[Trading] Technical Stock Analysis - Bollinger Bands and RSI

历史上30本值得一读的交易书籍

历史上30本值得一读的交易书籍(ZT)Top 30 history trading books虽然很长,但我想你应该认真的看完.我之所以用这个题目,而不用top 30 financial books, or top 30 investing books, or top 30 speculation books, 因为想从一个交易者的角度来看历史上排名的书籍, 虽然我用了多年的时间,每天消耗在美国图书馆达十几个小时,但这不表明这些推荐的书是最好的,当然有个人的偏见和爱好,公正在这个社会是不存在的,但合理是尽量的.法律没有完美的,但自律是应该的.所有图书基本上不是启蒙的. 所有这些书籍在东方华尔街论坛都有下载.我不是说中国的交易分析书籍不好,当然也有很经典的,遗憾的是我读过一些,感到还是英语的比较好,这是我的偏见,可能也是我愚钝的缘故.以下这些书籍我大多读过,有些还读过几十遍, 我个人的看法,如果人只是为了钱来到这个社会,那么要读的书籍真是太少了,因为你读过的非金融方面的书会成为你正统负担,而这些将为你的交易带来偏见,以至于你不得不一层层的剥皮,而成为一个好的交易师.给你的孩子一个忠告,我在一个讲座中也讲过这句话,当然遭到很多谴责. 如果你想让孩子成为亿万富翁,那么就应该让他读最值得读的书,很多书只能是浪费青春,读了太多只能加重交易的负担, 最值得读的书太少了,当然投资中的经典是最值得终身研究的. 什么佛教基督华伦功最好不要碰.做人和炒股完全是悖论, 当然这也不意味着我做人不怎么样. 高学位并不能带来最高受益, 看看炒股的巴菲特,读了什么书,当然是那本他老师经典的<证券分析学>了,我这里并不提倡你去读那本书,因为经典的基本分析已经被经典的投机分析取代了.这是我个人的观点.另外就是翻译问题,很多书翻译作者还没弄清书的真谛,为商业利益而翻译,建议能读英文原著最好,当然不能读的只好撮合翻译了.这里我尽力提供准确的翻译,当然我的水平也不是最好的,.我也想写一本经典的书,可是那是我退休以后的事情了.一. 10本经典的所有交易员需要终身领会的投资投机书籍1. How to Trade In Stocks 怎样交易股票by Jesse Livermore (Author)这本书是关于这个自杀者的总结,假使这本书出的早些,作者又会名扬天下的,这个人就是李佛摩尔.子书: Jesse Livermore: World's Greatest Stock Trader 李佛摩尔:世界最伟大的股票交易者by Richard Smitten (Author)其实瑞秋的这个标题不好,书中讲了很多除股市外的交易,如期货等.读这本书是不够的,你应该将这四本书一起读,仔细的领悟.子书: Reminiscences of a Stock Operator Illustrated (A Marketplace Book) 《股票作手回忆录》(大家都这么用这个题目,我也用了,因为太流行了,当然准确的翻译应该是: 一个股票操盘手回忆录的历程.by Edwin Lefevre (Author), Marketplace Books (Author), William J. O'Neil (Author)子书: Reminiscences of a Stock Operator (Wiley Investment Classics) 《股票作手回忆录》by Edwin Lefèvre (Author), Roger Lowenstein (Foreword)说明:这本书排名第一当之无愧, 它是立志于华尔街的案头书.2. 《华尔街四十五年》江恩华尔街四十五年英文版(William D. Gann - 45 Years In Wall Street一代大师江恩,当然是奇人,但要辩证的分析,早年的江恩近于玄学,这本书是它的心血结晶. 国内出版过中文版,翻译的不是非常理想。

