公司金融课后题答案CHAPTER18

中级会计学intermediateaccountingchapter18赖红宁课后答案

CHAPTER 18ACCOUNTING FOR INCOME TAXESCONTENT ANALYSIS OF EXERCISES AND PROBLEMSNumber Content Time Range(minutes)10-15E18-1 Single Temporary Difference. Deferred tax liability. Higherfuture tax rate. Scheduling. Preparation of income tax journalentry.10-15E18-2 Temporary Difference. Depreciation. Preparation of incometax journal entry. Balance sheet disclosure.10-15E18-3 Single Temporary Difference: Multiple Rates. Depreciation.Lower future rates. Scheduling. Preparation of income taxjournal entry.10-15E18-4 Single Temporary Difference. Deferred tax asset. Beginningbalance. Preparation of income tax journal entry. Balancesheet disclosure.10-15E18-5 Valuation Account. Deferred tax asset and valuationallowance. Preparation of income tax journal entries andpartial income statement.10-15E18-6 Income Taxes. Fill in missing information for various current anddeferred income tax items.15-20E18-7 Originating and Reversing Difference. Preparation of incometax journal entries for six years. Discuss originations and reversals.15-20E18-8 Multiple Temporary Differences. One deductible and onetaxable difference. Beginning balances. Preparation ofincome tax journal entry.10-15E18-9 Operating Loss. Preparation of income tax journal entry andpartial income statement for carryback.10-15E18-10 Operating Loss. Preparation of income tax journal entries andpartial income statement for carryforward.E18-11 Operating Loss. Preparation of income tax journal entries and20-30 partial income statements for two years. Carryforward.Discussion of election to forgo carryback.Number Content Time Range(minutes)15-20E18-12 Intraperiod Tax Allocation. Year-end journal entry. Incomestatement. Statement of retained earnings.15-20E18-13 Intraperiod Income Taxes. Calculation. Journal entry. Incomestatement.15-25E18-14 Intraperiod Tax Allocation. Income tax liability. Extraordinaryloss, loss from discontinued component, gain on disposal,change in depreciation method, prior period error. Incomestatement disclosure. Statement of retained earnings.10-15E18-15 Balance Sheet Disclosure. Presentation of income taxdisclosures.10-15E18-16 Change in Tax Rates. Correction of deferred tax liability.Calculation of amount and preparation of journal entry.10-20P18-1 Temporary and Permanent Differences. Identification andindication of result for various examples.P18-2 Definitions. Matching of terms with definitions related to current5-10 and deferred tax items.P18-3 Multiple Temporary Differences. Estimated warranty expense,15-20 depreciation. Preparation of income tax journal entry andpartial income statement. Balance sheet disclosure.20-30P18-4 Interperiod Tax Allocation: Change in Rate. Warranty expense,depreciation, rent receipts, gross profit. Preparation of incometax journal entry and condensed income statement.Balance sheet disclosures.25-35P18-5 Interperiod Tax Allocation. Computation of taxable incomegiven various information. Preparation of income tax journalentry. Discussion of permanent differences.P18-6 Interperiod Tax Allocation: Change in Rate. Computation of20-40 taxable income. Preparation of income tax journal entry andcondensed income statement.25-40P18-7 Deferred Tax Liability: Depreciation. Depreciation schedule,deferred tax liability schedule. Preparation of income taxjournal entry. Explanation of change in deferred tax liability.P18-8 Deferred Tax Liability: Depreciation. Depreciation schedule,25-40 deferred tax liability schedule. Preparation of income taxjournal entries and lower portions of income statements.Presentation of balance sheet disclosures.30-40P18-9 Deferred Taxes: Multiple Rates. One taxable and deductibledifference. Higher future tax rate. Scheduling. Preparation ofincome tax journal entry and lower portion of incomestatement. Preparation of income tax journal entries.Number Content Time Range(minutes)30-45P18-10 Operating Loss. Preparation of income statement and journalentries for two years. Carryback and carryforward. Valuationallowance.30-45P18-11 Operating Loss. Preparation of income statement and journalentries for two years. Carryback and carryforward. Novaluation account.25-35P18-12 Balance Sheet Reporting and Tax Rate Changes. Balancesheet disclosures. Correction of deferred tax items. Preparationof income tax journal entry. Computation of income taxexpense.30-40P18-13 Comprehensive: Intraperiod and Interperiod Tax Allocation.Allocation schedule. Preparation of income tax journal entry,partial income statement, statement of retained earnings.Balance sheet disclosures.30-40P18-14 Comprehensive: Interperiod and Intraperiod Tax Allocation.Preparation of income tax journal entry, partial incomestatement, statement of retained earnings. Balance sheetdisclosures.P18-15 Comprehensive: Operating Loss and Temporary Difference.30-45 Income taxes payable, schedules of deferred tax information,income tax journal entry, partial income statement, notedisclosure.ANSWERS TO QUESTIONSQ18-1 The objective of financial reporting is to provide useful information to decision makers about companies. This information is intended to enable investors to makebuy-hold-sell decisions. The overall objective of the Internal Revenue Code is toobtain funds, in an equitable manner, in order to operate the federal government.The Internal Revenue Code is also sometimes used to stimulate and regulate theeconomy.Q18-2 The five groups of possible differences between pretax financial income and taxable income (or between income tax expense and income taxes payable) are as follows:1. Permanent differences. Items of revenue or expense that a corporation reports forfinancial accounting purposes that it never reports for income tax purposes.2. Temporary differences. Items of revenue or expense that a corporation reports forfinancial accounting purposes in one period and for income tax purposes in anearlier or later period.。

HullOFOD9eSolutionsCh18第九版期权、期货及其他衍生品课后答案

of cattle in April. This position is marked to market in the usual way until you choose to close it out. Problem 18.10. Consider a two-month call futures option with a strike price of 40 when the risk-free interest rate is 10% per annum. The current futures price is 47. What is a lower bound for the value of the futures option if it is (a) European and (b) American? Lower bound if option is European is ( F0 K )e rT (47 40)e01212 688 Lower bound if option is American is F0 K 7 Problem 18.11. Consider a four-month put futures option with a strike price of 50 when the risk-free interest rate is 10% per annum. The current futures price is 47. What is a lower bound for the value of the futures option if it is (a) European and (b) American? Lower bound if option is European is ( K F0 )e rT (50 47)e01412 290 Lower bound if option is American is K F0 3 Problem 18.12. A futures price is currently 60 and its volatility is 30%. The risk-free interest rate is 8% per annum. Use a two-step binomial tree to calculate the value of a six-month European call option on the futures with a strike price of 60? If the call were American, would it ever be worth exercising it early? In this case u e 0.3

国际公司金融习题答案--第十八章

国际公司金融课后习题答案--第十八章第十八章课后习题参考答案1. 谈谈税收在经济中的作用。

税收在市场经济中主要起资源配置作用,通过税收政策和税收制度,在不同部门之间对各种资源进行配置,并在这一过程中影响个人和公司的经济活动。

首先,税收的变动会直接或间接地影响商品价格,从而影响商品的供求状况。

其次,税收影响经济结构,不同的税收政策对不同产品、不同行业、不同地区、不同企业组织形式都会产生影响。

通过影响商品价格以及经济结构,税收政策使各种资源在不同部门、不同地区间流动,而这些流动带来的影响意味着国际公司将不得不就此做出相应的经营决策。

这表明税收在经济中的作用最终会通过不同的渠道影响国际公司的经营。

2. 国际税收体系中的税收中性是指什么?对于税收中性,当前流行的国际税收理论中大体有两种观点:一是资本输出中性,二是资本输入中性。

所谓资本输出中性,就是税收不应影响投资者在国内、国外投资地点的选择,也不应影响投资者在各不同国家之间的选择,从而能使资本在世界范围内得到有效配置。

资本输入中性则认为,不同国籍的纳税人在同一国家从事投资活动,应享受相同的税收待遇。

3. 重复征税对于国际公司经营有什么弊端?从法律角度看,国际重复征税导致从事跨国投资和其他各种经济活动的纳税人相对于从事国内投资和其他各种经济活动的纳税人承受更为沉重的税收负担,从而违背了税收中立和税负公平的税法原则。

