管理会计F2选择题题库

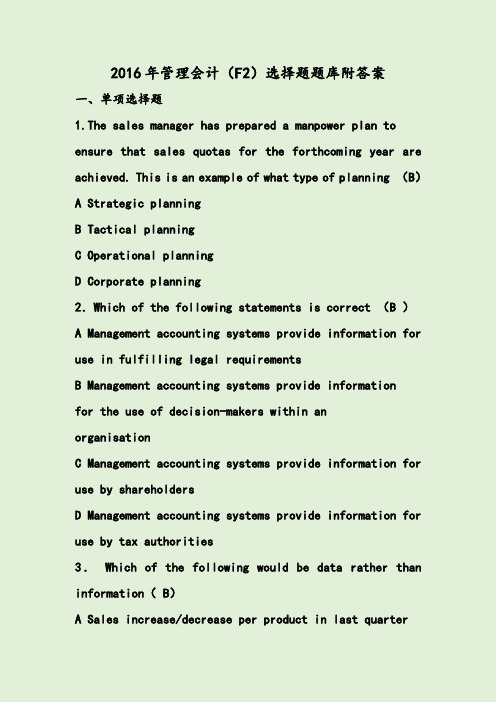

2016年管理会计(F2)选择题题库附答案

2016年管理会计(F2)选择题题库附答案一、单项选择题1.The sales manager has prepared a manpower plan to ensure that sales quotas for the forthcoming year are achieved.This is an example of what type of planning(B)A Strategic planningB Tactical planningC Operational planningD Corporate planning2.Which of the following statements is correct(B)A Management accounting systems provide information for use in fulfilling legal requirementsB Management accounting systems provide informationfor the use of decision-makers within anorganisationC Management accounting systems provide information for use by shareholdersD Management accounting systems provide information for use by tax authorities3.Which of the following would be data rather than information(B)A Sales increase/decrease per product in last quarterB Total sales value per productC Sales made per salesman as a percentage of total salesD Sales staff commission as a percentage of total sales 4.Which of the following would be classed as indirect labour(B)A Assembly workers in a company manufacturing televisionsB A stores assistant in a factory storeC Plasterers in a construction companyD A consultant in a firm of management consultants5.A company makes chairs and tables.Which of the following items would be treated as an indirect cost(D)A Wood used to make a chairB Metal used for the legs of a chairC Fabric to cover the seat of a chairD The salary of the sales director of the company 6.Which of the following best describes a controllable cost(C)A A cost which arises from a decision already taken, which cannot,in the short run,be changed.B A cost for which the behaviour pattern can be easily analysed to facilitate valid budgetary control comparisons.C A cost which can be influenced by its budget holder.D A specific cost of an activity or business which would be avoided if the activity or business did not exist. 7.Which of the following best describes a period cost (A)A cost that relates to a time period which is deducted as expenses for the period and is not included in the inventory valuation.B A cost that can be easily allocated to a particular period, without the need for arbitraryapportionment between periods.C A cost that is identified with a unit producedduring the period,and is included in the value of inventory.The cost is treated as an expense for the period when the inventory is actually sold.D A cost that is incurred regularly every period,eg every month or quarter.8.Fixed costs are conventionally deemed to be which of the following(D)A Constant per unit of outputB Outside the control of managementC Easily controlledD Constant in total when production volume changes9..Which one of the above graphs illustrates the costs described A linear variable cost–when the vertical axis represents cost incurred.(B)A Graph1B Graph2C Graph4D Graph5Which one of the above graphs illustrates the costs described A fixed cost–when the vertical axis represents cost incurred.(A)A Graph1B Graph2C Graph3D Graph6Which one of the above graphs illustrates the costs described A linear variable cost–when the vertical axis represents cost per unit.(A)A Graph1B Graph2C Graph3D Graph6Which one of the above graphs illustrates the costs described A semi-variable cost–when the vertical axis represents cost incurred.(C)A Graph1B Graph2C Graph4D Graph5Which one of the above graphs illustrates the costs described A step fixed cost–when the vertical axis represents cost incurred.(A)A Graph3B Graph4C Graph5D Graph610.A production worker is paid a salary of$650per month,plus an extra5cents for each unit produced during the month.How is this type of labour cost best described(D)A A variable costB A fixed costC A step costD A semi-variable cost11.A total cost is described as staying the same over a certain activity range and then increasing but remaining stable over a revised activity range in the short term.What type of cost is this(D)A A fixed costB A variable costC Asemi-variable cost D A stepped fixed cost12.What is the economic batch quantity used to establish Optimal(C)A reorder quantityB recorder levelC order quantityD inventory level for production13.A company determines its order quantity for a rawmaterial by using the Economic Order Quantity(EOQ)model. What would be the effects on the EOQ and the total annual holding cost of a decrease in the cost of ordering a batch of raw material(D)EOQ Total annual holding costA Higher LowerB Higher HigherC Lower HigherD Lower Lower14.Over-absorbed overheads occur when(A)A Absorbed overheads exceed actual overheadsB Absorbed overheads exceed budgeted overheadsC Actual overheads exceed absorbed overheadsD Actual overheads exceed budgeted overheads15.Budgeted overheads$690,480Budgeted machine hours15,344Actual machine hours14,128Actual overheads$679,550 Based on the data above,what is the machine hour absorption rate(to the nearest$)(B)A44per machine hourB45per machine hourC48per machine hourD49per machine hour16.Absorption costing is concerned with which of thefollowing(D)A Direct materialsB Direct labourC Fixed costsD Variable and fixed costs17.The following statements have been made about life cycle costing.(1)Life cycle costing can be applied to products with a short life cycle.(2)Product life cycle costing is not well-suited for use within budgetary control systems.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and218.The following statements have been made about target costing.(1)Target costing makes the business look at what competitors are offering at an early stage in thenew product development process.(2)Cost control is emphasised at the new product design stage so any engineering changes must happen before production starts.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and219.The following statements have been made about target costing.(1)Target costing is inappropriate for a new product that has no existing market.(2)It may be acceptable for a target cost for a new product to be exceeded during the growth stage of its life cycle.Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and220.The following statements have been made about throughput accounting.(1)When throughput accounting(TA)is used,the aim should be to have sufficient inventories to overcome bottlenecks in production.(2)Throughput accounting is based on the assumption that in the short run,most factory costs,other than materials, are fixed.Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and221.The following statements have been made about activity based costing.;’’(1)Implementation of ABC is unlikely to becost-effective when variable production costs area low proportion of total production costs.(2)In a system of ABC,for costs that vary with production levels,the most suitable cost driver is likely to be direct labour hours or machine hours.Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and222.In the theory of constraints and throughput accounting,which of the following methods may be used to elevate the performance of a bindingconstraint(C)(1)Acquire more of the resource that is the binding constraint.(2)Improve the efficiency of usage of the resource that is the binding constraint.A1onlyB2onlyC1and2D Neither1nor223.The following statements have been made about life cycle costing.(1)Life cycle costing is more useful for planning than for control purposes.(2)Most of the life cycle costs for a product are determined by decisions taken in the early stage ofa product’s life cycle.Which of the above statements is/are true(D)A1onlyC Neither1nor2D Both1and224.The following statements have been made about activity based costing.(1)Activity based costs are not the same as relevant costs for the purpose of short-rundecision-making.(2)Activity based costing is a form of absorption costing. Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and225.The following statements have been made about activity based costing.(1)In a system of ABC,apportionment of some overhead costs may need to be done on an arbitrary basis.(2)The costs of introducing and maintaining anactivity based costing system may exceed thebenefits of such a costing system.Which of the above statements is/are true(D)B2onlyC Neither1nor2D Both1and226.The following statements have been made about target costing.(1)Target costing ensures that new product development costs are recovered in the targetprice for the product.(2)A cost gap is the difference between the target price and the target cost.Which of the above statements is/are true(C)A1onlyB2onlyC Neither1nor2D Both1and227.In which of the following ways might financial returns be improved over the life cycle of a product(C)(1)Maximising the breakeven time.(2)Minimising the time to market.(3)Minimising the length of the life cycle.A1and2onlyB1and3onlyC2onlyD2and3only28.The following statements have been made about target costing.(1)Target costing is not well-suited for servicesthat have a large fixed cost base.(2)Costs may be reduced in target costing byremoving product features that do not add value.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and229.The following statements have been made about activity based costing.(1)Activity based costs are not the same as relevant costs for the purpose of short-run decision-making (2)Activity based costing is a form of absorption costing Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and230.The following statements have been made about target costing.(1)A target cost gap is the difference between the target cost for a product and its projected cost.(2)Products should not be manufactured if there isa target cost gap.Which of the above statements is/are true(A)A1onlyB2onlyC Neither1nor2D Both1and231.The following statements have been made about throughput accounting.(1)Inventory has no value and should be valued at$0.(2)Efficiency is maximised by utilising direct labour time and machine time to full capacity.Which of the above statements is/are true(C)A1onlyB2onlyD Both1and232.The following statements have been made about activity based costing.(1)In the short run,all the overhead costs for an activity vary with the amount of the cost driver for the activity.(2)A cost driver is an activity based cost.Which of the above statements is/are true(C)A1onlyB2onlyC Neither1nor2D Both1and233.The following statements have been made abouttarget costing.