衍生产品市场 课后答案 第二章

Chapter 2

An Introduction to Forwards and Options

Question 2.1

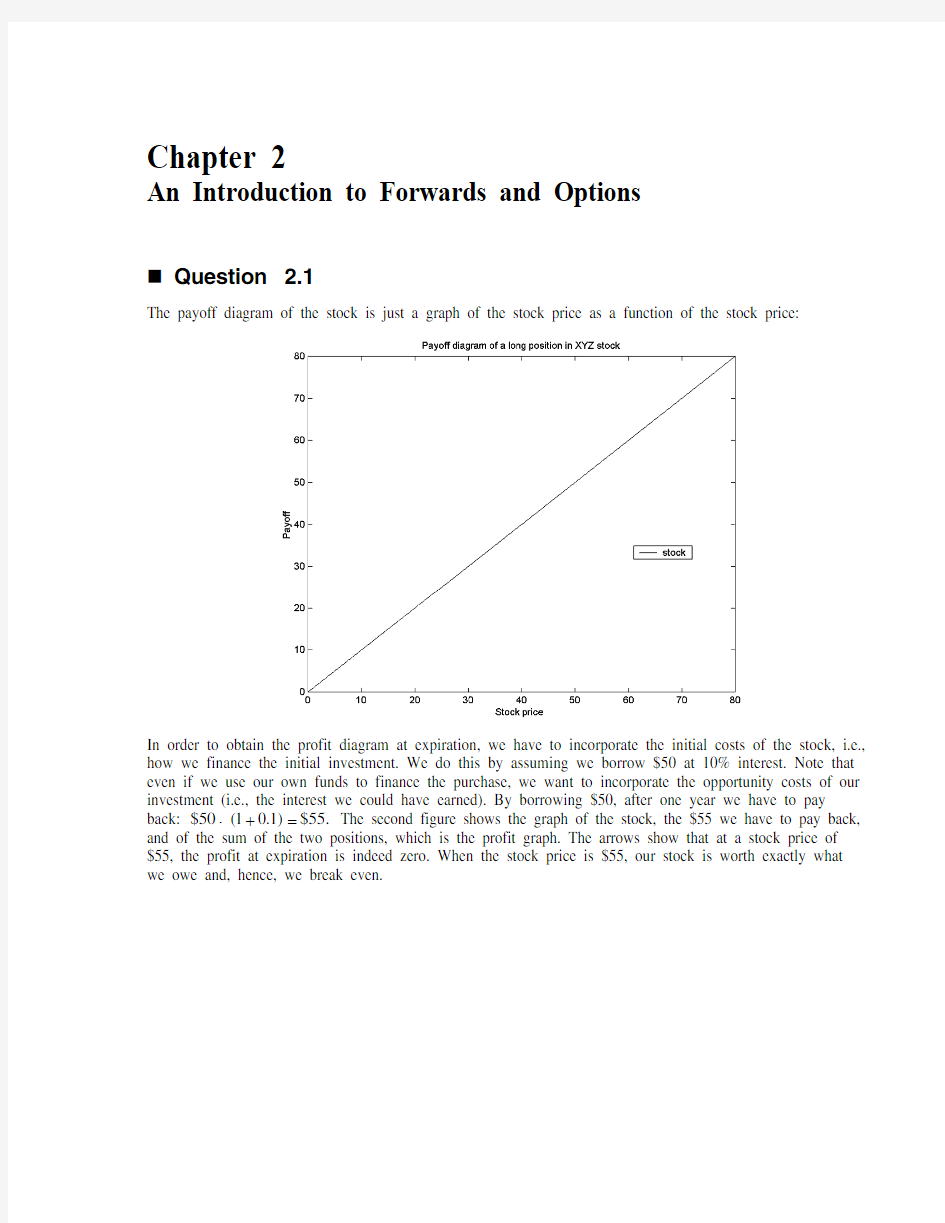

The payoff diagram of the stock is just a graph of the stock price as a function of the stock price:

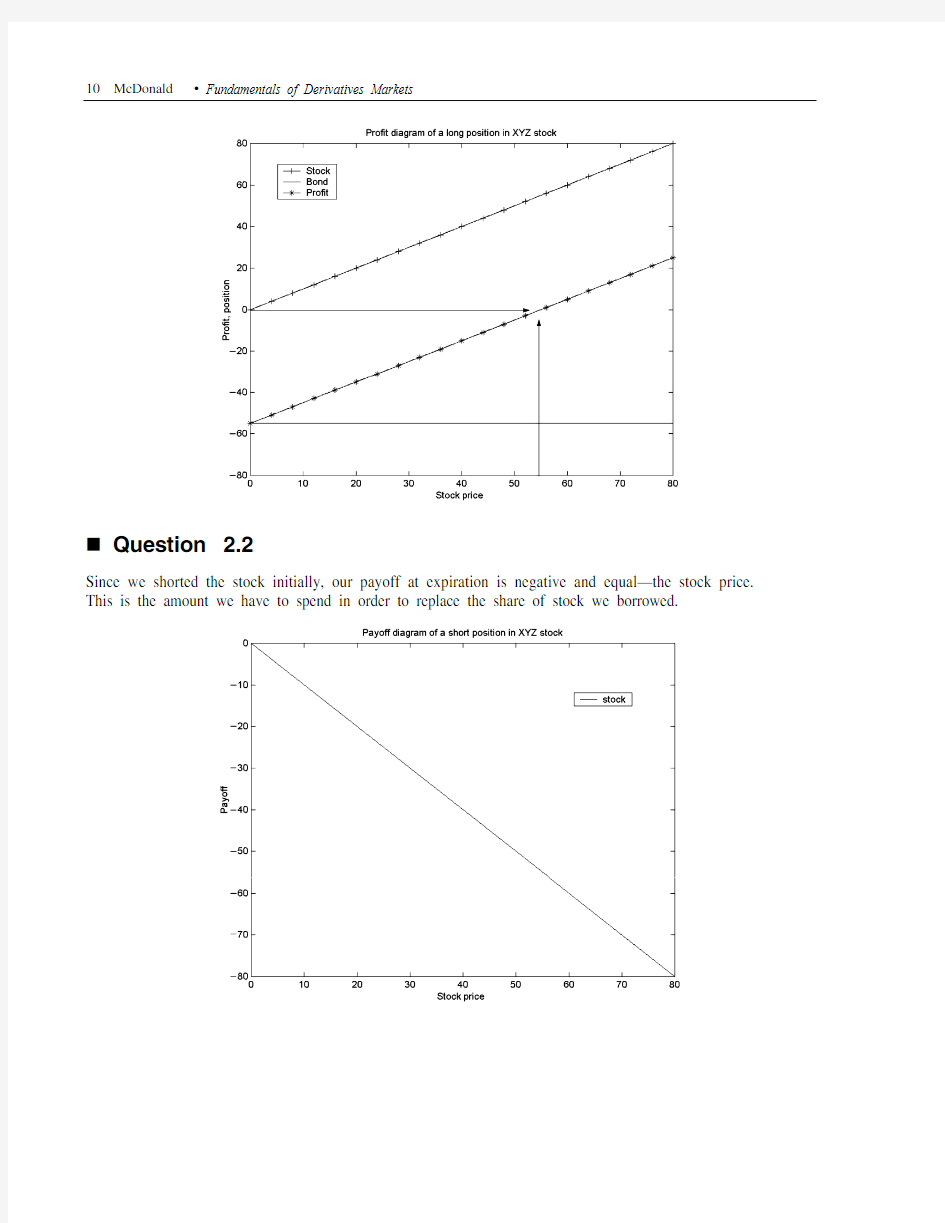

In order to obtain the profit diagram at expiration, we have to incorporate the initial costs of the stock, i.e., how we finance the initial investment. We do this by assuming we borrow $50 at 10% interest. Note that even if we use our own funds to finance the purchase, we want to incorporate the opportunity costs of our investment (i.e., the interest we could have earned). By borrowing $50, after one year we have to pay back: $50(10.1)$55.

×+= The second figure shows the graph of the stock, the $55 we have to pay back, and of the sum of the two positions, which is the profit graph. The arrows show that at a stock price of $55, the profit at expiration is indeed zero. When the stock price is $55, our stock is worth exactly what we owe and, hence, we break even.

