国际经济学模拟试题英文含答案

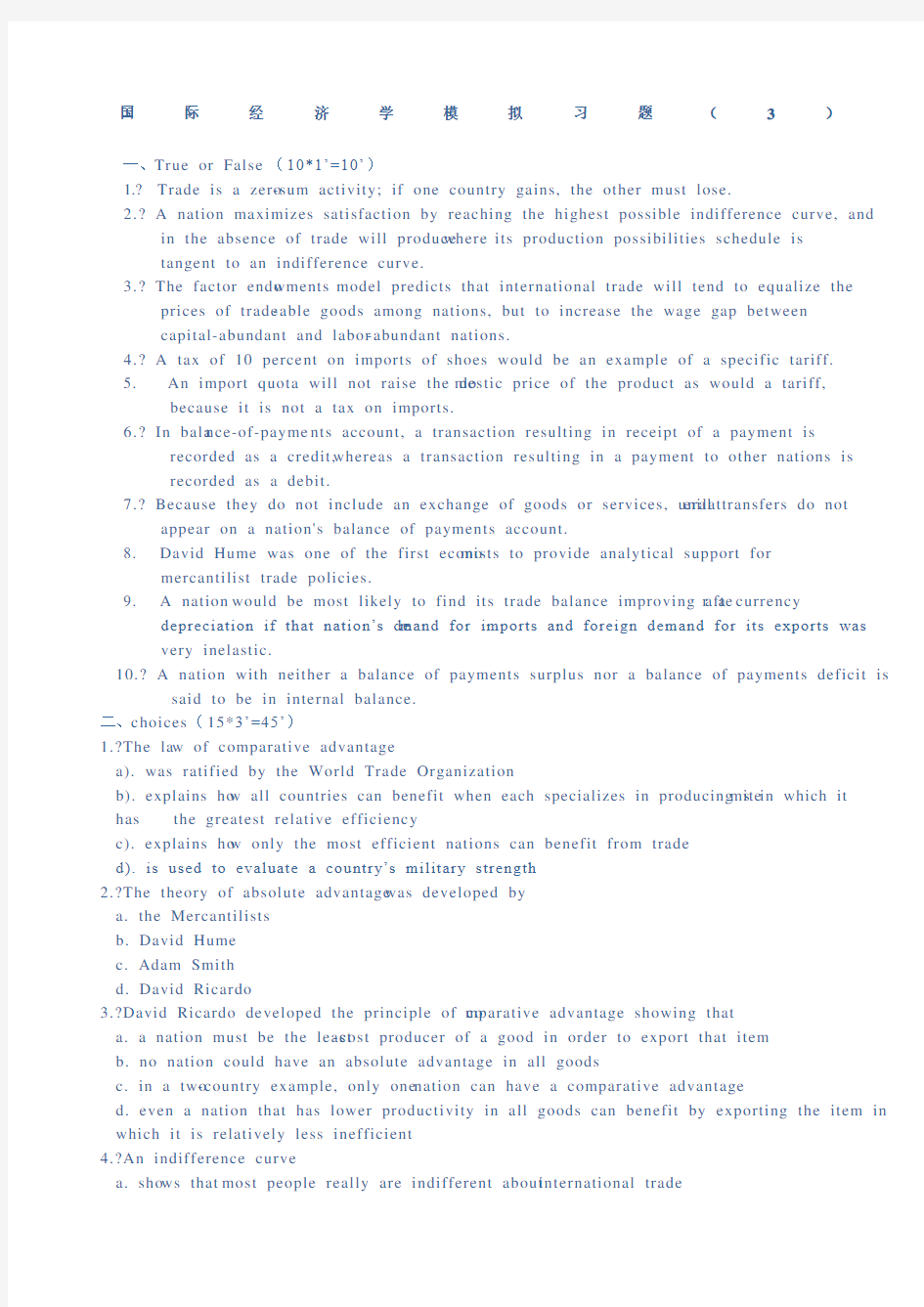

国际经济学模拟习题(3)

一、True or False (10*1’=10’)

1.?Trade is a zero-sum activity; if one country gains, the other must lose.

2.? A nation maximizes satisfaction by reaching the highest possible indifference curve, and

in the absence of trade will produce where its production possibilities schedule is

tangent to an indifference curve.

3.? The factor endo wments model predicts that international trade will tend to equalize the

prices of trade-able goods among nations, but to increase the wage gap between

capital-abundant and labor-abundant nations.

4.? A tax of 10 percent on imports of shoes would be an example of a specific tariff.

5. An import quota will not raise the do mestic price of the product as would a tariff,

because it is not a tax on imports.

