中英文财务指标

中英文财务指标Revised on November 25, 2020

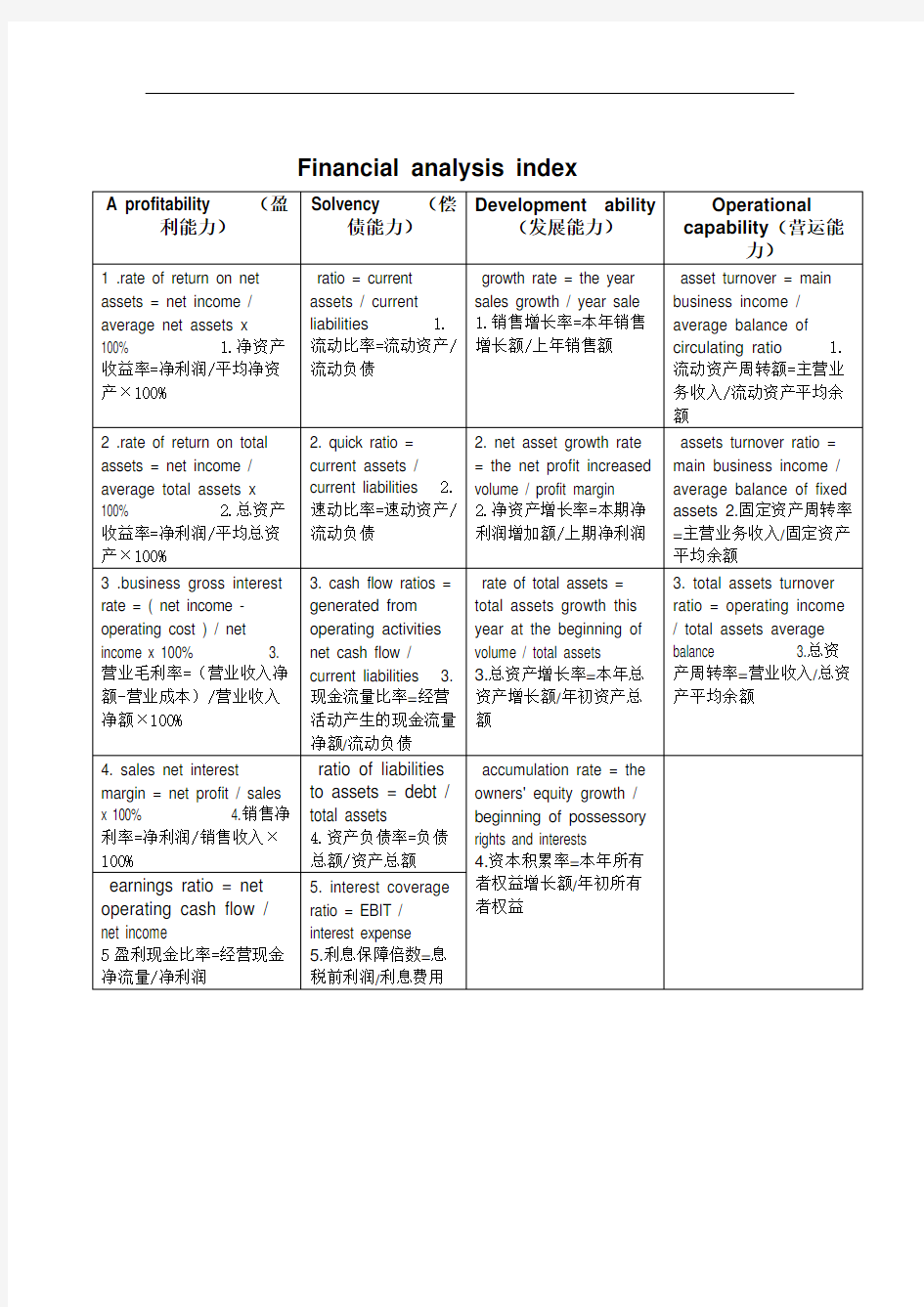

Financial analysis index

常见财务指标中英文简写

常见财务指标中英文简写 GAAP ?Generally?Accepted?Accounting?Principle?公认会计准则 CEO? Chief?Executive?Office?首席执行官 IASC International?Accounting?Standard?Committee国际会计准则委员会CPA Certificated?Public?Accountant注册会计师 WCR Working?Capital?Requirement营运资本需求量 ROE Return?on?Equity权益资本收益率(净资产收益率) ROIC Return?on?Investment?Capital投入资本收益率? EPS Earning?Per?Share每股净利润(每股收益) DPS Dividend?Per?Share?每股股利 P/E Price?-?Earning?Ratio市盈率 BVEPS Book?Value?of?Equity?Per?Share每股净资产(每股权益资本)EVA Economic?Value?Added经济增加值(经济利润) MVA Market?Value?Added市场增加值 EBT Earning?Before?Tax?税前利润 EBIT Earning?Before?Interest?And?Tax息税前利润 EAT Earning?After?Tax税后利润 ROA Return?on?Asset?资产收益率 DOL Degree?of?Operating?Leverage经营风险或经营杠杆程度 DFL Degree?of?Financial?Leverage?财务风险或财务杠杆程度 DTL Degree?of?Total?Leverage总风险或总杠杆 WACC Weighted?Average?Cost?of?Capital加权平均资本成本 TS Total?Sales销售收入? TC Total?Cost总成本 VC? Variable?Cost单位变动成本 TFC ?Total?Fixed?Cost?总固定成本 NPV Net?Present?Value净现值 IRR ?Internal?Rate?of?Return?内含报酬率 PBP Pay-back?Period回收期 BEP Break?Even?Point保本点 NWC Net?Working?Capital净营运资金 NCF Net?Cash?Flows现金净流量 DCPBP Discounted?Cash-flow?Pay-back?Period?折现累计回收期 BOPBP Bailout?Pay-back?Period脱险回收期 Net P Net profit 净利润

财务报表中英文对照

财务报表中英文对照 1.资产负债表Balance Sheet 项目ITEM 货币资金Cash 短期投资Short term investments 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable 应收出口退税Export drawback receivable 存货Inventories 其中:原材料Including:Raw materials 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a year 其他流动资产Other current assets 流动资产合计Total current assets 长期投资:Long-term investment: 其中:长期股权投资Including long term equity investment 长期债权投资Long term securities investment *合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价Fixed assets-cost 减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value 减:固定资产减值准备Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 固定资产合计Total tangible assets 无形资产Intangible assets 其中:土地使用权Including and use rights 递延资产(长期待摊费用)Deferred assets