10 McDonald ? Fundamentals of Derivatives Markets

Question 2.2

Since we shorted the stock initially, our payoff at expiration is negative and equal—the stock price. This is the amount we have to spend in order to replace the share of stock we borrowed.

Chapter 2 An Introduction to Forwards and Options 11 In order to obtain the profit diagram at expiration, we have to lend out the money we received from the short sale of the stock. We do so by buying a bond for $50. After one year we receive from the investment in the bond: $50(10.1)$55.

×+= The second figure shows the graph of the payoff of the shorted stock, the money we receive from the investment in the bond, and the sum of the two positions, which is the profit graph. The arrows show that at a stock price of $55, the profit at expiration is indeed zero. At $55, the amount of money we receive from our bond investment is exactly offset by the amount of money we need to buy back the one share of stock we borrowed.

Question 2.3

The position that is the opposite of a purchased call is a written call. A seller of a call option is said to be the option writer, or to have a short position in the call option. The call option writer is the counterparty to the option buyer, and his payoffs and profits are just the opposite of those of the call option buyer. Similarly, the position that is the opposite of a purchased put option is a written put option. Again, the payoff and profit for a written put are just the opposite of those of the purchased put.

It is important to note that the opposite of a purchased call is NOT the purchased put. If you do not see why, please draw a payoff diagram with a purchased call and a purchased put.

Question 2.4

1. The payoff to a long forward at expiration is equal to:

=?

Payoff to long forward Spot price at expiration forward price

12 McDonald ? Fundamentals of Derivatives Markets

Therefore, we can construct the following table:

Price of asset in 6 months Agreed forward price Payoff to the long forward

40 50 ?10

45 50?5

50 500

55 505

60 5010

2. The payoff to a purchased call option at expiration is:

=?

Payoff to call option max[0,spot price at expiration strike price] The strike price given is equal to $50. Therefore, we can construct the following table:

Price of asset in 6 months Strike price Payoff to the call option

40 50

45 500

50 500

55 505

60 5010

3. If we compare the two contracts, we immediately see that the call option has a protection for adverse

movements in the price of the asset.

If the spot price is below $50, the buyer of the call option is able to walk away and does not incur a loss; whereas, the holder of the long forward position incurs a loss since he is obligated to buy the asset for $50.

If the spot price is above $50, the holder of the call option and the holder of the long forward position have identical payoffs. Therefore, the call option should be more expensive due to this attractive walk away feature.

Question 2.5

1. The payoff to a short forward at expiration is equal to:

Payoff to short forward forward price spot price at expiration

=?

Therefore, we can construct the following table:

Price of asset in 6 months Agreed forward price Payoff to the short forward

40 50 10

45 505

50 500

55 50?5

60 50?10

Chapter 2 An Introduction to Forwards and Options 13

2. The payoff to a purchased put option at expiration is:

=?

Payoff to put option max[0,strike price spot price at expiration] The strike price given is equal to $50. Therefore, we can construct the following table:

Price of asset in 6 months Strike price Payoff to the put option

40 50 10

45 505

50 500

55 500

60 500

3. The same logic as in Question 2.4(3) applies. If we compare the two contracts, we see that the put

option holder is protected from increases in the price of the asset.

If the spot price is above $50, the buyer of the put option is able to walk away and does not incur a loss; whereas, the holder of the short forward position incurs a loss since he is obligated to sell the asset for $50.

If the spot price is above $50, the holder of the put option and the holder of the short forward position have identical payoffs. Therefore, the put option should be more expensive due to this walk away feature.

Question 2.6

We need to solve the following equation to determine the effective annual interest rate: $91(1)$100.

r

×+=

We obtain 100/9110.0989,

r=?= which means that the effective annual interest rate is approximately 9.9%. Remember that when we drew profit diagrams for the forward or call option, we drew the payoff on the vertical axis, and the index price at the expiration of the contract on the horizontal axis. Since the default-free zero-coupon bond pays $100 regardless of the index price, the payoff diagram is just a horizontal line equal to $100 (on the y-axis).

The textbook provides the answer to the question concerning the profit diagram in the section “Zero-Coupon Bonds in Payoff and Profit Diagrams.” When we were calculating profits, we saw that we had to find the future value of the initial investment. In this case, our initial investment is $91. How do we find the future value? We use the current risk-free interest rate and multiply the initial investment by it. However, as our bond is default-free, and does not bear coupons, the effective annual interest rate is exactly the 9.9% we have calculated before. Therefore, the future value of $91 is $91(10.0989)$100,

×+= and our profit in six months is zero! In general, by incorporating the time value of money in our profit diagrams, all risk free borrowing and lending has no affect on the profit diagrams for any investment strategy.

14 McDonald ? Fundamentals of Derivatives Markets

Question 2.7

1. It does not cost anything to enter into a forward contract—we do not pay a premium. Therefore, the payoff diagram of a forward contract coincides with the profit diagram:

2. We have seen in Question 2.1, that in order to obtain the profit diagram at expiration of a purchase of

XYZ stock, we have to finance the initial investment. We did so by borrowing $50. After one year we had to pay back: $50(10.1)$55.×+= Therefore, our total profit at expiration from the purchase of a stock that was financed by a loan was: $$55,T S ? where S T is the value of one share of XYZ at

expiration. This profit from buying the stock with borrowed funds is the same as the profit from our long forward contract. Both positions require zero initial cash and have the same payoff, hence there is no advantage in investing in either the stock or the forward contract.

3.

The dividend is only paid to the owner of the stock. The owner of the long forward contract is not entitled to receive the dividend, because she only has a claim to buy the stock in the future for a given price, but she does not own it yet. Therefore, it does matter now whether we own the stock or the

long forward contract. Because everything else is the same as in Parts (1) and (2), it is now beneficial to own the share. We can receive an additional payment in the form of the dividend if we own the stock at the ex-dividend date. This question hints at the very important fact that we have to be careful to take into account all the benefits and costs of an asset when we try to compare prices. We will

encounter similar problems in later chapters. Question 2.8

As in Question 2.7(2), there will be no advantage in either buying the stock or taking a long forward position if buying the stock with borrowed money has the same profit/payoff diagram as a long forward position. Note that the payoff and profit are the same since these strategies have zero initial cost. The payoff/profit of a long forward contract with a price for delivery of $53 is equal to $$53,T S ? where S T is the (unknown) value of one share of XYZ in one year. We must now determine what interest rate makes

Chapter 2 An Introduction to Forwards and Options 15

the buying stock with borrowed money strategy have the same profit. If we borrow $50 today to buy one share of XYZ stock (that costs $50), we have to repay in one year: $50(1).r ×+ Our total profit is therefore: $$50(1).T S r ?×+ Now we can equate the two profit equations and solve for the interest rate r :

$$53$$50(1)$53$50(1)

$531$50

0.06T T S S r r r r ?=?×+?

=×+??=?=

Therefore, the 1-year effective interest rate that is consistent with no advantage to either buying the stock or forward contract is 6%.

Question 2.9

1. If the forward price is $1,100, then the long position of the one-year forward contract receives in

one year a profit of: $$1,100,T S ? where S T is the (unknown) value of the S&R index in one year. Remember that it costs nothing to enter the forward contract.

Let us again follow our strategy of borrowing money to finance the purchase of the index today, so

that there is zero initial cost. If we borrow $1,000 today to buy the S&R index (that costs $1,000), we have to repay in one year: $1,000(10.10)$1,100.×+= Our total profit in one year from borrowing to buy the S&R index is therefore: $$1,100.T S ? The profits from the two strategies are identical.

2. Compared to the forward price of $1,110, the forward price of $1,200 is worse for our long position

since we are now obligated to buy at a higher price. For example, suppose the index after one year is $1,150. We would have made $50 with our long position in Part (1), but now, with a forward price of $1,100, we are losing $50. As there was no advantage in buying either the index with borrowed money or going long forward at a price of $1,100, we now need to be “bribed” to enter into the

off-market forward contract. We need to find an equation that makes all three strategies (i.e., the two long forward positions and the buying index with borrowed money) equivalent.