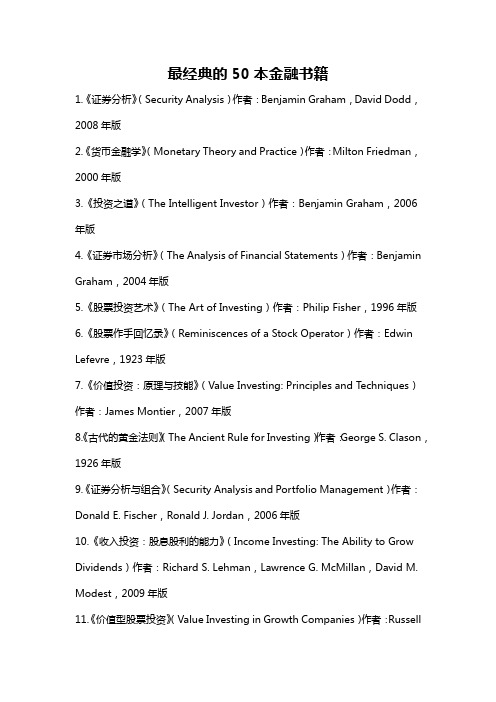

最经典的50本金融书籍

最经典的50本金融书籍1.《证券分析》(Security Analysis)作者:Benjamin Graham,David Dodd,2008年版2.《货币金融学》(Monetary Theory and Practice)作者:Milton Friedman,2000年版3.《投资之道》(The Intelligent Investor)作者:Benjamin Graham,2006年版4.《证券市场分析》(The Analysis of Financial Statements)作者:Benjamin Graham,2004年版5.《股票投资艺术》(The Art of Investing)作者:Philip Fisher,1996年版6.《股票作手回忆录》(Reminiscences of a Stock Operator)作者:Edwin Lefevre,1923年版7.《价值投资:原理与技能》(Value Investing: Principles and Techniques)作者:James Montier,2007年版8.《古代的黄金法则》(The Ancient Rule for Investing)作者:George S. Clason,1926年版9.《证券分析与组合》(Security Analysis and Portfolio Management)作者:Donald E. Fischer,Ronald J. Jordan,2006年版10.《收入投资:股息股利的能力》(Income Investing: The Ability to Grow Dividends)作者:Richard S. Lehman,Lawrence G. McMillan,David M. Modest,2009年版11.《价值型股票投资》(Value Investing in Growth Companies)作者:RussellJ. Wild,2002年版12.《通货膨胀投资》(Inflation-Proof Your Portfolio: How to Protect Your Money from the Coming Government Hyperinflation)作者:David Voda,2007年版13.《证券分析与管理》(Investment Analysis and Portfolio Management)作者:Frank K. Reilly,Keith C. Brown,2008年版14.《投资神话》(Investing Myths, Legends and Other Tall Tales)作者:Alan Skrainka,Barry R. James,2004年版15.《升势股票的投资法则》(The Little Book That Beats the Market)作者:Joel Greenblatt,2005年版16.《个人投资的艺术》(The Art of Personal Investing)作者:John L. Marietta,2006年版17.《股票分析与筛选总论》(The Complete Guide to Fundamental Analysis)作者:Rajiv Jackson,2004年版18.《股东人本主义》(The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public)作者:Lynn A. Stout,2012年版19.《领袖的经济学》(Leadership Economics)作者:Sam Allred,2003年版20.《散户投资指南》(The Individual Investor's Guide to the T op Mutual Funds and ETFs 2007-2008)作者:Morningstar,2007年版21.《股票市场分析方法》(Technical Analysis of Stock Trends)作者:RobertD. Edwards,John Magee,W.H.C. Bassetti,2006年版22.《金融政策》(Monetary Policy)作者:Axel Weber,2011年版23.《证券分析的寻找未来》(Looking Forward: The New Science of Financial Success)作者:Kenneth G. Winans,2002年版24.《超越普通股票评级》(Beyond the Wall Street Journal Guide to Understanding Money and Investing)作者:Byron R. Wien,2001年版25.《股票市场的历史》(A History of the Stock Market)作者:Mark R. Shenkman,2005年版26.《个人理财》(Personal Finance)作者:E. Thomas Garman,Raymond E. Forgue,2009年版27.《投资之道(译本)》(The Intelligent Investor)作者:Benjamin Graham,2006年版28.《投资学》(Investments)作者:Bodie/Kane/Marcus,2008年版29.《股票投资商》(Stock Investing for Everyone)作者:David Holt,2003年版30.《修建股票投资的基础设施》(Building the Stock Investing Infrastructure)作者:Brad R. Houk,2003年版31.《投资幸存指南》(Survival Guide for Investors)作者:Karen Lee,2009年版32.《股票市场不是超自然场所》(The Stock Market is Not a Supernatural Place)作者:Nicholas J. Darvas,2005年版33.《外汇交易从零开始》(Forex from Scratch: A Quick Course on Tradingthe Foreign Exchange Markets)作者:Alex Douglas,2004年版34.《利用技术分析的股票投资》(Stock Investing with Technical Analysis)作者:Bollinger John,2001年版35.《股票市场之心》(The Heart of the Stock Market)作者:Marvin Appel,2002年版36.《股票投机》(Stock Speculation)作者:Henry Clews,2005年版37.《理解股票市场》(Understanding the Stock Market)作者:Marc Chandler,2003年版38.《利用技术分析洞察股票行情》(Technical Analysis for the Trading Professional)作者:Constance M. Brown,2009年版39.《股票市场投资艺术》(The Art of Investing in the Stock Market)作者:Evans Alonzo,2008年版40.《投资新博弈》(The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns)作者:Lois Peltz,1998年版41.《股票市场投资战略分析》(The Investor's Guide to Active Asset Allocation)作者:Kayes Neil,2008年版42.《金融与金融市场》(Finance and Financial Markets)作者:Keith Pilbeam,2006年版43.《英美经济史》(An Economic History of England: 1066-1990)作者:George Clark,2006年版44.《金融危机》(Financial Crises and What to Do About Them)作者:Barry Eichengreen,2002年版45.《马倌经济学家》(The Marek Fuchs Economist)作者:Marek Fuchs,2008年版46.《交叉货币汇率的利益与缺陷》(The Benefits and Flaws of Cross-Currency Exchange Rates)作者:Janet M. Gorrie,2009年版47.《股票交易时代》(Trading the Stock Market)作者:Tom Connor,2009年版48.《策略型股市投资》(Strategic Stock Trading)作者:Simon Vine,2002年版49.《稳盈股票交易》(Steady-State Stock Trading)作者:Keith Schap,2003年版50.《基于Silicon Valley思维的股票投资》(Venture Investing: Silicon Valley Thinking and Silicon Alley Investing)作者:David Kline,2009年版。

