国际结算(英文版)清华大学出版社 答案

KEY OF INTERNATIONAL SETTLEMENT

Chapter1

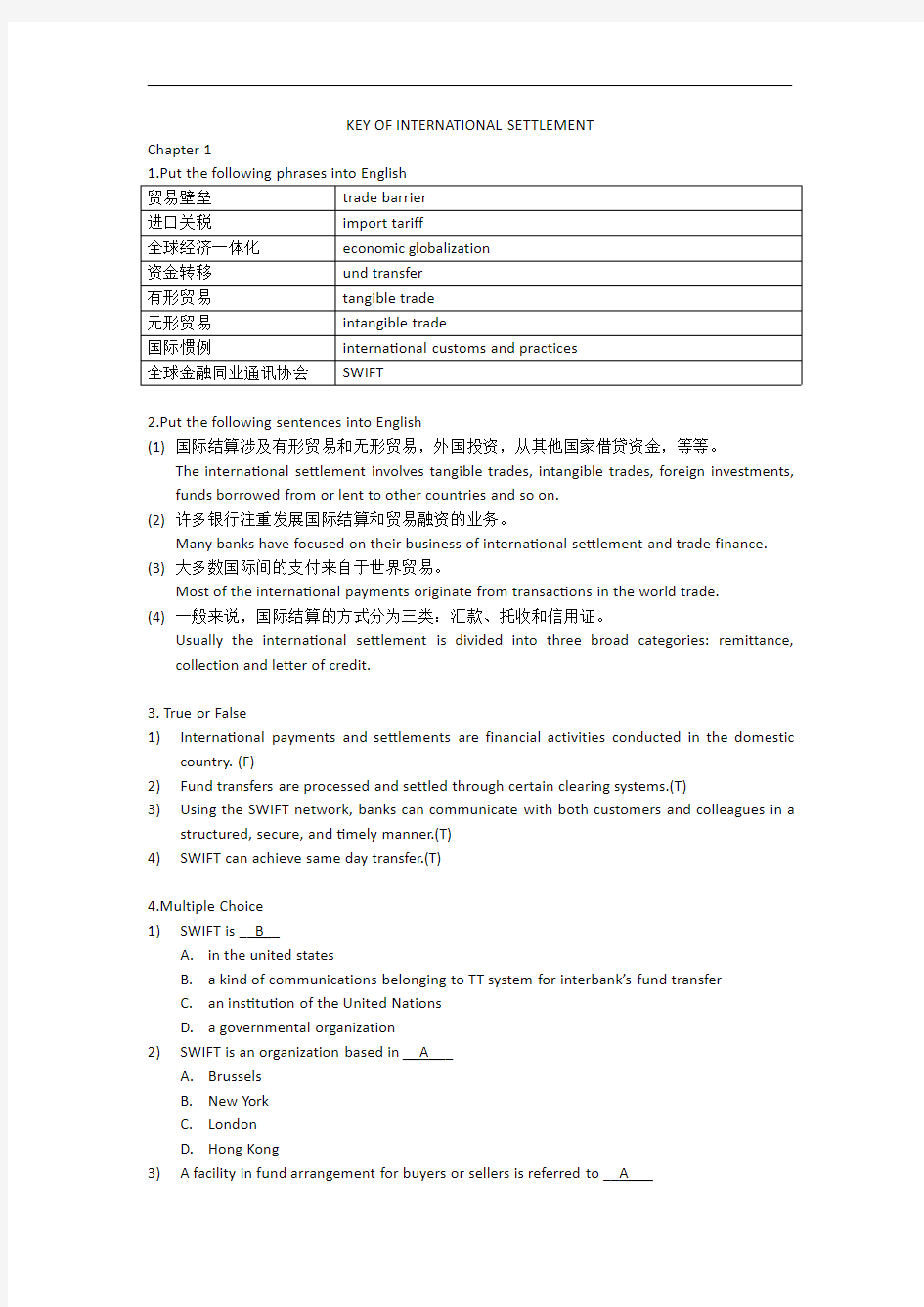

1.Put the following phrases into English

贸易壁垒trade barrier

进口关税import tariff

全球经济一体化ec onomic glob alization

资金转移und transfer

有形贸易tangible trade

无形贸易intangible trade

国际惯例international customs and practices

全球金融同业通讯协会SWIFT

2.Put the following sentences into English

(1)国际结算涉及有形贸易和无形贸易,外国投资,从其他国家借贷资金,等等。

The international settlement involves tangible trades,intangible trades,foreign investments, funds borrowed from or lent to other countries and so on.

(2)许多银行注重发展国际结算和贸易融资的业务。

Many banks have focused on their business of international settlement and trade finance. (3)大多数国际间的支付来自于世界贸易。

Most of the international payments originate from transactions in the world trade.

(4)一般来说,国际结算的方式分为三类:汇款、托收和信用证。

Usually the international settlement is divided into three broad categories:remittance, collection and letter of credit.

3.True or False

1)International payments and settlements are financial activities conducted in the domestic

country.(F)

2)Fund transfers are processed and settled through certain clearing systems.(T)

3)Using the SWIFT network,banks can communicate with both customers and colleagues in a

structured,secure,and timely manner.(T)

4)SWIFT can achieve same day transfer.(T)

4.Multiple Choice

1)SWIFT is__B__

A.in the united states

B.a kind of communications belonging to TT system for interbank’s fund transfer

C.an institution of the United Nations

D.a governmental organization

2)SWIFT is an organization based in__A___

A.Brussels

B.New York

C.London

D.Hong Kong

3)A facility in fund arrangement for buyers or sellers is referred to__A___

A.trade finance

B.sale contract

C.letter of credit

D.bill of exchange

4)Fund transfers are processed and settled through__C___

A.banks

B.SWIFT

C.clearing system

D.telecommunication systems

5)__C__is the reason why international trade first began.

A.Uneven distribution of resources

B.Patterns of demand

C.Economic benefits

https://www.360docs.net/doc/3811618069.html,parative advantages

5.Answer the following questions

1)Where are the medium of exchange originated from?

Tracing back the history of international settlement,the medium of exchange originated from coins to notes.

2)What will inevitably lead to under the international political,economic and cultural

exchanges?

The international political,economic and cultural exchange inevitably leads to credits and debts owed by one country to another.

3)Why do banks focus on the development of the businesses of international settlement?

Banks focus more and more on the development of the businesses because it is a major resource of profits.

4)What will banks do to meet the higher and higher demand of the international market?

Banks need to develop innovative products and deliver the best services possible in whatever way they can.

Chapter2

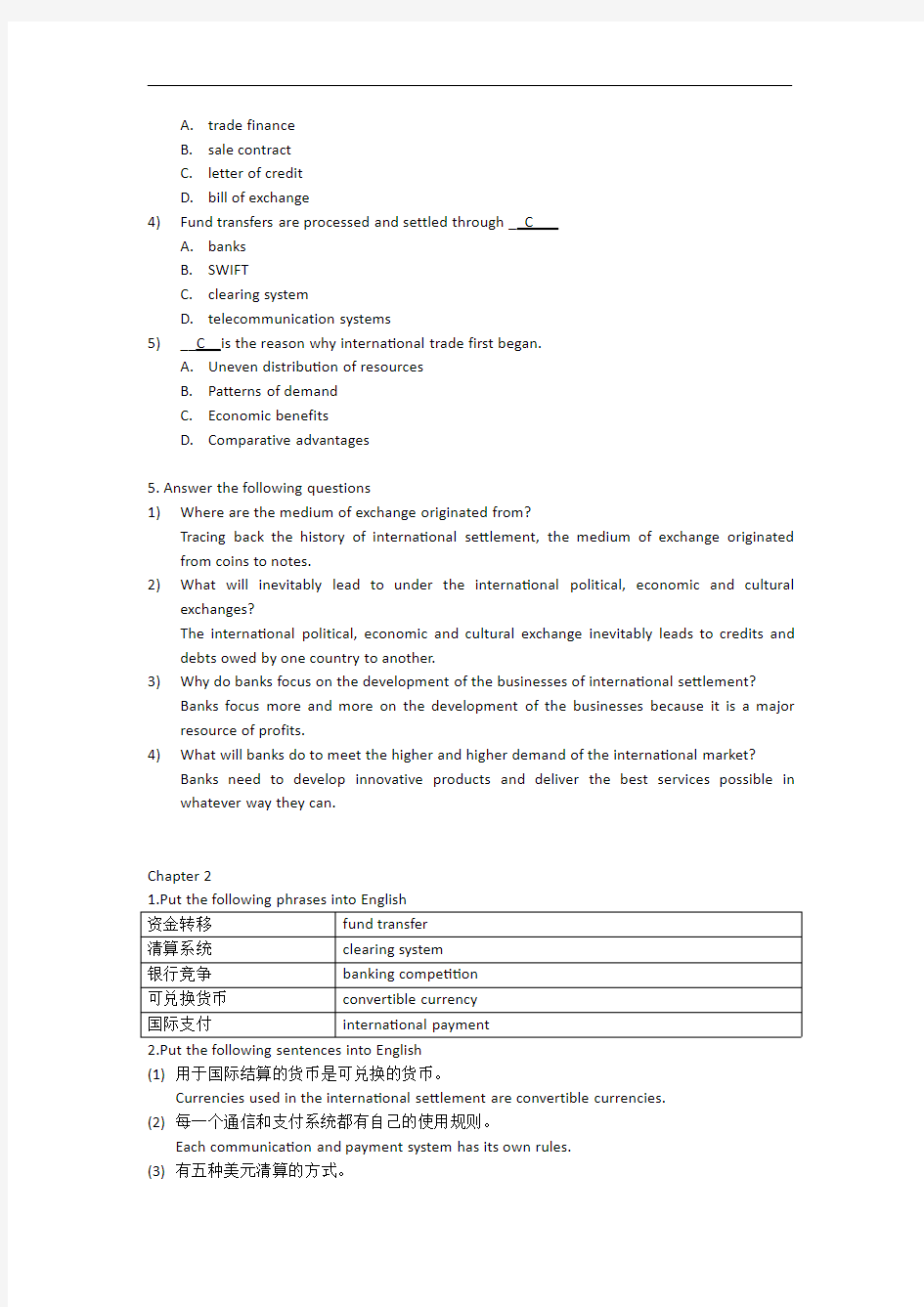

1.Put the following phrases into English

资金转移fund transfer

清算系统clearing system

银行竞争banking competition

可兑换货币convertible currency

国际支付international payment

2.Put the following sentences into English

(1)用于国际结算的货币是可兑换的货币。

Currencies used in the international settlement are convertible currencies.

