SAPFICO总账配置及其操作手册达沃旗

SAP_FICO实战项目基础信息配置操作手册

SAP_FICO基础信息配置操作手册1.FI基本设置部分1.1企业结构—定义—财务会计—定义公司(Company)维护公司名称、详细信息(地址、语言、国家、货币)1.2企业结构—定义—财务会计—定义信贷控制范围(Credit Control Area)建立维护信贷控制范围,专门用来控制客户信贷限额的组织单元。

它是一个独立的组织结构,需分配给公司代码。

可以为一个公司代码定义一个信贷控制范围,也可以一个科目表下的公司代码共用一个信贷控制范围。

1.3企业结构→分配→财务会计→给信贷控制区分配公司代码信贷控制范围(Credit Control Area)创建后,与公司代码(Company Code)并无联系。

此项操作就是将公司代码指定信贷控制范围。

每个公司代码只能指定一个信贷控制范围;一个信贷控制范围可以分配给多个公司代码。

1.4企业结构—定义—财务会计—定义、复制、删除,检查公司代码(Company Code)定义(新条目)、复制,删除,检查公司代码拷贝建立一个公司代码,删除现有的公司代码,检查公司代码的一致性编辑公司代码数据维护公司代码的名称、城市、国家、货币、语言1.5企业结构→分配→财务会计→给公司代码分配公司当公司(Company)和公司代码(Company Code)创建好后,彼此并无联系。

如需将两者联系起为,则需进行配置操作。

本文是在SAP系统后台,为公司代码指定公司。

1.6财务会计—财务会计全局设置—公司代码的全球参数—输入全局参数(GlobalParameters)设置公司代码的全局性数据:会计组织:会计科目表、公司、信贷管理范围、会计年度变式处理参数:字段状态变式、记帐期间变式地址:标题、名称、地址、邮箱、通讯、搜索等1.7财务会计—财务会计全局设置—分类帐→会计年度和过帐期间—维护会计年度变式(Fiscal Year Variant)维护每个年份的记帐财务期间设定,一般选用的是K4:12个记帐期间4个特别期间1.8财务会计—财务会计全局设置—会计年度—向一个会计年度变式分配公司代码为公司代码指定一个会计年度变式,一般使用K41.9财务会计—财务会计全局设置—凭证—过帐期间—定义未结清过帐期间变式定义一个过帐期间变式的代码1.10财务会计—财务会计全局设置—凭证—过帐期间—未清和关帐过帐期间修改不同变式不同帐户类型的科目的可用期间1.11财务会计—财务会计全局设置—凭证—过帐期间—将变式分配给公司代码为公司代码指定过帐期间变式1.12财务会计-财务会计全局设置-分类账-定义并激活未主导分类账设置平行分类账,以及记账期间变式1.13财务会计—财务会计全局设置(新)→分类帐→字段→客户字段→定义字段状态变式(Field Status Variants)增加或维护字段状态变式,科目组里的字段状态设定,是为了总帐科目在公司代码视图维护时的输入状态。

SAP操作手册_FICO_成本要素主数据

SAP操作⼿册_FICO_成本要素主数据成本要素主数据⽂档修改记录版本版本描述编写⼈最后修改⽇期V1 初稿,软件版本:V1511V2 终稿V3 修改1.业务说明成本要素、成本要素组主数据创建、修改、删除操作处理。

2.系统符号说明功能SAP系统符号说明⽤户菜单进⼊⽤户菜单系统菜单进⼊系统菜单保存保存在数据库中的⼯作返回(上⼀级)在不保存当前⼯作的情况下返回以前的屏幕取消(退出当前屏幕)在不保存当前⼯作的情况下退出当前的任务取消/放弃操作在不保存当前⼯作的情况下退出当前的任务确认(回车)进⼊下⼀个屏幕或窗⼝,Enter 有相同的功能全选选择所有的⾏项⽬取消全选取消选择所有的⾏项⽬翻页能够进⼊以后或以前的页,既可以进⼊第⼀页也可以是最后⼀页列能够显⽰以后或以前的列,既可以显⽰第⼀列也可以是最后⼀列创建新的会话快速打开⼀个新的会话窗⼝执⾏键开始⼀个系统活动打印打印新建项⽬新建⼀个或多个⾏项⽬取消项⽬删除⼀个或多个⾏项⽬删除删除显⽰凭证流程根据系统中的某张单据或凭证,查找到与其相关的单据及凭证。

显⽰凭证抬头细⽬显⽰凭证抬头状态总览状态总览帮助获得在线帮助明细将选择进⾏明细查看查找查找系统数据按升序排列依据选定列字段进⾏升序排列按降序排列依据选定列字段进⾏降序排列多项选择将对应字段进⾏多种选择从剪切板上载将复制的所有数据粘贴到系统中,不会因屏幕⾏项⽬数⽽限制设置筛选依据选列设置筛选输出将选择数据表导出系统变式选择提取系统设置的变式,如只⼀个直接提取,当有多个则进⼊变式选择界⾯总计将选择列数字进⾏汇总⼩计依据选择列字段将已进⾏“总计”的数据进⾏分别汇总3.系统操作前提与数据准备说明3.1 前提1)成本要素:按成本中费⽤的经济⽤途或费⽤的经济性质所作的⼀种分类。