(1)The value of target costing depends on having reliable estimates of sales demand.(2)Target costing may be applied to services that are provided free of charge to customers,such as costs of call centre handling.Which of the above statements is/are true(A)A1onlyB2onlyD Both1and234.The following statements have been made about life cycle costing.(1)An important use of life cycle costing is to decide whether to go ahead with the development of a new product.(2)Life cycle costing encourages management to finda suitable balance between investment costs and operating expenses.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and235.The following statements have been made about traditional absorption costing and activity based costing.(1)Traditional absorption costing may be used to set prices for products,but activity based costingmay not.(2)Traditional absorption costing tends to allocate too many overhead costs to low-volume products and notenough overheads to high-volume products.Which of the above statements is/are true(C)A1onlyB2onlyC Neither1nor2D Both1and236.For which one of the following reasons would the choice of penetration pricing be unsuitable for a product during the initial stage of its life cycle(B)A To discourage new entrants to the marketB To increase the length of the initial stage of the life cycleC To achieve economies of scaleD To set a price for a product that has a high price elasticity of demand37.The following statements have been made about theuse of ex pected values for decision-making under conditions ofuncertainty.(1)Expected values are used to support a risk-averse attitude todecision-making.(2)Expected values are more valuable as a guide to decision-making where theyrefer to outcomes which will occur many times over. Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and238.Which of the following statements about relevant costing is/are correct(C)(1)An opportunity cost is defined as the relevant cost of taking a business opportunity.(2)Business decisions should be taken on the basis of whether they improve profitor reduce costs.A1only is correctB2only is correctC Neither1nor2is correctD Both1and2are correct39.In which one of the following circumstances would the choice of a market skimming pricing policy be unsuitablefor a product during the initial stage of its life cycle (C)A The product is protected by a patentB Expected demand and the price sensitivity of customers for the new product are unknownC When the product is expected to have a long life cycleD To maximise short-term profitability40.The following statements have been made about relevant costing.(1)Sunk costs can never be a relevant cost for the purpose of decision-making.(2)If a company charges the minimum price for a product or service,based onrelevant costs,it will not improve its overall profitability.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and241.The following statements have been made about full cost plus pricing.(1)Charging prices at full cost plus a fixed margin for profit will ensure thatthe business will make a profit in each period.(2)Full cost plus pricing can lead to under-and over-pricing of productsWhich of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and242.A company wishes to decide on a selling price for a new product,and wants tochoose the price that will provide the most satisfactory weekly totalcontribution.Weekly sales of each product will depend on the price charge and also on c ustomers’response to the new product.The following pay-off table has been prepared(C)A P1B P2C P3D P443.The constraints in a linear programming problem are as follows:3x+120,000(Grade A labour hours)5x+4y160,000(Grade B labour hours)x30,000(Sales demand product X)y20,000(Sales demand Product Y)x,y≥0The objective function is to maximise total contribution: 20x+30y.A graph of the constraints is as followsWhere is the optimal solution to the linear programming problem(C)A Point AB Point BC Point CD Point D44.A decision tree is a way of representing decision choices in the form of adiagram.It is usual for decision trees to include probabilities of different outcomes.The following statements have been made about decision trees.(1)Each possible outcome from a decision is given an expected value.(2)Each possible outcome is shown as a branch on a decision tree.Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and2following statements have been made about cost plus pricing.(1)A price in excess of full cost per unit will ensurethat a company will coverall its costs and make a profit.(2)Cost plus pricing is an appropriate pricing strategy when jobs are carriedout to customer specifications.Which of the above statements is/are true(B)A1onlyB2onlyC Neither1nor2D Both1and246.The following statements have been made about solving linear programmingproblems for budgeting purposes.(1)Slack occurs when less than the maximum available ofa limited resource is required.(2)When the linear programming problem includes a constraint for minimum salesdemand for a product,there may be a surplus for sales demand in the optimal solution.Which of the above statements is/are true(D)A1onlyB2onlyC Neither1nor2D Both1and247.The following statements have been made about decision-making under conditionsof uncertainty.(1)Expected value is a more reliable basis for decision-making where thesituation and outcome will occur many times than for a one-off decision.(2)A risk-averse decision maker avoids all risks in decision-making.Which of the above statements is/are true(A)A1onlyB2onlyC Neither1nor2D Both1and248.Which method of pricing is most easily applied when two or more markets for theproduct or service can be kept entirely separate from each other(A)A Price discriminationB Product line pricingC SkimmingD Volume discounting50.Which of the following statements about decision trees is/are correct(B)(1)A decision tree can be used to identify the preferred decision choice usingthe minimax regret decision rule.(2)A decision tree is likely to present a simplified representation of reality.A1only is correctB2only is correctC Neither1nor2is correctD Both1and2are correct51.A company makes and sells four products.Direct labour hours are a scarce resource,but the company is able to sub-contract production of any products to external suppliers.The following information is relevant(A)A W,Y,X then ZB W,Z,X then YC X,Z,W then YD Z,X,Y then W52.A benefit sacrificed by taking one course of action instead of the most profitablealternative course of action is known as:(A)A An incremental costB An opportunity costC A relevant costD A sunk cost53.The following decision tree shows four decision options:1,2,3and4Using the expected value rule,which choice should be made so as to optimise the expected benefit(D)A Choice1B Choice2C Choice3D Choice454.Good information should have certain qualities.Which of the following are qualities of good information1 Complete2Extensive3Relevant4Accurate(B)A1,2and3B1,3and4C2and4D All of them55.Over which of the following is the manager of a profit centre likely to have control(D)(i)Selling(ii)Controllable costs(iii)Apportioned head office costs(iv)Capital investment in the centre A All of the above B(i),(ii) and(iii)C(i),(ii)and(iv)D(i)and(ii)56.Which of the following statements is/are true about group bonus schemes(C)(i)Group bonus schemes are appropriate when increased output depends on a numberof people all making extra effort(ii)With a group bonus scheme,it is easier to award each individual's performance(iii)Non-production employees can be rewarded as part of a group incentive schemeA(i)onlyB(i)and(ii)onlyC(i)and(iii)onlyD(ii)and(iii)only57.Factory overheads can be absorbed by which of the following methods(A)(i)Direct labour hours(ii)Machine hours(iii)As a percentage of prime cost(iv)$x per unitA(i),(ii),(iii)and(iv)B(i)and(ii)onlyC(i),(ii)and(iii)onlyD(ii),(iii)and(iv)only58.Which of the following would be the most appropriate basis for apportioningmachinery insurance costs to cost centres within a factory (C)A The number of machines in each cost centreB The floor area occupied by the machinery in each cost centreC The value of the machinery in each cost centreD The operating hours of the machinery in each cost centre59.Consider the following statements,regarding the reapportionment of service costcentre overheads to production cost centres,wherereciprocal services exist:(1).The direct method results in costs being reapportioned between service cost centres(2).If the direct method is used,the order in which the service cost centre overheads arereapportioned is irrelevant(3).The step down method results in costs being reapportioned between service cost centres(4).If the step down method is used,the order in which the service cost centre overheads arereapportioned is irrelevantWhich statement(s)is/are correct(D)A(1),(2)and(4)B(1),(3)and(4)C(2)onlyD(2)and(3)60.Which of the following are acceptable bases for absorbing production overheads(C)(i)Direct labour hours(ii)Machine hours(iii)As a percentage of the prime cost(iv)Per unitA Methods(i)and(ii)onlyB Methods(iii)and(iv)onlyC Methods(i),(ii),(iii)and(iv)D Methods(i),(ii)or(iii)only61.When comparing the profits reported under absorption costing and marginalcosting during a period when the level of inventory increased,which of the following is true(B)A Absorption costing profits will be higher and closing inventory valuationslower than those under marginal costing.B Absorption costing profits will be higher and closing inventory valuationshigher than those under marginal costing.C Marginal costing profits will be higher and closing inventory valuations lowerthan those under absorption costing.D Marginal costing profits will be higher and closing inventory valuations higherthan those under absorption costing.62.When comparing the profits reported under absorption costing and marginal costing duringa period when the level of inventory increased,which of the following is true(B)A Absorption costing profitswill be higher and closing inventory valuations lower than those under marginal costing.B Absorption costing profits will be higher and closing inventory valuations higher thanthose under marginal costing.C Marginal costing profits will be higher and closing inventory valuations lower than those underabsorption costing.D Marginal costing profits will be higher and closing inventory valuations higher than those underabsorption costing.。