(2)每一个通信和支付系统都有自己的使用规则。

Each communication and payment system has its own rules.

(3)有五种美元清算的方式。

There are five US dollar fund transfer payment methods.

(4)欧元是欧盟国家使用的货币。

Euro is the single currency of the European Union.

(5)香港作为国际金融中心必须遵循国际惯例。

As an international financial center,Hong Kong must follow international payment practice.

3.True or False

1)CHIPS payments are irrevocable and subject to a same-day net settlement process.(T)

2)Book transfers are payment made between parties that maintain accounts at the different

bank.(F)

3)In Japan,cash is not far more often used than checks for payment at the retail level.(F)

4)Not later than July2002,the Euro will replace the national currencies in all public and

private transactions.

4.Multiple Choice

1)The following are the special problems for international trade except for__C__

https://www.360docs.net/doc/3811618069.html,ing foreign languages and foreign currencies

B.under foreign laws,customs and regulations

C.having risks

D.numerous cultural differences

2)All the parties to a collection are bound by___C___

A.UCP400

B.UCP500

C.UCR522

D.URC254

3)An additional risk borne by the seller when granting a credit to the buyer is that the latter

will not__D___

A.accept the bill

B.take up the documents

C.take delivery

D.make payment at maturity

4)To the exporter,the fastest and safest method of settlement is__B__

A.letter of credit

B.advance payment

C.collection

D.banker’s draft

5)To the importer,the fastest and safest method of settlement is__C_

A.letter of credit

B.cash in advance

C.open account

D.banker’s draft

6)Which is the real international payment system?__A__

A.TARGET

B.FedWire

C.CHAPS

D.SWIFT

5.Answer the following questions

1)How will fund transfers be processed and settled?

Fund transfers are processed and settled through certain clearing systems.

2)What is FedWire?

FedWire is an electronic payment system operated by the U.S.Federal Reserve.It si used to make US dollar payments to banks and their customers throughout the United States.

3)When will the euro start to use?

From January1,1999,Euro is the single currency of the European Union.

4)What is the strongest of SWIFT?

The strongest feature of SWIFT is message text standards.

Chapter3

1.Put the following phrases into English

总资产total assets

缺乏经验lack of expertise

全球策略global strategy

专业服务professional service

财务报表financial statement

2.Put the following sentences into English

(1)两家银行建立代理行关系的原则是基于双方的互惠互利。

The overall principle to establish correspondent banking relationship between two banks is on the basis of mutual benefits.

(2)一家银行对其所在国金融系统的重要性是对该银行进行评级的重要因素。

The importance of a bank to its country’s financial system is a major factor in the rating process.

(3)穆迪和标准普尔在对银行进行评级时有许多相似之处。

Moody and Standard&Poor’s(“S&P”)share many similarities in rating banks.

(4)许多著名的大银行是根据一定的程序来向代理行提供信用额度。

The credit line for a correspondent is worked out according to certain procedures in many sizeable and well-know banks.

(5)银行不仅可从贸易融资中获利,而且还可以介入金融活动之中。

Not only banks can gain from trade finance,they can also engage in those financial activities.

3.True or False

1)Risk management strategies should be taken into consideration when rating correspondent

banks.(T)

2)A world wide computer network for monitoring the line is maintained by many banks.(T)

3)A bank should introduce or modify those products in order to have those products to be

marketed in its banking operation.(T)

4)Some correspondents will not extend credit facilities to the bank with nostro account and

offer a preferential account,so that conducting business will become more convenient and easier.(T)

4.Multiple Choice

1)From the point of view of a Chinese bank,__B__is our bank’s account in the book of an

overseas bank,denominated in foreign currency.

A.a vostro account

B.a nostro account

C.a mirrio account

D.a record account

2)A bank gets to know its exact position of funds by__A___

A.reflecting the credit balance

B.examining the mirror account

C.consulting a foreign bank

D.checking the nostro account

3)Statements of balance of international payment don’t include__D__

A.current account

B.capital account

C.balancing account

D.visible account

4)__A__refers to an exchange of services or assets between countries.

A.Invisible trade

B.Visible trade

C.International trade

D.Balance of trade

5)Each country has to earn__B__to pay for imports.

A.money

B.foreign exchange

C.cash

D.currency

5.Answer the following questions

1)How will ratio of earning be divided?

Ratios of earning can be divided into ratio of capital return(Earning/Total Capital,ROE)and ratio of asset return(Earning/Total Capital,ROE).

2)Why do banks develop the correspondent relationship with foreign banks?

For the purpose of rendering best service to the banks’clients,it is essential for the banks to develop direct correspondent relationship with foreign banks and offer more diversified banking services,thereby playing an increasingly prominent role in promoting and regulating the growth of the national economy.

3)What do American banks and European banks usually do in their financial activities?

American banks are active in marketing their products and services in the field of fund clearing,Trade finance has always been the main subject of correspondent banking

operations by many European banks for quite a long time.

4)What should the correspondent files be?

The correspondent files should be concise,but complete,and updated.

Chapter4

1.Put the following phrases into English

大小写金额amount in words and figures

无条件的书面支付命令unconditional order of payment in writing

远期汇票term bill

跟单汇票documentary draft

无条件的支付承诺unconditional promise of payment

流通工具negotiable instrument

2.Put the following sentences into English

1)由于这张信用卡的持卡人不讲信用,发卡银行将取消该卡。

The issuing bank of this credit will cancel the holders card because of his poor credit standing.

2)旅行支票易于在国外银行、旅店、商店、机场等兑现。

Traveler’s checks are easily encashabkes,hotels,ships and airports abroad.

3)汇票和本票的定义有一些相似之处。

There are some similarities between the definition of a bill of exchange and a promissory note.

4)Please draw a sight draft on Mr.Smith for US dollars2000.

2.True or False

1)In check transaction,the drawer and the payer are the same person.(T)

2)A check is a demand bank draft.(T)

3)A draft is a conditional order in writing.(F)

4)The person who draws the bill is called the drawer.(T)

5)Any usance bills need to be accepted.(T)

6)There is no acceptor in a promissory note.(T)

7)There are only two parties in a promissory note.(T)

8)Traveller’s checks are negotiable instruments.(T)

9)Traveller’s checks are fixed,round amounts.(T)

10)A line of credit is given by a bank according to the cardholder’s financial status.(T)

3.Multiple Choice

1)A check must be signed by__A__.

A.the drawer

B.the drawee

C.the payer

D.the payee

2)When financing is without recourse,this means that the bank has no recourse to the__D__

if such drafts are dishonored.

A.drewee

B.payee

C.payer

D.drawer

3)A time bill may be accepted by the__B__

A.drawer

B.drawee

C.holder

D.endorser

4)__A__is drawn by the exporter and sent to the buyer.

A.Draft

B.Promissory note

C.I.O.U

D.Check

5)Taveller’s checks are in__D__amounts.

A.fixed

B.round

C.convenient

D.fixed,round and convenient

6)If a bill is a__D__bill,the documents will be handed over against payment of the bill.

A.tenor

B.sight

C.clean

D.documentary

5.Answer the following questions

1)Under which circumstances do banks usually ask for endorsement?

Bank usually ask for endorsement of check when the check in favour of joint payees is credited to a sole account and when the check is cashed over the counter.

2)What are the essentials of a draft?

The essentials of a draft are as follows:an unconditional order;in writing;signed by the person giving it;drawee;payment date;a sum certain in money;payee;date and place of issuance of a draft;bearing the words”exchange for”.

3)What is meant by a documentary bill?

A documentary bill refers to one that is accompanied by the relevant documents that are

needed to complete the export transaction.

4)What is the important difference between the bill of exchange and the promissory note?

The important difference between the bill of exchange and the promissory note is that the promissory note is written and signed by the person who promises to make the payment (the buyer),and sent to the person who is owed the money(the exporter).A bill of exchange,in contrast,is drawn by the exporter and sent to the buyer(who“accepts”term bill).

5)How many parties are there in a promissory note?What are they?

There are two parties in a promissory note,and they are maker and holder.

Chapter5

1.Put the following phrases into English

海外分支机构和代理行overseas branches and correspondent banks

汇款人账户remitter’s account

SWIFT密押swift authentication key

授权签字authorized signature

金融机构financial institution

2.Put the following sentences into English

1)由于电信业的迅猛发展,大多数的付款业务都是通过电汇方式完成。

With rapid telecommunication,most payment transactions are handled by telegraphic transfer.

2)再付款业务中总是会出现一些差错。

In the process of payment transfer,some mistakes may occur.

3)处理付款业务员中的典型错误是将头寸付款方式和链式付款方式的报文混淆。

It is a typical mistake to confuse the message types of the cover method with those of the serial method.

4)在一些国家,通常用于国内付款的链式方式也用于跨境付款。

In some countries and for some currencies,the serial method---typical for domestic payments---is also used cross-border.

5)电汇常常用于大写金额和时间较紧的情况。

T/T is often used when the remittance amount is large and the transfer of funds is subject to

a time limit.