6.? In bala nce-of-payme nts account, a transaction resulting in receipt of a payment is

recorded as a credit, whereas a transaction resulting in a payment to other nations is

recorded as a debit.

7.? Because they do not include an exchange of goods or services, unilat eral transfers do not

appear on a nation's balance of payments account.

8. David Hume was one of the first econo mists to provide analytical support for

mercantilist trade policies.

9. A nation would be most likely to find its trade balance improving afte r a currency

depreciation if that nation’s de mand for imports and foreign demand for its exports was very inelastic.

10.? A nation with neither a balance of payments surplus nor a balance of payments deficit is

said to be in internal balance.

二、choices(15*3’=45’)

1.?The la w of comparative advantage

a). was ratified by the World Trade Organization

b). explains ho w all countries can benefit when each specializes in producing ite ms in which it has the greatest relative efficiency

c). explains ho w only the most efficient nations can benefit from trade

d). is used to evaluate a country’s military strength

2.?The theory of absolute advantage was developed by

a. the Mercantilists

b. David Hume

c. Adam Smith

d. David Ricardo

3.?David Ricardo developed the principle of co mparative advantage showing that

a. a nation must be the least-cost producer of a good in order to export that item

b. no nation could have an absolute advantage in all goods

c. in a two-country example, only one nation can have a comparative advantage

d. even a nation that has lower productivity in all goods can benefit by exporting the item in which it is relatively less inefficient

4.?An indifference curve

a. sho ws that most people really are indifferent about international trade

b. sho ws the demand preferences of consumers

c. reflects the relative costs of production within a nation

d. indicates how much labor a country has

5.?To maximize its satisfaction, a nation will ensure that its terms-of-trade line

a. is tangent to its production possibilities frontier at one point (production point) and also to the highest attainable indifference curve at another point (consumption point)

b. is tangent to its production possibilities frontier and intersects an indi fference curve

c. intersects its production possibilities frontier and is tangent to an indifference curve

d. intersects its production possibilities frontier at one point and an indifference curve at another point

6.?Factor-price equalization predicts that with international trade

a. the price of a nation’s abundant factor will rise and that of its scarce factor will fall

b. the price of a nation’s abundant factor will fall and that of its scarce factor will rise

c. the prices of a nation’s abundant a nd scarce factors both will rise

d. the prices of a nation’s abundant and scarce factors both will fall

7.?The effective rate of protection

a. distinguishes between tariffs that are effective and those that are ineffective

b. is the minimum level at whi ch a tariff beco mes effective in limiting imports

c. sho ws the increase in value-added for do mestic production that a particular tariff structure makes possible, in percentage terms

d. sho ws how effective a tariff is in raising revenue

8.?The institutio nal frame work developed in 1947 to promote trade liberalization is known as

a. the GATT

b. the WTO

c. the IMF

d. The World Bank

9.?Developing nations

a. have very limited involvement in international trade

b. trade mostly with each other

c. rely heavily on exports of primary products to industrial nations

d. rely heavily on exports of manufactured products

10.?A customs union is unique in that it

a. has no tariffs on trade among member nations

b. has no tariffs on trade among me mber nations and a c o mmon set of tariffs on imports from non-me mbers

c. has no tariffs on trade among member nations, a common set of tariffs on imports from non-me mbers, and free mobility of factors of production such as labor and capital among

me mbers

d. allows unrestricted labor immigration from non-me mber nations

11.?A nation's balance of payments statement

a. is a record of that nation's assets abroad and its liabilities to those from other nations

b. is an accounting adjustment process ensuring that a nation's expor ts will be equal to its imports

c. does not include transactions of foreign citizens or companies living or operating within that nation

d. is a record of the economic transactions between residents of that nation and the rest of the world, usually f or a period of one year.

12.?Since balance-of-payments accounting is a double-entry accounting system, an export of

U.S. wheat to Mexico paid for by a deposit to the U.S. exporters account in a Mexican bank would be recorded on the U.S. balance of payments as

a. a credit for merchandise exports and a credit to short-term financial flows

b. a credit for merchandise exports and a debit to short-term financial flows.

c. a credit for merchandise exports and a debit to unilateral transfers

d. a credit for mer chandise exports and a debit to official settlements

13.?The foreign-exchange market

a. is located in New York

b. is a market in Chicago for the international trading of co mmodities such as wheat or copper.

c. is a mechanism for individuals and institutions to exchange one national or regional currency or debt instrument for those of other nations or regions.

d. is open fro m 9:00 a.m. to 3:00 p.m. Ne w York time, Monday through Friday.

