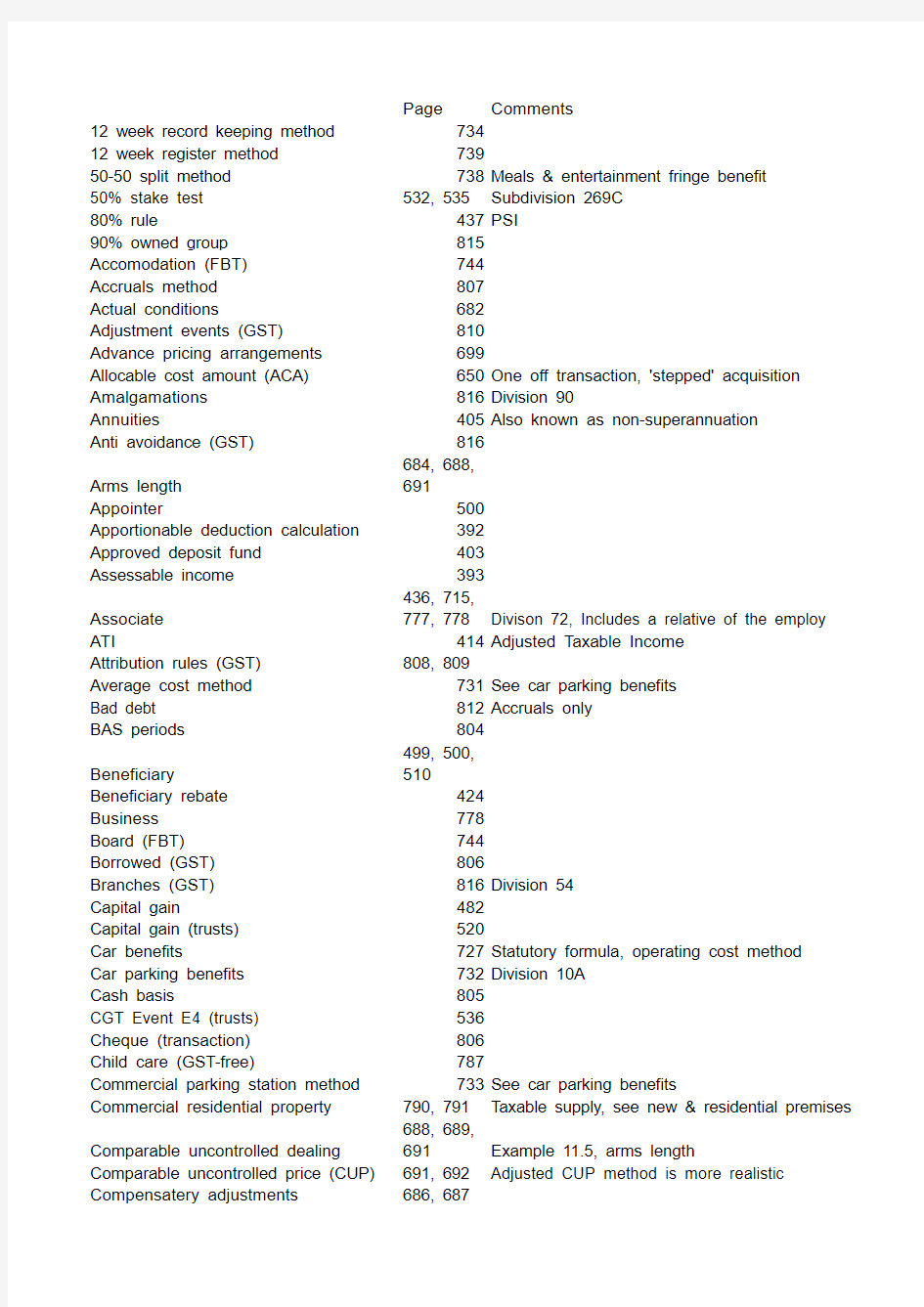

CPA Taxation Index

Page Comments

12 week record keeping method734

12 week register method739

50-50 split method738Meals & entertainment fringe benefit 50% stake test532, 535Subdivision 269C

80% rule437PSI

90% owned group815

Accomodation (FBT)744

Accruals method807

Actual conditions682

Adjustment events (GST)810

Advance pricing arrangements699

Allocable cost amount (ACA)650One off transaction, 'stepped' acquisition Amalgamations816Division 90

Annuities405Also known as non-superannuation

Anti avoidance (GST)816

Arms length 684, 688, 691

Appointer500 Apportionable deduction calculation392 Approved deposit fund403 Assessable income 393