英文财务指标及计算公式汇总

Ratios Profitability ratios Profitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return. Gross margin, Gross profit margin or Gross Profit Rate OR Operating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS) Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales) Profit margin, net margin or net profit margin Return on equity (ROE) Return on investment (ROI ratio or Du Pont ratio) Return on assets (ROA) Return on assets Du Pont (ROA Du Pont)

常见财务指标中英文简写

常见财务指标中英文简 写 SANY GROUP system office room 【SANYUA16H-

常见财务指标中英文简写 GAAP ?Generally?Accepted?Accounting?Principle?公认会计准则 CEO? Chief?Executive?Office?首席执行官 IASC International?Accounting?Standard?Committee国际会计准则委员会CPA Certificated?Public?Accountant注册会计师 WCR Working?Capital?Requirement营运资本需求量 ROE Return?on?Equity权益资本收益率(净资产收益率) ROIC Return?on?Investment?Capital投入资本收益率? EPS Earning?Per?Share每股净利润(每股收益) DPS Dividend?Per?Share?每股股利 P/E Price?-?Earning?Ratio市盈率 BVEPS Book?Value?of?Equity?Per?Share每股净资产(每股权益资本)EVA Economic?Value?Added经济增加值(经济利润) MVA Market?Value?Added市场增加值 EBT Earning?Before?Tax?税前利润 EBIT Earning?Before?Interest?And?Tax息税前利润 EAT Earning?After?Tax税后利润 ROA Return?on?Asset?资产收益率 DOL Degree?of?Operating?Leverage经营风险或经营杠杆程度 DFL Degree?of?Financial?Leverage?财务风险或财务杠杆程度 DTL Degree?of?Total?Leverage总风险或总杠杆 WACC Weighted?Average?Cost?of?Capital加权平均资本成本 TS Total?Sales销售收入? TC Total?Cost总成本 VC? Variable?Cost单位变动成本 TFC ?Total?Fixed?Cost?总固定成本 NPV Net?Present?Value净现值 IRR ?Internal?Rate?of?Return?内含报酬率 PBP Pay-back?Period回收期 BEP Break?Even?Point保本点 NWC Net?Working?Capital净营运资金 NCF Net?Cash?Flows现金净流量 DCPBP Discounted?Cash-flow?Pay-back?Period?折现累计回收期BOPBP Bailout?Pay-back?Period脱险回收期 Net P Net profit 净利润

