SOX Section 404 Material Weakness Disclosures and Audit Fees

AUDITING:A JOURNAL OF PRACTICE&THEORY

V ol.25,No.1

May2006

pp.99–114

SOX Section404Material Weakness

Disclosures and Audit Fees

K.Raghunandan and Dasaratha V.Rama

SUMMARY:Section404of the Sarbanes-Oxley Act and Auditing Standard No.2

(PCAOB2004)require management and the auditor to report on internal controls over

?nancial reporting.Section404is arguably the most controversial element of SOX,and

much of the debate around the costs of implementing section404has focused on

auditors’fees(Ernst&Young2005).In this paper,we examine the association between

audit fees and internal control disclosures made pursuant to section404.Our sample

includes660manufacturing?rms that have a December31,2004?scal year-end and

?led the section404report by May15,2005.We?nd that the mean(median)audit

fees for the?rms in our sample for?scal2004is86(128)percent higher than the

corresponding fees for?scal2003.Audit fees for?scal2004are43percent higher for

clients with a material weakness disclosure compared to clients without such disclo-

sure;however,audit fees for?scal2003are not associated with an internal control

material weakness disclosure(in the10-K?led following?scal2004).We also?nd that

the association between audit fees and the presence of a material weakness disclosure

does not vary depending on the type of material weakness(systemic or non-systemic).

INTRODUCTION

I n this paper we examine the association between material weakness disclosures made

pursuant to section404of the Sarbanes-Oxley Act(U.S.House of Representatives 2002)(SOX)and audit fees.Section404and the subsequent Public Company Account-ing Oversight Board(PCAOB)standards relating to this section(PCAOB2004)require(1) a management report on internal control over?nancial reporting,(2)auditor attestation of such a management report,and(3)an auditor’s report on internal control.The internal control reporting requirements have been the most controversial elements of SOX.Many SEC registrants and others have complained about the high costs associated with the new requirements(SEC2005b)and audit fees account for a signi?cant part of section404 implementation costs(American Bankers’Association[ABA]2005;Financial Executives Institute[FEI]2005;Ernst&Young2005).

Our analysis focuses on audit fees paid by660manufacturing?rms that have a De-cember31,2004?scal year-end and?led their404reports by May15,2005.While some submissions to the SEC and Congress have referred to surveys highlighting the magnitude of costs associated with section404,our study provides systematic empirical evidence about

K.Raghunandan and Dasaratha V.Rama are Professors at Florida International University.

We thank Joe Carcello,Bill Messier,Dan Simunic(editor),and two anonymous reviewers for many useful com-ments.We thank Ping Wang and Yun-chia Yan for research assistance.

Submitted:July2005

Accepted:December2005

99

100Raghunandan and Rama the higher audit fees following the implementation of section404.We?nd that the audit fees for2004are in general much higher than the corresponding fees for2003—the mean and median fees for2004are higher by86and128percent,respectively.Not surprisingly, we?nd that the audit fees are higher for the58?rms that disclosed material weaknesses in internal controls over?nancial reporting pursuant to section404of SOX.Of greater interest are our results related to the magnitude of the higher fees,the effects on prior-year audit fees,and the effects of types of internal control weaknesses on audit fees.

We?nd that audit fees for?scal2004are43percent higher for?rms that report a section404material weakness disclosure than for?rms without such disclosure.However, the material weakness indicator variable is not signi?cant in explaining audit fees for the same?rms for the?scal year ending December31,2003.We?nd that voluntary disclosures about internal control material weakness disclosures before section404became effective are not associated with higher audit fees for either2004or2003.Audit fees are higher irrespective of whether the internal control weaknesses can be categorized as systemic,and the impact on audit fees does not differ signi?cantly for systemic or non-systemic internal control weakness disclosures.

SOX became law in July2002and the associated SEC implementation rule was issued in early2003,so both companies and their auditors were aware of the internal-control-related reporting requirements well before2004.In addition,auditing standards have long required the auditor to consider the internal controls of the client in audit planning.Hence, the fact that the section404material weakness indicator is signi?cant in explaining audit fees for?scal2004,but not for?scal2003,is surprising.The results suggest that many auditors did not test internal controls extensively in2003but began to test extensively for internal controls(and accordingly modify their audit programs)only in2004and charged higher fees in the presence of internal control weaknesses in2004.The change in audit approach could perhaps be attributed to the fact that the PCAOB issued AS No.2only in March2004(with subsequent approval by the SEC in June2004)and additional guidance was issued by the PCAOB in June,July,October,and November2004.

Bond-rating agencies have noted that their reactions will differ depending on the type of material weakness disclosures:systemic or non-systemic(Moody’s Investor Service 2004;Fitch Ratings2005).However,we?nd that the association between audit fees and material weakness disclosures do not vary depending on the type of internal control weak-ness.These results suggest that the responses of auditors to different types of internal control weaknesses may differ from those of?nancial statement users.

In summary,our paper provides empirical evidence about audit fees for a group of manufacturing?rms that are subject to the requirements of section404of SOX.Our paper adds to both the audit fees and the internal control/section404literatures by documenting the association between audit fees and section404material weakness disclosures.

BACKGROUND AND RESEARCH QUESTIONS

SOX was enacted in July2002in the aftermath of the Enron,Andersen,and WorldCom failures.Section404(1)of SOX requires the SEC to prescribe rules requiring that each annual report?led with the SEC under the1934Securities Exchange Act shall‘‘contain an internal control report,which shall:

(1)state the responsibility of management for establishing and maintaining an adequate

internal control structure and procedures for?nancial reporting;and

Auditing:A Journal of Practice&Theory,May2006

SOX Section 404Material Weakness Disclosures and Audit Fees 101

Auditing:A Journal of Practice &Theory,May 2006

(2)contain an assessment,as of the end of the most recent ?scal year of the issuer,of

the effectiveness of the internal control structure and procedures of the issuer for

?nancial reporting.’’

In addition,section 404(2)speci?es that:

With respect to the internal control assessment required by subsection (a),each registered

public accounting ?rm that prepares or issues the audit report for the issuer shall attest to,

and report on,the assessment made by the management of the issuer ...Any such attestation

shall not be the subject of a separate engagement.

Section 404has arguably been the most controversial element of SOX.Many SEC

registrants and business associations have complained about the costs associated with the

internal control reporting requirement and some have called for the revision (if not repeal)

of such requirements (e.g.,American Electronics Association [AEA]2005;FEI 2005;Mi-

crosoft,Inc.2005;Powell 2005).Both the U.S.Senate and the U.S.House of Represen-

tatives held hearings that focused on the costs associated with the internal control reporting

requirements and other elements of SOX (U.S.Senate 2004;U.S.House of Representatives

2005).In such hearings,SEC Chairman William Donaldson acknowledged that ‘‘the inter-

nal control reporting and auditing requirements ...have required signi?cant outlays of time

and expense’’(Donaldson 2005).In light of such vociferous criticism,the SEC (1)thrice

postponed the adoption date for section 404,1(2)commissioned a round-table to discuss

implementation issues related to section 404,and (3)formed an advisory committee on

smaller companies to ‘‘examine the impact of the Sarbanes-Oxley Act and other aspects of

the federal securities laws on smaller companies’’(SEC 2005a).

Audit Fees and Section 404

Audit fees account for a substantial part of the costs associated with the implementation

of section 404(cf.,ABA 2005;FEI 2005).The CEO of Ernst &Young (EY)noted that

‘‘much of the debate regarding the high costs of 404implementation seems to be centered

on audit fees’’(EY 2005).Thus,patterns of increases in audit fees (as a result of the

implementation of section 404)are suf?ciently interesting to be examined in their own

light.

Professional organizations and others interested in section 404related issues have cited

evidence from surveys about the additional costs associated with the new rules (FEI 2005;

Charles River Associates [CRA]2005).For example,a widely cited FEI study indicates

that member ?rms spent ‘‘an average of $4.3million for added internal costs and additional

fees spent on auditors and other consultants and software associated with complying with

Section 404.’’While results from such surveys have been widely cited in submissions before

the SEC and Congress as part of efforts to change existing regulations,the nature of such

surveys preclude drawing de?nitive conclusions about the effect of section 404on audit

fees.It is not apparent how much of the increased costs are attributable to additional

audit fees,per se,as opposed to other costs.Also,Deloitte &Touche (2005)noted that

while ‘‘average per company costs have been estimated to be in the millions of dollars ...

1For registrants that are classi?ed as accelerated ?lers,section 404became effective for ?scal year-ends after November 15,2004.However,even within this category,for registrants with market ?oat of under $700million,the SEC granted an additional 45days to ?le the section 404reports if the ?scal year-end was on or before February 28,2005.For non-accelerated ?lers and foreign registrants,section 404is effective for ?scal year-ends on or after July 15,2007.

102Raghunandan and Rama

Auditing:A Journal of Practice &Theory,May 2006

the reported average cost estimates are skewed dramatically upwards by the higher costs

of the largest organizations.’’In addition,there is no empirical evidence about how audit

fees differ for ?rms with and without material weakness disclosures.2Thus,our study ?lls

a void in the literature about the effects of section 404on audit fees of ?rms with and

without internal control material weakness disclosures.

Auditing standards have long recognized the signi?cance of internal control in auditing,

since weak internal controls over ?nancial reporting result in less reliable numbers from

the accounting system.However,auditors had the option of not relying on internal controls

and to rely solely on the results from substantive tests.Thus,prior to SOX the only required

audit procedure related to internal controls was that auditors had to obtain an understanding

of clients’internal controls;tests of internal controls were necessary only if the auditor

decided to rely on the internal controls.

SOX changes the requirements related to internal controls,and requires the auditor to

evaluate management’s assertion about the effectiveness of internal controls.In addition,

AS No.2(PCAOB 2004)requires auditors to perform their own independent assessment

related to internal controls over ?nancial reporting and issue a report based on such as-

sessment.Hence,it is likely that the audit approaches would be substantially different in

the post-SOX period from the pre-SOX period.The CEO of EY acknowledged this and

noted that ‘‘the effort required by the audits of internal control under 404and AS2is

substantially greater than the effort traditionally required for consideration of internal con-

trol solely in connection with audits of ?nancial statements’’(EY 2005).

The presence of a material weakness creates signi?cant additional work for auditors

including additional (1)testing and changes in the audit program,(2)partner time related

to discussions with client management,and (3)documentation related to the decision to

classify a weakness as a material weakness as opposed to a signi?cant de?ciency (which

does not require disclosure in SEC ?lings).Such additional work can be expected to lead

to higher audit fees.

In addition,auditors and others also have noted that there would be adverse conse-

quences to issuers that disclose material weaknesses in internal controls.A senior manager

with PricewaterhouseCoopers (PWC)noted that when internal control over ?nancial re-

porting is determined to be ineffective it increases ‘‘the probability that accounting problems

exist’’(Wilfert 2005).Credit-rating agencies have suggested that certain types of internal

control weaknesses would be a factor in their rating decisions (Moody’s Investor Services

2004;Fitch Ratings 2005).Hence,the presence of a material weakness can also lead to an

increase in the auditor’s risk premium related to audit fees.

Together,the above discussion suggests the ?rst research question:

RQ1:What is the audit fee premium for ?rms disclosing a material weakness in

internal controls over ?nancial reporting compared to ?rms without such

disclosures?

SOX became law in July 2002,and both issuers and auditors were aware of the internal

control requirements of section 404.Audit ?rms have noted that ‘‘much of the preparation

for 404implementation started in 2003’’(e.g.,EY 2005).In addition,it is unlikely that the

2Charles River Associates (CRA)(2005)estimates the effect of section 404on audit fees,but is based on a small sample of 90?rms.Neither the CRA survey nor the FEI survey analyzes separately ?rms with and without material weakness disclosures.

SOX Section 404Material Weakness Disclosures and Audit Fees 103

Auditing:A Journal of Practice &Theory,May 2006

material weaknesses that were disclosed in section 404reports (in early 2005)developed

only in 2004but were not present in 2003.Hence,it is reasonable to expect that the effects

of material weaknesses in internal controls would be re?ected in the audit fees for ?scal

2003,well before the required implementation date of 2004.3However,as noted below,the

timeline of actions by regulators suggests that there may not be an association between

material weakness disclosures pursuant to section 404and audit fees for ?scal 2003.

