公司理财精要版原书第12版习题库答案Ross12e_Chapter02_TB

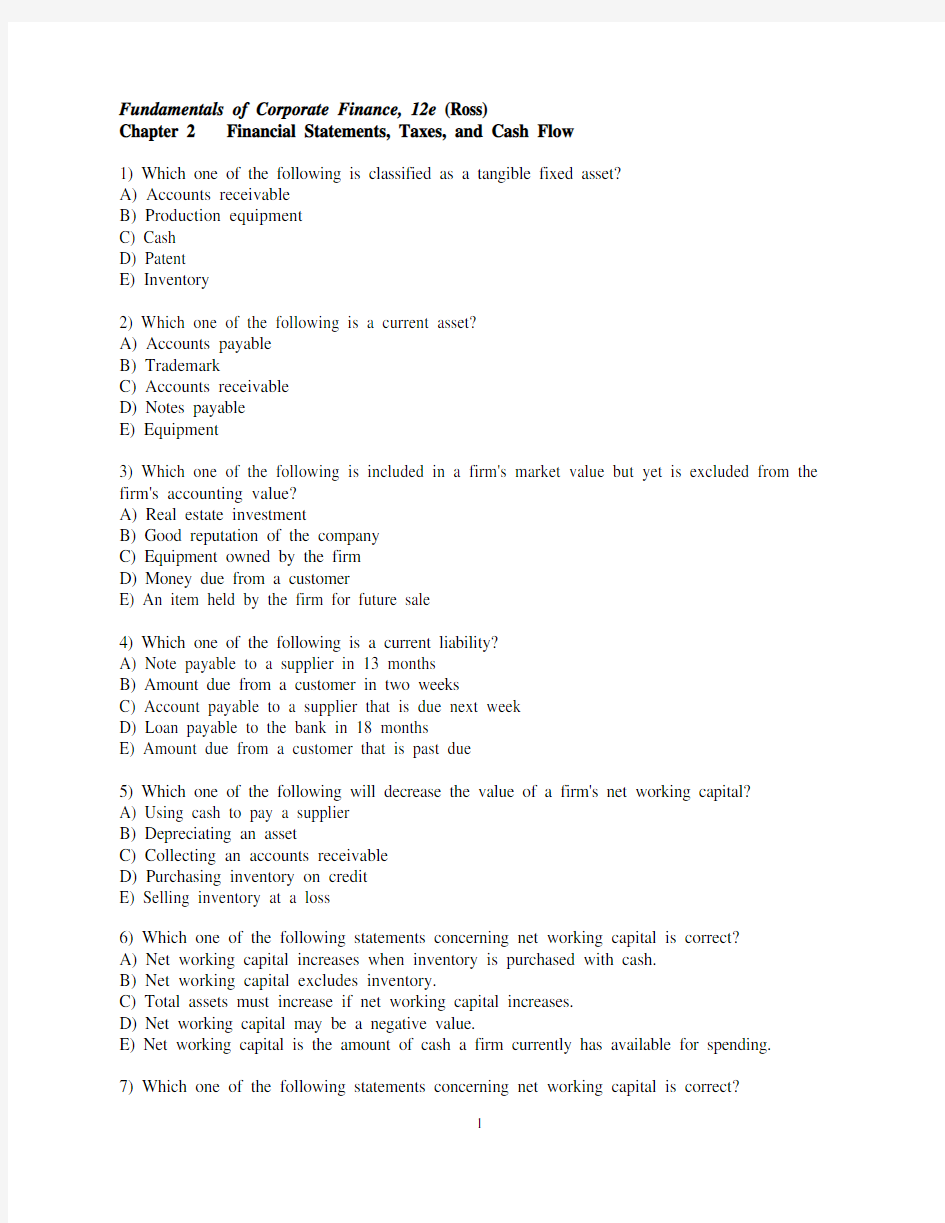

Fundamentals of Corporate Finance, 12e (Ross)

Chapter 2 Financial Statements, Taxes, and Cash Flow

1) Which one of the following is classified as a tangible fixed asset?

A) Accounts receivable

B) Production equipment

C) Cash

D) Patent

E) Inventory

2) Which one of the following is a current asset?

A) Accounts payable

B) Trademark

C) Accounts receivable

D) Notes payable

E) Equipment

3) Which one of the following is included in a firm's market value but yet is excluded from the firm's accounting value?

A) Real estate investment

B) Good reputation of the company

C) Equipment owned by the firm

D) Money due from a customer

E) An item held by the firm for future sale

4) Which one of the following is a current liability?

A) Note payable to a supplier in 13 months

B) Amount due from a customer in two weeks

C) Account payable to a supplier that is due next week

D) Loan payable to the bank in 18 months

E) Amount due from a customer that is past due

5) Which one of the following will decrease the value of a firm's net working capital?

A) Using cash to pay a supplier

B) Depreciating an asset

C) Collecting an accounts receivable

D) Purchasing inventory on credit

E) Selling inventory at a loss

6) Which one of the following statements concerning net working capital is correct?

A) Net working capital increases when inventory is purchased with cash.

B) Net working capital excludes inventory.

C) Total assets must increase if net working capital increases.

D) Net working capital may be a negative value.

E) Net working capital is the amount of cash a firm currently has available for spending.

7) Which one of the following statements concerning net working capital is correct?

A) A firm's ability to meet its current obligations increases as the firm's net working capital decreases.

B) An increase in net working capital must also increase current assets.

C) Net working capital increases when inventory is sold for cash at a profit.

D) Firms with equal amounts of net working capital are also equally liquid.

E) Net working capital is a part of the operating cash flow.

8) Which one of the following accounts is the most liquid?

A) Inventory

B) Building

C) Accounts Receivable

D) Equipment

E) Land

9) Which one of the following represents the most liquid asset?

A) $100 account receivable that is discounted and collected for $96 today

B) $100 of inventory that is sold today on credit for $103

C) $100 of inventory that is discounted and sold for $97 cash today

D) $100 of inventory that is sold today for $100 cash

E) $100 of accounts receivable that will be collected in full next week

10) Which one of the following statements related to liquidity is correct?

A) Liquid assets tend to earn a high rate of return.

B) Liquid assets are valuable to a firm.

C) Liquid assets are defined as assets that can be sold quickly regardless of the price obtained.

D) Inventory is more liquid than accounts receivable because inventory is tangible.

E) Any asset that can be sold is considered liquid.

11) Shareholders' equity:

A) is referred to as a firm's financial leverage.

B) is equal to total assets plus total liabilities.

C) decreases whenever new shares of stock are issued.

D) includes patents, preferred stock, and common stock.

E) represents the residual value of a firm.

12) As the degree of financial leverage increases, the:

A) probability a firm will encounter financial distress increases.

B) amount of a firm's total debt decreases.

C) less debt a firm has per dollar of total assets.

D) number of outstanding shares of stock increases.

E) accounts payable balance decreases.

13) The book value of a firm is:

A) equivalent to the firm's market value provided that the firm has some fixed assets.

B) based on historical cost.

C) generally greater than the market value when fixed assets are included.

D) more of a financial than an accounting valuation.