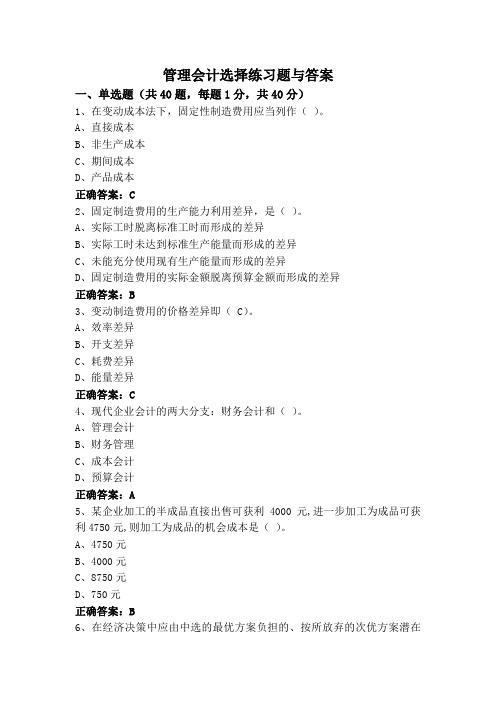

管理会计选择练习题与答案

管理会计选择练习题与答案一、单选题(共40题,每题1分,共40分)1、在变动成本法下,固定性制造费用应当列作()。

A、直接成本B、非生产成本C、期间成本D、产品成本正确答案:C2、固定制造费用的生产能力利用差异,是()。

A、实际工时脱离标准工时而形成的差异B、实际工时未达到标准生产能量而形成的差异C、未能充分使用现有生产能量而形成的差异D、固定制造费用的实际金额脱离预算金额而形成的差异正确答案:B3、变动制造费用的价格差异即( C)。

A、效率差异B、开支差异C、耗费差异D、能量差异正确答案:C4、现代企业会计的两大分支:财务会计和()。

A、管理会计B、财务管理C、成本会计D、预算会计正确答案:A5、某企业加工的半成品直接出售可获利4000元,进一步加工为成品可获利4750元,则加工为成品的机会成本是()。

A、4750元B、4000元C、8750元D、750元正确答案:B6、在经济决策中应由中选的最优方案负担的、按所放弃的次优方案潜在受益计算的那部分资源损失,就是所谓()。

A、沉没成本B、机会成本C、专属成本D、增量成本正确答案:B7、设某企业有固定搬运工10名,工资总额5000元;当产量超过3000件时,就需雇佣临时工。

临时工采用计件工资制,单位工资为每件1元,则该企业搬运工工资属于()。

A、阶梯式成本B、曲线成本C、延期变动成本D、半变动成本正确答案:C8、下列各项中,与传统的财务会计相对立概念而存在的是()。

A、现代会计B、成本会计学C、企业会计D、管理会计正确答案:D9、在关于变动成本法的应用上,下列说法中唯一正确的是()A、变动成本法可以与制造成本法同时使用,以提供两套平行的核算资料B、变动成本法的积极作用决定了它可以取代制造成本法C、变动成本法和制造成本法根本无法结合D、变动成本法和制造成本法的有机结合是最理想的做法。

正确答案:D10、已知企业某产品的单价为2 000元,目标销售量为3 500件,固定成本总额为100 000元,目标利润为600 000元,则企业应将单位变动成本的水平控制在( )。

管理会计(F2)选择题题库

管理会计(F2)选择题题库管理会计(F2)选择题题库---2016⼀、单项选择题1.The sales manager has prepared a manpower plan toensure that sales quotas for the forthcoming year are achieved. This is an example of what type of planning?(B)A Strategic planningB Tactical planningC Operational planningD Corporate planning2.Which of the following statements is correct? (B )A Management accounting systems provide information for use in fulfilling legal requirementsB Management accounting systems provide informationfor the use of decision-makers within an organisationC Management accounting systems provide information for use by shareholdersD Management accounting systems provide information for use by tax authorities3.Which of the following would be data rather than information?(B)A Sales increase/decrease per product in last quarterB Total sales value per productC Sales made per salesman as a percentage of total salesD Sales staff commission as a percentage of total sales 4.Which of the following would be classed as indirect labour? ( B )A Assembly workers in a company manufacturing televisionsB A stores assistant in a factory storeC Plasterers in a construction companyD A consultant in a firm of management consultants 5.A company makes chairs and tables. Which of the following items would be treated as an indirect cost?(D )A Wood used to make a chairB Metal usedfor the legs of a chairC Fabric to cover the seat of a chairD The salary of the sales director of the company6.Which of the following best describes a controllable cost? (C )A A cost which arises from a decision already taken, whichcannot, in the short run, be changed.B A cost for which the behaviour pattern can be easilyanalysed to facilitate valid budgetary controlcomparisons.C A cost which can be influenced by its budget holder.D A specific cost of an activity or business which would beavoided if the activity or business did not exist. 7.Which of the following best describes a period cost? (A )A cost that relates to a time period which is deducted as expenses for the period and is notincluded in the inventory valuation.B A cost that can be easily allocated to a particular period, without the need for arbitraryapportionment between periods.C A cost that is identified with a unit produced during theperiod, and is included in the value of inventory. Thecost is treated as an expense for the period when theinventory is actually sold.D A cost that is incurred regularly every period, eg every month or quarter.8.Fixed costs are conventionally deemed to be which of thefollowing? (D )A Constant per unit of outputB Outside the control of managementC Easily controlledD Constant in total when production volume changes9..Which one of the above graphs illustrates the costs described A linear variable cost – when the vertical axis represents cost incurred. (B )A Graph 1B Graph 2C Graph 4D Graph 5 Which one of the above graphs illustrates the costs described A fixed cost – when the vertical axis represents cost incurred. (A )A Graph 1B Graph 2C Graph 3D Graph 6 Which one of the above graphs illustrates the costs described A linear variable cost – when the vertical axis represents cost per unit. (A )A Graph 1B Graph 2C Graph 3D Graph 6Which one of the above graphs illustrates the costs described A semi-variable cost – when the vertical axis represents cost incurred. (C )A Graph 1B Graph 2C Graph 4D Graph 5Which one of the above graphs illustrates the costs described A step fixed cost – when the vertical axis represents cost incurred. (A )A Graph 3B Graph 4C Graph 5D Graph 6 10.A production worker is paid a salary of $650 per month, plus an extra 5 cents for each unit produced during the month. How is this type of labour cost best described?(D )A A variable costB A fixed costC A step costD A semi-variable cost11.A total cost is described as staying the same over a certain activity range and then increasing but remaining stable over a revised activity range in the short term.What type of cost is this? (D )A A fixed costB A variable costC A semi-variable costD A stepped fixed cost12.What is the economic batch quantity used to establish?Optimal (C )A reorder quantityB recorder levelC order quantityD inventory level for production 13.A company determines its order quantity for a raw material by using the Economic Order Quantity (EOQ) model. What would be the effects on the EOQ and the total annual holding cost of a decrease in the cost of ordering a batch of raw material? (D )EOQ Total annual holding costA Higher LowerB Higher HigherC Lower HigherD Lower Lower14.Over-absorbed overheads occur when (A )A Absorbed overheads exceed actual overheadsB Absorbed overheads exceed budgeted overheadsC Actual overheads exceed absorbed overheadsD Actual overheads exceed budgeted overheads 15.Budgeted overheads $690,480 Budgeted machine hours 15,344 Actual machine hours 14,128 Actual overheads $679,550Based on the data above, what is the machine hourabsorption rate (to the nearest $)?(B )A 44 per machine hourB 45 per machine hourC 48 per machine hourD 49 per machine hour16. Absorption costing is concerned with which of the following? (D )A Direct materialsB Direct labourC Fixed costsD Variable and fixed costs17. The following statements have been made about life cycle costing.(1) Life cycle costing can be applied to products with a short life cycle.(2) Product life cycle costing is not well-suited for use within budgetary control systems.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 218 . The following statements have been made about target costing.(1) Target costing makes the business look at whatcompetitors are offering at an early stage in the newproduct development process.(2) Cost control is emphasised at the new product designstage so any engineering changes must happen before production starts.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 219. The following statements have been made about target costing.(1) Target costing is inappropriate for a new product that has no existing market.(2) It may be acceptable for a target cost for a new productto be exceeded during the growth stage of its life cycle.Which of the above statements is/are true? (B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 220. The following statements have been made about throughput accounting.(1) When throughput accounting (TA) is used, the aim should be to have sufficient inventories to overcome bottlenecks in production.(2) Throughput accounting is based on the assumption that in the short run, most factory costs, other than materials, are fixed.。

