公司理财原版题库Chap007

Chapter 7

Net Present Value and Capital Budgeting Multiple Choice Questions

1. One of the key differences between corporate finance and financial accounting courses is the

A) focus on cash flows instead of earnings.

B) focus on marginal tax rates versus average tax rates.

C) role of total income flow versus incremental flows.

D) focus on corporate avarice versus stewardship.

E) None of the above.

Answer: A Difficulty: Medium Page: 178

2. A firm purchases a new truck for $30,000. It will be depreciated over 5 years at $6,000 per year. If

the tax rate is 30% what is the time 0 cash flow?

A) $-6,000

B) $-21,000

C) $-30,000

D) $-28,200

E) None of the above.

Answer: C Difficulty: Medium Page: 178

3. Money that the firm has already spent or is committed to spend regardless of whether a project is

taken is called a(n)

A) sunk cost.

B) opportunity cost.

C) erosion cost.

D) fixed cost.

E) None of the above.

Answer: A Difficulty: Easy Page: 179

4. The value of a previously purchased building to be used by a proposed project is an example of a(n)

A) sunk cost.

B) opportunity cost.

C) erosion cost.

D) fixed cost.

E) None of the above.

Answer: B Difficulty: Easy Page: 179-180

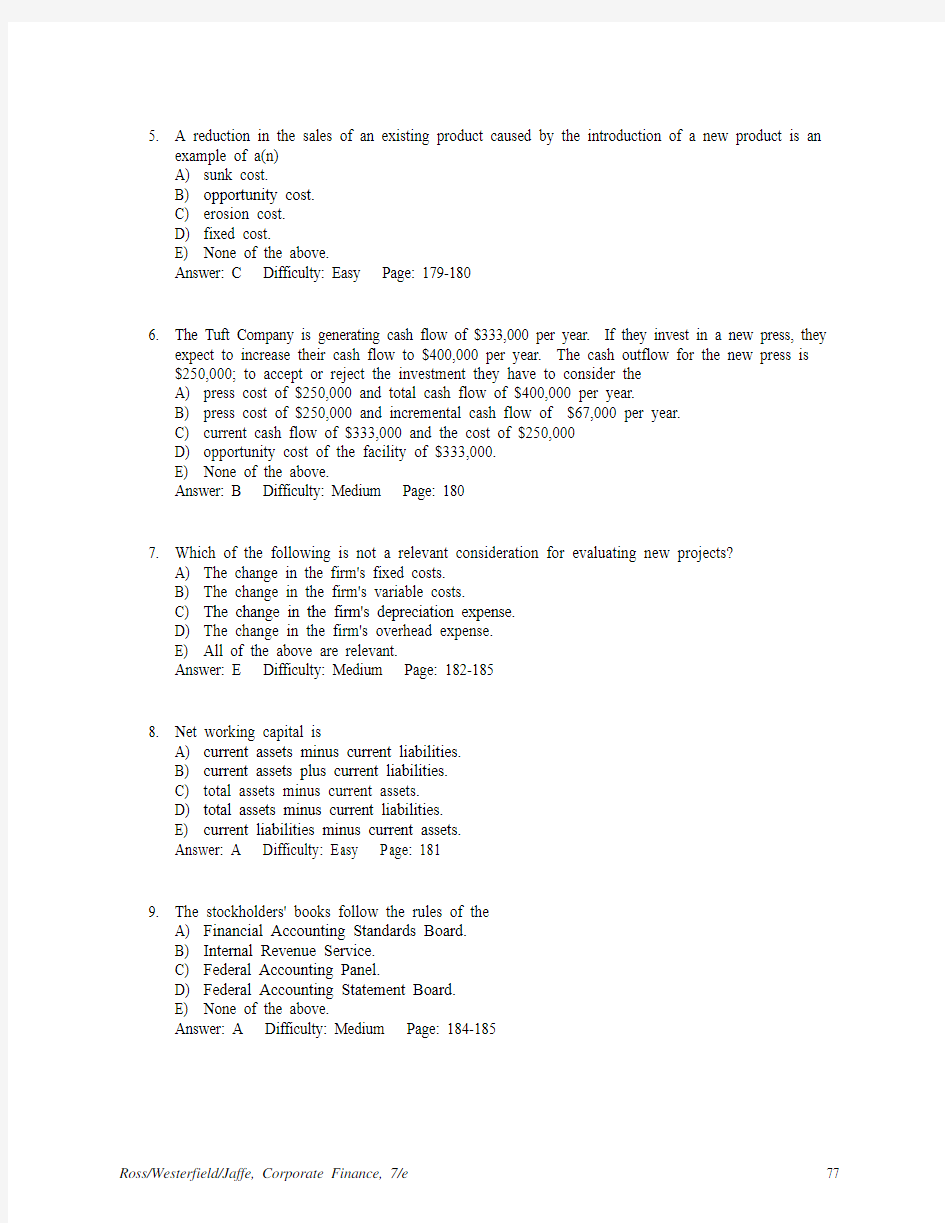

5. A reduction in the sales of an existing product caused by the introduction of a new product is an

example of a(n)

A) sunk cost.

B) opportunity cost.

C) erosion cost.

D) fixed cost.

E) None of the above.

Answer: C Difficulty: Easy Page: 179-180

6. The Tuft Company is generating cash flow of $333,000 per year. If they invest in a new press, they

expect to increase their cash flow to $400,000 per year. The cash outflow for the new press is $250,000; to accept or reject the investment they have to consider the

A) press cost of $250,000 and total cash flow of $400,000 per year.

B) press cost of $250,000 and incremental cash flow of $67,000 per year.

C) current cash flow of $333,000 and the cost of $250,000

D) opportunity cost of the facility of $333,000.

E) None of the above.

Answer: B Difficulty: Medium Page: 180

7. Which of the following is not a relevant consideration for evaluating new projects?

A) The change in the firm's fixed costs.

B) The change in the firm's variable costs.

C) The change in the firm's depreciation expense.

D) The change in the firm's overhead expense.

E) All of the above are relevant.

Answer: E Difficulty: Medium Page: 182-185

8. Net working capital is

A) current assets minus current liabilities.

B) current assets plus current liabilities.

C) total assets minus current assets.

D) total assets minus current liabilities.

E) current liabilities minus current assets.

