信用证审核练习题

(完整版)审核信用证题目及答案

幼儿园是孩子接触学校启蒙教育的最早阶段,教育内容的趣味性非常重要,既要有趣又要能够传达一些道理,培养孩子的各项基础能力。

幼儿园阶段最常用的资料是幼儿园教案,一般包括活动目标、活动准备过程、提问互动环节、活动反思等内容,帮助幼儿园教师梳理安排好每次的课堂环节。

好的教案设计能让孩子们积极参与,掌握知识技能。

为大家整理了幼儿园一些优质的教案案例,方便大家使用学习。

《大班音乐优质课教案《十个印第安小儿童》》这是优秀的大班音乐教案文章,希望可以对您的学习工作中带来帮助!设计意图:音乐活动是我园的特色之一,它带给幼儿的感觉是自由、轻松而愉悦。

本次活动是将双语渗透于音乐活动的一种新的尝试,教师希望通过此次活动能让幼儿学习双语的积极性得以最大限度地发挥。

在一次很偶然的谈话中,我了解到,幼儿对童话故事《白雪公主》中的“小矮人”形象非常喜爱,而且平时也总是饶有兴趣地哼唱《十个小矮人》这首歌。

于是,我便抓住幼儿这一兴趣,设计了这个活动,从幼儿的主体出发,让幼儿能主动、积极地参与双语活动,活动中教师能与幼儿上下互动,能让幼儿自信地发音并能自如地心情愉快的学习乐曲。

活动目标:1、初步学习歌曲《Ten Little Indian Children》,能大声地用英语来演唱。

2、复习双语单词one——ten,会与数字1——10相对应。

3、积极的参与活动,大胆的说出自己的想法。

4、培养幼儿乐观开朗的性格。

教学重难点:1、认识单词one—ten,会与数字1—10相对应。

2、学习新的乐曲《Ten Little Indian Children》,初步掌握歌词与旋律。

活动准备:1、印有英语单词one——ten的车票两套。

2、情景布置图及汽车座位上粘上数字1——10两排。

3、画有印第安小朋友的图片若干。

4、一套含有中英文的短句,如:一个小孩 one little 。

5、幼儿人手一个小背包,包内放有英语句子纸条两份。

6、幼儿水笔人手一份,教师事先在十个小指上画有简单的脸谱。

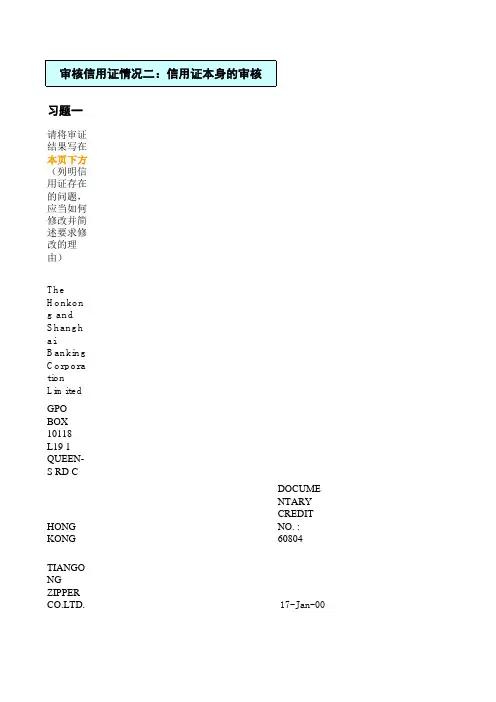

信用证审核_本身审核答案

45A GOODS:+ 157,400 MTS OF PRESS FASTENING TAPE HOOK SIDE - TTL AMOUNTUSD 14,174.67 MORE OR LESS 10 PCT+ 169,400 MTS OF PRESS FASTENING TAPE LOOP SIDE - TTL AMOUNTUSD 12,583.47 MORE OR LESS 10 PCTTOTAL AMOUNT USD 26,758.14 MORE OR LESS 10PCT CIF ANCONA PORT ASPER INCOTERMS 199046A DOCUMENTS REQUIRED:1) COMMERCIAL INVOIDE IN QUINTUPLOVATE SERTIFYING GOODS AS PERREVISED PROFORMA INVOICE N,ASO/982769 DATED 2000.01.132) FULL SET CLEAN ON BOARD MARINE BILL OF LADING ISSUED TO THORDER, BLANK ENDORSED, MARKED FREIGHT COLLECT, AND NOTIFYTO APPLOCANT AS ABOVE.3) FULL SET INSURANCE POLICY/CERTIFICATE ISSUED IN NEGOTIABLE FORMFOR 110 PCT PLUS CIF INVOICE VALUE, COVERING ICC (ALL RO\ISKD), WITHEXTENDED COVER, INVLUDING FROM BENEFICIARY'S WAREHOUSE IKONG TO GASPARRONT ERNINO'S E C.SNC WAREHOUSE IN VIA MAZZINI12/14 64011 ALBA ADRIATICA (TERAMO) CLAUSE, INSTITUTE WARCLAUSES, I.S.R.C.C. CLAUSE. THIS DOCUMENT MUST SHOW THE NUMBEROF ORIGINALS ISSUED,CLAIMS PAYABLE IN ITALY, AND COMPLETE NAMEAND ADDRESS OF THE COMPANY IN ITALY TO APPLY TO FOR CLAIMS.4) CERTIFICATE OF ORIGIN GSP FORM A ISSUED BY THE PEOPLE'SREPUBLIC OF CHINA COMPETENT AUTHORITY CERTIFYING THE CHINESEORIGIN OF GOODS, SHOWING ON BOX NO.4 THE STAMP AFFIXED BY THECHINA INSPECTION COMPANY LIMITED (CLCL) CERTIFYING THAT,,GOODS STATED IN THIS CERTIFICATE HAD NOT BEEN SUBJECT TO ANYONE ORIGINAL PLUS ONE COPY.5) PACKING, WEIGHT AND MEASUREMENT LIST IN TRIPLICATE.47A ADDITIONAL CONDITIONS:+ DOCS MADE OUT IN ENGLISH OR ITALIAN.+ THIRD PARTY SHIPPER ACCEPTABLE.+ GSP FORN A SHOWING SHIPMENT FROM CHINA TO ITALY VIA HONGKONG ACCEPTABLE+ THIS CREDIT CAN BE TRANSFERRED BY HONGKONG AND SHANGHAOBANKING VORPORATION LIMITED ONLY71B DETALLS OF CHARGES:……..ALL CHARGES OTHER THAN OUR OWN,REIMBURSEMENT CHARGES AND CHARGES ARE FOR THEBENEFICIARY'S ACCOUNT.48PERIOD FOR PRESENTATION:DOCS MUST BE PRESENTED WITHIN 15 DAYS AFTER B/LON BOARD DATE BUT WITHIN CREDIT VALIDITY.49CONFIRMATION INSTRUCTION:WITHOUT78INFO TO PRESENTING BK:+DOCUMENTS MUST BE SENT TO OUR BANK: TERCAS - CASSA DI简述要求修改的理由)O. : 6080414/100 ONLYt part , having receivedon dated 16JAN 2000 NSFERABLESNCTE) ITALYONL AMOUNTNCONA PORT ASG GOODS AS PERO THEAND NOTIFYABLE FORMLL RO\ISKD), WITHUSE IN HONGIN VIA MAZZINIOW THE NUMBER COMPLETE NAMEFOR CLAIMS.NG THE CHINESEAFFIXED BY THEUBJECT TO ANYY VIA HONGD SHANGHAOAND CHARGES ARE FOR THE ITHIN 15 DAYS AFTER B/L CREDIT VALIDITY.TIVE SETSBE ADVISED LEX (TELES OCUMENTS STRUCTINS..HONG KONG。

