新会计准则会计科目表(中英文对照)

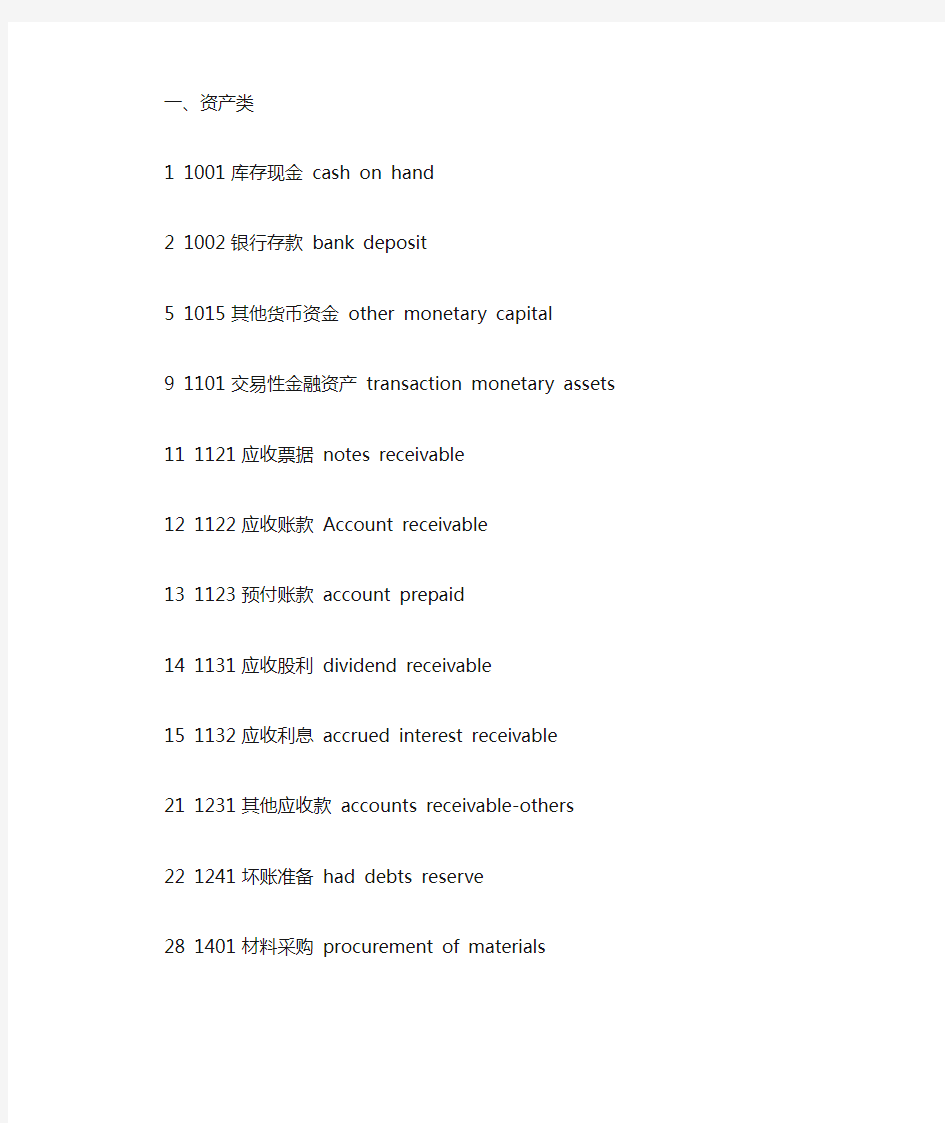

一、资产类

1 1001 库存现金cash on hand

2 1002 银行存款bank deposit

5 1015 其他货币资金other monetary capital

9 1101 交易性金融资产transaction monetary assets

11 1121 应收票据notes receivable

12 1122 应收账款Account receivable

13 1123 预付账款account prepaid

14 1131 应收股利dividend receivable

15 1132 应收利息accrued interest receivable

21 1231 其他应收款accounts receivable-others

22 1241 坏账准备had debts reserve

28 1401 材料采购procurement of materials

29 1402 在途物资materials in transit

30 1403 原材料raw materials

32 1406 库存商品commodity stocks

33 1407 发出商品goods in transit

36 1412 包装物及低值易耗品wrappage and low value and easily wornout articles

42 1461 存货跌价准备reserve against

stock price declining

45 1521 持有至到期投资hold investment due

46 1522 持有至到期投资减值准备hold investment due reduction reserve

47 1523 可供出售金融资产financial assets available for sale

48 1524 长期股权投资long-term stock ownership investment

49 1525 长期股权投资减值准备long-term stock ownership investment reduction reserve

50 1526 投资性房地产investment real eastate

51 1531 长期应收款long-term account

receivable

52 1541 未实现融资收益unrealized financing income

54 1601 固定资产permanent assets

55 1602 累计折旧accumulated depreciation

56 1603 固定资产减值准备permanent assets reduction reserve

57 1604 在建工程construction in process

58 1605 工程物资engineer material

59 1606 固定资产清理disposal of fixed assets

60 1611 融资租赁资产租赁专用

financial leasing assets exclusively for leasing

61 1612 未担保余值租赁专用unguaranteed residual value exclusively for leasing

62 1621 生产性生物资产农业专用productive living assets exclusively for agriculture

63 1622 生产性生物资产累计折旧农业专用productive living assets accumulated depreciation exclusively for agriculture

64 1623 公益性生物资产农业专用non-profit living assets exclusively for agriculture

65 1631 油气资产石油天然气开采专用oil and gas assets exclusively for oil and gas exploitation

66 1632 累计折耗石油天然气开采专用accumulated depletion exclusively for oil and gas exploitation

67 1701 无形资产intangible assets

68 1702 累计摊销accumulated amortization

69 1703 无形资产减值准备intangible assets reduction reserve

70 1711 商誉business reputation

71 1801 长期待摊费用long-term deferred expenses

72 1811 递延所得税资产deferred income tax assets

73 1901 待处理财产损溢waiting assets profit and loss

二、负债类debt group

74 2001 短期借款short-term loan

81 2101 交易性金融负债transaction financial liabilities

83 2201 应付票据notes payable

84 2202 应付账款account payable

85 2205 预收账款item received in advance

86 2211 应付职工薪酬employee pay payable

87 2221 应交税费tax payable

