[缠中说禅:教你炒股票108课]李彪文字插图版02b

【缠中说禅】教你炒股票108课完整版

【缠中说禅】教你炒股票108课完整版原文关于市场哲学数学原理的一共是108课。

通过分类,可以把这108课分为十四个专题来学习。

他们分别是:一、导引篇【该篇72课是为学习做了一次整体的梳理,为方便学习者制定了一个懒人学习路线。

】第72课:本ID已有课程的再梳理二、分型、笔、线段篇【该篇是基础中的基础,方便之后对中枢的各种演化做理解。

】第62课:分型、笔与线段第65课:再说说分型、笔、线段第67课:线段的划分标准第69课:月线分段与上海大走势分析、预判第71课:线段划分标准的再分辨第77课:一些概念的再分辨(缺口、分型、笔线段的释义)第78课:继续说线段的划分三、中枢、走势类型和买卖点篇【该篇是中枢理论的基础,也是中枢内容的核心部分,从中枢定义到最小级别中枢,再到各级别中枢、各级别走势类型和买卖点。

该篇都有系统介绍。

】第17课:走势终完美第83课:笔-线段与线段-最小中枢结构的不同心理意义1第18课:不被面首的雏男是不完美的(主要介绍中枢的生与死)第63课:替各位理理基本概念(主要对级别概念进行形象的比喻和释义)第20课:缠中说禅走势中枢级别扩张及第三类买卖点第21课:缠中说禅买卖点分析的完备性第35课:给基础差的同学补补课(该课程是在线段概念出现之前的课程,如果已经认可3线段重叠构成最低级别1分钟级别中枢的统一定义的,需要区别一下)第101课:答疑1(介绍第二类买卖点和走势必完美的问题,可以加深相关概念的理解)第102课:再说走势必完美(包含了级别和完全分类的释义)第53课:三个买卖点的再分辨第56课:530印花税当日行情图解(突发事件下的走势和操作实例)四、背驰篇【该篇的意义在于对动力学的深刻理解,任何判断操作离不开对级别和背驰的理解,所以是动力学的核心基础内容。

】第24课:MACD对背驰的辅助判断第25课:吻、MACD、背驰、中枢第27课:盘整背驰与历史性底部第29课:转折的力度与级别第37课:背驰的再分辨第43课:有关背驰的补习课第44课:小级别背驰引发大级别转折第64课:去机场路上给各位补课(macd对背驰辅助判断的一个实例)第61课:区间套定位标准图解(分析示范六)五、同级别分解篇【该篇我们可以知道对走势进行合理的分解对把握当下走势是非常重要的,最简单的走势分解也就是同级别分解,所以该篇也是必须掌握的。

缠中说禅中枢注释(教你炒股票)

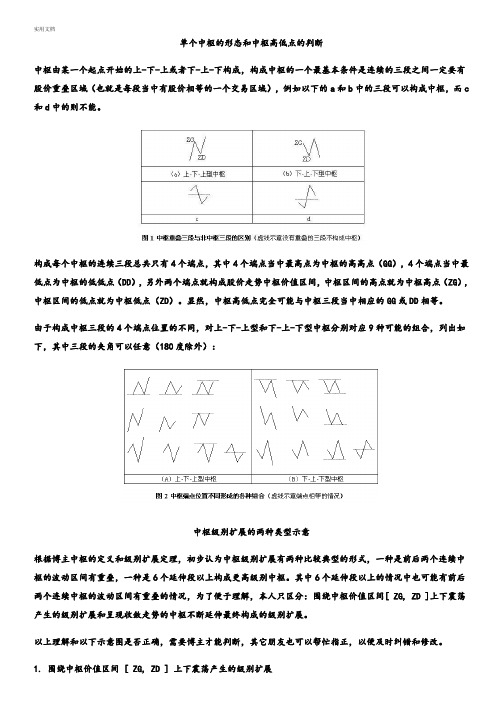

单个中枢的形态和中枢高低点的判断中枢由某一个起点开始的上-下-上或者下-上-下构成,构成中枢的一个最基本条件是连续的三段之间一定要有股价重叠区域(也就是每段当中有股价相等的一个交易区域),例如以下的a和b中的三段可以构成中枢,而c 和d中的则不能。

构成每个中枢的连续三段总共只有4个端点,其中4个端点当中最高点为中枢的高高点(GG),4个端点当中最低点为中枢的低低点(DD),另外两个端点就构成股价走势中枢价值区间,中枢区间的高点就为中枢高点(ZG), 中枢区间的低点就为中枢低点(ZD)。