股票术语中英文对照以及解释

股票术语中英文对照以及解释套利 (Arbitrage)在不同的市场同时买入和卖出单一证券,以赚取差价。

资产 (Assets)公司的所有权,可以是有形的、无形的、固定或流动的。

自行处理权 (At Discretion)客户给经纪买或卖处理权的指示类型。

限额 (At Limit)客户给股票经纪不能买超过或卖低于某一价位的限制。

At The Market以现行价格买或卖证券的订单。

额定资本 (Authorized Capital)在公司联合备忘录中协订的实缴资本的最高金额。

平均 (Averaging)以不同的价格买或卖同样的股票的过程,以建立平均成本。

基本点(Basic Points)指债券收益率。

债券收益率中每一个百分点等于100个基本点。

如果债券收益率从7.25%变为7.39%,即升高了14个基本点。

熊市(Bear)预测股价将跌落而抛售股票。

熊市是股价下跌的延伸期,通常为下跌20%或更多。

牛市(Bull)预期股价将上扬而买入股票。

牛市表明市场持续上扬走势。

B系数(Beta)衡量股市风险的一种尺度。

0.7意味着股价可能按市场同样方向移动70%。

-1.3意味着股价可能与市场相反方向移动130%。

蓝筹股(Blue Chip)在投资中级别最高的普通股。

债券(Bond)记录借款的凭证,承诺在特定时间支付债券持有人特别利息,并于到期日偿还借款额。

发行红(利)股(Bonus Issue)以无偿发行股票的形式(通常是以资本项目)分配资金给股东。

簿记截止日(Book Closing Date)公司股东记录截止登记日,以决定股息、红利或附加股的授权。

簿记价值(Book value)公司资产簿记帐面价值。

簿记价值不必与购买成本或市场价值一致。

经纪费,佣金(Brokerage)股票经纪人因其买或卖股票服务而收取的费用。

业务循环(Business Cycle)经济活动的周期性变动,带动收入和就业变动。

确保买进(Buying-in)买入证券,而由卖方承担风险。

股票英语术语

股票英语术语常用的股票英语术语:1.Stock/Share:股票,表示公司的所有权单位。

2.Equity:股本,代表公司所有权的总值。

mon Stock:普通股,享有公司盈利的分红权和投票权。

4.Preferred Stock:优先股,享有优先分红权,但通常没有投票权。

5.Dividend:股息,公司向股东支付的现金或股票形式的利润。

6.Market Capitalization:市值,公司所有股票的市场价值总和。

7.Bull Market:牛市,股票价格持续上涨的市场。

8.Bear Market:熊市,股票价格持续下跌的市场。

9.Stock Price:股票价格,指单股股票的交易价格。

10.IPO (Initial Public Offering):首次公开募股,公司首次在公开市场上发行股票。

11.Trading Volume:交易量,一定时间内买卖的股票数量。

12.Broker:经纪人,帮助投资者买卖股票的金融中介。

13.Portfolio:投资组合,投资者持有的所有股票和其他投资的总和。

14.Blue Chip Stock:蓝筹股,指大型、稳定且通常具有良好盈利记录的公司股票。

15.Penny Stock:低价股,价格极低的股票,通常具有较高的风险。

16.Growth Stock:成长股,指具有高增长潜力的公司股票。

17.Value Stock:价值股,指市场价格低于其内在价值的股票。

18.Market Maker:做市商,负责在交易市场上提供买卖报价并维持市场流动性的金融机构。

19.Technical Analysis:技术分析,通过分析历史价格和交易量数据来预测未来股价走势的方法。

20.Fundamental Analysis:基本面分析,通过分析公司的财务数据、经营情况和行业趋势来评估股票价值的方法。

我的投资目标英语作文带翻译

我的投资目标英语作文带翻译Learn how to invest in the stock market.If you are a beginner or expert,before investing in the stock market,you can find basic and advanced trading skills and ideas about stock investment on this website.You'd better learn some investment market skills.In other words,understanding the market is necessary for beginners.Investment skills and ideas(how to start):to start investing in the stock market,you must choose A stockbroker a stockbroker who trades financial instruments on the stock market as an agent for a client.You know that many people have the same trading opportunities in the stock market,but very few of them make money in the stock market.Many of them can't earn enough returns and have enough information to invest in the stock market.They will make some common mistakes,and you should avoid these mistakes through a high level of understanding of the market.There are two ways to invest in the stock market:technical analysis and fundamental analysis.Technical analysis is based on price and trading volume.Technical investors believe that price and volume canexplain everything in the market.They study charts to predict future changes in stock prices or financial prices.Learning technical analysis does not require academic knowledge.Fundamental analysis is a kind of use of financial and trading volume Economic analysis to predict stock price changes stock valuation method idea:learn more technical tips:you can learn about Fibonacci sequence,Elliott wave theory,Dow Theory and other stock trading strategies stock market risk:what do you know about risk and how do you know that risk is quantifiable how to manage risk concept and management is investment capital A complex part of Automated Trading:you can learn and use trading software to automate your stock investment strategies.Many investors use stock trading software to control their emotions,so that they can focus on stock trading strategies.There are many other advantages to using trading software and systems,such as saving time and managing risks,enjoying making money on stocks.We hope you can get through the software Read and learn these skills and ideas to improve your understanding of the stock market.中文翻译:学习如何投资股市如果你是初学者或专家,在投资股市之前,你可以在这个网站找到关于股票投资的基本和高级交易技巧和想法,你最好学习一些投资市场的技巧,换句话说,了解市场是必需的初学者投资技巧和想法(如何开始):开始投资股票市场,你必须选择一个股票经纪人股票经纪人作为客户的代理人在股票市场上进行金融工具的交易。