信用证审核1

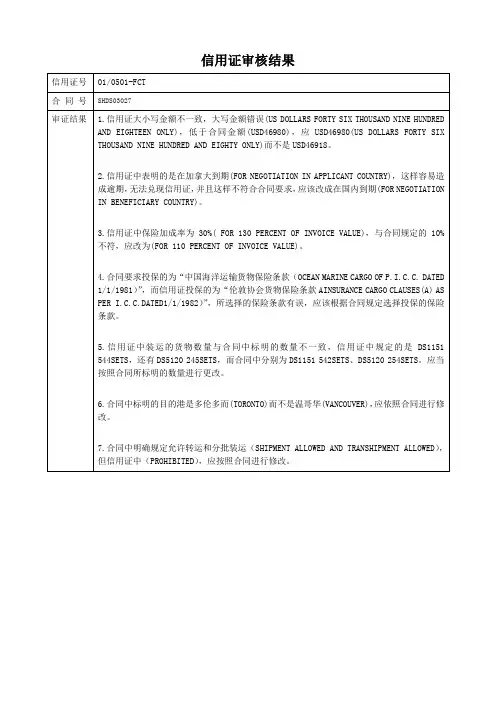

信用证号

01/0501-FCT

合 同 号

SHDS03027

审证结果

1.信用证大小写金额不一致,大写金额错误(US DOLLARS FORTY SIX THOUSAND NINE HUNDRED AND EIGHTEEN ONLY),低于合同金额(USD46980),应USD46980(US DOLLARS FORTY SIX THOUSAND NINE HUNDRED AND EIGHTY ONLY)而不是USD46918。

4.合同要求投保的为“中国海洋运输货物保险条款(OCEAN MARINE CARGO OF P.I.C.C. DATED 1/1/1981)”,而信用证投保的为“伦敦协会货物保险条款AINSURANCE CARGO CLAUSES(A) AS PER I.C.C.DATED1/1/1982)”,所选择的保险条款有误,应该根据合同规定选择投保的保险条款。

7.合同中明确规定允许转运和分批装运(SHIPMENT ALLOWED AND TRANSHIPMENT ALLOWED),但信用证中(PROHIBITED),应按照合同进行修改。

2.信用证中表明的是在加拿大到期(FOR NEGOTIATION IN APPLICANT COUNTRY),这样容易造成逾期,无法兑现信用证,并且这样不符合合同要求,应该改成在国内到期(FOR NEGOTIATION IN BENEFICIARY COUNTRY)。

3.信用证中保险加成率为30%( FOR 130 PERCENT OF INVOICE VALUE),与合同规定的10%不符,应改为(FOR 110 PERCENT OF INVOICE VALUE)。

5.信用证中装运的货物数量与合同中标明的数量不一致,信用证中规定的是DS1151 544SETS,还有DS5120 245SETS,而合同中分别为DS1151 542SETS、DS5120 254SETS。应当按照合同所标明的数量进行更改。

