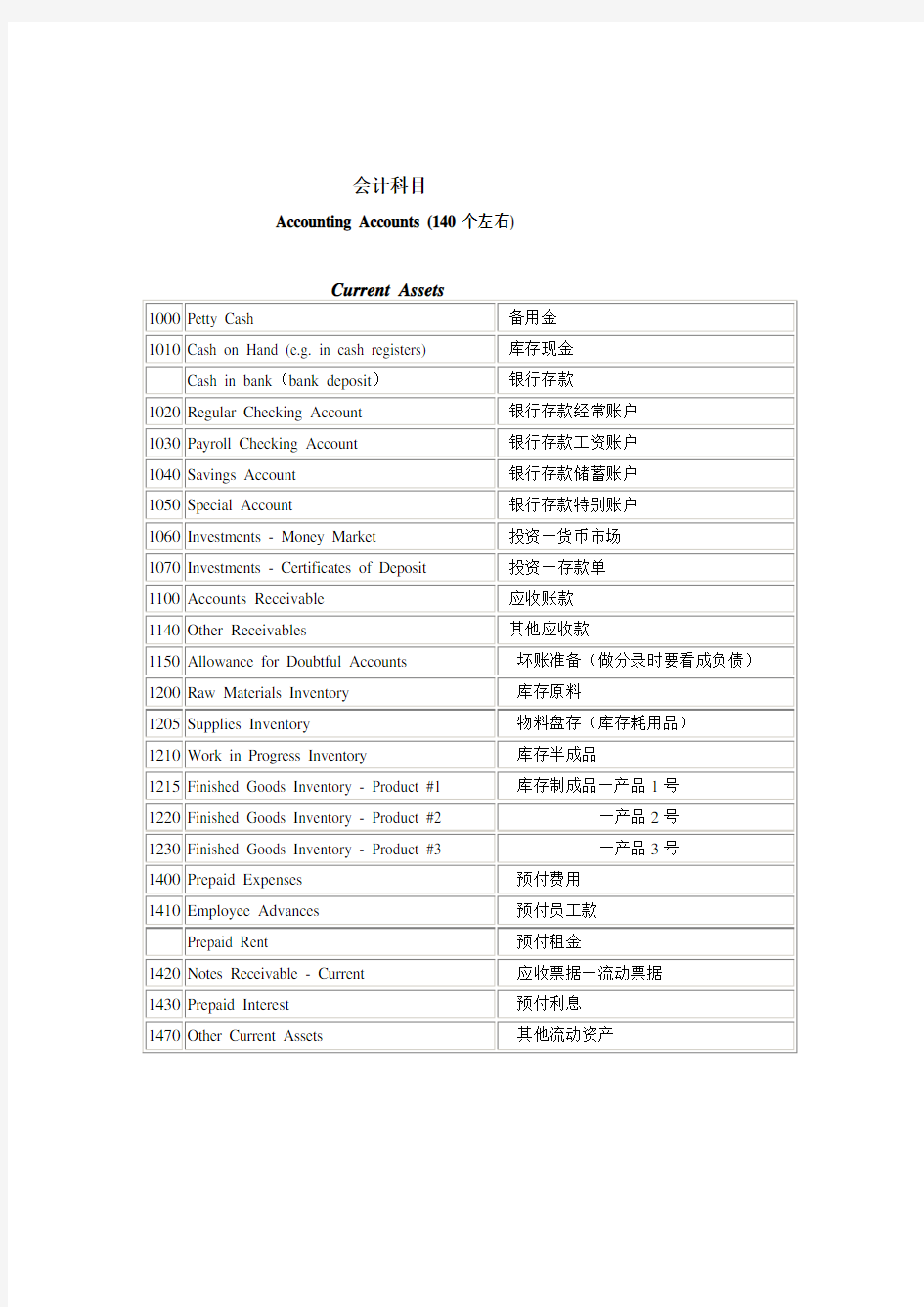

(财务会计)英语会计科目

会计科目Accounting Accounts (140个左右)

