CFA一级考试历年真题精选及答案0519-6

cfa一级考试模拟试题及答案

cfa一级考试模拟试题及答案CFA一级考试模拟试题及答案1. 以下哪项不是金融市场的基本功能?A. 资源配置B. 风险管理C. 价格发现D. 娱乐消遣答案:D2. 在CFA考试中,以下哪项不属于投资组合管理的三个主要步骤?A. 资产配置B. 证券选择C. 风险管理D. 市场预测答案:D3. 根据现代投资组合理论,以下哪项是影响投资组合预期收益的唯一因素?A. 无风险利率B. 市场风险溢价C. 投资组合的贝塔系数D. 投资组合的波动性答案:C4. 在评估固定收益证券时,以下哪项不是影响债券价格的主要因素?A. 利率水平B. 信用评级C. 债券的到期时间D. 股票市场的波动性答案:D5. 以下哪项不是有效市场假说(EMH)的三种形式之一?A. 弱式有效市场B. 半强式有效市场C. 强式有效市场D. 超级有效市场答案:D6. 在计算股票的自由现金流至企业(FCFF)时,以下哪项不应从营业利润中扣除?A. 折旧和摊销B. 营运资本的变动C. 资本支出D. 净债务的变动答案:C7. 下列关于财务报表分析的说法中,哪项是不正确的?A. 横向分析可以帮助识别趋势B. 纵向分析可以揭示财务比率的变化C. 比率分析可以用于评估公司的财务状况D. 现金流量表是评估公司盈利质量的唯一工具答案:D8. 在评估一个公司的财务健康状况时,以下哪项财务比率不是流动性比率?A. 流动比率B. 速动比率C. 利息保障倍数D. 现金比率答案:C9. 在国际投资中,以下哪项不是影响汇率变动的主要因素?A. 贸易平衡B. 利率差异C. 政治稳定性D. 黄金价格答案:D10. 在CFA考试中,以下哪项不是宏观经济分析的组成部分?A. 经济增长B. 通货膨胀C. 货币政策D. 公司治理答案:D请注意,以上提供的模拟试题及答案仅供参考,实际CFA一级考试的题目和内容可能会有所不同。

考生应以官方提供的教材和学习资料为准备考试的主要依据。

cfa一级考试真题及答案详解

cfa一级考试真题及答案详解CFA一级考试真题及答案详解1. 问题:在评估一个公司的财务状况时,以下哪项指标最能反映其偿债能力?A) 流动比率B) 速动比率C) 资产负债率D) 股东权益比率答案:C) 资产负债率解析:资产负债率是指公司总负债与总资产的比率,它反映了公司资产中有多少比例是通过借债获得的。

这个比率越高,说明公司的财务杠杆越大,偿债能力越弱。

因此,资产负债率是反映公司偿债能力的重要指标。

2. 问题:在进行股票投资分析时,以下哪项因素是影响股票价格的宏观经济因素?A) 公司盈利能力B) 利率水平C) 行业竞争状况D) 公司管理层能力答案:B) 利率水平解析:宏观经济因素包括利率水平、通货膨胀率、经济增长率等,这些因素会影响整个经济环境,进而影响股票市场。

利率水平是宏观经济因素之一,它会影响公司的融资成本和投资者的预期回报,从而对股票价格产生影响。

3. 问题:在固定收益投资中,以下哪项因素会导致债券价格上升?A) 市场利率上升B) 市场利率下降C) 债券信用评级下降D) 债券到期时间延长答案:B) 市场利率下降解析:在固定收益投资中,债券价格与市场利率呈反向关系。

当市场利率下降时,新发行的债券的票息率会低于市场上已有的债券,因此已有债券的相对吸引力增加,导致其价格上升。

4. 问题:在投资组合管理中,以下哪项策略是用于降低非系统性风险的?A) 资产配置B) 多元化投资C) 市场时机选择D) 杠杆投资答案:B) 多元化投资解析:非系统性风险是指特定于某个公司或行业的投资风险,这种风险可以通过多元化投资来降低。

