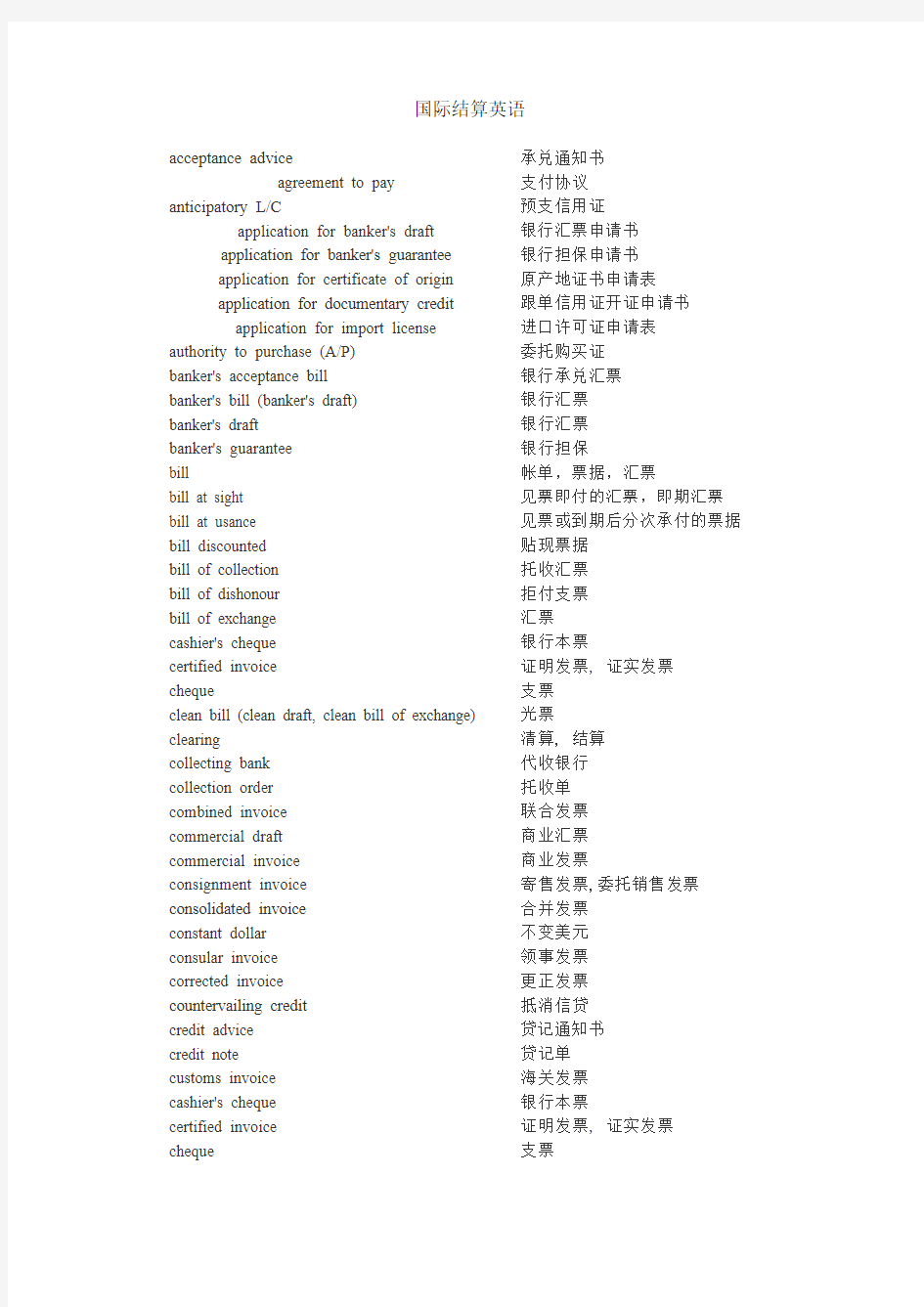

国际结算英语词汇

国际结算英语

acceptance advice承兑通知书

agreement to pay支付协议

anticipatory L/C预支信用证

application for banker's draft银行汇票申请书

application for banker's guarantee银行担保申请书

application for certificate of origin原产地证书申请表

application for documentary credit跟单信用证开证申请书

application for import license进口许可证申请表

authority to purchase (A/P)委托购买证

banker's acceptance bill 银行承兑汇票

banker's bill (banker's draft) 银行汇票

banker's draft 银行汇票

banker's guarantee 银行担保

bill 帐单,票据,汇票

bill at sight 见票即付的汇票,即期汇票bill at usance 见票或到期后分次承付的票据bill discounted 贴现票据

bill of collection 托收汇票

bill of dishonour 拒付支票

bill of exchange 汇票

cashier's cheque 银行本票

certified invoice 证明发票, 证实发票cheque 支票

clean bill (clean draft, clean bill of exchange) 光票

clearing 清算, 结算

collecting bank 代收银行

collection order 托收单

combined invoice 联合发票

commercial draft 商业汇票

commercial invoice 商业发票

consignment invoice 寄售发票,委托销售发票consolidated invoice 合并发票

constant dollar 不变美元

consular invoice 领事发票

corrected invoice 更正发票

countervailing credit 抵消信贷

credit advice 贷记通知书

credit note 贷记单

customs invoice 海关发票

cashier's cheque 银行本票

certified invoice 证明发票, 证实发票cheque 支票

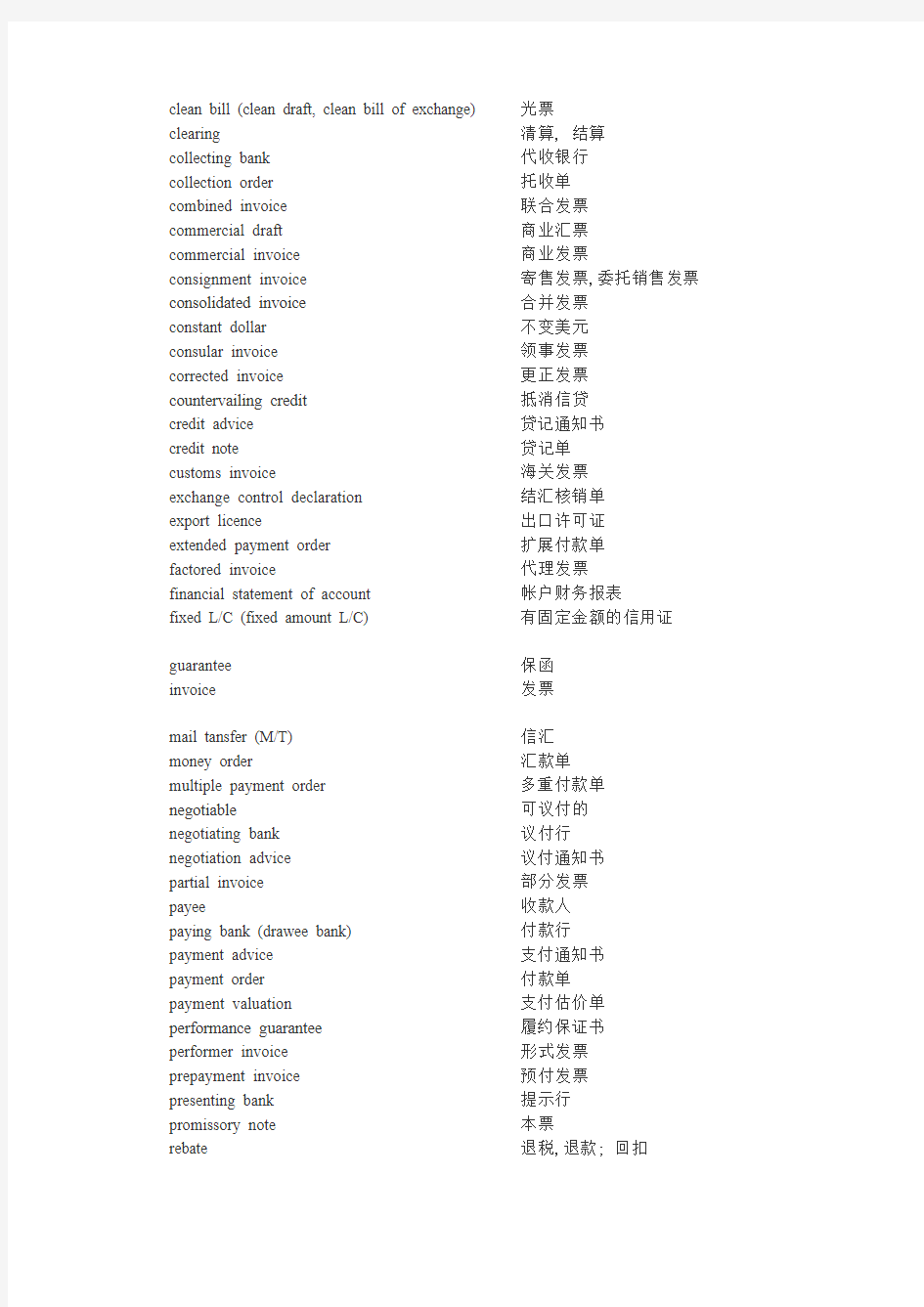

clean bill (clean draft, clean bill of exchange) 光票

clearing 清算, 结算

collecting bank 代收银行

collection order 托收单

combined invoice 联合发票

commercial draft 商业汇票

commercial invoice 商业发票consignment invoice 寄售发票,委托销售发票consolidated invoice 合并发票

constant dollar 不变美元

consular invoice 领事发票

corrected invoice 更正发票countervailing credit 抵消信贷

credit advice 贷记通知书

credit note 贷记单

customs invoice 海关发票

exchange control declaration 结汇核销单

export licence 出口许可证

extended payment order 扩展付款单

factored invoice 代理发票

financial statement of account 帐户财务报表

fixed L/C (fixed amount L/C) 有固定金额的信用证

