信用证审核练习

根据下述合同内容审核信用证,并指出不符之处

Exercise 1

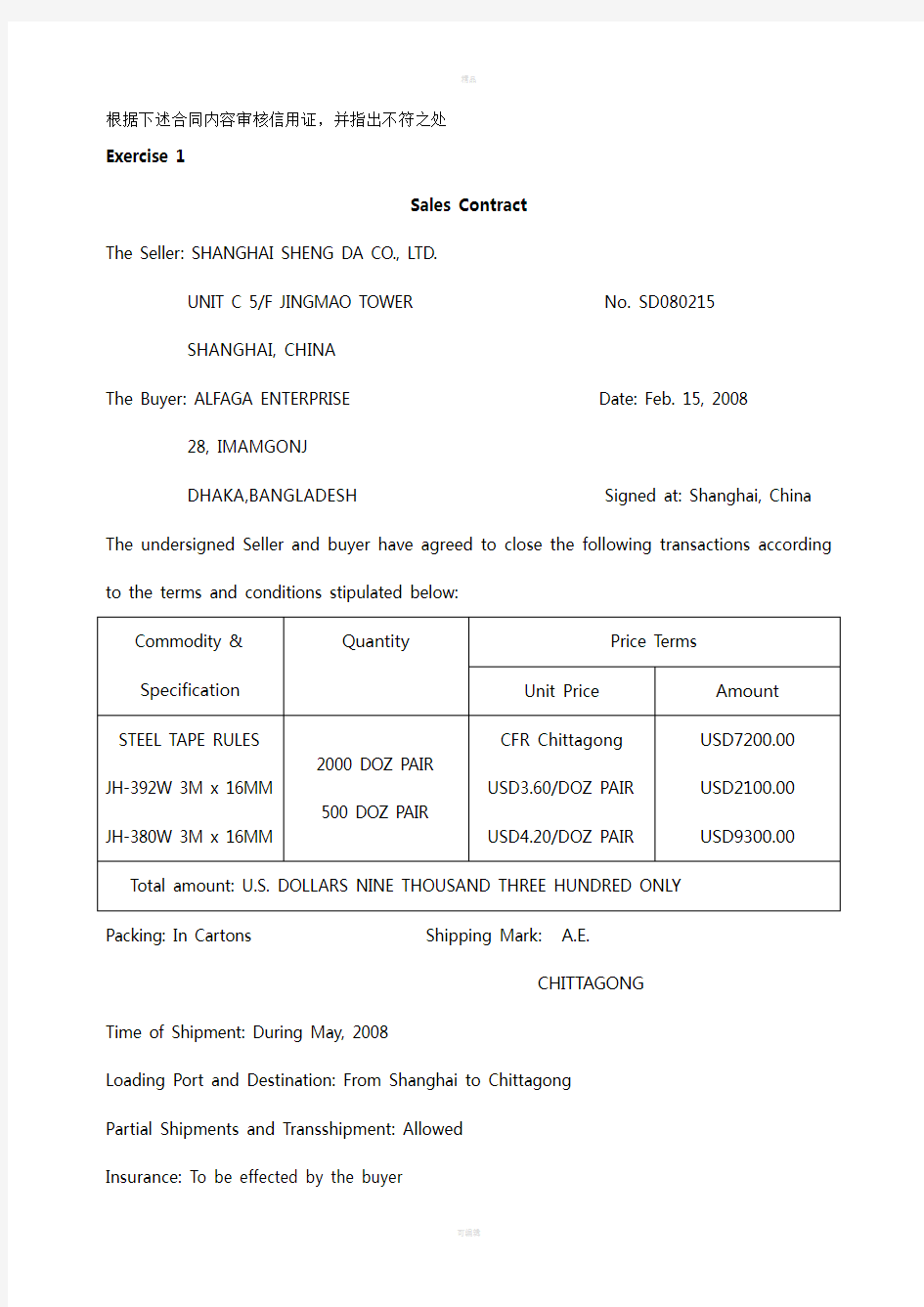

Sales Contract

The Seller: SHANGHAI SHENG DA CO., LTD.

UNIT C 5/F JINGMAO TOWER No. SD080215

SHANGHAI, CHINA

The Buyer: ALFAGA ENTERPRISE Date: Feb. 15, 2008 28, IMAMGONJ

DHAKA,BANGLADESH Signed at: Shanghai, China The undersigned Seller and buyer have agreed to close the following transactions according to the terms and conditions stipulated below:

Packing: In Cartons Shipping Mark: A.E.

CHITTAGONG

Time of Shipment: During May, 2008

Loading Port and Destination: From Shanghai to Chittagong

Partial Shipments and Transshipment: Allowed

Insurance: T o be effected by the buyer

Terms of Payment: The Buyer shall open through a bank acceptable to the Seller an irrevocable Sight Letter of Credit to reach the Sellers 30 days before the month of shipment. Valid for negotiation in China until the 15th day after the month of shipment.

