―cost‖are not acceptable accounting practice, the valuation remains at $185,000 until it is written down to $175,000 on the following December 31, 20X2.

IFRS: The inventory would be written down from $200,000 to $195,000 on December 1, 20X1. It would be written back up to $200,000 on April 30, 20X2. It would remain at $200,000 until December 31, 20X2, when it would be written down to $190,000.

7-52 (10–15 min.) Amounts are in millions of dollars.

The cost of inventory acquired during the year ending August 31, 2008, can be calculated as follows.

Beginning Inventory $ 4,879

Purchases X = 63,663

Cost of goods available Y = 68,542

Ending inventory (5,039)

Cost of merchandise sold $63,503

Y = 63,503 + 5,039 = 68,542

X = 68,542 – 4,879 = 63,663

7-53 (10 min.) Dollar amounts are in millions.

2009: ($13,724 - $8,976) ÷ $13,724 = 34.60%

2008: ($13,794 - $8,987) ÷ $13,794 = 34.85%

2007: ($13,050 - $8,638) ÷ $13,050 = 33.81%

The gross profit percentage was relatively steady over these three years, with an increase in 2008 followed by a modest dip in 2009.

Although not in the problem, it might be interesting to note that the gross profit percentage ranged from 27% to 31% for the ten years from 1994 to 2003. Specifically from 2001–2003 the values were significantly lower: 31.04%, 30.99% and 31.01%.

Chapter 7 Inventories and Cost of Goods Sold 243

1. ISLAND BUILDING SUPPLY

Statement of Gross Profit

For the Year Ended December 31, 20X9

Sales $1,200,000

Cost of goods sold:

Inventory, beginning $ 240,000

Add net purchases 1,035,000

Cost of goods available for sale $1,275,000

Deduct ending inventory (300,000)

Cost of goods sold 975,000

Gross profit $225,000

2. Inventory turnover = Cost of goods sold ÷ Average inventory

= $975,000 ÷ [1/2 × (240,000 + 300,000)]

= 975,000 ÷ 270,000

= 3.61 times

7-55 (30–40 min.)

The detailed income statement is in the accompanying exhibit on the following page. Note the classification of operating expenses into a selling category and a general and administrative category. The list of accounts in the problem contained one item that belongs in a balance sheet rather than an income statement, the Allowance for Bad Debts (an offset to Accounts Receivable).

The delivery expenses and the bad debts expense are shown under selling expenses. Some accountants prefer to show the bad debts expense as an offset to gross sales or as administrative expenses.

244

BACKBAY BATHROOM SUPPLY COMPANY

Income Statement

For the Year Ended December 31, 20X5

(In Thousands)

Revenues:

Gross sales $1,091 Deduct: Sales returns and allowances $ 50

Cash discounts on sales 16 66 Net sales $1,025 Cost of goods sold:

Inventory, December 31, 20X4 $200

Add purchases $600

Less: Purchase returns and allowances $40

Cash discounts on purchases 15 55

Net purchases $545

Add Freight in 55

Cost of merchandise acquired 600

Cost of goods available for sale $800

Deduct: Inventory, December 31, 20X5 300

Cost of goods sold 500 Gross profit from sales $ 525 Operating expenses:

Selling expenses:

Sales salaries and commissions $160

Rent expense, selling space 90

Advertising expense 45

Depreciation expense, trucks and store fixtures 29

Bad debts expense 8

Delivery expenses 20

Total selling expenses $352

General and administrative expenses:

Office salaries 46

Rent expense, office space 10

Depreciation expense, office equipment 3

Office supplies used 6

Miscellaneous expenses 13

Total general and administrative expenses 78

Total operating expenses 430 Income before income tax $ 95 Income tax expense 42 Net income $ 53 Chapter 7 Inventories and Cost of Goods Sold 245

Under the FIFO cost-flow assumption, the periodic and perpetual procedures give identical results. The ending inventory will be valued on the basis of the last purchases during the period.