14.?Market fundamental s that might be expected to influence exchange rate movements include

all of the following factors except

a. differences in real income growth rates betwe en countries

b. differences in real interest rates between countries

c. speculative opinion about fu ture exchange rates

d. changes in perceived profitability of economic investments between two countries

15.?If inflation is higher in Mexico than in the United States, the law of one price would predict that

a. trade between Mexico and the United States would decline

b. the dollar price of autos purchased in Mexico would be higher than the dollar price of

comparable autos purchased in the United States

c. the peso would appreciate relative to the dollar by an amount equal in percentage terms to the

difference between the two inflation rates

d. the peso would depreciate relative to the dollar by an amount equal in percentage terms to the

difference between the two inflation rates

三、Questions(45’, answer these questions in Chinese)

1. Assume that labor is the only factor used in production, and that the costs of producing

(1) Express the price of butter relative to the price of cloth in terms of labor content for Home and Foreign in the absence of trade.

(2) What do these relative prices reveal about each country’s comparative advantage?

(3) What do these relative prices sugge st about the world price of butter relative to cloth that will exist once these countries trade with each other?

(4) If the world price stabilizes at 1 with trade, what are the gains by the Home country achieved through trade with the Foreign country?

2. Explain the immiserizing growth and list the case for immiserizing growth to be occur. (8’)

3. Explain the exchange rate overshooting theory (8’)

4. Suppose that the nominal interest rate on 3-month Treasury bills is 8 percent in the United

States and 6 percent in the United Kingdom, and the rate of inflation is 10 percent in the United States and 4 percent in the United Kingdom.(9’)

(1) What is the real interest rate in each nation?

(2) In which direction would international investment flow in response to these real interest rates?

(3) What impact would these investment flo ws have on the dollar’s exchange value?

5. What effects does labor migration have on the country of immigration? The country of

emigration? The world as a whole?(12’)

国际经济学模拟习题(3)参考答案

一、判断题(每题1分,共10分)╳√ ╳╳╳√ ╳╳╳╳

二、选择题(每题3分,共45分)bcdba acacb dbccd

三、简答题(共45分)

1、(1) 封闭条件下,本国可以用一半的生产一单位布的劳动时间生产一单位黄油。这表示,在封闭条件下,本国黄油与布的相对价格是1/2,外国黄油与布的相对价格是2。(2分)

(2)根据上面的相对价格,表明本国生产黄油有比较优势,外国的比较优势是生产布。(2分)

(3)如果两国发生国际贸易,国际比价应该落在封闭条件下本国和外国国内相对价格之间。(2分)

(4)如果世界市场价格为1,本国通过出口黄油,进口布,用一单位黄油可以换得1单位布,比在本国用两单位黄油换一单位布多获得一单位黄油的利益。(2分)

2、出口偏向型增长对一国的福利产生两种相反的作用,因为生产的多,该国可获得好处,但由于出口价格下降,也遭受损失,如果贸易恶化的负向作用超过了产量增加的正向作用,该国就发生了贫困化增长。(4分)以下情况下最有可能发生贫困化增长:

(1)一国的经济增长偏向于它的出口部门(1分)

(2)该国相对于世界市场而言是个大国(1分)

(3)外国对本国出口产品的需求严重缺乏价格弹性(1分)

(4)本国严重依赖于国际贸易(1分)

3、汇率的粘性价格货币分析法简称为超调模型,它认为商品市场与资产市场的调整速度是不同的(2分),商品市场上的价格水平具有粘性,购买力平价短期内不成立(1分),经济存在由短期平衡向长期平衡调整的过程,而汇率作为一种特殊资产的价格,其变动受人们对未来市场基本因素预期的变化影响很大(1分),当货币供给一次性增加以后,本币汇率的瞬时贬值程度大于其长期贬值程度(2分),我们称这种现象为汇率超调现象,该现象有助于解释为什么汇率每一天的升值或贬值会如此剧烈(2分)。

4、(1)实际利率=名义利率-通货膨胀率(1分)美国实际利率=8%-10%=-2%(1分)

英国实际利率=6%-4%=2%(1分)

(2)国际资本应该从美国流向英国(2分)

(3)国际资本从美国流向英国,对英镑需求增加,英镑升值,所以即期市场上美元相对于英镑贬值(2分)。远期外汇市场上,美元升水率为4%(2分)。

5、(1)对世界来说,由于移民,工人被吸引到他们最有效率的领域,世界产出趋于扩张(2分)劳动力流动增加的世界收入并没有在所有国家和所有生产要素之间平均分配。(2分)

(2)对移入国,由于生产要素增加,总收入增加(2分),但收入由劳动力向资本再分配,其本土工人遭受损失(2分)