Answer: A Difficulty: Easy Page: 181

9. The stockholders' books follow the rules of the

A) Financial Accounting Standards Board.

B) Internal Revenue Service.

C) Federal Accounting Panel.

D) Federal Accounting Statement Board.

E) None of the above.

Answer: A Difficulty: Medium Page: 184-185

10. What is the nominal rate of interest given a real rate of interest of 5% and an inflation rate of 7%?

A) 1.9%

B) 2.0%

C) 12.0%

D) 12.35%

E) None of the above.

Answer: D Difficulty: Medium Page: 189

Rationale:

r = (1.05(1.07))-1 = 1.1235-1 = .1235 = 12.35%

11. The cash flow in dollars to be received in year 3 is expected to be $12,372. The firm uses a real

discount rate of 4% and the inflation rate is expected to be 2.5%. What is the real cash flow for year 3?

A) $10,242.15

B) $10,998.66

C) $11,488.63

D) $13,916.82

E) $14,944.75

Answer: C Difficulty: Medium Page: 191

Rationale:

$12,372/(1.025)3 = $11,488.63

12. Net cash flow is defined as

A) sales revenue – fixed costs – taxes - investment.

B) sales revenue – fixed costs – taxes + investment.

C) sales revenue – operating costs – taxes + investment..

D) sales revenue – operating costs – taxes - investment.

E) None of the above.

Answer: D Difficulty: Medium Page: 188

13. Interest expense is typically excluded in the project cash flow because

A) all projects are always financed only by equity.

B) taxes cannot be adjusted for the correct debt rate.

C) the discount rate or WACC reflects the cost of debt.

D) the analysis is too crude to handle debt impacts.

E) None of the above.

Answer: C Difficulty: Medium Page: 186

14. What is the inflation rate given a nominal interest rate is 13% when the real rate is 6%?

A) 6.60%

B) 7.00%

C) 19.00%

D) 19.78%

E) None of the above.

Answer: A Difficulty: Medium Page: 189

Rationale:

i = (1.13/1.06)-1 = 1.06603-1 = .06603 = 6.60%

15. The nominal interest rate is 18%. The inflation rate is 9%. What is the real rate?

A) 7.63%

B) 9.00%

C) 27.00%

D) 28.62%

E) None of the above.

Answer: E Difficulty: Medium Page: 189

Rationale:

r = (1.18/1.09) - 1 = 1.0826 - 1 = .0826 = 8.26%

16. Inflation is treated properly in NPV analysis by

A) discounting nominal cash flows by a nominal discount rate.

B) discounting real cash flows by a real discount rate.

C) discounting nominal cash flows by a real discount rate.

D) discounting real cash flows by a nominal discount rate.

E) Both A and B.

Answer: E Difficulty: Easy Page: 192

17. The cash flow in dollars to be received in year 3 is expected to be $12,372. The firm uses a real

discount rate of 4% and the inflation rate is expected to be 2.5%. What is the present value of the year 3 cash flow?

A) $ 9,105

B) $ 9,777

C) $10,213

D) $12,372

E) $13,285

Answer: C Difficulty: Medium Page: 192

Rationale:

($12,372/(1.066)3) = $10,213

18. This is a present value of cost problem. You have been asked to evaluate two machines. The

benefits from ownership are identical. Machine A costs $300 to buy and install, lasts for 5 years, and costs $160 per year to operate. Machine B costs $500, lasts for 7 years, and costs $120 per year to operate. Both machines have zero salvage value. Assuming this is a one-time acquisition, which machine do you recommend if the cost of capital is 15%?

A) Machine A, the PV of cost is $162.90 more than Machine B.

B) Machine A, the PV of cost is $162.90 less than Machine B.

C) Machine A, because the project length is two years less than Machine B.

D) Machine B, the PV of cost is $162.90 more than Machine A.

E) Machine B, the PV of cost is $162.90 less than Machine A.

Answer: B Difficulty: Hard Page: 192-193

Rationale:

Present Value A = $300 + $160(3.3522) = $300 + $536.35 = $836.35

Present Value B = $500 + $120(4.1604) = $500 + $499.25 = $999.25

Present Value B > Present Value A by $162.90; Choose A.

19. A printing press has a cost of $60,000 and fits into the MACRS 5 year class for depreciation. If the

company has a marginal tax rate of 40%, what is the first year's depreciation?

A) $ 6,000

B) $ 7,200

C) $10,000

D) $12,000

E) $16,000

Answer: C Difficulty: Easy Page: 183

Rationale:

Depreciable basis x MACRS depreciation rate = $60,000 x .20 = $12,000.

20. You have been asked to evaluate two pollution control devices. The wet scrub costs $100 to set up

and $50 per year to operate. It must be completely replaced every 3 years, and it has no salvage value. The dry scrub device costs $200 to set up and $30 per year to operate. It lasts for 5 years and has no salvage value. Assuming pollution control equipment is replaced as it wears out, which method do you recommend if the cost of capital is 10%?

A) Dry scrub, the EAC is $ 11.00.

B) Wet scrub, the EAC is $ 90.21.

C) Dry scrub, the EAC is $ 82.76.

D) Wet scrub, the EAC is $ 9.79.

E) Dry scrub, the EAC is $124.34.

Answer: C Difficulty: Hard Page: 194-197

Rationale:

NPV WS = $-100-$50*A.10,3 = $-100-$50(2.4869) = $-100-$124.35 =$-224.35

EAC WS = $224.35/2.4869 = $90.21

NPV DS = $-200-$30*A.10,5 =$ -200-$30(3.7908) = $-200-$113,72 = $-313.72

EAC DS = $-313.72/3.7908 = $82.76

21. Milton Toy Co. recorded sales of $2,500 and costs of $1,875. Net accounts receivable rose by $350

and net accounts payable declined by $240. What were cash sales minus cash costs?

A) $-110

B) $ 35

C) $ 90

D) $ 625

E) None of the above.

Answer: B Difficulty: Hard Page: 185

Rationale:

Total Sales - Increase in Accounts Receivable = Cash Sales = $2,500-$350 = $2,150

Costs + Decrease in Accounts Payable = Cash Cost = $1,875 + $240 = $2,115

Cash Sales - Cash Costs = $2,150 $2,115 = $35.