Liability Accounts

(财务会计)会计英语词汇

会计科目英文 会计系统 Accounting system 美国会计协会 American Accounting Association 美国注册会计师协会 American Institute of CPAs 审计 Audit 资产负债表 Balance sheet 簿记 Bookkeeping 现金流量预测 Cash flow prospects 内部审计证书Certificate in Internal Auditing 管理会计证书 Certificate in Management Accounting 注册会计师Certificate Public Accountant 成本会计Cost accounting 外部使用者External users 财务会计Financial accounting 财务会计准则委员会Financial Accounting Standards Board 财务预测Financial forecast 公认会计原则Generally accepted accounting principles 通用目的信息 General-purpose information 政府会计办公室Government Accounting Office 损益表 Income statement 内部审计师协会Institute of Internal Auditors 管理会计师协会Institute of Management Accountants 整合性Integrity 内部审计Internal auditing 内部控制结构Internal control structure 国内收入署Internal Revenue Service 内部使用者 Internal users 管理会计Management accounting 投资回报Return of investment 投资报酬Return on investment 证券交易委员会 Securities and Exchange Commission 现金流量表Statement of cash flow 财务状况表Statement of financial position 税务会计 Tax accounting 会计等式Accounting equation 勾稽关系 Articulation 资产 Assets 企业个体Business entity 股本Capital stock 公司Corporation 成本原则Cost principle 债权人Creditor 通货紧缩 Deflation 批露Disclosure 费用Expenses 财务报表Financial statement 筹资活动Financial activities 持续经营假设Going-concern assumption 通货膨涨 Inflation 投资活动Investing activities 负债Liabilities 负现金流量Negative cash flow 经营活动Operating activities 所有者权益Owner’s equity 合伙企业Partnership 正现金流量Positive cash flow 留存利润Retained earning 收入Revenue 独资企业Sole proprietorship 清偿能力Solvency 稳定货币假设Stable-dollar assumption 股东Stockholders

有关会计科目的中英文对照

一级科目二级科目三级科目四级科目 代码名称代码名称代码名称代码名称英译 1 资产assets 11~ 12 流动资产current assets 111 现金及约当现金cash and cash equivalents 1111 库存现金cash on hand 1112 零用金/周转金petty cash/revolving funds 1113 银行存款cash in banks 1116 在途现金cash in transit 1117 约当现金cash equivalents 1118 其它现金及约当现金other cash and cash equivalents 112 短期投资short-term investments 1121 短期投资-股票short-term investments - stock 1122 短期投资-短期票券short-term investments - short-term notes and bills 1123 短期投资-政府债券short-term investments - government bonds 1124 短期投资-受益凭证short-term investments - beneficiary certificates 1125 短期投资-公司债short-term investments - corporate bonds 1128 短期投资-其它short-term investments - other 1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market 113 应收票据notes receivable 1131 应收票据notes receivable 1132 应收票据贴现discounted notes receivable 1137 应收票据-关系人notes receivable - related parties 1138 其它应收票据other notes receivable 1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable 114 应收帐款accounts receivable 1141 应收帐款accounts receivable 1142 应收分期帐款installment accounts receivable 1147 应收帐款-关系人accounts receivable - related parties 1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable 118 其它应收款other receivables 1181 应收出售远汇款forward exchange contract receivable 1182 应收远汇款-外币forward exchange contract receivable - foreign currencies 1183 买卖远汇折价discount on forward ex-change contract 1184 应收收益earned revenue receivable 1185 应收退税款income tax refund receivable 1187 其它应收款- 关系人other receivables - related parties 1188 其它应收款- 其它other receivables - other 1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables 121~122 存货inventories 1211 商品存货merchandise inventory 1212 寄销商品consigned goods 1213 在途商品goods in transit 1219 备抵存货跌价损失allowance for reduction of inventory to market