Section 103of SOX requires the PCAOB to issue rules relating to the ‘‘auditor’s testing

of the internal control structure and procedures of the issuer.’’Pursuant to this mandate,the

PCAOB issued Auditing Standard No.2but only in March 2004,and the SEC approved

this standard in June 2004.EY (2005)notes that ‘‘only then,subsequent to AS2being

issued,did auditors have the opportunity to actively start identifying implementation issues

and seeking answers to their questions from the PCAOB staff.Additional interpretive guid-

ance was issued by the SEC and PCAOB during the latter half of 2004(in June,July,

October,and November)and in January 2005.’’

Thus,there are differing arguments about whether we are likely to ?nd an association

between the disclosures of a material weakness pursuant to section 404in ?lings made

with the SEC after ?scal 2004and audit fees for ?scal 2003.This leads to the second

research question:

RQ2:Were audit fees higher even in ?scal 2003for ?rms that subsequently

disclosed a material weakness in internal controls over ?nancial reporting?

METHOD

Model

We use the following model to examine the association between audit fees and the type

of internal control report:

LAFEE ?b 0?b 1*LNTA ?b 2*RECINV ?b 3*FORGN ?b 4*SQSEG ?b 5*LIQ

?b 6*DA ?b 7*ROA ?b 8*GC ?b 9*BIG4?b 10*MW .

The variables are de?ned as follows:

LAFEE

?natural log of audit fees;LNTA

?natural log of total assets at year-end;RECINV

?receivables and inventory as a proportion of total assets at year-end;FORGN

?1if the ?rm has foreign operations,else 0;SQSEG

?square root of the number of operating segments;LIQ

?current ratio at year-end;DA

?total debt divided by total assets at year-end;ROA

?return-on-assets (operating income/total assets);3Neither AS No.2(PCAOB 2004)nor the SEC rules related to section 404(SEC 2003)require the disclosure of when the internal control problems developed;these rules,as well as SOX itself,only require the disclosure based on internal control evaluations as of the ?scal year-end.Disclosure practices vary widely across ?rms.While some clients indicate that the internal control problems had existed for some time,others do not make any statement about when the internal control problems https://www.360docs.net/doc/f218376609.html,pounding the dif?culty is the fact that some of the ?rms in the latter group disclose restatements relating to prior years.Hence,we cannot infer when the problems developed if the disclosures are silent about the date of origin of the internal control problem.

104Raghunandan and Rama

Auditing:A Journal of Practice &Theory,May 2006

GC ?1if audit report modi?ed for going-concern,else 0;

BIG4?1if Big 4auditor,else 0;and

MW ?1if there is a material weakness disclosure in audit report,else 0.

Our control variables are derived based on prior research.Almost all models that seek

to explain audit fees follow the approach in Simunic (1980)and use various measures of

client size,complexity,and risk such as LNTA ,RECINV ,FORGN ,SQSEG ,and GC .We

include DA ,LIQ ,and ROA in our model given the signi?cance of these or similar variables

in recent research (e.g.,Francis and Wang 2005;Whisenant et al.2003).

Sample

We begin with a list of 2,956?rms that ?led their section 404reports by May 15,

2005,per the AuditAnalytics database.We restrict our analysis to manufacturing ?rms with

a December 31?scal year-end for the following reasons.First,prior research suggests that

audit fees vary across industries (e.g.,Simunic 1980;Casterella et al.2004).Second,it is

likely that both the presence of material weaknesses in internal control and the effects of

such weaknesses on audit effort and fees would vary across industries.4Hence,we delete

2,019?rms that are not in the manufacturing (i.e.,SIC codes 2000–3999)sector.

Section 404and AS No.2(PCAOB 2004)both have led to major changes in auditing.

Detailed guidance from the PCAOB was available only in the second half of 2004,and

given the time pressures on auditors and clients,we delete 147?rms that have a ?scal year-

end other than December 31,2004.Since section 404is not mandatory for foreign ?rms

until July 15,2007,we delete 24foreign ?rms from our sample.We rely on the Audit-

Analytics database for audit fee data,and delete 35?rms with missing fee data.Given the

unique nature of section 404work,and the steep learning curve associated with a new

client in the initial year of a 404audit,we delete 67?rms where either 2003or 2004is

an initial year audit for the auditor.Finally,we delete four ?rms that have very small values

for audit fees or client size.5Thus,our ?nal sample includes 660?rms.We obtain all of

our data from the Compustat and AuditAnalytics databases.

RESULTS

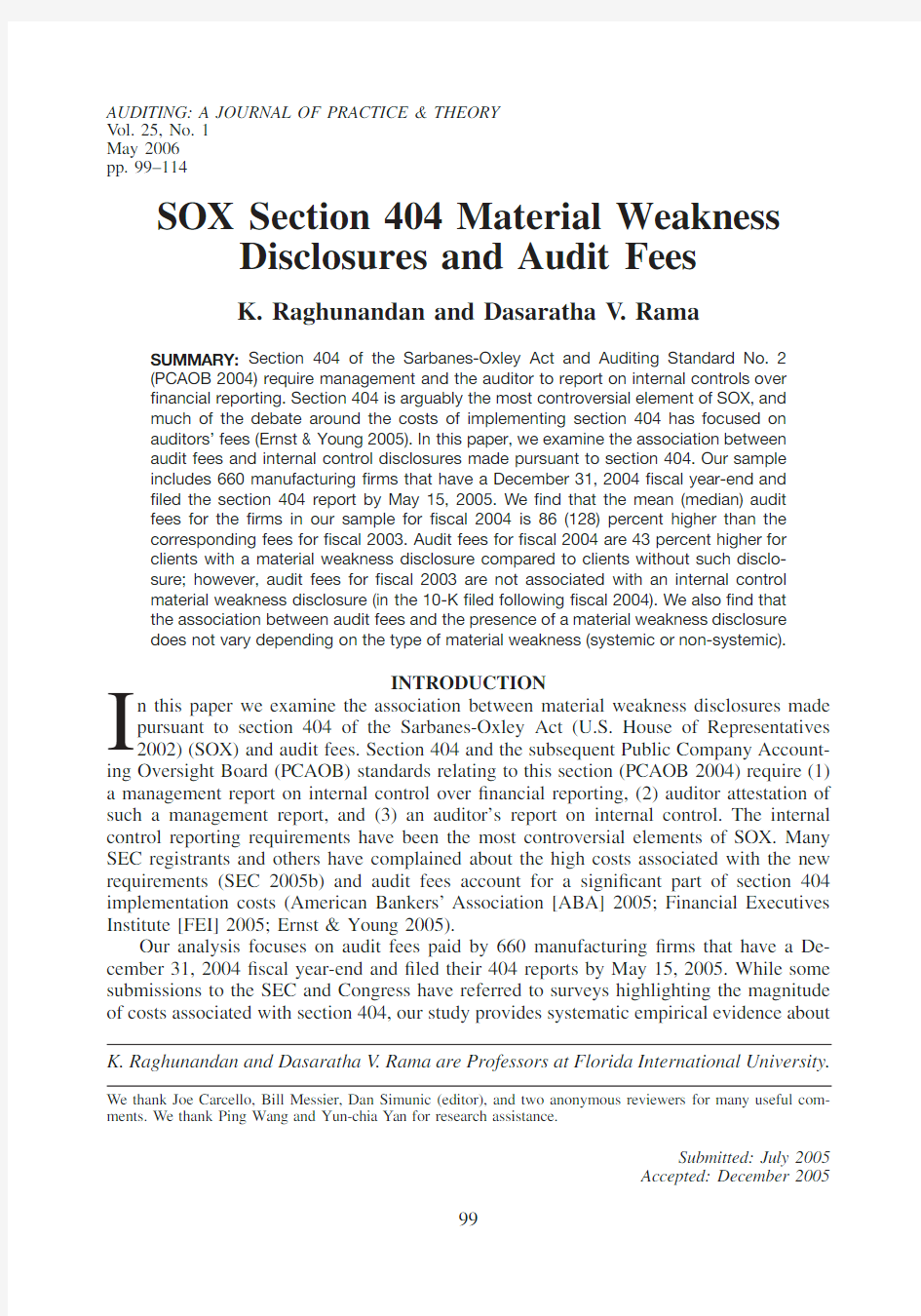

Table 1provides descriptive data about the sample for ?scal years ending December

31,2004and 2003.The mean total assets for 2004and 2003are $6,537and $5,832million,

respectively;the median values are much lower in both years,and provide evidence about

the skewness in the sample.The values for all of the control variables suggest that the 2004

and 2003values are quite similar;only LIQ has a change of more than 5percent in the

mean value across the years (changing from 4.18in 2003to 3.91in 2004).Receivables

and inventory constitute just less than a quarter of total assets and just under two-thirds of

the sample has foreign operations.Ninety-?ve percent of the sample is audited by the Big

4,and 2percent of the sample ?rms receive going-concern modi?ed audit opinions.Fifty-

eight of the ?rms (8.8percent)report one or more section 404material weaknesses in

internal control.The table also shows that the mean audit fees for 2004is $3.08million,

and represents an 86percent increase from the mean fees of $1.66million for 2003;the

4

Prior research (e.g.,Asare and Davidson 1995;Kreutzfeld and Wallace 1986)?nds that internal control problems are much more likely in inventory and receivables than in other asset accounts;further,auditing standards have long required auditors to use speci?c audit procedures in these two areas.The proportion of receivables and inventory (as a percent of total assets)varies across industries,so the impact of additional testing related to section 404can be expected to have differential impact across industries.5Two ?rms had total assets less than $10million and two other ?rms had audit fees less than $100,000.

SOX Section 404Material Weakness Disclosures and Audit Fees 105

Auditing:A Journal of Practice &Theory,May 2006TABLE 1

Sample Statistics

(n ?660)

Variable Fiscal 2004

Mean S.D.

Median Fiscal 2003Mean S.D.Median Total Assets ($MM)6,35736,689

5425,83234,953509Audit Fees ($000)3,0825,881

1,2121,6603,812532LNTA 20.29 1.91

20.1420.15 1.9220.05RECINV 0.240.16

0.230.230.150.23SQSEG 1.510.55

1.41 1.440.53 1.00FORGN 0.650.48

1.000.640.48 1.00LIQ 3.91 3.93

2.69 4.18 4.46 2.73DA 0.450.29

0.420.470.300.45ROA ?0.040.26

0.04?0.050.230.03GC 0.020.15

0.000.020.150.00BIG40.950.22

1.000.950.22 1.00MW 0.090.28

0.00———MWSYS 0.060.24

0.00———MWOTH 0.030.180.00———

The sample includes all manufacturing ?rms that ?led their section 404reports with the SEC by May 15,2005.

Variable De?nitions:Total Assets ?total assets;LNTA ?natural log of client’s total assets;RECINV ?proportion of total assets in accounts receivable and inventory;SQSEG ?square root of the number of segments;FORGN ?1if the ?rm has foreign operations,else 0;INITIAL ?1if ?rst year with auditor,else 0;LIQ ?ratio of current assets divided by current liabilities;DA ?total debt divided by total assets;ROA ?return on assets (operating income divided by total assets);GC ?1if audit opinion modi?ed for going concern,else 0;BIG4?1if Big 4auditor,else 0;MW ?1if material weakness in internal control,else 0;MWSYS ?1if ?rm disclosed systemic material weakness in internal control,else 0;and MWOTH ?1if ?rm disclosed non-systemic material weakness in internal control,else 0.

median audit fee increases by 128percent,from $0.53million in 2003to $1.21million in

2004.

