Dynamical Structures of High-Frequency Financial Data

a r X i v :p h y s i c s /0512225v 1 [p h y s i c s .s o c -p h ] 23 D e c 2005

Dynamical Structures of High-Frequency Financial Data

Kyungsik Kim 1,Seong-Min Yoon 2,SooYong Kim 3,Ki-Ho Chang 4,and Yup Kim 5

1

Department of Physics,Pukyong National University,

Pusan 608-737,Korea

2

Division of Economics,Pukyong National University,

Pusan 608-737,Korea

3

Department of Physics,Korea Advanced Institute of Science and Technology,Daejeon 305-701,Korea

4

Remote Sensing Research Laboratory,Meteorological Research Institute,KMA,Seoul 156-720,Korea

5

Department of Physics,Kyung Hee University,

Seoul 130-701,Korea

We study the dynamical behavior of high-frequency data from the Korean Stock Price Index (KOSPI)using the movement of returns in Korean ?nancial markets.The dynamical behavior for a binarized series of our models is not completely random.The conditional probability is numerically estimated from a return series of KOSPI tick data.Non-trivial probability structures can be consti-tuted from binary time series of autoregressive (AR),logit,and probit models,for which the Akaike Information Criterion shows a minimum value at the 15th order.From our results,we ?nd that the value of the correct match ratio for the AR model is slightly larger than the ?ndings of other models.PACS numbers:89.65.Gh,05.40.-a,05.45.Df,89.65.-s

Recent investigation of di?erently scaled economic systems has been received a considerable attention as an interdisciplinary ?eld of physicists and economists [1,2,3,4,5,6,7,8].One of challenging issues is to test e?cient market hypotheses from the perspective of em-pirical observations and theoretical considerations.To exploit or predict the dynamical behavior of continuous tick data for various ?nancial assets [9,10]is extremely desirable.Financial e?ciency and predictability can sig-ni?cantly bene?t investors or agents in the ?nancial mar-ket and successfully reinforce the e?ective network be-tween them.For example,when the price of stock rises or falls in the stock market,a trader’s decision to buy or sell is in?uenced by various strategies,external informa-tion,and other traders.One such strategy is to apply the up and down movement of returns to a correlation function and the conditional probability.This strategy,which is pivotal for predicting an investment,is a useful tool for understanding the stock transactions of company whose stock price is rising or falling.In the literature,Ohira et al.[9]mainly discussed conditional probability and the correct match ratio of high-frequency data for the yen-dollar exchange rate;they showed that such dy-namics is not completely random and that a probabilistic structure exists.Sazuka et al.[10]used the order k =10of the Akaike Information Criterion (IC)to determine the predictable value of the autoregressive (AR)model;in contrast,they numerically calculated the 5th order of the logit model [11].Motivated by such research,we ap-ply and analyze novelly the AR,logit,and probit models to the Korean ?nancial market,which,in contrast to ac-tive and well-established ?nancial markets,is now in a slightly unstable and risky state.

Interest in nonlinear models has recently grown,par-ticularly in the social,natural,medical,and engineering sciences.Statistical and mathematical physics provides a powerful and rigorous tool for analyzing social data.Moreover,several papers have focused on social phenom-ena models based on aspects of stochastic analysis,such as the di?usion,master,Langevin,and Fokker-Planck equations.Many researchers in econometrics or biomet-rics have proposed the use of AR,logit,and probit mod-els in the formulation of the discrete choices,including binary analysis.Interestingly,Nakayama and Nakamura [16]associated the fashion phenomena of the bandwagon and snob e?ects with the logit model.To our knowledge,in addition to the Akaike IC,there are at least two other similar standards such as the Hannan-Quinn IC and the Schwarz IC.However,we restrict ourselves to ?nd the Akaike IC as the residual test in order to minimize the remained value for binary analysis.Moreover,after cal-culating the binary structures and their Akaike IC value,we compute the correct match ratio,or the power of pre-dictability.Although the dynamical behavior of logit and probit models has been calculated and analyzed in scien-ti?c ?elds such as mathematics,economics,and econo-physics,until now these models have not been studied in detail with respect to ?nancial markets

In this letter,we present the future predictability func-tion of the AR,logit,and probit models,by using the tick data analysis of the Korean Stock Price Index (KOSPI)for the Korean ?nancial market.By examining the bi-nary phenomena of a ?nancial time series in terms of the nontrivial probability distribution,we show that the high-frequency data of our model follows a special con-ditional probability structure for the up and down move-

