Q4_2013_Private_Equity_Fundraising

一文读懂股权融资常用的24个英文术语

以下是股权融资中常用的24个英文术语:Equity:股本,公司所有者拥有的资产。

Stock:股票,代表公司的一部分所有权。

Shares:股份,股票的一部分,代表公司的一部分所有权。

Board of Directors:董事会,公司的最高决策机构,由股东选举产生。

Shareholder:股东,持有公司股票的人。

Management:管理层,负责公司的日常运营和决策。

Initial Public Offering (IPO):首次公开募股,公司首次向公众出售股票。

Secondary Offering:二次发行,公司在首次公开募股后再次向公众出售股票。

Private Equity (PE):私募股权,非公开交易的股权投资。

Venture Capital (VC):风险投资,提供给初创企业的股权投资。

11.天使投资人(Angel Investor):提供种子期资金的人,通常是个人投资者。

12.兼并(Merger):两家或多家公司合并为一个新的公司。

收购(Acquisition):一家公司购买另一家公司的全部或部分股权。

反收购(Anti-Takeover):公司采取措施防止被其他公司收购。

股权稀释(Equity Dilution):由于新发行股票或其他方式导致现有股东所持股份比例下降。

估值(Valuation):对公司的价值进行评估。

优先股(Preferred Stock):具有特殊权利的股票,通常在分红和投票方面优于普通股。

可转债(Convertible Bonds):可以转换为股票的债券。

尽职调查(Due Diligence):在交易前对潜在投资目标进行详细的调查和分析。

路演(Roadshow):向投资者展示公司或产品的推广活动。

招股说明书(Prospectus):包含公司详细信息的文件,用于吸引投资者购买股票。

基石投资者(Cornerstone Investors):在首次公开募股中承诺购买大量股票的投资者。

私募基金实务(精品)

私募基金吸引了谁

联系创始人

香港财政司司长享有 “梁财神”的称号 《不做总统就去做PE》

鼎晖投资董事长

创建中国首只世界 范围的私募股权基金

柳传志

弘毅投资董事长 加盟全球著名的资 产管理公司KKR。

梁锦松

梁锦松于2003年7月16 日加入美国黑石资产管 理集团任高级执行董事 兼大中华区主席

由于投资者具有抗风险能力 和自我保护的能力,因此政 府不需要对其进行监管。

私募股权基金的起源

1:私募股权基金起源于美国。 1976年,华尔街著名投资银行 贝尔斯登的三名投资银行家克尔 伯格(Kohlber)、克拉维斯 (Kravis)和罗伯茨(Roberts) 合伙成立了一家专门从事并购业 务的公司KKR,这是最早的私募 股权投资公司。

• 2 江苏高投 中国高传 制造业 HKMB

5191%

• 3 软银赛富 完美时空 互联网 NASDAQ 3115%

• 4 软银集团 阿里巴巴 互联网 HKMB

3025%

• 5 国泰财富 泛华保险 金融 NASDAQ 2944%

• 6 联创投资 西部矿业 能源 SSE(上) 2597%

• 7 软银赛富 中国数字电视 IT

私募基金实务

Private Offering Fund

模板效果图预览

目录 Contents

一、 二、 三、 四、 五、 六、

前言

我国现有地下私募基金的总量远远超过在深沪两地挂牌的封闭 式基金。其总量保守估计已在2000亿元左右,较高估计则达 5000亿元。按此估算,考虑到这些私募基金主要投资于证券市 场,我们可以认为,虽然在深沪两地挂牌的证券投资基金的股 本和净值占流通市值的比率不到4%,但加上私募基金部分,则 这一比例有可能赶上甚至超过美国等发达国家的水平(美国 1999年投资基金占股票市值的比率为18%)。所以,私募基金 实力强大,私募管理人作为私募业的核心主体将会有更为广阔 的发挥空间,私募行业也会迎来全新的快速发展时期。