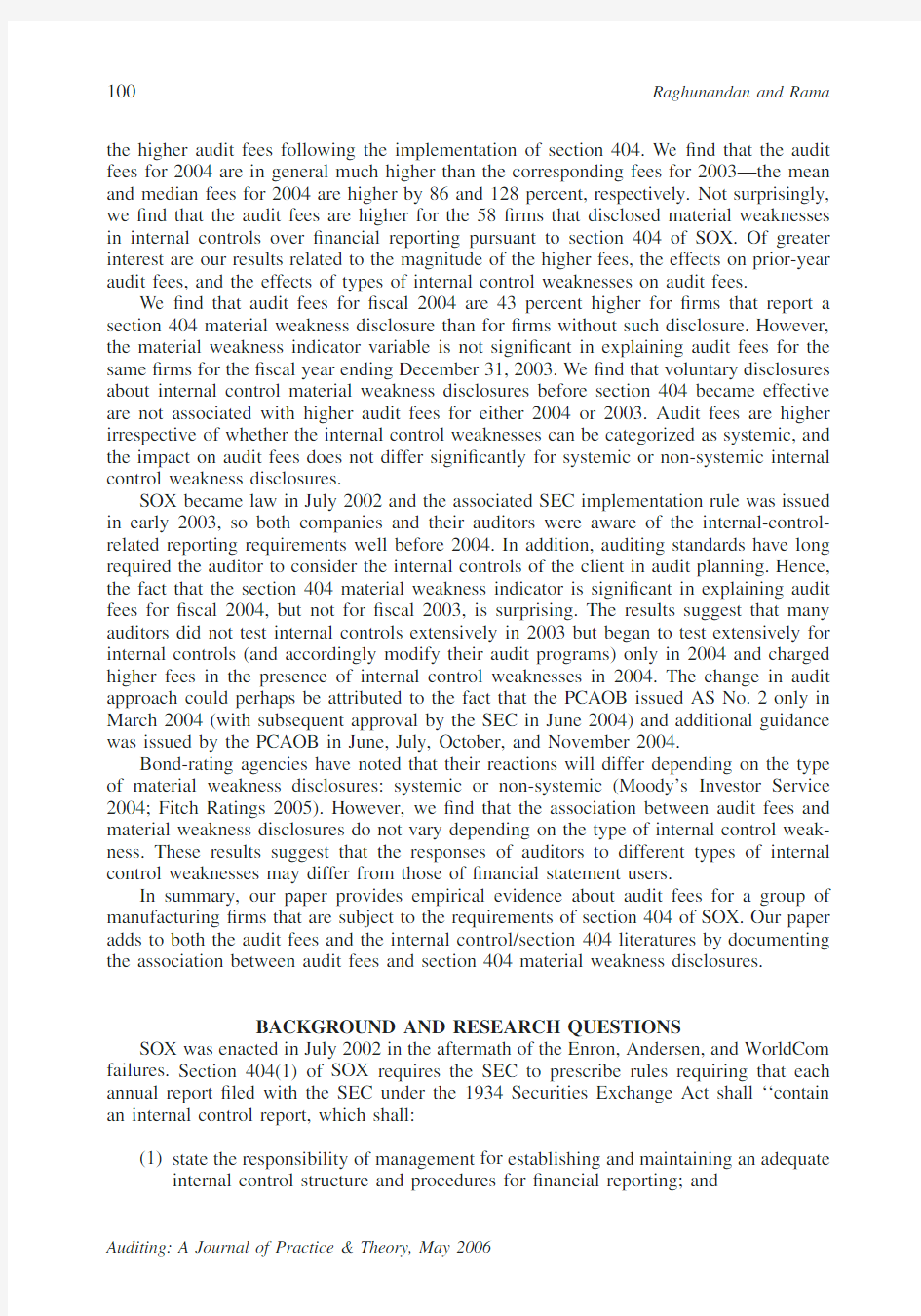

Table 2presents the correlation matrix for the independent variables.The highest cor-

relation is only .48,suggesting that multicollinearity is not likely to be a problem.This is

con?rmed later by VIF scores from our regression,none of which exceeds 1.6.6

Table 3presents details about the mean and median audit fees for 2003and 2004,when

we partition the sample by size quartiles (based on 2004total assets).A comparison of the

?rst two rows of the table show that in every quartile there is a signi?cant increase in

average audit fees from 2003to 2004,ranging from an increase of 136percent in the

second quartile to an increase of 79percent in the fourth quartile.Parametric and nonpar-

ametric tests indicate that the fee increases in the overall sample,as well as in each of the

6VIF scores less than 10indicate that inferences are not confounded by multicollinearity problems (Kennedy 2003).

106Raghunandan

and

Rama

Auditing:

A

Journal of Practice &Theory,May 2006TABLE 2

Pearson Correlations for 2004(2003)

Variable RECINV FORGN SQSEG LIQ DA ROA GC BIG4MW MWSYS MWOTH

LNTA 0.11**(0.14**)0.31**(0.35**)0.47**(0.46**)?0.40**(?0.40**)0.40**(0.48**)0.42**(0.40**)?0.05(?0.02)0.20**(0.20**)?0.01(?0.00)0.01(0.02)?0.02(?0.03)RECINV 0.23**(0.26**)0.25**(0.20**)?0.34**(?0.42**)0.06(0.15**)0.37**(0.45**)?0.08*(0.00)?0.05(?0.07)0.12**(0.13**)0.07(0.06)0.10*(0.13**)

FORGN 0.24**(0.28**)?0.24**(?0.28**)0.07(0.13**)0.25**(0.22**)?0.14**(?0.09*)0.11**(0.11**)0.07(0.10*)0.03(0.07)0.06(0.06)

SQSEG ?0.38**(?0.32**)0.31**(0.30**)0.29**(0.22**)?0.01(?0.09*)0.05(0.07)0.06(0.06)0.05(0.05)0.02(0.04)

LIQ ?0.44**(?0.45**)?0.19**(?0.26**)?0.04(?0.06)?0.07(?0.06)?0.05(?0.05)?0.04(?0.04)?0.03(?0.03)DA ?0.05(0.09*)0.24**(0.21**)0.12**(0.08*)0.05(0.05)0.05(0.07)0.01(?0.01)ROA ?0.18**(?0.04)0.04(0.04)?0.01(0.01)0.03(0.03)?0.05(0.02)GC 0.03(?0.01)?0.05(0.02)?0.04(0.04)?0.03(?0.03)BIG4?0.03(?0.03)0.03(0.02)?0.08*(?0.08*)**,*Indicate p ?.01and p ?.05,respectively.The variables are de?ned as in Table 1.

SOX Section 404Material Weakness Disclosures and Audit Fees 107

Auditing:A Journal of Practice &Theory,May 2006TABLE 3

2004Audit Fees Compared with 2003Audit Fees and Predicted Fees

Full Sample

Client Size Quartile 1234Mean (Median)FY 2003Fees ($)

1,659,692(532,000)243,346(195,100)384,272(317,830)1,030,373(877,500)4,651,869(2,959,000)Mean (Median)FY 2004Fees ($)

3,082,660(1,212,280)515,414(416,950)906,360(758,000)2,117,903(1,891,330)8,329,858(5,877,500)Mean (Median)of Ratio of 2004Fees to 2003Fees

2.35(2.08) 2.41(2.11) 2.58(2.31) 2.32(2.13) 2.09(1.88)Mean (Median)of Ratio of Actual to Predicted Fees (using 2003fee model) 2.25(2.02) 2.54(2.42) 2.01(1.82) 2.16(1.97) 2.21(2.02)four size-based quartiles,are signi?cant (p ?.01in each instance).The third row of the table shows that in each size quartile the means of the ratios of 2004fees to 2003fees are more than 2.0.The fourth row of the table indicates the means and medians of the ratio of actual 2004fees to the predicted fees for 2004using the 2003audit fee model (discussed in the next paragraph);the results show that for each quartile the ratio is more than 1.8.Finally,analyses of the fees for the two years indicate that audit fees for ?scal 2004are higher than the audit fees for ?scal 2003for 641of the 660?rms in our sample.Overall,the data suggest that the fee increases are not being driven by ?rms of any particular size.

Table 4presents the results from two regressions—one each for ?scal 2004and 2003fees.Both regressions are highly signi?cant,and the explanatory powers of both regressions are fairly high and quite similar (the adjusted R 2s are .82and .81for the 2004and 2003regressions,respectively).The variable of interest,MW ,is positive and signi?cant in the 2004regression but not signi?cant in the 2003regression,indicating that the presence of a section 404material weakness disclosure is associated with higher audit fees in 2004but not in 2003.The coef?cient for MW in the regression is 0.360,so the effect of having a material weakness in internal control corresponds to a 43percent increase in audit fees.7

The results show the signi?cance and magnitude of ?ve of the coef?cients (LNTA ,FORGN ,LIQ ,ROA ,BIG4)are quite similar across the two periods;t-tests indicate that we cannot reject the null hypothesis of no difference in the magnitude of the coef?cients of these ?ve variables in the two regressions.However,the pattern of results with respect to the other coef?cients is quite interesting.

While RECINV is positive and signi?cant in both regressions,a t-test indicates that the magnitude of the coef?cient is higher (p ?.10)in 2004than in 2003;as noted earlier,receivables and inventory are two areas that are most prone to errors and misstatements.It is reasonable to expect that receivables and inventory will have more complex internal control procedures,thus leading to greater section 404speci?c audit fees.SQSEG is positive and signi?cant in the 2004regression,but not in the 2003regression.Firms with more business segments require more/more complex internal controls.Intuitively,the greater the number of different business segments,the more work the auditor must perform in assessing internal controls resulting in higher fees.

7The dependent variable is natural log of audit fees,so the impact of a change in MW from 0to 1is given by e 0.36(?1.43).

108

Raghunandan and Rama

Auditing:A Journal of Practice &Theory,May 2006TABLE 4

Regression Results Model:LAFEE ?b 0?b 1*LNTA ?b 2*RECINV ?b 3*FORGN ?b 4*SQSEG ?b 5*LIQ

?b 6*DA ?b 7*ROA ?b 8*GC ?b 9*BIG4?b 10*MW

Variable

20042003Intercept

2.989(.00) 1.836(.00)LNTA

0.502(.00)0.539(.00)RECINV

0.598(.00)0.411(.02)FORGN

0.206(.00)0.183(.00)SQSEG

0.168(.00)0.020(.67)LIQ

?0.017(.01)?0.019(.00)DA

0.054(.53)0.191(.04)ROA

?0.440(.00)?0.440(.00)GC

0.301(.03)0.071(.63)BIG4

0.444(.00)0.416(.00)MW 0.360(.00)0.088(.27)F ?293.6;p ?.001Adj.R 2?.82F ?277.0;p ?.001Adj.R 2?.81

p-values are in https://www.360docs.net/doc/f218376609.html,FEE ?natural log of audit fees.Other variables are as de?ned in Table 1.

The GC variable is signi?cant in 2004but not in 2003.Firms in ?nancial distress may be more likely to cut back on control-related activities that may be viewed as discretionary spending items (Carcello et al.2005);hence,auditors may need to perform additional work in ?rms with a going-concern uncertainty.8However,DA is signi?cant in 2003but not in 2004;this suggests that cost drivers of audit fees could have shifted post-SOX-404.That is,leverage may affect auditors’work less than in previous years,consistent with auditors performing a more exhaustive audit in the post-SOX-404period as opposed to an audit tailored to business speci?c risks.

Overall,the results on the control variables reveal changes in the audit market and in the way auditors perform their work.Apart from the presence of a material weakness itself,factors that may be associated with the presence of a material weakness also lead to higher 8An alternative explanation is that perhaps auditors require larger risk premiums now for distressed ?rms.How-ever,it is unlikely that such an increase is caused essentially by section 404.

SOX Section 404Material Weakness Disclosures and Audit Fees 109Auditing:A Journal of Practice &Theory,May 2006

audit fees.9However,additional research work is required before de?nitive conclusions can be drawn about the impact of section 404on the audit process.The results do suggest possible opportunities for future research (e.g.,evaluate the impact of section 404in other industries as well as differences across industries,longer time periods,etc.).

Additional Analyses:Types of Material Weaknesses

Bond-rating agencies have noted that their responses to section 404disclosures will vary depending on the type of material weakness.For example,Fitch Ratings (2005)clas-si?es some internal control weakness disclosures as pervasive/systemic control weaknesses and notes that:

Certain material weaknesses might constitute pervasive risks,such as problems with ‘‘tone at the top’’or the quality of personnel in charge of the ?nancial reporting functions...Ratings for companies not previously identi?ed as having such pervasive weaknesses by Fitch will need to be looked at carefully,and negative action is likely ...Material weaknesses in internal controls can also occur at the transaction level,potentially affecting information such as speci?c account balances.However,auditors usually can perform tests fairly easily to ensure that account balances are fairly stated and disclosures are adequate.

Similarly,Moody’s Investors Service (2004)states that material weakness disclosures will be classi?ed as Type A or Type B—analogous to the account/transaction or systemic weakness categories of Fitch—and that their impact on bond ratings will be different,with adverse consequences more likely for Type B internal control weaknesses.

As seen in Table 5,37of the 58?rms with section 404material weakness disclosures disclose problems that are systemic in nature.For example,27of the ?rms note problems with the quality and/or training of accounting personnel,while 21?rms disclose prob-lems with the reconciliation of accounts and ?nancial statement preparation.