E) adjusted to the market value whenever the market value exceeds the stated book value.

14) The value of which one of the following is included in the market value of a firm but is excluded from the firm's book value?

A) Office equipment

B) Copyright

C) Distribution warehouse

D) Employee's experience

E) Land acquired over 25 years ago

15) You recently purchased a grocery store. At the time of the purchase, the store's market value and its book value were equal. The purchase included the building, fixtures, and inventory. Which one of the following is most apt to cause the market value of this store to be less than its book value?

A) A sudden and unexpected increase in inflation

B) The replacement of old inventory items with more desirable products

C) Improvements to the surrounding area by other store owners

D) Construction of a new restricted access highway located between the store and the surrounding residential areas

E) Addition of a stop light at the main entrance to the store's parking lot

16) Which one of the following is the financial statement that shows the accounting value of a firm's equity as of a particular date?

A) Income statement

B) Creditor's statement

C) Balance sheet

D) Statement of cash flows

E) Dividend statement

17) Net working capital is defined as:

A) total liabilities minus shareholders' equity.

B) current liabilities minus shareholders' equity.

C) fixed assets minus long-term liabilities.

D) total assets minus total liabilities.

E) current assets minus current liabilities.

18) Which one of these sets forth the common set of standards and procedures by which audited financial statements are prepared?

A) Matching principle

B) Cash flow identity

C) Generally Accepted Accounting Principles

D) Financial Accounting Reporting Principles

E) Standard Accounting Value Guidelines

19) Which one of the following is the financial statement that summarizes a firm's revenue and expenses over a period of time?

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Tax reconciliation statement

E) Market value report

20) Noncash items refer to:

A) fixed expenses.

B) inventory items purchased using credit.

C) the ownership of intangible assets such as patents.

D) expenses that do not directly affect cash flows.

E) sales that are made using store credit.

21) Which one of the following is true according to generally accepted accounting principles?

A) Depreciation is recorded based on the market value principle.

B) Income is recorded based on the realization principle.

C) Costs are recorded based on the realization principle.

D) Depreciation is recorded based on the recognition principle.

E) Costs of goods sold are recorded based on the recognition principle.

22) Which one of these is most apt to be a fixed cost?

A) Raw materials

B) Manufacturing wages

C) Management bonuses

D) Office salaries

E) Shipping and freight

23) Which one of the following statements is correct assuming accrual accounting is used?

A) The addition to retained earnings is equal to net income plus dividends paid.

B) Credit sales are recorded on the income statement when the cash from the sale is collected.

C) The labor costs for producing a product are expensed when the product is sold.

D) Interest is a non-cash expense.

E) Depreciation increases the marginal tax rate.

24) The percentage of the next dollar you earn that must be paid in taxes is referred to as the

________ tax rate.

A) mean

B) residual

C) total

D) average

E) marginal

25) The ________ tax rate is equal to total taxes divided by total taxable income.

A) deductible

B) residual

C) total

D) average

E) marginal

26) Which one of the following statements related to corporate taxes is correct?

A) A company's marginal tax rate must be equal to or lower than its average tax rate.

B) The tax for a company is computed by multiplying the marginal tax rate times the taxable income.

C) Additional income is taxed at a firm's average tax rate.

D) The marginal tax rate will always exceed a company's average tax rate.

E) The marginal tax rate for a company can be either higher than or equal to the average tax rate.

27) Which one of the following statements concerning corporate income taxes is correct for 2018?

A) All corporations are exempt from federal taxation.

B) Corporations pay no tax on their first $50,000 of income.

C) The federal income tax on corporations is a flat-rate tax with the same rate applying to all levels of taxable income.

D) The marginal tax rate will always be lower than the average tax rate.

E) The first 25 percent of corporate income is exempt from taxation.

28) The cash flow that is available for distribution to a corporation's creditors and stockholders is called the:

A) operating cash flow.

B) net capital spending.

C) net working capital.

D) cash flow from assets.

E) cash flow to stockholders.

29) Which term relates to the cash flow that results from a company's ongoing, normal business activities?

A) Operating cash flow

B) Capital spending

C) Net working capital

D) Cash flow from assets

E) Cash flow to creditors

30) Cash flow from assets is also known as the firm's:

A) capital structure.

B) equity structure.

C) hidden cash flow.

D) free cash flow.

E) historical cash flow.

31) The cash flow related to interest payments less any net new borrowing is called the:

A) operating cash flow.

B) capital spending cash flow.

C) net working capital.

D) cash flow from assets.

E) cash flow to creditors.

32) Cash flow to stockholders is defined as:

A) the total amount of interest and dividends paid during the past year.

B) the change in total equity over the past year.

C) cash flow from assets plus the cash flow to creditors.

D) operating cash flow minus the cash flow to creditors.

E) dividend payments less net new equity raised.

33) Which one of the following is an expense for accounting purposes but is not an operating cash flow for financial purposes?

A) Interest expense

B) Taxes

C) Cost of goods sold

D) Labor costs

E) Administrative expenses

34) Depreciation for a tax-paying firm:

A) increases expenses and lowers taxes.

B) increases the net fixed assets as shown on the balance sheet.

C) reduces both the net fixed assets and the costs of a firm.

D) is a noncash expense that increases the net income.

E) decreases net fixed assets, net income, and operating cash flows.

35) Which one of the following statements related to an income statement is correct?

A) Interest expense increases the amount of tax due.

B) Depreciation does not affect taxes since it is a non-cash expense.

C) Net income is distributed to dividends and paid-in surplus.

D) Taxes reduce both net income and operating cash flow.

E) Interest expense is included in operating cash flow.

36) Which one of the following statements is correct concerning a corporation with taxable income of $125,000?

A) Taxable income minus dividends paid will equal the ending retained earnings for the year.

B) An increase in depreciation will increase the operating cash flow.

C) Net income divided by the number of shares outstanding will equal the dividends per share.

D) Interest paid will be included in both net income and operating cash flow.

E) An increase in the tax rate will increase both net income and operating cash flow.

37) Which one of the following will increase the cash flow from assets, all else equal?

A) Decrease in cash flow to stockholders

B) Decrease in operating cash flow

C) Decrease in the change in net working capital

D) Decrease in cash flow to creditors

E) Increase in net capital spending

38) For a tax-paying firm, an increase in ________ will cause the cash flow from assets to increase.

A) depreciation

B) net capital spending

C) the change in net working capital

D) taxes

E) production costs

39) Which one of the following must be true if a firm had a negative cash flow from assets?

A) The firm borrowed money.

B) The firm acquired new fixed assets.

C) The firm had a net loss for the period.

D) The firm utilized outside funding.

E) Newly issued shares of stock were sold.

40) An increase in the interest expense for a firm with a taxable income of $123,000 will:

A) increase net income.

B) increase gross income.

C) increase the cash flow from assets.

D) decrease the cash flow from equity.

E) decrease the operating cash flow.

41) Which one of the following is excluded from the cash flow from assets?

A) Accounts payable

B) Inventory

C) Sales

D) Interest expense

E) Cost of goods sold

42) Net capital spending:

A) is equal to ending net fixed assets minus beginning net fixed assets.