显然,中枢高低点完全可能与中枢三段当中相应的GG或DD相等。

由于构成中枢三段的4个端点位置的不同,对上-下-上型和下-上-下型中枢分别对应9种可能的组合,列出如下,其中三段的夹角可以任意(180度除外):中枢级别扩展的两种类型示意根据博主中枢的定义和级别扩展定理,初步认为中枢级别扩展有两种比较典型的形式,一种是前后两个连续中枢的波动区间有重叠,一种是6个延伸段以上构成更高级别中枢。

其中6个延伸段以上的情况中也可能有前后两个连续中枢的波动区间有重叠的情况,为了便于理解,本人只区分:围绕中枢价值区间[ ZG, ZD ]上下震荡产生的级别扩展和呈现收敛走势的中枢不断延伸最终构成的级别扩展。

以上理解和以下示意图是否正确,需要博主才能判断,其它朋友也可以帮忙指正,以便及时纠错和修改。

1. 围绕中枢价值区间 [ ZG, ZD ] 上下震荡产生的级别扩展理论依据:缠中说禅走势级别延续定理二:更大级别缠中说禅走势中枢产生,当且仅当围绕连续两个同级别缠中说禅走势中枢产生的波动区间产生重叠。

(课程20)缠中说禅走势中枢中心定理二:前后同级别的两个缠中说禅走势中枢,后GG〈前DD等价于下跌及其延续;后DD〉前GG等价于上涨及其延续。

后ZG<前ZD且后GG〉=前DD,或后ZD〉前ZG且后DD=<前GG,则等价于形成高级别的走势中枢。

缠中说禅108课重点

每课重点内容推荐:教你炒股票1:不会赢钱的经济人,只是废人!这课是缘起,缠师简单介绍了下讲股票的原因。

“有人说,市场是老人挣新人的钱,而市场中的老人,套个10年8年的一抓一大把。

其实,市场从来都是明白人挣糊涂人的钱。

在市场经济中,只要你参与到经济中来,就是经济人了,经济人当然就以挣钱为目的,特别在资本市场中,没有慈善家,只有赢家和输家。

而不会赢钱的经济人,只是废人!无论你在其他方面如何成功,到了市场里,赢输就是唯一标准,除此之外,都是废话。

”教你炒股票2:没有庄家,有的只是赢家和输家!教你炒股票3:你的喜好,你的死亡陷阱!但你的喜好,就是你的死亡陷阱!在市场中要生存,第一条就是在市场中要杜绝一切喜好。

市场中唯一值得天长地久的就是赢钱,任何一个来市场的人,其目的就是赢钱,任何与赢钱无关的都是废话。

而市场中的行为,就如同一个修炼上乘武功的过程,最终能否成功,还是要落实到每个人的智慧、秉性、天赋、勤奋上来!教你炒股票4:什么是理性?今早买N中工就是理性!理性来自高水平操作,只有多操作,多总结才能出真知,其余都是假的,所以理性是干出来的,今天,你干了吗?教你炒股票5:市场无须分析,只要看和干!猎手只关心猎物,猎物不是分析而得的。

猎物不是你所想到的,而是你看到的。

相信你的眼睛,不要相信你的脑筋,更不要让你的脑筋动了你的眼睛。

被脑筋所动的眼睛充满了成见,而所有的成见都不过对应着把你引向那最终陷阱的诱饵。

猎手并不畏惧陷阱,猎手只是看着猎物不断地、以不同方式却共同结果地掉入各类陷阱,这里无所谓分析,只是看和干!如果觉得这有点残忍,那就到市场中来,这里有无数的虎豹豺狼,用你的眼睛去看,用你的心去感受,而不是用你的耳朵去听流言蜚语,用你的脑筋去抽筋!”作为散户,我们总喜欢追追小道消息,也很容易迷失在一些社会人士写的文章分析上,回头想想,有很多是很浪费时间的,也容易充满成见,忽然想起那天联通重组利好的跌停,好消息也要看是什么时候啊。

缠中说禅教你炒股票108课(Talking about Zen teach you to fry 108 lessons)

