Market Segmentation and Cross-predictability of Returns

THE JOURNAL OF FINANCE?VOL.LXV,NO.4?AUGUST2010

Market Segmentation and Cross-predictability

of Returns

LIOR MENZLY and OGUZHAN OZBAS?

ABSTRACT

We present evidence supporting the hypothesis that due to investor specialization

and market segmentation,value-relevant information diffuses gradually in?nancial

https://www.360docs.net/doc/c015448195.html,ing the stock market as our setting,we?nd that(i)stocks that are in eco-

nomically related supplier and customer industries cross-predict each other’s returns,

(ii)the magnitude of return cross-predictability declines with the number of informed

investors in the market as proxied by the level of analyst coverage and institutional

ownership,and(iii)changes in the stock holdings of institutional investors mirror the

model trading behavior of informed investors.

A GROWING BODY OF EMPIRICAL and theoretical research relaxes some of the strin-gent assumptions of the ef?cient markets hypothesis,and posits that gradual diffusion of information among investors explains the observed predictability of returns(Hong and Stein(1999)).To test the gradual diffusion of information hypothesis,the literature has focused mainly on studying the lagged price re-sponse of assets to their own past returns and their interaction with variables thought to affect the speed of information diffusion.This approach has been followed out of necessity because information?ow is a complex and unobserv-able process that is dif?cult to measure directly as separate from an asset’s own past return.

In this paper,we explore a new channel of information?ow that is sepa-rate from an asset’s own past return,namely,delayed price response to shocks that originate in related?rms in supplier and customer industries.By ex-amining the factors affecting such delay,we provide some of the?rst direct evidence on the gradual diffusion of information hypothesis,and on market segmentation as an underlying reason.The central contribution of our paper is thus to show that investor specialization,and the resulting informational segmentation of markets,has signi?cant effects on the formation of prices,and that gradual diffusion of information from economically related industries is pervasive.Our measures of information?ow—stock returns in supplier and customer industries—also allow us to explore untested implications of return ?Menzly is with Nomura Global Alpha,and Ozbas is with University of Southern California Marshall School of Business.We thank an anonymous referee,an anonymous associate editor,Wayne Ferson,Cam Harvey(the editor),Chris Jones,Berk Sensoy and Mark Wester?eld for helpful comments.Financial support from the Marshall General Research Fund is gratefully acknowledged.

1555

1556The Journal of Finance R

cross-predictability that arise in limited-information models among assets with correlated fundamentals.1

A long line of previous work studies return predictability based on publicly available information,and builds on modeling ingredients that are also nec-essary for there to be return cross-predictability.The main ingredients in this literature are:(i)information about fundamentals is dispersed(Hayek(1945)), (ii)at least some investors can process only a subset of publicly available infor-mation(Hong and Stein(1999))because either they have limited information-processing capabilities(Simon(1955),Jensen and Meckling(1992))or search-ing over all possible forecasting models using publicly available information itself is costly(Hong,Stein,and Yu(2007)),and(iii)there are limits to arbi-trage(De Long et al.(1990),Shleifer and Summers(1990),Shleifer and Vishny (1997)).Under these assumptions,new informative signals are incorporated into prices only partially because at least some investors do not adjust their demand by performing the Grossman-Stiglitz(1980)rational expectations in-ference of recovering informative signals from observed prices.As a result of this failure on the part of some investors,returns exhibit predictability.

To obtain cross-predictability in a limited-information model,two additional assumptions are needed:?rms in different industries or market segments have correlated fundamentals(A1),and,as in Hong,Torous,and Valkanov(2007), investors specialize along these boundaries to some degree(A2),which ren-ders markets informationally segmented.Our analysis of cross-predictability along the supply chain begins by providing evidence on these two important assumptions.We?nd that industry pro?ts along the supply chain are indeed correlated,and that analysts,who are among the most important producers of information,cover only a few stocks and even fewer industries,suggesting that the production of new information is specialized.While most,if not all,ana-lysts undoubtedly have some knowledge of related stocks or industries,all that a gradual diffusion of information model needs is that some producers of infor-mation be specialists and that they not be the source of some new information produced in related markets.

We next present four sets of cross-predictability?ndings that are consistent with the predictions of a gradual diffusion of information model.First,stock-and industry-level returns exhibit strong cross-predictability effects based on lagged returns in supplier and customer industries.By excluding small and illiquid stocks,we further verify that the cross-predictability results are not driven by delayed price response among small stocks(lead-lag effect)or stale prices.

Second,the extent of cross-predictability is negatively related to the level of information in the market.Ranking stocks by the level of analyst coverage or by the level of institutional ownership,stocks in the top quintile exhibit no

1We note that cross-predictability effects are different from lead-lag effects where one market either always leads or always lags another market,for example,large stocks always lead small stocks.With cross-predictability,a market can sometimes lead and sometimes lag another related market depending on where the information originates.

Market Segmentation and Cross-predictability of Returns1557 cross-predictability whereas stocks in the bottom quintile exhibit two to three times more cross-predictability than the average stock.

Third,the way in which institutional investors trade is consistent with the model trading behavior of informed investors exploiting the cross-market con-tent of informative signals.Speci?cally,institutions increase their ownership in a stock at the same time that they increase their ownership in supplier and customer industries,and decrease their ownership in a stock at the same time that they decrease their ownership in supplier and customer industries.We also?nd similar results using returns in supplier and customer industries, consistent with the joint behavior of returns and informed trade in limited-information models.

Fourth,we show that self-?nancing trading strategies based on cross-predictability effects yield economically and statistically signi?cant premiums. Speci?cally,a trading strategy that consists of buying industries with high returns in supplier industries over the previous month and simultaneously selling industries with low returns in supplier industries over the previous month yields an annual premium of7.3%.A similar trading strategy based on previous-month customer industry returns yields an annual premium of7.0%. Both trading strategies are consistently pro?table over the sample period,and returns from these strategies exhibit little exposure to well-known return fac-tors such as the Fama-French(1993)SMB,HML,and MOM factors.Moreover, we?nd that the return series of long/short equity hedge funds,which are thought to exploit predictability effects,are signi?cantly correlated,both eco-nomically and statistically,with the return series from the trading strategies described above.

The rest of the paper proceeds as follows.Section I provides a discussion of the setting,our empirical design,and related research.Section II explains our data sources and presents our main?ndings on cross-predictability.We explore various trading strategies in Section III,and provide concluding remarks in Section IV.

I.The Setting

A.Cross-predictability in Limited-Information Models

A limited-information model in the spirit of Hong et al.(2007)underlies our tests about the various aspects of cross-predictability.This subsection provides a summary of the model basics and assumptions required to demonstrate how the specialization of investors in their information gathering efforts can lead to informationally segmented markets and consequently cross-predictability in asset returns.

To?x ideas,suppose that there are two markets,three dates,and two types of investors,informed and uninformed,with both types of investors able to invest in both https://www.360docs.net/doc/c015448195.html,rmed investors specialize in one of the markets for which,at some intermediate stage,they receive an informative signal about the eventual cash?ow.Uninformed investors do not receive an informative signal,

1558The Journal of Finance R

and at least some of them do not process information because either they have limited information-processing capabilities or processing information is costly for them.

In this setting,it is fairly straightforward to show that returns exhibit pre-dictability based on publicly available information.When the informative sig-nal arrives at the intermediate stage,it is incorporated into the price through the demand of informed investors—but only partially because at least some un-informed investors,due to their limited information-processing capabilities,do not perform the Grossman-Stiglitz(1980)rational expectations inference and recover the informative signal from the observed price to adjust their demand. As a result of this failure on the part of some uninformed investors,returns exhibit positive auto-correlation.

With two asset markets,returns exhibit cross-predictability as a consequence of two additional assumptions:(i)the two markets have correlated fundamen-tals,and therefore an informative signal in one market has information content about the eventual payoff in the other market,and(ii)the two markets are in-formationally segmented.Due to the specialization of informed investors,an informative signal originating in one of the markets is received only by those investors who happen to specialize in that market,and not by investors who specialize in the other market.As a result,informative signals with cross-market content are incorporated into prices only partially,and returns exhibit cross-predictability.Note that this spillover effect is different from a lead-lag effect because either market can cross-predict the other when there is a new signal,rather than one market always leading or always lagging another. The limited-information setting outlined above has the following testable predictions.First,cross-predictability is to be expected across assets with cor-related fundamentals,and to be of the same sign as the correlation of funda-mentals.Second,allowing the number of informed investors to vary,the mag-nitude of cross-predictability should be lower where there are more informed investors.Intuitively,when the amount of information-impounding demand is high in a given market,and informative signals are by and large incorporated into prices fully,there is little left to be predicted.Third,allowing informed investors to exploit the cross-market content of their signals,their trades in fundamentally related markets should be correlated because while information acquisition activities may involve specialization,trading need not.2

B.Empirical Design

It is important that we also motivate our empirical design.Why do we test for cross-predictability effects along the supply chain?And,why do we focus on economic boundaries de?ned by industries?

2In a previous version of the paper,we derived these predictions by extending Hong et al.(2007).This analysis and several other complementary analyses are provided in an In-ternet Appendix available online in the“Supplements and Datasets”section at http://www.afajof. org/supplements.asp.

Market Segmentation and Cross-predictability of Returns1559 Firms close to each other along the supply chain are likely to face correlated cash?ow shocks,a necessary ingredient for there to be cross-predictability in limited-information models.Supplier and customer?rms may have correlated cash?ows because they interact with each other either directly through their trading relationships or indirectly through market prices for their inputs and outputs.Firms along the supply chain may also face relatively similar demand or technological shocks.The Benchmark Input-Output Surveys of the Bureau of Economic Analysis(BEA Surveys,hereafter)provide data on the amount of goods and services traded among industries.These data allow us to identify supplier and customer industries.

Economic boundaries de?ned by industries are also likely to represent in-formational boundaries induced by investor specialization.This is because the skills necessary to investigate and evaluate a given?rm are likely to be use-ful in understanding other same-industry?rms.Indeed,important economic agents such as equity analysts and money managers tend to specialize along industry lines.

The empirical design can alternatively focus on economic boundaries de?ned by companies.Indeed,Menzly and Ozbas(2004)and Cohen and Frazzini(2008) use COMPUSTAT’s customer information database to identify economically re-lated stocks.However,for the purposes of the present paper,we have ultimately decided for two reasons that the BEA Surveys represent the best empirical ap-proach to identify the set of economically related stocks for a given stock or in-dustry.First,only the smallest stocks exhibit cross-predictability effects based on lagged COMPUSTAT customer returns.This raises questions as to whether return cross-predictability is an economically important phenomenon worthy of study if it is limited to small stocks.Second,using the customer information database to identify supplier?rms(in effect,by using reported relationships in the reverse direction)and then testing for cross-predictability effects from supplier?rms yield no signi?cant results.This is because the customer?rms reported in COMPUSTAT are typically much larger than the reporting?rm. In comparison,the BEA Surveys enable us to identify,for each?rm,broad portfolios of supplier and customer?rms whose returns contain economically important information regardless of the size of the?rm in question.As a result, cross-predictability effects based on the BEA Surveys are robust even to the exclusion of small stocks.

C.Related Literature

Our?ndings relate to a large literature on return predictability,one strand of which explores lead-lag relations among stocks.In an in?uential paper,Lo and MacKinlay(1990)document that large stocks lead small stocks.Our paper, by showing that cross-predictability effects are robust to the exclusion of small stocks and monthly return observations without a closing price in the previ-ous month,addresses an important concern of this literature that observed lead-lag relations could be an artifact of thin markets and nonsynchronous prices.

1560The Journal of Finance R

In a recent paper,Hong et al.(2007)document that in the United States several important industries such as commercial real estate,petroleum,metal, retail,?nancial,and services lead the overall stock market as well as vari-ous economic indicators.Moreover,they show that the eight largest non-U.S. markets exhibit similar patterns.A natural interpretation of their?ndings is that information of macroeconomic importance in certain industries diffuses gradually to the rest of the market.In addition to the contributions we discuss below,our?ndings differ from those of Hong et al.(2007)in that we establish pervasive cross-predictability effects throughout the supply chain by focusing on returns in immediate supplier and customer industries.

Another strand of the literature following Lo and MacKinlay(1990)investi-gates the role of informed traders using proxies such as analyst coverage and in-stitutional ownership,as we do.Brennan,Jegadeesh,and Swaminathan(1993) show that many-analyst?rms lead few-analyst?rms,suggesting that many-analyst?rms adjust to common information faster than few-analyst?rms do. Badrinath,Kale,and Noe(1995)show that high-institutional ownership stocks lead low-institutional ownership stocks.Because we use return innovations in a relatively contained set of supplier and customer industries as opposed to return innovations in market-wide portfolios of stocks,which these previous papers use,we are able to establish an important role for informed traders in impounding relatively less common information into stock prices.