(3)对移出国,由于生产要素减少,总收入减少(2分),收入由资本向劳动力再分配,未移民的劳动力收入增加(2分)

《国际经济学》模拟试题及参考答案

《国际经济学》模拟试题及参考答案(一) 一、名词解释(每小题 5 分,共 20 分) 1.要素禀赋:亦即要素的丰裕程度,是指在不同国家之间,由于要素的稀缺程度不同所导致的可利用生产要素价格相对低廉的状况。赫克歇尔-俄林定理认为,要素禀赋构成一个国家比较优势的基础。 2.倾销:指出口商以低于正常价值的价格向进口国销售产品,并因此给进口国产业造成损害的行为。 3.黄金输送点:黄金输送点包括黄金输入点和黄金输出点,是黄金输入、输出的价格上限和下限,它限制着一个国家货币对外汇率的波动幅度。 4.三元悖论:也称为三元冲突理论,即在开放经济条件下,货币政策的独立性、汇率的稳定性和资本的自由流动三个目标不可能同时实现,各国只能选择其中对自己有利的两个目标。 二、单项选择题 2.根据相互需求原理,两国均衡的交换比例取决于( C ) A 两国的绝对优势 B 两国的比较优势 C 两国的相对需求强度 D 两国的要素禀赋 3.在当今的国际贸易格局中,产业内贸易更容易发生于( B ) A 发展中国家与发达国家 B 发达国家与发达国家 C 发展中国家与发展中国家 D 发展中国家和最不发达国家 4.课征关税会增加生产者剩余,减少消费者剩余,社会总福利的变化将( B ) A 上升 B 降低 C 不变 D 不确定 5.以下选项中,哪个选项不属于国际收支统计中居民的概念?( C ) A 外国企业 B 非盈利机构 C 国际经济组织 D 政府 7.布雷顿森林体系创立了( B ) A 以英镑为中心的固定汇率制度 B 以美元为中心的固定汇率制度 C 以英镑为中心的有管理的浮动汇率制度 D 以美元为中心的有管理的浮动汇率制度 8.在下列投资方式中,属于国际间接投资的是( D ) A 在国外设立分公司 B 在国外设立独资企业 C 在国外设立合资企业 D 购买国外企业债券 9.经济非均衡的无形传导方式不包括( C ) A 技术转让 B 信息交流 C 信息回授 D 示范效应 10.在斯图旺表中第三象限表示( C ) A 通货膨胀与国际收支顺差并存 B 衰退与国际收支顺差并存 C 衰退与国际收支逆差并存 D 通货膨胀与国际收支逆差并存 三、判断正误题 1.亚当。斯密的绝对利益学说和大卫•李嘉图的比较利益学说都是从劳动生产率差异的角度来解释国际贸易的起因。(√)

国际经济学英文题库(最全版附答案)

【国际经济学】英文题库 Chapter 1: Introduction Multiple-Choice Questions 1. Which of the following products are not produced at all in the United States? *A. Coffee, tea, cocoa B. steel, copper, aluminum C. petroleum, coal, natural gas D. typewriters, computers, airplanes 2. International trade is most important to the standard of living of: A. the United States *B. Switzerland C. Germany D. England 3. Over time, the economic interdependence of nations has: *A. grown B. diminished C. remained unchanged D. cannot say 4. A rough measure of the degree of economic interdependence of a nation is given by: A. the size of the nations' population B. the percentage of its population to its GDP *C. the percentage of a nation's imports and exports to its GDP D. all of the above 5. Economic interdependence is greater for: *A. small nations

国际经济学(英文版)