B) is equal to zero if the decrease in the net fixed assets is equal to the depreciation expense.

C) reflects the net changes in total assets over a stated period of time.

D) is equivalent to the cash flow from assets minus the operating cash flow minus the change in net working capital.

E) is equal to the net change in the current accounts.

43) Which one of the following statements related to the cash flow to creditors must be correct?

A) If the cash flow to creditors is positive, then the firm must have borrowed more money than it repaid.

B) If the cash flow to creditors is negative, then the firm must have a negative cash flow from assets.

C) A positive cash flow to creditors represents a net cash outflow from the firm.

D) A positive cash flow to creditors means that a firm has increased its long-term debt.

E) If the cash flow to creditors is zero, then a firm has no long-term debt.

44) A positive cash flow to stockholders indicates which one of the following with certainty?

A) The dividends paid exceeded the net new equity raised.

B) The amount of the sale of common stock exceeded the amount of dividends paid.

C) No dividends were distributed, but new shares of stock were sold.

D) Both the cash flow to assets and the cash flow to creditors must be negative.

E) Both the cash flow to assets and the cash flow to creditors must be positive.

45) A firm has $680 in inventory, $2,140 in fixed assets, $210 in accounts receivables, $250 in accounts payable, and $80 in cash. What is the amount of the net working capital?

A) $970

B) $720

C) $640

D) $3,110

E) $2,860

46) A firm has net working capital of $560. Long-term debt is $3,970, total assets are $7,390, and fixed assets are $3,910. What is the amount of the total liabilities?

A) $2,050

B) $2,920

C) $4,130

D) $7,950

E) $6,890

47) A firm has common stock of $6,200, paid-in surplus of $9,100, total liabilities of $8,400,

current assets of $5,900, and fixed assets of $21,200. What is the amount of the shareholders' equity?

A) $6,900

B) $15,300

C) $18,700

D) $23,700

E) $35,500

48) Your firm has total assets of $4,900, fixed assets of $3,200, long-term debt of $2,900, and short-term debt of $1,400. What is the amount of net working capital?

A) ?$100

B) $300

C) $600

D) $1,700

E) $1,800

49) Bonner Automotive has shareholders' equity of $218,700. The firm owes a total of $141,000 of which 40 percent is payable within the next year. The firm has net fixed assets of $209,800. What is the amount of the net working capital?

A) $149,900

B) $93,500

C) $125,600

D) ?$47,500

E) $56,500

50) Four years ago, Ship Express purchased a mailing machine at a cost of $218,000. This equipment is currently valued at $97,400 on today's balance sheet but could actually be sold for $92,900. This is the only fixed asset the firm owns. Net working capital is $41,300 and long-term debt is $102,800. What is the book value of shareholders' equity?

A) $31,400

B) $47,700

C) $35,900

D) $249,400

E) $253,900

51) The What-Not Shop owns the building in which it is located. This building initially cost $647,000 and is currently appraised at $819,000. The fixtures originally cost $148,000 and are currently valued at $65,000. The inventory has a book value of $319,000 and a market value equal to 1.1 times the book value. The shop expects to collect 96 percent of the $21,700 in accounts receivable. The shop has $26,800 in cash and total debt of $414,700. What is the market value of the shop's equity?

A) $867,832

B) $900,166

C) $695,832

D) $775,632

E) $1,190,332

52) The Widget Co. purchased all of its fixed assets three years ago for $4 million. These assets can be sold today for $2 million. The current balance sheet shows net fixed assets of $2,500,000, current liabilities of $1,375,000, and net working capital of $725,000. If all the current assets were liquidated today, the company would receive $1.9 million in cash. The book value of the total assets today is ________ and the market value of those assets is ________.

A) $4,600,000; $3,900,000

B) $4,600,000; $3,125,000

C) $5,000,000; $3,125,000

D) $5,000,000; $3,900,000

E) $6,500,000; $3,900,000

53) JJ Enterprises has inventory of $11,600, fixed assets of $22,400, total liabilities of $12,900, cash of $1,900, accounts receivable of $8,700, and long-term debt of $6,500. What is the net working capital?

A) $44,600

B) $15,700

C) $12,600

D) $15,800

E) $9,300

54) The River Side Stop has a current market value of $26,400 and owes its creditors $31,300. What is the market value of the shareholders' equity?

A) ?$4,900

B) ?$5,200

C) $0

D) $4,900

E) $5,200

55) Jensen Enterprises paid $700 in dividends and $320 in interest this past year. Common stock remained constant at $6,800 and retained earnings decreased by $180. What is the net income for the year?

A) $180

B) $520

C) $1,020

D) $880

E) $1,200

56) Andre's Bakery has sales of $487,000 with costs of $263,000. Interest expense is $26,000 and depreciation is $42,000. The tax rate is 21 percent. What is the net income?

A) $142,750

B) $123,240

C) $109,000

D) $128,700

E) $134,550

57) Hayes Bakery has sales of $30,600, costs of $15,350, an addition to retained earnings of $4,221, dividends paid of $469, interest expense of $1,300, and a tax rate of 21 percent. What is the amount of the depreciation expense?

A) $4,820.13

B) $5,500.89

C) $8,013.29

D) $8,180.01

E) $9,500.00

58) Last year, Kaylor Equipment had $15,900 of sales, $500 of net new equity, dividend payments of $75, an addition to retained earnings of $418, depreciation of $680, and $511 of interest expense. What are the earnings before interest and taxes at a tax rate of 21 percent?

A) $589.46

B) $1,135.05

C) $1,331.54

D) $1,560.85

E) $949.46

59) Galaxy Interiors income statement shows depreciation of $1,611, sales of $21,415, interest paid of $1,282, net income of $1,374, and costs of goods sold of $16,408. What is the amount of the noncash expenses?

A) $2,893

B) $1,282

C) $740

D) $1,611

E) $2,351

60) Beach Front Industries has sales of $546,000, costs of $295,000, depreciation expense of $37,000, interest expense of $15,000, and a tax rate of 21 percent. The firm paid $59,000 in cash dividends. What is the addition to retained earnings?

A) $98,210

B) $81,700

C) $95,200

D) $103,460

E) $121,680

61) Keisler's has cost of goods sold of $11,518, interest expense of $315, dividends of $420, depreciation of $811, and a change in retained earnings of $296. What is the taxable income given a tax rate of 21 percent?

A) $955.38

B) $967.78

C) $906.33

D) $776.41

E) $646.15

62) What is the average tax rate for a firm with taxable income of $118,740 in 2017?

Taxable Income Tax Rate

$ 0 - 50,000 15 %

50,001 - 75,000 25

75,001 - 100,000 34

100,001 - 335,000 39

A) 26.68 percent

B) 34.87 percent

C) 24.89 percent

D) 36.67 percent

E) 39.00 percent

63) For 2017, Nevada Mining had projected taxable income of $94,800. Its actual taxable income exceeded this projection by $21,000. How much additional tax did the firm owe due to the $21,000 increase in taxable income?

