会计英语课后习题参考答案.doc

Suggested Solution

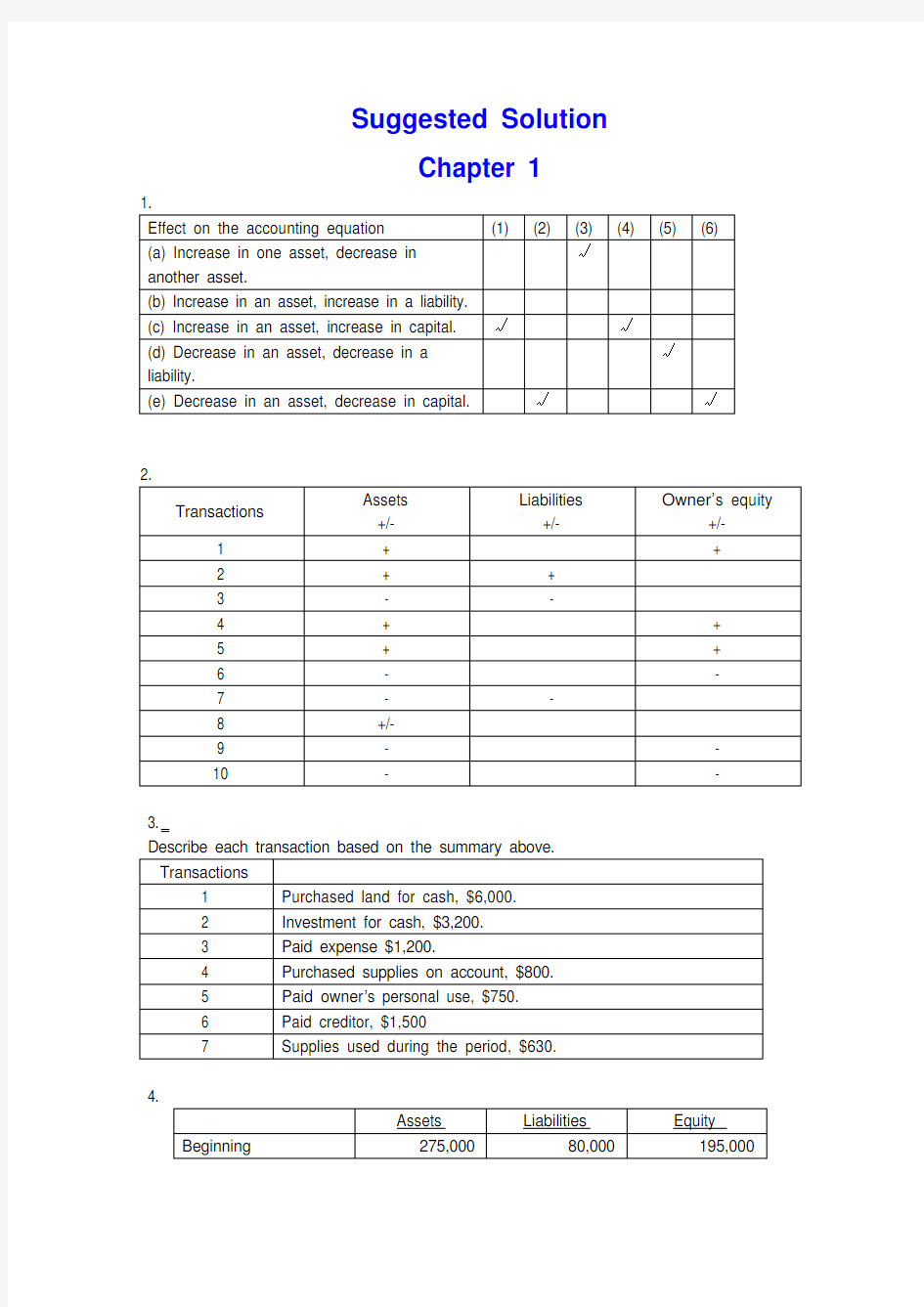

Chapter 1

3.

4.

5.

(b) net income = 9,260-7,470=1,790

(c) net income = 1,790+2,500=4,290

Chapter 2

1.

a.To increase Notes Payable -CR

b.To decrease Accounts Receivable-CR

c.To increase Owner, Capital -CR

d.To decrease Unearned Fees -DR

e.To decrease Prepaid Insurance -CR

f.To decrease Cash - CR

g.To increase Utilities Expense -DR

h.To increase Fees Earned -CR

i.To increase Store Equipment -DR

j.To increase Owner, Withdrawal -DR

2.

a.

Cash 1,800

Accounts payable ................................................... 1,800 b.

Revenue ................................................................... 4,500

Accounts receivable ...................................... 4,500

c.