3.True or False

1)Remittance refers to the transfer of funds from one party to another among different

countries through banks.(T)

2)Mail transfer can be replaced in the time of telecommunication developed rapidly.(F)

3)Under the serial payment method,the instruction to credit a beneficiary account is dent

together with the instruction to debit sender’s account.(T)

4)Serial payment method cannot,however,delay the payment between different time

zones.(F)

4.Multiple Choice

1)The remitting bank checks the documents received__D__.

A.as a service to its clients

B.to avoid unnecessary

C.before sending them out

D.all of the above

2)Large payments should be made by__D__

A.TT

B.SWIFT

C.MT

D.A or B

3)A__D__payment does not take as long as an MT payment.

A.SWIFT

B.TT

C.DD

D.A or B

4)Mail transfers are sent to the correspondent bank__C__,unless other wise instructed by

clients.

A.by courier service

B.by ordinary mail

C.by airmail

D.by seamail

5)When a customer asks its bank to make a telegraphic transfer to a beneficiary abroad,the

charges may__A__

A.be paid either the remitter or the remittee

B.be debited against the nostro account

C.be credited to the vostro account

D.be paid by the remitting bank

5.Answer the following questions

1)How do you define the two types of fund transfer?

Remittance can be defined as two typed of fund transfer:to a remit and to draw a draft.“To remit”refers to the funds to be transferred from remitter to a payee through banks,while “to draw a draft”means that the payee gets the funds from the remitter collected by banks.

2)What are the three main ways to make a remittance?Give us a brief description of the

three?

A mail transfer is to transfer funds by means of a payment order or a mail advice.A demand

draft is often used when the customer wants to transfer the funds to his beneficiary by himself.Telegraphic transfer refers to remittance by SWIFT.

3)What are the two methods adopted in the payment transactions by T/T?

They are cover payment method and serial payment method.

4)what are the differences of the two methods used in the payment transaction?

In the cover method,the customer payment instruction is sent separately from the instruction to transfer the funds,In the serial method,the customer[payment and the fund transfer are sent together.

5)When will the interbank compensation be used and what are the related errors occurring in

the payment transactions?

In the process of payment transfer,some mistakes may occur,such as late payment., duplicate payment,under and over payment,wrong account at the right bank and so on, which may arise loss for a bank,The Rules of Interbank Compensation is therefore worked out to settle the dispute among banks.

Chapter6

1.Put the following phrases into English

运输单据shipping document

托收指示collection instruction

需要时的代理agent in case of need

拒绝证书protest r

印花税stamp duty

赊账open account

2.Put the following sentences into English

1)跟单托收是用于出口商既不想用赊账也不愿意用信用证的情况。

Documentary collections are suitable in cases where the exporter is reluctant to supply the goods on an open account basis,but does not need the strong security provided by a documentary credit.

2)《跟单托收统一惯例》是国际托收业务中通行的规则。

The Uniform Rules for Collections(URC)form an internationally accepted code of practice covering documentary collections.

3)单据应符合进口国家的法律和法规的要求。

The type of documents should comply with the laws and regulations of the importing country.

4)拒绝证书是法庭认可的拒付的法律依据,它要由公证机构来制作。

Bill protesting is legal evidence of dishonor acceptable to account of law,and it will come into force by a notarization of notary office.

3.True or False

1)A collection on the basis of commercial credit is usually processed through banks acting as

the intermediary.(T)

2)Banks have responsibility to examine the documents thoroughly.(F)

3)Collecting bank handles the collection business according to the collection instruction.(T)

4)In receipt of dishonor advice,the remitting bank must give appropriate instructions as to the

further handling by the collecting bank.(T)

4.Multiple Choice

1)The instructions for collection are mainly__D__

A.those in the contract

B.written on the Bill of Exchange

C.given by the importers

D.given by the exporters

2)It will be more convenient if the collecting bank appointed by the seller__B__

A.is a large bank

B.is the remitting bank’s correspondent in the place of the importer

C.is in the exporter’s country

D.acts on the importer’s instructions

3)The operation of collection begins with__B__

A.the customer and the remitting bank

B.the remitting bank and the collecting bank

C.the presenting bank and the drawee

D.the collecting bank and the presenting bank

4)Detailed instructions must be sent to the collecting bank__B__

A.in the application form

B.in the collection order

C.in the documents

D.both A and B

5)The collecting bank will make a protest only when__C__

A.the documents are rejected

B.a case of need is nominated

C.specific instructions concerning protest are given

D.protective measures in respect of the goods are taken

6)If it is stated as D/P,the documents can be released__A__

A.against payment

B.against acceptance

C.in either way

D.against acceptance pour aval

7)__A__is the bank to which the principal has entrusting the collection,

A.The remitting bank

B.The collecting bank

C.The presenting bank

D.Both A and B

8)__C__must make his instructions to____clear in his collection order.

A.The remitting bank…the collecting bank

B.The principal…the drawee

C.The principal…the remitting bank

D.The drawee..the collecting bank

5.Answer the following questions

1)What is a collection in the international settlement?

After the exporter has shipped the goods or rendered services to his customers abroad,he draws a bill of exchange on the latter with or without shipping documents attached thereto and then gives the draft to his bank together with his appropriate collection instructions. 2)What are the parties of a collection?

They are exporters,importers,remitting banks and collecting banks.

3)What is a documentary collection?

A documentary collection is an operation in which a bank collects payment on behalf of the

seller(the principal)by delivering documents to the buyer.

4)How many types of documentary collection are there and what are they?

There are two types of documentary collection:documents against payment and documents against acceptance.

5)What does URC522refer to?

The Uniform Rules for Collections(URC)form an internationally accepted code of practice

covering documentary collections.

6)What are the duties of remitting bank and collecting bank?

Duties of the remitting bank and the collecting bank are documents pressing and operation upon the international practice and customs.

Chapter7

1.Put the following phrases into English

商业用途commercial utility

有条件的付款承诺conditional undertaking of payment

契约安排contractual arrangement

付款义务obligation of payment

独立责任independent responsibility

2.Put the following sentences into English

1)在此契约安排下的每一项条款都是独立的。

Each item in contracts in this arrangement is independent of one another.

2)进口商也要对远期汇票进行承兑并到期付款。

An importer is also obliged to make an acceptance on the term bill of exchange and make payment on its due.

3)既然大多数的信用证都是不可撤销的,故此滋养印就在开证申请书上。

Since the great majority of credits are irrevocable,the indication of irrevocability is printed in the application form.

4)出口商在向他的银行提示单据前就应确信其单据满足了信用证的要求。

Before the exporter presents the documents to his bank,he must ensure that they fully meet the requirements laid down in the credit.

5)银行必须根据信用证的条款和要求仔细地审核单据。

The bank must check the presented documents carefully against the wording of the terms of credit.

3.True or False

1)Three parties are involved in the contracted arrangement concerning a documentary

credit.(T)

2)The credit follows principles of independence and abstraction.(T)

3)The documents and the goods are not separated from each other.(F)

4)As long as the documents presented by the beneficiary are in complete compliance with the

terms and conditions of the credit,the issuing bank or the bank nominated by the credit shall fulfill the undertaking to pay,accept or negotiate.(T)

5)As for the exporter’s bank,it will pay or negotiate against documents presented by the

exporter provided that they are in compliance with the terms and conditions of the credit.(T)

6)The importer may not reject to issue the credit of the exporter does not effect performance

bond upon the stipulation on the sales contract.(F)

4.Multiple Choice

1)A letter of credit is__B__

A.a formal guarantee of payment

B.a conditional undertaking to make payment

C.an unconditional undertaking to make payment

D.a two bank guarantee of payment

2)A revocable credit cannot be amended or cancelled only after__C__

A.the documents under it have been honored

B.it has been amended once

C.the advising bank has notified the beneficiary of its opening

D.it has been confirmed by a correspondent bank

3)__D__gives the beneficiary a double assurance of payment.

A.An irrevocable credit

B.A revocable credit

C.A confirmed credit

D.An irrevocable confirmed credit

4)Before opening a credit,the issuing bank should__D__

A.go through the contract terms

B.fill in the application form

C.sign an agreement with the customer

D.inquire into the customer’s credit standing

5)Settlement by documentary credit is fair to__B__

A.the shipping company

B.the trading companies concerned

C.the banks involved

D.all of the above

6)In credit transactions,the goods and the documents are sent to the importer__A__

A.in different ways

B.in the same way

C.in different directions

D.at one time

7)The exporter can receive the payment only when__C__

A.he has shipped the goods

B.he has presented the documents

C.the documents presented comply with he credit terms

D.the importer has taken delivery of the goods

8)Banks are obligated to verify the documents received to see that__C__

A.they are authentic

B.they are regular

C.they are those listed in the collection order

D.they are in the right form

5.Answer the following questions

1)What are the roles of a letter of credit?

Letter of Credit is a popular method of payment in international trade and one of the most important methods of financing.It plays an important role in the guarantee and financing of trade in the international trade.

2)What are the primary parties of a letter of credit?

The primary parties to a Letter of Credit are the applicant,the issuing bank and the beneficiary.

3)What should the exporter do in a letter if credit?

The exporter should dispatch the goods or perform the service on time and prepare the documents required under the credit to be ready for presentation,

4)How do you understand a bill of lading?

A bill of lading,the most important document in overseas transactions,is a document

evidencing shipment.I t is issued by the carrier or his agent as a receipt for goods accepted for carriage by sea.It also contains the terms and conditions of the contract of carriage.A bill of lading is a document of title.Only the holder of the bill of lading can take possession of the goods.It is usually made out to order and can therefore be transferred by endorsement.

Chapter8

1.Put the following phrases into English

全球金融市场global financial market

破产法bankruptcy law

合同义务contractual obligation

信用评估credit evaluation

经济衰退economic recession

2.Put the following sentences into English

1)用于国际贸易中的保函分为两类:直接保函和间接保函。

The guarantees used in international business can be divided into two categories:direct guarantees and indirect guarantees.