些财务术语的英文缩写

一般是指资金、固定资产的投入.对电信运营商来说,有关的网络设备、计算机、仪器等一次性支出的项目都属于CAPEX,其中网络设备占最大的部分。OPEX指的是企业的管理支出. 2.什么是OPEX? OPEX是(Operating Expense)即运营成本,计算公式为:OPEX=维护费用+营销费用+人工成本(+折旧)。运营成本主要是指当期的付现成本。 (Capital Expenditure)即资本性支出,计算公式为:CAPEX=战略性投资+滚动性投资。资本性投资支出指用于基础建设、扩大再生产等方面的需要在多个会计年度分期摊销的资本性支出。 4.由于战略性投资的决策权不在本地网,因此BPR的指标考核中,Capex仅限于滚动性投资,不包括战略性投资。主要指标是Capex收入率和投资、回报率(ROI),前者为Capex收入比,反映资本性支出占收入的比重;后者反映投资效益。 &L就是profit&loss statement 也就是损益表 ,全称Earnings Before Interest and Tax,即息税前利润,从字面意思可知是扣除利息、所得税之前的利润。计算公式有两种,EBIT=净利润+所得税+利息,或EBIT=经营利润+投资收益+营业外收入-营业外支出+以前年度损益调整。 EBIT主要用来衡量企业主营业务的盈利能力,EBITDA则主要用于衡量企业主营业务产生现金流的能力。他们都反映企业现金的流动情况,是资本市场上投资者比较重视的两个指标,通过在计算利润时剔除掉一些因素,可以使利润的计算口径更方便投资者使用。 EBIT通过剔除所得税和利息,可以使投资者评价项目时不用考虑项目适用的所 得税率和融资成本,这样方便投资者将项目放在不同的资本结构中进行考察。EBIT与净利润的主要区别就在于剔除了资本结构和所得税政策的影响。如此, 同一行业中的不同企业之间,无论所在地的所得税率有多大差异,或是资本结构有多大的差异,都能够拿出EBIT这类指标来更为准确的比较盈利能力。而同一企业在分析不同时期盈利能力变化时,使用EBIT也较净利润更具可比性。 ,全称Earnings Before Interest, Tax, Depreciation and Amortization, 即息税折旧摊销前利润,是扣除利息、所得税、折旧、摊销之前的利润。计算公式为EBITDA=净利润+所得税+利息+折旧+摊销,或EBITDA=EBIT+折旧+摊销。 EBITDA剔除摊销和折旧,则是因为摊销中包含的是以前会计期间取得无形资产 时支付的成本,而并非投资人更关注的当期的现金支出。而折旧本身是对过去资本支出的间接度量,将折旧从利润计算中剔除后,投资者能更方便的关注对于未来资本支出的估计,而非过去的沉没成本。 20世纪80年代,伴随着杠杆收购的浪潮,EB