《管理会计》试题库及答案

《管理会计》专科题库及答案一.单项选择题1.C 2.C 3.C 4.C 5.B 6.B 7.C 8.D 9.C 10.A 11.B 12.C 13.B 14.B 15.D 16.B 17.D 18.A 19.B 20.C 21.C 22.A 23.C 24.C 25.C 26.B 27.B 28.C 29.C 30.D 31.A 32.D 33.B 34.C 35.A 36.A 37.B 38.C 39.B 40.D 41.C 42.A 43.A 44.B 45.D 46.C 47.D 48.A 49.C 50.B 51.D 52.B 53.B 54.C 55.A 56.B 57.D 58.A 59.C 60.A 61.D 62.C 63.D 64.C 65.B 66.D 67.A 68.B 69.C 70.D 71.B 72.C 73.B 74.D 75.B 76.C 77.D 78.B 79.B 80.D 81.A 82.D 83.D 84.A 85.C 86.B 87.B 88.A 89.C 90.B 91.B 92.C 93.D 94.D 95.B 96.A 97.C 98.B 99.B 100.A 101.C 102.B 103.C 104.C 105.C 106.B 107.A 108.B 109.C 110.A 111.D 112.B 113.A 114.B 115.B 116.A117.A118.A119.D 120.A1.下列各项中,与传统的财务会计相对立概念而存在的是()。

A.现代会计B.企业会计C.管理会计D.管理会计学2.现代管理会计的一个重要特征是()。

A.具有统一性和规范性B.必须遵循公认的会计原则C.方式方法更为灵活多样D.方法单一3.在Y=a+()X中,Y表示总成本,a表示固定成本,X表示销售额,则X的系数应是()。

A.单位变动成本B.单位边际贡献C.变动成本率D.边际贡献率4.单位产品售价减去单位变动成本的差额称为()。

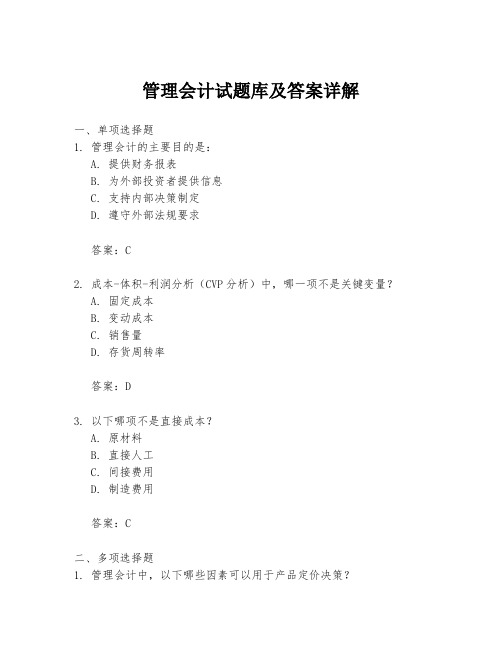

管理会计试题库及答案详解

管理会计试题库及答案详解一、单项选择题1. 管理会计的主要目的是:A. 提供财务报表B. 为外部投资者提供信息C. 支持内部决策制定D. 遵守外部法规要求答案:C2. 成本-体积-利润分析(CVP分析)中,哪一项不是关键变量?A. 固定成本B. 变动成本C. 销售量D. 存货周转率答案:D3. 以下哪项不是直接成本?A. 原材料B. 直接人工C. 间接费用D. 制造费用答案:C二、多项选择题1. 管理会计中,以下哪些因素可以用于产品定价决策?A. 市场需求B. 成本结构C. 竞争对手定价D. 政府规定答案:A, B, C2. 标准成本与实际成本的比较可以用于:A. 成本控制B. 预算编制C. 绩效评估D. 投资决策答案:A, C三、判断题1. 管理会计只关注短期决策。

()答案:错误2. 管理会计信息只对内部人员开放。

()答案:正确四、简答题1. 简述管理会计与财务会计的区别。

答案:管理会计主要服务于组织内部的决策制定,侧重于提供定制化、灵活的信息,通常不对外公开。

财务会计则侧重于对外报告,遵循特定的会计准则和法规,提供标准化的财务报表。

2. 解释什么是全面预算,并说明其在企业管理中的作用。

答案:全面预算是企业对未来一定时期内财务状况和经营成果的预计,包括销售预算、生产预算、成本预算等。

它有助于企业协调各部门活动,控制成本,评估绩效,并为战略规划提供依据。

五、计算题1. 某公司生产一种产品,其固定成本为$100,000,单位变动成本为$20,销售价格为$50。

若公司希望实现利润$30,000,请计算该公司需要销售多少单位产品。

答案:首先计算单位利润,即销售价格减去单位变动成本:$50 - $20 = $30。

然后,用目标利润除以单位利润,再加上固定成本除以单位利润,得到所需销售量:$30,000 / $30 + $100,000 / $30 =1,000 + 3,333.33 = 4,333.33。

管理会计试题及答案

管理会计试题及答案一、选择题1. 管理会计的主要目的是()A. 提供外部报告B. 为内部管理决策提供信息支持C. 遵守财务会计准则D. 提供税务筹划建议答案:B2. 以下哪项不是管理会计的基本职能()A. 预测和预算B. 分析和评价C. 规划和决策D. 外部报告答案:D3. 直接成本和间接成本的区别主要在于()A. 成本的计算方法B. 成本的可控性C. 成本的经济内容D. 成本与产品的关系答案:D4. 以下哪种成本计算方法属于变动成本法()A. 直接成本法B. 完全成本法C. 作业成本法D. 标准成本法答案:A5. 以下哪种方法不属于管理会计的成本控制方法()A. 预算控制B. 标准成本法C. 作业成本法D. 外部审计答案:D二、判断题1. 管理会计的主要服务对象是企业内部管理层。

()答案:正确2. 期间成本是指在一段时间内发生的成本,与产品生产无关。

()答案:正确3. 直接成本是指直接用于生产产品的成本,如原材料、直接人工等。

()答案:正确4. 在变动成本法下,固定成本在计算产品成本时不予考虑。

()答案:正确5. 管理会计的信息主要来源于财务会计系统。

()答案:错误三、计算题1. 某企业生产A产品,生产成本包括直接材料、直接人工和制造费用。

以下是A产品的成本数据:直接材料:10000元直接人工:5000元制造费用:20000元(其中变动制造费用为15000元,固定制造费用为5000元)请计算A产品的变动成本和完全成本。

答案:变动成本 = 直接材料 + 直接人工 + 变动制造费用变动成本 = 10000 + 5000 + 15000 = 30000元完全成本 = 变动成本 + 固定制造费用完全成本 = 30000 + 5000 = 35000元2. 某企业生产B产品,预算产量为1000件,实际产量为1200件。