缠中说禅教你炒股票108课(Talking about Zen teach you to fry108 lessons)Cannot download. Please report error. Thank youSoftware profile:Twist in say Zen buy law: big level of the second kind of buy point by the next level, the corresponding trend of the first kind of buy points constitute (patent). For example, the second type of buying on the weekly line is made up of the first kind of buying on the line. With this wrapped in the said Zen buy law, all buy points can be attributed to the first kind of buy point.Winding said Zen short difference program is: large level buy point intervention, in the sub level when the first kind of selling point appears, you can lighten up, and then in the sub level first class buy point appear when back up. For the week to buy points to intervene, we should use the first line of selling points to lighten up, and then buy back in the first class.Wrapped around said to buy a little law: large class of second buy points by the next level, the corresponding trend of the first kind of buy points constitute. If the amount of money is not particularly large, must be skilled entangled in the Zen short program: the level of buying intervention, appear in the level of the first selling point, to lighten up, later in the second level first class buy when covering.The part of a level, trend, type, overlapping by at least three successive, sub level movements.Winding up said Zen consolidation: at any level of any movement, a completion of the trend type contains only one wrapped in said Zen trend center, it is called the level of winding up, said Zen consolidation.The tendency of Zen to say: at any level of any trend, a completed trend type contains at least two or more, in turn, in the same direction, the Zen movement center is called the level of the Zen trend. The upward direction is called "rise" and "down" is called "fall". Note that there is absolutely no overlap between the movements in the trend, the Zen, and the center of the movement.The basic principles of Zen technical analysis: "any type of trend at any level should be completed.".The basic principle of Zen technique analysis two: any level of any completion trend type, it must contain more than one of the "Zen", "Zen", "trend center"."To say, Zen trend decomposition theorem": any level of any trend, can be broken down into the same level of "consolidation", "down" and "rising" three trends type of connection. .The theory of "Zen trend decomposition theorem two": any kind of trend type at any level is composed of at least three stages or more."The theory of the central tendency of Zen movements," said: "in the trend, the connection of two of the same level," said in turn, "Zen trend center" is necessarily sub level below the trend of the type.Maintain "wrapped said a necessary and sufficient condition for the trend of Zen Center" is any one left the central trend type must be a level below the level below the trend and we return,"To say, Zen, movement, central theorem two": in the consolidation, no matter whether the direction is "leave" or "return", the trend of "Zen Center" is definitely below the sub grade.The central theorem of Chan Chan's three:A level of "energy-saving central trend" damage, when and only when leaving a level of the trend of "energy-saving central trend", followed by a second level Huichou trend is not returned to the "energy-saving central trend".There are only three combinations of the two sub level movements in this theorem: trend + consolidation, trend + reverse, consolidation + reverse.Brief introduction of the authorSince you see the theory, do not look at the stock market dross book. - Li BiaoThe author blog named "global first blog"". Has published 1134posts, classified as entangled in the Zen, poetry, music, art and literature, politics, science and technology, economic mathematical vernacular essays, popular entertainment, the content covered a wide, complex knowledge system, but the best.Basic overviewEntangled in the said Zen blogger (Li Biao) suffering from nasopharyngeal carcinoma in October 31, 2008 died, and another identity is "fund analysis" columnist Muzi, whose death was less than 40 years old. It is said that Zen predicted the global financial crisis caused by the subprime mortgage crisis of the United States in 2007 and predicted the top of American stock market and Chinese stock market. He left his magic to the world. Every day thousands of people are studying his theories and his ideas.True identityWho exactly is the real identity of Zen? Have netizen doubt then he is the homologation trader Li Biao, the following is a simple analysis: in recent years, energy-saving is very active on the network. "Love math girl" on the horizon was a smash hit, "the number of female person like". "Hi the number of female" writing language and title, dazzling, quickly put the end of the world forum have been turned upside down. Later, in the Sina blog titled "energy-saving", language style changed a lot, like "hi the number of female" forceful, but still eye-catching style.It is said that Zen is MuziIn saying that Zen expressed himself, to do a publication. Not long after, Qingdao Muzi venture capital co founded the fund analysis and new finance. And Li Biaozheng is chairman of Qingdao Muzi venture capital. After the launch of the fund analysis, senior consultant