(财务会计)英语会计

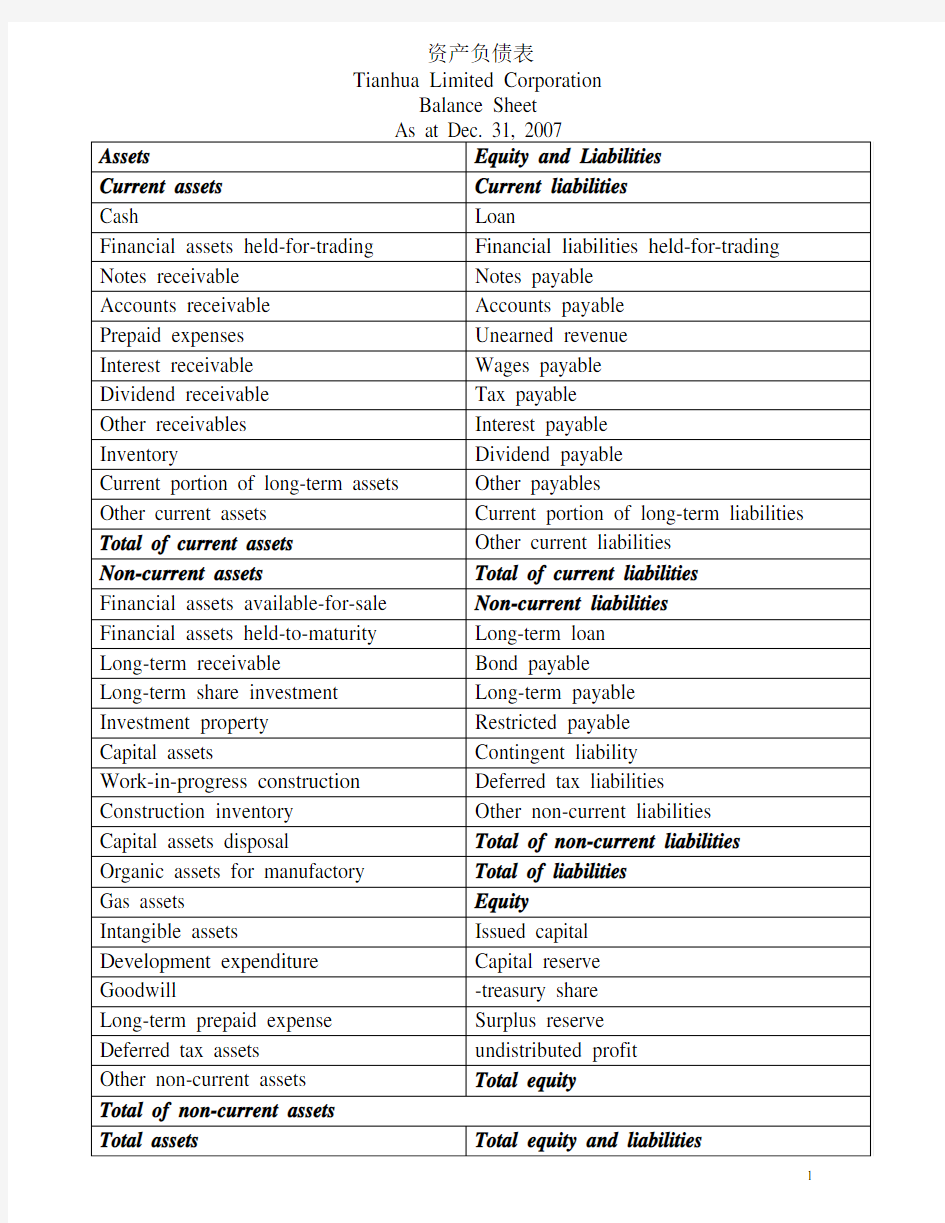

资产负债表Tianhua Limited Corporation

Balance Sheet

损益表Tianhua Limit Corporation Income Statement

现金流量表Tianhua Limit Corporation Cash Flow Statement

所有者权益变动表Tianhua Limit Corporation Statement of Changes in Equity

会计确认reorganization

计量measurement

表述presentation

揭示(附注)disclosure

Chap. 1 会计基本假设underlying assumptions

会计主体假设separate-entity assumption

持续经营假设continuity assumption

Going-concern assumption

会计分期accounting period

货币计量unit-of-measure assumption

币值稳定Nominal dollar capital maintenance assumption 会计信息质量要求qualitative criteria

可靠性reliability

相关性relevance

可理解性understandability

可比性comparability

实质重于形式substance over form

重要性materiality

谨慎性conservatism

及时性timeliness

会计要素的计量属性basis of measurement 历史成本historical cost

重置成本replacement cost

可实现净值net-realizable value

现值present value

公允价值fair value

财务报告financial statement

资产负债表Balance Sheet

利润表Income Statement

现金流量表Cash Flow Statement

所有者权益变动表Statement of Changes in Equity

附注notes

Disclosure notes

Chap. 2

货币资金monetary assets

现金cash

银行账户bank account

现金等价物cash equivalent

Chap. 3

金融资产financial instruments

以公允价值计量且变动计入当期损益的金融资产

Measure at fair value through profit or loss

交易性金融资产held for trading

指定为以公允价值计量且变动计入当期损益的金融资产

Identified as at fair value through profit or loss

持有到期投资Held-to –maturity investment

贷款和应收账款Loans and receivables

可供出售金融资产available-for-sale financial assets

减值impairment

减值损失impairment loss

Chap. 4

存货inventory

存货的种类:Classification of inventory

原材料raw materials inventory

在产品work-in-progress inventory

半成品component parts

产成品finished goods inventory

商品merchandise inventory

周转材料supplies inventory

发出存货的计量cost flow assumption

先进先出法first-in-first-out (FIFO)

后进先出法last-in-first-out (LIFO)

