WTO概论复习资料Word版

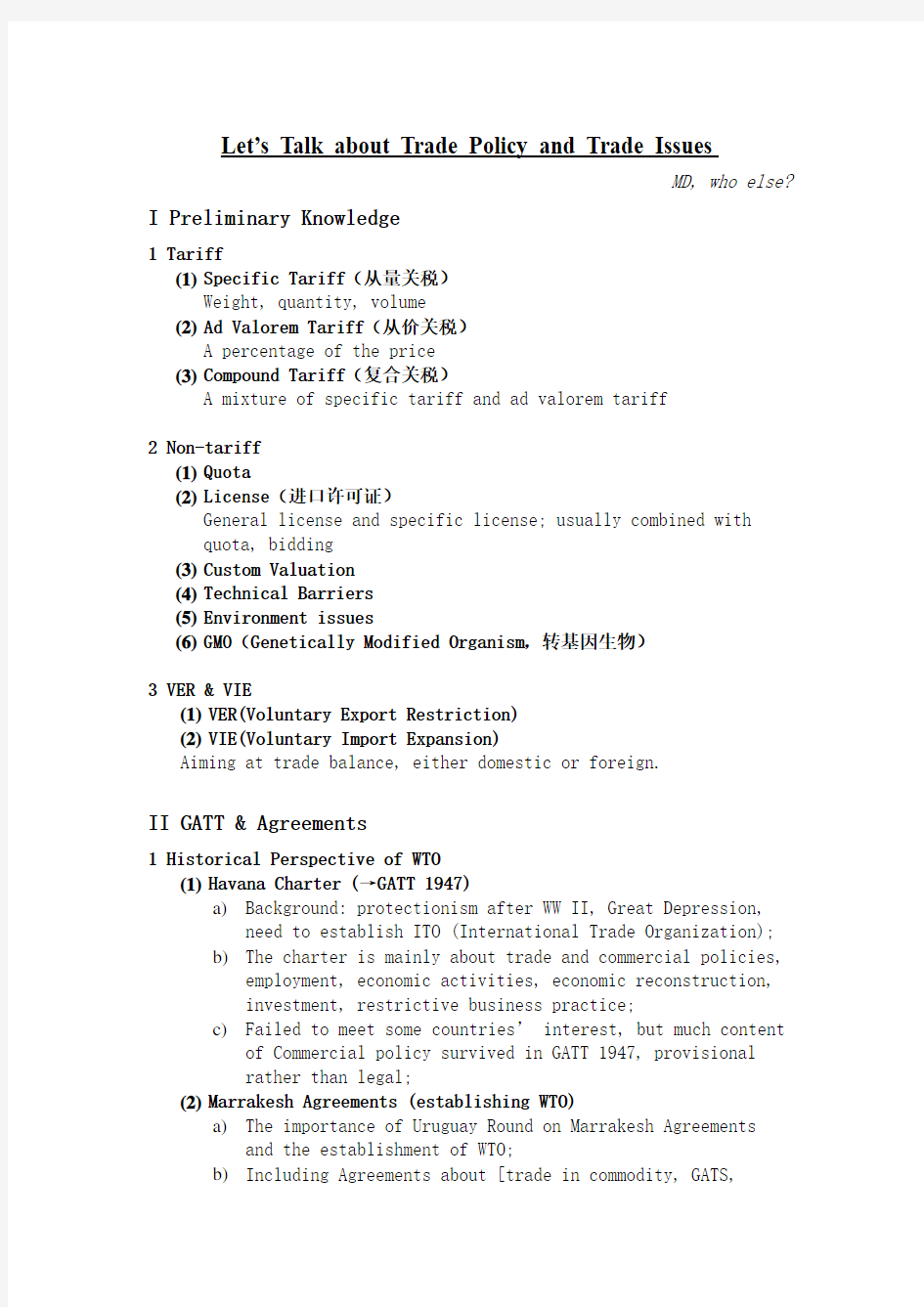

Let’s Talk about Trade Policy and Trade Issues

MD, who else?

I Preliminary Knowledge

1 Tariff

(1)Specific Tariff(从量关税)

Weight, quantity, volume

(2)Ad Valorem Tariff(从价关税)

A percentage of the price

(3)Compound Tariff(复合关税)

A mixture of specific tariff and ad valorem tariff

2 Non-tariff

(1)Quota

(2)License(进口许可证)

General license and specific license; usually combined with

quota, bidding

(3)Custom Valuation

(4)Technical Barriers

(5)Environment issues

(6)GMO(Genetically Modified Organism,转基因生物)

3 VER & VIE

(1)VER(Voluntary Export Restriction)

(2)VIE(Voluntary Import Expansion)

Aiming at trade balance, either domestic or foreign.

