Macroeconomics_exam_20090630_XiaoLiping[]武汉大学宏观经济学试卷

toMacroeconomics(宏观经济学加州大学詹姆斯·布

– the unemployment rate is equal to the number of unemployed people divided by the labor force

PPT文档演模板

toMacroeconomics(宏观经济学加州 大学詹姆斯·布

Figure 1.5 - The U.S. Unemployment Rate

• Will inflation make us poor by destroying our savings or rich by eliminating our debts?

PPT文档演模板

toMacroeconomics(宏观经济学加州 大学詹姆斯·布

Macroeconomics...

• is the subdiscipline of economics that tries to answer these six questions

– to be unemployed, a person must want to work and be actively looking for a job (but have not yet found one)

– the labor force consists of those who are employed and those who are unemployed

Six Key Economic Variables

• Real Gross Domestic Product

– often divided by the number of workers in the economy

– measures how well the economy produces goods and services that people find useful

Macroeconomics-习题集

习题集一Question 1In Australia ,using 2000-01 as the base year, we would find that:a)Nominal GDP is always larger than real GDP.b)Real GDP is always larger than nominal GDP for the period 1960 to 2000.c)Real GDP is larger than nominal GDP from 1998 to 2002.d)Real GDP is smaller than nominal GDP from 1988 to 1995.e)Real GDP and nominal GDP would be equal for the entire period.Note: please see figure 2.1 on page 31 of the text book.Question 2During the date 1990s, Japan experienced reductions in the GDP deflator. Given this information, we know with certainty that:a)Real GDP fell during these periods.b)Real GDP did not change during these periods.c)The overall price level in Japan decreased during these periods.d)Both real GDP and the overall price level decreased during these periods. Question 3Suppose that in January 2003 in Australia, 200 million people are working, 20 million are not working but are looking for work, and 40 million are not working and have given up looking for work. The official unemployment rate for that month is:a)7.7%b)9.1%c)10%d)23%e)30%Question 4A country using the Australian system of unemployment statistics has 100 million people, of whom 50 million are working age. Of these 50 million, 20 million have jobs. Of the remainder: 10 million are actively searching for jobs; 10 million would like jobs but are not searching; and 10 million do not want jobs at all.The labour force is:a)10 millionb)20 millionc)30 milliond)40 millione)50 millionQuestion 5Suppose the consumption equation is represented by the following: C=100+ .75Y D. The multiplier in this economy is_______.a)0.25b)0.75c) 1.33d) 2e) 4Question 6The paradox of saving suggests that an increase in the desire to save will cause:a)An incease in equilibrium GDP.b) A reduction in GDP.c)An increase in the desire to invest.d)No change in equilibrium GDP.e) A permanent increase in the level of saving.Note: Please see definition of “ paradox of saving” on page 674 of the text book.( saving S↑→Y↓→S↓(S=Y-T-C) so,saving is unchanged )Question 7When C= C0+C1Y D, an increase in C0 will cause which of the following to increase?a)Equilibrium incomeb)Equilibrium disposable incomec)Equilibrium savingd)All of the abovee)None of the aboveQuestion 8Suppose the central bank wishes to conduct expansionary monetary policy. Given this, we would expect which of the following to occur?a) A central bank purchase of bonds and an increase in the interest rateb) A central bank purchase of bonds and a reduction in the interest ratec) A central bank sale of bonds and an increase in the interest rated) A central bank sale of bonds and a reduction in the interest rateQuestion 9Suppose the money supply decreased. Which of the following events could cause this?a)An increase in the monetary baseb) A decrease in the ratio of reserves to depositsc) A shift in public preferences away from currency toward current accountdepositsd)All of the abovee)None of the aboveQuestion 10Suppose there is an open market sale of bonds. Such an event will cause:a)An increase in bond prices and an increase in the interest rate(i)b) A reduction in bond prices and an increase in i.c)An increase in bond prices and a reduction in i.d) A reduction in abond prices and a reduction in i.e)None of the aboveQuestion 11After a contractionary fiscal policy:a)The LM curve shifts and we move along the IS curve.b)The IS curve shifts and we move along the LM curve.c)Both the IS and LM curve shift.d)Neither the IS nor the LM curve shifts.e)Output will change causing a chage in money demand and a shift of the LMcurve.Quetsion 12Suppose there is a tax cut. Which of the following represents the complete list of variables that must increase in response to this tax cut?a)Consumptionb)Consumption and investmentc)Consumption, investment and outputd)Consumption and outpute)Consumption, output and the interest rateQuestion 13If efficiency wage theory is valid,we would expect a relatively high premium over the reservation wage when:a)The unemployment rate is high.b)The job requires very little training.c)Workers cannot be easily monitored.d)Workers have few other options for employment in the area.e)All of the aboveQuestion 14The natural level of output is the level of output that occurs when:a)The goods market is in equilibrium.b)The economy is operating at the unemployment rate consistent with both thewage-setting and price-setting equations.c)The financial markets are in equilibrium.d)The unemployment rate is zero.e)Both the goods and financial markets are in equilibrium.Question 15Use the following Phillips curve equation to answer this question: πt -πt-1 = (μ+z)-αu t.A permanent reduction in the unemployment rate causes:a)An increase in the markup over labour costs.b) A decrease in the markup over labour costs.c)An increase in the inflation rate over time.d) A decrease in the inflation rate over time.e)None of the aboveQuestion 16If policymakers underestimate the natural rate of unemployment, they may follow policies that cause Australia to have:a)More unemployment than necessary.b)An unemployment rate that is “to high”c) A higher inflation rate than necessary.d) A steadily decreasing inflation rate.e) A dramatically fluctuating unemployment rate.Question 17Based on a dynamic AD relation when the central bank controls nominal money, output growth will equal zero when which of the following conditions is satisfied?a)0% nominal money growth; 4% inflationb)4% nonminal money growth; 0% inflationc)-4% nominal money growth; 3% inflationd)4% nominal money growth; 4% inflatione)None of the aboveNote: dynamic AD relation: g y = g m - p. So, if g m = p = 4%, g y = 0.Question 18In the medium run, a reduction in the rate of inflation target will cause:a)An increase in the size of the sacrifice ratio.b) A reduction in the size of the sacrifice ratio.c) A reduction in adjusted money growth.d) A reduction in the rate of inflation.e)Both C and DNote: Please see figure 9.3 on page 217 of the text book.Question 19Which of the following will increase the steady-state growth rate of capital?a)An increase in the saving rateb)An increase in the population growth ratec) A temporary increase in technological progressd)All of the abovee)None of the aboveNote: Please see figure 12.3 on page 282 of the text book.Question 20Which of the following has been proposed as an explanation for the slowdown in technological progress since the mid-1970s?a)Measurement errorb) A dicline in manufacturing’s share in GDPc) A decline in spending on research and developmentd)All of the abovee)None of the aboveNote: Please see page 272- 274 of the text book of the last year.Question 21Which of the following is true whenever the inflation rate is positve?a)The real interest rate must be greater than the nominal interest rate.b)The real interest rate must be negative.c)The real interest rate must be positive.d)The nominal interest rate must be negative.e)None of the aboveQuestion 22If the nominal interest rate in 20% per year, how much money can an individual borrow today if she wants to repay $200 in one year?a)$240.00b)$150.00c)$160.00d)$166.67e)$180.00Note: 200/(1+20%) = $166.67Question 23Assume that the yield curve is downward-sloping yield curve. This suggests that financial market participants expect short-term interest rates to:a)Increase in the future.b)Decrease in the future.c)Be unstable in the future.d)Not change in the future.e)Rise in the near future, and fall in the more distant future.Question 24In general, when the short-term interest rates decrease, long-term rates will:a)Increaseb)Remain the same.c)Decrease by more than the short-term rate.d)Decrease by the same amount as the short-term rate.e)Decrease, but by less than the short-term rate.Question 25Which of following represents non-human wealth?a)Total wealth minus the present discounted value of expected future after-taxlabour incomeb)Total wealth minus financial wealthc)Wealth that cannot be taken from a person, by lawd)Financial wealth minus housing wealthe)Total wealth minuse housing wealthQuestion 26Suppose individuals expect that interest rates will rise in the future. Also assume that the RBA wants to prevent any change in current output. Given this goal of the RBA, the RBA should implement a plocy in the current period that:a)Shifts the IS cruve rightward.b)Shifts the IS curve leftward.c)Shifts the IS curve leftward and the LM curve upward.d)Shifts the LM curve upward.e)Shifts the LM curve downward.Question 27Suppose there is a real appreciation of the Australian dollar. Which of the following may have occurred?a)Foreign currency has become less expensive in the Australian dollars.b)Foreign goods have become more expensive to Americans.c)The foreign price level has increased relative to the Australian price level.d)All of the abovee)None of the aboveNote: e = EP/ P*Question 28An increase in the real exchange rate indicates that:a)Foreign goods are now relatively cheaper.b)Foreign goods are now relatively more expensive.c)Domestic goods are now relatively more expensive.d)Both A and CNote: e = EP/ P*. so P↑ or P*↓→ e↑Question 29Suppose there is a reduction in foreign output(Y*). This reduction in Y* will cause which of the following in the domestic country?a) A reduction in outputb) A reduction in consumptionc) A reduction in net exportsd)All of the abovee)None of the aboveNote : (1) Y*↓→ X↓→NX↓→Z↓→Y↓(2) C↓ = c0 + c1(Y↓ -T)Question 30Suppose net exports are postive(NX>0) for a country. Given this information, we know that:a)Demand for domestic goods will be equal to the domestic demand for goods.b)Demand for domestic goods will be greater than the domestic demand forgoods.c)Demand for domestic goods will be less than the domestic demand for goods.d) A budget surplus exists.Note : domestic demand for goods: DD = C+I+Gdemand for domestic goods: ZZ = C+I+G+NX = DD + NXQuestion 31In an open economy under flexible exchange rates, a reduction in the interest rate will cause an increase in which of the follwing?a)Investmentb)Exportsc)Net exportsd)All of the abovee)None of the aboveQuestion 32Suppose a country inplements simultaneously a fiscal expansion and monetarycontraction. In a flexible exchangerate regime, we know with certainty that:a)The exchange rate and output would both increase.b)The exchange rate would increase and output would decrease.c)The exchange rate would increase.d)The exchange rate would decrease output would increase.Question 33Which of the following explains why the Great Depression did not end sooner?a)An increase in the nominal money stockb)An increase in the price levelc)The presence of a liquidity trapd)All of the abovee)None of the aboveQuestion 34In the IS-LM model, an increase in the expected rate of deflation will cause:a)An increase in demand.b)An increase in the nominal interest rate.c)An increase in the real interest rate.d)An increase in the nominal money supply.e) A decrease in the nominal money supply.Note: r ≈ i - p eQuestion 35A dangerous sign for hyperinflation is when the government finances a growing proportion of its budget deficit through:a)Monetisationb)Tax collections.c)Bonds sold to foreigners.d)Bonds sold to domestic citizens.e)Voluntary contributions.Question 36Seignorage, the revenue from money creation, equals which of the following? a)The rate of inflationb)The rate of inflation times real money balancesc)Real money balancesd)The percentage growth rate of real moneye)The percentage growth rate of nominal money times real money balances Note : Seignorage =△M/P = (△M/M)(M/P)Question 37Due to uncertainty about the impact of monetary policy, it would be best for the central bank to increase money growth:a) 3 months after the start of a recession.b)By more than the increase that will get the desired response.c)By less than the increase that will get the desired response.d)Only when it can be certain about the value of Okun’s coefficient and thetiming of its impacts.e)Only after it is centain that the economy has entered a recession.Question 38The problem of time inconsistency in macro policy suggests that a nation might be better off:a)Using fiscal and monetary policy to fine tune the economy.b)Reducing the independence of the central bank.c)Appointing someone who is more conservative than the rest of thegovernment to head the central bank.d)Intervening frequently in the foreign exchange market.e)Eliminating rational expectations from econometric models used forforecasting.Question 39According to Keynes:a)The Great Depression was caused by ill-considered expansionary fiscal policy.b)Balancing the budget in the midst of a depression would be a serious mistake.c)Inflation is always and everywhere a monetary phenomenon.d)The Phillips curve is stable.e)None of the aboveQuestion 40Which of the following events led to the crisis in macroeconomics and to thedevelopment of rational expectations theory?a)The Great Depressionb)The stock market crash of 1987c)The stock market speculative bubble of the late 1990sd)Stagflation in the 1970se)Large budget deficits in the 1980s.Question 41Explain the concept of neutrality of money.( please see p673 of the text book and the slides of module 3(cont.). ) Question 42Explain the concept of time inconsistency.( please see the slides of module 6 (cont.) )Question 43Define each of the following terms:a)Okun’s Lawb)Sacrifice ratioc)Financial wealthQuestion 44Suppose some countries have been experiencing a slow-down in economic growth for last 2years. The slow-down was associated with a downturn in consumer confidence. The governments of these countries are thinking to implement expansionary fiscal and monetary policies (by increasing government expenditure and reducing interest rates) to overcome the situation. Using an IS-LM model, analyse the slow-down in growth and the short run effects of expansionary fiscal and monetary policies.Answer: ( please draw the Is and LM curve ) Question 45a)Consider an economy with output below the natural level and the nominalinterest rate equal to zero. Illustrate this economy in an IS-LM diagram.b)Under normal circumstances, how does the economy return to the naurallevel of output? Does this adjustment mechanism work when the nominal interest rate equals zero?c)Suppose the central bank wants to use monetary policy to return theeconomy to its natural level of output. Can it do so when the nominal interest rate is equal to zero? What happens if the central bank tries to use expansionary monetary policy? Illustrate your answer in an IS-LM diagram.d)In principle, can fiscal policy be used to restore the economy to its naturallevel of output when the nominal interest rate equals zero? If so, explain how the appropriate policy affects output. If not, explain why not.e)Consider the following policy advice: ‘Since the central bank can act to keepthe economy at the natural level of output, the government should never use fiscal policy to stimulate the economy.’Do your answers to this question support this advice?Answer: ( please see slides 13-31 of module 6 )。