As a reminder, the long forward position (at $1,100) and the buying the index with borrowed money

has a profit of $$1,100.T S ? Let x be the amount of money we receive today for entering in the higher priced $1,200 off-market forward contract. Note that we should receive money. When invested at the 10% interest rate, we will receive 1.1.x × Our profit from receiving the premium and entering into the off market long forward position at $1,200 is 1,200 1.1.T S x ?+ Equating this with the profit from the $1,100 forward contract (and/or buying the index with borrowed money) $$1,100T S ? we have

1,200 1.11,100

1.1100

100/1.190.91T T S x S x x ?+=??=?==

Hence we must receive $90.91 today to be willing to enter into a long forward contract at $1,200.

16 McDonald ? Fundamentals of Derivatives Markets

3. Similarly, the forward price of $1,000 is advantageous relative to a $1,100 forward price and we will

have to pay a premium in order for there to be no advantage of one over the other. Proceeding as

before, let x be the amount of money we pay for entering in the lower priced $1,200 off-market

forward contract. To arrive at our profit, we will borrow the x dollars at 10%.

Our profit from borrowing the premium amount and entering into the off market long forward position

at $1,000 is 1,000 1.1.T S x ?? Equating this with the profit from the $1,100 forward contract (and/or buying the index with borrowed money) $$1,100T S ? we have

1,000 1.11,100

100 1.1100/1.190.91T T S x S x

x ??=??=?==

Hence we would be willing to pay $90.91 today to enter into a long forward contract at $1,000. Question 2.10

1. Figure

2.6 depicts the profit from a long call option on the S&R index with 6 months to expiration

and a strike price of $1,000 with the future price of the option premium equal to $95.68. The profit of the long call option is max[0,$1,000]$95.68T S ?? where S T is the (unknown) value of the S&R index at expiration of the call option (six months).

The S&R index price at which the call option profit diagram intersects the x -axis is the point of

zero profit. Since the option payoff, max[0,$1,000],T S ? must be greater than zero at zero profit (to cover the premium), zero profit is at the point where 1,00095.68T S ?= which is $1,095.68.T S =

2. The profit of the 6 month forward contract with a forward price of 1,020 is 1,020.T S ? In order to

find the S&R index price at which the call option and the forward contract have the same profit, we need to find the value of S T such that

1,020max[0,$1,000]$95.68.T T S S ?=??

Since the option must have a premium, one can see from the graph that the intersection of the two

profit diagrams must occur to the left of the “kink” in the option profit function (i.e., the option is out-of-the-money). This makes sense, for if the option is in-the-money, the forward and the option have the same payoff which implies the option has a lower profit since it requires a premium.

Mathematically, we can show this by noting if 1,000T S > then the left hand side of the above

equation is 1,020T S ?which is greater than the right hand side, 1,095.68.T S ? Since T S must be less than 1,000 for the two lines to intersect, we can solve $$1,020$95.68$924.32,T T S S ?=??= which is the value we were asked to verify.

Question 2.11

1. Figure

2.8 depicts the profit from a long put option on the S&R index with 6 months to expiration and

a strike price of $1,000 with the future value of the put premium equal to $75.68. The profit of the long put option is max[0,$1,000]$75.68T S ?? where S T is the (unknown) value of the S&R index at expiration of the put option (six months).

The S&R index price at which the put option profit diagram intersects the x -axis is the point of zero

profit. Since the option payoff, max[0,$1,000],T S ? must be greater than zero at zero profit (to cover the premium), zero profit is at the point where 1,00075.68T S ?= which is $924.32.T S =

Chapter 2 An Introduction to Forwards and Options 17

2. In order for the profit of the put option to be equal to a short forward position, the option

must be out-of-the-money (i.e.,1,000)T S > for they have the same payoff if the option is in-the-

money and there is a premium to the option. So we must solve for the point where the short

forward position’s profit 1,020T S ? equals the profit of the out-of-the-money put ?75.68. This implies 1,02075.681,095.68T S =+= which was to be shown. Notice that we use the term “profit” even though it is a “loss”; i.e., negative profits are losses.

Question 2.12

1. Long Forward. The maximum loss occurs if the stock price at expiration is zero (the stock price

cannot be less than zero, because companies have limited liability). The forward then pays 0—forward price. The maximum gain is unlimited. The stock price at expiration has no absolute bound, and the profit of the long forward position becomes arbitrarily as large as the stock price at expiration does. 2. Short Forward. The profit for a short forward contract is forward price—stock price at expiration. Since there is no absolute bound to the stock price, the short forward position has an unlimited

potential for loss. The maximum gain occurs if the stock price is zero and we are able sell a worthless stock for the forward price.

3. Long Call. We will not exercise the call option we purchased if the stock price at expiration is less than the strike price (i.e., the option is out-of-the-money). Hence, if the call option is out-of-the-

money, the option holder’s maximum loss is the future value of the premium we paid initially to buy the option. As the stock price can grow without bound, so can the payoff to the option; hence the

profit is unlimited as the stock price goes to infinity.

4. Short Call. We have no control over the exercise decision when we write a call. The buyer of the call option decides whether to exercise or not and will only exercise it when it is in-the-money (i.e., when the stock price is greater than the strike price). As we have the opposite side, we will never receive a positive payoff at expiration. Our profit is maximized when the option expires out-of-the-money, the profit being the future value of the premium. The maximum loss is unbounded since the stock price at expiration can be very large and has no bound. At very large stock prices, we are obligated to sell a very valuable stock for a relatively low strike price.

5. Long Put. We will not exercise the put option if the stock price at expiration is larger than the strike price. Consequently, the only thing we lose whenever the terminal stock price is larger than the strike is the future value of the premium we paid initially to buy the option. We will profit from a decline in the stock prices. However, stock prices cannot be smaller than zero, so our maximum gain is restricted to strike price less the future value of the premium and it occurs at a terminal stock price of zero.

6.

Short Put. We have no control over the exercise decision when we write a put. The buyer of the put option decides whether to exercise or not, and he will only exercise it if the option is in-the-money (i.e., the stock price is lower than the strike price). As we have the opposite side, we never have a payoff at the expiration of the put option. Our profit is capped to the future value of the premium

when the option is out-of-the-money (i.e., the stock price is higher than the strike price). The put option writer has a negative payoff whenever the stock price is smaller than the strike. When

the stock price is as low as possible (equal to zero) we lose the strike price because somebody sells us a worthless asset for the strike price. This is the maximum loss as we are only compensated by the future value of the premium we received.

18 McDonald ? Fundamentals of Derivatives Markets

Question 2.13

In order to be able to draw profit diagrams, we need to find the future values of the call premia. They are: 1. 35-strike call: $9.12(10.08)$9.8496

×+=

2. 40-strike call: $6.22(10.08)$6.7176

×+=

3. 45-strike call: $

4.08(10.08)$4.4064

×+=

We can now graph the payoff and profit diagrams for the call options. The payoff diagram looks as follows:

We get the profit diagram by deducting the option premia from the payoff graphs. The profit diagram looks as follows:

Chapter 2 An Introduction to Forwards and Options 19 Before considering the payoff diagrams, the call’s strike price is the price at which you have the option

to buy. The lower the buying price, the more valuable the call option (all else equal). As to the payoff diagram, the 35-strike call’s payoff is equal to the other two’s payoffs when the stock price expires below 35, and strictly above the others when the stock price is above 35. Since its payoff is greater than or equal to the other two options, it must be the most valuable contract. Similarly, the 40-strike call has a payoff larger than the 45-strike call when the stock price is above 40 (they both pay off zero when the stock price is below 40). Hence the 40-strike call is more valuable than the 45-strike call.

As an aside, if the option premium of the 35-strike call was less than the premium of the 40-strike call, the 35-strike profit would be above the 40-strike profit, regardless of the stock price at expiration. Since profits take into consideration the initial cash flows, the 35-strike would be a superior investment relative to the 40-strike call (we will see this implies an arbitrage opportunity).

