Summary of THE AUDIT PROCESS--principles,practice and cases

Lecture 1

1One definition of an audit of financial and other information:

An audit is an investigation or a search for evidence to enable reasonable assurance to be given on the truth and fairness of financial and other information by a person or persons independent of the preparer and persons likely to gain directly from the use of the information, and the issue of a report on that information with the intention of increasing its credibility and therefore its usefulness.

2 Justification of audit

Reliability /Reassurance/ Insurance

Uncertainty/ Complexity/ Creditability /Need for Independence

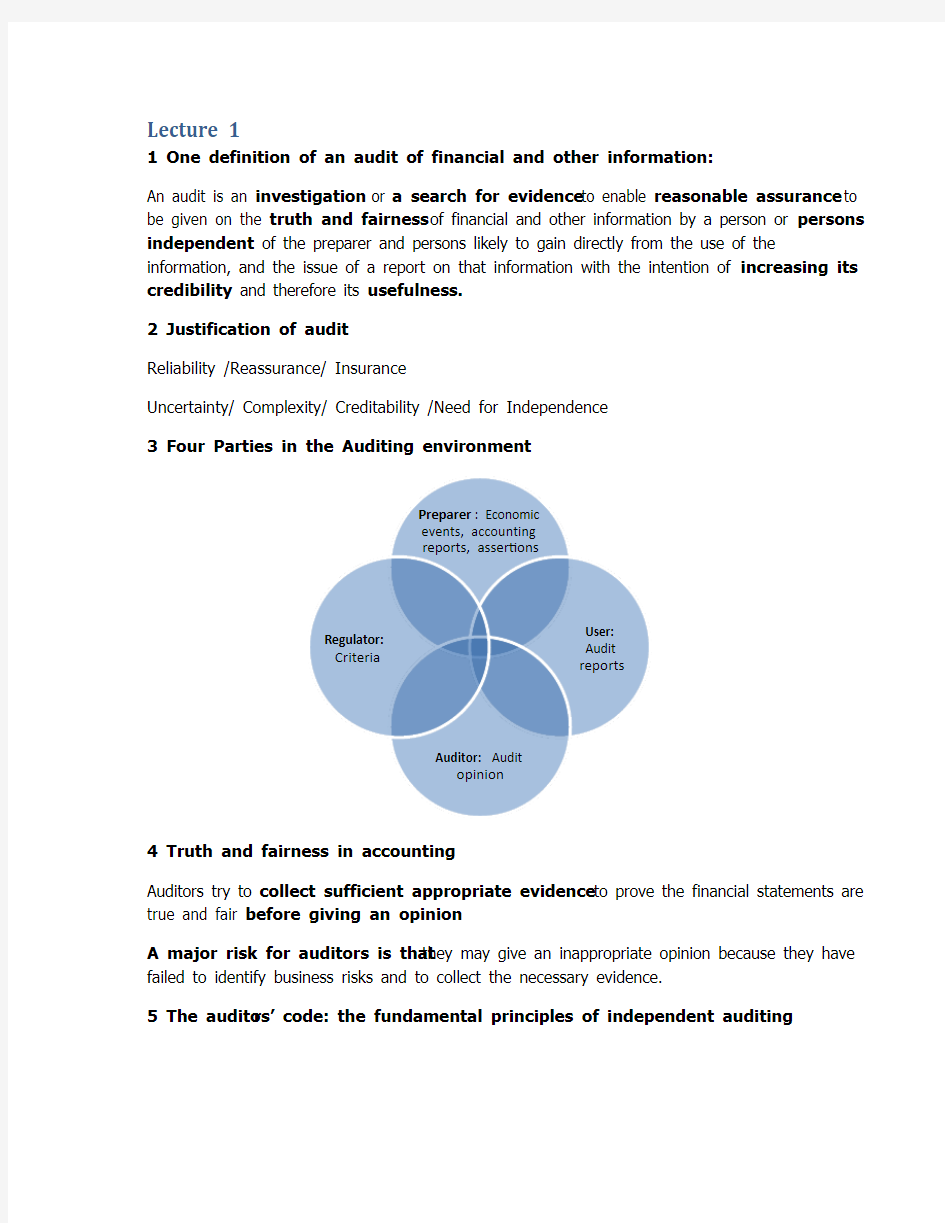

3 Four Parties in the Auditing environment

4 Truth and fairness in accounting

Auditors try to collect sufficient appropriate evidence to prove the financial statements are true and fair before giving an opinion.

A major risk for auditors is that they may give an inappropriate opinion because they have failed to identify business risks and to collect the necessary evidence.

