个人财务管理系统说明书

财务管理系统数据字典

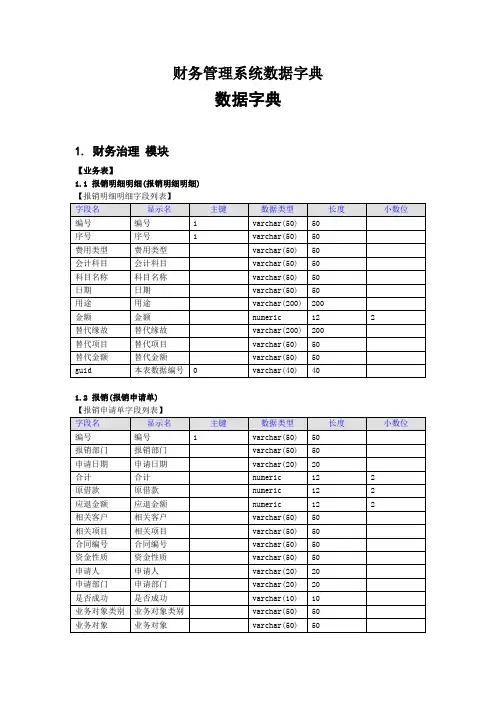

财务管理系统数据字典数据字典1. 财务治理模块1.6 调账单(调帐单)【调帐单字段列表】1.43 结算方式(付款方式)【(local)@allsbjname字段列表】【(local)@allsubjectlist字段列表】【(local)@nbzhang字段列表】【(local)@P_自动填充差旅费明细字段列表】【(local)@p费用对象权限字段列表】【(local)@p费用类型字段列表】【(local)@p内部银行字段列表】【(local)@p现金帐户余额字段列表】【(local)@sbjname字段列表】【(local)@updownlist字段列表】【(local)@v核销记录单字段列表】【(local)@v往来总帐字段列表】【(local)@V支付记录字段列表】【(local)@xjzhang字段列表】【(local)@yhzhang字段列表】【(local)@科目编号字段列表】【(local)@科目编号下级字段列表】【(local)@选择账户sp字段列表】注:本文档内容来自方正飞鸿ES2007论坛。

更多信息请关注ES2007相关信息。

1.ES2007 之概述founderfix :81/showtopic-977.aspx2.ES2007 简介founderfix :81/showtopic-986.aspx3.ES2007_Studio 设计器介绍founderfix :81/showtopic-987.aspx4.ES2007_WorkFlow 流程设计founderfix :81/showtopic-989.aspx5.ES2007_FormDesign 表单设计founderfix :81/showtopic-982.aspx6.ES2007_MSQ 即时通讯founderfix :81/showtopic-975.aspx7.ES2007_Theme 主题相关founderfix :81/showtopic-974.aspx8.ES2007_Coding 源码开发founderfix :81/showtopic-979.aspx9.ES2007_Develope 小型项目开发founderfix :81/showtopic-980.aspx10.ES2007_Others 其他功能组件介绍founderfix :81/showtopic-985.aspx11.ES2007_NewVerion 新版本功能设想founderfix :81/showtopic-984.aspx。