通过投资于多个不同公司或行业的资产,可以减少单一资产或行业波动对整个投资组合的影响。

5. 问题:在金融衍生品中,以下哪项产品允许投资者在未来以特定价格买入或卖出资产?A) 期货合约B) 远期合约C) 期权合约D) 掉期合约答案:C) 期权合约解析:期权合约是一种金融衍生品,它赋予持有者在未来某个时间以特定价格买入或卖出资产的权利,但不是义务。

cfa一级答案昨天考试

cfa一级答案昨天考试1. 在CFA一级考试中,关于投资组合管理的以下哪项陈述是正确的?A. 投资组合管理的主要目标是最大化投资回报。

B. 投资组合管理的目的是平衡风险和回报。

C. 投资组合管理只关注个别资产的表现。

D. 投资组合管理不考虑市场波动。

正确答案是B。

投资组合管理的目的是平衡风险和回报,以实现投资者的财务目标。

2. 在CFA一级考试中,以下哪项是有效市场假说(EMH)的核心原则?A. 市场价格总是正确的。

B. 所有信息都已反映在股票价格中。

C. 投资者总是理性的。

D. 市场参与者可以无限制地获取所有信息。

正确答案是B。

有效市场假说的核心原则是所有信息都已反映在股票价格中。

3. 在CFA一级考试中,关于固定收益证券的以下哪项陈述是错误的?A. 固定收益证券的收益通常比股票稳定。

B. 固定收益证券的价格对利率变化敏感。

C. 固定收益证券的信用风险通常高于股票。

D. 固定收益证券的到期收益率等于其票面利率。

正确答案是D。

固定收益证券的到期收益率不一定等于其票面利率,它受到多种因素的影响,如市场利率、债券的信用等级等。

4. 在CFA一级考试中,以下哪项不是财务报表分析的目的?A. 评估公司的盈利能力。

B. 识别公司的财务风险。

C. 预测公司未来的财务表现。

D. 比较不同公司的市场份额。

正确答案是D。

财务报表分析的目的不包括比较不同公司的市场份额,而是关注于评估公司的盈利能力、识别财务风险以及预测未来的财务表现。

5. 在CFA一级考试中,以下哪项是宏观经济分析的关键组成部分?A. 国内生产总值(GDP)。

B. 通货膨胀率。

C. 失业率。

D. 所有上述因素。

正确答案是D。

宏观经济分析的关键组成部分包括国内生产总值(GDP)、通货膨胀率和失业率等。

结束语:以上是对CFA一级考试中一些关键概念的简要概述。

希望这些信息能帮助考生更好地准备考试。

(完整版)CFA一级模考试题及答案.doc

(完整版)CFA一级模考试题及答案.docANSWERS FOR MOCK EXAM 1 (MORNING SESSION)1. D.Although Terence has passed Level III, he has not yet received his charter andcannot use the CFA designation. The description provided in the cover letterproperly describes his situation.2. C.Amy must take both actions-notifying her immediate supervisor and delivering acopy of the Code and Standards.3. D.4. C.Members may undertake an independent practice that could result in compensationor other benefit in competition with their employer provided they obtain writtenconsent from both their employer and the party for whom they undertakeindependent practice.5. C.To maintain his objectivity, Keith should pay his own hotel bill. Because the itineraryrequired charter flights due to a lack of commercial transportation, A& K Limited can appropriately provide them.6. C. Under ERISA, fiduciaries must act solely in the interest of, and for the exclusivepurpose of benefiting, the plan participants and beneficiaries.7. B. Daniel must give priority to transactions for clients and employers over transactionsfor his children.8. A.To avoid violating the standards, members cannot trade until the member's clients andemployers have had an adequate opportunity to act on the recommendation.9. C.The requirements of Standard IV (B.5) are not intended to prevent Lambert fromcooperating with an investigation by AIMR's Professional Conduct Program.10. B.Vivian should disclose to her clients and prospects her husband's holdings in DoubleLimited because this matter could be expected to impair her ability to makeunbiased and objective recommendations.11. B.12. B.Accruals accounting is required.13. C.Standard I(B) Fundamental Responsibilities. Prohibition against participating orassisting in illegal and ethical violations. If Roberts suspects someone isplanning or engaging in illegal activities, he should: (1) determine the legalityof the activities, (2) disassociate himself from the illegal or unethical activity, and(3) urge his firm to attempt to persuade the perpetrator to stop. The AIMRStandards of Professional Conduct do not require that Roberts report suchactivities to the authorities, but the law might.14. C.Standard III(C) Disclosure of Conflicts to Employer. Gloria should disclose to heremployer all matters that could reasonably be expected to interfere with herability to make unbiased and objective recommendations. Her service as atrustee of the Well Limited Foundation for Heart Research is most likely to beconsidered a conflict of interest with her responsibility to her employer.15. C.Standard III (E) Responsibilities of Supervisors. Paul may delegate supervisory duties,but such delegation does not relieve him of his supervisory responsibility.16. A.Standard IV (B.3) Fair Dealing. Johnson violated the standard on fair