Question 2.14

In order to be able to draw profit diagrams, we need to find the future values of the put premia. They are: 1. 35-strike put: $1.53(10.08)$1.6524

×+=

2. 40-strike put: $

3.26(10.08)$3.5208

×+=

3. 45-strike put: $5.75(10.08)$6.21

×+=

We get the following payoff diagrams:

20 McDonald ? Fundamentals of Derivatives Markets

We get the profit diagram by deducting the option premia from the payoff graphs. The profit diagram looks as follows:

Before considering the payoff diagrams, the put’s strike price is the price at which you have the option

to sell. The higher the selling price, the more valuable the put option (all else equal). As to the payoff diagram, the 45-strike put’s payoff is equal to the other two’s payoffs when the stock price expires above 45, and strictly above the others when the stock price is below 45. Since its payoff is greater than or equal to the other two options it must be the most valuable contract. Similarly, the 40-strike put has a payoff larger than the 35-strike put when the stock price is below 40 (they both payoff zero when the stock price is above 40). Hence the 40-strike put is more valuable than the 35-strike put.

As an aside, if the option premium of the 45-strike put was less than the premium of the 40-strike put, the 45-strike profit would be above the 40-strike profit, regardless of the stock price at expiration. Since profits take into consideration the initial cash flows, the 45-strike put would be a superior investment relative to the 40-strike put (we will see this implies an arbitrage opportunity).

Question 2.15

When we found the equivalence between a long forward position and a loan-financed stock index purchase, we relied on knowing today what our interest on the loan is. There was no uncertainty about the payment to be made. If we were to finance the purchase of the index by short selling IBM stock, we would introduce uncertainty in our dollar amount being owed, because the future value of the IBM stock is unknown today. Therefore, we could not calculate today the amount to be repaid, and it would be impossible to establish an equivalence between the forward and loan-financed index purchase today.

The calculation of a profit diagram would only be possible if we assumed an arbitrary value for IBM at expiration of the futures. We could then draw many profit diagrams with different assumed values for IBM to get an idea of the many possible profits we could make; i.e., the profit lines would shift depending on different values of IBM which would imply different borrowing rates. Alternatively, we could create a

3-dimensional profit diagram, with two axes (the x-axis and y-axis) being the S&R value and the IBM value and the third axis (the z-axis) being the profit.

Chapter 2 An Introduction to Forwards and Options 21

Question 2.16

The following is a copy of an Excel spreadsheet that solves the problem:

金融衍生品市场概述

金融衍生品市场及其工具 一、金融衍生品的概念与特征 1、金融衍生品又称金融衍生工具,建立在基础产品或基础变量之上,其价格取决于基础金融产品价格(或数值)变动的派生金融产品。其基础产品不仅包括现货金融产品,也包括金融衍生工具。基础变量:利率、汇率、通胀率、价格指数、各类资产价格及信用等级等。金融衍生品在形式上表现为一系列的合约,合约中载明交易品种、价格、数量、交割时间及地点等。 2、目前较为普遍的金融衍生品合约有:金融远期、金融期货、金融期权、金融互换和信用衍生品等。 二、金融衍生品市场的交易机制 根据交易目的的不同,金融衍生品市场上的交易主体划分为四类: 交易目的不同,交易主体可分为 套期保值者:又称风险对冲者,从事衍生品交易是为了减少未来的不确定性,降低甚至消除风险。 投机者:利用不同市场上的定价差异,同时在两个或两个以上的市场中进行交易,以获取利润的投资者 套利者:利用不同市场的价格差异,获取无风险收益。举例:美元利率3%,日元利率1%,投机者获取2%利差 经纪人:交易中介,以促成交易、收取佣金为目的 三、主要的金融衍生品 1、金融远期 (1)金融远期合约是最早出现的一类金融衍生品,合约的双方约定在未来某一确定日期按事先商定的价格,以预先确定的方式买卖一定数量的某种金融资产。 (2)远期合约是一种非标准化的合约类型,没有固定的交易场所。 (3)优点:自由灵活;缺点:降低流动性、加大交易风险。 (4)比较常见的远期合约主要有远期利率协议、远期外汇合约、远期股票合约。 2、金融期货 (1)金融期货是指交易双方在集中性的交易场所,以公开竞价的方式所进行的标准化金融期货合约的交易。 (2)金融期货合约就是协议双方同意在未来某一约定日期,按约定的条件

第二章练习题(含答案)

第二章地球上的大气练习题 读大气受热过程图,回答1-2题。 1.图中() A. 晴朗天气,a大部分为大气吸收 B. 湖泊湿地,b能和缓的加热大气 C. 二氧化碳增多,c较少补偿地面失热 D. 冰雪地面,a→b的转化率增加 2.甲、乙、丙代表太阳辐射能在自然界常见的三种类型,则() 读下列图表,回答3-4题。 3.下列说法正确的是()。 A.北京晴转多云,最低气温出现在午夜 B.上海中雨,可能诱发滑坡、泥石流灾害 C.哈尔滨有雾,大气能见度低 D.西宁晴,外出应做好防晒、防中暑准备 4.该日上海与北京最高气温不同,下图中能正确解释其根本原因的序号是()。 A.① B.② C.③ D.④ 左图为南昌附近一个蔬菜大棚的照片,右图为地球大气受热过程示意图,图中数字代表 某种辐射。回答5-6题。 5.乙图中()。 A.①能量大部分被大气所吸收 B.②是近地面大气的根本热源 C.③只出现在夜晚 D.④表示散失的少量长波辐射 6.照片拍摄季节,南昌的农民一般会给大棚覆盖黑色尼龙网,而不是我们常见的白色塑料薄膜或者玻璃大棚。照片拍摄的时间以及这样做的目的分别是()。 A.7-8月;削弱①以减少农作物水分蒸腾 B.10-11月;阻挡②以防止夜间温度过低 C.12-次年1月;增加③以提高土壤的温度 D.6-7月;增强④以降低白天大气的温度 据石家庄机场透露,7日,16时30分,受雾霾影响 石家庄机场能见度由1400米骤降至100米,导致55个

航班被迫取消。16时58分石家庄机场能见度提高,达到起飞标准,第一个离港航班NS3267石家庄至深圳顺利起飞,机场航班陆续恢复正常。下图为我国四个雾霾多发地区。回答7-8题。 7.雾霾天气使能见度降低的原因之一是: A.雾霾吸收地面辐射,增强大气逆辐射 B.雾霾削弱了地面辐射 C.雾霾对太阳辐射有反射作用 D.雾霾改变了太阳辐射的波长 8.图中四地深秋初冬时节多雾,其原因说法正确的是: A.昼夜温差较大,水汽不易凝结,直接附着在地面上 B.昼夜温差减小,水汽不易凝结,直接悬浮于大气中 C.昼夜温差减小,水汽易凝结,但风力微弱,水汽不易扩散 D.昼夜温差较大,水汽易凝结,且该季节晴好天气多,有利于扬尘的产生 火山冬天是指因一座较大的火山爆发,全球数年或者某年没有夏天而只有冬天。2014年9月2日冰岛东南部的巴达本加火山喷发,产生大量的火山灰。下图为火山喷发对大气影响示意图。回答9-10题。 9.火山冬天现象的主要成因是()。 A.火山灰和二氧化硫弥漫在对流层散射了太阳辐射 B.火山灰和二氧化硫到达平流层削弱了太阳辐射 C.火山灰和二氧化硫削弱了大气逆辐射 D.火山喷发形成酸雨削弱了太阳辐射 10.下列说法正确的是()。 A.火山爆发的动力是太阳辐射 B.火山喷发的火山灰对航空运输不会产生影响 C.冰岛冬季受低压控制,天气晴朗 D.火山喷发可能会导致降雨量增大 某学校地理兴趣小组设计并做了实验(如下图)。完成11-12题。 11.该实验的主要目的是测试()。 A. 水循环 B. 温室效应 C. 热力环流 D. 海陆热力性质差异 12.下图中所示地理现象的成因与所示实验原理相同的是()。 A.① B.② C.③ D.④ 下图为某滨海地区某日某时等压面垂直剖面图(相邻两个等压面气压差相等),回答13-14