财务管理手册说明书

SAMPLE FINANCIALPROCEDURES MANUALApproved by ___________ (organization’s) Board of Directors on ____________ (date)I. GENERAL1. The Board of Directors formulates financial policies, delegates administration of thefinancial policies to the Executive Director and reviews operations and activities.2. The Executive Director has management responsibility including financial management.3. Current job descriptions will be maintained for all employees, indicating financial dutiesand responsibilities.4. Financial duties and responsibilities must be separated so that no one employee hassole control over cash receipts; disbursements; payroll; reconciliation of bank accounts;etc.5. All employees involved with financial procedures shall take vacations or leaves of 5consecutive work days each year. During such periods, back-up personnel who havebeen cross-trained in their duties will perform their tasks.6. A blanket employee dishonesty coverage in the amount of $_________ shall bemaintained.7. Professional financial service providers will be established annually. For _______ (year)these include ___________ (accounting software), __________ (payroll services), the___________ (insurance), ____________ (banking), _______________ (restrictedinvestments and retirement services), and ______________ (auditors).8. The ___________ (staff position) will maintain a current and accurate log of the chart ofaccounts, job accounts and accounting classes.9. These policies and procedures will be reviewed bi-annually by the ___________ (BoardCommittee)II. CASH RECEIPTS (includes checks)1. The ____________ (staff position) opens any mail addressed to _____________(organization name) or without specific addressee. The receipt of checks or cash will berecorded in the accounting system. All other checks or cash will be immediatelyforwarded to the _________________ (staff position).2. The ___________ (staff position) will endorse all checks by rubber stamp to read asfollows:PAY TO THE ORDER OF________ BankAccount #FOR DEPOSIT ONLYOrganization NameAccount NumberThe endorsement stamp will specify into which corporate account (savings, checking) the deposit will be made.3. A report will be printed that includes the source and amount of the receipt as well as thetotal daily deposit amount.4. The checks and cash will then be forwarded to the _______________ (staff position), whowill complete deposit slips in duplicate. Receipts and deposit slip will be placed in an envelope for __________ (Bank).5. If no cash is present, the envelope may be sealed and sent through the US mail. If cashis present, the _______________ (staff position) will verify deposited funds prior tosealing the envelope and making the deposit in person.6. Documentation for all receipts (a copy of check, letter, etc.) will be attached to theduplicate slip and filed chronologically.7. All receipts will be deposited intact. No disbursements will be made from cash or checkreceipts prior to deposit.8. The ______________ (staff position) will record each cash payment received in a numberreceipt book with a duplicate for the payer. Cash shall be locked in a secure location until taken to the bank.9. The Executive Director will receive a copy of all deposit reports for review.10. Checks received at the _______ (other office) location will be endorsed as in #2 aboveand mailed to the mail office for processing. Receipts will be given for cash as in #8 above. Cash will be brought to the main office by a staff or board member.III. CASH DISBURSEMENTSA. CHECK AUTHORIZATION1. All invoices will be immediately forwarded to the ______________ (staff position) who willreview all invoices for mathematical accuracy, validity, conformity to the budget (or other board authorization) and compliance with bid requirements.2. Prior to payment, all invoices will be approved (indicated by initialing) by the________________ (staff position), who will code the invoice with an appropriateexpense or other chart of accounts line item number, class and job number (whereapplicable).a. By approving an invoice, the ______________ (staff position) indicates that it hasbeen reviewed by the ______________ (staff position) and authorizes a check.b. The _____________ (staff position) will ensure that all conditions and specificationson a contract or order have been satisfactorily fulfilled, including inventorying itemsreceived against packing slip counts. The ______________ (staff position) isresponsible for timely follow-up on discrepancies and payment.3. Approved invoices will be entered into the accounting system using the “Enter Bills”screen.4. The __________________ (staff position) will prepare checks on a weekly basis.5. Authorized signers on _____________ (organziation’s) accounts include the ExecutiveDirector, Chair and Treasurer of the Board.B. CHECKS1. The ________________ (staff position) will be responsible for all blank checks.2. All checks, including payroll checks (with the exception of direct deposit payroll items)will be signed by the Executive Director or designated members of the Board ofDirectors.3. The _______________ (staff position) will generate checks for approved invoices throughthe accounting system using “Pay Bills” and/or “Write Checks” screens whereappropriate.4. Voided checks will have "VOID" written boldly in ink on the face and have the signatureportion of the check torn out. Voided checks will be kept on file.5. In no event will:a. invoices be paid unless approved by an authorized signerb. blank checks (checks without a date or payee designated) be signed in advancec. checks be made out to "cash", "bearer", "petty cash", etc.d. checks be prepared on verbal authorization, unless approved by the ExecutiveDirector.6. In the event that it is necessary to issue a duplicate check for checks in an amount over$15, a stop payment will be ordered at the bank on the original check.C. BANK RECONCILIATIONS1. Bank statements will be received directly and opened by the _______________ (staffposition).2. The ________________ (staff position) will reconcile the bank statement monthly.3. The Treasurer of the Board will receive monthly statements of checks paid on allaccounts.4. The Executive Director shall verify the reconciliation of the bank accounts on at least aquarterly basis.5. On all checks outstanding over 90 days, the _____________ (staff position) should takeappropriate action.IV. PURCHASINGA. PURCHASES UNDER $5,0001. All purchases over $500 must be approved in advance by the Executive Director.2. The Project Director is responsible to know if the item ordered is within the budget andguidelines.3. If purchase is less than $150, persons authorized by the Project Director for immediatepurchase and delivery can make the purchase. When this is done, invoice copies are to be turned into the Project Director.B. PURCHASES OVER $5,0001. All purchases including services over $500 must be approved in advance by theExecutive Director.2. Purchases over $5000 will be required to undergo a competitive bid procedure.3. All bid requests will contain clear specifications and will not contain features which undulyrestrict competition.4. The Project Director will be responsible to ensure that all conditions and specifications ofa contract, bid, or order have been satisfactorily fulfilled and will be responsible fortimely follow-up of these purchases.5. The Project Director will obtain at least 3 bids wherever possible unless prior approvalby Executive Committee has been obtained.6. Purchases of over $5000 will not be fragmented or reduced to components of less than$5,000 to avoid the bid process.V. PAYROLLA. TIME SHEETS1. Each hourly employee will be responsible for completing a time sheet on a biweeklybasis.2. Completed time sheets will be dated and signed by the employee, time cards will bestapled to the back, and both will be submitted to the _____________ (staff position) atthe end of the last working day of each pay period.3. No payroll checks will be issued without a completed time sheet and time card ifrequired.4. Incomplete time sheets and cards will be returned to the employee for correction.5. The _______________ (staff position) will verify the accuracy of the time sheets andaddition.6. Employees will be paid every two weeks, deductions are itemized on each paycheck.B. PAYROLL1. The __________ (vendor name) Payroll System will enter payroll, print payroll checks,make direct deposit transfers print payroll reports and send reports to the ____________ (staff position).2. The _____________ (staff position) will review the payroll checks before they aredistributed.3. The ____________ (staff position) will distribute the payroll checks to the employees.Checks will not be issued to any person other than the employee without writtenauthorization from the employee.4. The _____________ (staff position) is responsible for entering payroll reports into theaccounting system.5. Voluntary terminations will be paid at regular pay date. Involuntary terminations will bepaid on day of separation.C. PAYROLL TAXES1. _______________ (staff position) will prepare and transmit the payroll tax reports, W-2forms, and 1099 forms.2. The _______________ (staff position) will verify payroll tax preparation on a quarterlybasis.D. BENEFITS1. Payroll will be prepared in accordance with the personnel policies and benefit plan. VI. TRAVEL & EXPENSES1. Each employee will complete an expense voucher if any traveling is done. Vouchershould include all expenses including credit card charges. Voucher will reflectreimbursement sources other than _____________ (organization).2. Mileage to and from residence will not be paid by _____________ (organization), exceptfor board members traveling from outside the Twin Cities to board meetings.3. The expense voucher will be submitted within 60 days for payment, with a total, signedby the employee, authorized for payment by the Executive Director.4. Reimbursement will be based upon current travel policies. Receipts