Muzi often writes columns in the Muzi view. These articles, all from the blog wrapped in said zen. Just because it's in the magazine, there are some local characters that have been modified.Wrap said the global financial crisis triggered by the U.S. subprime mortgage crisis and Zen in a few years ago the magic predicted the second half of 2007, level comparable to the world financial crisis in 1929; in 2005, the magic of forecasting the stock market bottomed out, there will be a big bull market in 2007 surge high and sweep forward; see the top magical prediction of stock market, even the specific point that. That is 6124.04 points. Because of the amazing public forecast success, so many fans on the network. Its fans are called "fans", and fans call it "Zen master"". In 2008, "Zen master" revealed that he was suffering from nasopharyngeal carcinoma, and he began to investigate the situation in order to know the true identity of "Zen master". Until the "fund" analysis of the text, finally uncover the mystery, the original energy-saving is Muzi.It is said that Zen and Li Biao are inseparableAt this point, the fan is still reluctant to believe that the Zen is "Li Biao", and more reluctant to accept the fact that he has died. So, continue to track down. In November 12, 2007, Yu said Zen said he was going on a business trip on his blog.Ben ID is going on a business trip." Later, Li Biao of Qingdao Muzi venture capital really with the Shenzhen innovation investment group co founded the Pingxiang Innovation Capital Venture Capital Co., ltd.. Time and events are again in striking agreement. In fact, now deep venture chairman Jin Haitao is president of the aeon group, extraordinary relationship with Li Biao.Li Biao and Jin Haitao signed a contract in November 14, 2007 after the Pingxiang seven star Int'L Commercial Affairs Hotel held in Pingxiang Venture Capital Co., Ltd and Pingxiang Innovation Capital Management Ltd. established ceremony innovation capital investment forum. In the hotel's website can be seen on the following notice the words "November 13th received the Pingxiang City Economic and Trade Commission, Pingxiang Venture Capital Co., Ltd and Pingxiang Innovation Capital Management Limited will be held on November 14th at the Int'L Commercial Affairs Hotel held a grand ceremony of the establishment of seven innovation capital investment forum.The main members of the delegation meeting are: Ms. Deputy Secretary of Pingxiang Municipal Committee, mayor Zeng Qinghong, Mr. Li Jinlin, chairman of the Pingxiang Venture Capital Co. Ltd., Mr. Jin Haitao, chairman of Shenzhen City Innovation Investment Group Limited, Qingdao venture capital center Mr. Li Biao Muzi". In November 15, 2007, which is second days after the signing of Li Biao, entangled in the Zen in the article said, "today a close, to catch to see business secretary personally, what is the way?" said the time of Zen's whereabouts, wrapped in, and Li Biao's whereabouts and time, with a high degree of consistency.Winding said Zen in the blog repeatedly expressed himself, in addition to stocks, mainly to do venture capital, to often see the project. The last article was written in October 10, 2008 after saying that Zen was seriously ill, and was never renewed. There are many people who claim to be Li Biao's classmates say in the Zen blog blog, recall Li Biao, but also some people in their blog writing, miss Li Biao.Net friend commentsI mentioned the energy-saving, this can not say a few words, it can be said that this is the China genius, other so-called scholars against the mountains with them is a mound mound is also very good.One is the only master to have "air, gas and domineering arrogance, hui". This is the "atmosphere", stands the sky, overlooking the earth global macro, inclusive, all-round transparent view to understand the formation mechanism and the context of human, the world and everything in the world; the "arrogance", is that it can objectively and rationally face, even in defiance of authority, power and money and the idea, and put these shackles of human vitality and creativity of things underfoot, get rid of the bondage, reached only for "freedom of thought realm of Kingdom of truth" speak; this "Hui Qi", that is the day before adding the inherent law and mechanism of "Zen" can get back everything diligence on one day; as for the "domineering", that is not the general master can have the quality, the level of small masters generally has "atmosphere Hui, arrogance, gas". But it must be "aggressive"theory system in some areas of creation and innovation or "master", and verified in practice successfully guiding the development and reform of human beings and the world idea system.Entangled in the Zen philosophy of "market" is the mathematical principle of market theory or around theory, theory of financial markets beyond time and space, ideological emancipation philosophy, economics theory and so on, is entangled in the Zen of this "ambition" and reflect the full performance. It is a pity that the theoretical system in many areas around the idea of creating or is built also just from the head, the lakes disappeared, it is very regrettable that, at least to postpone the progress and development of the many areas of N.The two is to learn the ancient and modern Chinese and western, almost