II GATT & Agreements

1 Historical Perspective of WTO

(1)Havana Charter (→GATT 1947)

a)Background: protectionism after WW II, Great Depression,

need to establish ITO (International Trade Organization);

b)The charter is mainly about trade and commercial policies,

employment, economic activities, economic reconstruction,

investment, restrictive business practice;

c)Failed to meet some countries’ interest, but much content

of Commercial policy survived in GATT 1947, provisional

rather than legal;

(2)Marrakesh Agreements (establishing WTO)

a)The importance of Uruguay Round on Marrakesh Agreements

and the establishment of WTO;

b)Including Agreements about [trade in commodity, GATS,

TRIPs], DSU(Understanding on Rules and Procedures Governing the Settlement of Disputes), TPRM, PTA(

Plurilateral Trade Agreements);

c)Entered into force on 1 Jan. 1995, 128 GATT signatories;

d)160 members since 26 Jun. 2014

2 GATT 1947

(1)Basic Principles of WTO

a)Nondiscrimination(MFN, NT), Graduation Clause

b)Trade Liberalization(tariff, non-tariff, market access)

c)Transparence

d)Fair Competition

(2)MFN clause---Article I

a)Most-Favored-Nation Treatment(MFN): any advantage, favor,

privilege or immunity granted by any contracting party to

any product shall be accorded immediately and

unconditionally to the like product of all other

contracting parties;

b)Accord the basic principles, nondiscrimination, promote

trade liberalization as it’s Multilateral;

c)Exceptions: GSP, FTA, Anti-dumping. safety issues, etc.

d)China’s benefits: double-edged sword;

(3)National Treatment---Article III

a)National Treatment on Internal Taxation and Regulation:

the contracting parties should treat imported products and

domestic products equally in terms of internal taxes

and/or other internal charges, laws, regulations, and

requirements;

b)Exceptions: government procurement, domestic subsidies,

etc.

c)Preference Policy and NT: depending on different

industries;

(4)Anti-dumping---Article VI

a)Dumping: products of one country are exported to another

country at a price less than the normal value, and is

causes or threatens material injury to the importer’s

industry;

b)“normal value” is defined by the comparable price, in

the ordinary course of trade, for the like product for

consumption in the exporting country; or if domestic price

not available: the highest comparable price for the like

product exported to a third country, or the cost of the

product plus a reasonable additional for selling and

profit;

c)Determinants in dumping: Dumping Margin and Material

Injury

(5)Rule of Origin(RoO)---Article IX

a)Marks of Origin: marks, characters, patterns, etc. that

indicate the original country/region of an imported

product or service;

b)Article 7: contracting parties cooperate to minimize the

difficulties, and to prevent misrepresent of the true

origin;

c)Determining origin and whether “substantial

transformation”: value-added, process test, change in

tariff classification(CTC);

d)Controversial issue on trade balance: different standards

to determine origin and processing trade;

e)MFN or not determined by the origin of the product;

(6)Administration of Trade Regulations---Article X

a)Publication: laws, regulations, judicial decisions and

administrative rulings of general application about

international trade (e.g. custom classification and

valuation, rates of duty/taxes, requirements,

restrictions, etc.) shall be published promptly to enable

traders become acquainted with them;

b)Administration: contracting parties shall maintain, or

institute judicial, arbitral, or administrative procedures

to deal with custom matters, and administrate laws,

regulations in a uniform and reasonable way;

(7)QRs(Quantitative Restrictions)---Article XI

a)Elimination of QRs: except duties, taxes or other charges,

contracting parties shall eliminate restrictions made

effect through quotas, licenses or other measures.

b)Exceptions: food, agriculture or fisheries product.