microeconomics Test-midterm-2009-11

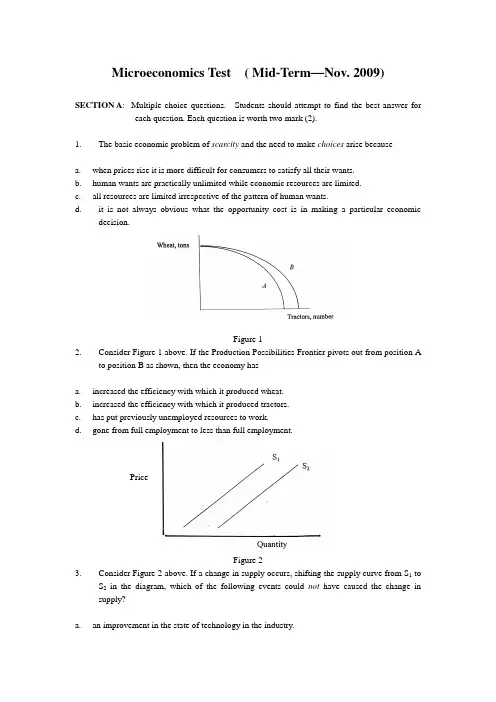

Microeconomics T est ( Mid-T erm —Nov. 2009)SECTION A : Multiple choice questions. Students should attempt to find the best answer foreach question. Each question is worth two mark (2).1.The basic economic problem of scarcity and the need to make choices arise becausea. when prices rise it is more difficult for consumers to satisfy all their wants.b. human wants are practically unlimited while economic resources are limited.c. all resources are limited irrespective of the pattern of human wants.d. it is not always obvious what the opportunity cost is in making a particular economicdecision.Figure 1 2.Consider Figure 1 above. If the Production Possibilities Frontier pivots out from position A to position B as shown, then the economy hasa. increased the efficiency with which it produced wheat.b. increased the efficiency with which it produced tractors.c. has put previously unemployed resources to work.d.gone from full employment to less than full employment.Figure 23. Consider Figure 2 above. If a change in supply occurs, shifting the supply curve from S 1 toS 2 in the diagram, which of the following events could not have caused the change in supply?a. an improvement in the state of technology in the industry.Priceb. a fall in the price of capital equipment employed in the industry.c. a rise in the price per unit of the good supplied by the firms in the industry.d. a significant increase in the number of firms operating in the industry.4. Which of the following impacts on the demand curve for wool does not cause a change in demand for wool?a. An increase in the disposable income of consumers purchasing woolen products.b. A fall in the price of cotton fabrics due to a surplus in supply of cotton.c. A fall in the price of wool per unit.d. A successful marketing campaign for woolen products by the Wool Marketing Board.5. If when the price of good Y is observed to fall by 20% the demand for good X is observedto increase by 10%, then, we can say that the two goods area. substitutes and exhibit a relatively inelastic cross price elasticity of demand.b. complements and exhibit a relatively inelastic cross price elasticity of demand.c. substitutes and exhibit a relatively elastic cross price elasticity of demand.d. complements and exhibit a relatively elastic cross price elasticity of demand.6. Which one is considered as a microeconomic problem?a. inflationb. unemploymentc. economic growthd. consumer’s decisions7. Which one belongs to the “normative economic statement”?a. The GDP growth rate of China last year is 10%b. The unemployment rate of Australian last year is 5%c. Higher federal budget deficits will cause interest rates to increase.d. Federal budget deficits should be reduced.8.The slope of the production possibility frontier (PPF) best represents thea. path along which the economy will move as it growsb. path along which the economy moves as it moves to full employment.c. the opportunity cost of an additional unit of one good in terms of units of another good forgone.d. the resource ratio of capital to labour in the economy given the state of technology.9. In an agricultural market, if the government fixed floor price drifts over timeabove the current competitive market price, it follows that other things constant, a. a shortage (or excess demand) for the good will result forcing the market pricehigher.b. a surplus (or excess supply) will result forcing the government to stock pile thegood at the expense of taxpayers.c. more producers will enter the market because the market is in disequilibrium.d. the government will reduce its stockpile as long as this disequilibrium situationremains.10. The opportunity cost of a new stadium is thea. money cost of hiring guards and staff for the new stadium.b. cost of constructing the new stadium in a future year.c. changes in the tax rates to pay off the new stadium.d. other goods and services that must be sacrificed to construct the new stadium.11.If in a certain market, P d = 100 - 5Q and P s = 30 + 5Q then the marketequilibrium price and quantity area. P = $65; Q = 6 units.b. P = $75; Q = 5 units.c. P = $65; Q = 7 units.d. P = $70; Q = 7 units.12. Which of the following is not a market characteristic of perfect competition?a. Free entry for potential rival firms.b. Highly differentiated products.c. Price-taking behavior by firms.d. the products are the same.13. The price elasticity of demand for pizza is greater than 1.0. Consequently, to increase totalrevenue you shoulda. increase the price of the pizza.b. hold the pizza price constant.c. decrease the price of pizza.d.decrease demand for your pizza.14. Assume that when the price of crude oil is $30 a barrel, 40 million barrels are demanded per day, but when the price rises to $40 a barrel, only 35 million barrels are demanded. Then the demand for oil is said to bea. elastic.b. inelastic. c. unit elastic.d. perfectly elastic.15. Consumer surplus at any point along the demand curve may best be defined asa. the height of the demand curve plus the price of the good.b. the height of the demand curve minus the actual market price paid by consumers.c. the maximum price consumers are willing to pay plus the price they actually pay.d. the height of the demand curve - independent of the market price.Section B: Short answers. Students should attempt to answer any three (3)from the following five (5) short answer questions. Each short answer question is worth fifteen (15) marks.1. Using the apple market to illustrate your discussion, explain carefully the differencebetween the expressions: (i) a change in demand for apples and (ii) a change in the quantity demanded of apples.2. Explain the difference between normal and inferior goods. How does a good’s i ncomeelasticity of demand help in classifying the good as normal or inferior? Give an example of each.3. What do economists mean by the concept of economic efficiency in a market economy?Explain with an appropriate diagram.4.Often it is claimed by consumer groups that a tax on luxury goods like cigarettes and alcoholis “unfair”, as the entire tax will simply be passed on to consumers. Under what special conditions would this actually happen? In what cases might very little of the tax be passed on to consumers? Explain using appropriate market diagrams.5.Discuss the types & the effects of price control.SECTION C: Problem Set questions. Students should attempt to finish One (1) from two (2) questions. Each question is worth twenty-five (25) marks.1. Consider the apple market.(1) Construct an apple market equilibrium diagram with demand curve and supply curve.(2) Indicate the effect on market equilibrium price and quantity when the followinghappens:i) a fall in the price of orangesii) an increase in consumer incomeiii) promotion of apple eating endorsed nationally by dentistsiv) an increase in wages for apple industry workers.v) an advance in technology of apple planting.2. With proper example, discuss the principle of comparative advantage. What are the differences between the absolute advantage & comparative advantage?。

Macroeconomics 1

Two measures of National product: goods flow and earnings flow

We begin by considering an oversimplified world in which there is no government,foreign trade or investment. For the moment,our little economy produces only consumption goods,which are items that are purchased by households to satisfy their wants. Consumption purchases $ Final goods and services Households Business

3. Stable Prices The most common measure of the overall price level is the consumer price index, known as the CPI. We call changes in the level of prices the rate of inflation, which denotes the rate of growth or decline of the price level one year to the next.

Chapter 20

Overview of Macroeconomics

What is Macroeconomics?

1. Macroecomics is the study of of the behavior of the economy as a whole. 2. Macroeconomics examines the reason behind the economic growth and decline of nations. We will focus on the two major elements of performance: the short-term fluctuations in output, employment, and prices that are called the business cycle; and the long-term trends in output and living standards that we call economic growth.