The Seller The Buyer

SHANGHAI SHENG DA CO., LTD. ALFAGA ENTERPRISE

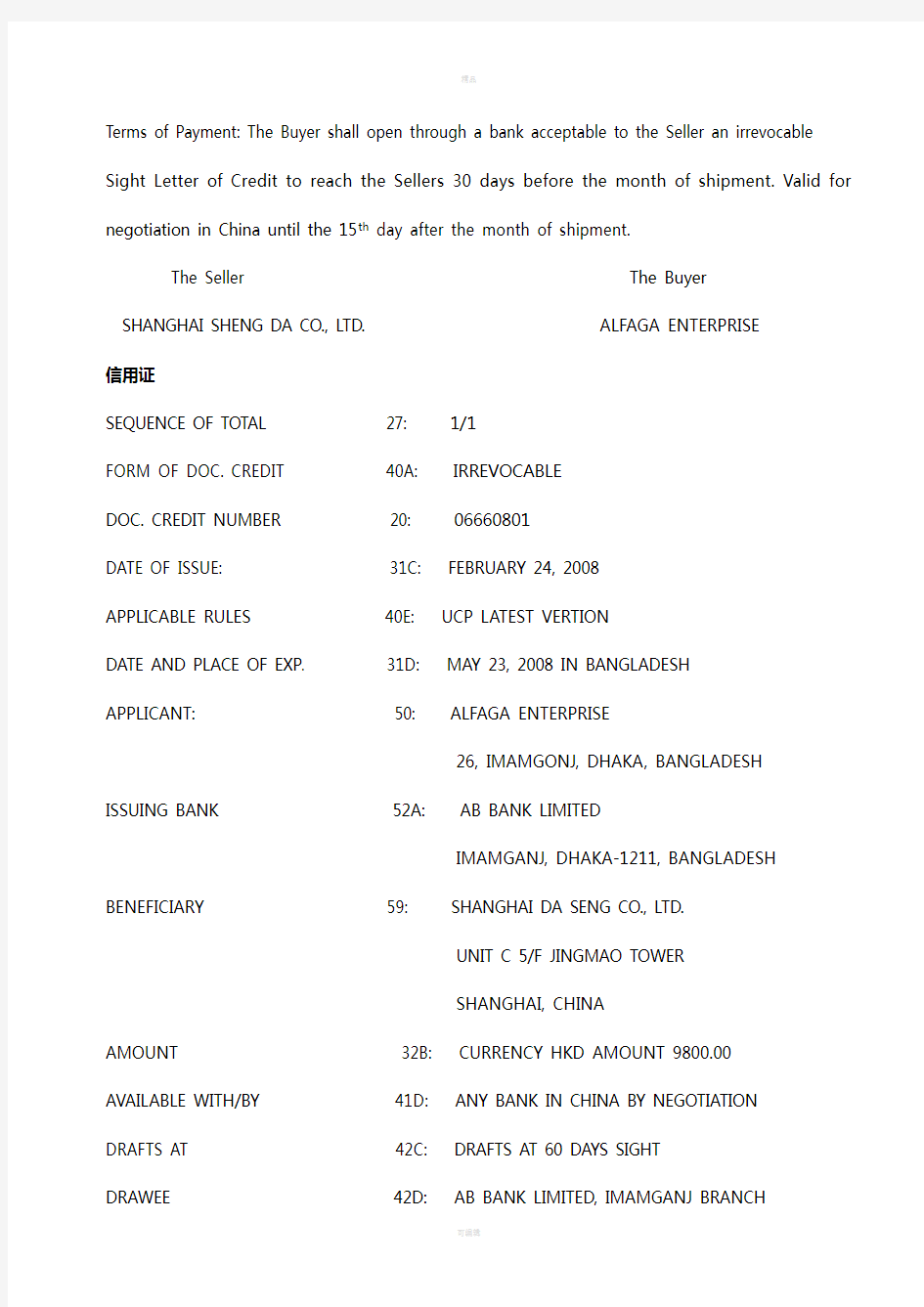

信用证

SEQUENCE OF TOTAL 27: 1/1

FORM OF DOC. CREDIT 40A: IRREVOCABLE

DOC. CREDIT NUMBER 20: 06660801

DATE OF ISSUE: 31C: FEBRUARY 24, 2008

APPLICABLE RULES 40E: UCP LATEST VERTION

DATE AND PLACE OF EXP. 31D: MAY 23, 2008 IN BANGLADESH APPLICANT: 50: ALFAGA ENTERPRISE

26, IMAMGONJ, DHAKA, BANGLADESH ISSUING BANK 52A: AB BANK LIMITED

IMAMGANJ, DHAKA-1211, BANGLADESH BENEFICIARY 59: SHANGHAI DA SENG CO., LTD.

UNIT C 5/F JINGMAO TOWER

SHANGHAI, CHINA

AMOUNT 32B: CURRENCY HKD AMOUNT 9800.00 AVAILABLE WITH/BY 41D: ANY BANK IN CHINA BY NEGOTIATION DRAFTS AT 42C: DRAFTS AT 60 DAYS SIGHT

DRAWEE 42D: AB BANK LIMITED, IMAMGANJ BRANCH

PARTIAL SHIPMENTS 43P: NOT ALLOWED

TRANSSHIPMENT 43T: NOT ALLOWE

LOADING/DISPATCHING/TAKING 44A: ANY CHINESE PORTS

IN CHARGE AT/FROM

TRANSPORTATION TO…44B: CHITTAGANG SEA PORT, BANGLADESH LATEST DATE OF SHIPMENT 44C: MAY 2, 2008

DESCRIP OF GOODS 45A: TAPE RULES

(1) 2000 DOZ PAIR MODEL: JH-395W

SIZE:3M x 16MM @ HKD3.60 PER DOZEN

CIF CHITTAGONG

(2) 500 DOZ PAIR MODEL: JH-386W

SIZE: 3M x 16MM @ HKD4.20 PER DOZEN

CIF CHITTAGONG

PACKING: EXPORT STANDARD SEAWORTHY

PACKING

DOCUMENTS REQUIRED 46A: + SIGNED COMMERCIAL INVOICE IN TRIPLICATE

+ SIGNED PACKING LIST IN TRIPLICATE

+ G.S.P. CERTIFICATE OF ORIGIN FORM A

+ BENEFICIARY’S CERTIFICATE STATING THAT

ONE SET OF ORIGINAL SHIPPING DOCUMENTS

INCLUDING ORIGINAL “FORM A” HAS BEEN

SENT DIRECTLY TO THE APPLICANT AFTER

THE SHIPMENT

+ INSURANCE POLICY OR CERTIFICATE

ENDORSED IN BLANK FOR 100 PCT OF CIF

VALUE, COVERING W.P.A. AND WAR RISKS

+ 3/3 PLUS ONE COPY OF CLEAN “ON BOARD”

OCEAN BILLS OF LADING MADE OUT TO

ORDER AND BLANK ENDORSED MARKED

“FREIGHT COLLECT”AND NOTIFY APPLICANT

ADDITIONAL CONDITION 47A: + ALL DRAFTS DRAWN HEREUNDER MUST BE

MARKED “DRAWN UNDER AB BANK LIMITED,

IMAMGANJ BRANCH CREDIT NO. 06660801

DATED FEBRUARY 24, 2008”

