Chapter_31Cash Management(公司金融)

CashManagement(国际财务管理,英文版)

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10

$20 $25

$25

$10

$10

$10

18-17

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

18-8

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

$20 $30

18-9

18-6

Multilateral Netting

Consider a U.S. MNC with three subsidiaries and the following foreign exchange transactions:

$10 $

$20 $30

$40 $10

$25 $60

$20 $30

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

公司金融英文版

Agency Problem Solutions

Takeovers Specialist Monitoring Legal and Regulatory Requirements

Role of the Financial Manager

Firm’s Operations

Real assets

(2)

(1)

Investors

Financial

Manager

(4a)

Financial

Assets

(3)

(4b)

1. Cash raised from investors (how?) 2. Cash invested in firm 3. Cash generated by operations 4A. Cash reinvested in the firm 4B. Cash returned to investors

Recent exampdoff

Agency Problem

Do managers really maximize value?

Agency Problems

• Managers are agents for stockholders, but the managers may act in their own interests rather than maximizing value

Corporations face the problem of double taxation Cash reinvested in the firm

The Financial Manager Benefits of the Corporation

lower managers The Financial Manager This chapter introduces the corporation, its goals, and the roles of financial managers. Bernard Madoff

2014-2015上公司金融期末考试

公司理财试卷详解单选1. A conflict of interest between the stockholders and management of a firm is called:A. stockholders' liability.B. corporate breakdown.C. the agency problem.代理问题D. corporate activism.E. legal liability.2. Agency costs refer to:A. the total dividends paid to stockholders over the lifetime of a firm.B. the costs that result from default and bankruptcy of a firm.C. corporate income subject to double taxation.D. the costs of any conflicts of interest between stockholders and management.股东和管理层利益冲突的成本E. the total interest paid to creditors over the lifetime of the firm.3. Working capital management includes decisions concerning which of the following?I. accounts payableII. long-term debtIII. accounts receivableIV. inventoryA. I and II onlyB. I and III onlyC. II and IV onlyD. I, II, and III onlyE. I, III, and IV only4. The process of planning and managing a firm's long-term investments is called:A. working capital management.B. financial depreciation.C. agency cost analysis.D. capital budgeting.资本预算E. capital structure.4. The mixture of debt and equity used by a firm to finance its operations is called:A. working capital management.B. financial depreciation.C. cost analysis.D. capital budgeting.E. capital structure.资本结构5. The management of a firm's short-term assets and liabilities is called:A. working capital management.运营资本管理B. debt management.C. equity management.D. capital budgeting.E. capital structure.6. Which of the following are advantages of the corporate form of business ownership?I. limited liability for firm debt对公司负债承担有限责任II. double taxation双重课税(缺点)III. ability to raise capital筹集资金能力强IV. unlimited firm life 无限存期性A.I and II onlyB.III and IV onlyC.I, II, and III onlyD.II, III, and IV onlyE.I, III, and IV only7. Earnings per share is equal to: 每股收益 income divided by the total number of shares outstanding.净利润/流通在外的股数 income divided by the par value of the common stock.C.gross income multiplied by the par value of the common stock.D.operating income divided by the par value of the common stock. income divided by total shareholders' equity8. Dividends per share is equal to dividends paid: 每股股利A.divided by the par value of common stock.B.divided by the total number of shares outstanding.股利/流通在外的股数C.divided by total shareholders' equity.D.multiplied by the par value of the common stock.E.multiplied by the total number of shares outstanding.9. The current ratio is measured as:A.current assets minus current liabilities.B.current assets divided by current liabilities.C.current liabilities minus inventory, divided by current assets.D.cash on hand divided by current liabilities.E.current liabilities divided by current assets.10. An investment is acceptable if its IRR:A.is exactly equal to its net present value (NPV).B.is exactly equal to zero.C.is less than the required return.D.exceeds the required return.E.is exactly equal to 100%.11.An analysis of what happens to the estimate of net present value when only one variable is changed is called _____ analysis.A. forecastingB. scenarioC. sensitivity敏感性D. simulationE. break-even12. A bond with a 7% coupon that pays interest semi-annually and is priced at parwill have a market price of _____ and interest payments in the amount of _____ each.A. $1,007; $70B. $1,070; $35C. $1,070; $70D. $1,000; $35E. $1,000; $7013.A bond with semi-annual interest payments, all else equal, would be priced _________ than one with annual interest payments.A. higherB. lowerC. the sameD. it is impossible to tellE. either higher or the same14.The constant dividend growth model:I. assumes that dividends increase at a constant rate forever.II. can be used to compute a stock price at any point of time.III. states that the market price of a stock is only affected by the amount of the dividend.IV. considers capital gains but ignores the dividend yield.A. I onlyB. II onlyC. III and IV onlyD. I and II onlyE. I, II, and III only15.Which one of the following types of securities has tended to produce the lowest real rate of return for the period 1926 through 2008A. U.S. Treasury billsB. long-term government bondsC. small company stocksD. large company stocksE. long-term corporate bonds16. The risk premium for an individual security is computed by:A. multiplying the security's beta by the market risk premium.B. multiplying the security's beta by the risk-free rate of return.C. adding the risk-free rate to the security's expected return.D. dividing the market risk premium by the quantity (1 - beta).E. dividing the market risk premium by the beta of the security.17. Which of the following statements is true?A. A well-diversified portfolio has negligible systematic risk.B. A well-diversified portfolio has negligible unsystematic risk.C. An individual security has negligible systematic risk.D. An individual security has negligible unsystematic risk.E. Both A and D.18. The beta of a firm is more likely to be high under what two c onditions?A. High cyclical business activity and low operating leverageB. High cyclical business activity and high operating leverageC. Low cyclical business activity and low financial leverageD. Low cyclical business activity and low operating leverageE. None of the above.19. Preferred stock may exist because:A.losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B.an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C.corporations get a 70% tax exemption on preferred dividends received.D.All of the above.E.None of the above.20. Which of the following would be indicative of inefficient marketA. Overreaction and reversionB. Delayed responseC. Immediate and accurate responseD. Both A and B.E. Both A and C.21. MM Proposition I with no tax supports the argument that:A.business risk determines the return on assets.B.the cost of equity rises as leverage rises.C.it is completely irrelevant how a firm arranges its finances.D. a firm should borrow money to the point where the tax benefit from debt is equal to the cost of the increased probability of financial distress.E.financial risk is determined by the debt-equity ratio.22. The MM theory with taxes implies that firms should issue maximum debt. In practice, this is not true because:A.debt is more risky than equity.B.bankruptcy is a disadvantage to debt.C.firms will incur large agency costs of short term debt by issuing long term debt.D.Both A and B.E.Both B and C25. A financial lease has the following as its primary characteristics:A.is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.B.is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.C.is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.D.is not fully amortized, lessor maintains equipment and there is a renewal clause.E.is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.26. The maximum value of a call option is equal to:A.the strike price minus the initial cost of the option.B.the exercise price plus the price of the underlying stock.C.the strike price.D.the price of the underlying stock.E.the purchase price.27.Which of the following statements are correct concerning option values?I. The value of a call increases as the price of the underlying stock increases. II. The value of a call decreases as the exercise price increases.III. The value of a put increases as the price of the underlying stock increases. IV. The value of a put decreases as the exercise price increases.A.I and III onlyB.II and IV onlyC.I and II onlyD.II and III onlyE.I, II, and IV only28. The value of a call increases when:I. the time to expiration increases.II. the stock price increases.III. the risk-free rate of return increases.IV. the volatility of the price of the underlying stock increases.A.I and III onlyB.II, III, and IV onlyC.I, III, and IV onlyD.I, II, and III onlyE.I, II, III, and IV29. An in-the-money put option is one that:A.has an exercise price greater than the underlying stock price.B.has an exercise price less than the underlying stock price.C.has an exercise price equal to the underlying stock price.D.should not be exercised at expiration.E.should not be exercised at any time.30. Options are granted to top corporate executives because:A.executives will make better business decisions in line with benefiting the shareholders.B.executive pay is at risk and linked to firm performance.C.options are tax-efficient and taxed only when they are exercised.D.All of the above.E.None of the above多选1. Preferred stock may be desirable to issue for which of following reason(s)? (第15章)A. If there is no taxable income, preferred stock does not impose a tax penalty(罚款).B. The failure to pay preferred dividends, cumulative(累积的) or noncumulative, will not cause bankruptcy.C. Preferred dividends are not tax deductible and therefore will not provide a tax shield hill will reduce net income.D. Both B and C2. Which of the following are factors that favor a high dividend policy? (第19章)A. stockholders desire for current incomeB. tendency for higher stock prices for high dividend paying firms.C. investor dislike of uncertainlyD. high percentage of tax-expense institutional stockholders3. Underpricing can possibly be explained by: (第20章)A. oversubscription(超额认购) of an issueB. strong demand by investorsC. under subscription of an issueD. both B and C4. Which of the following are uses of cash? (第8章)A. marketable securities are soldB. the amount of inventory an hand in increasedC. the firm takes out a long-term bank loanD. payment are paid on accounts payable5. To collect on the accounts receivable due to the firm, a firm can:A. send a delinquency letter of past due status to the customerB. make personal contest by telephoneC. employ a collection agencyD. take legal action against the customer as necessary6. Financial distress can involve which of the following: (第30章)A. asset restructuring(资产重组)B. financial restructuring(财务重组)C. liquidation(清算)D. raise cash(集资)7. Which of the following activities are commonly associated with takeovers(收购)? (第25章)A. the acquisition of assetsB. proxy(代理人) contestsC. managements buyouts(管理层收购)D. leveraged buyouts(杠杆收购)8. Which of the following are reasons why a firm may want to divest itself of some its assets?A. to raise cashB. to get rid of unprofitable operationC. to get rid of some assets received in an acquisitionD. to cash in on some profitable operation填空题0.The forecast of cash receipts and disbursements for the next planning period is called a Cash budget.1.The process of planning and maneging a firm's inverstments in fixed assets is called Capital budgeting.2.The mixfure of debt and quity used by a firm to finance its: operations is called: Capital structure.1.The management of a firm's short-term assets and liabilities call Working capital management.4.A business created as a distinct legal entity composed of one or more individuals or entities is called a corporation.5.The financial statement showing a firm's accounting value on a particular date is the Balance sheet. working capital refers to the difference between a firm's current assets and is current liability.7.An annuity stream where the payments occur forever is called a perpetuity.8.The difference between the present value of an investment and its cost is the net present value.9.The discount rate that makes the net present values of an inverstment exactlly equal to zero is called the internal rate of return.10. The interest rate charged per period multiplied by the number of period per year is called the annual percentage rate.11. the first public equity issue that is made by a company is referred to as initial public offering.简答题一、在以下情况下公司提供商业信用可能是有优势的:1. 如果销售企业相对于其他潜在的贷款人具有成本优势;2. 如果销售企业具有垄断力量;3. 如果销售企业可通过提供信用而减少税收;4. 如果销售企业的产品质量难以确定5. 如果销售企业打算建立长期的战略关系;6. 如果在信用管理中存在规模经济,企业的规模也可能是重要因素。