以下是B产品的成本数据:直接材料:20000元直接人工:15000元变动制造费用:10000元固定制造费用:5000元请计算B产品的单位变动成本和单位固定成本。

管理会计(F2)选择题题库

管理会计(F2)选择题题库---2016一、单项选择题1.The sales manager has prepared a manpower plan toensure that sales quotas for the forthcoming year are achieved. This is an example of what type of planning? (B)A Strategic planningB Tactical planningC Operational planningD Corporate planning2.Which of the following statements is correct? (B )A Management accounting systems provide information for use in fulfilling legal requirementsB Management accounting systems provide informationfor the use of decision-makers within anorganisationC Management accounting systems provide information for use by shareholdersD Management accounting systems provide information for use by tax authorities3. Which of the following would be data rather than information?( B)A Sales increase/decrease per product in last quarterB Total sales value per productC Sales made per salesman as a percentage of total salesD Sales staff commission as a percentage of total sales4.Which of the following would be classed as indirect labour? ( B )A Assembly workers in a company manufacturing televisionsB A stores assistant in a factory storeC Plasterers in a construction companyD A consultant in a firm of management consultants 5. A company makes chairs and tables. Which of the following items would be treated as an indirectcost?( D )A Wood used to make a chairB Metal used for the legs of a chairC Fabric to cover the seat of a chairD The salary of the sales director of the company6.Which of the following best describes a controllable cost? ( C )A A cost which arises from a decision already taken,which cannot, in the short run, be changed.B A cost for which the behaviour pattern can be easilyanalysed to facilitate valid budgetary controlcomparisons.C A cost which can be influenced by its budget holder.D A specific cost of an activity or business whichwould be avoided if the activity or business did not exist.7. Which of the following best describes a period cost? ( A )A cost that relates to a time period which is deducted as expenses for the period and is notincluded in the inventory valuation.B A cost that can be easily allocated to a particular period, without the need for arbitraryapportionment between periods.C A cost that is identified with a unit producedduring the period, and is included in the value of inventory. The cost is treated as an expense for the period when the inventory is actually sold.D A cost that is incurred regularly every period, eg every month or quarter.8.Fixed costs are conventionally deemed to be which of the following? (D )A Constant per unit of outputB Outside the control of managementC Easily controlledD Constant in total when production volume changes9..Which one of the above graphs illustrates the costs described A linear variable cost –when the vertical axis represents cost incurred. ( B )A Graph 1B Graph 2C Graph 4D Graph 5 Which one of the above graphs illustrates the costs described A fixed cost – when the vertical axis represents cost incurred. ( A )A Graph 1B Graph 2C Graph 3D Graph 6 Which one of the above graphs illustrates the costs described A linear variable cost –when the vertical axis represents cost per unit. ( A )A Graph 1B Graph 2C Graph 3D Graph 6 Which one of the above graphs illustrates the costs described A semi-variable cost – when the vertical axis represents cost incurred. ( C )A Graph 1B Graph 2C Graph 4D Graph 5 Which one of the above graphs illustrates the costs described A step fixed cost –when the vertical axis represents cost incurred. ( A )A Graph 3B Graph 4C Graph 5D Graph 610.A production worker is paid a salary of $650 per month, plus an extra 5 cents for each unit produced during the month. How is this type of labour cost best described? ( D )A A variable costB A fixed costC A step costD A semi-variable cost11.A total cost is described as staying the same overa certain activity range and then increasing butremaining stable over a revised activity range in the short term.What type of cost is this? ( D )A A fixed costB A variable costC Asemi-variable cost D A stepped fixed cost12.What is the economic batch quantity used to establish? Optimal ( C )A reorder quantityB recorder levelC order quantityD inventory level for production13.A company determines its order quantity for a raw material by using the Economic Order Quantity (EOQ) model. What would be the effects on the EOQ and the total annual holding cost of a decrease in the costof ordering a batch of raw material?(D )EOQ Total annual holding costA Higher LowerB Higher HigherC Lower HigherD Lower Lower14.Over-absorbed overheads occur when ( A )A Absorbed overheads exceed actual overheadsB Absorbed overheads exceed budgeted overheadsC Actual overheads exceed absorbed overheadsD Actual overheads exceed budgeted overheads 15.Budgeted overheads $690,480 Budgeted machine hours 15,344Actual machine hours 14,128 Actual overheads $679,550Based on the data above, what is the machine hour absorption rate (to the nearest $)?( B )A 44 per machine hourB 45 per machine hourC 48 per machine hourD 49 per machine hour16. Absorption costing is concerned with which of the following? ( D )A Direct materialsB Direct labourC Fixed costsD Variable and fixed costs17. The following statements have been made about life cycle costing.(1) Life cycle costing can be applied to products with a short life cycle.(2) Product life cycle costing is not well-suited for use within budgetary control systems.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 218 . The following statements have been made about target costing.(1) Target costing makes the business look at whatcompetitors are offering at an early stage in thenew product development process.(2) Cost control is emphasised at the new product design stage so any engineering changes must happenbefore production starts.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 219. The following statements have been made about target costing.(1) Target costing is inappropriate for a new product that has no existing market.(2) It may be acceptable for a target cost for a newproduct to be exceeded during the growth stage of its life cycle.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 220. The following statements have been made about throughput accounting.(1) When throughput accounting (TA) is used, the aim should be to have sufficient inventories to overcome bottlenecks in production.(2) Throughput accounting is based on the assumption that in the short run, most factory costs, other than materials, are fixed.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 221. The following statements have been made about activity based costing.;’’(1) Implementation of ABC is unlikely to becost-effective when variable production costs area low proportion of total production costs.(2) In a system of ABC, for costs that vary withproduction levels, the most suitable cost driver is likely to be direct labour hours or machine hours. Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 222. In the theory of constraints and throughputaccounting, which of the following methods may be used to elevate the performance of a bindingconstraint? ( C )(1) Acquire more of the resource that is the binding constraint.(2) Improve the efficiency of usage of the resource that is the binding constraint.A 1 onlyB 2 onlyC 1 and 2D Neither 1 nor 223. The following statements have been made about life cycle costing.(1) Life cycle costing is more useful for planning than for control purposes.(2) Most of the life cycle costs for a product aredetermined by decisions taken in the early stage ofa product’s life cycle.Which of the above statements is/are true? ( D ) A 1 only B 2 onlyC Neither 1 nor 2D Both 1 and 224. The following statements have been made about activity based costing.(1) Activity based costs are not the same as relevantcosts for the purpose of short-run decision-making.(2) Activity based costing is a form of absorption costing.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 225. The following statements have been made about activity based costing.(1) In a system of ABC, apportionment of some overheadcosts may need to be done on an arbitrary basis.(2) The costs of introducing and maintaining anactivity based costing system may exceed thebenefits of such a costing system.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 226. The following statements have been made about target costing.(1) Target costing ensures that new productdevelopment costs are recovered in the targetprice for the product.(2) A cost gap is the difference between the targetprice and the target cost.Which of the above statements is/are true? ( C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 227. In which of the following ways might financialreturns be improved over the life cycle of a product?( C )( 1) Maximising the breakeven time.(2) Minimising the time to market.(3) Minimising the length of the life cycle.A 1 and 2 onlyB 1 and 3 onlyC 2 onlyD 2 and 3 only28. The following statements have been made abouttarget costing.(1) Target costing is not well-suited for servicesthat have a large fixed cost base.(2) Costs may be reduced in target costing byremoving product features that do not add value.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 229. The following statements have been made about activity based costing.(1) Activity based costs are not the same as relevantcosts for the purpose of short-run decision-making(2) Activity based costing is a form of absorption costingWhich of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 230. The following statements have been made about target costing.(1) A target cost gap is the difference between thetarget cost for a product and its projected cost.(2) Products should not be manufactured if there isa target cost gap.Which of the above statements is/are true?(A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 231. The following statements have been made about throughput accounting.(1) Inventory has no value and should be valued at $0.(2) Efficiency is maximised by utilising direct labour time and machine time to full capacity.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 232. The following statements have been made about activity based costing.(1) In the short run, all the overhead costs for an activity vary with the amount of the cost driver for the activity.(2) A cost driver is an activity based cost.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 233. The following statements have been made about target costing.(1) The value of target costing depends on having reliable estimates of sales demand.