dealingbecause he did not deal fairly and objectively with all clients and prospectswhen disseminating investment recommendations. Instead, he showedfavoritism to his best clients. In disseminating investment recommendations,Johnson should consider making the information available to clients based ontheir interest and suitability. A change of recommendation from buy to sell or sellto buy is generally material.17. D.Standard IV(B.5) Preservation of Confidentiality. ChoiceB is false because thisAnswers for Mock Exam 1 (Morning Session) (Rev. 1) 1standard prohibits members from executing settlement agreements that preventmembers from providing information in an investigation by AIMR's ProfessionalConduct Program (PCP). Choice C is false because a person cannot withholdinformation during PCP investigations. Choice A is false because if a memberreceives information due to his or her special relationship with the clientindicating illegal behavior on the past of the client, the member may not have anobligation to inform the appropriate authorities.18. A.Standard IV(B.6) Prohibition against Misrepresentation. Members are not permitted tomake any assurances or guarantees about any investment, except tocommunicate accurate information. The statement that investment grade bondshave less default risk than junk bonds is an accurate statement.19. /doc/196717446.html,e BGN node: n = 10; i = 12 PMT = 1,000, compute FV = 19.654.5820. B.The present value of a perpetuity is PV = A/r = 500/0.1 = $5,000.21. B.i = 6/12 = 0.5; n = 10x12 = 120; PV = 40,000 Compute PMT22. A.23. A.A binomial random variable has an expected value or mean equal to np andvariance equal to np(1-p).Mean = 12(0.5) = 6; variance (12)(0.5)(1-0.5) = 324. D.25. B.Rbt-1 = In St+1 /St = (1+RL1-1) = In (40/25) = 0.47. Thus, 47% is thecontinuously computed return for the one-year holding period.26. B.Choice A describes cross-sectional data.Choice B describes time-series data.27. D.The dependent variable, Y, is equal to the intercept, b0, plus a slope coefficient, b1,times the independent, X, plus an error term, ε.28. C.I N FV Compute PV10 1 100 90.9110 2 150 123.9710 3 200 150.2610 4 250 170.75Total 535.8929. B.Step 1: Solve for the PV of the 5 payments of 3,000 to be received in years 3through 7.n = 5; i = 10; PMT = 3,000; compute PV =11,372.3611,372.36 falls one year before the first payment, or in year 2.Step 2: Find the present value of 11,372.36 that is two years in the future. n= 2; i = 10; FV =11,372.36; compute PV =9,398.64 or 9,399(rounded).30. D.From weakest to strongest, the ordering of measurements scales is nominal, ordinal,interval, and ratio.31. B.An interval is a set of return values within which an observation not falls.32. C.Step 1. Calculate the mean monthly return = 2% + (- 4%) + 1% + 5% = 4%M = 1%Step 2.Calculate the population standard deviation:([(2% - 1%) 2 + (-4% -1%) 2 +(1% - 1%) 2 +(5% -1%)2 ]N)1/ 2=3.24%Step 3. Calculate the sample standard deviation: ([(2% - 1%)2 + (-4% -1%) 2+ (1% - 1%) 2+ (5% - l%) 2 ])/n - 1) 1/ 2 = 3. 74%33. B.According to Chebyshev's inequality, the proportion of the observations within 2,which is k, standard deviations of the mean is at least 1 -(l/k) 2 = 1-(1/2 2) =0.75 or 75%.34. A.The probability is 30/200 = 0.15.35. /doc/196717446.html,ing the addition rule for probabilities, P (analyst or positive) =P(analyst) + Answers for Mock Exam 1 (Morning Session) (Rev. 1) 2P(positive) - P(analyst and positive)P (A or positive) = 130/200 + 140/200 - (100/130) = 0.58 or 58%36. B.Savings increases to hold interest rates constant. This means aggregate demandchanges little.37. C.The empirical evidence on the relationship between budget deficits and interest ratesis mixed.Few studies show a significant positive short-term link between budgetdeficits and real interest rates.38. B.Expansion = 1 / reserve requirement = 1/0.25 = 4(4)(150) = 60039. C.People realize this leads to inflation in the long run, so they reduce their moneyholdings. Output rises because the increase is unexpected.40. C.In purely competitive markets, there are a large number of dependent firms.41. D.42. D.43. C.44. C.45. D.Choice A: Accrual accounting does not require the receipt of cash for assurance ofpayment to exist.Choice C and D: These relate only to the condition of completion of theearnings process.46. D.47.ADemand for currency decreases when real interest rates decrease because ofdecreased capital flows.48.CForeign exchange quotations can be expressed on a direct basis -the home currencyprice of another currency — or an indirect basis-- the foreign currency price ofthe home currency.49.C F/S= (1 + r D )/(l + r F) where rates are listed as DC/FCF = (1.3/1.25)(0.4) = 0.41650. C.Direct method:Net income 1000Depreciation 70Goodwill 30Change in accounts receivable 25Change in inventory (35)Change in accounts payable 30Change in wages payable 15Operating cash flows 113551. B. Purchase equipment (200)Sell truck 25Investing cash flows (175)52. D. Sale of common stock 100Issuance of bonds 20Financing cash flows 12053. D.A common size balance sheet expresses all balance sheet accounts as apercentage of total assets.54. C. Original shares of common stock = 1,000,000(12) = 12,000,000Stock dividend = 200,000(12) = 2,400,000New shares of common stock = 200,000(3) = 600,000Total shares of common stock = 15,000,000/12= 1,250,000 Stock dividends are assumed to have been outstanding since the beginningof the year.55. D.Inventory turnover, defined as COGS/Average inventory, if often meaningless forLIFO companies due to the mismatching of costs. The numerator representscurrent costs, whereas the denominator reports outdatedhistorical costs. Thus,the turnover ratio under LIFO will, when prices decrease, trend lower becauseof small COGS and larger inventory. Net profit margin, defined as EA T/Sales,is higher during periods of decreasing profits for LIFO companies. LIFO leadsto a smaller COGS, which reduces EAT, without affecting sales.56. A.In this situation, LIFO results in lower cost of goods sold because it uses the morerecent and lower costs than LIFO. LIFO results in lower cash flows becausethe cash on income taxes is a percentage(the marginal tax rate) of thedifference in inventory values. Thus, with LIFO:Sales-COGS(smaller)EBT (larger)-Taxes (larger) Because taxes paid out are a cash outflow.EAT (larger) If taxes are larger, then cash flow ill be smaller.57. D.COGSFIFO = COGSLIFO - (Ending LIFO Reserve - Beginning LIFO Reserve)COGSFIFO = $250,000 - ($8,000-$5,000) = $247,00058. /doc/196717446.html,pared to expensing, capitalizing results in higher profitability in early years and lower profitability in later years.59. C.60. D.The present value of the minimum lease payments equals or exceeds 90 percent ofthe value of the fair value of the leased property.61. B.Capital lease affects on the income statement:Step1: Calculate the depreciation charge: ($3,500,000-$450,000)/10 = $305,000Step2: Calculate the interest expense: $3,500,000(0.15) = $525,000Total expense: $305,000+$525,000 = $830,00062. A.63. C.64. A.65. B.66. D.67. B.Dealer-markets are price-driven markets.68. D.69. C.70. C.P/E = Dividend payout ratio/(k-g)Dividend payout ratio = 1 - retention ratio = 1-0.2 = 0.8P/E = 0.8(0.15-0.08) =5.671. B.k = D1/P0+g = $4/$25+0.09 = 0.2572. A.Step1: Calculate the ending index value = ($100)(5) = $500Step2: Calculate the expected return.E(R1) = [Dividends + (Ending value - Beginning value)]/(Beginning value)=[40+(500-490)]/$490 = 0.1 or 10%73. D.The critical factors determining the franchise P/E are the difference between theexpected return on the new opportunities (R) and the current cost of capital (k)and the size of these growth opportunities relative