(完整版)投资学第10版习题答案09

CHAPTER 9: THE CAPITAL ASSET PRICING MODEL

PROBLEM SETS 1.

2.

If the security’s correlation coefficient with the market portfolio doubles (with all other variables such as variances unchanged), then beta, and therefore the risk premium, will also double. The current risk premium is: 14% – 6% = 8%

The new risk premium would be 16%, and the new discount rate for the security would be: 16% + 6% = 22%

If the stock pays a constant perpetual dividend, then we know from the original data that the dividend (D) must satisfy the equation for the present value of a perpetuity:

Price = Dividend/Discount rate 50 = D /0.14 ? D = 50 ? 0.14 = $7.00

At the new discount rate of 22%, the stock would be worth: $7/0.22 = $31.82The increase in stock risk has lowered its value by 36.36%.3.

a.False. β = 0 implies E (r ) = r f , not zero.

b.

False. Investors require a risk premium only for bearing systematic

(undiversifiable or market) risk. Total volatility, as measured by the standard deviation, includes diversifiable risk.

c.

False. Your portfolio should be invested 75% in the market portfolio and 25% in T-bills. Then:β(0.751)(0.250)0.75

P =?+?=4.

The expected return is the return predicted by the CAPM for a given level of systematic risk.

$1$5()β[()]

().04 1.5(.10.04).13,or 13%().04 1.0(.10.04).10,or 10%

i f i M f Discount Everything E r r E r r E r E r =+?-=+?-==+?-=()β[()].12

.18.06β[.14.06]β 1.5.08

P f P M f P P E r r E r r =+?-=+?-→=

=

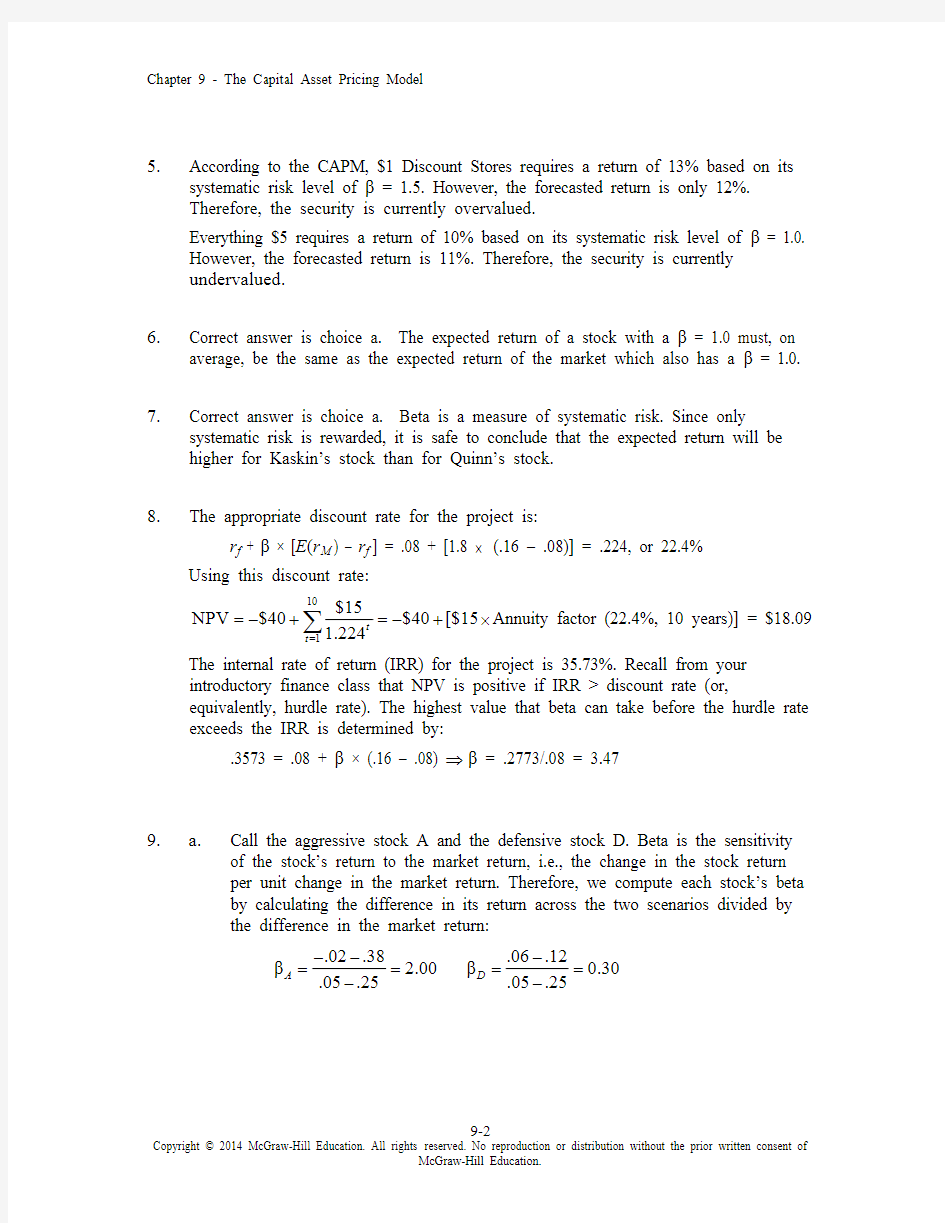

5.

According to the CAPM, $1 Discount Stores requires a return of 13% based on its systematic risk level of β = 1.5. However, the forecasted return is only 12%. Therefore, the security is currently overvalued.

Everything $5 requires a return of 10% based on its systematic risk level of β = 1.0. However, the forecasted return is 11%. Therefore, the security is currently undervalued.

6.

Correct answer is choice a. The expected return of a stock with a β = 1.0 must, on average, be the same as the expected return of the market which also has a β = 1.0.7.

Correct answer is choice a. Beta is a measure of systematic risk. Since only systematic risk is rewarded, it is safe to conclude that the expected return will be higher for Kaskin’s stock than for Quinn’s stock.

8.The appropriate discount rate for the project is:

r f + β × [E (r M ) – r f ] = .08 + [1.8 ? (.16 – .08)] = .224, or 22.4%

Using this discount rate:

Annuity factor (22.4%, 10 years)] = $18.0910

1$15

NPV $40$40[$151.224

t

t ==-+=-+?∑

The internal rate of return (IRR) for the project is 35.73%. Recall from your introductory finance class that NPV is positive if IRR > discount rate (or,

equivalently, hurdle rate). The highest value that beta can take before the hurdle rate exceeds the IRR is determined by:

.3573 = .08 + β × (.16 – .08) ? β = .2773/.08 = 3.47

9. a.