投资英语词汇翻译

投资英语词汇翻译English汉语Accrued interest应得利息All-Ordinaries Index所有普通股指数Arbitrage套戥Ask Price买价Asset-Backed Securities具资产保证的证券At-the-money刚到价Automatic Order Matching And Execution System自动对盘及成交系统Basis Point基点Bear Markets熊市Bid Price卖价Bid-ask Spread买卖差价Blue Chips蓝筹股Bond债券Book Value账面值Broker经纪Brokerage Fee经纪佣金Bull Markets牛市Call Option好仓期权/买入(认购)期权Callable Bonds可赎回债券Capital Gain资本增值Capital Markets资本市场Central Clearing and Settlement System中央结算系统Central Money Market Units债务工具中央结算系统Certificate of Deposits存款证China Concepts Stock中国概念股Closed-end闭端基金Collateral抵押品Commercial Paper商业票据Common Stock普通股Compound Interest复息Contract Note成交单Controlling Shareholder控制股东Convertible Bond可换股债券Corporate Bond公司债券Coupon票息Coupon Frequency派息次数Coupon Rate票面息率Covered warrants备兑认股权证Credit Rating信用评级Currency Board货币发行局Current Yield现价息率Custody of Securities证券托管Default Risk不能收回本金的风险Derivative Call衍生认购(认沽)认股权证Derivative Instrument衍生产品Direct Business直接成交Discount Bond折扣债券Diversification分散风险Duration期限Earnings收益Earnings per Share每股盈利Earnings Yield盈利率Equity股本Equity Call Warrants股本认购认股权证Ex-dividend除息Face Value/ Nominal Value面值Fixed Rate Bonds定息债券Fixed-income securities定息证券Floating Rate Bonds浮息债券Fundamental Analysis基本分析Future Value未来值Future Value of an Annuity定期供款之未来值Futures contract期货合约Hang Seng China Enterprises index恒生香港中资企业指数Hang Seng Index香港恒生指数Hang Seng London Reference Index恒生伦敦参考指数Hedge对冲Hong Kong Inter-Bank Offered Rate香港银行同业拆息Hong Kong Monetary Authority香港金融管理局Hong Kong Securities Clearing Company Ltd.香港中央结算有限公司H-Share股HSI Futures Contract恒生指数期货合约Income收入Index Fund指数基金Initial Public Offering首次公开招股Inside Information内幕消息Insider Trading内幕交易Intrinsic Value内在价值Investment投资Investment Adviser投资顾问IPO price首次公开招股价Junk Bond垃圾债券Leverage Ratio杠杆比率Limit Order限价指示Limited Company有限公司Liquidity变现能力Listing挂牌Listing Date上市日期Margin Call补仓Market Capitalisation市价总值Market Maker庄家Market Order市场指示Money Market货币市场Mutual Fund互惠基金Net Asset Value资产净值Offer For Sale公开发售Offer For Subscription公开认购Open Offer公开供股Open-end开放基金Option期权Oversubscribed超额认购Par Bond平价债券Par Value票面值Perpetual Bonds永久债券Placing配售Portfolio投资组合Preference Shares优先股Premium溢价(认股证)Premium Bond溢价债券Present Value现时值Present Value of An Annuity定期供款之现时值Price/Earnings Ratio市盈率Privatisation私有化Professional Conduct Regulations专业操守规例Prospectus招股书Put Option淡仓期权/卖出(认沽)期权Rate of Return收期率Real Interest Rate实质利率Red Chip红筹股Redemption Value赎回价值Reinvestment Value再投资利率Relative Strength Index/RSI相对强弱指数Repurchase Agreement回购协议Resistance Level阻力价位Return回报Rights Issue供股发行Risk-Averse, Risk-Neutral, Risk-Taking风险厌恶,风险中立,追求风险Securities And Futures Commission证券及期货事务监察委员会Securities Dealers´ Representatives证券交易商SEHK联交所Senior Bond优先债券Settlement结算Short Hedge空头对冲Short Position空仓Short Selling抛空/沽空Speculation投机Stock Splits股票分拆Subordinated Bond后偿债券Substantial Shareholder大股东Support Level支持价位Technical Analysis技术分析The Stock Exchange of Hong Kong Ltd.香港联合交易所有限公司Time Horizon投资期Trading Hours of SEHK联合交易所的交易时间Trading Rules交易规则Trust Deed信托契约Underlying Security认股权证相关的股份Unified Exchange Compensation Fund Scheme联合交易所赔偿基金Valuation估价Warrant认股权证Window Dressing粉饰橱窗Yield盈利率Yield To Maturity到期孳息率Zero Coupon Bond无息债券。