⽤以分析在各个时期各种⽣产费⽤⽀出的多少。

2)初级成本要素:初级成本要素与总账中的损益科⽬保持对应关系,财务会计模块或其它模块与成本对象相关的数据通过初级成本要素⾃动更新到管理会计模块。

SAP FICO说明书

1) Explain the term SAP FICO?SAP FICO stands for FI ( Financial Accounting) and CO (controlling). In SAP FICO, SAP FI take cares about accounting, preparation of financial statements, tax computations etc, while SAP CO take cares of inter orders, cost sheet, inventory sheet, cost allocations etc. It is the software that stores data, and also computes them and retrieves the result based on the current marketing scenario. SAP FICO prevents data lost and also does the verification and reporting of data.2) What are the other modules to which 'Financial Accounting' is integrated?The other modules to which 'Financial Accounting' is integrated area) Sales and Distributionb) Material Managementc) Human Resourced) Production Planninge) Controlling of financial transaction3) In SAP FI what are the organizational elements?The organizational elements in SAP FI are:a) Company Codeb) Business Areac) Chart of Accountd) Functional Area4) Explain what is posting key and what does it control?In order to determine the transaction type which is entered in the line item, a two digit numerical is used known as 'Posting Key'Posting key determinesa) Account Typesb) Types of posting. Debit or Creditc) Field status of transaction5) What is the company code in SAP?To generate financial statements like Profit and Loss statement, Balance sheets etc. company code is used.6) How many Chart of Accounts can company code have?You can have one Chart of Account for one company code which is assigned.7) For a Company Code how many currencies can be configured?There are three currencies that can be configured for a Company code, one is a local currency and two are the parallel currencies.8) What are the options in SAP for Fiscal years?Fiscal year in SAP is the way financial data is stored in the system. In SAP, you have 12 periods and four special periods. These periods are stored in fiscal year variant that is:a) Calendar Year: From Jan-Dec, April-Marchb) Year dependent fiscal year9) What is a 'year shift' in SAP calendar?SAP system does not know what is broken fiscal year e.g April 2012 to March 2013 and only understand the calendar year. If, for any business, the fiscal year is not a calendar year but the combination of the different months of two different calendar year and then one of the calendar year has to classified as a fiscal year for SAP and the month falling in another year has to be adjusted into the fiscal year by shifting the year by using the sign -1 or +1. This shift in the year is known as 'year shift'.Example: April 2012 to Dec 2012 is our first calendar year, and Jan 2013 to March 2013 is our second year, now if you are taking April-12 to Dec-12 as your fiscal year, then Jan-13 to March-13 automatically becomes the second year, and you have to adjust this year by using -1 shift, and vice versa if the scenario is reversed, here you will use +1 shift.10) What is year dependent fiscal year variant?In a year dependent fiscal year variant, the number of days in a month is not as per the calendar month. For example, in year 2005, month January end on 29th, month Feb ends on 26th etc.11) In SAP how input and output taxes are taken care?For each country tax procedure is defined, and tax codes are defined within this. There is a flexibility to either expense out the Tax amounts or capitalise the same to stocks.12) Explain what is validations and substitutions in SAP?For each functional area in SAP Validation or Substitution is defined eg, Assets, Controlling etc. at the following levelsa) Document Levelb) Line item Level13) What are the application areas that use validation and substitutions?a) FI- Financial accountingb) CO-Cost accountingc) AM-Asset accountingd) GL-Special purpose ledgere) CS-Consolidationf) PS-Project systemg) RE-Real estateh) PC-Profit center accounting14) In SAP what is the use of FSV ( Financial Statement Version) ?FSV ( Financial Statement Version) is a reporting tool. It can be used to extract final accounts from SAP like Profit and Loss Account and Balance Sheet. The multiple FSV's can be used for generating the output of various external agencies like Banks and other statutory authorities.15) What is a field status group?'Field status groups' control the fields which come up when the user does the transactions. In FIGL (Financial General Ledger) master, the field status group is stored.16) What is FI-GL (Financial- General Ledger) Accounting does?To get an overview of external Accounting and accounts, G L (General Ledger) Accounting is used. It does the recording of all business transactions incorporated with all other operational areas in a software system and also ensures that the Accounting dat a is always complete and accurate.17) What is the default exchange rate type which is picked up for all SAP transactions?For all SAP transaction, the default exchange rate is M (Average Rate).18) What are the methods by which vendor invoice payments can be made?a) Manual payment without the use of any output medium like cheques etc.b) Automatic payments like DME (Data Medium Exchange), cheques, Wire transfer19) What are the problems when business area is configured?The problem faced when a business area is configured, is splitting of account balance which is more pertinent in the case of tax accounts.20) For document clearing what are the customizing prerequisites ?The customizing pre-requisite for document clearing is to check the items cleared and uncleared, and this is done by open item management. Open item management manages your outstanding account, i.e account payable and account receivable. For instance, an invoice item that has not yet been paid is recorded as open account until it is paid.21) What is the importance of GR/IR ( Good Received/ Invoice Received) clearing account?GR/IR ( Good Received/ Invoice Received) is an interim account. In the legacy system, if the goods are received and the invoice is not received, the provision is made, in SAP at the goods receipt. It passes the Accounting entry debiting the Inventory and crediting the GR/IR account. Similarly, when an invoice is received the vendor account is credited, and the GR/IR account is debited, the GR/IR will show as an un-cleared items till the time the invoice is not received.22) What is parallel and local currency in SAP?Each company code can have two additional currencies, in addition to the company code, currency entered to the company code data. The currency entered in the company code creation is called local currency and the other two additional currencies are called parallel currencies. Parallel Currencies can be used in foreign business transactions. In order to do international transaction, parallel currency can be used. The two parallel currencies would be GROUP CURRENCY and HARD CURRENCY.23) Where can you use the internal order?To track the cost, internal orders are used; they are proposed to be incurred over on a short term basis.24) Is it possible to calculate depreciation to the day?Yes, it is possible to calculate depreciation, to do that you have to switch on the indicator Dep. to the day in the depreciation key configuration.25) In Asset Accounting what is the organizational assignments?In Asset Accounting, chart of depreciation is rated as the highest node, and this is assigned to the company node. All the depreciation calculations are stored under the chart of depreciation.26) What is the importance of asset classes? What asset classes are there?The asset class is the main class to classify assets. Every asset must be assigned to only one asset class. Example of asset class is Furniture & Fixtures, Plant & Machinery, and Computers etc. The asset class also contains G1 account, when any asset is procured, G1 account is debited. Whenever you create and asset master, it becomes mandatory to mention the assest class for which you are creating the required assets. So, whenever any asset transaction occurs, the G1 account attached to the asset class is automatically picked up and the entry is passed. You can also specify the default values for calculating the depreciation values and other master data in each asset class. 