+ T/T REIMBURSEMENT IS NOT ACCEPTABLE DETAILS OF CHARGES 71B: ALL BANKING CHARGES OUTSIDE BANGLADESH

ARE FOR BENEFICIARY’S ACCOUNT PRESENTATION PERIOD 48: DOCUMENTS MUST BE PRESENTED WITHIN 15

DAYS AFTER THE DATE OF ISSUANCE OF THE

SHIPPING DOCUMENTS BUT WITHIN THE

VALIDITY OF THE CREDIT

CONFIRMATION 49: WITHOUT

INSTRUCT. TO NEGOTIATING 78: THE AMOUNT AND DATE OF NEGOTIATION OF BANK EACH DRAFT MUST BE ENDORSED ON THE

REVERSE OF THIS CREDIT

ALL DOCUMENTS INCLUDING BENEFICIARY’S

DRAFTS MUST BE SENT BY COURIER SERVICE

DIRECTLY TO US IN ONE LOT. UPON OUR RECEIPT

OF THE DRAFTS AND DOCUMENTS WE SHALL

MAKE PAYMENT AS INSTRUCTED BY YOU. Exercise 2

SALES CONFIRMATION

No. LT07060

DATE: AUG. 10, 2005

The Sellers: AAA IMPORT AND EXPORT CO. The Buyers: BBB TRADING CO.

222 JIANGUO ROAD P.O.BOX 203

DALIAN, CHINA GDANSK, POLAND

The undersigned Sellers and Buyers have agreed to close the following transactions according to the terms and conditions stipulated bellowed:

TOTAL USD45,600.00 TOTAL VALUE: U.S. DOLLARS FORTY FIVE THOUSAND SIX HUNDRED ONLY.

PORT OF LORDING: DALIAN

DESTINATION: GDANSK

TRANSSHIPMENT: ALLOWED

PARTIAL SHIPMENTS: ALLOWED

SHIPMENT: DECEMBER, 2005

INSURANCE: TO EFFECTED BY THE SELLERS FOR 110% INVOICE VALUE COVERING F.P.A.

OF PICC CLAUSE

PAYMENT: BY TRANSFERABLE L/C PAYABLE 60 DAYS AFTER B/L DATE, REACHING THE SELLERS 4 DAYS BEFORE THE SHIPMENT

GENERAL TERMS:

1. Reasonable tolerance in quality, weight, measurements, designs and colors is allowed, for which no claims will be entertained.

2. The buyers are to assume full responsibilities for any consequences arising from:

(a) the use of packing, designs or pattern made of order;

(b) late submission of specifications or any other details necessary for the execution of this sales confirmation;

(c) late establishment of L/C;

(d) late amendment to L/C inconsistent with the previsions of this sales confirmation.

David King 苏进

The Buyers The Sellers

Please sign, and return one copy

LETTER OF CREDIT

FORM OF DOC. CREDIT *40A: IRREVOCABLE

DOC. CREDIT NUMBER *20: 70/1/5822

DATE OF ISSSUE 31C: 051007

EXPIRY 31D: DATE 060115 PLACE POLAND

ISSUING BANK 51D: SUN BANK, P.O. BOX 201 GDANSK, POLAND APPLICANT *50: BBB TRADING CO.

P.O. BOX 203 GDANSK, POLAND BENEFICIARY *59: AAA IMPORT AND EXPORT CO.

222 JIANGUO ROAD, DALIAN, CHINA AMOUNT *32B: CURRENCY USD AMOUNT 45,600.00 AVAILABLE WITH/BY *41A: BANK OF CHINA DALIAN BRANCH

BY DEF PAYMENT

DEFERRED PAYM. DET. *42P: 60 DAYS AFTER B/L DATE

PARTIAL SHIPMENTS 43P: NOT ALLOWED

TRANSSHIPMENT 43T: ALLOWED

LOADING IN CHARGE 44A: SHANGHAI

FOR TRANSPORT TO…44B: GDANSK

LATEST DATE OF SHIP. 44C: 051231

DESCRIPT. OF GOODS 45A: 65% POLYESTER 35% COTTON LADIES SHIRTS

STYLE NO. 101 200 DOZ @ USD60/PCE

STYLE NO. 102 400 DOZ @ USD84/PCE

ALL OTHER DETAILS OF GOODS ARE AS PER

CONTRACT NO. LT07060 DATED AUG. 10, 2005.

DELIVERY TERMS: CIF GDANSK

(INCOTERMS 2000)

DOCUMENTS REQUIRED 46A:

1. COMMERCIAL INVOICE MUNUALY SIGNED IN 2 ORIGINALS PLUS 1 COPY MADE OUT TO DDD TRADING CO., P.O.BOX 211, GDANSK, POLAND

2. FULL SET (3/3) OF ORIGINAL CLEAN ON BOARD BILLS OF LADING PLUS 3/3 NON NEGOTIABLE COPIES, MADE OUT TO ORDER OF ISSUING BANK AND BLANK ENDORSED, NOTIFY THE APPLICANT, MARKED FREIGH PREPAID, MENTIONING GROSS WEIGHT AND NET WEIGHT.

3. ASSORTMENT LIST IN 2 ORIGINALS PLUS 1 COPY.

4. CERTIFICATE OF ORIGIN IN 1 ORIGINAL PLUS 2 COPIES SIGNED BY CCPIT.

5. MARINE INSURANCE POLICY IN THE CURRENCY OF THE CREDIT ENDORSED IN BLANK FOR CIF VALUE PLUS 30 PCT MARGIN COVERING ALL RISKS OF PICC CLAUSES INCLUDING CLAIMS PAYABLE IN POLAND.

ADDITIONAL COND. 47A:

+ ALL DOCS MUST BE ISSUED IN ENGLISH.

+ SHIPMENTS MUST BE EFFECTED BY FCL.

+ B/L MUST SHOWING SHIPPING MARKS: BBB, S/C L/T07060, GDAND, C/NO.

+ ALL DOCS MUST NOT SHOW THIS L/C NO. 70/1/5822.

+ FOR DOCS WHICH DO NOT COMPLY WITH L/C TERMS AND CONDITIONS, WE SHALL DEDUCT FROM THE PROCEEDS A CHARGE OF EUR50.00 PAYABLE IN USD EQUIVALENT PLUS ANY INCCURED SWIFT CHARGES IN CONNECTION WITH.