all social sciences disciplines have not been studied and dabbled in, and even more entangled with the natural sciences, such as mathematics, physics, chemistry and so on are very profound attainments. The study and memory ability, perception ability of keen knowledge of broad, profound knowledge, knowledge of the thinking ability of agile, sweep down irresistibly from a commanding height, master ability of innovation and creativity of the shock, intrepid, only "genius" word can be summed up to describe its shape, its quality. Other people if not satisfied, can be compared, also do not have what can be unconvinced, look at yourself all day long "regressed donghonghong" thought in the creation of their own what history is a bit too narrow!The 21st century Chinese mentor- godfather of Chinese stock market- China's most cattle trader- saying that the Analects of Confucius was the first person in ancient and modern times- far more investors than Buffett and Soros- China's first contemporary poet- a master of world economics- the first person in Chinese opera creation- Contemporary Chinese mathematiciansContent screenshotCatalog:The stock market talk, G shares are G-spot, Daniel not set! (2006-05-12, 19:02:25)Teach you the stock 1: not winning the economy, just useless! (2006-06-07, 18:08:15)Teach you to fry stocks 2: no banker, some just winners and losers! (2006-06-07, 22:41:27)Teach you to fry stocks 3: your preferences, your death trap! (2006-06-09, 17:03:48)Teach you to fry stock 4: what is rational? Buying a N worker this morning is rational! (2006-06-19, 21:41:14)Teach you to fry stocks 5: market without analysis, as long as see and dry! (2006-06-21, 20:52:02)Teach you to fry shares 6: this ID how to draw on the Wuliangye, Baotou Steel warrants?! (2006-10-24, 12:45:16)Teach you to fry stocks 7: to earn the index lost money2006-11-16 12:00:01 adviceTeach you 8 stocks: investment such as the selection of the first, the G-spot as the center, refused to ED male! (2006-11-20, 12:00:31)Teach you to fry stock 9: screening "premature ejaculation", male mathematics principle! (2006-11-22, 12:00:00)Teach you to fry stocks 10:2005 June, why this ID after four years to re look at the stock (2006-11-24 12:02:50)?Teach you to fry shares 11: will not kiss, no climax!(2006-11-29, 12:00:00)Teach you 12 stocks: Kiss how ecstasy? (2006-12-01, 12:03:48)Teach you to fry shares 13: without a set of operations, not good operation! (2006-12-04, 12:08:28)Teach you to fry shares 14: drink Moutai climax program! (2006-12-05, 11:35:20)Teach you to fry stocks 15: no trend, no back chi. (2006-12-08, 11:55:57)Teach you to fry stock 16: small and medium funds efficient trading law. (2006-12-14, 12:06:47)Teach you to fry stocks 17: 2006-12-18 11:52:42Teach you the stock 18: not to be the first young man is not perfect. (2006-12-26, 15:05:58)Teach you to fry stocks 19: learn to talk about Zen, technical analysis of the key theory (2006-12-27, 15:18:10)Teach you to fry stocks 20: winding said Zen trend, central level expansion and the three kind of trading point (2007-01-05 15:23:22)Teach you to fry stock 21: twist in say Zen, trading point analysis 15:03:58 (2007-01-09)The stock market will teach you 22: 800 million to 5 rice dealer's stomach. (2007-01-11, 15:10:32)Teach you to fry stocks 23: market and life (2007-01-1515:50:11)Teach you the stock 24:MACD on the divergence (2007-01-18 15:02:43) assistant judgeTeach you 25 stocks: kiss, MACD, divergence, central(2007-01-23 15:13:13)Teach you to fry stock 26: how to avoid market risk (2007-01-30 15:09:57)?Teach you to fry stocks 27: consolidation, Chi Chi and historical bottom (2007-02-02 15:11:27)Teach you to fry stocks 28: next goal: 2007-02-06 15:04:50Teach you to fry stocks 29: Turning intensity and level (2007-02-09, 15:08:08)Teach you to fry stocks 30: wrapped in said Zen theory 15:07:02 (2007-02-13, absolute)Teach you to fry stocks 31: the most solid foundation of fund management (2007-02-15, 15:16:12)Teach you to fry stocks 32: the trend of the moment and investors' thinking (2007-02-28 08:44:37)Teach you to fry stocks 33: the trend of ambiguity (2007-03-02 15:20:37)Teach you the stock 34: when the first Mo Ning, male (2007-03-07 15:09:54) to complainTeach you to fry stocks 35: to the basis of poor students make up missed lessons (2007-03-09 11:51:34)Teach you to fry stocks 36: trend type, connection, combination of simple use (2007-03-13, 09:00:49)Teach you to fry stocks 37: 2007-03-16 11:51:32Teach you to fry shares 38: trend type connection of the same level decomposition (2007-03-21 15:23:21)Teach you to fry stocks 39: same level decomposition, 15:16:51 (2007-03-23)Teach you to fry stocks 40: 2007-03-27 12:53:22 with the same level of decompositionTeach you to fry stocks 41: no rhythm, only 15:17:22(2007-03-30)Teach you to fry stocks 42: some people are not suited to participate in the market (2007-04-04 15:31:30)Teach you to fry stocks 43: 2007-04-06 15:31:28 about the Chi ChiTeach you to fry stocks 44: small level back Chi triggered big grade 15:23:46 (2007-04-10)Teach you to fry shares 45: holding and holding coins, the two most basic operations. (2007-04-12, 15:39:04)Teach you to fry stocks 46: daily trend classification (2007-04-18 15:36:09)Teach you to fry stock 47: one night stand Market Analysis (2007-04-20 08:51:58)Teach