In another related paper,Hong,Lim,and Stein(2000)document that stocks with more analyst coverage exhibit less price momentum.This is consistent with the idea that stocks with more analyst coverage adjust more quickly to value-relevant information.However,the source as well as nature of the infor-mation to which stocks adjust in their study remain unclear.In this respect,our ?ndings complement theirs by showing that stocks with more analyst coverage adjust more quickly to value-relevant information originating in supplier and customer industries.

Finally,by relating the trading behavior of institutional investors to returns in supplier and customer industries,we contribute to the literature investigat-ing the joint behavior of stock returns and informed trade in“disagreement models”as articulated by Hong and Stein(2007).Earlier work by Cohen,Gom-pers,and Vuolteenaho(2002)shows that institutional investors pro?t from the momentum effect in prices.We further show that the holdings of institutional investors change in a manner consistent with trading strategies that pro?t from the cross-predictability effect in prices.

II.Empirical Results

A.Data

A.1.CRSP and COMPUSTAT

Our return data come from the Center for Research in Security Prices(CRSP) monthly returns database.The sample period is from July1963to June2005. Consistent with standard practice,we use NYSE,Amex,and NASDAQ stocks,

Market Segmentation and Cross-predictability of Returns1561 and exclude closed-end funds,real estate investment trusts,American De-positary Receipts,foreign companies,primes,and scores.We obtain?nancial statement and other company information through the Merged COMPUSTAT-CRSP database.

A.2.Benchmark Input-Output Surveys

We use a series of Benchmark Input-Output Surveys of the Bureau of Eco-nomic Analysis to identify supplier and customer industries for a given stock or industry(see Fan and Lang(2000),Matsusaka(1993)).BEA Surveys pro-vide a detailed picture of the interdependent structure of the U.S.economy by assigning gross output to industry accounts and by reporting the amount of inter-industry?ows of goods and services in the Use Table.

BEA Surveys are published roughly once every5years to coincide with the Economic Census conducted by the U.S.Census Bureau.We draw on11differ-ent surveys(2002,1997,1992,1987,1982,1977,1972,1967,1963,1958,and 1947)on a rolling basis to measure supplier and customer relations.We adopt this approach primarily to improve measurement accuracy because each sur-vey provides a historical snapshot and thus may be inadequate for describing the structure of the U.S.economy for our entire sample period.For the?rst part of our analysis testing the underlying economics of cross-predictability,we use data from a given survey until a new snapshot is provided by the following survey,that is,we use data from the1963Survey between1963and1966,the 1967Survey between1967and1971,and so on.For the second part of our analysis investigating various trading strategies based on cross-predictability effects,we delay using any data from a given survey until the end of the year in which the survey is publicly released.The different BEA Surveys mentioned above were released during2007,2002,1997,1994,1991,1984,1979,1974, 1969,1964,and1952,respectively.

For the purposes of our analysis,we merge three separate industry accounts, namely,2301(new nonresidential construction),2302(new residential con-struction),and2303(maintenance and repair construction),in the1997and 2002BEA Surveys into a single account because these three industry accounts stake overlapping claims on the same North American Industry Classi?cation System(NAICS)codes and?rms.In pre-1997BEA Surveys based on Standard Industrial Classi?cation(SIC)codes,we merge industry account pairs1-2(live-stock and agricultural products),5-6(metallic ores mining),9-10(nonmetallic minerals mining),11-12(construction),20-21(lumber and wood products),and 33-34(footwear,leather,and leather products)because the industry accounts within each pair stake overlapping claims on the same SIC codes.In addition, we drop miscellaneous industry accounts related to government,import,and inventory adjustments because they do not appear to correspond to any clear economic activity or industry.

We use BEA SIC and NAICS code dictionaries to assign each stock to an industry based on the stock’s reported SIC or NAICS code in

1562The Journal of Finance R

COMPUSTAT.3If this information is missing in COMPUSTAT,we use the reported code in CRSP.Based on the industry assignments,we next calculate value-weighted monthly industry returns.We require that there be a market capitalization at the end of June of a given year for a stock to be included in the analysis for the subsequent12months.We impose this requirement primarily to stabilize the composition of industry portfolios.

After calculating industry portfolio returns,we further form two separate portfolios for each industry,one composed of supplier industries and another composed of customer industries.To calculate monthly returns for these port-folios,we use data on the?ow of goods and services to and from the industries in question as portfolio weights.In particular,the share of an industry’s total purchases from other industries is used to calculate supplier industry returns, and the share of the industry’s total sales to other industries is used to calcu-late customer industry returns.For the purpose of testing limited-information models of gradual information diffusion,this portfolio weighting scheme has the desired properties of(i)identifying the set of economically related supplier and customer industries for a given industry,and(ii)re?ecting the relative economic importance of related industries as proxied by the amount of inter-industry trade.

A.3.I/B/E/S and13F Holdings

We use the I/B/E/S database,both its detail and summary history?les,to con-struct measures of analyst coverage and earnings expectations for each stock on CRSP.Because the I/B/E/S?les are historical snapshots,we use historical CUSIP codes to link the two databases.Finally,we use Thomson Financial’s 13F Holdings database to construct measures of institutional ownership for each stock on CRSP,where we again use historical CUSIP codes to link the two databases.

B.Preliminary Evidence

We begin by presenting preliminary evidence on two important assumptions in limited-information models for there to be cross-predictability from supplier and customer industries.These two assumptions are that(i)?rms in a given in-dustry have correlated fundamentals with?rms in their supplier and customer industries,and(ii)informed investors specialize in their information-gathering activities.

To see whether?rms along the supply chain have correlated fundamentals, we construct?rm-and industry-level measures of pro?tability and estimate

3Firms that operate in multiple industries pose a conceptual problem.In the Internet Appendix, we show that our cross-predictability results are fairly similar for single-and multi-segment?rms. Classifying a multi-segment?rm according to its reported code in COMPUSTAT representing the ?rm’s main business appears to constitute a reasonable method to identify the?rm’s main economic exposure for our purposes.

Market Segmentation and Cross-predictability of Returns

1563panel regressions of the form

ROA i ,t =αi +θmarket ROA market t

+θsupplier ROA supplier i ,t +θcustomer ROA customer i ,t +e i ,t ,(1)

where ROA i ,t is the return on assets of ?rm or industry i in year t .We mea-sure ?rm-level ROA as the ratio of cash ?ow to total assets (COMPUSTAT data item 6),where cash ?ow is the sum of earnings before extraordinary items (item 18)and depreciation and amortization (item 14).We calculate industry-and market-level ROA by aggregating ?rm-level ROA with a portfolio approach using ?rm assets as portfolio weights.We then calculate ROA supplier i ,t and ROA customer i ,t for each industry by weighting the industry-level ROA of sup-plier and customer industries with the ?ow of goods and services to and from the industries in question,similar to our approach for calculating returns in supplier and customer industries.Depending on the speci?cation,αi represents ?rm-or industry-level ?xed effects that control for unmodeled heterogeneity across ?rms and industries.Finally,we use robust standard errors that are adjusted for double clustering (Thompson (2009),Petersen (2009))by ?rm and year for the ?rm-level speci?cation,and by industry and year for the industry-level speci?cation.The remaining source of independence is therefore between different ?rms or industries in different years.

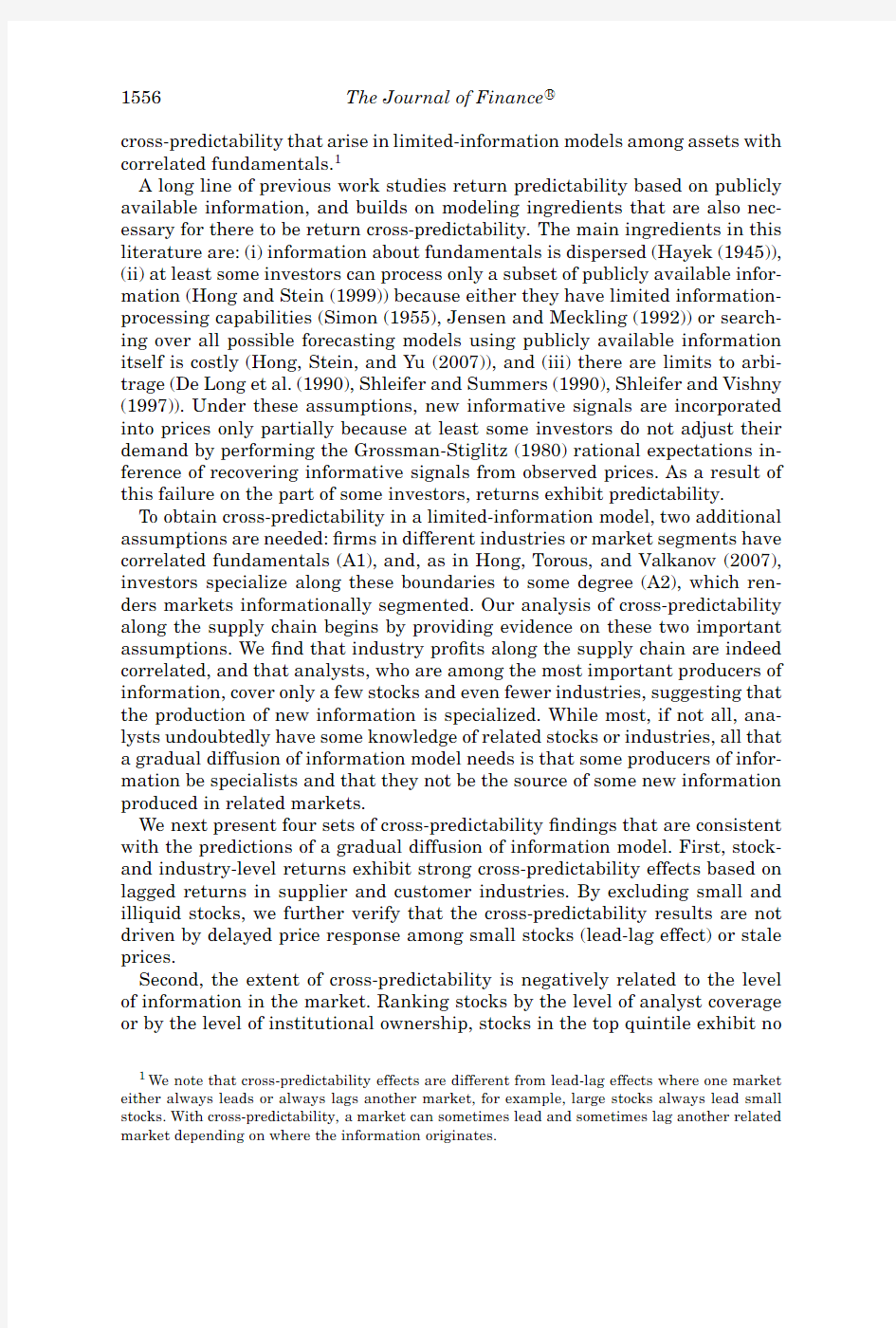

The results in Table I con?rm the validity of our empirical design for test-ing cross-predictability,and show that,indeed,?rms along the supply chain have positively correlated fundamentals.In column 1,where we present ?rm-level evidence,?rm-level ROA is positively correlated with contemporaneous ROA in supplier and customer industries over and above the market-wide ROA as evidenced by statistically signi?cant coef?cients on ROA supplier i ,t (0.471)and ROA customer i ,t (0.465).In column 2,where the unit of analysis is an in-dustry instead of a ?rm,the results con?rm the validity of our supply chain approach at the industry level.Speci?cally,industries along the supply chain have positively correlated fundamentals over and above the market-wide ROA as evidenced by statistically signi?cant coef?cients on ROA supplier i ,t (0.398)and ROA customer i ,t (0.164).We next address the assumption of specialization among informed investors by presenting evidence on the specialization of equity analysts,who arguably constitute one of the most informed groups of market players.Recall that for there to be cross-predictability of returns in limited-information models,informative signals need to be dispersed among informed investors.To shed some light on this issue,in Figure 1we provide histograms of the average number of stocks and industries covered by an analyst in any given month by using the analyst’s entire record in the I/B/E/S detail history ?le.We restrict our analysis to the period from January 1982to June 2005due to data quality concerns related to the pre-1982I/B/E/S data (the number of analyst estimates displays a large jump from 1981to 1982).For the purposes of the ?gure,we consider only earnings per share (EPS)forecasts and assume that an analyst

1564The Journal of Finance R

Table I

Supply Chain Fundamentals

This table presents stock-and industry-level panel regressions of annual return on assets (ROA)on contemporaneous market-wide ROA and ROA in related supplier and customer industries.The industries are based on the Benchmark Input-Output Surveys of the Bureau of Economic Analysis.Assets are measured as COMPUSTAT item 6.Cash ?ow is measured as the sum of earnings before extraordinary items (item 18)and depreciation and amortization (item 14).Market-wide and industry ROA are weighted by ?rm assets.Supplier (customer)ROA is calculated by weighting the industry ROAs of supplier (customer)industries by the inter-industry ?ow of goods and services reported in the Survey.Stock-and industry-level speci?cations include stock and industry ?xed effects in columns 1and 2,respectively.t -statistics are reported in parentheses.Standard errors are heteroskedasticity consistent and adjusted for double clustering by stock and year in column 1,and by industry and year in column 2.???,??,or ?indicates that the coef?cient estimate is different from zero at the 1%,5%,or 10%level,respectively.