27) How capital WIP (Work In Process) and Assets accounted for in SAP?'Capital WIP' is referred to as Assets under construction in SAP and is represented under specific asset class. Depreciation is not charged under 'Capital WIP' usually. The cost incurred on building a capital asset can be booked to an 'internal order' and through the settlement procedures, and can be posted onto an 'Asset Under Construction'.28) What are the major components of Chart of Accounts?The major components of Chart of Accounts are:a) Chart of account keyb) Namec) Maintain Languaged) Length GL account numbere) Controlling Integrationf) Consolidation-Group chart of accountsg) Block indicator29) What is credit control area in SAP?To immune your company from the risk of bad debts and multiple outstanding receivable, you can set a credit limit for your customer by using credit control area in SAP. With the help of SAP, you can block the deliveries to your customer based on the credit limit and the accounts receivable balance in their account which is maintained by you.30) How can you create Credit Control Area in SAP?By using transaction code OB45 or path you can create Credit Control Area in SAPSPRO> enterprise structure >maintain structure>definition>financial accounting>maintain credit control area and then enter the following descriptiona) Updateb) Name of the credit control area in SAPc) Currencyd) Descriptione) Credit Limitf) Risk Categoryg) Fiscal Varianth) Rep group31) What is posting period variants?In fiscal year posting period is a period for which the transactions figures are updated. The posting period variants in SAP is accountable to control which Accounting period is open for posting and ensures that the closed periods remain balanced.32) Explain in simple terms what is field status and what does it control?Field status group is a group configured in FSV (Field Status Variant) to maintain field status forG/L (General Ledger) accounts. It controls which field should suppress, display, optional and required.33) What is short-end fiscal year?A short-end fiscal year results when you change from a normal fiscal year to a non-calendar fiscal year, or other way around. This type of change happens when an enterprise becomes part of a new co-corporate group.34) What is an account group and where it is used?To control the data that needs to be entered at the time of the creation of a master record an account group is used. Account group exist for the definition of GL account, Customer Master and Vendor.35) What is the purpose of "Document type" in SAP?The purpose of " Document type" in SAP isa) Number range for documents are defined by itb) Types of accounts that can be posted are controlled by it, e.g Assets, Vendor, Customer, Normal GL accountc) It is used for the reversal of entries36) Is business area at company code level?No. Business area is at client level which means other company codes can also be posted to the same business area.37) In SAP, Customer and Vendor code are stored at what level?The Vendor and Customer codes are stored at the client level. It means that by extending the company code view any company code can use the customer and vendor code.38) How are tolerances for invoice verification defined?Tolerance determines whether the payable places matching or tax hold on the invoice. The following are the instances of tolerance can be defined for Logistic Invoice Verification.a) Small differencesb) Moving average price variancesc) Quantity variancesd) Price variances39) What is a country Chart of Accounts?Country Chart of Accounts contains G/L (General Ledger) accounts needed to meet the country's legal requirements.40) What is APP in SAP Fico?APP stands for 'Automatic Payment Program'; it is a tool provided by SAP to companies to pay its vendors and customers. APP tools help to avoid any mistakes taken place in posting manually. Also, when number of employees is more in the company, payment through APP becomes more feasible.41) In SAP FICO what are the terms of payment and where are they stored?Payment terms are created in the configuration and determine the payment due date for vendor/customer invoice.They are stored on the customer or vendor master record and are pulled through onto the customer/vendor invoice postings. The due date can be changed on each individual invoice if required.42) What are one-time vendors?In certain companies, especially the one dealing with high cash transactions, it is not practical to create new master records for every vendor trading partner. One time vendors allows a dummy vendor code to be used on invoice entry and also the information which is usually stored in the vendor master.43) What are the standard stages of the SAP payment run?The following steps are the standard stages of the SAP payment runa) Entering of parameters ( Vendor Accounts, Company Codes, Payment Methods)b) Proposal Scheduling – the system proposes the list of invoice paidc) Payment booking- the booking of the actual payments in the ledgerd) Printing of payment forms ,example cheques44) In Accounts Receivable, what is the difference between the 'Residual Payment' and 'Part Payment' methods of allocating cash?'Residual payment' and 'Part payment' are the two methods for allocating partial methods from customers. For example, an invoice for $100 is generated, customer has paid $70. Now this $70 will be off-set and leaving the remaining balance $30. With residual payment, the invoice is cleared for the full value of $100 and a new invoice is generated for the remaining balances $30.45) What is "dunning" in SAP?'Dunning' is the process by which payment chasing letters are issued to customers. SAP can determine which customers should receive the letters and for which overdue items. Different letters can be printed in SAP depending on the overdue payment date, with a simple reminder.With the help of dunning level on the customer master, we can know which letter has been issued to the customer.46) What is the purpose of the account type field in the GL (General Ledger) master record?At the end of the year, profit and loss accounts are cleared down to the retained earnings balance sheets account. The field contains an indicator which is linked to a specific GL (General Ledger) accounts to use in this clear down.47) Explain what is recurring entries and why are they used?Recurring entries can eliminate the need for the manual posting of Accounting documents which do not change from month to month. For example, an expense document can be generated which can be scheduled for the last days of each month or whenever an individual wants it. Usually multiple recurring entries are created at one go and then processed all together as a batch month end using transaction.48) What is a 'Value Field' in the CO-PA module?Value fields are number or value related fields in profitability analysis such as quantity, sales revenue, discount value etc.49) What are the statistical internal orders?Statistical internal orders are dummy cost objects used for reporting and analysis purposes. It must be posted to in conjunction with a real object such as a cost center.50) For what purposes internal orders can be used?You can use internal orders fora) Overhead Orders: It monitors internal jobs settled to cost centresb) Investment Orders: It monitors internal jobs settled to fixed assetsc) Accrual Orders: Offsetting posting of accrued costs calculated in COd) Orders with Revenue: It display the cost controlling parts of Sales and Distribution, it does not affect the core business of the companyGuru99 Provides FREE ONLINE TUTORIAL on Various courses likeJava MIS MongoDB BigData Cassandra Web Services SQLite JSP Informatica Accounting SAP Training Python Excel ASP Net HBaseProject ManagementTest Business Ethical Hacking Management AnalystPMPLive Project SoapUI Photoshop Manual Testing MobileTesting Selenium CCNA AngularJS NodeJS PLSQL。