to the firm's current size.74. A.75. C.76. D The completed contract method less net income in the periods beforeconstruction is completed, but not at the end of the contract, than using thepercentage-of-completion method. This is because the completed contractmethod recognizes revenue and expense only when the contract has beencompleted.77. A. Net income 1,000Adjustment for non-cash andnon-operating itemsDepreciation 100Deferred taxes (increase) 40Profit from sale ofequipment (10)Adjustment for workingcapital items:Accounts receivable (decrease) (120)Inventory (increase) (40)Accounts payable (increase) (20)Wages payable (decrease) (10)Cash flow from operations 94078. D79.A When inventory and accounts receivable increase, this is a use of cash (cashoutflow); when assets decrease, this is a source (cash inflow). When accountspayable increase, this is a source of cash (cash inflow); when liabilities decrease,this is a use (cash outflow).80.BCash conversion cycle = receivables days + inventory processing days -payables payment period.Receivables days = 365/receivabies turnover = 365/30 = 12.17 days.Inventory processing days = 365/inventory turnover = 365/15 = 24.33 days.Payables payment period = 365/payabIes turnover = 365/20 = 18.25days.Cash collection cycle = 12.17 + 24.33 –18.25 = 18.25 days.81.BChoice A: Buying fixed assets on credit does not affect current assets butincreases current liabilities. Therefore, the current ratio falls.Choice B: Buying inventory on account increases both inventory and accountspayable. Because the current ratio started off below I, the ratio will increase.Choice C: Selling marketable securities for cash does not affect the amount ofcurrent assets and leaves the current ratio unaffected,Choice D : Paying off accounts payable from cash lowers current assetsand current liabilities by the same amount. Because the current ratio startedoff below 1, the ratio will fall.82.D ROE = Profit margin x Total asset turnover x financial leverageROE = (0.3)(2.1)(0.5)= 0.315 or 31.5%83.AROE = [(S/A)(EBIT/S) - (I/A)](A/EQ)(I - t)ROE = [(2.5)(0.2) - (0.08)](1.2)(0.6) = 0.30 or 30%84. A85.B EPS = ($180,000 - $4,000) / 50,000 = $3.52 per share86. B87. D88.CThese relationships are reversed in the latter years of the asset's life if the firm'scapital expenditures decline.89. D90. C.91. C.92. D.93. D.Absolute yield spread = Yield on Bond A - Yield on Bond B = 10%-7% = 3%94. B.Relative yield spread = (Yield on Bond A - Yield on BondB)/(Yield on BondB)=(10%-7%)/7% = 0.43 = 43%95. B.Yield ratio = (Yield on Bond A)/(Yield on Bond B) = 6%/7% = 1.4396. B.Current yield = (Annual dollar coupon interest)/(Price of the bond) = 8/130 =0.0625 or 6.25%97. A.When the stock's price (S) - the strike price (X) is positive, a call option isin-the-money. 25-X = 8 so X = 17.98. A.99. A.The writer of put loss = $60-premiun$5 = $55 Thewriter of call gets a maximum gain of $8100. A.101. C.102. D.103. A.104. D.105. B.106. D.107. C.108. A.Securities that fall on the SML are properly valued.109. A.110. A.If a stock's beta were equal to 1, an investor would be expected to get the marketrate of return from buying the stock. E(R) = 5%+1(10%-5%) = 10% 111. D112. D113. C114.BPerfect positive correlation (r = + 1) of the returns of two assets offers no risk reduction, whereas perfect negative correlation (r = -1) offers the greatestrisk reduction.115.BPortfolio A does not lie on the efficient frontier because it has a lower return than Portfolio B but has greater risk. Portfolio D does not lie on the efficient frontier because it has higher risk than Portfolio C but has the same return. 116. C.117.DChoice A: Unsystematic risk is diversifiable risk.Choice B: Systematic risk is undiversifiable risk.Choice C: Total risk= Systematic risk+ Unsystematic risk.118. C119.DCAPM specifies the factor (market risk) but APT doesnot.120. A。