guarantee 保函

invoice 发票

mail tansfer (M/T) 信汇

money order 汇款单

multiple payment order 多重付款单negotiable 可议付的

negotiating bank 议付行

negotiation advice 议付通知书

partial invoice 部分发票

payee 收款人

paying bank (drawee bank) 付款行

payment advice 支付通知书

payment order 付款单

payment valuation 支付估价单performance guarantee 履约保证书

performer invoice 形式发票

prepayment invoice 预付发票

presenting bank 提示行

promissory note 本票

rebate 退税,退款; 回扣

recipe invoice 收妥发票refund 退款remitting bank 汇出行

repayment guarantee 还款保证书, 还款担保, 还款保函

retention money guarantee 保留金保证书reversal of credit 贷记撤消

reversal of debit 借记撤消

sample invoice 样品发票

self-billed invoice 自用发票

sight draft 即期汇票

SWIFT(Society for Worldwide Interbank

Financial Telecomunication)

环球银行金融通信系统tax demand 催税单

tax invoice 税务发票

telegraphic transfer (T.T.) 电汇

time bill (time draft) 远期汇票

trust receipt 信托收据

usance bill 远期汇票

国际结算英文版课后练习答案.doc

Chapter One 1.Fill in the blanks to complete each sentence. (1)local legal system, political, exchange risks (2)open account, advance payment, remittance and collection (3)letter of credit, bank guarantee (4)price terms, delivery terms (5)least/minimum, most/maximum (6)advance payment (7)open account (8)clean collection, documentary collection 2.略 3.Translate the following terms into English. (1)settlement on bank credit (2)the potential for currency fluctuation (3)to dear the goods for export (4)to pay the insurance premium (5)to carry out export formalities (6)the major participants in international trade (7)the commodity inspection clause (8)to fulfill the obligation to deliver the goods (9)the goods have passed over the ship's rail (10)International contract is concluded in a completely different context than domestic ones 4.Decide whether the following statements are true or false. ⑴ F (2)F (3)T (4)T (5) T (6)T (7)F (8)T (9)T (10) F 5.Choose the best answer to each of the following statements ⑴?