常见财务指标中英文简写

常见财务指标中英文简写 GAAP Generally Accepted Accounting Principle 公认会计准则 CEO Chief Executive Office 首席执行官 IASCInternational Accounting Standard Committee国际会计准则委员会CPACertificated Public Accountant注册会计师 WCRWorking Capital Requirement营运资本需求量 ROEReturn on Equity权益资本收益率(净资产收益率)ROICReturn on Investment Capital投入资本收益率 EPSEarning Per Share每股净利润(每股收益) DPSDividend Per Share 每股股利 P/EPrice - Earning Ratio市盈率 BVEPSBook Value of Equity Per Share每股净资产(每股权益资本)EVAEconomic Value Added经济增加值(经济利润) MVAMarket Value Added市场增加值 EBTEarning Before Tax 税前利润 EBITEarning Before Interest And Tax息税前利润 EATEarning After Tax税后利润 ROAReturn on Asset 资产收益率 DOLDegree of Operating Leverage经营风险或经营杠杆程度DFLDegree of Financial Leverage 财务风险或财务杠杆程度DTLDegree of Total Leverage总风险或总杠杆 WACCWeighted Average Cost of Capital加权平均资本成本 TSTotal Sales销售收入 TCTotal Cost总成本 VC Variable Cost单位变动成本 TFC Total Fixed Cost 总固定成本 NPVNet Present Value净现值 IRR Internal Rate of Return 内含报酬率 PBPPay-back Period回收期 BEPBreak Even Point保本点 NWCNet Working Capital净营运资金 NCFNet Cash Flows现金净流量 DCPBPDiscounted Cash-flow Pay-back Period 折现累计回收期BOPBPBailout Pay-back Period脱险回收期 Net P Net profit 净利润

财务报表中英文对照

一、企业财务会计报表封面FINANCIAL REPORT COVER 报表所属期间之期末时间点Period Ended 所属月份Reporting Period 报出日期Submit Date 记账本位币币种Local Reporting Currency 审核人Verifier 填表人Preparer 二、资产负债表Balance Sheet 资产Assets 流动资产Current Assets 货币资金Bank and Cash 短期投资Current Investment 一年内到期委托贷款Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备Less: Impairment for current investment 短期投资净额Net bal of current investment

应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收账款Account receivable 减:应收账款坏账准备Less: Bad debt provision for Account receivable 应收账款净额Net bal of Account receivable 其他应收款Other receivable 减:其他应收款坏账准备Less: Bad debt provision for Other receivable 其他应收款净额Net bal of Other receivable 预付账款Prepayment 应收补贴款Subsidy receivable 存货Inventory 减:存货跌价准备Less: Provision for Inventory 存货净额Net bal of Inventory 已完工尚未结算款Amount due from customer for contract work 待摊费用Deferred Expense 一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year

财务部门英文缩写

财务部门英文缩写 【篇一:财务部门英文缩写】 公司高层职位的英文缩写: ceo : chief executive officer 首席执行官 cfo : chief financial officer 首席财务官 coo : chief operated officer 首席运营官 cto : chief technology officer 首席技术官 cio : chief information officer 首席信息官 cro : chief risk officer 首席风险官 ceo(chief executive officer),即首席执行官 cfo(chief financial officer)意指公司首席财政官或财务总监 coo (chief operation officer )首席营运官的职责主要是负责公司的日常营运,辅助ceo的工作。一般来讲,coo负责公司职能管理组织体系的建设,并代表ceo处理企业的日常职能事务。 cto(首席技术官、技术长)是英语chief technology officer的简写,意即企业内负责技术的最高负责人。 cio 英文全称是chief information officer cio原指政府管理部门中的首席信息官,随着信息系统由后方办公室的辅助工具发展到直接参与企业的有力手段,美国企业的首席信息经理相称于副总经理直接对最高决策者负责。 cro (chief risk officer)首席风险官首席风险官在中国还是一个全新的职务,但在国外却有约40%的企业设立了该职位,而且是最重要职位之一。这是一个应企业风险管理意识的加强而产生的职位。

财务报表各项目中英文对照

财务报表各项目中英文对照 一、损益表INCOME STATEMENT Aggregate income statement 合并损益表 Operating Results 经营业绩 FINANCIAL HIGHLIGHTS 财务摘要 Gross revenues 总收入/毛收入 Net revenues 销售收入/净收入 Sales 销售额 Turnover 营业额 Cost of revenues 销售成本 Gross profit 毛利润 Gross margin 毛利率 Other income and gain 其他收入及利得 EBITDA 息、税、折旧、摊销前利润(EBITDA) EBITDA margin EBITDA率 EBITA 息、税、摊销前利润 EBIT 息税前利润/营业利润 Operating income(loss)营业利润/(亏损) Operating profit 营业利润 Operating margin 营业利润率 EBIT margin EBIT率(营业利润率) Profit before disposal of investments 出售投资前利润 Operating expenses: 营业费用: Research and development costs (R&D)研发费用 marketing expenses Selling expenses 销售费用 Cost of revenues 营业成本 Selling Cost 销售成本 Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用 Selling and distribution costs 营销费用/行销费用 General and administrative expenses 管理费用/一般及管理费用 Administrative expenses 管理费用 Operating income(loss)营业利润/(亏损) Profit from operating activities 营业利润/经营活动之利润 Finance costs 财务费用/财务成本 Financial result 财务费用 Finance income 财务收益 Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动 Loss on the derivative component of convertible bonds 可換股債券衍生工具之損失 Equity loss of affiliates 子公司权益损失 Government grant income 政府补助 Other (expense) / income 其他收入/(费用)