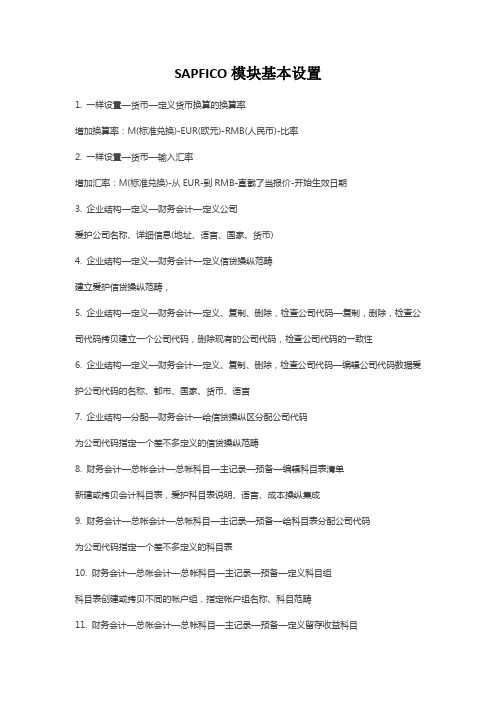

SAPFICO模块基本设置

SAP FI/CO 模块设置(上篇)1. 一般设置—货币—定义货币换算的换算率增加换算率:M(标准兑换)-EUR(欧元)-RMB(人民币)-比率2. 一般设置—货币—输入汇率增加汇率:M(标准兑换)-从EUR-到RMB-直接报价-开始生效日期3. 企业结构—定义—财务会计—定义公司维护公司名称、详细信息(地址、语言、国家、货币)4. 企业结构—定义—财务会计—定义信贷控制范围建立维护信贷控制范围,5. 企业结构—定义—财务会计—定义、复制、删除,检查公司代码—复制,删除,检查公司代码拷贝建立一个公司代码,删除现有的公司代码,检查公司代码的一致性6. 企业结构—定义—财务会计—定义、复制、删除,检查公司代码—编辑公司代码数据维护公司代码的名称、城市、国家、货币、语言7. 企业结构—分配—财务会计—给信贷控制区分配公司代码为公司代码指定一个已经定义的信贷控制范围8. 财务会计—总帐会计—总帐科目—主记录—准备—编辑科目表清单新建或拷贝会计科目表,维护科目表说明、语言、成本控制集成9. 财务会计—总帐会计—总帐科目—主记录—准备—给科目表分配公司代码为公司代码指定一个已经定义的科目表10. 财务会计—总帐会计—总帐科目—主记录—准备—定义科目组科目表创建或拷贝不同的帐户组,指定帐户组名称、科目范围11. 财务会计—总帐会计—总帐科目—主记录—准备—定义留存收益科目设置自动结帐科目,业务:BIL结转余额,损益表科目类型:X 科目:31410100利润分配-未分配利润12. 财务会计—财务会计全局设置—公司代码—输入全局参数设置公司代码的全局性数据:会计组织:会计科目表、公司、信贷管理范围、会计年度变式处理参数:字段状态变式、记帐期间变式地址:标题、名称、地址、邮箱、通讯、搜索等13. 财务会计—财务会计全局设置—会计年度—维护会计年度变式维护财务期间设定,一般选用的是K4-12个记帐期间4个特别期间14. 财务会计—财务会计全局设置—会计年度—向一个会计年度变式分配公司代码为公司代码指定一个会计年度变式,一般使用K415. 财务会计—财务会计全局设置—凭证—过帐期间—定义未结清过帐期间变式定义一个过帐期间变式的代码16. 财务会计—财务会计全局设置—凭证—过帐期间—未清和关帐过帐期间修改不同变式不同帐户类型的科目的可用期间17. 财务会计—财务会计全局设置—凭证—过帐期间—将变式分配给公司代码为公司代码指定过帐期间变式18. 财务会计—财务会计全局设置—凭证—凭证号范围—定义凭证号范围查看和指定不同公司代码下的凭证范围。

SAP FICO总账会计GL操作手册

SAP FICO总账会计GL操作手册(版本V01)目录总账会计(GL) (3)1、基本介绍 (3)1.1公司代码 (3)1.2记帐码 (3)1.3、会计科目表 (5)1.4、会计科目主要概念介绍 (5)1.5、行项目及行项目显示: (6)1.6、自动过帐 (6)1.7、凭证类型 (6)1.8、会计凭证编号 (7)1.9、会计期间的不同 (7)2、维护会计科目主数据流程 (7)2.1、业务流程简介 (7)2.2、业务流程图 (8)2.3、操作步骤 (9)3、总帐凭证处理 (14)3.1、业务流程简介 (14)3.2、业务流程图 (14)3.3、操作步骤 (16)4、工资计提业务处理流程 (18)4.1、业务流程简介 (18)4.2、业务流程图 (18)4.3、操作步骤 (20)5、工资支付流程: (20)5.1、业务流程简介: (20)5.2、业务流程图 (21)5.3、操作步骤 (22)6、预制凭证的过帐 (22)6.1、业务流程简介 (22)6.2、操作步骤 (22)7、周期凭证 (25)7.1、业务流程简介 (25)7.2、操作步骤 (25)8、样本凭证的处理 (34)8.1、业务流程简介 (34)8.2、主要步骤: (34)8.3、业务操作:凭证冲销和重新过账 (41)9、查询科目余额/科目余额表/日记账凭单/行项目摘要/记账总额 (45)9.1、业务流程简介 (45)9.2、操作步骤 (45)10、月结处理 (49)10.1、业务流程简介 (49)10.2、业务流程图 (50)10.3、操作步骤 (51)总账会计(GL)1、基本介绍总账会计模块主要是指FI模块中直接记账,生成业务数据的核算内容,包括直接的FI手工记账凭证的输入等相关操作、及公司财务数据的总括及会计报表的编制工作等。

总账子模块主要针对公司财务数据的使用者提供简明、准确的数据资料。

业务范围:主要包括各法人公司财务部为了核算公司的业务利润,编制各项财务报告,进行的总账业务操作。

FI学习手册-总账篇-达沃旗教育SAP

SAP-FI学习手册—总账1.SAP登陆及基础操作 (2)1.1. 基本界面操作说明 (2)2.总账 (7)2.1.会计科目的维护 (7)2.2.总账凭证录入 (9)2.3. 凭证显示及更改 (15)3.凭证过账的辅助方法及后续工作的处理方法 (17)3.1.总账凭证的快速输入(快速过账) (17)3.2.参考已过帐凭证过帐 (20)3.3.预制凭证操作步骤 (22)3.4.周期性凭证 (29)3.5.总账科目余额显示 (38)4.总账报表查询 (42)5.总账开关账期 (43)6.汇率 (45)SAP登陆及基础操作1.1.基本界面操作说明进入SAP界面如下图,如ides项目已存在,点击登录进入;如果没有ides项目,点击新建项目进入新建界面:新建时有一处界面如下,其中的内容如不知道填什么,需咨询系统管理员:进入系统后需输入相应内容,如下,用户名和口令是系统管理员分配的,需牢记:进入系统后界面如下:续上图,事务代码可以看到了:在实际操作中的模糊查询输入:实际操作中有的值是可以通过选取获得的,如下图:2.总账2.1.会计科目的维护必须先建立会计科目,其他有关设定才能进行,会计科目是账务的最基本的元素路径:FS00-会计→财务会计→总分类帐→主记录→总账科目→单个处理→集中地进入下一界面如下:点击创建后下面界面变成可输入界面,如下:2.2.总账凭证录入输入总账科目凭证有两种方法:第一种方法:F-02 - 会计-> 财务会计-> 总分类帐-> 过帐-> 一般过帐界面如下图:双击一般记账,进入下面的界面:输入完上述内容后,点击回车到下一界面输入相应的借方科目内容:点击回车,进入下一界面录入贷方科目相应内容:显示结果如下:第二种方法:FB50-会计→财务会计→总分类帐→过账→输入总账科目凭证:进入FB50输入总账科目凭证,可以看出抬头部分和F-02一般过帐基本上是一样的,公司代码是我们设置好的默认值,FB50中不需要我们输入凭证类型。