Owner’s withdrawals ................................................ 1,500

Salaries Expense ............................................ 1,500 d.

Accounts Receivable (750)

Revenue (750)

3.

Prepare adjusting journal entries at December 31, the end of the year.

Advertising expense 600

Prepaid advertising 600

Insurance expense (2160/12*2) 360

Prepaid insurance 360

Unearned revenue 2,100

Service revenue 2,100

Consultant expense 900

Prepaid consultant 900

Unearned revenue 3,000

Service revenue 3,000 4.

1. $388,400

2. $22,520

3. $366,600

4. $21,800

5.

1. net loss for the year ended June 30, 2002: $60,000

2. DR Jon Nissen, Capital 60,000

CR income summary 60,000

3. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000

Chapter 3

1. Dundee Realty bank reconciliation

October 31, 2009

Reconciled balance $6,220 Reconciled balance $6,220

2. April 7 Dr: Notes receivable—A company 5400

Cr: Accounts receivable—A company 5400

12 Dr: Cash 5394.5

Interest expense 5.5

Cr: Notes receivable 5400

June 6 Dr: Accounts receivable—A company 5533

Cr: Cash 5533

18 Dr: Cash 5560.7

Cr: Accounts receivable—A company 5533

Interest revenue 27.7

3. (a) As a whole: the ending inventory=685

(b) applied separately to each product: the ending inventory=625

4. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,000

5.(1) 24,000+60,000-90,000*0.8=12000

(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828

Chapter 4

1. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;

(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;

(c) first-year depreciation = 114,000 * 40% = 45,600

second-year depreciation = (114,000 – 45,600) * 40% = 27,360;

(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.

2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000

(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,500

3. (1) depreciation expense = 30,000

(2) book value = 600,000 – 30,000 * 2=540,000

(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500

(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,500

4. Situation 1:

Jan 1st, 2008 Investment in M 260,000

Cash 260,000

June 30 Cash 6000

Dividend revenue 6000

Situation 2:

January 1, 2008 Investment in S 81,000

Cash 81,000

June 15 Cash 10,800

Investment in S 10,800

December 31 Investment in S 25,500

Investment Revenue 25,500

5. a. December 31, 2008 Investment in K 1,200,000

Cash 1,200,000

June 30, 2009 Dividend Receivable 42,500

Dividend Revenue 42,500

December 31, 2009 Cash 42,500

Dividend Receivable 42,500

b. December 31, 2008 Investment in K 1,200,000

Cash 1,200,000 December 31, 2009 Cash 42,500

Investment in K 42,500

Investment in K 146,000

Investment revenue 146,000 c. In a, the investment amount is 1,200,000

net income reposed is 42,500

In b, the investment amount is 1,303,500

Net income reposed is 146,000

Chapter 5

1.

a. June 1: Dr: Inventory 198,000

Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000

Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000

Cr: Notes Payable 300,000

b. Dr: Interest Expenses (for notes on June 11) 12,100

Cr: Interest Payable 12,100

Dr: Interest Expenses (for notes on June 12) 8,175

Cr: Interest Payable 8,175

c. Balance sheet presentation:

Notes Payable 498,000 Accrued Interest on Notes Payable 20,275

d. For Green:

Dr: Notes Payable 198,000 Interest Payable 12,100

Interest Expense 7,700

Cr: Cash 217,800

For Western:

Dr: Notes Payable 300,000

Interest Payable 8,175

Interest Expense 18,825

Cr: Cash 327,000

2.

(1) 20?8 Deferred income tax is a liability 2,400

Income tax payable 21,600 20?9 Deferred income tax is an asset 600

Income tax payable 26,100

(2) 20?8: Dr: Tax expense 24,000

Cr: Income tax payable 21,600 Deferred income tax 2,400 20?9: Dr: Tax expense 25,500

Deferred income tax 600

Cr: Income tax payable 26,100 (3) 20?8: Income statement: tax expense 24,000

Balance sheet: income tax payable 21,600 20?9: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,100

3.

a. 1,560,000 (20000000*12 %* (1-35%))

b. 7.8% (20000000*12 %* (1-35%)/20000000)

5.

Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896

Chapter 6

1. Mar. 1

Cash 1,200,000

Common Stock 1,000,000

Paid-in Capital in Excess of Par Value 200,000

Mar. 15

Organization Expense 50,000

Common Stock 50,000

Mar. 23

Patent 120,000

Common Stock 100,000

Paid-in Capital in Excess of Par Value 20,000

The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.

2. July.1

Treasury Stock 180,000

Cash 180,000

The cost of treasury purchased is 180,000/30,000=60 per share.