Private Equity in China. Challenges and Opportunities

BrochureMore information from /reports/2112831/Private Equity in China. Challenges and OpportunitiesDescription:Learn valuable lessons from the newly successful private equity players in China and explore the challenges and opportunities offered in Chinese marketsThe first book to deal with private equity finance in China, Private Equity in China: Challenges andOpportunities provides much-needed guidance on an investment concept that has so far provedelusive in Asia. Focusing on the opportunities that the Chinese finance market offers to privateequity firms, the book shows how these firms can strategically position themselves in order tomaximize success in this new marketplace.Private Equity in China includes in-depth case studies illustrating both successful and failedventures by private equity firms operating in China, outlining the challenges faced by private equityfirms in setting up new funds. It contains a collection of valuable experience and insights aboutacquiring companies and turning them around essential for any firm currently operating in, orconsidering entering, the Chinese market.- Discusses the challenges faced by private equity firms in China including setting up the initialfund, fund raising, deal sourcing, deal execution, and monitoring and exit strategies- Provides key insights drawn from keen observations and knowledge of the more mature privateequity market in Western countries, analyzing the way forward for the Chinese private equityindustry- Discusses the role of renminbi-denominated funds in the development of the private equityindustry in ChinaBreaking new ground in exploring and explaining the private equity market in China, the bookoffers incredible new insight into how equity companies can thrive in the Chinese marketplace.Contents:Preface xiiiAcknowledgments xviiCHAPTER 1 Private Equity: An Introduction 1Overview 1Stages of Development of a Company 2Differences between Private Equity and Venture Capital 5Differences between Private Equity Investments and Corporate Mergers and Acquisitions 6Inventis Private Equity Model 8Structure of a Private Equity Fund 11General Partners 11Limited Partners 12Investment Committee/Advisors 12Professionals 12Private Equity Investment Process 13Planning, Fund-Raising, and Deal Sourcing 14Due Diligence 16Deal Structuring 18Portfolio Management 21Exit Strategies 24CHAPTER 2 Overview of the Political, Macroeconomic, and Financial Landscape in China 33 Overview 33Regulatory Environment 35Chinese Government Agencies and Their Relevance to Private Equity 37China’s Macroeconomic Conditions and Trends 45Macroeconomic Condition 1: Inflation 48Macroeconomic Condition 2: Widening Income Disparity 49Macroeconomic Condition 3: Accelerated Aging Population Structure 50Macroeconomic Trend 1: Increasing Urbanization 51Macroeconomic Trend 2: Westward Shift in Industrialization and Development 53 Macroeconomic Trend 3: Strong Growth in Domestic Consumption 54Macroeconomic Trend 4: Shift Toward Value-Added Industries 56China’s Financial Markets 57Key Phases of Developments in China’s Capital Markets 58China’s Equity Markets 62Foreign Listings on Chinese Exchanges 65China’s Credit Market 67Trust Financing 72China’s Futures Markets: Commodity Exchanges and Derivatives Exchanges 73Summary 75CHAPTER 3 Private Equity in China 77Overview 77Key Market Trends and Developments 79Private Minority Placement Quadrant 81Private Majority Placement Quadrant 82PIPE Minority Deals Quadrant 83Private Equity Funds in China 97Foreign-Owned Private Equity Funds (FOPE) 97Chinese-Owned Private Equity Funds (COPE) 99State-Owned Industrial Private Equity Funds (SOPE) 100Hybrid Foreign/Chinese USD and RMB Private Equity Fund (HOPE) 101Private Equity Investment Structures in China 102Red Chip Structure or Round-Trip Investment 102Onshore Structures 108Leveraged Buyouts 112Valuation Adjustment Mechanism 114VAM in China’s Private Equity Industry 114Financial Measures 116Non-Financial Redemption Measures and Stock Offerings 117Stock Offering: Expiration of VAM Agreement 119Challenges of VAM 121Exit Strategies for Private Equity Investment in China 121Initial Public Offerings 122Initial Public Offerings in Domestic Markets 125Initial Public Offerings in Overseas Markets 129Trade Sales 130Secondary Sales 130Leveraged Recapitalization/Distribution of Dividend 131Benefits of Private Equity for China 132The Case for Demutualization of Chinese Stock Exchanges through Private Equity Investments 136 CHAPTER 4 Renminbi Private Equity Fund 137Overview 137Setting Up and Fund-Raising in China 138Investing in China 142Exit Options for the RMB Fund 143The Renminbi Private Equity Fund 144Types of RMB Funds 145Domestic Limited Partners 149Private Equity Regulations and Incentives 159RMB Funds’ Edge in Investing in China 160Challenges and Opportunities for FOPE-RMB Funds 161The Future of Domestic Limited Partners 162Qualifi ed Foreign Limited Partnership Pilot Program 163Management of Hybrid Funds 166Onshore Legal Structures of RMB Funds 171Restrictions for Foreign-Invested Partnerships (FIPs) 175Treatment of FOPE-RMB Funds: Domestic or Foreign? 176Exit Options for RMB Funds 177Domestic Listings on Chinese Stock Exchanges 178Private Equity Secondary Markets in China 179China’s Domestic Limited Partners 180Impacts of RMB Convertibility on RMB Private Equity Funds 181RMB Private Equity Outbound Investments 182CHAPTER 5 Investment Opportunities for Private Equity in China 187 Overview 187Foreign Acquisition and National Security Review 189China’s Five-Year Plan for National Economic and Social Development 191 China’s Seven Emerging Strategic Industries 195Energy Saving and Environmental Protection 199Renewable Energy 205Alternative Energy Vehicles 210Next Generation Information Technology 213High-End Equipment Manufacturing 215Biotechnology 217New Materials 221Investment Opportunities in China’s Energy Sector 224Key Energy Security Concerns 224Strategies to Tackle China’s Energy Challenges 227Trends in the Oil and Gas Sector in China 230Relationship between the Energy Firms and the Government 233CHAPTER 6 Challenges and the Future of Private Equity in China 235Overview 235Fund-Raising 236Deal Sourcing 238Good Deals Are Getting Scarce, Valuations Becoming Too High 239FOPE Funds Are Competing with COPE Funds in Deal Sourcing 239Moving West 240Consolidation Opportunities 240Seeking Uniqueness from Other Funding Sources 241Due Diligence 242Reliability of Financial Statements 243Intellectual Property Rights 245Deal Structuring 247Portfolio Management 250Change from Boss Culture to Management Culture 251Communication and Timely Information 251Resistance to Change 252Fighting for Control 253Exit 255Valuation Obstacles 256China’s Private Equity Secondary Sales Market Is in the Nascent Stage 257Foreign Exchange Controls and RMB Convertibility 258Avoiding the Restriction or Seeking Local Government’s Aid 258Gradual Loosening of Capital Inflows, Especially for Private Equity 259Capital Outflows Are Strict, But Less Stringent than Inflows 259The RMB Fund Advantage—Artificial and Temporary? 260Media Reports and Public Perception 262Guanxi Management 264One Party to Gain Positive Career Prospects, the Other to Gain Justice Support 265Private Equity Firms Do Not Invest in Green Fields, So No Need to Build Complicated Relationships 266The Company Shareholders and Management Team Already Have Guanxi for Running the Business266Private Equity Firms Can Engage an External Consulting or Public Relations Firm 266FOPE-RMB Funds 268COPE-USD Funds 269Leveraged Buyouts 270Private Equity Professionals in China 271Trend 1: From Foreign to Domestic Private Equity 273Trend 2: From Investment Banks to Private Equity 274Trend 3: From Traditional Industries to Private Equity 275Trend 4: From Entrepreneurs to GPs and LPs 275Conclusion 276APPENDIX A Government Structure of the People’s Republic of China 281APPENDIX B Key Points in a Private Placement Memorandum 287APPENDIX C Geography of China 289APPENDIX D Selected Private Equity Funds in Greater China 293About the Author 299IndexOrdering:Order Online - /reports/2112831/Order by Fax - using the form belowOrder by Post - print the order form below and send toResearch and Markets,Guinness Centre,Taylors Lane,Dublin 8,Ireland.Fax Order FormTo place an order via fax simply print this form, fill in the information below and fax the completed form to 646-607-1907 (from USA) or +353-1-481-1716 (from Rest of World). If you have any questions please visit/contact/Order Information Please verify that the product information is correct.Product Format Please select the product format and quantity you require:* Shipping/Handling is only charged once per order.Contact InformationPlease enter all the information below in BLOCK CAPITALSProduct Name:Private Equity in China. Challenges and Opportunities Web Address:/reports/2112831/Office Code:OC8DIROPONQPTX QuantityHard Copy :EURO€ 116.00 + Euro €25 Shipping/HandlingTitle:MrMrsDrMissMsProf First Name:Last Name:Email Address: *Job Title:Organisation:Address:City:Postal / Zip Code:Country:Phone Number:Fax Number:* Please refrain from using free email accounts when ordering (e.g. Yahoo, Hotmail, AOL)Payment InformationPlease indicate the payment method you would like to use by selecting the appropriate box.Please fax this form to:(646) 607-1907 or (646) 964-6609 - From USA+353-1-481-1716 or +353-1-653-1571 - From Rest of WorldPay by credit card:American ExpressDiners ClubMaster CardVisa Cardholder's Name Cardholder's Signature Expiry Date Card Number CVV Number Issue Date(for Diners Club only)Pay by check:Please post the check, accompanied by this form, to:Research and Markets,Guinness Center,Taylors Lane,Dublin 8,Ireland.Pay by wire transfer:Please transfer funds to:Account number833 130 83Sort code98-53-30Swift codeULSBIE2D IBAN numberIE78ULSB98533083313083Bank Address Ulster Bank,27-35 Main Street,Blackrock,Co. Dublin,Ireland.If you have a Marketing Code please enter it below:Marketing Code:Please note that by ordering from Research and Markets you are agreeing to our Terms and Conditions at /info/terms.asp。