2

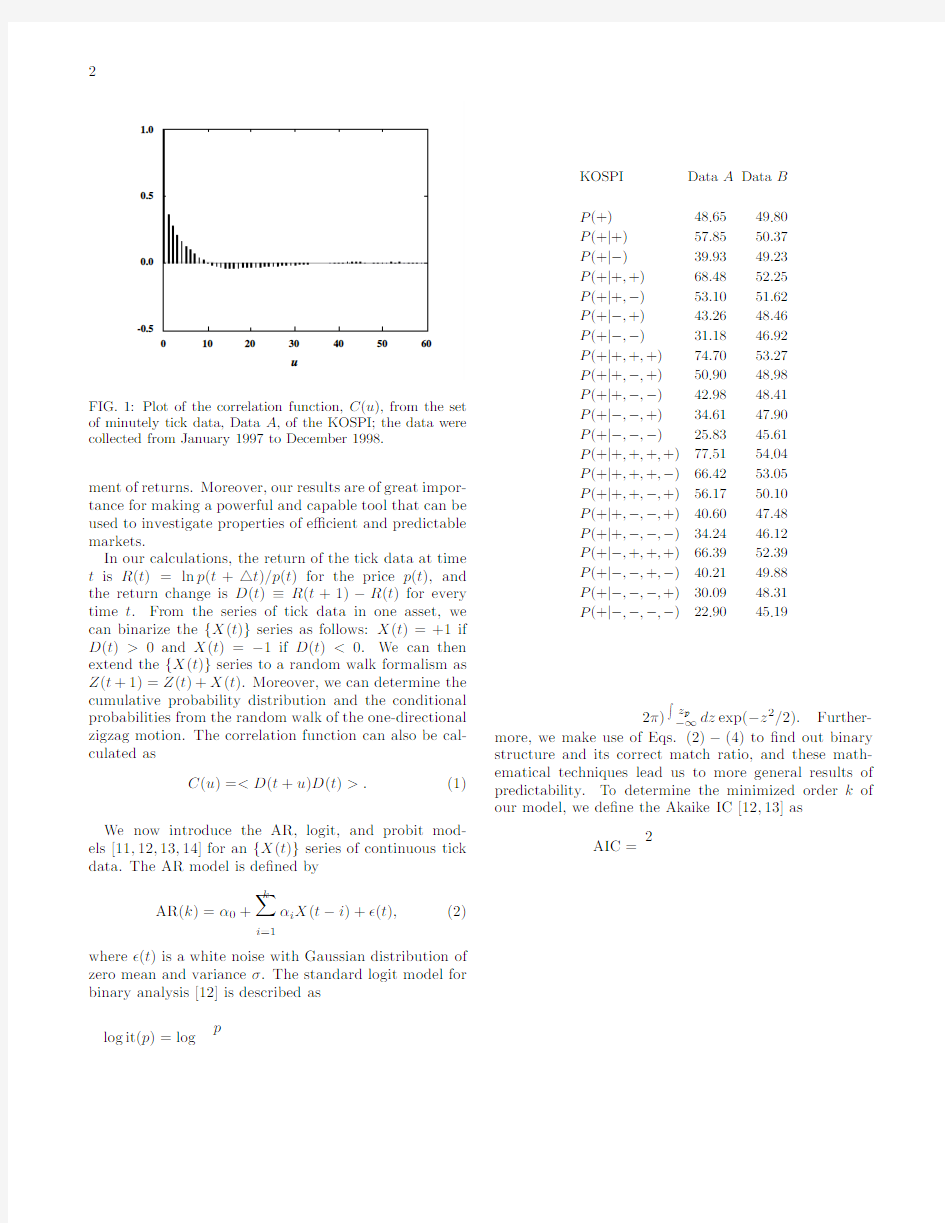

FIG.1:Plot of the correlation function,C(u),from the set of minutely tick data,Data A,of the KOSPI;the data were collected from January1997to December1998.

ment of returns.Moreover,our results are of great impor-tance for making a powerful and capable tool that can be used to investigate properties of e?cient and predictable markets.

In our calculations,the return of the tick data at time t is R(t)=ln p(t+△t)/p(t)for the price p(t),and the return change is D(t)≡R(t+1)?R(t)for every time t.From the series of tick data in one asset,we can binarize the{X(t)}series as follows:X(t)=+1if D(t)>0and X(t)=?1if D(t)<0.We can then extend the{X(t)}series to a random walk formalism as Z(t+1)=Z(t)+X(t).Moreover,we can determine the cumulative probability distribution and the conditional probabilities from the random walk of the one-directional zigzag motion.The correlation function can also be cal-culated as

C(u)=

AR(k)=α0+

k

i=1

αi X(t?i)+?(t),(2)

where?(t)is a white noise with Gaussian distribution of zero mean and varianceσ.The standard logit model for binary analysis[12]is described as

log it(p)=log p

KOSPI Data A Data B

P(+)48.6549.80

P(+|+)57.8550.37

P(+|?)39.9349.23

P(+|+,+)68.4852.25

P(+|+,?)53.1051.62

P(+|?,+)43.2648.46

P(+|?,?)31.1846.92

P(+|+,+,+)74.7053.27

P(+|+,?,+)50.9048.98

P(+|+,?,?)42.9848.41

P(+|?,?,+)34.6147.90

P(+|?,?,?)25.8345.61

P(+|+,+,+,+)77.5154.04

P(+|+,+,+,?)66.4253.05

P(+|+,+,?,+)56.1750.10

P(+|+,?,?,+)40.6047.48

P(+|+,?,?,?)34.2446.12

P(+|?,+,+,+)66.3952.39

P(+|?,?,+,?)40.2149.88

P(+|?,?,?,+)30.0948.31

P(+|?,?,?,?)22.9045.19

2π) z p?∞dz exp(?z2/2).Further-

more,we make use of Eqs.(2)?(4)to?nd out binary

structure and its correct match ratio,and these math-

ematical techniques lead us to more general results of

predictability.To determine the minimized order k of

our model,we de?ne the Akaike IC[12,13]as

AIC=

2

3

FIG.2:Conditional probabilities P(+|m=3)for the set of minutely tick data,Data A,of the KOSPI.