中英文对照版财务报表

一、企业财务会计报表封面 FINANCIAL REPORT COVER 报表所属期间之期末时间点 Period Ended 所属月份 Reporting Period 报出日期 Submit Date 记账本位币币种 Local Reporting Currency 审核人 Verifier 填表人 Preparer 二、资产负债表 Balance Sheet 资产 Assets 流动资产 Current Assets 货币资金 Bank and Cash 短期投资 Current Investment 一年内到期委托贷款 Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备 Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备 Less: Impairment for current investment 短期投资净额 Net bal of current investment 应收票据 Notes receivable 应收股利 Dividend receivable 应收利息 Interest receivable 应收账款 Account receivable 减:应收账款坏账准备 Less: Bad debt provision for Account receivable 应收账款净额 Net bal of Account receivable 其他应收款 Other receivable 减:其他应收款坏账准备 Less: Bad debt provision for Other receivable 其他应收款净额 Net bal of Other receivable 预付账款 Prepayment 应收补贴款 Subsidy receivable 存货 Inventory 减:存货跌价准备 Less: Provision for Inventory 存货净额 Net bal of Inventory 已完工尚未结算款 Amount due from customer for contract work 待摊费用 Deferred Expense 一年内到期的长期债权投资 Long-term debt investment due within one year 一年内到期的应收融资租赁款 Finance lease receivables due within one year 其他流动资产 Other current assets 流动资产合计 Total current assets 长期投资 Long-term investment 长期股权投资 Long-term equity investment 委托贷款 Entrusted loan receivable 长期债权投资 Long-term debt investment

相关财务英文全称及缩写

相关财务指标英文缩写 PE:市盈率(Price to Earning Ratio,简称PE或P/E Ratio) ,也称本益比“股价收益比率”或“市价盈利比率(简称市盈率)”。PE =股价(PRICE)/ 每股净利(EARNING PER SHARE) PB称为市净率,也就是市价除以每股净资产;平均市净率=股价/账面价值。其 中,账面价值=总资产-无形资产-负债-优先股权益。可以看出,所谓账面价值是公司解散清算的价值。如果公司要清算,那么先要还债,无形资产则将不复存在,而优先股的优先权之一就是清算的时候先分钱,但是本股市没有优先股。这样,用每股净资产来代替账面价值,则PB就是大家理解的市净率,即:PB(市净率)=股价/每股净资 Ebit:息税前利润 Ebitda:税息折旧及摊销前利润 EBITDA=营业利润(EBIT)+ 折旧费用+ 摊销费用 ROA:英文全称:Return On Assets 资产收益率 公式:资产收益率(ROA)=税后净收入/总资产 ROE英文全称:Rate of Return on Common Stockholders’ Equity (Return On Equity) 净资产收益率ROE=净利润/股东权益=净利润/销售收入*销售收入/资产*资产/股东权益可写为:股东权益收益率=销售利润率*资产周转率*财务杠杆(财务杠杆指权益乘数,即资产/权益) COE:为股权成本率;COE的计算公式为:无风险收益率+市场风险溢价×贝它值。 PE/G是预期市盈率,市盈率与业绩增长率之比”也就是市价除以今年预期每股收益。因为当前只能知道上一年的每股收益,所以今年预期每股收益可能不同的