从经济角度看,国际重复征税造成税负不公致使跨国纳税人处于不利的竞争地位,势必挫伤其从事跨国经济活动的积极性,从而阻碍国际间资金、技术和人员的正常流动和交往。

4. 出现国际重复征税的原因是什么?应如何解决?国际重复征税的出现,最根本的原因是税收管辖权出了问题。

甲国根据自己的税法,认为对一项收入应由自己征税;乙国则认为应由乙国征税,于是纳税管辖权出现了重合,两国都向同一项收入征收所得税,国际重复征税就出现了。

各国为了避免重复征税,会通过一定方式对国际公司已缴国外所得税进行抵免,从而消除或减轻这种不利影响。

最新《公司金融学》全本课后习题参考答案

最新《公司金融学》全本课后习题参考答案《公司金融》课后习题参考答案各大重点财经学府专业教材期末考试考研辅导资料第一章导论第二章财务报表分析与财务计划第三章货币时间价值与净现值第四章资本预算方法第五章投资组合理论第六章资本结构第七章负债企业的估值方法第八章权益融资第九章债务融资与租赁第十章股利与股利政策第十一章期权与公司金融第十二章营运资本管理与短期融资第一章导论1.治理即公司治理(corporate governance),它解决了企业与股东、债权人等利益相关者之间及其相互之间的利益关系。

融资(financing),是公司金融学三大研究问题的核心,它解决了公司如何选择不同的融资形式并形成一定的资本结构,实现企业股东价值最大化。

估值(valuation),即企业对投资项目的评估,也包括对企业价值的评估,它解决了企业的融资如何进行分配即投资的问题。

只有公司治理规范的公司,其投资、融资决策才是基于股东价值最大化的正确决策。

这三个问题是相互联系、紧密相关的,公司金融学的其他问题都可以归纳入这三者的范畴之中。

2.对于上市公司而言,股东价值最大化观点隐含着一个前提:即股票市场充分有效,股票价格总能迅速准确地反映公司的价值。

于是,公司的经营目标就可以直接量化为使股票的市场价格最大化。

若股票价格受到企业经营状况以外的多种因素影响,那么价值确认体系就存在偏差。

因此,以股东价值最大化为目标必须克服许多公司不可控的影响股价的因素。

第二章财务报表分析与财务计划1.资产负债表;利润表;所有者权益变动表;现金流量表。

资产= 负债+ 所有者权益2.我国的利润表采用“多步式”格式,分为营业收入、营业利润、利润总额、净利润、每股收益、其他综合收益和综合收益总额等七个盈利项目。

3.直接法是按现金收入和支出的主要类别直接反映企业经营活动产生的现金流量,一般以利润表中的营业收入为起算点,调整与经营活动有关项目的增减变化,然后计算出经营活动现金流量。

朱叶公司金融第二版【课后习题答案】

【复旦大学 431 金融学考研专业课重难点】

复旦大学 431 金融学专业课一共四门课程,即《投资学》, 《货币银行学》,《国际金融学》以及《公司金融学》。这四门课 的重要程度排序为:《国际金融学》,《投资学》,《公司金融》,《货

3

朱叶——《公司金融》——课后习题详解

点进行系统梳理,总结归纳就显得非常重要。

三、注重实际运用

我个人认为,对金融学把握不太好的表现之一就是不会实际 运用。例如,中国的广义货币(M2)当前存量大概为 80 万亿, 有同学会去根据中国的高能货币以及货币乘数算出来这个货币 存量吗?例如,同学们都学过国际金本位体系,布雷顿森林体系, 牙买加体系的知识。那么可否根据这些知识说明当前国际收支体 系的问题、汇率调节机制的问题或者未来国际收支体系的发展方 向?实际上,这些问题并不难以回答,仍然跳不出我们在书本上 学到的知识,只是很多同学从来没尝试过用书本上的知识来解释 现实。因此,学会实际运用,不仅可以使得同学们对知识理解得 更加深刻,更重要的是,它会使得同学们养成自己的经济学金融 学思维,而这正是复旦大学经济学院研究生所必须具备的素质!

(3)企业的投资决策问题。由于投资企业是创造和利用投资机会的最佳工具,从而成 为经济发展的根本驱动力。但在公司金融理论的研究中,一般都遵循费雪的分离原理,即公

7

朱叶——《公司金融》——课后习题详解

司的投资与融资决策是相分离的,莫迪格利安尼与米勒(1958)的开创性论文对此做了较为 严格的证明。然而,现实中的企业即使面临无限的投资机会,并不可能获得全部足够的资金 支持。因此,由于各种原因,企业可能面临着投资不足或者投资过度的两难处境。为了保证 企业能够有效把握投资机会,并能从可供选择的投资机会中筛选出最能实现其市场价值最大 化的投资项目,需要运用相应的金融技术与程序。随着金融理论与技术的发展,资本预算的 方法与程序,也处于不断的发展过程之中。

公司金融课后习题

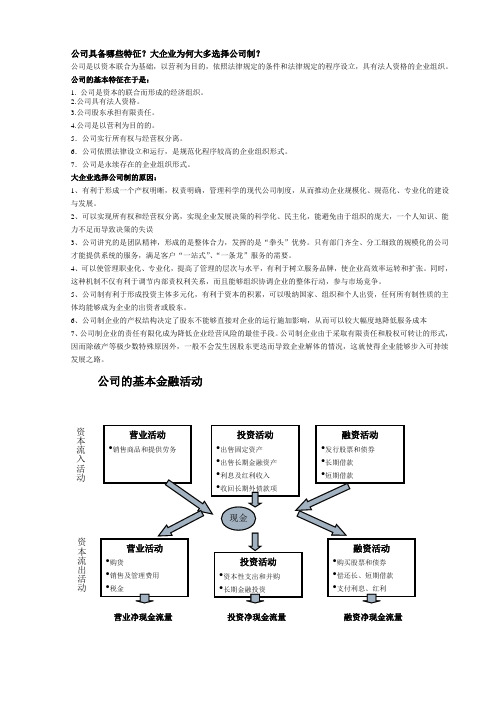

公司具备哪些特征?大企业为何大多选择公司制?公司是以资本联合为基础,以营利为目的,依照法律规定的条件和法律规定的程序设立,具有法人资格的企业组织。

公司的基本特征在于是:1. 公司是资本的联合而形成的经济组织。

2.公司具有法人资格。

3.公司股东承担有限责任。

4.公司是以营利为目的的。

5.公司实行所有权与经营权分离。

6.公司依照法律设立和运行,是规范化程序较高的企业组织形式。

7.公司是永续存在的企业组织形式。

大企业选择公司制的原因:1、有利于形成一个产权明晰,权责明确,管理科学的现代公司制度,从而推动企业规模化、规范化、专业化的建设与发展。

2、可以实现所有权和经营权分离,实现企业发展决策的科学化、民主化,能避免由于组织的庞大,一个人知识、能力不足而导致决策的失误3、公司讲究的是团队精神,形成的是整体合力,发挥的是“拳头”优势。

只有部门齐全、分工细致的规模化的公司才能提供系统的服务,满足客户“一站式”、“一条龙”服务的需要。

4、可以使管理职业化、专业化,提高了管理的层次与水平,有利于树立服务品牌,使企业高效率运转和扩张。

同时,这种机制不仅有利于调节内部责权利关系,而且能够组织协调企业的整体行动,参与市场竞争。

5、公司制有利于形成投资主体多元化,有利于资本的积累,可以吸纳国家、组织和个人出资,任何所有制性质的主体均能够成为企业的出资者或股东。

6、公司制企业的产权结构决定了股东不能够直接对企业的运行施加影响,从而可以较大幅度地降低服务成本7、公司制企业的责任有限化成为降低企业经营风险的最佳手段。

公司制企业由于采取有限责任和股权可转让的形式,因而除破产等极少数特殊原因外,一般不会发生因股东更迭而导致企业解体的情况,这就使得企业能够步入可持续发展之路。

公司的基本金融活动营业净现金流量 投资净现金流量 融资净现金流量 资本流入活动资本流出活动如何理解公司价值最大化作为公司金融目标的合理性?企业价值不等于账面资产的总价值,它取决于企业潜在或预期获利能力。

Essentials_Of_Investments_8th_Ed_Bodie_投资学精要(第八版)课后习题答案 Chapter 18

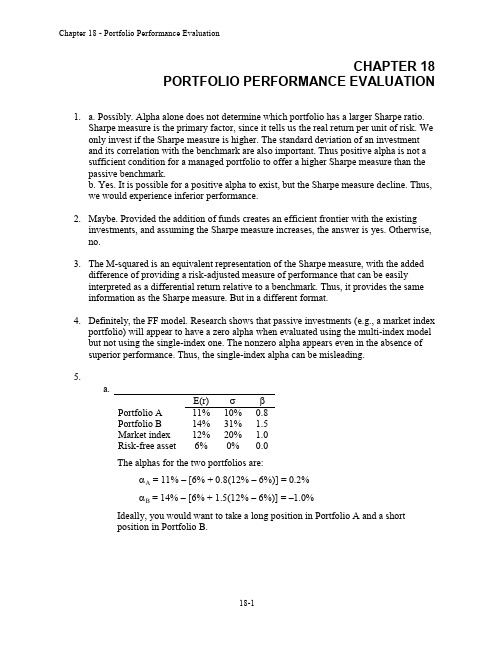

The alphas for the two portfolios are: A = 11% – [6% + 0.8(12% – 6%)] = 0.2% B = 14% – [6% + 1.5(12% – 6%)] = –1.0% Ideally, you would want to take a long position in Portfolio A and a short position in Portfolio B.