信用证审核中常见问题汇总

信用证审核中可能会发现的问题有: 信用证的性质 信用证未生效或有限制生效的条款; 信用证为可撤销的; 信开信用证中没有保证付款的责任文句; 信用证内漏列适用国际商会UCP规则条款 信用证未按合同要求加保兑: 信用证密押不符。 信用证有关期限 信用证中没有到期日(有效期); 到期地点在国外; 信用证的到期日和装运期有矛盾; 装运期、到期日或交单期规定与合同不符; 装运期或有效期的规定与交单期矛盾; 交单期限过短。 信用证当事人 开证申请人公司名称或地址与合同不符: 受益人公司名称或地址与合同不符。 信用证金额货币 信用证号码有矛盾; 信用证金额不够(不符合合同、未达到溢短装要求),金额大小写不一致; 信用证货币币种与合同规定不符。 汇票 付款期限与合同规定不符; 没有将开证行作为汇票的付款人。 分批和转运 分批规定与合同规定不符; 转运规定与合同规定不符; 装运港口与合同规定或成交条件不符;

目的地不符合同或成交条件; 装运期限与合同规定不符。 货物 货物品名规格不符; 货物数量不符; 货物包装有误: 商品单价有误; 贸易术语错误; 使用术语与条款有矛盾: 货物单价数量与总金额不吻合; 证中援引的合同号码与日期错误; 漏列溢短装规定。 单据 发票种类不当; 商业发票要求领事签证; 提单收货人一栏的填制要求不当; 提单抬头和背书要求有矛盾; 提单运费条款规定与成交条件矛盾; 正本提单全部或部分直寄客户; 产地证明出具机构有误(国外机构或无授权机构); 漏列必须提交的单据(如CⅣ成交条件下的保险单); 空运提单收货人不是正证行; 费用条款规定不合理; 运输工具限制过严; 要求提交的检验证书种类与实际不符; 要求提供客检证书; 保险单种类不对; 保险险别范围与合同规定不一致; 投保金额未按合同规定。

实训十一 信用证的审核与修改

实训十一信用证的审核与修改 实训目的与要求: 1.能够审核信用证 2. 能够修改信用证 重点: 能够审核并修改信用证 难点:能够审核并修改信用证 实训项目:根据背景资料审核并修改: http://10.99.36.252/icd3 实训指导: 要求说明: 请根据审证的一般原则和方法对收到的信用证进行认真细致的审核,列明信用证存在的问题并陈述要求改证的理由。 提示: 1.审核L/C 的商品货号是否与合同不一致。 2.审核金额(大写/小写)是否与合同不一致。 3. L/C 条款是否与合同相应条款不符。(例如:保险条款在合同中写明All Risks as perC.I.I dated 1/1/1982. 但L/C 显示War Risk and All risks. ) 4.付款方式是否不符合同要求。(例如:合同中为by sight L/C, 而信用证中为draft at 30days' sight. ) 注意:信用证本身常出现的问题: 1.注意L/C 的到期地点。 2.信开本信用证应写明"subject to UCP 600"。 3.注意信用证"三期",即:有效期、装运期和交单期。 4.L./C 中的"软条款"。(例如:要求卖方提交客检证书;正本B/L 全部或部分直寄客户。) 修改信用证应注意: --对信用证修改内容的接受或拒绝有两种表示形式: --收到信用证修改后,应及时检查修改内容是否符合要求,并分别情况表示接受或重新提出修改 ---对于修改内容要么全部接受,要么全部拒绝;部分接受修改中的内容是无效的; ---有关信用证修改必须通过原信用证通知行通知才算真实、有效;通过客户直接寄送的信用证修改申请书或修改书复印件不是有效的修改 ---明确修改费用由谁承担,一般按照责任归属来确定修改费用由谁承担

国际结算试题三篇

国际结算试题三篇 篇一:国际结算试题 简答题 1、简述福费廷业务特点。 2、简述循环信用证的循环原理。 3、简述托收项下出口押回与信用证项下出口押汇的区别。 4、简述远期D/P和D/A异同点。 5、简述国际保理业务及应用。 6、假远期信用证及应用。 7、汇票的抬头是指什么?有几种填写方法? 8、A公司出口一笔货物,提单日期为5月21日通过中国银行办理D/A30days after sight支付方式的托收手续。6月1日单到国外代收行,代收行当天即向付款人提示汇票。付款人应于何日付款?何日取得单据(不计优惠期)? 9、简述票据的特性。 10、信用证是什么?它有哪些作用 11、打包放款与预支信用证的异同。 12、备用证与银行保函的异同。? 参考答案 1、答:(1)主要提供中长期贸易融资(2)债权凭证的购买无追索权(3)融资金额一般较大(4)债权凭证须经担保(5)按规定的时间间隔出具债权凭证(6)主要以美元、欧元以及英镑作为计价货币

(7)业务项下的商品交易主要是资本性商品交易(8)绝大多数包买票据业务的债务以各种汇票或本票形式出现 2、答:循环信用证可分为按时间循环和按金额循环。 A、按时间循环信用证是规定可以按一定的时间周期循环使用信用证上约定的金额,直到达到信用证约定的期限或总金额为止的循环信用证。可分为非积累和可积累的两种。 非积累循环信用证指规定不能将上一个循环周期内未用完的信用证金额在下一个循环周期内积累使用。 可积累循环信用证指规定可以将上一个循环周期内未用完的信用证金额在下一个循环周期内积累使用。 B、按金额循环信用证是规定信用证每被使用一次之后,可以恢复到原金额被再度循环使用多次,直至达到信用证约定的次数或中金额为止的循环信用证。可分为自动循环、半自动循环和被动循环。 自动循环信用证指规定信用证每被使用一次后,指定兑现银行可以立即自动将其恢复金额再度循环使用。 半自动循环信用证规定信用证每被使用一次后,只要指定兑现银行没有在约定期限内收到开证行发出撤销循环的指示,即可自行将其恢复到原金额再度循环使用。 被动循环信用证规定信用证每被使用一次后,指定兑现银行必须在收到开证行发出允许循环的指示后,才能将其恢复到原金额再度循环使用。 3、答:托收项下出口押汇与信用证项下的出口押汇的根本区别在于