Chapter 13 Balance of Payment 13.1 Introduction International finance: examination of the monetary aspects of international economics Balance of Payment: a summary statement in which all the transactions of the nation’s residents with the foreigners are recorded during a certain period. Main purpose of BOP: inform the government of the international position of the nation; to help it in its monetary, fiscal and trade policies. BOP traits: The BOP aggregates all the trades into a few categories Only the net balance of each type of international capital flow is included International transaction: Exchange of a good, service or assets between the residents of two nations. Gifts and certain transfers + International Transactions People Concerning BOP: Diplomats, soldiers, tourists and workers belong to motherland Corporation: motherland/ foreign branches: local International institutions: nowhere 13.2 BOP Accounting Principles Credit transactions: involve the receipt of payments from foreigners + Exports, unilateral transfers and goods received, capital inflow Capital inflow: an increase in foreign assets in the nation/本国持有外国资产上升 a reduction in the nation’s assets abroad/本国在外资产减少 Debit transactions: involve the making of payments to the foreigners - Imports, unilateral transfers or gifts paid, capital outflow Capital Outflow: an increase in the nation’s assets abroad a reduction in foreign assets in the nation Double-Entry Bookkeeping: each international transaction is recorded twice, once as a credit and once as a debit of an equal amount. 5 Examples in Textbooks 13.3 The International Transactions of the USA rounding. The official reserve assets: ?Gold holdings of monetary authorities黄金储备 ?Special Drawing Rights特别提款权(paper gold) International reserves created on the books of the IMF and distributed to member nations according to importance in international trade ?The reserve position in the IMF在IMF的头寸 The reserves paid in by the nation on joining the IMF, which the nation can then borrow automatically and without questions asked in case of need ?The official foreign currency holdings of monetary authorities外汇储备 Statistical Discrepancy: This is required to make the total credits equal to the total debits, as required by double-entry bookkeeping. 13.4 Accounting Balances and Disequilibrium in International Transactions Autonomous transactions: transactions in current account + capital account Take place for business or profit motives and independently of BOP considerations Items above the line Current account: All sales and purchases of currency produced goods and services, investment incomes, and unilateral transfers Link between the nation’s international transactions and its national income Current account surplus stimulates domestic production and income. Current account deficit dampens domestic production and income. Capital account: The changes in US-owned assets abroad and foreign-owned assets in the US other than official reserve assets Change in reserves reflects government policy rather than the market force. Accommodating transactions: Transactions in official reserve assets Items below the line The accommodating items form the Official Reserve Account. The balance on the official reserve account is called the Official Settlements Balance. Deficit in the BOP: The excess of debits over credits in the current and capital accounts The excess of credits over debits in official reserve account Surplus in the BOP: The excess of debits over credits in official reserve account The excess of credits over debits in the current and capital accounts

国际经济学期末考试卷及答案

国际经济学半期考试题及答案 1、假设中美两国都生产大米和小麦,且劳动是唯一的生产要素,两国有相同的劳动力资源,都是100人。由于生产技术的不同,产出是不同的。如果两国所有的劳动都用来生产大米,假设中国可以生产100吨,美国只能生产150吨。如果两国的劳动都用来生产小麦,假设中国能生产50吨,而美国能生产100吨。 (1)请判断中国和美国分别在生产那种产品上有优势 (2)如果发生自由贸易,中美两国会分别出口哪种产品,请确定大米的世界市场相对价格的范围? (3)画图说明自由贸易发生前后中美两国的福利变化。 2、作图说明什么是“悲惨增长”,并说明悲惨增长实现的条件。 3.如果假定法国生产葡萄和汽车,资本是特定要素(生产葡萄所用的资本不能流动到汽车生产行业)。工人可以在这两个部门之间自由流动。在特定要素模型的框架内,如果世界市场上葡萄的价格上升5%,讨论国内要素的报酬怎样变化。 4、叙述罗伯津斯基定理的内容,并作图分别说明在大国和小国的情况下,出口部门所密集使用的要素增长对贸易条件的影响。 5、A 、B 两国在封闭条件下的状态如下图所示,请继续作图,画出自由贸易发生以后A 、B 两国的福利变化和贸易三角。 6、画图说明关税和出口补贴所引起的进口国福利的变化。 7、画图说明什么是持续性倾销并说明持续性倾销存在的条件。 8、假设某一国拥有20000单位的劳动,X 、Y 的单位产出所要求的劳动投入分别为5个单钢铁 B 国 钢铁 大米 A 国

位和4个单位,试画出生产可能性边界;如果X的国际市场相对价格为2,进口量为2000个单位,试确定该国的出口量。 1、解:依题意可知,两国劳动生产率为: 中美 大米劳动生产率 1 1.5 小麦劳动生产率0.5 1 Y表示小麦,a、b分别表示中美两国生产率。 (1)美国在大米与小麦生产上均占绝对优势 因为 1 1.5 2> 1.5 0.51 x x y y a b a b ==== n 1 1.5 2> 1.5 0.51 x x y y a b a b ==== n 所以中国在生产大米上具有比较优势,美国在生产小麦上占有比较优势。 (2)若自由贸易则发生专业化分工,中国将出口大米,美国将出口小麦。 由于未贸易前:中国 1 2 y x y x a p p a == 美国: 12 1.53 y x y x a p p a === 则贸易后世界市场价格介于1/2~2/3之间。 (3) 中国美国 X+2Y=100 2/3X+Y=100 可见无差异曲线均向上移动,福利水平得到改善(注:画图时Pw线要平行) 2、 “悲惨增长”也叫贫困化增长,条件为:1.经济增长偏向于增长国的出口部分;2.增长国在世界市场上是打过,出口品供应量会影响世界市场价格;3. 增长国进口边际倾向较高,即增长国对进口产品的需求会因经济增长而显著增加;4.增长国出口产品在世界市场上需求弹性非常好。P70