私募股权投最新资与被投资企业高管薪酬契约

私募股权投资与被投资企业高管薪酬契约——基于公司治理视角的研究王会娟/张然• 2013-04-16 17:20:54 来源:《管理世界》(京)2012年9期一、引言私募股权投资(Private Equity,简称PE)相对于公开发行股权而言,通常以基金的形式运作,通过非公开方式向特定投资人出售股权筹集资金,然后对非上市公司进行权益性投资,投资后进行管理使其增值,最终通过上市、并购或管理层收购及柜台市场股权转让等方式实现退出并获得收益。

PE是20世纪以来全球金融领域最成功的创新成就之一。

随着PE的快速发展,PE已经逐渐成为全球资本市场的新兴力量,私募股权投资相关研究也已经成为金融研究的重要领域。

近年来,我国越来越多的企业通过私募进行融资。

投中集团发布的《2010中国PE市场统计分析报告》显示,我国2010年全年披露PE投资案例375起,投资总额196.13亿美元,相比2009年分别上升114.0%和16.1%,无论披露投资案例数量还是投资金额,均达到历史最高。

私募股权投资过程主要包括四部分内容:融资、投资、管理、退出;涉及3个主体:投资者、PE管理者和项目资金使用者。

在这个过程中存在着双重的代理关系:第一重委托代理关系是融资时投资者和PE管理人之间的委托代理关系,即投资者(Limited Partner,LP)作为委托人,PE管理者(General Partner,GP)作为代理人。