We examine the association between audit fees and the type of material weakness by replacing the MW variable with two indicator variables:MWSYS and MWOTH .MWSYS takes a value of 1if the issuer reported a systemic problem,and 0otherwise,while MWOTH takes the value of 1if there is a material weakness that is not systemic,and 0otherwise.10We include MWSYS and MWOTH in the regression (but drop the MW variable).Panel B of Table 5presents the results from such regressions.11Both MWSYS and MWOTH are signi?cant for ?scal 2004fees but not for ?scal 2003fees.Tests indicate that the differences in magnitude between the two coef?cients are not statistically signi?cant in either regres-sion.Thus,the results indicate that audit fees are higher for issuers that disclose a section 404internal control weakness disclosure,irrespective of the type of material weakness disclosure.

Additional Analyses:Voluntary Disclosures in 2004

Section 302of SOX deals with another type of disclosures related to controls within an entity:disclosure controls.There is signi?cant overlap between disclosure controls and internal controls over ?nancial reporting (SEC 2003).However,there are many differences 9

t-tests indicate that the coef?cients of SQSEG ,DA ,and GC are signi?cantly different (p ?.05)in the 2004and 2003regressions;the change in the coef?cient of RECINV is signi?cant at p ?.10.10

Thus,by construction,every instance of a systemic problem implies the presence of problems related to trans-actions—but not vice-versa.11For the sake of brevity,we do not report the coef?cients of the other variables in the table since all of the coef?cients are quite similar to those reported earlier in Table 4.

110

Raghunandan and Rama Auditing:A Journal of Practice &Theory,May 2006TABLE 5

Types of Material Weaknesses and Audit Fees

Panel A:Types of Section 404Internal Control Weaknesses Disclosed

Problems in speci?c types of transactions or accounts only:

21Systemic or Broad Weaknesses:Quality and training of accounting personnel 27Segregation of duties 9Reconciliation of accounts,?nancial statement preparation 21Information Systems related problems 7Quality of internal audit and/or audit committee 2Total ?rms with systemic or broad weaknesses

37a

Panel B:Association between Types of Weaknesses and Audit Fees Model:LAFEE ?b 0?b 1*LNTA ?b 2*RECINV ?b 3*FORGN ?b 4*SQSEG ?b 5*LIQ

?b 6*DA ?b 7*ROA ?b 8*GC ?b 9*BIG4?b 10*MWSYS

?b 11*MWOTH

Variable

20042003Other control variables

Omitted from table Omitted from table MWSYS

.389(.00).113(.22)MWOTH .344(.00)

.117(.35)F ?267.2;p ?.001Adj.R 2?.82F ?251.9;p ?.001Adj.R 2?.81

p-values are in parentheses.

a Many ?rms had more than one of the above problems,so the numbers do not add to 37.

Variables De?nitions:MWSYS ?1if ?rm disclosed systemic material weakness in internal control,else 0;and MWOTH ?1if ?rm disclosed non-systemic material weakness in internal control,else 0.

Other variables are as de?ned as in Tables 1and 3.For the sake of brevity,we do not report the coef?cients for the control variables.The coef?cients for all of the control variables in the two regressions are substantively similar to (magnitude within 5percent of,and not signi?cantly different from)the coef?cients reported in Table 2.

between disclosures under sections 302and 404.One of the differences is that auditor association with section 302disclosures is only indirect,in contrast to the direct assessment and reporting requirements under section 404.Section 302of SOX became effective on August 29,2002,while section 404of SOX became effective for ?scal year-ends after November 15,2004.An industry newsletter (ComplianceWeek )notes that some ?rms vol-untarily disclosed problems in internal control over ?nancial reporting in 2004while making section 302disclosures,before the implementation date for section 404.It is possible that audit fees are also higher for ?rms that voluntarily disclosed internal control problems prior to the required implementation date for section 404.

We obtained the list of voluntary internal control weakness disclosures made by ?rms in 2004prior to the required 404disclosures from ComplianceWeek and checked if any of the 660?rms in our sample had made prior section 302disclosures about internal control

SOX Section 404Material Weakness Disclosures and Audit Fees 111Auditing:A Journal of Practice &Theory,May 2006

weaknesses in SEC ?lings.12Nine ?rms in our sample voluntarily disclosed a material weakness in internal control during 2004,but only seven of these ?rms later also disclosed a weakness under section 404;an additional 21?rms in our sample voluntarily disclosed internal control weaknesses earlier in 2004without using the term ‘‘material weakness’’and six of these ?rms subsequently reported a material weakness under section 404.13We included a dummy variable in our regression model to capture the effects of voluntary reporting of internal control weaknesses prior to the implementation date of section 404.VOLMW equals 1if the ?rm voluntarily disclosed a weakness in internal controls in 2004,and 0otherwise.Since we want to distinguish ?rms that voluntarily disclosed a material weakness from those that only disclosed under section 404,we include both MW and VOLMW in the regression.VOLMW is not signi?cant in the fee regressions for either 2004or 2003,and the signi?cance of the other variables remains substantively similar to those reported in Table 4.

Additional Analysis:Nonaudit Fees

Given the ready availability of nonaudit fees,and the recent surge in interest related to various nonaudit-fee-related issues,we also examined the nonaudit fees and the nonaudit fee ratio (nonaudit fees as a proportion of audit fees)for the sample ?rms in 2003and in 2004.We ?nd that the nonaudit fee ratio does not differ,either in 2003or in 2004,for ?rms with and without a material weakness disclosure.14

Sensitivity Tests

We perform the following size-related tests.First,we partition the sample into two groups based on total assets (below or above median)and perform separate regressions on the two samples.Our results related to the variable of interest,MW ,hold in both samples.Second,we delete outlier observations that were more than two standard deviations away from the mean.Third,for the continuous variables we use the values at the 1st and 99th percentiles to winsorize the sample.In each instance,our results remain qualitatively similar to those presented in the paper.

Our sample includes 32?rms audited by non-Big 4?rms.We delete these 32?rms,and thus restrict the sample to clients of the Big 4?rms.The results with the subsample of Big 4clients are similar to those reported in the paper.In addition,to check if clients of any particular Big 4?rm were driving the results we add three dummy variables in the regression;the coef?cient for PricewaterhouseCoopers is positive and signi?cant indicating the presence of a PWC fee premium,but the inferences related to the other variables remain unchanged.

SUMMARY AND CONCLUSIONS

Section 404of the Sarbanes-Oxley Act has arguably been the most controversial ele-ment of SOX.There have been numerous complaints about the high costs associated with that part of SOX,and ‘‘much of the debate regarding the high costs of 404implementation 12

Thus,we assume that none of the other ?rms in our sample had disclosed an internal control weakness under section 302in quarterly ?lings with the SEC.As a test,we examined a random sample of 20?rms that did not appear in the ComplianceWeek list for each quarter in 2004and found that none of them had made any internal control weakness disclosures.13

Some of these ?rms used terms such as ‘‘signi?cant de?ciency’’(used in AS No.2)or ‘‘reportable condition’’(used in prior AICPA standards.)14However,the average nonaudit fee ratio (nonaudit fees/audit fees)declines from 0.65in 2003to 0.31in 2004.While the average audit fee increases from $1.66million in 2003to $3.08million in 2004,the average nonaudit fee declines from $1.26million in 2003to $1.12million in 2004.

112Raghunandan and Rama seems to be centered on audit fees’’(Ernst&Young2005).In this paper,we examine the association between section404disclosures and audit fees.Our sample includes660man-ufacturing?rms with a December31,2004?scal year-end that had?led their section404 reports by May15,2005.

We?nd that the mean(median)audit fees for?scal2004is86(128)percent higher than the corresponding audit fees for?scal2003;while the fact that the fees are higher is itself not surprising,the magnitude of the increase in fees gives some empirical evidence about the changed audit environment in2004compared to2003.

Results from our regression model indicate that the audit fee for?scal2004for?rms disclosing a material weakness in internal control over?nancial reporting is43percent higher than for?rms without such a disclosure.However,we?nd that the audit fees for ?scal2003are not associated with the presence of a material weakness disclosure(in the 10-K?led following?scal2004).Auditing standards have long required auditors to evaluate the client’s internal controls(unless the auditor decided not to rely on internal controls), so the result related to2003fees is initially surprising.Unless the material weaknesses developed only in2004,the evidence suggests that auditors(1)were not testing internal controls extensively in2003and therefore did not charge higher fees in the presence of internal control weaknesses in2003,but(2)began to test extensively for internal controls (and accordingly modify their audit programs)only in2004and charged higher fees in the presence of internal control weaknesses in2004.An alternative,but not mutually exclusive, explanation is that some companies and their auditors may not have started their section 404work until2004,but once the auditor and/or client identi?ed a material weakness the audit fees went up drastically.Of course,detailed guidance from the PCAOB relating to section404audits was available only in March2004,with additional guidance provided throughout the year.Hence,it is reasonable that audit programs were adjusted during2004, resulting in higher fees for?scal2004,particularly in the presence of a material weakness in internal control over?nancial reporting.

Some?rms have voluntarily disclosed weaknesses in internal control in other?lings with the SEC during2004,before the required implementation date of section404.We ?nd that such voluntary disclosure is not associated with higher audit fees in either?scal 2004or?scal2003;however,our inferences must be viewed with caution given the small sample of?rms with such voluntary disclosures.

Bond-rating agencies have stated that user perceptions about internal control weakness disclosures will vary depending on the type of internal control weakness,with disclosures about systemic or pervasive weaknesses leading to more adverse consequences than dis-closures of problems that are account-or transaction-speci?c.However,we?nd that the association between audit fees and internal control disclosures does not vary depending on the type of material weakness.While this may appear to contradict the views expressed by bond-rating agencies about the differences in risks associated with the two types of disclo-sures,it could simply re?ect the fact that auditors may increase the level of substantive testing in the presence of either type of internal control problem—at least in the initial year of identifying a material weakness.

The results also suggest many interesting avenues for future research.How do users react to the disclosure of material weaknesses?For example,is the cost of capital higher Auditing:A Journal of Practice&Theory,May2006

SOX Section 404Material Weakness Disclosures and Audit Fees 113Auditing:A Journal of Practice &Theory,May 2006

for ?rms disclosing a material weakness in internal control?15Another issue for future research is to examine if auditors’reactions vary depending on the type of internal control weakness.For example,are auditors more likely to resign from engagements in the presence of systemic or pervasive internal control problems?Auditors may have been reluctant to resign from engagements in 2004after a material weakness determination,and thus add to the clients’problems in a year of signi?cant change,but may be more likely to resign once the initial-year work associated with section 404is over.Another interesting issue is to examine the pattern of audit fees for clients disclosing different types of internal control weaknesses.The Big 4have noted in submissions to the SEC that they expect audit fees to be lower in future years,given the learning-curve effect related to section 404work (e.g.,PricewaterhouseCoopers 2005;EY 2005).However,the pattern of reductions in audit fees may vary depending on (1)the existence of a material weakness,and (2)the type of material weakness.These are empirical questions for future research.

REFERENCES

American Bankers’Association (ABA)https://www.360docs.net/doc/f218376609.html,ments submitted to the SEC Roundtable on Im-

plementation of Internal Control Reporting Provisions.Washington,D.C.:SEC.Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/soxcomp-brunner.pdf.

American Electronics Association (AEA).2005.Sarbanes-Oxley Section 404:The ‘‘Section’’of Un-

intended Consequences and Its Impact on Small Business .Washington,D.C.:AEA.

Asare,S.,and R.Davidson.1995.Expectation of errors in unaudited book values:The effect of

control procedures and ?nancial condition.Auditing:A Journal of Practice &Theory 14(Spring):1–18.

Carcello,J.,D.Hermanson,and K.Raghunandan.2005.Factors associated with U.S.public com-

panies’investment in internal auditing.Accounting Horizons (June):65–80.

Casterella,J.R.,J.R.Francis,B.L.Lewis,and P.L.Walker.2004.Auditor industry specialization,

client bargaining power,and audit pricing.Auditing:A Journal of Practice &Theory (Spring):123–140.

Charles River Associates (CRA).2005.Sarbanes-Oxley Section 404Costs and Remediation of De?-

ciencies.Washington, D.C.:Charles River Associates.Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/soxcomp-all-attach.pdf.

Deloitte &Touche.2005.Feedback on experiences with the implementation of the auditing and

reporting requirements of Section 404of the Sarbanes-Oxley Act of 2002.Available at https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/soxcomp-koch.pdf.