(5) BCCBD (6)-(10) DACCC (11)-(15) BDDCD (16)-(20) DCACD Chapter Two 1. Fill in the blanks to complete each sentence. (1)barter (2)medium of exchange (3)expensive, risky (4)our ⑸ Vostro (6)vostro ⑺ nostro (8) specimen of authorized signatures, telegraphic test keys, terms and conditions, Swift authentic keys 2. Define the following terms (1)Correspondent relationship KA bank having direct connection or friendly service relations with another bank.』 (2)International settlements [[International settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them. 3 (3)Visible trade [[The exchange of goods and commodities between the buyer and the seller across borders.2 (4)Financial transaction [[International financial transaction covers foreign exchange market transactions^ government

(完整版)商务英语词汇大全

商务英语词汇大全(一) economist 经济学家 socialist economy 社会主义经济capitalist economy 资本主义经济collective economy 集体经济planned economy 计划经济controlled economy 管制经济 rural economics 农村经济 liberal economy 经济 mixed economy 混合经济 political economy 政治经济学protectionism 保护主义 autarchy 闭关自守 primary sector 初级成分 private sector 私营成分,私营部门public sector 公共部门,公共成分economic channels 经济渠道economic balance 经济平衡economic fluctuation 经济波动economic depression 经济衰退economic stability 经济稳定economic policy 经济政策 economic recovery 经济复原understanding 约定 concentration 集中 holding company 控股公司 trust 托拉斯 cartel 卡特尔 rate of growth 增长 economic trend 经济趋势 economic situation 经济形势infrastructure 基本建设 standard of living 生活标准,生活水平purchasing power, buying power 购买力scarcity 短缺 stagnation 停滞,萧条,不景气underdevelopment 不发达underdeveloped 不发达的developing 发展中的 initial capital 创办资本 frozen capital 冻结资金 frozen assets 冻结资产 fixed assets 固定资产 real estate 不动产,房地产