公司金融研究第一讲(研究生)(公司金融研究-上海财经大学 李曜)

阅读文献

1、参见张新,关于金融学的讨论文章,《金融研 究》2003年第8期;

2、张新,“中 国金 融学面 临的挑战和发 展前 景”

/financecomment/2 0040825/1845975658.shtml

公司金融学的特点

1、以资本成本(Cost Of Capital)理论为核心研究公 司金融学

公司金融中的基本假设是,投资者向企业融资,他 们期望有一定的投资回报,这种回报就成了公司的 融资成本。公司价值是用资本成本折现的一系列的 现金流。

如何投资(项目价值决策);如何融通资金(资本结构 决策);为投资人提供多少回报(股利政策决策)。

参考书目

教案中提到的阅读文献

1、Ross, Westerfield, Jaffe, Corporate Finance, (第7版),机械工业出版社2005;

Finance一词的汉语对译主要有“金融”、 “财政”、“财务”、“融资”四种。

“货币流通和信用活动以及与之相联系的 经济活动的总称”(刘鸿儒,1995)

现代金融学体系:微观金融学,宏观金 融学,以及由金融与数学、法学等学科 互渗形成的交叉学科。

1、微观金融学(Finance) 公司金融、投资学、证券市场微观结构 (Securities Market Microstructure)

2、宏观金融学(Macro Finance) 国际证券投资 、金融市场和金融中介机构

(Financial Market And Intermediations ) 、 货币银行学、国际金融

3、金融学和其他学科的交叉学科

一是由金融和数学、统计、工程学等交叉而形 成的“金融工程学(Financial Engineering)” ;

公司金融 导论

Board of Directors Chairman President Chief Executive Officer CEO Chief Operation Officer / COO Chief Financial Officer / CFO Treasurer

Current Assets

Fixed Assets 1 Tangible 2 Intangible

What longterm investments should the firm engage in?