FIG.3:Plot of conditional probabilities P(+|m)and P(?|m) for the set of minutely tick data,Data A,of the KOSPI.

to a binary strategy of the buy and sell trend of traders in?nancial markets.Fig.1plots the correlation function ,C(u),which we obtained from the return change D(t). The plot suggests that the minutely returns for Data A of the KOSPI are not entirely independent of,or di?erent from,the random walk model but almost independent for long periods.Given the probabilistic structure of our model,we can deduce from the correlation function that the dynamical behavior is completely nonrandom.

By quantitative analysis,we can relate the X(t)series to conditional probability.To analyze the high-frequency data of the KOSPI,we concentrated on the up and down return movements in terms of conditional probability. The parameter P(+|+,+)refers to the conditional prob-ability that a tend in the price returns is likely to move in the same direction;that is,that the price is likely to rise after

two consecutive steps in the same direction.Table 1summarizes the results of various conditional proba-FIG.4:Plot of the Akaike IC values for the AR model(the value of the left y-axis)for Data A and of the logit model(the value of the right y-axis)for Data B;in each case,the Akaike IC value decreases gradually as the order of model grows. TABLE II:Values of the correct match ratio from the simu-lation results of Data A and Data B.

NP133,82386,561

bilities for Data A and Data B of the KOSPI.Fig.2 shows that the conditional probability of P(+|+,+,+) has a remarkably larger value than the probability of P(+|m=3),except P(+|+,+,+).From our results, we can give the relation of the three parameters as P(+|+,+)=p,P(+|?,+)=q,and P(+|+,+,+)= p+αfor0<α For simplicity,we used the AR,logit,and probit mod-els to analyze the X(t)series for high-frequency tick data 4 of the Korean?nancial market.As shown in Fig.4,we found that the Akaike IC values for the AR and logit models decrease gradually as the order of the models in-creases.Because the Akaike IC for the three models has approximately the same value in a range larger than the order of k=15,we consider this value to be the mini-mum value;in addition,this value is similar to the10th order of the AR model of the yen-dollar exchange rate [11].Hence,the function shape of the logit model is sim-ilar to that of the probit model,and each probability structure tends to move continuously in the same direc-tion.By minimizing the Akaike IC value of our model, we were also able to calculate the correct match ratio. Table2shows the values of the correct match ratios for Data A and Data B.The AR model of Data A has a higher value than other models for the correct match ra-tio;in contrast,the logit model of Data B has a smaller value. In conclusion,we used the AR,logit,and probit models to determine the probability structure of high-frequency tick data of the KOSPI in the Korean?nancial market. The value of our conditional probability of the KOSPI is slightly greater than that of the yen-dollar exchange rate.Our results show that the Korean?nancial market is slightly unstable and less systematic than other?nan-cial markets,though the results may be related to actual transactions of all assets.In addition,by using the AR, probit,and logit models,we deduce that the forecasted (or simulated)sign is equal to the sign of the actual re-turns.This deduction enables us to obtain the correct match ratio.Moreover,because the match ratio is al-ways greater than0.5,we can conclude that our model has an improved forecasting capability.The AR model, which is expected to have a higher predictable value only in the Korean?nancial market,robustly supports the fu-ture predictability of price movement trends in?nancial markets.We also note