国际结算常用缩写

国际结算常用缩写 AA Always afloat 经常漂浮 AA Always accessible 经常进入 AA Average adjusters 海损理算师 AAR Against all risks 承保一切险 AB Able bodied seamen 一级水手 AB Average bond 海损分担证书 A/B AKtiebolaget (瑞典)股份公司 A/B Abean 正横 ABS American Bureau of Shipping 美国船级协会ABT About 大约 ABB Abbreviation 缩略语 A/C,ACCT Account 帐目 AC Alter couse 改变航向 AC Account current 活期存款,来往 AC Alernating current 交流电 ACC Accepted; acceptance 接受,同意 ACC.L Accommodation ladder 舷梯 A.&C.P. Anchor & chains proved 锚及锚链试验合格ACV Air cushion vehicle 气垫船 ACDGLY Accordingly 遵照 AD Anno Domini 公元后 AD After draft 后吃水 ADD Address 地址 ADDCOM Address commission 租船佣金 ADF Automatic direction finder 自动测向仪 AD VAL Ad valorm 从价(运费) ADV Advise;advice; advance 告知;忠告;预支 A/E Auxiliary engine 辅机 AF Advanced freight 预付运费 AFAC As fast as can 尽可能快地 AF Agency fee 代理费 AFP Agence France press 法新社 AFS As follows 如下 AFT After 在。。。之后 A/G Aktiengeselskabet (德)股份公司 AG Act of god 天灾 AGRIPROD Agricultural products 农产品 AGN Again 再 AGT Agent 代理 AGW All going well 一切顺利 AH After hatch 后舱 AHL Australian hold ladder 澳洲舱梯 AL 1st class ship at Lloyd's 劳氏一级船

国际结算英文术语

国际结算英文术语

国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI(Electronic Data Intercharge)电子数据交换, 控制文件(Control Documents) 有权签字人的印鉴(Specimen Signatures) 密押(Test Key) 费率表(Terms and Condition) 货物单据化,履约证书化,( cargo documentation , guarantee certification) 权利单据(document of title) 流通转让性(Negotiability) 让与(Assignment) 转让(Transfer) 流通转让(Negotiation) 汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum

payable at days/ months after stated date) ④板期付款(bills payable on a fixed future date) ⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee) 同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid) 需要时的受托处理人(referee in case of need)出票人(drawer) 收款人(payee) 背书人(endorser) 被背书人(endorsee) 出票(issue) (1)制成汇票并签字(to draw a draft and to sign it); (2)将制成的汇票交付给收款人(to deliver the draft

国际结算术语汇总

International Settlements terms Chapter one Brief introduction to international trade transshipmen 转运 capacity容量,生产量 inspection检查,视察,检验,商检 arbitration仲裁,公断 inquiry质询,调查,询盘,问价 quotation价格,报价单,行情表,报价 facilitate便利,使容易 1oan facility贷款便利 domestic家庭的,国内的 domestic product国内生产的产品 consideration体谅,考虑,需要考虑的事项,报酬,因素 dimension尺寸,尺度,维(数),体积 warehouse 仓库v.存仓 premises房屋及周围的土地,这里表示“公司或企业的所在地”amendment改善,改正,修改 update使现代化,使跟上最新的发展 reversal颠倒,逆转,反转,倒转 fulfill履行,实现,完成(计划等) fulfill ones obligation履行(职责) formality拘谨,礼节,正式手续 quay码头 procure获得,取得 to procure marine insurance 办理海上保险 to procure ship租船 breach n.违背,破坏,破裂 breach of the contract毁约 frontier国境,边疆,边境 adjoin邻接,临近,毗邻 adjoining邻接的,隔壁的,临近的 the adjoining room隔壁的房子 adjoining country邻国 furnish供应,提供, deficiency缺乏,不足 jurisdiction权限,司法权,裁判权 fluctuation波动,起伏 variation变更,变化,变异,变种 permutation置换,彻底改变,兑变 commitment委托事项,许诺,承担义务,承诺 domicile住处,法定居住地 currency/foreign exchange fluctuation汇率波动