11 6 0.5 10

14 6 0.26 31

Therefore, using the Sharpe criterion, Portfolio A is preferred. 6. We first distinguish between timing ability and selection ability. The intercept of the scatter diagram is a measure of stock selection ability. If the manager tends to have a positive excess return even when the market’s performance is merely “neutral” (i.e., the market has zero excess return) then we conclude that the manager has, on average, made good stock picks. In other words, stock selection must be the source of the positive excess returns. Timing ability is indicated by the curvature of the plotted line. Lines that become steeper as you move to the right of the graph show good timing ability. The steeper slope shows that the manager maintained higher portfolio sensitivity to market swings (i.e., a higher beta) in periods when the market performed well. This ability to choose more market-sensitive securities in anticipation of market upturns is the essence of good timing. In contrast, a declining slope as you move to the right indicates that the portfolio was more sensitive to the market when the market performed poorly, and less sensitive to the market when the market performed well. This indicates poor timing. We can therefore classify performance ability for the four managers as follows: A B C D 7. a. Actual: (0.70 2.0%) + (0.20 1.0%) + (0.10 0.5%) = 1.65% Bogey: (0.60 2.5%) + (0.30 1.2%) + (0.10 0.5%) = 1.91% Underperformance = 1.91% – 1.65% = 0.26% Selection Ability Bad Good Good Bad Timing Ability Good Good Bad Bad