2)银行开具各种类型的保函:投标保函、履约保函、预付款保函、尾款保函。

Banks issue various types of guarantee or bond,and they are bid bonds,performance bonds, maintenance or retention bonds.

3)预付款保函向买方提供了一个资金安全的保证。

The advance payment guarantee provides financial security to the buyer.

4)开立传统的信用证是为了国际贸易中货物交易的付款。

The traditional documentary letter of credit serves the purpose of securing payment of the contract price in the international trade of goods.

5)信用证和保函的主要不同点是:信用证是一个付款工具,而保函是一个合同义务被履行

的保证。

The main difference between a letter of credit and a guarantee is that the letter of credit actually represents a payment instrument while the guarantee is an assurance that contractual obligations will be fulfilled.

3.True or False

1)Bank guarantees are written instruments issued by banks to an overseas buyer if the seller

fails to fulfill his obligations under a contract.(T)

2)Most bank guarantees are intended to secure the buyer’s commitment to deliver the goods

or to render a service in a correct fashion.(F)

3)A bank guarantee is not a unilateral contract between a bank as guarantor and a beneficiary

as warrantee,in which the bank undertakes to make payment to the beneficiary within the limits of a stated sum of money if a third party fails to perform an obligation.(F)

4)The nature of a standby letter of credit is,to give a security similar to a bank guarantee.(T)

5)The key feature of standby L/C is that they are usually not listed on the issuer’s or

beneficiary’s balance sheet.(T)

4.Multiple Choice

1)A bond is a guarantee to__A__that_____will fulfill his contractual obligations.

A.the buyer...that exporter

B.the exporter...that buyer

C.the guarantor…the buyer

D.the exporter...that guarantor

2)one of the main functions of a banker is to accept__D__from the customers.

A.money

B.cash

C.advance

D.deposit

3)All guarantees should include the principal debtor,the__A__and the guarantor.

A.beneficiary

B.creditor

C.mortgagee

D.lender

4)the bond should state that claims must be received__D__than the expiry date.

A.a little earlier

B.a little later

C.not earlier

D.not later

5)The borrower will use the__B__of the facility for financing of said contract.

A.margin

B.proceeds

C.profits

D.interests

5.Answer the following questions

1)What is a bank guarantee?

A bank guarantee is a unilateral contract between a bank as guarantor and a beneficiary as

warrantee,in which the bank undertakes to make payment to the beneficiary within the limits of a stated sum of money of a third party fails to perform an obligation.

2)When will a bid bond be used?

A bid bond will be used in the following situation:The exporter,who tenders to a project,

generally of about5to10of the contract value.

3)What is the advantage for using standby letter of credit?

The development of standby letters of credit has allowed banks to avoid using up their scarce reserves but still help their customers with needed financing.

4)What is the function of a performance guarantee?

A performance guarantee is issued by a bank to the buyer or importer at the request of

seller or exporter of goods or services,guaranteeing that the exporter will carry out the contract in compliance with the terms and specifications.

5)Why is the standby L/C so popular in banking business?

Many bankers have found it cost effective to improve their institutions’capital-to-assets ratio either by selling loans off the balance sheet or by packaging,issuing securities against them,and setting those assets aside.

Chapter9

1.Put the following phrases into English

法律文件legal document

多式联运提单multimodal transport document

面值face value

带有不符点的单据discrepant document

指定银行nominated bank

2.Put the following sentences into English

1)出口商收到信用证后,将根据信用证的要求准备出货和缮制单据。

On receipt of a letter of credit,the exporter will prepare his shipments according to the requirements of the credit and complete the relating documents.

2)一般来说,信用证要规定最后交单日期。

In general,the latest date of presentation is specified in the credit.

3)在信用证业务中,银行应只审核单据。

In credit operations,banks must make examination on the basis of the documents alone. 4)银行对没有要要求提示的单据不予理会,以避免由此而产生的拒付。

Banks should disregard conditions without stating the documents to be presented in compliance to avoid unnecessary refusal.

5)提单是出口商和承运人之间的运输合同。

The bill of lading is an evidence of the contract for carriage between the exporter and the carrier.

3.True or False

1)If the documents appear to be inconsistent with the credit,the negotiating bank will inform

the beneficiary to amend the discrepancies.(T)

2)A credit will not fix an exact date of expiry and an effective place for presentation,(F)

3)Banks should disregard conditions without stating the documents to be presented in

compliance to avoid unnecessary refusal.(T)

4)A commercial invoice is not an import demonstration issued by the exporter.(F)

5)The value of the goods insured should be what it is required by the credit or at least110%

of the CIF or CIP value of the goods.(T)

4.Multiple Choice

1)If a credit calls for an insurance policy,banks will accept__A__

A.an insurance policy

B.an insurance certificate

C.A or B

D.both A and B

2)The documents will not be delivered to the buyer until__B__

A.the goods have arrived

B.the bill is paid or accepted

C.the buyers has cleared the goods

D.both A and B

3)The importance of distinction between financial documents and commercial documents lies

in that it helps decide whether it is__D__

A.inward collection or outward collection

B.bill collection or goods collection

C.cash collection or check collection

D.clean collection or documentary collection

4)When is a bill of lading issued?__B__

A.When the shipper makes up the order

B.When the carrier received the goods

C.When the producer manufactures the goods

D.When the carrier delivers the goods to the consignee

5)A commercial invoice is__B__

A.a contract for delivery of the ma=erchandise

B.a demand for payment

C.a statement describing the merchandise,its cost,and shipping charges

D.a promise of payment

5.Answer the following questions

1)What are the functions of B/l?

There are four main functions of B/L:

a)A bill of lading acts as a receipt of the goods from the shipping company to the exporter.

b)A bill of lading is an evidence of the contract for carriage between the exporter and the

carrier.

c)A bill of lading is a quasi-negotiable document.

d)A bill of lading acts as a document of title to goods being shipped overseas.

2)What are the final procedures of export L/C?

Dispatching documents and making reimbursement claim are the final procedures of export L/C.

3)What are the liabilities of the negotiating bank?

The liabilities of the negotiating bank are to assert whether the documents appear on their face value,to be in compliance with the terms and conditions of the credit and that there is no inconsistency.

4)Is the beneficiary liable for the risk of delivery loss of documents from the nominated bank

to the issuing bank?

The beneficiary is not liable for the risk of delivery loss of documents from the nominated bank to the issuing bank.

5)What does the dual mature dates mean?

A credit with dual mature dated contains both an expiry date and a date for the latest

shipment,if these two dates are the same,an amendment can be applied to extend the credit expiry date.

Chapter10

1.Put the following phrases into English

信誉调查credit investigation

提货担保shipping guarantee

转移风险transfer risk

第二还款来源the second source of repayment

信用额度credit line

2.Put the following sentences into English

1)国际贸易融资是银行向进口商和出口商提供的国际结算项下的融资服务。

International trade finance is a financial service under the international trade settlement provided by banks for importers and exporters.

2)信用额度内容和贸易融资产品是构成贸易融资的重要因素。

Credit line structure and trade financing facilities constitute important factors of trade finance.

3)在信用证业务下,银行应该特别关注贸易背景和市场。

The bank should always keep an eye on the trade background and its market under the letter of credit.

4)监督是控制打包放款风险的重要措施。

Supervision is an important step to control the risk of packing loan.

5)出口押汇是出口银行提供的贸易融资产品。

Export bill purchased refers to a financing facility provided by exporter’s bank.

3.True or False

1)Trust Receipt(T/R)is not a kind of credit line granted by the bank to the importer.(F)

2)Business of letter of credit is not a contingent liability of a bank.(F)

3)The bank should establish a credit file for the importer,and is ready to cut the proportion of

loan tat any time if there is any sign of risk.(T)

4)The bank must be careful when it makes a packing loan for a transferable letter of credit.(T)

5)The bank can only purchase the documents and bills when thy comply with the terms and

conditions of the credit,because the issuing bank is obliged to effect payment upon the conformity of documents with the letter of credit.(T)

4.Multiple Choice

1)To the exporter,the fastest and safest method of settlement is__B__

A.letter of credit

B.advance payment

C.collection

D.banker’s draft

2)To the importer,the fastest and safest method of settlement is__C__

A.letter of credit

B.advance payment

C.collection

D.banker’s draft

3)The cost for the production will decrease if the goods are produced on a large scale.This is

called__A__

A.economies of scale

B.variety of style

C.specialization

D.patterns of demand

4)Invisible trade consists of such items as__D__

A.transportation services across national borders

B.foreign tourist expenses

C.insurance services across national borders

D.product exchange across national borders

5)In international trade,the seller ships the goods to the buyer when there is no purchase

made.The seller retains title to the goods until the buyer has sold them.This is__C__

A.bidding

B.agency

C.consignment

D.auction

5.Answer the following questions

1)What are the facilities of trade finance included?

Those facilities include letter of credit issuing,bill purchased,trust receipt,shipping guarantee,receivables and warehouse bill as pledge,anticipatory credit,packing loan,bill discounted,factoring and forfeiting.

2)What does the soft clause mean?

The soft clauses of a letter of credit are important factors to affect the refund of a packing loan.The soft clauses are those which beneficiaries cannot or are hard to fulfill even if they make grate efforts.

3)Why will the bank be well informed about the market?

The bank should also be kept informed about the market,because the market is changeable, and the operation of a letter of credit will last more than one month.

4)What does Forfaiting refer to?

Forfeiting is the term generally used to denote the purchase of obligations falling due at some future date,arising from deliveries of goods and services—mostly exporter

transactions–without recourse to any previous holder of the obligation.

5)What is export financing?

Export financing is a fund arrangement provided by banks for export-oriented transactions.