Nov. 1

Cash 70,000

Treasury Stock 60,000

Paid-in Capital from Treasury Stock 10,000

Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.

Dec. 20

Cash 75,000

Paid-in Capital from Treasury Stock 15,000

Treasury Stock 90,000

The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.

3. a. July 1

Retained Earnings 24,000

Dividends Payable—Preferred Stock 24,000

b.Sept.1

Dividends Payable—Preferred Stock 24,000

Cash 24,000

c. Dec.1

Retained Earnings 80,000

Dividends Payable—Common Stock 80,000

d. Dec.31

Income Summary 350,000

Retained Earnings 350,000

4.

a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.

The 7% cumulative term indicates that the investors earn 7% fixed dividends.

b. 7%*120%*20,000=504,000

c. If corporation issued debt, it has obligation to repay principal

d. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.

5.

a. Jan. 15

Retained Earnings 35,000

Accumulated Depreciation 35,000

To correct error in prior year’s depreciation.

b. Mar. 20

Loss from Earthquake 70,000

Building 70,000

c. Mar. 31

Retained Earnings 12,500

Dividends Payable 12,500

d. Apirl.15

Dividends Payable 12,500

Cash 12,500

e. June 30

Retained Earnings 37,500

Common Stock 25,000

Additional Paid-in Capital 12,500

To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;

2500*$15=$37,500

f. Dec. 31

Depreciation Expense 14,000

Accumulated Depreciation 14,000

Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).

g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.

Chapter 7

1.

Requirement 1

If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:

Year 1

Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventory

Inventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventory

Accounts receivable ...................................................................... 310,000 Sales revenue ......................................................................... 310,000 To record sale of goods on account

Cost of goods sold ........................................................................ 220,000 Inventory ................................................................................. 220,000 To record the cost of the goods sold as an expense

Sales returns (I/S) ......................................................................... 15,500* Allowance for sales returns (B/S) ........................................... 15,500 To record provision for return of goods sold under 30-day return period

* 5% of $310,000

Warranty expense ......................................................................... 31,000* Provision for warranties (B/S) ................................................. 31,000 To record provision, at time of sale, for warranty expenditures

* 10% of $310,000

Allowance for sales returns .......................................................... 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within 30-day return period.

It is assumed the returned goods have no value and are disposed of.

Provision for warranties (B/S) ....................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures in year 1 for warranty work

Cash .............................................................................................. 297,600*

Accounts receivable ............................................................... 297,600 To record collection of Accounts Receivable

* $310,000 – $12,400

Year 2

Provision for warranties (B/S) ....................................................... 8,400 Cash/Accounts payable .......................................................... 8,400 To record expenditures in year 2 for warranty work

Requirement 2

If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:

Year 1

Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventory

Inventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventory

Accounts receivable ...................................................................... 310,000 Inventory ................................................................................. 220,000 Deferred gross margin ............................................................ 90,000 To record sale of goods on account

Deferred gross margin .................................................................. 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within the 30-day return period. It is assumed the goods have

no value and are disposed of.

Deferred warranty costs (B/S) ...................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognized

Cash .............................................................................................. 297,600* Accounts receivable ............................................................... 297,600 To record collection of Accounts receivable

* $310,000 – $12,400

Year 2

Deferred warranty costs ................................................................ 8,400 Cash/Accounts payable .......................................................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.

Deferred gross margin .................................................................. **77,600

Cost of goods sold ........................................................................ 220,000 Sales revenue ......................................................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period

* $310,000 – $12,400

** ($90,000 – $12,400)

Warranty expense ......................................................................... 27,000* Deferred warranty costs ......................................................... 27,000 To record recognition of warranty expense at same time as related sales revenue recognition

* $18,600 + $8,400

Requirement 3

Allied Auto Parts Inc. might choose to recognize revenue only after the warranty period

has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it

will eventually earn on the sales. The performance criteria might also be invoked here.

The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.

2.

Percentage-of-completion method:

The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determine the percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):

End of 2005 End of 2006 End of 2007

Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%

Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):

2005 2006 2007

2005 $20,000 × 30% $ 6,000

2006 $20,000 × 70% $ 14,000

2007 $20,000 × 100% $ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000

Therefore, the profit to be recognized each year on the construction project would be:

2005 2006 2007 Total

Revenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200

The following journal entries are used to record the transactions under the

percentage-of-completion method of revenue recognition:

2005 2006 2007

1. Costs of construction:

Construction in progress .................. 5,400 7,550 5,850 Cash, payables, etc. ..... 5,400 7,550 5,850 2. Progress billings:

Accounts receivable ............ 3,100 4,900 12,000 Progress billings ............ 3,100 4,900 12,000 3. Collections on billings:

Cash .................................... 2,400 4,000 12,400 Accounts receivable ...... 2,400 4,000 12,400 4. Recognition of profit:

Construction in progress ..... 600 450 150

Construction expense.......... 5,400 7,550 5,850 Revenue from long-term

contract ...................... 6,000 8,000 6,000 5. To close construction in progress:

Progress billings .................. 20,000 Construction in progress .20,000

学术英语 课文翻译

U8 A 1 在过去的30年里,作为一个专业的大提琴演奏家,我花了相当于整整20年时间在路上执行和学习音乐传统和文化。我的旅行使我相信在我们的全球化的世界中,文化传统来自于一个身份、社会稳定和富有同情心的互动的基本框架。 2 世界在快速改变,正如我们一定会创造不稳定的文化,让人质疑他们的地方。全球化使我们服从于别人的规则,这往往会威胁到个人的身份。这自然使我们紧张,因为这些规则要求我们改变传统习惯。所以如今全球领导者的关键问题是:如何使习惯和文化发展到融入更大的行星,同时不必牺牲鲜明特色和个人的骄傲? 3 我的音乐旅程提醒了我,全球化带来的相互作用不只是摧毁文化;他们能够创造新的文化,生机,传播存在已久的传统。这不像生态“边缘效应”,它是用来描述两个不同的生态系统相遇发生了什么,例如,森林和草原。在这个接口,那里是最小密度和生命形式的最大的多样性,每种生物都可以从这两个生态系统的核心作画。有时最有趣的事情发生在边缘。在交叉口可以显示意想不到的连接。 4 文化是一个由世界每个角落的礼物组成的织物。发现世界的一种方式是例如通过深入挖掘其传统。例如音乐方面,在任何的大提琴演奏家的曲目的核心是由巴赫大提琴组曲。每个组件的核心是一个称为萨拉班德舞曲的舞蹈动作。这种舞蹈起源于北非的柏柏尔人的音乐,它是一个缓慢的、性感的舞蹈。它后来出现在西班牙,在那里被禁止,因为它被认为是下流的。西班牙人把它带到了美洲,也去了法国,在那里成为一个优雅的舞蹈。在1720年,巴赫公司的萨拉班德在他的大提琴组曲运动。今天,我扮演巴赫,一个巴黎裔美国人的中国血统的音乐家。所以谁真正拥有的萨拉班德?每一种文化都采用了音乐,使其具有特定的内涵,但每一种文化都必须共享所有权:它属于我们所有人。 5 1998年,我从丝绸之路发现在数千年来从地中海和太平洋许多文化间观念的流动。当丝绸之路合奏团执行,我们试图把世界上大部分集中在一个阶段。它的成员是一个名家的同等团体,大师的生活传统是欧洲、阿拉伯、阿塞拜疆、亚美尼亚、波斯、俄罗斯、中亚、印度、蒙古、中国、韩国或日本。他们都慷慨地分享他们的知识,并好奇和渴望学习其他形式的表达。 6 在过去的几年里,我们发现每一个传统都是成功的发明的结果。确保传统的生存的一个最好的方法是由有机进化,目前利用我们所有可用的工具。通过录音和电影;通过驻在博物馆、大学、设计学校和城市;通过表演从教室到体育场,合奏的音乐家,包括我自己,学习有用的技能。回到家中,我们和其他人分享这些技能,确保我们的传统在文化桌上有一席之地。 7 我们发现,在本国执行传统出口的是国外激励从业者。最重要的是,我们对彼此的音乐发展出了激情,并建立了相互尊重、友谊和信任的纽带,每一次我们都在舞台上这都是可触及的。这种欢乐的互动是为了一个理想的共同的更大的目标:我们始终能够通过友好的对话解决任何分歧。我们相互开放,我们形成一个桥进入陌生的传统,驱逐往往伴随着变化和错位的恐惧。换句话说,当我们扩大我们看世界的镜头的时候,我们更好地了解自己,自己的生活和文化。我们与我们的小星球的遥远的行星有更多的共同分享,而不是我们意识到的。 8 发现这些共同的文化是很重要的,但不只是为了艺术的缘故。所以我们的许多城市,不仅是伦敦,纽约,东京,现在即使甚至是中小城市正在经历着移民潮。我们将如何吸取同化有自己独特的习惯的人群?移民不可避免地会导致抵抗和冲突,就像过去一样?有什么关于德国的土耳其人口的阿尔巴尼亚人在意大利,北非人在西班牙和法国?文化繁荣的引擎可以帮助我们找出如何集合可以和平融合,同时不牺牲个性身份。这不是政治正确性。它是关于对人而言什么是珍贵的承认,和每一个文化已经给予我们世界的礼物。