88 2231 应付股利dividend payable

89 2232 应付利息interest payable

90 2241 其他应付款other account payable

98 2411 预计负债estimated liabilities

99 2501 递延收益deferred income

100 2601 长期借款money borrowed for long term

101 2602 长期债券long-term bond

106 2801 长期应付款long-term account payable

107 2802 未确认融资费用unacknowledged financial charges

108 2811 专项应付款special accounts payable

109 2901 递延所得税负债deferred income tax liabilities

三、共同类

112 3101 衍生工具derivative tool

113 3201 套期工具arbitrage tool

114 3202 被套期项目arbitrage project

四、所有者权益类

115 4001 实收资本paid-up capital

116 4002 资本公积contributed surplus

117 4101 盈余公积earned surplus

119 4103 本年利润profit for the current year

120 4104 利润分配allocation of profits

121 4201 库存股treasury stock

五、成本类

122 5001 生产成本production cost

123 5101 制造费用cost of production

124 5201 劳务成本service cost

125 5301 研发支出research and development expenditures

126 5401 工程施工建造承包商专用engineering construction exclusively for construction contractor

127 5402 工程结算建造承包商专用engineering settlement exclusively for

construction contractor

128 5403 机械作业建造承包商专用mechanical operation exclusively for construction contractor

六、损益类

129 6001 主营业务收入main business income

130 6011 利息收入金融共用interest income financial sharing

135 6051 其他业务收入other business income

136 6061 汇兑损益金融专用exchange gain or loss exclusively for finance

137 6101 公允价值变动损益sound value flexible loss and profit

138 6111 投资收益income on investment

142 6301 营业外收入nonrevenue receipt

143 6401 主营业务成本main business cost

144 6402 其他业务支出other business expense

145 6405 营业税金及附加business tariff and annex

146 6411 利息支出金融共用interest expense financial sharing

155 6601 销售费用marketing cost

156 6602 管理费用managing cost

157 6603 财务费用financial cost

158 6604 勘探费用exploration expense

159 6701 资产减值损失loss from asset devaluation

160 6711 营业外支出nonoperating expense

161 6801 所得税income tax

162 6901 以前年度损益调整prior year profit and loss adjustment

说明:新准则是在资产负债表中没有了这两个项目,但是平时可以根据需要设置的,待摊费用的期末余额在预付款项项目核算,预提费用期末余额在预收款项项目核算。

三、详细讲解

金融资产应当在初始确认时划分为下列四类:The initial recognition of financial assets could be categorized into 4 groups:

1)以公允价值计量且其变动计入当期损益的金融资产;

Financial assets measured at fair value and changes recorded into current period profit or loss (或:Financial assets at fair value through profit or loss)

2)持有至到期投资;The investments which will be held-to-maturity; (或:held-to-maturity investments)

3)贷款和应收款项;Loans and the accounts receivable; and

4)可供出售金融资产。Financial assets available for sale.