《国际经济学》模拟试卷(2) (2)

《国际经济学》模拟试卷(2) 一二三四五六得分统分人复核人 一、单项选择题(10小题,每小题1分,共10分):在每题中的括号内填上正确答案的序号。 1.本国生产X1、X2、X3、X4四种产品的单位劳动投入分别为1、2、4、15,外国生产这四种产品的单位劳动投入分别为15、 18、24、30,根据李嘉图模型,本国在哪种产品上拥有最大比较优势?在哪种产品上拥有最大比较劣势?() A.X4、X1 B.X3、X2 C.X1、X4D X2、X3 2.在特定要素模型中,一国经济在贸易后达到新的均衡时应满足() A.w x=P X MP LX且w y=P y MP Ly B.r x=P X MP kX且r y=P y MP ky C.w=P X MP LX=P y MP Ly D.r x=P X MP kX=P y MP ky 3.可以用来解释产业内贸易现象的理论是() A.绝对优势理论 B.比较优势理论 C.要素禀赋理论 D.规模经济理论 4.大国设置的进口关税() A.会增加该国的福利 B.会减少该国的福利 C.会使该国福利保持不变 D.上述三者都是可能的 5.贸易保护的政治经济学分析是从()的角度出发来解释现实中所存在的贸易保护现象的。 A.外部经济 B.市场不完全竞争 C.收入再分配 D.市场完全竞争 6.开放经济下,政府面临内外平衡两个目标,根据蒙代尔的“分配法则”,应该将国内平衡的任务分配给(),而将稳定国际收支的任务分配给()。 A.财政政策,货币政策 B.货币政策,财政政策 C.收入政策,货币政策 D.收入政策,财政政策 7.就国家整体而言,分配进口配额最好的方法是() A.竞争性拍卖 B.固定的受惠 C.资源使用申请程序 D.政府适时分配 8.下面不属于资本流动纯理论模型的是() A.费雪模型 B.证券组合模型 C.双缺口模型 D.麦克道格尔模型 9.()是国际收支平衡表中最基本和最重要的项目。 A.经常项目 B.资本项目 C.贸易收支 D.平衡项目 10.根据货币分析法,在固定汇率制度下,减少一国国际收支赤字的最佳方案是()。 A.货币升值 B.货币贬值 C.提高货币供给增长率 D.降低货币供给增长率 二、判断题(10小题,每小题1分,共10分):若判断正确,在小题后的括号内填上“ ”号;若判断不正确,则在小题后的括号内填上“×”号。 1.国际交换比例越接近本国的国内交换比例,本国所得的利益越少;反之,越接近对方国家的国内交换比例,本国所得的利益越多。() 2.要素禀赋是指生产某种产品所投入两种生产要素的相对比例。() 3.在商品相对价格不变的条件下,某一要素的增加会导致密集使用该种要素部门的生产增加,而另一部门的生产则下降。()4.无论是大国还是小国,是强国还是弱国,都能征收最优关税使各自的国家福利达到最大。() 5.基于有效保护率的考虑,各国的关税结构通常是从初级产品、半制成品到成品,随加工程度的深化,税率不断下降。()6.证券组合模型认为,利率差异是资本国际流动的原因和动力,而资本流动的最终结果是消除了利率差异。() 7.远期汇率高于即期汇率称为远期汇率贴水。() 8.无抛补利率平价的含义为:本国利率高于(低于)外国利率的差额等于本国货币的预期贬值(升值)幅度。()