国际结算英语翻译

1.汇票的制作10个项目 汇票的内容又分为绝对必要项目和相对必要项目。绝对必要项目:1.有“汇票”的字样。2.无条件支付命令。3.确定金额4.收款人名称5.付款人名称6出票日期7出票人签章 相对必要项目:1.出票地2.付款地3.付款日期 2.支票的种类 按抬头不同分类:1.记名支票2.不记名支票 对付款闲置不同分类:1.普通支票:可取现金。2.划线支票:不可取现金,只能转账。划线支票好处在于可以延缓交易时间,可以便于追踪资金轨迹。划线支票又分为特别划线支票和一般划线支票。特别划线支票平行线会加注付款账号行名称。一般划线无须固定账户。 按是否可以流通分为可流通支票和不可流通支票。 3.提单的总类 按提单收货人的抬头划分:1.记名提单,不记名提单,指示提单。 按货物是否已装船划分:1.已装船提单,收妥备运提单。 按提单上有无批注划分:1.清洁提单2不清洁提单。 按照运输方式的不同划分为:1.直达提单2转船提单3.联运提单4.多式联运提单 按签发提单的时间划分为:1.正常提单2过期提单3.预借提单4.倒签提单 4.信用证的种类 1.不可撤销信用证 2.保兑信用证 3.即期付款信用证,迟期信用证,议付信用证,承兑信用证。 4.假远期信用证 5.红条款信用证 6.循环信用证 7.可转让信用证8背靠背信用证9对开信用证 5.托收的种类 托收根据金融单据是否伴随商业单据分为光票托收和跟单托收。跟单托收又根据票据的期限分为付款交单(D/P)(即期)和承兑交单(D/A)(远期)。付款交单是指付款人对即期汇票付款然后交单。而承兑交单是指付款人对远期汇票承兑而进行交单。 汇票 BILL OF EXCHANGE No. 汇票编号Date: 出票日期 For: 汇票金额 At 付款期限sight of this second of exchange (first of the same tenor and date unpaid) pay to the order of 受款人 the sum of金额 Drawn under 出票条款 L/C No. 信用证号Dated 信用证开征时间 To. 付款人 出票人签章

国际结算英文专业术语词汇18页

国际结算专业词汇 A Acceptance The act of giving a written undertaking on the face of a usance bill of exchange to pay a stated sum on the maturity date indicated by the drawee of the bill, (usually in exchange for documents of title to goods shipped on D/A terms) - see Collections Introduction. Acceptance Credit A documentary credit which requires the beneficiary to draw a usance bill for subsequent acceptance by the issuing bank or the advising bank or any other bank as the credit stipulates - see Documentary Credits. Accommodation Bill In the context of fraud, a bill drawn without a genuine underlying commercial transaction. Accountee Another name for the applicant/opener of a documentary credit i.e. the importer = the person for whose account the transaction is made. Advice of Fate The Collecting Bank informs the Remitting Bank of non- payment/non-acceptance or (for D/A bills) of acceptance and the bill maturity date - see Handling Import Collections. Advising Act of conveying the terms and conditions of a DC to the beneficiary. The advising bank is the issuing bank agent, usually located in the beneficiary country - see Export - DC Advising.

国际结算单选题大合集资料

二、单选题 1.最简单的结算方式为() A.汇款B.托收 C.信用证D.银行保函 答案: A 2.()贸易方式采购大型机器设备需要开立保函,还要开立延期付款信用证,是一种最复杂的结算方式。() A.投标B.补偿贸易 C.易货贸易D.寄售 答案:A 3.国际结算是随着()的发展而产生和发展的。() A.国际贸易B.商品生产 C.商品交换D.国际金融 答案:A 4.易货贸易方式采用()方式,比普通信用证复杂一些。() A.汇款B.托收 C.循环信用证D.对开信用证 答案:D 5.电子数据交换的英文缩写为() A.EDI B.B/E C.B/L D.EID 答案:A 6.某银行签发一张汇票,以另一家银行为受票人,则这张汇票是() A.商业汇票B.银行汇票 C.商业承兑汇票D.银行承兑汇票 答案:B 7.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张() A.即期汇票B.远期汇票 C.跟单汇票D.光票 答案:B 8.在我国实际出口业务中,出口公司开出的汇票在信用证结算方式下出票原因栏应填写() A.合同号码及签订日期 B.发票号码及签发日期

C.提单号码及签发日期 D.信用证号码及出证日 答案:D 9.在信用证结算方式下,汇票的受款人通常的抬头方式是()。 A.限制性抬头B.指示式抬头 C.持票人抬头D.来人抬头 答案:B 10.在汇票的使用过程中,使汇票一切债务终止的环节是() A.提示B.承兑 C.背书D.付款 答案:D 11.如果出票人想避免承担被追索的责任,也可以在汇票上加注() A.付一不付二B.见索即偿 C.不受追索D.单到付款 答案:C 12.某支票签发人在银行的存款总额低于他所签发的支票票面金额,他签发的这种支票称() A.现金支票B.转帐支票 C.旅行支票D.空头支票。 答案:D 13.计算汇票付款具体时间时,必须包括() A.见票日B.出票日 C.提单日D.付款日 答案:D 14.属于汇票必要项目的是() A.“付一不付二”的注明B.付款时间 C.对价条款D.禁止转让的文字 答案:B 15.背书人在汇票背面只有签名,不写被背书人,这是() A.限定性背书B.特别背书 C.记名背书D.空白背书 答案:D 16.承兑人对出票人的指示不加限制地同意确认,这是() A.一般承兑B.特别承兑 C.普通承兑D.限制承兑 答案:A