Call the aggressive stock A and the defensive stock D. Beta is the sensitivity of the stock’s return to the market return, i.e., the change in the stock return per unit change in the market return. Therefore, we compute each stock’s beta by calculating the difference in its return across the two scenarios divided by the difference in the market return:

.02.38

.06.12

β 2.00

β0.30

.05.25

.05.25

A D ---=

==

=--

b.

With the two scenarios equally likely, the expected return is an average of the two possible outcomes:

E (r A ) = 0.5 ? (–.02 + .38) = .18 = 18%E (r D ) = 0.5 ? (.06 + .12) = .09 = 9%

c.

The SML is determined by the market expected return of [0.5 × (.25 + .05)] = 15%, with βM = 1, and r f = 6% (which has βf =

0). See the following graph:

The equation for the security market line is:

E (r ) = .06 + β × (.15 – .06)

d.

Based on its risk, the aggressive stock has a required expected return of:

E (r A ) = .06 + 2.0 × (.15 – .06) = .24 = 24%

The analyst’s forecast of expected return is only 18%. Thus the stock’s alpha is:

αA = actually expected return – required return (given risk)= 18% – 24% = –6%

Similarly, the required return for the defensive stock is:

E (r D ) = .06 + 0.3 × (.15 – .06) = 8.7%

The analyst’s forecast of expected return for D is 9%, and hence, the stock has a positive alpha:

t αD = Actually expected return – Required return (given risk)= .09 – .087 = +0.003 = +0.3%

The points for each stock plot on the graph as indicated above.

e.

The hurdle rate is determined by the project beta (0.3), not the firm’s beta. The correct discount rate is 8.7%, the fair rate of return for stock D.

10.

Not possible. Portfolio A has a higher beta than Portfolio B, but the expected return for Portfolio A is lower than the expected return for Portfolio B. Thus, these two portfolios cannot exist in equilibrium.

11.

Possible. If the CAPM is valid, the expected rate of return compensates only for systematic (market) risk, represented by beta, rather than for the standard deviation, which includes nonsystematic risk. Thus, Portfolio A’s lower rate of return can be paired with a higher standard deviation, as long as A’s beta is less than B’s.12.

Not possible. The reward-to-variability ratio for Portfolio A is better than that of the market. This scenario is impossible according to the CAPM because the CAPM predicts that the market is the most efficient portfolio. Using the numbers supplied:

.16.10

.18.10

0.50.33.12

.24

A M S S --=

==

=Portfolio A provides a better risk-reward trade-off than the market portfolio.

13.

Not possible. Portfolio A clearly dominates the market portfolio. Portfolio A has both a lower standard deviation and a higher expected return.

14.

Not possible. The SML for this scenario is: E(r ) = 10 + β × (18 – 10)Portfolios with beta equal to 1.5 have an expected return equal to:

E (r ) = 10 + [1.5 × (18 – 10)] = 22%

The expected return for Portfolio A is 16%; that is, Portfolio A plots below the SML (α A = –6%) and, hence, is an overpriced portfolio. This is inconsistent with the CAPM.

15.

Not possible. The SML is the same as in Problem 14. Here, Portfolio A’s required return is: .10 + (.9 × .08) = 17.2%

This is greater than 16%. Portfolio A is overpriced with a negative alpha:α A = –1.2%16.Possible. The CML is the same as in Problem 12. Portfolio A plots below the CML, as any asset is expected to. This scenario is not inconsistent with the CAPM.

17.

Since the stock’s beta is equal to 1.2, its expected rate of return is:

.06 + [1.2 ? (.16 – .06)] = 18%

110

110$50$6()0.18$53$50

D P P P

E r P P -+-+=

→=→=18.

The series of $1,000 payments is a perpetuity. If beta is 0.5, the cash flow should be discounted at the rate:

.06 + [0.5 × (.16 – .06)] = .11 = 11%

PV = $1,000/0.11 = $9,090.91

If, however, beta is equal to 1, then the investment should yield 16%, and the price paid for the firm should be:

PV = $1,000/0.16 = $6,250

The difference, $2,840.91, is the amount you will overpay if you erroneously

assume that beta is 0.5 rather than 1.19.

Using the SML: .04 = .06 + β × (.16 – .06) ? β = –.02/.10 = –0.2

20.r 1 = 19%; r 2 = 16%; β1 = 1.5; β2 = 1

a.

To determine which investor was a better selector of individual stocks we look at abnormal return, which is the ex-post alpha; that is, the abnormal return is the difference between the actual return and that predicted by the SML.

Without information about the parameters of this equation (risk-free rate and market rate of return) we cannot determine which investor was more accurate.b.

If r f = 6% and r M = 14%, then (using the notation alpha for the abnormal return):

α1 = .19 – [.06 + 1.5 × (.14 – .06)] = .19 – .18 = 1%α 2 = .16 – [.06 + 1 × (.14 – .06)] = .16 – .14 = 2%

Here, the second investor has the larger abnormal return and thus appears to be the superior stock selector. By making better predictions, the second

investor appears to have tilted his portfolio toward underpriced stocks.c.

If r f = 3% and r M = 15%, then:

α1 = .19 – [.03 + 1.5 × (.15 – .03)] = .19 – .21 = –2%α2 = .16 – [.03+ 1 × (.15 – .03)] = .16 – .15 = 1%

Here, not only does the second investor appear to be the superior stock selector, but the first investor’s predictions appear valueless (or worse).

21. a.

Since the market portfolio, by definition, has a beta of 1, its expected rate of return is 12%.

b.β = 0 means no systematic risk. Hence, the stock’s expected rate of return in market equilibrium is the risk-free rate, 5%.

c.

Using the SML, the fair expected rate of return for a stock with β = –0.5 is:

()0.05[(0.5)(0.120.05)] 1.5%E r =+-?-=The actually expected rate of return, using the expected price and dividend for next year is:

$41$3

()10.1010%$40

E r +=

-==Because the actually expected return exceeds the fair return, the stock is underpriced.

22.In the zero-beta CAPM the zero-beta portfolio replaces the risk-free rate, and thus:

E (r ) = 8 + 0.6(17 – 8) = 13.4%

23. a.E (r P ) = r f + βP × [E (r M ) – r f ] = 5% + 0.8 (15% ? 5%) = 13%

α = 14% - 13% = 1%

You should invest in this fund because alpha is positive.

b.