that,with nonlinear models of data analysis,international?nance theories can o?er an enhanced interpretation of results.For the past decade, many econophysical investigations have led to greater ap-preciation of,and insight into,scale invariance and the universality of statistical approaches to physics and eco-nomics.Our results should encourage interdisciplinary research of physics and economics. [1]R.N.Mantegna and H.E.Stanley,An Introduction to Econophysics:Correlation and Complexity in F inance (Combridge University Press,Cambridge,2000). [2]Y.Liu,P.Gopikrishnan,P.Cizeau,M.Meyer, C.-K. Peng,and H.E.Stanley,Phys.Rev.E60,1390(1999). [3]X.Gabaix,P.Gopikrishnan,V.Plerou and H.E.Stanley, Nature423,267(2003). [4]F.Lillo and R.N.Mantegna,Phys.Rev.E68,016119 (2003). [5]P.Ch.Ivanov,A.Yuen,B.Podobnik and Y.Lee,Phys. Rev.E69,056107(2004). [6]E.Scalas,R.Goren?o,H.Luckock,F.Mainardi,M.Man- telli and M.Raberto,Phys.Rev.E69,011107(2004);J. Masoliver,M.Montero and G.H.Weiss,Phys.Rev.E67, 021112(2003);S.-M.Yoon,J.S.Choi,C.C.Lee,M.-K. Yum and K.Kim,Physica A359,569(2006). [7]L.S.Sabatelli,S.Keating,J.Dudley and P.Richmond, Eur.Phys.J.B27,273(2002). [8]K.Yamasaki,L.Muchnik,S.Havlin,A.Bunde and H. E.Stanley,Proc.Natl.Acad.Sci.102,9424(2005). [9]T.Ohira,N.Sazuka,K.Marumo,T.Shimizu,M. Takayasu and H.Takayasu,P hysica A308,368(2002). [10]N.Sazuka,T.Ohira,K.Marumo,T.Shimizu,M. Takayasu and H.Takayasu,Physica A324,366(2003). [11]N.Sazuka,Physica A355,183(2005). [12]W.Weidlich,Phys.Rep.204,1(1991);W.Weidlich and G.Haag,Concepts and Models of a Quantatitive Sociol- ogy:The Dynamics of Interacting Populations,Springer, Berlin,1983. [13]D.McFadden,Frontiers in Econometrics:Conditional logit analysis of qualitative choice behavior,P.Zarembka (Ed.),Academics Press,New York,2000,pp.105-142. [14]M.Ben-Akiva and S.R.Lerman,Discrete Choice Anal- ysis:Theory and application to Travel Demand,MIT Press,Cambridge,MA,1985. [15]J.Aldrich and F.Nelson,Linear probability,logit,and probit models,Sage Publications,Beverly Hills,1984. [16]S.Nakayama and Y.Nakamura,Physica A337,625 (2004). [17]H.Akaike,Canonical Correlation Analysis of Time Se- ries and the Use of an Information Criterion,in R.K. Mehra and https://www.360docs.net/doc/84698518.html,inotis(eds.),Academic Press,New York,1976,pp.52-107. [18]H.Akaike,2nd International Symposium on Information Theory,B.N.Petrov and F.Csaki(Ed.),Akademia Ki-ado,Budapest,1973,pp.267-281;R.S.Tsay,Analysis of Financial Time Series,John Wiley and Sons,Inc.,USA, 2002,pp.314-322. [19]E.J.Hannan and B.G.Quinn,J.R.Statist.Soc.B41, 190(1979). [20]E.J.Hannan,Ann.Statist.8,1071(1980). [21]G.Schwarz,Ann.Statist.6,461(1978). RB/T 214:2017检验检测机构资质认定能力评价检验检测机构通用要求培训考核试卷部门:姓名:成绩: 一、判断题(每题4分,共40分) 1、检验检测机构中所有可能影响检验检测活动的人员,无论是内部还是外部人员,均应行为公正,受到监 督,胜任工作,并按照管理体系要求履行职责。() 2、设备出现故障或者异常时,检验检测机构应采取相应措施,如停止使用、隔离或加贴停用标签、标记, 直至设备技术工程师维修完好,表明能正常工作为止。() 3、检验检测机构不得使用同时在两个及以上检验检测机构从业的人员。() 4、检验检测标准或者技术规范对环境条件有要求时或环境条件影响检验检测结果时,应监测、控制和记录 环境条件。当环境条件不利于检验检测的开展时,应停止检验检测活动。() 5、检验检测机构应对检验检测结果、抽样结果的准确性或有效性有影响或计量溯源性有要求的设备有计划 地实施检定或校准,不包括用于测量环境条件等辅助测量设备。() 6、检验检测机构应建立和保持记录管理程序,确保每一项检验检测活动技术记录的信息充分,确保记录的 标识、贮存、保护、检索、保留和处置符合要求。() 7、内部审核通常每年一次,由质量负责人策划内审并制定审核方案。若资源允许,内审员应独立于被审核 的活动。() 8、检验检测机构应建立和保持管理评审的程序。管理评审通常12个月一次,由最高管理者负责。() 9、检验检测方法包括标准方法、非标准方法(含自制方法)。应优先使用标准方法,并确保使用标准的有 效版本。在使用标准方法前,应进行验证。() 10、检验检测机构应建立和保持样品管理程序,以保护样品的完整性并为客户保密。检验检测机构应有样品 的标识系统,为确保平行样的一一对应,平行样品标识应与原样品标识相同。