22. Nominal cash flows should be discounted at the

A) true rate of interest.

B) real rate of interest.

C) inflation rate plus the nominal rate of interest.

D) nominal rate of interest

E) None of the above.

Answer: D Difficulty: Medium Page: 191

23. A five year MACRS asset is depreciated over ___ years.

A) 3

B) 4

C) 5

D) 6

E) 7

Answer: D Difficulty: Easy Page: 183

24. An investment in net working capital arises when

A) inventory is purchased.

B) cash is kept in the project as a buffer against unexpected expenses.

C) credit sales are made.

D) Both A and B.

E) A, B, and C are correct.

Answer: E Difficulty: Medium Page: 185

25. Accounting earnings are not emphasized in capital budgeting decisions because they do

A) not consider their timing or risk.

B) not measure all cash flows.

C) represent managers choice of allocation rules.

D) All of the above.

E) None of the above.

Answer: D Difficulty: Easy Page: 178-179

26. Which of the following is not a relevant item to consider in cash flow estimation?

A) a change in current assets invested in the project.

B) a change in current liabilities to finance new inventories.

C) regular meeting fees for the board of directors incurred when vote on the project occurs.

D) any net changes in working capital over the life of the investment.

E) All of the above.

Answer: C Difficulty: Easy Page: 182-184

27. Cash flow determination for a project can vary considerably from income determination using

FASB principles because

A) management is always trying to "cook the books".

B) management uses IRS rules to determine actual tax payments.

C) it does not matter as long as the long-run net income is positive.

D) management is trying to hide their perquisite consumption.

E) tax payments are the same under FASB and IRS rules.

Answer: B Difficulty: Medium Page: 184-185

28. All else equal, deflation in costs will have a ________ impact on the NPV of a project by

A) negative; reducing the value of the future cash flows.

B) zero; not being able to re-adjust your cash flow estimates.

C) negative; increasing the current cost of the investment.

D) positive; increasing the value of future cash flows.

E) None of the above.

Answer: D Difficulty: Medium Page: 191

29. If the inflation rate was positive the expected NPV of an investment would be

A) understated if real cash flows were discounted by the nominal discount rate.

B) understated if nominal cash flows were discounted by the nominal discount rate.

C) overstated if the real cash flows were discounted by the nominal discount rate.

D) understated if the nominal cash flows were discounted by the real discount rate.

E) overstated if the real cash flows are discounted by the real discount rate.

Answer: A Difficulty: Medium Page: 191-193

Essay Questions

30. You are considering whether to replace an existing flow meter. The existing meter currently has a

value of $50 or it can be sold in 1 year for $10. It costs $30 per year to operate and maintain. A new meter costs $400 and has a 10-year life. It could be sold for $40 at the end of its life. The new

meter costs $14 per year to operate and maintain. What do you recommend if the cost of capital is 12%?

Difficulty: Hard Page: 195-197

Answer:

The cost of keeping the old machine 1 more year in year 1 is:$50 + $30/(1.12) - $10(1.12) = $67.86;

$67.86(1.12) = $75.99 or $76.

The equivalent annual cost of the new machine is:$400 + $14 * A.12,10 - $40/(1.12)10 = $471.87;

$471.87/5.6502 = $83.51

Because the cost of keeping the old machine is less than the cost of the new machine, the old

machine should not be replaced.

31. A proposed investment has a cost of $250. It will have a life of 4 years. The cost will be

depreciated straight-line to a zero salvage value, and will be worth $50 at that time. Cash sales will be $230 per year and cash costs will run $120 per year. The firm will also need to invest $70 in net working capital at year 0. The appropriate discount rate is 8% (use for all flows), and the corporate tax rate is 40%. What are the cash flows in years 1, 2, 3, and 4?

Difficulty: Medium Page: 182-183

Answer:

Year 1, 2, and 3: (Rev-Exp) (1-t) + t(Dep) ($230-$120) (1-.4) + .4($62.5) = $91 each year

Year 4: $91 + ($50) (1-.4) = $121

32. A machine lasts 3 years and has a purchase price of $100. It costs $40 per year to operate and can be

sold as junk for $15 at the end of its life. What is the EAC of the costs of operating a series of such machines into perpetuity if the discount rate is 15%?

Difficulty: Medium Page: 191-193

Answer:

The present value of the cost of the machine is:

$100 + $40 * A.15,3 - $15/(1.15)3 = $181.47

The machine's equivalent annual cost is: $181.47/2.283 = $79.48

33. Recently, you calculated the cash flows for the Highfeed project to determine the feasibility of a

new feed mix process. Since that time you have now discovered that the calculation of the standard cash flow for Year 1 of $55,000 did not consider the following anticipated changes: account

receivable are expected to increase $7,000; cash will rise by $2,000; inventory will increase by $4,000; and account payable are expected to increase $5,000. Determine the new estimated cash flow for Year 1.

Difficulty: Medium Page: 185

Answer:

Change in Working Capital = ($7,000 + $2,000 + 4,000) - $5,000 = $8,000.

Therefore, Year 1 cash flow = $55,000 - $8,000 = $47,000.

34. The Expresso Roast Corporation is considering the purchase of a new bean roaster and grinder.

The revenues are expected to be the same for Expresso Roast no matter which machine is acquired.

The Quick-Roast machine has a cost of $75,000 and is expected to last 4 years with operating costs of $12,000 per year. The Mellow-Roast Co. machine has a cost of $50,000 and operating costs of $4,500 per year but will last for only 2 years. The discount rate is 8%. What is the present value of the costs? What is the EAC of each machine and which machine should be chosen?

Difficulty: Hard Page: 194-195

Answer:

PV Quick-Roast =$ 75,000 + $12,000*Ann. Factor(.08,4) = $114,745.52

PV Mellow-Roast = $50,000 + $4,500*Ann. Factor(.08,2) = $58,024.69

EAC (Quick-Roast) = $114,745.52/Ann. Factor(.08,4)3.312 = $34,644.34

EAC (Mellow-Roast) = $58,024.69/Ann. Factor(.08,2)1.783 = $32,537.82

Choose the Mellow-Roast machine since the EAC is lower.