cfa一级考试题库答案

cfa一级考试题库答案

1. 以下哪项是CFA一级考试中关于财务报表分析的主要内容?

A. 理解财务报表的结构和内容

B. 识别和分析财务报表中的异常情况

C. 预测未来财务报表的趋势

D. 所有以上选项

正确答案:D. 所有以上选项

2. 在CFA一级考试中,关于投资组合管理的哪项说法是正确的?

A. 投资组合管理只关注资产配置

B. 投资组合管理包括资产配置、选择证券和风险管理

C. 投资组合管理与市场时机无关

D. 投资组合管理只涉及股票投资

正确答案:B. 投资组合管理包括资产配置、选择证券和风险管理

3. 在CFA一级考试中,关于固定收益证券的以下哪项说法是错误的?

A. 固定收益证券的利息支付是固定的

B. 固定收益证券的价格与市场利率呈负相关

C. 固定收益证券的风险高于股票

D. 固定收益证券的到期收益率是固定的

正确答案:C. 固定收益证券的风险高于股票

4. 在CFA一级考试中,关于衍生品的以下哪项说法是正确的?

A. 衍生品的价值完全独立于标的资产

B. 衍生品可以用来对冲风险

C. 衍生品只能用于投机

D. 衍生品不能用于投资组合管理

正确答案:B. 衍生品可以用来对冲风险

5. 在CFA一级考试中,关于经济学的以下哪项说法是错误的?

A. 经济学研究资源的分配和利用

B. 宏观经济学关注整体经济的运行

C. 微观经济学研究个体经济单位的行为

D. 经济学只关注市场均衡状态

正确答案:D. 经济学只关注市场均衡状态

结束语:以上是CFA一级考试题库中的一些典型题目及其答案,希望能够帮助考生更好地准备考试。

2023年CFA一级考试真题与解析

2023年CFA一级考试真题与解析2023年CFA一级考试已经圆满结束,本文将为大家带来这次考试的真题与解析,帮助考生更好地了解考试内容和备考要点。

第一部分:道德与职业准则第一题:伦理与个人行为题目:小林是一位注册投资顾问,他的新客户Mr. Smith希望通过投资来增加自己的财富。

小林了解到Mr. Smith退休计划的绝大部分资金已经投资在一个过度集中的地方,并且其他重要的因素也没有得到考虑。

这种情况下,小林应该如何处理?解析:根据CFA协会的道德与职业准则,投资顾问有责任了解客户的财务情况和投资目标,并提供客观、全面的建议。

在这种情况下,小林应该提醒客户他所面临的风险,并提出分散投资、考虑其他因素的建议,以保护客户的财务利益。

第二题:外部投资者关系题目:公司XYZ近期在一家领先的社交媒体平台上展开一项新产品的在线推广活动。

按照与CFA协会的协议,公司XYZ应如何披露这个推广活动?解析:根据CFA协会的投资者关系准则,公司在展开新产品的推广活动时,需要向投资者提供及时、准确的信息。

公司XYZ应在适当的时候披露这个推广活动,提供项目的重要信息以及潜在的风险和影响,以便投资者做出明智的决策。

第二部分:投资工具第三题:权益估值模型题目:一个分析师使用股利贴现模型(Dividend Discount Model,DDM)来估算一家公司的股票价格。

该公司估计未来一年的股息为2美元,预计增长率为5%,使用12%的折现率。

根据这些数据,该公司的股票价格为多少?解析:根据股利贴现模型,股票价格等于未来股息现值的总和。

在这个例子中,未来一年的股息为2美元,增长率为5%,折现率为12%。

根据计算,未来股息的现值为2/(0.12-0.05)=33.33美元。

因此,该公司的股票价格为33.33美元。

第四题:债券估值题目:一家公司发行了一笔面值为1000美元、票面利率为6%、到期日为5年的债券。

目前市场利率为8%。

根据这些信息,该债券的市场价格是多少?解析:债券的市场价格等于未来现金流的现值之和。

cfa一级考试真题及答案详解

cfa一级考试真题及答案详解CFA一级考试真题及答案详解1. 问题:在计算投资组合的预期收益率时,以下哪种资产的预期收益率对投资组合的预期收益率影响最大?A. 资产A,占投资组合的10%B. 资产B,占投资组合的20%C. 资产C,占投资组合的30%D. 资产D,占投资组合的40%答案:D解析:投资组合的预期收益率是通过加权平均各个资产的预期收益率来计算的。