5 The audito rs’ code: the fundamental principles of independent auditing

Accountability/Integrity/Objectivity and Independence/Competence/Rigor/Judgment Clear, complete and effective communication /Association/providing value

6 The postulate of auditing

1.The primary condition for an audit is that there is a relationship of accountability or a

situation of public accountability.

2.The subject matter of accountability is too remote, too complex and/or of too great

a significance for the discharge of the duty to be demonstrated without the process of

audit.

3. Essential distinguishing characteristics of audit are the independence of its status and its

freedom from investigatory and reporting constraints.

4. The subject matter of audit, for example, conduct, performance or achievement or record of

events or state of affairs or a statement of fact relating to any of these, is susceptible to verification by evidence.

5. Standards of accountability, for example, conduct, performance, achievement and quality

of information can be set for those who are accountable: actual conduct, etc. can be measured and compared with these standards by reference to known criteria and the process of measurement and comparison requires special skill and judgement.

6. The meaning, significance and intention of financial and other statements and data, which

are audited, are sufficiently clear that the credibility given thereto as a result of audit can be clearly expressed and communicated.

7. An audit produces an economic or social benefit.

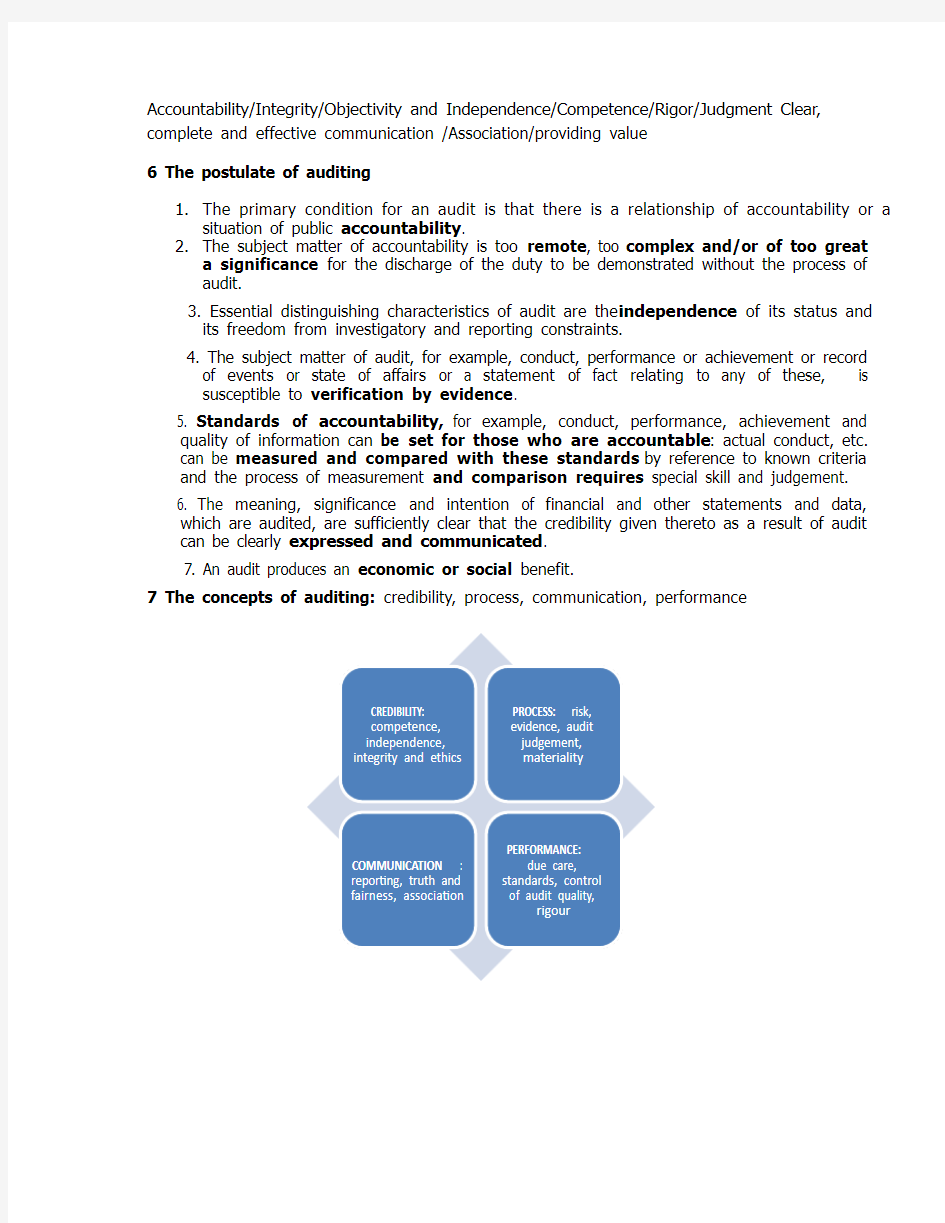

7 The concepts of auditing: credibility, process, communication, performance

8 Basic audit frameworks

9

Summary of principles

Reliability aspect: truth and fairness

Audit is form of investigation, using a number of useful techniques.