Associate 436, 715,

777, 778Divison 72, Includes a relative of the employ

ATI414Adjusted Taxable Income Attribution rules (GST)808, 809

Average cost method731See car parking benefits Bad debt 812Accruals only

BAS periods804

Beneficiary 499, 500, 510

Beneficiary rebate424

Business778

Board (FBT)744

Borrowed (GST)806

Branches (GST)816Division 54

Capital gain482

Capital gain (trusts)520

Car benefits727Statutory formula, operating cost method

Car parking benefits732Division 10A

Cash basis805

CGT Event E4 (trusts)536

Cheque (transaction)806

Child care (GST-free)787

Commercial parking station method733See car parking benefits

Commercial residential property790, 791Taxable supply, see new & residential premises

Comparable uncontrolled dealing 688, 689,

691Example 11.5, arms length

Comparable uncontrolled price (CUP)691, 692Adjusted CUP method is more realistic Compensatery adjustments686, 687

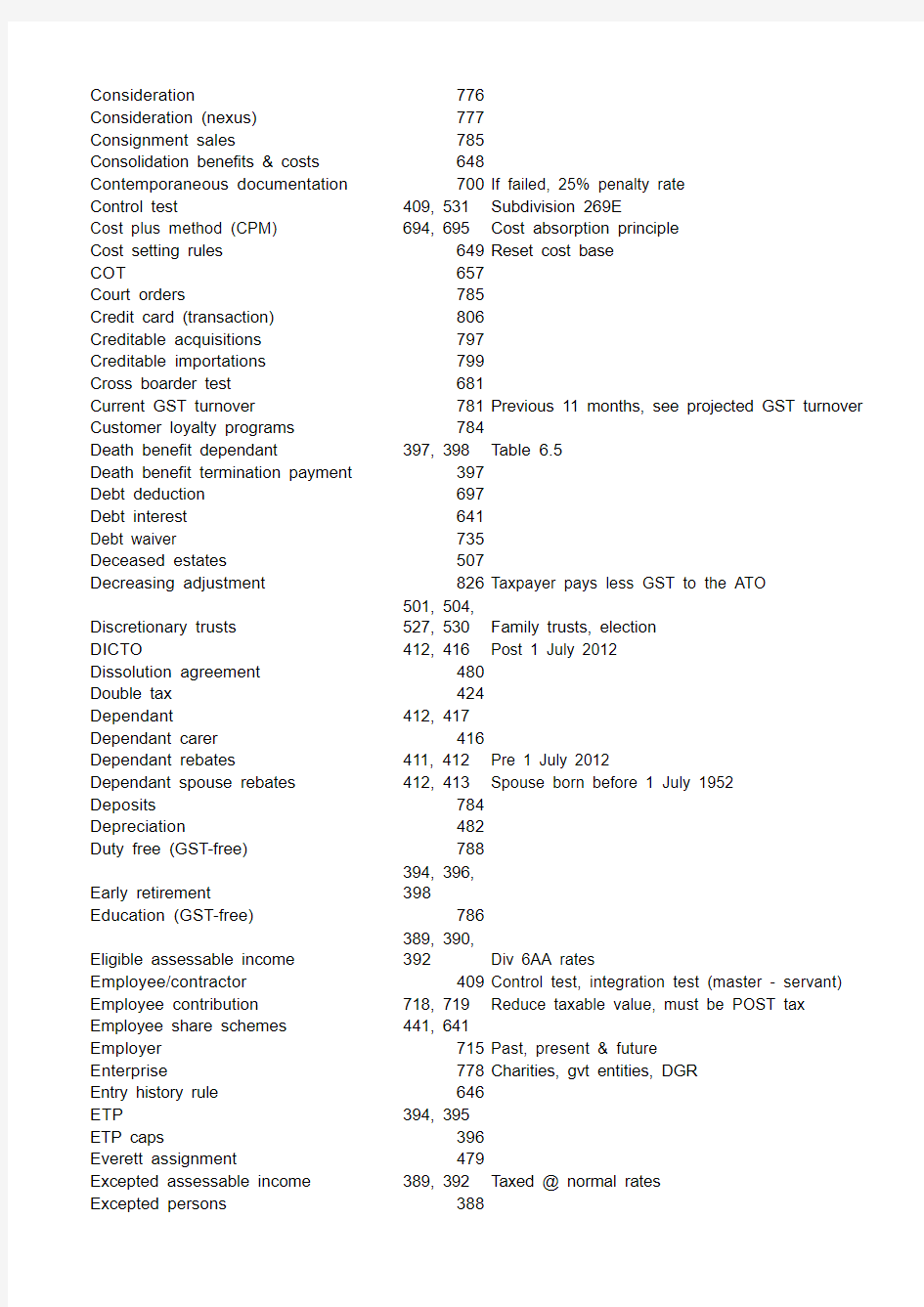

Consideration776

Consideration (nexus)777

Consignment sales785

Consolidation benefits & costs648

Contemporaneous documentation700If failed, 25% penalty rate

Control test409, 531Subdivision 269E

Cost plus method (CPM)694, 695Cost absorption principle

Cost setting rules649Reset cost base

COT657

Court orders785

Credit card (transaction)806

Creditable acquisitions797

Creditable importations799

Cross boarder test681

Current GST turnover781Previous 11 months, see projected GST turnover Customer loyalty programs784