Shareholders’ Equity

The Balance-Sheet Model of the Firm

–

2.

• • •

对现金流的重视

权责发生制;收付实现制 现金流具有时间价值 现金流具有风险性

随着公司形式的变迁,对公司本身的研究将和公司金融的 研究密不可分。公司理论的基本问题将逐渐转向公司金融 问题,法律研究和金融研究在这一领域将日益融合。 当前公司金融最有意义的课题: 3.

从法律的角度研究公司金融;以资本成本为核心研究公司金融;资本结 构;公司治理;公司价值评估

Corporate Finance 公司金融

Semester 2, 2008-2009 吴辉凡

General Information

办公室: 办公楼南楼1407 电话: 37215327(O) E-mail: 内部邮箱, Wu_HuiFan@

阿甘正传

• Life was like a box of chocolate ,you never know what you're gonna get. • 人生就像一盒巧克 力,总会有各种意 外发生。

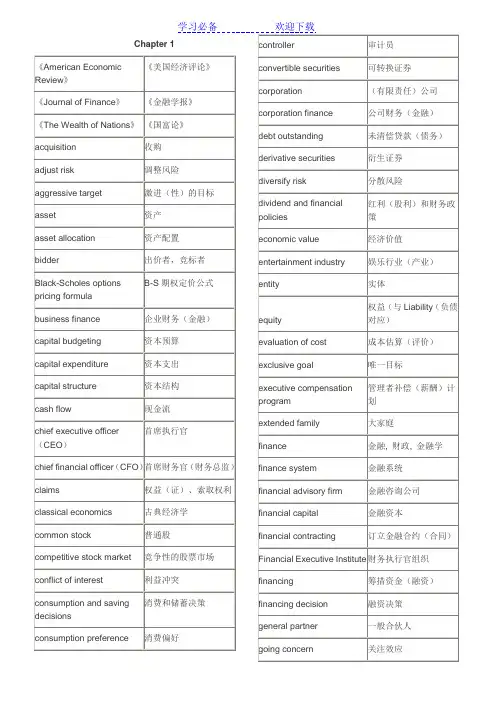

Finance(国际金融)关键术语名词解释

Chapter 1《American EconomicReview》《美国经济评论》《Journal of Finance》《金融学报》《The Wealth of Nations》《国富论》acquisition 收购adjust risk 调整风险aggressive target 激进(性)的目标asset 资产asset allocation 资产配置bidder 出价者,竞标者Black-Scholes optionspricing formulaB-S期权定价公式business finance 企业财务(金融)capital budgeting 资本预算capital expenditure 资本支出capital structure 资本结构cash flow 现金流chief executive officer(CEO)首席执行官chief financial officer(CFO)首席财务官(财务总监)claims 权益(证)、索取权利classical economics 古典经济学common stock 普通股competitive stock market 竞争性的股票市场conflict of interest 利益冲突consumption and savingdecisions消费和储蓄决策consumption preference 消费偏好controller 审计员convertible securities 可转换证券corporation (有限责任)公司corporation finance 公司财务(金融)debt outstanding 未清偿贷款(债务)derivative securities 衍生证券diversify risk 分散风险dividend and financialpolicies红利(股利)和财务政策economic value 经济价值entertainment industry 娱乐行业(产业)entity 实体equity权益(与Liability(负债对应)evaluation of cost 成本估算(评价)exclusive goal 唯一目标executive compensationprogram管理者补偿(薪酬)计划extended family 大家庭finance 金融, 财政, 金融学finance system 金融系统financial advisory firm 金融咨询公司financial capital 金融资本financial contracting 订立金融合约(合同)Financial Executive Institute 财务执行官组织financing 筹措资金(融资)financing decision 融资决策general partner 一般合伙人going concern 关注效应infrastructure 基础设施、架构initial outlay 初始投入integrated financial program 完整的财务计划investment decision 投资决策ITT corporation 国际电报电话公司learning curve 学习曲线liability 负债、债务、责任limited liability 有限责任limited partner 有限责任合伙人long-lived asset 长期资产long-range incentivesystem长期激励系统market discipline 市场规则market interest rate 市场利率market risk premium 市场风险价格market value of shares 股票市场价值(简称市值)marketing 营销maximize the wealth (使)财富最大化merger 兼并,合并mortgage loan 抵押贷款multinational conglomerate 跨国企业集团mutual fund 共同基金net worth 净资产operating margin 营业利润option 期权original core business 原始的核心业务partnership 合伙企业pension liabilities 养老金负债personal investing 个人投资physical capital 实物资本pool联营;集中使用的(资金,物)portfolio 投资组合portfolio of asset 资产组合preferred stock 优先股president 总裁primary commitment 首要(基本)任务private corporation 私人(非公众)公司professional managers 职业经理人profit 利润profit-maximizationcriterion利润最大化标准proposition 命题public corporation 公众公司quantitative model 定量模型regulatory body 监管机构resource allocationdecision资源配置决策retail outlet 零售摊点return 回报,收益risk-averse 风险厌恶(规避)security price 证券价格share price appreciation 股价上涨(增值)shareholder-wealth-maximization股东财富最大化sole proprietorship 个体(业主制)企业spin-off 配股spread out over time 跨时间分布stake 资助,资金stock option 股票期权strategic planning 战略规划supplier 供货商takeover 接管the exchange of assetsand risks资产和风险的交换the set of markets andother institutions市场及其它机构的集合trade off 权衡uncertain benefit 不确定性收益unlimited (limited)liability无(有)限责任vice-president forfinancial财务副总裁voting right (股东)投票权welfare 福利well-functioning capitalmarket高效的资本市场working capitalmanagement营运资本管理Chapter 2accounting procedure 会计程序adverse selection 逆向选择American Express 美国运通信用卡arithmetic mean 算术平均数asymmetry 不对称average risk premium 平均风险升水(溢价)Bank for InternationalSettlement(BIS)国际清算银行banking panic 银行危机bartern. 易货贸易;v. 讨价还价board of directors 董事会by-product 副产品call option 买入期权(看涨期权)capital gain(loss)资本收益(损失)Capital market资本市场(即长期资金市场)cash dividend 现金股利(红利)central bank 中央银行charge price 要价clearing and settlingpayment清算和结算支付closed-end 封闭式的collateral 担保品collateralization 以…担保commercial loan 商业贷款commercial loan rate 商业贷款利率credit card 信用卡default 违约、托债、弃权default risk 违约风险deficit unit 赤字部门defined-benefit pensionplan规定收益型养恤金制defined-contributionpension plan规定缴费型养恤金制depository savingsinstitution存款储蓄机构(系统)derivative 衍生(证券)Deutsche Bank 德意志银行dissemination 推广、传播dividend reinvestment 红利(股利)再投资dollar-denominated asset 以美元计价的资产double-entry-bookkeeping 复式记账法equity 权益equity-kickers 权益条件expected rates of return 期望(预期)收益率Federal Reserve System 联邦储备系统Finance AccountingStandardsBoard财务会计标准委员会financial instrument 金融工具financial intermediary 金融中介financial market parameters 金融市场参数financial variable 金融(财务)变量fixed-income-instruments 固定收益证券flow of fund 资金流flow of fund 资金流foreign exchange 