Taxable Income Tax Rate

$ 0 - 50,000 15 %

50,001 - 75,000 25

75,001 - 100,000 34

100,001 - 335,000 39

A) $7,930

B) $8,036

C) $8,150

D) $7,682

E) $8,197

64) In 2017, Boyer Enterprises had $76,700 in taxable income. What was the firm's average tax rate for the year?

Taxable Income Tax Rate

$ 0 - 50,000 15 %

50,001 - 75,000 25

75,001 - 100,000 34

100,001 - 335,000 39

A) 28.25 percent

B) 18.68 percent

C) 26.48 percent

D) 20.14 percent

E) 29.03 percent

65) Winston Industries had sales of $843,800 and costs of $609,900. The company paid $38,200 in interest and $35,000 in dividends. The depreciation was $76,400. The firm has a combined tax rate of 24 percent. What was the addition to retained earnings for the year?

A) $55,668

B) $57,240

C) $61,060

D) $56,200

E) $68,400

66) RTF Oil has total sales of $911,400 and costs of $787,300. Depreciation is $52,600 and the tax rate is 21 percent. The firm is all-equity financed. What is the operating cash flow?

A) $108,410

B) $108,320

C) $109,924

D) $106,417

E) $109,085

67) Nielsen Auto Parts had beginning net fixed assets of $218,470 and ending net fixed assets of $209,411. During the year, assets with a book value of $6,943 were sold. Depreciation for the year was $42,822. What is the amount of net capital spending?

A) $33,763

B) $40,706

C) $58,218

D) $65,161

E) $67,408

68) At the beginning of the year, a firm had current assets of $121,306 and current liabilities of $124,509. At the end of the year, the current assets were $122,418 and the current liabilities were $103,718. What is the change in net working capital?

A) ?$19,679

B) ?$11,503

C) $19,387

D) $15,497

E) $21,903

69) At the beginning of the year, the long-term debt of a firm was $72,918 and total debt was $138,407. At the end of the year, long-term debt was $68,219 and total debt was $145,838. The interest paid was $6,430. What is the amount of the cash flow to creditors?

A) $1,731

B) ?$1,001

C) $11,129

D) $13,861

E) $19,172

70) Ernie's Home Repair had beginning long-term debt of $51,207 and ending long-term debt of $36,714. The beginning and ending total debt balances were $59,513 and $42,612, respectively. The interest paid was $2,808. What is the amount of the cash flow to creditors?

A) ?$11,685

B) ?$11,272

C) $17,301

D) $17,418

E) $11,174

71) The Daily News has projected annual net income of $272,600, of which 28 percent will be distributed as dividends. Assume the company will have net sales of $75,000 worth of common stock. What will be the cash flow to stockholders if the tax rate is 21 percent?

A) ?$75,000

B) $1,328

C) $24,623.52

D) $76,328

E) $151,328

72) The Lakeside Inn had operating cash flow of $48,450. Depreciation was $6,700 and interest paid was $2,480. A net total of $2,620 was paid on long-term debt. The firm spent $24,000 on fixed assets and decreased net working capital by $1,330. What was the amount of the cash flow to stockholders?

A) $5,100

B) $7,830

C) $18,020

D) $19,998

E) $20,680

73) For the past year, Galaxy Interiors had depreciation of $2,419, beginning total assets of $23,616, and ending total assets of $21,878. Current assets decreased by $1,356. What was the amount of net capital spending for the year?

A) ?$382

B) $2,037

C) $2,801

D) $1,993

E) $1,172

74) Carlisle Express paid $1,282 in interest and $975 in dividends last year. Current assets increased by $2,700, current liabilities decreased by $420, and long-term debt increased by $2,200. What was the cash flow to creditors?

A) ?$530

B) ?$918

C) $1,839

D) 2,132

E) $3,094

75) CBC Industries has sales of $21,415, interest paid of $1,282, costs of $9,740, and depreciation of $1,480. What is the operating cash flow if the tax rate is 22 percent?

A) $10,114.14

B) $9,900.86

C) $8,985.86

D) $8,536.67

E) $9,714.14

76) Williamsburg Markets has an operating cash flow of $4,267 and depreciation of $1,611. Current assets decreased by $1,356 while current liabilities decreased by $2,662, and net fixed assets decreased by $382 during the year. What is free cash flow for the year?

A) $1,732

B) $2,247

C) $2,961

D) $3,915

E) $4,267

77) Up Towne Cleaners has taxable income of $48,900 and a tax rate of 21 percent. What is the change in retained earnings if the firm pays $20,200 in dividends for the year?

A) $18,942

B) $19,948

C) $19,374

D) $18,431

E) $18,574

78) For the year, B&K United increased current liabilities by $1,400, decreased cash by $1,200, increased net fixed assets by $340, increased accounts receivable by $200, and decreased inventory by $150. What is the annual change in net working capital?

A) ?$2,550

B) ?$70

C) $590

D) $550

E) ?$2,210

79) TJH, Inc. purchased $145,000 in new equipment and sold equipment with a net book value of $68,400 during the year. What is the amount of net capital spending if the depreciation was $38,600?

A) $115,200

B) $76,600

C) $94,200

D) $38,000

E) ?$38,000

80) Nu Furniture has sales of $241,000, depreciation of $32,200, interest expense of $35,700, costs of $103,400, and taxes of $14,637. What is the operating cash flow for the year?

A) $108,229

B) $121,367

C) $122,963

D) $117,766

E) $128,037

81) HiWay Furniture has sales of $316,000, depreciation of $47,200, interest expense of $41,400, costs of $148,200, and taxes of $16,632. The firm has net capital spending of $36,400 and a decrease in net working capital of $14,300. What is the cash flow from assets for the year?

A) $145,985

B) $129,068

C) $119,655

D) $120,810

E) $134,585

82) At the beginning of the year, Trees Galore had current liabilities of $15,932 and total debt of $68,847. By year end, current liabilities were $13,870 and total debt was $72,415. What is the amount of net new borrowing for the year?

A) $5,630

B) ?$2,480

C) $3,568

D) $4,677

E) ?$2,062

83) JJ Enterprises has current assets of $10,406, long-term debt of $4,780, and current liabilities of $9,822 at the beginning of the year. At year end, current assets are $11,318, long-term debt is $5,010, and current liabilities are $9,741. The firm paid $277 in interest and $320 in dividends during the year. What is the cash flow to creditors for the year?

A) ?$47

B) ?$507

C) ?$97

D) $47

E) $507

84) BK Enterprises neither sold nor repurchased any shares of stock during the year. The firm had annual sales of $7,202, depreciation of $1,196, cost of goods sold of $4,509, interest expense of $318, taxes of $248, beginning-of-year shareholders' equity of $4,808, and end-of-year shareholders' equity of $4,922. What is the amount of dividends paid during the year?

A) $817

B) $1,009

C) $864

D) $709

E) $515

85) Carlisle Carpets has cost of goods sold of $92,511, interest expense of $4,608, dividends paid of $3,200, depreciation of $14,568, an increase in retained earnings of $11,920, and a tax rate of 21 percent. What is the operating cash flow?

A) $34,296.00

B) $42,122.42

C) $36,462.58

D) $31,543.10

E) $36,741.42

86) Webster World has sales of $13,800, costs of $5,800, depreciation expense of $1,100, and interest expense of $700. What is the operating cash flow if the tax rate is 23 percent?