35. Depreciation is an expense based on the investment cost of asset acquired and fixed over its

depreciable life. Explain how a company can have a different net income reported to shareholders than reported to the IRS. (Assume the only difference is due to depreciation.) Will this situation last forever with respect for the single asset acquired, explain what will happen?

Difficulty: Medium Page: 184-185

Answer:

Net Income is reported to shareholders based on GAAP. Depreciation for tax usually based on fastest deduction method, which is MACRS. In early years, MACRS will be greater than

straight-line depreciation, but this will reverse in later years. In the end, the total depreciation will be the same (assuming a 0 salvage value).

36. Explain the difference between erosion and synergy.

Difficulty: Easy Page: 179-180

Answer:

Both are side effects in the capital budgeting process. Erosion occurs when a new product reduces the sales and, hence, the cash flows of existing projects; i.e. these may be substitutes.. Synergy occurs when a new project increases the cash flows of existing projects; i.e. this may be a

complement.

37. The Equivalent Annual Cost method allows comparison of the costs of equipment with unequal

lives. If Quick-Roll machine has an eleven-year life, and an NPV of $2,100; while the Zip-Roller machine has a seven-year life and an NPV of $2,000. Which machine would you choose if the business is expected to continue and the discount rate for both is 14%?

Difficulty: Medium Page: 194-195

Answer:

EAC11(QR) = $2,100/5.4527= $385.13

EAC7(ZR) = $2,000/4.2883 = $466.39

Choose the Zip-Roller machine assuming replacement.

38. Your boss just turned back your capital budgeting report because she is unsure of your results. The

yearly revenues are going up at a constant rate equal to the consumer price index of 4% and the discount used was 6%. The boss also mentions that the long term Treasury bond rate is only 7.5%.

Explain the boss' dilemma and how it should be corrected.

Difficulty: Medium Page: 189-193

Answer:

The rates do not match. Nominal cash flows are being used as they increase at CPI inflation.

Discount rate < Long term Treasury bond rate implies error or use of real rate. Real rate

approximation of 6% from Nominal-Inflation; Nominal would approximate 6 + 4 = 10%. The boss is correct to be concerned about this. Correct by using real cash flows with real rates or nominal cash flows with nominal rates.

公司理财原版题库Chap010

Chapter 10 Return and Risk: The Capital-Assets-Pricing Model Multiple Choice Questions 1. When a security is added to a portfolio the appropriate return and risk contributions are A) the expected return of the asset and its standard deviation. B) the expected return and the variance. C) the expected return and the beta. D) the historical return and the beta. E) these both can not be measured. Answer: C Difficulty: Medium Page: 255 2. When stocks with the same expected return are combined into a portfolio A) the expected return of the portfolio is less than the weighted average expected return of the stocks. B) the expected return of the portfolio is greater than the weighted average expected return of the stocks. C) the expected return of the portfolio is equal to the weighted average expected return of the stocks. D) there is no relationship between the expected return of the portfolio and the expected return of the stocks. E) None of the above. Answer: C Difficulty: Easy Page: 261 3. Covariance measures the interrelationship between two securities in terms of A) both expected return and direction of return movement. B) both size and direction of return movement. C) the standard deviation of returns. D) both expected return and size of return movements. E) the correlations of returns. Answer: B Difficulty: Medium Page: 258-259 Use the following to answer questions 4-5: GenLabs has been a hot stock the last few years, but is risky. The expected returns for GenLabs are highly dependent on the state of the economy as follows: State of Economy Probability GenLabs Returns Depression .05 -50% Recession .10 -15 Mild Slowdown .20 5 Normal .30 15% Broad Expansion .20 25 Strong Expansion .15 40

(公司理财)公司理财期末复习大纲以及模拟题C公司财务管

1 对外经济贸易大学远程教育学院 2005—2006学年第一学期 《公司理财》期末考试题型与复习题 要求掌握的主要内容 一、掌握课件每讲后面的重要概念 二、会做课件后的习题 三、掌握各公式是如何运用的,记住公式会计算,特别是经营杠杆和财务杠杆要求对计算出的结果 给予正确的解释。 四、掌握风险的概念,会计算期望值、标准差和变异系数,掌握使用这三者对风险判断的标准。 五、了解财务报表分析的重要性,掌握常用的比率分析法,会计算各种财务比率。 六、会编制现金流量表,并会用资本预算的决策标准判断项目是否可行。 七、最佳资本预算是融资与投资的结合,要求掌握计算边际资本成本表,根据内含报酬率排序,决 定哪些项目可行。 八、从资本结构开始后主要掌握基本概念(第八、九、十讲),没有计算题,考基本概念,类似期 中作业。 模拟试题 注:1、本试题仅作模拟试题用,可能没有涵盖全部内容,主要是让同学们了解大致题的范围,希望同 学们还是要脚踏实地复习,根据复习要求全面复习。最后考试题型或许有变化,但对于计算题,要回答选择题,仍然需要一步一步计算才能选择正确。 2、在正式考试时,仍然需要认真审题,看似相似的题也可能有不同,认真审题非常重要,根据题 目要求做才能保证考试顺利。 预祝同学们考试顺利! 一、模拟试题,每小题2分,正式考试时只有50题,均采用这种题型 一、单项选择题 (每小题2分) 1. 零息债券按折价出售。 A. 正确 B. 不对 2. 股东的收益率是股利收益率和资本收益率的和。 A. 正确 B. 不对 3. 11.财务经理的行为是围绕公司目标进行的,并且代表着股东的利益。因此,财务经理在投资、 筹资及利润分配中应尽可能地围绕着以下目标进行。 A.利润最大化 B.效益最大化 C.股票价格最大化 D.以上都行 4. 12.在企业经营中,道德问题是很重要的,这是因为不道德的行为会导致 A.中断或结束未来的机会 B.使公众失去信心 C.使企业利润下降 D.以上全对 5. 14. 每期末支付¥1,每期利率为r ,其年金现值为: A.n r )1(+ B. n r )1(1+ C.r r n 1 )1(-+ D.n n r r r )1(1)1(+-+