外汇formation extraction 信息提取forward contract 远期合约functional perspective (从)功能(的角度或观点)future 期货German marks 德国马克go public 上市incentive problem 激励问题index fund 指数(化)基金index-linked bonds(与物价)指数联系的债券information service 信息咨讯(服务)insurance company 保险公司interest rate 利息率(简称利率)interest rate arbitrage 利率套利interest rate equalization 利率平价intermediary 中介International BankforReconstruction andDevelopment国际复兴开发银行International Monetary Fund(IMF)国际货币基金组织International Swap DealersAssociation国际掉期交易商协会intertemporal 跨期的(多阶段的)IOUI owe you的简称,喻指“借条”issuing stock 发行股票Japanese yen 日元life annuity 人寿年金limited liability 有限责任liquidity 流动性maturity (票据)到期日;期限money market货币市场(即短期资金市场)moral-hazard 道德风险mortgage 抵押mortgage rate 抵押利率mutual fund 共同基金New York Stock Exchange 纽约股票交易所nominal interest rate 名义利率offset 弥补、抵消open-end 开放式的option 期权Osaka Options and FuturesExchange大阪期货期权交易所over-the-counter-market(OTC)场外(交易)市场parties to contract 合约的参与者pool or aggregate 联营;集中使用的(资金或物品);premium 升水、溢价price appreciation 增值principal-agent problem 委托-代理问题pro rata 按比例的put option 卖出期权(看跌期权)qusai- 准、半rate of exchange 汇率rates of return 收益(回报)率rating agency 评级机构real interest rate 实际利率real rate of return 实际收益率redeem 赎回、偿还residual claim 剩余索取(求偿)权risk aversion 风险厌恶(规避)risk premium 风险升水(溢价)security dealer 证券交易商shed specific risk 规避(分散)特定(或私有)风险standard deviation 标准差standardized option contract (经)标准化的期权合约surplus unit 盈余部门trade-off 权衡trust company 信托公司U.S Treasury Bills 美国国库券underwrite 认购、包销unit of account 计值单位universal bank全能银行(指兼做中央银行和商业银行业务的银行)volatility 波动性well-information 信息充分的yen rate of return(以)日元(记值)的收益率yield curve 收益(率)曲线yield spread 收益价差Chapter 3accounting earnings 会计收入accounting rule 会计规则accrual 应计的accrual accounting 应计制(权责发生制)accumulated depreciation 累计折旧amortize 摊销、分期偿还apocryphal 伪经的、假冒的asset turnover(ATO)资产周转率(销售收入/总资产)audit 查账、审计balance sheet 资产负债表benchmark (比较)基准bond-rating 债券评级book value 账面价值capital structure 资本结构capital-incentive utility 资本密集型的公用事业(公司)cash and equivalents 现金及其等价物cash budget 现金预算cash cycle time 现金循环周期cash inflow 现金流入cash outflow 现金流出common stock outstanding 流通在外的普通股contingent liability 或有负债(如:可能发生的诉讼赔偿等)current asset 流动资产current liability 流动负债current ratio 流动比率depreciation 折旧、贬值disclose 披露dividend payout rate 股利支付率earnings before interest and tax (EBIT)息税前利润(=毛利- GS&A)earnings per share 每股盈余(收益)earnings retention rate (收益)留存比率expiration date 到期日external financing 外部融资(比如,发行股票和债券)financial distress 财务危机(困境)financial leverage 财务杠杆(率)financial ratio 财务比率financial statement 财务报表general, selling, andadministrative expenses(GS&A)管理及销售费用goodwill 商誉gross margin 毛利(润)(=销售收入-产品销售成本)income statement 损益表income tax 所得税intangible asset 无形资产inventory 库存、存货inventory turnover 存货周转率liquidity 流动性long-term debt 长期负债market to book 市值价值/账面价值marking to market 盯住市场net income(or net profit)净利润(即税后利润=EBIT-利息-所得税)net working capital 净营运资本(=流动资产-流动负债)net worth 净资产(即权益,=资产-负债)off-balance-sheet 表外项目operation income 营运收益(营业利润)opportunity cost 机会成本owner’s equity所有者权益paid-in capital 实收资本payable 应付账款percent-of-sales method 销售(收入)百分比法planning horizon 计划(时间)跨度price to earnings 市盈率(价格/盈余)profitability 盈利能力、盈利性property 土地、地产、所有权quick ratio 速动比率receivable 应收账款receivables turnover 应收账款周转率retained earnings 留存收益ROA(return on asset)资产收益率(EBIT/资产)ROE(return on equity)净资产收益率(即权益报酬率,=税后利润/净资产)ROS(return on sales)销售利润率(EBIT/销售收入)short-term debt 短期负债specify performance target 设定业绩目标statements of cash flow 现金流量表sustainable growth rate 持续增长率taxable income 应税收益(即税前利润=EBIT-利息)times interest earned 利息保障倍数Tobin’s Q托宾Q值(=资产市值/重置成本)total shareholder returns 总的股东收益(率)Chapter 4after-tax interest rate 税后利率amortization 分期偿还、摊销annual percentage rate(APR)年度百分比(利率)annuity 年金before-tax interest rate 税前利率compound interest 复利compounding 复和(与discounting 相反的概念)discount rate 折现率、贴现率discounted cash flow(DCF)折现现金流discounting 折现、折扣effective annual rate(EFF)有效年利率exchange rate 汇率future value 终值future value factor 终值系数(即由现值计算终值的换算因子)growth annuity 增长年金immediate annuity 即付年金implied interest rate 隐含利率installment 分期付款internal rate of return(IRR)内部报酬率market capitalizationrate市场资本化利率(简称市场利率)net present value(NPV)净现值opportunity cost ofcapital资本的机会成本ordinary annuity 普通年金(即后付年金)original principal (初始)本金outstanding balance 未平头寸payback period 回收期perpetual annuity(orperpetuity)永续年金present value 现值present value factor (终值)现值系数(终值系数的倒数)reinvest 再投资simple interest 单利tax-exempt 免税的time value of money (TVM)货币(或资金)的时间价值yield to maturity 到期收益率Chapter 5bequest 遗赠、遗赠物break-even 得失相当的,盈亏平衡的deductible 可扣除(或抵扣)的explicit cost 显性成本feasible plan 