Dependent V ariable:ROA

(1)(2)ROA market

0.725???0.172???(5.16)(2.60)ROA supplier

0.471???0.398???(2.68)(4.53)ROA customer

0.465???0.164?(2.98)(1.90)Fixed Effects

Yes Yes Clustered Standard Errors

Yes Yes R 2

0.5920.394N obs 275,2913,002

P e r c e n t

Number of Stocks

P e r c e n t

Number of Industries Figure 1.Average number of stocks and industries covered by equity analysts.

Market Segmentation and Cross-predictability of Returns1565 remains actively engaged in a stock for a12-month period after making an EPS forecast on that stock.We also truncate the average number of stocks and industries covered by an analyst at their95th percentiles for presentation.

As both graphs in Figure1illustrate,equity analysts appear to be highly specialized in their information gathering efforts.The median(across all ana-lysts)of the average number of stocks covered by an analyst in any given month is6.60;in comparison,the average number of stocks that satisfy our sample requirements and thus could hypothetically be covered by an analyst during the same sample period is about6,036.The corresponding statistic for the number of industries covered is1.91,which indicates that the specialization of equity analysts can be explained in part by their specialization along industry lines.We?nd similar results regarding analyst specialization along the supply chain,our empirical setting.Consistent with the assumption of specialization in information-gathering activities,the median analyst produces information in supplier industries that in total provide only8.64%of the covered?rm’s inputs,as indicated by active coverage of a stock in the?rm’s supplier indus-tries.The corresponding statistic is8.73%for customer industries that buy the covered?rm’s output.Note that this evidence does not suggest that analysts have no knowledge about?rms in related supplier and customer industries; rather,the evidence supports the assumption of limited-information models that information production is specialized to some degree.

C.Stock-and Industry-Level Cross-predictability Effects

We now test whether stock-level returns are cross-predictable based on lagged returns in supplier and customer industries.To do so,we conduct Fama-MacBeth(1973)regressions of the form

r i,t=αt+λsupplier

t r supplier

i,t?1

+λcustomer

t

r customer

i,t?1

+ t Z i,t?1+e i,t,(2)

where r i,t is the return of stock i in month t,r supplier

i,t?1is the return on stock i’s

portfolio of supplier industries in month t?1,r customer

i,t?1is the return on stock

i’s portfolio of customer industries in month t?1,and Z i,t is a vector of lagged control variables known to predict r i,t such as short-term reversal and medium-term continuation at the stock(Jegadeesh and Titman(1993))and industry (Moskowitz and Grinblatt(1999))level.For short-term reversal,we use r i,t?1, the return of stock i in the previous month t?1.We use r i,t?2:t?12,the return of stock i over the11months covering months t?12through t?2,to control for medium-term continuation at the stock level.We divide this variable by11in our regressions to maintain comparability with other variables.For medium-

term continuation at the industry level,we use r industry

i,t?1,the value-weighted

return in month t?1of the industry in which stock i is a member.Further including estimated return betas such as market,HML,and SMB to control for risk as well as?rm characteristics such as book-to-market and size do not affect the results,and so we omit them for brevity.

We report the time-series average of each regression coef?cient(obtained from monthly cross-sectional regressions)along with the time-series t-statistics

1566The Journal of Finance R

Table II

Cross-predictability Effects in Stock and Industry Returns

This table presents time-series averages of coef?cient estimates from monthly cross-sectional regressions of stock returns in columns1through3and industry returns in column4.Supplier (customer)returns consist of supplier(customer)industry returns weighted by the inter-industry ?ow of goods and services reported in the Benchmark Input-Output Surveys of the Bureau of Economic Analysis.All return variables are in excess of the risk-free rate.t-statistics are reported in parentheses.Standard errors assume independence across monthly regressions.???,??,or?indicates that the coef?cient estimate is different from zero at the1%,5%,or10%level,respectively.

(1)(2)(3)(4) Constant0.005??0.006??0.006??0.006??

(2.01)(2.33)(2.45)(2.35)

r supplier,t?10.114???0.105???0.117???0.113???

(5.03)(4.37)(5.04)(4.88)

r customer,t?10.071???0.058???0.059???0.075???

(4.11)(3.26)(3.46)(4.27)

r stock,t?1?0.062????0.047????0.067???

(14.44)(10.41)(13.84)

r stock,t?2:t?12×1110.072???0.099???0.099???

(4.07)(5.01)(5.37)

r industry,t?10.134???0.117???0.137???0.032???

(15.52)(12.33)(15.29)(2.83)

R20.0280.0510.0340.091

T492492492503 Sample excludes–<20th NYSE No closing price at observations:percentile end of month t?1

in Table II.The time-series averages can be interpreted as premiums that can be replicated with self-?nancing trading strategies whose weighted loading equals one on the speci?c regressor variable and zero on others(Fama(1976)). The results in column1con?rm that lagged returns in supplier and cus-tomer industries cross-predict stock-level returns as evidenced by statistically

signi?cant coef?cients on r supplier

i,t?1(0.114)and r customer

i,t?1

(0.071).Importantly,the

coef?cient estimates are also economically signi?cant—the combined premium on the two portfolios is comparable to known medium-term continuation effects

as represented by the coef?cients on r i,t?2:t?12(0.072)and r industry

i,t?1(0.134).Con-

sistent with short-term reversal,the coef?cient on r i,t?1(?0.062)is negative. In column2,we exclude stocks with market capitalizations below the20th NYSE percentile to address the possibility that thin markets might be driving

our cross-predictability results.The estimated coef?cients on r supplier

i,t?1(0.105)

and r customer

i,t?1(0.058)are smaller,but they remain statistically signi?cant and

the combined premium is still comparable to medium-term continuation ef-

fects as represented by the coef?cients on r i,t?2:t?12(0.099)and r industry

i,t?1(0.117).

The coef?cient on r i,t?1(?0.047)is smaller in magnitude,as one might expect following the exclusion of small stocks with potential thin trading problems. In column3,we exclude monthly return observations without a closing price (but with a bid-ask average instead)in the previous month to address the

Market Segmentation and Cross-predictability of Returns1567 possibility that nonsynchronous prices might be behind our results,and?nd

that the estimated coef?cients on r supplier

i,t?1(0.117)and r customer

i,t?1

(0.059)remain

signi?cant.

Next,we test whether the stock-level cross-predictability effects also hold at the industry level.There are good reasons to explore this question.One can reasonably argue that industry-level returns are economically more impor-tant than stock-level returns in some sense because they are value-weighted. Moreover,Moskowitz and Grinblatt(1999)show that there is momentum in industry-level returns.They conjecture that momentum may be susceptible to aggregate shocks and that the associated premium may represent compensa-tion for taking on undiversi?able risk.If cross-predictability effects also survive the industry aggregation,then it is quite possible that its premium represents compensation for taking on undiversi?able risk,in which case it could be a permanent feature of stock returns.Furthermore,limited-information models predict economically related assets to exhibit cross-predictability,regardless of whether the unit of analysis is a stock or an industry,as long as the aggregation process does not result in the complete elimination of market segmentation. For these reasons,we see the tests using industry-level returns as being more than a robustness exercise.

Using industry-level returns,we conduct Fama-MacBeth(1973)regressions of the same form as(2),where now r i,t is the return of industry i in month

t,r supplier

i,t?1is the return on industry i’s portfolio of supplier industries in month

t?1,and r customer

i,t?1is the return on industry i’s portfolio of customer industries

in month t?1.The only lagged control variable is r i,t?1,which is the return of industry i in month t?1.As before,including estimated betas on the market, HML and SMB do not affect the results,and so we omit them for brevity.

The results in column4con?rm the main prediction of limited-information models at the industry https://www.360docs.net/doc/c015448195.html,gged returns in economically related sup-plier and customer industries cross-predict industry-level returns as evidenced

by statistically signi?cant coef?cients on r supplier

i,t?1(0.113)and r customer

i,t?1

(0.075).

These coef?cient estimates are similar in magnitude to those in stock-level re-gressions reported in columns1–3.Interestingly,the coef?cient on r i,t?1(0.032) is smaller for industry-level returns than it is for stock-level returns.The de-cline in the predictive power of r i,t?1for value-weighted industry-level returns suggests that there is an important size effect,where large?rms in an industry lead same-industry small?rms,consistent with the recent work of Hou(2007).

D.The Effect of Informed Investors

A clear prediction of limited-information models is that the magnitude of cross-predictability should be lower where there are more informed investors—whose information-impounding demand leaves little to be predicted.We now turn to testing this prediction.

In testing the effect of informed investors on cross-predictability,we work with stock-level returns rather than industry-level returns to preserve the

1568The Journal of Finance R

degree of cross-sectional heterogeneity of information conditions and investor types at the stock level.We employ two different stock-level proxies to test for the effect of informed investors:the amount of analyst coverage and the presence of institutional investors as owners in the stock.Both proxies have been used in prior research to establish an important role for informed investors in incorporating common information into prices(Brennan et al.(1993)and Badrinath et al.(1995)).

To construct our stock-level analyst coverage measure,we make use of ana-lyst forecast data in the I/B/E/S detail history?le and consider only forecasts of earnings per share,which is the most commonly available type of analyst forecast.We obtain similar results using other types of analyst forecasts such as sales or dividends per share with the limitation of a thin sample until the late1990s.We restrict our analysis to post-1982data in I/B/E/S due to data quality concerns.

To proxy for the amount of analyst coverage for a stock,we calculate two different measures that count the number of analysts who actively follow the stock on a monthly basis.The?rst measure assumes that an analyst is active if the analyst has made a forecast for the stock within the last12months.By allowing for such a long grace period,we hope to account for some analysts who appear to release their forecasts once a year.The obvious drawback of this approach is that we might erroneously consider the stale forecast of an inactive analyst.To address this concern,we construct a second measure where we require an analyst to have made a forecast for the stock during a given month to be considered active for that month.

To see whether the cross-predictability effects based on lagged returns in supplier and customer industries are weaker for stocks with higher analyst coverage,we augment our Fama-MacBeth(1973)regressions using

r i,t=αt+

5

j=1

λj t A j

t?1

r related

i,t?1

+e i,t,(3)

where r i,t is the return of stock i in month t,A j

t?1is an indicator variable equal to

one if the level of analyst coverage for stock i in month t?1places the stock in

the j th quintile and zero otherwise,and r related

i,t?1is the return on stock i’s portfolio

of related supplier and customer industries in month t?1.In the Internet Appendix,we further allow for cross-sectional differences in expected returns

across the different quintiles by including the indicator variables A j

t?1directly

in the speci?cation.We also exclude stocks with market capitalization below the20th NYSE percentile.None of these variations affects our conclusions. For brevity,we report results for the speci?cation where we use a composite

variable r composite

i,t?1for r related

i,t?1

,which we calculate by taking the average of r supplier

i,t?1

and r customer

i,t?1.This composite variable has the bene?t of reducing the number

of parameters to be estimated while being model-justi?ed.Indeed,limited-information models require that assets be economically related for there to be cross-predictability,but beyond that they make no distinction between supplier and customer industries.

Market Segmentation and Cross-predictability of Returns1569

Table III

Analyst Coverage,Institutional Ownership,

and Cross-predictability Effects

This table presents time-series averages of coef?cient estimates from monthly cross-sectional regressions of stock returns on lagged related industry returns interacted with lagged analyst coverage and institutional ownership.r composite represents returns in related industries,and is calculated as the average of r supplier and r customer.Analyst coverage for a stock in a given month is measured as the number of analysts who made an EPS forecast for the stock within the last 12months(column1)or the number of analysts who made an EPS forecast for the stock in that month(column2).Institutional ownership is measured as the percentage of outstanding shares owned by institutions(column3).Stocks are ranked into?ve quintiles based on analyst coverage and institutional ownership.All return variables are in excess of the risk-free rate.t-statistics are reported in parentheses.Standard errors assume independence across monthly regressions.???,??,or?indicates that the coef?cient estimate is different from zero at the1%,5%,or10%level,

respectively.

(1)(2)(3) Constant0.008?0.008?0.008??

(1.95)(1.89)(1.97)

r composite,t?1×Rank t?1(1st Quintile?Lo w)0.293???0.300???0.380???