公司理财精要版原书第12版习题库答案Ross12e_Chapter18_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 18 Short-Term Finance and Planning1) Which one of the following actions represents a source of cash?A) Granting credit to a customerB) Purchasing new machineryC) Making a payment on a bank loanD) Purchasing inventoryE) Accepting credit from a supplier2) Which one of these actions represents a use of cash?A) Collecting a receivableB) Paying employee wagesC) Selling inventory for cashD) Obtaining a bank loanE) Purchasing inventory on credit3) Which one of these activities represents a source of cash?A) Increasing accounts receivableB) Decreasing inventoryC) Increasing fixed assetsD) Decreasing accounts payableE) Decreasing common stock4) Which one of the following actions will increase net working capital? Assume the current ratio is greater than 1.0.A) Paying a supplier for a previous purchaseB) Paying off a long-term debtC) Selling inventory at cost for cashD) Purchasing inventory on creditE) Selling inventory at a profit on credit5) Which one of the following will decrease net working capital? Assume the current ratio is greater than 1.0.A) Selling inventory at costB) Collecting payment from a customerC) Paying a dividend to shareholdersD) Selling a fixed asset for less than book valueE) Paying a supplier for prior purchases6) Which one of these actions will increase the operating cycle? Assume all else held constant.A) Decreasing the payables periodB) Decreasing the receivables turnover rateC) Increasing the payables periodD) Decreasing the average inventory levelE) Increasing the inventory turnover rate7) The operating cycle is equal to the:A) cash cycle plus the accounts receivable period.B) inventory period plus the accounts receivable period.C) inventory period plus the accounts payable period.D) accounts payable period minus the cash cycle.E) accounts payable period plus the accounts receivable period.8) Which one of the following will decrease the operating cycle?A) Decreasing the inventory turnover rateB) Decreasing the accounts payable periodC) Increasing the accounts receivable turnover rateD) Increasing the accounts payable periodE) Increasing the accounts receivable period9) The operating cycle describes how a product:A) is priced.B) is sold.C) moves through the current asset accounts.D) moves through the production process.E) generates a profit.10) Which one of these affects the length of the cash cycle but not the operating cycle?A) Inventory periodB) Accounts payable periodC) Both the accounts receivable and inventory periodsD) Accounts receivable periodE) Both the accounts receivable and the accounts payable periods11) Which one of these will decrease the cash cycle, all else held constant?A) Increasing the accounts receivable turnover rateB) Decreasing the accounts payable periodC) Increasing the inventory periodD) Decreasing the inventory turnover rateE) Increasing the accounts receivable period12) A decrease in which one of the following will increase the cash cycle, all else held constant?A) Payables turnoverB) Days sales in inventoryC) Operating cycleD) Inventory turnover rateE) Accounts receivable period13) Metal Designs historically produced products for inventory. Now, they only produce a product when an actual order is received from a customer. All else equal, this change will:A) increase the operating cycle.B) lengthen the accounts receivable period.C) shorten the accounts payable period.D) decrease the cash cycle.E) decrease the inventory turnover rate.14) Which one of these statements is correct? Assume all else held constant.A) A decrease in the accounts receivable turnover rate decreases the cash cycle.B) The cash cycle is equal to the operating cycle minus the inventory period.C) A negative cash cycle is preferable to a positive cash cycle.D) A decrease in the accounts payable period shortens the cash cycle.E) The cash cycle plus the accounts receivable period is equal to the operating cycle.15) Which one of the following statements is correct concerning the cash cycle?A) The longer the cash cycle, the more likely a company will need external financing.B) Increasing the accounts payable period increases the cash cycle.C) Accepting a supplier's discount for early payment decreases the cash cycle.D) The cash cycle can exceed the operating cycle if the payables period is equal to zero.E) Offering early payment discounts to customers will tend to increase the cash cycle.16) Which one of the following actions will tend to increase the inventory period?A) Discontinuing all slow-selling merchandiseB) Selling obsolete inventory below cost just to get rid of itC) Buying raw materials only as needed for the manufacturing processD) Producing goods on demand versus for inventoryE) Increasing inventory selection to attract more customers17) Which one of the following actions will tend to increase the accounts receivable period from its current 14 days?A) Tightening the standards for granting credit to customersB) Refusing to grant additional credit to any customer who pays lateC) Increasing the finance charges applied to all customer balances outstanding over 30 daysD) Granting discounts for cash salesE) Eliminating the discount for early payment by credit customers18) An increase in which one of the following is an indicator that an accounts receivable policy is becoming more restrictive?A) Bad debtsB) Accounts receivable turnover rateC) Accounts receivable periodD) Credit salesE) Operating cycle19) Assume all else held constant. If you pay your suppliers three days sooner, then:A) your payables turnover rate will decrease.B) you may require additional funds from other sources to fund the cash cycle.C) the cash cycle will decrease.D) your operating cycle will decrease.E) the accounts receivable period will decrease.20) Which one of the following will increase the accounts payable period, all else held constant?A) A decrease in the inventory periodB) An increase in the ending accounts payable balanceC) An increase in the cash cycleD) A decrease in the operating cycleE) An increase in the accounts payable turnover rate21) Which one of the following managers determines which customers must pay cash and which can charge their purchases?A) Purchasing managerB) Credit managerC) ControllerD) Production managerE) Payables manager22) Which one of the following managers determines when a supplier will be paid?A) ControllerB) Payables managerC) Credit managerD) Purchasing managerE) Production manager23) The length of time between the purchase of inventory and the receipt of cash from the sale of that inventory is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.24) The length of time that elapses between the day at item of inventory is purchased and the day that item sells is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.25) The length of time between the sale of inventory and the collection of the payment for that sale is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.26) The length of time between the day an item is purchased from a supplier until the day that supplier is paid for that purchase is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.27) Central Supply paid off an accounts payable for a toboggan it had purchased on credit three weeks ago. The time period between today and the day Central Supply will receive cash from the sale of this toboggan is called the:A) operating cycle.B) inventory period.C) accounts receivable period.D) accounts payable period.E) cash cycle.28) Costs that increase as a firm acquires additional current assets are called ________ costs.A) carryingB) shortageC) orderD) safetyE) trading29) Costs that decrease as a company acquires additional current assets are called ________ costs.A) carryingB) shortageC) debtD) equityE) payables30) A firm with a flexible short-term financial policy will:A) maintain a low balance in accounts receivables.B) only have minimal amounts, if any, invested in marketable securities.C) invest heavily in inventory.D) have low cash balances.E) have tight restrictions on granting credit to customers.31) Which one of these is indicative of a short-term restrictive financial policy?A) Purchasing inventory on an as-needed basisB) Granting credit to all customersC) Investing heavily in marketable securitiesD) Maintaining a large accounts receivable balanceE) Keeping inventory levels high32) If a company adheres to a restrictive short-term financial policy, then they will generally have:A) little, if any, investment in marketable securities.B) low inventory turnover rates.C) liberal credit terms for customers.D) few, if any, stockouts.E) high cash balances.33) The Lumber Mart recently replaced its management team. As a result, they are implementinga restrictive short-term financial policy in place of the flexible policy under which they had been operating. Which one of the following should the employees expect as a result of this policy change?A) Increasing monthly sales as compared to the prior yearB) Greater inventory selectionC) Fewer out-of-stock occurrencesD) Loss of credit customersE) More liberal credit terms34) A flexible short-term financial policy:A) increases the need for long-term financing.B) minimizes net working capital.C) avoids bad debts by only selling items for cash.D) maximizes fixed assets and minimizes current assets.E) is most appropriate when carrying costs are high and shortage costs are low.35) A flexible short-term financial policy:A) maximizes cashouts.B) increases shortage costs due to frequent cash-outs.C) tends to decrease sales as compared to a restrictive policy.D) incurs more carrying costs than a restrictive policy.E) requires only a minimum investment in current assets.36) Shortage costs are least associated with:A) stockouts and cashouts.B) lost customer goodwill.C) disruptions of production schedules.D) inventory ordering costs.E) opportunity costs incurred by high levels of working capital.37) The optimal investment in current assets for an active company occurs at the point where:A) both shortage costs and carrying costs equal zero.B) shortage costs are equal to zero.C) carrying costs are equal to zero.D) carrying costs exceed shortage costs.E) shortage costs and carrying costs are equal.38) A company:A) with a restrictive financing policy secures sufficient long-term financing to fund all its assets.B) with a flexible financing policy frequently invests in marketable securities.C) with a flexible financing policy tends to use short-term financing on an ongoing basis.D) will tend to avoid short-term financing under both restrictive and flexible financing policies.E) with seasonal sales must select flexible financing policies.39) Which one of the following statements is correct?A) Seasonal needs are financed with short-term loans when companies adhere to a flexible financing policy.B) A flexible financing policy tends to increase the risk of encountering financial distress.C) Long-term interest rates tend to be less volatile than short-term rates.D) Most companies tend to finance inventory with long-term debt.E) Short-term interest rates are generally higher than long-term rates.40) Which one of these best describes a characteristic of a flexible financing policy?A) All of a company's assets are financed with long-term debt.B) Only long-term assets are financed with long-term debt.C) Short-term financing will be used to finance seasonal peaks.D) Inventory is purchased with cash.E) Low levels of inventory are maintained.41) With a compromise financial policy companies will:A) borrow only long-term funds and refuse any loans that require compensating balances.B) borrow short-term funds and also invest in marketable securities.C) finance all of their assets with various short-term loans.D) finance their seasonal asset peaks with short-term debt and the remainder of their assets with equity.E) finance half of their fixed assets with long-term debt and half with short-term debt.42) Assume each month has 30 days and a company has a 30-day accounts receivable period. During the second calendar quarter of the year, that company will collect payment for the sales it made during which of the following months?A) February, March, and AprilB) April, May and JuneC) December, January, and FebruaryD) January, February, and MarchE) March, April, and May43) The Harvester collects 55 percent of sales in the month of sale, 40 percent of sales in the month following the month of sale, and 5 percent of sales in the second month following themonth of sale. During the month of April, they will collect:A) 55 percent of February sales.B) 5 percent of April sales.C) 40 percent of March sales.D) 5 percent of March sales.E) 40 percent of February sales.44) Timko has a 90-day collection period and produces seasonal merchandise. Sales are lowest during the first calendar quarter of a year and the highest during the third quarter. The company maintains a relatively steady level of production which means that its cash disbursements are fairly equal in all quarters. This company is most apt to face a cash-out situation in:A) the first quarter.B) the second quarter.C) the third