must be attachedto the expense voucher for lodging, common carrier transportation, and receipts formeals where required.5. Incomplete expense vouchers will be returned.6. Employees and board members will be reimbursed for travel and other relatedexpenses at the rate set by the Board. The Executive Director must approve employee travel and workshop expenditures prior to their occurrence. The organization willreimburse no more than the standard mileage rate for the business use of a car asestablished by the IRS. _____________ (organization) will reimburse meal expensesincurred in direct connection with _____________ (organization) employment, or a perdiem rate of $___ per day. The mileage rate and per diem rate will be establishedannually by the board.VII. CONSULTANTS1. Consideration will be made of internal capabilities to accomplish services beforecontracting for them.2. Written contracts clearly defining work to be performed, terms and conditions will bemaintained for all consultant and contract services.3. The qualifications of the consultant and reasonableness of fees will be considered inhiring consultants.4. Consultant services will be paid for as work is performed or as delineated in the contract.5. The Board of Directors will approve audit and other significant contracts.6. The ________________ (staff position) will prepare 1099 returns for consultants at year-end.VIII. PROPERTYA. EQUIPMENT1. Equipment shall be defined as all items (purchased or donated) with a unit cost of $500or more and a useful life of more than one year.2. The _______________ (staff position) will maintain an inventory log; which shall list adescription of the item, date of purchase or acquisition, price or fair value of the item and its location.3. A depreciation schedule shall be prepared at least annually for the audited financialstatements.4. The _____________ (staff position) will record all equipment in the accounting system.An entry must be made whenever property is disposed of or acquired.IX. LEASESA. REAL ESTATE1. The Executive Director will review leases prior to submission to the Board of Directorsfor approval.2. All leases, clearly delineating terms and conditions, will be approved by the Board ofDirectors and signed by the Board Chair.3. The Executive Director will keep a copy of each lease on file.4. The Consulting Accountant will be notified of each lease and lease specifications, andwill make proper general journal entries for same.B. EQUIPMENT1. The Executive Director will review all leases.2. All leases, clearly delineating terms and conditions, will be approved and signed by theExecutive Director.3. The Executive Director will keep a copy of each lease on file.4. The Consulting Accountant will be notified of each lease and lease specifications, andwill make proper general journal entries for same.X. INSURANCE1. Reasonable, adequate coverage will be maintained to safeguard the assets of thecorporation. Such coverage will include property and liability, worker’s compensation, employee dishonesty and other insurance deemed necessary.2. The Executive Director will carefully review insurance policies before renewal.3. The Executive Director will maintain insurance policies in insurance files.4. Insurance policies will correspond to the calendar year whenever possible.5. The __________________ (staff position) will prepare and maintain an insurance register. XI. TELEPHONE1. Personal long distance or cellular phone calls made on _____________ (organization’s)telephones by employees must be logged with the _______________(staff position),indicating that it is a personal call. Employees will be billed on these calls.2. _____________ (organization) business calls from phones outside the office should bebilled to the _____________ (organization’s) telephone account.XII. BOOKS OF ORIGINAL ENTRY1. _____________ (organization will utilize a double entry system for accounting for allfunds.2. Adequate documentation will be maintained to support all general entries.3. At the end of each month, the ____________ (staff position) will prepare a BalanceSheet, Statement of Activities, and Statement of Activities by Project that will bereviewed by the Executive Director.4. The Statement of Activities report will include a comparison to the budget.5. _____________ (organization will maintain its accounting records on the accrual basis ina manner that facilitates the preparation of audited financial statements conforming togenerally accepted accounting principles.XIII. GRANTS AND CONTRACTS1. The Executive Director will carefully review each award and contract to ensurecompliance with all financial and programmatic provisions. The ____________ (staffposition) will maintain originals of all grants and contracts in a file. The ConsultingAccountant will prepare initial entries as appropriate to record each award.2. The ______________ (staff position) will prepare and maintain on a current basis aGrant/Contract Summary form for each grant or contract awarded to _____________(organization). This form shall include the name, address, contact person, and phonenumber for the funding organization; the time period applicable to expenditures; allsignificant covenants (such as bonding or liability insurance requirements) andrestrictions on expenditures; all require financial and program report and due dates; and the chart of accounts line item number for the revenue deposited.3. Payments for projects for which _____________ (organization serves as fiscal agentshall be paid out within one week.4. The Consulting Accountant will prepare financial reports to funding sources as required.5. The Executive Director will review and approve all reports to funding sources.6. It will be the responsibility of the Executive Director to insure that all financial reports aresubmitted on a timely basis.XIV. BUDGETS1. The Executive Director and the _______________(staff position) will prepare thefinancial budget.2. The __________________ (staff position) will insure that budgets are on file.3. The Board of Directors must approve proposed changes in the budget, should theyexceed $______ or _______% of the line item, whichever is greater.XV. LOANS1. The Board of Directors will approve loans.2. A promissory note will be prepared and signed by the Board Chair and another officerof the Board before funds are borrowed.XVI. OTHERA. MINUTES OF MEETINGS1. The Secretary of the Board will prepare accurate minutes of all meetings of the Board ofDirectors and committees.2. The Executive Director will note all items in the minutes relating to finance and takeappropriate action.B. NON-PROGRAM INCOME1. Donations of cash and non-program related income will be separately accounted for.C. ACCOUNTS RECEIVABLE1. Documentation will be maintained for accounts receivable.2. Accounts receivable will be recorded in the books and collected on a timely basis.D. FINANCIAL PROCEDURES1. Financial procedures will be reviewed bi-annually by the Finance Committee. TheBoard of Directors must approve changes to the financial procedure manual prior toimplementation.E. FORM 9901. 1.The Board of Directors in conjunction with the audit will authorize preparation of Form990. Form 990 will be signed by an officer of the Board.2. Copies of Form 990 will be files in the _____________ (staff position)’s files, and a copyof the _____________ (organization’s) Form 990 and Form 1023 shall be located at thefront desk for public inspection and/or copying.F. AUDITS1. The Board of Directors shall annually contract with an independent auditing firm a fullaudit of the books, to be completed prior to the following first of September.G. PERSONNEL FILES1. The _______________ (staff position) will maintain a personnel file for each employee,containing appropriate documents, such as the signed compensation agreement,approval of changes in compensation, an I-9 immigration form, and withholding forms for taxes, benefits, deferred compensation, and charitable contributions.H. FISCAL AGENT STATUS1. The _____________ (organization) executive committee must authorize all fiscalsponsorship arrangements, which are then approved by the board.2. All fiscal sponsorship arrangements will begin with a written agreement, stating the termsof the relationship and the purpose for the use of funds.3. Fiscal sponsorships will be limited to projects for which the _____________(organization’s) executive committee determines that the project is charitable andconsistent with the _____________ (organization’s) mission of strengthening the nonprofit sector, and that no real or perceived conflicts of interest exist with board or executivecommittee members.4. The _____________ (organization) will negotiate with the sponsored project a rate forindirect or direct costs to cover the _____________ (organization’s) expenses ofadministering the temporarily restricted fund.5. Sponsored projects will be required to submit full and complete quarterly and year endreports to the _____________ (organization) by the end of the _____________(organization’s)fiscal year, (date)_____________,: and must include:• detailed expenses using budget categories for original grant;• program accomplishments and activities;• lobbying expenditures; and• amount of remaining funds.6. Any changes in the purpose for which grant funds are spent must be approved in writingby the _____________ (organization) before implementation. The _____________(organization) retains the right, if sponsored project’s breaches the fiscal sponsorshipagreement, or if a sponsored project jeopardizes the _____________ (organization) legal or tax status, to withhold, withdraw, or demand immediate return of grant funds.7. The _____________ (organization’s) executive director will submit quarterly reports to theExecutive Committee, to be circulated to the entire board, on the status of active fiscal sponsorships.8. The _____________ (organization) will file appropriate tax forms for sponsored projects,including IRS form 1099.。

账易通财务管理系统V4.0安装使用说明书

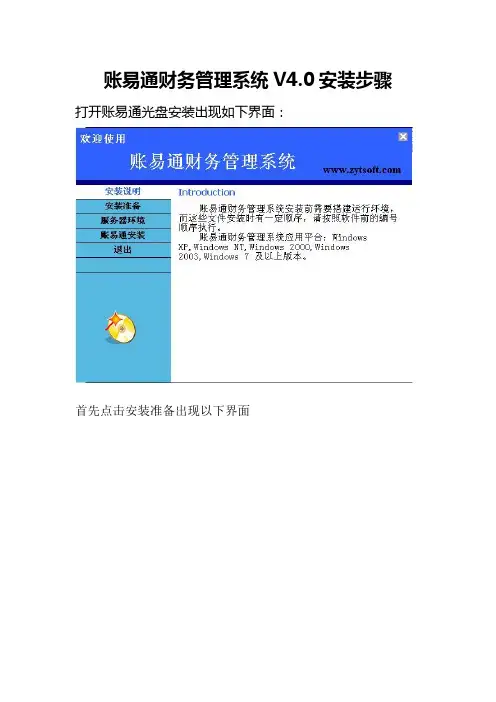

账易通财务管理系统V4.0安装步骤打开账易通光盘安装出现如下界面:

首先点击安装准备出现以下界面

1、2、3、4、5要按顺序依次安装,安装完成后点击服务器环境出现的界面

→依次安装→

最后点击账易通安装安装完成后在电脑桌面上会自动出现两个桌面

图标登录账易通财务管理系统之前要保证账易通服务控制平台是正常运行的。

查看电脑右下角是否这样的一个图标存在点击查看

设置账套和用户名的方法:在安装目录下找

这个图标点击打开出现

密码为空直接点击登录即可,

登录之后出现

点击“文件”出现新建帐套

输入正确的信息保存后再点击“会计设置”

选择好“适用的会计准则”和你要启用的”会计启用日期”点击保存, 保存之后再点击“用户及权限”出现如下画面

输入用“户登录名”和“用户姓名”保存之后推出再点击“用户权限”出现界面

选中该用户名分配该使用的权限和明细权限然后保存。

退出后用你设置的用户名去登录.点击选择你所设置的账套

双击该帐套信息显示如下界面登录即可操作本公司业务!

登录软件的操作界面如下:。

财务管理系统说明书

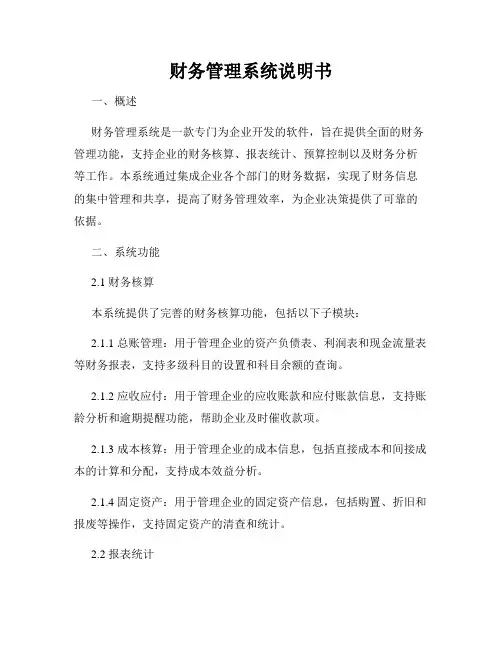

财务管理系统说明书一、概述财务管理系统是一款专门为企业开发的软件,旨在提供全面的财务管理功能,支持企业的财务核算、报表统计、预算控制以及财务分析等工作。

本系统通过集成企业各个部门的财务数据,实现了财务信息的集中管理和共享,提高了财务管理效率,为企业决策提供了可靠的依据。

二、系统功能2.1 财务核算本系统提供了完善的财务核算功能,包括以下子模块:2.1.1 总账管理:用于管理企业的资产负债表、利润表和现金流量表等财务报表,支持多级科目的设置和科目余额的查询。

2.1.2 应收应付:用于管理企业的应收账款和应付账款信息,支持账龄分析和逾期提醒功能,帮助企业及时催收款项。

2.1.3 成本核算:用于管理企业的成本信息,包括直接成本和间接成本的计算和分配,支持成本效益分析。

2.1.4 固定资产:用于管理企业的固定资产信息,包括购置、折旧和报废等操作,支持固定资产的清查和统计。

2.2 报表统计本系统提供了灵活的报表统计功能,包括以下子模块:2.2.1 现金流量表:用于统计企业的现金流量情况,包括经营活动、投资活动和筹资活动的流入流出情况,分析企业的现金流量状况。

2.2.2 利润表:用于统计企业的利润情况,包括销售收入、成本支出和利润分配等指标,帮助企业评估经营绩效。

2.2.3 资产负债表:用于统计企业的资产和负债情况,包括流动资产、固定资产和所有者权益等指标,反映企业的财务状况。

2.3 预算控制本系统提供了强大的预算控制功能,包括以下子模块:2.3.1 预算编制:支持企业的预算编制工作,包括收入预算和支出预算的制定,提供预算编制模板和预算执行跟踪功能。

2.3.2 预算执行:用于监控企业的预算执行情况,包括预算执行进度和预算偏差的分析,提供预算执行报告和异常预警功能。

2.4 财务分析本系统提供了全面的财务分析功能,包括以下子模块:2.4.1 财务比率分析:用于计算和分析企业的财务比率,包括流动比率、速动比率和资产负债率等指标,帮助企业评估财务风险和盈利能力。

c语言个人财务管理系统[1]

![c语言个人财务管理系统[1]](https://uimg.taocdn.com/e19c22d1de80d4d8d05a4f9a.webp)

个人财政支出管理付欣05计算机四班指导老师:梁新元一、问题描述及分析 (1)二、实验程序设计思想及功能描述 (2)3、主要函数模块的设计思想和具体实现 (3)三、实验程序测试 (7)1、程序开始执行时系统的所显示的页面: (7)2、选择退出系统: (7)3、选择登陆,并且输入的帐号和密码都正确: (7)4、用户输入的帐号不正确: (8)5、用户输入的帐号正确,密码不正确: (8)四、实验程序自我评价 (9)五、课程设计创新 (10)六、课程设计总结 (10)七、参考书目: (10)八、实验程序源代码 (10)一、问题描述及分析编写一个个人财政支出管理系统,主要解决的问题是作为一个系统而言,它所要面对不只是某一个人而言,而是要面对很多的用户。

那么想要解决这一问题,就必须要求这个系统能够存储许多用户的基本信息和记录。

同时也要求系统能够对不同的用户的身份进行查找和验证。

在验证通过之后,在对其进行用户所要求的操作。

作为一个财政支出系统,那么就要求对于用户关于金钱的每一项操作都要有相应的记录,同时并允许用户对于每一条整体的记录进行操作,例如可以根据时间来查找某一确定日期是否进行了收入或者支出的操作,也可以根据特定的需要来删除某一条整体的记录。

但不允许对每条记录的单项数据进行更改,因为不管是收入还是支出,所涉及的金额都是固定的,时间也是固定的,所以系统不允许用户对其进行操作。

除此之外,还必须有足够大的空间来存储新的记录。

所以此程序就是基于这个思想而编写出来的,基本满足了用户对于一个财政支出管理系统所要求的相关功能。

二、实验程序设计思想及功能描述根据前面对于编写一个个人财政支出管理系统的程序的问题描述和分析,确定了此程序的基本思想和相关功能。

1、基本思想首先定义一个结构体数组,这个数组的功能便是用来所有用户的所有信息。

它的成员为每个用户的帐号(account)、密码(code)、姓名(name)、记录(record rec[max]),以及记录的条数(rec_len)。

个人财务情况说明

个人财务情况说明

当谈及个人财务情况,很多人都可能感到困惑和压力。

然而,对于理智的人来说,了解自己的财务状况是至关重要的。

本文将介绍如何评估个人财务状况,制定财务目标,以及管理个人资金。

评估个人财务状况

首先,了解个人财务状况的第一步是制作一份资产负债表。

资产包括现金、股票、房产等所有拥有的财产,而负债则包括房贷、车贷、信用卡债务等所有欠款。

计算净值是减去负债后的资产总额。

另一个关键因素是了解个人现金流。

这意味着计算每月的收入和支出,以确定个人每月的结余或透支情况。

如果支出高于收入,那么就需要调整预算或增加收入来实现财务平衡。

制定财务目标

制定财务目标是管理个人财务的关键。

目标可以包括储蓄一定比例的收入、还清所有高利负债、投资房地产或股票等。

确保目标符合SMART原则,即具体、可衡量、可实现、相关和有时间限制。

管理个人资金

管理个人资金意味着拥有一个明智的预算,并严格执行它。

为必要开支、娱乐支出和储蓄设立不同的账户,以确保资金的划分清晰。

同时,定期审查预算,调整支出计划以及寻找额外的收入来源。

另外,了解基本的投资知识也是管理个人资金的一部分。

选择适合自己风险承受能力和财务目标的投资产品,并定期审查投资组合以确保稳健增长。

结语

个人财务状况的明智管理不仅可以确保个人财务的稳健增长,还可以提高生活质量,减少焦虑和压力。

通过评估财务状况、制定明确的财务目标和有效管理个人资金,每个人都可以实现理想的财务状态。

愿每个人都能在个人财务管理的道路上取得成功。

系统功能说明书模板

系统功能说明书模板一、概述本系统功能说明书旨在为使用者提供关于系统的详细说明,包括系统的功能、特点、操作方式、维护方法等。

本说明书将帮助使用者更好地理解、使用和维护该系统。

二、系统功能说明1、功能介绍本系统的主要功能是,通过使用先进的技术,实现功能,提高效率。

2、功能特点本系统具有以下特点:(1)易于操作:界面友好,操作简单,用户只需经过简单的培训即可熟练使用。

(2)高效稳定:采用先进的技术,确保系统运行稳定,提高数据处理效率。

(3)安全可靠:数据传输和存储均采用加密技术,确保用户信息安全。

(4)智能提示:系统具备智能提示功能,帮助用户快速解决问题,提高工作效率。

三、操作说明1、登录与退出用户通过输入用户名和密码进行登录,登录成功后即可进入系统主界面。

如需退出系统,请点击主界面右上角的“退出”按钮。

2、主要功能操作本系统主要功能包括等,下面分别进行说明:(1)操作:进入界面,输入相关参数,然后点击“确定”按钮即可完成操作。

(2)操作:进入界面,选择要操作的数据项,然后点击“编辑”按钮进行修改。

修改完成后,点击“保存”按钮即可完成操作。

四、维护说明为确保系统的正常运行,请定期进行以下维护操作:(1)定期备份数据:建议每周对系统数据进行备份,以防止意外情况造成的数据丢失。

(2)更新程序:请定期检查并更新系统的最新版本,以确保系统的稳定性和安全性。

(3)清理缓存:定期清理系统缓存,以提高系统运行速度和稳定性。

(4)检查硬件设备:定期检查硬件设备是否正常运行,如有问题请及时报修。

五、常见问题及解决方案在使用本系统的过程中,可能会遇到一些常见问题,下面列出并给出相应的解决方案:(1)问题一:无法登录系统。

解决方案:检查用户名和密码是否正确,确认无误后再次尝试登录。

如仍有问题,请技术支持人员。

(2)问题二:无法完成某项功能。

解决方案:请检查系统是否正常运行,如有异常情况,请技术支持人员进行处理。

如因用户操作不当导致的问题,请参考操作说明进行修正。

蜜蜂源财务软件说明书

8、日常业务处理 · 固定资产 37 8.1、日常处理 37 8.1.1、生成折旧凭证 37 8.1.2、录入固定资产增加资料 37 8.1.3、录入固定资产减少资料 38 8.1.4、录入固定资产其他变动资料 38 8.2、报表查询 38 8.2.1、固定资产清单 39 8.2.2、固定资产台账 39 8.2.3、折旧费用分配表 39 9、日常业务处理 · 出纳管理 9.1、录入出纳序时账 9.1.1、序时账对账 9.1.2、出纳分类日记账 9.1.3、出纳现金收支报表 9.2、银行对账 9.2.1、录入对账单 9.2.2、凭证对账分录 40 40 40 41 41 41 42 43

附录 65 附录一:打印设置 65 1、设置打印机、打印纸 65 2、页面设置 65 3、字体及其颜色设置 65 4、杂项设置 66 5、小预览窗 66 附录二:凭证套打 66 附录三:账簿套打参数设置 71 附录四:现金流量表编制方法 72 1、编表目的 72 2、现金流量表的编制 72 3、现金流量表的编制方法 73 4、现金流量表的编制程序 73 5、同步循环法 73

Preface 前言

版本声明 本书著作权属深圳蜜蜂源软件有限公司所有,在未经本公司许可授权情况下,任何单位和个人不 得以任何方式对本书的部分内容和全部内容进行增删、编辑、节录、翻译、翻印、改写。 关于本手册 本手册以图表、操作步骤、实例等各种方式对蜜蜂源财务管理软件V7作以全面地介绍,使您全面 地了解蜜蜂源财务管理软件V7的强大功能,助您方便、快捷地提升管理功效,帮助您获得成功。 本文指导您如何应用蜜蜂源财务管理软件V7来解决管理问题,并按照系统流程及工作流程引导您 按部就班地完成工作,并解答您工作中可能遇到的问题,让您的工作变得轻松和愉悦。使您更深 入地了解蜜蜂源财务管理软件V7的内涵,并获得更多的管理思想。 前提和假设 本手册假设您对手册中所涉及的业务领域具有较好的工作经验和理论基础,并对蜜蜂源财务软件 的一贯风格和知识体系有较多的了解。如果您是第一次使用蜜蜂源财务软件,建议您参加一次或 多次蜜蜂源财务软件的技术培训,并同深圳蜜蜂源软件有限公司的各分支机构联系以获得更多的 技术支持与培训,同时获得更新的软件版本和技术文档。 严禁使用各种数据库工具修改蜜蜂源财务软件V7的数据结构 数据的完整和数据结构的完整是蜜蜂源财务管理软件V7的生命基础,如果您使用ACCESS等数据 库工具或流传于互联网上的数据库解密工具,修改了蜜蜂源财务管理软件V7的数据库结构或数据 内容,您将有破坏蜜蜂源财务管理软件V7数据完整性和数据结构完整性的风险,修改结果将是不 可恢复的,且不能追查修改变更记录。由此而产生的损失,深圳蜜蜂源软件有限公司及分支机构 将不负任何责任,且不提供任何修复服务。 其它信息来源及服务策略 您还可通过以下途径了解我们的系统,并获取您所需要的技术服务和支持。 1、在线信息 您如果需要及时了解蜜蜂源财务管理软件V7的产品动态,交流产品应用经验,请登录深圳蜜蜂源 软件有限公司网站: 2、售前咨询服务 根据企业发展的需要和管理需要,提供咨询及解决方案,帮助企业做出快速、正确的决策。 3、产品培训 深圳蜜蜂源软件有限公司秉承创新技术、服务客户的精神,在不断地开发新产品,提供新的解决 方案的同时,不断推出新的配套培训和服务策略,帮助用户应用蜜蜂源软件达到事半功倍的效果的同 时,感受到蜜蜂源细致入微的服务精神。 4、现场支持服务 我们的资深技术支持工程师亲临现场和您面对面地沟通,对实际问题进行研究分析,以使问题能 够迅速得到解决。 5、服务中心 设在公司总部的服务中心,可以快速地解答您的问题,并可由软件技术人员聆听您的指教,和您 在软件技术上进行沟通。 6、个性化服务 针对企业个性化的要求,我们提供“量身定做”服务,使用一切资源为您提供全面的解决方案。 7、版本升级服务 版本升级服务保证随时代的进步而保持投资的增值,以优惠的价格实现软件的“以旧换新”。 致谢 感谢您使用蜜蜂源财务管理软件V7,感谢您对我们的信任和支持,我们期待您的反馈意见。有了 您的支持,我们将进步更快并为您提供更好的产品、更优的服务。

财务管理和标准手册说明书

F INANCIAL A DMINISTRATION AND S TANDARDS M ANUALCHAPTER:TEAMSNUMBER: 2.4 REFERENCE: FASM 2.3 – Table Maintenance EFFECTIVE DATE:March 25, 2019 SUPERSEDES: March 27, 2017 REVIEW DATE: March 2021 PAGE NUMBER: Page 1 of 2 SUBJECT:A CCOUNTING AND C LASSIFICATION S TRUCTURES APPROVED SIGNATURE: /s/ Tracy Wroblewski Chief Financial OfficerP URPOSE : This standard provides the policy for managing the accounting and classification structures in the Transportation Environment Accounting and Management System (TEAMS). S TANDARD : TEAMS accounting and classification structures allow the Department to capture and classify information regarding daily operating activities and performance. Processing in TEAMS requires standard coding be used for all revenue and expenditure transactions recorded in the system. Following nightly processing, the transactions become available for reporting. The TEAMS Structure Group reviews the TEAMS data elements and makes appropriate changes to the classification structures as appropriate. TEAMS data classification is organized into the following areas:• Activity Structure• Appropriation Structure• EA Type and Status• Expenditure Account (EA/Subjob)• Expenditure Object Structure (Category, Object, Object Detail)• Fund Structure• Organization Structure• Organizational Unit Number• Program Structure• Related EA• Revenue/Agency Source Structure2.4 Accounting and Classification StructuresPage 2 of 2 R ESPONSIBILITIES:R ESPONSIBILITY A CTIONFinancial Services •Ensure that financial accounting and classification structures aremaintained accurately and timely to facilitate the flow of informationacross the organization for financial and management reportinganalysis.Fleet ServicesHighway Budget Office Transportation Development Division – Active Transportation Section •Coordinate with Financial Services to ensure that financial accounting and classification structures are maintained accurately and timely to facilitate the flow of information across the organization for financial and management reporting analysis.TEAMS Structure Group:•Define TEAMS data elements.•Review and approve recommended changes to TEAMS dataelements ensuring they do not have a negative effect to theDepartment in obtaining and reporting financial information.•Implement changes and communicate the changes to thoseaffected.。

华博系统说明书

华博系统说明书华博系统是一个全方位的智能化管理系统,旨在为企业和机构提供高效、智能的管理解决方案。

本说明书将详细介绍华博系统的功能和使用方法,帮助用户更好地理解和使用本系统。

一、系统概述华博系统是一款基于云计算和物联网技术的先进管理系统。

它整合了各种管理模块,包括人力资源管理、财务管理、销售管理、供应链管理等,满足企业日常运营和管理的需求。

华博系统的特点是高效、安全且可定制化,能够适应不同规模和行业的企业。

二、功能介绍1. 人力资源管理:华博系统提供全面的人力资源管理功能,包括员工信息管理、考勤管理、薪资福利管理等。

用户可以通过该模块实现员工档案管理、签到打卡、薪资发放等功能。

2. 财务管理:华博系统拥有强大的财务管理功能,包括会计科目管理、财务报表生成、预算管理等。

用户可以通过该模块实现财务记账、报表分析、预算控制等重要功能,帮助企业实现财务管理的高效与准确。

3. 销售管理:华博系统支持完整的销售管理流程,包括客户管理、销售订单管理、销售统计分析等。

用户可以通过该模块实现客户信息记录、订单跟踪、销售业绩分析等功能,帮助企业提升销售效率和竞争力。

4. 供应链管理:华博系统提供全面的供应链管理支持,包括供应商管理、采购订单管理、库存管理等。

用户可以通过该模块实现供应商信息管理、采购计划安排、库存监控等功能,帮助企业实现供应链的优化和成本控制。

三、使用方法1. 注册登录:用户首先需要在华博系统官方网站上注册账号,填写相关信息并选择适合自己企业需求的套餐。

注册成功后,用户可以使用注册的账号和密码登录华博系统。

2. 界面导航:华博系统的界面设计简洁明了,主要分为顶部导航栏、左侧菜单栏和主要工作区。

用户可以通过顶部导航栏进行主要功能区的切换,通过左侧菜单栏选择所需的模块,实现功能的具体操作。

3. 功能操作:当用户选择相应的模块后,会进入具体功能页面。

用户可以根据自己的需求使用相应功能,操作简单直观,只需按照系统给予的提示逐步完成操作即可。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

摘要Visual FoxPro是一种用于数据库设计、创建和管理的软件,利用它可以对各种事务管理工作中的大量数据进行有效的管理并满足数据检索的需要。

本系统就是根据公司现阶段的需要,通过Visual FoxPro开发一个公司信息管理系统来实现对公司信息准确、高效的管理和维护。

整个系统从符合操作简便、界面友好、灵活、实用、安全的要求出发,完成工资管理的全过程,包括员工信息、工资信息、员工信息和工资信息的添加、修改、删除等管理工作以及用户管理权限的改变等。

本文主要介绍了本课题的开发背景,所要完成的功能和开发的过程。

重点说明了系统的设计思路、总体设计、各个功能模块的设计与实现方法。

关键词:个人财务管理系统,Visual FoxPro目录1.2 功能需求分析 (3)2.1 系统模块划分 (4)2.2 系统模块结构图 (4)3 数据库设计 (5)3.1 逻辑设计 (5)3.2 物理设计 (5)3.2.1 表结构设计 (5)4系统详细设计 (7)4.1 系统封面设计 (7)4.2系统登陆面设计 (8)4.3系统主界面设计 (9)4.4添加收入界面和添加支出界面设计 (10)4.5 修改密码界面设计 (12)4.6系统主程序 (13)5 系统连编与运行 (14)5.1 连编 (14)5.2 运行 (14)参考文献 (16)1 需求分析当前生活节奏加快,人们生活水平不断提高,收入和支出越来越趋于多样化,传统的人工方式记录和管理家庭或自己的财务情况的记录方式不仅不便于长期保存,还有一些不可避免的缺点。

开发一个能管理个人财务收支的软件系统已经很有必要。

这样可以减轻人们在个人财务统计和其他财务管理的负担。

能够克服传统方法的多个缺点。

1.1数据需求分析本系统的主要数据信息有个人财务收入表、个人财务支出表和修改表。

个人财务收入表包括:年月,姓名,基本工资,奖金,提成等。

个人财务支出表包括:年月,姓名,水电等基本支出,送礼和买衣服等。

修改表包括:姓名,年月等。

1.2 功能需求分析本系统主要实现对个人财务进行管理,需要实现以下几个方面的管理功能:(1)收入管理:收入的查询,添加新的收入。

(2)支出管理:支出的查询,添加新的支出。

(3)修改:对用户的密码等进行修改。

2 系统总体设计2.1 系统模块划分本系统主要是对个人财务的管理,包括了有关数据的查询、修改、添加、删除等功能。

整个系统分为以下几个模块。

1、主界面模块本模块提供财务管理系统的主菜单界面,供用户选择与执行各项管理工作。

同时在本模块中还将核对进入本系统操作人员的用户名和密码。

2、查询模块本模块用于用户查询各项信息,例如收入信息查询、支出信息查询等。

2.2 系统模块结构图根据系统功能设计,对应的系统模块结构图如图1所示图1 系统模块结构图3 数据库设计3.1 逻辑设计根据数据需求分析以及关系数据库设计原则,本系统创建了一个数据库,并在该库中建立了收入信息表(收入.dbf)及密码信息表(密码表.dbf)个人支出表(支出.dbf)等数据表。

各表的关系模式如下:(1)密码表(密码)。

(2)收入表(年月,姓名,基本工资,奖金,提成)。

(3)支出表(年月,姓名,水电等支出)。

(4)情况统计表(编号,销售量,进货量,药品名称)。

3.2 物理设计根据各表的关系模式,建立表的物理结构。

3.2.1 表结构设计药店药品信息表,密码,排行榜表,情况统计表。

这四个表的表结构如表1、表2、表3、表4所示。

表1 收入表结构表2 支出表结构4系统详细设计4.1 系统封面设计创建如图2所示的个人财务管理系统系统登陆表单,并设定为顶层表单,以文件名首页.scx存盘。

该表单在运行后,由用户单击表单上的相应的命令按钮进入相应的功能界面。

图2 个人财务管理系统登陆界面此表单的具体设计步骤如下:(1)单击文件-新建-表单,单击新建文件,进入表单设计器窗口。

在表FORM1中添加一个Label1、Label2,两个命令按钮command1、command2,一个计时器Timer1,并调整它们的大小和位置,设置各控件的属性。

(2)为使本表单作为顶层表单,始终处于屏幕中央,不出现表单的标题栏,并以一幅指定的图像作为其背景,需要设置变淡FORM1的Autocenter属性值为.T.,picture属性值为图像文件……,Titlebar属性值为“0-关闭”,Showwindow属性值为“2-作为顶层表单”。

(3)设置Lablel1的caption属性值为“个人财务管理系统”,BackStyle 属性值为“0-透明”;设置label2的caption属性值为“08计七—李森”Backstyle 属性值为“0-透明”。

(4)为使本表单在显示1秒后自动关闭并启动验证程序验证.scx,需要设置计时器Timer1的Interval属性值为1000毫秒,同时为Timer1的Timer事件编写如下代码thisform.releasedo form 验证.scx4.2系统登陆面设计登陆界面是为了防止非管理人员的操作,要求将登陆界面设计成如图3所示的界面。

图3 登录界面此表单的具体设计步骤如下:(1)在“项目1”项目器窗口中,单击“文档”选项卡,选择“表单”,单击“新建”按钮,打开“表单设计器”窗口,设计出如图4所示的表单。

(2)在表单中一个标签Label1,一个文本框Text1,三个命令按钮Command1,Command2,Command3并调整它们的位置和大小,设置各控件的属性。

(3)编写Command1的代码如下:Command1的click代码如下:i=i+1if i<3if thisform.text1.value="123"messagebox("密码正确,欢迎进入本系统")thisform.releasedo form 主表单.scxelsemessagebox("密码错误,重新输入!")thisform.text1.value=""thisform.text1.setfocusendifelsemessagebox("密码错误,禁止进入本系统!")this.enabled=.f.endif && 关闭本表单Command2的click代码如下:thisform.text1.value=""thisform.text1.setfocusCommang3的代码如下:thisform.releasequit4.3系统主界面设计个人财务管理系统的主界面提供进入系统其他功能模块的方法,使用户能方便地调用收入信息查询、支出信息查询、管理维护等操作界面,实施个人财务的基本管理。

要求将个人财务管理系统的应用程序主界面设计成如图4所示的界面。

图4主系统界面此表单的具体设计步骤如下:(1)在“项目1”项目器窗口中,单击“文档”选项卡,选择“表单”,单击“新建”按钮,打开“表单设计器”窗口,设计出如图5所示的表单。

(2)在表单上添加一个标签Label1,一个页框Pageframe1,调整它们的大小,并设置属性。

将页框设置如图所示,分别为收入查询、支出查询、管理维护。

(3)在Page1收入查询页面内添加两个形状Shape1、Shape2,四个命令按钮command1,command2,command3,command4,调整它们的大小,并设置属性。

编写command1的click代码如下:close alldo form 收入.scx编写command2的click代码如下:close alldo form 添加收入.scx编写command3的click代码如下thisform.release编写command4的click代码如下thisform.releasequit(4)在Page2支出查询页面添加,两个形状Shape1、Shape2,四个命令按钮command1、command2,command3,command4调整它们的大小,并设置属性。

编写command1的click代码如下:close alldo form 支出.scx编写command2的click代码如下:close alldo form 添加支出.scxcommand3,command4的click代码同收入查询的command3和command4。

(5)在Page3管理维护页面添加一个标签Label1,一个形状Shape1,一个命令按钮command1调整它们的大小,并设置属性。

编写command1的click代码如下:DO FORM 修改密码4.4添加收入界面和添加支出界面设计添加收入和添加支出界面显示了收入的具体信息,要其详细信息界面设计成如图5和图6所示。

图5添加收入界面步骤如下(1)在“项目1”项目器窗口中,单击“文档”选项卡,选择“表单”,单击“新建”按钮,打开“表单设计器”窗口,设计出如图7所示的表单。

(2)在表单中添加两个命令按钮框command1和command2(3)把command1和command2的fontsize都改为14,fontcolor都改为255,0,0。

把command1的caption属性改为“添加收入”,把command2的caption属性值改为“返回”。

(4)编写command1的click代码如下:go bottomappend blankeditthisform.refreshreturn编写command2的click代码如下thisform.release图6添加支出界面步骤如下(1)在“项目1”项目器窗口中,单击“文档”选项卡,选择“表单”,单击“新建”按钮,打开“表单设计器”窗口,设计出如图7所示的表单。

(2)在表单中添加两个命令按钮框command1和command2(3)把command1和command2的fontsize都改为14,fontcolor都改为255,0,0。

把command1的caption属性改为“添加支出”,把command2的caption属性值改为“返回”。

(4)编写command1的click代码如下:go bottomappend blankeditthisform.refreshreturn编写command2的click代码如下thisform.release4.5 修改密码界面设计为了保证信息的及时性和准确性,我设置了修改密码的表单,随时与权限认证联系在一起。

修改密码界面如下图7所示。

图7 修改密码界面此表单的具体设计步骤如下:(1)打开表单设计器,在表单Form1中添加两个标签Label1、Label2,,两个文本框Text1、Text2,还有一个命令按钮组commandground1,并调整好它们的大小、位置,设置各个控件的属性。