会计科目英文词汇

中国注册会计师考试英文测试词汇整理 现金 Cash in hand 银行存款 Cash in bank 其他货币资金-外埠存款Other monetary assets - cash in other cities 其他货币资金-银行本票 Other monetary assets - cashier's check 其他货币资金-银行汇票 Other monetary assets - bank draft 其他货币资金-信用卡 Other monetary assets - credit cards 其他货币资金-信用证保证金 Other monetary assets - L/C deposit 其他货币资金-存出投资款 Other monetary assets - cash for investment 短期投资-股票投资 Investments - Short term - stocks 短期投资-债券投资 Investments - Short term - bonds 短期投资-基金投资 Investments - Short term - funds 短期投资-其他投资 Investments - Short term - others 短期投资跌价准备 Provision for short-term investment 长期股权投资-股票投资 Long term equity investment - stocks 长期股权投资-其他股权投资 Long term equity investment - others 长期债券投资-债券投资 Long term securities investemnt - bonds 长期债券投资-其他债权投资 Long term securities investment - others 长期投资减值准备 Provision for long-term investment 应收票据 Notes receivable 应收股利 Dividends receivable 应收利息 Interest receivable 应收帐款 Trade debtors 坏帐准备- 应收帐款 Provision for doubtful debts - trade debtors 预付帐款 Prepayment 应收补贴款 Allowance receivable 其他应收款 Other debtors 坏帐准备- 其他应收款 Provision for doubtful debts - other debtors 其他流动资产 Other current assets 物资采购 Purchase 原材料 Raw materials 包装物 Packing materials 低值易耗品 Low value consumbles 材料成本差异 Material cost difference

会计科目英文缩写

一、企业财务会计报表封面FINANCIAL REPORT COVER 报表所属期间之期末时间点Period Ended 所属月份Reporting Period 报出日期Submit Date 记账本位币币种Local Reporting Currency 审核人Verifier 填表人Preparer 记账符号 DR:debit record (借记) CR:credit recrod(贷记) 二、资产负债表Balance Sheet 资产Assets 流动资产Current Assets 货币资金Bank and Cash 短期投资Current Investment 一年内到期委托贷款Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备Less: Impairment for current investment 短期投资净额Net bal of current investment 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable

应收账款Account receivable 减:应收账款坏账准备Less: Bad debt provision for Account receivable 应收账款净额Net bal of Account receivable 其他应收款Other receivable 减:其他应收款坏账准备Less: Bad debt provision for Other receivable 其他应收款净额Net bal of Other receivable 预付账款Prepayment 应收补贴款Subsidy receivable 存货Inventory 减:存货跌价准备Less: Provision for Inventory 存货净额Net bal of Inventory 已完工尚未结算款Amount due from customer for contract work 待摊费用Deferred Expense 一年内到期的长期债权投资Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year 其他流动资产Other current assets 流动资产合计Total current assets 长期投资Long-term investment 长期股权投资Long-term equity investment 委托贷款Entrusted loan receivable 长期债权投资Long-term debt investment 长期投资合计Total for long-term investment 减:长期股权投资减值准备Less: Impairment for long-term equity investment 减:长期债权投资减值准备Less: Impairment for long-term debt investment

财务会计英语

1Accounting会计is an information system.it measures data into reports,and communicates results to people 2Financial accounting财务会计(外部)the branch of accounting that provides information to people outside the firm Management accounting管理会计(内部)the branch of decision makers of a business,such as top executives. 3流动资产包括current assets Cash and Cash equivalents现金及其等价物short-term investments短期投资Inventories存货 Accounts (notes) receivable应收账款(票据)prepaid expenses and other current assets预付账款(其他流动资产) 4The account账户the record of the changes that have occurred in a particular asset liability,or stockholders’ equity during a period. 5Assets资产(cash,accouts receivable,notes expense,land buildings,equipment furniture fixtures) Liabilites负债(notes payable,accounts payable,accrued liabilities

