Note for tax

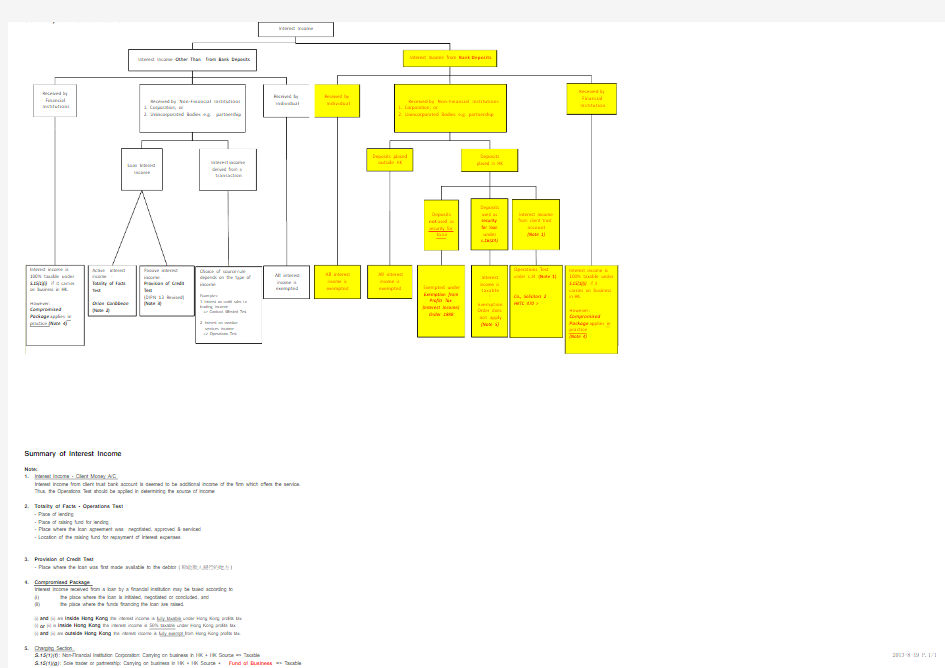

Summary of Interest Income

Note:

1.Interest Income - Client Money A/C

Interest income from client trust bank account is deemed to be additional income of the firm which offers the service.

Thus, the Operations Test should be applied in determining the source of income

2.Totality of Facts - Operations Test

- Place of lending

- Place of raising fund for lending

- Place where the loan agreement was negotiated, approved & serviced

- Location of the raising fund for repayment of interest expenses

3.Provision of Credit Test

- Place where the loan was first made available to the debtor (睇收款人銀行的地方)

https://www.360docs.net/doc/978626831.html,promised Package

Interest income received from a loan by a financial institution may be taxed according to

(i)the place where the loan is initiated, negotiated or concluded, and

(ii)the place where the funds financing the loan are raised.

(i) and (ii) are inside Hong Kong, the interest income is fully taxable under Hong Kong profits tax

(i) or (ii) is inside Hong Kong, the interest income is 50% taxable under Hong Kong profits tax

(i) and (ii) are outside Hong Kong, the interest income is fully exempt from Hong Kong profits tax.

5.Charging Section

S.15(1)(f): Non-Financial Institution Corporation: Carrying on business in HK + HK Source => Taxable

S.15(1)(g): Sole trader or partnership: Carrying on business in HK + HK Source + Fund of Business => Taxable

S.15(1)(i): Financial Institution: Carrying on business in HK + Deemed HK Source => 100% Taxable ('.' Worldwide taxable basis) but Compromised Package in practice 2013-8-19 P.1/1