() Nonlinear Analysis:Real World Applications7(2006)1104– 1118 https://www.360docs.net/doc/84698518.html,/locate/na Analysis of a predator–prey model with modi?ed Leslie–Gower and Holling-type II schemes with time delay A.F.Nindjin a,M.A.Aziz-Alaoui b,?,M.Cadivel b a Laboratoire de Mathématiques Appliquées,Universitéde Cocody,22BP582,Abidjan22,C?te d’Ivoire,France b Laboratoire de Mathématiques Appliquées,Universitédu Havre,25rue Philippe Lebon,B.P.540,76058Le Havre Cedex,France Received17July2005;accepted7October2005 Abstract Two-dimensional delayed continuous time dynamical system modeling a predator–prey food chain,and based on a modi?ed version of Holling type-II scheme is investigated.By constructing a Liapunov function,we obtain a suf?cient condition for global stability of the positive equilibrium.We also present some related qualitative results for this system. ?2005Elsevier Ltd.All rights reserved. Keywords:Time delay;Boundedness;Permanent;Local stability;Global stability;Liapunov functional 1.Introduction The dynamic relationship between predators and their prey has long been and will continue to be one of dominant themes in both ecology and mathematical ecology due to its universal existence and importance.A major trend in theoretical work on prey–predator dynamics has been to derive more realistic models,trying to keep to maximum the unavoidable increase in complexity of their mathematics.In this optic,recently[2],see also[1,5,6]has proposed a?rst study of two-dimensional system of autonomous differential equation modeling a predator prey system.This model incorporates a modi?ed version of Leslie–Gower functional response as well as that of the Holling-type II. They consider the following model ???? ???˙x= a1?bx? c1y x+k1 x, ˙y= a2? c2y x+k2 y (1) with the initial conditions x(0)>0and y(0)>0. This two species food chain model describes a prey population x which serves as food for a predator y. The model parameters a1,a2,b,c1,c2,k1and k2are assuming only positive values.These parameters are de?ned as follows:a1is the growth rate of prey x,b measures the strength of competition among individuals of species x,c1 ?Corresponding author.Tel./fax:+133232744. E-mail address:Aziz-Alaoui@univ-lehavre.fr(M.A.Aziz-Alaoui). 1468-1218/$-see front matter?2005Elsevier Ltd.All rights reserved. doi:10.1016/j.nonrwa.2005.10.003 《检验检测机构资质认定能力评价通用要求》 试题库《检验检测机构资质认定生态环境监测机构评审补充要求》 一、名词解释 1、检验检测机构:依法成立,依据相关标准和技术规范,利用仪器设备、环境设施等技术条件和专业技能,对产品或法律规定的特定对象进行 检验检测的专业技术组织。 2、生态环境监测:是指运用化学、物理、生物等技术手段, 针对水和废水、环境空气和废气、海水、土壤、沉积物、固体废物、生物、噪声、 振动、辐射等要素开展环境质量和污染排放的监测(检测)活动。 3、能力验证:依据预先制定的准则,采用检验检测机构间比对的方式,评价参加者的能力。 4、验证:提供客观的证据,证明给定项目是否满足规定要求。 5、确认:对规定要求是否满足预期用途的验证。 二、填空题 1、生态环境监测机构及其负责人对其监测数据的真实性和准确性负责,采样与分析人员、审核与授权签字人分别对原始监测数据、监测报告的真 实性终身负责。 2、生态环境监测机构应保证人员数量、及其专业技术背景、工作经历、监测能力等与所开展的监测活动相匹配,中级及以上专业技术职称或同等 能力的人员数量应不少于生态环境监测人员总数的15%。 3、生态环境监测机构技术负责人应掌握机构所开展的生态环境监测工 作范围内的相关专业知识,具有生态环境监测领域相关专业背景或教育培 训经历,具备中级及以上专业技术职称或同等能力,且具有从事生态环境 监测相关工作 5 年以上的经历。 4、生态环境监测机构授权签字人应掌握较丰富的授权范围内的相关专 业知识,并且具有与授权签字范围相适应的相关专业背景或教育培训经历, 具备中级及以上专业技术职称或同等能力,且具有从事生态环境监测相关 工作 3 年以上经历。 5、生态环境监测人员承担生态环境监测工作前应经过必要的培训和能 力确认,能力确认方式应包括基础理论、基本技能、样品分析的培训与考核等。 6、生态环境监测机构的管理体系应覆盖生态环境监测机构全部场所进 行的监测活动,包括但不限于点位布设、样品采集、现场测试、样品运输和保存、样品制备、分析测试、数据传输、记录、报告编制和档案管理等过程。 7、生态环境监测机构应就分包结果向客户负责(客户或法律法规指 定的分包除外),应对分包方监测质量进行监督或验证。 8、生态环境监测活动中由仪器设备直接输出的数据和谱图,应以纸质或电子介质的形式完整保存。当输出数据打印在热敏纸或光敏纸等保存时间较短的介质上时,应同时保存记录的复印件或扫描件。 9、生态环境监测机构初次使用标准方法前,应进行方法验证,使用非标准方法前,应进行方法确认。非标准方法应由不少于3 名本领域高级职称及以上专家进行审定。 10、检验检测机构应明确其组织结构及管理、技术运作和支持服务之 间的关系。检验检测机构应配备检验检测活功所需的人员、设施、设备、系统及支持服务。 11、检验检测机构及其人员从事检验检测活动,应遵守国家相关法律法规的规定,遵循客观独立、公平公正、诚实信用原则,恪守职业道德,承 担社会责任。 RB/T 214-2017新标准宣贯及培训考试试卷 姓名分数 一、填空题(每题2分) 1、《检验检测机构资质认定能力评价、检验检测机构通用要求》总体框架包括 2、法人或其他组织应具有效的登记、注册文件,其登记、注册文件中的经营范围应包含 ;不得有影响其检测活动公正性的经营项目;生产企业内部的检验检测机构不在检验检测机构资质认定范围之内;但生产企业出资设立的检验检测机构可以申请检验检测机构资质认定。 3、检验检测机构应明确其组织机构及管理之间的关系,检验检测应配备检验检测活动所需的人员、设施、设备系统及支持服务。 4、检验检测机构应建立识别出现公正性风险的长效机制。如识别出公正性风险,检验检测机构应能证明消除减少风险。若检验检测机构所在的还从事检验检测以外的活动,应识别并采取措施避免潜在的利益冲突。检验检测机构不得使用。 5、客户的秘密包括客户的。 6、授权签字人任职资格。 7、同等能力 ⑴、博士生从事相关专业检验检测活动 ⑵、硕士生从事相关专业检验检测活动 ⑶、本科生从事相关专业检验检测活动 ⑷、专科生从事相关专业检验检测活动 8、人员监督,质量监控具体措施。 9、人员档案包括 等。 10、当相邻区域的活动或工作出现不相容或相互影响时,检验检测机构应对相关区域进行有效隔离,采取措施消除影响,防止干扰或者交叉感染在一起情况。 11、设备设施管理程序文件应包含。 