两者通过双向选择,投资者将资金交与管理者,并成立私募股权基金。

第二重委托代理关系是投资时PE管理人和项目资金使用者之间的委托代理关系,PE管理人作为委托人,项目资金使用者作为代理人。

由于存在信息不对称,代理人可能产生两种行为倾向:道德风险和逆向选择(Jensen & Meckling,1976)。

而要降低道德风险和逆向选择发生的可能性,需要制定有效的激励和约束机制,来激励和约束PE管理人或项目资金使用者采取有利于出资人利益最大化的行为。

私募基金词汇中英文

资本(Capital)

是指基金所持有的用于投资的资本额。

附带权益(Carried Interest)

附带权益是向私募基金普通合伙人支付的,以基金利润的一定股份比例计算的一种绩效激励。

附带权益可以基于整个基金计算(取决于基金经理对整个基金全部投资组合的收益),也可以基于单个投资计算(取决于投资经理代表基金经理所进行的单个投资所取得的收益)。

安永金融服务转让定价私募股权的定义术语定义投资审核investmentreview是指对由各种不同的投资所构成的投资组合例如审核潜在的退出机会进行的调查或审核和或对即将获得的潜在投资进行的审有限合伙企业limitedpartnerships基金通常是以有限合伙的方式构建的

安永金融服务转让定价

C–私募基金的定义及概念

交易费(Transa费用。

分级支付(Waterfall Payment Structure)

是指一种费用分配方式,在此方式下,高位阶债权人比低位阶债权人优先取得本金的偿还及利润的分配。

下文中的术语可能被用于安永对私募基金转让定价的陈述中。应注意的是,这些术语的定义仅为提供背景资料,其中某些术语的定义专用于转让定价。当用于其它场合时,该术语或许会有不同的解释。此外,业内不同当事方对于某些术语的理解存在轻微的差异,我们在此提供的仅仅是较为常用的释义。

术语

定义

管理资产规模(AUM)(Assets Under Management )

锁定期(封闭期)(Lock-in Period)

是指投资于基金的资金不得赎回的期间。

管理费用(Management Expenses)

是指基金经理在管理投资基金过程中所发生的费用。

富达基金

The Best Overall Fund Management Firm (Asia Pacific ex-Japan) 2006, 2007, 2008 and 2009, Asia Pacific Survey 2006, 2007, 2008 and 2009 conducted by Thomson Extel Surveys. 2006、 2007、 2008及2009 Thomson Extel (亞太區)調查— 2006、 2007、 2008 及2009整體最傑出基金管理公司大獎—亞太區(日本除外)。 Fidelity, Fidelity International, and Fidelity International and Pyramid Logo are trademarks of FIL Limited. 「富達」及其標誌均為 FIL Limited的商標。

私募融资20问

私募融资20问1、什么是私募股权投资基金?私募股权投资基金是指通过私募形式对非上市企业进行权益性投资,投资者按照其出资份额分享投资收益,承担投资风险。

在交易实施过程中附带考虑了将来的退出机制,即通过上市、并购或管理层回购等方式,出售持股获利。

但是目前也有少部分私募股权基金投资已上市公司的股权,另外在投资方式上亦采取债权型投资方式,不过以上只占很少部分。

私募股权基金的投资对象主要是那些已经形成一定规模的,并产生稳定现金流的成熟企业,这是其与风险投资基金最大的区别。

2、私募股权投资基金有哪些类型?私募股权投资基金通常包括创业投资基金,并购投资基金,过桥基金。

创业投资基金投资于包括种子期和成长期的企业;并购投资基金投资于扩展期企业的直接投资和参与管理层收购;过桥基金则投资于过渡企业或上市前的企业。

3、什么是私募基金?私募基金,与公募基金相对,是指通过非公开的方式向特定投资者、机构与个人募集资金,按投资方和管理方协商回报进行投资理财的基金产品。

其方式基本有两种,一是基于签订委托投资合同的契约型集合投资基金,二是基于共同出资入股成立股份公司的公司型集合投资基金。

4、什么是私募融资?私募融资是指不采用公开方式,而通过私下与特定的投资人或债务人商谈,以招标等方式筹集资金,形式多样,取决于当事人之间的约定,如向银行贷款,获得风险投资等。

私募融资分为私募股权融资和私募债务融资。

私募股权融资是指融资人通过协商、招标等非社会公开方式,向特定投资人出售股权进行的融资,包括股票发行以外的各种组建企业时股权筹资和随后的增资扩股。

私募债务融资是指融资人通过协商、招标等非社会公开方式,向特定投资人出售债权进行的融资,包括债券发行以外的各种借款。

5、私募股权基金投资者对被投资企业进行尽职调查私募股权基金投资者对被投资企业进行尽职调查的内容主要包括八个方面:调查拟投资目标公司主体资格合法性。

对目标公司主体资格合法性的调查主要包括两个方面:一是其资格,即目标公司是否依法成立并合法存续,包括其成立、注册登记、股东情况、注册资本缴纳情况、年审、公司变更、有无吊销或注销等;二是其是否具备从事营业执照所登记的特定行业或经营项目的特定资质。

acca p4公式

ACCA P4考试(ACCA Professional level - Paper P4 Advanced Financial Management)涉及许多概念和技术,因此并没有一个固定的公式列表。