投行人常用的英语金融词汇

投行人常用的英语金融词汇 2012年01月15日 15:37:32 Accounts payable 应付帐款 Accounts receivable 应收帐款 Accrued interest 应计利息 Accredited Investors 合资格投资者;受信投资人 指符合美国证券交易委员(SEC)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者 Accredit value 自然增长值 ACE 美国商品交易所 ADB 亚洲开发银行 ADR 美国存股证;美国预托收据;美国存托凭证 [股市] 指由负责保管所存托外国股票的存托银行所发行一种表明持有人拥有多少外国股票(即存托股份)的收据。ADR一般以美元计价和进行交易,及被视为美国证券。对很多美国投资者而言,买卖ADR比买卖ADR所代表的股票更加方便、更流动、成本较低和容易。 大部份预托收据为ADR;但也可以指全球预托收(GDR) ,欧洲预托收据(EDR) 或国际预托收据(IDR) 。从法律和行政立场而言,所有预托收据具有同样的意义。 ADS 美国存托股份 Affiliated company 关联公司;联营公司 After-market 后市 [股市] 指某只新发行股票在定价和配置后的交易市场。市场参与者关注的是紧随的后市情况,即头几个交易日。有人把后市定义为股价稳定期,即发行结束后的30天。也有人认为后市应指稳定期过后的交易市况。然而,较为普遍的是把这段时期视为二级市场 AGM 周年大会 Agreement 协议;协定 All-or-none order 整批委托 Allocation 分配;配置 Allotment 配股 Alpha (Market Alpha) 阿尔法;预期市场可得收益水平 Alternative investment 另类投资 American Commodities Exchange美国商品交易所 American Depository Receipt 美国存股证;美国预托收据;美国存托凭证 (简称“ADR ”参见ADR栏 目) American Depository Share 美国存托股份 Amercian Stock Exchange 美国证券交易所 American style option 美式期权

国际结算模拟试题

《国际结算》模拟试题(六) 一、写出下列专业术语英文缩写的中文全称(5分) 1、T/R : 2、W/W : 3、GSPD : 4、EMS : 5、DHL : 二、单项选择题(只有唯一正确答案)(每题1分,共10分) 1、目前,世界集装箱航运中心位于()。 A、北美地区 B、中东地区 C、欧洲地区 D、亚太地区 2、目前,我国的货币-人民币属于()。 A、自由兑换的货币 B、不能自由兑换的货币 C、有限度的自由兑换货币 D、以上都不是 3、非贸易国际结算的内容不包括()。 A、保险收支 B、银行收支 C、外轮代理与服务收入 D、补偿贸易收入 4、旅行信用证的兑付银行是()。 A、旅行地的任意银行 B、开证行指定银行 C、申请人挑选的银行 D、任意银行 5、欧洲的支付系统是()。 A、CHAPS B、BOT-NET C、SIC D、TARGET 6、最主要的头寸调拨方式是()。 A、先拨后付 B、先付后偿 C、预付货款 D、货到付款 7、()不属于汇款方式。 A、逆汇 B、票汇 C、电汇 D、信汇 8、《跟单信用证统一惯例》规定,若信用证上既没有注明"可撤销",又没注明"不可撤销",则该信用证属于()。 A、可撤销信用证 B、不可撤销信用证 C、无效信用证 D、以上都不对 9、除非信用证另有说明,否则可转让信用证能转让()。 A、一次 B、二次 C、三次 D、无限次 10、以下汇票中,什么项目是确认债务的唯一方法()。 A、无条件支付命令 B、收款人姓名 C、付款人姓名 D、出票人签名 三、多项选择题(每题2分,共22分) 1、国际货币基金组织规定,若遵守其协定的第八条款,则必须()。 A、不限制经常性往来的支付和资金转移 B、不实行歧视性货币政策 C、实行单一汇率制度 D、实行完全自由的浮动汇率制度 E、兑换其他成员国从经常性交易中所取得的本国货币 2、开证行在承担跟单信用证的付款责任时,要求卖方做到()。 A、提供买方所需要的货运单据 B、提供买卖双方签订的贸易合同 C、在信用证的效期内交单 D、在信用证的装期内装船 E、所要求的金额在信用证的规定金额之内 3、《跟单信用证统一惯例》规定,银行在信用证业务中只须审查()。 A、信用证 B、贸易合同 C、货运单据 D、货物样品 E、以上都必须 4、支付系统的基本要素包括()。 A、收款人 B、付款人开户行 C、付款人 D、收款人开户行 E、票据交换所 5、EDI在外贸领域的应用已达到比较成熟的阶段,贸易商可以通过EDI()。 A、发订单 B、办理海关手续 C、接受订单 D、询问有关商品信息 E、办理货物运输 6、下列银行业务中,属于逆汇结算的有()。 A、电汇 B、信汇 C、信用证业务 D、托收 E、票汇