可行(的)计划human capital 人力资本implicit cost 隐性成本incremental 增量的、增值的intertemporal budgetconstraint跨期预算约束optimization model 优化模型permanent income 永久性收入provision 条文、条款tax deferred 税收(可)延缓的tax exempt 免税的trial-and-error 试错Chapter 6after-tax cash flow 税后现金流all-equity-financed firm 全权益融资公司annualized capital cost 年金化资本成本appropriation 拨款、占用break-even point 盈亏平衡点capital budgeting 资本预算cost of capital 资本成本coupon bond 息票债券cumulative present value 累计现值full-fledged 完备的、正式的horizontal axis 横轴(或横坐标)labor-intensive 劳动密集型的liquidate 清算、清偿market-related risk 市场相关(或者承认予以补偿)的风险,即系统风险(systematic risk)prototype 模型、原型residual value 残值risk premium 风险溢价risk-adjusted discountrate(经)风险调整的折现率sensitivity analysis 敏感性分析vertical axis 纵轴(或纵坐标)zero-inflation 零通涨(率)Chapter 7Arbitrage 套利arbitrageurs 套利(交易)者beverage 饮料bona fide 真正的bond 债券default risk 违约风险default-free 无违约(风险)的earnings per share 每股盈余efficient marketshypothesis(EMH)有效市场假说fetch 售得…fixed-income securities 固定收益证券foreign exchangemarket外汇市场fundamental value 基础价值information set 信息集interest-rate arbitrage 利率套利intrinsic value 内在价值laundry 洗衣店Law of One Price 一价定律price/earnings multiple 市盈率(倍数)real estate 房地产、不动产sibling 兄弟、同胞、氏族成员tautologically 同意反复地transaction costs 交易成本triangular arbitrage 三角套利vending 售货well-informed 信息充分的Chapter 8abscissa 横坐标ask price 卖价、要价(报价)bid price 买价、出价(询价)callable bond 可赎回债券convertible bond 可转换债券coupon bond 带息债券、息票债券current yield 即期收益(率)discount bond 折价债券face value/ par value 面值maturity 到期日ordinate 纵坐标par bond 平价债券premium bond 溢价债券pure discount bond 纯折现债券quote 牌价redeem 赎回、偿还risk-free interest rate 无风险利率yield curve 收益(率)曲线yield to maturity 到期收益(率)zero-coupon bond 零息(票)债券Chapter 9New York StockExchange纽约股票交易所cash dividend 现金股利(或红利、分红)closing price 收盘价Constant-Growth-RateDDM不变增长率股利折现模型current/existingstockholders现有股东、老股东discounted-dividendmodel(DDM)股利折现模型dividend policy 股利政策dividend yield 分利收益率ex-dividend price 除息(即股息)价格expected rate of return 期望收益率(或报酬率)infinite 无穷(或无限)的internal equity financing 内部权益融资Investment opportunity 投资机会market capitalization rate 市场资本化利率odd lots 零星(交易量)per se 亲自、亲身perpetual 永久的price/earnings ratio 市盈率Reinvested earnings 再投资收益required rate of return 必要报酬率(或收益率)risk-adjusted discountrate(经)风险调整折现率round lots 整批(交易量)share repurchase 股票回购skeptical 怀疑的stock dividend 股票股利stock splits 股票分割Chapter 10actuary 精算师caterer 酒席承办人colossal 巨大的、异常的confidence intervals 置信区间consortium 社团、合伙continuous probability distribution 连续概率分布diversification 分散化(投资)diversifying 分散化、多样化dunce 笨蛋、书呆子ex ante 事先的ex post 事后的expected rate of return 期望收益率(报酬率)flexibility 灵活性、柔性forward contract 远期合约hedger (套期)保值者、对冲者hedging 保值、对冲、对两方下注以防止(赌博、冒险等)的损失insuring 投保、给…保险jurisdiction 司法、权力、权限layoff 解雇、失业materialize 实现mean 均值normal distribution 正态分布overview 概述perverse 故意作对的、任性的portfolio 投资组合precautionary saving 预防性储蓄probability distribution 概率分布quadruple adj. 四倍的;v. 使…(增加)四倍recrimination 反责refund 退还risk assessment 风险评估risk aversion 风险规避risk avoidance 风险避免risk exposure 风险暴露risk identification 风险识别risk management 风险管理risk retention 风险保留risk transfer 风险转移sinful 有罪的、过错的、不道德的speculator 投机者square root 平方根stakeholder 利益相关者standard deviation 标准差swap 互换volatility 波动率Chapter 11American-type option 美式期权call option 买入期权(简称“买权”)cap (利率)上限condominium 公寓私有的共有方式co-payment 共同支付counterparty 交易对手credit guarantee 信用担保credit risk 信用风险deductible/deduction 免赔额delivery 交割delivery date 交割日derivative 衍生工具diversifiable risk 可分散的风险diversification principle 分散化(或多元化)原则European-type option 欧式期权exclusion 除外责任expiration date 到期日expire 到期face value 面值fictitious 虚构的firm-specific risk (公司)私有(或特有)风险forward contract 远期合约forward price 远期价格future contract 期货合约guarantee 保证、保证人、担保、担保品loan guarantee 债务保单long position 多头market risk 市场风险non-diversifiable risk 不可分散的风险premium 保险费、附加费、溢价proceed n. 盈利put option 卖出期权(简称“卖权”)rolling over 滚动(式)的short position 空头shortfall 不足之数、赤字spot price 即期价格standardized (经)标准化的strike price/ exerciseprice执行价格、行权价swap contract 互换合约、调期合约Chapter 12decision horizon 决策(修正)期限efficient portfolio 有效组合efficient portfolio frontier 有效组合前沿expected return 期望收益率mean-variance model 均值-方差模型minimum-varianceportfolio最小方差组合mutual fund 共同基金optimal combination ofrisky assets风险资产最优组合planning horizon 计划期、规划期point of tangency 切点portfolio selection (投资)组合选择risk premium 风险溢价risk tolerance 风险容忍(度)riskless asset 无风险资产risky-asset portfolio 风险资产组合set of……的集合tangency portfolio 切线组合target expected return 目标期望收益率trade-off 权衡、平衡trading horizon 交易(间隔)期限Chapter 13active investmentstrategies积极投资策略active portfolio selectionstrategy积极的组合选择策略Arbitrage Pricing Theory (APT)套利(定价)理论beat the market 打败市场benchmark 基准benchmark portfolio 基准组合Capital Asset PricingModel(CAPM)资本资产定价模型capital market line(CML)资本市场线consensus 一致、一致同意cost of capital 资本成本covariance 协方差equilibrium asset price 均衡(的)资产价格equilibrium expectedreturn均衡(的)期望收益率equilibrium price 均衡价格equilibrium risk premium 均衡风险溢价indexing 指数化irreducible 不能减少的、难复位的marginal contribution 边际贡献market portfolio 市场组合market-related risk 市场相关的(或承认的)风险multifactor IntertemporalCapital Asset PricingModel(ICAPM)多因子、跨期资本资产定价模型mutual fund 共同基金non-market risk 非市场风险passive investing 消极投资passive portfolio selectionstrategy消极的组合选择策略pension fund 养老基金regression coefficient 回归系数reward-to-risk ratio 风险补偿比率security market line(SML)证券市场线short-sale 卖空systematic risk 系统风险unsystematic risk 非系统风险Chapter 14arbitrageur 套利者bountiful 慷慨的、充足的casino 卡西诺赌场、小别墅closing out(one’s/a)position平仓continuouscompounding连续复利cost of carry 持有成本daily marking to market 逐日盯市(即每日无负债清算制度)delivery 交割delivery date 交割日delivery price 交割价格expectationshypothesis期望假说financial future 金融期货(即标的物为金融产品的期货合约)foreign-exchangeparity relation汇率平价关系forward contract 远期合约forward price 远期价格forward-spotprice-parity relation 远期-即期价格间的平价关系future contract 期货合约future price 期货价格future spot price 将来的现货价格hedger 套期保值者intrinsic value 内在价值margin 保证金open interest 未平仓合约数、头寸开放权益数position 头寸posting of margin (对)保证金(进行)过帐quasi-arbitrage 准套利(机会)replicate 复制speculator 投机者spoilage 损坏spot price 即期价格、现货价格spread 价差、差额the wall street journal 《华尔街日报》Chapter 15American-typeoption美式期权arrear 应付欠款、储备物at the money option 两平期权Black-Scholes model 布莱克-斯科尔斯期权定价模型boom 繁荣的bullish 乐观的call (option)买入期权(简称买权)、看涨期权capital-gain 资本(性)收益cash settlement 现金结算Chicago BoardOptions Exchange(CBOE)芝加哥期权交易所commission 佣金Contingent Claims 或有权益(简称或有权、或然权)credit guarantee 信用保证(或承诺)de facto 实际的、实际上decision tree 决策树delinquency 失职、违法行为dividend yield 股利收益率dividend-adjusted option formula 股利调整期权(定价)公式embedded option 嵌入式期权European put option 欧式卖权European-typeoption欧式期权evasion 逃避、躲避Exchange-traded option 场内(即在交易所交易的)期权exercise price/strikeprice执行价格/敲定价格expirationdate/maturity date到期日explicit 外生的flexibility 灵活性、柔性FutureOptions/Option onFutures期货期权growth option 增长期权guarantor 保证人hedge ratio 对冲比率、套期比率implicit 内生的implied volatility 隐含波动率in the money option 虚值期权incremental 增量的、增加的index option 指数期权intrinsicvalue/tangible value内在价值、执行价值junk bond 垃圾债券litigation 诉讼、争论mainline 主流的、传统的natural logarithm 自然对数normal distribution 正态分布Option 期权out of the moneyoption实值期权Over-the-counteroption场外(交易的)期权payoff diagrams 支付图plaintiff 起诉人provision 条文、条款put (option)卖出期权(简称卖权)、看跌期权put-call parityrelation买(权)与卖(权)间的平价关系real option 实物期权recession 衰退self-financinginvestment strategy自融资投资策略sequel 续篇、后果shortfall 不足之数、赤字stochastic 随机的 swap 互换 time value 时间价值 truncate截断two-state (binomial )option pricing model 两状态(二项式)期权定价模型 underlying asset 标的资产、基础资产Chapter 16account payable 应付账款accrued wage应计工资adjusted present value (APV )(经)调整的现值 after-tax incremental cash flow 税后增量现金流agency cost 代理成本 allegiance 忠诚、忠贞 all-equtiy financing 全权益融资 bankruptcy cost破产成本bankruptcy proceeding 破产程序、破产诉讼 Capital Structure资本结构capital structure irrelevance proposition 资本结构无关性定理 circumvent 绕过、智胜 collateral 担保品 common stock 普通股 corporate income tax公司所得税cost of financial distress 财务危机(危难)成本 debt financing 债务融资 entity实体、本质、存在 equity financing 权益融资 external financing外部融资(筹资) fiduciary受信托的 financial distress财务危机(危难) financing instrument 金融工具 franchise 特许权 free cash flow自由现金流 frictionless 无摩擦的gourmet供美食家的享用的、美食家imminent 临近的、迫在眉睫的 interest tax shield (债务)利息税盾 internal financing 内部融资(筹资) issuing new stock 发行新股leveraged investment 杠杆投资(即投资额中有部分债务融资) long-term lease 长期租赁 M & M proposition MM 定理market debt-to-equity ratio(用)市场(价值表示的)债务-权益比率market-value/economic balance sheet (用)市场价值(表示的)资产负债表 Modigliani & Miller (M 莫迪里阿尼和米勒& M )optimal capital structure 最优资本结构 pension liability 养老金(形式的)债务 perk额外补贴 personal income tax 个人所得税 preferred stock优先股学习必备欢迎下载prestige 威信、声望pro rata 按比例的realized capital gains 已实现资本收益redeploy 重新部署(布置、调派)repurchase stock 回购股票residual claim 剩余索取权(求偿权)retained earning 留存收益scrutiny 细致检查secured debt 安全债务stock option 股票期权subsidy 津贴、财政援助、特别津贴voting right 投票权warrant 认股权证、认股权weighted average costof capital(WACC)加权资本成本Chapter 17acquisition 收购bargain v. 讲价、讨价还价;n. 便宜货、交易、协定breakup 分散、中止、崩溃consolidation 合并、联合、巩固consummate 完成、使…完美contest 竞争、争夺corroborate 加强证实、巩固、支持discretion 决定权、谨慎、判断力divest 使…脱去information set 信息集loss carry-forward 亏损递延malevolence 恶意、坏影响merger 兼并opaqueness 不透明real option 实物期权spin-off 派生出、让产易股、抽资脱离synergy 协同增效takeover 接管。