SAPFICO模块基本设置

SAPFICO模块基本设置1. 一样设置—货币—定义货币换算的换算率增加换算率:M(标准兑换)-EUR(欧元)-RMB(人民币)-比率2. 一样设置—货币—输入汇率增加汇率:M(标准兑换)-从EUR-到RMB-直截了当报价-开始生效日期3. 企业结构—定义—财务会计—定义公司爱护公司名称、详细信息(地址、语言、国家、货币)4. 企业结构—定义—财务会计—定义信贷操纵范畴建立爱护信贷操纵范畴,5. 企业结构—定义—财务会计—定义、复制、删除,检查公司代码—复制,删除,检查公司代码拷贝建立一个公司代码,删除现有的公司代码,检查公司代码的一致性6. 企业结构—定义—财务会计—定义、复制、删除,检查公司代码—编辑公司代码数据爱护公司代码的名称、都市、国家、货币、语言7. 企业结构—分配—财务会计—给信贷操纵区分配公司代码为公司代码指定一个差不多定义的信贷操纵范畴8. 财务会计—总帐会计—总帐科目—主记录—预备—编辑科目表清单新建或拷贝会计科目表,爱护科目表说明、语言、成本操纵集成9. 财务会计—总帐会计—总帐科目—主记录—预备—给科目表分配公司代码为公司代码指定一个差不多定义的科目表10. 财务会计—总帐会计—总帐科目—主记录—预备—定义科目组科目表创建或拷贝不同的帐户组,指定帐户组名称、科目范畴11. 财务会计—总帐会计—总帐科目—主记录—预备—定义留存收益科目设置自动结帐科目,业务:BIL结转余额,损益表科目类型:X 科目:31410100利润分配-未分配利润12. 财务会计—财务会计全局设置—公司代码—输入全局参数设置公司代码的全局性数据:会计组织:会计科目表、公司、信贷治理范畴、会计年度变式处理参数:字段状态变式、记帐期间变式地址:标题、名称、地址、邮箱、通讯、搜索等13. 财务会计—财务会计全局设置—会计年度—爱护会计年度变式爱护财务期间设定,一样选用的是K4-12个记帐期间4个专门期间14. 财务会计—财务会计全局设置—会计年度—向一个会计年度变式分配公司代码为公司代码指定一个会计年度变式,一样使用K415. 财务会计—财务会计全局设置—凭证—过帐期间—定义未结清过帐期间变式定义一个过帐期间变式的代码16. 财务会计—财务会计全局设置—凭证—过帐期间—未清和关帐过帐期间修改不同变式不同帐户类型的科目的可用期间17. 财务会计—财务会计全局设置—凭证—过帐期间—将变式分配给公司代码为公司代码指定过帐期间变式18. 财务会计—财务会计全局设置—凭证—凭证号范畴—定义凭证号范畴查看和指定不同公司代码下的凭证范畴。

(实施)FI学习手册总账篇达沃旗教育SAP 品质

(实施)FI学习手册总账篇达沃旗教育SAP 品质SAP-FI学习手册—总账1.SAP登陆及基础操作 (2)1.1. 基本界面操作说明 (2)2.总账 (7)2.1.会计科目的维护 (7)2.2.总账凭证录入 (9)2.3. 凭证显示及更改 (15)3.凭证过账的辅助方法及后续工作的处理方法 (17)3.1.总账凭证的快速输入(快速过账) (17)3.2.参考已过帐凭证过帐 (20)3.3.预制凭证操作步骤 (22)3.4.周期性凭证 (29)3.5.总账科目余额显示 (38)4.总账报表查询 (42)5.总账开关账期 (43)6.汇率 (45)SAP登陆及基础操作1.1.基本界面操作说明进入SAP界面如下图,如ides项目已存在,点击登录进入;如果没有ides项目,点击新建项目进入新建界面:新建时有一处界面如下,其中的内容如不知道填什么,需咨询系统管理员:进入系统后需输入相应内容,如下,用户名和口令是系统管理员分配的,需牢记:进入系统后界面如下:续上图,事务代码可以看到了:在实际操作中的模糊查询输入:实际操作中有的值是可以通过选取获得的,如下图:2.总账2.1.会计科目的维护必须先建立会计科目,其他有关设定才能进行,会计科目是账务的最基本的元素路径:FS00-会计→财务会计→总分类帐→主记录→总账科目→单个处理→集中地进入下一界面如下:点击创建后下面界面变成可输入界面,如下:2.2.总账凭证录入输入总账科目凭证有两种方法:第一种方法:F-02 - 会计-> 财务会计-> 总分类帐-> 过帐-> 一般过帐界面如下图:双击一般记账,进入下面的界面:输入完上述内容后,点击回车到下一界面输入相应的借方科目内容:点击回车,进入下一界面录入贷方科目相应内容:显示结果如下:第二种方法:FB50-会计→财务会计→总分类帐→过账→输入总账科目凭证:进入FB50输入总账科目凭证,可以看出抬头部分和F-02一般过帐基本上是一样的,公司代码是我们设置好的默认值,FB50中不需要我们输入凭证类型。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