matlab课后习题解答第二章doc

第2章符号运算 习题2及解答 1 说出以下四条指令产生的结果各属于哪种数据类型,是“双精度” 对象,还是“符号”符号对象? 3/7+0.1; sym(3/7+0.1); sym('3/7+0.1'); vpa(sym(3/7+0.1)) 〖目的〗 ●不能从显示形式判断数据类型,而必须依靠class指令。 〖解答〗 c1=3/7+0.1 c2=sym(3/7+0.1) c3=sym('3/7+0.1') c4=vpa(sym(3/7+0.1)) Cs1=class(c1) Cs2=class(c2) Cs3=class(c3) Cs4=class(c4) c1 = 0.5286 c2 = 37/70 c3 = 0.52857142857142857142857142857143 c4 = 0.52857142857142857142857142857143 Cs1 = double Cs2 = sym Cs3 = sym Cs4 = sym 2 在不加专门指定的情况下,以下符号表达式中的哪一个变量被认 为是自由符号变量. sym('sin(w*t)'),sym('a*exp(-X)'),sym('z*exp(j*th)') 〖目的〗 ●理解自由符号变量的确认规则。 〖解答〗 symvar(sym('sin(w*t)'),1) ans = w symvar(sym('a*exp(-X)'),1) ans = a

symvar(sym('z*exp(j*th)'),1) ans = z 3 求以下两个方程的解 (1)试写出求三阶方程05.443 =-x 正实根的程序。注意:只要正实根,不要出现其他根。 (2)试求二阶方程022=+-a ax x 在0>a 时的根。 〖目的〗 ● 体验变量限定假设的影响 〖解答〗 (1)求三阶方程05.443 =-x 正实根 reset(symengine) %确保下面操作不受前面指令运作的影响 syms x positive solve(x^3-44.5) ans = (2^(2/3)*89^(1/3))/2 (2)求五阶方程02 2 =+-a ax x 的实根 syms a positive %注意:关于x 的假设没有去除 solve(x^2-a*x+a^2) Warning: Explicit solution could not be found. > In solve at 83 ans = [ empty sym ] syms x clear syms a positive solve(x^2-a*x+a^2) ans = a/2 + (3^(1/2)*a*i)/2 a/2 - (3^(1/2)*a*i)/2 4 观察一个数(在此用@记述)在以下四条不同指令作用下的异同。 a =@, b = sym( @ ), c = sym( @ ,' d ' ), d = sym( '@ ' ) 在此,@ 分别代表具体数值 7/3 , pi/3 , pi*3^(1/3) ;而异同通过vpa(abs(a-d)) , vpa(abs(b-d)) , vpa(abs(c-d))等来观察。 〖目的〗 ● 理解准确符号数值的创建法。 ● 高精度误差的观察。 〖解答〗 (1)x=7/3 x=7/3;a=x,b=sym(x),c=sym(x,'d'),d=sym('7/3'), a =

大学基础会计习题(附答案)及案例(二)

第二章 会计要素与会计等 式 (一)单项选择题 1. 企业的原材料属于会计要素中的( A .资产 B .负债 C 2. 企业所拥有的资产从财产权力归属来看, A .企业职工 B .债权人 3. 一个企业的资产总额与权益总额( A .必然相等 B C.不会相等 D 4. 一个企业的资产总额与所有者权益总额( A .必然相等 B C.不会相等 D 5. 一项资产增加,一项负债增加的经济业务发生后,都会使资产与权益原来的总额( A .发生同增的变动 C.不会变动 6. 某企业刚刚建立时, )。 .所有者权益 D .权益 一部分属于投资者,另一部分属于( C .债务人 D .企业法人 )。 .有时相等 .只有在期末时相等 )。 .有时相等 .只有在期末时相等 )。 )。 B .发生同减的变动 D .发生不等额的变动 权益总额为 80万元,现发生一笔以银行存款 10万元偿还银行借款的经 济业务,此时,该企业的资产总额为( )。 A . 80万元 B . 90万元 7. 企业收入的发生往往会引起( A .负债增加 B .资产减少 8. 企业生产的产品属于( )。 A .长期资产 B ?流动资产 9. 对会计对象的具体划分称为( A .会计科目 B ?会计原则 10. 构成企业所有者权益主体的是( A .盈余公积金 B ?资本公积金 11. 经济业务发生仅涉及资产这一会计要素时, A .同增变动 B . C. 一增一减变动 D . 12. 引起资产和权益同时减少的业务是( A .用银行存款偿还应付账款 C.购买材料货款暂未支付 13. 以下各项属于固定资产的是( A .为生产产品所使用的机床 C.已生产完工验收入库的机床 (二)多项选择题 1. 下列等式中属于正确的会计等式有( A .资产=权益 B C.收入-费用=利润 D E .资产+负债-费用=所有者权益+收入 2. 属于引起会计等式左右两边会计要素变动的经济业务有( )。 A .收到某单位前欠货款 20000元存入银行 B .以银行存款偿还银行借款 C.收到某单位投来机器一台,价值 80万元 D .以银行存款偿还前欠货款 10万元 C . 100万元 D . 70万元 )。 C .资产增加 .所有者权益减少 )。 C )。 B D .固定资产 .长期待摊费用 .会计要素 )。 .实收资本 只引起该要素中某些项目发生( 同减变动 不变动 )。 向银行借款直接偿还应付账款 工资计入产品成本但暂未支付 .会计方法 .未分配利润 ) 。 正在生产之中的机床 已购入但 尚未安装完毕的机床 )。 .资产 =负债 +所有者权益 .资产 =负债 +所有者权益 +(收入 - 费用)

DS第二章-课后习题答案

第二章线性表 2.1 填空题 (1)一半插入或删除的位置 (2)静态动态 (3)一定不一定 (4)头指针头结点的next 前一个元素的next 2.2 选择题 (1)A (2) DA GKHDA EL IAF IFA(IDA) (3)D (4)D (5) D 2.3 头指针:在带头结点的链表中,头指针存储头结点的地址;在不带头结点的链表中,头指针存放第一个元素结点的地址; 头结点:为了操作方便,在第一个元素结点前申请一个结点,其指针域存放第一个元素结点的地址,数据域可以什么都不放; 首元素结点:第一个元素的结点。 2.4已知顺序表L递增有序,写一算法,将X插入到线性表的适当位置上,以保持线性表的有序性。 void InserList(SeqList *L,ElemType x) { int i=L->last; if(L->last>=MAXSIZE-1) return FALSE; //顺序表已满 while(i>=0 && L->elem[i]>x) { L->elem[i+1]=L->elem[i]; i--; } L->elem[i+1]=x; L->last++; } 2.5 删除顺序表中从i开始的k个元素 int DelList(SeqList *L,int i,int k) { int j,l; if(i<=0||i>L->last) {printf("The Initial Position is Error!"); return 0;} if(k<=0) return 1; /*No Need to Delete*/ if(i+k-2>=L->last) L->last=L->last-k; /*modify the length*/

场外金融衍生品市场概述 测试答案

一、单项选择题 1. 当市场表现为震荡时,场外金融衍生品投资者更倾向于购买采用()方案的产品。 A. Digital Call B. Call Spread C. Double No Touch D. Up and Out Barrier 二、多项选择题 2. 海外投行场外衍生品业务的成功经验主要包括:()。 A. 有功能强大的交易分析和风控平台 B. 以上均正确 C. 海外投行的销售交易业务有良好的外部环境 D. 海外投行拥有经验丰富而有分工精细的专业人才 3. 场外金融衍生品销售业务对手方包括:()。 A. 证券公司 B. 保险公司 C. 上市公司股东和高净值个人 D. 商业银行、基金公司、券商资管等财富管理机构 E. 私募基金 4. 我国场外金融衍生品市场发展的问题包括()。 A. 证券公司杠杆融资的限制 B. 证券公司的风险管理部门职能有待完善 C. 场内衍生品市场的缺失 D. 其他可能影响公司持续经营的事项 E. 信用交易及主协议的缺失 三、判断题 5. 顶级海外投行销售交易业务的核心竞争力包括:融资及杠杆的可能性(无苛刻的净资本约束)、发达的场内市场产品用于风险对冲(场内期权等)、成熟的信用交易协议与规范(ISDA)和开放的市场准入制度。() 正确 错误 6. 根据海外投行的经验,经验丰富而又分工精细的专业人才是发展场外衍生品市场的重要条件。() 正确 错误 7. 缺乏跨市场、跨资产类别、被广泛接受的信用交易主协定(类似于ISDA)导致了我国场外衍生品市场交易的低效率。() 正确 错误 8. 对证券公司杠杆融资的限制没有影响我国金融场外衍生品业务的大规模发展。() 正确 错误