Donadson,W.2005.Testimony:Concerning the Impact of the Sarbanes-Oxley Act .U.S.House of

Representatives,Committee on Financial Services.Washington,D.C.:Government Printing Of?ce.

Ernst &https://www.360docs.net/doc/f218376609.html,ments submitted to the SEC’s Roundtable on Implementation of Internal

Control Reporting Provisions.Implementation of Sarbanes-Oxley Internal Controls Provisions .Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/soxcomp-turley.pdf.

Financial Executives Institute (FEI)https://www.360docs.net/doc/f218376609.html,ments of the Committee on Corporate Reporting.

Submitted to the SEC Roundtable on Implementation of Internal Control Reporting Provisions.15If auditors provide an unquali?ed opinion in their report on the ?nancial statements,regardless of the presence of a material weakness,there may be no reason for users to assess the quality of the ?nancial information any differently and thus react differently.On the other hand,if users discount the value of a ?rm more severely following the disclosure of systematic material weaknesses,then this could be driven by factors other than ?nancial information quality.One implication of the above argument is that research examining differences in user reactions to the presence of material weaknesses (or different types of weakness disclosures)may need to control for other factors,such as those related to business risk.

114Raghunandan and Rama Washington,D.C.:SEC.Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/soxcomp-brod.

pdf.

Fitch Ratings.2005.Fitch’s Approach to Evaluating Management and Auditor Assessments of Internal Control.New York,NY:Fitch.

Francis,J.R.,and D.Wang.2005.Impact of the SEC’s public fee disclosure requirement on subse-quent period fees and implications for market ef?ciency.Auditing:A Journal of Practice& Theory(Supplement):145–160.

Kennedy,P.2003.A Guide to Econometrics.5th Edition.Malden,MA:Blackwell Publishing. Kreutzfeld,R.,and W.Wallace.1986.Error characteristics of audit populations:Their pro?le and relationships to environmental factors.Auditing:A Journal of Practice&Theory6(Fall):20–

43.

Microsoft,https://www.360docs.net/doc/f218376609.html,ments submitted to the SEC Roundtable on Implementation of Internal Control Reporting Provisions.Washington,D.C.:SEC.Available at:https://www.360docs.net/doc/f218376609.html,/news/ press/4-497/microsoft033105.pdf.

Moody’s Investors Service.2004.Special Comment:Section404Reports on Internal Control.New York,NY:Moody’s Investors Service.

Powell,S.S.2005.Costs of Sarbanes-Oxley are out of control.Letters to the Editor.Wall Street Journal(March21):A-17.

https://www.360docs.net/doc/f218376609.html,ments submitted to the SEC’s Roundtable on Implementation of Internal Control Reporting Provisions.Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp/ soxcomp-stauffer.pdf.

Public Company Accounting Oversight Board(PCAOB).2004.An Audit of Internal Control Over Financial Reporting Performed in Conjunction with An Audit of Financial Statements.Auditing Standard No.2.Washington,D.C.:PCAOB.

Securities and Exchange Commission(SEC).2003.Final Rule:Management’s Reports on Internal Control Over Financial Reporting and Certi?cation of Disclosure in Exchange Act Periodic Reports.Release Nos.33-8238,34-47986.Washington,D.C.:SEC.

———.2005a.Press Release:SEC Chairman Donaldson Announces Members of Advisory Committee on Smaller Public Companies.Washington,D.C.:SEC.

———.2005b.Spotlight On:Implementation of Internal Control Reporting Provisions.Washington,

D.C.:SEC.Available at:https://www.360docs.net/doc/f218376609.html,/spotlight/soxcomp.htm.

Simunic,D.1980.The pricing of audit services:Theory and evidence.Journal of Accounting Research 18(1):161–190.

U.S.House of Representatives.2002.The Sarbanes-Oxley Act of2002.Public Law107-204[H.R.

3763].Washington,D.C.:Government Printing Of?ce.

———.2005.The Impact of the Sarbanes-Oxley Act.Hearing before the Committee on Financial Services.April21.Washington,D.C.:Government Printing Of?ce.

U.S.Senate.2004.Examining the Impact of the Sarbanes-Oxley Act.Hearings before the Senate Banking Committee.September9.Washington,D.C.:Government Printing Of?ce. Whisenant,S.,S.Sankaraguruswamy,and K.Raghunandan.2003.Joint determination of audit and non-audit fees.Journal of Accounting Research(September):721–744.

Wilfert,G.E.2005.The?rst wave of section404reporting.Orange County Business Journal28

(6):4.

Auditing:A Journal of Practice&Theory,May2006

房地产公司年度目标分解指标

房地产公司年度目标分解指标 房地产公司二○XX年度目标分解指标 管理目标: 1、顾客综合服务满意度为87%以上; 2、顾客投诉落实率为100%; 3、服务项目检查合格率为93%以上; 4、控制重大危险源,无重大火灾、重大治安事件发生; 5、改善办公环境,提高全员健康水平,职业病发生率为零; 6、预防和控制环境污染事件,污染物排放达到国家或地区控制标准。 办公室: 1、文件收发建档及时准确率100%; 2、记录归档及时率100%; 3、办公设备使用完好率95%以上,保证业务正常开展; 4、低值易耗品管理无差错,使用完好率90%; 5、合同管理完善,档案规范,审核、建档及时率100%; 6、在合格供方处采购; 7、按时组织内审和管理评审; 8、体系运行、目标监督考核及时,符合相关规定; 9、根据岗位需求及人力资源现状科学合理地进行人员配置和制定用工计划,通过岗位现效管理对人员进行综合考评; 10、特殊岗位人员培训合格持证上岗率100%; 11、培训计划编写切合实际,落实实施率95%以上; 12、公平、公正、公开组织岗位绩效评估。

工程部: 1、设备台账与实物相符,准确率100%; 2、设备完好率≥90%,大修兑现率100%; 3、房屋及附属设施台账完整,地点标示准确率100%; 4、特种设备、防护器材、仪器仪表定期检验落实率100%; 5、能源耗用控制100%; 6、修缮服务检查合格率95%; 7、工期控制保证计划完成工程任务; 8、工程造价控制在合理范围内; 9、招投标合同的编写、招投过程、合同管理规范; 10、项目手续办理及时,图纸设计规范; 11、工程售后维修服务及时率100%; 12、技术资料档案管理规范,审核、建档及时率100%。 市场部: 1、房屋资产统计建档及时准确率100%; 2、房屋销售、出租率95%以上,房款、租金回收及时准确率100%; 3、协调与代理公司关系,保证销售计划的实现; 4、销售现场控制有效; 5、做好宣传工作,维护并提升公司形象。 计财部: 1、持证上岗率100%; 2、财务收支无差错率100%;

财务岗位操作流程-内部审计岗工作流程

十、内部审计岗工作流程 5、每月18前编制出调节表,并按调节表挂账情况催促相应会计岗清理挂账。 (一)资产审计 1、货币资金审计 (1)审计目标 证实货币资金余额的存在性、完整性、收付业务的合法性 (2)内部控制系统测试 调查了解货币资金内部控制系统——→查验签发支票登记簿与签发支票存根——→抽验资金收付款凭证——→核实收入货币资金收款收据——→检查日记账,抽查银行存款调节表与库存现金盘点表——→检查不相容职务划分情况——→检查货币资金收付凭证管理——→评价货币资金内部控制系统。 (3)实质性审查 ①库存现金审查 首先出纳员将现金全部放入保险柜暂作封存,要求出纳员将全部凭证入账,结出当日现金日记账余额,填写“现金出纳报告书”。在会计主管人员和内审人员在场的情况下清点现金,并作记录。填制“库存现金清点表”,该表由出纳员、会计人员共同签字,作为审计工作底稿。库存现金清点表应反映实际库存现金清点数,当日现金日记账结余数,账实是否相符。即有无溢缺。 ②现金收付业务的审查 抽查现金日记账记录,至少抽查1至2个月的现金日记账,审查原始凭证。 ③银行存款的审查 审核银行存款日记账记录,核证银行存款收支的截止日期,抽查银行存款的账面余额。 2、存货审计 (1)审计目标 证实存货的存在性、完整性、所有权归属、计价的正确性、采购与销售的合法性、分类的正确性 (2)内部控制系统测试 调查了解企业存货内部控制系统——→抽查部分采购业务文件,追踪其业务系统——→抽查部分存货出库业务,追踪其业务处理系统——→审查存货管理制度——→抽查盘点记录——→评价存货内部控制系统(3)实质性审查 ①材料的审查 材料采购的审查:审查订货合同——→审查材料的验收入库情况——→审查材料采购成本,查看采购成本的

常见蛋白质分子量参考值

常见蛋白质分子量参考值(单位:dalton) 蛋白质分子量 肌球蛋白[myosin] 甲状腺球蛋白[thyroglobulin] β-半乳糖苷酶[β-galactosidase] 副肌球蛋白[paramyosin] 磷酸化酶a[phosphorylase a] 血清白蛋白[serum albumin] L-氨基酸氧化酶[L-amino acid oxidase] 地氧化氢酶[catalase] 丙酮酸激活酶[pyruvate kinase] 谷氨酸脱氢酶[glutamate dehydrogenase] 亮氨酸氨肽酶[glutamae dehydrogenase] γ-球蛋白,H链[γ-globulin, H chain] 延胡索酸酶(反丁烯二酸酶)[fumarase] 卵白蛋白[ovalbumin] 醇脱氢酶(肝)[alcohol dehydrogenase (liver)]烯醇酶[enolase] 醛缩酶[aldolase] 肌酸激酶[creatine kinase]220,000 165,000 130,000 100,000 94,000 68,000 63,000 60,000 57,000 53,000 53,000 50,000 49,000 43,000 41,000 41,000 40,000 40,000

胃蛋白酶原[pepsinogen] D-氨基酸氧化酶[D-amino acid oxidase] 醇脱氢酶(酵母)[alcohol dehydrogenase (yeast)] 甘油醛磷酸脱氢酶[dlyceraldehyde phosphate dehydrogenase] 原肌球蛋白[tropomyosin] 乳酸脱氢酶[lactate dehydrgenase] 胃蛋白酶[pepsin] 转磷酸核糖基酶[phosphoribosyl transferase] 天冬氨酸氨甲酰转移酶,C链[aspertate transcarbamylase, C chain] 羧肽酶A[carboxypeptidase A] 碳酸酐酶[carbonic anhydrase] 枯草杆菌蛋白酶[subtilisin] γ-球蛋白,L链γ-blobulin,L chain[] 糜蛋白酶原(胰凝乳蛋白酶原)[chymotrypsinogen 胰蛋白酶[trypsin] 木瓜蛋白酶(羧甲基)[papain (carboxymethyl)] β-乳球蛋白[β-lactoglobulin] 烟草花叶病毒外壳蛋白(TWV外壳蛋白)[TWV coat protein 肌红蛋白[myoglobin] 天门冬氨酸氨甲酰转移酶,R链[aspartate transcarbamylase, R chain] 血红蛋白[h(a)emoglobin]40,000 37,000 37,000 36,000 36,000 36,000 35,000 35,000 34,000 34,000 29,000 27,600 23,500 25,700 23,300 23,000 18,400 17,500 17,200 17,000

房地产工作计划与目标

房地产工作计划与目标 篇一:房地产销售经理年度工作计划 篇一:房地产销售经理工作总结及工作计划 在不知不觉中,XX年已经过了一半,加入公司的时间拼拼凑凑也有不少的时间了。在这段时间里,从一名置业顾问一步步晋升为销售经理,我不断的学习的知识并积累了很多的经验,也同时锻炼和提高了业务能力,这让自己的人生多了一份激动,一份喜悦,一份悲伤,最重要的增加了一份人生的阅历。可以说在九阳的这段时间中,收货颇多,感触颇多。在这里,非常感谢公司的每一位领导和同仁的帮助和指导,现在已能独立完成本职工作,现对目前的工作做以下总结。 一、任务完成 今年实际完成销售认购签约回款佣金的情况和竞争对手易居的对比的情况。 二、团队管理方面 1、招聘面试方面 自己在招聘面试的时候缺少精心的设计和安排,有时候自己也不加重视,总是奔着你情我愿的想法,没有必要跟着面试者讲太多,正是因为自己的不重视应聘这个环节从而导致一部分优秀人员的流失,也给人事部部门增添了不少麻烦。