The passive portfolio with the same beta as the fund should be invested 80% in the market-index portfolio and 20% in the money market account. For this portfolio:

E (r P ) = (0.8 × 15%) + (0.2 × 5%) = 13%14% ? 13% = 1% = α

24. a.We would incorporate liquidity into the CCAPM in a manner analogous to the

way in which liquidity is incorporated into the conventional CAPM. In the

latter case, in addition to the market risk premium, expected return is also

dependent on the expected cost of illiquidity and three liquidity-related betas

which measure the sensitivity of: (1) the security’s illiquidity to market

illiquidity; (2) the security’s return to market illiquidity; and, (3) the security’s

illiquidity to the market return. A similar approach can be used for the

CCAPM, except that the liquidity betas would be measured relative to

consumption growth rather than the usual market index.

b.As in part (a), nontraded assets would be incorporated into the CCAPM in a

fashion similar to part (a). Replace the market portfolio with consumption

growth. The issue of liquidity is more acute with nontraded assets such as

privately held businesses and labor income.

While ownership of a privately held business is analogous to ownership of an

illiquid stock, expect a greater degree of illiquidity for the typical private

business. If the owner of a privately held business is satisfied with the

dividends paid out from the business, then the lack of liquidity is not an issue.

If the owner seeks to realize income greater than the business can pay out,

then selling ownership, in full or part, typically entails a substantial liquidity

discount. The illiquidity correction should be treated as suggested in part (a).

The same general considerations apply to labor income, although it is probable

that the lack of liquidity for labor income has an even greater impact on

security market equilibrium values. Labor income has a major impact on

portfolio decisions. While it is possible to borrow against labor income to

some degree, and some of the risk associated with labor income can be

ameliorated with insurance, it is plausible that the liquidity betas of

consumption streams are quite significant, as the need to borrow against labor

income is likely cyclical.

CFA PROBLEMS

1. a.Agree; Regan’s conclusion is correct. By definition, the market portfolio lies on

the capital market line (CML). Under the assumptions of capital market theory, all

portfolios on the CML dominate, in a risk-return sense, portfolios that lie on the

Markowitz efficient frontier because, given that leverage is allowed, the CML

creates a portfolio possibility line that is higher than all points on the efficient

frontier except for the market portfolio, which is Rainbow’s portfolio. Because

Eagle’s portfolio lies on the Markowitz efficient frontier at a point other than the

market portfolio, Rainbow’s portfolio dominates Eagle’s portfolio.

b.Nonsystematic risk is the unique risk of individual stocks in a portfolio that is

diversified away by holding a well-diversified portfolio. Total risk is composed of

systematic (market) risk and nonsystematic (firm-specific) risk.

Disagree; Wilson’s remark is incorrect. Because both portfolios lie on the

Markowitz efficient frontier, neither Eagle nor Rainbow has any nonsystematic

risk. Therefore, nonsystematic risk does not explain the different expected returns.

The determining factor is that Rainbow lies on the (straight) line (the CML)

connecting the risk-free asset and the market portfolio (Rainbow), at the point of

tangency to the Markowitz efficient frontier having the highest return per unit of

risk. Wilson’s remark is also countered by the fact that, since nonsystematic risk

can be eliminated by diversification, the expected return for bearing

nonsystematic risk is zero. This is a result of the fact that well-diversified

investors bid up the price of every asset to the point where only systematic risk

earns a positive return (nonsystematic risk earns no return).

2.E(r) = r f + β × [E(r M) ?r f]

Furhman Labs: E(r) = .05 + 1.5 × [.115 ? .05] = 14.75%

Garten Testing: E(r) = .05 + 0.8 × [.115 ? .05] = 10.20%

If the forecast rate of return is less than (greater than) the required rate of return,

then the security is overvalued (undervalued).

Furhman Labs: Forecast return – Required return = 13.25% ? 14.75% = ?1.50%

Garten Testing: Forecast return – Required return = 11.25% ? 10.20% = 1.05%

Therefore, Furhman Labs is overvalued and Garten Testing is undervalued.

3. a.

4. d.From CAPM, the fair expected return = 8 + 1.25 × (15 - 8) = 16.75%

Actually expected return = 17%

α = 17 - 16.75 = 0.25%

5. d.

6. c.

7. d.

8. d.[You need to know the risk-free rate]

h

9. d.[You need to know the risk-free rate]

10.

Under the CAPM, the only risk that investors are compensated for bearing is the risk that cannot be diversified away (systematic risk). Because systematic risk (measured by beta) is equal to 1.0 for both portfolios, an investor would expect the same rate of return from both portfolios A and B. Moreover, since both portfolios are well diversified, it doesn’t matter if the specific risk of the individual securities is high or low. The firm-specific risk has been diversified away for both portfolios.

11. a.

McKay should borrow funds and invest those funds proportionately in

Murray’s existing portfolio (i.e., buy more risky assets on margin). In addition to increased expected return, the alternative portfolio on the capital market line will also have increased risk, which is caused by the higher proportion of risky assets in the total portfolio.

b.

McKay should substitute low-beta stocks for high-beta stocks in order to reduce the overall beta of York’s portfolio. By reducing the overall portfolio beta, McKay will reduce the systematic risk of the portfolio and, therefore, reduce its volatility relative to the market. The security market line (SML) suggests such action (i.e., moving down the SML), even though reducing beta may result in a slight loss of portfolio efficiency unless full diversification is maintained. York’s primary objective, however, is not to maintain efficiency but to reduce risk exposure; reducing portfolio beta meets that objective. Because York does not want to engage in borrowing or lending, McKay cannot reduce risk by selling equities and using the proceeds to buy risk-free assets (i.e., lending part of the portfolio).

12. a.

Expected Return

Alpha

Stock X 5% + 0.8 × (14% - 5%) = 12.2%14.0% - 12.2% = 1.8%Stock Y

5% + 1.5 × (14% - 5%) = 18.5%

17.0% - 18.5% = -1.5%

b.

i. Kay should recommend Stock X because of its positive alpha, compared to Stock Y, which has a negative alpha. In graphical terms, the expected return/risk profile for Stock X plots above the security market line (SML), while the profile for Stock Y plots below the SML. Also, depending on the individual risk preferences of Kay’s clients, the lower beta for Stock X may have a beneficial effect on overall portfolio risk.

ii. Kay should recommend Stock Y because it has higher forecasted return and lower standard deviation than Stock X. The respective Sharpe ratios for Stocks X and Y and the market index are:

Stock X:(14% - 5%)/36% = 0.25

Stock Y:(17% - 5%)/25% = 0.48

Market index:(14% - 5%)/15% = 0.60

The market index has an even more attractive Sharpe ratio than either of the individual stocks, but, given the choice between Stock X and Stock Y, Stock Y is the superior alternative.