(4.98)(4.95)(5.89)

r composite,t?1×Rank t?1(2nd Quintile)0.299???0.259???0.317???

(5.12)(4.65)(5.55)

r composite,t?1×Rank t?1(3rd Quintile)0.185???0.201???0.244???

(3.27)(3.71)(4.50)

r composite,t?1×Rank t?1(4th Quintile)0.143??0.157??0.177???

(2.37)(2.61)(3.16)

r composite,t?1×Rank t?1(5th Quintile?High)0.0270.0340.067

(0.43)(0.55)(1.12)

R20.0140.0120.012

T281281303

We report our results on analyst coverage in the?rst two columns of Table III.The results in column1are based on our?rst measure of ana-lyst coverage whereas the results in column2are based on the second.Re-gardless of the measure used,we?nd that stocks with low analyst coverage exhibit more cross-predictability than stocks with high analyst coverage.Im-portantly,the magnitude of the cross-predictability effects declines monotoni-cally across the analyst coverage quintiles.Furthermore,we?nd large spreads across the analyst coverage quintiles:stocks in the lowest quintile of analyst coverage exhibit signi?cant cross-predictability whereas stocks in the highest quintile of analyst coverage exhibit no cross-predictability at conventional lev-els.Overall,the results are supportive of limited-information models to the extent that the number of analysts can be considered a good proxy for the supply of information to the market and hence for the number of informed investors.

In our next set of results in Table III,we test whether the cross-predictability effects based on lagged returns in supplier and customer industries are weaker

1570The Journal of Finance R

for stocks with more institutional owners.For this exercise we use Thomson Financial’s13F Holdings database,which contains the stock-level holdings of institutional money managers collected from mandatory quarterly13F?lings made with the Securities Exchange Commission under the Securities Exchange Act Section3(a)(9)and Section13(f)(5)(A).To proxy for the effect of institutional investors using these data,we sum the holdings of institutional investors in the stock at a given quarter-end report date and then divide by the number of outstanding shares at the time to compute the percentage ownership by insti-tutional investors(we obtain qualitatively similar results using an alternative proxy,namely,the number of different institutional investors in the stock at a given quarter-end report date).We restrict our analysis to holdings data with a report date in1980or later because the database contains very few observations with a report date prior to1980.

In column3,A j

t?1is now an indicator variable equal to one if the institu-

tional ownership in stock i at the end of month t?1based on the then-most recent quarterly holdings data places the stock in the j th quintile and zero otherwise.We?nd that stocks with low institutional ownership exhibit more cross-predictability than stocks with high institutional ownership.Moreover, the magnitude of the cross-predictability effects declines monotonically across the institutional ownership quintiles,and the resulting spread across the in-stitutional ownership quintiles is even larger than that across the analyst coverage quintiles in columns1and2.All in all,we take these results as also supportive of limited-information models to the extent that institutional in-vestors can generally be considered more informed than other investors.In the Internet Appendix,we investigate whether repeated use of the same quarterly holdings data in multiple monthly cross-sectional regressions poses statistical problems;we?nd that robust standard errors that allow for clustering at the year-quarter level do not change our conclusions.

E.Evidence on Institutional Trading

Another untested implication of limited-information models is that when informed investors are allowed to trade in markets other than the one in which they specialize to acquire informative signals,they trade simultaneously in fundamentally related markets to exploit the cross-market content of their signals.

Assuming that institutional investors are more informed than the rest of the investor population,we test this implication by estimating panel regressions of the form

IO i,q=αi+γq+βrelated IO related

i,q

+e i,q,(4) where IO i,q is the change in the percentage ownership of institutional in-

vestors in stock i from quarter q?1to quarter q,and IO related

i,q is the change

in the percentage ownership of institutional investors in the related indus-

tries( IO supplier

i,q , IO customer

i,q

)of stock i from quarter q?1to quarter q.We use

Market Segmentation and Cross-predictability of Returns1571

Table IV

Change in Institutional Ownership

This table presents panel regressions in which quarterly changes in institutional ownership at the stock level are regressed on contemporaneous changes in institutional ownership in related industries in columns1and2,and on contemporaneous quarterly returns in related industries in columns3and4.Related supplier and customer industries are based on the inter-industry trade data reported in the Benchmark Input-Output Survey of the Bureau of Economic Analysis.All re-turn variables are in excess of the risk-free rate.All speci?cations include stock and year-quarter ?xed effects.t-statistics are reported in parentheses.Standard errors are heteroskedasticity consis-tent and adjusted for clustering at the industry-year level.???,??,or?indicates that the coef?cient estimate is different from zero at the1%,5%,or10%level,respectively.

(1)(2)(3)(4) IO supplier,q0.073???

(2.78)

IO customer,q0.055???

(2.77)

r supplier,q0.009???

(2.80)

r customer,q0.007??

(2.28)

R20.0520.0520.0520.052 N obs500,250500,250500,250500,250

the?ow of goods and services as portfolio weights in constructing IO supplier

i,q

and IO customer

i,q ,as we do in constructing r supplier

i,t?1

and r customer

i,t?1

.We include

stock-level?xed effectsαi to control for potential biases that could arise due

to unobserved heterogeneity across stocks even though we consider changes

and not levels.We further include year-quarter?xed effectsγq to control for

systematic fund in?ows and out?ows that ultimately should affect institutional

holdings.Finally,we compute robust standard errors that allow for the cluster-

ing of error terms at the industry-year level to allay concerns about the possible

persistence of fund?ows across different quarters within a year at the indus-

try level.Note that any systematic persistence of fund?ows across different

quarters within a year is already modeled by the inclusion of year-quarter?xed

effectsγq.

We report the results of this analysis in the?rst two columns of Table IV.

Given our earlier?ndings of positive return cross-predictability,we expect

institutional investors to increase their ownership in a stock at the same time

that they increase their ownership in supplier and customer industries,and

to decrease their ownership in a stock at the same time that they decrease

their ownership in supplier and customer industries.Therefore,we expect βrelated to be positive also.Consistent with this view,we?nd that changes in institutional ownership at the stock level are positively related to changes

in institutional ownership in related industries as evidenced by statistically

signi?cant coef?cients on IO supplier

i,q (0.073)in column1and IO customer

i,q

(0.055)

in column2.

1572The Journal of Finance R

Next we explore the joint behavior of returns and contemporaneous informed trade by replacing IO related i ,q with r related i ,q in (4)and estimating panel regressions of the form

IO i ,q =αi +γq +βrelated r related i ,q

+e i ,q ,(5)where r related i ,q is the return on the portfolio of related industries (r supplier i ,q ,r customer i ,q )of stock i in quarter q .Using returns in related supplier and customer industries as information proxies also addresses the possibility that the results above are spurious and driven by factors other than information.Once again,given our earlier ?ndings of positive return cross-predictability,we expect institutional investors to be increasing their ownership in a stock when returns in related industries are high,and to be decreasing their owner-ship in a stock when returns in related industries are low.The results support this prediction as evidenced by statistically signi?cant coef?cients on r supplier i ,q (0.009)in column 3and r customer i ,q (0.007)in column 4.Overall,we take the results in Table IV to be uniformly supportive of limited-information models.The trading behavior of institutional investors appears to be consistent with the trading behavior of informed investors.The one unan-swered question,however,is the extent to which institutional investors pro?t from the trading behavior that we document,as we lack holdings data at a higher frequency than quarterly.Although there is little that we can do about what is obviously a data issue,we attempt to shed some light on this question in the next section by studying the pro?tability of various trading strategies that institutional investors could potentially use to exploit cross-predictability.

III.Self-?nancing Trading Strategies

In this section,we analyze the pro?tability of self-?nancing trading strategies that are based on the cross-predictability effects documented in the previous section.Because an important objective of the analysis from our perspective is to assess the economic signi?cance of cross-predictability,we focus here exclu-sively on trading strategies that involve the buying and selling of industries as opposed to trading strategies that involve the buying and selling of individual stocks.The use of industries (which are value-weighted portfolios of stocks)should address potential concerns that thin markets could be driving the re-sults or that transactions costs could render the trading strategies unattrac-tive.In trading strategies reported in the Internet Appendix,we exclude stocks with market capitalization below the 20th NYSE percentile in the formation of value-weighted industry portfolios and obtain similar results.

The way we construct our self-?nancing trading strategies using industries is fairly standard.At the beginning of each month,we sort industries into ?ve bins based on returns in supplier and customer industries in the previous month.We allocate industries with previous-month related industry returns in the bottom quintile to the ?rst bin,industries with previous-month related industry returns in the second quintile to the second bin,and so on.After

Market Segmentation and Cross-predictability of Returns1573

Table V

Self-?nancing Trading Strategies

This table reports the mean and standard deviation of monthly excess returns on value-weighted portfolios of industries formed on the basis of related industry returns in the previous month (reported?gures are annualized).Industries are sorted into?ve bins at the beginning of each month according to returns in related industries in the previous month.Self-?nancing trading strategies reported in the last column consist of buying the high(5)portfolio(top quintile)and selling the low(1)portfolio(bottom quintile).

Low(1)(2)(3)(4)High(5)H?L

Panel A:Industries Sorted on r supplier,t?1

Mean return0.0280.0540.0560.0720.1000.073 Standard deviation0.1590.1750.1780.1780.1620.110 Sharpe ratio0.1730.3060.3130.4060.6170.660

Panel B:Industries Sorted on r customer,t?1

Mean return0.0160.0600.0520.0650.0850.070 Standard deviation0.1760.1660.1570.1650.1840.134 Sharpe ratio0.0900.3610.3330.3950.4630.520

Panel C:Industries Sorted on r composite,t?1

Mean return0.0130.0360.0740.0710.1000.087 Standard deviation0.1690.1650.1720.1740.1720.132 Sharpe ratio0.0770.2200.4300.4090.5820.658 sorting industries in this fashion,we form value-weighted portfolios for each of the?ve bins and calculate returns on these portfolios for the ensuing1-month period.Self-?nancing trading strategies consist of buying the high portfolio (industries with previous-month related industry returns in the top quintile) and selling the low portfolio(industries with previous-month related industry returns in the bottom quintile).

Table V reports the mean and standard deviation of monthly excess returns for the?ve portfolios described earlier(reported?gures are annualized).Look-ing at Panel A,in which industries are sorted according to returns in supplier

industries in the previous month(r supplier

i,t?1),the mean excess return over the

next month is10.0%for the high portfolio and2.8%for the low portfolio.A self-?nancing trading strategy that exploits the return difference between the two portfolios yields7.3%annually with a Sharpe ratio of about0.7.In Panel B,we sort industries according to returns in customer industries over the previous

month(r customer

i,t?1).Again,we?nd a visible positive trend in mean excess returns

across the?ve portfolios.A self-?nancing trading strategy that exploits the return difference between the high portfolio and low portfolios yields7.0%.Fi-nally,in Panel C we sort industries on the basis of composite returns in supplier

and customer industries in the previous month(r composite

i,t?1as de?ned earlier).A

self-?nancing trading strategy of buying the high portfolio and selling the low portfolio yields8.7%.

1574The Journal of Finance R

Table VI

Return Factor Exposure

This table presents the return factor exposure of monthly returns from self-?nancing trading strategies formulated on the basis of returns in related industries in the previous month.Monthly trading returns are regressed on the monthly CRSP value-weighted market return,and Fama-French SMB,HML,and MOM factors.t-statistics are reported in parentheses.???,??,or?indicates that the coef?cient estimate is different from zero at the1%,5%,or10%level,respectively. Trading Strategy Based on r supplier,t?1r customer,t?1r composite,t?1

Alpha0.005???0.005???0.006???

(3.42)(2.61)(3.22)

R market?R f0.0170.0510.038

(0.48)(1.08)(0.89) SMB0.016?0.0650.004

(0.35)(1.15)(0.07) HML?0.0130.0540.015

(0.24)(0.82)(0.23) MOM0.102???0.0680.144???

(2.89)(1.59)(3.41)

R20.0190.0120.024

N obs503503503

The results in Table V show that the pro?tability of self-?nancing trading strategies based on cross-predictability effects can be signi?cant.In what fol-lows,we check whether the returns from these trading strategies are exposed to well-known return factors,and whether the return series of long/short eq-uity hedge funds,which are thought to exploit predictability effects,contain any traces of these trading strategies.We also report on a wide range of trading strategies with alternative formation and holding periods.

A.Return Factor Exposure

A potential concern that one might have is that the returns from the self-?nancing trading strategies laid out in Table V are not abnormal because they contain a signi?cant amount of systematic risk.Alternatively,if they are highly exposed to already well-known return factors,we might not be documenting anything new.

To address these concerns,we take the monthly returns from the trading strategies reported in Table V and regress them on the excess market return as well as the Fama-French(1993)SMB,HML,and MOM return factors.We report the estimated betas in Table VI.