2、团队培训工作 没有计划的培训,培训目的的不明确,培训前没有系统的准备 对团队的打造目标不够明确比较笼统,培训的计划做的也比较笼统,因此在培训工作开展时想到什么就培训什么,感觉团队缺少什么就培训什么,有的时候很少培训,有的时候天天都在培训也达不到预期的效果。不但增加了置业顾问的负担更影响大家的心情。 对于培训没有一个长期统筹安排和布置,自己也没有提前做好充足的准备工作。自己不但没有得到锻炼,更使整个团队褒足不前。也没有研究过老的置业顾问和新人进行区别培训,导致新人学习难度增大,老的置业顾问也感觉付出了时间却得不到较好的效果。 3、监督、督促工作方面的 很多事情都是及时的安排下去,但是没有给予及时的督促和监督,导致安排下去的事情做的不理想甚至是基本上没有完成。例如置业顾问的约电约客问题,自己很少去督促和检查他们的来电来客,导致置业顾问在这方面的工作开展的不是很理想。有的置业顾问甚至很长时间对客户都不进行约访,损失了公司难得的客户资源。 4、及时总结学习方面的 当工作期间遇到一定难题的时候,自己很少去总结学习

内审部岗位职责

内部审计部门岗位职责 一、审计主管职责 1、根据公司整体战略规划,拟定并完善内部审计制度和流程,制定审计计划; 2、根据年度审计工作计划,组织进行公司各项审计; 3、拟定审计方案,起草审计报告和管理建议书等审计文书; 4、及时发现公司潜在问题和风险,提出改进意见; 5、出具内部审计报告,将审计结果上报公司领导; 6、检查公司财务及相关部门审计意见的执行情况; 7、负责审计过程中与相关部门的协调和沟通; 8、配合公司聘请的外部审计机构,全面负责公司内、外部财务审计工作; 9、跟踪监控公司的财产和资金使用情况、流程运行状况,分析资产报表,判断企业运行 效率,及时发现风险并提出改进建议; 10、熟练使用各种财务软件,各种办公软件; 二、审计专员职责 1、在部长领导下,按照国家审计法规、公司财会审计制度的有关规定,负责拟订公司具 体审计实施细则,在上级批准后组织执行。 监督公司各部门及下属单位对各项财经规章制度的执行。 2、控制、考核、纠正下属单位偏离公司整体财务目标计划的行为。 3、负责或会同其他部门查处公司内滥用职权、有章不循、违反财务制度、贪污挪用财物、 泄密、贿赂等行为和经济犯罪的情况。 4、协助政府审计部门和会计师事务所对公司的独立审计活动。 5、定期或不定期地进行必要的专项审计、专案审计和财务收支审计。 6、负责或参与对公司重大经营活动、重大项目、重大经济合同的审计活动。 7、负责对所有涉及的审计事项,编写内部审计报告,提出处理意见和建议。 8、负责做好有关审计资料的原始调查的收集、整理、建档工作,按规定保守秘密和保护 当事人合法权益。 9、完成总经理和财务部部长临时交办的其他任务。 三、审计助理职责 1、负责公司月度例行审计工作、对常规业务实施具体稽核,分析运营环节财务数据,跟 进及反馈异常事项的处理结果; 2、按照年度项目审计计划,开展以经济业务为主的内部控制制度审计、各运营环节的成 本管理审计等,寻求薄弱点,提出改善建议; 3、协助完成审计报告的撰写及发现问题的整改落实; 4、完成上级领导交办的其他事项。篇二:内审人员工作职责(修) 铜化集团内部审计人员岗位职责(修订稿) 一、审计部长岗位职责 1、审计部长主持审计部的全面工作,负责向领导请示和汇报工作,对领导负责,当好领 导的参谋和助手。 2、负责贯彻执行党和国家的有关方针、政策、制度和法规及公司的有关规定。 3、组织制定审计工作的中、长期规划和年度审计工作计划,并加以实施,定期组织有关 人员研究制定完成审计任务的措施和办法,指导和协调审计工作的开展,检查各项计划的执 行情况。 4、组织制定和修改审计工作规章制度并检查、督促制度的贯彻执行情况。 5、主持召开部务会议、传达、布置、学习、讨论、检查、总结审计工作,审议、决定审

房地产发展规划第三章 房地产集团的战略目标

第三章房地产集团战略规划 二、房地产集团的战略目标 1 战略指导思想 房地产集团战略指导思想:以投资最大化为指导,以进入行业500强为目标,以“一主两翼”型投资格局为导向,以全面提升企业核心竞争力为动力,推动房地产集团健康、快速、持续的发展。 房地产集团战略指导思想具备以下含义: 投资理念:投资价值最大化。房地产集团战略根本出发点是以投资价值最大化,从而实现股东利益最大化;在未来的产业选择及业务组合的战略制定中,必须以此作为基本原则。投资价值并不单指投资回报,企业发展必须考虑短期利益同长期利益的相结合,追求总体回报的最大化而非单一的财务收益最大化。 战略目标:中国房地产业500强。实现2016年收入70亿利润11亿的财务目标,进入500强不是企业的终极目的,而是为了激励企业发展,制定经营战略而设定的总目标。 业务架构:“一主两翼”型投资格局。随着集体一系列经营性资产的产生,业务定位进入到“房地产开发为主,汽车制造与现代传媒为并行”的“一主两翼”型格局。逐步实现房地产开发业务、资产经营业务、基础设施投资业务三个方面的业务组合,在分散风险的同时

建立持续发展能力。 工作重点:全面提升企业核心竞争力。通过5年时间,全面提升房地产集体在投资决策、项目策划、规划设计、工程管理、资本运作、人力资源方面的能力。形成高效、强有力的投资决策能力;产品研发能力、项目策划和项目管理能力等达到行业领先水平,形成初步完善的产品体系;具备高效的资本运作能力;形成行业优秀人力资源的高地。 2 集团未来三年的战略目标 房地产集团未来5年战略目标是:成为以房地产为核心主业的企业集团,进入中国房地产500强。 要实现如上的战略目标,结合房地产行业以及房地产集团的发展趋势保守估计,房地产业务在2016年应实现利润总额11亿元,收入约70亿元。进入500强不少企业终极目的,而是为了激励企业发展,制定经营战略而设定的总目标,它具有全局性、长远性、竞争性、纲领性四个特性。以500强为目标可以为房地产建立一个全方位的学习标杆,未来房地产集团要树立的7个学习目标为:备受尊敬的企业形象与地位、厚重的企业文化与价值观、卓越的领导人理念和人格、第一流的市场及财务业绩、企业核心竞争力的着力塑造、组织与管理的创新和控制与执行能力。

公司财务流程之内部审计岗工作流程

公司财务流程之内部审计岗工作流程 (一)资产审计 1、货币资金审计 (1)审计目标 证实货币资金余额的存在性、完整性、收付业务的合法性 (2)内部控制系统测试 调查了解货币资金内部控制系统——查验签发支票登记簿与签发支票存根——抽验资 金收付款凭证 ----- 核实收入货币资金收款收据-------- 检查日记账,抽查银行存款调节表与 库存现金盘点表 ----- 检查不相容职务划分情况 ------- 检查货币资金收付凭证管理------- > 评价货币资金内部控制系统。 (3)实质性审查 ①库存现金审查 首先出纳员将现金全部放入保险柜暂作封存,要求出纳员将全部凭证入账,结出当日现金日记账余额,填写“现金出纳报告书”。在会计主管人员和内审人员在场的情况下清点现金,并作记录。填制“库存现金清点表”,该表由出纳员、会计人员共同签字,作为审计工作底稿。库存现金清点表应反映实际库存现金清点数,当日现金日记账结余数,账实是否相符。即有无溢缺。②现金收付业务的审查 抽查现金日记账记录,至少抽查1 至2 个月的现金日记账,审查原始凭证。 ③银行存款的审查审核银行存款日记账记录,核证银行存款收支的截止日期,抽查银行存款的账面余额。

2、存货审计 (1)审计目标 证实存货的存在性、完整性、所有权归属、计价的正确性、采购与销售的合法性、分类的正确性(2)内部控制系统测试 调查了解企业存货内部控制系统——抽查部分采购业务文件,追踪其业务系统——部分存货出库业务,追踪其业务处理系统-------- 审查存货管理制度 ------ 抽查盘点记录 ---- 评价存货内部控制系统 (3)实质性审查 ①材料的审查 材料采购的审查:审查订货合同------- 审查材料的验收入库情况------- 审查材料采购成本,查看采购成本的构成项目是否正确,采购费用分配比例是否合理,采购成本是否合法、 采购成本的计算方法是否正确------- 审查在途材料------ 审查材料采购的账务处理 ②库存材料审查 盘点库存材料,时间安排在结账日或接近结账日 ③材料出库的审查 对生产领用材料应核实生产计划,核查发出材料的计价,揭露弄虚作假的行为 3、应收账款审计 (1)审计目标 ①证实应收款项的存在性、正确性、销售退回、折让与折扣的合法性、截止日期的正确性、 坏账损失的真实性 2)内部控制系统测试抽查 正确。

万科房地产目标成本管理

房地产目标成本管理 2010年07月11日 11:30 房地产目标成本管理 1. 目的 提高公司成本管理水平,建立先进合理的目标成本管理体系。 2. 范围 本实施细则适用于所属各地产公司。为所属各地产公司制订目标成本和实施目标成本管理提供相应依据和规范。 3. 职责 3.1 公司成本与计划管理委员会负责本实施细则的制订、修改、指导、解释与检查落实,公司财务管理部成本审算中心负责有关具体对接事宜。 3.2 所属各地产公司负责贯彻实施。 4. 方法与过程控制 4.1 目标成本释义 4.1.1 目标成本是公司基于市场状况,并结合公司的经营计划,根据预期售价和目标利润进行预先确定的,经过努力所要实现的成本指标。应体现公司“以经济合理性最大的成本提升产品的竞争力,并形成行业成本优势”的成本管理宗旨。 4.1.2 目标成本文件分为三个部分:《目标成本测算表》《目标成本控制责任书》《动态成本月评估》。 4.1.3 《目标成本测算表》是反应项目的总目标成本和分项目标成本的金额。建设项目的总目标成本是建设项目成本的控制线,由各分项目标成本组成。各分项目标成本包括各专业工程造价指标及各种费用指标。 4.1.4 《目标成本控制责任书》是对各项目费用的责任部门及其主要职责的说明,包括控制内容、控制要点和手段,需要注意的已完工程的失败教训。 4.1.5 《动态成本月评估报告》反映各成本项目的动态变化情况,分析原因,提出成本控制建议。 4.2 目标成本管理原则 4.2.1 市场导向原则:目标成本管理以市场为导向,确保目标利润的实现。4.2.2 准确严谨原则:目标成本指标应科学准确,每项来源都要有充分依据,保证目标成本的权威性。 4.2.3 事前控制原则:目标成本管理贯穿于建设项目的每一阶段,凡事做到事先控制为主,事中事后控制为辅,在立项、设计、施工之前发现问题,减少无效成本。 4.2.4 动态管理原则:建设项目的动态成本要及时与目标成本进行比较并纠偏,确保建设项目总成本在目标成本控制范围内。 4.3 目标成本科目的分类:详附件《目标成本科目分类》 4.4 目标成本文件制订的步骤及时间要求 4.4.1 项目定位阶段:在投资分析和概念设计阶段,根据可行性研究报告,以及营销、设计、成本、工程、财务等相关部门互动讨论确定的项目定位,完成“项目定位阶段的全成本测算”。确定各项费用的计划金额,包括设计、报建、环境配套、营销费等,并向各费用的负责部门交底达成一致,作为各部门的工作目标。主体建安费以设计部编制的《建设项目综合经济技术指标表》为依据,在五个工作日内完成,并根据测算基础,提出实施方案设计阶段的成本控制目标、措施或