macroeconomicsstephenwilliamsonmanual-hd…

Macroeconomics Stephen Williamson ManualIf looking for the book Macroeconomics stephen williamson manual in pdf form, then you've come to the loyal site. We furnish full edition of this ebook in ePub, PDF, txt, DjVu, doc forms. You may read Macroeconomics stephen williamson manual online macroeconomics-stephen-williamson-manual.pdf either download. Additionally to this book, on our website you can read the guides and diverse artistic eBooks online, either load theirs. We wish to draw on your consideration what our website does not store the eBook itself, but we give link to site whereat you can download or read online. So that if you need to download Macroeconomics stephen williamson manual pdf macroeconomics-stephen-williamson-manual.pdf, then you've come to the loyal site. We have Macroeconomics stephen williamson manual doc, ePub, DjVu, txt, PDF formats. We will be happy if you get back over.macroeconomics williamson 4th edition solutions - Macroec onomics Williamson 4th Edition Solutions Manual Accounting For Managers Interpreting Accounting Information for Decision-making, 3rd Edition Collierstephen d williamson solutions | - Stephen D Williamson Solutions. Below are Chegg supported textbooks by Stephen D Williamson. Select a textbook to see worked-out Solutions.macroeconomics stephen d williamson 3rd - manuals - Eco 209 / Intermediate Macroeconomics Spring 2008 T&Th 2:00 - 3:15, Room: Stephen D. Williamson, Macroeconomics, 3rd Ed, Addison-Wesley (ISBN0-321-41658-9)steven williamson | barnes & noble - Barnes & Noble - Steven Williamson - Save with New Lower Prices on Millions of Books. FREE Shipping on $25 orders! Skip to Main Content; Sign in. My Account. Manage macroeconomics 4th stephen williamson solutions - macroeconomics 4th stephen williamson solutions manual at - Download free pdf files,ebooks and documents of macroeconomics 4th stephen williamsonstudy guide for macroeconomics: 9780131368743: - Study Guide for Macroeconomics: 9780131368743:*************************.AmazonTryPrimeBooks.Go.ShopbyDepartment.Hello.SigninYour Account Sign in Yourmacroeconomics stephen williamson pearson - Macroeconomics Stephen Williamson Pearson.pdf To download full version "Macroeconomics Stephen Williamson Pearson.pdf" copy this link into your browser:stephen williamson macroeconomics pdf - ebook - Stephen Williamson Macroeconomics downloads at - Download free pdf files,ebooks and documents - Macroeconomics (5 edition) by Stephen Williamsonmacroeconomics stephen williamson solution manual - Tricia Joy. Register; Operation Management 10th ed by Stevenson Solution Manual. Filetype: 9th edition by stephen a Macroeconomics by williamson, macroeconomics stephen williamson solution manual - Results for macroeconomics stephen williamson solution manual High Speed Direct Downloads macroeconomics stephen williamson solution manual - [Full Version]pearson - macroeconomics, 4/e - stephen d. d. williamson - Macroeconomics, 4/E Stephen D. D. Williamson productFormatCode=C02 Companion Website for Macroeconomics, 4/E Williamson ISBN-10: 0131368818 ISBN-13:stephen d williamson macroeconomics 4th edition - Macroeconomics - Fourth edition Williamson SD (4th edition) 3 copies Anthony The Labour Party Continuity & Change in the Making of 'New' Labour Steven Fieldingmacroeconomics 3th edition stephen williamson - - Required Texts: Stephen D. Williamson: Macroeconomics, 4th edition. 1 Course Outline and Overview This course is the basic course in macroeconomic theory formacroeconomics stephen williamson solutions - file type: .doc verified by: satoch hosted: source title: 7205d1296058663-tbs-doc source description: Stephen damron, solutions manual. macroeconomics williamson study guide - Macroeconomics Stephen Williamson Study Guide Pdf | Tricia Joy New Monetarist Economics: Methods. New Monetarist Economics: Methods Stephen Williamson Washingtonstephen williamson | barnes & noble - Barnes & Noble - Stephen Williamson - Save with New Lower Prices on Millions of Books. FREE Shipping on $25 orders! Skip to Main Content; Sign in. My Account. macroeconomics (5th edition): 9780132991339: economics books - This item: Macroeconomics (5th Edition) by Stephen D. Williamson Paperback $208.45. Microeconomic Theory: Using Econometrics: A Practical Guide (6th Edition)macroeconomics 4th edition by williamson solution - New updated files for macroeconomics 4th edition by williamson solution manual; solution manual to Macroeconomics, 5E Olivier Blanchardsolution manual of macroeconomics stephen | tricia - Tricia Joy. Register; Terms Macroeconomics Stephen D. Williamson Macroeconomics Solutions Manual williamson free PDF ebook downloads. eBooks and manuals for macroeconomics by stephen d williamson - new, rare & used - Macroeconomics by Stephen D Williamson starting at $0.99. Macroeconomics has 9 available editions to buy at Alibrismacroeconomics 4th ed stephen williamson solution - Home New updated files for macroeconomics 4th ed stephen williamson solution manualstudy guide macroeconomics stephen - Study Guide Macroeconomics Stephen Books: Study Guide for Macroeconomics (Paperback) by Stephen Author: Stephen D. Williamson (Author), Title: Study Guide for pearson - macroeconomics, 5/e - stephen d. - Macroeconomics, 5/E Stephen D. Williamson Companion Web Site for Macroeconomics, 5/E Williamson ISBN-10: 0132992779 ISBN-13: 9780132992770Related PDFs:compumedics psg operation manual, kx 65 manuals, manual de instrucciones sony icf ds15ip 4361619, 97 town and country manual, introduction to optimization solution manual chong zak, lincoln town car repair manual transmission, manual for 85 yamaha maxim x 700, everlast exercise guide, air conditioning and heat manual gm sunfire, bendix abs troubleshooting guide, siemens 3at2 manual, honda gx120 engine manual, honda nsc50r manual, sterling sc8000 repair manual, ford audio system manual, mercedes model w210 maintenance manual, sonata 2015 navigation system manual, tm 175 new holland manual air conditioner, stock worker test guide, project management professional exam study guide 7th, biology study guide answers populations, accumark manual, introductory nuclear physics solution manual krane, alfa mito service light reset manual, 1903a3 remington manual, pel job on line manual, nissan patrol manual, wedding photo posing guide, konica 7022 service manual, uh 72a operators manual, case 1450 dozer parts manual, chilton manual for 46re, hare press hd manual, 1999 15hp honda outboard owners manual, ocr preschool pacing guide, lg lcd tv repair manual, praxis 0061 study guide, a330 systems manual, microeconomic theory walter nicholson solution manual, kawasaki vulcan 1700 service manual。

中级宏观经济学(Macroeconomics)考试试题答案重点

2003-2004学年第二学期中级宏观经济学(Macroeconomics考试试题答案(经济试验班021、022Ⅰ.Choose the best answers (2'×101.B2.A3.C4.B5.C6.A7.B8.C9.C 10.DⅡ. Explain the following terms. (20 points1.Endogenous variables: 经济模型中要解释的变量。