The auditor has to behave in a competent and independent manner.

Audit is a search for evidence to arrive at what the auditor perceives to be the truth.

An attitude of professional skepticism should be adopted.

Do not assume business people are engaged in fraudulent activity.

Lecture 2

1 Introduction - Fundamental principles of independent auditing

Objectivity - impartial opinions unaffected by bias, prejudice, compromise and conflicts of interest.

Independence -free from situations and relationships which would make it probable that a reasonable and informed third party would conclude that the auditors’ objectivity either is impaired or could be impaired

2 Independence- by definition

The social concept of audit is a special kind of examination by a person other than the parties involved which compares performance with expectation and reports the result; it is part of the public and private control mechanism of monitoring and securing

accountability.’(Flint (1988) defines audit in broad terms)

3 Mautz and Sharaf ----Two types of independence

A Close relationship which the profession of public accounting has with business

– Apparent financial dependence

– Existence of a confidential relationship

– Strong emphasis on service to management

B The organization of the profession

– Tendency towards the emergence of a limited number of firms

– Lack of profession solidarity

–Tendency to introduce ‘salesmanship’.

4 Shockley’s conceptual model on Conflict, power of auditor and client and effect on

perceived independence

Factors as having an impact on the auditor’s ability to withstand pressure:

1. Provision of non-audit or non-assurance services, termed management advisory services (MAS).

2. Competition in the auditing profession (competition).

3. The period for which the auditor has held the position (tenure).

4. Size of the audit firm (size).

5. The flexibility of accounting standards (accounting flexibility).

6. The degree of severity of professional sanctions and their application (professional sanctions).

7. The extent of the auditor’s legal liability to third parties (legal liability).

8. The fear the auditor might have of losing clientele and of losing his/her reputation (fear of losing clientele, reputation)

5 Pressures affecting independence might arise from

6 Potential threats to objectivity

(a) Self-interest(b) Self-review

(c) Advocacy (d) Familiarity

(e) Intimidation

7 Specific threats to integrity, objectivity and independence

?Financial, business, employment and personal relationships

?Long association with the audit engagement

?Fees, remuneration and evaluation policies, litigation, gifts and hospitality ?Non-audit (or non-assurance) services provided to audit clients

8 General principles of the IFAC code

(a) Integrity– straightforward and honest in all professional and business relationships.

(b) Objectivity– no bias, conflict of interest or undue influence of others to override professional or business judgments.

(c) Professional competence and due care – maintain professional knowledge and skill at level required to ensure client or employer receives competent professional services based on current developments in practice, legislation and techniques, and act diligently and in accordance with applicable technical and professional standards.

(d) Confidentiality– respect confidentiality of information acquired as a result of professional and business relationships, and not disclose any such information to third parties without proper and specific authority, unless a legal or professional right or duty to disclose, nor use the information for personal advantage of the professional accountant or third parties.

(e) Professional behavior– to comply with relevant laws and regulations and avoid any action that discredits the profession.

9 Safeguards to counter threats to integrity, objectivity and independence

Safeguards created by profession, legislation or regulation

Educational, training and experience requirements for entry

Continuing professional development requirements

Corporate governance regulations

Professional standards

Professional/regulatory monitoring and disciplinary procedures

External review by legally empowered third party of reports, returns, communications or information produced by a professional accountant

Safeguards in the work environment

Firm-wide safeguards, such as leadership of firm es tablishing ‘tone at the top’ and control environment

Engagement specific safeguards, such as review by EQCR (not part of assurance team) of assurance work performed

Safeguards within client’s systems and procedures

10 Audit expectations gap – definition

?Common element in the various definitions of the gap is that auditors are performing in

a manner which is at variance with the beliefs and desires of others who are party

to or interested in the audit.

11

Chapter 17 Fraud and going concern

1 Introduction to fraud

?Fraud: ‘Intentional act by one or more individuals among management, those charged with governance, employees or third parties, involving the use of deception to obtain an unjust or illegal advantage.’ (ISA 240)

?Managerial fraud or fraud by those charged with governance (TCWG):

– Important in context of the financial statements

– More difficult for the auditors to detect.