When a stock is held as a single stock portfolio, standard deviation is the relevant risk measure. For such a portfolio, beta as a risk measure is irrelevant. Although holding a single asset is not a typically recommended investment strategy, some investors may hold what is essentially a single-asset portfolio when they hold the stock of their employer company. For such investors, the relevance of standard deviation versus beta is an important issue.

第一章 1.名词解释: 国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。 国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。 国际私人投资:是指私人或私人企业以营利为目的而进行的投资。 短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。 长期投资:一年以上的债权、股票以及实物资产被称为长期投资。 产业安全:可以分为宏观和中观两个层次。宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。 资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。 2、简述20世纪70年代以来国际投资的发展出现了哪些新特点 (一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。国际直接投资成为了国际经济联系中更主要的载体。 (二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台 (三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。 (四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。 3.如何看待麦克杜格尔模型的基本理念 麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。资本流动的原因在于前者的资本价格低于后者。资本国际流动的结果将通过资本存量的调整使各国资本价格趋于均等,从而提高世界资源的利用率,增加世界各国的总产量和各国的福利。 虽然麦克杜格尔模型的假设较之现实生活要简单得多,且与显示生活有很大的反差,但是这个模型的理念确实是值得称道的,既国际投资能够同时增加资本输出输入国的收益,从而增加全世界的经济收益。 第二章 三优势范式 决定跨国公司行为和对外直接投资的最基本因素有三,即所有权优势、内部化优势和区位优势。 所有权特定优势(Ownership)指一国企业拥有能够得到别国企业没有或难以得到的资本、规模、技术、管理和营销技能等方面的优势。邓宁认为的所有权特定优势有以下几个方面:①资产性所有权优势。对有价值资产的拥有大公司常常以较低的利率获得贷

CHAPTER 1: THE INVESTMENT ENVIRONMENT PROBLEM SETS 1.Ultimately, it is true that real assets determine the material well being of an economy. Nevertheless, individuals can benefit when financial engineering creates new products that allow them to manage their portfolios of financial assets more efficiently. Because bundling and unbundling creates financial products with new properties and sensitivities to various sources of risk, it allows investors to hedge particular sources of risk more efficiently. 2.Securitization requires access to a large number of potential investors. To attract these investors, the capital market needs: 1. a safe system of business laws and low probability of confiscatory taxation/regulation; 2. a well-developed investment banking industry; 3. a well-developed system of brokerage and financial transactions, and; 4.well-developed media, particularly financial reporting. These characteristics are found in (indeed make for) a well-developed financial market. 3.Securitization leads to disintermediation; that is, securitization provides a means for market participants to bypass intermediaries. For example, mortgage-backed securities channel funds to the housing market without requiring that banks or thrift institutions make loans from their own portfolios. As securitization progresses, financial intermediaries must increase other activities such as providing short-term liquidity to consumers and small business, and financial services. 4.Financial assets make it easy for large firms to raise the capital needed to finance their investments in real assets. If Ford, for example, could not issue stocks or bonds to the general public, it would have a far more difficult time raising capital. Contraction of the supply of financial assets would make financing more difficult, thereby increasing the cost of capital. A higher cost of capital results in less investment and lower real growth.

作业1资产组合理论&CAPM 一、基本概念 1、资本资产定价模型的前提假设就是什么? 2、什么就是资本配置线?其斜率就是多少? 3、存在无风险资产的情况下,n种资产的组合的可行集就是怎样的?(画图说明);什么就是有效边界?风险厌恶的投资者如何选择最有效的资产组合?(画图说明) 4、什么就是分离定理? 5、什么就是市场组合? 6、什么就是资本市场线?写出资本市场线的方程。 7、什么就是证券市场线?写出资本资产定价公式。 8、β的含义 二、单选 1、根据CAPM,一个充分分散化的资产组合的收益率与哪个因素相关( A )。 A.市场风险 B.非系统风险 C.个别风险 D.再投资风险 2、在资本资产定价模型中,风险的测度就是通过( B)进行的。 A.个别风险 B.贝塔系数 C.收益的标准差 D.收益的方差 3、市场组合的贝塔系数为( B)。 A、0 B、1 C、-1 D、0、5 4、无风险收益率与市场期望收益率分别就是0、06与0、12。根据CAPM模型,贝塔值为1、2的证券X的期望收益率为( D)。 A.0、06 B.0、144 C.0、12美元 D.0、132 5、对于市场投资组合,下列哪种说法不正确( D ) A.它包括所有证券 B.它在有效边界上 C.市场投资组合中所有证券所占比重与它们的市值成正比 D.它就是资本市场线与无差异曲线的切点 6、关于资本市场线,哪种说法不正确( C) A.资本市场线通过无风险利率与市场资产组合两个点 B.资本市场线就是可达到的最好的市场配置线 C.资本市场线也叫证券市场线 D.资本市场线斜率总为正 7、证券市场线就是( D)。 A、充分分散化的资产组合,描述期望收益与贝塔的关系

投资学第9章习题及答案 篇一:投资学第九版课后习题答案--第10、11章 第10章 5、因为投资组合F的β=0,所以其预期收益等于无风险利率对于投资组合A,风险溢价与β的比率为(12-6)/1.2=5 对于投资组合E,风险溢价与β的比率为(8-6)/0.6=3.33 对比表明,这里有套现机会存在。例如,我们能创建一个投资组合G,其包含投资组合A和投资组合F,并且两者有相等的权重,使它满足β等于0.6;这样投资组合F的期望收益和β为: E(rG ) = (0.5 × 12%) + (0.5 × 6%) = 9% βG = (0.5 × 1.2) + (0.5 × 0%) = 0.6 对比投资组合G和投资组合E,投资组合G跟E具有相同的β值,但具有更高的期望收益。因此通过买入投资组合G,并卖出相同数量投资组合E资产就可以实现套现机会。这种套现利润: rG – rE =[9% + (0.6 × F)] ? [8% + (0.6 × F)] = 1% 6、设无风险利率为rf,风险溢价因素RP,则: 12% = rf + (1.2 × RP) 9% = rf + (0.8 × RP) 解之得: rf=3%,RP=7.5% 7、 a、由题目知,买进100万美元等权重的正α值的股票并同时卖出100万美元的等权重的负α值的股票;假定市场风险为0;则预期收益为:$1,000,000*0.02-$1,000,000*(-0.02)=$40,000 b、对于分析师分析的20只股票,每只股票持有时都分别为$100,000,市场风险为0,公司持有的收益标准差为30%,所以20只股票的方差为 20 ×[($100,000 ×0.30)* ($100,000 ×0.30)] =