12、仪器设备标识(三色标识)贴绿色标识;贴黄色标识;贴红色标识。 13、标准物质—具有足够均匀和稳定的特性的物质。其特性被证实的预期用途,机构应对标准物质进行期间核查。 14、质量管理体系文件的构成,第一层第二层第三层第四层。 15、记录分为和两大类。 16、内部审核通常每年由策划内审并制定审核方案,由质量负责人组织。内审员不应审核自己或与自己相关的工作,内审的覆盖问题。 17、质量监督员起质量监督作用。内审员起内部质量管理体系审核作用。质量监督员侧重于技术方面的检查,内审员侧重于管理方面的检查。 IX: Introduction to the theory of dynamical systems, stability and bifurcations Parts: 1. Introduction. 2. Diskrete dynamical systems. 3. The Lyapunov exponent. 4. Julia and Mandelbrot sets. 5. Continuous dynamical systems. 6. Some introductory examples. 7. Classification of critical points. 8. The general solution of a linear system. 9. Classification of equilibrium points in specific systems. 10. Exercises. 1. Introduction. A dynamical system is a phenomenon that changes with tim, for instance the position of a pendulum, the weather, the amount of predators and prey in a lake, et cetera. The traditional way of describing a dynamical system is to use a linear system of differential equations. In this case we have a pretty simple theory to solve the problem (see for instace part 8). A more realistic model however often leads to nonlinear systems of differential equations. In this case it is much more complicated to describe the behavios in the long run, but with help of computers and existing theories we can sometimes obtain the solution as an attractor to the system. In many other cases we will instead get bifurcations or chaos. Chaos means that it is hard (or impossible) to determine the long term behavior; small changes in indata gives dramatic changes in the long term behavior. Some attractors can be described as fractals, some particular self similar sets (a small part of the set has the same structure as the whole set). Such attractors are sometimes called strange attractors. Scalable Nonlinear Dynamical Systems for Agent Steering and Crowd Simulation Siome Goldenstein Menelaos Karavelas Dimitris Metaxas Leonidas Guibas Eric Aaron Ambarish Goswami Computer and Information Science Department,University of Pennsylvania. Computer Science Department,Stanford University. Discreet. 1Introduction Modeling autonomous digital agents and simulating their behavior in virtual envi-ronments is becoming increasingly important in computer graphics.In virtual real-ity applications,for example,each agent interacts with other agents and the environ-ment,so complex real-time interactions are necessary to achieve non-trivial behav-ioral scenarios.Modern game applications require smart autonomous agents with varying degrees of intelligence to permit multiple levels of game complexity.Agent behaviors must allow for complex interactions,and they must be adaptive in terms of both time and space(continuous changes in the environment).Finally,the mod-eling approach should scale well with the complexity of the environment geometry, the number and intelligence of the agents,and the various agent-environment inter-actions. There have been several promising approaches towards achieving the above goal. Many of them,however,are restrictive in terms of their application domain.They do not scale well with the complexity of the environment.They do not model time explicitly.They do not guarantee that the desired behavior will always be exhib-ited.This paper presents an alternative:a scalable,adaptive,and mathematically rigorous approach to modeling complex low-level behaviors in real time. We employ nonlinear dynamical system theory,kinetic data structures,and har-monic functions in a novel three-layer approach to modeling autonomous agents in a virtual environment.The?rst layer consists of differential equations based on nonlinear dynamic system theory,modeling the low-level behavior of the au-tonomous agent in complex environments.In the second layer,the motions of the agents,obstacles,and targets are