4月全国高等教育自学考试国际经济学试题及答案解析

全国2018年4月高等教育自学考试 国际经济学试题 课程代码:00140 一、单项选择题(本大题共25小题,每小题1分,共25分) 在每小题列出的四个备选项中只有一个是符合题目要求的,请将其代码填写在题后的括号内。错选、多选或未选均无分。 1.阿根廷经济学家劳尔·普雷维什认为整个世界可以分为两类国家,其中处于“中心”地位的是( ) A.发达国家B.发展中国家 C.出口国家D.进口国家 2.建立国际贸易组织的基石是( ) A.《扩大世界贸易和就业的建议》B.《国际贸易组织宪章》 C.关税与贸易总协定临时议定书D.乌拉圭回合协定 3.关税与贸易总协定中谈到的第一阶段所要解决的主要问题是( ) A.进口关税减让B.非关税减让 C.一揽子解决多边贸易体制D.建立世界贸易组织 4.套利业务所必备的条件是( ) A.汇率存在差异B.利率存在差异 C.同一外汇市场D.不同外汇市场 5.属于国际直接投资方式的是( ) A.购买外国政府债务B.购买外国企业债券 C.向外国企业提供商业贷款D.在国外开设合资企业 6.国际收支平衡表中最基本的项目是( ) A.平衡项目B.资本项目 C.经常项目D.官方结算项目 7.当需求弹性无穷大时,其需求曲线是( ) A.水平的B.垂直的 C.向右上方倾斜D.向右下方倾斜 8.当一国货币贬值后( ) A.会改善该国的贸易条件B.会恶化该国的贸易条件 C.对该国的贸易条件无影响D.对该国的贸易条件的影响不确定 9.设c为边际消费倾向,s为边际储蓄倾向,m为边际进口倾向,则开放经济条件下的外贸乘数为( ) A.1/s B.1/(1-c) C.1/(s+m) D.1/(1-s-m)

《国际经济学(英文版)》选择题汇总版(附答案)

《国际经济学》选择题汇总版(附答案) Ch1-Ch3 1.The United States is less dependent on trade than most other countries because A) the United States is a relatively large country with diverse resources. B) the United States is a “Superpower.” C)the military power of the United States makes it less dependent on anything. D) the United States invests in many other countries. E) many countries invest in the United States. 2. Because the Constitution forbids restraints on interstate trade, A) the U.S. may not impose tariffs on imports from NAFTA countries. B) the U.S. may not affect the international value of the $ U.S. C) the U.S. may not put restraints on foreign investments in California if it involves a financial intermediary in New York State. D) the U.S. may not impose export duties. E) the U.S. may not disrupt commerce between Florida and Hawaii. 3. International economics can be divided into two broad sub-fields A) macro and micro. B) developed and less developed. C) monetary and barter. D) international trade and international money. E) static and dynamic. 4. International monetary analysis focuses on A) the real side of the international economy. B) the international trade side of the international economy. C) the international investment side of the international economy. D) the issues of international cooperation between Central Banks. E) the monetary side of the international economy, such as currency exchange. 5. The gravity model offers a logical explanation for the fact that A)trade between Asia and the U.S. has grown faster than NAFTA trade. B) trade in services has grown faster than trade in goods. C) trade in manufactures has grown faster than in agricultural products. D) Intra-European Union trade exceeds international trade by the European Union. E) the U.S. trades more with Western Europe than it does with Canada. 6. The gravity model explains why A)trade between Sweden and Germany exceeds that between Sweden and Spain. B)countries with oil reserves tend to export oil. C)capital rich countries export capital intensive products. D) intra-industry trade is relatively more important than other forms of trade between neighboring

克鲁格曼国际经济学(第六版)的教师手册(含英文习题答案)imch19

CHAPTER 19 MACROECONOMIC POLICY AND COORDINATION UNDER FLOATING EXCHANGE RATES Chapter Organization The Case For Floating Exchange Rates Monetary Policy Autonomy Symmetry Exchange Rates as Automatic Stabilizers The Case Against Floating Exchange Rates Discipline Destabilizing Speculation and Money Market Disturbances Injury to International Trade and Investment Uncoordinated Economic Policies The Illusion of Greater Autonomy Case Study: Exchange Rate Experience Between the Oil Shocks, 1973 - 1980 The First Oil Shock and Its Effects, 1973 - 1975 Revising the IMF's Charter, 1975 - 1976 The Weak Dollar, 1976 - 1979 The Second Oil Shock, 1979 - 1980 Macroeconomic Interdependence Under a Floating Rate Case Study: Disinflation, Growth, Crisis, and Recession 1980 - 2001 Disinflation and the 1981 - 1983 Recession Fiscal Policies, the Current Account, and the Resurgence of Protectionism From the Plaza to the Louvre and Beyond: Trying to Manage Exchange Rates Global Slump Once Again, Recovery, Crisis, and Slowdown What Has Been Learned Since 1973? Monetary Policy Autonomy Symmetry The Exchange Rate as an Automatic Stabilizer Discipline Destabilizing Speculation International Trade and Investment