Exogenous variables:模型给出作为既定的变量。

2. Menu costs:企业因通货膨胀改变价格的成本。

shoe-leather costs:为减少持有货币的损失而发生的成本。

3. GDP deflator :名义GDP/实际GDP,是相对于基年商品和劳务价格的那一年的商品和劳务价格。

CPI:即消费价格指数,是相对于某个基年一篮子物品与劳务价格的同样一篮子物品与劳务的现期价格。

4. Adaptive expectation :人们根据过去的经验或数据来预测未来。

rational expectation:人们尽可能地利用所有可以获得地信息,包括关于现在政府政策地信息预测未来。

5. Real exchange rate :两国物品的相对价格。

nominal exchange rate:两国通货的相对价格。

Ⅲ.Answer the following questions by drawing or calculating. (10’ ×41.We want to consider the effects of a tax cut when the LM* curve depends on disposable income instead of income: M/P = L[r, Y –T].A tax cut now shifts both the IS* and the LM* curves. Figure 12–22 shows the case of floating exchange rates. The IS* curve shifts to the right, from IS to IS . The LM* curve shifts to the left, however, from LM to LM .We know that real balances M/P are fixed in the short run, while the interest rate is fixed at the level of the world interest rate r*. Disposable income is the only variable that can adjust to bring the money market into equilibrium: hence, the LM* equation determines the level of disposable income. If taxes T fall, then income Y must also fall to keep disposable income fixed. In Figure 12–22, we move from an original equilibrium at point A to a new equilibrium at point B. Income falls by the amount of the tax cut, and the exchange rate appreciates. If there are fixed exchange rates, theIS* curve still shifts to the right; but the initial shift in the LM* curve no longer matters. That is, the upward pressure on the exchange rate causes the central bank to sell dollars and buy foreign exchange; this increases the money supply and shifts the LM* curve to the right, as shown in Figure 12–23. The new equilibrium, at point B, is at the intersection of the new IS* curve, IS , and the horizontal line at the level of the fixed exchange rate. There is no difference between this case and the standard case where money demand depends on income.2. a.将生产函数两边同时除以效率工人,则有:(4.04.06.04.0k L E K L E L E K L E Y y =⎪⎭⎫⎝⎛⨯=⨯⨯=⨯=b .s=0.25 δ=5% n=2% g=3%; 带入经济稳定的条件:38.15.275.01(*84.15.2*6.45.2*1.025.0((3/23/24.03/54.0≈⨯=-=≈==≈==⋅++=⋅y s c k y k kk kg n k f s δc.当g 变为5%时,有: 63.11225*4.31225*12.025.0((3/24.03/54.0≈⎪⎭⎫⎝⎛==≈⎪⎭⎫⎝⎛==⋅++=⋅k y k kk kg n k f s δ 这种变化导致了效率工人的人均资本量减少,效率工人的人均产量下降;但总产出会增加。