国际结算模拟试题及答案备课讲稿

国际结算模拟试题及 答案

《国际结算》模拟试题 一、名词解释:(每题4分,共20分) 1、本票: 2、汇款: 3、沉默保兑: 4、完全背书: 5、背对信用证: 二、单项选择题(每题2分,共20分) 1、甲国向乙国提供援助款100万美元,由此引起的国际结算是()。 A.国际贸易结算B.非贸易结算 C.有形贸易结算D.无形贸易结算 2、属于顺汇方法的支付方式是()。 A.票汇 B.托收 C.保函 D.直接托收 3、公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()。

A.即期汇票 B.远期汇票 C.跟单汇票 D.光票 4、以下是国际贸易中经常用到的结算方式,其中哪种不属于汇款方式?()A.押汇 B.预付货款 C.寄售 D.凭单付汇 5、收款最快,费用较高的汇款方式是()。 A.T/T B.M/T C.D/D D.D/P 6、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是()。 A.打包放款 B.汇票贴现 C.押汇 D.红条款信用证 7、审核单据,购买受益人交付的跟单信用证项下汇票,并付出对价的银行是()。 A.开证行 B.保兑行 C.付款行 D.议付行 8、以下关于可转让信用证说法错误的是:()。 A.可转让信用证适用于中间商贸易 B.信用证可以转让给一个或一个以上的第二受益人,而且这些第二受益人又可以转让给两个以上的受益人 C.未经过信用证授权的转让行办理,受益人自行办理的信用证转让业务视为无效 D.可转让信用证中只有一个开证行 9、以下关于承兑信用证的说法正确的是()。 A.在该项下,受益人可自由选择议付的银行 B.承兑信用证的汇票的期限是远期的 C.其起算日是交单日 D.对受益人有追索权 10、以下不属于出口商审证的内容的是:()。

国际结算练习及标准答案 ()

国际结算练习及答案 (1)

————————————————————————————————作者:————————————————————————————————日期: 2

单选题 1、现代国际结算的中心是( D )。 A. 票据 B.买卖双方 C.买方 D.银行 2、在汇票的使用过程中,使汇票一切债务终止的环节是( D )。 A. 出票 B.背书 C.承兑 D.付款 3、以下属于顺汇方法的支付方式是( A )。 A.汇付 B.托收 C.信用证 D.银行保函 4、对于出口商而言,承担风险最大的交单条件是( C )。 A.D/P at sight B.D/P after at sight C.D/A after at sight D.T/R T/R:TRUST/RECEIPT 付款交单凭信托收据借单(货),简称D/P下的T/R,西方国家的一种变通做法 5、审核单据,购买受益人交付的跟单信用证项下汇票,并付出对价的银行是( D )。 A. 开证行 B.保兑行 C.付款行 D.议付行 6、一份信用证如果未注明是否可以撤销,则是( B )的。 A. 可以撤销的 B.不可以撤销的 C.由开证行说了算 D.由申请人说了算 7、D/P·T/R意指( C )。 A. 付款交单 B.承兑交单 C.付款交单凭信托收据借单 D.承兑交单凭信托收据借单 8、背书人在汇票背面只有签字,不写被背书人名称,这是( D )。 A. 限定性背书 B.特别背书 C.记名背书 D.空白背书 9、汇票债务人承担汇票付款责任次序在承兑后是( D )。 A.出票人—第一背书人—第二背书人 B.承兑人—出票人—第一背书人 C.承兑人—第一背书人—第二背书人 D.出票人—承兑人—第一背书人 10、光票托收中不可缺少的单据是( C )。 A.货运单据 B.提单 C.汇票 D.商业发票 11、UCP500第三十七条关于商业发票的规定,商业发票必须由信用证受益人开具,必须以( B )为抬头。 A.开证行 B.开证申请人 C.指定付款行 D.议付行

国际结算题库及其答案

一、填空题 1、非现金结算就是指使用________各种代替现金流通手段得各种支付工具_______,通过银行间得_________划账冲抵_____来结清国际间债权债务关系。 2、在国际结算中得往来银行主要有________________往来与______________往来。 3、现代国际结算就是以_______票据________为基础、_______单据_______为条件、______银行________为中枢、结算与融资相结合得非现金结算。 二、判断题(用“T”表示正确,“F”表示错误) 1、我国内地与港、澳、台地区之间得货币收付,因属同一个国家所以属于国内结算。(F) 2、目前得国际结算绝大多数都采用记账结算。( F) 3、银行间得代理关系,一般由双方银行得总行直接建立,分行不能独立对外建立代理关系。( T) 4、至今已经形成了一系列被各国银行、贸易航运、法律等各界人士公认,并广泛采用得国际惯例,因此国际惯例对贸易得当事人具备强制性。( F) 5、某银行如果在某国得某地区,即使没有联行或代理行关系,也能够顺利地开展国际结算业务。(F ) 三.选择题(包括单项选择与多项选择) 1、银行在办理国际结算业务时选择往来银行得优先次序就

是( C) A、账户行、非账户行与联行 B、非账户行、联行与账户行 C、联行、账户行与非账户行 D、联行、非账户行与账户行 2、对本课程来说,国际结算得基本内容包括:( ABDE) A、国际结算工具 B、国际结算方式 C、国际结算银行 D、国际结算单据 E、国际惯例 F、国际法律 3、银行在国际贸易结算中居于中心枢纽得地位,具体而言,银行在国际贸易结算中得作用,可以概括为以下几个方面(ABCD ) A、国际汇兑 B、提供信用保证 C、融通资金洽 D、减少外汇风险 4、银行建立代理关系时得控制文件所不包括得内容就是:( D) A、密押 B、印鉴 C、费率表 D、代理范围 5、目前得国际贸易结算绝大多数都就是:(C ) A、现金结算 B、非现金结算 C、现汇结算 D、记账结算 6、引起跨国货币收付得原因中,不属于国际贸易结算范畴得

国际结算试卷答案最全版

一、单项选择题 1、(D)信用证规定受益人开立远期汇票,但能即期收款,受票人到期支付,开证申请人承担贴现息和承兑费。 A、即期付款 B、延期付款 C、承兑 D、假远期 2、下列属于信用证条款中开证行保证文句的是(B)。 A、Letter of guarantee and discrepancies are not acceptable. B、We hereby undertake to honor all drafts drawn in accordance with terms of this credit. C、One copy of commercial invoice and packing list should be sent to the credit openers 15 days before shipment. D、Drafts to be drawn for full CIF value less 5% commission, invoice to show full CIF value. 3、可转让信用证下办理交货的是(D)。 A、第一受益人 B、开证申请人 C、中间商 D、第二受益人 4、如信用证未作规定,则汇票的付款人是(C)。 A、开证申请人 B、受益人 C、开证行 D、议付行 5、汇票的抬头做成指示样式,说明(D)。 A、汇票不能通过背书转让 B、汇票无须通过背书即可转让 C、仅能由银行转让 D、须通过背书方能转让 6、(D)在商业单据中处于核心地位。 A、海关发票 B、海运提单 C、保险单据 D、商业发票 7、信用证项下商业发票的抬头人一般是(B)。 A、出口商 B、开证申请人 C、开证行 D、议付行 8、某合同和相关的信用证都规定交易货物为纸箱包装1500台电风扇,不允许分批装运。但在装船时发现,有30个纸箱破损,其中电风扇外罩变形,不能出运。受益人(B)。 A、可引用国际贸易中有关溢短装的惯例,出运1470台电风扇 B、可引用国际贸易中有关溢短装的惯例,出运1425台电风扇 C、只能另换30台包装完好、品质合格的电风扇,合成1500台一次性出运 9、信用证上所称的“唛头”,是指(D)。 A、货物标志 B、货物销售标志 C、货物商标 D、货物运输标志 10、来证规定:“Documents to be presented within 14 days after the date of B/L, but in any event within the credit validity.”假设最迟装运期为某年9月10 9

国际结算试题集及答案

国际结算习题 QQ:405506457 第三章国际结算中的票据 一.名词解释 1.票据 2.汇票 3.付对价持票人 4.正当持票人 5.承兑人 6.背书人 7.承兑 8.背书 9.记名式背书 10.空白背书 11.限制背书 12.贴现 13.提示 14.追索权 15.跟单汇票 16.光票 17.本票 18.支票 二.是非题 1.票据转让人必须向债务人发出通知。 2.如果票据受让人是以善意并付对价获得票据,其权利不受前手权利缺陷的影响。3.汇票是出票人的支付承诺。 4.汇票上金额须用文字大写和数字小写分别表明。如果大小写金额不符,则以小写为准。 5.票据贴现,其它条件相等时,贴现率越高,收款人所得的净值就越大。 6.本票是出票人的支付命令。 7.支票可以有即期或远期的。 8.划线支票是只可提取现金的支票。 9.支票的付款人一定是银行。 10.支票的主债务人始终是出票人。 三.单项选择题 1.票据的背书是否合法,以()地法律解释。 A.出票地

B.行为地 C.付款地 D.交单地 2.票据的有效性应以()地国家的法律解释。 A.出票地 B.行为地 C.付款地 D.交单地 3.票据的作成,形式上需要记载的必要项目必须齐全,各个必要项目又必须符合票据法律规定,方可使票据产生法律效力。这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 4.票据所有权通过交付或背书及交付进行转让,这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 5.票据上的债权人在请求票据债务人履行票据义务时,必须向付款人提示票据,方能请求付给票款。这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 6.出票人在票据上立下书面的支付信用保证,付款人或承兑人允诺按照票面规定履行付款义务。这是票据的()作用。 A.结算作用 B.信用作用 C.流通作用 D.抵消债务作用 7.汇票的付款期限的下述记载方式中, ( ) 必须由付款人承兑后才能确定具体的付款日期. A. at sight B. at XX days after sight C. at XX days after date D. at XX days after shipment 8.承兑是()对远期汇票表示承担到期付款责任的行为。 A.付款人B。收款人 C.持票人D。受益人

国际结算第三章 课后练习和答案(中文)