国际结算 英文名词翻译 按章整理

英文名词翻译 第一章 国际结算导论 international settlement 美国CHIPS 系统:纽约清算银行同业支付系统 英国CHAPS 系统: 清算所自动支付体系 布鲁塞尔SWIFT 系统: 环球银行金融电讯协会 (Critical Point for Delivery) 交货临界点 (Critical Point for Risk) 风险临界点 (Critical Point for Cost)费用临界点 《国际贸易术语解释通则》 Incoterms2000 visible trade :有(无)形贸易 (representative office) 代表处 ( agency office)代理处 (overseas sister bank /branch,subbranch )海外分/支行 (correspondent bank ) 代理银行 (subsidiary bank )附属银行(子银行) (affiliated banks ) 联营银行 (consortium bank )银团银行 甲行以乙国货币在乙行设立帐户: 甲行是往帐(Nostro a/c),即我行在你行设帐(Our a/c with you ) 乙行以甲国货币在甲行设立帐户 甲行是来帐(V ostro a/c),即你行在我行设帐(Your a/c with us ) 在银行实际业务中,增加使用“贷记”(To Credit ),减少使用“借记”(To Debit ) 第二章 票据Instrument drawer 出票人 drawee/payer 付款人 payee 收款人 endorser 背书人 endorsee 被背书人 holder in due course 善意持票人 acceptor 承兑人 guarantor 保证人 bill of exchange 汇票 mandatory elements issue 出票 endorsement 背书 presentation 提示 acceptance 承兑 payment 付款 dishonor 拒付 recourse 追索 guarantee 保证 限制性抬头 restrictive order (pay E company only)(pay E company not transferable) 指示性抬头 demonstrative order (pay to the order of B company)(pay to B company or order) 持票来人抬头 payable to bearer (pay to bearer)(pay to A company or bearer) UCP600:《跟单信用证统一惯例》 URC 522 ;《托收统一规则》 URDG458:《见索即付保函统一规则》 URR 525:《跟单信用证项下银行间偿付统一规则》 URCB524:《合同保函统一规则》

国际结算(英文版)清华大学出版社-答案

国际结算(英文版)清华大学出版社-答案

KEY OF INTERNATIONAL SETTLEMENT Chapter 1 I.Put the following phrases into English 2.Put the following sentences into English (1)国际结算涉及有形贸易和无形贸易,外国投资, 从其他国家借贷资金,等等。

The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on. (2)许多银行注重发展国际结算和贸易融资的业 务。 Many banks have focused on their business of international settlement and trade finance. (3)大多数国际间的支付来自于世界贸易。 Most of the international payments originate from transactions in the world trade. (4)一般来说,国际结算的方式分为三类:汇款、 托收和信用证。 Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit. 3.True or False 1)I nternational payments and settlements are finan cial activities con ducted in the domestic coun try. (F)

国际结算英文术语

国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI(Electronic Data Intercharge)电子数据交换, 控制文件(Control Documents) 有权签字人的印鉴(Specimen Signatures) 密押(Test Key) 费率表(Terms and Condition) 货物单据化,履约证书化,( cargo documentation , guarantee certification) 权利单据(document of title) 流通转让性(Negotiability) 让与(Assignment) 转让(Transfer) 流通转让(Negotiation) 汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to the order or specified person or to bearer. “汇票” (bill of exchange,exchange或draft) 无条件支付命令(unconditional order to pay) 出票条款(drawn clause) 利息条款(with interest) 分期付款(by stated instalment) 支付等值其它货币( pay the other currency according to an indicated rate of exchange) 付款人(payer)受票人(drawee) 付款期限(time of payment)或(tenor) 即期(at sight, on demand, on presentation)付款。 远期(at a determinable future time , time/ usance / term bill)付款。 期限远期付款的表现形式: ①见票后若干天(月)付款(bills payable at days/ months after sight) ②出票后若干天(月)付款(bills payable at days/ months after date) ③预定日期后若干天(月)付款(bills payable at days/ months after stated date) ④板期付款(bills payable on a fixed future date) ⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee) 同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid) 需要时的受托处理人(referee in case of need) 出票人(drawer) 收款人(payee) 背书人(endorser) 被背书人(endorsee) 出票(issue)

国际结算(英文版)清华大学出版社-答案

KEY OF INTERNATIONAL SETTLEMENT Chapter 1 1.Put the following phrases into English 2.Put the following sentences into English (1)国际结算涉及有形贸易和无形贸易,外国投资,从其他国家借贷资金,等等。 The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on. (2)许多银行注重发展国际结算和贸易融资的业务。 Many banks have focused on their business of international settlement and trade finance. (3)大多数国际间的支付来自于世界贸易。 Most of the international payments originate from transactions in the world trade. (4)一般来说,国际结算的方式分为三类:汇款、托收和信用证。 Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit.