一些财务术语的英文缩写

1.CAPEX一般是指资金、固定资产的投入.对电信运营商来说,有关的网络设备、计算机、仪器等一次性支出的项目都属于CAPEX,其中网络设备占最大的部分。OPEX指的是企业的管理支出. 2.什么是OPEX? OPEX是(Operating Expense)即运营成本,计算公式为:OPEX=维护费用+营销费用+人工成本(+折旧)。运营成本主要是指当期的付现成本。 3.CAPEX(Capital Expenditure)即资本性支出,计算公式为:CAPEX=战略性投资+滚动性投资。资本性投资支出指用于基础建设、扩大再生产等方面的需要在多个会计年度分期摊销的资本性支出。 4.由于战略性投资的决策权不在本地网,因此BPR的指标考核中,Capex仅限于滚动性投资,不包括战略性投资。主要指标是Capex收入率和投资、回报率(ROI),前者为Capex收入比,反映资本性支出占收入的比重;后者反映投资效益。 5.P&L就是profit&loss statement 也就是损益表 6.EBIT,全称Earnings Before Interest and Tax,即息税前利润,从字面意思可知是扣除利息、所得税之前的利润。计算公式有两种,EBIT=净利润+所得税+利息,或EBIT=经营利润+投资收益+营业外收入-营业外支出+以前年度损益调整。 EBIT主要用来衡量企业主营业务的盈利能力,EBITDA则主要用于衡量企业主营业务产生现金流的能力。他们都反映企业现金的流动情况,是资本市场上投资者比较重视的两个指标,通过在计算利润时剔除掉一些因素,可以使利润的计算口径更方便投资者使用。 EBIT通过剔除所得税和利息,可以使投资者评价项目时不用考虑项目适用的所得税率和融资成本,这样方便投资者将项目放在不同的资本结构中进行考察。EBIT与净利润的主要区别就在于剔除了资本结构和所得税政策的影响。如此,同一行业中的不同企业之间,无论所在地的所得税率有多大差异,或是资本结构有多大的差异,都能够拿出EBIT这类指标来更为准确的比较盈利能力。而同一企业在分析不同时期盈利能力变化时,使用EBIT也较净利润更具可比性。 7.EBITDA,全称Earnings Before Interest, Tax, Depreciation and Amortization,即息税折旧摊销前利润,是扣除利息、所得税、折旧、摊销之前的利润。计算公式为EBITDA=净利润+所得税+利息+折旧+摊销,或EBITDA =EBIT+折旧+摊销。 EBITDA剔除摊销和折旧,则是因为摊销中包含的是以前会计期间取得无形资产时支付的成本,而并非投资人更关注的当期的现金支出。而折旧本身是对过去资本支出的间接度量,将折旧从利润计算中剔除后,投资者能更方便的关注对于未来资本支出的估计,而非过去的沉没成本。 20世纪80年代,伴随着杠杆收购的浪潮,EB

中英文财务报表词语对照表

中英文财务报表词语对照表 一、企业财务会计报表封面 FINANCIAL REPORT COVER 报表所属期间之期末时间点 Period Ended 所属月份 Reporting Period 报出日期 Submit Date 记账本位币币种 Local Reporting Currency 审核人 Verifier 填表人 Preparer 二、资产负债表 Balance Sheet 资产 Assets 流动资产 Current Assets 货币资金 Bank and Cash 短期投资 Current Investment 一年内到期委托贷款 Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备 Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备 Less: Impairment for current investment 短期投资净额 Net bal of current investment 应收票据 Notes receivable 应收股利 Dividend receivable 应收利息 Interest receivable 应收账款 Account receivable 减:应收账款坏账准备 Less: Bad debt provision for Account receivable

应收账款净额 Net bal of Account receivable 其他应收款 Other receivable 减:其他应收款坏账准备 Less: Bad debt provision for Other receivable 其他应收款净额 Net bal of Other receivable 预付账款 Prepayment 应收补贴款 Subsidy receivable 存货 Inventory 减:存货跌价准备 Less: Provision for Inventory 存货净额 Net bal of Inventory 已完工尚未结算款 Amount due from customer for contract work 待摊费用 Deferred Expense 一年内到期的长期债权投资 Long-term debt investment due within one year 一年内到期的应收融资租赁款 Finance lease receivables due within one year 其他流动资产 Other current assets 流动资产合计 Total current assets 长期投资 Long-term investment 长期股权投资 Long-term equity investment 委托贷款 Entrusted loan receivable 长期债权投资 Long-term debt investment 长期投资合计 Total for long-term investment 减:长期股权投资减值准备 Less: Impairment for long-term equity investment