Except for statistically signi?cant exposure to the momentum factor MOM (0.102for the supplier strategy in column1and0.144for the composite strat-egy in column3),the monthly trading returns appear to be fairly orthogonal to the market(which is not surprising because of the long-short nature of the trading strategies)as well as the Fama-French(1993)SMB and HML

世界地理北美美国知识总结

北美美国 自然地理特征 一:位置范围 1.经纬度位置:30°N—80°N 170°W—90°W----20°W 2、海陆位置:美洲北部,北起北冰洋,南至墨西哥湾,东靠大西洋,西临太平洋 二:地形 南北纵列三大地形区,以山地、平原为主 地势:东西两侧高中间低 西部高山区:落基山、海岸山、内华达山等组成科迪勒拉山系北段;山脉盆地 高原相间; 位于美洲板块与太平洋板块交界处,多火山地震,年轻,海拔高。(多4000m以上高山) 东部高原山地区:拉布拉多高原、阿巴拉契亚山地,古老,海拔较低。(多1000m以下) 中部平原区:中央大平原,北部多冰蚀湖,南部密西西比河平原 三:气候 温带大陆性气候为主;特征:冬冷夏热,降水较少,夏雨稍多。 地形对北美气候影响较大 1.海岸山脉紧逼着太平洋沿岸,迎风坡地形雨丰沛。但是,海岸山脉阻挡了太平洋上的暖湿西风向东深入,限制了温带海洋性气候和地中海气候向东延伸,使上述二种气候呈南北向带状分布于沿海地区。山间高原盆地由于地形闭塞,海洋水汽难以进入,因此,气候干旱,呈现出荒漠的景象。 2.东部山地西北坡面迎冬季西北风,常造成大雪;东南坡面对大西洋水汽产生抬升作用,造成地形雨。但因东部高低缓,连续性差,冬季干冷的西北风可影响到东海岸,夏季从大西洋的暖湿气流亦可越过高地,进入内陆。 3. 中部平原地区气温、降水季节变化最大,大陆性较强。这是因为中部平原地势低平,贯通南北,致使南北气流畅通无阻。冬季极地冷气团可长驱南下,骤然降温,形成大风和寒潮天气。夏季来自墨西哥湾的热带暖气团可自由北上,使本区普遍暖热。中部平原在冷暖气团交替控制之下,形成气温、降水季节变化据烈、大陆性较强的温带大陆性气候。 北美洲年降水量的空间分布特征

经典大学毕业演讲致辞经典大学毕业演讲稿

经典大学毕业演讲致辞经典大学毕业演讲稿毕业季又如期而来,大学毕业生如何做好演讲致辞呢?以下是由关于经典大学毕业演讲致辞的内容,希望大家喜欢! 尊敬的领导、来宾,亲爱的老师、同学们: 大家好! 我是厦门大学人文学院哲学系XX届博士毕业生,曾永志。非常荣幸能够作为XX届毕业生代表在此发言,请允许我代表人文与艺术学部的全体毕业生向亲爱的母校致以崇高的敬意,向辛勤培育我们的老师以及家长表示由衷的感谢! 身为厦大人,我们是幸福的。本科四年,硕博五年,我在厦大度过了最美好的时光。最美丽的校园、最具魅力的老师们、最可爱的同学们,定格为此刻的记忆,一笔一划镌刻在心中,成为永恒的纪念与财富。凌晨,南普陀寺的钟声还声声在耳;清早,芙蓉湖畔结伴读书的画面还历历在目;夕阳西下,上弦场上,挥汗踢球、轻松漫步、依山看海的种种也犹在昨日。美丽的母校依然美丽,而我们,在各自的三年、四年、七年、九年,亦或十年里,悄然成长。 身为厦大人,我们是富足的。从九年前的集美中学到现在的厦门大学,陈嘉庚先生的精神,始终照耀着我的求学生涯。九年里,每当我漫步校园,身边的一砖一瓦无不镌刻着创校先贤们的痕迹:嘉庚先生的民族大义,倾资办学;罗扬才烈士的革命精神,奋不顾身;萨本栋校长的迁学闽西,自强不息;王亚南校长、陈景润教授的刻苦钻研,科学至上,无不让我身怀感慨。

九年里我见证了母校的点滴变化:从“421”住宿环境到米饭,我们的学习没有了后顾之忧;从湖畔咖啡到校长早餐有约活动,我们更广泛地参与学校事务的决策;从优博培育工程到国际交换生项目,我们以更积极的姿态迈向世界。有此历史,有此文化,有此校园,我们厦大人青春与幸福同行。 身为厦大人,我们是广博的。我们的厦大是一所校门向大海敞开的大学。她用海纳百川的胸襟包容、尊重每个学生,让每个独立的存在都具有无可取代的价值;她用春暖花开的气度培育、锻造每位青年,让每个人都拥有自己独立的空间、绝对的人格;她用感恩、责任、奉献的情怀熏陶、感染每名学子,让每一个充满个性的灵魂同时具备深深的社会责任感,肩负起时代使命。宽容与大爱,是我们厦大的品格,更是我们厦大人永远的精神品质。 身为厦大人,我们是幸运的。我们专业的老师们,以他们严谨的治学态度、前沿创新的学术思想、开拓进取的科研精神,引领我们在科学研究的道路上大步向前。仍记得,在博士论文完成之际,正值厦大90周年校庆,我的导师百忙之中仍为我三易初稿,细致到甚至是对“方面”与“部分”这两个概念的区分。那本先生在旅途的车上用铅笔注得密密麻麻的论文,已成为我毕生的珍藏。我们的政工、行政及后勤等老师们,他们与我们相互理解,相互尊重,分享彼此的经历与思考,指引我们获得更积极健康的思想情怀与人生经验。 或许,我们无以回报,唯有谨记。但我相信,在座的每一位毕业生同学都将与我一样,带着母校的关爱,带着厦大人自强不息的精

世界地理北美及美国同步测试题附答案

北美与美国同步练习题 1.关于地形对北美气候的影响正确的说法是( ) A.西部高大山系阻挡西风吹入内地,使地中海气候局限于西部沿海 B.东部山地阻挡东南季风吹入内地,内地降水少 C.中部平原地势低,冬季气温比东部沿海高 D.北部高原是冬季风的发源地 2.世界上最大的淡水湖群及其成因是( ) A.中国长江中下游湖泊——河流改道 B.北美洲的五大湖——冰川的刨蚀作用 C.芬兰境内的湖泊群——冰川的作用 D.贝加尔湖——断裂下陷 3.冬季影响北美的灾害性天气是( ) A.寒潮 B.飓风 C.台风 D.暴雨 4.美国破坏程度较大的地震最集中的区域是( ) A.东部 B.中部 C.西部 D.北部 5.加拿大的小麦带分布于中部平原的南部,其主要原因是( ) ①平原土层深厚肥沃 ②南部地区热量条件较好 ③南部人口密集 ④该地区矿产丰富 A.①② B.②③ C.③④ D.①④ 6.北美洲的两个主要粮食出口国是( ) A.美国和墨西哥 B.美国和加拿大 C.加拿大和墨西哥 D.美国和古巴 7.北美洲气候的大陆性特征没有亚洲强的主要原因是( ) A.季风不典型 B.陆地面积比较小 C.植被遭到破坏 D.影响气候的洋流为暖流 读“美国降水分布图”,回答第12~15题。 8.美国落基山脉以东的地区,关于其降水的空间分布规律的说法正确的是( ) A.从东向西逐渐减少 B.从西向东逐渐减少 C.从西北向东南逐渐减少 D.从西南向东北逐渐减少 下图为“某大陆北纬48o沿线地区的年降水童变化示意图”,据此回答下题。 9.该大陆为( ) A.欧洲大陆 B.南美大陆 C.北美大陆 D.澳大利亚大陆 10.甲地气候类型为( ) A.温带海洋性气候 B.亚热带季风气候 C.热带雨林气候 D.亚寒带针叶林气候 11.影响a 地降水的主要风向是( ) A.东南风 B.东北风 C.西南风 D.西北风 12.下列图示能反映美国人口迁移的是( ) 13.下列组合中,两地主要产业部门不相一致的是( ) A.福山—匹兹堡 B.丰田—底特律 C.硅谷—九州岛 D.休斯敦—长崎 14.下列关于美国农业的叙述,不正确的是( ) A.粮食总产量居世界首位 B.畜牧业产值居世界首位 C.小麦出口量居世界首位 D.农业生产高度专业化 读下面两区域图,回答17~18题 15.甲、乙两城市重点防范的自然灾害中相同的是 A .地震 B .干旱 C .寒潮 D .飓风 16.甲城所在地区,受上述灾害影响较大并可能影响全国的工业部门是

大学毕业典礼发言稿

大学毕业典礼发言稿 大学只有短短的四年的时间,终究会随着时光的步伐走到毕业的那 一天。 曾经是多么的盼望着早些离开校园、离开宿舍、离开课堂、离开书本、离开学生的称呼,但到了真正不得不离开的那一刹那,才知道,自 己对这片土地是多么的留念。在这里,留下了我最最美好的回忆和记 忆。 几年的课堂,老师们或滔滔不绝,或循循善诱,或旁征博引的风格,为我们展现了知识的无限魅力。如果黑板就是浩淼的大海,那么,老师 便是海上的水手。铃声响起那刻,你用教职工鞭作浆,划动那船只般泊 在港口的课本。课桌上,那难题堆放,犹如暗礁一样布列,你手势生动 如一只飞翔的鸟,在讲台上挥一条优美弧线——船只穿过……天空飘不 来一片云,犹如你亮堂堂的心,一派高远。 许还有一些遗憾吧,那么多精彩的讲座,我们已经来不及聆听;那 么多精彩的活动,我们已经来不及参与。也许还有一些愧疚吧,面对慈 父严母般的老师,我们总能杜撰出各种逃课的理由。面对认真批改作业 的各科老师,我们很多时候都只能拿出一个版本。 大学毕业典礼发言稿 怀着梦想和激情走进大学的校门,开始一段新的人生旅程。转眼离 别的时候就要到了,真希望时间慢些走,让我再多点时间好好享受下大 学里的生活,友谊。大学的生活真好,回忆起来诸多辛酸苦辣。

那是因为您,亲爱的母校。是您包容了我们的懂无知,是您孕育 了我们的睿智果断,是您给了我们如此优越的学习环境和展示自我的舞台。我们在教室留下刻苦学习的身影,在球场上留下顽强拼搏的精神, 在舞台上秀出个性自我,在通宵晚会里变换角色体味人生。我们沉浸在 知识的海洋,徜徉在落英缤纷的林荫道,醉心于同学间的欢声笑语。在 您的怀抱中,我们心怀梦想,放飞梦想。 最近,我常常考虑一个问题:假如我可以再度过一次大学生活,又 会选择怎样的生活方式?会努力地追求些什么?放弃些什么?有些问题真 的会有和当时不一样的答案。 首先我想谈谈我在大学的收获。其实原先没有想到这个问题,上回 应聘主考官问我这,记得当时为了求职说了些冠冕堂皇的话,现在觉得 大学我的收获并不是学到了多少知识,也并不是受到了那个教授,老师 的熏陶,点拨,而是学会了怎么去为人处世,怎么去独立,怎么去快乐 的生活,怎么去正确的看待,分析社会的一些问题。这也许就是所谓的 成熟吧,我觉得这些应该比知识还要重要些。 在中学同学印象中我也许是个勤奋,刻苦努力的人,但是在大学同 学印象中,他们原话是你活的比较悠闲,其实意思是懒散,呵呵。确实,大学我包过夜,挂过科,顶撞过老师,逃课,抄作业是很正常的事,但 是我并不认为这就是所谓的堕落,一方面因为我觉得初中是身体上累, 高中是精神上累,大学有时只是想让自己随心所欲的生活一下,但还是 有些人说看见你天天开开心心的,一定能长寿的,很高兴我大学里学会 了怎么去让自己快乐的生活,也带给身边的人快乐。另一方面我还是知

区域地理北美和美国导学案(学校教学)