you to fry stocks 48: slump, bull market one night stand (2007-04-24 08:52:02)Teach you to fry stocks 49: profit margin of the largest mode of operation (2007-04-26 08:16:56)Teach you to fry stock 50: 2007-04-27 08:42:51 in operationTeach you 51: short-term stock appraise the marketing trick (2007-05-09 08:30:16)Teach you 52 stocks: the stock market is the real Buddha (2007-05-18 08:49:05)Teach you to fry stocks 53: three types of trading points 08:47:18 (2007-05-23)Teach you to fry stocks 54: an analysis of specific trends (2007-05-24 01:37:31)Teach you 55: buy stocks of foreplay, selling climax(2007-05-28 08:12:41)Teach you to stock 56:530 stamp duty 2007-05-30 22:49:10Teach you to fry stocks 57: present graphic analysis and demonstration (2007-05-31, 22:35:44)Teach you to fry stocks 58: graphic analysis, demonstration three (2007-06-04 22:34:47)Teach you to fry stocks 59: graphic analysis, demonstration four (2007-06-14 08:23:43)Teach you to fry stocks 60: graphic analysis, demonstration five (2007-06-19 08:04:06)Teach you to fry stock 61: range set standard graphic (analysis demonstration six) (2007-06-21 08:13:21)Teach you to fry stocks 62: typing, pen and 09:49:51(2007-06-30)Teach you to fry stocks 63: 2007-07-02 00:07:39 for you the rationaleTeach you to fry stocks 64: go to the airport on the way to make up for you (2007-07-02 21:37:44)Teach you to fry stock 65: say again cent, pen, line (2007-07-16 22:14:16)Teach you to fry stocks 66: the 2007-07-30 22:42:05 of the main fundsTeach you to fry stock 67: line division criterion (2007-08-01 22:31:55)Teach you to fry stocks 68: the precise meaning of trend prediction (2007-08-05 10:36:28)Teach you to fry stock 69: monthly line segmentation and Shanghai big trend analysis, 23:03:22 (2007-08-09)Teach you to fry stocks 70: a textbook trend demonstration analysis (2007-08-15 22:41:35)Teach you to fry stock 71: line division standard 23:02:06 (2007-08-16)Teach you to fry stocks 72: this ID has 2007-08-21 22:37:20Teach you to fry stocks 73: 2007-08-23 22:35:20 absolute classification of market profit opportunitiesTeach you to fry stock 74: how to avoid policy risk (2007-08-28 08:41:11)?Teach you 75 stocks: funny play some makers (2007-08-29 22:00:23) earned 1Teach you 76: make some speculation in the stock market makers play 2 miscellaneous (2007-09-03 19:19:43)Teach you to fry stocks 77: some concepts of 23:24:01 (2007-09-05)Teach you to fry stock 78: continue to say line division (2007-09-06 22:28:31)Teach you to fry stocks 79: sub type auxiliary operations and some questions 22:37:13 (2007-09-10 answer)Teach you to fry stocks 80: market no sympathy, 21:38:07 tears (2007-09-11)Teach you to fry stock 81: Legend, correction and typing, 22:57:16 type of trend (2007-09-17, Philosophy)Teach you to fry stocks 82: psychological factors of typing structure (2007-09-24, 21:31:06)Teach you to fry stocks 83: Pen - line segments and line segments - minimum central structure of different psychological meaning 1 (2007-09-26, 21:28:05)Teach you to fry stock 84: this ID theory, some must pay attention to the problem (2007-10-07 16:09:06)Teach you 85: make some speculation in the stock market makers play 3 miscellaneous (2007-10-22 21:42:06)Teach you to fry stocks 86: trend analysis must be put an end to 2007-10-24 21:53:45Teach you 87: make some speculation in the stock market makers play 4 miscellaneous (2007-10-30 22:05:40)Teach you to fry stock 88: graphic growth of a specific case (2007-11-06 22:38:43)Teach you the stock 89: specific analysis of bardo stage (2007-11-18 20:14:06)Teach you the stock 90: auxiliary judgment bardo state end time (2007-12-03 22:33:08)Teach you to fry stock 91: the dual structure of the trend of internal and external relations 1 (2007-12-17 21:40:15)Teach you to fry stock 92: Central concussion monitor(2007-12-27 20:31:33)Teach you to fry stock 93: the dual structure of the trend of internal and external relations 2 (2008-01-15 18:08:05)Teach you the stock 94: make a prompt decision (2008-01-21 17:29:47)Teach you to fry stocks 95: self-discipline 16:10:20(2008-01-22)Teach you to fry stocks 96: 2008-01-23 16:18:38 everywhereTeach you to fry stocks 97: Chinese medicine, art of war, poetry,operation 1 (2008-01-29, 15:49:06)Teach you to fry stocks 98: Chinese medicine, art of war, poetry, operation 2 (2008-02-04, 19:51:49)Teach you to fry stock 99: the dual structure of the trend of internal and external relations 3 (2008-02-18 16:19:16)Teach you to fry stocks 100: Chinese medicine, art of war, poetry, operation 3 (2008-02-25, 16:32:23)Teach you to fry stocks 101: Answer 1 (2008-03-04 16:14:02)Teach you to fry stocks 102: 2008-03-06 16:10:18 will be perfectTeach you to fry stock 103: learn to kill the dragon, learn 2008-03-19 15:58:15 before you kill the DragonTeach you to fry stock 104: geometric structure and energy dynamics structure 1 (2008-03-26, 15:47:42)Teach you to fry stocks 105: stay away from smart, mechanical operations (2008-04-13 21:51:14)Teach you to fry stocks 106: moving average, round and winding, said Zen plate strength index (2008-07-10 12:12:22)Teach you to fry shares 107: how to operate 2008-08-19 16:10:39?Teach you to fry stock 108: what is the bottom? From the moon line to see the evolution of the medium-term trend (2008-08-2909:15:01)Winding up the mind Twist the classics。