信用证实训

一、根据下列信用证回答问题 TO: BANK OF CHINA SHANGHAI BRANCH FROM: THE HONGKONG AND SHANGHAI BANKING CORPORATION NEW YORK BRANCH LC NO:1678 APPLICANT:HOME TEXTILES CO.LTD. 220 HILL STREET ,NEW YORK,NY.,U.S.A. BENIFICIARY: SHANGHAI TEXTILE IMP AND EXP CORPORATION 27 ZHONGSHAN ROAD SHANGHAI.P.R. CHINA. DATE OF ISSUE: 30 FEB 1997 EXPIRY DATE AND PLACE: 30 APR 1997 SHANGHAI AMOUNT: USD 64,500 (SAY U.S. DOLLARS SIXTY FOUR THOUSAND AND FIVE HUNDRED ONLY) AVAILABLE BY NEGOTIATION WITH ANY BANK AGAINST BENEFICIARY'S DRAFT AT 30 DAYS SIGHT DRAWN ON US SHIPMENT FROM SHANGHAI TO NEW YORK NOT LATER THAN 15 APR 1997 PARTIAL SHIPMENTS ALLOWED TRANSHIPMENT NOT ALLOWED DOCUMENTS REQUIRED: --COMMERCIAL INVOICE IN DUPLICATE --FULL SET CLEAN ON BOARD BILLS OF LADING MADE OUT OUR ORDER MARKED FREIGHT PREPAID NOTIFY APPLICANT --INSURANCE POLICY/CERTIFICATE COVERING W.A. AND W.R. AS PER CIC 1/1/1981 COVERING:10,000 METER 100 PCT COTTON PRINT 54/56" AT USD 6.45 PER METER CIF NEW YORK SHIPPING MARKS:

信用证练习题

第一章信用证一、练习题 (一)中英文术语、短语互译 1. 不可撤销信用证 2. 开证日期 3. 电汇索偿 4. 一切银行费用 5. 佣金 6. 出票根据 7. 正本单据 8. 通知行 9. 账户 10 保兑行 1. Applicant 2. Beneficiary 3. Negotiation Bank 4. Drawee Bank

5. Expiry Date 6. Documentary Credit 7. Documents Required 8. Special Conditions 9. Up to an Aggregate Amount of 10. The Full Name and Address of the Openers 二单项选择题 1.不可撤销信用证在信用证的有效期内,未经()的同意,开证行或开证人不得撤销或修改。 A. 受益人 B. 开证人 C. 开证行 D. 受益人 2.根据《UCP600》的规定,若信用证没有注明()字样,则认为该信用证为不保兑信用证。 A. Confirmed B. Revocable C. Revolving D. Transferable 3.在进料加工贸易中,经常先向外商购买原材料或配件,我方加工成品后再卖给该外商。为了避免上当受骗,我方应采用()比较稳妥。 A.保兑信用证 B. 可转让信用证 C. 预支信用证 D. 对开信用证 4.下列对信用证有效期的描述,属于直接写明具体日期的是()

A. Documents must be presented for negotiation within 10 days after the on board date of bill of lading B. Negotiation must be on or before the 15th day of shipment C. This L/C is valid for negotiation in China until Oct. 1. 2002 D. Documents to be presented to negotiation bank within 15 days after shipment. 5.根据《UCP600》的规定,如使用“于或约于”之类的词语限定装运日期,银行将视为在所述日期前后各()内装运,起讫日包括在内。 A. 3天 B. 5天 C. 7天 D. 10 天 6.下列词组中,表示“议付行”的是()。 A. Confirming Bank B. Opening Bank C. Negotiation Bank D. Advising Bank 7.根据《UCP600》的规定,若信用证没有特别说明,则信用证()。 A. 未注明“Transferable”字样或条款,即为可转让信用证。 B. 未注明“Irrevocable”字样,即为可撤销信用证。 C. 未注明“Confirmed”字样,即为不保兑信用证。

信用证审核和制单注意点

信用证审核和制单注意点 如果是直接出口,国外的信用证开到自己公司的名下,那么您的开户银行收到信用证后会直接通知您,并把正本或复印件(一般是复印件,如无必要,正本建议留在银行保存)交给您。如果是通过代理出口,信用证开到代理名下,那么就要及时敦促代理去查询,收到后让代理传真给您。在实务中,因为代理不熟悉你的客户,所以交接上容易出现问题。代理接到信用证却不知道是谁的,导致耽误,所以,一旦得知你的客户开证了,就要把名称、金额告诉出口代理,盯紧进度。一般说来,从客户开证,到咱们这边收到信用证,快则1周,慢则10天。跟随信用证一起交给你的,通常还有一页《信用证通知书》,这是你的银行出具的,主要列明了此份信用证的基本情况如信用证编号、开证行、金额、有效期等等,同时盖章。除了银行公章外,还会有个“印鉴相符”章或“印鉴不符,出货前请洽我行”一类的章。什么意思呢?因为目前信用证一般是通过电报传递的(通行的是SWIFT电传,一个银行专业的电讯服务机构,有特定的编码格式),理论上有伪造的风险,冒充银行名义开信用证。因此银行间会预留密码和印鉴,以兹核对。不过现实生活中这种现象很少见,因为信用证能通过SWIFT开立,基本就是真实的,印鉴不符的原因恐怕多为交接操作问题。所以,碰到“印鉴不符”的情况,也不必紧张,必要时咨询一下银行即可。 一,巧妙看懂信用证 接下来就是信用证本身的审核了。条款密密麻麻,但有个简便窍门。如前所述,信用证是通过SWIFT开立的,而SWIFT对信用证有专门格式,这个格式按照信用证条款的内容性质分门别类,给予固定的编号。也就是说,每个条款在顶头位置都有一个编号,根据此编号就可以知道这个条款是说什么的了。固定格式为:编号,条款属性:条款内容。例如:31DDATEANDPLACEOFEXPIRY:25/11/2005CHINA。“31D”就是编号,属性是“信用证有效期和有效地点”,知道这一点,我们就很容易理解“25/11/2005CHINA”相应的意思就是这份信用证的有效期是2005年11月25日,以中国为有效期地点,即在中国范围内,这份信用证在11月25日