第1章:投资环境 问题集 1.的确,实际资产决定经济的物质享受。然而,当金融工程创建新产品时, 个人可以受益,可以让他们更有效地管理金融资产投资组合。因为对于不同的风险来源,捆绑和拆分创造具有新属性和敏感性的金融产品,能让投资者更有效地对冲特定来源的风险。 2.证券化需要大量的潜在投资者。为了吸引这些投资者,资本市场需求: 1。一个安全系统的商业法律和概率低的没收的税收法律/法规; 2。一个成熟的投资银行业; 3。成熟的经纪和金融交易系统,; 4。发达的媒介,尤其是财务报告。 这些特征在一个发达的金融市场中具有。 3.证券化导致金融脱媒;也就是说,证券化为市场参与者提供了一个手段绕过中介。例如,抵押贷款支持证券是房地产市场获得资金不需要通过银行或储蓄机构发放贷款的投资组合。随着资产证券化的发展,金融中介机构必须增加其他活动,例如向消费者和小型企业提供短期流动性,金融服务。 4.金融资产使大公司筹集支持实物资产投资的资本变得容易。如果福特,例如,可以不向公众发行股票或债券,这将更难以筹集资金。紧缩金融资产的供应将使融资更加困难,从而增加了资本成本。更高的资本成本导致更少的投资和较低的实际增长。 5.即使公司不需要发行股票,股票市场对于财务经理依然很重要。股票价格提供关于公司投资项目的市场价值的重要信息。例如,如果股票价格大幅上涨,经理可能得出结论,认为公司的前景是光明的。这对于公司继续投资扩大资产业务可能是个有用的信号。此外,股票可以在二级市场交易是对初始投资者更具吸引力的方面,因为他们知道他们可以出售股票。反过来这会使得市场投资者更愿意购买初始股票,从而使得公司更容易在股市筹集资金。6.a、不会,价格的增加不会增加经济的生产能力。 b、是的,股票在这些资产的价值增加了。 c、未来业主作为一个整体更糟,因为抵押贷款债务也增加了。此外,这个房 价泡沫最终会破裂,社会作为一个整体将承受损失。 7.a 银行贷款是兰尼的金融负债,收到的现金是兰尼的金融资产。银行的金融资产转换成本票。 b 兰尼将金融资产投入到软件开发,则兰尼得到实物资产,开发的软件。没 有创造和减少金融资产,金融资产(现金)只是从一方转移到了另一方。 c 兰尼用实物资产(软件)和微软公司交换了金融资产(1500股股票),如 果微软为了支付兰尼增发了新股,则创造了金融资产。 d 兰尼将股票金融资产转化为了现金金融资产。兰尼将部分现金金融资产还 给银行,赎回借据金融资产,则减少了金融资产。 8

CHAPTER 7: OPTIMAL RISKY PORTFOLIOS PROBLEM SETS 1. (a) and (e). Short-term rates and labor issues are factors that are common to all firms and therefore must be considered as market risk factors. The remaining three factors are unique to this corporation and are not a part of market risk. 2. (a) and (c). After real estate is added to the portfolio, there are four asset classes in the portfolio: stocks, bonds, cash, and real estate. Portfolio variance now includes a variance term for real estate returns and a covariance term for real estate returns with returns for each of the other three asset classes. Therefore, portfolio risk is affected by the variance (or standard deviation) of real estate returns and the correlation between real estate returns and returns for each of the other asset classes. (Note that the correlation between real estate returns and returns for cash is most likely zero.) 3. (a) Answer (a) is valid because it provides the definition of the minimum variance portfolio. 4. The parameters of the opportunity set are: E (r S ) = 20%, E (r B ) = 12%, σS = 30%, σB = 15%, ρ = From the standard deviations and the correlation coefficient we generate the covariance matrix [note that (,)S B S B Cov r r ρσσ=??]: Bonds Stocks Bonds 225 45 Stocks 45 900 The minimum-variance portfolio is computed as follows: w Min (S ) =1739.0) 452(22590045 225)(Cov 2)(Cov 2 22=?-+-=-+-B S B S B S B ,r r ,r r σσσ w Min (B ) = 1 = The minimum variance portfolio mean and standard deviation are:

习题参考答案 第2章答案: 一、选择 1、D 2、C 二、填空 1、公众投资者、工商企业投资者、政府 2、中国人民保险公司;中国国际信托投资公司 3、威尼斯、英格兰 4、信用合作社、合作银行;农村信用合作社、城市信用合作社; 5、安全性、流动性、效益性 三、名词解释: 财务公司又称金融公司,是一种经营部分银行业务的非银行金融机构。其最初是为产业集团内部各分公司筹资,便利集团内部资金融通,但现在经营领域不断扩大,种类不断增加,有的专门经营抵押放款业务,有的专门经营耐用消费品的租购和分期付款业务,大的财务公司还兼营外汇、联合贷款、包销证券、不动产抵押、财务及投资咨询服务等。 信托公司是指以代人理财为主要经营内容、以委托人身份经营现代信托业务的金融机构。信托公司的业务一般包括货币信托(信托贷款、信托存款、养老金信托、有价证券投资信托等)和非货币信托(债权信托、不动产信托、动产信托等)两大类。 保险公司是一类经营保险业务的金融中介机构。它以集合多数单位或个人的风险为前提,用其概率计算分摊金,以保险费的形式聚集资金建立保险基金,用于补偿因自然灾害或以外事故造成的经济损失,或对个人因死亡伤残给予物质补偿。 四、简答 1、家庭个人是金融市场上的主要资金供应者,其呈现出的主要特点如下:(1)投资目标简单;(2)投资活动更具盲目性(3)投资规模较小,投资方向分散,投资形式灵活。 企业作为非金融投资机构,其行为呈现出了以下的显著特点:(1)资金需求者地位突现;(2)投资目标的多元化;(3)投资比较稳定;(4)短期投资交易量大。 2、商业银行在经济运行中主要的职能如下:(1)信用中介职能;(2)支付中介职能;(3)调节媒介职能;(4)金融服务职能;(5)信用创造职能; 总的来说,商业银行业务可以归为以下三类:(1)负债业务:是指资金来源的业务;(2)资产业务:是商业银行运用资金的业务;(3)中间业务和表外业务:中间业务指银行不需要运用自己的资金而代客户承办支付和其他委托事项,并据以收取手续费的业务 第3章答案: 一、选择题 1、D 2、D 3、B 二、填空题 1、会员制证券交易所和公司制证券交易所、会员制、公司制。 2、上海期货交易所、郑州商品交易所、大连商品交易所。