会计科目中英文对照

完整英文版资产负债表、利润表及现金流量表来源:冯硕的日志 资产负债表Balance Sheet 项目ITEM 货币资金Cash 短期投资Short term investments 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable 应收出口退税Export drawback receivable 存货Inventories 其中:原材料Including:Raw materials 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets 流动资产合计Total current assets 长期投资:Long-term investment: 其中:长期股权投资Including long term equity investment 长期债权投资Long term securities investment *合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价Fixed assets-cost 减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value 减:固定资产减值准备Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 固定资产合计Total tangible assets 无形资产Intangible assets 其中:土地使用权Including and use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including:Fixed assets repair 固定资产改良支出Improvement expenditure of fixed assets 其他长期资产Other long term assets

新发布企业会计准则目录、会计科目、财务报表(中英文)

新发布企业会计准则目录(中英文对照版) 企业会计准则目录 Index for Accounting Standards for Business Enterprises Announced February 2006 Effective 2007 for Listed Companies 1. 企业会计准则---------基本准则 (Accounting Standard for Business Enterprises - Basic Standard) 2. 企业会计准则第1 号---------存货 (Accounting Standard for Business Enterprises No. 1 - Inventories) 3. 企业会计准则第2 号---------长期股权投资 (Accounting Standard for Business Enterprises No. 2 - Long-term equity invest ments) 4. 企业会计准则第3 号---------投资性房地产 (Accounting Standard for Business Enterprises No. 3 - Investment properties) 5. 企业会计准则第4 号---------固定资产 (Accounting Standard for Business Enterprises No. 4 - Fixed assets) 6. 企业会计准则第5 号---------生物资产 (Accounting Standard for Business Enterprises No. 5 - Biological assets) 7. 企业会计准则第6 号---------无形资产 (Accounting Standard for Business Enterprises No. 6 - Intangible assets) 8. 企业会计准则第7 号---------非货币性资产交换 (Accounting Standard for Business Enterprises No. 7 - Exchange of non-monet ary assets) 9. 企业会计准则第8 号---------资产减值 (Accounting Standard for Business Enterprises No. 8 - Impairment of assets) 10. 企业会计准则第9 号---------职工薪酬 (Accounting Standard for Business Enterprises No. 9 – Employee compensatio n ) 11. 企业会计准则第10 号--------企业年金基金 (Accounting Standard for Business Enterprises No. 10 - Enterprise annuity fun d)

会计科目英文对照2

中国会计制度科目英文对照 应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable 应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a year 长期投资:Long-term investment: 其中:长期股权投资Including: Long term equity investment 长期债权投资Long term securities investment 固定资产原价Fixed assets-cost 固定资产净值Fixed assets-net value 减:固定资产减值准备Less: Impairment of fixed assets 固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 其中:土地使用权Including: Land use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including: Fixed assets repair 其他长期资产Other long term assets 无形及其他资产合计Total intangible assets and other assets 递延税款借项Deferred assets debits 应付票款Notes payable 应付帐款Accounts payab1e预收帐款Advances from customers 应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e 应交税金T axes payable其他应交款Other payable to government其他应付款Other creditors 预提费用Provision for expenses预计负债Accrued liabilities 一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities长期借款Long-term loans payable 应付债券Bonds payable长期应付款long-term accounts payable 长期负债合计Total long term liabilities 递延税款贷项Deferred taxation credit * 少数股东权益Minority interests 实收资本(股本) Subscribed Capital国家资本National capital 集体资本Collective capital法人资本Legal person's capital 其中:国有法人资本Including: State-owned legal person's capital 集体法人资本Collective legal person's capital个人资本Personal capital 外商资本Foreign businessmen's capital 资本公积Capital surplus 盈余公积surplus reserve 其中:法定盈余公积Including: statutory surplus reserve 公益金public welfare fund 补充流动资本Supplementary current capital * 未确认的投资损失(以“-”号填列)Unaffirmed investment loss 未分配利润Retained earnings 所有者权益合计T otal shareholder's equity