?Fraud can involve participation of third parties.

1.Reporting fraud occurred or suspected may be required by law, such as money

laundering legislation.

2.Auditors take seriously reporting of fraud because they owe a duty of

confidentiality to their clients.

3.Definition of money laundering is wide and includes a criminal offence that gives

rise to some benefit.

Case of Sasea Finance Limited (In liquidation) vs KPMG (2000) – an example involving fraud and auditors’ duty to report to a third party.

2 Responsibility for fraud detection

ISA 210 – management responsible for such internal control‘is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error’.

ISA 240 – objectives of auditor:

‘To identify and assess the risks of material misstatement of the financial statements due to fraud’ and ‘to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses.’

Broad audit approach:

1)Get management estimate of extent to which financial statements materially misstated

by fraud.

2)Determine entity procedures to identify and respond to risks of fraud – tone set.

3)Maintain attitude of professional skepticism during planning – possibility of fraud.

4)Plan and conduct audit tests to limit possibility that material fraud goes undetected.

5)Consider factors increasing possibility of fraud.

Change in approach to fraud:

?Greater focus to material misstatements of financial statements.

?Acknowledging greater risk to auditor lies in failure to detect misstatements rather than failure to detect the theft of inventories or cash.

?Misappropriation of assets unlikely to be sufficiently material to distort the truth and fairness of the financial statements.

?Material misstatements in the financial statements often arise from overstatement of revenue.

3 Why fraud is difficult to detect?

A.Inherent limitations in audit techniques and tests, including sampling.

https://www.360docs.net/doc/0f11669312.html,e of deceit, collusion and other means to conceal well-planned and executed fraud

(often by individuals with responsible role in company).

C.Fact that auditors only required to arrive at an opinion on the financial statements

(evidence in terms of persuasiveness) rather than give a guarantee.

D.Limit to effectiveness of internal controls.

4 Fraudulent financial reporting achieved by…

1.Manipulation, falsification, suppression or alteration of accounting documents or records.

2.Misrepresentation or omission of transactions or events.

3.Inappropriate classification or disclosure in the accounts.

4.Misapplication of accounting principles.

5 Pressure to misrepresent financial performance may be high

Poor financial performance

Pressure from markets

Directors wish to show growth continuing

Company expanding by acquiring other companies, directors have incentive to show policy resulted in group continuing to be profitable

Where company has liquidity problems and directors do not want shareholders or the markets to become aware of this

6 Reporting fraud and error internally

Auditors’ procedures:

1.Be aware of facts and ensure understood situation correctly.

2.Discuss with management or audit committee.

3.TCWG take action on reported suspicions of fraud/error.

4.Document process until satisfactory resolution.

5.Obtain copies of false documents, if any.

Responsibilities of the directors:

1.Develop appropriate control environment.

2.Establish strong & effective internal controls.

3.Encourage strong ethical environment.

4.Establish audit committee to whom the auditors can report.

5.Conduct review of effectiveness of company’s internal controls; report to shareholders.

7 Consideration of law and regulations

Law and regulations relating directly to financial statements: auditors obtain audit evidence of compliance. Companies Acts or legislation relating to particular commercial sectors.

Audit procedures:

–Obtain understanding of laws and regulations of industry, determine how entity ensures compliance.

– Inspect correspondence with regulatory/licensing authorities.

– Discuss with management if aware of non-compliance.

– Consult with lawyers.

– Auditor gathers sufficient appropriate audit evidence to give assurance entity has complied with law and regulations.

Audit reporting:

1 If uncertain about potential financial impact--ensure matter is fully disclosed in notes to the accounts and refer to it in an explanatory paragraph in their audit report.

2 If disagree with management on a material non-compliance: --issue ‘except for’ or adverse opinion.

3 If limitations in scope of audit work imposed by the entity:--issue an except for opinion or a disclaimer of opinion.

8 Money laundering legislation

Responsibilities on accountancy firms:

– Appoint money laundering reporting officer (MLRO) to receive money laundering reports from other members of firm and report to the Serious and Organized Crime Agency.

–Training employees of firm on legislation requirements and how to react to potential money laundering situation and report to MLRO.

–Verifying new clients’ id entity and keeping records of evidence.

– Establishing internal procedures to forestall/prevent money laundering.

Potential serious impact on auditors:

A.Interim guidance for auditors stresses requirements relate to performing of accountancy

services which encompass not only audit but other services also.

B.Legislation can apply to activities conducted overseas, but considered an offence if conducted

in the UK.

Auditors might have to seek advice from their legal advisor.