(2) Target costing may be applied to services that areprovided free of charge to customers, such as costs of call centre handling.Which of the above statements is/are true?(A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 234. The following statements have been made about life cycle costing.(1) An important use of life cycle costing is to decidewhether to go ahead with the development of a new product.(2) Life cycle costing encourages management to finda suitable balance between investment costs andoperating expenses.Which of the above statements is/are true? (D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 235. The following statements have been made abouttraditional absorption costing and activity basedcosting.(1) Traditional absorption costing may be used to setprices for products, but activity based costingmay not.(2) Traditional absorption costing tends to allocatetoo many overhead costs to low-volume products and not enough overheads to high-volume products.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 236. For which one of the following reasons would thechoice of penetration pricing be unsuitable for aproduct during the initial stage of its life cycle?(B )A To discourage new entrants to the marketB To increase the length of the initial stage of the life cycleC To achieve economies of scaleD To set a price for a product that has a high price elasticity of demand37. The following statements have been made about theuse of ex pected values for decision-making under conditions ofuncertainty.(1) Expected values are used to support a risk-averse attitude todecision-making.(2) Expected values are more valuable as a guide to decision-making where theyrefer to outcomes which will occur many times over.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 238. Which of the following statements about relevant costing is/are correct? ( C )(1) An opportunity cost is defined as the relevant cost of taking a business opportunity.(2) Business decisions should be taken on the basis of whether they improve profitor reduce costs.A 1 only is correctB 2 only is correctC Neither 1 nor 2 is correctD Both 1 and 2 are correct39. In which one of the following circumstances would the choice of a market skimming pricing policy be unsuitable for a product during the initial stage of its life cycle? ( C )A The product is protected by a patentB Expected demand and the price sensitivity of customers for the new product are unknownC When the product is expected to have a long life cycleD To maximise short-term profitability40. The following statements have been made about relevant costing.(1) Sunk costs can never be a relevant cost for the purpose of decision-making.(2) If a company charges the minimum price for a product or service, based onrelevant costs, it will not improve its overall profitability.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 241. The following statements have been made about full cost plus pricing.(1) Charging prices at full cost plus a fixed margin for profit will ensure thatthe business will make a profit in each period.(2) Full cost plus pricing can lead to under- and over-pricing of productsWhich of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 242. A company wishes to decide on a selling price for a new product, and wants tochoose the price that will provide the most satisfactory weekly totalcontribution. Weekly sales of each product will depend on the price charge and also on customers’ response to the new product. The following pay-off table has been prepared( C )A P1B P2C P3D P443. The constraints in a linear programming problem are as follows:3x + 4.8y 120,000 (Grade A labour hours)5x + 4y 160,000 (Grade B labour hours)x 30,000 (Sales demand product X)y 20,000 (Sales demand Product Y)x, y ≥ 0The objective function is to maximise total contribution: 20x + 30y. A graph of the constraints is as followsWhere is the optimal solution to the linear programming problem? ( C)A Point AB Point BC Point CD Point D44. A decision tree is a way of representing decision choices in the form of adiagram. It is usual for decision trees to include probabilities of different outcomes.The following statements have been made about decision trees.(1) Each possible outcome from a decision is given an expected value.(2) Each possible outcome is shown as a branch on a decision tree.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 245.The following statements have been made about cost plus pricing.(1) A price in excess of full cost per unit will ensure that a company will coverall its costs and make a profit.(2) Cost plus pricing is an appropriate pricing strategy when jobs are carriedout to customer specifications.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 246. The following statements have been made about solving linear programmingproblems for budgeting purposes.(1) Slack occurs when less than the maximum available of a limited resource is required.(2) When the linear programming problem includes a constraint for minimum salesdemand for a product, there may be a surplus for sales demand in the optimal solution.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 247. The following statements have been made about decision-making under conditionsof uncertainty.(1) Expected value is a more reliable basis for decision-making where thesituation and outcome will occur many times than for a one-off decision.(2) A risk-averse decision maker avoids all risks in decision-making.Which of the above statements is/are true? ( A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 248. Which method of pricing is most easily applied when two or more markets for theproduct or service can be kept entirely separate from each other? ( A )A Price discriminationB Product line pricingC SkimmingD Volume discounting50. Which of the following statements about decision trees is/are correct? ( B )(1) A decision tree can be used to identify the preferred decision choice usingthe minimax regret decision rule.(2) A decision tree is likely to present a simplified representation of reality.A 1 only is correctB 2 only is correctC Neither 1 nor 2 is correctD Both 1 and 2 are correct51. A company makes and sells four products. Direct labour hours are a scarce resource, but the company is able to sub-contract production of any products to external suppliers. The following information is relevant( A )A W, Y, X then ZB W, Z, X then YC X, Z, W then YD Z, X, Y then W52. A benefit sacrificed by taking one course of action instead of the most profitablealternative course of action is known as: ( A )A An incremental costB An opportunity costC A relevant costD A sunk cost53. The following decision tree shows four decision options: 1, 2, 3 and 4Using the expected value rule, which choice should be made so as to optimise the expected benefit? ( D )A Choice 1B Choice 2C Choice 3D Choice 454. Good information should have certain qualities. Which of the following are qualities of good information? 1 Complete 2 Extensive 3 Relevant 4 Accurate ( B )A 1, 2 and 3B 1, 3 and 4C 2 and 4D All of them55.Over which of the following is the manager of a profit centre likely to have control? ( D )(i) Selling (ii) Controllable costs(iii) Apportioned head office costs (iv) Capital investment in the centreA All of the aboveB (i), (ii) and (iii)C (i), (ii) and (iv)D (i) and (ii)56. Which of the following statements is/are true about group bonus schemes? ( C )(i) Group bonus schemes are appropriate when increased output depends on a numberof people all making extra effort(ii) With a group bonus scheme, it is easier to award each individual's performance(iii) Non-production employees can be rewarded as part of a group incentive schemeA (i) onlyB (i) and (ii) onlyC (i) and (iii) onlyD (ii) and (iii) only57. Factory overheads can be absorbed by which of the following methods? ( A )(i) Direct labour hours (ii) Machine hours(iii) As a percentage of prime cost (iv) $x per unitA (i), (ii), (iii) and (iv)B (i) and (ii) onlyC (i), (ii) and (iii) onlyD (ii), (iii) and (iv) only58. Which of the following would be the most appropriate basis for apportioningmachinery insurance costs to cost centres within a factory? ( C )A The number of machines in each cost centreB The floor area occupied by the machinery in each cost centreC The value of the machinery in each cost centreD The operating hours of the machinery in each cost centre59. Consider the following statements, regarding the reapportionment of service costcentre overheads to production cost centres, where reciprocal services exist:(1). The direct method results in costs being reapportioned between service cost centres(2). If the direct method is used, the order in which the service cost centre overheads arereapportioned is irrelevant(3). The step down method results in costs being reapportioned between service cost centres(4). If the step down method is used, the order in which the service cost centre overheads arereapportioned is irrelevantWhich statement(s) is/are correct? ( D )A (1), (2) and (4)B (1), (3) and (4)C (2) onlyD (2) and (3)60. Which of the following are acceptable bases for absorbing production overheads? ( C )(i) Direct labour hours (ii) Machine hours(iii) As a percentage of the prime cost (iv) Per unitA Methods (i) and (ii) onlyB Methods (iii) and (iv) onlyC Methods (i), (ii), (iii) and (iv)D Methods (i), (ii) or (iii) only61. When comparing the profits reported under absorption costing and marginalcosting during a period when the level of inventory increased, which of the following is true? ( B )A Absorption costing profits will be higher and closing inventory valuationslower than those under marginal costing.B Absorption costing profits will be higher and closing inventory valuationshigher than those under marginal costing.C Marginal costing profits will be higher and closing inventory valuations lowerthan those under absorption costing.D Marginal costing profits will be higher and closing inventory valuations higherthan those under absorption costing.62.When comparing the profits reported under absorption costing and marginal costing duringa period when the level of inventory increased, which of the following is true? ( B )A Absorption costing profits will be higher and closing inventory valuations lower thanthose under marginal costing.B Absorption costing profits will be higher and closing inventory valuations higher thanthose under marginal costing.C Marginal costing profits will be higher and closing inventory valuations lower than those underabsorption costing.D Marginal costing profits will be higher and closing inventory valuations higher than those underabsorption costing..。