(shortage or surplus)

(8)General Exceptions---Article XX

a)Protect public morals;

b)Protect human, animal or plant life or health;

c)Trade relating to gold or silver;

d)Secure compliance with laws or regulations consistent with

the provisions (e.g. intellectual property);

e)Prison labor products;

f)National treasures;

g)Exhaustible resources;

h)Intergovernmental commodity agreement that are approved;

i)Ensure essential domestic quantities;

j)General or local short supply;

(9)State Trading Enterprise---Article XVII

a)Contracting parties can establish or maintain state

enterprises, but they shall act in a manner consistent

with general principles of non-discriminatory treatment

for governmental measures affecting trades by private

traders;

b)Such enterprises shall make purchases or sales solely in

accordance with commercial considerations, including

price, quality, availability, transportation, etc.

c)Contracting parties shall not prevent enterprises from

acting in accordance with the principles;

(10)S ubsidies---Article XVI

a)Subsidies in General: when granting any subsidies,

contracting parties shall notify other parties in writing

of the extent, nature, estimated effect and necessity;

b)In case of serious prejudice, the contracting party

granting the subsidy shall discuss with other parties

about the possibility of limiting the subsidization;

c)Additional Provisions: parties shall seek to avoid the use

of subsidies on the export of primary products, or the

subsidy shall not increase the party’s equitable share of

the world export in that product;

(11)I mplemental Mechanism---Article XXIV

a)Territorial Application-Frontier Traffic-Customs Unions-

Free Trade Areas, an exception of MFN

(12)G SP(Generalized System of Preference)

a)Between developed countries and developing countries;

b)Nondiscrimination, unilateral;

(13)H istory: China’s reenter in GATT

a)An original contracting party;

b)Suspended its eligibility as a contracting party in 1950;

c)Taiwan: observer to GATT in 1965;

d)China’s efforts to reenter in 1986;

e)Complexity of China’s relevance to GATT;

3 GATT 1994

(1)The framework of UR

a)Agreements about [trade in commodity, GATS, TRIPs],

b)DSU(Understanding on Rules and Procedures Governing the

Settlement of Disputes),

c)TPRMs

d)PTA (Plurilateral Trade Agreements);

(2)The initiatives of WTO

a)Principles?

(3)Legal instruments under GATT 1947

a)Tariff concession;

b)Protocols of accession;

c)Waiver granted under Article 25

(4)Understanding on Paragraph1(2) Article II

a)Aims at promoting the transparency of the rights and

obligations;

b)Agreement to record in national schedules “other duties

or charges”(which shall be exempted) levied in addition

to the recorded tariff, and to bind them at the levels

prevailing at the date established in the UR Protocol;

(5)Understanding on Article XVII

a)To promote the transparency of state-trading enterprises’

activities, contracting parties shall report such

enterprises to the committee, regardless of whether export

has happened or not;

b)Increase surveillance of enterprises’ activities through

stronger notification and review procedures;

(6)Understanding on Article XVIII

a)Article 18: for the Balance-of-Payment(BOP) and

development of economy, especially for the less developed

countries, tariff protection and QRs can be imposed;

b)The schedule for the restriction measures on import shall

be notified as soon as possible;

c)Contracting parties imposing restrictions for BOP purposes

shall do so in the least trade-disruptive manner, and

shall favor price-based measures, like import surcharges

and import deposits, rather than quantitative

restrictions.

d)Agreement is also on procedure for consultations by GATT

BOP Committee, as well as for notification.

(7)Understanding on Article XXIV

a)Clarify and reinforce the standard and procedures for the

review of new or enlarged custom unions or FTA and for the

evaluation of their effects on third parties;

b)Clarify the procedure to be followed for achieving any

necessary compensatory adjustment in the event of

contracting parties forming a customs union seeking to

increase a bound tariff;

c)The obligations of contracting parties in regard to

measures taken by regional or local governments or

authorities within territories are also clarified;

4 Other Agreements

(1)Agreement on Technical Barriers to Trade(TBT,技术性贸易壁垒

协议)

a)Narrow TBT: processing and production methods related to

the characteristics of the product itself;

b)Dilemma on Broad TBT: needs for industrialization vs.

potentiality toward protection;

c)This agreement will extend and clarify the Agreement on

Technical Barriers to Trade reached in the Tokyo Round. It

seeks to ensure that technical negotiations and standards, as well as testing and certification procedures, do not create unnecessary obstacles to trade. However, it recognizes that countries have the right to establish protection, at levels they consider appropriate, for example for human, animal or plant life or health or the environment, and should not be

prevented from taking measures necessary to ensure those

levels of protection are met. The agreement therefore

encourages countries to use international standards where

these are appropriate, but it does not require them to change their levels of protection as a result of standardization.

Innovative features of the revised agreement are that it covers processing and production methods related to the

characteristics of the product itself. The coverage of

conformity assessment procedures is enlarged and the

disciplines made more precise. Notification provisions

applying to local government and non-governmental bodies are elaborated in more detail than in the Tokyo Round agreement. A Code of Good Practice for the Preparation, Adoption and

Application of Standards by standardizing bodies, which is

open to acceptance by private sector bodies as well as the

public sector, is included as an annex to the agreement.