高二地理导学案—区域部分 班级____姓名______编辑教师:王海健编号--11 课 题 北美和美国日期2013/12/8 目标1、通过学习,了解北美、美国的位置、范围. 2、通过析图,了解并掌握北美、美国的地形、气侯、河流的主要特征 3、学会辨析,掌握北美、美国在人口、资源、环境、发展等方面的主要问题及其基本对策 重难点1、北美地形对气候类型的影响。 2、美国主要农业带的分布。 3、美国三大工业区和主要工业城市的分布。 学 法 地图分析法、查阅资料法、合作探究法等 课前预习区 内容建议 一、位置: 1、经纬度位置:在北美图上填注: 主要经纬线:30°N、66.5°N、80°W 100°W 、120°W. 2、海陆位置: ●读北美洲地图找到以下地理事物: 1、政区、半岛和岛屿: 阿拉斯加半岛、格陵兰半岛、巴芬岛、 拉布拉多半岛、佛罗里达半岛、下加 利福尼亚半岛、夏威夷岛。 2、海、湾、海峡: 太平洋、大西洋、北冰洋、墨西哥湾、 加勒比海、阿拉斯加湾、加利福尼亚 湾、巴芬湾、哈德孙湾、白令海峡、丹麦海峡、巴拿马运河、五大湖及其分布和名 称、圣劳伦斯河。 二、自然环境: 1、地形: 以和为主,其次是平原,地势起伏较大,东中西三大地形区南北纵列分布。 西部:高大的山地;中部:广阔的;东部:低缓的和。 ●读北美洲地图找到以下地形: 科迪勒拉山系、落基山、海岸山、内华达山、阿巴拉挈亚山脉、拉布拉多高原、加

拿大平原、滨海平原、密西西比平原、大平原。 2、气候: (1)地跨热带、温带、和寒带三带, (2)大陆中部以 (3)气候深受地形影响 3、河流与湖泊 北美洲河流多 ,水能资源丰富,有著名的尼亚加拉大瀑布,密西西比河是世界第 长河。 五大湖:是世界最大淡水湖群,是由过去 作用形成的湖。 三、 居民和经济 1、人口3亿多, 人种为主,城市化水平高,通用语言 ,土著居民印第安人和因纽特人是黄色人种 2、自然资源丰富 水力资源、森林资源、渔业资源丰富, 渔场是世界著名渔场。 3、经济发展不平衡 四、美 国 1、国土组成 本土48各州,1个特区,海外州有阿卡斯加州(冰山和北极熊)和夏威夷洲(热带海岛风光 ) 以 人种为主,有色人种主要是黑人,旧金山、洛杉矶、纽约是 聚居区。 人口分布: 、 沿海平原和 稠密, 人口稀疏。 2、自然概况 位置:本土三面濒临海洋:东临 ,西临 ,南临 ; 地形: 面积占全国面积一半以上,耕地面积占世界的10%。 气候:本土都在 (南部为亚热带),热带水果需要进口。 河湖: 和 利于灌溉、航运、发电、渔业、旅游等经济活动。密 西西比河支流 是世界治理的典范。 资源:矿产、深林、草原、水资源等自然资源丰富。 3、经济特征 a 、农业发达:农产品输出最多的国家,热带农产品需要进口,农业高度 ,地区生产 。 b 、农业带 农业地域类型:乳畜业、商品谷物农业、大牧场放牧业、灌溉农业、地中海农业 4、 发达的工业 ① 西部高山阻挡, 、 分布在沿海 ② 东部低缓,降水由沿海向内陆逐渐递减 ③ 中部地形平坦,冷空气可长驱南下,有 天气,夏季暖湿气流也可自 由北上,有台风、 天气。 自然条件:地形 、耕地 、 充足。 社会经济条件: 发达、 便利。 条件

毕业生就业演讲稿

毕业生就业演讲稿 各位老师,各位同学: 大家晚上好! 大学生毕业找工作,是人生中一件非常重要的事情! 一、作为即将毕业的大学生,应该敢于主动去找工作,敢于主动去寻找机会就业。 主动寻找就业,是职业生涯中一个非常关键的技巧,而不是等待家庭的安排或者是等待机会的到来;什么是就业?我的理解和新东方的总裁俞敏洪先生理解的几乎一样,就是找上一份工作,不管喜欢不喜欢,能有工作干,能通过自

己的努力得到一份薪水,不再需要花父母的钱,这就是就业。 二、工作都需要持之以恒、都需要认定工作是不分贵贱的。 一个人在工作岗位上,作为领导者,不是来看你今天跳槽明天跳槽的,他需要看见自己招聘的工作人员能安心守份地上班。 三、只有在寻找就业的时候放下自己,那么才能在工作中开心。 你可以让自己起点高,这是一个充分有自信的表现。但是能给你的岗位,也许并不是如你意的,或者还是与你专业背道相弛的,这个时候,要沉下心来,坚持你的岗位,坚持就业的方向。跳槽是允许的,但是一定要条件成熟。 初期的工作,一定要放下自己,调整好心态,这就是就业。 说了找工作,我们说说大学生应不应该一开始就创业。我的个人主张是,大学生不适合一走出校门就去创业,而

是要找了工作,得到锻炼并且有一定机会时候,再开始创业。当然,如果一直找不到工作,或者找了工作又无法忍受的时候,可以考虑创业,但是不要沉沦,一定要在任何时候,都要坚强地站起来。 我想告诉大家几点: 一、有知识,更应该适应社会环境的发展,使自己融入到社会大家庭中来;有知识,也要沉下心来,先找好工作,再展示能力,最后追求自己的理想; 二、不管是工作,还是自己创业,一定要建立在国家的稳定繁荣的基础上。我们要感谢我们稳定强大繁荣的祖国,给了我们这样的生存环境,我们更应该珍惜,更应该找好工作岗位,为国家的稳定繁荣做出自己的贡献! 三、学会分享!不管是就业还是创业,与人分享,与人交往,是当代大学生适应社会的一种技能!所以,大家毕业后就赶快行动起来,为自己的就业去寻找机会吧! 相信:天生我材必有用,千金

高中区域地理北美与美国练习题

1200 120 900 600 00 00 美 国 北回归线 墨西哥 哥伦比亚 北美与美国练习题 哥伦比亚已经成为世界重要的鲜切花生产国。读图1,完成1~3题。 1、 每年的情人节(2月14日),在美国销售的鲜切玫瑰花多来自 哥伦比亚。与美国相比,在此期间,哥伦比亚生产鲜切玫瑰花的优势自然条件是( ) A. 地形较平 B. 降水较丰沛 C. 气温较高 D. 土壤较肥沃 2. 哥伦比亚向美国运送鲜切玫瑰花宜采用( ) A. 公路运输 B. 铁路运输 C. 航空运输 D. 海洋运输 3. 目前,墨西哥已成为哥伦比亚在美国鲜切花市场的竞争对手,与哥 伦比亚相比,墨西哥开拓美国鲜切花市场的优势在于( ) A. 运费低 B. 热量足 C. 技术高 D. 品种全 甘德国际机场(图2)曾是世界上最繁忙的航空枢纽之一,当时几乎所有横跨北大西洋的航班都要经停该机场补充燃料.如今,横跨北大西洋的航班不再需要经停此地.据此完成4~6题. 4. 导致甘德国际机场成为世界上最繁忙机场的主要因素是( ) A. 位置 B. 经济C. 地形 D. 人口 5. 甘德国际机场失去国际航空枢纽地位的主要原因是( ) A. 地区经济发展缓慢 B. 横跨北大西洋航班减少 C. 飞机飞行成本降低 D. 飞机制造技术进步 6. 一架从甘德机场起飞的飞机以650千米/小时的速度飞行,1小时候后该飞机的纬度位置可能为( ) A. 66.5°N B. 60°N C. 53°N D. 40°N 下图为某洲大陆沿22°S 纬线的地形剖面图。 7.图中乙地气候类型属于( ) A.热带季风气候 B.热带稀树草原气候 C.热带沙漠气候 D.高原山地气候 8.导致乙地降水量与甲地明显不同的主要因素是乙地( ) A.处于盛行风向的迎风坡上 B.受沿岸寒流影响 C.全年受赤道低气压带影响D.受高峻地势影响 雾是近地面大气层中出现大量微小水滴而形成的一种天气现象。当暖湿空气经过寒冷的下垫而时,就易形成雾。图3中,S 市附近海域夏季多雾,并影响S 市。据此完成9~11题。 9.S 市附近海域夏季多雾的主要原因是( ) A .沿岸暖流提供了充足的暖湿空气 B .半岛东侧海湾海水温度较低 C .海陆间气温差异较大 D .沿岸寒流的降温作用较强

大学毕业生代表演讲稿(完整版)

大学毕业生代表演讲稿 大学毕业生代表演讲稿 我们一定还记得刚入校时你我所立的雄心壮志,一定还记得在教室,图书馆和实验室中你我孜孜不倦学习的身影,一定还记得老师的谆谆教诲,一定还记得在运动场上你我生龙活虎的锻炼场景..太多太多的情景值得我们去回忆. 在四年半里,我们更进一步学会了分析与思考,学会了丰富与凝练,学会了合作与竞争,学会了继承与创新,也进一步学会了如何不断超越,突破自己的极限而成长.如今我们就要毕业了,所有这些温暖的记忆都 将铭刻在我们内心深处,那是我们生命中最难忘的日子.喜欢好友常说 的一句话: 我们都是只有一只翅膀的天使,只有互相拥抱才能飞翔. 四年半的同窗友谊,让我们学会了彼此相信并依赖.四年半的生活,我们都有过低谷,但我们相互扶持,鼓励,朋友温馨的笑容,班级温暖的气氛,让我们都走了过来,让我们学会去爱,去坚持,去相信阳光总在风雨后 . 我敬爱的老师,您用您辛勤的汗水,无私的奉献,无数夜的伏案耕耘,给 了我们一个清醒的头脑,一双洞察的眼睛和一颗热忱的心灵,再华丽的 辞藻也无法表达我们对您既是老师,又是朋友,更是亲人的尊敬和爱戴.学生即将远行,请允许我们深情地道一声: 老师,您辛苦了!谢谢你们的关怀和教育 毕业是一首久唱不衰的老歌,是散场之后的余音绕耳,所有甜美或 者苦涩的故事,定格为热泪盈眶的欣悦,依然真诚直率的目光,依然奔流激荡的热血,正牵引着我们再一次传唱,传唱那飘逝的日月春秋. 乘风 破浪会有时,直挂云帆济沧海. 让时间作证,承载着我们学院领导,老师

们的殷切期望和深情嘱托,我们一定会做拥有智慧并富有激情的人,做胸怀大志并脚踏实地的人,做德才兼备并勇于创新的人,做富有责任并敢挑重担的人!同学们,临别之际,让我们立下誓言:今天,我们以作为技师学院的毕业生为荣;明天,学院将会以我们祖国的栋梁,为荣!我们要走了,学院的老师们为我们所做的一切,我们暂时无以回报,我们06电气j 4.5班毕业生送上我们深深的祝福祝:学院欣欣向荣,蒸蒸日上 我的发言完毕,谢谢大家. 第二篇: 大学毕业生代表发言演讲稿 尊敬的各位领导、老师、同学们: 大家上午好! 很荣幸我能在这里代表毕业生向辛勤培育我们四年的母校表达最诚挚的谢意! 青春是人生最美好的时光,而在海大度过的这一段青春岁月无疑将成为我们人生中最为宝贵的记忆。四年时光,弹指一挥间,但很多记忆将成为我们生命中最为珍重的收藏,还记得四年前刚入校时你我所立下的雄心壮志吗,还记得在教室、图书馆中你我孜孜不倦学习的身影吗,还记得导师的谆谆教诲和小有收获时你我那种发自内心的喜悦吗太多太多的情景值得我们去回忆。海大四年,我们学会了分析与思考,学会了丰富与锻炼,学会了合作与竞争,学会了继承与创新,也学会了如何不断超越、突破自己的极限而成长。如今我们就要毕业了,所有这些温暖的记忆都将铭刻在我们心灵的最深处,那会是我们生命中最难忘的岁月。

大学毕业生坚持梦想演讲稿

( 演讲稿 ) 单位:_________________________ 姓名:_________________________ 日期:_________________________ 精品文档 / Word文档 / 文字可改 大学毕业生坚持梦想演讲稿Speech for college graduates to stick to their dreams

大学毕业生坚持梦想演讲稿 当高中的莘莘学子们踏入高考教室的那天,也正是我到公司报到的日子,那是一个值得纪念的日子,六月八日。 有的时候,人生就是一次又一次的选择所组成的,选择学校,选择专业,选择工作,是在大城市发展还是在小城市发展等等。特别是作为一个欲在外打拼的人来说,脱离父母,就意味着很多东西,比如说独立。 蓦然回首,我才发现,我已在六月的30天中悄然地度过了自己的职场生活,自己在新的环境中翻开了人生中新的一页。其间,有困惑,也有改变;有茫然,也有洒脱。更是自我的成长。 成长,包含了太多太多。成长,你珍重他,他便在你的身后长出绿茵,结出沉甸甸的果实;你漠视他,他就化成轻烟,消散的无影