Macroeconomics宏观经济学

Macroeconomics----------------------------------------------------------------------------------------------------------------------Part I IntroductionChapter 1 The Science of Macroeconomics【Mainpoints】1.Exogenous Variables and Endogenous VariablesExample: The total quantity and price level of pizza in a country.Exogenous variables are given in a model. [aggregate income, price of materials]Endogenous variables are what a model explains. [price level and total quantity of pizza]2.Flexible Price and Sticky PriceFlexible price: easy to adjust, in short run.Sticky price: hard to adjust, in long run.===========================================Chapter 2 The Data of Macroeconomics【Mainpoints】1.GDP(1) Real GDP and Nominal GDP, GDP deflator(2) economy's income = economy's expenditure(3) GDP = C + G + I + NX2.CPI(1) CPI measures the price of a basket of goods(2) CPI = ∑P m Q / ∑P n Q(3) difference between GDP deflator and CPI3. The Unemployment Rate(1) Labour Force = Number of Unemployment + Number of Employment(2) Unemployment Rate = Number of Unemployment / Labour Force × 100%---------------------------------------------------------------------------------------------------------------------- Part II Classical Theory: The Economy in the Long Run ---- Flexible Price Chapter 3 National Income: Where It Comes From and Where It Goes【Mainpoints】1.Total Production(1) Production Function: Y = F(L,K)(2) constant returns to scale: zY = zF(L,K)2. National Income Distribution(1) Factor Prices ---- Labour:MPL = F(L+1,K) - F(L,K)ΔProfit = ΔRevenue - ΔCost = MPL×P - WIn order to maximize profit, make ΔProfit = 0. So MPL=W/P, Real WageLabour Income = MPL×L(2) Factor Prices ---- CapitalMPK = F(L,K+1) - F(L,K)ΔProfit = ΔRevenue - ΔCost = MPK×P - RIn ordet to maximize profit, make ΔProfit= 0 . So MPK=R/P, Real Rental Price ofCapitalCapital Income = MPK×K3)The Cobb-Douglas Production FunctionLabour Income = MPL×L = (1-α)YCapital Income = MPK×K = αY→F(K,L) = AKαL(1-α) , A measures the productivity of the available technology3.Total Demand1)Consumption:Determined by disposable incomeC=C(Y-T)Marginal Propensity to ConsumeMPC=C(Y-T+1)-C(Y-T)2)Investment:Determined by interest rateI=I(r)When r is high, investors will give upinvestment because cost of loan is higherthan rate of return.3) Government PurchasesG vs T, measures government budget5. Equilibrium (in a closed economy)(1) Market of Goods and ServicesY=C(Y-T)+I(r)+G(2) Market of Loanable FundsS=Y-C(Y-T) - G = I(r)investment is crowded out ===========================================Chapter 4 Money and Inflation【Mainpoints】1.Concept of Money(1) Funtions of Money: 1) Store of Value. Example: You can hold your money and trade itfor goods and services at some time in the future.2) Unit of Account. Example: In store people use money to showprice.3) Medium of Exchage. Example: People use money as tool toexchange goods.(2) Types of Money: 1) Fiat Money. No value, example: Paper Money.2) Commodity Money. With value, example: Gold and Silver.(3) Control of Money: 1) Institution: Central Bank. Example: Deutsche Bundesbank2) Method: Open-Markt Operation. Example: Buy governmentbonds to increase money supply.2.The Quantity Theory of Money(1) Quantity Equation: MV=PT →MV=PYQuantity Theory of Money: MV=PY(2) Real Money Balances: M/P , measured in quantity of goods and services.The Money Demand Function: (M/P)d = L(Y,i) = M/P← Money Supply. Y↑, d↑; i↑,d↓(3) Money and Inflation: ΔM% + ΔV% = ΔP% + ΔY% So M↑, P↑3.Inflation and Interest Rate(1) Fisher Equation: i = r + π===========================================Chapter 5 The Open Economy【Mainpoints】1.International Trade in a Samll Open Economy(1) View of goods and capital flow: NX = Y- (C+G+I)(2) View of capital flow: NX = Y-C-G-I = S-I= S-I(r*)r* is World Interes Rate(3) Trade Policies: 1) Domestic Fiscal Policy, influenceG↑,T↓→S↓→NX↓2) Fiscal Policy Abroad, influenceG e↑, T e↓→S e↓→r*↑→NX↑3) Shift in investment demand. Example: Government provides aninvestment tax credit2.Exchange Rates(1) Nominal Exchange Rates(e) and Real Exchange Rates(ε)Nominal exchange rates are measured in currency. Example: 100 yen / 1 dollarReal exchage rates are measured in goods and services. Example: 2 Japan Car / 1 USA car ε = e × (P/P*) , P* means price level of foreign countries.(2) The Real Exchange Rates and Trade Balance:NX = NX(ε)ε↓, P/P*↓, means domestic goods and servicesare cheaper than abroad. NX↑When NX(ε) = S - I, ε is equilibrium real ex.rate.(3) Trade Policies: 1) Domestic Fiscal Policy:G↑,T↓ → S↓(Expansionary Fiscal Policy)2) Fiscal Policy Abroad:G e↑, T e↓→S e↓→r*↑→I↓3) Shift in investment demand.4) Shift in NX(ε) Example: Protectionist Trade Policies(4) Inflation and nominal exchange rates:e = ε × (P*/P) → Δe%= Δε% + (π* - π)(5) PPP(Purchasing-Power Parity): 1 Dollar can buy the same quantity of wheat in anycountry.===========================================Chapter 6 Unemployment【Mainpoints】1.Natual Rate of Unemployment(1) Concept: The rate of unemployment which the economy get closed to in the long run.(2) Calculation: L-Labour Froce, E-Number of Employed, U-Number of Unemployed, f-rate of job fiding, s-rate of job seperating.L=E+U, fU=sE → U/L=1/(1+f/s)2.Causes for Unemployment(1) Frictional Unemployment:Unemployed people need time to find jobs.e.g. sectoral shift, unemploymetn insurance.(2) Structural Unemployment:Wage Rigidity. Wage is above the equlibrium level.e.g. Minimum-Wage Laws, Unions, Efficiency Wages.---------------------------------------------------------------------------------------------------------------------- Part III Growth Theory: The Economy in the Very Long Run ---- Solow Growth Model Chapter 7 Economic Growth I: Capital Accumulation and Population GrowthAssumption: Constant Return to Scale【Mainpoints】1.Capital Accumulation(1) Production Function per worker: zY=F(zK,zL)→Y/L=F(K/L,1)→y=f(k),MPK=f(k+1)-f(k)(2) Output and consumption per worker: y=c+i→c=(1-s)y→i=sy→i=sf(k)(3) The Steady State: Capital stock growth Δk = 0Δk=i-δk, δ is depreciation rate→Δk=sf(k)-δk=0→sf(k*)=δk*(4)Golden Rule level of capital: k*gold which maximizes cc=y-i→c=f(k)-sf(k)→c*=f(k*)-δk*→c max:MPK=δ2. Population Growth(at rate of n)(1) The Steady State:Δk=i-k(δ+n)→Δk=sf(k)-k(δ+n)=0→sf(k*)=(δ+n)k*(2) Golden Rule level of capital:k*gold, c=y-i→c max:MPK=δ+nChapter 8 Economic Growth I: Technology, Empirics, and Policy1.Technological Progress in the Solow ModelAssumption: Technology growth is a given exogenous variable g(1) Efficiency of Labour: Y=F(K,EL)(2) The Steady State: Δk=sf(k)-(g+n+δ)k=0→sf(k*)=(g+n+δ)k*(3) Golden Rule level of capital: k*gold , c=y-i→MPK=g+n+δ2.Endogenous Growth TheoryAssupmtion: Technolgy growth is a endogenous function g(μ), capital includes knowledge (1) 2 Sector Model: Y=F[K,(1-μ)EL], ΔE=g(μ)E, ΔK=sY-δK---------------------------------------------------------------------------------------------------------------------- Part IV Business Cycle Theory: The Economy in the Short Run ---- Sticky Price Chapter 9 Introduction to Economic Fluctuations【Key Concepts】Recession: A period of falling output and rising unemployment.Business Cycle: Short-run fluctuations in output and employment.【Mainpoints】1.GDP and unemployment(1) Okun's Law: ΔReal GDP%=3%-2×ΔUnemployment Rate(2) Leading Economic Indicators: Forecasts. Example: Average work time, Index of stock prices, Money Supply....2.Aggregate Demand and Aggregate Supply( P=P(Y))(1) The Quantity Theory of Money→AD: MV=PY→M/P=(M/P)d=kY(2) AS: SRAS---P=P, LRAS---Y=Y(3) From Short Run to Long Run: M changes AD, Y is unchanged inthe long run, but P in the long run changes. (A→B→C)(4) Shocks to AD and AP:1) Shocks to AD. Example: Credit Card makes V rise.Policy: Reduce the Money Supply.2) Shocks to AP. Example: A drought that destroys crops. Cartel. Union. etc. P↑Policy: Wait! Then price returns original level eventually(But it takes longtime). Or expand AD(But price level will be high in long period of time).===========================================Chapter 10 Aggregate Demand I: Building the IS-LM Model (Y-r)【Mainpoints】1.IS Curve(1) Good and Service Market→The Keynesian Cross: Y=C+I+G, PE=AE(2) IS curve:Y=C(Y-T)+I(r)+G 1) r↑→I↓→Y↓ 2) Fiscal Policy: G↑→Y↑→IS→, Governmetn-purchases multiplier, tax multiplier.2.LM Curve(1) Money Market→The Theory of Liquidity Peference: M/ P=L(r), M s=M d(2) LM Curve: M/P=L(r,Y). 1) Y↑,M d↑, r↑ 2)M s↑,r↓,LM←3. The Short-Run Equilibrium=========================================== Chapter 11 Aggregate Demand II: Applying the IS-LM Model (Y-P) 【Mainpoints】1.IS-LM Model as a Theroy of Aggregate Demand(1) Derivation: P↑,(M/P)s↓,r↑,LM↑→Y↓(2) Shift in AD: G,T,M→IS/LM→Y(3) In long run and short run: In long run Y<Y===========================================Chapter 12 The Open Economy Revisited: The Mundell-Fleming Model and the Exchange Rate Regime【Mainpoints】1.Mundell-Fleming Model(1) IS* Curve: Y=C(Y-T)+I(r*)+G+NX(ε) (2) LM* Curve: M/P=L(r*,Y)2.Under Floating Exchange Rates(1)Fiscal Policy:Shift IS*,ineffectual; Monetary Policy:Shift LM*; Trade Policy:Shift NX(ε)→IS* 3.Under Fixed Exchange Rates(1) Theory: Arbitrageur arbitrage so that M changes.(2)Fiscal Policy shifts IS*→LM*; Monetary Policy:Shift LM*, ineffectual; Trade Policy: ShiftNX(ε)→IS*→LM*4. Policy Choice: Impossible Trinity5. Mundell-Fleming Model in Short andLong RunChapter 13 AS and the Short-Run Tradeoff Between Inflation and Unemployment1.Aggregate Supply ModelY=Y+α(P-P e)2.Inflation, Unemployment and Phillips Curve(1)Y=Y+α(P-P e)→P-P-1=P e-P-1+1/α(Y-Y)+v→π=πe+β(μ-μn)+v [Okun's Law] v-supply shock(2) Sacrifice Ratio: π↓1%, GDP ↓ ? %----------------------------------------------------------------------------------------------------------------------Part V Macroeconomic Policy DebateChapter 14 Stabilization Policy1.Inside Lag and Outside Lag(1) Inside lag is the time between economy shock and the policy anction responds. Example: Policy makers need time to recognize a shock and react.(2) Outside lag is the time between a policy action and its influence on the economy. Example: Change in money supply and interest rate.===========================================Chapter 15 Government Debt and Budget Deficits1.The Traditional View of Government Debt(1) In the short run, T↓,C↑,S↓,r↑,I↓,lower steady-state K and a lower level of Y.(2) In the lo ng run, T↓,C↑,IS→,AD↑, finally Y=Y, P is higher.(3) In open economy, T↓,C↑,IS→, ε↑2.The Ricardian View of Government Debt(1) Ricardian Equivalence: Consumers are forward-looking.They think that government will raise tax at some point in the future, in order to afford budget. So they won't change consumption. --------------------------------------------------------------------------------------------------------------------- Part VI More on the Microeconomics Behind MacroeconomicsChapter 18 Money Supply, Money Demand and the Banking System1.Money Supply(1) Money Supply (M) = Currency (C) + Demand Deposits (D)(2) Reserves: The money that bank receive but don't lend out. Reserve-deposit ratio-rr1) 100% Reserve Banking. 1C→1D, M remains constant.2) Fractional-Reserve Banking. 1C→rrD+(1-rr)C, M increases. And (1-rr)C can be put into another bank, the process of money creation can be continued.(3) Money Supply Model: M=C+D.B(Monetary Base)=C+R [Control by Central Bank]→ M=(cr+1)/(cr+rr)×B=m×B [cr is currency-deposit ratio](4) Monetary Policy Tool: open-market operation, reserve requirements, discout rate[the rate that banks borrow from central bank].2.Money Demand(1) Quantity Theory: (M/P)d=L(i;Y)(2) Portfolio Theory: (M/P)d=L(r s,r b,πe,W) [r s-expected real return on stock, r b-expected real return on bonds, W-real wealth]。

01 Introduction to Macroeconomics (UGBA 101B -- Summer)

Introduction to Macroeconomics

1-10

Introduction to Macroeconomics

3. Employment and Unemployment investigates how changes in economic activity affect the labor market.

2. Looking for patterns in the data.

– Economics is a social science. Identifying and interpreting “patterns” is frequently the subject of debate.

1-21

Model Based

1-6

Introduction to Macroeconomics

1. Long-run Economic Growth investigates the reasons economic activity stagnates or expands over long periods of time.

1-5

Introduction to Macroeconomics

• Macroeconomics focuses on 4 major issues:

1. Long-term Economic Growth,

2. Short-term Business Fluctuations,

3. Employment and Unemployment, and 4. Inflation.

1. How the key economic variables are related to one another. 2. What happens to the endogenous variables if an exogenous variable(s) changes. 3. What can be inferred about what happened to the exogenous variable(s) if an endogenous variable(s) changes.

电子科技大学二零 一三 至二零 一四 学年第 一 学期期 中 考试

………密………封………线………以………内………答………题………无………效……电子科技大学二零一三至二零一四学年第一学期期中考试经济学II 课程考试题 A 卷(95分钟)考试形式:闭卷考试日期:2013年11月 21 日课程成绩构成:平时 30 分,期中 20 分,实验 0 分,期末 50 分一、判断题(正确的打“√”,错误的打“×”,每小题2分,共20分)(√ )1.Macroeconomics examines the behavior of economic aggregates. Microeconomics is the foundation of Macroeconomics.( ×)2.Investment is the change of capital stock.(√ )3.The slope of the saving curve is positive and increasing in income Y.(√ )4.In equilibrium, the inventory unplanned is 0.(√ )5.The basic tools of supply and demand are as central to macroeconomic analysis as they are to microeconomic analysis.( ×)6.Changes in wealth lead to movements along the consumption function.( ×)7.If the GDP deflator in 2004 was 150 and the GDP deflator in 2005 was 120, then the inflation rate in 2005 was 25%.(√ )8.Suppose a small closed economy has GDP of $5 billion, consumption of $3 billion, and government expenditures of $1 billion. Then investment and national saving are both $1 billion.( ×)9.When economists refer to investment, they mean the purchasing of stocks and bonds and other types of saving.(√ )10.GDP adds together many different kinds of products into a single measure of the value of economic activity by using market prices.………密………封………线………以………内………答………题………无………效……二、单项选择题(每小题2分,共40分)( D )1.Which of the following newspaper headlines is more closely related to what microeconomists study than to what macroeconomists study?A.Unemployment rate rises from 5 percent to 5.5 percent.B.Real GDP grows by 3.1 percent in the third quarter.C.Retail sales at stores show large gains.D.The price of oranges rises after an early frost.( D )2.Dead-weight costs of inflation include:A.Informational costs B.Menu costs C.Shoe-leather costs D.All above( A )3.Unemployment rate isA.percentage of the labor force that is unemployedB.the fraction of the adult population that …participates‟ in the labor forceC.percentage of labor force that is not employed and not looking for workD.None of the above( D )4.In the IS model, endogenous variable(s) is (are)A.consumption B.investment C.saving D.all above variables( B )5.If the consumption function is C = 100 + 0.75Y, the MPS isA.100 B.0.25 C.0.75 D.None of the above( A )6.The multiplier of transfer payment isA.MPC/(1-MPC ) B.-MPC/(1-MPC ) C.1/(1-MPC ) D.-1/(1-MPC )( D )7.Equilibrium occursA.when there is no tendency for change.B.when planned aggregate expenditure is equal to aggregate outputC.when I = S in the good and service market for a two-sector economyD.All above( A )8.If the spontaneous consumption decreases, the IS curve willA.shift to left B.shift to right C.be unchanged D.move down………密………封………线………以………内………答………题………无………效……( B )9.Which one is commodity money below?A.Token B.Silver C.Fiat D.Legal tender( A )10.China‟s nominal GDP in 2012 is about¥A.52 trillion B.60 trillion C.15 trillion D.71.3 trillion( B )11.Which of the following changes will decrease investment?A.A doubling of the annual revenues. B.A rise in interest rates.C.An increase in tax rate on net profits D.All above( D )12.Money is not income, and money is not wealth. Money is:: A.a means of payment B.a store of valueC.a unit of account D.All of above.( A )13.M1, or transactions money is money that can be directly used for transactions. It includes:: A.currency held outside banks B.all personal depositsC.non-checkable deposits D.All above.( A )14.The central bank performs important functions, but not including:A.Set the tax rateB.Clearing interbank paymentsC.Regulating the banking systemD.All of above( B )15.The IS model shows the relationship betweenA.Y & P B.Y & r C.P & r D.I & S(D )16.Consider the following three items of spending by the government: (1) the federal government pays a $500 unemployment benefit to an unemployed person; (2) the federal government makes a $2,000 salary payment to a Navy lieutenant; (3) the city of Bozeman, Montana makes a $10,000 payment to ABC Lighting Company for street lights in Bozeman. Which of these payments contributes directly to government purchases in the national income accounts?A.(1) B.(2)C.(1) and (2) D.(2) and (3).( C )17.An American soldier stationed in California receives a paycheck from the federal government for………密………封………线………以………内………答………题………无………效……$500, which she uses to purchase a $300 stereo made in Korea by a Korean firm and $200 worth of groceries produced in California. As a result, U.S. GDP increases byA.$200 B.$500 C.$700 D.$1000( D )18.When economists talk about growth in the economy, they measure that growth as the A.absolute change in nominal GDP from one period to another.B.percentage change in nominal GDP from one period to another.C.absolute change in real GDP from one period to another.D.percentage change in real GDP from one period to another.( C )19.Many things that society values, such as good health, high-quality education, enjoyable recreation opportunities, and desirable moral attributes of the population, are not measured as part of GDP. It follows that A.GDP is not a useful measure of society's welfare.B.GDP is still a useful measure of society's welfare because providing these other attributes is the responsibility of government.C.GDP is still a useful measure of society's welfare because it measures a nation's ability to purchase the inputs that can be used to help produce the things that contribute to welfare.D.GDP is still the best measure of society's welfare because these other values cannot actually be measured. ( B )20.During a presidential campaign, the incumbent argues that he should be reelected because nominal GDP grew by 12 percent during his 4-year term in office. You know that population grew by 4 percent over the period and that the GDP deflator increased by 6 percent during the past 4 years. You should conclude that real GDP per personA.grew by more than 12 percent. B.grew, but by less than 12 percent. C.was unchanged. D.decreased.三、计算题(共40分)………密………封………线………以………内………答………题………无………效……1.The table below contains data for the country of Wrexington for the year 2006a). How much is the market value of all final goods and services produced within Wrexington in 2006? (1分)The market value of all final goods and services produced within Wrexington in 2009 = GDP = 110b). Gross national product for Wrexington in 2006 is? (1分)GNP= GDP- Income foreigners earn here + Income earned by citizens abroad=100c). Net national product for Wrexington in 2006 is? (1分)NNP = GNP - Losses from depreciation=96d). National income for Wrexington in 2006 is? (2分)………密………封………线………以………内………答………题………无………效……NI = NNP - Indirect business taxes (0.5’) + Business subsidies (0.5’) = 92e). Personal income for Wrexington in 2006 is? (3分)PI = NI - Corporate income taxes (0.5’) - Retained earnings (0.5’) - Social insurance contributions (0.5’) + Interest paid to households by government (0.5’) + Transfer payments to households from government (0.5’) = 91f). Disposable personal income for Wrexington in 2006 is? (2分)DPI = PI - Personal taxes (0.5’) - Nontax payments to government (0.5’) = 562.In a three sector economy, the consumption function is C=150+0.8Y d. The total income isY. The tax is T=200. Planned investment is I=100. Government expenditure is G=200.Disposable income is Y d=Y-T.(共20分)(1)Please calculate the equilibrium Y1450, 2‟, S 100, 1‟and C1150, 2‟. (5分)(2)Compare the tax and the investment, which has stronger effect on total income? Why? (6分)ΔY/ΔT = -MPC/(1-MPC ) = -4 (2’). ΔY/ΔI = 1/[1-MPC] = 5 (2’). Investment has stronger effect (2’).(3)If the real output is 1200, how many is the IU?C= 950, 0.5‟; C+I+G = 1250, 0.5‟; IU = -50, 1‟(2分)(4)If the investment increases to 200, how many will the Y increase?500 (2分)………密………封………线………以………内………答………题………无………效……(5)If the consumption function changes to C=150+0.5Y d, I is still 100, how will theEquilibrium Y-750, 2‟, S 0, 1‟ and C-750, 2‟ change (Compare to Equilibrium Y, S and C in (1))? (5分)………密………封………线………以………内………答………题………无………效……3.In a four-sector economy, there is a peasant planting pineapple, a restaurant, manyconsumers and a government. The peasant produces 10 million pineapples, each sold at $2.6 million go to the restaurant; remaining 4 million go to the consumers. Pays 4.5 millionfor wages, 0.5 million for interest on loan and 2 million taxes. The restaurant sells $30 million meals, pays 4 million for wages, 3 million for ernment provides protection from attacks from other islands. It collects taxes ($5 million from firms, 1 million from consumers) and pays 6 million for wages.Consumers work for the business and government, receive interest, pay taxes.(共10分)(1)Please calculate the GDP of this economy with expenditure (GDP = Consumption +Investment + Government Expenditure + Net Exports = 38 + 0 + 6 + 0 =44, 0.5’ for each number, 0.5’ for calculation of consumption) and income (GDP = Wage Income + After-Tax Profits + Interest Income + Taxes from firms= 14.5 + 24 + 0.5 + 5 = 44, 0.5’ for each number, 0.5’ for calculation of wage and profits )approaches respectively. (6‟) (Hint: List the components of GDP in different approaches. You can earn point for the correct component listing. )(2)Suppose now the peasant produces 13 million pineapples instead of 10 million, but onlysell out 10 million. What is GDP now? (2‟)44 + 2*3 (2’)= 50 (2’)(3)Suppose now the restaurant imports additional 2 million pineapples from other islands at$2 each. What is GDP now? (2‟)44-2*2 (2’) = 40 (2’)………密………封………线………以………内………答………题………无………效……。