quarter.D) the fourth quarter.E) any quarter with equal probabilities of occurrence.45) Summertime Adventures is a seasonal firm that enjoys its highest sales during July and August. The company purchases inventory one month before it is sold and pays for its purchases 60 days after the invoice date. Which one of the following statements is supported by this information?A) Inventory purchases will be highest during the months of July and August.B) Inventory purchases will be highest during the months of May and June.C) Payments to suppliers will be highest during the months of June and July.D) Payments to suppliers will be highest during the months of July and August.E) Payments to suppliers will be highest during the months of August and September.46) Which one of the following combinations is most apt to cause a company that is generally financially sound to have a negative net cash inflow for a particular quarter?A) Low fixed expenses and level monthly salesB) A one-time asset purchase and approaching high seasonal salesC) Highly seasonal sales and a flexible financing policyD) A flexible financing policy and level monthly salesE) A large cash sale and low fixed expenses47) Which one of the following statements is correct concerning a company's cash balance?A) Most firms attempt to maintain a zero cash balance at all times.B) The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum desired cash balance.C) On a cash balance report, the cumulative cash surplus at the end of May is used as June's beginning cash balance.D) A cumulative cash deficit indicates a borrowing need.E) The ending cash balance must equal the minimum desired cash balance.48) A cumulative cash deficit indicates a company:A) has at least a short-term need for external funding.B) is facing long-term financial distress.C) will go out of business within the year.D) is capable of funding all of its needs internally.E) is using its cash wisely.49) Steve has estimated the cash inflows and outflows for his hardware store for next year. The report that he has prepared recapping these cash flows is called a:A) pro forma income statement.B) sales projection.C) cash budget.D) receivables analysis.E) credit analysis.50) Taylor Supply has made an agreement with its bank that allows it to borrow up to $10,000 at any time over the next year. This arrangement is called a(n):A) floor loan.B) open loan.C) compensating balance.D) line of credit.E) bank note.51) Money deposited by a borrower with a bank in a low or non-interest-bearing account as a condition of a loan agreement is called a:A) compensating balance.B) secured credit deposit.C) letter of credit.D) line of cash.E) pledge.52) Brustle's Pottery either factors or assigns all of its receivables to other firms. This is known as:A) accounts receivable financing.B) pledged financing.C) capital funding.D) daily funding.E) capital financing.53) Rose's Gift Shop borrows money on a short-term basis by pledging its inventory as collateral. This is an example of a(n):A) debenture.B) line of credit.C) banker's acceptance.D) working loan.E) inventory loan.54) The most common way to finance a temporary cash deficit is with a:A) long-term secured bank loan.B) short-term secured bank loan.C) short-term issue of corporate bonds.D) long-term unsecured bank loan.E) short-term unsecured bank loan.55) The primary difference between a line of credit and a revolving credit arrangement is the:A) type of collateral used to secure the loan.B) length of the credit period.C) fact that the line of credit is a secured loan and the revolving credit arrangement is unsecured.D) fact that the line of credit is an unsecured loan and the revolving credit arrangement is secured.E) loan's classification as either a committed or a non-committed loan.56) A compensating balance:A) is required when a company acquires any bank financing other than a line of credit.B) is often used by banks as a means of rewarding their best credit customers.C) decreases the cost of short-term bank financing.D) only applies to zero-interest rate loans.E) may be required even if a company never borrows funds.57) High Point Hotel (HPH) has $218,000 in accounts receivable. To finance a major purchase, the company assigns these receivables to Cross Town Bank. Which one of the following statements correctly describes this transaction?A) HPH will immediately receive $218,000 and will have no further obligation related to these receivables.B) HPH will receive some amount of cash immediately while maintaining full responsibility for any uncollected receivables.C) Cross Town Bank accepts full responsibility for the collection of the accounts receivables and, in exchange, immediately pays HPH a discounted value for its receivables.D) Cross Town Bank accepts full responsibility for collecting the accounts receivables and pays HPH a discounted price for the accounts collected after the normal collection period has elapsed.E) HPH receives the full amount of its receivables upon assignment but must reimburse Cross Town Bank for any uncollected account.58) Which one of the following statements is correct?A) The assignment of receivables involves selling accounts receivables at full price.B) Lines of credit frequently require a cleanup period.C) With maturity factoring, the borrower receives the loan amount immediately.D) Commercial paper is short-term financing offered to highly rated corporations by major banks.E) Credit card receivables funding is a relatively inexpensive method of borrowing on a short-term basis.59) Which type of arrangement is a hardware store most apt to use to finance its inventory?A) Accounts receivable assignmentB) Blanket inventory lienC) Trust receiptD) Commercial paperE) Field warehouse financing60) An orange grower is most apt to use which type of financing for its crop?A) Accounts receivable assignmentB) Blanket inventory lienC) Trust receiptD) Commercial paperE) Field warehouse financing61) All of the following are benefits derived from short-term financial planning with the exception of:A) having advance notice of when your firm should require external financing.B) knowing for certain what your cash balance will be six months in advance.C) knowing if excess funds should be available for investing.D) being able to determine the approximate extent of time for which a loan is required.E) having the ability to time capital expenditures in order to place the least financial burden possible on a firm.62) Auto Detailers has a book net worth of $29,700. Long-term debt is $4,800. Net working capital, other than cash, is $3,700 and fixed assets are $27,400. How much cash does the company have?A) $3,900B) $4,800C) $4,300D) $3,400E) $3,70063) New Products has sales of $749,500 and cost of goods sold of $368,600. Beginning inventory is $54,700 and ending inventory is $58,200. What is the length of the inventory period?A) 15.01 daysB) 17.89 daysC) 55.90 daysD) 90.53 daysE) 113.67 days64) Mid-Western Markets has sales of $1,389,400 and costs of goods sold of $892,700. Beginning inventory is $94,300 and ending inventory is $110,200. What is the inventory turnover rate?A) 8.73 timesB) 10.78 timesC) 13.59 timesD) 11.37 timesE) 12.64 times65) North Side Wholesalers has sales of $1,648,900. The cost of goods sold is equal to 71 percent of sales and the average inventory is $75,800. How many days on average does it take to sell the inventory?A) 28.30 daysB) 23.63 daysC) 20.48 daysD) 33.28 daysE) 21.68 days66) The Bear Rug has sales of $647,000. The cost of goods sold is equal to 66 percent of sales. Accounts receivable has a beginning balance of $53,400 and an ending balance of $49,600. How long on average does it take to collect the receivables?A) 12.56 daysB) 29.05 daysC) 18.58 daysD) 20.44 daysE) 19.17 days67) Morning Star has credit sales of $1,032,800, costs of goods sold of $662,350, average accounts receivable of $86,300, and average accounts payable of $92,600. On average, how long does it take Morning Star's credit customers to pay for their purchases?A) 11.97 daysB) 39.24 daysC) 30.50 daysD) 21.88 daysE) 19.56 days68) The Mountain Top Shoppe has sales of $828,000, average accounts receivable of $64,100 and average accounts payable of $72,700. The cost of goods sold is equivalent to 68 percent of sales. How long does it take The Mountain Top Shoppe to pay its suppliers?A) 69.31 daysB) 68.38 daysC) 47.13 daysD) 35.89 daysE) 36.97 days69) HG Livery Supply has a beginning accounts payable balance of $68,800 and an ending accounts payable balance of $72,700. Sales for the period were $942,800 and costs of goods sold were $534,200. What is the payables turnover rate?A) 7.55 timesB) 8.39 timesC) 7.02 timesD) 13.33 timesE) 12.85 times70) Bradley's has an inventory turnover rate of 7.6, a payables turnover rate of 11.4, and a receivables turnover rate of 12.6. How long is the operating cycle?A) 20.20 daysB) 76.99 daysC) 70.63 daysD) 30.13 daysE) 24.11 days71) Meryl Enterprises currently has an operating cycle of 76.4 days. The company is implementing some operational changes that are expected to increase the accounts receivable period by 2.2 days, decrease the inventory period by 5.3 days, and increase the accounts payable period by 1.5 days. What is the new operating cycle expected to be?A) 78.0 daysB) 74.8 daysC) 73.3 daysD) 79.5 daysE) 71.8 days72) On average, Furniture & More is able to sell its inventory in 54.2 days and takes 65.3 days on average to pay for its purchases. Its average customer pays with a credit card which allows the company to collect its receivables in 2.9 days. Given this information, what is the length of operating cycle?A) 57.1 daysB) 88.3 daysC) −8.2 daysD) 116.6 daysE) 122.4 days73) Interior Designs has an inventory period of 84.6 days, an accounts payable period of 43.2 days, and an accounts receivable period of 41.7 days. Management is considering an offer from their suppliers to pay within 10 days and receive a discount of 2 percent. If the new discount is taken, the accounts payable period is expected to decline by 30.4 days. What will be the new operating cycle given the change in the payables period?A) 95.9 daysB) 115.0 daysC) 97.4 daysD) 126.3 daysE) 139.1 days74) Metal Products Co. has an inventory period of 94.2 days, an accounts payable period of 40.4 days, and an accounts receivable turnover rate of 17.6. What is the length of the cash cycle?A) 71.40 daysB) 74.54 daysC) 96.28 daysD) 114.94 daysE) 108.28 days75) West Chester Automation has an inventory turnover of 9.1 and an accounts payable turnover of 10.6. The accounts receivable period is 32.8 days. What is the length of the cash cycle?A) 35.67 daysB) 38.48 daysC) 41.02 daysD) 46.47 daysE) 48.81 days76) Peterson's Antiquities currently has a 32.6-day cash cycle. Assume the company changes its operations such that it decreases its receivables period by 3.1 days, increases its inventory period by 1.8 days, and increases its payables period by 2.2 days. What will the length of the cash cycle be after these changes?A) 33.5 daysB) 36.1 daysC) 30.2 daysD) 29.1 daysE) 27.6 days77) Rossiter's currently has a cash cycle of 43.4 days. Assume the operations are changed such that the receivables period decreases by 2.6 days, the inventory period by increases by 1.3 days, and the payables period increases by 3.4 days. What will be the length of the cash cycle after these changes?A) 39.2 daysB) 45.5 daysC) 38.7 daysD) 41.3 daysE) 48.1 days78) AC Corporation has beginning inventory of $11,062, accounts payable of $8,010, and accounts receivable of $7,844. The end of year values are $11,362 for inventory, $7,898 foraccounts payable, and $8,029 for accounts receivable. Net sales are $109,100 and costs of goods sold are $56,220. How many days are in the cash cycle?A) 47.7 daysB) 80.2 daysC) 55.8 daysD) 97.9 daysE) 67.8 days79) Wake-Up Coffee has projected next year's quarterly sales at $960, $890, $980, and $1,050 for Quarters 1 to 4, respectively. Accounts receivable at the beginning of the year are $212 and the collection period is 18 days. What is the amount of the accounts receivable balance at the end of Quarter 2? Assume a year has 360 days.A) $212B) $207C) $178D) $184E) $16780) Tall Guys Clothing has a 30-day collection period. Sales for the next calendar year are estimated at $1,950, $2,100, $2,650 and $3,200, respectively, by quarter, starting with the first quarter of the year. Given this information, which one of the following statements is correct? Assume a year has 360 days.A) The Quarter 2 collections will be $2,000.B) The accounts receivable balance at the beginning of Quarter 4 will be $940.C) The Quarter 3 collections will be $2,375.D) The end of Quarter 4 accounts receivable balance will be $2,133.E) The Quarter 4 collections will be $3,017.81) Plant Mart has a beginning receivables balance on February 1 of $1,648. Sales for February through May are $2,670, $2,940, $3,820, and $4,450, respectively. The accounts receivable period is 15 days. What is the amount of the April collections? Assume a year has 360 days.A) $3,010B) $3,380C) $2,805D) $3,545E) $3,470。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