公司理财 期末复习提纲

The Review Sheets of Corporate Finance Key Concepts and Questions 1. What Is Corporate Finance? Corporate finance addresses several important questions: 1) What long-term investments should the firm take on? (Capital budgeting) 2) Where will we get the long-term financing to pay for the investment? (Capital structure) 3)How will we manage the everyday financial activities of the firm? (Working capital) 2.The financial manager is concerned with three primary categories of financial decisions. 1) Capital budgeting –process of planning and managing a firm’s investments in fixed assets. The key concerns are the size, timing and riskiness of future cash flows. 2) Capital structure –mix of debt (borrowing) and equity (ownership interest) used by a firm. What are the least expensive sources of funds? Is there an optimal mix of debt and equity? When and where should the firm raise funds? 3) Working capital management – managing short-term assets and liabilities. How much inventory should the firm carry? What credit policy is best? Where will we get our short-term loans? 3.The Balance Sheet assets = liabilities + owners’ equity 4. Net Working Capital The difference between a firm’s current assets and its current liabilities. Assets are listed on a balance sheet in order of how long it takes to convert them to cash. Liability order reflects time to maturity. 5.Noncash Items The largest noncash deduction for most firms is depreciation. It reduces a firm’s taxes and its net income. Noncash deductions are part of the reason that net income is not equivalent to cash flow. 6.Cash Flow Free Cash Flow (FCF) FCF= Operating cash flow – net capital spending – changes in net working capital Operating cash flow (OCF) = EBIT + depreciation – taxes Net capital spending (NCS) = ending fixed assets – beginning fixed assets + depreciation Changes in NWC = ending NWC – beginning NWC Working capital = current assets-current liabilities 7. Sources and Uses of Cash

公司理财(英文版)题库2

CHAPTER 2 Financial Statements & Cash Flow Multiple Choice Questions: I. DEFINITIONS BALANCE SHEET b 1. The financial statement showing a firm’s accounting value on a particular date is the: a. income statement. b. balance sheet. c. statement of cash flows. d. tax reconciliation statement. e. shareholders’ equity sheet. Difficulty level: Easy CURRENT ASSETS c 2. A current asset is: a. an item currently owned by the firm. b. an item that the firm expects to own within the next year. c. an item currently owned by the firm that will convert to cash within the next 12 months. d. the amount of cash on hand the firm currently shows on its balance sheet. e. the market value of all items currently owned by the firm. Difficulty level: Easy LONG-TERM DEBT b 3. The long-term debts of a firm are liabilities: a. that come due within the next 12 months. b. that do not come due for at least 12 months. c. owed to the firm’s suppliers. d. owed to the firm’s shareholders. e. the firm expects to incur within the next 12 months. Difficulty level: Easy NET WORKING CAPITAL e 4. Net working capital is defined as: a. total liabilities minus shareholders’ equity. b. current liabilities minus shareholders’ equity. c. fixed assets minus long-term liabilities. d. total assets minus total liabilities. e. current assets minus current liabilities. Difficulty level: Easy LIQUID ASSETS d 5. A(n) ____ asset is on e which can be quickly converted into cash without significant loss in value.

广东金融学院公司理财模拟试卷一

广东金融学院 20 /20 学年第学期模拟试题( 一 ) 课程名称:公司金融课程代码: 考试方式:闭卷考试时间: 120 分钟 系别____________ 班级__________ 学号___________ 姓名___________ 一、单项选择题(本题共10小题,每小题1分,共10分) 1.企业财务管理目标的最优表达是()。 A.利润最大化B.每股利润最大化 C.企业价值最大化D.资本利润最大化 2.A方案在三年中每年年初付款100元,B方案在三年中每年年末付款100,若利率为10%,则二者在第三年年末时的终值相差()。 A.33.1B.31.3C.133.1D.13.31 3.假定某公司普通股预计支付股利为每股1.8元,每年股利预计增长率为10%,权益资本成本为15%,则普通股内在价值为()。 A.10.9B.36C.19.4D.7 4.采用销售百分比率法预测资金需要时,下列项目中被视为不随销售收入的变动而变动的是()。 A.现金B.应付账款 C.存活D.公司债券 5.下列筹资活动不会加大财务杠杆作用的是()。 A.增发普通股B.增发优先股 C.增发公司债券D.增加银行借款 6.下列表述不正确的是()。 A.净现值时未来期报酬的总现值与初始投资额现值之差 B.当净现值为0时,说明此时的贴现率等于内涵报酬率 C.当净现值大于0时,现值指数小于1 D.当净现值大于0时,说明该方案可行 7.作为企业财务管理目标,每股利润最大化目标较之利润最大化目标的优

点在于()。 A .考虑的资金时间价值因素 B .反映了创造利润与投入资本之间的关系 C .考虑了风险因素 D .能够避免企业的短期行为 8.如果投资组合中包括全部股票,则投资者()。 A.只承受市场风险B.只承受特有风险 C.只承受非系统风险D.不承受系统风险 9.某企业去年的销售净利率为5.73%,资产周转率为2.17%;今年的销售净利率为4.88%,资产周转率为2.88%。若两年的资产负债率相同,今年的权益净利率比去年的变化趋势为()。 A.下降B.不变C.上升D.难以确定 10.公司法规定,若公司用盈余公积金抵补亏损后支付股利,留存的法定盈余公积金不得低于注册资本的()。 A.10%B.5%~10%C.25%D.50% 二、多项选择题(在下列各题的备选答案中选择2至4个正确的,多选、少选、错选均不得分。本题共10小题,每题2分,共20分) 1.企业财务的分层管理具体为()。 A.出资者财务管理B.经营者财务管理 C.债务人财务管理D.财务经理财务管理 2.长期资本只要通过何种筹集方式()。 A.预收账款B.吸收直接投资 C.发行股票D.发行长期债券 3.β系数是衡量风险大小的重要指标,下列有关β系数的表述中正确的有()。 A.某股票的β系数等于0,说明该证券无风险 B.某股票的β系数等于1,说明该证券风险等于平均风险 C.某股票的β系数小于1,说明该证券风险小于平均风险 D.某股票的β系数小于1,说明该证券风险大于平均风险

罗斯公司理财题库全集

Chapter 20 Issuing Securities to the Public Multiple Choice Questions 1. An equity issue sold directly to the public is called: A. a rights offer. B. a general cash offer. C. a restricted placement. D. a fully funded sales. E. a standard call issue. 2. An equity issue sold to the firm's existing stockholders is called: A. a rights offer. B. a general cash offer. C. a private placement. D. an underpriced issue. E. an investment banker's issue. 3. Management's first step in any issue of securities to the public is: A. to file a registration form with the SEC. B. to distribute copies of the preliminary prospectus. C. to distribute copies of the final prospectus. D. to obtain approval from the board of directors. E. to prepare the tombstone advertisement. 4. A rights offering is: A. the issuing of options on shares to the general public to acquire stock. B. the issuing of an option directly to the existing shareholders to acquire stock. C. the issuing of proxies which are used by shareholders to exercise their voting rights. D. strictly a public market claim on the company which can be traded on an exchange. E. the awarding of special perquisites to management.