教你炒股票108图例word版(中)

教你炒股票缠中说禅108课图例(中)1教你炒股票27:盘整背驰与历史性底部2009-11-1 22:0322007-02-01 21:59:55 缠主你好:今天600836我如果按照原来的思路今天我就会满仓进,明天出.可是你说过不追高买票,我忍了.但是如果它走出600817当年的走势,我们不就失去一次很好的机会?这样的超强的股票如何把握?== 今天14点半,是一个典型的1分钟上,第一中枢上来,0轴回抽构成第二类买点的例子,如果在那时候买了,你算又学了点东西。

根本不存在追高的问题。

如果拉起来再买,那就没必要了。

所谓超强的股票,主要是他在第一、二类买点的时候你没发现而已,没什么特别的。

该股30分钟的第一类买点在1月4日10点左右。

第二类买点在1月18的11点,都很容易发现的。

3关于600836缠在07.2.1回复该股买点问题3.jpg427课缠在回复中答600331的提问缠27课回复070202-600331图例5分-1.gif567教你炒股票28:下一目标:摧毁基金2009-11-18070206本课文后缠回复600016个股背驰图例91028课后缠回复大盘1分钟背驰图例缠28课回复070206-大盘背驰图例1分-1.gif教你炒股票29:转折的力度与级别缠29课回复070209-大盘0206-0209走势图例5分-1.gif教你炒股票30:缠中说禅理论的绝对性零向量长度为0的向量叫做零向量,记作0.零向量的始点和终点重合,所以零向量没有确定的方向,或说零向量的方向是任意的。

[编辑本段]向量的运算设a=(x,y),b=(x',y')。

1、向量的加法向量的加法满足平行四边形法则和三角形法则。

AB+BC=AC。

a+b=(x+x',y+y')。

a+0=0+a=a。

向量加法的运算律:交换律:a+b=b+a;结合律:(a+b)+c=a+(b+c)。

2、向量的减法如果a、b是互为相反的向量,那么a=-b,b=-a,a+b=0. 0的反向量为0 AB-AC=CB. 即“共同起点,指向被减”a=(x,y) b=(x',y') 则a-b=(x-x',y-y').缠30课回复070213-000581走势图例30分-1.gif (从28课发课时间070206至30课发课时间070213这期间缠的回复图例汇集在一起,大家可以更好地体会当时的实盘详细讲解。

缠中说禅炒股108课(转载)

缠中说禅炒股108课(转载)判断走势,如同中医看病,未病而治的是第一等的,次之的是对治欲病,到已病阶段,那只能算是亡羊补牢了。

但绝大多数的人,病入膏肓了还在幻想,市场里最终牺牲的,总是这种人。

级别的存在,可以比拟成一种疾病的级别,1分钟的可能是一个小感冒,而有时候一个5分钟的下跌就足以是一个小的感冒流行了。

至于30分钟、日线的下跌,基本就对应着一些次中级或中级的调整,大概就相当于肺结核之类的玩意。

而周线、月线之类的下跌,那是什么就不用说了。

如果是季线、年线级别的下跌,就算不是死人一个,也至少是植物人了。

未病-欲病-已病,对应的界限就是相应级别的第一、二、三类买卖点,注意,对于上涨来说,踏空也是一种病,涨跌之病是相对的。

如何诊断出这病所处的阶段,这和中医的道理是一样的。

例如,肺和大肠相表里,注意,中医里的肺不单单指西医那叫肺的玩意,而是相应的一个功能系统,例如,鼻子就属于肺这个系统的,因此,鼻子的毛病,可能就和大肠相关系着,而在西医里,这两样东西无论如何都是不搭界的。

而在走势中,当下的走势,就对应着这样类似的两重表里关系。

在我们前面所讨论的走势分解的配件中,有两种类型:一、能构成中枢的。

二、不能构成中枢的。

第一种,包括线段、以及各种级别的走势类型;第二种,只有笔。

笔是不能构成中枢的,这就是笔和线段以及线段以上的各种级别走势类型的最大区别。

因此,笔在不同时间周期的K线图上的相应判断,就构成了一个表里相关的判断。

越平凡的事情往往包含最大的真理,一个最简单的笔,里面包含了什么必然的结论?一个最显然又有用的结论就是:缠中说禅笔定理:任何的当下,在任何时间周期的K线图中,走势必然落在一确定的具有明确方向的笔当中(向上笔或向下笔),而在笔当中的位置,必然只有两种情况:一、在分型构造中。