CHAPTER 18VALUATION AND CAPITAL BUDGETING FOR THE LEVERED FIRMAnswers to Concepts Review and Critical Thinking Questions1.APV is equal to the NPV of the project (i.e. the value of the project for an unleveredfirm) plus the NPV of financing side effects.2. The WACC is based on a target debt level while the APV is based on the amount of debt.3.FTE uses levered cash flow and other methods use unlevered cash flow.4.The WACC method does not explicitly include the interest cash flows, but it doesimplicitly include the interest cost in the WACC. If he insists that the interest payments are explicitly shown, you should use the FTE method.5. You can estimate the unlevered beta from a levered beta. The unlevered beta is the beta ofthe assets of the firm; as such, it is a measure of the business risk. Note that the unlevered beta will always be lower than the levered beta (assuming the betas are positive). The difference is due to the leverage of the company. Thus, the second risk factor measured by a levered beta is the financial risk of the company.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basic1. a.The maximum price that the company should be willing to pay for the fleet of carswith all-equity funding is the price that makes the NPV of the transaction equal tozero. The NPV equation for the project is:NPV = –Purchase Price + PV[(1 – t C )(EBTD)] + PV(Depreciation Tax Shield)If we let P equal the purchase price of the fleet, then the NPV is:NPV = –P + (1 – .35)($140,000)PVIFA13%,5 + (.35)(P/5)PVIFA13%,5Setting the NPV equal to zero and solving for the purchase price, we find:0 = –P + (1 – .35)($140,000)PVIFA13%,5 + (.35)(P/5)PVIFA13%,5P = $320,068.04 + (P)(0.35/5)PVIFA13%,5P = $320,068.04 + .2462P.7538P = $320,068.04P = $424,609.54b.The adjusted present value (APV) of a project equals the net present value of theproject if it were funded completely by equity plus the net present value of any financing side effects. In this case, the NPV of financing side effects equals the after-tax present value of the cash flows resulting from the firm’s debt, so:APV = NPV(All-Equity) + NPV(Financing Side Effects)So, the NPV of each part of the APV equation is:NPV(All-Equity)NPV = –Purchase Price + PV[(1 – t C )(EBTD)] + PV(Depreciation Tax Shield)The company paid $395,000 for the fleet of cars. Because this fleet will be fullydepreciated over five years using the straight-line method, annual depreciationexpense equals:Depreciation = $395,000/5Depreciation = $79,000So, the NPV of an all-equity project is:NPV = –$395,000 + (1 – 0.35)($140,000)PVIFA13%,5 + (0.35)($79,000)PVIFA13%,5 NPV = $22,319.49NPV(Financing Side Effects)The net present value of financing side effects equals the after-tax present value of cash flows resulting from the firm’s debt, so:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Payments)Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt R B. So, the NPV of the financing side effects are:NPV = $260,000 – (1 – 0.35)(0.08)($260,000)PVIFA8%,5– [$260,000/(1.08)5]NPV = $29,066.93So, the APV of the project is:APV = NPV(All-Equity) + NPV(Financing Side Effects) APV = $22,319.49 + 29,066.93APV = $51,386.422.The adjusted present value (APV) of a project equals the net present value of the projectif it were funded completely by equity plus the net present value of any financing side effects. In this case, the NPV of financing side effects equals the after-tax present value of the cash flows resulting from the firm’s deb t, so:APV = NPV(All-Equity) + NPV(Financing Side Effects)So, the NPV of each part of the APV equation is:NPV(All-Equity)NPV = –Purchase Price + PV[(1 – t C )(EBTD)] + PV(Depreciation Tax Shield)Since the initial investment of $1.9 million will be fully depreciated over four yearsusing the straight-line method, annual depreciation expense is:Depreciation = $1,900,000/4Depreciation = $475,000NPV = –$1,900,000 + (1 – 0.30)($685,000)PVIFA9.5%,4 + (0.30)($475,000)PVIFA13%,4 NPV (All-equity) = – $49,878.84NPV(Financing Side Effects)The net present value of financing side effects equals the aftertax present value of cash flows resulting from the firm’s debt. So, the NPV of the financing side effects are:NPV = Proceeds(Net of flotation) – Aftertax PV(Interest Payments) – PV(PrincipalPayments)+ PV(Flotation Cost Tax Shield)Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt, R B. Since the flotation costs will be amortized over the life of the loan, the annual flotation costs that will be expensed each year are:Annual flotation expense = $28,000/4Annual flotation expense = $7,000NPV = ($1,900,000 – 28,000) – (1 – 0.30)(0.095)($1,900,000)PVIFA9.5%,4–$1,900,000/(1.095)4+ 0.30($7,000) PVIFA9.5%,4NPV = $152,252.06So, the APV of the project is:APV = NPV(All-Equity) + NPV(Financing Side Effects) APV = –$49,878.84 + 152,252.06APV = $102,373.233. a.In order to value a firm’s equity using the flow-to-equity approach, discount the cashflows available to equity holders at the cost of the firm’s levered equity. The cashflows to equity holders will be the firm’s net income. Remembering that the companyhas three stores, we find:Sales $3,600,000COGS 1,530,000G & A costs 1,020,000Interest 102,000EBT $948,000Taxes 379,200NISince this cash flow will remain the same forever, the present value of cash flowsavailable to the firm’s equity holders is a perpetuity. We can discount at the leveredcost of equity, so, the value of the company’s equity is:PV(Flow-to-equity) = $568,800 / 0.19PV(Flow-to-equity) = $2,993,684.21b.The value of a firm is equal to the sum of the market values of its debt and equity, or:V L = B + SWe calculated the value of the company’s equity in part a, so now we need tocalculate the value of debt. The company has a debt-to-equity ratio of 0.40, whichcan be written algebraically as:B / S = 0.40We can substitute the value of equity and solve for the value of debt, doing so, wefind:B / $2,993,684.21 = 0.40B = $1,197,473.68So, the value of the company is:V = $2,993,684.21 + 1,197,473.68V = $4,191,157.894. a.In order to determine the cost of the firm’s debt, we need to find the yield to maturityon its current bonds. With semiannual coupon payments, the yield to maturity in thecompany’s bonds is:$975 = $40(PVIFA R%,40) + $1,000(PVIF R%,40)R = .0413 or 4.13%Since the coupon payments are semiannual, the YTM on the bonds is:YTM = 4.13%× 2YTM = 8.26%b.We can use the Capital Asset Pricing Model to find the return on unlevered equity.According to the Capital Asset Pricing Model:R0 = R F+ βUnlevered(R M– R F)R0 = 5% + 1.1(12% – 5%)R0 = 12.70%Now we can find the cost of levered equity. According to Modigliani-MillerProposition II with corporate taxesR S = R0 + (B/S)(R0– R B)(1 – t C)R S = .1270 + (.40)(.1270 – .0826)(1 – .34)R S = .1387 or 13.87%c.In a world with corporate taxes, a firm’s weighted average cost of capital is equalto:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SThe problem does not provide either the debt-value ratio or equity-value ratio.H owever, the firm’s debt-equity ratio of is:B/S = 0.40Solving for B:B = 0.4SSubstituting this in the debt-value ratio, we get:B/V = .4S / (.4S + S)B/V = .4 / 1.4B/V = .29And the equity-value ratio is one minus the debt-value ratio, or:S/V = 1 – .29S/V = .71So, the WACC for the company is:R WACC = .29(1 – .34)(.0826) + .71(.1387) R WACC = .1147 or 11.47%5. a.The equity beta of a firm financed entirely by equity is equal to its unlevered beta.Since each firm has an unlevered beta of 1.25, we can find the equity beta for each.Doing so, we find:North PoleβEquity = [1 + (1 – t C)(B/S)]βUnleveredβEquity = [1 + (1 – .35)($2,900,000/$3,800,000](1.25)βEquity = 1.87South PoleβEquity = [1 + (1 – t C)(B/S)]βUnleveredβEquity = [1 + (1 – .35)($3,800,000/$2,900,000](1.25)βEquity = 2.31b.We can use the Capital Asset Pricing Model to find the required return on each firm’sequity. Doing so, we find:North Pole:R S = R F+ βEquity(R M– R F)R S = 5.30% + 1.87(12.40% – 5.30%)R S = 18.58%South Pole:R S = R F+ βEquity(R M– R F)R S = 5.30% + 2.31(12.40% – 5.30%)R S = 21.73%6. a.If flotation costs are not taken into account, the net present value of a loan equals:NPV Loan = Gross Proceeds – Aftertax present value of interest and principalpaymentsNPV Loan = $5,350,000 – .08($5,350,000)(1 – .40)PVIFA8%,10– $5,350,000/1.0810NPV Loan = $1,148,765.94b.The flotation costs of the loan will be:Flotation costs = $5,350,000(.0125)Flotation costs = $66,875So, the annual flotation expense will be:Annual flotation expense = $66,875 / 10 Annual flotation expense = $6,687.50If flotation costs are taken into account, the net present value of a loan equals:NPV Loan = Proceeds net of flotation costs – Aftertax present value of interest