(2)Agreement on the Application of Sanitary and Phytosanitary

Measures(SPS,实施动植物卫生检疫措施协议)

a)Specific in the protection of human health and ecological

balance,

(3)Agreement on Trade-Related Investment Measures(TRIMs,与贸易

有关的投资措施协议)

a)This Agreement, negotiated during the Uruguay Round,

applies only to measures that affect trade in goods.

Recognizing that certain investment measures can have

trade-restrictive and distorting effects, it states that

no Member shall apply a measure that is prohibited by the

provisions of GATT Article III (national treatment) or

Article XI (quantitative restrictions). Examples of

inconsistent measures, as spelled out in the Annex‘s

Illustrative List, include local content or trade balancing requirements. The Agreement contains

transitional arrangements allowing Members to maintain notified TRIMs for a limited time following the entry into force of

the WTO 。The Agreement also establishes a Committee on

TRIMs to monitor the operation and implementation of these

commitments.

(4)Agreement on Agriculture(农业协议)

a)Long-term objectives: substantial progressive reduction in

agricultural support;

b) A decisive move towards the objective of increased market

orientation in agricultural trade;

c)Total AMS(Aggregate Measure of Support): covers all

support provided on either a product-specific or non-

product-specific basis;

d)Market access---tariffication: non-tariff border measures

are replaced by tariffs that provide substantially same

level of protection; Tariff-quota: under 10% & outside

80%;

e)Domestic support---amber, blue, green box.

f)Amber box:All domestic support measures considered to

distort production and trade (with some exceptions) fall

into the amber box, which is defined in Article 6 of the

Agriculture Agreement as all domestic supports except

those in the blue and green boxes. These include measures

to support prices, or subsidies directly related to

production quantities. These supports are subject to

limits: “de minimis” mini mal supports are allowed (5% of

agricultural production for developed countries, 10% for

developing countries); the 30 WTO members that had larger

subsidies than the de minimis levels at the beginning of

the post-Uruguay Round reform period are committed to

reduce these subsidies.

g)Blue Box:This is the “amber box with conditions” —

conditions designed to reduce distortion. Any support that

would normally be in the amber box, is placed in the blue

box if the support also requires farmers to limit

production (details set out in Paragraph 5 of Article 6

of the Agriculture Agreement). At present there are no

limits on spending on blue box subsidies. In the current

negotiations, some countries want to keep the blue box as

it is because they see it as a crucial means of moving

away from distorting amber box subsidies without causing

too much hardship. Others wanted to set limits or

reduction commitments, some advocating moving these

supports into the amber box.

h)Green Box: In order to qualify, green box subsidies must

not distort trade, or at most cause minimal distortion

(paragraph 1). They have to be government-funded (not by

charging consumers higher prices) and must not involve

price support. They tend to be programmes that are not

targeted at particular products, and include direct income

supports for farmers that are not related to (are

“decoupled” from) current production levels or prices.

They also include environmental protection and regional

development programmes. “Green box” subsidies are

therefore allowed without limits, provided they comply

with the policy-specific criteria set out in Annex 2.

In the current negotiations, some countries argue that

some of the subsidies listed in Annex 2 might not meet

the criteria of the annex’s first paragraph — because of

the large amounts paid, or because of the nature of these

subsidies, the trade distortion they cause might be more

than minimal. Among the subsidies under discussion here

are: direct payments to producers (paragraph 5),

including decoupled income support (paragraph 6), and

government financial support for income insurance and

income safety-net programmes (paragraph 7), and other

paragraphs. Some other countries take the opposite view —

that the current criteria are adequate, and might even

need to be made more flexible to take better account of

non-trade concerns such as environmental protection and

animal welfare.

i)Export competition: Members are required to reduce the

value of mainly direct export subsidies to a level 36 per

cent below the 1986-90 base period level over the six-year

implementation period, and the quantity of subsidized

exports by 21 per cent over the same period.

(5)Agreement on Textiles and Clothing(纺织品与服装协议)

a)MFA(Multifibre Arrangement): Up to the end of the Uruguay

Round, textile and clothing quotas were negotiated

bilaterally and governed by the rules of the Multifibre

Arrangement (MFA). This provided for the application of

selective quantitative restrictions when surges in imports

of particular products caused, or threatened to cause,

serious damage to the industry of the importing country.

The Multifibre Arrangement was a major departure from the

basic GATT rules and particularly the principle of non-