审核信用证题目及答案-精选.pdf

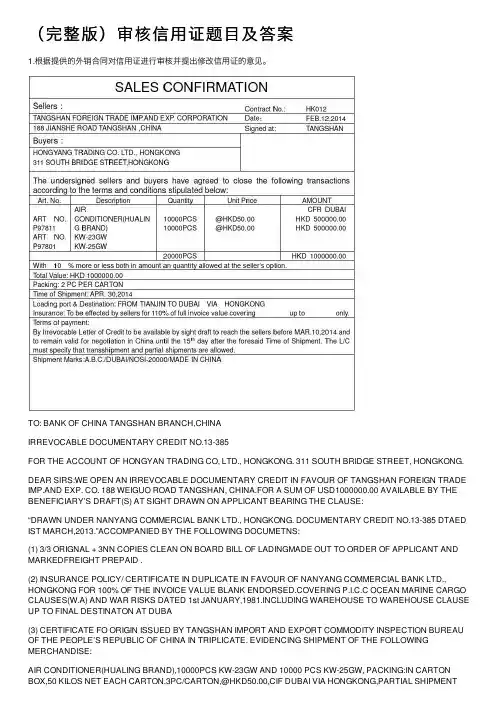

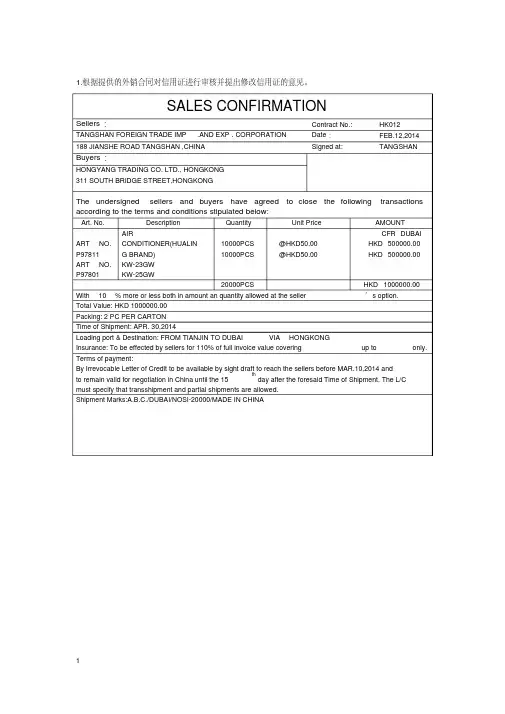

1.根据提供的外销合同对信用证进行审核并提出修改信用证的意见。

SALES CONFIRMATIONSellers:Contract No.: HK012 TANGSHAN FOREIGN TRADE IMP.AND EXP. CORPORATION Date:FEB.12,2014 188 JIANSHE ROAD TANGSHAN ,CHINA Signed at: TANGSHAN Buyers:HONGYANG TRADING CO. LTD., HONGKONG311 SOUTH BRIDGE STREET,HONGKONGThe undersigned sellers and buyers have agreed to close the following transactions according to the terms and conditions stipulated below:Art. No. Description Quantity Unit Price AMOUNTART NO. P97811 ART NO. P97801 AIRCONDITIONER(HUALING BRAND)KW-23GWKW-25GW10000PCS10000PCS@HKD50.00@HKD50.00CFR DUBAIHKD 500000.00HKD 500000.0020000PCS HKD 1000000.00With 10 % more or less both in amount an quantity allowed at the seller’s option.Total Value: HKD 1000000.00Packing: 2 PC PER CARTONTime of Shipment: APR. 30,2014Loading port & Destination: FROM TIANJIN TO DUBAI VIA HONGKONGInsurance: To be effected by sellers for 110% of full invoice value covering up to only. Terms of payment:By Irrevocable Letter of Credit to be available by sight draft to reach the sellers before MAR.10,2014 andto remain valid for negotiation in China until the 15th day after the foresaid Time of Shipment. The L/Cmust specify that transshipment and partial shipments are allowed.Shipment Marks:A.B.C./DUBAI/NOSI-20000/MADE IN CHINATO: BANK OF CHINA TANGSHAN BRANCH,CHINAIRREVOCABLE DOCUMENTARY CREDIT NO.13-385FOR THE ACCOUNT OF HONGYAN TRADING CO, LTD., HONGKONG. 311 SOUTH BRIDGE STREET, HONGKONG.DEAR SIRS:WE OPEN AN IRREVOCABLE DOCUMENTARY CREDIT IN FAVOUR OF TANGSHAN FOREIGN TRADE IMP.AND EXP. CO. 188 WEIGUO ROAD TANGSHAN, CHINA.FOR A SUM OF USD1000000.00 AVAILABLE BY THE BENEFICIARY’S DRAFT(S) AT SIGHT DRAWN ON APPLICANT BEARING THE CLAUSE:“DRAWN U NDER NANYANG COMMERCIAL BANK LTD., HONGKONG. DOCUMENTARY CREDIT NO.13-385 DTAED IST MARCH,2013.”ACCOMPANIED BY THE FOLLOWING DOCUMETNS:(1) 3/3 ORIGNAL + 3NN COPIES CLEAN ON BOARD BILL OF LADINGMADE OUT TO ORDER OF APPLICANT AND MARKEDFREIGHT PREPAID .(2) INSURANCE POLICY/ CERTIFICATE IN DUPLICATE IN FAVOUR OF NANYANG COMMERCIALBANK LTD., HONGKONG FOR 100% OF THE INVOICE VALUE BLANK ENDORSED.COVERING P.I.C.C OCEAN MARINE CARGO CLAUSES(W.A) AND WAR RISKS DATED 1st JANUARY,1981.INCLUDING WAREHOUSE TO WAREHOUSE CLAUSE UP TO FINAL DESTINATONAT DUBA(3) CERTIFICATE FO ORIGIN ISSUED BY TANGSHAN IMPORT AND EXPORT COMMODITY INSPECTION BUREAU OF THE PEOPLE’S REPUBLIC OF CHINA IN TRIPLICATE. EVIDENCING SHIPMENT OF THE FOLLOWING MERCHANDISE:AIR CONDITIONER(HUALING BRAND),10000PCS KW-23GW AND 10000 PCS KW-25GW, PACKING:IN CARTON BOX,50 KILOS NET EACH CARTON,3PC/CARTON,@HKD50.00,CIF DUBAIVIA HONGKONG,PARTIAL SHIPMENT AND TRANSSHIPMENT PROHIBITED. LATEST DATE FOR SHIPMENT: 30TH APRIL,2014. EXPIRY DATE:15TH MAY,2014.IN PLACE OF OPENER FOR NEGOTIATION. WITH 5 % MORE OR LESS BOTH IN AMOUNT AN QUANTILY ALLOWED AT THE SELLER’S OPTION.OTHER TERMS AND CONDITIONS:SHIPPER MUST SEND ONE COPIES OF SHIPPING DOCUMENTS DIRECT TO BUYER AND CERTIFICATE TO THIS EFFECT IS REQUIRED.审核结果:(1)HONGYAN 错误,应为HONGYANG。

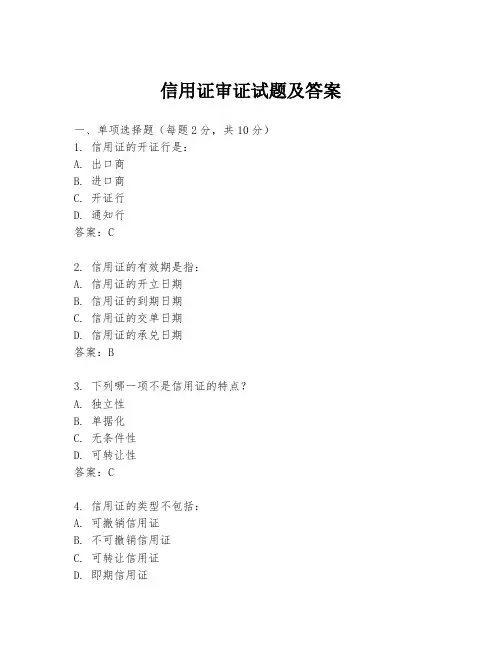

信用证审证试题及答案

信用证审证试题及答案一、单项选择题(每题2分,共10分)1. 信用证的开证行是:A. 出口商B. 进口商C. 开证行D. 通知行答案:C2. 信用证的有效期是指:A. 信用证的开立日期B. 信用证的到期日期C. 信用证的交单日期D. 信用证的承兑日期答案:B3. 下列哪一项不是信用证的特点?A. 独立性B. 单据化C. 无条件性D. 可转让性答案:C4. 信用证的类型不包括:A. 可撤销信用证B. 不可撤销信用证C. 可转让信用证D. 即期信用证答案:A5. 信用证中规定的“最迟装运日期”是指:A. 货物必须在该日期之前装运B. 货物必须在该日期之前到达C. 货物必须在该日期之前清关D. 货物必须在该日期之前支付答案:A二、多项选择题(每题3分,共15分)1. 信用证审证时,以下哪些单据是必须审核的?A. 发票B. 提单C. 保险单D. 装箱单E. 原产地证明答案:A, B, C2. 信用证中可能包含的条款包括:A. 付款条款B. 交货条款C. 运输条款D. 保险条款E. 质量保证条款答案:A, B, C, D3. 信用证审证时,以下哪些情况可能导致拒付?A. 单据与信用证条款不符B. 单据与合同条款不符C. 单据与国际惯例不符D. 单据内容不完整E. 单据过期答案:A, D, E4. 信用证的有效期和到期地点通常包括:A. 有效期B. 到期地点C. 交单期限D. 交单地点E. 承兑期限答案:A, B5. 信用证审证时,以下哪些因素需要特别注意?A. 单据的一致性B. 单据的完整性C. 单据的准确性D. 单据的时效性E. 单据的合规性答案:A, B, C, D, E三、简答题(每题5分,共20分)1. 请简述信用证审证的基本流程。

答案:信用证审证的基本流程包括:接收信用证、审核信用证条款、准备单据、提交单据、审核单据、处理不符点、结算和通知。

2. 信用证审证时,如何处理不符点?答案:处理不符点时,首先需要确定不符点的性质和严重程度。

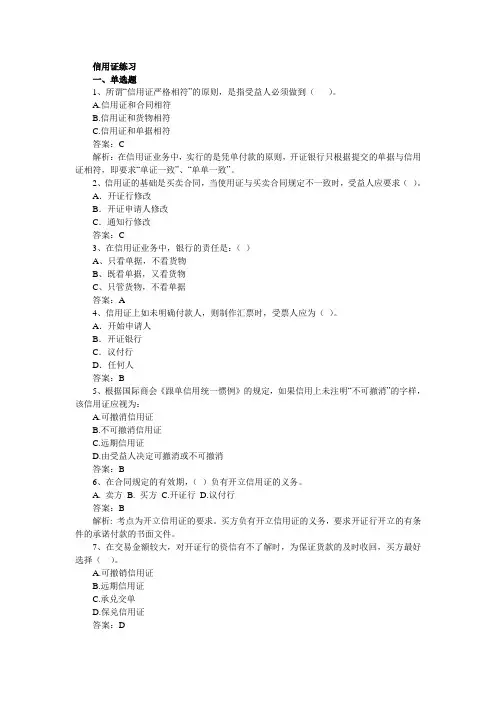

信用证练习(有答案)

信用证练习一、单选题1、所谓“信用证严格相符”的原则,是指受益人必须做到()。

A.信用证和合同相符B.信用证和货物相符C.信用证和单据相符答案:C解析:在信用证业务中,实行的是凭单付款的原则,开证银行只根据提交的单据与信用证相符,即要求“单证一致”、“单单一致”。

2、信用证的基础是买卖合同,当使用证与买卖合同规定不一致时,受益人应要求()。

A.开证行修改B.开证申请人修改C.通知行修改答案:C3、在信用证业务中,银行的责任是:()A、只看单据,不看货物B、既看单据,又看货物C、只管货物,不看单据答案:A4、信用证上如未明确付款人,则制作汇票时,受票人应为()。

A.开始申请人B.开证银行C.议付行D.任何人答案:B5、根据国际商会《跟单信用统一惯例》的规定,如果信用上未注明“不可撤消”的字样,该信用证应视为:A.可撤消信用证B.不可撤消信用证C.远期信用证D.由受益人决定可撤消或不可撤消答案:B6、在合同规定的有效期,()负有开立信用证的义务。

A. 卖方B. 买方C.开证行D.议付行答案:B解析: 考点为开立信用证的要求。

买方负有开立信用证的义务,要求开证行开立的有条件的承诺付款的书面文件。

7、在交易金额较大,对开证行的资信有不了解时,为保证货款的及时收回,买方最好选择()。

A.可撤销信用证B.远期信用证C.承兑交单D.保兑信用证答案:D解析:信用证的选择问题,ABC收回货款的风险大。

采用保兑信用证,是指一家银行开立的信用证,由另一家银行加以保证兑付,保兑行在信用证下也承担了第一付款责任。

8、关于信用证的有效期,除特殊规定外,银行将拒绝接受迟于运输单据出单日期()天后提交的单据。

A.20B.30C.25D.21答案:D解析:本题是关于信用证的有效期与银行交单的关系。

银行拒绝接受迟于运输单据出单日期21天后提交的单据(出单日期指提单签发日期,即货物装船完毕日期)9、按照《跟单信用证统一惯例》的解释,在信用证中如未注明是可以撤销,则该证为:A.可撤销信用证B.不可撤销信用证C.由双方协商决定答案:B解析:根据《跟单信用证统一惯例》规定,信用证上未注明是可撤销信用证或不可撤销信用证时,视为不可撤销信用证。

根据合同审核信用证

习题二:信用证审核一、思考题:1.何谓信用证?简述其一般流程。

2.信用证方式的基本当事人有哪些?在什么情况下,又可能有什么当事人?各当事人分别承担什么责任?3.信用证方式的主要特点是什么?4.何谓“议付”?“议付”与“付款”有什么区别?二、操作题:1.练习目的:学会阅读信用证2.练习要求:根据下面的信用证范例找出下列内容:(1)信用证的种类(2)信用证号码(3)开证日期(4)信用证的有效期(5)信用证的到期地点(6)开证申请人名称、地址(7)受益人名称、地址(8)开证行名称(9)信用证金额及货币单位(10)分批运输(11)转运(12)装运港(地)、目的港(地)(13)最迟装运期(14)货名及规格(15)价格术语(16)交单期限(17)信用证要求的单据(18)信用证特别条款信用证范例:JUNE 5,2003 14:35:46 LOGICAL TERMINAL HN03MT S700 ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC HNHQP786MSGACK DWS6789 AUTH OK,KEY B003060267DE43AF,ICBKCNBJ BFDC***RECORDBASIC HEADER F01 ICBKCNBJ A367 0675 780609 APPLICATION HEADER O700 2851 030605 BFDCIE2DAXXX 5439 447618 020605 1806N* BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)USER HEADER SERVICE CODE 103BANK PRIORITY 113MSG USER REF. 108INFO. FROM CI 115TO:INDUSTRIAL AND COMMERCIAL BANK OF CHINA ZHEJIANG,CHINA(ICBKCNZJYYY)SEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT *40A : IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 : AF/651909DATE OF ISSUE 31C : 20030605EXPIRY *31D :DATE 20030810 PLACE CHINAAPPLICANT *50 : A AND D SARUE DU CHEMIN VERTCENTRE DE GROS NO.102AS0678 LESQUIN CEDEX FRANCEBENEFICIARY *59 : ZHEJIANGMACHINERY IMPORT& EXPORTCORPORATION,350 WENHUI ROAD,HANGZHOU,ZHEJIANG, CHINAAMOUNT *32B : CURRENCY USD AMOUNT 17600.00AVAILABLE WITH *41D : ANY BANKBY NEGOTIATION DRAFTS AT … 42C : SIGHTDRAWEE 42D : BFDCIE2DAXXX*BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)PARTIAL SHIPMENTS 43P : NOT ALLOWED TRANSHIPMENT 43T : ALLOWED:LOADING IN CHARGE 44A :SHANGHAI CHINAFOR TRANSPORTATION TO 44B :ANTWERPLATEST DATE OF SHIPMENT 44C : 20030725DESCRIPTION OF GOODS 45A :PARTS QTY. UNIT PRICELA1 500PCS @USD10.20 USD5100.00LA2 1000PCS @USD12.50 USD12500.00TOTAL USD 17600.00AS PER PROFORMA NR ZIEG/D003021 DATED 12/05/2003 AND ORDER NBER 03-758FREE ON BOARD SHANGHAIDOCUMENTS REQUIRED 46A :+COMMERCIAL INVOICE IN 03 ORIGINAL(S) AND 00 COPIES+PACKING LIST AND WEIGHT NOTE IN 03 ORIGINAL(S) AND 00 COPIES+3/3 ORIGINAL CLEAN ON BOARD OCEAN BILL OF LADING PLUS MORE 2 COPIES, ISSUED TO ORDER OF A AND D SA, RUE DU CHEMIN VERT,CENTRE DE GROS NO.102, AS0678 LESQUIN CEDEX FRANCE AND MARKED ” FREIGHT COLLECT ” AND NOTIFY DUBOIS SA ZONE INDUSTRIELLE DU PORT FLUVIAL 3749 TOURNAI BEIGIUM+CERTIFICATE GSP FORM A 1 ORIGINAL AND 1 COPY. ADDITIONAL CONDITIONS 47A:+ALL CHARGES OF BANKS OTHER THAN OUR OWN CHARGES ARE TO BE BORNE BY BENEFICIARY+QUANTITY AND VALUE MORE OR LESS 5 PERCENT ACCEPTABLE.+SHIPPING MARKS AS STATED ON THE RELEVANT SALES CONFIRMATION(S) OR PROFORMA INVOICE(S).+THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION) INTERNATIONAL CHAMBER OF COMMERCE, PUBLICATION NUMBER 500.PRESENTATION PERIOD 48 : DOCUMENTS MUST BE PRESENTEDWITHIN 15 DAYS AFTER THE DATEOF SHIPMENT,BUT NOT LATERTHAN THE EXPIRY DATE OFCREDIT.CONFIRMATION * 49 : WITHOUTINSTRUCTIONS 78:+ WE WILL CREDIT NEGOCIATING BANK AT ITS BEST CONVENIENCE AFTER RECEIPT AT OUR COUNTERS OF DOCUMENTS ISSUED IN STRICT COMPLIANCE WITH TERMS OF ISSUED L/C. PLEASE FORWARD US DOCUMENTS VIA ANY COURRIER SERVICE. KINDLY ACKNOWLEDGE RECEIPT OF THIS L/C QUOTING YOUR REF.SEND TO RECO INFO. 72 : KINDLY ACKNOWLEDGE RECEIPTTHIS CREDIT BY RETURN SWIFT WILLBE MUCH APPRECIATEDTRAILER : MAC 6B32791ACHK:C7C590AF567A其他参考资料:发票号码: ZJIXM0135 发票日期: 2003年7月15日提单号码: WL-5307 提单日期: 2003年7月20日船名: KAMAN V.151 装运港: 上海集装箱号: GESU5637586(40’) 货物装箱情况: 25PCS/CTN毛重: @ 50KGS/CTN 净重: @48KGS/CTN 体积: @ 0.216CBM/CTN一、根据合同审核信用证(一)合同上海远大进出口公司SHANGHAI YUANDA IMPORT & EXPORT COMPANY上海市溧阳路1088号龙邸大厦16楼16TH FLOOR, DRAGON MANSION, 1088 LIYANG ROAD ,SHANGHAI200081 CHINASALES CONTRACTNO.: YD-MDSC9811 DA TE: 2007/11/8BUYERS: MAURICIO DEPORTS INTERNA TIONAL S.A. ADDRESS: RM 1008-1011 CONVENTION PLAZA,101 HARBOR ROAD, COLON, R.P.TEL.: FAX:THE UNDERSIGNED SELLERS AND BUYERS HA VE AGREED TO CLOSE THE FOLLOWING TRANSACTION ACCORDING TO THEQUANTITY AT THE SELLER’S OPTION.PACKING: 50KGS TO ONE GUNNY BAG. TOTAL 40000BAGS. SHIPMENT: TO BE EFFECTED DURING DEC.2007 FROM SHANGHAI, CHINA TO COLON,R.P. ALLOWING PARTIAL SHIPMENTS AND TRANSHIPMENT.INSURANCE: TO BE COVERED FOR 110% OF INVOICE V ALUE AGAINST ALL RISKS AS PER AND SUBJECT TO OCEAN MARINE CARGO CLAUSES OF PICC DA TED 1/1/1981.PAYMENT: THE BUYERS SHALL OPEN THROUGH A FIRST-CLASSBANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE L/C AT 30DAYS AFTER B/L DATE TO REACH THE SELLER NOV .25,2007 ANDV ALID FOR NEGOTIATION IN CHINA UNTIL THE 15TH DAY AFTERTHE DATE OF SHIPMENT.SELLERS SHANGHAI YUANDA IMPORT &EXPORT COMPANY 赵国斌BUYER: MAURICIO DEPORTS INTERNATIONAL S.A. D.H.HONENEY请指出信用证中存在的问题:模拟练习:根据合同审核信用证(一)售货确认书售货确认书SALES CONFIRMATIONNO.LT07060DATE: AUG.10, 2005The sellers: AAA IMPORT AND EXPORT CO. The buyer: BBB TRADING CO.222 JIANGUO ROAD P.O.BOX 203DALIAN, CHINA GDANSK, POLAND下列签字双方同意按以下条款达成交易:The undersigned Sellers and Buyers have agreed to close the following总值TOTAL VALUE: U.S. DOLLARS FORTY FIVE THOUSAND ANDSIX HUNDRED ONL Y.装运口岸PORT OF LOADING: DALIAN目的地DESTINA TION: GDANSK转运TRANSSHIPMENT: ALLOWED分批装运PARTIAL SHIPMENTS: ALLOWED装运期限SHIPMENT: DECEMBER, 2005保险INSURANCE: BE EFFECTED BY THE SELLERS FOR 110%INVOICE V ALUE COVERING F.P.A. RISKS OFPICC CLAUSE付款方式PAYMENT: BY TRANSFERABLE CONFIRMED L/CPAY ABLE 60 DAYS AFTER B/L DA TE,REACHING THE SELLERS 45 DAYS BEFORETHE SHIPMENT一般条款GENERAL TERMS:1. 合理差异: 质地、重量、尺寸、花形、颜色均允许合理差异,对合理范围内查里提出的索赔,概不受理。

信用证习题及答案解析

信用证习题及答案解析(一)选择题1.按照《UCP500》的规定,信用证未明确是否保兑,就是()。

A、未保兑的信用证B、已保兑的信用证C、由通知银行来决定是否保兑D、由进口人来决定是否保兑答案:A解析:保兑,是指开证行以外的银行保证对信用证承担付款责任。

按照《UCP500》的规定,信用证未明确是否保兑,则为不保兑信用证,只有在不可撤销信用证上才能加保。

2.审核信用证的依据是()。

A、《UCP500》和合同B、保险单C、商业发票D、提单答案:A解析:首先,作为审核信用证依据的《跟单信用证统一惯例》(Uniform Customs and Practice for Documentary Credits,简称UCP),是国际银行界、律师界、学术界自觉遵守的“法律”,是全世界公认的、到目前为止最为成功的一套非官方规定。

70多年来,160多个国家和地区的ICC和不断扩充的ICC委员会持续为UCP的完善而努力工作着。

而最新的版本则是UCP600版本,所以,UCP600版本也是作为最新审核信用证的依据,任何人想完美操作并且审核信用证,都必须熟读UCP600原则来作为审核信用证的依据,这样才能做到没有不符点,完美操作信用证。

再者,审核信用证也应以订立的合同为依据。

符合合同规定,并且保证信用证上的条款可以办到,否则,应申请对方改证。

注意:题目答案的《UCP500》并不是最新版本,最新版本是《UCP600》3.某公司出口乒乓球,信用证规定:“乒乓球10000打,单价每打2.38美元,总金额23800.00美元,禁止分批装运”。

根据《UCP500》规定,卖方交货的()。

A、数量和总金额均可在5%的范围内增减B、数量和总金额均可在10%的范围内增减C、数量可以有5%的范围内增减,但总金额不得超过23800.00美元D、数量和金额均不得增减答案:D解析:根据《UCP600》,除非信用证规定,在所支付款项不超过信用证金额的条件下,货物数量准许有5%的增减幅度。

(信用管理)信用证审核练习

(信用管理)信用证审核练习ADVANTAGEANDDISADVANTAGEOFCOLLECTIONThemostunsatisfactoryfeatureoftheD/Pfromoftransacti onisthepossibilityofthebuyerorthisbankerrefusingtohonor thedraftandtakeuptheshippingdocuments,especiallyatatime whenthemarketisfalling.Insuchacase,thesellermaynotrecei vehispayment,althoughheisstilltheownerofthegoods.UnderD/Pmethod,beforemakingpayment,thebuyercannotge tdocumentsoftitletothegoodsandtakedeliveryofthegoods.Th eownershipofthegoodsstillremainsinthehandsoftheseller.I fthebuyerdishonorsthedraft,thesellercansellthegoodstoot hers.InthecaseofpaymentbyD/A,thefurtherdifficultyarisest hat,onthebuyeracceptingthedraft,thedocumentsoftitlewill besurrenderedtohim.Hence,ifthebuyergoesbankruptorbecome sinsolventbeforethepaymentbyD/PorD/A,unlessthebuyerisof unquestionableintegrityorofthereisaspecialrelationbetwe enthesellerandthebuyer.ItisfarbetterfortheexportertouseL/CratherthanD/PorD/A.However,undercertaincircumstances orforcertainpurposes,paymentbyD/PorD/Aisstilldeemednece ssary,forinstance:(1)Forimplementationofforeigntradepolicy,especially forthepromotionoftradewithdevelopingcountries.(2)Forpromotionofexports,especiallytopushthesaleofo urnewproductsanddifficultsellcommodities.(3)Forpromotionoftradewiththesmallenterprisesbytheg rantingcreditstothem.(4)Forsimplifyingproceduresofpaymentwhiledoingbusin esswithaffiliatedcorporations.3.案例分析某公司出售壹批货物给香港商人,成交条件为CIF香港,付款条件是付款交单见票后30天(D/Pat30daysaftersight)付款,出口商于合同规定的装运期限内将货物装船后,开立远期汇票,连同商业发票和已装船海运提单委托中国银行通过港商指定的某代收银行收取货款.5天后,出口商所交货物安全运抵香港,由于anchmarket”Freightprepaid”andnotifytheaboveapplicant.(5)Marineinsurancepoliciesorcertificatesinnegotiabl efromfor110%ofCIFinvoicevaluecoveringAllRisksandWarRisksasperoceanmarinecargoclauseofthePeo ple’sInsuranceCompanyofChinadated1/1/1981withextendedc overuptoKualaLumpurwithclaimspayableatdestinationinthec urrencyofdraft.。

(完整版)信用证审证练习答案

SALES CONFIRMATIONDATE:MAY 10,2004OUR REFERENCE:IT123JSSELLER: CHINA INTERNATIONAL TEXTILES I/E CORP. JIANGSU BRANCH ADDRESS: 20 RANJIANG ROAD ,NANJING,JIANGSU,CHINABUYER: TAI HING LOONG SDN, BHD, KUALA LUMPURADDRESS: 7/F, SAILING BUILDING, NO.50 AIDY STREET, KUALA LUMPUR, MALAYSIATEL:060-3-74236211 FAX:060-3-74236212THE UNDERSIGNED SELLERS AND BUYERS HAVE AGREED TO CLOSE THE FOLLOWING TRANSACTION ACCORDING TO THE TERMS AND CONDITIONS STIPULATED BELOW:DESCRIPTION OF GOODS:QUANTITY : 300,000 YARDS 100% COTTON GREE LAWNUNIT PRICE: HKD3.00PER YARD CIF SHANGHAIAMOUNT HKD900,000.00CIF SINGAPORESHIPMENT: DURING JUNE/JULY,2004 IN TRANSIT TO MALAYSIAPAYMENT:IRREVOCABLE SIGHT L/CINSURANCE:TO BE EFFECTED BY SELLERS COVERING WPA AND WAR RISKS FOR 10% OVER THE INVOICE VALUETHE BUYER THE SELLERTAI HING LOONG SDN, CHINA INTERNATIONAL TEXTILES I/E CORP. BHD, KUALA LUMPUR. JIANGSU BRANCH买方开来的信用证如下所示:FROM: BANGKOK BANK LTD., KUALALUMPURDOCUMENTARY CREDIT NO.:98/12345DATE:JUNE 12,2004ADVISING BANK: BANK OF CHINA, JIANGSU BRANCHAPPLICANT: TAI HING LOONG SDN, BHD., P.O.B.666 KUALA LUMPUR BENEFICIARY: CHINA INTERNATIONAL TEXTILES I/E CORP., BEIJING BRANCH AMOUNT: HKD 900,000.00 (HONGKONG DOLLARS NINE HUNDRED THOUSAND ONLY)EXPIRY DATE: JUN 15, 2004 IN CHINA FOR NEGOTIATIONDEAR SIRS:WE HEREBY ISSUE THIS DOCUMENTARY CREDIT IN YOUR FAVOR, WHICH IS AVAILABLE BY NEGOTIATION OF YOUR DRAFT(S) IN DUPLICATE AT SIGHT DRAWN ON BENEFICIARY BEARING THE CLAUSE: “DRAWN UNDER L/C NO.98/12345 OF BANGKOK BANK LTD., KUALA LUMPUR DATED JUNE 12, 2004” ACCOMPAINED BY THE FOLLOWING DOCUMENTS:— SIGNED INVOICE IN QUADRUPLICATE COUNTER-SIGNED BY APPLICANT. COVERING ABOUT 300,000 YARDS (5% MORE OR LESS ACCEPTABLE) OF 65% POLYESTER, 35% COTTON GREY LAWN.— FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER, ENDORSED IN BLANK, MARKED :” NOTIFY BENEFICIARY”.— MARINE INSURANCE POLICY OR CERTIFICATE FOR FULL INVOICE VALUE PLUS 50% COVERING ALL RISKS AND WAR RISKS FROM WAREHOUSE TO WAREHOUSE UP TO KUALALUMPUR INCLUDING SRCC CLAUSE— PACKING LIST IN QUADRUPLICATE— CERTIFICATE OF ORIGIN ISSUED BY BANK OF CHINA, NANJING.— SHIPMENT FROM SHANGHAI TO PORT KELANG TO BE MADE AS SOON AS POSSIBLE. PARTIAL SHIPMENTS ARE ALLOWED TO BE DELIVERED ON TWO EQUAL SHIPMENTS.TRANSSHIPMENT PROHIBITED.SHIPMENT CAN ONLY BE EFFECT UPON RECEIPT OF APPLICANT’S SHIPPING INSTRUCTIONS THROUGH L/C OPENING BANK NOMINATING THE NAME OF CARRYING VESSEL BY MEANS OF SUSEQUENT CREDIT AMENDMENT. THE SIGNATURE SIGHED BY THE APPLICANT ON CARGO ECEIPT MUST BE IN CONFORMITY WITH THE RECORD KEPT IN ISSUING BANK.(只有收到信用证修改方式通过开证行发过来的申请人装运指示,指定装运船名后方可发货;收货单据上申请人的签名必须与留在开证行的记录相符。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

华侨商业银行有限公司TO CUSTOMER

HUA CHIAO COMMERCIAL BANK LTD.

022030 02/05/08 018970 191 BH20 0000L/C NO.M-01-Q-10666

ADV.BANK: BANK OF CHINA SHANGHAI

(SHANGHAI BRANCH)

MT700ISSUE OF A DOCUMENTARY CREDIT- SWIFT -

27SEQUENCE OF TOTAL1/1

40A FORM OF DOCUMENTARY CREDIT IRREVOCABLE

20DOCUMENTARY CREDIT NUMBER M-01-Q-10666

31C DATE OF ISSUE020508

31D DATE AND PLACE OF EXPIRY020731 AT HONGKONG

50APPLICANT TIAN MING TRADING COMPANY

194 KI LUNG STREET, SHAMSHUIPO,

KOWLOON, HONG KONG

59BENEFICIARY SHANGHAI MORNING STAR CORPORATION

375 DONG DA MING ROAD

SHANGHAI CHINA

32B CURRENCY COOE, AMOUNT USD830,800.00

41 D AVAILABLE WITH …BY….BANK OF CHINA

BY NEGOTIATION

42C DRAFTS AT30 DAYS AFTER SIGHT

QUOTING NO. AND DATE OF THIS LC AND NAME OF LC ISSUING BANK

42 D DRAWEE ISSUING BANK FOR FULL INVOICE VALUE 43P PARTIAL SHIPMENTS PROHIBITED

43T TRANSSHIPMENT ALLOWED

44A LOADING ON BOARD/DISPATCH/AT/FROM SHANGHAI

44B FOR TRANSPORTATION TO HONG KONG

44C LATEST DATE OF SHIPMENT020731

45A DESCRIPTION OF GOODS AND/OR SERVICES

4 ITEMS OF OFFICE APPLIANCES AS PER S/C NO 983837 CIF HONG KONG

46A DOCUMENTS REQUIRED

1. SIGNED COMMERCIAL INVOICE IN TRIPLICATE SHOWING THIS L/C NUMBER

2. SIGNED PACKING LIST IN DUPLICATE.

3. FULL SET (2/2) MARINE INSURANCE POLICY OR CERTIFICATE,

ENDORSED IN BLANK, FOR 120 PERCENT OF FULL CIF VALUE, COVERING

INSTITUTE CARGO CLAUSES (A) AND INSTITUTE WAR CLAUSES (CARGO)

SHOWING CLAIMS, IF ANY, ARE TO BE PAID AT DESTINATION IN THE

SAME CURRENCY OF THE DRAFTS.

4. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO

THE ORDER OF HUA CHIAO COMMERCIAL BANK LTD., HONG KONG MARKED

FREIGHT TO COLLECT AND NOTIFY APPLICANT WITH FULL ADDRESS.

47A ADDITIONAL CONDITIONS

1. PROCESSING OF DOCUMENTS WHICH DO NOT COMPLY WITH THE

TERMS AND CONDITIONS OF THE LETTER OF CREDIT IS SUBJECT

TO A SPECIAL DISCREPANCY HANDLING FEE OF U.S.DOLLARS

40.00 OR EQUIVALENT PER SET OF DOCUMENTS PLUS RELATED

RELATED CABLE CHARGES WHICH WILL BE DEDUCTED FROM ANY PROCEEDS.

2. TWO ADDITIONAL COPIES/PHOTOCOPIES EACH OF THE RELATIVE

INVOICE(S) AND TRANSPORT DOCUMENT(S) ARE REQUESTED TO BE

PRESENTED TOGETHER WITH THE DOCUMENTS FOR THE ISSUING

BANK'S REFERENCE ONLY.

71B CHARGES ALL BANKING CHARGES ARE FOR A/C OF BENEFICIARY

48PERIOD FOR PRESENTATION

7 DAYS AFTER THE DATE OF SHIPMENT

49CONFIRMATION INSTRUCTIONS WITHOUT

** END OF MESSAGE ***

审证信用证 C卷。