A) $6,016

B) $5,969

C) $6,574

D) $7,036

E) $7,100

87) Webster's has beginning net fixed assets of $684,218, ending net fixed assets of $679,426, and depreciation expense of $48,859. What is the net capital spending for the year if the tax rate is 25 percent?

A) $42,920

B) $53,651

C) $44,067

D) $35,255

E) $48,600

88) Global Tours has beginning current assets of $1,360, beginning current liabilities of $940, ending current assets of $1,720, and ending current liabilities of $1,080. What is the change in net working capital?

A) $220

B) $170

C) $190

D) $940

E) $1,060

89) The Beach Shoppe has beginning total debt of $682,400 and ending total debt of $697,413. Current liabilities increased by $18,915 during the year. What was the cash flow to creditors if the firm paid $34,215 in interest during the year?

A) $384

B) $287

C) $38,117

D) $20,228

E) $19,202

90) The Outlet started the year with $650,000 in the common stock account and $1,318,407 in the additional paid-in surplus account. The end-of-year balance sheet showed $720,000 and $1,299,310 in the same two accounts, respectively. What is the cash flow to stockholders if the firm paid $68,500 in dividends?

A) ?$17,597

B) $17,597

C) ?$1,500

D) $1,500

E) $68,500

91) During the year, RIT Corp. had sales of $565,600. Costs of goods sold, administrative and selling expenses, and depreciation expenses were $476,000, $58,800, and $42,800, respectively. In addition, the company had an interest expense of $112,000 and a tax rate of 22 percent. What is the operating cash flow for the year? Ignore any tax loss carry-forward provisions.

A) $17,920

B) $21,840

C) $30,800

D) $52,600

E) $77,840

公司理财原版题库Chap010

Chapter 10 Return and Risk: The Capital-Assets-Pricing Model Multiple Choice Questions 1. When a security is added to a portfolio the appropriate return and risk contributions are A) the expected return of the asset and its standard deviation. B) the expected return and the variance. C) the expected return and the beta. D) the historical return and the beta. E) these both can not be measured. Answer: C Difficulty: Medium Page: 255 2. When stocks with the same expected return are combined into a portfolio A) the expected return of the portfolio is less than the weighted average expected return of the stocks. B) the expected return of the portfolio is greater than the weighted average expected return of the stocks. C) the expected return of the portfolio is equal to the weighted average expected return of the stocks. D) there is no relationship between the expected return of the portfolio and the expected return of the stocks. E) None of the above. Answer: C Difficulty: Easy Page: 261 3. Covariance measures the interrelationship between two securities in terms of A) both expected return and direction of return movement. B) both size and direction of return movement. C) the standard deviation of returns. D) both expected return and size of return movements. E) the correlations of returns. Answer: B Difficulty: Medium Page: 258-259 Use the following to answer questions 4-5: GenLabs has been a hot stock the last few years, but is risky. The expected returns for GenLabs are highly dependent on the state of the economy as follows: State of Economy Probability GenLabs Returns Depression .05 -50% Recession .10 -15 Mild Slowdown .20 5 Normal .30 15% Broad Expansion .20 25 Strong Expansion .15 40

公司理财试题及答案

1)单选题,共20题,每题5.0分,共100.0分1 单选题 (5.0分) 资产未来创造的现金流入现值称为? A. 资产的价格 B. 资产的分配 C. 资产的价值 D. 资产的体量 2 单选题 (5.0分) 谁承担了公司运营的最后风险? A. 债权人 B. 股东 C. 管理层 D. 委托人 3 单选题 (5.0分) 金融市场有哪些类型? A. 货币市场 B. 资本市场 C. 期货市场 D. 以上都是 4 单选题 (5.0分) 以下哪项是债券价值评估方式? A. 现值估价模型 B. 到期收益率 C. 债券收益率 D. 以上都是 5 单选题 (5.0分) 融资直接与间接的划分方式取决于? A. 融资的受益方 B. 金融凭证的设计方 C. 融资来源 D. 融资规模

6 单选题 (5.0分) 以下哪种不是财务分析方法? A. 比较分析 B. 对比分析 C. 趋势百分比分析 D. 财务比例分析 7 单选题 (5.0分) 以下哪个不是价值的构成? A. 现金流量 B. 现值 C. 期限 D. 折现率 8 单选题 (5.0分) 比率分析的目的是为了? A. 了解项目之间的关系 B. 了解金融发展变化 C. 分析资金流动趋势 D. 分析金融风险 9 单选题 (5.0分) 影响公司价值的主要因素是? A. 市场 B. 政策 C. 信息 D. 时间 10 单选题 (5.0分) 以下哪种是内部融资方式? A. 留存收益 B. 股票 C. 债券 D. 借款 11 单选题 (5.0分)

什么是营运资本? A. 流动资产-流动负债 B. 流动资产+流动负债 C. 流动资产*流动负债 D. 流动资产/流动负债 12 单选题 (5.0分) PMT所代表的含义是? A. 现值 B. 终值 C. 年金 D. 利率 13 单选题 (5.0分) 金融市场的作用是什么? A. 资金的筹措与投放 B. 分散风险 C. 降低交易成本 D. 以上都是 14 单选题 (5.0分) 以下哪项不是财务管理的内容? A. 筹资 B. 融资 C. 信贷 D. 营运资本管理 15 单选题 (5.0分) 微观金融的研究对象是什么? A. 机构财政 B. 账目管理 C. 股市投资 D. 公司理财 16 单选题 (5.0分) 计划经济时代企业的资金来源是?

公司理财精要版计算题

可持续增长假设下列比率是固定的,可持续增长率是多少? 总资产周转率=1.40 利润率=7.6% 权益乘数=1.50 股利支付比率=25% 计算EFN ERT公司最新财务报表如下表所示(单位:美元)。2006年的销售收入预期增长20%。利息费用将维持固定;税率和股利支付比率也将维持固定。销货成本、其他费用、流动资产和应付账款随着销售收入自发增加。 ERT公司2005年损益表 销售收入 905000 成本 710000 其他费用 12000 息前税前利润 183000 利息支付 19700 应税利润 163300 所得税(35%) 57155 净利润 106145 股利42458

留存收益增加 63687 ERT 公司资产负债表(截至2005年12月31日) 资产 负债和所有者权益 流动资产 流动负债 现金 25000 应付账款 65000 应收账款 43000 应付票据 9000 存货 76000 合计 74000 合计 144000 长期债务 156000 固定资产 所有者权益 厂房和设备净值 364000 普通股和股本溢价 21000 留存收益 257000 合计 278000 资产总计 508000 负债和所有者权益总计 508000 A. 如果该企业以完全产能运营且没有发行任何新的债务或权益,要支持20%销售收入增长率所需外部融资是多少? B. 假设该企业2005年仅以80%产能在运营。此时EFN 是多少? C. 假设该企业希望它的负债-权益比率固定,此时的EFN 是多少? 永久生命保险公司正在向你推荐一项保险政策,该政策规定,公司将永久性地每年向你和你的后代支付15 000美元。 a 、如果必要的投资收益率为8%时,你愿意以什么价格购买该保险? 1. 187500 美元 2. 178500美元 3. 158700美元 4.185700美元 b 、假定该保险公司告诉你这项保险的价格为19 5000美元,请你计算利率为多少? 1. 6.79% 2. 7.96% 3. 7.69% 4. 9.76%