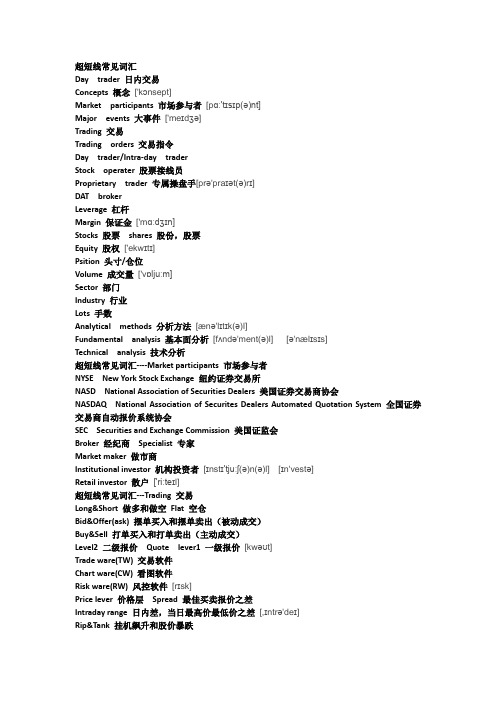

美股常用词

超短线常见词汇Day trader 日内交易Concepts 概念['kɔnsept]Market participants 市场参与者[pɑː'tɪsɪp(ə)nt]Major events 大事件['meɪdʒə]Trading 交易Trading orders 交易指令Day trader/Intra-day traderStock operater 股票接线员Proprietary trader 专属操盘手[prə'praɪət(ə)rɪ]DAT brokerLeverage 杠杆Margin 保证金['mɑːdʒɪn]Stocks 股票shares 股份,股票Equity 股权['ekwɪtɪ]Psition 头寸/仓位Volume 成交量['vɒljuːm]Sector 部门Industry 行业Lots 手数Analytical methods 分析方法[ænə'lɪtɪk(ə)l]Fundamental analysis 基本面分析[fʌndə'ment(ə)l] [ə'nælɪsɪs]Technical analysis 技术分析超短线常见词汇----Market participants 市场参与者NYSE New York Stock Exchange 纽约证券交易所NASD National Association of Securities Dealers 美国证券交易商协会NASDAQ National Association of Securites Dealers Automated Quotation System 全国证券交易商自动报价系统协会SEC Securities and Exchange Commission 美国证监会Broker 经纪商Specialist 专家Market maker 做市商Institutional investor 机构投资者[ɪnstɪ'tjuːʃ(ə)n(ə)l] [ɪn'vestə]Retail investor 散户['riːteɪl]超短线常见词汇---Trading 交易Long&Short 做多和做空Flat 空仓Bid&Offer(ask) 摆单买入和摆单卖出(被动成交)Buy&Sell 打单买入和打单卖出(主动成交)Level2 二级报价Quote lever1 一级报价[kwəʊt]Trade ware(TW) 交易软件Chart ware(CW) 看图软件Risk ware(RW) 风控软件[rɪsk]Price lever 价格层Spread 最佳买卖报价之差Intraday range 日内差,当日最高价最低价之差[,ɪntrə'deɪ]Rip&Tank 挂机飙升和股价暴跌超短线常见词汇---Trading orders 交易指令Limit order 限价指令Limit buy/Limit sell 限制购买/限制出售Stop order 止损指令Order routing 买卖盘传递/指令路由['ru:tiŋ]Hybrid trading 混合交易制度['haɪbrɪd]Trading mechanism 交易机制['mek(ə)nɪz(ə)m]经济新闻词汇(一)Blue chip shares 热门股票Blue chip stocks 蓝筹股Bearish 看跌的,卖空的['beərɪʃ]Bears 空头Bullish 看多的,牛市的['bʊlɪʃ]Bulls 多头Rally 价格止跌回稳['rælɪ]Recover 恢复经济新闻词汇(二)在证券交易所Active trading 交易活跃Moderate trading 交易适度['mɒd(ə)rət]Over/excessive trading 过度交易[ɪk'sesɪv]Change hands 易手,交易成功Turnover 成交金额['tɜːnəʊvə]经济新闻词汇(三)Dull 乏味的,阴沉的,低沉的,笨的Hesitant 迟疑的,犹豫不定的['hezɪt(ə)nt]Lackluster 无光泽的,死气沉沉的,无生气的['læk,lʌstə] Light 轻的Negligible 可以忽略不计的['neglɪdʒɪb(ə)l]Quiet 安静的,轻声的Slow 慢的,不忙碌的Sluggish 怠慢的['slʌgɪʃ]Thin薄,细,瘦,稀薄Weak 虚弱的能力差的经济新闻词汇(四)股票的价格趋向不清晰时,用下列形容词Bumpy 颠簸的,起伏不平的['bʌmpɪ]Choppy 波涛汹涌的['tʃɒpɪ]Hesitant 迟疑的,犹豫不定的Mixed 混合的,形形色色的,弄糊涂的[mɪkst] Uncertain 不定的,不可靠的[ʌn'sɜːt(ə)n]。