管理会计(F2)选择题题库--2016

管理会计(F2)选择题题库---2016一、单项选择题1.The sales manager has prepared a manpower plan to ensurethat sales quotas for the forthcoming year are achieved. This is an example of what type of planning? (B)A Strategic planningB Tactical planningC Operational planningD Corporate planning 2.Which of the following statements is correct? (B )A Management accounting systems provide information for use in fulfilling legal requirementsB Management accounting systems provide information for theuse of decision-makers within an organisationC Management accounting systems provide information for use by shareholdersD Management accounting systems provide information for use by tax authorities3.Which of the following would be data rather than information?(B)A Sales increase/decrease per product in last quarterB Total sales value per productC Sales made per salesman as a percentage of total salesD Sales staff commission as a percentage of total sales 4.Which of the following would be classed as indirect labour? ( B )A Assembly workers in a company manufacturing televisionsB A stores assistant in a factory storeC Plasterers in a construction companyD A consultant in a firm of management consultants5.A company makes chairs and tables. Which of the following items would be treated as an indirect cost?(D )A Wood used to make a chairB Metal used for the legs of a chairC Fabric to cover the seat of a chairD The salary of the sales director of the company6.Which of the following best describes a controllable cost? (C )A A cost which arises from a decision already taken, whichcannot, in the short run, be changed.B A cost for which the behaviour pattern can be easily analysedto facilitate valid budgetary control comparisons.C A cost which can be influenced by its budget holder.D A specific cost of an activity or business which would beavoided if the activity or business did not exist.7.Which of the following best describes a period cost? (A )A cost that relates to a time period which is deducted as expenses for the period and is notincluded in the inventory valuation.B A cost that can be easily allocated to a particular period, without the need for arbitraryapportionment between periods.C A cost that is identified with a unit produced during theperiod, and is included in the value of inventory. The costis treated as an expense for the period when the inventory isactually sold.D A cost that is incurred regularly every period, eg every month or quarter.8.Fixed costs are conventionally deemed to be which of the following? (D )A Constant per unit of outputB Outside the control of managementC Easily controlledD Constant in total when production volume changes9.Which one of the above graphs illustrates the costs described A linear variable cost – when the vertical axis represents cost incurred. (B )A Graph 1B Graph 2C Graph 4D Graph 5 Which one of the above graphs illustrates the costs described A fixed cost – when the vertical axis represents cost incurred. (A )A Graph 1B Graph 2C Graph 3D Graph 6 Which one of the above graphs illustrates the costs described A linear variable cost – when the vertical axis represents cost per unit. (A )A Graph 1B Graph 2C Graph 3D Graph 6 Which one of the above graphs illustrates the costs described A semi-variable cost – when the vertical axis represents cost incurred. (C )A Graph 1B Graph 2C Graph 4D Graph 5Which one of the above graphs illustrates the costs described A step fixed cost – when the vertical axis represents cost incurred. (A )A Graph 3B Graph 4C Graph 5D Graph 6 10.A production worker is paid a salary of $650 per month, plus an extra 5 cents for each unit produced during the month.How is this type of labour cost best described? (D )A A variable costB A fixed costC A step costD A semi-variable cost11.A total cost is described as staying the same over a certain activity range and then increasing but remaining stable over a revised activity range in the short term.What type of cost is this? (D )A A fixed costB A variable costC A semi-variable costD A stepped fixed cost12.What is the economic batch quantity used to establish?Optimal (C )A reorder quantityB recorder levelC order quantityD inventory level for production 13.A company determines its order quantity for a raw material by using the Economic Order Quantity (EOQ) model. Whatwould be the effects on the EOQ and the total annual holdingcost of a decrease in the cost of ordering a batch of rawmaterial? (D )EOQ Total annual holding costA Higher LowerB Higher HigherC Lower HigherD Lower Lower14.Over-absorbed overheads occur when (A )A Absorbed overheads exceed actual overheadsB Absorbed overheads exceed budgeted overheadsC Actual overheads exceed absorbed overheadsD Actual overheads exceed budgeted overheads 15.Budgeted overheads $690,480 Budgeted machine hours 15,344Actual machine hours 14,128 Actual overheads $679,550 Based on the data above, what is the machine hour absorption rate (to the nearest $)?(B )A 44 per machine hourB 45 per machine hourC 48 per machine hourD 49 per machine hour16. Absorption costing is concerned with which of the following? (D )A Direct materialsB Direct labourC Fixed costsD Variable and fixed costs17. The following statements have been made about life cycle costing.(1) Life cycle costing can be applied to products with a short life cycle.(2) Product life cycle costing is not well-suited for use within budgetary control systems.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 218 . The following statements have been made about target costing.(1) Target costing makes the business look at what competitorsare offering at an early stage in the new productdevelopment process.(2) Cost control is emphasised at the new product design stage so any engineering changes must happen before production starts.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 219. The following statements have been made about target costing.(1) Target costing is inappropriate for a new product that has no existing market.(2) It may be acceptable for a target cost for a new product to beexceeded during the growth stage of its life cycle.Which of the above statements is/are true? (B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 220. The following statements have been made about throughput accounting.(1) When throughput accounting (TA) is used, the aim should be to have sufficient inventories to overcome bottlenecks in production.(2) Throughput accounting is based on the assumption that in the short run, most factory costs, other than materials, are fixed.Which of the above statements is/are true? (B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 221. The following statements have been made about activity based costing.;’’(1) Implementation of ABC is unlikely to be cost-effective whenvariable production costs are a low proportion of totalproduction costs.(2) In a system of ABC, for costs that vary with production levels, the most suitable cost driver is likely to be direct labour hours or machine hours.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 222. In the theory of constraints and throughput accounting, whichof the following methods may be used to elevate theperformance of a binding constraint? ( C )(1) Acquire more of the resource that is the binding constraint.(2) Improve the efficiency of usage of the resource that is the binding constraint.A 1 onlyB 2 onlyC 1 and 2D Neither 1 nor 223. The following statements have been made about life cycle costing.(1) Life cycle costing is more useful for planning than for control purposes.(2) Most of the life cycle costs for a product are determined bydecisions taken in the early stage of a product’s life cycle. Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 224. The following statements have been made about activity based costing.(1) Activity based costs are not the same as relevant costs forthe purpose of short-run decision-making.(2) Activity based costing is a form of absorption costing. Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 225. The following statements have been made about activity based costing.(1) In a system of ABC, apportionment of some overhead costsmay need to be done on an arbitrary basis.(2) The costs of introducing and maintaining an activity basedcosting system may exceed the benefits of such a costingsystem.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 226. The following statements have been made about target costing.(1) Target costing ensures that new product developmentcosts are recovered in the target price for the product. (2) A cost gap is the difference between the target price and the target cost.Which of the above statements is/are true? ( C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 227. In which of the following ways might financial returns beimproved over the life cycle of a product? ( C )( 1) Maximising the breakeven time.(2) Minimising the time to market.(3) Minimising the length of the life cycle.A 1 and 2 onlyB 1 and 3 onlyC 2 onlyD 2 and 3 only28. The following statements have been made about target costing.(1) Target costing is not well-suited for services that have a large fixed cost base.(2) Costs may be reduced in target costing by removing productfeatures that do not add value.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 229. The following statements have been made about activity based costing.(1) Activity based costs are not the same as relevant costs forthe purpose of short-run decision-making(2) Activity based costing is a form of absorption costingWhich of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 230. The following statements have been made about target costing.(1) A target cost gap is the difference between the target costfor a product and its projected cost.(2) Products should not be manufactured if there is a target cost gap.Which of the above statements is/are true? (A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 231. The following statements have been made about throughput accounting.(1) Inventory has no value and should be valued at $0.(2) Efficiency is maximised by utilising direct labour time and machine time to full capacity.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 232. The following statements have been made about activity based costing.(1) In the short run, all the overhead costs for an activity vary with the amount of the cost driver for the activity.(2) A cost driver is an activity based cost.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 233. The following statements have been made about target costing.(1) The value of target costing depends on having reliable estimates of sales demand.(2) Target costing may be applied to services that are providedfree of charge to customers, such as costs of call centrehandling.Which of the above statements is/are true? (A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 234. The following statements have been made about life cycle costing.(1) An important use of life cycle costing is to decide whether togo ahead with the development of a new product. (2) Life cycle costing encourages management to find a suitablebalance between investment costs and operating expenses.Which of the above statements is/are true? (D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 235. The following statements have been made about traditionalabsorption costing and activity based costing.(1) Traditional absorption costing may be used to set prices forproducts, but activity based costing may not.(2) Traditional absorption costing tends to allocate too manyoverhead costs to low-volume products and not enoughoverheads to high-volume products.Which of the above statements is/are true? (C )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 236. For which one of the following reasons would the choice ofpenetration pricing be unsuitable for a product during the initial stage of its life cycle? (B )A To discourage new entrants to the marketB To increase the length of the initial stage of the life cycleC To achieve economies of scaleD To set a price for a product that has a high price elasticity of demand37. The following statements have been made about the use ofex pected values for decision-making under conditions of uncertainty.(1) Expected values are used to support a risk-averse attitude to decision-making.(2) Expected values are more valuable as a guide to decision-making where they refer to outcomeswhich will occur many times over.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 238. Which of the following statements about relevant costing is/are correct? ( C )(1) An opportunity cost is defined as the relevant cost of taking a business opportunity.(2) Business decisions should be taken on the basis of whether they improve profit or reducecosts.A 1 only is correctB 2 only is correctC Neither 1 nor 2 is correctD Both 1 and 2 are correct39. In which one of the following circumstances would the choice of a market skimming pricing policy be unsuitable for a product during the initial stage of its life cycle? ( C )A The product is protected by a patentB Expected demand and the price sensitivity of customers for the new product are unknownC When the product is expected to have a long life cycleD To maximise short-term profitability40. The following statements have been made about relevant costing.(1) Sunk costs can never be a relevant cost for the purpose of decision-making.(2) If a company charges the minimum price for a product or service, based on relevant costs, itwill not improve its overall profitability.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 241. The following statements have been made about full cost plus pricing.(1) Charging prices at full cost plus a fixed margin for profit will ensure that the business willmake a profit in each period.(2) Full cost plus pricing can lead to under- and over-pricing of productsWhich of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 242. A company wishes to decide on a selling price for a new product, and wants to choose the pricethat will provide the most satisfactory weekly total contribution. Weekly sales of each product willd epend on the price charge and also on customers’ response to the new product. The followingpay-off table has been prepared( C )A P1B P2C P3D P443. The constraints in a linear programming problem are as follows:3x + 4.8y 120,000 (Grade A labour hours)5x + 4y 160,000 (Grade B labour hours)x 30,000 (Sales demand product X)y 20,000 (Sales demand Product Y)x, y ≥ 0The objective function is to maximise total contribution: 20x + 30y. A graph of the constraints is as followsWhere is the optimal solution to the linear programming problem? (C)A Point AB Point BC Point CD Point D44. A decision tree is a way of representing decision choices in the form of a diagram. It is usual fordecision trees to include probabilities of different outcomes.The following statements have been made about decision trees.(1) Each possible outcome from a decision is given an expected value.(2) Each possible outcome is shown as a branch on a decision tree.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 245.The following statements have been made about cost plus pricing.(1) A price in excess of full cost per unit will ensure that a company will cover all its costs andmake a profit.(2) Cost plus pricing is an appropriate pricing strategy when jobs are carried out to customerspecifications.Which of the above statements is/are true? ( B )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 246. The following statements have been made about solving linear programming problems forbudgeting purposes.(1) Slack occurs when less than the maximum available of a limited resource is required.(2) When the linear programming problem includes a constraint for minimum sales demand for aproduct, there may be a surplus for sales demand in the optimal solution.Which of the above statements is/are true? ( D )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 247. The following statements have been made about decision-making under conditions of uncertainty.(1) Expected value is a more reliable basis for decision-making where the situation and outcomewill occur many times than for a one-off decision.(2) A risk-averse decision maker avoids all risks in decision-making.Which of the above statements is/are true? ( A )A 1 onlyB 2 onlyC Neither 1 nor 2D Both 1 and 248. Which method of pricing is most easily applied when two or more markets for the product orservice can be kept entirely separate from each other? ( A )A Price discriminationB Product line pricingC SkimmingD Volume discounting50. Which of the following statements about decision trees is/are correct? ( B )(1) A decision tree can be used to identify the preferred decision choice using the minimax regretdecision rule.(2) A decision tree is likely to present a simplified representation of reality.A 1 only is correctB 2 only is correctC Neither 1 nor 2 is correctD Both 1 and 2 are correct51. A company makes and sells four products. Direct labour hours are a scarce resource, but the company is able to sub-contract production of any products to external suppliers. The following information is relevantA )A W, Y, X then ZB W, Z, X then YC X, Z, W then YD Z, X, Y then W52. A benefit sacrificed by taking one course of action instead of the most profitable alternativecourse of action is known as: (A )A An incremental costB An opportunity costC A relevant costD A sunk cost53. The following decision tree shows four decision options: 1, 2, 3 and 4Using the expected value rule, which choice should be made so as to optimise the expected benefit? (D )A Choice 1B Choice 2C Choice 3D Choice 454. Good information should have certain qualities. Which of the following are qualities of good information? 1 Complete 2 Extensive 3 Relevant 4 Accurate (B )A 1, 2 and 3B 1, 3 and 4C 2 and 4D All of them55.Over which of the following is the manager of a profit centre likely to have control? (D )(i) Selling (ii) Controllable costs(iii) Apportioned head office costs (iv) Capital investment in the centreA All of the aboveB (i), (ii) and (iii)C (i), (ii) and (iv)D (i) and (ii)56. Which of the following statements is/are true about group bonus schemes? (C )(i) Group bonus schemes are appropriate when increased output depends on a number of peopleall making extra effort(ii) With a group bonus scheme, it is easier to award each individual's performance(iii) Non-production employees can be rewarded as part of a group incentive schemeA (i) onlyB (i) and (ii) onlyC (i) and (iii) onlyD (ii) and (iii) only57.Factory overheads can be absorbed by which of the following methods? (A )(i) Direct labour hours (ii) Machine hours(iii) As a percentage of prime cost (iv) $x per unitA (i), (ii), (iii) and (iv)B (i) and (ii) onlyC (i), (ii) and (iii) onlyD (ii), (iii) and (iv) only58. Which of the following would be the most appropriate basis for apportioning machineryinsurance costs to cost centres within a factory? (C )A The number of machines in each cost centreB The floor area occupied by the machinery in each cost centreC The value of the machinery in each cost centreD The operating hours of the machinery in each cost centre59. Consider the following statements, regarding the reapportionment of service cost centreoverheads to production cost centres, where reciprocal services exist:(1). The direct method results in costs being reapportioned between service cost centres(2). If the direct method is used, the order in which the service cost centre overheads arereapportioned is irrelevant(3). The step down method results in costs being reapportioned between service cost centres(4). If the step down method is used, the order in which the service cost centre overheads arereapportioned is irrelevantWhich statement(s) is/are correct? ( D )A (1), (2) and (4)B (1), (3) and (4)C (2) onlyD (2) and (3)60. Which of the following are acceptable bases for absorbing production overheads? ( C )(i) Direct labour hours (ii) Machine hours(iii) As a percentage of the prime cost (iv) Per unitA Methods (i) and (ii) onlyB Methods (iii) and (iv) onlyC Methods (i), (ii), (iii) and (iv)D Methods (i), (ii) or (iii) only61. When comparing the profits reported under absorption costing and marginal costing during aperiod when the level of inventory increased, which of the following is true? ( B )A Absorption costing profits will be higher and closing inventory valuations lower than thoseunder marginal costing.B Absorption costing profits will be higher and closing inventory valuations higher than thoseunder marginal costing.C Marginal costing profits will be higher and closing inventory valuations lower than those underabsorption costing.D Marginal costing profits will be higher and closing inventory valuations higher than those underabsorption costing.62.When comparing the profits reported under absorption costing and marginal costing during a period when the level of inventory increased, which of the following is true? ( B )A Absorption costing profits will be higher and closing inventory valuations lower than those undermarginal costing.B Absorption costing profits will be higher and closing inventory valuations higher than those under marginalcosting.C Marginal costing profits will be higher and closing inventory valuations lower than those underabsorption costing.D Marginal costing profits will be higher and closing inventory valuations higher than those underabsorption costing.。