macroeconomics

3

Irasema Alonso ()

Measuring a nation’s income

July 2011

4 / 38

Firms and households

Households sell labor and capital services to firms. For these services, firms pay incomes to households: wages and interest for the use of capital and profits since they own the firms. Aggregate income received by all households is Y . Firms sell goods and services. The total payments that households make for these goods and services is consumption expenditures C. Firms’ purchases of new plant, equipment, buildings, and the addition to inventories (unsold output) are investment I . Firms finance their investment by borrowing from households in financial markets. Households’ savings flow into financial markets, and firms’ borrowing flows out of financial markets. These flows are neither income nor expenditure (payments for goods and services are not involved in these transactions).

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

武汉大学2008-2009学年第二学期期末考试经济与管理学院 2008级 2009年6月30日宏观经济学(A卷)Principles of Macroeconomics (Paper A)Instructions: You have two hours to complete the test. Full marks are 100 points. Write your answers on the answer sheet. You can answer your questions either in English or Chinese. Read the questions carefully before answering them. Be precise and to the point.Good luck!Problem 1 (10 points)True or False? Explain your answer completely but briefly.a.James Bond is about to retire and is thinking of selling his car. He spends £1,000in repairing and tuning the engine, and finally agrees to sell it to Miss MoneyPenny for £10,000. As a result, GDP increases by £11,000.b.Robinson Crusoe will live better by catching fish, if he has more physical capital,human capital, natural resources and technological knowledge.c.It is one case of moral hazard that a patient is more likely to apply for healthinsurance than healthy men.d.According to the theory of efficiency wages, firms who pay wages at theequilibrium level will operate more efficiently.e.The introduction of ATM machines has made it easier to withdraw cash fromchecking accounts. As a result, the Central Bank now has to buy more bonds in the market every time it wants to increase the stock of money in the economy by a certain amount.Problem 2 (10 points)Suppose there is a small farming economy. It produces some corn and imports 7 bushels of corn. Of these, 80 bushels are consumed, 10 go for government purchases to feed the army, and 6 go into domestic investment as increases in inventories, 11 bushels are exported. In addition, taxes are 12 bushels.a.What is the GDP of the economy?b.Calculate private saving, public saving and net capital outflow. Then explain therelationship between saving and investment.c.Assuming in the economy, women have worked more hours in producing corn.How would this affect GDP? Explain the paradox, “When a person marries his or her gardener, GDP goes down.” Do you think GDP is a good measure of national accounts?Problem 3 (10 points)Below are some data about Pizza and Latte.pute the GDP deflator for each year, using 2006 as the base year.b.Suppose that the base year for the CPI is 2006. If the CPI basket consists of 400pieces of pizza and 1000 cups of latte during the three years, compute the CPI for each year. What is the CPI inflation rate from 2007 to 2008?c.According to your computation, what is the difference between GDP deflator andCPI?Problem 4 (15 points)The Federal Reserve conducts a $20 million open-market purchase of government bonds. The required reserve ratio is 10 percent.a.What is the money multiplier? How can this purchase affect money supply? Whatis the largest possible effect? What is the smallest possible effect? Explain.b.Show the effects of this purchase in a diagram of money supply and moneydemand. What happpen to value of money and price level)?c.Can you find roles of commercial banks and individual depositors in the creationof money in terms of multiplier formula?Problem 5 (10 points)Suppose Japanese decided they no longer wanted to buy U.S. assets as before. Using a three-panel diagram used in textbook for open economy, show the following effectsof the change.a.What would happen in U.S. market for loanable funds? In particular, what wouldhappen to U.S. Interest rates, U.S. saving, and U.S. investment?b.What would happen in the market for foreign-currency exchange? In particular,what would happen to the value of the dollar and the U.S. trade balance?Problem 6 (15 points)Suppose that the economy is in a long-run equilibrium.e a diagram to illustrate the state of the economy. Be sure to show aggregatedemand, short-run aggregate supply, and long-run aggregate supply and explain why these curves look like this.b.Now suppose that a stock market crash causes aggregate demand to fall. Use yourdiagram to show what will happen to output and the price level in the short-run.What happen to the unemployment rate? And in the long run?c.Now suppose that a war in Middle East drives up the cost of producing oilproducts. What are the likely macroeconomic effects of such a change? Explain with the help of appropriate graphs.Problem 7 (15 points)a.Suppose the government increases its purchase expenditure by $20 billion, whichfinally raises the total demand for goods and services by $100 billion. If we ignore the possibility of crowding out, what would the marginal propensity to consume to be? If we allow for crowding out, would the marginal propensity to consume in this case be larger or smaller than their initial one?b.Suppose the government reduces taxes by $20 billion, there is no crowding out,and the MPC is 0.8. What is the initial effect of the tax reduction on aggregate demand? What is the total effect of this policy?c.How does the total effect of the $20 billion tax cut in part (b) compare to the totaleffect of a $20 billion increase in government purchase in part (a)? Why?Problem 8 (15 points)Suppose king's weather (好天气)drives down the cost of producing food products.a.Show the impact of such a change in both the aggregate-demand/aggregate-supplydiagram and in the Phillips-curve diagram. What happens to inflation andunemployment in the short-run?b.Do the effects of this event mean there is no short-run tradeoff between ininflation and unemployment? Why or why not?c.Suppose in the following year, bad weather brings stagflation, and the centralbank pursues contractionary monetary policy to reduce inflation. Use the Phillips curve to show the short-run and long-run effects of this policy. How might the short-run costs of the policy against inflation be reduced (6 points)?武汉大学2008-2009学年第二学期期末考试经济与管理学院 2008级 2009年6月30日宏观经济学(A卷)Principles of Macroeconomics ( Paper A )说明:考试时间为2小时,满分为100分。