Death benefit dependant397, 398Table 6.5

Death benefit termination payment397

Debt deduction697

Debt interest641

Debt waiver 735

Deceased estates507

Decreasing adjustment826Taxpayer pays less GST to the ATO

Discretionary trusts 501, 504,

527, 530Family trusts, election

DICTO412, 416Post 1 July 2012

Dissolution agreement480

Double tax424

Dependant412, 417

Dependant carer416

Dependant rebates411, 412Pre 1 July 2012

Dependant spouse rebates412, 413Spouse born before 1 July 1952 Deposits784

Depreciation482

Duty free (GST-free)788

Early retirement 394, 396, 398

Education (GST-free)786

Eligible assessable income 389, 390,

392Div 6AA rates

Employee/contractor409Control test, integration test (master - servant) Employee contribution718, 719Reduce taxable value, must be POST tax Employee share schemes441, 641

Employer715Past, present & future

Enterprise778Charities, gvt entities, DGR

Entry history rule646

ETP394, 395

ETP caps396

Everett assignment479

Excepted assessable income389, 392Taxed @ normal rates

Excepted persons388

Excepted trust income390, 529

Exempt employers (rebates)750Schools, religious inst, etc

Exempt fringe benefits716Division 13

Exempt fringe residual benefits748

Exit history rule663

External (property fringe benefit)746

Expense payment fringe benefit737

Exports (GST-free)787

Facilitator789Does not supply financial supplies, see provider Family group527

Family situation rebates411

Family trusts527, 530

FBT 3 conditions7141 July 1986 non assessable, non exempt

FBT 12 categories716

FBT cap726$17k/$30k cap on grossed up value

FBT exclusions714

FBT exempt725, 752$17k/$30k cap

FBT gross up amount713, 72147%

FBT instalments713Over $3,000

FBT lodgement71321 May or 28 May (using tax agent)

FBT no private benefit declaration719, 737See otherwise deductible rule

FBT record keeping752

FBT reduction in taxable value716Division 14

FBT steps724

Financial supplies (Input taxed supply)789, 802,

806, 81975% reduction

Fines, penalties & taxes784

FITO424<$1,000 offset

Fixed trusts 501, 504,

529, 535Lifetime, entitlement that is indefeasable

Food (FBT)742, 743Excess of reasonable food allowance Food (GST-free)786

Franking credits511

Franking credit tax offset424

Foreign partners471

Foreign sourced salary408Pre 1 July 2009, 91 day+ exempt Forfeiture (real risk)442ESS deferred tax

Further tax (p/ship)479Trustees, minors, primary producers

Genuine redundancy payments 394. 398, 400

Going concern (GST-free)787

Gross up formula (FBT & GST)721Type 1 and Type 2 fringe benefit GST apportionment793, 794

GST calculation793

GST free supply 769, 770,

785Division 38

GST grouping815

GST registration78021 days

GST requirements780$75k turnover threshold

GST timing804Monthly/quaterly/annually

GST value & price772Value = GST exc. Price = GST inc.

Guardian500

Head company640

Health (GST-free)786

HELP repayment429

Hire purchase (GST)806

Housing fringe benefit739Urban areas v remote areas Hybrid trusts501Lifetime, both fixed & discretionary Importations792, 793Importer is liable

In-house property fringe benefit745

Income injection test530, 535Division 270, "outsider"

Indirect/overhead costs (GST)799

Input tax credits796

Input taxed supply 769, 771,

789Division 40, 4 years

Interdependancy relationship397

Intergration test410

International Taxation Agreements (ITA)686Mutual agreement procedure

Internet/telephone (transaction)806

Invalidity segment calculation395Tax free comp of ETP

Invoices813$75 rule

Joint venture467

Land (transaction)806

Lease806

Life benefit termination payment394, 396

LITO422

Living away from home allowance 7411-Oct-12

Loan fringe benefits735Less than benchmark FBT rate (5.95%)