国际经济学题库(英文版)知识分享

Part Ⅰ. Fill in the blank with suitable content. 1.Seven themes recur throughout the study of international economics. These are the gains from trade , the pattern of trade , protectionism the balance of payments, exchange rate determination, international policy coordination, international capital market. 2. Countries engage in international trade for two basic reasons : comparative advantage and economics of scale . 3. A country has a comparative advantage in producing a good if the opportunity cost of producing that good in terms of other goods is lower in that country than it is in other countries. 4. Labor is the only one factor of production. LC a 、LW a and *LC a 、* LW a are the unit labor requirement in cheese and wine at Home and Foreign, respectively. If aLC/aLW Key Terms of International Economics Chapter3 Labor Productivity and Comparative Advantage Comparative advantage 比较优势 Absolute advantage 绝对优势 Opportunity cost 机会成本 Production possibility frontier 生产可能性边界 Unit labor requirement 单位产品劳动投入 Relative price 相对价格 Relative demand curve相对需求曲线 Relative supply curve 相对供给曲线 Relative wage 相对工资 Relative quantity 相对产量 Ricardian model 李嘉图模型 Pauper labor argument 贫民劳动论 Nontraded goods 非贸易商品 Chapter 4 Resources and Trade: the Heckscher-Ohlin Model Abundant factor 丰裕要素 Biased expansion of production 偏向性生产扩张 Equalization of factor prices 要素价格均等化 Factor abundance 要素丰裕度 Factor intensity 要素密集度 Scarce factor 稀缺要素 Leontief paradox 里昂惕夫悖论 land-intensive 土地密集型 Labor-intensive劳动密集型 the ratio of 2 factor prices 要素价格比 Wage-rental ratio 工资-租金比 Land-labor ratio ,the ratio of land to labor 土地劳动比 Chapter 5 The standard Trade Model Biased growth 偏向性增长 Export-biased growth 出口偏向性增长 《国际经济学》模拟试卷(1) 一、单项选择(10小题,每小题1分,共10分):在四个备选答案中选择一个最适合的答案。 1.关于一般均衡分析的新古典模型,说法不正确的是()。 A.国际贸易理论的标准模型 B.采用2 2 1模型进行阐述 C.将技术、要素禀赋、需求偏好集于一体 D.由哈伯勒、勒纳、里昂惕夫和米德等人提出 2.国际金融理论的发展一直是围绕着()这一十分重要的问题而展开的。 A.外部平衡 B.内部平衡 C.外部平衡与内部平衡 D.规模经济 3.生产可能性曲线的假设条件有()。 A.两种生产要素的总供给都是可变的 B.生产要素可在两个部门间自由流动 C.两种生产要素没有充分利用 D.两种商品的生产技术条件是可变的 4.要素密集度可借助于()来说明。 A.社会无差异曲线 B.需求曲线 C.等产量曲线 D.供给曲线 5.国际贸易会()贸易国出口部门特定要素的实际收入。 A.提高 B.降低 C.不影响 D.可能影响 6.在产品生命周期的产品成熟阶段,产品属于()。 A.研究与开发密集型 B.资本密集型 C.劳动密集型 D.土地密集型 7.属于国际收支账户中服务项目的有()。 A.证券投资 B.商品修理 C.计算机和信息服务 D.非货币黄金 8.购买力平价论(the theory of purchasing power parity),简称PPP理论,是()在其1922年出版的《1914年以后的货币与外汇》(money and foreign exchange after 1914)中第一次系统阐述的。 A.勒纳 B.卡塞尔 C.凯恩斯 D.多恩布什 9.假设某国的边际消费倾向为0.80,边际进口倾向为0.30,试问该国的对外贸易乘数是()。 A.1 B.2 C.3 D.4 10.假设即期汇率l英镑=2美元,在欧洲市场美元一年期的利率为15%,英镑为10%,求一年后的远期汇率1英镑等于()美元。 A.2.091 B.2 C.1.913 D.3 二、判断题(10小题,每小题1分,共10分):若判断正确,在小题后的括号内填上“√”号;若判断不正确,则在小题后的括号内填上“×”号。 1.相对国内经济而言,在国际经济中市场机制不容易得到贯彻。() 2.在机会成本不变条件下,两国生产中存在着不完全分工(incomplete specialization)。 () 3.李嘉图的比较优势学说比斯密的绝对优势学说更具有普遍的意义。() 4.要素禀赋是一个相对的概念,与一国所拥有的生产要素绝对数量无关。() 5.劳动在短期内是属于一种特定要素。() 6.产业内贸易反映比较优势。() 7.费雪模型证明,资本是从利率较低的国家流向利率较高的国家,即资本的流动是单向的,结果是各国的利率差消失。这种分析是以不存在风险为前提的。() 8.汇率超调模型在长期强调商品市场的价格粘性。() 9.国际收支的弹性分析法是一种一般均衡分析。() 10.在浮动汇率制度下,如果资本具有完全的流动性,通过财政政策刺激总需求不会实现影响均衡产量或均衡收入的目的。()国际经济学英文第七版克鲁格曼英文经济名词翻译

10套-《国际经济学》期末试卷及答案