SAP 总账业务配置及操作手册目录SAP 总账业务配置及操作手册概述业务说明预收款和预付款在SAP 中预收款和预付款统一称为预付款,预收款称为收到的预付款( Recieved),预付Down Payment 款称为支出的预付款(Down Payment Made) 。

Table®3I乩龙㈣ apinnumnw mi 軌啣 印QCdUQUOflFYpM"吨石 何王! 4023533幻 rj1!J3I W&S1S电寸li.JWjLBfi'WIMWirmJll I^UFI-IaiJFUi=llJFh 1LFH 闪口1:13■巧 刑皿11 LjaifcaHpj 中」耳飢冲刪e«®c幻□- - 口护炉~|&^pi?_E9中j 刃.謝□品¥WM3JJ 爲 ■=4¥州 FKje iSBLFnq | jnne^yjs _EC ur^i_rn EBl 目岸 LK34JLTIT BLU I I rBi-s SSHutre EU4 Ffingtg paa 伯护二叮cm qpa E =MV oujLOj ipar eu^Sij■ J.' JHT2-! 'S -"ZL'S J A.•,4亠」丄仏旳jj £>LUIFlljj>V I^XA M JuQlilUUSQ 陌 鸟— 立商邱10胆2U6址I mplL 空:峑|刃刀 轡 羽&FLP 广蚯卫居<1山日 邑d 筑学网旧工□日科引章叫吗 © 名羊广中 m 旳£山门1|] &J awJOQs-L 曲$ 萨]『;-5J-CJ ①'{JOf] 戲d 唸Ml<L >'Uo n 宅■和 rm 苛"町刊nq w 啊H 切歯勿 m 兄耳5 75 rH F /l^'v V护:;G r*j ;^a切痣L :QK Q 囱尅+□sn常 JJ&l^-S [H 59315A UOWEUl 判UI FSQPP? ^o5 1P§ 申忑 i 丄丸曰扫—总肪问丁1甲3罰貝叭Sn-et Klfcto Ung”倂g Con tryCurcnrf创建信用控制范围创建公司代码口厨@如护goto 竺ctton unites蝕蚁Q r qciqq EE 忑;匕、J 8Change View "Company Code M: Overview少a [2“ Sirs G L4.色B] B S J£rtry-*0ofS7创建科目表清单总账字段状态SAP 系统在很多个类型的定义上都会设置字段状态,字段状态主要是指定在显示时需要显示和输入的内容,例如可以控制这类数据哪些属性隐藏、哪些属性必输、哪些属性是可选的、哪些属性只是显示不可修改。

因为每个记账码对应的帐户类型是不同的,所以系统在设置字段状态时就可以针对不同类型的帐户来进行设置,例如客户、供应商、会计科目等,只是设置的方式不同而已。

定义科目组( OBD4 )设置损益科目( OB53 )这一步需要在创建科目以前做,因为科目未创建,系统会给出提示科目不存在,直接确认即可。

在设置时,因为会计科目还没有创建,所以系统会给出提示,直接确认即可。

这个设置必须在科目创建前做,那样这个科目肯定是没有创建了,这个设计有些变态。

设置了损益科目以后,在定义科目时,对于损益类科目就可以设置其对应的结转科目,设置这个的原因在于sap 默认是采用表结法,在年末结转时需要将损益类的科目结转到指定的本年利润科目。

定义容差组(容差组的使用需要专题说明)记账凭证账户类型系统对不同的账户进行的一个统一归类,分为:客户、供应商、总账、物料、资产。

其中客户和供应商是结合统驭科目进行使用,在客户和供应商维护中指定,总账直接对应总账科目。

物料和资产暂时没有做具体的测试,应该是分别对应物料管理中的物料和固定资产管理中的固定资产。

写住 H TW lg lff T -rs T >glg g ^d §A r5lg-m lE.tipn』L K i la «=s-^len-^Bb&H hl去 一G e 费冋逛绥审 P B I B al F !D @ss f ^ IMG■f - _ L m峯帛E F_」…E一 WhwEheLu£ 一r .・t-l畦rg-g gitFg t o黑e g Is最匾hg a m常®l*..」ml e s d旧-曲庁b o 3M -阈@c h &n Q s <l4w ■•D Q -n u m Hi s tT*72JO VENDEWIK pmtnn"一 Bidsafaa ■MiiMIIWIMilPMMMMmMMMMIBmMM —w —wh号码范围:用于指定不同的号码范围,也就是号码范围的一个类编码,这样可以实现多个凭证类型使用一个号码范围。