第三章课后练习和答案(一) 一、选择题(包括单选和多选) 1、我们说票据的无因性是指()。 A、出票人出票没有原因 B、票据成立与否取决于出票的原因 C、票据的付款是无条件的 分析:正确答案应为C。我们所指的票据的无因性是指汇票、支票的付款是无条件命令,本票的付款是无条件承诺。 2、本票分为一般本票和银行本票两种,一般本票指的是出票人为企业或个人,付期期限为()的本票 A.即期 B.远期 C.既可以是即期也可以是远期 D.远期180天以内。 分析:正确答案应为C。本票实际上就是付款人为出票人自身的特殊汇票,大多数国家没有专门的本票法,本票视同为汇票,因此本票的期限和汇票是一致的,本票可以是即期的,也可以是远期的。(注意:由于不同国家的法律环境不同,因而不同的国家对票据的期限会有不同的规定)。 3、银行承兑汇票的出票人应为()。 A、银行 B、商业企业 C、银行或商业企业 分析:正确答案应为B。银行承兑汇票就出票人而言属于商业汇票,为补充商业汇票流通性不足的缺陷,银行应出票人或其他人的请求对汇票予以承竞。 4、拒绝证书是持票人在提示票据遭到拒付或拒绝承兑后向公证机构申请办理的一种证明文件。制作拒绝证书的主要目的是()。 A.持票人可以合法地要求付款退货 B.持票人可以合法地向前手行使追索权 C.证明托收单据由持票人合法持有 D.证明付款人的行为严重违背《合同法》中的有关规定 分析:正确答案应为B。票据持有人向付款人提示票据,遭到拒付或拒绝承兑时,必须作拒绝证书,其主要目的是合法地向前手行使追索权。 5、票据的善意持票人是指(),取得了一张表面完整、合格的、有效的持票人。 A、虽未付对价,但由别人无偿赠予 B、善意地付了票据的全部对价 C、无意中拾到,但找不到失主 D、从他人手上低价购得 分析:正确答案应为B。票据的善意持票人就是指支付了票据的全部金额的持票人。 6、.以下何种背书属于空白背书()。 A、Pay to the order of Henry Brown B、Pay to Henry Brown only C、William White William White William White 分析:正确答案应为C。所谓空白背书是指仅转让人签署了自身的姓名,而没有被转让人的姓名。 7、.在承兑交单方式下,如果托收单据中附有汇票,则应要求付款人在汇票上进行承兑。承兑的内容一般应包括()。 A.“承兑”字样 B.承兑日期或到期日 C.承兑人签字 D.承兑人地址 分析:正确答案应为ABC。承兑地址是多余的,是没有必要的。 8、.关于汇票的付款时间,如果提示日为4月20日,票面上写明“At 90 days from sight”,则到期日付

国际结算试卷题目及答案

判断 1、信用证是开证行应申请人的申请而向受益人开立的,因此在受益人提交全套符合信用证规定的单据后,开证行在征得开证申请人同意的情况下向受益人付款。 2、每张正本提单都有相同的提货效力,因此只有控制全套正本才能真正控制提货权 3、国际保理业务适用于O/A、D/A、D/P等结算方式 4、一张连续背书的汇票,若其中一人在其背书时加注“不得追索”,则这张汇票的持票人就丧失了在被拒付情况下的追索权 5、保理融资属长期融资,主要适用于资本型货物贸易的融资需求 6、备用信用证与银行保函的法律当事人一般包括申请人、开证行或担保行和受益人 7、出口商使用福费廷业务导致进口商会承担较高的货物交易价格 8、信用证的到期地点应该是受益人所在地 9、委托人在出口托收申请书上可指定代收行,如不指定,委托行可自行选择它认为合适的银行作为代收行。委托行由于使用其他银行的服务而发生的费用和风险,在前种情况下由委托人承担,在后种情况下由委托行承担。 10、根据债权债务产生的原因对国际结算分类,其中侨民汇款、旅游开支、服务偿付等属于有形贸易结算 11、在福费廷业务中,无论是使用出口商签发的汇票,还是进口商签发的本票,都应要求进口方银行对有关票据的付款提供担保 12、保兑信用证,取得了开证行和保兑行的双重付款保证,对出口商极为有利 13、所谓转汇行,是指接受汇出行委托,将款项转汇给收款人的银行 14、若持票人未在规定时间内提示票据,则丧失使用该票据向其前手追索的权利 15、在托收方式下,信托收据实质上是银行对进口商提供资金融通的一种方式 16、福费廷业务通常金额巨大,付款期限长,贸易双方都是大型进出口商 1-5FTFFF6-10TTFFF11-16TTFTTT 单选 1、当前,业务覆盖面最广的银行间电讯网络是() A 、CHAPS B、SWIFT C、CHIPS D、TARGET 2、以下不属于出口商审证的内容的是() A开证申请人的资信 B信用证条款的可接受性 C价格条件的完整性 D信用证与合同的一致性 3、票据背书是否合法,以()地法律解释 A出票地 B交单地 C付款地 D行为地 4、一信用证规定应出运2500台工业用缝纫机,总的开证金额为USD305000,每台单价为USD120,则出口商最多可发货的数量和索汇金额应为() A、2540台,USD304000 B、2530台,USD303600 C、2500台,USD305000 D、2500台,USD300000 5 一项福费廷业务中,从出口商与进口商签订交易合同后,至出口商依其与包买商签订的福费廷协议向包买商贴现的一段时间称为() A选择期 B宽限期 C.承担期 D.协商期 6 以下关于托收指示中说法错误的是() A.是根据托收申请书缮制的 B.是托收行进行托收业务的依据 C.是托收行制作的 D.是代收行进行托收业务的依据 7 .一般而言,在常年定期、定量交易的情况下,()最合适

国际结算试题集及答案

国际结算习题 第三章国际结算中的票据 一.名词解释 1.票据 2.汇票 3.付对价持票人 4.正当持票人 5.承兑人 6.背书人 7.承兑 8.背书 9.记名式背书 10.空白背书 11.限制背书 12.贴现 13.提示 14.追索权 15.跟单汇票 16.光票 17.本票 18.支票 二.是非题 1.票据转让人必须向债务人发出通知。 2.如果票据受让人是以善意并付对价获得票据,其权利不受前手权利缺陷的影响。3.汇票是出票人的支付承诺。 4.汇票上金额须用文字大写和数字小写分别表明。如果大小写金额不符,则以小写为准。 5.票据贴现,其它条件相等时,贴现率越高,收款人所得的净值就越大。 6.本票是出票人的支付命令。 7.支票可以有即期或远期的。 8.划线支票是只可提取现金的支票。 9.支票的付款人一定是银行。 10.支票的主债务人始终是出票人。 三.单项选择题 1.票据的背书是否合法,以()地法律解释。 A.出票地 B.行为地

C.付款地 D.交单地 2.票据的有效性应以()地国家的法律解释。 A.出票地 B.行为地 C.付款地 D.交单地 3.票据的作成,形式上需要记载的必要项目必须齐全,各个必要项目又必须符合票据法律规定,方可使票据产生法律效力。这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 4.票据所有权通过交付或背书及交付进行转让,这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 5.票据上的债权人在请求票据债务人履行票据义务时,必须向付款人提示票据,方能请求付给票款。这是票据的()性质。 A.要式性 B.设权性 C.提示性 D.流通转让性 6.出票人在票据上立下书面的支付信用保证,付款人或承兑人允诺按照票面规定履行付款义务。这是票据的()作用。 A.结算作用 B.信用作用 C.流通作用 D.抵消债务作用 7.汇票的付款期限的下述记载方式中, ( ) 必须由付款人承兑后才能确定具体的付款日期. A. at sight B. at XX days after sight C. at XX days after date D. at XX days after shipment 8.承兑是()对远期汇票表示承担到期付款责任的行为。 A.付款人B。收款人 C.持票人D。受益人

国际结算期末模拟试题B及参考答案

国际结算期末模拟试题B及参考答案 一、单项选择题:(每题2分,共10分) 1.T/T、M/T和D/D的中文含义分别为( D )。 A.信汇、票汇、电汇 B.电汇、票汇、信汇 C.电汇、信汇、票汇 D.票汇、信汇、电汇 2.以下哪种信用证对受益人有追索权( B ) A.延期信用证 B.议付信用证 C.承兑信用证 D.即期信用证 3.与信用证方式相比,国际保理业务的独有的特点是(D )。 A.对出口商提供信用担保 B.进口商承担开证费用 C.要求单证一致 D.要求货物与合同一致 4.以下关于海运提单的说法不正确的是( B )。 A.是收货证明 B.是无条件支付命令 C.是运输契约 D.是物权证书 5.允许单据有差异,只要差异不损害进口人,或不违反法庭的“合理、公平、善意”的概念即可,该原则在审证中被称为( A )。 A. 实质一致 B.严格一致 C. 横审法 D.纵审法 二、多项选择题:(每题2分,共10分) 1.根据要求付款人付款时间的长短划分,汇票可以分为:(AB ) A.即期汇票B.远期汇票 C.长期汇票D.远期承兑汇票 2.下列哪些汇票是可以流通的(BCD ) A.限制性抬头B.指示性抬头 C.来人抬头D.最后的背书是空白背书 3.下列那些属于汇票的必须记载事项:(ABCD ) A.出票地B.付款时间 C.付款人名称D.付款地点 4.在()的信用证上,加具(AB ),使受益人的收款有了双重保障。 A.不可撤销B.保兑 C.即期付款D.承兑 5.一笔银行保函业务的当事人中,包括:(ABCDEF) A.委托人B.受益人 C.担保人D.通知行 E.保兑行F.反担保人 三、填空题:(每空1分,共10分) 1.国际结算的方式,基本有三大类:汇款方式、_托收__方式、_信用证_方式。