然而,以下是一些可能涉及到的重要概念和公式:1. **资本资产定价模型(CAPM)**:\[ r = r_f + \beta \times (r_m - r_f) \]其中,\(r\) 是资产的预期收益率,\(r_f\) 是无风险收益率,\(\beta\) 是资产的β系数,\(r_m\) 是市场预期回报率。

2. **股票评估**:- **股息折现模型(Dividend Discount Model,DDM)**:\[ P_0 = \frac{D_0 \times (1 + g)}{r - g} \]其中,\(P_0\) 是当前股票价格,\(D_0\) 是当前年度股息,\(r\) 是资本成本,\(g\) 是股息增长率。

- **市盈率(P/E)估值**:\[ P_0 = \frac{EPS_0 \times P/E}{r} \]其中,\(P_0\) 是当前股票价格,\(EPS_0\) 是每股收益,\(P/E\) 是市盈率,\(r\) 是资本成本。

3. **期权定价**:- **布莱克-斯科尔斯期权定价模型(Black-Scholes Option Pricing Model)**:\[ C = S_0 \times N(d_1) - X \times e^{-rt} \times N(d_2) \]其中,\(C\) 是期权价格,\(S_0\) 是股票当前价格,\(X\) 是执行价格,\(r\) 是无风险利率,\(t\) 是到期时间,\(d_1\) 和\(d_2\) 是相关的计算值,\(N\) 是标准正态分布函数。

4. **风险管理**:- **价值-at-Risk(VaR)**:\[ VaR = Z \times \sigma \times V \]其中,\(VaR\) 是价值-at-Risk,\(Z\) 是标准正态分布的Z分数,\(\sigma\) 是资产价格的波动率,\(V\) 是投资组合的价值。