移动加权平均法moving-average unit cost

全月一次加权平均法weighted-average system

个别计价法(具体辨认法)specific identification

期末存货的计量ending balance of inventory

成本与可变现净值孰低lower-of –cost-or-market value

Net-realizable value

存货跌价准备Allowance to reduce inventory to LCM

资产减值损失—存货减值损失loss of impairment on assets ---- loss of impairment on inventor

Chap. 5

长期股权投资long-term investment –share

Investment in subsidiary ***

成本法cost method

权益法equity method

投资收益investment income

可转换 convertible

Chap. 6

固定资产 capital assets

在建工程 wok-in-progress construction

折旧 amortization

平均年限法 straight-line-method

工作量法 unit-of- production

双倍余额递减法 declining-balance method

年数总和法 sum-of-the-years-digits method

后续支出 subsequent expenditure

资本化 capitalized cost

费用化 expensed cost

处置 retirement and disposal

持有待售的固定资产 capital assets held for sale

固定资产清理 disposal of capital assets

固定资产减值准备 allowance of impairments on capital assets

Chap. 7

无形资产intangible assets

专利权patents

非专利技术industrial design registration

商标权trademarks and trade name

著作权copyright

特许权franchise rights

土地使用权rights of using land

Chap. 8

投资性房地产investment property / profitable estate

Chap. 9

非货币性资产交换non-monetary assets exchange

商业实质commercial substance

Chap. 10

资产减值assets impairment

估计evaluation

资产组assets group cash generate unit

商誉goodwill

Chap. 11 负债liabilities

流动负债current liabilities

非流动负债non-current liabilities

初始计量initial measurement

辞退福利fire fringe

进口import

出口export

可转换公司债券convertible bond

Chap. 12 所有者权益equity

实收资本issued capital

资本公积capital reserve

股本溢价share premium

留存收益retained earnings

未分配利润distributed profit

Chap. 13 完工百分比法percentage of completion method

建造合同construction contract

直接法direct method

间接法indirect method

分部报告segment report

关联方related party

租赁lease

担保guarantee

Chap. 15 或有事项contingencies

或有资产contingent assets

或有负债contingent liabilities

亏损合同onerous contract

Chap.16 重组reorganization /resutruction

Chap. 18 借款费用borrowing costs borrowing expenditure

溢价premium

折价discount

资本化capitalize costs

Chap. 20 所得税income tax

计税基础tax base

永久性差别permanent difference

暂时性差别temporary difference

应纳税暂时性差异taxable temporary differences

可抵扣暂时性差异deductible temporary difference

递延所得税资产deferred tax assets

递延所得税负债deferred tax liabilities

Chap. 21

外币折算translation of foreign currency

外币交易foreign currency transactions

外币财务报表折算translation of foreign currency financial statement

即期汇率current exchange rate

远期汇率future exchange rate

通货膨胀inflation

Chap. 22

出租人lessor

承租人lessee

经营租赁operating lease

融资租赁finance lease / capital lease

售后租回sale and leaseback

Chap. 23

会计政策、会计估计变更和差错更正

Changes in accounting policies, changes in accounting estimates and corrections of errors 会计估计

Accounting estimates

Chap. 24

资产负债表日后事项

Events after the balance sheet date

调整事项Adjusting event

非调整事项Unadjusting event

利润分配profit allocation

以前年度损益调整retained earnings--prior year adjustment

Undistributed profit—prior year adjustment