会计报表术语中英文对照

会计报表术语中英文对照 一、损益表INCOME STA TEMENT Aggregate income statement 合并损益表 Operating Results 经营业绩 FINANCIAL HIGHLIGHTS 财务摘要 Gross revenues 总收入/毛收入 Net revenues 销售收入/净收入 Sales 销售额 Turnover 营业额 Cost of revenues 销售成本 Gross profit 毛利润 Gross margin 毛利率 Other income and gain 其他收入及利得 EBITDA 息、税、折旧、摊销前利润(EBITDA) EBITDA margin EBITDA率 EBITA 息、税、摊销前利润 EBIT 息税前利润/营业利润 Operating income(loss)营业利润/(亏损) Operating profit 营业利润 Operating margin 营业利润率 EBIT margin EBIT率(营业利润率) Profit before disposal of investments 出售投资前利润 Operating expenses: 营业费用: Research and development costs (R&D)研发费用 marketing expensesSelling expenses 销售费用 Cost of revenues 营业成本 Selling Cost 销售成本 Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用 Selling and distribution costs 营销费用/行销费用 General and administrative expenses 管理费用/一般及管理费用 Administrative expenses 管理费用 Operating income(loss)营业利润/(亏损) Profit from operating activities 营业利润/经营活动之利润 Finance costs 财务费用/财务成本 Financial result 财务费用 Finance income 财务收益 Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动 Loss on the derivative component of convertible bonds 可換股債券衍生工具之損失 Equity loss of affiliates 子公司权益损失 Government grant income 政府补助

常见财务指标中英文简写

常见财务指标中英文简写GAAP?Generally?Accepted?Accounting?Principle?公认会计准则 CEO?Chief?Executive?Office?首席执行官 IASCInternational?Accounting?Standard?Committee国际会计准则委员会CPACertificated?Public?Accountant注册会计师 WCRWorking?Capital?Requirement营运资本需求量 ROEReturn?on?Equity权益资本收益率(净资产收益率)ROICReturn?on?Investment?Capital投入资本收益率? EPSEarning?Per?Share每股净利润(每股收益) DPSDividend?Per?Share?每股股利 P/EPrice?-?Earning?Ratio市盈率 BVEPSBook?Value?of?Equity?Per?Share每股净资产(每股权益资本)EVAEconomic?Value?Added经济增加值(经济利润) MVAMarket?Value?Added市场增加值 EBTEarning?Before?Tax?税前利润 EBITEarning?Before?Interest?And?Tax息税前利润 EATEarning?After?Tax税后利润 ROAReturn?on?Asset?资产收益率 DOLDegree?of?Operating?Leverage经营风险或经营杠杆程度DFLDegree?of?Financial?Leverage?财务风险或财务杠杆程度DTLDegree?of?Total?Leverage总风险或总杠杆 WACCWeighted?Average?Cost?of?Capital加权平均资本成本TSTotal?Sales销售收入? TCTotal?Cost总成本 VC?Variable?Cost单位变动成本 TFC?Total?Fixed?Cost?总固定成本 NPVNet?Present?Value净现值 IRR?Internal?Rate?of?Return?内含报酬率 PBPPay-back?Period回收期 BEPBreak?Even?Point保本点 NWCNet?Working?Capital净营运资金 NCFNet?Cash?Flows现金净流量 DCPBPDiscounted?Cash-flow?Pay-back?Period?折现累计回收期BOPBPBailout?Pay-back?Period脱险回收期 NetPNetprofit净利润

