金融学(双语)复习资料第4章

金融学基础(英语)复习资料

名词解释:Credit refers to a behavior of borrowing and lending with the feature of repayment of the principals plus interests . Financial markets refer to the whole of the places and activities of the financing and transactions of financial instruments. Sale on commission(推销): It refers to the case in which investment bankers sell securities on behalf of issuers and earn from what they have sold, but have no obligation to take up what’s left as medium of Money demand refers to the quantity of money that the whole economy needs exchange, means of payment and store of value under certain economic condition. Inflation is a continuous and obvious rise of the price level caused by great increase of money supply and it reduces the purchasing power of each unit of a currency. 二1 General equivalent 一般等价物2 Public credit 国家信用3 Default risk 违约风险4 Repurchase agreement(RP)回购协议5 Interest-rate future 利率期货6 Re-discount 再贴现7 Compound interest 复利8 Liquidity preference 流动偏好即货币需求9 Speculative motive 投机动机10 Adverse selection 逆向选择11 Require reserves 存款准备金12 Overdraft 透支13 Time lag 时滞14 velocity of money 货币流通速度15 money stock 货币存量16 derivative deposit 派生存款17 excess reserve 超额储备18 Money multiplier 货币乘数19 Endogenous 内生性判断题T F 1. When a central bank carries out expansionary monetary policy, bank reserves R will increase. T F 2. The monetary base consists of banking system reserves and the currency held by the non-bank public T F 3. The moral hazard arises before a financial transaction begins. T F 4. As is subject to time limit, the commercial credit can only be short-term one. T F 5. Sale on commission refers to the case in which investment bankers sell securities on behalf of issuers and earn from what they have sold, but have no obligation to take up what’s what’s left. left. T F 6. 6. If If If a a a central central central bank bank bank wants wants wants to to to cool cool cool an an an inflationary inflationary inflationary boom, boom, boom, it it it will will will raise raise raise the the the discount discount discount rate, rate, which which will will will lead lead lead to to to a a a general general general interest interest interest rates rates rates rise rise rise for for for loans, loans, loans, decreasing decreasing decreasing the the the demand demand demand for for borrowing. T F 7. 7. A A A central central central bank bank bank is is is the the the financial financial financial institution institution institution that that that can can can gain gain gain profit profit profit in in in its its its operation operation operation and and businesses, but it is not a profit-seeker. T F 8. When a central bank carries out tight monetary policy, interest rates fall. T F 9. The theory of “Quantity theory of money” means that an increase in prices of all goods and and services services services leads leads leads to to to an an an increase increase increase in in in the the the supply supply supply of of of money money money when when when everything everything everything remains remains unchanged. T F 1010. Banker’s credit is an indirect credit . Banker’s credit is an indirect credit英译汉英译汉1. On the one hand, although the central bank does not make loans to enterprises and can not derive derive deposits deposits deposits directly, directly, it it controls controls controls the the the sources sources sources of of of commercial commercial commercial banks` banks` banks` money money money creation creation —the creation creation and and and supply supply supply of of of the the the monetary monetary monetary base; base; base; and and and on on on the the the other other other hand hand hand commercial commercial commercial banks` banks` banks` money money creation creation through through through taking taking taking in in in deposits deposits deposits and and and granting granting granting loans loans loans is is is based based based on on on the the the central central central bank's bank's bank's monetary monetary base. 一方面,尽管中央银行并不直接为企业发放贷款,尽管中央银行并不直接为企业发放贷款,也不能产生派生存款,也不能产生派生存款,也不能产生派生存款,但是中央银行却控但是中央银行却控制着商业银行创造货币的源泉——基础货币的供给和创造。

《金融英语听说》Unit4

Unit 4Listen carefully and choose the best answer to the question after each dialog. Scripts & AnswersDialog 1M: Well, you’re back at last from the bank.W: Yes, just now. The manager of the Credit Department said that they willlearn about the economic performance of our business from the financialstatements submitted to them.M: Exactly. He can make a comparison between the financial statementsof one year with those of the next year. It is particularly helpful inunderstanding a company’s financial position.W: I understand that if we want to borrow money from a bank, we shouldprepare accounting reports and submit to the bank our financial statementson all the activities of operating, investing and financing of our company.M: Yes. The manager will read the statements and get the data implied by the accounting reports in order to make decision.Question: What need to be submitted to the bank according to the dialog? (B)译文男:啊,你总算从银行回来了。

金融市场与金融机构基础(英文版)第4章

Functions of Central Banks

Bank of England -BOE

Risk assessment Risks reduction Oversight of payment systems Crisis management

3

Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall

Store of Value

Time deposits

12

Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall

Monetary Aggregates

Monetary Base: Currency in circulation Currency and coins plus total reserves M1 Money Supply Currency plus demand deposits M2 Money Supply M1 plus short-term time deposits

5

Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall

The Federal Reserve System

Board of Governors Federal Reserve Banks Member Banks Federal Open Market Committee

6

Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall

金融学双语考试复习资料

金融学双语考试复习资料Chapter 1经济学关注的3个问题:How scarce resources are allocated in the productionprocess among competing uses.How income generated in the production and sale of goods and services is distributed among members of society.How people allocate their income through spending, saving, borrowing and lending decisions.Default(违约)- When a borrower fails to repay a financial claim.借方未能偿还金融债务Liquidity(流动性)- The ease with which a financial claim can be converted to cash without loss of value. 金融索取权可以比较容易地且不损失价值地转化成现金的特性。

Depository institutions (储蓄机构)–Financial intermediaries, such as commercial banks, savings and loan associations, credit unions, and mutual savings banks, that issue checkable deposits. 发放支票存款的金融中介,如商业银行、存储贷款、信用联盟、互助储蓄银行。

5. Why do financial intermediaries exist? What services do they provide to the public? Are all financial institutions financial intermediaries?Financial intermediaries exist to link up net lenders and net borrowers and to help minimize the transaction costs associated with borrowing and lending. Financial services provided by financialintermediaries include appraising and diversifying risk from individual net lenders. Not all financial intermediaries areinstitutions, such as stock and bond brokers merely link up net lenders and net borrowers for a fee and do not issue claims on themselves.16. Diane Weil earns wages of $45,000 and interest and dividend income of $5,000. She spends $8,000 as a down payment on a newly constructed mountain cabin and lends $4,000 in financial markets. Assuming that Diane spends the remainder of her income on consumption, what is her saving? Is she a net lender or a net borrower? What is her consumption?Chapter 2Money (货币)- Anything that functions as a means of payment (medium of exchange), unit of account, and store of value. 作为支付手段(即交换媒介)、记账单位和价值储藏手段的物品。

金融英语4

外汇 外汇管制 外汇票据 外汇银行 外汇投机 外汇账户 固定利率 浮动利率 官方利率 市场利率

basic rate cross rate spot rate forward rate telegraphic transfer rate mail transfer rate demand draft rate opening rate closing rate single rate

Difficulties Investment Banking Activities Teaching Methods Teacher’s explanations Questioning Discussing Exercise

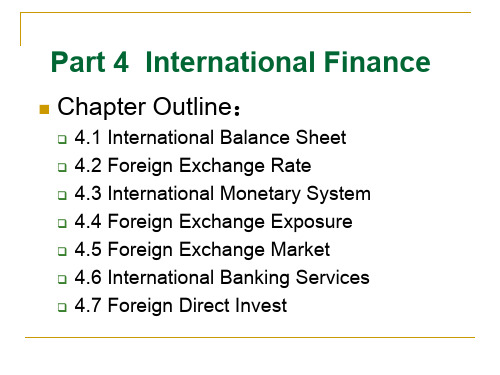

Teaching Procedures Warming-Up Exercise: Exchange Rates (汇率) 汇率是一国(或地区)货币兑换另一国(或地区)货币 的比率,即一种货币以另一种货币表示的价格。外汇汇率的 种类有很多种,为了认识和掌握汇率,可以从不同的角度对 汇率进行分类。主要分类如下: 1.按汇率的稳定性分为固定汇率(Fixed Rate)和浮动汇率 (Floating Rate)。 2. 按汇率的管制程度可分为官方汇率(Official Rate)和市 场汇率(Market Rate)。 3. 按汇率的制定方法可分为基础汇率(Basic Rate)和交叉 汇率(Cross Rate)。

W:近来,1美元大约要值115日元。1个单位的美元为什么 会值100多个单位的日元?这似乎不公平。 K:这就是汇率的含义之所在了。我刚才说过,汇率主要是 由供求关系决定的。再说,货币的购买力也是确定汇率 的一个重要因素。 W:听起来挺有趣的。你有没有些对于我来说容易看懂的这 方面的书? K:有,我有些较基础的书。 W:好的。克里,我什么时候来找你呢? K:我全天都在家。 W:好,我马上就来。再见。

金融英语-4-International Finance资料文档

payments

($64.39)

($444.69) identity hold:

($152.44) ($124.94) ($303.27)

BCA + BKA = – BRA

($444.69) + $444.26 + $0.73 = $0.30= –($0.30)

($0.30)

Balance of Payments Trends

4.1.1 The Current Account

Includes all imports and exports of goods and services, unilateral transfers(经常转移) of foreign aid.

The net balance on the merchandise transactions is called the trade balance.

other investments mainly refers to the

short-term capital records the net changes in international assets and liabilities with an original maturity of one year or less in which domestic residents (excluding official monetary institutions) are creditors and debtors.

They are composed of the following:

The Current Account 经常账户 The Capital Account 资本账户 The Official Reserves Account 储备帐户 Statistical Discrepancy 统计误差

金融英语-4-Economics and trade

4.1.2 Protectionism

Protectionism(保护主义) is a kind of government activity to restrict imports in order to help local products. The protection include:

4.2.1 Fixed and floating rates

For 25 years after World War Ⅱ, the levels of most major currencies were determined by governments. They were fixed or pegged against the US dollar(与美元挂钩), and the dollar was pegged against gold (与黄金挂钩). It was ended in 1971, because of the following inflation in the USA, the Federal Reserve did not have enough gold to guarantee the American currency.

4.2.2 Government intervention

Managed floating exchange rates(有管理 的浮动汇率制): Governments and central banks sometimes intervene in exchange markets, using foreign currency reserves to buy their own currency—in order to raise its value-or selling to lower it. However, speculators also have a lot of money in its reserve of foreign currency to influence exchange rates.

金融学(双语)复习资料第4章

A Chapter 4F 1. A financial intermediary transfers funds from borrowersto lenders by creating claims on itself.金融中介机构通过建立自身债权转让从借款人的资金贷款T 2. When cash is deposited in a checking account, thereserves of commercial banks are increased.当现金存入支票帐户时,商业银行的准备金增加F 3. When funds are deposited in a savings account, the excess reserves of banks are unaffected.当资金存入储蓄账户中,银行的超额准备金不受影响F 4. Large certificates of deposit in units of $500,000 are insured by FDIC.存款50万元的单位大证由美国联邦存款保险公司的保险保障T 5. In general, banks prefer loans that stress liquidityand safety.一般情况下,银行更喜欢强调流动资金贷款和安全性T 6. Savings and loan associations are a major source of mortgage funds.储蓄和贷款协会是抵押贷款资金的主要来源F 7. Insurance companies are a major source of loans to individuals.保险公司是个人贷款的主要来源T 8. Money market mutual funds invest in short-term securities like U.S. Treasury bills.货币市场共同基金投资于如美国国库券的短期证券F 9. An increase in interest rates tends to reduce theearnings of money market mutual funds.在利率上升往往会降低货币市场共同基金的收益T 10. A pension plan that invests in the stock of IBM orVerizon does not perform the function of a financial intermediary.投资于IBM或Verizon公司的股票的退休金计划不执行金融中介的功能F 11. Investments in money market mutual funds are insured up to $100,000 by the federal government.在货币市场共同基金投资是投保高达10万美元的联邦政府T 12. A financial intermediary creates claims on itself, when it accepts depositors' funds.金融中介机构建立自身债权,当它接受存款人的资金F 13. If a firm issues securities that are sold to a commercial bank, individuals' savings are directly transferred to the firm. 。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

A Chapter 4

F 1. A financial intermediary transfers funds from borrowers

to lenders by creating claims on itself.金融中介机构通过建立自身债

权转让从借款人的资金贷款

T 2. When cash is deposited in a checking account, the

reserves of commercial banks are increased.当现金存入支票帐户时,商业银行的准备金增加

F 3. When funds are deposited in a savings account, the excess reserves of banks are unaffected.当资金存入储蓄账户中,银行的超额准备金不受影响

F 4. Large certificates of deposit in units of $500,000 are insured by FDIC.存款50万元的单位大证由美国联邦存款保险公司的保险保障

T 5. In general, banks prefer loans that stress liquidity

and safety.一般情况下,银行更喜欢强调流动资金贷款和安全性

T 6. Savings and loan associations are a major source of mortgage funds.储蓄和贷款协会是抵押贷款资金的主要来源

F 7. Insurance companies are a major source of loans to individuals.保险公司是个人贷款的主要来源

T 8. Money market mutual funds invest in short-term securities like U.S. Treasury bills.货币市场共同基金投资于如美国国库券的短期证券

F 9. An increase in interest rates tends to reduce the

earnings of money market mutual funds.在利率上升往往会降低货币市场共同基金的收益

T 10. A pension plan that invests in the stock of IBM or

Verizon does not perform the function of a financial intermediary.投资于IBM或Verizon公司的股票的退休金计划不执行金融中介的功能

F 11. Investments in money market mutual funds are insured up to $100,000 by the federal government.在货币市场共同基金投资是投保高达10万美元的联邦政府

T 12. A financial intermediary creates claims on itself, when it accepts depositors' funds.金融中介机构建立自身债权,当它接受存款人的资金

F 13. If a firm issues securities that are sold to a commercial bank, individuals' savings are directly transferred to the firm. 。

如果一家公司发出的出售给商业银行证券,个人储蓄会直接传送到该公司

F 14. M-2 excludes checking accounts in savings banks.M-2不包括

检查储蓄银行账户

a 1. Which of the following is not a financial intermediary?下列哪项不属于金融中介?

a. New York Stock Exchange纽约证券交易所

b. Washington Savings and Loan华盛顿储蓄和贷款

c. First National City Bank第一国民城市银行

d. Merchants Savings Bank招商储蓄银行

c 2. Which of the following assets are the most liquid?下列哪些资产是流动性最强?

a. money and antiques钱和古董

b. bonds and real estate债券和房地产

c. savings accounts and checking accounts储蓄账户和支票账户

d. stocks and bonds股票和债券

a 3. M-1 includes coins, currency, and .M≥1,包括硬币,货币,和。

a. demand deposits活期存款

b. savings accounts储蓄账户

c. certificates of deposit存款证

d. time deposits定期存款

b 4. The power to create money is given by the Constitution to 创造货币的权力是宪法赋予

a. state governments州政府

b. Congress国会

c. the Federal Reserve美联储

d. commercial banks商业银行

a 5. The assets of a typical commercial bank include一个典型的商业银行的资产包括

a. commercial loans商业贷款

b. demand deposits活期存款

c. common stock普通股

d. equity公平

a 6. Federally insured investments include联邦保险投资包括

a. savings accounts in national commercial banks在全国性商业银行储蓄账户

b. certificates of deposit in excess of $100,000存款超过10万美元的股票

c. life insurance policies寿险保单

d. commercial bank assets商业银行的资产

b 7. The primary assets of life insurance companies include寿险公司的主要资产包括

a. life insurance人寿保险

b. corporate securities公司证券

c. municipal securities市政证券

d. insurance policies保险

a 8. A pension plan that grants mortgage loans授予按揭贷款的退休金计划

a. is an example of a financial intermediary是一种金融中介的一个例子

b. cannot suffer losses不能吃亏

c. is called a savings and loan association被称为储蓄和贷款协会

d. is not a financial intermediary是不是一个金融中介机构

c 9. Money market mutual funds invest in货币市场共同基金投资于

a. corporate bonds企业债券

b. corporate stock公司股票

c. federal government Treasury bills联邦政府国库券

d. federal government Treasury bonds联邦政府国债

b 10. A financial intermediary transfers金融中介转让

a. savings to households储蓄户

b. savings to borrowers节约借款人

c. stocks to brokers股票经纪

d. new stock issues to buyers新股发行给买家

a 11. M-2 includes M≥2包括

1. demand deposits活期存款

2. savings accounts储蓄账户

3. negotiable certificates of deposit可转让存款证

a. 1 and 2

b 12. An investment bank is not a financial intermediary because 投资银行是不是一个金融中介,因为

a. it does not transfer money from investors to firms它不会从投资者转移资金到企业

b. it does not create claims on itself它不创造自身债权

c. it does facilitate the transfer of funds它确实有利于资金的转移

d. it creates claims on itself它创建自己索赔。