audit-assignment3

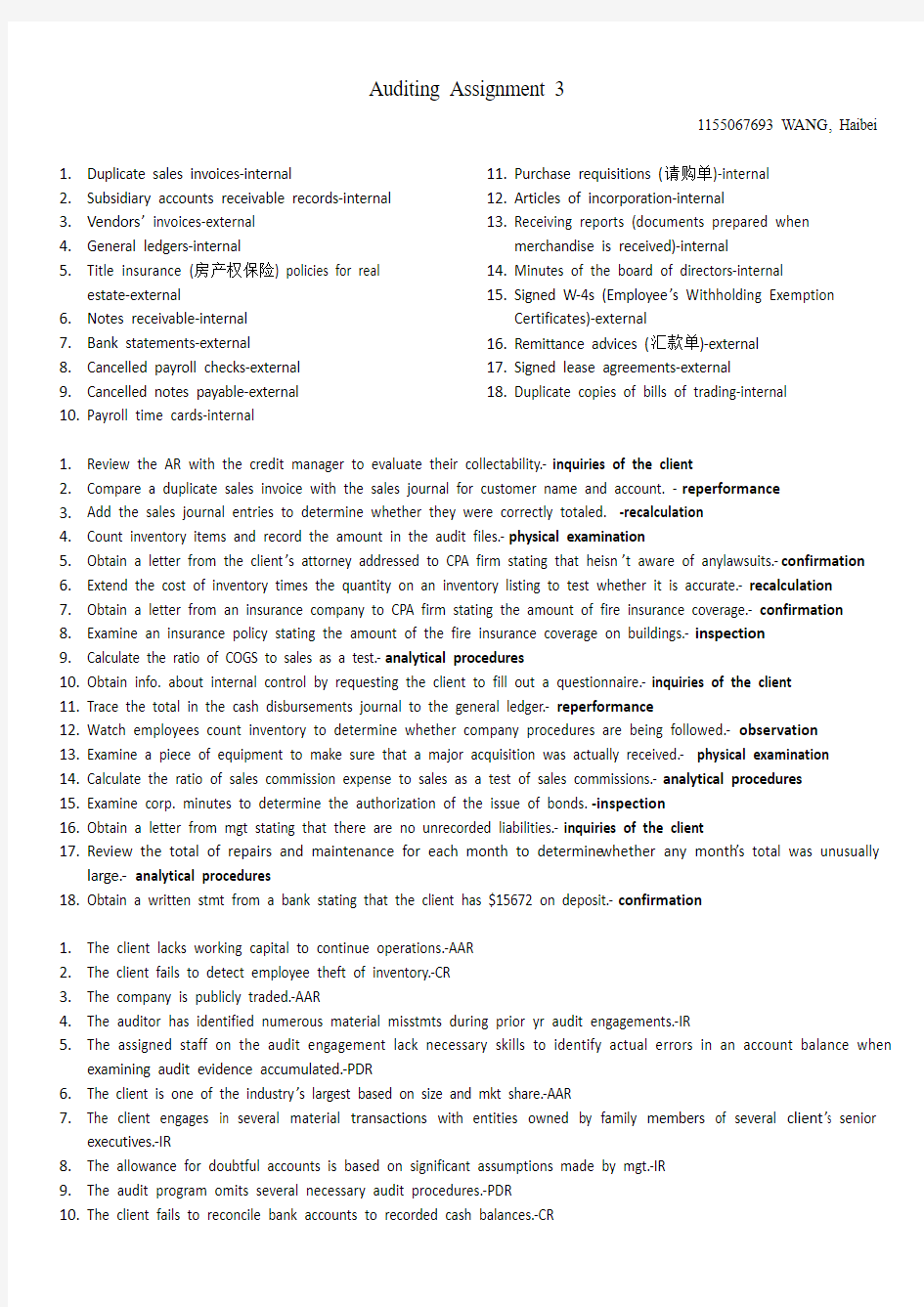

Auditing Assignment 3

1155067693 WANG, Haibei

1.Duplicate sales invoices-internal

2.Subsidiary accounts receivable records-internal

3.Vendors’ invoices-external

4.General ledgers-internal

5.Title insurance (房产权保险) policies for real

estate-external

6.Notes receivable-internal

7.Bank statements-external

8.Cancelled payroll checks-external

9.Cancelled notes payable-external

10.Payroll time cards-internal 11.Purchase requisitions (请购单)-internal

12.Articles of incorporation-internal

13.Receiving reports (documents prepared when

merchandise is received)-internal

14.Minutes of the board of directors-internal

15.Signed W-4s (Employee’s Withholding Exemption

Certificates)-external

16.Remittance advices (汇款单)-external

17.Signed lease agreements-external

18.Duplicate copies of bills of trading-internal

1.Review the AR with the credit manager to evaluate their collectability.-inquiries of the client

https://www.360docs.net/doc/ce7839069.html,pare a duplicate sales invoice with the sales journal for customer name and account. -reperformance

3.Add the sales journal entries to determine whether they were correctly totaled. -recalculation

4.Count inventory items and record the amount in the audit files.-physical examination

5.Obtain a letter from the client’s attorney addressed to CPA firm stating that heisn’t aware of anylawsuits.-confirmation

6.Extend the cost of inventory times the quantity on an inventory listing to test whether it is accurate.-recalculation

7.Obtain a letter from an insurance company to CPA firm stating the amount of fire insurance coverage.-confirmation

8.Examine an insurance policy stating the amount of the fire insurance coverage on buildings.-inspection

9.Calculate the ratio of COGS to sales as a test.-analytical procedures

10.Obtain info. about internal control by requesting the client to fill out a questionnaire.-inquiries of the client

11.Trace the total in the cash disbursements journal to the general ledger.-reperformance

12.Watch employees count inventory to determine whether company procedures are being followed.-observation

13.Examine a piece of equipment to make sure that a major acquisition was actually received.- physical examination

14.Calculate the ratio of sales commission expense to sales as a test of sales commissions.-analytical procedures

15.Examine corp. minutes to determine the authorization of the issue of bonds.-inspection

16.Obtain a letter from mgt stating that there are no unrecorded liabilities.-inquiries of the client

17.Review the total of repairs and maintenance for each month to determine whether any month’s total was unusually

large.- analytical procedures

18.Obtain a written stmt from a bank stating that the client has $15672 on deposit.-confirmation

1.The client lacks working capital to continue operations.-AAR

2.The client fails to detect employee theft of inventory.-CR

3.The company is publicly traded.-AAR

4.The auditor has identified numerous material misstmts during prior yr audit engagements.-IR

5.The assigned staff on the audit engagement lack necessary skills to identify actual errors in an account balance when

examining audit evidence accumulated.-PDR

6.The client is one of the industry’s largest based on size and mkt share.-AAR

7.The client engages in several material transactions with entities owned by family members of several client’s senior

executives.-IR

8.The allowance for doubtful accounts is based on significant assumptions made by mgt.-IR

9.The audit program omits several necessary audit procedures.-PDR

10.The client fails to reconcile bank accounts to recorded cash balances.-CR