私募股权投资基金:收益特征、收益因素和投资者策略【外文翻译】

外文翻译原文Private equity funds: Return characteristics, return drivers andconsequences for investorsMaterial Source: Journal of Financial Transformation, 2005(12), p107-117.Author: Christoph Kaserer and Christian DillerIntroductionThis article addresses two important topics concerning the performance of private equity funds. Firstly, we argue that the performance of a private equity fund should not be measured by the IRR. Instead, we offer the PME as a more meaningful performance measure. On that basis we offer some performance data for mature European private equity funds. Secondly, we analyze what factors have an impact on these returns. In our perspective, this asset class is characterized by illiquidity, stickiness, and segmentation. As a consequence, we can show that the so-called ‘money chasing deals phenomenon’explains a significant part of the variation in private equity funds’ returns. Apart from the importance of fund flows, we can also demonstrate that the skills of the management team have a significant impact on the fund’s returns. Finally we discuss the impact of these results on private equity investment strategies.DatasetOver the last decade private equity has become an important asset class for institutional investors. For several reasons its importance will further increase over the years to come. Evidently, the changing regulatory environment will have a substantial influence in this process. Actually, the widespread implementation of international accounting rules in Europe (IFRS/IAS) may increase institutional investors’ propensity to allocate more of their investments to this asset class. On the other side, however, it may be that the ongoing change in banking and insurancesupervision makes private equity investments more expensive. Whatever the shift in the regulatory environment will be, any portfolio allocation decision is ultimately driven by return expectations. Therefore, there is a widespread need to gather more information on the historical performance record of private equity investment. It is the aim of this article to make a contribution with respect to that question.The past three years have been extremely good for private equity with returns for all but the smallest funds comfortably beating the S&P 500 index. Long-term performance also looks strong, at least at first glance. From 1980 to 2001, the average fund generated higher gross returns than investing in the S&P 500, according to a study by Steve Kaplan of the University of Chicago and Antoinette Schoar of the Massachusetts Institute of Technology.The results of this article are based on a large dataset provided by the European Venture Capital and Private Equity Association (EVCA) and Thomson Venture Economics (TVE). It consists of 777 European private equity funds with vintage years from 1980 to 2003. At this point it should be noted that one cannot calculate a time weighted return for a private equity fund due to the unobservable market price. This again is a very important difference with public market funds. It is well known that the alternative to a time weighted return is a value weighted return, with the IRR being the most prominent example. However, the IRR can only be calculated if the complete cash flow history of a fund is known. For most of the funds in our dataset this is not the case, as most of them were still in operation by the year 2003. Only 95 funds in the dataset were liquidated by that year. Looking at liquidated funds only could bias our findings, as there would be an under representation of more recent vintage years in our sample2.Performance analysis of private equity funds:Some puzzling issues in return measurementWe start with presenting the results of the return distribution of our sample of European private equity funds. We have already pointed out that for an illiquid asset, i.e., an asset without an observable market price, a time weighted return cannot be calculated. The most frequent alternative used is the IRR, which is also a very common return measure used by the private equity industry. Two important drawbacks of this approach should be mentioned here [Kaserer and Diller(2004b)]. Firstly, it is well known from finance textbooks that the IRR is not a return measure but just a critical interest rate giving the maximum opportunity cost of capitalsupported by the project under analysis. In other words, if the IRR is equal to 15% then the investment in that project generates value as long as the cost of capital is not higher than 15%. From this it follows that the comparison of different investment projects on the basis of the IRR makes no sense. We will see in the following that this is not just a theoretical argument, but that there is a possible pitfall when comparing existing private equity funds on the basis of their IRRs.Secondly, institutional investors need information about the return distribution of private equity investments in order to feed their asset allocation models. By definition, all these models start from the distribution of time weighted returns. Furthermore, an asset allocation approach makes the use of a value weighted return meaningless. Hence, the IRR provides only limited information to limited partners (LP) in private equity funds. Evidently, this is also true for the multiple, another return measure used in the industry. As a multiple does not even account for the time value of money, its shortcomings are more than obvious.Now, the interesting question is whether there is any alternative to the IRR that is not affected by these caveats. Well, the answer is yes, although this alternative return measure, which is called the public market equivalent (PME), comes at a price. Basically, under this approach the simplifying assumption is made that the opportunity cost of a private equity investment is equal to the rate of return of a public market benchmark [Kaserer and Diller (2004b)]. Using this assumption, any cash flow pattern of a private equity fund could be transformed over time in an arbitrary way, as any distribution can be reinvested in the benchmark portfolio for whatever period is desired.Finally, it should be noted that there is a second alternative to the IRR used in the literature, namely the excess-IRR approach. It is defined as the IRR of a single fund minus the return on a benchmark index over the fund’s lifetime. It is presumed that in this way the return of a fund is benchmarked against a public market investment. However, given that the IRR is not an appropriate return measure, any other measure based directly on the IRR must suffer from the same problems. We will see that, in fact, a fund ranking based on the excess-IRR approach can contradict a fund ranking based on the PME approach.Evidence of the money chasing deals phenomenon It has already been argued that the paradigm of frictionless and perfectly competitive capital markets cannot be applied to the private equity market. Mainlythis is due to three specific characteristics of this market: segmentation, stickiness, and illiquidity. Convincing evidence in this regard has already been presented by Gompers and Lerner (2000), who show that capital inflows into venture funds increase the valuations of venture deals. Although it is an open question whether increased valuations are triggered by money pouring into the private equity industry or whether this money flow is triggered by improved expectations of future investment opportunities, and hence by increased valuations, Gompers and Lerner (2000) present some evidence that is more consistent with the former hypothesis. They basically argue that there is a limited number of favorable investments in the private equity industry giving way to the so-called money chasing deals phenomenon.Segmentation might be an especially important argument in this regard. Actually, private equity funds are not normally allowed to invest their committed capital in any other asset class. Often, they are even restrained from investing in segments within the private equity industry. Hence, even if the GPs would be aware of an overvaluation in the industry or in a specific part of the industry, it would be hard for them to redirect their money towards other investment projects. As a second problem, Ljungqvist and Richardson (2003) point out that capital flows between GPs and LPs tend to be sticky, i.e., it takes a longer time to adjust the capital invested in the industry to changed expectations or valuations. Those who are not familiar with private equity funds should note that such a fund typically collects capital commitments during its fundraising. Committed capital, however, is not paid into the fund immediately, but drawn down over a period of 3 to 5 years, depending on the market conditions. Now, if expectations of investors improve because of improved economic prospects, capital commitments would increase. However, it may take months or even years before the money is completely drawn down. Hence, it may well be that the time pattern of capital supply does not match the capital demand caused by attractive target companies. This mismatch may be accentuated because one can easily imagine that attractive investment opportunities are fixed in the short-run. So, if the market is not perfectly flexible and investors do not have perfectly rational foresight, it might be the case that abundant capital supply faces only a small number of promising target companies. In that situation, deal competition may be high, which would push prices higher. Alternatively, it could be that capital supply is scarce, while the number of promising target companies is high. In that case deal competition is low and entrepreneurs have to offer shares in theircompanies at rather low prices.Finally, illiquidity, i.e., the absence of a secondary market, aggravates the pressure on deal pricing. Because investors already engaged in the private equity market cannot sell their investment stakes, additional money pouring into the industry must be absorbed in the primary markets in their entirety.What is the impact of the GP’s skills?From the specific characteristics of the private equity market it follows that skills of the management team could have a more significant impact on fund returns than is the case for funds investing in public securities markets. In efficient public markets a great deal of information, public or private, is incorporated in asset prices. Hence, the ultimate outcome of an investment strategy should be almost the same, regardless of whether the investor undertakes informational activities or not. In fact, there is no clear evidence from the mutual fund performance literature that fund returns may be driven by fund managers’ skills, like selection or timing abilities.We would expect fund management skills to be much more important in private equity funds than in public mutual funds. knowledge about investment opportunities in the private equity industry may be distributed very unequally and, due to the lack of a secondary market for these assets, it may take a long time until this information is disseminated. Now, if there is a systematic difference in knowledge about private equity investment opportunities among different management teams, we would expect that good deals are concentrated in a small number of fund portfolios, i.e., the portfolios of the skilled management teams. The first consequence of this idea is that deal returns should have a much more skewed distribution than public stock market prices. In fact, private equity funds’ returns distributions are heavily skewed. Finally, if skills are unequally distributed at a given point in time, it may well be that their distribution is not independent over time. Hence, we would expect that returns of subsequent funds run by the same management team are correlated. This gives way to the so called persistence phenomenon in private equity funds’ returns.ConclusionIn this article a comprehensive dataset of European private equity funds was analyzed. In the first step we analyzed the performance of a sample of mature funds. Instead of using the widespread IRR as a performance measure, we introduced the PME-approach. As one would expect from theoretical considerations, we were ableto show that benchmarking on an IRR-basis could lead to substantially distorted results. Moreover, even a ranking of different funds on basis of the IRR could generate pitfalls. Hence, LPs should not benchmark the track record of a GP on the basis of IRR; they should instead use the PME.The main focus of this article, however, was to give new insights into the determinants of funds’ returns. For that purpose we started from the presumption that the private equity asset class is characterized by illiquidity, stickiness, and segmentation. It has been argued in theoretical and empirical papers that these characteristics can cause an over- or undershooting of private equity asset prices, at least in the short-run. We document that funds closed in periods where overshooting is less present have significantly higher returns than funds closed during these periods. Hence, the so-called money chasing deals phenomenon is an important factor in explaining private equity returns. From an investment perspective, this result has two implications. Firstly, a private equity investor should implement a contrarian investment strategy, in the sense that he should invest when overshooting does not occur. Secondly, diversifying funds over different vintage years as well as different fund types seems to be very important for reducing the risk of being exposed to the money chasing deal phenomenon.Apart from the importance of fund flows the article also shows that GPs’ skills have a significant impact on fund returns. More precisely, returns of subsequent funds run by the same management team are correlated. So, we present evidence in favor of the persistence phenomenon governing the returns of European private equity funds. From an investment perspective it is, however, rather difficult to base an investment strategy on this result. Although the result is a justification of why track records are very important for inferring the abilities of a management team, it is of little help as this information is almost public. Nevertheless, the result indicates that the selection of a management team is a key success factor for private equity investments.Due to the specific characteristics of the private equity asset class — i.e., the illiquidity of the investment, the stickiness of fund flows, the restricted number of target companies, and the segmentation from other asset classes — the market may be far from being frictionless and perfectly competitive, at least in the short-run. Overall, the lack of an organized secondary market seems to be the crucial factor.译文私募股权投资基金:收益特征、收益因素和投资者策略资料来源:金融转型[J]. 2006(5),第5期,p107-117.作者:克里斯多夫·卡瑟勒尔,克里斯汀·第勒尔引言本文以论述私募股权投资基金两种重要的运作业绩表现为主题。