andprincipalpayments + Present value of the flotation cost tax shieldNPV Loan = ($5,350,000 – 66,875) – .08($5,350,000)(1 – .40)(PVIFA8%,10)– $5,350,000/1.0810 + $6,687.50(.40)(PVIFA8%,10)NPV Loan = $1,099,840.407.First we need to find the aftertax value of the revenues minus expenses. The aftertax valueis:Aftertax revenue = $3,800,000(1 – .40)Aftertax revenue = $2,280,000Next, we need to find the depreciation tax shield. The depreciation tax shield each year is:Depreciation tax shield = Depreciation(t C)Depreciation tax shield = ($11,400,000 / 6)(.40)Depreciation tax shield = $760,000Now we can find the NPV of the project, which is:NPV = Initial cost + PV of depreciation tax shield + PV of aftertax revenueTo find the present value of the depreciation tax shield, we should discount at the risk-free rate, and we need to discount the aftertax revenues at the cost of equity, so:NPV = –$11,400,000 + $760,000(PVIFA6%,6) + $2,280,000(PVIFA14%,6)NPV = $1,203,328.438.Whether the company issues stock or issues equity to finance the project is irrelevant. Thecompany’s optimal capital structure determines the WACC. In a worl d with corporate taxes, a firm’s weighted average cost of capital equals:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SR WACC = .80(1 – .34)(.072) + .20(.1140)R WACC = .0608 or 6.08%Now we can use the weighted average cost of capital to discount NEC’s unlevered cash flows. Doing so, we find the NPV of the project is:NPV = –$40,000,000 + $2,600,000 / 0.0608NPV = $2,751,907.399. a.The company has a capital structure with three parts: long-term debt, short-term debt,and equity. Since interest payments on both long-term and short-term debt are tax-deductible, multiply the pretax costs by (1 – t C) to determine the aftertax costs to beused in the weighted average cost of capital calculation. The WACC using the bookvalue weights is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = ($3 / $19)(.035)(1 – .35) + ($10 / $19)(.068)(1 – .35) + ($6 / $19)(.145)R WACC = 0.0726 or 7.26%ing the market value weights, the company’s WACC is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = ($3 / $40)(.035)(1 – .35) + ($11 / $40)(.068)(1 – .35) + ($26 / $40)(.145) R WACC = 0.1081 or 10.81%ing the target debt-equity ratio, the target debt-value ratio for the company is:B/S = 0.60B = 0.6SSubstituting this in the debt-value ratio, we get:B/V = .6S / (.6S + S)B/V = .6 / 1.6B/V = .375And the equity-value ratio is one minus the debt-value ratio, or:S/V = 1 – .375S/V = .625We can use the ratio of short-term debt to long-term debt in a similar manner to find the short-term debt to total debt and long-term debt to total debt. Using the short-term debt to long-term debt ratio, we get:STD/LTD = 0.20STD = 0.2LTDSubstituting this in the short-term debt to total debt ratio, we get:STD/B = .2LTD / (.2LTD + LTD)STD/B = .2 / 1.2STD/B = .167And the long-term debt to total debt ratio is one minus the short-term debt to total debt ratio, or:LTD/B = 1 – .167LTD/B = .833Now we can find the short-term debt to value ratio and long-term debt to value ratio by multiplying the respective ratio by the debt-value ratio. So:STD/V = (STD/B)(B/V) STD/V = .167(.375) STD/V = .063And the long-term debt to value ratio is:LTD/V = (LTD/B)(B/V)LTD/V = .833(.375)LTD/V = .313So, using the target capital structure weights, the company’s WACC is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = (.06)(.035)(1 – .35) + (.31)(.068)(1 – .35) + (.625)(.145)R WACC = 0.1059 or 10.59%d.The differences in the WACCs are due to the different weighting schemes. Thecompany’s WACC will most closely resemble the WACC calculated using targetweights since future projects will be financed at the target ratio. Therefore, theWACC computed with target weights should be used for project evaluation.Intermediate10.The adjusted present value of a project equals the net present value of the project underall-equity financing plus the net present value of any financing side effects. In the joint venture’s case, the NPV of financing side effects equals the aftertax present value of cash flows resulting from the firms’ debt. So, the APV is:APV = NPV(All-Equity) + NPV(Financing Side Effects)The NPV for an all-equity firm is:NPV(All-Equity)NPV = –Initial Investment + PV[(1 – t C)(EBITD)] + PV(Depreciation Tax Shield)Since the initial investment will be fully depreciated over five years using the straight-line method, annual depreciation expense is:Annual depreciation = $30,000,000/5Annual depreciation = $6,000,000NPV = –$30,000,000 + (1 – 0.35)($3,800,000)PVIFA5.13%,20 +(0.35)($6,000,000)PVIFA5,13%,20NPV = –$5,262,677.95NPV(Financing Side Effects)The NPV of financing side effects equals the after-tax present value of cash flows resulting from the firm’s debt. The coupon rate on the debt is relevant to determine the interest payments, but the resulting cash flows should still be discounted at the pretax cost of debt. So, the NPV of the financing effects is:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Repayments)NPV = $18,000,000 – (1 – 0.35)(0.05)($18,000,000)PVIFA8.5%,15– $18,000,000/1.08515 NPV = $7,847,503.56So, the APV of the project is:APV = NPV(All-Equity) + NPV(Financing Side Effects)APV = –$5,262,677.95 + $7,847,503.56APV = $2,584,825.6111.If the company had to issue debt under the terms it would normally receive, the interestrate on the debt would increase to the company’s normal cost of debt. The NPV of an all-equity project would remain unchanged, but the NPV of the financing side effects would change. The NPV of the financing side effects would be:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Repayments)NPV = $18,000,000 – (1 – 0.35)(0.085)($18,000,000)PVIFA8.5%,15–$18,000,000/((1.085)15NPV = $4,446,918.69Using the NPV of an all-equity project from the previous problem, the new APV of the project would be:APV = NPV(All-Equity) + NPV(Financing Side Effects)APV = –$5,262,677.95 + $4,446,918.69APV = –$815,759.27The gain to the company from issuing subsidized debt is the difference between the two APVs, so:Gain from subsidized debt = $2,584,825.61 – (–815,759.27)Gain from subsidized debt = $3,400,584.88Most of the value of the project is in the form of the subsidized interest rate on the debt issue.12.The adjusted present value of a project equals the net present value of the project underall-equity financing plus the net present value of any financing side effects. First, we need to calculate the unlevered cost of equity. According to Modigliani-Miller Proposition II with corporate taxes:R S = R0 + (B/S)(R0– R B)(1 – t C).16 = R0 + (0.50)(R0– 0.09)(1 – 0.40)R0 = 0.1438 or 14.38%Now we can find the NPV of an all-equity project, which is:NPV = PV(Unlevered Cash Flows)NPV = –$21,000,000 + $6,900,000/1.1438 + $11,000,000/(1.1438)2 +$9,500,000/(1.1438)3NPV = –$212,638.89Next, we need to find the net present value of financing side effects. This is equal the aftertax present value of cash flows resulting from the firm’s debt. So:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Payments)Each year, an equal principal payment will be made, which will reduce the interest accrued during the year. Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt, so the NPV of the financing effects are:NPV = $7,000,000 – (1 – .40)(.09)($7,000,000) / (1.09) – $2,333,333.33/(1.09)– (1 – .40)(.09)($4,666,666.67)/(1.09)2– $2,333,333.33/(1.09)2– (1 – .40)(.09)($2,333,333.33)/(1.09)3– $2,333,333.33/(1.09)3 NPV = $437,458.31So, the APV of project is:APV = NPV(All-equity) + NPV(Financing side effects)APV = –$212,638.89 + 437,458.31APV = $224,819.4213. a.To calculate the NPV of the project, we first need to find the company’s WACC. Ina world with corporate taxes, a firm’s weighted average cost of capital equals:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SThe market value of the company’s equity is:Market value of equity = 6,000,000($20)Market value of equity = $120,000,000So, the debt-value ratio and equity-value ratio are:Debt-value = $35,000,000 / ($35,000,000 + 120,000,000)Debt-value = .2258Equity-value = $120,000,000 / ($35,000,000 + 120,000,000)Equity-value = .7742Since the CEO believes its current capital structure is optimal, these values can beuse d as the target weights in the firm’s weighted average cost of capital calculation.The yield to maturity of the company’s debt is its pretax cost of debt. To find thecompany’s cost of equity, we need to calculate the stock beta. The stock beta can becalculated as:β = σS,M / σ2Mβ = .036 / .202β = 0.90Now we can use the Capital Asset Pricing Model to determine the cost of equity. The Capital Asset Pricing Model is:R S = R F+ β(R M– R F)R S = 6% + 0.90(7.50%)R S = 12.75%Now, we