权重越大的资产对投资组合的预期收益率影响越大。

因此,资产D作为权重最大的资产,其预期收益率对投资组合的预期收益率影响最大。

2. 问题:以下哪种金融工具最适合用于对冲利率风险?A. 股票B. 债券C. 利率互换D. 货币期权答案:C解析:利率互换是一种利率衍生品,允许两方交换利率支付流。

这种金融工具可以用来对冲利率风险,因为它允许投资者锁定未来的利率水平,从而减少利率变动对投资组合价值的影响。

3. 问题:在进行财务分析时,以下哪种比率最能反映公司的流动性状况?A. 流动比率B. 速动比率C. 资产负债率D. 权益乘数答案:A解析:流动比率是衡量公司短期偿债能力的指标,它通过比较公司的流动资产和流动负债来计算。

一个较高的流动比率表明公司有足够的流动资产来覆盖其短期负债,因此最能反映公司的流动性状况。

4. 问题:在计算经济增加值(EVA)时,以下哪个因素不是必要的?A. 公司的税后营业利润B. 公司的资本成本C. 公司的总资产D. 公司的权益乘数答案:D解析:经济增加值(EVA)是通过从公司的税后营业利润中减去资本成本来计算的。

资本成本反映了公司资本的机会成本,而权益乘数并不是计算EVA所必需的。

EVA的计算公式为:EVA = NOPAT - (WACC * 资本投入)。

结束语:通过以上对CFA一级考试真题的分析,可以看出,理解各个金融概念和工具的基本原理对于通过考试至关重要。

希望这些真题及答案详解能够帮助考生更好地准备考试,提高通过率。

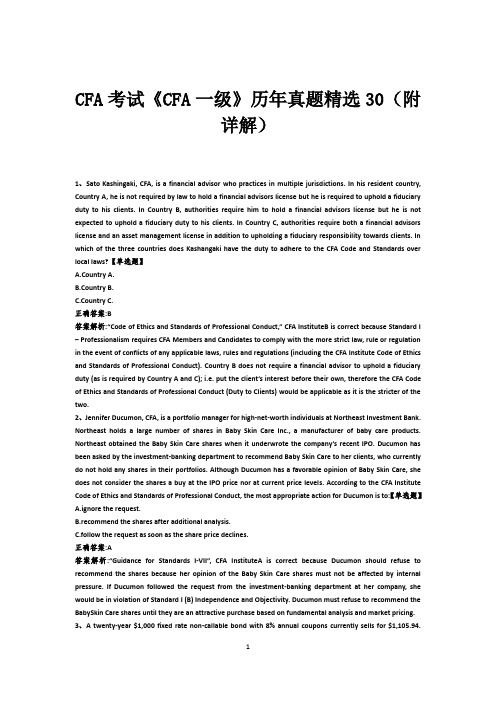

CFA考试《CFA一级》历年真题精选30(附详解)

