CFA考试一级章节练习题精选0329-46(附详解)

CFA考试一级章节练习题精选0329-46(附详解)

1、Which of the following statements best describes a trial balance? A trial balance is a document or computer file that:【单选题】

A.shows all business transactions by account.

B.lists account balances at a particular point in time.

C.contains business transactions recorded in the order in which they occur.

正确答案:B

答案解析:"Financial Reporting Mechanics,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, p. 67

Study Session: 7-30-f

Describe the flow of information in an accounting system.

A trial balance is a document that lists account balances at a particular point in time.

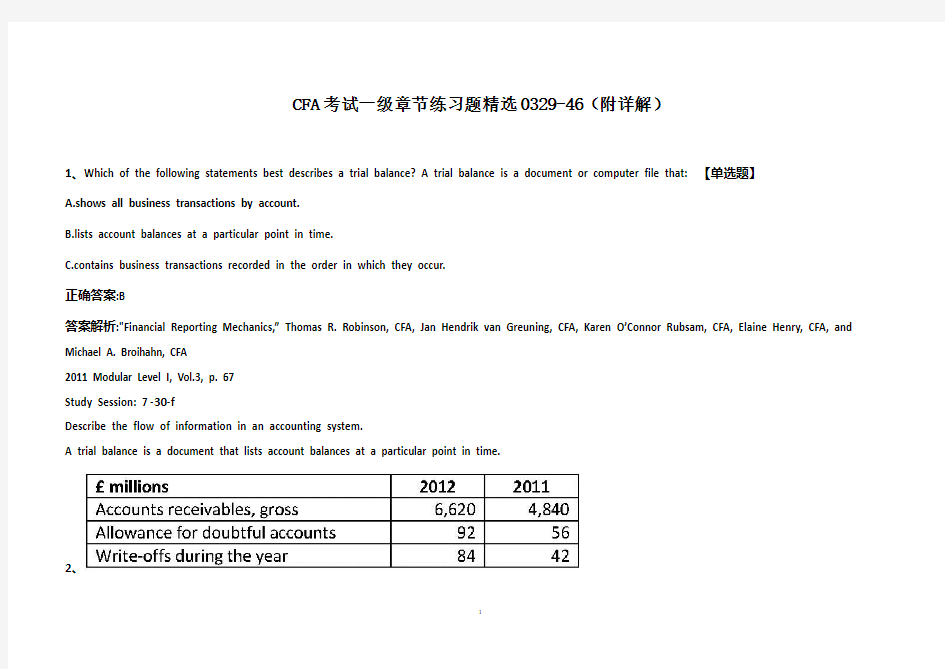

2、

Based on the above information about a company’s trade receivables, the bad debt expense (in millions) for 2012 is closest to:【单选题】

A.£36.

B.£84.

C.£120.

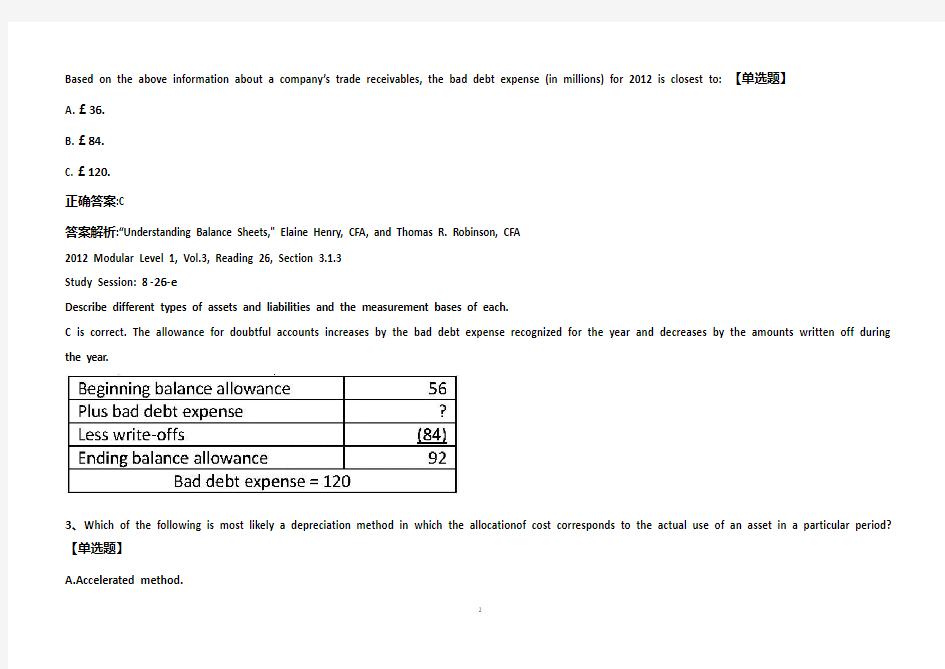

正确答案:C

答案解析:“Understanding Balance Sheets," Elaine Henry, CFA, and Thomas R. Robinson, CFA

2012 Modular Level 1, Vol.3, Reading 26, Section 3.1.3

Study Session: 8-26-e

Describe different types of assets and liabilities and the measurement bases of each.

C is correct. The allowance for doubtful accounts increases by the bad debt expense recognized for the year and decreases by the amounts written off during the year.

3、Which of the following is most likely a depreciation method in which the allocationof cost corresponds to the actual use of an asset in a particular period?【单选题】

A.Accelerated method.

B.Weighted average method.

C.Units-of-production method.

正确答案:C

答案解析:折旧(depreciation)费用的3种计算方法如下:

● 直线折旧法[ straight-line(sl)method]:[初始成本(original cost)-残值(residualvalue)]/应折旧年限(depreciable life)。

● 加速折旧法(accelerated method):例如,双倍余额递减法[double-declining balance(DDB)method],其计算公式中没有残值(salvage value),故在计算最后一年折旧费用时要注意折旧费用不能超过残值,depreciation in year × = (2/ depreciable life)×book value at the beginning of year × ,如果此公式中2改为1,就是单倍余额递减法。

● 单位产出法(units-of-production method):生产中耗用了多少,就按其比例计算多少折旧费用。

4、According to International Financial Reporting Standards, which of the following is a condition that must be met for revenue recognition to occur?【单选题】

A.Costs can be reliably measured.

B.Payment has been partially received.

C.Goods have been delivered to the customer.

正确答案:A

答案解析:The IFRS's conditions that must be met include that the costs incurred can be reliably measured, the seller knows what it expects to collect and is reasonably certain of collection, and the significant risks and rewards of ownership have been transferred, which is normally (but not always) when the goods have been delivered.

2014 CFA Level I

“Understanding Income Statements,” by Elaine Henry and Thomas R. Robinson

Section 3.1

5、A company whose objective is to maximize income had spent $1,000,000 for a machine with two significant components as indicated below. The machine is expected to have an overall useful life of 10 years and the company uses the straight line method of depreciation.

The depreciation expense for the first year computed under IFRS compared with under U.S. GAAP will most likely be:【单选题】

A.the same.

B.$50,000 lower.

C.$50,000 higher.

正确答案:C

答案解析:“Long-Lived Assets” Elaine Henry, CFA and Elizabeth A Gordon

2013 Modular Level I, Vol. 3, Reading 30, Section 3.1, Example 5

Study Session 9–30–d

Calculate depreciation expense.

C is correct.