在后台可以定义每个号码范围的码段。

冲销凭证类型:指定该凭证类型的凭证生成的冲销凭证的凭证类型。

审核组允许的账户类型:就是系统在生成记账凭证时,行项目允许的账户类型,例如,如果没有允许客户这一账户类型,那么行项目的账户如果为客户时系统将不允许继续。

这里的账户类型控制同记账码中的账户类型控制在生成记账凭证时同时起作用。

客户供应商检查:是指一个凭证中只能记录一个客户或者是供应商的记录。

这样可以避免将多个客户或者供应商的发生额放在一张凭证上的情况,会增加一定的凭证数量。

该项设置在凭证保存时才会检查,这是因为因为这个时候才是最终的凭证,检查的方式更有效果。

公司间过账(Inter-company postgs) :允许一张凭证属于多个公司代码,这一项没有进行测试,应该是在行项目中指定不同的公司代码。

在输入贸易伙伴的说明中,此项被称作跨公司过账(Cross-Company),感觉那个名字更加合适。

输入交易伙伴:可以允许输入交易伙伴的凭证,这个部分还不知道如何处理,需要结合公司间过账来统一考虑。

仅允许批量输入:就是该凭证类型仅用于批量输入。

建议外币汇率类型:该类型凭证建议的货币类型。

合资企业的相关设置还没有弄,在学习多会计单位时统一作为专题学习。

凭证号码范围SAP 的科目号码是按照年度来区分的,也就是在凭证表中年度也是也是一个主键 (key ),用户也可以自己定义一个跨越多年的号码范围,也就是一直顺序编号,而不是每年重新编号。

统驭科目(参见单独的总结文档)对于一些科目,需要直接记账到明细账,SAP 提供一种方法可以直接记录到每个明细账,同时根据明细账对应的总账科目自动记录到相应的总账科目中。

主要的统驭科目类型包括:客户、供应商、资产、应收合同科目。

需要说明的是,如果物料需要在凭证中记录明细账,那么可以采用物料分类账,具体需要专题说明。

行项目在每个记账凭证中,凭证的明细称为行项目,每个行项目需要对应一个记账码、使用的科目、科目金额,以及其他一些附属的属性,例如按照供应商核算的科目的供应商,分成本中心核算的不同成本中心。

记账码( Post key )对于每个记账码都要说明清楚是属于借方还是贷方,应为这个直接影响到所输入金额在科目汇总表中余额显示的方向。

对于帐户类型,主要确定在做记账凭证时的帐户需要指定为什么样的。

1. 假如帐户类型设置为客户,那么在进行会计凭证编制时选择的帐户就是客户编码而不是会计科目,否则系统就会提示“ Customer %kmid% is not defined in company code TE01 ”。

在维护客户时需要对应到一个统驭科目。

系统在记账时是记录了这个客户编码,同时根据客户编码追溯记录其对应的统驭科目编码。

帐户类型设置为供应商也是类似的。

2. 如果设置为总分类帐科目,只需要在编制记账凭证时帐户指定为会计科目即可。

3. 如果设置为资产,应该是指固定资产,具体没有做。

4. 如果设置为物料,更加的没有做过。

对于冲销记账码,主要是在生成冲销记账凭证时,设置是该记账码的行项目在新生成的行项目上的记账码是什么,必须是借贷标识不同的记账码。

主数据会计科目如果设置为本位币相同的货币,则科目可以记账其他货币。

如果设置为仅以本位币记账,那么科目在行项目中仅记录本位币,这样可以避免汇率差,以一些清帐科目应该设置该选项。

对于现金折扣科目和GR/IR 清帐科目必须设置仅以本位币记账。

会计科目上线时的批量导入程序RFBISA00 可以批量导入会计科目主数据。

业务处理预制凭证预制记账凭证预置记账凭证过账预置凭证过账时可以调整凭证明细的信息,凭证头只能调整“Reference ”删除预置记账凭证说明:系统在删除了预置的凭证后,凭证号并不会释放,所以会产生空凭证号的情况。

可以通过T-CODE:S_ALR_ 查询出所有跳号的信息。

中间做过测试,在F-02 中指定删除的凭证号,系统一样不允许。

缺少)预制凭证的工作流方式样本凭证创建样本凭证 F-01修改和显示样本凭证创建FBM1修改FBM2显示FBM3显示修改FBM4使用样本凭证在通过F-02 进行凭证创建时,可以使用参考样本凭证的方式进行凭证的创建。

执行“ Post with reference ”。

回车以后就可以生成正常的凭证。

重复凭证Recurring_Document 创建重复凭证 FBD1IDl (1)0X1 3| CNREnter Recuning Entty: Header Data[G f4it UtaUiV/J Q axunljiuKiW ineV g 丄BOOLRrel rin on last rm on Inteiv^ nirmthsRm JUrurtKbU C liertfer mo inn n b:Z curenzv 匚"I&E 幻 14 dfwrits hlocj C5UKYtr©iler»rPX» 40 AttOint lDMOLOl |»3Llnd少“9 眄crmrit S 炉em 却 _______________________________00© •丨Conor2009-06-132^]^f厂匚 tax twtsTTjp@□ BQ 苛p e回©迂:0P1②艮Enter Recuriing Entry Add G/L account Item| 旦0 E2|®LJlE・A|L^C?ni 圧IE朋•州[U口Ql^ccorc Coma an r Cadr 10020101 仮行E・A尺巧5001 |Tngoer MachreIDI(i>ax 31^9® CWRPost修改和显示重复凭证操作方式同于FB02 。