Chap. 25

企业合并corporate combination

长期股权投资long-term investment--share

Investment in subsidiary ***

Chap. 26

合并财务报表consolidated financial statement

Consolidated Balance Sheet

Consolidated Income Statement

Consolidated Cash Flow Statement

Consolidated Statement of Changes in Equity

(财务会计)会计英语词汇

会计科目英文 会计系统 Accounting system 美国会计协会 American Accounting Association 美国注册会计师协会 American Institute of CPAs 审计 Audit 资产负债表 Balance sheet 簿记 Bookkeeping 现金流量预测 Cash flow prospects 内部审计证书Certificate in Internal Auditing 管理会计证书 Certificate in Management Accounting 注册会计师Certificate Public Accountant 成本会计Cost accounting 外部使用者External users 财务会计Financial accounting 财务会计准则委员会Financial Accounting Standards Board 财务预测Financial forecast 公认会计原则Generally accepted accounting principles 通用目的信息 General-purpose information 政府会计办公室Government Accounting Office 损益表 Income statement 内部审计师协会Institute of Internal Auditors 管理会计师协会Institute of Management Accountants 整合性Integrity 内部审计Internal auditing 内部控制结构Internal control structure 国内收入署Internal Revenue Service 内部使用者 Internal users 管理会计Management accounting 投资回报Return of investment 投资报酬Return on investment 证券交易委员会 Securities and Exchange Commission 现金流量表Statement of cash flow 财务状况表Statement of financial position 税务会计 Tax accounting 会计等式Accounting equation 勾稽关系 Articulation 资产 Assets 企业个体Business entity 股本Capital stock 公司Corporation 成本原则Cost principle 债权人Creditor 通货紧缩 Deflation 批露Disclosure 费用Expenses 财务报表Financial statement 筹资活动Financial activities 持续经营假设Going-concern assumption 通货膨涨 Inflation 投资活动Investing activities 负债Liabilities 负现金流量Negative cash flow 经营活动Operating activities 所有者权益Owner’s equity 合伙企业Partnership 正现金流量Positive cash flow 留存利润Retained earning 收入Revenue 独资企业Sole proprietorship 清偿能力Solvency 稳定货币假设Stable-dollar assumption 股东Stockholders

(财务会计)会计英语教案

教案编号: 03 教学时间: 2010年 9月第 4周 教学班级: 09 级会计班 授课类型:讲授 教学目的及要求: Upon the completion of this lesson, the students will be able to: 1.Have general knowledge of types of accounting, 2.Get the knowledge of financial accounting and managerial accounting,respectively. 教学重点: 1.Classification in the discipline of accounting 2. Essential concept of financial accounting 3.Essential concept of management accounting 教学难点: Accountancy bodies work for financial accounting

Chapter 1 step into the world of accounting 1.4 Types of accounting Classification-financial accounting and managerial accounting 1.4.1 Financial Accounting Production of financial statements-external users International Accounting Standards(IASs)国际会计准则Generally Accepted Accoungting Principles(GAAPs)公认会计准则 1.4.2 Management accounting Management accounting works for internal users 内部管理会计工作举例: Strategy formulating 战略规划 Decision making 内部决策 Optimized resources usage优化资源利用率 1.5The Accounting Profession and Careers 1.5.1Classification of Accounting Profession Public Accountant -Auditing -Tax services -Consulting services