CFA考试《CFA一级》历年真题精选30(附详解)1、Sato Kashingaki, CFA, is a financial advisor who practices in multiple jurisdictions. In his resident country, Country A, he is not required by law to hold a financial advisors license but he is required to uphold a fiduciary duty to his clients. In Country B, authorities require him to hold a financial advisors license but he is not expected to uphold a fiduciary duty to his clients. In Country C, authorities require both a financial advisors license and an asset management license in addition to upholding a fiduciary responsibility towards clients. In which of the three countries does Kashangaki have the duty to adhere to the CFA Code and Standards over local laws?【单选题】A.Country A.B.Country B.C.Country C.正确答案:B答案解析:“Code of Ethics and Standards of Professional Conduct,” CFA InstituteB is correct because Standard I – Professionalism requires CFA Members and Candidates to comply with the more strict law, rule or regulation in the event of conflicts of any applicable laws, rules and regulations (including the CFA Institute Code of Ethics and Standards of Professional Conduct). Country B does not require a financial advisor to uphold a fiduciary duty (as is required by Country A and C); i.e. put the client’s interest before their own, therefore the CFA Code of Ethics and Standards of Professional Conduct (Duty to Clients) would be applicable as it is the stricter of the two.2、Jennifer Ducumon, CFA, is a portfolio manager for high-net-worth individuals at Northeast Investment Bank. Northeast holds a large number of shares in Baby Skin Care Inc., a manufacturer of baby care products. Northeast obtained the Baby Skin Care shares when it underwrote the company’s recent IPO. Ducumon has been asked by the investment-banking department to recommend Baby Skin Care to her clients, who currently do not hold any shares in their portfolios. Although Ducumon has a favorable opinion of Baby Skin Care, she does not consider the shares a buy at the IPO price nor at current price levels. According to the CFA Institute Code of Ethics and Standards of Professional Conduct, the most appropriate action for Ducumon is to:【单选题】A.ignore the request.B.recommend the shares after additional analysis.C.follow the request as soon as the share price declines.正确答案:A答案解析:“Guidance for Standards I-VII”, CFA InstituteA is correct because Ducumon should refuse to recommend the shares because her opinion of the Baby Skin Care shares must not be affected by internal pressure. If Ducumon followed the request from the investment-banking department at her company, she would be in violation of Standard I (B) Independence and Objectivity. Ducumon must refuse to recommend the BabySkin Care shares until they are an attractive purchase based on fundamental analysis and market pricing.3、A twenty-year $1,000 fixed rate non-callable bond with 8% annual coupons currently sells for $1,105.94.Assuming a 30% marginal tax rate and an additional risk premium for equity relative to debt of 5%, the cost of equity using the bond-yield-plus-risk-premium approach is closest to:【单选题】A.9.9%.B.12.0%.C.13.0%.正确答案:B答案解析:“Cost of Capital,” Yves Courtois, CFA, Gene Lai, and Pamela Peterson Drake, CFAThe bond-yield-plus-risk-premium approach is calculated by adding a risk premium to the cost of debt (i.e. the yield-to-maturity for the debt) making the cost of equity 12.00% (= 7% +5%).4、An investor purchases a 5 percent coupon bond maturing in 3 years for $102.80, providing a yield-to-maturity of 4 percent. At what rate must the coupon payments be reinvested to generate the 4 percent yield?【单选题】A.0%B.4%C.5%正确答案:B答案解析:“Yield Measures, Spot Rates, and Forward Rates”, Frank J. Fabozzi, CFAB is correct since the yield-to-maturity measure assumes that the coupon payments can be reinvested at an interest rate equal to the yield-to-maturity, in this case 4%.5、A factor that most likely measures a client's ability to bear risk is his or her:【单选题】A.time horizon.B.inclination to independent thinking.C.personality type.正确答案:A答案解析:A longer time horizon tends to imply greater ability to take risk.Section 2.2.16、Michael Allen, CFA, works for an investment management company and managesportfolios for a variety of retail and institutional clients for his firm, includinghis wealthy uncle, all of whom pay a management fee for his wrenceBrown, an analyst at a brokerage firm has recommended Allen a high yield hedgefund based on its historical performance.Allen purchases a large block of thishedge fund and allocates proportionately to all client portfolios, including hisuncle's portfolio.Has Allen most likely violated the Standards of ProfessionalConduct?【单选题】A.No.B.Yes, relating to suitability.C.Yes, relating to fair dealing.正确答案:B答案解析:因为Allen的叔叔也是他的客户,所以Allen需要公平地对待所有客户,包括他的叔叔。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

CFA一级考试历年真题精选及答案0519-6 CFA一级经济学

Markets for produced goods that are primarily sold to customersare best described as:

A. capital markets.

B. intermediate goods markets.

C. services and finished markets.

Solution:C

Markets for produced goods such as cars, clothing, and liquor thatare sold primarily to customers are considered as finished and servicesmarkets.

CFA一级固定收益

Which of the following statement about bond';s indenture is mostcorrect?

A. It containsits covenants.

B. It is thesame as a debenture.

C. It relatesonly to its interest and principal payments.

Solution: A

Anindenture is the contract between the company and its bondholders and containsthe bond';s covenants.、

CFA一级企业理财

With regard to the most appropriatetreatment of cash flows in capital budgeting,which of the following is correct?

A. A project is evaluated using its incrementalcash flows on an after-tax basis.

B. Interest costs are included in theproject';s cash flows to reflect financing costs.

C. Sunk costs and externalities should notbe included in the cash flow estimates.

Solution: A

CFA一级职业伦理

Dacy Chen, CFA, is an independent financial advisor for a high networth client. He had not contacted with the customer in over two years. Duringa recent brief telephone conversation, the client stated he wanted to increasehis risk exposure. Dacy。