会计专业英语模拟试题及答案

《会计专业英语》模拟试题及答案 一、单选题(每题1分,共 20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost. 2) In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? $8 500 Dr $8 500 Cr $14 000 Dr $14 000 Cr Should dividends paid appear on the face of a company’s cash flow statement? Yes No Not sure Either Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? Weighted Average cost First in first out (FIFO) Last in first out (LIFO) Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position? (1) plant, equipment, and property (2) company car (3) €4000 cash (4) €1000 cheque A. (1), (3)

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

(完整版)会计专业英语词汇大全

一.专业术语 Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。加速折旧法主要包括余额递减折旧法 declining balance depreciation,双倍余额递减折旧法 double declining balance depreciation,年限总额折旧法 sum of the years' depreciation Account 科目,帐户 Account format 帐户式 Account payable 应付帐款 Account receivable 应收帐款 Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。在连续的会计期间周而复始的循环进行 Accounting equation 会计等式:资产= 负债+ 业主权益 Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额/ 应收帐款平均余额 Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。 Accrued dividend 应计股利 Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。 Accrued revenue 应记收入 Accumulated depreciation 累计折旧 Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratio Acquisition cost 购置成本 Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。 Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。 Adverse 应收帐款的帐龄分类 Aging of accounts receivable 应收帐款的帐龄分类 Allocable 应分配的 Allowance for bad debts 备抵坏帐 Allowance for depreciation 备抵折旧 Allowance for doubtful accounts 呆帐备抵 Allowance for uncollectible accounts 呆帐备抵 Allowance method 备抵法:用备抵帐户作为各项资产帐户的抵销帐户,以使交易的费用与收入相互配合的方法。 Amortization 摊销,清偿 Annuity due 期初年金 Annuity method 年金法 Appraisal method 估价法 Asset 资产 Bad debt 坏帐 Bad debt expense 坏帐费用:将坏帐传人费用帐户,冲销应收帐款 Balance sheet 资产负债表 Bank discount 银行贴现折价 Bank reconciliation 银行往来调节:企业自身的存款帐户余额和银行对帐单的余额不符时,应对未达帐进行调节。 Bank statement 银行对帐单,银行每月寄给活期存款客户的对帐单,列明存款兑现支票和服务费用。

学术英语课后翻译答案

学术英语(理工)课后英译汉练习答案 Text 1 1有些人声称黑客是那些扩宽知识界限而不造成危害的好人(或即使造成危害,但并非故意而为),而“破碎者”才是真正的坏人。 2这可以指获取计算机系统的存储内容,获得一个系统的处理能力,或捕获系统之间正在交流的信息。 3那些系统开发者或操作者所忽视的不为人知的漏洞很可能是由于糟糕的设计造成的,也可能是为了让系统具备一些必要的功能而导致计划外的结果。 4另一种是预先设定好程序对特定易受攻击对象进行攻击,然而,这种攻击是以鸟枪式的方式发出的,没有任何具体目标,目的是攻击到尽可能多的潜在目标。 5另外,考虑安装一个硬件防火墙并将从互联网中流入和流出的数据限定在仅有的几个你真正需要的端口,如电子邮件和网站流量。 Text 2 1看似无害的编程错误可以被利用,导致电脑被侵入并为电脑蠕虫和病毒的繁衍提供温床。 2当一个软件漏洞被发现,黑客可以将漏洞变成一个侵入点,从而造成极大的破坏,在这之前,往往需要争分夺秒地利用正确的软件补丁来防止破坏的发生。 3最简单的钓鱼骗局试图利用迅速致富的伎俩诱使诈骗目标寄钱。但网络骗子们也变得越来越狡猾,最近的陷阱是通过发送客户服务的电子邮件让用户进入假银行或商 业网站,并在那里请他们“重新输入”他们的账户信息。 4间谍软件与垃圾邮件和钓鱼网络一起,构成了三个令人生厌的互联网害虫。尽管有些程序可以通过入侵软件漏洞从而进入电脑,但这些有害而秘密的程序通常会随着 其他通常是免费的应用软件侵入到计算机系统中。 5尽管因特网已经彻底改变了全球通讯,但是对于那些意图为了罪恶目的而利用网络力量的人和那些负责阻止这些网络犯罪的人来说,他们之间的较量才刚刚开始。Text 5 1.最近在《纽约时报》上刊登的一篇文章谈到了一种新计算机软件,该软件在瞬间就能通 过数以千计的法律文件筛选并寻找到那些可诉讼的条款,这为律师们节省了在阅读文件上所花费的数百小时。 2.他们主要靠耕种来养活自己,然后再多种一些用以物品交易或卖一些盈余 3.从事农业和畜牧业者的绝对数量大约在1910年时达到顶峰(约有1,100—1,200万), 在此之后人数便急剧下降 4.这个故事总结了美国几个世纪以来的工作经历,从失业工人的层面上讲是悲剧,但从全 国劳动力的层面上讲是件好事。 5.人工智能是一种新的自动化技术吗?是一种削弱了曾经是20世纪末就业标志的脑力工 作的技术吗?是一种只会消除更好的工作机会的技术吗? Text 6 1.就前者来说,玩家按照顺序移动,(那么)每个人都了解其他玩家之前的动作。就 后者而言,玩家同时做出动作,则不了解其他玩家的动作。 2.当一个人思考别人会如何反应的时候,他必须站在别人的角度,用和他们一样的思 考方式进行思考一个人不能将自己的推理强加在别人的身上。 3.尽管各位玩家同时做出动作,不知道其他玩家当前的动作,然而,每个玩家都必须