内部审计工作计划表范文【三篇】

内部审计工作计划表范文【三篇】 【导语】内部审计之父索耶关于内部审计的定义是:对组织中各类业务和控制进行独立评价,以确定是否遵循公认的方针和程序,是否符合规定和标准,是否有效和经济的使用了资源,是否在实现组织目标。下面是WTT 为您整理的内部审计工作计划表范文【三篇】仅供大家参考。 医院内部审计工作计划 一、财政审计 1、本级财政预算执行审计(省定),医院审计工作计划。以促进加强财政预算管理,规范财政资金分配行为,逐步构建和完善公共财政制度为目标,组织市、县(市)、区审计机关对20xx 年度本级财政预算执行及其他财政财务收支情况进行审计,重点检查预算编制和执行、预算超收收入的分配使用、转移支付资金的管理使用、供电供水等附加的征收和使用情况,揭露和查处预算超收收入分配使用不合理不合规,转移支付资金管理使用混乱以及预算编制不科学、违反财经法纪和执行财政改革政策不严等问题。 6 月底结束。 2、乡镇负债审计(省定、全省大交叉)。以摸清乡镇债务情况,促进乡镇健康运行为目标,组织市、县(市)、区审计机关对乡镇负债情况进行清理审计,摸清乡镇负债的数量、种类及用途,揭示负债形成的原因,并有针对性地提出审计建议,为市委、市政府化解乡镇债务提供决策依据。 4 月底结束。 3、财政决算审计。以摸清财政运行管理现状,促进深化财政改革,提高财政运行质量为目标,对阳新县(省厅审计)、西塞山区(市定上年结转项目)20xx-20xx 年度财政决算进行审计。重点审计财政收支状况及运行质量,地方政府管理和运作本级财政,财税部门预算管理和理财治税情况,以及各项财政资金管理使用的合法、合规情况,揭露和查处财政收入质量不高、执行各项财政改革政策不到位、违反国家税收征管政策等问题。8 月底结束。 4、财政四项改革政策执行情况审计调查(市定)。结合预算执行审计对有关单位执行财政四项改革政策情况进行审计调查。 6 月底结束。 二、行政事业审计 5、市直及有关单位财务收支审计(市定)。以促进规范预算管理,提高财政资金使用效益 和财政财务管理水平为目标,对市政公用事业局、市*** 支队、市人事局等 3 家行政事业单位20xx 财务收支以及市人民政府驻上海联络处20xx-20xx 年度财务收支情况进行审计。重点查处虚报支出项目骗取财政预算资金,利用职权乱收费、乱摊派、乱罚款,违反收支两条线,乱发乱补,用*** 大吃大喝及*** 旅游,私设“小金库”等问题。11 月底结束。

审计工作职责

岗位职责: 1、展开公司内控审计:对总公司、各子公司的内部控制、流程制度的设计和实施进行独立审计,以合理确保公司内部控制的安全性和高效性; 2、展开公司综合审计:对公司各部门进行常规的综合审计和专项审计,以合理确保各机构和部门的内部控制、经营状况得到真实、全面、准确的反映和评价; 3、展开公司离任审计:对子公司负责人、总公司总监及以上高管的调任、离任进行离任审计,以确保审计对象在任期间的经营业绩、合规情况得到真实、全面、准确的反映和评价; 4、识别审计中发现的问题,进行风险分析并提出合理专业的管理建议;参与公司业务流程或制度改进和风险评估; 5、参与公司的其他审计工作,完成公司分配的其他任务。 岗位职责: 1、按照国家审计法规、公司财会审计制度的有关规定,负责拟订公司具体审计实施细则; 2、建立对于资产和资金使用的监控机制及其它财务监控机制,发现违规现象时,及时采取预警措施; 3、组织对公司重大经营活动、重大项目、重大经济合同的审计活动; 4、全面审查各中心对授权制度和作业流程的执行情况; 5、定期或不定期地组织必要的专项审计、专案审计和财务收支审计; 岗位职责: 1、负责组织对集团及各分子公司财务执行情况、各项财务收支、专项资金使用和核算情况进行审计; 2、确认会计记录的真实性及是符合会计准则要求; 3、审阅财务报表及分析报告,确认其真实性、准确性及完整性; 4、推动完善公司内控管理体系建立; 5、向管理层提供有关审计发现及建议的内审报告,并与各负责部门一起监控审计问题的整改情况; 6、领导交代的其它工作。

岗位职责: 1.根据公司相关内部管理制度及公司的具体情况,起草审计规章制度、建立各项内部审计制度与业务流程; 2.按照审计工作计划及审计项目特点,合理规划审计项目,制定具体的审计工作方案,重点负责制定总部、分子公司资产审计计划并组织实施; 3.取得审计工作证据,编制审计工作底稿,并对取得的审计证据的真实性、完整性负责, 负责审计资料的立卷,收集、整理归档工作; 4.起草审计报告,客观地反映被审计单位或部门的情况,客观公正地给予评价,并提出建设性的建议和处理意见,对审计中发现的问题进行催促跟进再审计,对重要岗位进行经济责任、离任审计,出具专项审计报告; 5.规范公司各项内部控制制度及业务流程,独立编制业务流程及流程图,建立内部审计控制体系,对公司流程与制度的执行有效性进行审计评估; 6.完成上级领导交办的其他事务。 岗位职责: 1、根据内部审计条例拟定和完善财务审计操作指引、财务审计流程; 2、根据年度审计计划,对审计计划实施方案进行调整和分解,编制月度审计计划; 3、负责组织实施年报审计、内控审计、专项审计等各类审计活动; 4、编制内审方案,整理审计证据,准备相关审计文件; 5、参与现场审计,复核工作底稿,起草审计报告,提出审计建议,送财务总监审核; 岗位职责: 1、基于公司流程制度及内控管理的要求,定期进行内控审核和测试,识别流程制度的执行情况及存在的问题,并提出改进意见; 2、根据审核结果,编制内控审核报告,跟踪并促进整改方案的落实; 3、跟进并协助业务部门进行流程或制度文档的修改,弥补现有流程风险和漏洞;

房地产销售目标计划范本

Clear objectives, matters, methods and record progress, so as to make planning direction consistent, action coordinated and orderly. 姓名:___________________ 单位:___________________ 时间:___________________ 房地产销售目标计划

编号:FS-DY-32515 房地产销售目标计划 房地产行业一直是带动国家经济发展的重要行业之一,尤其是最近几年,我国房地产事业取得了巨大的发展,不过也产生了很多的泡沫,导致全球金融危机到来之后我们国家的房地产行业出现了巨大的危机。为了应付这次危机,我们相处了很多的办法,但是都是治标不治本,所以我们一定要相处一个号的办法和计划来。 一个好的房地产营销方案必须有一个好的计划书,以在整体上把握整个营销活动。市场营销计划更注重产品与市场的关系,是指导和协调市场营销努力的主要工具、房地产公司要想提高市场营销效能,必须学会如何制订和执行正确的市场营销计划。 在房地产市场营销中,制订出一份优秀的营销计划十分重要。一般来说,市场营销计划包括计划概要:对拟议的计划给予扼要的综述,以便管理部分快速浏览。

2.市场营销现状:提供有关市场,产品、竞争、配销渠道和宏观环境等方面的背景资料。 3.机会与问题分析:综合主要的机会与挑战、优劣势、以及计划必须涉及的产品所面临的问题。 4.目标:确定计划在销售量、市场占有率和盈利等领域所完成的目标。 5.市场营销策略:提供用于完成计划目标的主要市场营销方法。 6.行动方案:本方案回答将要做什么?谁去做?什么时候做?费用多少? 7.预计盈亏报表:综述计划预计的开支。 8.控制:讲述计划将如何监控。 一、计划概要 计划书一开头便应对本计划的主要目标和建议作一扼要的概述,计划概要可让高级主管很快掌握计划的核心内容,内容目录应附在计划概要之后。 二、市场营销现状 计划的这个部分负责提供与市场、产品、竞争、配销和

内部审计工作流程步骤详解

内部审计工作流程步骤详解 规范内部审计具体业务的操作流程是完善集团内部审计工作、确保 审计人员顺利完成审计任务的重要保证,根据集团《内部审计制度》及 《内部审计实务标准》的相关规定,内部审计业务的具体操作流程规范如下,审计人员应在审计工作中按规定遵照执行。 根据内部审计工作的实质要求,审计工作可分为以下步骤: 步骤一:审计立项与授权 一、审计立项 审计立项是指确定具体的内部审计项目,即被审计的对象。审计对象包括集团下属的各子公司,集团内部的各职能部门、各项经营活动或项目、系统等。 审计对象的选择一般由以下三种方式决定: 1、集团审计部通过对集团的经营活动进行系统地分析风险来制定年度内部审计工作计划表,经批准后逐项实施。 2、由集团总裁或董事会下达的计划外专项审计任务。 3、由被审计者提出审计要求,经批准实施审计业务。

二、审计批准与授权 对于已立项的审计项目,审计部应在审计实施前以正式报告的形式报集团总裁审核、批准与授权。 步骤二:审计准备 在确定审计事项后,审计人员幵始审计准备工作,制订审计计划。审计准备工作包括以下内容: 一、初步确定具体审计目标和审计范围。 1、内部审计的总目标是审查和评价集团各项经营管理活动,协助集团组织的成员有效地履行他们的职责。针对已确定的具体审计任务,审计人员应制定具体的审计目标以有助于拟定审计方案和审计工作结束后的审计评价。 2、内部审计的范围一般包括以下几个方面: 1)组织内部控制系统的恰当性、有效性。 2)财务会计信息、资料的准确性、完整性、可靠性。 3)经营活动的效率和效果。 4)资产的护卫情况。 5)对法律、法规及政策、计划的遵守、执行情况。

房地产目标市场的选择

房地产目标市场的选择 一、市场细分 由于消费者构成极为复杂,不便于市场把控。因此,在这里我们以产品为细分对象,依据总价和单价指标,将市场细分为低端、中低端、中端、中高端及高端市场。 表1——产品价格指标比较表: 二、细分市场轮廓描述 1.低端市场 (1)市场特征:该类产品一般为低总价(15万以内),低单价,或小户型;产品品质较低,大多为满足人们最基本的居住需要。开发技术层面要求不高。 (2)目标客户群: ●年龄:主要集中在30周岁以下的未婚人士和其它年龄段的低收入者 ●收入:年收入大多在万以下 ●家庭结构:2人及以下,比例为24%(2001年政府权威部门调查) ●受教育程度:他们大多受过较高的教育 ●置业情况:大多为第一次置业,现在主要以租房为主 ●购房目的:成家立业的需要,作为过渡性住房,解决基本的居住问题。 ●购买行为:注重产品的经济实用,对品牌基本没有要求。 2.中低端市场 (1)市场特征:该类产品总价主要集中在15~20万,单价多为1500~2000元;产品品质一般,产品变现速度较快,对开发商市场运作能力要求不高,因此,竞争对手该市场较为容易。 (2)目标客户群:

●年龄:这个阶层的年龄范围较广,界定这个阶层主要以收入和购买能力为标准,年龄主要集中在40 岁以下 ●收入情况:年收入3万—5万 ●家庭结构:这部分人群大多已经成家,家庭人口以3人为主,或3人以上 ●职业状况:企事业单位的普通职工、公司员工 ●受教育程度:受教育程度普遍不高 ●置业情况:第一次置业为主,二次置业为辅 ●购房目的:家庭居住需要,迫切需要改变居住环境。 ●购买行为:对价格特别敏感,注重产品的实用性和舒适性,对品牌基本没有要求。 3.中端市场 (1)市场特征:该类产品总价大多在20~30万,单价在2000~2500元,产品品质较好,配套设施比较齐全,环境较好,因此销售速度一般较快。该市场开发商进入的难度较中低端市场大些。 (2)目标客户: ●年龄:30—40岁,这部分人群也属于有效消费的主力人群,在中成公司2002年的市场调查中,这 个年龄段的人群占到了%,与华西都市报所做的市场调查的结果和本公司在2002年3月做的视察调查的结果大致相同。 ●收入:他们的收入在5万—8万之间,有一部分积蓄 ●家庭结构:三口之家为主 ●置业情况:相当大的一部分为二次置业 ●购房目的:改善居住环境,提高居住水平。 ●购房行为:比较理智,除实用外,比较注重产品的舒适性,对品牌有一定的要求。 4.中高端市场 (1)市场特征:该类市场总价在30~50万,单价在2500~3000元,产品品质较高,建筑结构多为框剪,户型设计新颖,配套设施齐全,注重小区环境,运用新型建筑材料或建筑技术,对开发商运作水平要求较高。 (2)目标客户群:

某集团公司内部审计工作计划及要点

2007年内部审计工作要点 2007年,公司内部审计工作将继续按照国资委、监事会和国家审计署的要求,在集团公司党组的领导下,探索推进SOX法案遵循工作的常态化机制,以风险为导向,完善公司风险管理和内部控制体系,服务于公司“新跨越战略”重要举措的落实和公司“软实力”的提升;充分发挥内部审计监督作用,除弊兴利;创新审计技术和领域,建立健全内部审计规章制度体系,探索完善内部审计管理体系,强化双重管理机制,加强内审团队建设;加强内部沟通,推动良好审计文化的形成,营造良好工作氛围;加强外部交流,扩大内部审计影响。围绕“增值、创新、和谐”,打造“世界一流内审”。 1、巩固法案遵循成果,建立常态内控机制 巩固2006年SOX遵循项目成果,将法案遵循工作向常态化转变。逐步将内控手册的维护、内部控制的测试工作与企业的日常经营管理活动相融合,形成常规化、制度化、规范化的常态工作机制,逐步使内部控制成为业务流程的一个有机部分并得到持续有效的执行。将原有开展的“十四个核心业务流程和管理机制”的风险及运营审计工作与SOX法案遵循测试工作、总部的独立测试与各子公司的自我测试工作有机结合,统筹安排,节约审计资源,提高工作效率。对于内部控制缺陷加大修补和执行的监督力度。继续完成相关业务流程和管理机制的审计,并对发现的问题进行跟踪落实,确保相关问题得到有效整改。按照SOX法案要求强化执行力,从细节着手,持续提高公司经营管理水平,增强公司的“软实力”,提升企业价值。 2.完善风险管理体系,健全风险评估机制 认真贯彻国资委下发的《中央企业全面风险管理指引》,围绕公司总体经营目标和外部监管要求,进一步完善公司风险管理体系,健全风险评估机制。编制企业风险评估问卷并组织实施风险评估,根据风险评估结果制定公司的风险管理策略;依据公司风险管理解决方案,制定审计计划并实施审计,监督风险应对措施的落实,降低公司经营管理风险。

SDS-PAGE电泳测定蛋白质相对分子量

SDS-PAGE电泳测定蛋白质相对分子量 一、实验目的: 1、了解SDS-PAGE垂直板型电泳法的基本原理及操作技术。 2、学习并掌握SDS-PAGE法测定蛋白质相对分子量的技术。 二、实验原理: SDS-PAGE电泳法,即十二烷基硫酸钠—聚丙烯酰胺凝胶电泳法,。1.在蛋白质混合样品中各蛋白质组分的迁移率主要取决于分子大小和形状以及所带电荷多少。 2.在聚丙烯酰胺凝胶系统中,加入一定量的十二烷基硫酸钠(SDS),SDS 是一种阴离子表面活性剂,加入到电泳系统中能使蛋白质的氢键和疏水键打开,并结合到蛋白质分子上,使各种蛋白质—SDS复合物都带上相同密度的负电荷,其数量远远超过了蛋白质分子原有的电荷量,从而掩盖了不同种类蛋白质间原有的电荷差别。此时,蛋白质分子的电泳迁移率主要取决于它的分子量大小,而其它因素对电泳迁移率的影响几乎可以忽略不计。 三、仪器、原料和试剂 1、仪器:垂直板型电泳槽;直流稳压电源;50或100μl微量注射器、玻璃板、水浴锅,染色槽;烧杯;吸量管;常头滴管等。 2、原料:低分子量标准蛋白质按照每种蛋白0.5~1mg·ml-1样品溶解液配制。可配制成单一蛋白质标准液,也可配成混合蛋白质标准液。 3、试剂: (1)分离胶缓冲液(Tris-HCl缓冲液PH8.9):取1mol/L盐酸48mL,Tris 36.3g,用无离子水溶解后定容至100mL。 (2)浓缩胶缓冲液(Tris-HCl缓冲液PH6.7):取1mol/L盐酸48mL, Tris 5.98g,用无离子水溶解后定容至100mL。 (3)30%分离胶贮液:配制方法与连续体系相同,称丙烯酰胺(Acr)30g 及N,N’-甲叉双丙烯酰胺(Bis)0.8g,溶于重蒸水中,最后定容至100ml,过滤后置棕色试剂瓶中,4℃保存。 (4)10%浓缩胶贮液:称Acr 10g及Bis 0.5g,溶于重蒸水中,最后定容至100mL,过滤后置棕色试剂瓶中,4℃贮存。 (5)10%SDS溶液:SDS在低温易析出结晶,用前微热,使其完全溶解。(6)1%TEMED; (7)10%过硫酸铵(AP):现用现配。

房地产年度目标计划书通用范本

内部编号:AN-QP-HT547 版本/ 修改状态:01 / 00 The Production Process Includes Determining The Problem Object And Influence Scope, Analyzing Problems, Proposing Solutions And Suggestions, Cost Planning And Feasibility Analysis, Implementation, Follow-Up And Interactive Correction, Summary, Etc. 编辑:__________________ 审核:__________________ 单位:__________________ 房地产年度目标计划书通用范本

房地产年度目标计划书通用范本 使用指引:本计划文件可用于对自我想法的进一步提升,对工作的正常进行起指导性作用,产生流程包括确定问题对象和影响范围,分析问题提出解决问题的办法和建议,成本规划和可行性分析,执行,后期跟进和交互修正,总结等。资料下载后可以进行自定义修改,可按照所需进行删减和使用。 今年以来,公司在董事会的领导下,经过全体员工的努力,各项工作进行了全面铺开,“XX”品牌得到了社会的初步认同。总体上说,成绩较为喜人。为使公司各项工作上一个新台阶,在新的年度里,公司将抓好“一个中心”、搞好“两个建立”、做到“三个调整”、进行“四个充实”、着力“五个推行”。其房地产公司年度工作计划如下: 一、以XX项目建设为中心,切实完成营销任务 XX项目,是省、市重点工程。市委、市政府对其寄予了殷切的期望。由于项目所蕴含的

公司内部审计工作流程

工作行为规范系列 公司内部审计工作流程(标准、完整、实用、可修改)

编号:FS-QG-30108公司内部审计工作流程 Company internal audit workflow 说明:为规范化、制度化和统一化作业行为,使人员管理工作有章可循,提高工作效率和责任感、归属感,特此编写。 公司内部审计工作流程 (一)资产审计 1、货币资金审计 (1)审计目标 证实货币资金余额的存在性、完整性、收付业务的合法性 (2)内部控制系统测试 调查了解货币资金内部控制系统――→查验签发支票登记簿与签发支票存根――→抽验资金收付款凭证――→核实收入货币资金收款收据――→检查日记账,抽查银行存款调节表与库存现金盘点表――→检查不相容职务划分情况――→检查货币资金收付凭证管理――→评价货币资金内部控制系统。

(3)实质性审查 ①库存现金审查 首先出纳员将现金全部放入保险柜暂作封存,要求出纳员将全部凭证入账,结出当日现金日记账余额,填写“现金出纳报告书”。在会计主管人员和内审人员在场的情况下清点现金,并作记录。填制“库存现金清点表”,该表由出纳员、会计人员共同签字,作为审计工作底稿。库存现金清点表应反映实际库存现金清点数,当日现金日记账结余数,账实是否相符。即有无溢缺。 ②现金收付业务的审查 抽查现金日记账记录,至少抽查1至2个月的现金日记账,审查原始凭证。 ③银行存款的审查 审核银行存款日记账记录,核证银行存款收支的截止日期,抽查银行存款的账面余额。 2、存货审计 (1)审计目标 证实存货的存在性、完整性、所有权归属、计价的正确

性、采购与销售的合法性、分类的正确性 (2)内部控制系统测试 调查了解企业存货内部控制系统――→抽查部分采购业务文件,追踪其业务系统――→抽查部分存货出库业务,追踪其业务处理系统――→审查存货管理制度――→抽查盘点记录――→评价存货内部控制系统 (3)实质性审查 ①材料的审查 材料采购的审查:审查订货合同――→审查材料的验收入库情况――→审查材料采购成本,查看采购成本的构成项目是否正确,采购费用分配比例是否合理,采购成本是否合法、正确。采购成本的计算方法是否正确――→审查在途材料――→审查材料采购的账务处理 ②库存材料审查 盘点库存材料,时间安排在结账日或接近结账日 ③材料出库的审查 对生产领用材料应核实生产计划,核查发出材料的计价,揭露弄虚作假的行为

房地产年度目标计划书

房地产年度目标计划书 新的一年开始了,房地产年度目标计划书要如何制定的呢下面由小编为大家搜集的房地产年度目标计划书,欢迎大家阅读与借鉴! 【房地产年度目标计划书一】今年以来,公司在董事会的领导下,经过全体员工的努力,各项工作进行了全面铺开,“”品牌得到了社会的初步认同。总体上说,成绩较为喜人。为使公司各项工作上一个新台阶,在新的年度里,公司将抓好“一个中心”、搞好“两个建立”、做到“三个调整”、进行“四个充实”、着力“五个推行”。其房地产公司年度工作计划如下: 一、以项目建设为中心,切实完成营销任务 项目,是省、市重点工程。市委、市政府对其寄予了殷切的期望。由于项目所蕴含的社会效益和潜在的经济效益,我们必须把它建成,而不能搞砸;我们只能前进,而不能停滞甚或后退。因此,公司计划: (一)确保一季度工程全面开工,力争年内基本完成第一期建设任务。 第一期工程占地面积为60亩,总投资亿元,建筑面积万平方米。建筑物为商业广场裙楼、大厦裙楼和一栋物流仓库。 1、土地征拆工作。

春节前后务必完成第一期工程的土地征拆工作。元月份完成征地摸底调查,二月份完成征地范围内的无证房屋的拆迁。三月份完成征地范围内有证房屋拆迁及国土储备中心土地和集体土地的征收工作。各部门关系的协调,以总经理室为主,顾问室配合,工程部具体操作。工程进入实施阶段后,工程部应抓紧第二期工程的土地征拆工作联系,适时调整主攻方向。 2、工程合同及开工。 元月份签订招投标代理合同,工程进入招投标阶段。二月份确定具有实力的施工企业并行签订施工合同;确定监理企业并行签订监理合同。三月份工程正式开工建设。另外,工程部应加强工程合同、各类资料的存档管理,分门别类、有档可查。建立一套完整的工程档案资料。 3、报建工作。 工程部应适时做到工程报建报批,跟进图纸设计。元月份完成方案图的设计;二月份完成扩初图的设计。在承办过程中,工程部应善于理顺与相关部门关系,不得因报建拖延而影响工程开工。 4、工程质量。 项目是省、市重点工程,也是品牌的形象工程。因而抓好工程质量尤为重要。工程部在协助工程监理公司工作的同时,应逐渐行成公司工程质量监督体系。以监理为主,以自

蛋白质分子量标准(高)使用说明书

蛋白质分子量标准(高) Protein Molecular Weight Marker (High) 使用说明书 Takara Code : D531A 浓度: 10 μg/μl 制品内容(约200次量) Protein MW Marker(high)50 μl 5×Loading Buffer 1000 μl 1 M DTT(Dithiothreitol)100 μl 制品说明 Protein Molecular Weight Marker(High)是由五种纯化好的不同分子量的蛋白质组成的,它的分子量范围为:44.3 KDa~200KDa。进行聚丙烯酰胺凝胶电泳时,经考马斯亮蓝R-250染色后的各种蛋白质的条带强度均一。每微升本制品的蛋白量为10 μg,稀释20倍后进行聚丙烯酰胺凝胶电泳,每次取5 μl(for SDS-PAGE mini gel)。以每次使用5 μl(20倍稀释液)计算时本制品约可使用200次。 保存条件 制品原液可在-20℃下长期保存,制品的20倍稀释液可在-20℃下保存2~3个月,制品的原液和制品的20倍稀释液都应避免多次反复冻融。 制品中的各种蛋白质种类 使用注意 推荐使用7.5~10%的聚丙烯酰胺凝胶。浓度太高,高分子量的蛋白分离效果不好,有可能聚集于分离胶的上部。使用方法 1. 首先按以下方法配制“稀释液”。 1 M DTT 2 μ l 5×Loading Buffer 20 μl * 稀释液可于室温下放置一个月左右。 2.按以下方法稀释本制品。 稀释液22 μl 灭菌蒸馏水73 μl * 20倍的制品稀释液可在-20℃下保存2~3个月,但应 避免多次反复冻融。如果一次稀释量较多时,可以小量 分装后在-20℃下保存,以避免反复冻融。 3. 均匀混合后,100℃加热处理5分钟,然后取5 μl进行7.5~10% 的聚丙烯酰胺凝胶电泳(for SDS-PAGE mini gel)。 4. 7.5%、10%的聚丙烯酰胺凝胶电泳后,经考马斯亮蓝R-250染 色后的结果如下。 V2012,01 KDa 200.0 116.0 97.2 66.4 44.3 200.0 116.0 97.2 66.4 44.3 KDa 7.5% 10%