管理会计考试题及答案

管理会计考试题及答案一、单项选择题1. 管理会计的目的是()。

A. 为外部投资者提供决策信息B. 为内部管理者提供决策信息C. 为政府提供监督信息D. 为外部审计提供审计信息答案:B2. 管理会计与财务会计的主要区别在于()。

A. 信息使用者不同B. 信息内容不同C. 信息目的不同D. 信息使用者、内容和目的都不同答案:D3. 下列哪项不是管理会计的主要职能?()。

A. 规划B. 决策C. 控制D. 审计答案:D4. 管理会计信息的提供应遵循的原则是()。

A. 可靠性B. 相关性C. 及时性D. 所有以上选项答案:D5. 标准成本法中,固定制造费用差异的计算公式是()。

A. 固定制造费用差异 = 固定制造费用预算 - 固定制造费用实际B. 固定制造费用差异 = 固定制造费用预算 - 固定制造费用标准C. 固定制造费用差异 = 固定制造费用标准 - 固定制造费用实际D. 固定制造费用差异 = 固定制造费用实际 - 固定制造费用预算答案:C二、多项选择题1. 管理会计在企业中的作用包括()。

A. 辅助决策B. 规划预算C. 成本控制D. 绩效评价答案:ABCD2. 以下哪些因素会影响管理会计信息的相关性?()A. 信息的及时性B. 信息的可靠性C. 信息的可理解性D. 信息的可比性答案:ABCD3. 管理会计中,以下哪些方法用于成本控制?()A. 标准成本法B. 作业成本法C. 弹性预算法D. 责任会计答案:ABCD4. 管理会计中的成本分析方法包括()。

A. 成本-体积-利润分析B. 贡献边际分析C. 本量利分析D. 变动成本法答案:ABCD5. 以下哪些是管理会计中常用的预算方法?()A. 零基预算B. 增量预算C. 弹性预算D. 滚动预算答案:ABCD三、判断题1. 管理会计只关注短期决策。

()答案:错误2. 管理会计信息不需要遵守会计准则。

()答案:错误3. 管理会计的目的是为外部投资者提供决策信息。

管理会计考试题及答案

管理会计考试题及答案一、选择题(每题2分,共20分)1. 管理会计的主要目的是什么?A. 编制财务报表B. 内部决策支持C. 税务筹划D. 外部投资者信息披露答案:B2. 成本-体积-利润分析(CVP分析)主要关注的是:A. 成本结构B. 销售量与利润的关系C. 产品定价D. 投资回报率答案:B3. 标准成本与实际成本的差异称为:A. 直接成本差异B. 预算差异C. 标准成本差异D. 机会成本答案:C4. 以下哪项不是管理会计的职能?A. 成本控制B. 预算编制C. 财务报告D. 绩效评估答案:C5. 以下哪个是变动成本的特点?A. 与产量无关B. 随产量增加而减少C. 随产量增加而增加D. 固定不变答案:C6. 预算编制的第一步是什么?A. 收集历史数据B. 确定预算目标C. 分配预算资源D. 制定预算计划答案:B7. 管理会计中的“责任会计”主要关注的是:A. 财务报告B. 个人绩效C. 部门绩效D. 组织绩效答案:C8. 以下哪项不是成本中心的特点?A. 负责成本控制B. 负责收入C. 有明确的成本责任D. 有明确的成本目标答案:B9. 以下哪种方法用于确定最优产品组合?A. 线性规划B. 标准成本计算C. 预算差异分析D. 成本-体积-利润分析答案:A10. 以下哪种方法不是用于成本估算的?A. 直接成本法B. 标准成本法C. 作业成本法D. 资本预算法答案:D二、简答题(每题10分,共30分)1. 简述管理会计与财务会计的主要区别。

答案:管理会计主要为内部管理层提供决策支持,侧重于成本控制、预算编制和绩效评估等,不对外公开;而财务会计则侧重于编制财务报表,对外公开,遵循严格的会计准则和法规。

2. 解释什么是直接成本和间接成本,并给出各自的例子。

答案:直接成本是指可以直接追溯到特定产品或服务的成本,如原材料费用;间接成本则不能直接追溯到产品或服务,需要通过分配方法分摊到产品或服务上,如工厂租金。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。