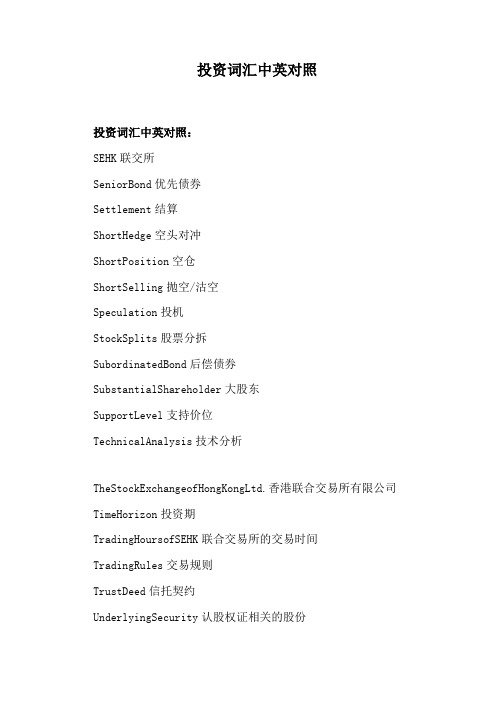

投资词汇中英对照

投资词汇中英对照投资词汇中英对照:SEHK联交所SeniorBond优先债券Settlement结算ShortHedge空头对冲ShortPosition空仓ShortSelling抛空/沽空Speculation投机StockSplits股票分拆SubordinatedBond后偿债券SubstantialShareholder大股东SupportLevel支持价位TechnicalAnalysis技术分析TheStockExchangeofHongKongLtd.香港联合交易所有限公司TimeHorizon投资期TradingHoursofSEHK联合交易所的交易时间TradingRules交易规则TrustDeed信托契约UnderlyingSecurity认股权证相关的股份UnifiedExchangeCompensationFundScheme联合交易所赔偿基金Valuation估价Warrant认股权证WindowDressing粉饰橱窗Yield盈利率YieldToMaturity到期孳息率ZeroCouponBond无息债券Accruedinterest应得利息All-OrdinariesIndex所有普通股指数Arbitrage套戥AskPrice买价Asset-BackedSecurities具资产保证的证券At-the-money刚到价AutomaticOrderMatchingAndExecutionSystem自动对盘及成交系统BasisPoint基点BearMarkets熊市BidPrice卖价Bid-askSpread买卖差价BlueChips蓝筹股Bond债券BookValue账面值Broker经纪BrokerageFee经纪佣金BullMarkets牛市CallOption好仓期权/买入(认购)期权CallableBonds可赎回债券CapitalGain资本增值CapitalMarkets资本市场CentralClearingandSettlementSystem中央结算系统CentralMoneyMarketUnits债务工具中央结算系统CertificateofDeposits存款证ChinaConceptsStock中国概念股Closed-end闭端基金Collateral抵押品CommercialPaper商业票据CommonStock普通股CompoundInterest复息ContractNote成交单ControllingShareholder控制股东ConvertibleBond可换股债券CorporateBond公司债券Coupon票息CouponFrequency派息次数CouponRate票面息率Coveredwarrants备兑认股权证CreditRating信用评级CurrencyBoard货币发行局CurrentYield现价息率CustodyofSecurities证券托管DefaultRisk不能收回本金的风险DerivativeCall衍生认购(认沽)认股权证DerivativeInstrument衍生产品DirectBusiness直接成交DiscountBond折扣债券Diversification分散风险Duration期限Earnings收益EarningsperShare每股盈利EarningsYield盈利率Equity股本EquityCallWarrants股本认购认股权证Ex-dividend除息FaceValue/NominalValue面值FixedRateBonds定息债券Fixed-incomesecurities定息证券FloatingRateBonds浮息债券FundamentalAnalysis基本分析FutureValue未来值FutureValueofanAnnuity定期供款之未来值Futurescontract期货合约HangSengChinaEnterprisesindex恒生香港中资企业指数HangSengIndex香港恒生指数HangSengLondonReferenceIndex恒生伦敦参考指数Hedge对冲HongKongInter-BankOfferedRate香港银行同业拆息HongKongMonetaryAuthority香港金融管理局HongKongSecuritiesClearingCompanyLtd.香港中央结算有限公司H-Share股HSIFuturesContract恒生指数期货合约Income收入IndexFund指数基金InitialPublicOffering首次公开招股InsideInformation内幕消息InsiderTrading内幕交易IntrinsicValue内在价值Investment投资InvestmentAdviser投资顾问IPOprice首次公开招股价JunkBond垃圾债券LeverageRatio杠杆比率LimitOrder限价指示LimitedCompany有限公司Liquidity变现能力Listing挂牌ListingDate上市日期MarginCall补仓MarketCapitalisation市价总值MarketMaker庄家MarketOrder市场指示MoneyMarket货币市场MutualFund互惠基金NetAssetValue资产净值OfferForSale公开发售OfferForSubscription公开认购OpenOffer公开供股Open-end开放基金Option期权Oversubscribed超额认购ParBond平价债券ParValue票面值PerpetualBonds永久债券Placing配售Portfolio投资组合PreferenceShares优先股Premium溢价(认股证)PremiumBond溢价债券PresentValue现时值PresentValueofAnAnnuity定期供款之现时值Price/EarningsRatio市盈率Privatisation私有化ProfessionalConductRegulations专业操守规例Prospectus招股书PutOption淡仓期权/卖出(认沽)期权RateofReturn收期率RealInterestRate实质利率RedChip红筹股RedemptionValue赎回价值ReinvestmentValue再投资利率RelativeStrengthIndex/RSI相对强弱指数RepurchaseAgreement回购协议ResistanceLevel阻力价位Return回报RightsIssue供股发行Risk-Averse,Risk-Neutral,Risk-Taking风险厌恶,风险中立,追求风险SecuritiesAndFuturesCommission证券及期货事务监察委员会SecuritiesDealers´Representatives证券交易商。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Subject: Technical Stock AnalysisBollinger BandsDeveloped by John Bollinger, Bollinger Bands allows users to compare volatility and relative price levels over a period time. Bollinger Bands are envelopes which surround the price bars on a chart. They are plotted two standard deviations away from a simple moving average. Because standard deviation is a measure of volatility, the bands adjust themselves to ongoing market conditions. They widen during volatile market periods and contract during less volatile periods. Bollinger Bands are, essentially, moving standard deviation bands.Bollinger Bands are sometimes displayed with a third center line. This is the simple moving average line. Mr. Bollinger recommends using a 10 day moving average for short term trading, 20 days for intermediate term trading, and 50 days for longer term trading.The standard deviation value may be varied. Increase the value of the standard deviation from 2 standard deviations to 2-1/2 standard deviations away from the moving average when using a 50 day moving average. Conversely, lower the value of the standard deviation from 2 to 1-1/2 standard deviations away from the moving average when using a 10 day moving average. Bollinger Bands do not generate buy and sell signals alone. They should be used with another indicator. I use them with RSI, described below. This is because when price touches one of the bands, it could indicate one of two things. It could indicate a continuation of the trend; or it could indicate a reaction the other way. By themselves they do not tell us when to buy and sell. However, when combined with an indicator such as RSI, they become powerful. RSI is an excellent indicator with respect to overbought and oversold conditions. When price touches the upper band, and RSI is below 70, we have an indication that the trend will continue. When price touches the lower band, and RSI is above 30, we have an indication that the trend will continue. If we run into a situation where price touches the upper band and RSI is above 70 (possibly approaching 80) we have an indication that the trend may reverse itself and move downward. On the other hand, if price touches the lower band and RSI is below 30 (possibly approaching 20) we have an indication that the trend may reverse itself and move upward.Avoid using several different indicators all using same input data. If you're using RSI with the Bollinger Bands, don't use MACD too. They both use the same inputs. Consider using On Balance Volume, or Money Flow with RSI. Relying on different inputs they measure different things. They can be used together as further confirmation of a trend.While there are many ways to use Bollinger Bands, following are a few rules that serve as a good beginning point.1.Bollinger Bands provide a relative definition of high and low.2.That relative definition can be used to compare price action and indicator action to arrive atrigorous buy and sell decisions.3.Appropriate indicators can be derived from momentum, volume, sentiment, open interest,inter-market data, etc.4.Volatility and trend have already been deployed in the construction of Bollinger Bands, sotheir use for confirmation of price action is not recommended.5.The indicators used should not be directly related to one another. For example, you might useone momentum indicator and one volume indicator successfully.6.Bollinger Bands can also be used to clarify pure price patterns such as "M" tops and "W"bottoms, momentum shifts, etc.7.Price can, and does, walk up the upper Bollinger Band and down the lower Bollinger Band.8.Closes outside the Bollinger Bands are continuation signals, not reversal signals. (This hasbeen the basis for many successful volatility breakout systems.)9.The default parameters of 20 periods for the moving average and standard deviationcalculations, and two standard deviations for the bandwidth may be varied for the market. 