公司理财-20082009学年第一学期《公司理财》期末考试卷(答案)

丽水职业技术学院2008/2009学年第一学期 《公司理财》期末考试卷 适用班级:财务0701、0705、0706、0707 考试方式:开卷班级学号姓名 校对:钭志斌 (40分) 1、分析师称,中国央行今年(2008)将继续执行从紧的货币政策,加息的可能性较 场的现券价格有一定负面影响。 中国人民银行2008年1月22日以价格招标方式向公开市场业务一级交易商发行了2008年第十期中央银行票据,发行价格为96.10元,参考收益率为4.0583%。期限1年,到期按面值100元兑付。请问: (1)为什么说利率上涨,会对二级市场的债券价格有一定的负面影响?请从资金时间价值原理角度进行分析。(5分) 参考答案:债券给投资者未来的收益是稳定的,如每年利息固定,到期收回本金固定。利率的上涨,必然会引起投资者投资的期望报酬率的上升;在未来金额一定的情况下,折现率的上升,将会使现值下降。所以,在利率上升的情况下,债券交易价格将会下降。 (2)在财务管理上,该第十期中央银行票据属于债券中的哪一类债券?其参考收益率如何计算?请列出计算过程。(5分) 参考答案:属于贴现债券。 96.10=100×(P/F,IRR,1) 查表,采用内插法求解,得出IRR为4.0583%。 2、2008年10月,天音控股发布公告,将用自有资金在二级市场以集中竞价交易方式回购不超过2000万股社会公众股,回购资金总额不超过7000万元。这是证监会发布股份回购新规以来,第一家公布回购计划的上市公司。回购价格不超过每股3.5元。以最高回购数量2000万股计算,回购比例为目前总股本的2.11%,占实际流通股本的2.21%。预计本次回购完成后每股收益约提高1.06%,净资产收益率约提高1.33%,回购后速动比率约1倍。

《公司理财》期末试卷A(含答案)

XXXX 学 院 2015 /2016 学年第 2学期考试试卷( A )卷 课程名称: 公司理财 适用专业/年级:2014级会计电算化 本卷共 5 页,考试方式: 闭卷 ,考试时间: 90 分钟 一、单项选择题 (本题共12小题,每题2分,共24分) 1. 以下企业组织形式当中创立最容易维持经营固定成本最低的是( )?。 A.个人独资企业 B.合伙制企业 C.有限责任公司 D.股份有限公司 2.公司的目标不包括以下( )。 A.生存目标 B.发展目标 C.盈利目标 D.收购目标 3.资产负债率主要是反映企业的( )指标。 A.盈利能力 B.长期偿债能力 C.发展能力 D.营运能力 4.企业的财务报告不包括( )。 A.现金流量表 B.财务状况说明书 C.利润分配表 D.比较百分比会计报表 5.资产负债表不提供( )等信息。 A.资产结构 B.负债水平 C.经营成果 D.资金来源情况 6.某校准备设立永久性奖学金,每年计划颁发36000元资金,若年复利率为12%,该校现在应向银行存入( )元本金。 A .450000 B .300000 C .350000 D .360000 7.债券投资中,债券发行人无法按期支付利息或本金的风险称为( )? A.违约风险???????????? ???B.利息率风险? C.购买力风险???????? ?????D.流动性风险 专业班级: 姓 名: 学 号: 密 封 线 装 订 线

8.某人将10000元存入银行,银行的年利率为10%,按复利计算。则5年后此人可从银行取出()元。 A.17716 B.15386 C.16105 D.14641 9.股票投资的特点是()? A.股票投资的风险较小? B.股票投资属于权益性投资? C.股票投资的收益比较稳定? D.股票投资的变现能力较差 10.下列各项年金中,只有现值没有终值的年金是() A.普通年金 B.即付年金 C.永续年金 D.先付年金 11. 在公司理财市场环境风险分析当中无法通过分散投资来消除的风险是() A.系统风险 B.非系统风险 C.绝对风险 D.财务风险 12.流动比率的计算公式是() A.流动负债/流动资产 B.流动资产/流动负债 C.流动资产/总资产 D.流动资产/负债总额 二、多项选择题(本题共6小题,每题3分,共18分) 1.公司企业的优点包括()。 A.无限存续 B.容易转让所有权 C.有限债务责任 D.组建公司的成本高 2.公司理财的目标理论包括()。 A.费用最大化 B.利润最大化 C.每股收益最大化 D.企业价值最大化 3.影响公司理财行为的外部环境因素有()。 A.经济形势 B.法律制度 C.国内市场 D.企业规模 4.以下能反映企业盈利能力的指标有()。 A.净资产收益率 B.总资产收益率 C.权益净利率 D.总资产净利率 5.影响资金时间价值大小的因素主要包括()。 A.单利 B.复利 C.资金额 D.利率和期限

罗斯公司理财题库全集

Chapter 30 Financial Distress Multiple Choice Questions 1. Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action? A. Cash payments are delayed to creditors. B. The market value of the stock declines by 10%. C. The firm's operating cash flow is insufficient to pay current obligations. D. Cash distributions are eliminated because the board of directors considers the surplus account to be low. E. None of the above. 2. Insolvency can be defined as: A. not having cash. B. being illiquid. C. an inability to pay one's debts. D. an inability to increase one's debts. E. the present value of payments being less than assets. 3. Stock-based insolvency is a: A. income statement measurement. B. balance sheet measurement. C. a book value measurement only. D. Both A and C. E. Both B and C. 4. Flow-based insolvency is: A. a balance sheet measurement. B. a negative equity position. C. when operating cash flow is insufficient to meet current obligations. D. inability to pay one's debts. E. Both C and D.