Units $

Beginning Inventory 110 550

Purchases 290 2,050

Goods available 400 2,600

Units sold 255 1,485**

Units in ending inventory 145 1,115*

* 145 units remain in ending inventory

100 will be valued at the $8 cost from the October 21 purchase and the remaining 45 will be valued at the $7 cost from the May 9 purchase

100 × $8 = $ 800

45 × $7 = 315

$1,115 Ending inventory

** Reconciliation: Cost of Goods Sold:

255 Units: 110 × $5 = $ 550

80 × $6 = 480

65 × $7 = 455

$1,485

246

财务专业术语中英文对照表

财务专业术语中英文对照表 英文中文说明 Account Accounting system 会计系统 American Accounting Association 美国会计协会 American Institute of CPAs 美国注册会计师协会 Audit 审计 Balance sheet 资产负债表 Bookkeepking 簿记 Cash flow prospects 现金流量预测 Certificate in Internal Auditing 部审计证书 Certificate in Management Accounting 管理会计证书 Certificate Public Accountant注册会计师 Cost accounting 成本会计 External users 外部使用者 Financial accounting 财务会计 Financial Accounting Standards Board 财务会计准则委员会 Financial forecast 财务预测 Generally accepted accounting principles 公认会计原则 General-purpose information 通用目的信息 Government Accounting Office 政府会计办公室 Income statement 损益表 Institute of Internal Auditors 部审计师协会 Institute of Management Accountants 管理会计师协会 Integrity 整合性 Internal auditing 部审计 Internal control structure 部控制结构 Internal Revenue Service 国收入署 Internal users部使用者 Management accounting 管理会计 Return of investment 投资回报 Return on investment 投资报酬 Securities and Exchange Commission 证券交易委员会

各种花的英文名

各种花卉的英文名 iris蝴蝶花 cockscomb鸡冠花 honeysuckle金银花chrysanthemum菊花 carnation康乃馨 orchid兰花 canna美人蕉 jasmine茉莉花 daffodil水仙花 peony牡丹 begonia秋海棠 cactus仙人掌 christmas flower圣诞花/一品红poppy罂粟 tulip郁金香 chinese rose月季 violet紫罗兰 peach flower桃花 aloe芦荟 mimosa含羞草 dandelion蒲公英

plum bolssom梅花中国水仙 new year lily 石榴 pomegranate 月桂victor's laurel 报春花 polyanthus 木棉 cotton tree 紫丁香 lilac 吊钟 lady's eardrops 紫荆 Chinese redbud 百合 lily 紫罗兰 wall flower 桃花 peach 紫藤 wisteria 杜鹃 azalea 铃兰 lily-of-the-valley 牡丹 tree peony 银杏 ginkgo 芍药 peony 蝴蝶兰 moth orchid 辛夷 violet magnolia 蟹爪仙人掌 Christmas cactus 玫瑰 rose 郁金香 tulip

茶花 common camellia 千日红 common globe-amaranth 非洲堇 African violet 栀子花 cape jasmine 木槿 rose of Sharon 风信子 hyacinth 百子莲 African lily 牵牛花 morning glory 君子兰 kefir lily 荷包花 lady's pocketbook 含笑花 banana shrub 非洲菊 African daisy 含羞草 sensitive plant 茉莉 Arabian jasmine 猪笼草 pitcher plant 凌霄花 creeper 树兰 orchid tree 康乃馨coronation 鸡冠花 cockscomb 荷花lotus 鸢萝 cypress vine 菩提 botree

会计中英文对照

财会常见名词英汉对照表 (1)会计与会计理论 会计accounting 决策人Decision Maker 投资人Investor 股东Shareholder 债权人Creditor 财务会计Financial Accounting 管理会计Management Accounting 成本会计Cost Accounting 私业会计Private Accounting 公众会计Public Accounting 注册会计师CPA Certified Public Accountant 国际会计准则委员会IASC 美国注册会计师协会AICPA 财务会计准则委员会FASB 管理会计协会IMA 美国会计学会AAA 税务稽核署IRS 独资企业Proprietorship 合伙人企业Partnership 公司Corporation

会计目标Accounting Objectives 会计假设Accounting Assumptions 会计要素Accounting Elements 会计原则Accounting Principles 会计实务过程Accounting Procedures 财务报表Financial Statements 财务分析Financial Analysis 会计主体假设Separate-entity Assumption 货币计量假设Unit-of-measure Assumption 持续经营假设Continuity(Going-concern) Assumption 会计分期假设Time-period Assumption 资产Asset 负债Liability 业主权益Owner's Equity 收入Revenue 费用Expense 收益Income 亏损Loss 历史成本原则Cost Principle 收入实现原则Revenue Principle 配比原则Matching Principle 全面披露原则Full-disclosure (Reporting) Principle