incorporated into a kinetic data structure,provid-ing an ef?cient,scalable approach for adapting an agent’s motion to its changing local environment.In the third layer,differential equations based on harmonic func-tions determine a global course of action for an agent,initializing the differential equations from the?rst layer,guiding the agent,and keeping it from getting stuck in local minima.We also discuss how hybrid systems concepts for global planning can capitalize on both our layered approach and the continuous,reactive nature of our agent steering. In the?rst layer,we characterize in a mathematically precise way the behavior of our agents in complex dynamic virtual environments.The agents exist in a real-time virtual environment consisting of obstacles,targets,and other agents.Depending on the application,agents reach one or multiple targets while avoiding obstacles; targets and obstacles can be stationary and/or moving.Further,the inclusion of time as a variable in our system makes the formulation ef?cient,natural and powerful compared to traditional AI approaches. Our agent modeling is based on the coupling of a set of nonlinear dynamical sys- IEEE TRANSACTIONS ON CIRCUITS AND SYSTEMS—II: EXPRESS BRIEFS, VOL. 55, NO. 2, FEBRUARY 2008 检验检测机构资质认定能力评价检验检测机构通用要求 RB/T214-2017 4 要求 4.1机构 4.1.1 检验检测机构应是依法成立并能够承担相应法律责任的法人或者其他组织。检验检测机构或者其所在的组织应有明确的法律地位,对其出具的检验检测数据、结果负责,并承担相应法律责任。不具备独立法人资格的检验检测机构应经所在法人单位授权。 4.1.2 检验检测机构应明确其组织结构及管理、技术运作和支持服务之间的关系。检验检测机构应配备检验检测活功所需的人员、设施、设备、系统及支持服务。 4.1.3 检验检测机构及其人员从事检验检测活动,应遵守国家相关法律法规的规定,遵循客观独立、公平公正、诚实信用原则,恪守职业道德,承担社会责任。 4.1.4 检验检测机构应建立和保持维护其公正和诚信的程序。检验检测机构及其人员应不受来自内外部的、不正当的商业、财务和其他方面的压力和影响,确保检验检测数据、结果的真实、客观、准确和可追溯。检验检测机构应建立识别出现公正性风险的长效机制。如识别出公正性风险,检验检测机构应能证明消除或减少该风险。若检验检测机构所在的组织还从事检验检测以外的活动,应识别并采取措施避免潜在的利益冲突。检验检测机构不得使用同时在两个及以上检验检测机构从业的人员。 4.1.5 检验检测机构应建立和保持保护客户秘密和所有权的程序,该程序应包括保护电子存储和传输结果的的要求。检验检测机构及其人员应对其在检验检测活功中听知悉的国家秘密、商业秘密和技术秘密负有保密义务,并制定和实施相应的保密措施。 4.2 人员 4.2.1 检验检测机构应建立和保持人员管理程序,对人员资格确认、任用、授权和能力保持等进行规范管理。检验检测机构应与其人员建立劳动、聘用或录用关系,明确技术人员和管理人员的岗位职责、任职要求和工作关系,使其满足岗位要求并具有所需的权力和资源,履行建立、实施、保持和持续改进管理体系的职责。检验检测机构中所有可能影响检验检测活动的人员。无论是内部还是外部人员,均应行为公正,受到监督,胜任工作,并按照管理体系要求履行职责。 4.2.2 检验检测机构应确定全权负责的管理层,管理层应履行其对管理体系的领导作用和承诺: a.对公正性做出承诺; b.负责管理体系的建立和有效运行; c.确保管理体系所需的资源; d.确保制定质量方针和质量目标; e.确保管理体系要求融入检验检测的全过程; f.组织管理体系的管理评审; g.确保管理体系实现其预期结果; h.满足相关法律法规要求和客户要求; i.提升客户满意度; j.运用过程方法建立管理体系和分析风险、机遇。 4.2.3 检验检测机构的技术负责人应具有中级及以上相关专业技术职称或同等能力,全面负责技术运作;质量负责人应确保质量管理体系得到实施和保持;应指定关键管理人员的代理人。 4.2.4 检验检测机构的授权签字人应具有中级及以上专业技术职称或同等能力,并经过资质认定部门批准,非授权签字人不得签发检验检测报告或证书。 4.2.5 检验检测机构应对抽样、操作设备、检验检测、签发检验检测报告或证书以及提出意见和解释的人员,依据相应的教育、培训、技能和经验进行能力确认。应由熟悉检验检测目的、程序、方法和结果评价的人员,对检验检测人员包括实习员工进行监督。 4.2.6 检验检测机构应建立和保持人员培训程序,确定人员的教育和培训目标,明确培训需求和实施人员培训,并评价这些培训活动的有效性。培训计划应 4.1机构 4.1.1检验检测机构应是依法成立并能够承担相应法律责任的法人或者其他组织。检验检测机构或者其所在的组织应有明确的法律地位ie,对其出具的检验检测数据、结果负责,并承担相应法律责任。不具备独立法人资格的检验检测机构应经所在法人单位授权。 和技术秘密负有保密义务,并制定和实施相应的保密措施。 4.2人员 所需的权力和资源,履行建立、实施、保持和持续改进管理体系的职责。检验检测机构中所有可能影响检验检测活动的人员,无论是内部人员还是外部人员,均应行为公正,受到监督,胜任工作,并按照管理体系要求履行职责。 a)对公正性做出承诺; b)负责管理体系的建立和有效运行; c)确保管理体系所需的资源; d)确保制定质量方针和质量目标 e)确保管理体系要求融入检验检测的全过程 f)组织管理体系的管理评审 g)确保管理体系实现其预期结果 h)满足相关法律法规要求和客户要求 i)提升客户满意度 j)运用过程方法建立管理体系和分析风险、机遇 ,全面负责技术运作;质量负责人应确保管理体系得到实施和保持;应指定关键管理人员的代理人。 4.3场所环境 4.3.1检验检测机构应有固定的、临时的、可移动的或多个地点的场所,上述场所应满足相关法律法规、标准或技术规范的要求。检验检测机构应将其从事检验检测活动所必需的场所、环境要求制定成文件。 4.4设备设施 检验检测机构应配备满足检验检测(包括抽样、物品制备、数据处理与分析)要求的设备和设施。用于检验检测的设施,应有利于检验检测工作的正常开展。设备包括检验检测活动所必需并影响结果的仪器、软件、测量标准、标准物质、参考数据、试剂、消耗品、辅助设备或相应组合装置、检验检测机构使用非本机构的设施和设备时,应确保满足本标准要求。 检验检测机构租用仪器设备开展检验检测时,应确保: a)租用仪器设备的管理应纳入本检验检测机构的管理体系 b)本检验检测机构可全权支配使用,即:租用的仪器设备由本检验检测机构的人员操作、维护、检定或校准,并对使用环境和贮存条件进行控制c)在租赁合同中明确规定租用设备的使用权 d)同一台设备不允许在同一时期被不同检验检测机构共同租赁和资质认定。 检验检测机构应建立和保持检验检测设备和设施管理程序,以去报设备和设施的配置、使用和维护满足检验检测工作要求。 设备出现故障或者异常时,检验检测机构应采取相应措施,如停止使用、隔离或加帖停用标签、标记,直至修复并通过检定、校准或核查表面能正常工作为止。应核查这些缺陷或偏离对以前检验检测结果的影响。 检验检测机构应建立和保持标准物质管理程序。标准物质应尽可能溯源到国际检测机构通用要求培训试卷