会计专业英语翻译

. 1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing. 2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language." 3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.

常用会计类英语词汇汇总

常用会计类英语词汇汇总基本词汇 A (1)account 账户,报表 A (2)accounting postulate 会计假设 A (3)accounting valuation 会计计价 A (4)accountability concept 经营责任概念 A (5)accountancy 会计职业 A (6)accountant 会计师 A (7)accounting 会计 A (8)agency cost 代理成本 A (9)accounting bases 会计基础 A (10)accounting manual 会计手册 A (11)accounting period 会计期间 A (12)accounting policies 会计方针 A (13)accounting rate of return 会计报酬率 A (14)accounting reference date 会计参照日 A (15)accounting reference period 会计参照期间A (16)accrual concept 应计概念 A (17)accrual expenses 应计费用 A (18)acid test ratio 速动比率(酸性测试比率) A (19)acquisition 收购 A (20)acquisition accounting 收购会计 A (21)adjusting events 调整事项 A (22)administrative expenses 行政管理费 A (23)amortization 摊销 A (24)analytical review 分析性复核 A (25)annual equivalent cost 年度等量成本法 A (26)annual report and accounts 年度报告和报表A (27)appraisal cost 检验成本 A (28)appropriation account 盈余分配账户 A (29)articles of association 公司章程细则 A (30)assets 资产 A (31)assets cover 资产担保 A (32)asset value per share 每股资产价值 A (33)associated company 联营公司 A (34)attainable standard 可达标准 A (35)attributable profit 可归属利润 A (36)audit 审计 A (37)audit report 审计报告 A (38)auditing standards 审计准则 A (39)authorized share capital 额定股本 A (40)available hours 可用小时 A (41)avoidable costs 可避免成本 B (42)back-to-back loan 易币贷款

学术英语Unit1~4课文翻译

Unit 1 Text A 神经过载与千头万绪的医生 患者经常抱怨自己的医生不会聆听他们的诉说。虽然可能会有那么几个医生确实充耳不闻,但是大多数医生通情达理,还是能够感同身受的人。我就纳闷为什么即使这些医生似乎成为批评的牺牲品。我常常想这个问题的成因是不是就是医生所受的神经过载。有时我感觉像变戏法,大脑千头万绪,事无巨细,不能挂一漏万。如果病人冷不丁提个要求,即使所提要求十分中肯,也会让我那内心脆弱的平衡乱作一团,就像井然有序同时演出三台节目的大马戏场突然间崩塌了一样。有一天,我算过一次常规就诊过程中我脑子里有多少想法在翻腾,试图据此弄清楚为了完满完成一项工作,一个医生的脑海机灵转动,需要处理多少个细节。 奥索里奥夫人 56 岁,是我的病人。她有点超重。她的糖尿病和高血压一直控制良好,恰到好处。她的胆固醇偏高,但并没有服用任何药物。她锻炼不够多,最后一次 DEXA 骨密度检测显示她的骨质变得有点疏松。尽管她一直没有爽约,按时看病,并能按时做血液化验,但是她形容自己的生活还有压力。总的说来,她健康良好,在医疗实践中很可能被描述为一个普通患者,并非过于复杂。 以下是整个 20 分钟看病的过程中我脑海中闪过的念头。 她做了血液化验,这是好事。 血糖好点了。胆固醇不是很好。可能需要考虑开始服用他汀类药物。 她的肝酶正常吗? 她的体重有点增加。我需要和她谈谈每天吃五种蔬果、每天步行 30 分钟的事。 糖尿病:她早上的血糖水平和晚上的比对结果如何?她最近是否和营 养师谈过?她是否看过眼科医生?足科医生呢? 她的血压还好,但不是很好。我是不是应该再加一种降血压的药?药 片多了是否让她困惑?更好地控制血压的益处和她可能什么药都不吃 带来的风险孰重孰轻?