一些英语财务术语缩写解释

一些英语财务术语缩写解释 1.CAPEX一般是指资金、固定资产的投入.对电信运营商来说,有关的网络设备、计算机、仪器等一次性支出的项目都属于CAPEX,其中网络设备占最大的部分。OPEX指的是企业的管理支出. 2.什么是OPEX? OPEX是(Operating Expense)即运营成本,计算公式为:OPEX=维护费用+营销费用+人工成本(+折旧)。运营成本主要是指当期的付现成本。 3.CAPEX(Capital Expenditure)即资本性支出,计算公式为:CAPEX=战略性投资+滚动性投资。资本性投资支出指用于基础建设、扩大再生产等方面的需要在多个会计年度分期摊销的资本性支出。 4.由于战略性投资的决策权不在本地网,因此BPR的指标考核中,Capex仅限于滚动性投资,不包括战略性投资。主要指标是Capex收入率和投资、回报率(ROI),前者为Capex收入比,反映资本性支出占收入的比重;后者反映投资效益。 5.P&L就是profit&loss statement 也就是损益表 6.EBIT,全称Earnings Before Interest and Tax,即息税前利润,从字面意思可知是扣除利息、所得税之前的利润。计算公式有两种,EBIT=净利润+所得税+利息,或EBIT=经营利润+投资收益+营业外收入-营业外支出+以前年度损益调整。 EBIT主要用来衡量企业主营业务的盈利能力,EBITDA则主要用于衡量企业主营业务产生现金流的能力。他们都反映企业现金的流动情况,是资本市场上投资者比较重视的两个指标,通过在计算利润时剔除掉一些因素,可以使利润的计算口径更方便投资者使用。 EBIT通过剔除所得税和利息,可以使投资者评价项目时不用考虑项目适用的所得税率和融资成本,这样方便投资者将项目放在不同的资本结构中进行考察。EBIT与净利润的主要区别就在于剔除了资本结构和所得税政策的影响。如此,同一行业中的不同企业之间,无论所在地的所得税率有多大差异,或是资本结构有多大的差异,都能够拿出EBIT这类指标来更为准确的比较盈利能力。而同一企业在分析不同时期盈利能力变化时,使用EBIT也较净利润更具可比性。 7.EBITDA,全称Earnings Before Interest, Tax, Depreciation and Amortization,即息税折旧摊销前利润,是扣除利息、所得税、折旧、摊销之前的利润。计算公式为EBITDA=净利润+所得税+利息+折旧+摊销,或EBITDA=EBIT+折旧+摊销。 EBITDA剔除摊销和折旧,则是因为摊销中包含的是以前会计期间取得无形资产时支付的成本,而并非投资人更关注的当期的现金支出。而折旧本身是对过去资本支出的间接度量,将折旧从利润计算中剔除后,投资者能更方便的关注对于未来资本支出的估计,而非过去的沉没成本。 20世纪80年代,伴随着杠杆收购的浪潮,EB

财务报表中英文

新会计准则下的英文版的会计报表 一、企业财务会计报表封面 FINANCIAL REPORT COVER 报表所属期间之期末时间点 Period Ended 所属月份Reporting Period 报出日期Submit Date 记账本位币币种Local Reporting Currency 审核人Verifier 填表人Preparer 二、资产负债表Balance Sheet 资产Assets 流动资产Current Assets 货币资金Cash and Cash Equivalents 短期投资Short-term Investment 一年内到期委托贷款Entrusted Loan Receivable Due within One Year 减:一年内到期委托贷款减值准备 Deduct: Depreciation Reserve for Entrusted Loan Receivable Due within One Year 减:短期投资跌价准备Deduct: Falling Price Reserve for Short-term Investment 短期投资净额Net Value of Short-term Investment 应收票据Notes Receivable 应收股利Dividends Receivable 应收利息Interest Receivable 应收账款Accounts Receivable 减:应收账款坏账准备Deduct: Bad Debt Reserve for Accounts Receivable 应收账款净额Net Value of Accounts Receivable 其他应收款Other Receivable 减:其他应收款坏账准备Deduct: Bad Debt Reserve for Other Receivable 其他应收款净额Net Value of Other Receivable 预付账款Prepayment 应收补贴款Subsidy Receivable 存货Inventory 减:存货跌价准备Deduct: Inventory Falling Price Reserve 存货净额Net Value of Inventory 已完工尚未结算款Amount Due from Customer for Contract Work 待摊费用Deferred Expense 一年内到期的长期债权投资Long-term Investment on Bonds Due within One Year 一年内到期的应收融资租赁款Financial Lease Receivable Due within One Year 其他流动资产Other Current Assets 流动资产合计Total Current Assets 长期投资Long-term Investment 长期股权投资Long-term Investment on Stocks 委托贷款Entrusted Loan 长期债权投资Long-term Investment on Bonds 长期投资合计Total Long-term Investment 减:长期股权投资减值准备Deduct: Depreciation Reserve for Long-term Investment on Stocks 减:长期债权投资减值准备Deduct: Depreciation Reserve for Long-term Investment on