Analysis of a predator–prey model with modified Leslie–Gower

《检验检测机构资质认定能力评价通用要求》考试题

内审员RBT214-2017新标准宣贯及培训考试试卷附答案

dynamical system动力学系统

Scalable nonlinear dynamical systems for agent steering and crowd simulation

Adaptive Feedback Synchronization of a General Complex Dynamical Network With Delayed Nodes

183

Adaptive Feedback Synchronization of a General Complex Dynamical Network With Delayed Nodes

Qunjiao Zhang, Junan Lu, Jinhu Lü, Senior Member, IEEE, and Chi K. Tse, Fellow, IEEE

Abstract—In the past decade, complex networks have attracted much attention from various ?elds of sciences and engineering. Synchronization is a typical collective behavior of complex networks that has been extensively investigated in recent years. To reveal the dynamical mechanism of synchronization in complex networks with time delays, a general complex dynamical network with delayed nodes is further studied. Based on a suitable model, we investigate the adaptive feedback synchronization and obtain several novel criteria for globally exponentially asymptotic synchronization. In particular, our hypotheses and the proposed adaptive controllers for network synchronization are very simple and can be readily applied in practical applications. Finally, numerical simulations are provided to illustrate the effectiveness of the proposed synchronization criteria. Index Terms—Adaptive feedback synchronization, complex networks, delayed nodes.

I. INTRODUCTION HE so-called complex network refers to a set of nodes connected by edges (graph) that has certain nontrivial topological features that are not found in simple networks [1]–[4]. Such nontrivial features involve a degree distribution with a heavy-tail, a hierarchical structure, a high clustering coef?cient, a community structure at different scales, and assortativity or disassortativity among vertices [2], [5]–[8]. It is well known that complex networks exist in many natural and man-made systems, e.g., food webs, neural networks, cellular and metabolic networks, electrical power grids, computer networks, technological networks, the World Wide Web, coauthorship and citation networks, social networks, etc. [1], [2]. Time delay inevitably exists in natural and man-made networks [9]–[15]. In much of the literature, time delays in the cou-

T

Manuscript received May 25, 2007; revised September 17, 2007. This work was supported by National Natural Science Foundation of China under Grants 60574045, 70771084, 60221301 and 60772158, by National Basic Research (973) Program of China under Grant 2007CB310800 and 2007CB310805, by Important Direction Project of Knowledge Innovation Program of Chinese Academy of Sciences under Grant KJCX3-SYW-S01, and by Scienti?c Research Startup Special Foundation on Excellent PhD Thesis, and Presidential Award of Chinese Academy of Sciences. This paper was recommended by Associate Editor J. Suykens. Q. Zhang and J. Lu are with the School of Mathematics and Statistics, Wuhan University, Wuhan 430072, China (e-mail: qunjiao99@https://www.360docs.net/doc/84698518.html,, jalu@https://www.360docs.net/doc/84698518.html,). J. Lü is with the Institute of Systems Science, Academy of Mathematics and Systems Science, Chinese Academy of Sciences, Beijing 100080, China, and also with the State Key Laboratory of Software Engineering, Wuhan University, Wuhan 430072, China (e-mail: jhlu@https://www.360docs.net/doc/84698518.html,). C. K. Tse is with the Department of Electronic and Information Engineering, Hong Kong Polytechnic University, Hong Kong, China (e-mail: encktse@polyu. edu.hk). Digital Object Identi?er 10.1109/TCSII.2007.911813

plings (edges) are considered [9]–[11]; however, the time delays in the dynamical nodes [12]–[15], which are more complex, are still relatively unexplored. As a matter of fact, one can ?nd numerous examples in the real world which are characterized by delayed differential equations having time delays in the dynamical nodes [12]–[15]. For example, the delayed logistic differential equation, which has time delay in the dynamical node, is a representative dynamical model of the electrochemical intercalations and physiological systems [15]. It is thus imperative to further investigate complex dynamical networks with delayed nodes. However, such complex networks are still relatively unexplored due to their complexity and the absence of an appropriate simpli?cation procedure [9], [10]. Further, the lack of a general approach or tool to study such kind of complex networks has also obstructed the progress of development of their analysis [11]. Recently, we developed a method to deal with such kind of complex networks [16], and in this paper we further investigate the synchronization of a general complex dynamical network with delayed nodes. Synchronization is now widely regarded as a kind of collective behavior which is exhibited in many natural systems [1], [16], [17]. In essence, synchronization is a form of self-organization. It has been demonstrated that many real-world problems have close relationships with network synchronization [1], [2], [8]. For example, theoretical and experimental results show that a mammalian brain not only displays in its storage of associative memories, but also modulates oscillatory neuronal synchronization by selective perceive attention [18]. Recently, synchronization of complex dynamical networks has been a focus in various ?elds of science and engineering. Wu [5] investigated the synchronization of random directed networks. Lü and Chen [8] studied the synchronization of time-varying complex dynamical networks. Li et al. [9], [11] explored the synchronization of complex dynamical networks with nonlinear inner-coupling functions and time delays. Zhou et al. [16] studied the adaptive synchronization of an uncertain complex dynamical network. Sorrentino et al. [17] investigated the controllability of complex networks with pinning controllers. However, the important issue of synchronization of complex dynamical networks with delayed nodes has only been lightly covered [9]–[15]. This paper will further investigate the adaptive feedback synchronization of complex dynamical networks with delayed nodes. In particular, we obtain several novel criteria for globally exponentially asymptotic synchronization. It should be pointed out that our hypotheses and the proposed adaptive controllers for network synchronization are very simple and easy to apply. This paper is organized as follows. Section II introduces a general complex dynamical network with delayed nodes and several useful hypotheses. A set of novel adaptive feedback synchronization criteria are given in Section III. Section IV uses two

1549-7747/$25.00 ? 2008 IEEERBT214-2017检验检测机构通用要求

RBT 检验检测机构资质认定能力评价 检验检测机构通用要求