考点一:以公允价值计量且其变动计入当期损益的金融资产

Financial Assets Measured at Fair

Value and Changes Recorded into Current Period Profit or Loss

以公允价值计量且其变动计入当期损益的金融资产,可以进一步分为交易性金融资产和指定为以公允价值计量且其变动计入当期损益的金融资产。

Financial assets measured at fair value the changes of which are recorded into current profit or loss could be further divided into tradable financial assets and financial assets that are designated as financial assets measured at fair value and the changes of which are recorded into current period profit or loss.

金融资产满足下列条件之一的,应当划分为交易性金融资产:

It should be classified as tradable financial asset if one of the following conditions is met:

(1)取得该金融资产的目的,主要是为了近期内出售。

The purpose of obtaining financial

assets is to sell recently.

(2)属于进行集中管理的可辨认金融工具组合的一部分,且有客观证据表明企业近期采用短期获利方式对该组合进行管理。

It is a part of identifiable financial instrument which is centrally managed and there is objective evidence stating that the enterprise manages the combination through the way of obtaining short term gain in recent period.

(3)属于衍生金融工具。

It belongs to the derivative financial instruments.

会计处理Accounting treatments

1.初始计量Initial measurement

应当按照公允价值进行初始计量。

Upon initial measurement,it should be measured at fair value.

注意:please note:

(1)对于以公允价值计量且其变动计入当期损益的金融资产,相关交易费用

应当直接计入当期损益。

For the financial assets measured at fair values and the changes of which are recorded into the profit and loss of the current period, the transaction expenses thereof shall be directly recorded into the profit and loss of the current period.

(2)支付的价款中包含的已宣告但尚未发放现金股利或债券利息,应当单独确认为应收项目进行处理。

The debenture interests or cash dividends declared but not paid included in the payments for acquisition of financial assets should be recorded into receivable separately.

会计分录Journal entry:

Dr: Tradable financial assets –cost

Dividend receivable/Interest receivable

Investment income

Cr: Cash in bank

2.后续计量Subsequent measurement

以公允价值计量且其变动计入当期损益的金融资产应当采用公允价值进行后续计量。

Financial assets measured at fair value and the changes of which are recorded into current period profit or loss should be measured at fair value in subsequent measurement.

资产负债表日,企业应将其公允价值变动计入当期损益。

On the balance sheet date, company should record the change of fair value into current profit and loss.

会计分录Journal entry:

Dr:Cash in bank

Cr:Dividend receivable

Dr:Tradable financial assets-changes in fair value

Cr: The profits and losses on the changes in fair value

3.交易性金融资产处置的处理Disposal of tradable financial assets

处置该金融资产时,其公允价值与初始入账金额之间的差额应确认为投资收益,同时调整公允价值变动损益。Upon disposal of tradable financial assets, the difference between the fair value and the initial measurement value should be recognized as investment income and the profits and losses on the changes in fair value account should be adjusted into investment income.

会计分录Journal entry:

Dr: Cash in bank

The profits and losses on the changes in fair value

Cr: Tradable financial assets

–cost

-changes in fair value

考点二:持有至到期投资

Held-to- maturity investments

持有至到期投资,是指到期日固定、回收金额固定或可确定,且企业有明确

意图和能力持有至到期的非衍生金融资产。

Held-to-maturity investments refer to non-derivative financial assets, the maturity date, the recoverable amount of which is fixed or could be determined and the company has clear intention and ability to hold to maturity.

存在下列情况之一的,表明企业没有明确意图将金融资产投资持有至到期:

Under any of the following circumstances, it shows that the enterprise concerned is not able to hold the fixed term financial asset investment to maturity:

(1)持有该金融资产的期限不确定;

The term of holding the financial assets is indefinite;

(2)发生市场利率变化、流动性需要变化、替代投资机会及其投资收益率变化、融资来源和条件变化、外汇风险变化等情况时,将出售该金融资产。但是,无法控制、预期不会重复发生且难以合理预计的独立事项引起的金融资产出售除外;