Controls,andCashBusiness(公司金融会计)

2. Received in the mail from credit customers. Cash is in the form of checks.

Control Procedures Risk Assessment

Control Environment

C6 - 5

Internal Control Framework

1. Control Environment 2. Risk Assessment 3. Control Procedures 4. Monitoring

1. Control Environment 2. Risk Assessment

ቤተ መጻሕፍቲ ባይዱ

Risk Assessment Control Environment

C6 - 4

Internal Control Framework

1. Control Environment 2. Risk Assessment 3. Control Procedures

All cash is sent to the Cashier’s Department. An employee prepares a bank deposit ticket and makes a bank deposit. The bank deposit record is sent to the Accounting Department where it is recorded.

Chapter F6

Power Notes

国际金融英文版习题Chapter-3(1)

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in __________, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the __________.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the __________.A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to __________.A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market?A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are __________ respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because __________.A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. __________ earn a profit by a bid-ask spread on currencies they buy and sell. __________ on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as __________ whereas __________ are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote?A. SFr 1.25/€B. $1.55/₤C. ¥ 110/€D. €0.0091/ ¥11. Which of the following is true about the foreign exchange market?A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchange rates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculators from different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be _________.A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes?A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ now. If the RMB were to undergo a 10% depreciation, the new exchange rate in terms of ¥/$ would be:A. 6.1671B. 7.5375C. 6.9238D. 7.613515. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciates rapidly against that of the dollar over a year, this would reduce the dollar value of the euro profit made by the European subsidiary. This is a typical __________.A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The company has a (an) __________.A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchange risk known as Translation Exposure may be defined as __________.A. change in reported owner’s equity in consolidated financial statements caused by a change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the change in expected future cash flows arising from an unexpected change in exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreign exchange risk exposure. So if an American firm expects to receive a dollar-paymentfrom a Chinese company in the next 30 days, the U.S. firm has the possible __________.A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a __________ position in foreign exchanges can __________ that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japanese yens for Swiss francs could be described either as __________ or __________,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forward21. Dollars are trading at S0SFr/$=SFr0.7465/$ in the spot market. The 90-day forward rate is F1SFr/$=SFr0.7432/$. So the forward __________ on the dollar in basis points is __________:A. discount, 0.0033B. discount, 33C. premium, 0.0033D. premium, 3322. If the spot rate is $1.35/€, 3-month forward rate is $1.36/€, which of the following is NOT true?A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be __________.A. 1.0330 – 1.0345B. 1.0280 – 1.0285C. 0.9681 – 0.9667D. 0.9728 – 0.972324. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be __________.A. 30/25B. 25/30C. – (23/28)D. – (28/23)25. The current U.S. dollar exchange rate is ¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum __________ of __________.A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions 1 through 10 are based on the information presented in Table 3.1. (2 credits for each question, total credits 2 x 10 = 20)Table 3.1Country Exchange rate Exchange rate CPI V olume of Volume of (2008) (2009) (2008) exports to U.S imports from U.S. Germany €0.75/$ €0.70/$ 102.5 $200m $350m Mexico Mex$11.8/$ Mex$12.20/$ 110.5 $120m $240mU.S. 105.31. The real exchange rate of the dollar against the euro in 2009 was __________.2. The real exchange rate of the dollar against the peso in 2009 was __________.3. The dollar was __________ against the euro in nominal term by __________.A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was __________ against the dollar in nominal term by __________.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was __________.6. The volume of the Mexican foreign trade with the U.S. was __________.7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2009 against a basket of currencies of euro and Mexican peso, the weight assigned to the euro should be __________.8. The weight assigned to the peso should be __________.9. Assume the 2008 is the base year. The dollar effective exchange rate in 2009 was __________.10. Was the dollar generally stronger or weaker in 2009 according to your calculation?11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥95.00/SFrAssume you have an initial SFr10 million. Can you make a profit via triangular arbitrage? If so, show steps and calculate the amount of profit in Swiss francs. (8 credits)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dollar? (5 credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rates S SFr/$= SFr1.7223/$, S$/¥= $0.009711/¥, and S¥/SFr = ¥61.740/SFr unprofitable? Explain. (7 credits14. You are given the following exchange rates:S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670Calculate the bid and ask rate of S¥/£: (5 credits)15. Suppose the spot quotation on the Swiss franc (CHF) in New York is USD0.9442 –52 and the spot quotation on the Euro (EUR) is USD1.3460 –68. Compute the percentage bid-ask spreads on the CHF/EUR quote. ( 5 credits)Answers to Assignment Problems (3)Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 = 0.71912. 12.2 x (105.3/110.5) = 12.2 x .9529 = 11.62593. B (0.7 /.75) – 1 = -6.67%4. D (1/12.2)/(1/11.8) – 1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 = 39.569. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.11. Since S¥/$S$/SFr S SFr/¥= 80 x 1/0.8900 x 1/95.00 = 0.946186 < 1, there is an arbitrage opportunity.Steps:①Buy ¥ from Deutsche Bank, SFr10 million x 95.00 = ¥950 million②Buy $from Fuji Bank, $950 m / 80.00 = $11.875 m③Buy SFr from UBS, $11.875 x 0.8900 = SFr10.56875 mProfit (ignoring transaction fees):SFr10.56875 – SFr10 = 0.56875 million = 568,75012. (x – 1) = 1000%; 1/11 – 1 = 90.9%13. S SFr/$ S$/¥S¥/SFr = SFr1.7223/$ x $0.009711/¥ x ¥61.740/SFr = 1.0326If transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.14. Given: S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670So, S¥/₤ = 67.05/0.3670 = 182.70 (bid)S£/₤ = 68.75/0.3590 = 191.50 (ask)15. Given: USD0.9442 – 52/SFrUSD1.3460 – 68/SFrSo, S SRr/€ = 1.3460/0.9452 =1.424 (bid)S SFr/€ = 1.3468/0.9442 = 1.4264 (ask)。