。张元萍《投资学》课后习题答案 第一章能力训练答案 选择题 思考题 1.投资就是投资主体、投资目的、投资方式和行为内在联系的统一,这充分体现了投资必然与所有权相联系的本质特征。也就是说,投资是要素投入权、资产所有权、收益占有权的统一。这是因为:①反映投资与所有权联系的三权统一的本质特征,适用于商品市场经济的一切时空。从时间上看,无论是商品经济发展的低级阶段还是高度发达的市场经济阶段,投资都无一例外地是要素投入权、资产所有权、收益占有权的统一;从空间上看,无论是在中国还是外国乃至全球范围,投资都无一例外地是这三权的高度统一。②反映投资与所有权联系的三权统一的本质特征,适用于任何投资种类和形式。尽管投资的类型多种多样,投资的形式千差万别,但它们都是投资的三权统一。③反映投资与所有权联系的三权统一本质特征贯穿于投资运动的全过程。投资的全过程是从投入要素形成资产开始到投入生产,生产出成果,最后凭借对资产的所有权获取收益。这一全过程实际上都是投资三权统一的实现过程。④反映投资与所有权联系的三权统一本质特征,是投资区别于其他经济活动的根本标志。投资的这种本质特征决定着投资的目的和动机,规定着投资的发展方向,决定着投资的运动规律。这些都使投资与其他经济活动区别开来,从而构成独立的经济范畴和研究领域。 2.金融投资在整个社会经济中的作用来看,金融投资的功能具有共性,主要有以下几个方面: (1)筹资与投资的功能。这是金融投资最基本的功能。筹资是金融商品服务筹资主体的功能,投资是金融商品服务投资主体的功能。社会经济发展的最终决定力量是其物质技术基础,物质技术基础的不断扩大、提高必须依靠实业投资。(2)分散化与多元化功能。金融投资促进了投资权力和投资风险分散化,同时又创造了多元化的投资主体集合。金融投资把投资权力扩大到了整个社会。(3)自我发展功能。金融投资具有一种促进自己不断创新和发展的内在机制。(4)资源配置优化功能。货币是经济增长的第一推动力和持续动力,因此如筹集货币和分配货币并通过货币的分配而优化整个经济系统的资源配置,是经济运行的首要问题。金融投资为有效地利用货币资本和优化资源配置提供了条件。(5)经济运行的调节功能。金融投资对国民经济运行的反应十分灵敏,能够充分地展现出经济运行的动向。经济发展前景看好,金融投资的价格就上升。(6)增值与投机功能。金融投资本质上是货币资本的运动,货币资本自身具有增值的要求。金融投资在这里充当其货币资本增值的工具。投机性,产生于金融商品的性质和市场价格的波动以及相应的交易制度。 3.投资和投机的区别表现在五个方面:

张元萍《投资学》课后习题答案 第一章能力训练答案 选择题 思考题 1.投资就是投资主体、投资目的、投资方式和行为内在联系的统一,这充分体现了投资必然与所有权相联系的本质特征。也就是说,投资是要素投入权、资产所有权、收益占有权的统一。这是因为:①反映投资与所有权联系的三权统一的本质特征,适用于商品市场经济的一切时空。从时间上看,无论是商品经济发展的低级阶段还是高度发达的市场经济阶段,投资都无一例外地是要素投入权、资产所有权、收益占有权的统一;从空间上看,无论是在中国还是外国乃至全球范围,投资都无一例外地是这三权的高度统一。②反映投资与所有权联系的三权统一的本质特征,适用于任何投资种类和形式。尽管投资的类型多种多样,投资的形式千差万别,但它们都是投资的三权统一。③反映投资与所有权联系的三权统一本质特征贯穿于投资运动的全过程。投资的全过程是从投入要素形成资产开始到投入生产,生产出成果,最后凭借对资产的所有权获取收益。这一全过程实际上都是投资三权统一的实现过程。④反映投资与所有权联系的三权统一本质特征,是投资区别于其他经济活动的根本标志。投资的这种本质特征决定着投资的目的和动机,规定着投资的发展方向,决定着投资的运动规律。这些都使投资与其他经济活动区别开来,从而构成独立的经济范畴和研究领域。 2.金融投资在整个社会经济中的作用来看,金融投资的功能具有共性,主要有以下几个方面:(1)筹资与投资的功能。这是金融投资最基本的功能。筹资是金融商品服务筹资主体的功能,投资是金融商品服务投资主体的功能。社会经济发展的最终决定力量是其物质技术基础,物质技术基础的不断扩大、提高必须依靠实业投资。(2)分散化与多元化功能。金融投资促进了投资权力和投资风险分散化,同时又创造了多元化的投资主体集合。金融投资把投资权力扩大到了整个社会。(3)自我发展功能。金融投资具有一种促进自己不断创新和发展的内在机制。(4)资源配置优化功能。货币是经济增长的第一推动力和持续动力,因此如筹集货币和分配货币并通过货币的分配而优化整个经济系统的资源配置,是经济运行的首要问题。金融投资为有效地利用货币资本和优化资源配置提供了条件。(5)经济运行的调节功能。金融投资对国民经济运行的反应十分灵敏,能够充分地展现出经济运行的动向。经济发展前景看好,金融投资的价格就上升。(6)增值与投机功能。金融投资本质上是货币资本的运动,货币资本自身具有增值的要求。金融投资在这里充当其货币资本增值的工具。投机性,产生于金融商品的性质和市场价格的波动以及相应的交易制度。

