eFM3_CHMDL_11_CostofCapital

SECTION 11-712/08/11 SOLUTIONS TO SELF-TEST QUESTIONS

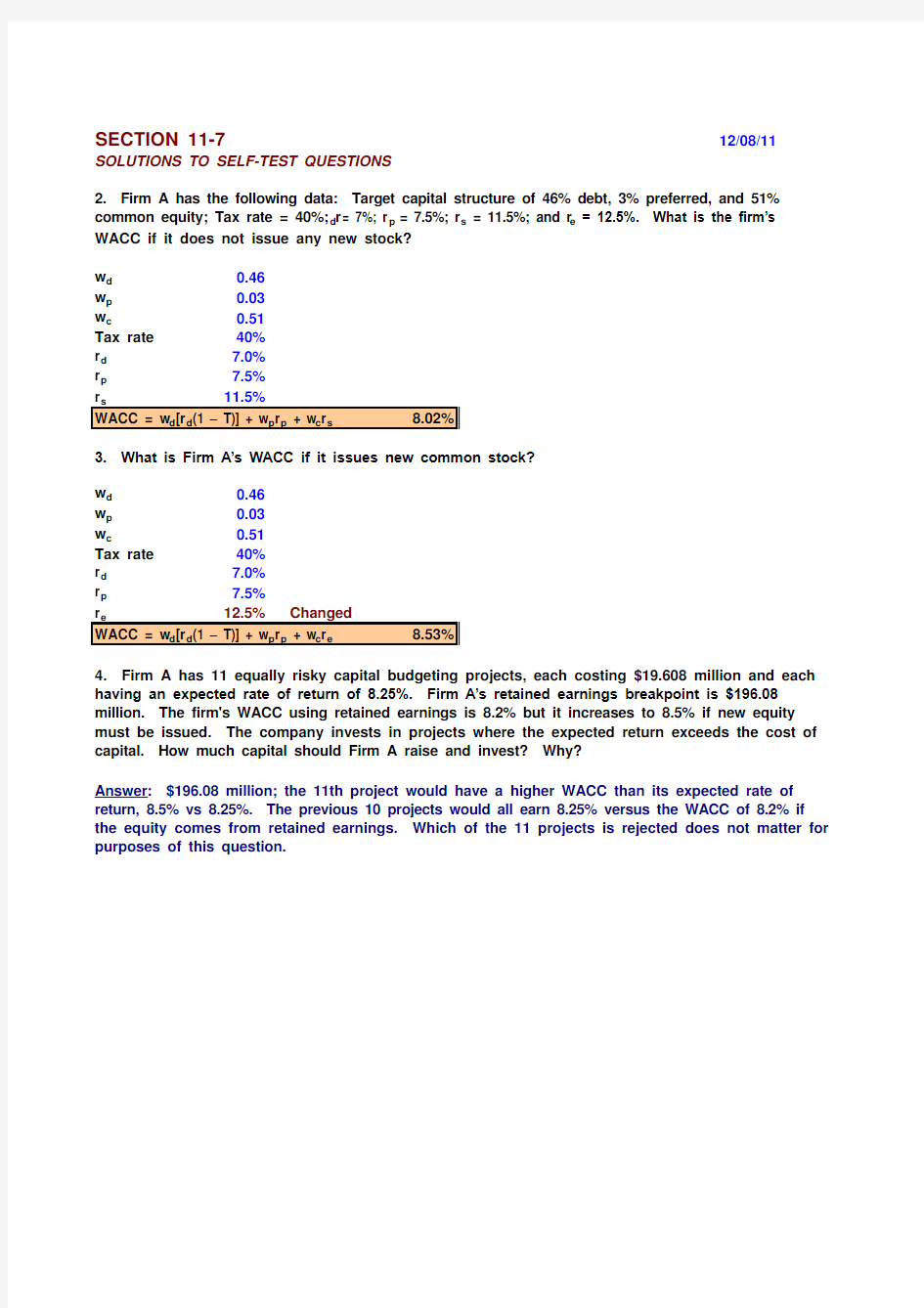

2. Firm A has the following data: Target capital structure of 46% debt, 3% preferred, and 51% common equity; Tax rate = 40%; r d = 7%; r p= 7.5%; r s = 11.5%; and r e = 12.5%. What is the firm’s WACC if it does not issue any new stock?

w d0.46

w p0.03

w c0.51

Tax rate40%

r d7.0%

r p7.5%

3. What is Firm A’s WACC if it issues new common stock?

w d0.46

w p0.03

w c0.51

Tax rate40%

r d7.0%

r p7.5%

4. Firm A has 11 equally risky capital budgeting projects, each costing $19.608 million and each having an expected rate of return of 8.25%. Firm A’s retained earnings breakpoint is $196.08 million. The firm's WACC using retained earnings is 8.2% but it increases to 8.5% if new equity must be issued. The company invests in projects where the expected return exceeds the cost of capital. How much capital should Firm A raise and invest? Why?

Answer: $196.08 million; the 11th project would have a higher WACC than its expected rate of return, 8.5% vs 8.25%. The previous 10 projects would all earn 8.25% versus the WACC of 8.2% if the equity comes from retained earnings. Which of the 11 projects is rejected does not matter for purposes of this question.