无踪。正因为你是试着走出第一步,而不是跟着走出第一步,所谓的“成长”才显得尤为的重要。有时短暂的一瞬间会成为永恒,这是因为他把脚印深深地留在了人们的心里,如刹那间的烟火那样驻留人心;有时,漫长的岁月会成为一瞬,这是因为浓雾和风沙湮没了他的脚印,如同烟消云逝归于平静。这正是因为你的或行或止。一粒不起眼的种子,也可以破土而出,最终绽放美丽的花朵;一条平凡的小溪,也可夺路而下成为壮观的瀑布;一座缄默的火山,也可刹那间喷发,豪情四射。也许我,也许你,就是一粒种子,一条小溪,一座火山,只要你我愿意接受蜕变。刚来时,上级领导就曾经反复强调,公司已经为我们提供了平台,究竟在台上舞出怎样的风采,关键在于我们自己。个中涵义也许就是这样吧。 “逝者如斯夫,不舍昼夜。”风吹万叶婆娑,湖水漾起万千涟漪,生命萌芽破土,岁月静默流淌。时间在流逝,岁月在积淀。新的历史起点上,征途漫漫,时不我待。谁也无法描绘出成长的面目,但世界上处处都能听到他的脚步。 知道父母的不易,懂得生活上勤俭节约,知道他人的不易,懂

关于大学毕业生演讲稿

关于大学毕业生演讲稿 尊敬的各位领导、各位老师,亲爱的同学们,早上好! 我怀着无比喜悦和激动的心情,参加广东工业大学成人高等教育20XX年第二批本、专科生毕业典礼,现在,请允许我代表20XX届第二批本、专科毕业生向本校全体教职员工表示深深的感谢,感谢您们这些年来对我们的栽培和厚爱;感谢您们传授我们知识与技能;感谢您们教会我们学习、工作和做人;更要感谢您们引导我们生活的信心,启迪我们的生活智慧,让我们的生活更自信,更精彩,让我们的工作更加沉着有力。 曾经,有一个朋友对我说:在广州这个地方,只要你勤奋,肯吃苦,你就一定不会挨饿!我相信,只要我们够勤奋,肯学习,会思考,我们不但不会饿着,而且能过得更好,还能对社会负更多的责任。我非常荣幸和这么多勤奋的同学同窗四年。大家通过不断的努力,印证了我们强劲的生命力和进取心;我们这强烈的进取心,让我们在这四到八年里,留下深深的奋斗的痕迹,取得喜人的成绩;这喜人的成绩,充分说明广东工业大学、继续教育学院的优越性,以及她丰硕的教学成果、严谨的办学风范。在广东工业大学这美好的校园里,在全体教职员工营造的这个平台上,大家的勤奋得以延伸,大家的能力得以提升。 今天,我们毕业了!这是个喜庆的日子!回想过去这一

千五百来个日日夜夜,所有情景历历在目!我们下了班,来不及坐下吃口好饭,就勿勿赶往广工,穿梭在这暮色渐浓的城市;当我们回到家时,已是深夜,我们勿勿地吃点东西,疲惫的身体已经把我们困在座椅上,我们不知何时睡着了。我们无论是在生活的轮转中,还是在工作的竞争里,还是在和睦的家庭生活下,每每到下午七点钟,我们都会聚到一个共同的地方,那就是广工,我们的校园,我们的教室。这深深说明,我们爱学习,我们肯努力,我们爱我们的学校我们的老师、我们的同学!我们为自己是广工的学子,是广工人而自豪! 今天,我们毕业了!我深深记得,四年前,黄花岗剧院的开学典礼,多么的振奋人心。今天,我们毕业了,却对广工恋恋不舍。深深记得,四年前,就在今天这个地方,我们上的第一堂《学分制》的课上,杨锐院长提到的一个情景:她看到继续教育学院的学生领到毕业证那一刹的情景,同学们沉醉了,沉醉在奋斗这么多年所取得的成果中,手拿毕业证那忘我的表情,痴痴的表情,让在场的老师感动!今天,我想说,我内心相当激动,我也陶醉在这一情景里!这是导师们的悉心教导和我们共同努力的结果!过去,继续教育学院所培养出来的学友们,今天正在社会的各个岗位上做出优秀的成绩,他们有的身担重任,有的出国深造,无论如何,在广工继续教育学院学习后,他们对社会释放更多的能量,

大学毕业生演讲稿

大学毕业生演讲稿 四年时间,不知不觉已到尽头,记忆中留下了太多的片段,有太多的不舍、太多的留恋。下面是小编为你整理的几篇大学毕业生演讲稿,希望能帮到你哟。 大学毕业生演讲稿篇一同学们: 今天的典礼标志着你们圆满结束了学业,即将开启崭新的人生旅程。首先,我代表学院,向你们致以热烈的祝贺和深情的祝福!同时,向所有教育、帮助、关心你们的老师、亲人和朋友们,致以诚挚的敬意和亲切的问候! 在中青院不大却精致的校园里,你们度过了人生中最宝贵的一段时光。你们志存高远、胸怀祖国、关注社会,你们风华正茂、勤勉苦读、砥砺思想,你们脚踏实地、热心公益、投身实践。这里留下了你们的成长足迹,镌刻了你们的青春乐章。我相信,你们必将永远铭记这段洋溢激情与希望的校园岁月,必将永远传承这种追求光荣与梦想的奋斗精神。 毕业典礼后,你们将奔赴五湖四海,拼搏奋斗在祖国各地各条战线上。正如毛泽东同志所讲,“同学们毕业出去,好像撒入河水里去一样,可能有若干人会被潮水卷去”。如何做到“战胜潮水,朝着总的方向,达到预定的目的”,是你们必须面对、必须思考的人生重大课题。 今年五月四日,参加“实现中国梦、青春勇担当”主题团日活动

时,深刻指出“中国梦是我们的,更是你们青年一代的”,希望青年一代坚定理想信念,练就过硬本领,勇于创新创造,矢志艰苦奋斗,锤炼高尚品格。团xx大闭幕后,在同团中央新一届领导班子集体谈话时强调,青年时代树立正确的理想、坚定的信念十分紧要,不仅要树立,而且要在心中扎根,一辈子都能坚持为之奋斗。我想,高举理想信念的旗帜,认真践行提出的五条希望,正是回答如何“战胜潮水”、“实现梦想”这一人生课题的满意答案。希望你们用心学习、真正践行的重要讲话,把未来的人生道路越走越宽广。 作为院长,在大家即将毕业之际,与大家分享些什么?最近两部热映的青春题材电影给了我一些启发。一个是《中国合伙人》。三位追梦人的成功,有发现机会的敏锐嗅觉,有精诚合作的团队精神,有经受挫折的坚韧意志,但最不可忽视的还有改革开放这一支撑他们干事创业的宏观时代背景。另一个是《致我们终将逝去的青春》。将来你们回忆青春,当然希望看到诚挚的友情,看到青涩的爱情,但更重要的应该还有奋斗的激情。因为,任何一代青年追梦圆梦、有所作为,都离不开时代主题,都缺不得奋斗精神。你们这一代青年尤其如此。 希望你们在追梦圆梦、干事创业中,识大势、知大局、行大道。深刻指出,全党全国各族人民正在为实现党的提出的奋斗目标而奋发努力,正在朝着实现中华民族伟大复兴的中国梦而奋勇迈进。这是党和国家工作大局,也是中国青年运动的时代主题。我想,这更是你们这一代青年练本领、展身手、有作为的广阔舞台。你们的人生,注定与实现中国梦的征程同行。再过7年,正当你们积累人生阅历、步入

北美地区和美国 区域地理知识总结精华

北美地区和美国 一、位置与范围 1、经纬度位置: 北温带为主,北部为北寒带(25oN—85o N,20oW—120oW -180o)西半球北部,大部分处于西经度。 2、海陆位置: 美洲北部,北起北冰洋,南至墨西哥湾, 东靠大西洋,西临太平洋 3、范围: 加拿大、美国、格陵兰岛(丹麦) 二、自然区域特征 1、地形:以山地、平原为主,南北纵列三大地形区 白令海峡 丹 麦 海 峡 纽芬兰岛东部为古老的高原和山地,如拉布拉多高原、阿巴拉契亚山脉 西部是科迪勒拉山系北部,有海岸山、落基山等南北走向山脉,太平洋板块和美洲板块碰撞形成,地壳不稳定,多火山地震 巴 芬 岛 中部是宽广的中央大平原地区,平原北部湖泊众多,南部为密西西比河冲积平原,西部为大平原 2.主要河流和湖泊:水量大,利于灌溉、航运和发电 (1)密西西比河: 世界第四长河,流域北起五大湖附近,南达墨西哥湾 (2)圣劳伦斯河: 从安大略湖东北端流出,向东北注入大西洋圣劳伦斯湾 (3)五大湖 按大小分别为苏必利尔湖(世界上最大的淡水湖)、休伦湖、密歇根湖、伊利湖和安大略湖,是世界最大的淡水湖群。 是冰川活动的最终产物。除密歇根湖外均为美、加两国共有。五大湖的安大略湖与圣劳伦斯河相通,注入大西洋。 3.气候 大部分属于温带大陆性气候,地形对气候的影响大 北美温带大陆性气候特征:冬冷夏热,夏雨稍多 地形对气候影响大 ①为什么极地气候西高东低?----洋流 ②为什么在北美西部,温带海洋性气候 和地中海气候狭长分布于沿海地区?----地形 ③为什么在北美东部降水量是从沿海向 内陆地区逐渐减少?---东部山脉低缓

3.自然资源丰富 主要矿产:石油、天然气、煤、铁、有色金属 水力资源、森林资源、渔业资源丰富 (纽芬兰渔场:北大西洋暖流和拉布拉多寒流) 三、人文区域特征 当地居民:因纽特人、印第安人,均为黄种人 外来移民:欧洲各国白人、非洲黑人、拉丁美 洲移民和亚洲移民及其后裔 语言:以英语为主 宗教: 主要信奉基督教和天主教。 加拿大考点:原P123 (1)高纬度地区-----人口稀少 (2)国土面积世界第二-----地广 (3)自然带-----亚寒带针叶林、苔原、冰原 (4)南部地区工农业发达的原因: A气候B地形C交通D市场E开发历史(工业+资源+能源) (5)纽芬兰渔场成因(寒暖流大陆架) 美国 一、地理位置和范围 1、纬度位置:本土以北温带(25oN-50oN)为主,阿拉斯加寒带,夏威夷热带 2、海陆位置:北美洲中部,东临大西洋,西靠太平洋,南接墨西哥湾 3、范围:本土(48个州和一个特区)、阿拉斯加、夏威夷; 二、自然地理特征 ①地形:平原面积占全国面积一半以上 死谷:位于内华达山脉东侧,-86米,西半球陆地最低点。 科罗拉多大峡谷:主要由流水侵蚀作用形成。 ②气候:本土都在温带、亚热带,阿拉斯加在寒带和亚寒带,夏威夷在热带。 ③河流:密西西比河(世界第四长河)和五大湖为灌溉、航运和发电提供便利 ④交通:本土三面临海,沿海多优良海港,冬季不冻,海上航运便利。 ⑤资源:矿产、森林、草原、水资源等自然资源丰富。 能源资源:煤炭——东北部阿巴拉契亚山脉 石油、天然气——南部墨西哥湾沿岸 铁矿资源:五大湖西部 但由于高消费和浪费仍大量进口,是世界进口石油最多的国家 3.农业发达 世界最大的农产品出口国 农业生产现代化,高度机械化 农业生产实现地区专门化

大学毕业生代表演讲稿

大学毕业生代表演讲稿 尊敬的领导,老师,各位同学: 大家好! 今天,我站在这里,代表06电气j4.5班的毕业生向我们的母校道别,向学院的师长道别,向朝夕相处的同窗们道别,也向这段不能忘怀的岁月道别! 岁月匆匆,四年半转瞬即逝.我们将离开我的学生生活.走过楼兰,走过荒滩,只是为了那句"路在脚下,明天会更好". 这四年半的路,我们走的辛苦而快乐,四年半的生活,我们过的充实而美丽,我们流过眼泪,却伴着欢笑.四年半的岁月,多少个日日夜夜,听起来似乎是那么的漫长,而当我们今天面对离别,又觉得它是那么的短暂.四年半的时光,弹指一挥间,但很多记忆将成为我们生命中最为珍重的收藏:宽阔的操场,明亮的教室,甜蜜的欢笑......我们一定还记得刚入校时你我所立的雄心壮志,一定还记得在教室,图书馆和实验室中你我孜孜不倦学习的身影,一定还记得老师的谆谆教诲,一定还记得在运动场上你我生龙活虎的锻炼场景.....太多太多的情景值得我们去回忆. 在四年半里,我们更进一步学会了分析与思考,学会了丰富与凝练,学会了合作与竞争,学会了继承与创新,也进一步学会了如何不断超越,突破自己的极限而成长.如今我们就要毕业了,所有这些温暖的记忆都将铭刻在我们内心深处,那是我们生命中最难忘的日子.喜欢好友常说的一句话:"我们都是只有一只翅膀的天使,只有互相拥抱才能飞翔."四年半的同窗友谊,让我们学会了彼此相信并依赖.四年半的生活,我们都有过低谷,但我们相互扶持,鼓励,朋友温馨的笑容,班级温暖的气氛,让我们都走了过来,让我们学会去爱,去坚持,去相信"阳光总在风雨后".我敬爱的老师,您用您辛勤的汗水,无私的奉献,无数夜的伏案耕耘,给了我们一个清醒的头脑,一双洞察的眼睛和一颗热忱的心灵,再华丽的辞藻也无法表达我们对您——既是老师,又是朋友,更是亲人的尊敬和爱戴.学生即将远行,请允许我们深情地道一声:"老师,您辛苦了!谢谢你们的关怀和教育" 毕业是一首久唱不衰的老歌,是散场之后的余音绕耳,所有甜美或者苦涩的故事,定格为热泪盈眶的欣悦,依然真诚直率的目光,依然奔流激荡的热血,正牵引着我们再一次传唱,