国际结算双语考卷答案

广西大学行健文理学院课程考试 试卷答案要点及评分细则 课程名称:国际结算(双语)考试班级:2007级国贸各班 试卷类型:期中考试卷 命题教师签名:2010年 5 月14 日 Part I单选题 1-5 CBCAD 6-10 DAADD Part II翻译题Please translate the following sentences from English to Chinese. (20 Points) 1.To issue a bill of exchange comprises two acts by the drawer: 1) to draw and sign a bill; and 2) to deliver it to the payee. 签发汇票由出票人的两个行为构成:一是开出汇票并在签字;二是交付给收款人。 2.International settlement consists of international trade settlement and non-trade settlement. 国际结算包括国际贸易结算和非贸易结算。 3.SWIFT authentic key is used between SWIFT member banks for authenticating all messages to be transmitted through SWIFT. 环球银行金融电讯协会证实押被环球银行金融电讯协会成员行用于证实通过环球银行金融电讯协会系统传输的所有信息的真实性。 4.The guarantor is the bank that issues a letter of guarantee at the request of its customer. 保证行是在其顾客要求下签发保函的银行。 5.In cover, we have authorized Bank A to debit our account and credit your accounts with the above sum. 为偿付头寸,我们已经授权A银行将上述金额借记我们的账户,并贷记你们的账户。 6. A foreign branch bank is an operational branch established by a commercial bank in a foreign country. 一家国外支行是某家商业银行在国外开立的经营性质的分支机构。 7.Confirming bank means a bank that adds its confirmation to a credit upon the issuing bank’s authorization or request. 保兑行指的是在开证银的授权或要求下对信用证进行保兑的银行。 8.Remittance refers to the transfer of funds from one party to another among different countries. 汇款(汇付)是指资金在不同国家之间的转移。 9.TARGET (the Trans-European Automated Real-time Gross Settlement Express Transfer System) is a real-time gross settlement system of the euro. 欧洲跨国清算系统是实时的统一欧元清算系统。 10.A holder in due course refers to an individual who acquires a negotiable instrument in good faith. 一个正当持票人指的是一个善意得到一张可流通票据的人。

国际结算模拟试题及答案

国际结算模拟试题及答 案 Company number:【WTUT-WT88Y-W8BBGB-BWYTT-19998】

《国际结算》模拟试题 一、名词解释:(每题4分,共20分) 1、本票: 2、汇款: 3、沉默保兑: 4、完全背书: 5、背对信用证: 二、单项选择题(每题2分,共20分) 1、甲国向乙国提供援助款100万美元,由此引起的国际结算是()。 A.国际贸易结算B.非贸易结算 C.有形贸易结算D.无形贸易结算 2、属于顺汇方法的支付方式是()。 A.票汇 B.托收 C.保函 D.直接托收 3、公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张 ()。 A.即期汇票 B.远期汇票 C.跟单汇票 D.光票 4、以下是国际贸易中经常用到的结算方式,其中哪种不属于汇款方式()A.押汇 B.预付货款 C.寄售 D.凭单付汇 5、收款最快,费用较高的汇款方式是()。 T T D P 6、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是()。

A.打包放款 B.汇票贴现 C.押汇 D.红条款信用证 7、审核单据,购买受益人交付的跟单信用证项下汇票,并付出对价的银行是()。 A.开证行 B.保兑行 C.付款行 D.议付行 8、以下关于可转让信用证说法错误的是:()。 A.可转让信用证适用于中间商贸易 B.信用证可以转让给一个或一个以上的第二受益人,而且这些第二受益人又可以转让给两个以上的受益人 C.未经过信用证授权的转让行办理,受益人自行办理的信用证转让业务视为无效 D.可转让信用证中只有一个开证行 9、以下关于承兑信用证的说法正确的是()。 A.在该项下,受益人可自由选择议付的银行 B.承兑信用证的汇票的期限是远期的 C.其起算日是交单日 D.对受益人有追索权 10、以下不属于出口商审证的内容的是:()。 A.信用证与合同的一致性 B.信用证条款的可接受性 C.价格条件的完整性 D.开证申请人的资信 三、判断正误题(以下各命题,请在正确命题后的括号内打“√”,错误的打“×”,每题1分,共10分) 1、信用证的基本当事人包括:出口商、进口商、开证行。()

国际结算题库及答案

一、单选 1、不可撤销保兑信用证的鲜明特点就是(A)。第7章 A、给予受益人双重的付款承诺 B、有开证行确定的付款承诺 C、给予买方最大的灵活性 D、给予卖方以最大的安全性 2、国际贸易结算就是指由(C)带来的结算。第1章 A、一切国际交易 B、服务贸易 C、有形贸易 D、票据交易 3、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商与进口商来说有资金融通的作用,以下选项不一定就是信用证对于出口商的融资方式的就是(C)。第6章 A、打包放款 B、汇票贴现 C、押汇 D、红条款信用证 4、信用证能否转让给二个以上的第二受益人取决于(C)。第8章 A、信用证上面就是否标明“transferable”字样 B、受益人与转让行之间的协议就是否规定 C、信用证就是否规定了分批转运 D、第一受益人与第二受益人商议决定 5 、一份信用证如果未注明就是否可以撤销,则就是(B)的。第6章 A、可以撤销的 B、不可撤销的 C、由开证行说了算 D、由申请人说了算 6、信用证业务中,三角契约安排规定了开证行与受益人之间权责义务受(A)约束。第6章 A、销售合同 B、开证申请书 C、担保文件 D、跟单信用证 7 、以下属于顺汇方法的支付方式就是(A)。第3章 A、汇付 B、托收 C、信用证 D、银行保函 8 、以下关于海运提单的说法不正确的就是(C)。第9章 A、就是货物收据 B、就是运输合约证据 C、就是无条件支付命令 D、就是物权凭证 9 、背书人在汇票背面只有签字,不写被背书人名称,这就是(D)。第2章 A、限定性背书 B、特别背书 C、记名背书 D、空白背书 10 、信用证业务特点之一就是:银行付款依据(A)。第6章 A、信用证 B、单据 C、货物 D、合同 11 、对于出口商而言,承担风险最大的交单条件就是(C)。第4章 A、D/P at sight B、D/P after at sight C、D/A after at sight D、T/R 12 、远期信用证中开证行会指定一家银行作为受票行,由它对远期汇票做出承兑,这家银行应该就是(C)。第6章 A、议付行 B、付款行 C、承兑行 D、偿付行 13 、下列关于信用证的说法正确的就是(B)。第6章 A、单证相符时,开证行或保兑行应独立的履行其付款承诺。除了受买方申请人制约,不应受其她当事人干扰 B、信用证就是独立文件,与销售合同分离 C、信用证作为一种结算工具,其就是否有效执行,取决于该笔交易就是否得到银行认可 D、采用信用证方式,银行不仅处理单据,还要监管货物 14 、银行审核单据的合理时间就是不超过收到单据次日起的(C个工作日。第11章 A、1 B、3 C、7 D、5 15 、信用证的议付行与付款行的本质区别在于:(C)。第6章 A、付款行就是开证行的付款代理人,而议付行不就是

国际结算测试题一

一、名词解释(若为英文,请先说明其中文意思,再解释含义。每题4分,共20分) 1.国际结算: 2.票据: 3.托收指示: 4.L/G: 5.信用卡: 二、单项选择题(每题只有一个正确答案,每题2分,共20分) 1.以往的国际贸易是用黄金白银为主作为支付货币的,但黄金白银作为现金用于国际结算,存在着明显的缺陷是()。 A.清点上的困难 B.运送现金中的高风险C.运送货币费用较高D.以上三项 2.汇票债务人承担汇票付款的责任次序在承兑后是()。 A.出票人—第一背书人—第二背书人 B.承兑人—出票人—第一背书人C.承兑人—第一背书人—第二背书人D.出票人—承兑人—第一背书人3.票据的必要项目必须齐全,且符合法定要求,这叫做票据的( )。 A.无因性 B.流通性 C.提示性 D.要式性 4.在英美票据法中“transfer”是指票据的交付转让,转让人()。A.应征得债务人的同意,受让人获得的权利要优于出让人 B.无须征得债务人的同意,受让人获得的权利要优于出让人 C.应征得债务人的同意,受让人获得的权利要受到出让人权利缺陷的影响D.无须征得债务人的同意,受让人获得的权利要受到出让人权利缺陷的影响

5.T/T、 M/T和 D/D的中文含义分别为()。 A.信汇、票汇、电汇 B.电汇、票汇、信汇 C.电汇、信汇、票汇 D.票汇、信汇、电汇 6.跟单托收业务中,即期D/P、远期D/P、D/A做法步骤不同主要发生在()之间。 A.委托人与托收行 B.委托人与代收行 C.托收行与代收行 D.代收行与付款人 7.某汇票其见票日为5月31日, (1)“见票后90天”,(2)“从见票日后90天”,(3)“见票后1个月”的付款日期分别是() A.8月28日,8月29日,6月29日 B.8月28日,8月29日,6月30日C.8月29日,8月28日,6月30日 D.8月29日,8月28日,6月29日8.信用证能否转让给二个以上的第二受益人取决于(). A.信用证上面是否标明“transferable”字样B.受益人与转让行之间的协议是否规定 C.信用证是否规定了分批转运D.第一受益人与第二受益人商议决定 9.以下哪种信用证对受益人有追索权()。 A.延期信用证 B.议付信用证 C.承兑信用证 D.即期信用证 10.允许单据有差异,只要差异不损害进口人,或不违反法庭的“合理、公平、善意” 的概念即可,该原则在审证中被称为()。 A.横审法 B.严格一致 C.实质一致 D.纵审法 三、判断正误题(以下各命题,请在正确命题后的括号内打“√”,错误的