会计英语试题及复习资料

会计英语试题及答案 会计专业英语是会计专业人员职业发展的必要工具。学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。 一、单选题 1. ? 1) . 2) . 3) . 4) , a . A 1 3 B 1 4 C 3 D 2 3 2. $5 500 2010. 31 2010 $55 000 $46 500 . 31 2010? A. $8 500 B. $8 500 C. $14 000 D. $14 000 3. a ’s ? A. B. C. D. 4. a ? A. B. () C. () D. 5. a ’s ? (1) , , (2) (3) 4000 (4) 1000 A. (1), (3) B. (1), (2) C. (2), (3) D. (2), (4)

6. a ’s ? (1) (2) . (3) . (4) A (1), (2) (3) B (1), (2) (4) C (1), (3) (4) D (2), (3) (4) 7. 30 2010 : $992,640 $1,026,480 , , ? 1. $6,160 . 2. $27,680 a . 3. $6,160 a . 4. $21,520 . A 1 2 B 2 3 C 2 4 D 3 4 8. . (1) (2) (3) (4) ? A (1), (3) (4) B (1), (2) (4) C (1), (2) (3) D (2), (3) (4) ( = [])({ : "u3054369" }); 9. ? (1) , (2) a (3) , A. 2 3 B. C. 1 2 D. 3 10. ? (1)

(完整版)会计专业英语重点词汇大全

?accounting 会计、会计学 ?account 账户 ?account for / as 核算 ?certified public accountant / CPA 注册会计师?chief financial officer 财务总监?budgeting 预算 ?auditing 审计 ?agency 机构 ?fair value 公允价值 ?historical cost 历史成本?replacement cost 重置成本?reimbursement 偿还、补偿?executive 行政部门、行政人员?measure 计量 ?tax returns 纳税申报表 ?tax exempt 免税 ?director 懂事长 ?board of director 董事会 ?ethics of accounting 会计职业道德?integrity 诚信 ?competence 能力 ?business transaction 经济交易?account payee 转账支票?accounting data 会计数据、信息?accounting equation 会计等式?account title 会计科目 ?assets 资产 ?liabilities 负债 ?owners’ equity 所有者权益 ?revenue 收入 ?income 收益

?gains 利得 ?abnormal loss 非常损失 ?bookkeeping 账簿、簿记 ?double-entry system 复式记账法 ?tax bearer 纳税人 ?custom duties 关税 ?consumption tax 消费税 ?service fees earned 服务性收入 ?value added tax / VAT 增值税?enterprise income tax 企业所得税?individual income tax 个人所得税?withdrawal / withdrew 提款、撤资?balance 余额 ?mortgage 抵押 ?incur 产生、招致 ?apportion 分配、分摊 ?accounting cycle会计循环、会计周期?entry分录、记录 ?trial balance试算平衡?worksheet 工作草表、工作底稿?post reference / post .ref过账依据、过账参考?debit 借、借方 ?credit 贷、贷方、信用 ?summary/ explanation 摘要?insurance 保险 ?premium policy 保险单 ?current assets 流动资产 ?long-term assets 长期资产 ?property 财产、物资 ?cash / currency 货币资金、现金