管理会计第二章课后习题及答案

思考题 1. 管理会计对成本是如何进行分类的?各种分类的主要目的是什么? 管理会计将成本按各种不同的标准进行分类, 以适应企业经营管理的不同需 求。 1. 按成本经济用途分类:制造成本和非制造成本。 主要目的是用来确定存货成本和期间损益,满足对外财务报告的需要。 2. 按性态分类:固定成本、变动成本和混合成本。 按性态进行划分是管理会计这一学科的基石, 管理会计作为决策会计的角色, 其许多决策方法尤其是短期决策方法都需要借助成本性态这一概念。 3. 按可控性分类:可控成本和不可控成本 4. 按是否可比分类:可比成本和不可比成本 5. 按特定的成本概念分类:付现成本和沉没成本、原始成本和重置成本、可 避免成本和不可避免成本、差别成本和边际成本、机会成本 6. 按决策相关性分类:相关成本和无关成本 2. 按成本性态划分,成本可分为几类?各自的含义、构成和相关范围是什么? 按成本性态可以将企业的全部成本分为固定成本、 变动成本和混合成本三类。 1)固定成本是指其总额在一定期间和一定业务量范围内,不受业务量变 动的影响而保持固定不变的成本。但是符合固定成本概念的支出在 的强弱上还是有差别的, 所以根据这种差别又将固定成本细分为酌量性固定成本 和约 束性固定成本。 酌量性固定成本也称为选择性固定成本或者任意性固定成本, 是指管理当局的决策可以改变其支出数额的固定成本。 约束性固定成本与酌量性 固定成本相反, 是指管理当局的决策无法改变其支出数额的固定成本, 为承诺性固 定成本, 它是企业维持正常生产经营能力所必须负担的最低固定成本, 其支出的大小只取决于企业生产经营的规模与质量, 因而具有很大的约束性, 企 业管理当局不能改变其数额。 固定成本的 “固定性”不是绝对的,而是有限定条件的,这种限定条件在 管理会计中叫做相关范围, 表现为一定的期间范围和一定的空间范围。 就期间范 围而言, 固定成本表现为在某一特定期间内具有固定性。 从较长时间看, 所有成 第二章课后习题 固定性” 因而也称

大物第二章课后习题答案

简答题 什么是伽利略相对性原理什么是狭义相对性原理 答:伽利略相对性原理又称力学相对性原理,是指一切彼此作匀速直线运动的惯性系,对于描述机械运动的力学规律来说完全等价。 狭义相对性原理包括狭义相对性原理和光速不变原理。狭义相对性原理是指物理学定律在所有的惯性系中都具有相同的数学表达形式。光速不变原理是指在所有惯性系中,真空中光沿各方向的传播速率都等于同一个恒量。 同时的相对性是什么意思如果光速是无限大,是否还会有同时的相对性 答:同时的相对性是:在某一惯性系中同时发生的两个事件,在相对于此惯性系运动的另一个惯性系中观察,并不一定同时。 如果光速是无限的,破坏了狭义相对论的基础,就不会再涉及同时的相对性。 什么是钟慢效应 什么是尺缩效应 答:在某一参考系中同一地点先后发生的两个事件之间的时间间隔叫固有时。固有时最短。固有时和在其它参考系中测得的时间的关系,如果用钟走的快慢来说明,就是运动的钟的一秒对应于这静止的同步的钟的好几秒。这个效应叫运动的钟时间延缓。 尺子静止时测得的长度叫它的固有长度,固有长度是最长的。在相对于其运动的参考系中测量其长度要收缩。这个效应叫尺缩效应。 狭义相对论的时间和空间概念与牛顿力学的有何不同 有何联系 答:牛顿力学的时间和空间概念即绝对时空观的基本出发点是:任何过程所经历的时间不因参考系而差异;任何物体的长度测量不因参考系而不同。狭义相对论认为时间测量和空间测量都是相对的,并且二者的测量互相不能分离而成为一个整体。 牛顿力学的绝对时空观是相对论时间和空间概念在低速世界的特例,是狭义相对论在低速情况下忽略相对论效应的很好近似。 能把一个粒子加速到光速c 吗为什么 答:真空中光速C 是一切物体运动的极限速度,不可能把一个粒子加速到光速C 。从质速关系可看到,当速度趋近光速C 时,质量趋近于无穷。粒子的能量为2 mc ,在实验室中不存在这无穷大的能量。 什么叫质量亏损 它和原子能的释放有何关系 答:粒子反应中,反应前后如存在粒子总的静质量的减少0m ?,则0m ?叫质量亏损。原子能的释放指核反应中所释 放的能量,是反应前后粒子总动能的增量k E ?,它可通过质量亏损算出20k E m c ?=?。 在相对论的时空观中,以下的判断哪一个是对的 ( C ) (A )在一个惯性系中,两个同时的事件,在另一个惯性系中一定不同时;

中国衍生品市场概况与未来发展

中国衍生品市场概况与未来发展 Chinese derivatives market’s summary and future development 吴建刚中欧陆家嘴国际金融研究院研究员 【内容摘要】中国改革开放三十年来,经济高速成长,金融不断完善,衍生品市场也逐步发展起来。此次金融危机暴发后,金融衍生品最早成为被归咎的对象。中国衍生品市场还处于初级发展阶段,作为后发展国家,这就提出了危机对中国衍生品发展的启示和未来如何发展中国衍生品市场的问题。针对这一问题,本文首先分析了近二十几年来中国场内和场外的衍生品市场发展概况,然后提出了此次金融危机对中国发展衍生品的启示,最后对中国衍生品市场未来发展提出了一系列建议。 【关键词】衍生品市场发展概况危机启示发展建议 Abstract: After three decades of China's reform and opening up, its economy grew rapidly, its finance system has been improved and its derivatives market although began late has also progressively been developed. After the outbreak of the financial crisis, financial derivatives have become the first target to be blamed. China's derivatives market is still in the early stage of development, as a developing country, the crisis put forward the question of how to learn from this crisis and develop China's derivatives market. To answer this question, the paper first analyzes the development of the derivatives market in past two decades, then analyzes the enlightenment of the financial crisis on China's development of derivatives, and finally gives a series of recommendations on the future development of China's derivatives market. Keywords: Derivatives market Development summary Crisis inspiration Development proposals

大学马克思第二章练习题及参考答案

第二章习题库 、单项选择题(下列每题给出的备选项中,只有一个选项正确) 1. 辩证唯物论的认识论之第一的和基本的观点是()。 A.实践的观点 B.联系的观点C发展的观点D.物质 2. 马克思主义认为,实践()。 A.是理性自主的道德活动 B.被称为践行”实行”或行”与知”相对应,但主要是指道德伦理行为C是人类能动地改造世界的社会性的物质活动D.是主观改造客观对象的创造性的精神活动 3. 在实践活动中具有自主性和能动性的因素是()。 A.实践主体 B.实践客体 C.实践行为 D.实践中介 4.实践活动所指向的对象是()。 A.实践主体 B.实践客体 C.实践行为 D.实践中介 5. 达成实践主体和实践客体相互作用的是()。 A.践主体 B.实践客体 C.实践行为 D.实践中介 6. 实践的主体和客体相互作用关系中,最根本的关系是()。 A.实践关系 B.认识关系 C.价值关系 D.指向关系 7. 主体把眼睛作为自己身体器官的延长包括在主体的活动之中,属于()。 A.实践主体 B.实践客体C主体客体化D.客体主体化 8. “见多识广”这一成语所包含的哲理是()。 A.实践是认识的来源 B.实践是认识发展的动力C实践是认识发展的动力D. 实践是检验认识真理性的唯一标准

9. 恩格斯说: “社会一旦有技术上的需要,这种需要就会比十所大学更能把 科学推向前进。 ”这句话表明()。 A.实践是认识的来源 B.实践是认识发展的动力C 实践是认识发展的动力D. 实践是检验认识真理性的唯一标准 10.把人的认识看成是上帝的启示或绝对精神的产物,这种观点属于()。 A.主观唯心主义 B.客观唯心主义 C.唯物主义 D.辩证法 11. “路遥知马力,日久见人心 ”所蕴含的哲理是()。 A.感性认识咼于理性认识 B.经验是判断是非的标准 C.时间是检验是非的标 准 D.实践是检验认识真理性的标准 12.牛顿说 “假如我能够比别人瞭望得略为远些,那是因为我站在巨人们的肩 膀 上。 ”这句话肯定了()。 A.感性认识的作用 B.理性认识的作用C 直接经验的作用D.间接经验的作用 13.毛泽东指出: “认识有待于深化,认识的感性阶段有待于发展到理性阶段 这就是认识论的辩证法。 ”这句话表明()。 A.感性认识有待于发展和深化为理性认识 B.理性认识依赖于感性认识 C.感 性认识和理性认识相互渗透、相互包含 D.理性认识不依赖于感性认识 14.中国工程院院士袁隆平曾结合自己的 科研经历,语重心长地对年轻人 但是书本电脑里种不出水稻来, A.实践水平的提高有赖于认识水平的提高 C 理 论对实践的指导作用没有正确与错误之分 认识到实践的第二次飞跃更加重要 15. “世界不会满足人,人决心以自己的行动来改变世界。 ”这句话体现的是 实践基本特征中的()。 说:“书本知识非常重要,电脑技术也很重要, 只有在田里才能种出水稻来。 ”这表明()。 B.实践是人类认识的基础和来源 D.由实践到认识的第一次飞跃比

第二章课后习题与答案

第2章人工智能与知识工程初步 1. 设有如下语句,请用相应的谓词公式分别把他们表示出来:s (1)有的人喜欢梅花,有的人喜欢菊花,有的人既喜欢梅花又喜欢菊花。 解:定义谓词d P(x):x是人 L(x,y):x喜欢y 其中,y的个体域是{梅花,菊花}。 将知识用谓词表示为: (?x )(P(x)→L(x, 梅花)∨L(x, 菊花)∨L(x, 梅花)∧L(x, 菊花)) (2) 有人每天下午都去打篮球。 解:定义谓词 P(x):x是人 B(x):x打篮球 A(y):y是下午 将知识用谓词表示为:a (?x )(?y) (A(y)→B(x)∧P(x)) (3)新型计算机速度又快,存储容量又大。 解:定义谓词 NC(x):x是新型计算机 F(x):x速度快 B(x):x容量大 将知识用谓词表示为: (?x) (NC(x)→F(x)∧B(x)) (4) 不是每个计算机系的学生都喜欢在计算机上编程序。 解:定义谓词 S(x):x是计算机系学生 L(x, pragramming):x喜欢编程序 U(x,computer):x使用计算机 将知识用谓词表示为: ? (?x) (S(x)→L(x, pragramming)∧U(x,computer)) (5)凡是喜欢编程序的人都喜欢计算机。 解:定义谓词 P(x):x是人 L(x, y):x喜欢y 将知识用谓词表示为:

(?x) (P(x)∧L(x,pragramming)→L(x, computer)) 2 请对下列命题分别写出它们的语义网络: (1) 每个学生都有一台计算机。 解: (2) 高老师从3月到7月给计算机系学生讲《计算机网络》课。 解: (3) 学习班的学员有男、有女、有研究生、有本科生。 解:参例2.14 (4) 创新公司在科海大街56号,刘洋是该公司的经理,他32岁、硕士学位。 解:参例2.10 (5) 红队与蓝队进行足球比赛,最后以3:2的比分结束。 解:

金融衍生品及其市场概述

云南大学经济学院 本科生学年论文 题目:金融衍生品及其市场概述 系别:经济 专业:经济学 学号: 20081030170 姓名:李林峰 指导教师:字来宏 2011年 6 月

摘要 近10年来,全球金融衍生工具市场成交量迅猛发展,仅交易所交易的金融衍生工具合约的名义价值就是全球股票市值的几十倍,而且正在以每年20%以上的速度成长。一方面,金融衍生工具由于其成交活跃、成本低廉,为各类企业、机构投资者和个人投资者提供了对冲风险的手段,从而为它们稳定了收入预期,增加了收益并转移了不愿承担的风险。正如默顿·米勒自信的指出,这些金融产品使企业和机构有效且经济地处理困扰自己没有几百年也有几十年的风险成为可能金融衍生工具使世界变得更加安全而不是更加危险;另一方面,金融衍生工具交易中又不断暴露出巨额损失、公司倒闭等爆炸性事件。这使得金融衍生工具在学术界、业界和金融监管层中都饱受争议。尽管如此,越来越多的衍生工具正被创造出来,越来越多的公司和投资者在利用衍生工具管理风险,衍生工具在金融创新中的作用越来越重要,公司和个人的理财活动越来越离不开衍生工具。本文主要研究商业银行金融衍生品及其市场的概况,以及股票衍生工具,股票指数衍生工具。 关键词:金融衍生品衍生市场期货期权

Abstract The derivative instruments make the world safer not more dangerous. These financial products make enterprises and institutions to deal effectively and economically troubled himself not hundreds of years also have decades of risk possible. ——Mertonian miller《The derivative instruments》In recent years, the global financial derivatives market volume rapid development. Today, the only exchange of financial derivatives in the name of the contract value is global in stock value, and a few times a year are rate of more than 20% growth. On one hand, financial derivatives due to its active, low cost, clinch a deal for the of all kinds enterprise, institutional investors and individual investors provides the means, and hedge risk for their stable income expected earnings and transfer, increased the does not want to assume the risk, On the other hand, financial derivatives trading and constantly exposed huge losses, the company went bankrupt and other explosive events. This makes financial derivatives in academia, industry and financial supervision in layer controversial. Even so, more and more derivatives instruments are being created, more and more companies and investors in the use of derivatives risk management, derivatives instruments in the role of financial innovation is more and more important, the company and personal finance activities more and more from derivatives instruments. China's derivatives market although start later, but the development of the world over the past few years to the sit up and take notice. Part of our agricultural futures contract turnover among the most actively traded futures contract of the top 10, we in the three years ago which was just as equity division reform affiliate products of authority card was becoming the world's most active authority card market, derivatives have in the financial

卫生统计学案例版丁元林课后思考题答案

第一章:ECDBB 第二章:BDABC 第三章:DEBCD AEA 第四章:DCCDD DCBD 第五章:DCBDB AEEEC 第六章:CBEDC DDDDA 第七章:ACCBB DACEA 第八章:ABCDD BDADB 第九章:DDBCD AEA 第十章:BDCCE BDAEA 第十一章:CAEDC DBCCD 第十二章:BCAEE BA 第十三章:DDBCC BCDE 第十四章:无 第十五章:无 第十六章:无 第十七章:DBABC BDE 第十八章:无 第十九章:BDCDC CCADC 《卫生统计学》思考题参考答案 第一章绪论 1、统计资料可以分为那几种类型举例说明不同类型资料之间是如何转换的 答:(1)1定量资料(离散型变量、连续型变量)、2无序分类资料(二项分类资料、无序多项分类资料)、3有序分类资料(即等级资料);(2)例如人的健康状况可分为“非常好、较好、一般、差、非常差”5个等级,应归为等级资料,若将该五个等级赋值为5、4、3、2、1,就可按定量资料处理。 2、统计工作可分为那几个步骤 答:设计、收集资料、整理资料、分析资料四个步骤。 3、举例说明小概率事件的含义。 答:某人打靶100次,中靶次数少于等于5,那么该人一次打中靶的概率≤,即可称该人一次打中靶的事件为小概率事件,可以视为很可能不发生。 第二章调查研究设计 1、调查研究有何特点 答:(1)不能人为施加干预措施 (2)不能随机分组 (3)很难控制干扰因素 (4)一般不能下因果结论 2、四种常用的抽样方法各有什么特点 答:(1)单纯随机抽样:优点是操作简单,统计量的计算较简便;缺点是当总体观察单位数量庞大时,逐一编号繁复,有时难以做到。 (2)系统抽样:优点是易于理解、操作简便,被抽到的观察单位在总体中分布均匀,抽样误差较单纯随机抽样小;缺点是在某些情况下会出现偏性或周期性变化。 (3)分层抽样:优点是抽样误差小,各层可以独立进行统计分析,适合大规模统计;缺点是事先要进行分层,操作麻烦。