标准会计英语词汇大全(完整)

AAA 美国会计学会 Abacus 《算盘》杂志 abacus 算盘 Abandonment "废弃,报废;委付" abandonment value 废弃价值abatement ①减免②冲销 ability to service debt 偿债能力abnormal cost 异常成本 abnormal spoilage 异常损耗 above par 超过票面价值 above the line 线上项目 absolute amount "绝对数,绝对金额" absolute endorsement 绝对背书absolute insolvency 绝对无力偿付absolute priority 绝对优先求偿权absolute value 绝对值 absorb "摊配,转并" absorption account "摊配账户,转并账户" absorption costing 摊配成本计算法abstract 摘要表 abuse 滥用职权 abuse of tax shelter 滥用避税项目ACCA 特许公认会计师公会 accelerated cost recovery system 加速成本收回制度 accelerated depreciation method "加速折旧法,快速折旧法" acceleration clause "加速偿付条款,提前偿付条款" acceptance ①承兑②已承兑票据③验收acceptance bill 承兑票据acceptance register 承兑票据登记簿 acceptance sampling 验收抽样 access time 存取时间accommodation 融通 accommodation bill 融通票据accommodation endorsement 融通背书account "①账户,会计科目②账簿,报表③账目,账项④记账" accountability "经营责任,会计责任" accountability unit 责任单位Accountancy 《会计》杂志accountancy 会计 accountant "会计员,会计师" accountant general "会计主任,总会计" accounting in charge 主管会计师"accountant,s legal liability " 会计师的法律责任 "accountant,s report " 会计师报告"accountant,s responsibility " 会计师职责 account form "账户式,账式" accounting ①会计②会计学 accounting assumption "会计假定,会计假设" accounting basis "会计基准,会计基本方法" accounting changes 会计变更accounting concept 会计概念accounting control 会计控制accounting convention "会计常规,会计惯例" accounting corporation 会计公司accounting cycle 会计循环accounting data 会计数据accounting doctrine 会计信条accounting document 会计凭证accounting elements 会计要素accounting entity "会计主体,会计个体" accounting entry 会计分录accounting equation 会计等式accounting event 会计事项accounting exposure "会计暴露,会计暴露风险" accounting firm 会计事务所Accounting Hall of Fame 会计名人堂 accounting harmonization 会计协调化 accounting identity 会计恒等式accounting income 会计收益accounting information 会计信息accounting information system 会计信息系统 accounting internationalization

财务会计英语

1Accounting会计is an information system.it measures data into reports,and communicates results to people 2Financial accounting财务会计(外部)the branch of accounting that provides information to people outside the firm Management accounting管理会计(内部)the branch of decision makers of a business,such as top executives. 3流动资产包括current assets Cash and Cash equivalents现金及其等价物short-term investments短期投资Inventories存货 Accounts (notes) receivable应收账款(票据)prepaid expenses and other current assets预付账款(其他流动资产) 4The account账户the record of the changes that have occurred in a particular asset liability,or stockholders’ equity during a period. 5Assets资产(cash,accouts receivable,notes expense,land buildings,equipment furniture fixtures) Liabilites负债(notes payable,accounts payable,accrued liabilities

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

财务会计英语常用单词教材

A部 AAA 美国会计学会 Abacus 《算盘》杂志 abacus 算盘 Abandonment 废弃,报废;委付 abandonment value 废弃价值 abatement ①减免②冲销 ability to service debt 偿债能力 abnormal cost 异常成本 abnormal spoilage 异常损耗 above par 超过票面价值 above the line 线上项目 absolute amount 绝对数,绝对金额 absolute endorsement 绝对背书 absolute insolvency 绝对无力偿付 absolute priority 绝对优先求偿权 absolute value 绝对值 absorb 摊配,转并 absorption account 摊配账户,转并账户 absorption costing 摊配成本计算法 abstract 摘要表 abuse 滥用职权 abuse of tax shelter 滥用避税项目 ACCA 特许公认会计师公会 accelerated cost recovery system 加速成本收回制度accelerated depreciation method 加速折旧法,快速折旧法acceleration clause 加速偿付条款,提前偿付条款acceptance ①承兑②已承兑票据③验收 acceptance bill 承兑票据 acceptance register 承兑票据登记簿 acceptance sampling 验收抽样 access time 存取时间 accommodation 融通 accommodation bill 融通票据 accommodation endorsement 融通背书 account ①账户,会计科目②账簿,报表③账目,账项④记账accountability 经营责任,会计责任 accountability unit 责任单位 Accountancy 《会计》杂志 accountancy 会计 accountant 会计员,会计师 accountant general 会计主任,总会计