10.The average deployed should not be the best one for crossovers. Rather, it should bedescriptive of the intermediate-term trend.11.If the average is lengthened the number of standard deviations needs to be increasedsimultaneously; from 2 at 20 periods, to 2.5 at 50 periods. If the average is shortened the number of standard deviations should be reduced; from 2 at 20 periods, to 1.5 at 10 periods.12.Bollinger Bands are based upon a simple moving average. This is because a simple movingaverage is used in the standard deviation calculation and we wish to be logically consistent.13.Make no statistical assumptions based on the use of the standard deviation calculation in theconstruction of the bands. The sample size in most deployments of Bollinger Bands is simply too small for statistical significance.14.Finally, tags of the bands are just that, tags not signals. Touching the upper band is NOT in-and-of-itself a sell signal and touching the lower band is NOT in-and-of-itself a buy signal. Again, this indicator consists of three bands encompassing a security's price action. Defaults are:1. A simple moving average in the middle, usually 20 days for intermediate investing.2.An upper band ( 20 day SMA plus 2 standard deviations)3. A lower band (20 day SMA minus 2 standard deviations)Standard deviation is a statistical term that provides a good indication of volatility. Using it ensures the bands will react quickly to price movements and reflect periods of high and low volatility. Sharp price changes and hence volatility, will lead to a widening of the bands. Closing prices are usually used to compute Bollinger Bands. Other variations can also be used. The length of the moving average and number of deviations can be adjusted to better suit individual preferences and specific characteristics of a security.One method to determine an appropriate moving average length is a visual assessment. Bollinger Bands should encompass the majority of price action, but not all. After sharp moves, penetration of the bands is normal. If prices appear to penetrate the outer bands too often, then a longer moving average may be required. If prices rarely touch the outer bands, then a shorter moving average may be required.A more exact method to determine moving average length is by matching it with a reaction low after a bottom. For a bottom to form and a downtrend to reverse, a security needs to form a low that is higher than the previous low. Properly set Bollinger Bands should hold support established by the second (higher) low. If the second low penetrates the lower band, then the moving average is too short. If the second low remains above the lower band, then the moving average is too long. The same logic can be applied to peaks and reaction rallies. The upper band should mark resistance for the first reaction rally after a peak.In addition to identifying relative price levels and volatility, Bollinger Bands can be combined with price action and other indicators to generate signals and foreshadow significant moves:Double bottom buy: A double bottom buy signal is given when prices penetrate the lower band and remain above the lower band after a subsequent low forms. Either low can be higher or lower than the other. The important thing is that the second low remains above the lower band. The bullish setup is confirmed when the price moves above the middle simple moving average.Double top sell: A sell signal is given when prices peak above the upper band and a subsequent peak fails to break above the upper band. The bearish setup is confirmed when prices decline below the middle band.Sharp price changes can occur after the bands have tightened and volatility is low. In this instance, Bollinger Bands do not give any hint as to the future direction of prices. Direction must be determined using other indicators and aspects of technical analysis. Many securities go through periods of high volatility followed by periods of low volatility. Using Bollinger Bands, these periods can be easily identified with a visual assessment. Tight bands indicate low volatility and wide bands indicate high volatility.Again, although Bollinger Bands can help generate buy and sell signals, they are not designed to determine the future direction of a security. The bands were designed to augment other analysis techniques and indicators. By themselves, Bollinger Bands serve two primary functions:•To identify periods of high and low volatility•To identify periods when prices are at extreme, and possibly unsustainable, levels.As stated above, securities can fluctuate between periods of high volatility and low volatility. Being able to identify a period of low volatility can serve as an alert to monitor the price action of a security. Other aspects of technical analysis, such as momentum, moving averages and retracements, can then be employed to help determine the direction of the potential breakout. Remember, buy and sell signals are not given when prices reach the upper or lower bands. Such levels merely indicate that prices are high or low on a relative basis. A security can become overbought or oversold for an extended period of time. Knowing whether prices are high or low on a relative basis enhances interpretation of other indicators and timing issues in trading. Bollinger Bands are a pair of values placed as an "envelope" around a data field. The values are calculated by taking the moving average of the data for the given period and adding or subtracting the specified number of standard deviations for the same period from the moving average. Since Bollinger Bands use a moving average, the value at the beginning of a data series is not defined until there are enough values to fill the given period. Used to confirm trading signals, normally from a Momentum Indicator, the bands indicate overbought and oversold levels relative to a moving average.The bands are calculated at specified standard deviations above and below the moving average, causing them to widen when prices are volatile and contract when prices are stable.Bollinger Bands are useful for determining whether current values of a data field are behaving normally or breaking out in a new direction. For example, when the closing price of a security increases above its upper Bollinger Band, it will typically increase in that direction.Bollinger Bands can