《保险英语》复习资料

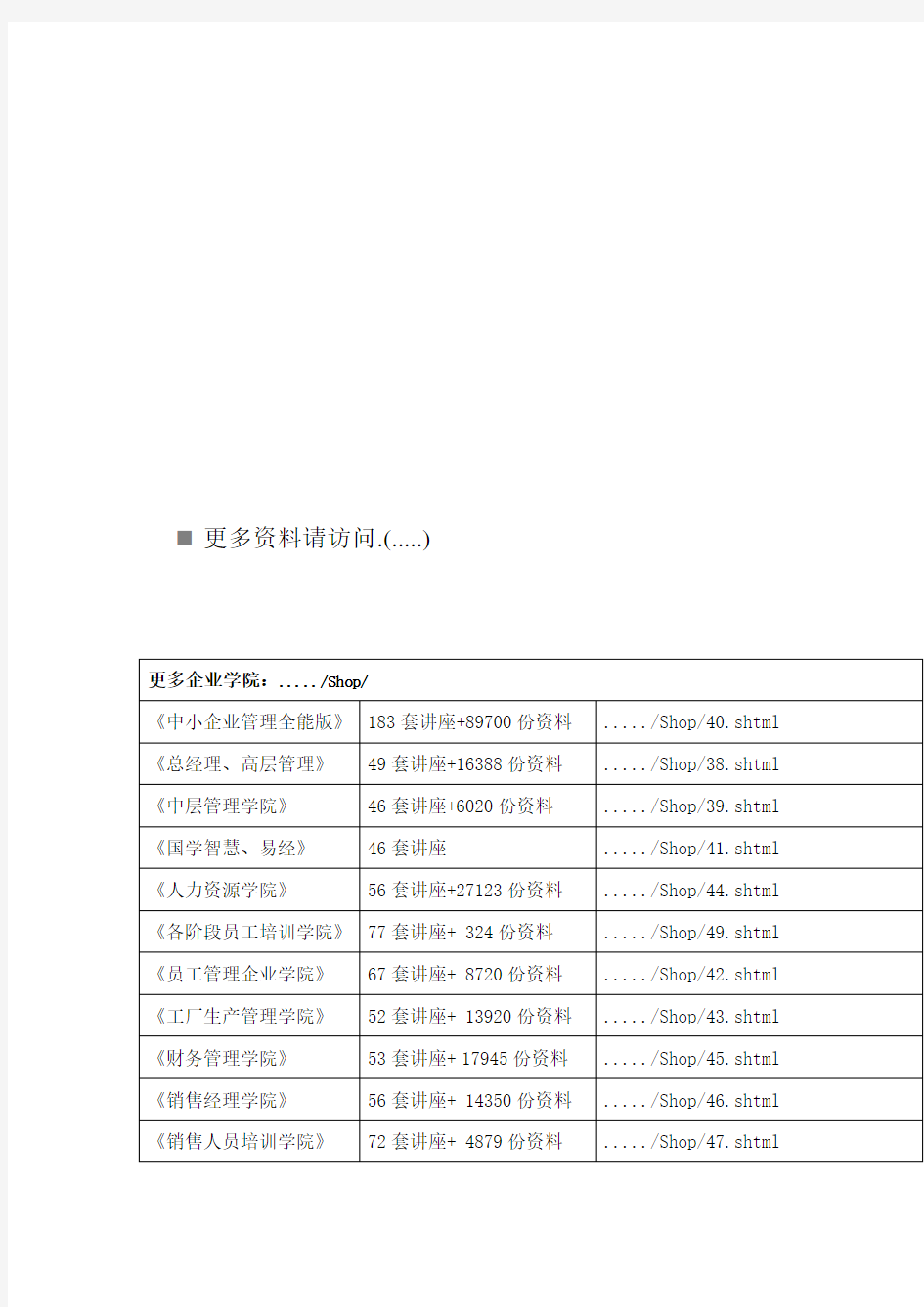

更多资料请访问.(.....)

《保险英语》复习保险英语复习概要(不保证一定考,也不保证不考)

保险利益原则----- principle of insurable interest

损失补偿原则----- principle of indemnity

代位求偿原则----- principle of subrogation

最大诚信原则----- principle of utmost good faith

近因原则----- principle of proximity

--------------------------------------------------------------------------- 风险分担----- risk-sharing/risk-pooling

分散风险----- spreading risk

保险人----- insurer/ underwriter

投保人-----insurance applicant

被保险人-----Insured

受益人----- beneficiary

保险代理人-----insurance agent

保险经纪人-----insurance broker

保险公估人-----insurance surveyor/ adjuster/appraiser

保险条款----- insurance clause/ treatment

不可抗辩条款----- incontestable clause

保费----- premium

保险标的----- subject –matter of insurance

保险价值----- insured value// (1)