衍生产品市场 课后答案 第八章

Chapter 8 Swaps Question 8.1 We first solve for the present value of the cost per two barrels: 2 $22$23 41.033.1.06(1.065) += We then obtain the swap price per barrel by solving: 241.033(1.065)1.0622.483, x x x +=?= which was to be shown. Question 8.2 1. We first solve for the present value of the cost per three barrels, based on the forward prices: 23 $20$21$22 55.3413.1.06(1.065)(1.07)++= Hence we could spend $55.3413 today to receive 1 barrel in each of the next three years. We then obtain the swap price per barrel by solving: 2 355.34131.06(1.065)(1.07)20.9519 x x x x ++=?= 2. We first solve for the present value of the cost per two barrels (Year 2 and Year 3): 23 $21$22 36.473.(1.065)(1.07) += Hence we could spend $36.473 today and receive 1 barrel of oil in Year 2 and Year 3. We obtain the swap price per barrel by finding two equal payments we would make in Years 2 and 3 that have the same present value: 2 336.473(1.065)(1.07)21.481 x x x +=?=

最新统计学方积乾 第七版 第二章 定量资料的统计描述课后练习题答案资料

第2章 定量资料的统计描述 案例2-1(P27) 答:该资料为一正常人群发汞值的检测结果,已整理成频率分布表(P27)。统计描述时应首先考察资料的分布规律,通过频率(频数)分布表(表2-9 P27)和直方图(图2-3 P14)可以看出,此238人发汞值的频数分布呈正偏态分布,即观察值绝大多数集中在发汞值较小的组段。 对偏态分布,选用算术均数和标准差进行统计描述是不恰当的。应选用中位数描述该市居民发汞平均水平,选用四分位间距描述居民发汞值变异度,计算如下: 25507523.5(23825%20) 4.7(mol/kg) 6625.5(23850%86) 6.6(mol/kg) 602 7.5(23875%146)8.9(mol/kg) 48(%) x x L x i P L n x f f P u P u P u =+?==+?==+?==+?S

离散程度指标: 四分位间距=P75-P25=8.9-4.7=4.2umol/kg。 故该市居民发汞平均水平为6.6 umol/kg,离散度为4.2umol/kg,

思考与练习(P31) 1. 答: (1) 某年某地120例6-7岁正常男童胸围测量结果(cm)的频数分布 Group Frequency Percent Cumulative Percent 49.0- 1 .8 .8 50.0- 4 3.3 4.2 51.0- 8 6.7 10.8 52.0- 6 5.0 15.8 53.0- 19 15.8 31.7 54.0- 18 15.0 46.7 55.0- 14 11.7 58.3 56.0- 26 21.7 80.0 57.0- 10 8.3 88.3 58.0- 9 7.5 95.8 59.0- 4 3.3 99.2 61.0-62.0 1 .8 100.0 Total 120 100.0

第二章课后习题答案

1. 已知某一时期内某商品的需求函数为Q =50-5P ,供给函数为Qs=-10+5p。(1)求均衡价格Pe和均衡数量Qe,并作出几何图形。 (2)假定供给函数不变,由于消费者收入水平提高,使需求函数变为Qd=60-5P。求出相应的均衡价格Pe 和均衡数量Qe ,并作出几何图形。(3)假定需求函数不变,由于生产技术水平提高,使供给函数变为Qs=-5+5p。 求出相应的均衡价格Pe 和均衡数量Qe ,并作出几何图形。 (4)利用(1)(2 )(3),说明静态分析和比较静态分析的联系和区别。(5)利用(1)(2 )(3),说明需求变动和供给变动对均衡价格和均衡数量的影响. 解答: (1)将需求函数Qd = 50-5P和供给函数Qs =-10+5P 代入均衡条件Qd = Qs ,有: 50- 5P= -10+5P 得: Pe=6 以均衡价格Pe =6 代入需求函数Qd =50-5p ,得: Qe=20 所以,均衡价格和均衡数量分别为Pe =6 , Qe=20 (图略) (2)将由于消费者收入提高而产生的需求函数Qd=60-5p 和原供给函数 Qs=-10+5P, 代入均衡条件Q d= Qs ,有: 60-5P=-10+5P 得Pe=7 以均衡价格Pe=7代入Qd方程,得Qe=25 所以,均衡价格和均衡数量分别为Pe =7 , Qe=25 (图略) (3) 将原需求函数Qd =50-5p和由于技术水平提高而产生的供给函数Q =-5+5p , 代入均衡条件Qd =Qe ,有: 50-5P=-5+5P得Pe= 5.5 以均衡价格Pe= 5.5 代入Qd =50-5p ,得22.5 所以,均衡价格和均衡数量分别为Pe=5.5 Qe=22.5 (4)所谓静态分析是考察在既定条件下某一经济事物在经济变量的相互作用下所实现的均衡状态及其特征.也可以说,静态分析是在一个经济模型中根据所给的外生变量来求内生变量的一种分析方法.以(1)为例,在图中,均衡点 E 就是一个体现了静态分析特征的点.它是在给定的供求力量的相互作用下所达到的一个均衡点.在此,给定的供求力量分别用给定的供给函数Q=-10+5P 和需求函数Q=50-5P表示,均衡点具有的特征是:均衡价格P=6 且当P =6 时,有Q= Q d= Qe =20 ,同时,

衍生品行业市场分析报告

衍生品行业市场分析报告 2020年4月

▍ 行业聚焦 香港衍生品市场自20 世纪80 年代中期建立以来,经过30 余年的发展,已经成为亚洲最活跃的衍生品市场之一,并且在全球衍生品市场中也有着举足轻重的地位。金融衍生品是香港交易所最重要的交易品种之一,目前已与香港证券类产品形成显著的协同效应。近年来,香港衍生品产品数量、规模、流动性等方面均有较大幅度的提升,不断刷新历史 记录,在香港交易所的收入来源中扮演着越来越重要的角色。未来,金融衍生品市场也将 成为香港交易所实施全球化战略的核心竞争力。总体上看,香港衍生品市场有以下几个特点: 第一,衍生品种类丰富,可以满足多种风险管理需求。香港衍生品市场涵盖了股指、 个股、外汇、商品、利率等多种类别的衍生品。自2003 年以后市场规模和流动性显著提升,2019 年,香港衍生品市场年度总成交量已达2.63 亿张合约,年末未平仓合约数量总 计达970 万张。总体上可满足较大体量、较复杂的风险对冲需求。 第二,参与者类别多元化,市场风险受全球定价。2018 年7 月至2019 年6 月期间,香港衍生品市场中外地投资者成交量占总成交量的比例达到30%,是一个全球参与的市场,其价格包含了全球投资者的预期和风险偏好。 第三,交易机制健全,定价合理有效。香港市场对于现货和衍生品都具有完善的多空 交易机制,并且有成熟的做市商群体为市场提供流动性,这保证了衍生品与现货间、衍生 品与衍生品之间价格更加稳定有效。并且设置了错价处理程序、市场波动率调节机制、收 市后交易制度等,既提升了交易效率,又起到了稳定市场的作用。 对于内地投资者来说,我国大陆资本市场已全面加速对外开放的进程,未来A 股市场将不再是一个孤立的市场,其与全球市场的联动性将进一步加大。虽然当下大部分A 股投资者进行跨境衍生品交易的限制仍然较多,但随着市场的进一步开放,这些限制将逐步减少,而且香港又是A 股联通世界的一个重要窗口,因此其衍生品市场对于指导投资、以及指导 A 股衍生品市场建设都具有重要的意义。 本文,我们将从交易品种、交易制度、市场规模及流动性、以及衍生品对于市场情绪 的反映等方面详细分析香港的金融衍生产品市场,来为读者提供直观的认识和第一手的基础资料。 ▍ 香港衍生品市场综述 香港交易所交易品种构成——证券产品+衍生品种 香港市场是一个开放的全球性金融市场,相较于内地市场,其产品类型更加多样、交 易手段更加丰富,对金融创新的限制也远低于中国内地。根据香港交易所对其自身交易标的的划分标准,其交易产品主要分为证券类产品、衍生品产品两大类。其中,证券类产品 除了涵盖股票、债券等传统资产以外,还包括交易所交易产品(ETP,包括交易所交易基