第一章证券市场概述 1、什么是投资?实体投资与金融投资、直接金融与间接金融、直接金融投资与间接金融 投资的区别在哪里? 答:投资是经济主体为了获得未来的收益而垫支资本转换为资产的过程,这一结果因存在风险而存在不确定性。实体投资是指对设备、建筑物等固定资产的购置以形成新的生产能力。其最终的结果是增加了社会物质财富和经济总量。金融投资是指投资者为了获得收益而通过银行存款,购买股票、债券等金融资产方式让渡资金使用权以获取收入行为过程。 直接金融是融资方与投资方不通过金融中介而直接融通资金的方式,间接金融是融资方与投资方通过金融中介而间接融通资金的方式,二者的区别是资金融通过程中是否有中介机构的参与并与投资者产生契约关系,在间接融资中,投资银行只起帮助其中一方寻找或撮合适当的另一方以实现融资的委托代理关系的作用。直接金融投资是投资者通过在资本市场直接买卖股票、债券等由筹资者发行的基础证券以获得收益的投资方式,而间接金融投资指投资者不直接购买股票、债券等有价证券,他们购买银行存单、基金、信托产品或金融衍生产品以间接的获取收益。直接金融投资者可以参加股东大会或债权人大会,了解发行公司信息较为容易,而间接金融投资者无这些特权。 2、什么是证券?其特征有哪些?可以分成几类? 答:证券是一种凭证,它表明持有人有权依凭证所记载的内容取得相应的权益并具有法律效力。按权益是否可以带来收益,证券可以分为有价证券和无价证券。有价证券可分为广义有价证券和狭义有价证券。广义有价证券分为商品证券、货币市场证券、和资本证券三种,狭义有价证券仅指资本证券。 证券的基本特征主要如下: 1.所有权特征。该特征指有价证券持有人依所持有的证券份额或数量大小对相应的资 产拥有一定的所有权。 2.收益性特征。指证券持有人可以通过转让资本的使用权而获取一定数额的资本收 益。 3.流通性特征。指证券持有人可以在规定的场所按自己的意愿快速地转让证券以换取 现金。 4.风险性特征。指证券持有者面临着预期投资收益不能实现,甚至本金也遭受损失的 可能性。 3、什么是证券市场?其主体是什么?有哪些分类? 答:证券市场是股票、债券等各种有价证券发行和买卖的场所。证券市场是通过证券信用的方式融通资金,通过证券的买卖活动改变资金的流向,使社会资源的配置更加合理有效,支持和推动经济的发展。 证券市场的主体主要包括: 1.证券发行主体。主要包括政府部门,企业金融机构。 2.证券投资主体。包括个人投资者、机构投资者、政府投资者和企业投资者。 3.证券市场中介。主要包括证券公司、证券投资咨询公司、证券交易所、证券服务机 构。 证券市场的类型主要包括货币市场、债券市场、股票市场。

基础题1、单位投资信托基金的运营费用应该较低。因为一旦信托设立,信托投资组合是固定的,当市场改变时,它不需要支付投资组合经理不断监控和调整投资者组合的费用。因为投资组合是固定的,所以单位投资信托基金几乎没有交易成本。 2、a 单位信托基金:大规模投资的多元化,大规模交易的低成本,低管理费用,可预测的投资组合成分,投资组合的低换手率。 b 开放式基金:大规模投资的多元化,大规模交易的低成本,专业的管理可以实现在机会出现时的买入或卖出,记录交易过程。 c 个人自主选择的股票和债券:没有管理费用,在协调个人所得税的情况下实现资本利得或者损失,可以根据个人风险偏好来设计投资组合。 3、开放式基金是有义务以资产净值赎回投资者的股票,因此必须保持手头现金及现金证券以满足潜在的赎回。封闭式基金不需要现金储备,因为对封闭式基金不能赎回。封闭式基金的投资者希望套现时,他们会出售股票。 4、平衡基金以相对稳定的比例投资于每个资产类别,供投资者投资整个资产组合时选择使用。生命周期基金属于平衡基金,其资产配置取决于投资者的年龄构成。积极的生命周期基金,持有大量的股票,是面向年轻的投资者,而保守的生命周期基金,则持有大量的债券,主要针对年长的投资者。 相比之下,资产配置基金会根据对每一个板块相对业绩的预测而显著改变基金在每一个市场的资产配置比例。因此资产配置资金更强调市场时机的选择。 5、与开放式基金不同,其基金股份随时准备以资产净值赎回,封闭式基金作为一种证券在交易所中交易,因此,它的价格可以偏离它的净值。 6、交易所交易基金的优势:交易所交易基金持续地交易,并且可以通过保证金来购买和出售当交易所交易基金出售时,没有资本利得税(股票只是从一个投资者转移到了另一个投资者)投资者直接从经纪人处购买,从而基金节省了直接向

第10章 5、因为投资组合F的β=0,所以其预期收益等于无风险利率 对于投资组合A,风险溢价与β的比率为(12-6)/1.2=5 对于投资组合E,风险溢价与β的比率为(8-6)/0.6=3.33 对比表明,这里有套现机会存在。例如,我们能创建一个投资组合G,其包含投资组合A和投资组合F,并且两者有相等的权重,使它满足β等于0.6;这样投资组合F的期望收益和β为: E(rG ) = (0.5 × 12%) + (0.5 × 6%) = 9% βG = (0.5 × 1.2) + (0.5 × 0%) = 0.6 对比投资组合G和投资组合E,投资组合G跟E具有相同的β值,但具有更高的期望收益。因此通过买入投资组合G,并卖出相同数量投资组合E资产就可以实现套现机会。这种套现利润: rG – rE =[9% + (0.6 × F)] [8% + (0.6 × F)] = 1% 6、设无风险利率为rf,风险溢价因素RP,则: 12% = rf + (1.2 × RP) 9% = rf + (0.8 × RP) 解之得:rf=3%,RP=7.5% 7、

a 、由题目知,买进100万美元等权重的正α值的股票并同时卖出100万美元的等权重的负α值的股票;假定市场风险为0;则预期收益为: $1,000,000*0.02-$1,000,000*(-0.02)=$40,000 b 、对于分析师分析的20只股票,每只股票持有时都分别为$100,000,市场风险为0,公司持有的收益标准差为30%,所以20只股票的方差为 20 × [($100,000 × 0.30)* ($100,000 × 0.30)] = $18,000,000,000 故标准差为$134,164 a 、 如果分析师分析的是50只股票,那么每只股票持有时都分别为$40,000,计算收益方差: 50 × [(40,000 × 0.30)* (40,000 × 0.30)] = 7,200,000,000 故标准差为$84,853;由于总投入资金不变,α值不变,故其期望收益也不变,为$40,000 8、 a 、)e (22 M 22σ+σβ=σ 88125)208.0(2222=+?=A σ 50010)200.1(2222 B =+?=σ

C H A P T E R1:T H E I N V E S T M E N T E N V I R O N M E N T PROBLEM SETS 1.Ultimately, it is true that real assets determine the material well being of an economy. Nevertheless, individuals can benefit when financial engineering creates new products that allow them to manage their portfolios of financial assets more efficiently. Because bundling and unbundling creates financial products with new properties and sensitivities to various sources of risk, it allows investors to hedge particular sources of risk more efficiently. 2.Securitization requires access to a large number of potential investors. To attract these investors, the capital market needs: 1. a safe system of business laws and low probability of confiscatory taxation/regulation; 2. a well-developed investment banking industry; 3. a well-developed system of brokerage and financial transactions, and; 4.well-developed media, particularly financial reporting. These characteristics are found in (indeed make for) a well- developed financial market. 3.Securitization leads to disintermediation; that is, securitization provides a means for market participants to bypass intermediaries. For example, mortgage-backed securities channel funds to the housing market without requiring that banks or thrift institutions make loans from their own portfolios. As securitization progresses, financial intermediaries must increase other activities such as providing short-term liquidity to consumers and small business, and financial services. 4.Financial assets make it easy for large firms to raise the capital needed to finance their investments in real assets. If Ford, for example, could not issue stocks or bonds to the general public, it would have a far more difficult time raising capital. Contraction of the supply of financial assets would make financing more difficult, thereby increasing the cost of