can calculate the company’s WACC, which is:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SR WACC = .2258(1 – .35)(.08) + .7742(.1275)R WACC = .1105 or 11.05%Finally, we can use the WACC to discount the unlevered cash flows, which gives usan NPV of:NPV = –$45,000,000 + $13,500,000(PVIFA11.05%,5)NPV = $4,837,978.59b.The weighted average cost of capital used in part a will not change if the firm choosesto fund the project entirely with debt. The weighted average cost of capital is basedon optimal capital structure weights. Since the current capital structure is optimal,all-debt funding for the project simply implies that the firm will have to use moreequity in the future to bring the capital structure back towards the target.Challenge14. a.The company is currently an all-equity firm, so the value as an all-equity firm equalsthe present value of aftertax cash flows, discounted at the cost of the firm’s unleveredcost of equity. So, the current value of the company is:V U = [(Pretax earnings)(1 – t C)] / R0V U = [($28,000,000)(1 – .35)] / .20V U = $91,000,000The price per share is the total value of the company divided by the sharesoutstanding, or:Price per share = $91,000,000 / 1,500,000Price per share = $60.67b.The adjusted present value of a firm equals its value under all-equity financing plusthe net present value of any financing side effects. In this case, the NPV of financingside effects equals the aftertax present value of cash flows resulting from the firm’sdebt. Given a known level of debt, debt cash flows can be discounted at the pretaxcost of debt, so the NPV of the financing effects are:NPV = Proceeds – Aftertax PV(Interest Payments)NPV = $35,000,000 – (1 – .35)(.09)($35,000,000) / .09NPV = $12,250,000So, the value of the company after the recapitalization using the APV approach is:V = $91,000,000 + 12,250,000V = $103,250,000Since the company has not yet issued the debt, this is also the value of equity after the announcement. So, the new price per share will be:New share price = $103,250,000 / 1,500,000New share price = $68.83c.The company will use the entire proceeds to repurchase equity. Using the share pricewe calculated in part b, the number of shares repurchased will be:Shares repurchased = $35,000,000 / $68.83Shares repurchased = 508,475And the new number of shares outstanding will be:New shares outstanding = 1,500,000 – 508,475New shares outstanding = 991,525The value of the company increased, but part of that increase will be funded by the new debt. The value of equity after recapitalization is the total value of thecompany minus the value of debt, or:New value of equity = $103,250,000 – 35,000,000New value of equity = $68,250,000So, the price per share of the company after recapitalization will be:New share price = $68,250,000 / 991,525New share price = $68.83The price per share is unchanged.d.In order to v alue a firm’s equity using the flow-to-equity approach, we must discountthe cash flows available to equity holders at the cost of the firm’s levered equity.According to Modigliani-Miller Proposition II with corporate taxes, the required return of levered equity is:R S = R0 + (B/S)(R0– R B)(1 – t C)R S = .20 + ($35,000,000 / $68,250,000)(.20 – .09)(1 – .35)R S = .2367 or 23.67%After the recapitalization, the net income of the company will be:EBIT $28,000,000Interest 3,150,000EBT $24,850,000 Taxes 8,697,500 Net incomeThe firm pays all of its earnings as dividends, so the entire net income is availableto shareholders. Using the flow-to-equity approach, the value of the equity is:S = Cash flows available to equity holders / R SS = $16,152,500 / .2367S = $68,250,00015. a.If the company were financed entirely by equity, the value of the firm would be equalto the present value of its unlevered after-tax earnings, discounted at its unleveredcost of capital. First, we need to find the company’s unlevered cash flows, which are:Sales $28,900,000Variable costs 17,340,000EBT $11,560,000Tax 4,624,000Net incomeSo, the value of the unlevered company is:V U = $6,936,000 / .17V U = $40,800,000b.According to Modigliani-Miller Proposition II with corporate taxes, the value oflevered equity is:R S = R0 + (B/S)(R0– R B)(1 – t C)R S = .17 + (.35)(.17 – .09)(1 – .40)R S = .1868 or 18.68%c.In a world with corporate taxes, a firm’s weighted average cost of capital equals:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SSo we need the debt-value and equity-value ratios for the company. The debt-equityratio for the company is:B/S = 0.35B = 0.35SSubstituting this in the debt-value ratio, we get:B/V = .35S / (.35S + S)B/V = .35 / 1.35B/V = .26And the equity-value ratio is one minus the debt-value ratio, or:S/V = 1 – .26S/V = .74So, using the capital structure weights, the company’s WACC is:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SR WACC = .26(1 – .40)(.09) + .74(.1868)R WACC = .1524 or 15.24%We can use the weighted average cost of capital to discount the firm’s unlevered aftertax earnings to value the company. Doing so, we find:V L = $6,936,000 / .1524V L = $45,520,661.16Now we can use the debt-value ratio and equity-value ratio to find the value of debt and equity, which are:B = V L(Debt-value)B = $45,520,661.16(.26)B = $11,801,652.89S = V L(Equity-value)S = $45,520,661.16(.74)S = $33,719,008.26d.In order to value a firm’s equity using the flow-to-equity approach, we can discountthe cash flows available to equity holders at the cost of the firm’s levered equity.First, we need to calculate the levered cash flows available to shareholders, which are:Sales $28,900,000Variable costs 17,340,000EBIT $11,560,000Interest 1,062,149EBT $10,497,851Tax 4,199,140Net incomeSo, the value of equity with the flow-to-equity method is:S = Cash flows available to equity holders / R SS = $6,298,711 / .1868 S = $33,719,008.2616. a.Since the company is currently an all-equity firm, its value equals the present valueof its unlevered after-tax earnings, discounted at its unlevered cost of capital. Thecash flows to shareholders for the unlevered firm are:EBIT $83,000Tax 33,200Net incomeSo, the value of the company is:V U = $49,800 / .15V U = $332,000b.The adjusted present value of a firm equals its value under all-equity financing plus thenet present value of any financing side effects. In this case, the NPV of financingside effects equals the after-tax present value of cash flows resulting from debt. Givena known level of debt, debt cash flows should be discounted at the pre-tax cost ofdebt, so:NPV = Proceeds – Aftertax PV(Interest payments)NPV = $195,000 – (1 – .40)(.09)($195,000) / 0.09NPV = $78,000So, using the APV method, the value of the company is:APV = V U + NPV(Financing side effects)APV = $332,000 + 78,000APV = $410,000The value of the debt is given, so the value of equity is the value of the companyminus the value of the debt, or:S = V – BS = $410,000 – 195,000S = $215,000c.According to Modigliani-Miller Proposition II with corporate taxes, the requiredreturn of levered equity is:R S = R0 + (B/S)(R0– R B)(1 – t C)R S = .15 + ($195,000 / $215,000)(.15 – .09)(1 – .40)R S = .1827 or 18.27%d.In order to value a firm’s equity using the flow-to-equity approach, we can discountthe cash flows available to equity holders at the cost of the firm’s levered equity.First, we need to calculate the levered cash flows available to shareholders, whichare:EBIT $83,000Interest 17,550EBT $65,450Tax 26,180Net incomeSo, the value of equity with the flow-to-equity method is:S = Cash flows available to equity holders / R SS = $39,270 / .1827S = $215,00017.Since the company is not publicly traded, we need to use the industry numbers to calculatethe industry levered return on equity. We can then find the industry unlevered return on equity, and re-lever the industry return on equity to account for the different use of leverage. So, using the CAPM to calculate the industry levered return on equity, we find:R S = R F+ β(MRP)R S = 5% + 1.2(7%)R S = 13.40%Next, to find the average cost of unlevered equity in the holiday gift industry we can use Modigliani-Miller Proposition II with corporate taxes, so:R S = R0 + (B/S)(R0– R B)(1 – t C).1340 = R0 + (.35)(R0– .05)(1 – .40)R0 = .1194 or 11.94%Now, we can use the Modigliani-Miller Proposition II with corporate taxes to re-lever the return on equity to account for this company’s debt-equity ratio. Doing so, we find:R S = R0 + (B/S)(R0– R B)(1 – t C)R S = .1194 + (.40)(.1194 – .05)(1 – .40)R S = .1361 or 13.61%Since the project is financed at the firm’s target debt-equity ratio, it must be discounted at t he company’s weighted average cost of capital. In a world with corporate taxes, a firm’s weighted average cost of capital equals:。