Long service leave 394, 399,

400Table 6.6

Losses (consolidation)659Satisfy COT & SBT

Market value method733See car parking benefits

Margin scheme795, 802 1 July 2000, no input tax credits on purchase MAWTO426, 427

Meals and entertainment73850-50 split method, 12 week register method Medical expenses rebate416, 417

Medicare levy428

Medicare levy surcharge428

Metals (GST-free)788, 789GST-free or input tax credits

Minors 388, 390,

478Div 6AA

Modified COT/SBT659

Mutual agreement procedure687ATO v IRS, reach a common goal

New residential premises791See residential & commercial residential Non assessable payments536

Non resident408

Non resident beneficiary505Figure 8.1 p 506

Non unit trusts (fixed)501Lifetime

Notional income512Franking credits, CGT

One off transaction (consolidation)650Steps 1, 2, 6, 7, 8

Operating cost method730See car benefits

Otherwise deductible rule719Reduce taxable income

Overtime737

Part IVA469

Partners interest476

Partnership466

Partnership income - control478

Partnership loss471, 473

Partnership net income 471

Partnership salary474Salary deficiency - not assessable TY but may be NY Pattern of distributions test533Subdivision 269D

PAYG (FBT)718Qtrly 28th / Mthly 21st

Pensions405

Pre-established costs800

Presently entitled504Legal disability? S99 & S99A

Preservation age396

Prescribed persons388

Private health insurance offset425

Profit entitlement479

Profit split method (PSM)695

Projected GST turnover782Next 11 months, see current GST turnover

Property (FBT)745See in-house and external

Proportionate approach512, 519

Proportioning rule403

Provider789Generally input taxed, see facilitator

PSB436Results test, unrelated clients, employment

PSI426, 432

Reallocation748

Rebateable reduction526Cap gain + fr dist > trust net inc

Reconstitution (p/ship)481

Recurring fringe benefit declaration719, 737Business use decreases by 10%

Reimbursements800

Remote areas740Housing fringe benefit, exempt conditions apply Reportable fringe benefits752

Resale price method (RPM)693, 694Later resold to an independent party

Reset cost base655

Residents408

Residents test zone rebate)419

Residentual premises/rent 790See commercial & new residential

Residual benefit (FBT)416If it doesn't fall under any other category

Retained cost base asset654

Retirement savings account403

Requirements to lodge a tax return385

Safe harbour concessions698Non core, de minimis

Salary sacrifice 717, 745,

747, 753Documentation needed

SAPTO422

SBE805

SBT657

Scheme8162-Dec-98 Second hand goods800, 808$300 rule Security deposits784

Settled sum499

Settlor499

Single entity rule644

Social security pension422

Spouse412

Super guarantee charge403

Supply774, 775Passing of possession to another party Supply (Composite)775

Supply (Mixed)775

Supply (Money)774, 776NOT a supply, unless it is an obligation Special professional385

Specifically entitled523

Statutory formula method728, 734Car & car parking benefit

Stepped acquition (consolidation)650Steps 3, 4, 5, see ACA

Streaming (trusts)521, 522, 523

Subsidiary member641 Superannuation benefits403<$200 tax free Tax refund/payable385

Taxable Income (Individuals)385

Taxable supply 769, 773, 793 (calc)

Taxi749

Termination (ETP)394, 395Invalidity segment

Tertiary student financial supplement430

Testamentary trusts509

Thin capitalisation697

Threshold (Individuals)387

TR 97/20686, 691 5 accepted methodologies

Trading stock481Election pre 1 Sept

Transactional net margin method (TNMM)696

Transfer pricing (4 step process)688

Transfer pricing (actual conditions)682

Transfer pricing (consequential adjust)686

Transfer pricing (decision chart)681

Transfer pricing (documentation)700

Transfer pricing benefits685

Transport (GST-free)788

Travelling allowance741

Trial year65712 months from joining time

Trust (closely held)537

Trust (net income)511, 519Tax income, see trust income

Trust deed500

Trust distribution tax52746.50%

Trust TFN withholding537

Trust income519Acc income, franking credits are excluded

Trust property599

Type 2 fringe benefit7221.8868 GST exclusive (child care, education) Unearned income391

Unit trusts (fixed)501, 529Lifetime

Unused annual leave394, 39918 Aug 1993 exception

Urban areas739Housing fringe benfit, market value v stat annual

Valid tax sharing agreement661Allocates liabilities amongst members Vesting period500

Veterans affairs pensioner422

Veterans entitlement act422

Vouchers (GST)783

Wholly owned641

Work in progress477

Zone rebate419

mployee idential premises

T turnover aster - servant)

provider

chase gister method

but may be NY

ST turnover employment

conditions apply

ed

re, education) alue v stat annual