如何审核信用证

如何审核信用证 一、审核信用证的实际作用和意义 1. 信用证的定义: 信用证, 指一项不可撤销的安排,无论其名称或描述如何,该项安排构成开证行对相符交单予以承付的确定承诺。 (Credit means any arrangement, however named or described, that is irrevocable and thereby constitute a definite undertaking of the issuing bank to honour a complying presentation.) 2. 意义和作用: 根据信用证的定义,只要受益人提交了与信用证条款相符的单据,开证行就必须承担付款的义务。因此,在履行合同的实务中,认真细致的审核信用证就成为是否能够安全及时收汇的关键环节。 二、审核信用证的依据 出口商,即信用证的受益人在审核信用证时的主要依据是: 1.买卖双方订立的《销售合同》或《成交确认书》; 2.国际商会的《跟单信用证统一惯例》(国际商会第600号 出版物,2007年修订本) 3.出口国国内的有关贸易政策和规定。 三、审核信用证的基本原则

1. 信用证条款的规定比合同条款更加严格,会影响安全收汇和顺利履行合同,或者卖方即受益人无法做到,或者条款之间互相矛盾,则应该作为信用证中存在的问题向信用证申请人提出修改要求。 2. 当信用证条款的规定比合同条款宽松时,则往往可以不要求申请人修改信用证。 四、审核信用证的基本要点 (一) 信用证本身方面说明的审核: 1. 信用证的类别: (1) 信用证是否为不可撤销的信用证: 《UCP600》规定,信用证只能为不可撤销的(IRREVOCABLE),如果为可撤销(REVOCABLE),则必须修改;有时虽然在信用证的类别栏目里面没有出现可“REVOCABLE”的字样,但是在信用证的附加条款里面出现“This is a revocable documentary credit, it is subject to cancellation or amendment at any time without prior notice.” ( 这是一张可撤销的信用证,它可不必预先通知,随时撤销或修改。)时,应该删去此条款,否则这张信用证就是可撤销的。 (2) 信用证是否为可转让的: 《UCP600》规定,只有特别注明“TRANSFERABLE”的信用证,才是可转让信用证,当受益人在合同要求信用证为可转让信用证,而信用证没有说明时,则必须修改。

修改信用证实训

信用证实训 一、根据下列合同审核并修改信用证 SALES CONFIRMATION S/C NO.:SPT-211 DATE: Jan.8, 2015 The Seller: SHANGHAI SPORTING GOODS IMP. & EXP. CORP Address: 215 HUQIU ROAD SHANGHAI CHINA The Buyer: PETRRCO INTERNATIONAL TRADING CO. Address: 1100 SHEPPARD AVENUE EAST SUITE406 PORT OF LOADING AND DESTINATION: From Shanghai to Vancouver with transshipment and partial shipment allowed. TIME OF SHIPMENT: During Mar. 2015 TERMS OF PAYMENT: The buyer shall open through a bank acceptable to the seller an irrevocable letter of credit at sight to reach the seller 30 days before the month of shipment valid for negotiation in Vancouver until the 15th day after the date of shipment. INSURANCE: To be covered by the seller for 110% of the invoice value against All Risks and War Risks as per the relevant ocean marine cargo clauses of the People’s Insurance Company of China dated 01/01/1981. REMARKS: 1.The Buyer shall have the covering letter of credit reach the seller 30 days before shipment, falling which the Seller reserves the right to rescind without further notice, or to regard as still valid whole or any part of this contract not fulfilled by the Buyer, or to lodge a claim for losses thus sustained, if any. 2.In case of any discrepancy in Quality/Quantity, claim should be filed by the Buyer within 130 days after the arrival of the goods at port of destination; while for quantity discrepancy, claim should be filed by the Buyer within 150 days after the arrival of the goods at port of destination. 3.For transactions concluded on C.I.F. basis, it is understood that the insurance amount will be for 110% of the invoice value against the risks specified in the Sales Confirmation. If additional insurance amount or coverage required, the Buyer must have the consent of the Seller before Shipment, and the additional premium is to be borne by the Buyer. 4.The Seller shall not hold liable for non-delivery or delay in delivery of the entire lot or a portion of the goods hereunder by reason of natural disasters, war or other causes of Force Majeure. However, the Seller shall notify the Buyer as soon as possible and furnish the Buyer within 15 days by registered airmail with a certificate issued by the China Council for the Promotion of International Trade attesting such event(S). 5.All disputes arising out of the performance of, or relating to this contract, shall be settled through negotiation. In case no settlement can be reached through negotiation, the case shall arbitration in

2010年6月单证员操作试题及答案 (2)资料

2010 年全国国际商务单证员专业考试 国际商务单证缮制与操作试题 一、根据下述合同内容审核信用证,指出不符之处,并提出修改意见。 (36 分) SALES CONTRACT THE SELLER: NO. WILL09068 SHANGHAI WILL TRADING. CO.,L TD. DATE: JUNE.1, 2009 NO.25 JIANGNING ROAD, SHANGHAI, CHINA SIGNED AT: SHANGHAI,CHINA THE BUYER: NU BONNETERIE DE GROOTE AUTOSTRADEWEG 6 9090 MEUE BELGIUM This Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the buyers agree to buy the under-mentioned goods according to the terms and Packing: IN CARTONS OF 50 PCS EACH Shipping Mark: AT SELLER’S OPTION Time of Shipment: DURING AUG. 2009 BY SEA Loading Port and Destination: FROM SHANGHAI, CHINA TO ANTWERP, BELGIUM Partial Shipment and Transshipment: ARE ALLOWED Insurance: TO BE EFFECTED BY THE SELLER FOR 110 PCT OF INVOICE V ALUE AGAINST ALL RISKS AND W AR RISK AS PER CIC OF THE PICC DATED 01/01/1981.