also be used for identifying when trend reversals may occur. New highs or lows outside of the bands followed by another high/low inside of the bands typically indicates a reversal in the current trend.Since the standard deviation can be used as a volatility indicator, the current width of the envelope can also be used for trend information. A wide envelope indicates a high amount of volatility, while a narrow envelope indicates a lower amount. High volatility levels can sometimes be used to time trend reversals, such as market tops and bottoms. Low volatility levels can sometimes be used to time the beginning of new upward price trends following periods of consolidation.Another observable trait of Bollinger Bands is that moves that begin at one band tend to go all the way to the other band. This can be useful for forecasting future values. Bollinger Bands are similar to Trading Bands and share many of their characteristics. However, unlike Bollinger Bands, Trading Bands do not vary in width based on volatility.In this example Microsoft is charted using 20 day Bollinger bands at 2 standard deviations.Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. The first breakout is often a false move, preceding a strong trend in the opposite direction. A contracting range [C] is evident in June 1998: the bands converge to a width of $2, followed by a breakout in July to a new high.A move that starts at one band normally carries through to the other, in a ranging market. A move outside the band indicates that the trend is strong and likely to continue - unless price quickly reverses. Note the quick reversal [QR] in early August. A trend that hugs one band signals that the trend is strong and likely to continue. Wait for divergence on a Momentum Indicator to signal the end of a trend.In this example, 20 day Bollinger Bands at 2 standard deviations and 10 day Rate of Change.1.Go short [S] - bearish divergence on ROC.2.Contracting Bollinger Bands [C] warn of increased volatility. This begins with a false rally(note the ROC triple divergence) followed by a sharp fall.3.Go long [L] - price hugs the lower band, followed by a bullish divergence on ROC.4.Go short [S] - price hugs the upper band, followed by a bearish divergence on ROC.RSI – Relative Strength IndicatorDeveloped by J. Welles Wilder and introduced in his book, New Concepts in Technical Trading Systems, the Relative Strength Index (RSI) is an extremely popular momentum oscillator. The RSI compares the magnitude of a stock's recent gains to the magnitude of its recent losses and turns that information into a number that ranges from 0 to 100. It takes a single parameter, the number of time periods to use in the calculation. Wilder recommends using 14 periods.The RSI's full name is actually rather unfortunate as it is easily confused with other forms of Relative Strength analysis. Most other kinds of "Relative Strength" stuff involve using more than one stock in the calculation. Like most true indicators, the RSI only needs one stock to be computed. In order to avoid confusion, avoid using the RSI's full name and just call it "the RSI."To be used in conjunction with Bollinger Bands, the Relative Strength Indicator or index is based on a ratio of the average upward changes to the average downward changes over a given period of time. It has a range of 0 to 100 with values typically remaining between 30 and 70.Higher values indicate overbought conditions while lower values indicate oversold conditions. The Relative Strength Index at the beginning of a data series is not defined until there are enough values to fill the given period. In addition, the value is defined as 100 when no downward changes occur during the given period. The Relative Strength Index (RSI) is typically used with a 9, 14, or 25 calendar day (7, 10, or 20 trading day) period against the closing price of a security or commodity. The more days that are included in the calculation, the less volatile the value. The RSI usually leads the price by forming peaks and valleys before the price data, especially around the values of 30 and 70. In addition, when the RSI diverges from the price, the price will eventually correct to the direction of the index. The Relative Strength Index function determines the internal strength of a field using the number of upward and downward price changes over a given period of time. To simplify the formula, the RSI has been broken down into its basic components which are the Average Gain, the Average Loss, the First RS, and the subsequent Smoothed RS's.For a 14-period RSI, the Average Gain equals the sum total all gains divided by 14. Even if there are only 5 gains (losses), the total of those 5 gains (losses) is divided by the total number of RSI periods in the calculation (14 in this case). The Average Loss is computed in a similar manner. Calculation of the First RS value is straightforward: divide the Average Gain by the Average Loss. All subsequent RS calculations use the previous period's Average Gain and Average Loss for smoothing purposes.When the Average Gain is greater than the Average Loss, the RSI rises because RS will be greater than 1. Conversely, when the average loss is greater than the average gain, the RSI declines because RS will be less than 1. The last part of the formula ensures that the indicator oscillates between 0 and 100.Wilder recommended using 70 and 30 and overbought and oversold levels respectively. Generally, if the RSI rises above 30 it is considered bullish for the underlying stock. Conversely, if the RSI falls below 70, it is a bearish signal. Some traders identify the long-term trend and then use extreme readings for entry points. If the long-term trend is bullish, then oversold readings could mark potential entry points.Buy and sell signals can also be generated by looking for positive and negative divergences between the RSI and the underlying stock. For example, consider a falling stock whose RSI rises from a low point of (for example) 15 back up to say, 55. Because of how the RSI is constructed, the underlying stock will often reverse its direction soon after such a divergence. As in that example, divergences that occur after an overbought or oversold reading usually provide more reliable signals.The centerline for RSI is 50. Readings above and below can give the indicator a bullish or bearish tilt. On the whole, a reading above 50 indicates that average gains are higher than average losses and a reading below 50 indicates that losses are winning the battle. Some traders look for a move above 50 to confirm bullish signals or a move below 50 to confirm bearish signals.。