私募股权投资基金基础知识考点精析

私募股权投资基金基础知识全称“私人股权投资基金”(Private Equity Fund),指主要投资于“私人股权”(Private Equity),即非公开发行和交易股权的投资基金。

包括非上市企业和上市企业非公开发行和交易的普通股、可转换为普通股的优先股和可转换债券。

在国际市场上,股权投资基金既有非公开募集(私募)的。

也有公开募集(公募)的.在我国,只能以非公开方式募集。

准确含义应为“私募类私人股权投资基金”.与货币市场基金、固定收益证券等“低风险、低期望收益"资产相比,股权投资基金在资产配置中具有“高风险,高期望收益”特点。

股权投资基金起源于美国.1946年成立的美国研究与发展公司(ARD)全球第一家公司形式运作的创业投资基金。

早期主要以创业投资基金形式存在.1953年美国小企业管理局(SBA)成立,1958年设立“小企业投资公司计划”(SBIC),以低息贷款和融资担保的形式鼓励小企业投资公司,以增加对小企业的股权投资。

1973年美国创业投资协会(NVCA)成立,标志创业投资成为专门行业。

20世纪50~70年代,主要投资于中小成长型企业,是经典的狭义创投基金。

70年代后,开始拓展到对大型成熟企业的并购投资,狭义创投发展到广义.1976年KKR成立,专业化运作并购投资基金,经典的狭义的私人股权投资基金.特别是80年代美国第四次并购浪潮,催生了黑石(1985)、凯雷(1987)、和德太(1992)等著名并购基金管理机构。

过去,并购基金管理机构作为NVCA会员享受行业服务并接受行业自律。

2007年,KKR、黑石、凯雷、德太等脱离NVCA,发起设立服务于狭义股权投资基金管理机构的美国私人股权投资协会(PEC)。

狭义上的股权投资基金特指并购投资基金,但后来的并购投资基金管理机构也兼做创业投资,同时市场上出现了主要从事定向增发股票投资的股权投资基金、不动产投资基金等新的股权投资基金品种,一般广义股权投资基金概念。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