公司理财(英文版)题库2

CHAPTER 2 Financial Statements & Cash Flow Multiple Choice Questions: I. DEFINITIONS BALANCE SHEET b 1. The financial statement showing a firm’s accounting value on a particular date is the: a. income statement. b. balance sheet. c. statement of cash flows. d. tax reconciliation statement. e. shareholders’ equity sheet. Difficulty level: Easy CURRENT ASSETS c 2. A current asset is: a. an item currently owned by the firm. b. an item that the firm expects to own within the next year. c. an item currently owned by the firm that will convert to cash within the next 12 months. d. the amount of cash on hand the firm currently shows on its balance sheet. e. the market value of all items currently owned by the firm. Difficulty level: Easy LONG-TERM DEBT b 3. The long-term debts of a firm are liabilities: a. that come due within the next 12 months. b. that do not come due for at least 12 months. c. owed to the firm’s suppliers. d. owed to the firm’s shareholders. e. the firm expects to incur within the next 12 months. Difficulty level: Easy NET WORKING CAPITAL e 4. Net working capital is defined as: a. total liabilities minus shareholders’ equity. b. current liabilities minus shareholders’ equity. c. fixed assets minus long-term liabilities. d. total assets minus total liabilities. e. current assets minus current liabilities. Difficulty level: Easy LIQUID ASSETS d 5. A(n) ____ asset is on e which can be quickly converted into cash without significant loss in value.

罗斯公司理财题库全集

Chapter 20 Issuing Securities to the Public Multiple Choice Questions 1. An equity issue sold directly to the public is called: A. a rights offer. B. a general cash offer. C. a restricted placement. D. a fully funded sales. E. a standard call issue. 2. An equity issue sold to the firm's existing stockholders is called: A. a rights offer. B. a general cash offer. C. a private placement. D. an underpriced issue. E. an investment banker's issue. 3. Management's first step in any issue of securities to the public is: A. to file a registration form with the SEC. B. to distribute copies of the preliminary prospectus. C. to distribute copies of the final prospectus. D. to obtain approval from the board of directors. E. to prepare the tombstone advertisement. 4. A rights offering is: A. the issuing of options on shares to the general public to acquire stock. B. the issuing of an option directly to the existing shareholders to acquire stock. C. the issuing of proxies which are used by shareholders to exercise their voting rights. D. strictly a public market claim on the company which can be traded on an exchange. E. the awarding of special perquisites to management.

公司理财精要版原书第12版习题库答案Ross12e_Chapter05_TB

Fundamentals of Corporate Finance, 12e (Ross) Chapter 5 Introduction to Valuation: The Time Value of Money 1) Andy deposited $3,000 this morning into an account that pays 5 percent interest, compounded annually. Barb also deposited $3,000 this morning at 5 percent interest, compounded annually. Andy will withdraw his interest earnings and spend it as soon as possible. Barb will reinvest her interest earnings into her account. Given this, which one of the following statements is true? A) Barb will earn more interest in Year 1 than Andy will. B) Andy will earn more interest in Year 3 than Barb will. C) Barb will earn more interest in Year 2 than Andy. D) After five years, Andy and Barb will both have earned the same amount of interest. E) Andy will earn compound interest. 2) Nan and Neal are twins. Nan invests $5,000 at 7 percent at age 25. Neal invests $5,000 at 7 percent at age 30. Both investments compound interest annually. Both twins retire at age 60 and neither adds nor withdraws funds prior to retirement. Which statement is correct? A) Nan will have less money when she retires than Neal. B) Neal will earn more interest on interest than Nan. C) Neal will earn more compound interest than Nan. D) If both Nan and Neal wait to age 70 to retire they will have equal amounts of savings. E) Nan will have more money than Neal at any age. 3) You are investing $100 today in a savings account. Which one of the following terms refers to the total value of this investment one year from now? A) Future value B) Present value C) Principal amount D) Discounted value E) Invested principal 4) Christina invested $3,000 five years ago and earns 2 percent annual interest. By leaving her interest earnings in her account, she increases the amount of interest she earns each year. The way she is handling her interest income is referred to as: A) simplifying. B) compounding. C) aggregating. D) accumulating. E) discounting.

罗斯公司理财题库全集

Chapter 30 Financial Distress Multiple Choice Questions 1. Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action? A. Cash payments are delayed to creditors. B. The market value of the stock declines by 10%. C. The firm's operating cash flow is insufficient to pay current obligations. D. Cash distributions are eliminated because the board of directors considers the surplus account to be low. E. None of the above. 2. Insolvency can be defined as: A. not having cash. B. being illiquid. C. an inability to pay one's debts. D. an inability to increase one's debts. E. the present value of payments being less than assets. 3. Stock-based insolvency is a: A. income statement measurement. B. balance sheet measurement. C. a book value measurement only. D. Both A and C. E. Both B and C. 4. Flow-based insolvency is: A. a balance sheet measurement. B. a negative equity position. C. when operating cash flow is insufficient to meet current obligations. D. inability to pay one's debts. E. Both C and D.

罗斯公司理财题库全集

Chapter 13 Risk, Cost of Capital, and Capital Budgeting Answer Key Multiple Choice Questions 1. The weighted average of the firm's costs of equity, preferred stock, and after tax debt is the: A. reward to risk ratio for the firm. B. expected capital gains yield for the stock. C. expected capital gains yield for the firm. D. portfolio beta for the firm. E. weighted average cost of capital (WACC). Difficulty level: Easy Topic: WACC Type: DEFINITIONS 2. If the CAPM is used to estimate the cost of equity capital, the expected excess market return is equal to the: A. return on the stock minus the risk-free rate. B. difference between the return on the market and the risk-free rate. C. beta times the market risk premium. D. beta times the risk-free rate. E. market rate of return. Difficulty level: Easy Topic: CAPM Type: DEFINITIONS

完整word版公司理财英文版题库8

CHAPTER 8 Making Capital Investment Decisions I. DEFINITIONS INCREMENTAL CASH FLOWS a 1. The changes in a firm's future cash flows that are a direct consequence of accepting a project are called _____ cash flows. a. incremental b. stand-alone c. after-tax d. net present value e. erosion Difficulty level: Easy EQUIVALENT ANNUAL COST e 2. The annual annuity stream o f payments with the same present value as a project's costs is called the project's _____ cost. a. incremental b. sunk c. opportunity d. erosion e. equivalent annual Difficulty level: Easy SUNK COSTS c 3. A cost that has already been paid, or the liability to pay has already been incurred, is a(n): a. salvage value expense. b. net working capital expense. c. sunk cost. d. opportunity cost. e. erosion cost. Difficulty level: Easy OPPORTUNITY COSTS d 4. Th e most valuable investment given up i f an alternative investment is chosen is a(n): a. salvage value expense. b. net working capital expense.

罗斯公司理财题库cha16

Chapter 16 Capital Structure: Basic Concepts Multiple Choice Questions 1. The use of personal borrowing to change the overall amount of financial leverage to which an individual is exposed is called: A. homemade leverage. B. dividend recapture. C. the weighted average cost of capital. D. private debt placement. E. personal offset. 2. The proposition that the value of the firm is independent of its capital structure is called: A. the capital asset pricing model. B. MM Proposition I. C. MM Proposition II. D. the law of one price. E. the efficient markets hypothesis. 3. The proposition that the cost of equity is a positive linear function of capital structure is called: A. the capital asset pricing model. B. MM Proposition I. C. MM Proposition II. D. the law of one price. E. the efficient markets hypothesis. 4. The tax savings of the firm derived from the deductibility of interest expense is called the: A. interest tax shield. B. depreciable basis. C. financing umbrella. D. current yield. E. tax-loss carry forward savings.

公司理财精要 罗斯 第四版 附录B 公式

第2章 1. 资产负债表恒等式:资产=负债+股东权益 2. 损益表等式:收入-费用=利润 源自资产的现金流量= 流向债权人的现金流量 + 流向股东的现金流量 此处:a.源自资产的现金流量 = 经营性现金流量 - 净资本支出 - 净营运资本的变化 1) 经营性现金流量 = 息税前利润(EBIT) + 折旧 - 所得税 2) 净资本性支出 = 期末净固定资产 - 期初净固定资产 + 折旧 3) 净营运资本变化 = 期末净营运资本 - 期初净营运资本 b.流向债权人的现金流量 = 支付的利息 - 新增净借款额 c.流向股东的现金流量 = 支付的股利 - 新增净权益资本 第3章 1. 流动比率 = 流动资产/流动负债 2. 速动比率(酸性测试比率) = (流动资产 - 存货)/流动负债 3. 现金比率 = 现金/流动负债 4. 总负债比率 = (资产总额 - 权益总额)/资产总额 5. 负债-权益比率 = 负债总额/权益总额 6. 权益乘数 = 资产总额/ 权益总额 7. 利息保障倍数 = 息税前利润/利息费用 8. 现金覆盖率 = (息税前利润 + 折旧)/利息费用 9. 存货周转率(次数) = 产品销售成本/存货 10. 存货周转天数 = 365天/存货周转率 11. 应收账款周转率= 销售收入/应收账款 12. 应收账款周转天数 = 365天/应收账款周转率 13. 总资产周转率 = 销售收入/总资产 14. 销售利润率 = 净利润/销售收入 15. 资产报酬率 = 净利润/总资产 16. 权益报酬率 = 净利润/权益总额 17. 每股收益 = 净利润/流通在外的股票票数量 18. 市盈率 = 每股市价/每股收益 19. 市净率 = 每股市价/每股账面价值 20. 杜邦财务分析体系: 权益报酬率 = 资产报酬率 权益报酬率 = 销售利润率×总资产周转率×权益乘数 21. 股利支付率 = 现金股利/净利润 22. 盈余留存比率 = 留存收益增加额/净利润 23. 内部增长率 = b -1b ??资产报酬率资产报酬率 24. 可持续增长率 = b -1b ??权益报酬率权益报酬率 第4章 1.对于每一美元,投资t 个时期,每时期的收益率未r ,那么终值 = $1(1 +r)t 2.T 时期后1美元的现值(折现率为r ) PV = $1×[1/(1+r)t ] = $1/(1+r)t 3.现值和终值之间的关系: PV ×(1 + r) t = FV t PV=FV t /(1 + r) r = FV t ×[1/(1 + r) t ] 4.72规则:本金在t 年内翻一番: t r% 72 = 第5章 1. 年金现值,t 阶段,每阶段年金为C ,收益率或 者利率为r 的情况下: 年金现值=)r -1(现值系数?C = [] ? ?????+-?r r C t )1/(11= t 2r C r C r C ?++ 2. 年金终值系数 = (终值系数 - 1)/r = [(1 + r)t - 1]/ r 3. 预付年金现值 = 普通年金×(1 + r) 4. 永续年金现值 = C/r = C ×(1/r) 5. 有效年利率(EAR), m 是一年中复利次数 EAR = (1 + 名义利率/m) m - 1 第6章 1. 债券价值。假设一份债权:(1)在到期时面值为F ;(2)每期支付利息为C ;(3)到期时间为t ;(4)要求收益率为r ,那么: 债券价值 = C ×[1 - 1/(1 + r) t ]/r+F/(1 + r) t 债券价值= 券面利息的现值 + 面值的现值 2. 费雪效应:1 + R=(1 + r)×(1 + h) h 代表通货膨胀率 3. 1 + R=(1 + r)×(1 + h) R= r + h + r ×h 4. R ≈r + h 第7章 P 0当前股票价格,P 1为下期的价格,D 1是期末支付的现金股利(下一年得到的股利)。 1. P 0 = R P D ++11 1 2. P 0 = D/R 3. P 0 = g R g D -+?)1(0 = g R D -1 权益总额资产资产 销售收入销售收入净利润??

陈雨露《公司理财》配套题库-章节题库(财务报表分析)【圣才出品】

第二章财务报表分析 一、单选题 1.假定甲公司向乙公司赊销产品,并持有丙公司的债券和丁公司的股票,且向戊公司支付公司债利息。在不考虑其他条件的情况下,从甲公司的角度看,下列各项中属于本企业与债权人之间财务关系的是()。(南京大学2011金融硕士) A.甲公司与乙公司之间的关系 B.甲公司与丙公司之间的关系 C.甲公司与丁公两之间的关系 D.甲公司与戊公司之间的关系 【答案】D 【解析】甲公司与乙公司是商业信用关系;甲公司为丙公司的债权人;甲公司是丁公司的股东;戊公司是甲公司的债权人。 2.杜邦财务分析体系的核心指标是()。(浙江财经学院2011金融硕士) A.总资产报酬率 B.可持续增长率 C.ROE D.销售利润率 【答案】C 【解析】杜邦分析体系是对企业的综合经营理财及经济效益进行的系统分析评价,其恒

等式为:ROE=销售利润率×总资产周转率×权益乘数。可以看到净资产收益率(ROE)反映所有者投入资金的获利能力,反映企业筹资、投资、资产运营等活动的效率,是一个综合性最强的财务比率,所以净资产收益率是杜邦分析体系的核心指标。 3.影响企业短期偿债能力的最根本原因是()。(浙江财经学院2011金融硕士)A.企业的资产结构 B.企业的融资结构 C.企业的权益结构 D.企业的经营业绩 【答案】D 【解析】短期偿债能力比率是一组旨在提供企业流动性信息的财务比率,有时也被称为流动性指标。它们主要关心企业短期内在不引起不适当压力的情况下支付账单的能力,因此,这些指标关注企业的流动资产和流动负债,但短期偿债能力比率的大小会因行业类型而不同,影响企业短期偿债能力的最根本原因还是企业的经营业绩。 4.市盈率是投资者用来衡量上市公司盈利能力的重要指标,关于市盈率的说法不正确的是()。(浙江工商大学2011金融硕士) A.市盈率反映投资者对每股盈余所愿意支付的价格 B.市盈率越高表明人们对该股票的评价越高,所以进行股票投资时应该选择市盈率最高的股票 C.当每股盈余很小时,市盈率不说明任何问题 D.如果上市公司操纵利润,市盈率指标也就失去了意义

罗斯公司理财题库全集

Chapter 26 Short-Term Finance and Planning Multiple Choice Questions 1.The length of time between the acquisition of inventory and the collection of cash from receivables is called the: A.operating cycle. B.inventory period. C.accounts receivable period. D.accounts payable period. E.cash cycle. 2.The length of time between the acquisition of inventory and its sale is called the: A.operating cycle. B.inventory period. C.accounts receivable period. D.accounts payable period. E.cash cycle. 3.The length of time between the sale of inventory and the collection of cash from receivables is called the: A.operating cycle. B.inventory period. C.accounts receivable period. D.accounts payable period. E.cash cycle.