财会专业英语

2007年版 现金Cash in hand 银行存款Cash in bank 其他货币资金-外埠存款Other monetary assets - cash in other cities 其他货币资金-银行本票Other monetary assets - cashier‘s check 其他货币资金-银行汇票Other monetary assets - bank draft 其他货币资金-信用卡Other monetary assets - credit cards 其他货币资金-信用证保证金Other monetary assets - L/C deposit 其他货币资金-存出投资款Other monetary assets - cash for investment 短期投资-股票投资Investments - Short term - stocks 短期投资-债券投资Investments - Short term - bonds 短期投资-基金投资Investments - Short term - funds 短期投资-其他投资Investments - Short term - others 短期投资跌价准备Provision for short-term investment 长期股权投资-股票投资Long term equity investment - stocks 长期股权投资-其他股权投资Long term equity investment - others 长期债券投资-债券投资Long term securities investemnt - bonds 长期债券投资-其他债权投资Long term securities investment - others 长期投资减值准备Provision for long-term investment 应收票据Notes receivable 应收股利Dividends receivable 应收利息Interest receivable 应收帐款Trade debtors 坏帐准备- 应收帐款Provision for doubtful debts - trade debtors 预付帐款Prepayment 应收补贴款Allowance receivable 其他应收款Other debtors 坏帐准备- 其他应收款Provision for doubtful debts - other debtors 其他流动资产Other current assets 物资采购Purchase 原材料Raw materials 包装物Packing materials 低值易耗品Low value consumbles 材料成本差异Material cost difference 自制半成品Self-manufactured goods 库存商品Finished goods 商品进销差价Difference between purchase & sales of commodities 委托加工物资Consigned processiong material 委托代销商品Consignment-out 受托代销商品Consignment-in 分期收款发出商品Goods on instalment sales 存货跌价准备Provision for obsolete stocks 待摊费用Prepaid expenses

财会英语口语集锦

财会英语:On the way to the bank Zhang: Are you going to deposit the cash in the bank? Liu: Yes, our internal control over cash requires that all cash receipts be deposited daily in the bank. 张:你又要去送存现金了吗? 刘:是的,我们的现金内部控制制度要求我们每天都将现金收入存入银行。 财会英语:Problem is solved Zhang: Hello, Ms Liu. This is Li .I found that we had left out a payout during checking the voucher. Liu: I thought as much! Then it is understandable that the bank statement is right. Ok, problem is solved. Please add the account! 李:刘小姐您好,我是小李啊。我查了原始凭证,发现是我们漏记了一笔支出。 张:果然不出我所料!难怪银行这里没问题。那好吧,请你把这笔账补上吧。 财会英语:What's happened Zhang: Look here, Ms Liu, I cannot find a 30000-Yuan payout in the Journal, which is noted in the bank statement. Liu: It is impossible! Let me have a look! It's true. I will come to the bank tomorrow, and you check the voucher, ok! 张:刘小姐,您看,银行寄来的对账单中有一笔30000元人民币的支出和我们日记账对不上啊! 刘:怎么可能?让我看一看,还真是啊,明天我到银行去核对一下,你查查原始凭证好吗? 财会英语:The bank agreed Liu: Sir, after hard negotiation, the bank agreed to loan us a 500000-Yuan short -term credit at last. Cheng: That is great! I am just worrying about the working capital. Thank you for your hard working these days! 刘:经理,经过艰苦的谈判,我们终于同银行谈妥了一笔50万元的短期贷款。