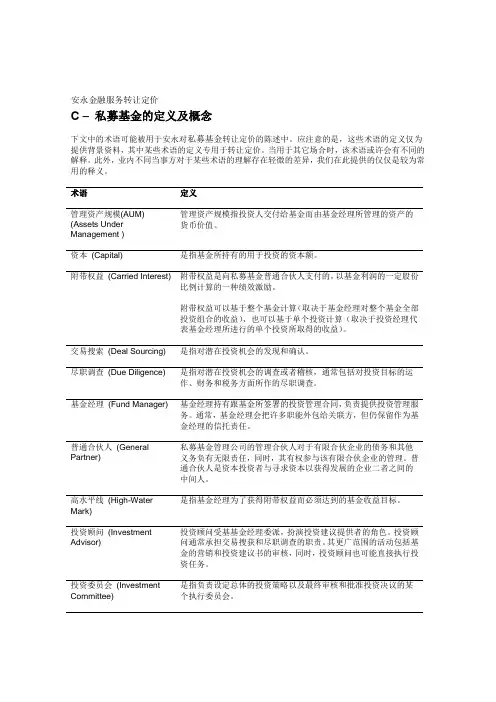

Fig. 1: 10 Largest Funds to Hold a Final Close in Q4 2013Fig. 2: Breakdown of Q4 2013 Fundraising by Type and GeographyFig. 3: Quarterly Global Fundraising, Q1 2009 - Q4 201350100150200250300350400Q 1 2009Q 2 2009Q 3 2009Q 4 2009Q 1 2010Q 2 2010Q 3 2010Q 4 2010Q 1 2011Q 2 2011Q 3 2011Q 4 2011Q 1 2012Q 2 2012Q 3 2012Q 4 2012Q 1 2013Q 2 2013Q 3 2013Q 4 2013No. of FundsAggregate CapitalRaised ($bn)Fig. 4: Geographic Split of Funds Closed in Q4 2013102030405060708090100North AmericaEuropeAsiaRest of WorldNo. of Funds AggregateCapitalRaised ($bn)2013 FundraisingNorth America-focused private equity funds raised $266bn in 2013 compared with $200bn throughout 2012.Capital raised for funds targeting regions outside of Europe and North America totalled $61bn in 2013, down from $86bn the year before.Carlyle Partners VI was the largest fund to close in the Q4 2013, having raised $13bn, and it accounts for almost 60% of capital secured by North America-focused funds closed in the quarter.CVC European Partners VI was the largest fund to close throughout2013, raising €10.5bn ($14bn) in capital commitments.Fund FocusFundraising Market at PresentA record 2,084 private equity funds are in market as of January 2014, seeking to raise an aggregate $750bn. This compares to the 1,949 funds seeking $797bn in commitments as of the start of 2013.A further $33bn was raised through 147 private equity funds holding interim closes throughout Q4 2013.Fig. 5: Top 10 Largest Funds to Hold a Final Close in 2013Fig. 6: Breakdown of 2013 Fundraising by Type and GeographyFig. 7: Funds on the Road over Time, January 2008 - January 20145001000150020002500J a n -0J a n -0J a n -1J a n -1J a n -1J a n 1A p r -1J u l -1O c t -1J a n -1No. of Funds on RoadAggregate Target ($bn)Fig. 8: Average Time Taken for Funds to Acheive a Final Close byYear of Fund Close2468101214161820Year of Final CloseA v e r a g e N o . o f M o n t h s i n M a r k e tPreqin provides information, products and services to private equity firms, funds of funds, investors, placement agents, law firms, advisors and other professionals across the following areas:• Fund Performance • Fundraising • Buyout Deals• Venture Capital Deals • Fund Manager Profiles • Investor Profiles• Fund Terms and Conditions• Compensation and Employment Available as:• Online Database Services • Hard Copy Publications • Tailored Data DownloadsFor more information and to register for a demo, please visit:/privateequityPreqin’s new Research Center Premium provides users with access to complimentary live data, league tables and research. For further information and to signup, please visit:/researchalternative assets. intelligent data.Fig. 11: Regions Investors View as Presenting the Best Opportunities in the Current Financial Climate, Preqin Investor Survey Q4 20130%10%20%30%40%50%60%70%P r o p o r t i o n o f R e s p o n d e n t sCurrent Investor AttitudesNinety percent of investors plan to maintain or increase their allocations to private equity in 2014, according to Preqin’s survey of investors undertaken in December 2013.Fifty-nine percent of investors feel that Europe presents the best investment opportunities in the current fi nancial climate.For more information, please contact press@New York : One Grand Central Place, 60 E 42nd Street, Suite 630, NewYork NY 10165 Tel: +1 212 350 0100London: Equitable House, 47 King William Street, London EC4R 9AF Tel: +44 (0)20 7645 8888Singapore: One Finlayson Green, #11-02, Singapore, 049246 Tel: +65 6305 2200 San Francisco: 580 California Street, Suite 1638, San Francisco, CA 94104 Tel: +1 415 635 3580Fig. 10: Investors’ Intentions for Their Private Equity Allocations, Preqin Investor Survey Q4 20130%10%20%30%40%50%60%70%80%90%100%Next 12 MonthsLonger TermDecrease AllocationMaintain AllocationIncrease AllocationP r o p o r t i o n o f R e s p o n d e n t sFig. 9: Annual Fundraising by Region, 2007 - 20131002003004005006007008002007200820092010201120122013Rest of WorldAsiaEurope North AmericaA g g r e g a t e C a p i t a l R a i s e d ($b n )Year of Final Close。