植物花卉中英文对照

植物花卉中英文对照、花卉英文名大全 金橘--------------kumquat 米仔兰(米兰)--------- milan tree 变叶木-------------croton 一品红-------------poinsettia 扶桑--------------Chinese hibiscus 吊灯花-------------fringed hibiscus 马拉巴栗(发财树)------- Guiana chestnut 山茶--------------camellia 云南山茶------------Yunnan camellia 金花茶-------------golden camellia 瑞香--------------daphne 结香--------------paper bush 倒挂金钟------------fuchsia 八角金盘------------Japan fatsia 常春藤-------------ivy 鹅掌柴-------------umbrella tree 杜鹃花-------------rhododendron 茉莉花-------------jasmine 桂花--------------sweet osmanthus 夹竹桃-------------sweet-scented oleander 黄花夹竹桃-----------lucky-nut-thevetia 鸡蛋花-------------frangipani 龙吐珠-------------bleeding-heart glorybower 夜香树(木本夜来香)------night jasmine 鸳鸯茉莉------------broadleaf raintree 栀子花-------------cape jasmine 蝴蝶兰-------------moth orchid 卡特兰-------------cattleya 石斛--------------dendrobium 兜兰--------------lady slipper 兰花--------------orchid 春兰--------------goering cymbidium

会计专业专业术语中英文对照

会计专业专业术语中英文对照 一、会计与会计理论 会计 accounting 决策人 Decision Maker 投资人 Investor 股东 Shareholder 债权人 Creditor 财务会计 Financial Accounting 管理会计 Management Accounting 成本会计 Cost Accounting 私业会计 Private Accounting 公众会计 Public Accounting 注册会计师 CPA Certified Public Accountant 国际会计准则委员会 IASC 美国注册会计师协会 AICPA 财务会计准则委员会 FASB 管理会计协会 IMA 美国会计学会 AAA 税务稽核署 IRS 独资企业 Proprietorship 合伙人企业 Partnership 公司 Corporation

会计目标 Accounting Objectives 会计假设 Accounting Assumptions 会计要素 Accounting Elements 会计原则 Accounting Principles 会计实务过程 Accounting Procedures 财务报表 Financial Statements 财务分析Financial Analysis 会计主体假设 Separate-entity Assumption 货币计量假设 Unit-of-measure Assumption 持续经营假设 Continuity(Going-concern) Assumption 会计分期假设 Time-period Assumption 资产 Asset 负债 Liability 业主权益 Owner's Equity 收入 Revenue 费用 Expense 收益 Income 亏损 Loss 历史成本原则 Cost Principle 收入实现原则 Revenue Principle 配比原则 Matching Principle

各种花的英文名

iris 蝴蝶花hon eysuckle 金银花 chrysanthemum 菊花 carnation 康乃馨 orchid 兰花 canna 美人蕉 jasmine 茉莉花 daffodil 水仙花 peony 牡丹 begonia 秋海棠 cactus 仙人掌 christmas flower 圣诞花/一品红 poppy 罂粟 tulip 郁金香 chi nese rose 月 季 violet 紫罗兰 peach flower 桃花 aloe 芦荟 mimosa 含羞草 dandelion 蒲公英 plum bolssom 梅花中国水仙new year lily

石榴pomegranate 月桂victor's laurel 报春花polyanthus 木棉cotton tree 紫丁香lilac 吊钟lady's eardrops 紫荆Chinese redbud 百合lily 紫罗兰wall flower 桃花peach 紫藤wisteria 杜鹃azalea 铃兰lily-of-the-valley 牡丹tree peony 银杏ginkgo 芍药peony 蝴蝶兰moth orchid 辛夷violet magnolia 蟹爪仙人掌Christmas cactus 玫瑰rose 郁金香tulip

非洲堇African violet 栀子花cape jasmine 木槿rose of Sharon 风信子hyacinth 百子莲African lily 牵牛花morning glory 君子兰kefir lily 荷包花lady's pocketbook 含笑花bana shrub 非洲菊African daisy 含羞草sensitive plant 茉莉Arabian jasmine 猪笼草pitcher plant 凌霄花creeper 树兰orchid tree 康乃馨coronation 荷花lotus 鸢萝cypress vine 菩提botree 大理花dahlia

常见花的英文单词新选

常见花的英文单词 中国水仙new year lily 石榴pomegranate 月桂victor's laurel 报春花polyanthus 木棉cotton tree 紫丁香lilac 吊钟lady's eardrops 紫荆Chinese redbud 百合lily 紫罗兰wall flower 桃花peach 紫藤wisteria 杜鹃azalea 铃兰lily-of-the-valley 牡丹tree peony 银杏ginkgo 芍药peony 蝴蝶兰moth orchid 辛夷violet magnolia 蟹爪仙人掌Christmas cactus 玫瑰rose 郁金香tulip 茶花common camellia 千日红common globe-amaranth 非洲堇African violet 栀子花cape jasmine 木槿rose of Sharon 风信子hyacinth 百子莲African lily 牵牛花morning glory 君子兰kefir lily 荷包花lady's pocketbook 含笑花banana shrub 非洲菊African daisy 含羞草sensitive plant 茉莉Arabian jasmine 猪笼草pitcher plant 凌霄花creeper 树兰orchid tree 康乃馨coronation 鸡冠花cockscomb

荷花lotus 鸢萝cypress vine 菩提botree 大理花dahlia 圣诞百合Christmas bell 一串红scarlet sage 紫薇crape myrtle 勿忘我forget-me-not 睡莲water lily 文心兰dancing lady 吊兰spider plant 白头翁pappy anemone 向日葵sunflower 矢车菊cornflower 竹bamboo 金鱼草snapdragon 夹竹桃oleander 金盏花pot marigold 月季花china rose 金银花honeysuckle 长春花old maid 金莲花garden nasturtium 秋海棠begonia 非洲凤仙African touch-me-not 美人蕉canna 曼陀罗angel's trumpet 晚香玉tuberose 梅花flowering apricot 野姜花ginger lily 圣诞红common poinsettia 菊花chrysanthemum 虞美人Iceland poppy 昙花epiphyllum 鸢尾iris 龙胆royal blue 腊梅winter sweet 麒麟花crown of thorns 木芙蓉cotton rose 九重葛paper flower 火鹤花flamingo flower 三色堇tricolor viola 嘉德丽亚兰cattleya

亚洲常见花卉英文译名

亚洲常见花卉英文译名Abutilon pictum / Thomsonii风铃花 Abutilon Hybriden金铃花 Acacia dealbata银栲皮树 Acaena / New Zealand burr无瓣蔷薇(纽西兰球果属植物) Acanthus叶蓟属植物 Acer palmatum掌叶槭 Achillea / Yarrow丽纹锯草(蓍草属植物) Achimenes / Cupid's bower / hot water plant长筒花Actinidia狝猴桃<--攀缘植物 Adenium obesum沙漠玫瑰(天宝花) Adiantum capilus-veneris / True maidenhair fern铁线蕨Aegopodium podagraia 'Variegata'斑叶羊角芹 African daisy非洲菊 Agapanthus / African lily百子莲 Agastache藿香 Agave龙舌兰属植物 Ageratum houstonianum紫花霍香蓟 Agrostemma githago / Corn cockle麦仙翁 Ajuga reptans匍筋骨草 Akebia木通(别名:巧克力藤蔓) <--攀缘植物

Alcea rosea / Hollyhock蜀葵 Alchemilla / Lady's mantle斗篷草 Allium葱属 Aloe芦荟属植物 Alyssum香荠属植物 Amaranthus苋属植物 Ampelopsis山葡萄<--攀缘植物 Ampelopsis brevipedunculata蛇白蔹 Anchusa capensis / Alkanet非洲勿忘草Androsace carnea / Rock jasmine铜钱花Anethu, graveolens / Dill莳萝 Annual phlox福禄考 Antennaria dioica山荻 Anthemis西洋甘菊 Anthemis punctata subsp cupaniana春黄菊Antirrhinum majus / Snapdragon金鱼草 Arabis / Rock cress南芥菜(岩水芹) Aralia elata黃斑高? Arbutus野草莓樹 Arctotis Fastuosa / Monarch of the veldt南非雛菊Arenaria balearica蚤綴

AICPA财务英语中英文对照

AICPA财务英语中英文对照表 A account 账户 account payable 应付账款 accounting system 会计系统 Accounting Principle Board (APB) (美国)会计准则委员会 accrual basis 权责发生制(应计制) accumulated depreciation 累计折旧 account FORMat 账户格式 accrue 应计 accounting cycle 会计循环 accounts receivable 应收账款 accounts receivable turnover 应收账款周转率 accelerated depreciation 加速折旧 adjusting entries 调整分录 adjustment 调整 aging of accounts receivable 应收账款账龄分析法 allowance for bad debts 坏账准备 allowance for doubtful accounts 坏账准备 allowance for uncollectible 坏账准备 allowance method 备抵法 allowance for depreciation 折旧备抵账户 amortization 摊销 annual report 年度报告 annuity 年金 assets 资产

audit 审计 auditor’s opinion 审计意见书 auditor 审计师 audit committee 审计委员会 average collection period 平均收账期AICPA 美国注册会计师协会 APB Opinions 会计准则委员会意见书B balance 余额 bad debt recoveries 坏账收回 bad debts 坏账 bad debts expense 坏账费用 balance sheet 资产负债表 balance sheet equation 资产负债表等式basket purchase 一揽子采购 betterment 改造投资,改造工程投资bearer instrument 不记名票据 bonds 债券 book of original entry 原始分录账簿 book value 账面价值 C capital 资本 capital stock certificate 股本证明书 cash basis 收付实现制(现金收付制)cash dividends 现金股利 cash flow statement 现金流量表 carrying amount 账面价值 carrying value 账面价值 callable bonds 可赎债券,可提前兑回债券

会计专业术语中英文对照参考

A (1)ABC 作业基础成本计算 A (2)absorbed overhead 已汲取制造费用 A (3)absorption costing 汲取成本计算 A (4)account 帐户,报表 A (5)accounting postulate 会计假设 A (6)accounting series release 会计公告文件 A (7)accounting valuation 会计计价 A (8)account sale 承销清单 A (9)accountability concept 经营责任概念 A (10)accountancy 会计职业 A (11)accountant 会计师 A (12)accounting 会计 A (13)agency cost 代理成本 A (14)accounting bases 会计基础 A (15)accounting manual 会计手册 A (16)accounting period 会计期间 A (17)accounting policies 会计方针 A (18)accounting rate of return 会计酬劳率 A (19)accounting reference date 会计参照日 A (20)accounting reference period 会计参照期间A (21)accrual concept 应计概念 A (22)accrual expenses 应计费用

A (23)acid test ration 速动比率(酸性测试比率) A (24)acquisition 购置 A (25)acquisition accounting 收购会计 A (26)activity based accounting 作业基础成本计算A (27)adjusting events 调整事项 A (28)administrative expenses 行政治理费 A (29)advice note 发货通知 A (30)amortization 摊销 A (31)analytical review 分析性检查 A (32)annual equivalent cost 年度等量成本法 A (33)annual report and accounts 年度报告和报表A (34)appraisal cost 检验成本 A (35)appropriation account 盈余分配帐户 A (36)articles of association 公司章程细则 A (37)assets 资产 A (38)assets cover 资产保障 A (39)asset value per share 每股资产价值 A (40)associated company 联营公司 A (41)attainable standard 可达标准 A (42)attributable profit 可归属利润 A (43)audit 审计 A (44)audit report 审计报告

会计专业术语中英文对比

财务术语中英文对照大全,财务人必备! 2015-05-28注册会计师注册会计师 知道“会计”的英语怎么说吗?不会?那可真够无语的额! 想要进入外资企业做会计?想要进入四大会计师事务所工作?好的英语水平是必不可少的!所以小编特地整理了财务数中英文大全,赶紧从基础英语学起,拿起笔做好笔记吧! 增加见识也好,装装逼也行。 目录 一、会计与会计理论 二、会计循环 三、现金与应收账款 四、存货 五、长期投资 六、固定资产 七、无形资产

八、流动负债 九、长期负债 十、业主权益 一、财务报表 二、财务状况变动表 三、财务报表分析 四、合并财务报表 五、物价变动中的会计计量 一、会计与会计理论 会计accounting 决策人Decision Maker 投资人Investor 股东Shareholder 债权人Creditor 财务会计Financial Accounting 管理会计Management Accounting成本会计Cost Accounting

私业会计Private Accounting 公众会计Public Accounting 注册会计师CPA Certified Public Accountant 国际会计准则委员会IASC 美国注册会计师协会AICPA 财务会计准则委员会FASB 管理会计协会IMA 美国会计学会AAA 税务稽核署IRS 独资企业Proprietorship 合伙人企业Partnership 公司Corporation 会计目标Accounting Objectives 会计假设Accounting Assumptions 会计要素Accounting Elements 会计原则Accounting Principles 会计实务过程Accounting Procedures 财务报表Financial Statements 财务分析Financial Analysis 会计主体假设Separate-entity Assumption 货币计量假设Unit-of-measure Assumption 持续经营假设Continuity(Going-concern)Assumption

常见花卉的中英文名称对照

各种花卉的中英文名称对照 mangnolia 玉兰花 morning glory 牵牛(喇叭花) narcissus 水仙花 oleander 夹竹桃 orchid 兰花 pansy 三色堇 peony 牡丹 peony 芍药 phalaenopsis 蝶兰 rose 玫瑰 rose 月季 setose asparagus 文竹touch-me-not (balsam) 凤仙花 tulip 郁金香 violet, stock violet 紫罗兰 water hyacinth 凤眼兰 Chinese enkianthus 灯笼花 Chinese flowering crab-apple 海棠花金橘----kumquat 米仔兰(米兰)--milan tree 变叶木--croton 一品红--poinsettia 扶桑--Chinese hibiscus 吊灯花--fringed hibiscus 马拉巴栗(发财树)-- Guiana chestnut 山茶--camellia 云南山茶--Yunnan camellia 金花茶---golden camellia 瑞香--daphne 结香---paper bush 倒挂金钟--fuchsia 八角金盘--Japan fatsia 常春藤--ivy 鹅掌柴--umbrella tree 杜鹃花--rhododendron 茉莉花--jasmine 桂花--sweet osmanthus 夹竹桃--sweet-scented oleander 黄花夹竹桃--lucky-nut-thevetia 鸡蛋花--frangipani 龙吐珠--bleeding-heart glorybower 夜香树(木本夜来香)--night jasmine 鸳鸯茉莉--broadleaf raintree 栀子花--cape jasmine 蝴蝶兰--moth orchid 卡特兰--cattleya 石斛--dendrobium 兜兰--lady slipper 兰花--orchid 春兰--goering cymbidium 仙客来--florists cyclamen

会计分录中英文对照表

account 账户、科目 account payable 应付账款 account title / accounting item 会计科目 accounting document/ accounting voucument 会计凭证 accounting element 会计要素 accounting entity 会计主体 accounting entries 会计分录 accounting equation / accounting identity 会计恒等式 accounting function 会计职能 accounting postulate 会计假设 accounting principle 会计原则 accounting report /accounting statement 会计报表 accounting standard 会计准则 accounting time period concept 会计分期 accounts receivable / receivables

accrual- basis accounting 权责发生制原则 accumulated depreciation 累计折旧 amortization expense /expense not allocated 待摊费用 annual statement 年报 Arthur Andersen Worldwide 安达信全球 assets 资产 balance 余额 balance sheet 资产负债表 begainning balance/ opening balance 期初余额 capital 资本 capital expenditure 资本性支出 capital share 股本 capital surplus 资本公积 cash 现金

亚洲常见花卉英文译名

亚洲常见花卉英文译名 Abutilon pictum / Thomsonii 风铃花 Abutilon Hybriden 金铃花 Acacia dealbata 银栲皮树 Acaena / New Zealand burr 无瓣蔷薇(纽西兰球果属植物) Acanthus 叶蓟属植物 Acer palmatum 掌叶槭 Achillea / Yarrow 丽纹锯草(蓍草属植物) Achimenes / Cupid's bower / hot water plant 长筒花Actinidia 狝猴桃<--攀缘植物 Adenium obesum 沙漠玫瑰(天宝花) Adiantum capilus-veneris / True maidenhair fern 铁线蕨Aegopodium podagraia 'Variegata' 斑叶羊角芹 African daisy 非洲菊 Agapanthus / African lily 百子莲 Agastache 藿香 Agave 龙舌兰属植物 Ageratum houstonianum 紫花霍香蓟 Agrostemma githago / Corn cockle 麦仙翁 Ajuga reptans 匍筋骨草 Akebia 木通(别名:巧克力藤蔓) <--攀缘植物 Alcea rosea / Hollyhock 蜀葵 Alchemilla / Lady's mantle 斗篷草 Allium 葱属 Aloe 芦荟属植物 Alyssum 香荠属植物 Amaranthus 苋属植物 Ampelopsis 山葡萄<--攀缘植物 Ampelopsis brevipedunculata 蛇白蔹 Anchusa capensis / Alkanet 非洲勿忘草 Androsace carnea / Rock jasmine 铜钱花 Anethu, graveolens / Dill 莳萝 Annual phlox 福禄考 Antennaria dioica 山荻 Anthemis 西洋甘菊 Anthemis punctata subsp cupaniana 春黄菊 Antirrhinum majus / Snapdragon 金鱼草 Arabis / Rock cress 南芥菜(岩水芹) Aralia elata 黃斑高? Arbutus 野草莓樹 Arctotis Fastuosa / Monarch of the veldt 南非雛菊Arenaria balearica 蚤綴 Argemone / Prickly Poppy 薊罌粟屬植物

中英文植物志对照名录:十字花科

黑色字体:为新疆植物志有,英文版也保留; 红色字体:为新疆植物志有,英文版无; 绿色字体:为新疆植物志没有,英文版有; 十字花科——CRUCIFERAE 1.长柄芥族--Trib.Stanleyeae 1.长柄芥属——Macropodoum 1.长柄芥M.nivale 2.芸苔族——Trib.Brassiceae 2.芸苔属——Brassica 1.甘蓝B.oleracea 莲花白var. capitata L. 花椰菜var. botrytis L. 羽衣甘蓝var. acephala L. 绿花菜var.italica 擘蓝B.oleracea var. gongylodes L. 2.擘蓝B.caulorapa——合入擘蓝B.oleracea var. gongylodes L 3. 欧洲油菜B.napus 4. 芜青B.rapa——蔓青 芸苔B.rapa var.oleifera DC. 白菜B.rapa var. glabra Reg. 青菜B.rapa var.chinensis (L.)Kitamura 5. 白菜B.pekinensis*----------合入芜青B.rapa var.glabra 6. 青菜B.chinenis-------------合入芜青B.rapa var.chinensis 7.芸苔B.campestris* ---------合入芜青B.rapa 8. 芥菜B.juncea 芥菜(原变种) var. juncea 芥菜疙瘩B.juncea var.napiformis 大头菜(变种) var. megarrhiza——合入芥菜疙瘩B.juncea var.napiformis 雪里蕻(变种) var. multiceps Tsen et Lee——合入芥菜(原变种) var. juncea 油芥菜(变种) var. gracilis Tsen. et Lee——合入芥菜(原变种) var. juncea 9. 黑芥B.nigra 10.新疆毛芥B.xinjiangensis——合入新疆白芥S.arrensis 11. 短喙芥B.brevirostrata——合入短喙芥B. elongata 12.短喙芥B. elongata 3.白芥属——Sinapis 1.白芥S.alba 2.田野白芥S. arvensi s L.——叫新疆白芥S.arvensis 长喙白芥var. brachycrpa——不知去向

财务术语中英文对照Financial Accounting

财务术语中英文对照FinancialAccounting (1)会计与会计理论 会计accounting 决策人DecisionMaker 投资人Investor 股东Shareholder 债权人Creditor 财务会计FinancialAccounting 管理会计ManagementAccounting 成本会计CostAccounting 私业会计PrivateAccounting 公众会计PublicAccounting 注册会计师CPACertifiedPublicAccountant 国际会计准则委员会IASC 美国注册会计师协会AICPA 财务会计准则委员会FASB 管理会计协会IMA 美国会计学会AAA 税务稽核署IRS 独资企业Proprietorship 合伙人企业Partnership 公司Corporation 会计目标AccountingObjectives 会计假设AccountingAssumptions 会计要素AccountingElements 会计原则AccountingPrinciples 会计实务过程AccountingProcedures 财务报表FinancialStatements 财务分析FinancialAnalysis 会计主体假设Separate-entityAssumption 货币计量假设Unit-of-measureAssumption 持续经营假设 Continuity(Going-concern)Assumption 会计分期假设Time-periodAssumption 资产Asset 负债Liability 业主权益Owner'sEquity 收入Revenue 费用Expense 收益Income 亏损Loss 历史成本原则CostPrinciple 收入实现原则RevenuePrinciple 配比原则MatchingPrinciple 全面披露原则 Full-disclosure(Reporting)Principle 客观性原则ObjectivePrinciple 一致性原则ConsistentPrinciple 可比性原则ComparabilityPrinciple 重大性原则MaterialityPrinciple 稳健性原则ConservatismPrinciple 权责发生制AccrualBasis

各种花的英文名(全)22页word

茉莉花 :Jasmine 玫瑰花:Rose 海棠花 begonia 菊花chrysanthemum 丁香花:Lilac 康乃馨:Carnation 紫罗兰:Violet 百合:Lily 荷花:Lotus tulip 郁金香 sunflower 向日葵 geranium 天竺葵 morning-glory 牵牛花 pansy 三色堇,三色紫罗兰 poppy 罂粟花 marigold 金盏花 hyacinth 风信花 daffodil 水仙 marguerite, daisy 雏菊 orchid 兰花 cyclamen 仙客来 hawthorn 山楂

camellia 山茶 peony 芍药,牡丹 azalea 杜鹃 gardenia 栀子 最早花语的起源是古希腊,但是那个时候不止是花,还有叶子、果树都有一定的含义。在希腊神话里记载过爱神出生时创造了玫瑰的故事,玫瑰从那个时代起就成为了爱情的代名词。 真正花语盛行是在法国皇室时期,贵族们将民间对于花卉的资料整理遍档,里面就包括了花语的信息,这样的信息在宫廷后期的园林建筑中得到了完美的体现。 大众对于花语的接受是在18XX年左右,那个时候的社会风气还不是十分开放,在大庭广众下表达爱意是难为情的事情,所以恋人间赠送的花卉就成为了爱情的信使。 随着时代的发展,花卉成为了社交的一种赠与品,更加完善的花语代表了赠送者的意图。 我找出了一部分如下: 5.凤尾の热情 很久很久以前,铁角凤尾草就被当做迷恋要来使用。换句话说,只要把根茎的汁液让意中人喝下,就可以抓住对方的心。铁角凤尾草是一种具备特殊迷惑力的植物,因此它的花语是-热情。

会计科目中英文对照cpa版

第一课财务会计导读 Glossary accrual basis 权责发生制 Asset资产 balance sheet资产负债表 capital adequacy ratio 资本充足率 cash basis 收付实现制 cash flow statement现金流量表 double entry method 复式记账法 Expenses费用 Fair value公允价值 financial reports 财务报告 going concern 持续经营 guarantee 担保 Historical cost历史成本 Impairment 减值 impairment provision减值准备 income statement利润表 Liabilities负债 Maturity 到期 Net realizable value可变现净值 Owners’ Equity 所有者权益 post-amortization costs摊余成本 Present value现值 Profit利润 Replacement cost重置成本 stewardship 受托责任 transferor转出方 transferee转入方 1.资产类科目Assets 现金:Cash and cash equivalents 银行存款:Bank deposit 应收账款:Account receivable 应收票据:Notes receivable 应收股利:Dividend receivable 应收利息:Interest receivable 其他应收款:Other receivables 原材料:Raw materials 在途物资:Materials in transport 库存商品:inventory 存货跌价准备:provision for the decline in value of inventories

各类花的花语及中英文对照

各种花的花语及中英文对照^_^(1)一月 1月1日纯白的爱雪莲花(Snow Drop) 1月2日神秘黄水仙(Narcisus Jonquilla) 1月3日执著藏红花(Spring Crocus) 1月4日游戏人生风信子(Hyacinth) 1月5日耐心雪割草(hepatica) 1月6日洁白无瑕的爱白色紫罗兰(Violet) 1月7日单恋白色郁金香(Tulip) 1月8日爱情紫色紫罗兰(Violet) 1月9日纯朴黄色紫罗兰(Voilet) 1月10日不屈不挠黄杨(Box-Tree) 1月11日善良匀桧叶(Arbor-Vitae) 1月12日优雅庭荠(Sweet Alyssum) 1月13日自我水仙(Narcissus) 1月14日含羞报春花(Cyclamen) 1月15日严格剌竹(Thorn) 1月16日竞争黄色风信子(Hyacinth) 1月17日挚爱酸模(Sorrel) 1月18日猜测印度锦葵(Indian Mallow) 1月19日健康,长寿松(Pine) 1月20日童真金凤花(Butter Cup) 1月21日沉静,安详常春藤(Ivy) 1月22日母爱苔藓(Moss) 1月23日服从芦荟(Bulrush) 1月24日进退得宜番红花(Saffron Crocus) 1月25日纯真鼠耳草(Cerasrium) 1月26日敏感含羞草(Humble Plant) 1月27日坚固七度灶(Mountain Ash) 1月28日勇气黑色白杨木(Black Piolar) 1月29日呵护苔藓(Moss) 1月30日盼望的幸福金盏花(Marsh Marigold) 1月31日青春喜悦黄色藏红花(Spring Crocus) 二月 2月1日青春的烦恼樱草(Primrose) 2月2日平凡木瓜花(Japanese Quince) 2月3日奉献小豆蔻(Cardamine) 2月4日无悔的爱红色樱草(Primrose) 2月5日迷人芍药(Paeonia lactiflora[P.albiflora])