(财务会计)英语学习会计专业英语必备

弃我去者,昨日之日不可留 乱我心者,今日之日多烦忧 过急会计术语英汉对照 Accounting system 会计系统 American Accounting Association 美国会计协会 American Institute of CPAs 美国注册会计师协会 Audit 审计 Balance sheet 资产负债表Bookkeepking 簿记 Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书 Certificate in Management Accounting 管理会计证书 Certificate Public Accountant注册会计师Cost accounting 成本会计 External users 外部使用者 Financial accounting 财务会计 Financial Accounting Standards Board 财务会计准则委员会 Financial forecast 财务预测 Generally accepted accounting principles 公认会计原则 General-purpose information 通用目的信息Government Accounting Office 政府会计办公室 Income statement 损益表 Institute of Internal Auditors 内部审计师协会 Institute of Management Accountants 管理会计师协会 Integrity 整合性 Internal auditing 内部审计 Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者 Management accounting 管理会计 Return of investment 投资回报 Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会 Statement of cash flow 现金流量表Statement of financial position 财务状况表 Tax accounting 税务会计 Accounting equation 会计等式 Articulation 勾稽关系 Assets 资产 Business entity 企业个体 Capital stock 股本 Corporation 公司 Cost principle 成本原则 Creditor 债权人 Deflation 通货紧缩 Disclosure 批露 Expenses 费用 Financial statement 财务报表 Financial activities 筹资活动 Going-concern assumption 持续经营假设 Inflation 通货膨涨 Investing activities 投资活动 Liabilities 负债 Negative cash flow 负现金流量 Operating activities 经营活动 Owner's equity 所有者权益 Partnership 合伙企业 Positive cash flow 正现金流量 Retained earning 留存利润 Revenue 收入 Sole proprietorship 独资企业 Solvency 清偿能力 Stable-dollar assumption 稳定货币假设 Stockholders 股东 Stockholders' equity 股东权益 Window dressing 门面粉饰 Account 帐户 基本词汇 A (1)account 账户,报表 A (2)accounting postulate 会计假设 A (3)accounting valuation 会计计价 A (4)accountability concept 经营责任 概念 A (5)accountancy 会计职业 A (6)accountant 会计师 A (7)accounting 会计 A (8)agency cost 代理成本 A (9)accounting bases 会计基础 A (10)accounting manual 会计手册 A (11)accounting period 会计期间 A (12)accounting policies 会计方针 A (13)accounting rate of return 会计报 酬率 A (14)accounting reference date 会计 参照日 A (15)accounting reference period 会 计参照期间 A (16)accrual concept 应计概念 A (17)accrual expenses 应计费用 A (18)acid test ratio 速动比率(酸性测 试比率) A (19)acquisition 收购 A (20)acquisition accounting 收购会计 A (21)adjusting events 调整事项 A (22)administrative expenses 行政管 理费 A (23)amortization 摊销 A (24)analytical review 分析性复核 A (25)annual equivalent cost 年度等量 成本法 A (26)annual report and accounts 年度 报告和报表 A (27)appraisal cost 检验成本 A (28)appropriation account 盈余分配 账户 A (29)articles of association 公司章程 细则 A (30)assets 资产 A (31)assets cover 资产担保 A (32)asset value per share 每股资产 价值 A (33)associated company 联营公司 A (34)attainable standard 可达标准 A (35)attributable profit 可归属利润 A (36)audit 审计 A (37)audit report 审计报告 A (38)auditing standards 审计准则 A (39)authorized share capital 额定股 本 A (40)available hours 可用小时 A (41)avoidable costs 可避免成本 B (42)back-to-back loan 易币贷款 B (43)backflush accounting 倒退成本 计算 B (44)bad debts 坏帐 B (45)bad debts ratio 坏帐比率 B (46)bank charges 银行手续费 B (47)bank overdraft 银行透支 B (48)bank reconciliation 银行存款调 节表 B (49)bank statement 银行对账单 B (50)bankruptcy 破产 B (51)basis of apportionment 分摊基 础 B (52)batch 批量 B (53)batch costing 分批成本计算

研究生学术英语课后习题答案

Unit 1英译汉:15 Outlines are essential to effective speeches.By outlining, you make sure that related ideas are together, that your thoughts flow from one to another, and that the structure of your speech is coherent. You will probably use two kinds of outlines for your speeches--the detailed preparation outline and the brief speaking outline. 发言提纲是有效发言的基础。通过写发言提纲,你可以确保你的想法是关联的,你的思路从一点谈到另一点,你的讲话结构是连贯的,通常准备演讲你可以采用两种提纲方式:详细准备提纲和简单发言提纲。 In a preparation outline, you should state your specific purpose and central idea, and identify main points and sub--points using a consistent pattern. The speaking outline sho uld consist of brief notes to help you while you deliver the speech. It should contain ke y words or phrases to bolster your memory. In making up your speaking outline, follow the same visual framework used in your preparation outline. Keep the speaking outline a s brief as possible and be sure it is plainly legible 在准备提纲中,应该写出你的特定目的及中心思想,并以连贯的方式确定主要观点和次要观点。发言提纲应该由简要的提要组成,这些提要在你讲话时能够给你一些帮助。发言提纲还应包括帮助你记忆的重点词或重点短语。在写发言提纲时,可采用准备提纲的模式,尽可能使你的发言提纲简要,同时,要确保提纲清晰、易于辨认。 汉译英: 当你发表学术演讲时,首先要做好充分的准备;其次,你演讲的主要观点要明确,层次要清楚。演讲时,语速不要过快,语言要清晰。不要总是在读你准备好的稿子。最后,你应该经常看一下你的听众。这样,一方面你对你的听众表示尊重,另一方面,你可以更顺利地进行你的演讲。 Before you deliver an academic speech, firstly you should get well prepared for it. Then, you should make your major points clear in your speech, and your speech should be well organized. When speaking, you should not speak too fast, and your language should be explicit. Don’t always read the notes you prepared beforehand. From time to time, you should look at your audience. On one hand, you can show your respect to your audience, and on the other hand, you will be able to go on with your speech more smoothly.