国际结算题库及答案

一、单选 1、不可撤销保兑信用证得鲜明特点就是(A)。第7章 A、给予受益人双重得付款承诺 B、有开证行确定得付款承诺 C、给予买方最大得灵活性 D、给予卖方以最大得安全性 2、国际贸易结算就是指由(C)带来得结算。第1章 A、一切国际交易 B、服务贸易 C、有形贸易 D、票据交易 3、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商与进口商来说有资金融通得作用,以下选项不一定就是信用证对于出口商得融资方式得就是(C)。第6章 A、打包放款 B、汇票贴现 C、押汇 D、红条款信用证 4、信用证能否转让给二个以上得第二受益人取决于(C)。第8章 A、信用证上面就是否标明“transferable”字样 B、受益人与转让行之间得协议就是否规定 C、信用证就是否规定了分批转运 D、第一受益人与第二受益人商议决定 5 、一份信用证如果未注明就是否可以撤销,则就是(B)得。第6章 A、可以撤销得 B、不可撤销得 C、由开证行说了算 D、由申请人说了算 6、信用证业务中,三角契约安排规定了开证行与受益人之间权责义务受(A)约束。第6章 A、销售合同 B、开证申请书 C、担保文件 D、跟单信用证 7 、以下属于顺汇方法得支付方式就是(A)。第3章 A、汇付 B、托收 C、信用证 D、银行保函 8 、以下关于海运提单得说法不正确得就是(C)。第9章 A、就是货物收据 B、就是运输合约证据 C、就是无条件支付命令 D、就是物权凭证 9 、背书人在汇票背面只有签字,不写被背书人名称,这就是(D)。第2章 A、限定性背书 B、特别背书 C、记名背书 D、空白背书 10 、信用证业务特点之一就是:银行付款依据(A)。第6章 A、信用证 B、单据 C、货物 D、合同 11 、对于出口商而言,承担风险最大得交单条件就是(C)。第4章 A、D/P at sight B、D/P after at sight C、D/A after at sight D、T/R 12 、远期信用证中开证行会指定一家银行作为受票行,由它对远期汇票做出承兑,这家银行应该就是(C)。第6章 A、议付行 B、付款行 C、承兑行 D、偿付行 13 、下列关于信用证得说法正确得就是(B)。第6章 A、单证相符时,开证行或保兑行应独立得履行其付款承诺。除了受买方申请人制约,不应受其她当事人干扰 B、信用证就是独立文件,与销售合同分离 C、信用证作为一种结算工具,其就是否有效执行,取决于该笔交易就是否得到银行认可 D、采用信用证方式,银行不仅处理单据,还要监管货物 14 、银行审核单据得合理时间就是不超过收到单据次日起得(C个工作日。第11章 A、1 B、3 C、7 D、5 15 、信用证得议付行与付款行得本质区别在于:(C)。第6章 A、付款行就是开证行得付款代理人,而议付行不就是

国际结算试题及答案00867

一、名词解释: 1. 国际结算: P1 两个不同国家的当事人,不论是个人间的、单位间的、企业间的,或政府间的当事人因为商品买卖、服务供应、资金调拨、国际借贷,需要通过银行办理的两国间货币收付业务叫做国际结算。 2. 国际贸易结算与非国际贸易结算: P1 国际贸易经常大量发生货款结算,经结清买卖双方间的债权、债务关系,称之为国际贸易结算。 国际贸易以外的其他经济活动,以及政治、文化等交流活动,例如,服务供应、资金调拨、国际借贷等引起的货币收付,称为非贸易结算。 3. 狭义票据与广义票据: P5 广义票据是指商业上的权利单据,它作为某人的、不在他实际占有下的金钱或商品的所有权的证据。 狭义票据是以支付金钱为目的的证券,由出票人签名于根据上,无条件地约定由自己或另一人支付一定金额,可以流通转让。 4. 承兑、背书、追索权:P20承兑意指远期汇票的付款人,以其签名表示同意按照出票人命令而付款的票据行为。 P18 背书是指在汇票背面签字并交付给被背书人以转让票据权利的票据行为。 P24 追索权是指汇票遭到拒付,持票人对其前手背书人或出票人有请求其偿还汇票金额及费用的权利。 5. 汇票、本票、支票:P8汇票是由一人开致另一人的书面的条件命令,由发出命令的人签名,要求接受命令的人立即,或在固定时间,或在可以确定的将来时间,把一定金额的货币支付给一个特定的人,或他的指定人,或来人。 P28 本票是一项书面的无条件的支付承诺,由一人作成,并交给另一人,经制票人签名承诺即期或定期或在可以确定的将来时间,支付一定数目的金钱给一个特定的人或其指定人或来人。 P39 支票是银行存款客户向他开立帐户的银行签发的,授权该银行即期支付一定数目的货币给一个特定人,或其指定人,或来人的无条件书面支付命令。 二、选择题(将所选正确答案的字母序号填写到题前的括号内) (A 、 C 、 D)1. 狭义票据包括下列哪几项: A. 汇票 B. 提单 C.支票 D.本票 (A 、D) 2. 下列可采用过户转让的票据有 A. 股票 B. 提单 C.本票 D.人寿保险单 (B 、C 、 D) 3. 下列可采用流通转让的票据有: A. 股票 B. 本票 C.支票 D.大额定期存单 (A、B ) 4. 汇票的当事人中,对汇票可享有充分权利的当事人有: A. 收款人 B. 被背书人 C. 背书人 D. 出票人(A、B、C) 5. 汇票的当事人中,对汇票付款承担责任的当事人有: A. 承兑人 B. 背书人 C. 出票人 D. 被背书人 (A、B、C) 6.How many basic parties are there in a bill of exchange? 在一张汇票中有多少基本 当事人? A. Drawer B. Drawee C. Payee D. Indorser (A、D ) 7. What bills are invalid? 什么票据是有效的? P9 A. “Pay to M Co. or order the sum of one thousand USdollars. ” B. “Pay to M Co. providing the goods they supply are complied with contract the sum of one thousand US dollars. ” C. “Pay to M Co. out of the proceeds in our No. 1 account the sum of one thousand US dollars. ” D. “Pay to M Co or order the sum of one thousand US dollars and charge/debit same to applicant 's account maintained with you. ” (C、D ) 8. What bills are negotiable? 什么票据是可流通的?P13 A. Pay to John David only B. Pay to John David not transferable

国际结算辅导第四章参考答案

《国际结算》辅导(第四章)参考答案 第四章托收练习答案 七、案例题 1.答:日本B公司要求更改支付方式的目的显然是推迟付款,以利于其资金周转;而指定由J银行担任代收行,则是便于向该银行借得提单提货,以便早日获得经济利益。一般情况下,在远期付款交单业务中,代收行为了避免不必要的纠纷,在未经委托人授权的情况下,是不会轻易答应进口商借单提货的。但本案中,日本B公司如此明确地提出由J银行担任代收行,显然其彼此间有相应的融资业务关系,而可取得提前借单提货的便利,以达到进一步利用我国A公司资金的目的。 2.答:根据国际商会的《托收统一规则》(URC522)第四条A款第3项规定:“在托收指示中,除非另有授权,银行将不理会除收到委托的当事人/银行以外的任何当事人/银行的任何指示。”显然,按照上述的规定,代收行办理本笔托收业务的依据只能是托收委托书中所交代的,按装运后30天付款交单办理,而不能按进口商所声称的30天承兑交单意见办理。 3.答:代收行应赔偿出口商的损失。理由是:出口商与进口商之间的合同约定的是远期付款交单方式结算贸易货款。严格按付款交单的要求,则代收行只能在进口商支付了货款后,才能将单据交给进口商提货。但在本案中,代收行未经出口商的同意,就允许进口商以信托收据方式借取提单提货销售。对此,代收行就应承担对货物的责任。出现题目所说明的情况,则代收行只能自己承担向出口商赔偿的责任。附带提请注意:国际商会在其第522号出版物《托收统一规则》第七条A款中十分明确地指出:“托收应不包含在将来日期付款的汇票,并有指示说到商业单据凭着付款而交出。”——国际商会不赞成远期付款交单的托收方式。本案例就是一个例子。 4.1、对托收的商业信用性质的把握。根据《托收统一规则》(URC522)的有关规定:只要委托人向托收行作出了清楚明确的指示,银行对由此产生的任何后果不负责任,后果由委托

国际结算习题集及答案

国际结算习题 第一章绪论 一、名词解释 国际结算、国际贸易结算、国际非贸易结算、国际结算信用管理 二、单项选择题: 1. 商品进出口款项的结算属于( C ) A . 双边结算 B . 多边结算 C . 贸易结算 D . 非贸易结算 2. “汇款方式”是基于( B )进行的国际结算 A . 国家信用 B . 商业信用 C . 公司信用 D . 银行信用 3. 实行多边结算需使用( D ) A . 记账外汇 B . 外国货币 C . 黄金白银 D . 可兑换货币 4. 以下( C )反映了商业汇票结算的局限性 A . 进、出口商之间业务联系密切, 相互信任; B . 进、出口商一方有垫付资金的能力; C . 进、出口货物的金额和付款时间不一致; D . 出口商的账户行不在进口国 5. 当代国际结算信用管理的新内容涉及到( A ) A . 系统信用和司法信用 B . 员工信用和银行信用 C . 公司信用和商业信用 D . 银行信用和商业信用 6. 以下 ( )引起的货币收付,属于“非贸易结算”. A. 服务供应 B . 资金调拨 C . 设备出口 D. 国际借贷 7. ( B )不是纸币本位制度下使用多边结算方式必备的条件. A . 结算货币具有可兑换性 B . 不实行资本流动管制 C . 有关国家的商业银行间开立各种清算货币的账户 D . 清算账户之间资金可以自由调拨 8. 建国初我国对苏联和东欧国家的贸易使用( C )的方式 A . 单边结算 B . 多边结算 C . 双边结算 D .集团性多边结算 9. 传统的国际贸易和结算中的信用主要是( D )两类。 A .系统信用和银行信用 B . 系统信用和司法信用 C .商业信用和司法信用 D . 商业信用和银行信用