3. True or False 1)International payments and settlements are financial activities conducted in the domestic country. (F) 2)Fund transfers are processed and settled through certain clearing systems.(T) 3)Using the SWIFT network, banks can communicate with both customers and colleagues in a structured, secure, and timely manner.(T) 4)SWIFT can achieve same day transfer.(T) 4.Multiple Choice 1)SWIFT is __B__ A.in the united states B. a kind of communications belonging to TT system for interbank’s fund transfer C.an institution of the United Nations D. a governmental organization 2)SWIFT is an organization based in __A___ A.Brussels B.New York C.London D.Hong Kong 3) A facility in fund arrangement for buyers or sellers is referred to __A___ A.trade finance B.sale contract C.letter of credit D.bill of exchange 4)Fund transfers are processed and settled through __C___

国际结算双语课程标准--英文版

International settlement(bilingualism) course standard First, summary of course It is the core course of international economic and trade major, based on the operating skills’cultivation about methods of international settlement, combining theory with reality, emphasising on positional operation, paying attention to the cultivation of comprehensive ability about finding, analyzing and solving problems, etc. Second, before and after courses International settlement(before courses are International trade practice (bilingualism)、International business documents) , after courses are international trade business comprehensive trading and Foreign trade correspondence. Third, the course content

参考资料:《国际结算》相关术语中英文对照与中文名词解释

参考资料:《国际结算》相关术语中英文对照 国际结算 International Settlement 有形贸易 Visible Trade 无形贸易 Invisible Trade 洗钱 Money Laundering 支付协定 Payment Agreement 国际结算制度 System of International Settlement 支付系统 Payment System 代表处 Representative Office 代理处 Agency Office 海外分、支行(境外联行) Overseas Sister Bank/Branch,Subbranch 代理银行 Correspondent Banks 附属银行(子银行) Subsidiary Banks 联营银行 Affiliated Banks 银团银行 Consortium Bank 票据 Instrument 设权性 Right to Be Paid 无因性 Non causative Nature 要式性 Requisite in Form 流通性 Negotiability 可追索性 Recoursement 基本当事人 Immediate Parties 附属当事人 Remote Parties 出票人 Drawer 付款人 Payer,Drawee 收款人 Payee 背书人 Endorser 被背书人 Endorsee 持票人 Holder 承兑人 Acceptor 保证人 Guarantor 汇票 Bill of Exchange 限制性抬头 Restrictive Order 指示性抬头 Demonstrative Order 持票来人抬头 Payable to Bearer 出票日期 Date of Issue 出票人签字 Signature of the Drawer 出票地点 Place of Payment 付款地点 Place of Payment 付款日期 Tenor

(金融保险)常用金融英语词汇

常用金融英语词汇 Accounts payable 应付帐款 Accounts receivable 应收帐款 Accrued interest 应计利息 Accredited Investors 合资格投资者;受信投资人 指符合美国证券交易委员(SEC)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者 Accredit value 自然增长值 ACE 美国商品交易所 ADB 亚洲开发银行 ADR 美国存股证;美国预托收据;美国存托凭证 [股市] 指由负责保管所存托外国股票的存托银行所发行一种表明持有人拥有多少外国股票(即存托股份)的收据。ADR一般以美元计价和进行交易,及被视为美国证券。对很多美国投资者而言,买卖ADR比买卖ADR所代表的股票更加方便、更流动、成本较低和容易。大部份预托收据为ADR;但也可以指全球预托收(GDR) ,欧洲预托收据(EDR) 或国际预托收据(IDR) 。从法律和行政立场而言,所有预托收据具有同样的意义。 ADS 美国存托股份 Affiliated company 关联公司;联营公司 After-market 后市 [股市] 指某只新发行股票在定价和配置后的交易市场。市场参与者关注的是紧随的后市情况,即头几个交易日。有人把后市定义为股价稳定期,即发行结束后的30天。也有人认为后市应指稳定期过后的交易市况。然而,较为普遍的是把这段时期视为二级市场 AGM 周年大会 Agreement 协议;协定 All-or-none order 整批委托 Allocation 分配;配置 Allotment 配股 Alpha (Market Alpha) 阿尔法;预期市场可得收益水平 Alternative investment 另类投资 American Commodities Exchange 美国商品交易所 American Depository Receipt 美国存股证;美国预托收据;美国存托凭证(简称“ADR ”参见ADR栏目) American Depository Share 美国存托股份 Amercian Stock Exchange 美国证券交易所 American style option 美式期权 Amex 美国证券交易所 Amortization 摊销 Amsterdam Stock Exchange 阿姆斯特丹证券交易所 Annual General Meeting 周年大会 Antitrust 反垄断 APEC 亚太区经济合作组织(亚太经合组织) Arbitrage 套利;套汇;套戥