保险索赔----- claim

告知----- representation

声明----- declaration

误告----- misrepresentation

死亡表----- life table/ mortality table

Rate-making -----费力厘定

Occupancy ----- 用途

Construction ----- 构造

Protection ----- 防护

Location ----- 位置

大数法则----- law of large numbers

效应理论----- utility theory

毛保费----- gross premium

纯保费----- net premium

附加保费----- loading premium

均衡保费----- level premium

趸缴保费----- lump sum premium/single premium

准备金----- reserve

现金价值----- cash value

附加条款----- rider

保险期间----- insurance period

保额----- amount of insurance

保险索赔----- claim

保险责任(受保范围)------ coverage

除外责任------ exclusion

保证----- warranty

隐瞒----- concealment

要约----- offer

反要约----- counteroffer

保单不丧失权益-----nonforfeiture benefits

延期定期寿险----- deferred term life insurance

两全保险----- endowment life insurance

万能寿险----- universal life insurance

分红寿险-----participating life insurance

红利---- dividend

养老金----- pension

联合人寿-----joint life

投连险----- unit-linked life insurance

定期寿险----- term life insurance

终身寿险----- whole life insurance

变额万能寿险----- variable universal life insurance

年金寿险----- annuity life insurance

财产保险----- Property & casualty insurance

巨灾保险----- catastrophe insurance /Act of God insurance

重大疾病保险-----critical illness/dreadful illness insurance

意外保险----- accidental insurance

重复保险------double insurance

投保单----- application form/proposal form

保单----- insurance policy

暂保单----- binding slip/cover note

批单------ endorsement

保险凭证(小保单)-----certificate of insurance

保单持有人----- policyholder/policyowner

再保险-----Reinsurance

分出公司----- ceding company

分入公司------ceded company

国有保险公司-----state-owned insurance company

股份制保险公司---- stock-based insurance company

自保公司----- captive company

相互保险公司----- mutual company

合作保险公司------ cooperative company

互助保险公司------ fraternal company

------------------------------------------------------------------------------------------------------- Risk -----a measure of possible variation of economic outcomes.

Hazard ----- a condition that increases the chance of loss due to a peril

Peril ----- risk event or risk incident which refers to a possible cause of loss.

Exposure to risk ----- a situation created whenever an act gives rise to possible gain or

loss that cannot be predicted

Cost of risk ----- the cost imposed upon organizations because of the presence

of risk.

Asymmetric information----- one party of insurance contract possesses more

knowledge than the other.

Moral Hazard----- a potential cost of insurance in which the presence of

insurance increases the tendency for losses to occur through careless,

irresponsible, or perhaps illegal behavior.

Adverse selection----- a potential effect of insurance whereby

worse-than-average risks are likely to buy insurance

------------------------------------------------------------------------------------------------------- 1.财产保险的定义有狭义和广义之分。

Property insurance can refer to two kinds of definition, viz. property & casualty insurance in a narrow sense and broad sense.

2.按保险价值分类,财产保险可分为定值保险和不定值保险。

In conformity to the insurance value, property insurance can be classified into fixed value and unfixed value insurance.

3.自然灾害包括雷、电、暴风雨、冰雹、洪水、潮浪、海啸、大风暴、台风、旋风、龙卷风、飓风、山崩、雪崩、地陷、地震、地下火,以及火山喷发等等。这些都可能对财产造成巨大损毁或人身伤亡。

Natural disasters comprise thundering, lightning, rainstorm, hail, floods, tidal wave Tsunami, Tempest, typhoon, cyclone, tornado, hurricane,rockslide, avalanche, subsidence of ground, earthquake , subterranean fire, volcanic eruption and so forth, all of which may give rise to innumerable cases of loss to properties or death or personal injury.

4.保险的基本原理是分散风险。

The basic tenet of insurance is spreading of risk.

5.同一利益投保了两张或多张保单称为重复保险。

Double insurance means that teo or more policies are effected on the same interest.

6.保险的重要作用对社会大众来说是显而易见的。

The important role of insurance is apparent to the social public.

7.俗话说,天有不测风云,人有旦夕祸福。

As the saying goes, in nature there are unexpected storms and in life there are unpredictable vicissitudes.

8. 免赔额是指保单中规定的某一金额或百分比,赔额必须超过该金额或百分比时方予赔偿。

Deduction denotes an amount or percentage specified in the policy which must be exceeded before a claim is payable.

9. 机动车辆保险标的主要是车身和第三者责任。

The subject-matter of motor vehicle insurance is motor vehicle and third party liability in the main.

10. 任何保险文件,如保险契约、保单、保险凭证、暂保单的变动或补充都可以通过背书办理。

Any amendment or addition to a existing insurance document such as an insurance contract, policy, insurance certificate or cover note can be made by endorsement. 11. 损失的可能性越大,缴纳的保险费就越多。

The more probable the loss, the greater the premium will be.

风险成为可保风险的条件(what makes a risk insurable?)

1.It should be economically feasible.

2.The economic value of the insurance should be calculable.

3.The loss must be definite.

4.The loss must be random in nature.

5.The exposure in any rate class must be homogenous.

6.Exposure units should be spatially and temporally independent.

1.风险应该经济上可行

2.经济价值可以计算的

3.损失是有限的

4.损失是随机的

5.风险在任何一类风险中是同质的

6.风险单位是暂时的在空间上独立。

财产风险(property risk)

All business and individuals that own,rent,or use property are exposed to the risk that property may be damaged, destroyed. or stolen. Property owned or used outside

of the building may also be susceptible to loss. Typical examples include trucks, automobiles, and mobile equipment. To fully analyze property risk exposures, businesses must consider both the types of property susceptible to loss and the potential sources of such risk. Sources of risk include not only fire and lightning but also theft, tornadoes, hurricanes, explosions, riots, collisions, falling objects, floods, earthquakes, and freezing, to name only a few.

风险管理过程(Risk management process)

1.identify risks

2.evaluate risks

3.select risk management techniques

4.implement and review decisions