公司理财(西大期末复习题)

公司理财参考复习资料 一、单选题 1.公司价值是指全部资产的() A.评估价值 B.账面价值 C.潜在价值 D.市场价值 参考答案:D 2.某上市公司股票现时的系数为 1.5 ,此时无风险利率为6% ,市场上所有股票 的平均收益率为10% ,则该公司股票的预期收益率为()。 A.4% B.12% C.16% D.21% 参考答案:B 3.无差别点是指使不同资本结构下的每股收益相等时的()。 A . 息税前利润 B . 销售收入 C . 固定成本 D . 财务风险 参考答案:A 4.上市公司应该最先考虑的筹资方式是()。 A . 发行债券 B . 发行股票 C . 留存收益 D . 银行借款 参考答案:C 5.对零增长股票,若股票市价低于股票价值,则预期报酬率和市场利率之间的关系是 ()。 A . 预期报酬率大于市场利率 B . 预期报酬率等于市场利率 C . 预期报酬率小于市场利率 D . 取决于该股票风险水平 参考答案:A 6.A 证券的标准差是12% ,B 证券的标准差是20%,两种证券的相关系数是0.2 ,对A 、 B 证券的投资比例为 3 :2 ,则 A 、B 两种证券构成的投资组合的标准差为()。 A . 3.39% B . 11.78% C . 4.79% D . 15.2 % 参考答案:B 7.在公司理财学中,已被广泛接受的公司理财目标是()。 A . 公司价值最大化 B . 股东财富最大化 C . 股票价格最大化 D . 每股现金流量最大化参考答案:A 8.当公司的盈余和现金流量都不稳定时,对股东和企业都有利的股利分配政策是()。 A . 剩余股利政策 B . 固定股利支付率政策 C . 低正常股利加额外股利政策 D . 固定股利政策 参考答案:C 9.考察了企业的财务危机成本和代理成本的资本结构模型是()。

公司理财期末考试题(C卷)

《公司理财》期末考试题(C 卷) 一、判断题(共10分,每小题1分) 1.企业财务管理是基于企业再生产过程中客观存在的资金运动而产生的,是企业组织资金运动的一项经济管理工作。 ( ) 2.解聘是一种通过市场约束经营者的办法。 ( ) 3.终值系数和现值系数互为倒数,因此,年金终值系数与年金现值系数也互为倒数。 ( ) 4.经营性租赁和融资性租赁都是租赁,它们在会计处理上是没有区别的。 ( ) 5.留存收益是企业经营中的内部积累,这种资金不是向外界筹措的,因而它不存在资本成本。 ( ) 6.多个互斥方案比较,一般应选择净现值大的方案。 ( ) 7.营运资金就是流动资产。 ( ) 8.企业是否延长信用期限,应将延长信用期后增加的销售利润与增加的机会成本、管理成本和坏账成本进行比较。 ( ) 9.相关比率反映部分与总体的关系。 ( ) 10.采用因素分析法,可以分析引起变化的主要原因、变动性质,并可预测企业未来的发展前景。( ) 二、单项选择题(共15分,每小题1分) 1.财务管理目标是( )。 A 现金流量最大化 B 市场份额最大化 C 预期盈利最大化 D 股价最大化 2.企业财务关系中最为重要的关系是( )。 A 股东与经营者之间的关系 B 股东与债权人之间的关系 C 股东、经营者与债权人之间的关系 D 企业与作为社会管理者的政府有关部门、社会公众之间的关系 3.边际贡献率和变动成本率( )。 A 反方向变化 B 同方向变化 C 同比例变化 D 反比例变化 4.安全边际越小,保本点就越太、利润就( )。 A 越大 B 不变 C 不一定 D 越小 5.融资性租赁实质上是由出租人提供给承租人使用固定资产的一种( )。 A 信用业务 B 买卖活动 C 租借业务 D 服务活动 6.在计算资本成本时,与所得税有关的资金来源是下述情况中的( )。 A 普通股 B 优先股 C 银行借款 D 留存收益 7.当经营杠杆系数是5,财务杠杆系数是1.1,财综合杠杆系数是( )。 A 5.5 B 6.5 C 3.9 D 7.2 8.某企业拥有一块土地,其原始成本为250万元,账面价值为180万元。现准备在这块土地上建造工厂厂房,但如果现在将这块土地出售,可获得收入220万元,则建造厂房机会成本是( )。 A 250万元 B 70万元 C 180万元 D 220万元 9.假定某项投资风险系数为1,无风险收益率为10%,市场平均收益率为20%,其必要收益率为( )。 ………………………………………………………………………………………………………………………………………………………… ………………………………………密……………………………封………………………………………线……………………………………… 班级 姓名 学号

罗斯公司理财题库全集

Chapter 13 Risk, Cost of Capital, and Capital Budgeting Answer Key Multiple Choice Questions 1. The weighted average of the firm's costs of equity, preferred stock, and after tax debt is the: A. reward to risk ratio for the firm. B. expected capital gains yield for the stock. C. expected capital gains yield for the firm. D. portfolio beta for the firm. E. weighted average cost of capital (WACC). Difficulty level: Easy Topic: WACC Type: DEFINITIONS 2. If the CAPM is used to estimate the cost of equity capital, the expected excess market return is equal to the: A. return on the stock minus the risk-free rate. B. difference between the return on the market and the risk-free rate. C. beta times the market risk premium. D. beta times the risk-free rate. E. market rate of return. Difficulty level: Easy Topic: CAPM Type: DEFINITIONS

4公司理财期末考试复习题

公司理财复习题 一、说明 1.考试题型:计算题2道题、简述题5道题、论述题3道题。 2.考试地点:教学楼610教室。 3.考试时间:20XX年1月7日上午8:30-11:00。 4.考试形式:闭卷。 二、计算题:(本题20分) (一)、见《财务会计学》第277页表12-1资产负债表和第282页表12-5利润表。 注意:考试时,可能存在数据的变化。 1.资产负债率 = 负债总额/资产总额×100% 代入数据: 资产负债率 = 3090362 / 7833717 × 100% = 39.45%。 2.流动比率 = 流动资产 / 流动负债 = 2/1(较为合理数值) 代入数据: 流动比率 = 2538117 / 1849462 = 1.37 3.速动比率 = (流动资产–存货) / 流动负债 = 1/1 代入数据: 速动比率 = (2538117-518710) / 1849462 = 1.09 4.应收周转率 = 赊销收入净额 / 应收账款的平均余额 说明: ①赊销余额假设为50万,考试时可能会变换此数值。 ②应收账款的平均余额 = (应收账款年初数+应收账款期末数)÷2 代入数据:

应收周转率= 50万/(392000+492940)÷2 = 50万/442470=1.13 5.存货周转率 = 销售成本 / 存货平均余额 说明: ①销售成本假设40万,考试时可能会变换次数值。 ②存货平均余额=(存货年初数+存货期末数)÷2 代入数据: 存货周转率=40万/(348200+518710)÷2=40万/433455 = 0.92 6.总资产收益率=(净利润+利息费用)/总资产平均余额×100% 说明: ①总资产平均余额 = (资产年初数+资产期末数)÷2 ②总资产指表格中的资产总计。 代入数据: 总资产收益率=(143700+56500)/(8160100+7833717) ÷2 = 200200 / 7996908.50 = 2.50% 7.所有者权益报酬率 = 净利润 / 所有者权益余额× 100% 代入数据: 所有者权益报酬率 = 143700 / 4743355 = 3.03% (二)、某企业共有长期资金15000万元,其中发行长期债券为3000万元,票面利率为6%,筹资费率3%,按面值发行;发行普通股12000万元,发行价格6元,筹资费率4%,第一年股利为每股0.42元,预计每年增长率为5%。企业所得税为30%。根据以上资料,计算该企业长期资金的个别资本成本和加权平均资本成本(即综合资金成本)?并说明该企业降低资本成本的可能性和途径? 注意:考试时,可能存在数据的变化,复习时,可参考《财务管理学》第186页至198页例题。 解: 1.债券资本成本率=年使用成本(利息、红利)/(筹资额-筹资费用)

完整word版公司理财英文版题库8

CHAPTER 8 Making Capital Investment Decisions I. DEFINITIONS INCREMENTAL CASH FLOWS a 1. The changes in a firm's future cash flows that are a direct consequence of accepting a project are called _____ cash flows. a. incremental b. stand-alone c. after-tax d. net present value e. erosion Difficulty level: Easy EQUIVALENT ANNUAL COST e 2. The annual annuity stream o f payments with the same present value as a project's costs is called the project's _____ cost. a. incremental b. sunk c. opportunity d. erosion e. equivalent annual Difficulty level: Easy SUNK COSTS c 3. A cost that has already been paid, or the liability to pay has already been incurred, is a(n): a. salvage value expense. b. net working capital expense. c. sunk cost. d. opportunity cost. e. erosion cost. Difficulty level: Easy OPPORTUNITY COSTS d 4. Th e most valuable investment given up i f an alternative investment is chosen is a(n): a. salvage value expense. b. net working capital expense.

公司理财期末试卷答案图文稿

公司理财期末试卷答案 Company number【1089WT-1898YT-1W8CB-9UUT-92108】

XXXX 学 院 2015 /2016 学年第 2学期考试试卷( A )卷 课程名称: 公司理财 适用专业/年级:2014级会计电算化 本卷共 5 页,考试方式: 闭卷 ,考试时间: 90 分钟 一、单项选择题 (本题共12小题,每题2分,共24分) 1. 以下企业组织形式当中创立最容易维持经营固定成本最低的是( )。 A.个人独资企业 B.合伙制企业 C.有限责任公司 D.股份有限公司 2.公司的目标不包括以下( )。 A.生存目标 B.发展目标 C.盈利目标 D.收购目标 3.资产负债率主要是反映企业的( )指标。 A.盈利能力 B.长期偿债能力 C.发展能力 D.营运能力 4.企业的财务报告不包括( )。 A.现金流量表 B.财务状况说明书 C.利润分配表 D.比较百分比会计报表 5.资产负债表不提供( )等信息。 A.资产结构 B.负债水平 C.经营成果 D.资金来源情况 6.某校准备设立永久性奖学金,每年计划颁发36000元资金,若年复利率为12%,该校现在应向银行存入( )元本金。 专业班级: 姓 名: 学 号: 密 封 线 装 订 线

A.450000 B.300000 C.350000 D.360000 7.债券投资中,债券发行人无法按期支付利息或本金的风险称为 () A.违约风险 B.利息率风险 C.购买力风险 D.流动性风险 8.某人将10000元存入银行,银行的年利率为10%,按复利计算。则5年后此人可从银行取出()元。 9.股票投资的特点是() A.股票投资的风险较小 B.股票投资属于权益性投资 C.股票投资的收益比较稳定 D.股票投资的变现能力较差 10.下列各项年金中,只有现值没有终值的年金是() A.普通年金 B.即付年金 C.永续年金 D.先付年金 11. 在公司理财市场环境风险分析当中无法通过分散投资来消除的风险是() A.系统风险 B.非系统风险 C.绝对风险 D.财务风险 12.流动比率的计算公式是() A.流动负债/流动资产 B.流动资产/流动负债 C.流动资产/总资产 D.流动资产/负债总额 二、多项选择题(本题共6小题,每题3分,共18分) 1. 公司企业的优点包括()。 A.无限存续 B.容易转让所有权 C.有限债务责任 D.组建公司的成本高 2.公司理财的目标理论包括()。 A.费用最大化 B.利润最大化

罗斯公司理财题库cha16

Chapter 16 Capital Structure: Basic Concepts Multiple Choice Questions 1. The use of personal borrowing to change the overall amount of financial leverage to which an individual is exposed is called: A. homemade leverage. B. dividend recapture. C. the weighted average cost of capital. D. private debt placement. E. personal offset. 2. The proposition that the value of the firm is independent of its capital structure is called: A. the capital asset pricing model. B. MM Proposition I. C. MM Proposition II. D. the law of one price. E. the efficient markets hypothesis. 3. The proposition that the cost of equity is a positive linear function of capital structure is called: A. the capital asset pricing model. B. MM Proposition I. C. MM Proposition II. D. the law of one price. E. the efficient markets hypothesis. 4. The tax savings of the firm derived from the deductibility of interest expense is called the: A. interest tax shield. B. depreciable basis. C. financing umbrella. D. current yield. E. tax-loss carry forward savings.