罗斯公司理财题库全

Chapter 21 Leasing Multiple Choice Questions 1.In a lease arrangement, the owner of the asset is: A.the lesser. B.the lessee. C.the lessor. D.the leaser. E.None of the above. 2.In a lease arrangement, the user of the asset is: A.the lesser. B.the lessee. C.the lessor. D.the leaser. E.None of the above. 3.Which of the following would not be a characteristic of a financial lease? A.They are not usually fully amortized. B.They usually do not have maintenance necessary for the leased assets. C.They usually do not include a cancellation option. D.The lessee usually has the right to renew the lease at expiration. E.All of the above are characteristics of financial leases.

4.An independent leasing company supplies ___________ leases versus the manufacturer who supplies ________________ leases. A.leveraged; direct B.sales and leaseback; sales-type C.capital; sales-type D.direct; sales-type E.None of the above

公司理财精要版知识点归纳

第一章.公司理财导论 1.企业组织形态:单一业主制、合伙制、股份公司(所有权和管理相分离、相对容易转让 所有权、对企业债务负有限责任,使企业融资更加容易。企业寿命不受限制,但双重课税) 2.财务管理的目标:为了使现有股票的每股当前价值最大化。或使现有所有者权益的市场 价值最大化。 3.股东与管理层之间的关系成为代理关系。代理成本是股东与管理层之间的利益冲突的成 本。分直接和间接。 4.公司理财包括三个领域:资本预算、资本结构、营运资本管理 第二章. 1.在企业资本结构中利用负债成为“财务杠杆”。 2.净利润与现金股利的差额就是新增的留存收益。 ¥ 3.来自资产的现金流量=经营现金流量(OCF)-净营运资本变动-资本性支出 =EBIT+折旧-税 5.净资本性支出=期末固定资产净值-期初固定资产净值+折旧 6.流向债权人的现金流量=利息支出-新的借款净额 7.流向股东的现金流量=派发的股利-新筹集的净权益 第三章 1.现金来源:应付账款的增加、普通股本的增加、留存收益增加 ) 现金运用:应收账款增加、存货增加、应付票据的减少、长期负债的减少 2.报表的标准化:同比报表、同基年度财报 =边际利润(经营效率)X总资产周转率(资产使用效率)X权益乘数(财务杠杆) 4.为何评价财务报表: 内部:业绩评价。外部:评价供应商、短期和长期债权人和潜在投资者、信用评级机构。第四章. 1.制定财务计划的过程的两个维度:计划跨度和汇总。 【 2.一个财务计划制定的要件:销售预测、预计报表、资产需求、筹资需求、调剂、经济假设。 3.销售收入百分比法: 提纯率=再投资率=留存收益增加额/净利润=1-股利支付率 资本密集率=资产总额/销售收入 4.内部增长率=(ROAXb)/(1-ROAXb) 可持续增长率=ROE/(1-ROEXb):企业在保持固定的债务权益率同时没有任何外部权益筹资的情况下所能达到的最大的增长率。是企业在不增加财务杠杆时所能保持的最大的增长率。(如果实际增长率超过可持续增长率,管理层要考虑的问题就是从哪里筹集资金来支持增长。如果可持续增长率始终超过实际增长率,银行家最好准备讨论投资产品,因为管理层的问题是怎样处理所有的这些富余的现金。) 5.。 6.增长率的决定因素

完整word版公司理财题库答案

单选题: 1.贴现率越大,净现值( C )。 [A] 越大 [B] 不变 [C] 越小 [D] 不确定 2.以企业价值最大化作为公司理财目标存在的问题有( C )。 [A] 没有考虑资金的时间价值 [B] 没有考虑资金的风险价值 [D] 容易引起企业的短期行为[C] 企业的价值难以评定 3.资金的时间价值相当于没有风险和没有通货膨胀下的( A )。 [A] 社会平均资金利润率 [B] 企业利润率 [D] 单利下的利息率[C] 复利下的利息率 4.下列关于名义利率与实际年利率的说法中,正确的是( B )。 [A]名义利率是不包含通货膨胀的金融机构报价利率 [B]计息期小于一年时,实际年利率大于名义利率 [C]名义利率不变时,实际年利率随着每年复利次数的增加而呈线性递减 [D]名义利率不变时,实际年利率随着期间利率的递减而呈线性递增 5.在上市公司杜邦财务分析体系中,最具有综合性的财务指标是( B )。 [A]营业净利率 [B]净资产收益率 [C]总资产净利率 [D]总资产周转率 6.下列各项中,不会稀释公司每股收益的是( B )。 [A]发行认股权证 [B]发行短期融资券 [C]发行可转换公司债券 [D]授予管理层股份期权 7.某公司按照2/20,N/60的条件从另一公司购入价值1000万的货物,由于资金调度的限制,该公司放弃了获取2%现金折扣的机会,公司为此承担的信用成本率是(D)。 [A]2.00% [B]12.00% [C]12.24% [D]18.37% 8.某企业2007年和2008年的营业净利润分别为7%和8%,资产周转率分别为2和1.5,两年的资产负债率相同,与2007年相比,2008年的净资产收益率变动趋势为( B )。 [A]上升 [B]下降 [C]不变 [D]无法确定 9.已知甲乙两个方案投资收益率的期望值分别为10%和12%,两个方案都存在投资风险,在比较甲乙两方案风险大小时应使用的指标是( A )。 [A]标准离差率 [B]标准差 [C]协方差 [D]方差 10.下列事项中,能够改变特定企业非系统风险的是( C )。 [A]汇率波动 [B]国家加入世界贸易组织 [C]竞争对手被外资并购 [D]货币政策变化 11.下列各项企业财务管理目标中,能够同时考虑资金的时间价值和投资风险因素的是( D )。 [A]产值最大化 [B]利润最大化 1 [C]每股收益最大化 [D]企业价值最大化 12.已知某公司股票的β系数为0.5,短期国债收益率为6%,市场组合收益率为10%,则该公司股票的必要收益率为( B )。 [A]6% [B]8% [C]10% [D]16% 13.作为整个企业预算编制的起点的是( A )。 [A]销售预算 [B]生产预算 [C]现金预算 [D]直接材料预算 14.与生产预算没有直接联系的预算是( C )。