信用证审核的常错处

(1)经审核,信用证上的错误有: 1.到期地点错(31D) 按照合同信用证应该是装运后15天在中国到期,应改为:120630 IN CHINA。 2.受益人名称错(50) 按照合同,受益人名称应该是:SHANGHAI SHENHUA FOREIGN TRADE CO., LTD.。 3.信用证币制错(32B) 按照合同,应该是美元USD,应改为:USD15000,00。 4.汇票期限错(42C) 按照合同,应该是即期议付信用证,应改为:DRAFT A T SIGHT。 5.目的港错(44F) 按照合同,目的港是多伦多,不是温哥华,应改为:TORONTO, CANADA。 6.装运日期错(44C) 按照合同,最迟装运日是1208年6月15日,应改为:120615。 7.货物描述错(45A) 品名是:V ALVE SEA T INSENT,贸易术语不能省略,也不可以省略诸如合同号码等合同上规定要显示的内容。应改为:V ALVE SEA T INSENT, CIF TORONTO, AS PER CONTRACT NO SJ2012-JB02。 8.提单份数错(46A第1条) 一般情况下提单应该是“整套”,也就是FULL SET或3/3 SET,应改成:FULL SET ORIGINAL …… 或3/3 SET ORIGINAL ……。 9.保单加成错(46A第3条) 按照合同,保险金额是发票金额的110%,应改成A T 110 PERCENT OF THE INVOICE V ALUE。 10.交单期错(48) 合同规定交单期是15天,应改为:15 DA YS …… 。 (2)经审核,信用证存在以下问题: 1.合同规定信用证有效期为装运日后15天,即2012年10月30日,而信用证为2012年10月20日; 2.根据合同信用证的到期地点不应在英国,而应在中国。 3.受益人名称与合同有差异,名称应为“CO.”,而不是“CORP.”。 4.信用证金额大小写都有误,应是32400美元,SA Y U. S. DOLLARS THIRTY TWO THOUSAND FOUR HUNDRED ONLY。 5.根据合同中汇票期限应为即期,而信用证错为见票后30天远期。 6.根据合同,可以分批装运,信用证错为不可以分批。 7.根据合同,货号HE21的单价是USD18.50/PC,信用证错为USD18.00/PCS。 8.货物描述中的总金额应该是USD32400.00,信用证错为USD32040.00。 9.货物描述中的合同号错,应该为SH2012X826。 10.根据合同,保险险别是一切险和战争险,信用证错为一切险。 11.合同上的交单期为提单后15天,而信用证错为10天。 12.信用证金额、数量前面都没有5%的增减幅度,而合同中规定金额和数量允许的5%溢短装幅度。

030203审核信用证

题目要求和说明 售货确认书 SALES CONFIRMATION 编号: No. 205001 买方:电传/传真:日期: BUYERS:BELLAFLOR TELEX/FAX:0732-306-075 DATE:2009-05-09 地址:买方订单号: ADDRESS:BUYERS ORDER: 卖方:大连工艺品进出口公司电传/传真: SELLERS:DALIAN ARTS&CRAFTS IMPORT & EXPORT CORP TELEX/FAX: 地址: ADDRESS:NO. 23 FUGUI STR. DALIAN, CHINA 兹经买卖双方同意,成交下列商品,订立条款如下: The undersigned buyers and sellers have agreed to close the following transactions according to the terms and conditions

数量及总值均允许增减%。 With 10 percent more or less both in the amount and quantity of the S/C allowed. 总金额: Total Value:U.S.DOLLAR TWENTY TWO THOUSAND FIVE HUNDRED NINE AND CENTS FORTY. 包装: PACKING:IN CARTON 3 保险: INSURANCE:BY SELLER, FOR THE INVOICE VALUE PLUS 10PCT, AGAINST ALL RISKS AND WAR & S.R.C.C. RISKS. 装运时间: TIME OF SHIPMENT: JUNE. 1, 2009 装运港和目的港: PORT OF LOADING & DESTINATION: ANY PORT OF CHINA TO VIENNA 付款: PAYMENT: L/C AT SIGHT, ARRIVED THE SELLER BEFORE MAY 15TH, 2009. 一般条款:请参看本合同背面唛头: GENERAL TERMS AND CONDITIONS: (Please see overleaf) SHIPPING MARKS 买方签字:卖方签字: THE SIGNATURE OF BUYERS THE SIGNATURE OF SELLERS

信用证_综合制单实训

实训:综合制单 练习:根据下列国外来证及有关信息缮制发票、装箱单、原产地证书、提单、保单、汇票等 单据。AWC-23-522号合同项下商品的有关信息如下:该批商品用纸箱包装,每箱装10 盒,每箱净重为75公斤,毛重为80公斤,纸箱尺寸为113×56×30CM,商品编码为 6802.2110,货物由“胜利”轮运送出海。 FROM: HONGKONG AND SHANGHAI BANKING CORP., HONGKONG TO: BANK OF CHINA, XIAMEN BRANCH, XIAMEN CHINA TEST: 12345 DD. 010705 BETWEEN YOUR HEAD OFFICE AND US. PLEASE CONTACT YOUR NO. FOR VERIFICATION. WE HEREBY ISSUED AN IRREVOCABLE LETTER OF CREDIT NO. HKH123123 FOR USD8,440.00, DATED 040705. APPLICANT: PROSPERITY INDUSTRIAL CO. LTD. 342-3 FLYING BUILDING KINGDOM STREET HONGKONG BENEFICIARY: XIAMEN TAIXIANG IMP. AND EXP. CO. LTD. NO. 88 YILA ROAD 13/F XIANG YE BLOOK RONG HUA BUILDING, XIAMEN, CHINA THIS L/C IS AVAILABLE WITH BENEFICIARY’S DRAFT A T 30 DAYS AFTER SIGHT DRAWN ON US ACCOMPANIED BY THE FOLLOWING DOCUMENTS: 1.SIGNED COMMERCIAL INVOICE IN TRIPLICATE. 2.PACKING LIST IN TRIPLICATE INDICATING ALL PACKAGE MUST BE PACKED IN CARTON/ NEW IRON DRUM SUITABLE FOR LONG DISTANCE OCEAN TRANSPORTATION. 3.CERTIFICATE OF CHINESE ORIGIN IN DUPLICATE. 4.FULL SET OF CLEAN ON BOARD OCEAN MARINE BILL OF LADING MADE OUT TO ORDER AND BLANK ENDORSED MARKED “FREIGHT PREPAID” AND NOTIFY APPLICANT. 5.INSURANCE POLICY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK FOR THE VALUE OF 110 PERCENT OF THE INVOICE COVERING FPA/WA/ALL RISKS AND WAR RISK AS PER CIC DATED 1/1/81. SHIPMENT FROM: XIAMEN, CHINA .SHIPMENT TO: HONGKONG LATEST SHIPMENT 31 AUGUST 2004 PARTIAL SHIPMENT IS ALLOWED, TRANSSHIPMENT IS NOT ALLOWED. COVERING SHIPMENT OF: COMMODITY AND SPECIFICATIONS QUANTITY UNIT PRICE AMOUNT CIF HONGKONG. 1625/3D GLASS MARBLE 2000BOXES USD2.39/BOX USD4,780.00 1641/3D GLASS MARBLE 1000BOXES USD1.81/BOX USD1,810.00 2506D GLASS MARBLE 1000BOXES USD1.85/BOX USD1,850.00 SHIPPING MARK: P.7. HONGKONG NO. 1-400 ADDITIONAL CONDITIONS:

第一章信用证练习题

第一章信用证 一、练习题 (一)中英文术语、短语互译 1. 不可撤销信用证 2. 开证日期 3. 电汇索偿 4. 一切银行费用 5. 佣金 6. 出票根据 7. 正本单据 8. 通知行 9. 账户 10 保兑行 1. Applicant 2. Beneficiary 3. Negotiation Bank 4. Drawee Bank

5. Expiry Date 6. Documentary Credit 7. Documents Required 8. Special Conditions 9. Up to an Aggregate Amount of 10. The Full Name and Address of the Openers 二单项选择题 1.不可撤销信用证在信用证的有效期内,未经()的同意,开证行或开证人不得撤销或修改。 A. 受益人 B. 开证人 C. 开证行 D. 受益人 2.根据《UCP600》的规定,若信用证没有注明()字样,则认为该信用证为不保兑信用证。 A. Confirmed B. Revocable C. Revolving D. Transferable 3.在进料加工贸易中,经常先向外商购买原材料或配件,我方加工成品后再卖给该外商。为了避免上当受骗,我方应采用()比较稳妥。 A.保兑信用证 B. 可转让信用证 C. 预支信用证 D. 对开

信用证 4.下列对信用证有效期的描述,属于直接写明具体日期的是() A. Documents must be presented for negotiation within 10 days after the on board date of bill of lading B. Negotiation must be on or before the 15th day of shipment C. This L/C is valid for negotiation in China until Oct. 1. 2002 D. Documents to be presented to negotiation bank within 15 days after shipment. 5.根据《UCP600》的规定,如使用“于或约于”之类的词语限定装运日期,银行将视为在所述日期前后各()内装运,起讫日包括在内。 A. 3天 B. 5天 C. 7天 D. 10 天 6.下列词组中,表示“议付行”的是()。 A. Confirming Bank B. Opening Bank C. Negotiation Bank D. Advising Bank

审核信用证题目及答案-精选.pdf

1.根据提供的外销合同对信用证进行审核并提出修改信用证的意见。 SALES CONFIRMATION Sellers:Contract No.: HK012 TANGSHAN FOREIGN TRADE IMP.AND EXP. CORPORATION Date:FEB.12,2014 188 JIANSHE ROAD TANGSHAN ,CHINA Signed at: TANGSHAN Buyers: HONGYANG TRADING CO. LTD., HONGKONG 311 SOUTH BRIDGE STREET,HONGKONG The undersigned sellers and buyers have agreed to close the following transactions according to the terms and conditions stipulated below: Art. No. Description Quantity Unit Price AMOUNT ART NO. P97811 ART NO. P97801 AIR CONDITIONER(HUALIN G BRAND) KW-23GW KW-25GW 10000PCS 10000PCS @HKD50.00 @HKD50.00 CFR DUBAI HKD 500000.00 HKD 500000.00 20000PCS HKD 1000000.00 With 10 % more or less both in amount an quantity allowed at the seller’s option. Total Value: HKD 1000000.00 Packing: 2 PC PER CARTON Time of Shipment: APR. 30,2014 Loading port & Destination: FROM TIANJIN TO DUBAI VIA HONGKONG Insurance: To be effected by sellers for 110% of full invoice value covering up to only. Terms of payment: By Irrevocable Letter of Credit to be available by sight draft to reach the sellers before MAR.10,2014 and to remain valid for negotiation in China until the 15th day after the foresaid Time of Shipment. The L/C must specify that transshipment and partial shipments are allowed. Shipment Marks:A.B.C./DUBAI/NOSI-20000/MADE IN CHINA

TMT国际贸易实训_上海金海贸易公司 实验九 修改信用证

实验九修改信用证 根据你的审证结果草拟改证函 金海贸易公司 GOLDEN SEA TRADING CORPORATION ---------------------------------------------------------------------------------------------------------------------- ADD: 8TH FLOOR, JIN DU BUILDING, TEL: 0086-21-64331255 277 WU XING ROAD, FAX: 0086-21-64331256 SHANGHAI, CHINA ---------------------------------------------------------------------------------------------------------------------- TO: F.L.SMIDTH & CO. A/S FAX: (01)20 11 90 DATE: APRIL 25, 2003 Dear Sirs your L/C No. FLS-JHLC06 to hand, but we are quite sorry to find that it contains some discrepancies with the S/C. Please instruct your bank to amend the L/C as quickly as possible. The L/C is to be amended as follows: ●The place of expiry shall be "In China", in stead of "at our counter". ●The address of applicant is 77, Vigerslev, Alle, DK-2500 Valley, and Copenhagen, Denmark, in stead of ‘DK-2600……' ●The name of the goods is YE803 26' and TE600 24', instead of YE803 24' and TE600 26'. * Delete the clause "1/3 original B/L……".And it shall be "3/3 original clean shipped on board marine bill of lading ..."instead of "2/3 original clean shipped on board marine bill of lading..." ●The S/C No. should be JH-FLSSC06, instead of FLS9711. ●The transshipment is allowed anywhere, not 'transshipment is allowed only in Hong Kong'. * Documents to be presented within 15 days after the date of issuanceOf the transport documents instead of within 5 days. We are looking forward to hearing from you soon. Yours faithfully, GOLDEN SEA TRADING CORP. Manager MARY SHENG