2020大学生毕业典礼演讲稿5篇

2020大学生毕业典礼演讲稿5篇 【篇一】2020大学生毕业典礼演讲稿 尊敬的老师、亲爱的同学们: 大家好! 眨眼间,又一批熟悉的面孔将带着大学四年的回忆离开校园。四年时光匆匆,大一的青涩懵懂,大二的奋起拼搏,大三的勤学苦练似乎都还在眼前,还未好好享受,却要轻轻挥手,告别哭过、笑过、闹过的兄弟姐妹,告别迷惘过、奋斗过的校园青春。 大学里最值得骄傲的事情也许是坚持并实现了自己的梦想,也许是收获了甜蜜的爱情,也许是结识到了知己。有无悔,也有遗憾。比赛的失力,考试的挂科,同学间的小摩擦等等,也在调剂着大学这碗五味杂陈的汤。当然,还会有不少感悟。新闻学院大四的邹佼向记者畅谈道:“我认为大一到大四都要坚持努力学习,劳逸结合,学和玩都不能少。大一做到适应大学生活,学会独立,多阅读、多交朋友,打下优良基础。大二思考一下自己想做什么,确定大体的方向,并做初步准备。大三可以根据之前所学去实践一下,并为自己选择的道路做最后的冲刺。在大四,一方面要淡定地等待努力的结果,另一方面可以去做自己以前没时间做的事情。”这些感悟都为学弟学妹们提供了优良的参考,促进他们主动向上,创造一个多彩无悔的大学生活。 我始终相信,告别是为了下一次更好的相见。步入竞争激烈的社会,才真正的见识到拥挤的招聘大厅,或是切实地

感受到考研的重重压力,遇到了以前从未碰到的难题,拉开了另一个生活场景的帷幕。据了解,这一年全国毕业生数量达到xx万人,被戏称为“最难就业年”,竞争压力可想而知。与此同时,在收入等严峻的实际问题驱使之下,众多大学生竟相信花x万就能进银行、国企或事业单位等骗局,不仅打碎了“铁饭碗”梦,也将自己推入更深的渊谷。这其中虽然有许多社会急待解决的问题,但仔细想想许多大学生的观念更是亟须纠正,走后门、托关系的投机取巧心理是万万不可行的,既危害个人,又败坏社会风气。 要想出人头地,大学毕业生不应该嫌弃职位的高低贵贱,三百六十行,行行出状元,只要脚踏实地,做好手头工作,多积累经验,终有出头日。 又到了要说再见的时候了,可是再见是为了再一次的相见。等到几年、十几年、几十年之后,等到大家都接受了社会和生活的磨炼,等到每个人都变得成熟优秀,等到各自都有了全新的生活,再次相见,微微一笑,大家仍然是朋友,仍然有拥抱的理由,因为友谊地久天长,因为青春值得我们去追忆。 毕业离歌渐响,还未离开,却已开始怀念。青春终究是会逝去的,不必伤感,不必慌张,它将永刻在岁月里,化成一股温暖的力量,让前行的路因回忆而充满无限阳光。 我的演讲完毕,谢谢大家!【篇二】2020大学生毕业典礼演讲稿 尊敬的各位领导、老师、亲爱的同学们:

大学生关于毕业的演讲稿(精选多篇)

大学生关于毕业的演讲稿(精选多篇) 第一篇:大学生毕业演讲稿 尊敬的各位领导、各位老师,亲爱的同学们: 大家好!我很荣幸能作为毕业生代表在此发言。首先,请允许我代表所有毕业生同学向长期以来关心、教育和帮助我们的学校各位领导致以衷心的感谢!向辛勤培育我们的各位辅导员、各位任课老师们致以崇高的敬意!向为我们的学习、生活和工作默默奉献的学校各部门的老师们表示诚挚的感谢! 今天,我站在这里,代表毕业生向我们的母校道别,向老师道别,向朝夕相处的同窗们道别,也向这段不能忘怀的岁月道别! 都说时光匆匆,岁月荏苒,一低眉间大家就要背上行李,各自奔赴下一段旅程。我此刻的心情应当和在座的各位一样,掩不住的是回忆与留恋。留恋我走过大学的每一个角落,留恋我相识的老师,留恋我相知的朋友,留恋这美丽的南华。2014年9月,命运让我们聚首南华,回望过往,经历的点点滴滴仍历历在目,我们一定还记得清远校区辽阔的操场上,那段挥洒汗水、灼伤皮肤的军训岁月,炎炎烈日晒去了我们的懒惰,雨水洗去我们的娇气,同时它也凝结了我们的友谊。我们一定还记得在那如火如荼进行着的各样“金鹰杯”大赛,赛场上配合与拼杀身影,呐喊与助威的声音,是那么的激烈,紧张与精彩。一定还记得那些丰富多彩的文艺晚会和社团演出,一定还记得我们一起参与一起奉献的社会志愿者活动,一定还记得我们一起学习,一起看书,

一起考试考证的种种……南华是一个充满激情的舞台,让我们个性飞扬,流光溢彩。同时她也是一个温暖的大家庭,让我们无忧无虑,自然快乐。阳光下,我们笑靥如花。树荫下,我们舒适而自在。淡淡的微风,淡淡的凉意。吹不淡的是我们共同拥有的美好回忆。 如今大学即将结束了,而我们的生活却刚刚拉开序幕。现在的我们正处在一个尴尬的年龄,我们能做什么,会做什么?仿佛我们什么都不懂!离开学校,社会把我们青涩的外衣脱了,却不肯让我们立马换上成熟的那件。妖怪般的大都市鲸吞了多少热血的梦想?却不肯给我们一份合适工作一份可靠爱情。逆着时间,往回推几个岁月,那时的我们会有欢笑,有泪水,有同学,有一起站在阳光下的影子,背后有父母,有老师,生活得无忧无虑;往后穿梭数个岁月,各兄弟姐妹会有自己的家庭,有经历岁月淘沙留下来的亲朋好友。可是现在的我们正在社会上裸奔,且方向迷茫。 初出茅庐,对于社会的了解,凤毛麟角。也许我们说话依然天真幼稚,处事不够圆滑,让我们工作、生活处处碰壁。但请记住大学三年我们并非一无所获,在这里我们学会了从思考中确立自我,从学习中寻求真理,从独立中体验自主,从实践中赢得价值,从追求中获得力量。我们有足够的自信和勇气应对各种磨砺与挑战。阅历不足,但只要有信心,时间会帮助我们挺过去。现在给我们挫折,让我们难堪,我们要心存感激,只有这样才能成长,才能弥补不足。 亲爱的同学们请勇敢起来,现在的你并不是一个人在战斗。有一句话说:“我们都是只有一只翅膀的天使,只有互相拥抱才能飞翔。”三年

2021年大学毕业生演讲稿400字

2021年大学毕业生演讲稿400字 2021年大学毕业生演讲稿400字1 四年让我们知道什么是痛并快乐着,我们带着这样美好的回忆踏入社会,开始另一段的奋斗。我们朝夕相处,情同手足。这四年的盛宴,让我们更加懂得了珍惜。 时光飞逝,转眼间四年的大学生崖即将结束。在即将毕业离校之计,我心中充满了对母校的不舍以及对学校领导和老师们的感激之情。在这四年经历了许多喜怒哀乐的事,我也交了许多朋友,这些朋友在我伤心的时候,鼓励我、安慰我,也有许多老师教导我做人做事的道理,让我在这四年里成长了许多,我要感谢老师的教导,虽然大学生崖结束了,但不代表学习结束。 现在要离开,还真舍不得,这些美好回忆将永远留在我心里,成为我一生最难忘的事。在上大学的这四年里,我曾经常回忆我的小学,初中,高中生活,那时的人和事,让我觉得那么的美好......而如今,我深深的明白,大学里的一点一滴,也将是我一生的美好回忆......深切地祝福沈阳理工大学,祝福老师们,祝福同学们...... 我是如此平凡,却又如此幸运。真心谢谢大家!四年改变了我们的容颜和那颗曾经年轻的心,而成长的代价就是我们失去纯真的微笑,而多了一份离别的伤感。无论我们有多少不舍,都唤不回逝去的四年。但我们无须失落,我们依然可以一路高歌,让六月的骄阳永远见证我们的无悔青春…… 快毕业了,真的很留恋大学四年的美好时光。我最感谢的是四年

来同甘共苦的好朋友,好姐妹们。虽然还有一个月就要离开了,但是在最后的这段日子里,我相信我们能开心度过,珍惜相处的每一刻。我在大学体会了除离别以外的一切美好!现在让离别画上美好的句号!道一声“思量”,又怎不“思量”!要记住,作为沈阳理工大学的毕业生,不管今后我们身在何方,我们永远都是母校的一员,永远都将代表自己的母校。 2021年大学毕业生演讲稿400字2 亲爱的老师、同学们: 大家好!我今天要演讲的题目是:《我难忘的大学生活》 2018年9月我从地处偏僻的黄金乡来到这旅游名城哈尔滨,走进了旅游学院,圆了我多年梦寐以求的大学梦。有人说:“大学是铸就平凡人的辉煌,造就大师的摇篮。”作为一名普通的大学生,我注定不能成为大师,但平凡的我决不能选择平庸。“非志无以成学,非学无以广才”,这次难得的求学机会将是我人生中一次重要的转折点,所以我会倍加珍惜。带着这份朴素的感情、也带着我的希望和梦想,就这样默默地坚持着三年的大学生活。我虽然柔弱,但我不乏毅力;我虽然基础不扎实,但我用勤奋和汗水弥补着不足。 在两年多姿多彩的大学生活中,学院领导的关心爱护以及老师的谆谆教诲、同学们的和谐快乐相处,给我留下了美好的记忆,我衷心的感谢你们,感谢你们给予我知识和能力,给予我温暖和关怀,在这里我要真诚地说一声:谢谢你们!丰富多彩的大学生活需要自己好好

大学生毕业典礼发言稿(15篇)

大学生毕业典礼发言稿(15篇) 大学生毕业典礼发言稿1 尊敬的亓院长、各位领导,亲爱的老师和同学们: 大家下午好! 我是电气自动化专业3102班的任俊峰。很荣幸今天能站在这里代表电气系20xx届715名毕业生发言,向辛勤培养我们的母校道别,向亓院长等学院领导道别,向潜心教育我们的老师道别,向三年来朝夕相处的同学道别,更向这段令人无法忘怀的青春时光道别。 三年弹指一挥间。三年前,我们怀揣梦想,背负期望,来到安徽机电职业技术学院,来到电气工程系。还记得刚报到时那一张张稚气未脱的脸庞,还记得军训时那一声声铿锵有力的呼喊,还记得教室里那一个个刻苦学习的背影,还记得运动场上那一阵阵响彻云霄的掌声。感谢你们,我亲爱的老师,你们传道、授业、解惑,让我们成为社会主义合格的建设者和可靠的接班人;感谢你们,我亲爱的同学,三年来,我们相互了解,相互学习,相互倾诉,相互帮助,最终成为奋斗的伙伴,一生的挚友,更成为我们人生路上一笔最珍贵的财富。 进入安机电以来,遵循“修德,练技,立业,报国”的校训,在老师和同学们的帮助下,通过自身的努力,我取得了优异的成绩。先后获得校三好学生和优秀共青团员称号;光荣地加入了中国共产党;多次荣获学院奖学金并获得国家励志奖学金;在安徽省大学生创业大赛中两次获奖;毕业前获得校级和省级优秀毕业生光荣称号。现在顺利地通过了专升本的考试,被铜陵学院自动化专业录取。在此,我特别要向精心培养我的领导及所有老师表示最衷心的感谢和最诚挚的敬意(鞠躬)。 感谢我们的母校,给了我们学习求知的环境,给了我们成长成才的阶梯,给了我们展现自己的舞台,更给了我们拼搏进取的信心!在学院的亲切关怀之下,我们在学习中追求真理,在实践中成就价值,在兴趣中获得快乐,在历练中懂得了感恩。