1、 答案可能不一 2、 交易商公布买入价格和卖出价格。 交易不活跃的股票的买卖价差大。 交易活跃的股票的 买卖价差小。 3、 a 原则上,潜在的损失是无限的,随着股票的价格上升而增加。 b 如果止购指令为128,则每股的损失最大为8美元,总共为800美元。当IBM的股价超过128美元,止购指令就会被执行,限制卖空交易的损失。 4、 a 市场委托指令是指按照当前市场价格立即执行的买入或者卖出指令。市场委托指令强调的是执行的速度(执行不确定性的减少)。市场委托指令的缺点就是执行价格不能提前确定,因此造成价格的不确定性。 5、 a电子通信网络的优势在于它能够执行大宗订单而不影响公众的报价。因为证券的流动性较差,大宗交易不太可能发生,因此他不可能通过电子通信网络交易。电子限价指令市场办理证券的交易量大,这个流动性不足的证券不大可能被电子限价指令市场交易。 中级题 6、 a 股票购买价格为:300*$40=$12000.借款为$4000,因此投资者权益(保证金) 为:$8000 b 股票的价值为:300*$30=$9000。年末借款变为: $4,000 × 1.08 = $4,320。因此,投资者账 户中的剩余保证金为:$9,000 ? $4,320 = $4,680, 则保证金比例为:$4,680/$9,000 = 0.52 = 52%,因此投资者不会收到保证金催缴通知。 c 投资收益率=(期末权益-期初权益)/期初权益=($4,680 ? $8,000)/$8,000 = ?0.415 = ?41.5% 7、 a 期初保证金是:0.50 × 1,000 × $40 = $20,000。股票价格上涨, 则投资者损失为:$10 × 1,000 = $10,000。此外,投资者必须支付股利:$2 × 1,000 = $2,000 ,所以,剩余保证金为:$20,000 – $10,000 – $2,000 = $8,000。 b 保证金比例为:$8,000/$50,000 = 0.16 = 16%,所以投资者会收到保证金催缴通知。 c 投资收益率=(期末权益-期初权益)/期初权益=(?$12,000/$20,000) = ?0.60 = ?60% 8、 a 买入指令会在最低的限价卖出指令处执行,执行价格:$50.25 b 下一条买入指令会在次优限价卖出指令处执行,执行价格为$51.50 c 要增加库存。有相当大的购买需求价格略低于50美元,这表明下行风险有限。相反,限价卖出指令较少,说明适度的买入指令会导致价格大幅上升。 9 a $10,000购买200股股票。股价上涨10%,则 收益= $10,000*10%=$1,000。利息=0.08 ×$5,000 = $400,收益率=($1,000-$400)/ $5,000=0.12=12% b

基础题 1、单位投资信托基金的运营费用应该较低。因为一旦信托设立,信托投资组合是固定的, 当市场改变时,它不需要支付投资组合经理不断监控和调整投资者组合的费用。因为投资组合是固定的,所以单位投资信托基金几乎没有交易成本。 2、a 单位信托基金:大规模投资的多元化,大规模交易的低成本,低管理费用,可预测 的投资组合成分,投资组合的低换手率。 b 开放式基金:大规模投资的多元化,大规模交易的低成本,专业的管理可以实现在 机会出现时的买入或卖出,记录交易过程。 c 个人自主选择的股票和债券:没有管理费用,在协调个人所得税的情况下实现资本 利得或者损失,可以根据个人风险偏好来设计投资组合。 3、开放式基金是有义务以资产净值赎回投资者的股票,因此必须保持手头现金及现金证券 以满足潜在的赎回。封闭式基金不需要现金储备,因为对封闭式基金不能赎回。封闭式基金的投资者希望套现时,他们会出售股票。 4、平衡基金以相对稳定的比例投资于每个资产类别,供投资者投资整个资产组合时选择使 用。生命周期基金属于平衡基金,其资产配置取决于投资者的年龄构成。积极的生命周期基金,持有大量的股票,是面向年轻的投资者,而保守的生命周期基金,则持有大量的债券,主要针对年长的投资者。相比之下,资产配置基金会根据对每一个板块相对业绩的预测而显著改变基金在每一个市场的资产配置比例。因此资产配置资金更强调市场时机的选择。 5、与开放式基金不同,其基金股份随时准备以资产净值赎回,封闭式基金作为一种证券在 交易所中交易,因此,它的价格可以偏离它的净值。 6、交易所交易基金的优势: 交易所交易基金持续地交易,并且可以通过保证金来购买和出售 当交易所交易基金出售时,没有资本利得税(股票只是从一个投资者转移到了另一个投资者) 投资者直接从经纪人处购买,从而基金节省了直接向小投资者销售的成本,这种费用降低了管理费用。 交易所交易基金的劣势: 价格可能偏离资产净值(不像开放式基金) 在从经纪人手中购买时,必须支付费用(不像免佣基金) 中级题 7、发行价格包括6%的前端费用,也即销售费用,意味着每一美元的支付,仅能得到$0.94 的股票净值。因此发行价格=NAV/(1-load)=$10.70/(1-0.06)=$11.38 8、NAV=发行价格*(1-load)=$12.30*(1-0.05)=$11.69 9、股票价值 A $7,000,000 B $12,000,000 C $8,000,000 D $15,000,000 总值$42,000,000 NAV=($42,000,000-$30,000)/4,000,000=$10.49 10、股票的交易量=$15,000,000 换手率=$15,000,000/$42,000,000=0.357=35.7% 11、 a NAV=($200,000,000-$3,000,000)/5,000,000=$39.40

Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return Multiple Choice Questions 1、 ___________ a relationship between expected return and risk、 A、 APT stipulates B、 CAPM stipulates C、 Both CAPM and APT stipulate D、 Neither CAPM nor APT stipulate E、 No pricing model has found 2、 Consider the multifactor APT with two factors、 Stock A has an expected return of 17、6%, a beta of 1、45 on factor 1 and a beta of 、86 on factor 2、 The risk premium on the factor 1 portfolio is 3、2%、 The risk-free rate of return is 5%、 What is the risk-premium on factor 2 if no arbitrage opportunities exit? A、 9、26% B、 3% C、 4% D、 7、75% E、 9、75% 3、 In a multi-factor APT model, the coefficients on the macro factors are often called ______、 A、 systemic risk B、 factor sensitivities C、 idiosyncratic risk D、 factor betas E、 both factor sensitivities and factor betas