公司金融简答题

1.3 Corporations.What is the primary disadvantage of the corporate form of organization? Name at least two of the advantages of corporate organization.什么是公司组织形式的主要劣势呢?至少写两个法人组织的优点The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends. Some advantages include: limited liability, ease of transferability, ability to raise capital, and unlimited life.企业形式的主要缺点是股东收益和红利的双重征税。

一些优势包括:有限责任,便于可转让性,筹集资金的能力,和无限的生活。

1.6Who owns a corporation? Describe the process whereby the owners control the firm’s management. What is the main reason that an agency relationship exists in the corporate form of organization?In this context, what kinds of problem can arise?谁拥有一个公司?描述所有者控制公司的管理过程。

是什么主要原因导致代理关系存在于企业组织形式中?在这种情况下,会出现什么样的问题?In the corporate form of ownership, the shareholders are the owners of the firm. The shareholders elect the directors of the corporation, who in turn appoint the firm's management. This separation of ownership from control in the corporate form of organization is what causes agency problems to exist. Management may act in its own or someone else's best interests, rather than those of the shareholders. If such events occur, they may contradict the goal of maximizing the share price of the equity of the firm.企业的所有制形式,股东是公司的所有者。

《Corporate Finance (公司金融学)》课件 (32)

Chapter Outline

31.1 What is Financial Distress? 31.2 What Happens in Financial Distress? 31.3 Bankruptcy Liquidation and Reorganization 31.4 Private Workout or Bankruptcy: Which is Best? 31.5 Prepackaged Bankruptcy 31.6 Summary and Conclusions

• Reorganization (Chapter 11) is the option of keeping the firm a going concern.

– Reorganization sometimes involves issuing new securities to replace old ones.

Liquidation

Responses to Financial Distress

• Think of the two sides of the balance sheet. • Asset Restructuring:

– Selling major assets. – Merging with another firm. – Reducing capital spending and R&D spending.

• A firm that defaults on a required payment may be forced to liquidate its assets. More often, a defaulting firm will reorganize.

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

31- 7

Managing Float

Payers attempt to create delays in the check clearing process. Recipients attempt to remove delays in the check clearing process. Sources of delay

commercial paper certificates of deposit repurchase agreements

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 13

Inventories & Cash Balances

The optimal amount of short term securities sold to raise cash will be higher when annual cash outflows are higher and when the cost per sale of securities is higher. Conversely, the initial cash balance falls when the interest is higher.

Principles of Corporate Finance

Seventh Edition

Chapter 31

Cash Management

Richard A. Brealey Stewart C. Myers

Slides by Matthew Will

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 12

Inventories & Cash Balances

Determination of optimal order size

31- 8

Managing Float

Check mailed

Mail float

Check received

Availability float Processing float Check deposited Presentation float Check charged to payer’s account

Inventory costs, dollars

Total costs Carrying costs

Total order costs Optimal order size Order size

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw Hill/Irwin

=

= 25

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 5

Float

Availability Float illustration - The company deposits a $100,000 check that has not yet cleared.

Company’s ledger balance

$900,000

+

equals

Payment float

Initial cash balance =

2 x annual cash outflows x cost per sale of securities interest rate

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 10

Money Markets

Money Market - market for short term financial assets.

Company’s ledger balance

$800,000

+

equals

Payment float

$200,000

Bank’s ledger balance $1,000,000

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 2

Topics Covered

Cash Collection and Disbursement Systems

Managing Float

How Much Cash Should the Firm Hold? Investing Idle Cash Money Market Investments Floating Rate Preferred Stock

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 3

Float

Time exists between the moment a check is written and the moment the funds are deposited in the recipient’s account. This time spread is called Float. Payment Float - Checks written by a company that have not yet cleared. Availability Float - Checks already deposited that have not yet cleared.

31- 14

Inventories & Cash Balances

Cash balance ($000) 25

(Everyman’s Bookstore)

Average 12.5

inventory

0

1

2

3

4

5

Weeks

Value of bills sold = Q = 2 x annual cash disbursement x cost per sale interest rate 2 x 1260 x 20 .08

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31- 4

Float

Payment Float illustration - The company issues a $200,000 check that has not yet cleared.

Time it takes to mail check Time for recipient to process check Time for bank to clear check

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

Cash available to recipient

McGraw Hill/Irwin

31- 9

Managing Float

Concentration Banking - system whereby customers make payments to a regional collection center which transfers the funds to a principal bank. Lock-Box System - System whereby customers send payments to a post office box and a local bank collects and processes checks. Zero-Balance Accounts - Regional bank accounts to which just enough funds are transferred daily to pay each day’s bills.

Bank’s ledger balance

$1,100,000

equals Available balance $1,000,000 Availability float $100,000

+

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved