国际结算练习 一

国际结算练习一

Make your choice according to the following flowchart.Drawer payee the first transferee the second transferee bill bill as gift negotiated to--------------------------精品文档,可以编辑修改,等待你的下载,管理,教育文档----------------------------------------------------------------------------------------------------------------------------------------------------------------D P C Egoods clothesA drawee / acceptor1. C is a (holder in due course, holder for value).2. If C negotiated the bill to E, E is a (holder in due course, holder for value).3. If the bill is unpaid by A, E ( may, may not) claim from C.E (may, may not) claim from P.E (may, may not) claim from D.4. E’s title (is, is not) superior to C’s.E’s title (is, is not) superior to P’s.C’s title (is, is not) superior to P’s.the second drawer payee the first transferee transfereebearer billstolen by C who sends it negotiates toD give value P as gift toE FC moneypickpocketA:Drawee, acceptor1. E is a (holder in due course, holder for value).2. E’s title (is, is not) better than his prior parties, or his title is (complete, defective).3. F is a (holder in due course, holder for value).4. F’s title (is, is not) better than his prior parties.5. Being a holder in due course, F is a (holder, true owner) of the bill, but C is still the (holder, true owner) of the bill, since he is the person in possession of a bill payable to bearer.6. The acceptor A pays the bill to F, the bill (is, is not) discharged.--------------------------精品文档,可以编辑修改,等待你的下载,管理,教育文档----------------------------------------------------------------------------------------------------------------------------------------------------------------the second drawer payee the first transferee transfereeorder bill P’s endorsement forged by Cwho negotiates bill to E negotiates toD give value PE FC money moneypickpocketA:Drawee, acceptorAccording to Bills of Exchange Act 1882,1. F is a (holder in due course, holder for value, holder, possessor).2. E is a (holder in due course, holder for value, holder, endorser).3. When the bill is delivered to P, P is (a payee, an endorser).4. If acceptor A pays the bill to F before forged endorsement has been discovered, is the responsibility of the bill discharged by such payment? (Y es, No.)5. After forged endorsement was discovered, the true owner P (can, cannot) force A to pay him again.6. A(can, cannot) recover from F the money he has paid.7. If F refunds A, he (can, cannot) claim from E.8. If P discovers the lost bill in the hands of E, P(has, does not have) the right to demand restoration of his title to the bill.According to Uniform Law for Bills of Exchange and Promissory Notes signed at Geneva,1. F is (holder in due course, holder for value, holder, possessor).2. The loss of the bill will be compensated by (F, E, C, A).--------------------------精品文档,可以编辑修改,等待你的下载,管理,教育文档----------------------------------------------------------------------------------------------------------------------------------------------------------------。

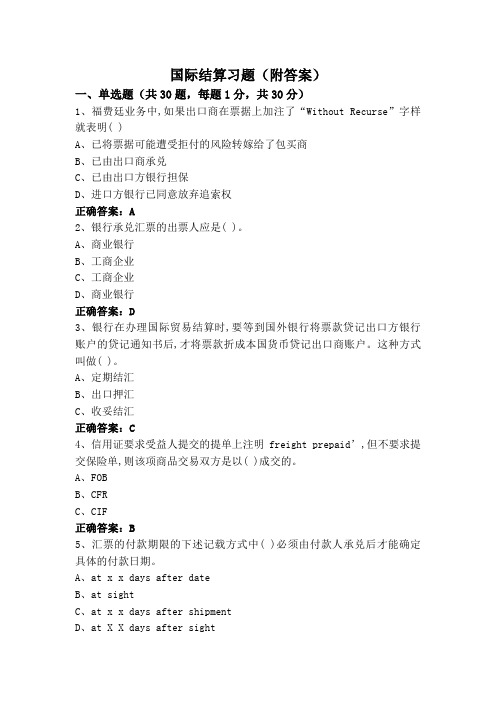

国际结算习题(附答案)

国际结算习题(附答案)一、单选题(共30题,每题1分,共30分)1、福费廷业务中,如果出口商在票据上加注了“Without Recurse”字样就表明( )A、已将票据可能遭受拒付的风险转嫁给了包买商B、已由出口商承兑C、已由出口方银行担保D、进口方银行已同意放弃追索权正确答案:A2、银行承兑汇票的出票人应是( )。

A、商业银行B、工商企业C、工商企业D、商业银行正确答案:D3、银行在办理国际贸易结算时,要等到国外银行将票款贷记出口方银行账户的贷记通知书后,才将票款折成本国货币贷记出口商账户。

这种方式叫做( )。

A、定期结汇B、出口押汇C、收妥结汇正确答案:C4、信用证要求受益人提交的提单上注明freight prepaid’,但不要求提交保险单,则该项商品交易双方是以( )成交的。

A、FOBB、CFRC、CIF正确答案:B5、汇票的付款期限的下述记载方式中( )必须由付款人承兑后才能确定具体的付款日期。

A、at x x days after dateB、at sightC、at x x days after shipmentD、at X X days after sight正确答案:D6、一张金额为30万美元的可撤销信用证,未规定可否分批装运受益人装运了价值为5万美元的货物后,即向出口地银行办理了议付。

第二天收到开证行撤销该信用证的通知此时,开证行( )A、对已办理议付的5万美元仍应偿付其余25万美元则失效B、对已办理议付的5万美元可以拒绝偿付,并指示议付行向受益人追索所议付的5万美元C、因撤销通知到达前,该证已被凭以办理部分议付故该信用证不能被撤销正确答案:A7、某笔信用证业务中,信用证要求受益人按发票金额的110%投保。

这增加的10%,是( )。

A、进口商自愿多向保险公司交纳保险费B、进口商的预期毛利润率C、保险公司向进口商提出的要求D、进口商想从保险公司多得到补偿正确答案:B8、根据我国的票据法,当票据上金额的大小写不一致时( )。

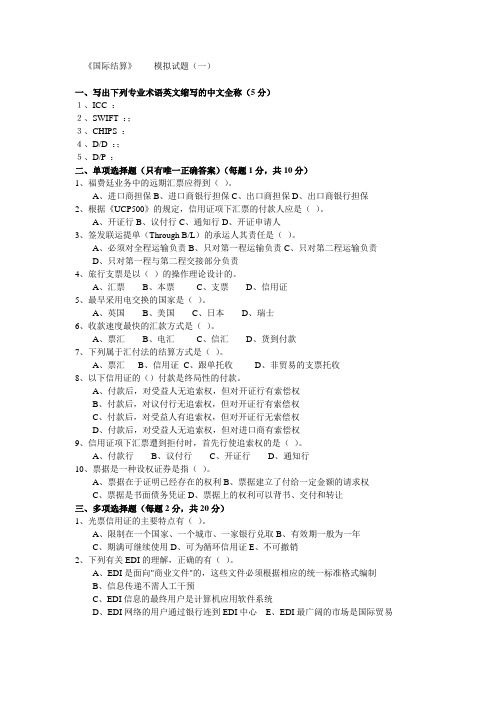

《国际结算》 模拟试题(一)

《国际结算》模拟试题(一)一、写出下列专业术语英文缩写的中文全称(5分)1、ICC :2、SWIFT :;3、CHIPS :4、D/D :;5、D/P :二、单项选择题(只有唯一正确答案)(每题1分,共10分)1、福费廷业务中的远期汇票应得到()。

A、进口商担保B、进口商银行担保C、出口商担保D、出口商银行担保2、根据《UCP500》的规定,信用证项下汇票的付款人应是()。

A、开证行B、议付行C、通知行D、开证申请人3、签发联运提单(Through B/L)的承运人其责任是()。

A、必须对全程运输负责B、只对第一程运输负责C、只对第二程运输负责D、只对第一程与第二程交接部分负责4、旅行支票是以()的操作理论设计的。

A、汇票B、本票C、支票D、信用证5、最早采用电交换的国家是()。

A、英国B、美国C、日本D、瑞士6、收款速度最快的汇款方式是()。

A、票汇B、电汇C、信汇D、货到付款7、下列属于汇付法的结算方式是()。

A、票汇B、信用证C、跟单托收D、非贸易的支票托收8、以下信用证的()付款是终局性的付款。

A、付款后,对受益人无追索权,但对开证行有索偿权B、付款后,对议付行无追索权,但对开证行有索偿权C、付款后,对受益人有追索权,但对开证行无索偿权D、付款后,对受益人无追索权,但对进口商有索偿权9、信用证项下汇票遭到拒付时,首先行使追索权的是()。

A、付款行B、议付行C、开证行D、通知行10、票据是一种设权证券是指()。

A、票据在于证明已经存在的权利B、票据建立了付给一定金额的请求权C、票据是书面债务凭证D、票据上的权利可以背书、交付和转让三、多项选择题(每题2分,共20分)1、光票信用证的主要特点有()。

A、限制在一个国家、一个城市、一家银行兑取B、有效期一般为一年C、期满可继续使用D、可为循环信用证E、不可撤销2、下列有关EDI的理解,正确的有()。

A、EDI是面向"商业文件"的,这些文件必须根据相应的统一标准格式编制B、信息传递不需人工干预C、EDI信息的最终用户是计算机应用软件系统D、EDI网络的用户通过银行连到EDI中心E、EDI最广阔的市场是国际贸易3、下列可成为银行保函申请人的是()。

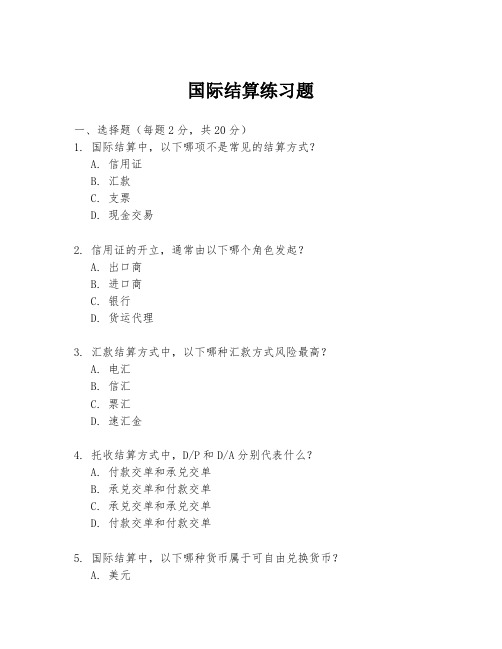

国际结算练习题

国际结算练习题一、选择题(每题2分,共20分)1. 国际结算中,以下哪项不是常见的结算方式?A. 信用证B. 汇款C. 支票D. 现金交易2. 信用证的开立,通常由以下哪个角色发起?A. 出口商B. 进口商C. 银行D. 货运代理3. 汇款结算方式中,以下哪种汇款方式风险最高?A. 电汇B. 信汇C. 票汇D. 速汇金4. 托收结算方式中,D/P和D/A分别代表什么?A. 付款交单和承兑交单B. 承兑交单和付款交单C. 承兑交单和承兑交单D. 付款交单和付款交单5. 国际结算中,以下哪种货币属于可自由兑换货币?A. 美元B. 人民币C. 印度卢比D. 巴西雷亚尔6. 信用证的到期地点通常在哪个国家?A. 出口国B. 进口国C. 第三国D. 任何国家7. 国际结算中,以下哪种支付方式属于非现金支付?A. 现金B. 支票C. 汇票D. 以上都是8. 以下哪种情况下,银行可以拒绝支付信用证下的款项?A. 单据不符B. 信用证过期C. 货物未按时到达D. 以上都是9. 托收结算方式中,如果进口商拒付,出口商应如何处理?A. 直接向银行索赔B. 向进口商追索C. 放弃追索权D. 重新议价10. 国际结算中,以下哪种风险属于信用风险?A. 汇率风险B. 政治风险C. 信用证欺诈D. 运输风险二、简答题(每题10分,共30分)1. 请简述信用证结算方式的一般流程。

2. 什么是远期信用证和即期信用证?它们的主要区别是什么?3. 在国际结算中,为什么需要进行风险管理?请列举至少三种常见的风险管理方法。

三、案例分析题(每题25分,共50分)1. 某出口商与进口商签订了一笔价值100万美元的货物销售合同,合同规定使用信用证结算。

出口商按照合同要求准备货物,并在货物装运后,向银行提交了所有必要的单据。

但是,银行发现单据中存在不符点,拒绝支付款项。

请问出口商应如何处理这种情况?2. 假设你是一家国际贸易公司的财务经理,公司最近与一家国外供应商达成了一笔交易,供应商要求使用托收结算方式。

国际结算练习一

国际结算练习题(一)Practices for International settlement1. Choose the true answer of the following sentences.(1).A bill shows: Pay to ABC Co. the sum of ten thousand US dollars on condition that shipment of the goods has been made.( )(A) acceptable (B) unacceptable (2).drawerpayee the first transferee the second transfereeD CE A(drawee)C ( ) is a(A) holder in due course (B) holder for value (C) holder(3)A holder of a crossed cheque wants to get payment by cash through presenting it at the counter of paying bank. ( )(A) yes (B)no(4)Draft is correctly endorsed if necessary. Draft ( ) bear restrictive endorsement “ withoutrecourse ”(A)should (B)should not(5) The person paying the money is a ( ) of the check.(A) payee (B) endorser (C) drawer (D) endorser(6) A check is valid for ( ) months from the date of issue. Unless a shorter period is written on the face of it.(A) six (B) nine (c) three (D) one(7) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2000, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(8) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2001, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(9) The effect of a blank endorsement is to make the check payable to the ( )(A) order of a specified person (B) specified person(C) bearer (D) named person(10) Banks usually ask for endorsement when checks in favor of ( ) payee are credited to a ( ) account.(A) joint , joint (B) joint , sole (C) bearer (D) sole ,joint(11) “ Payee James Smith endorsed James Smith pay to L. Green ”, This is a ( ) endorsement(A) specific (B) blank (C) general (D) restrictive(12) If a bill is payable “ 60 days after date ” the date of payment is decided according to ( )(A) the date of acceptance (B) the date of presentation( C ) the date of the bill (D) the date of maturity(13) A ( ) carries comparatively little risks and can be discounted at the finest rate of interest.(A) sight bill (B) bank bill (C) commercial bill (D) trade bill(14) A term bill may be accepted by the ( )(A) drawer (B) drawee (C) holder (D) payee(15) The party to whom the bill is addressed is called the ( )(A) drawer (B) drawee (C) holder (D) payee(16) When financing is without recourse, this means that the bank has no recourse to the ( ) if such drafts are dishonored.(17) Only by endorsement can the interest in the bill be transferred by ( )(A) drawer (B) drawee (C) holder (D) any person to the bill(18) A promissory note is “inchoate” until it has been delivered to the ( )(A) payer or bearer (B) payee or drawee (C) payee or bearer (D) holder or drawer(19) The ( ) of a promissory note has prime liability while the other parties have secondary liabilities(A) holder (B) drawee (C)maker (D) acceptor(20) An acceptance with the wording “ payable on delivery of bill of lading” is ( )(A) a general acceptance (B) qualified acceptance(C) non acceptance (D) partial acceptance(21) ( ) must be accepted by the drawee before payment(A) A sight bill (B) A bill payable xx days after sight(C )A promissory note (D) A bill payable xx days after date(22) A(n) ( ) is a financial document(A) bill of exchange (B) bill of lading (C) insurance policy (D) commercial invoice(23) In order to retain the liabilities of the other parties, a bill that has been dishonored must be( )(A) protested (B) given to the acceptor (C) retained in the file (D) presented to the advising bank2.Please fill the blanks of the following sentences.(1)A bill is payable at several days after sight. What date is the day from which time of payment begins to run?(2) A bill is payable at several days after date. What date is the day from which time of payment begins to run?(3)The maturity of a draft is one month after 31 Jan. It is .(4)Order of liability after acceptance is as follows: takes primary liability for payment. ________ takes second liability for payment.(5) The differences between a bill and a note are as followsA bill is an unconditional order to pay. A note is an unconditional to pay.A bill has three basic parties . A note has .(6) The differences between a bill and a cheque are as followsThe drawee of a bill may be any person. The drawee of a cheque must beThere are four kinds of tenor for the bills. The tenor is merely payableA bill can be drawn in a set. A cheque can not be drawn in a .(7)Remittance through a bank from one country to another may usually be made by one of the following methods: 1 2 3 .(8)Financial documents mean , promissory note and cheque. Commercial document mean , transport document and insurance document.(9) account means your account .(10) Control document are lists of and3、Decide whether the following statement are true or false(1) In a promissory note, the drawer and the payer are the same person. ( )(2) A promissory note is an unconditional order in writing. ( )(3) There is no acceptor in a promissory note. ( )(4) A bank draft is a check drawn by one bank on another. ( )(5) A trade bill is usually a documentary bill. ( )(6) The interest in the bill of exchange can only be transferred by endorsement. ( )(7) An endorser of a bill is liable on it to subsequent endorsers as holders of the bill. ( )(8) the person who draws the bill is called the drawer. ( )(9) Bills of exchange drawn by and accepted commercial firms are known as trade bills. (t )(10) Trade bills are usually documentary bills. ( )(11) Endorsements are needed when checks in favor of a sole payee are credited to a jointed account. ( )(12) An open check can be paid into a bank account. ( )(13) An open check can be cashed over the counter. ( )(14) A crossed check can be cashed over the counter. ( )(15) The payment of a check cannot depend upon certain conditions being met. ( t )(16) In a check, the drawer and the payer are the same person. ( )(17) If a check is presented un dated, the payee can insert a date ( )(18) A draft is a conditional order in writing. ( )(19) If a bill is payable “at 30 days after date”, the date of payment is decided according to the date of acceptance.(20) A bill payable “ at 90 days after sight” is a sight bill. ( )4.Draw a bill of exchange according to the requisite items as follows. (15 points) date: 24 Feb, 2003 amount: USD 4,242.00 tenor: 22 May, 2003drawer: Sherman Motor Incorporation, New Yorkdrawee: The Chase Bank N. A. , New Yorkpayee: Sherman Motor Incorporation’s order5..In accordance with the following conditions, please write a able text of remittance.(10 points)Remitting bank: Bank of China , Tianjin. Paying bank: Midland Bank Ltd., London.Date of cable : 10 June. Test: 3561 Ref No:208TT0992Amount: GBP 54,420.00 Value on:10 JunePayee: ABC Co., London. Account No.3698044 with Midland Bank Ltd.Message: Contract No. 201541 Remmitter: Tianjin Trust & Investment Corp., TianjinCover: Debit our H.O. account FM:TO:DA TETEST OUR REF PAY VALUE TOFOR CREDIT OF ACCOUNT NO. OFMESSAGEB/O。

国际结算习题集(附答案)

国际结算习题第一章绪论一、名词解释国际结算、国际贸易结算、国际非贸易结算、国际结算信用管理二、单项选择题:1. 商品进出口款项的结算属于( C )A . 双边结算B . 多边结算C . 贸易结算D . 非贸易结算2. “汇款方式”是基于( B )进行的国际结算A . 国家信用B . 商业信用C . 公司信用D . 银行信用3. 实行多边结算需使用( D )A . 记账外汇B . 外国货币C . 黄金白银D . 可兑换货币4. 以下( C )反映了商业汇票结算的局限性A . 进、出口商之间业务联系密切, 相互信任;B . 进、出口商一方有垫付资金的能力;C . 进、出口货物的金额和付款时间不一致;D . 出口商的账户行不在进口国5. 当代国际结算信用管理的新内容涉及到( A )A . 系统信用和司法信用B . 员工信用和银行信用C . 公司信用和商业信用D . 银行信用和商业信用6. 以下 ( )引起的货币收付,属于“非贸易结算”.A. 服务供应 B . 资金调拨 C . 设备出口 D. 国际借贷7. ( B )不是纸币本位制度下使用多边结算方式必备的条件.A . 结算货币具有可兑换性B . 不实行资本流动管制C . 有关国家的商业银行间开立各种清算货币的账户D . 清算账户之间资金可以自由调拨8. 建国初我国对苏联和东欧国家的贸易使用( C )的方式A . 单边结算B . 多边结算C . 双边结算D .集团性多边结算9. 传统的国际贸易和结算中的信用主要是( D )两类。

A .系统信用和银行信用B . 系统信用和司法信用C .商业信用和司法信用D . 商业信用和银行信用10. 国际结算制度的核心即是( A )。

A .信用制度B .银行制度C .贸易制度D .外汇管理制度三、填充题:1. 使用商业汇票结算债权的三个必备条件是:进、出口商之间有_______________________;进出口商的任何一方有________________________;进出口货物的______________________________。

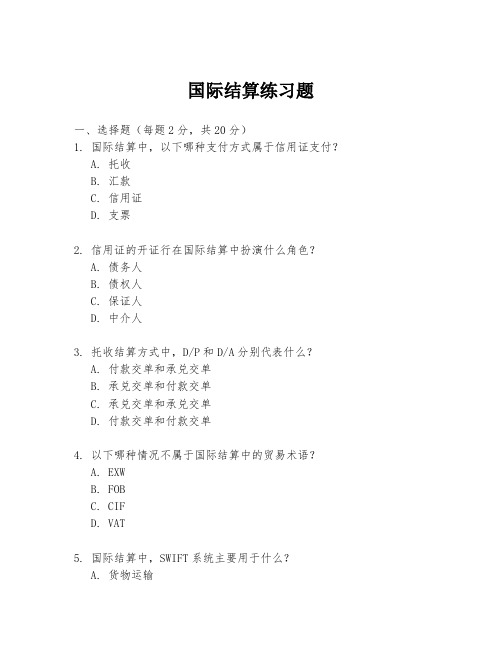

国际结算练习题

国际结算练习题一、选择题(每题2分,共20分)1. 国际结算中,以下哪种支付方式属于信用证支付?A. 托收B. 汇款C. 信用证D. 支票2. 信用证的开证行在国际结算中扮演什么角色?A. 债务人B. 债权人C. 保证人D. 中介人3. 托收结算方式中,D/P和D/A分别代表什么?A. 付款交单和承兑交单B. 承兑交单和付款交单C. 承兑交单和承兑交单D. 付款交单和付款交单4. 以下哪种情况不属于国际结算中的贸易术语?A. EXWB. FOBC. CIFD. VAT5. 国际结算中,SWIFT系统主要用于什么?A. 货物运输B. 资金转移C. 信用证开立D. 风险管理6. 国际结算中,以下哪种货币不属于主要的储备货币?A. 美元B. 欧元C. 日元D. 土耳其里拉7. 国际结算中,风险最小化的支付方式是?A. 预付款B. 信用证C. 托收D. 汇款8. 国际结算中,以下哪种情况属于商业信用?A. 银行信用B. 政府信用C. 个人信用D. 企业信用9. 国际结算中,以下哪种保险属于货物运输保险?A. 信用保险B. 货物保险C. 健康保险D. 人寿保险10. 国际结算中,以下哪种方式不属于结算方式?A. 信用证B. 托收C. 汇款D. 合同二、判断题(每题1分,共10分)1. 信用证是一种无条件的支付承诺。

()2. 托收结算方式中,D/P和D/A的风险是相同的。

()3. 国际结算中,SWIFT系统只能用于银行间的信息传递。

()4. 贸易术语中的FOB表示货物在装运港交货。

()5. 国际结算中,使用信用证支付可以完全避免贸易风险。

()6. 承兑交单(D/A)方式下,买方必须在规定期限内付款。

()7. 国际结算中,货币的汇率波动不会影响结算结果。

()8. 信用证结算方式下,开证行对货物的质量不承担责任。

()9. 国际结算中,银行只负责资金的转移,不参与贸易合同的执行。

()10. 国际结算中,使用电子汇款可以节省时间和成本。

国际结算习题(带答案)

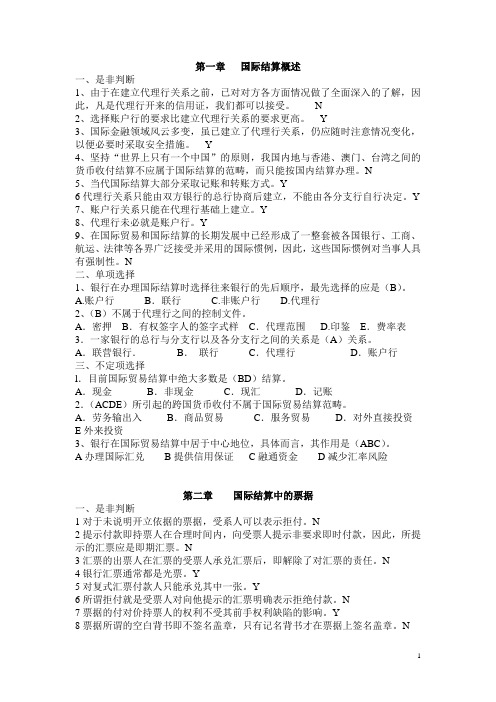

第一章国际结算概述一、是非判断1、由于在建立代理行关系之前,已对对方各方面情况做了全面深入的了解,因此,凡是代理行开来的信用证,我们都可以接受。

N2、选择账户行的要求比建立代理行关系的要求更高。

Y3、国际金融领域风云多变,虽已建立了代理行关系,仍应随时注意情况变化,以便必要时采取安全措施。

Y4、坚持“世界上只有一个中国”的原则,我国内地与香港、澳门、台湾之间的货币收付结算不应属于国际结算的范畴,而只能按国内结算办理。

N5、当代国际结算大部分采取记账和转账方式。

Y6代理行关系只能由双方银行的总行协商后建立,不能由各分支行自行决定。

Y7、账户行关系只能在代理行基础上建立。

Y8、代理行未必就是账户行。

Y9、在国际贸易和国际结算的长期发展中已经形成了一整套被各国银行、工商、航运、法律等各界广泛接受并采用的国际惯例,因此,这些国际惯例对当事人具有强制性。

N二、单项选择1、银行在办理国际结算时选择往来银行的先后顺序,最先选择的应是(B)。

A.账户行B.联行 C.非账户行 D.代理行2、(B)不属于代理行之间的控制文件。

A.密押B.有权签字人的签字式样C.代理范围 D.印鉴E.费率表3.一家银行的总行与分支行以及各分支行之间的关系是(A)关系。

A.联营银行.B.联行C.代理行D.账户行三、不定项选择l.目前国际贸易结算中绝大多数是(BD)结算。

A.现金B.非现金C.现汇D.记账2.(ACDE)所引起的跨国货币收付不属于国际贸易结算范畴。

A.劳务输出入B.商品贸易C.服务贸易D.对外直接投资E外来投资3、银行在国际贸易结算中居于中心地位,具体而言,其作用是(ABC)。

A办理国际汇兑B提供信用保证C融通资金D减少汇率风险第二章国际结算中的票据一、是非判断1对于未说明开立依据的票据,受系人可以表示拒付。

N2提示付款即持票人在合理时间内,向受票人提示非要求即时付款,因此,所提示的汇票应是即期汇票。

N3汇票的出票人在汇票的受票人承兑汇票后,即解除了对汇票的责任。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Exercises for

International Settlement

CHAPTER ONE

I Choose the best answer to each of the following statements.

1. There are four main methods of securing payment in international trade: ⑴payment under documentary credit; ⑵open account; ⑶collection; ⑷payment in advance. From an exporter’s point of view, t he order of preference is( ) .

A. ⑴, ⑵, ⑶,⑷

B. ⑷, ⑶, ⑴, ⑵

C. ⑷, ⑴, ⑶, ⑵

D. ⑵, ⑷, ⑴, ⑶

2.. An exporter sells goods to a customer abroad on FOB and on CIF terms, Who is responsible for the freight charges in each?( )

A. Importer, exporter

B. Exporter, importer

C. Importer, importer

D. Exporter, exporter

3. Foreign trade can be conducted on the following terms except for ( )

A. open account

B. documentary collection

C. documentary credit

D. public bonds

4.International cash settlement has the following disadvantages except( )

A. expensive

B. safe

C. risky

D. time-consuming

5. Under a letter of credit, the exporter can receive the payment only when( )

A. he has shipped the goods

B. he has presented the documents

C. the documents presented comply with the credit terms

D. the importer has taken delivery of the goods

6. Which of the following is based on commercial credit?( )

A. letter of credit

B. bank letter of guarantee

C. collection

D. insurance policy

7.CHIPS is the electronic clearing system for( )

A. GBP

B. USD

C. CNY

D. EUR

8.. CHAPS is the electronic clearing system for ( )

A. GBP

B. USD

C. CNY

D. EUR

9.The control documents exchanged by correspondent banks include all of the

following except( )

A. specimen of authorized signatures

B. table of test keys

C. schedule of terms and conditions

D. current accounts

10.Financial documents means ( ),or other similar instruments.

A. invoices

B. B/L

C. promissory notes

D. insurance policies。