二、分型构造确认后延伸为笔的过程中。

根据这个定理,对于任何的当下走势,在任何一个时间周期里,我们都可以用两个变量构成的数组精确地定义当下的走势。

《缠中说禅》:禅师解盘图解

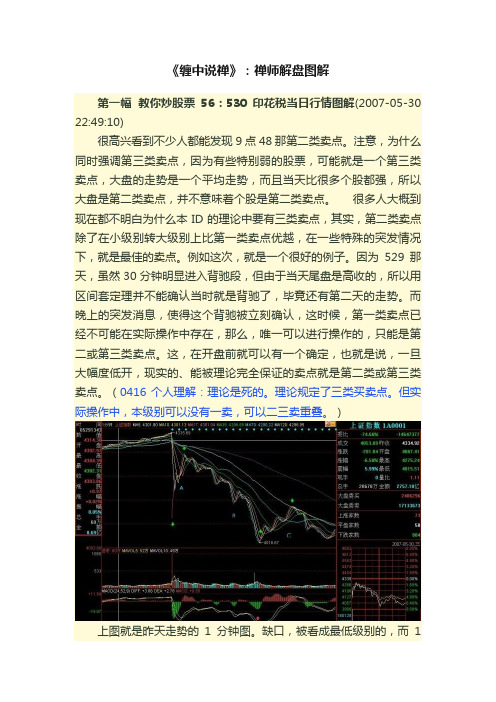

《缠中说禅》:禅师解盘图解第一幅教你炒股票56:530印花税当日行情图解(2007-05-30 22:49:10)很高兴看到不少人都能发现9点48那第二类卖点。

注意,为什么同时强调第三类卖点,因为有些特别弱的股票,可能就是一个第三类卖点,大盘的走势是一个平均走势,而且当天比很多个股都强,所以大盘是第二类卖点,并不意味着个股是第二类卖点。

很多人大概到现在都不明白为什么本ID的理论中要有三类卖点,其实,第二类卖点除了在小级别转大级别上比第一类卖点优越,在一些特殊的突发情况下,就是最佳的卖点。

例如这次,就是一个很好的例子。

因为529那天,虽然30分钟明显进入背驰段,但由于当天尾盘是高收的,所以用区间套定理并不能确认当时就是背驰了,毕竟还有第二天的走势。

而晚上的突发消息,使得这个背驰被立刻确认,这时候,第一类卖点已经不可能在实际操作中存在,那么,唯一可以进行操作的,只能是第二或第三类卖点。

这,在开盘前就可以有一个确定,也就是说,一旦大幅度低开,现实的、能被理论完全保证的卖点就是第二类或第三类卖点。

(0416个人理解:理论是死的。

理论规定了三类买卖点。

但实际操作中,本级别可以没有一卖,可以二三卖重叠。

)上图就是昨天走势的1分钟图。

缺口,被看成最低级别的,而1分钟以下级别,在1分钟图上,被看成没有内部结构的线段,所以缺口和1分钟以下级别在1分钟图上是同级别的。

图上绿尖头都指着两个1分钟以下级别的分界点,两相邻绿箭头之间都是1分钟以下级别的走势类型。

其中B段,看似要形成3个1分钟的中枢,但由于每一个的第三段其实都是向下倾斜下去的,其实都是第二段向下的一部分,不能算是形成中枢。

昨天走势其实就这么简单,就是5个1分钟以下走势类型的组合。

(0410:图中4335点到第一个绿箭头是第一段,与两个绿箭头之间的A段及后面的BC段一样,都是一分线段级别)显然,这第一段的1分钟以下级别走势类型是以向下缺口的形式构成的,根据第二类卖点的定义,就知道,一旦一个1分钟以下级别的向上过程不能创新高或背驰,都将构成第二类卖点。

缠中说禅108课重点

每课重点内容推荐:教你炒股票1:不会赢钱的经济人,只是废人!这课是缘起,缠师简单介绍了下讲股票的原因。

“有人说,市场是老人挣新人的钱,而市场中的老人,套个10年8年的一抓一大把。

其实,市场从来都是明白人挣糊涂人的钱。

在市场经济中,只要你参与到经济中来,就是经济人了,经济人当然就以挣钱为目的,特别在资本市场中,没有慈善家,只有赢家和输家。

而不会赢钱的经济人,只是废人!无论你在其他方面如何成功,到了市场里,赢输就是唯一标准,除此之外,都是废话。

”教你炒股票2:没有庄家,有的只是赢家和输家!教你炒股票3:你的喜好,你的死亡陷阱!但你的喜好,就是你的死亡陷阱!在市场中要生存,第一条就是在市场中要杜绝一切喜好。

市场中唯一值得天长地久的就是赢钱,任何一个来市场的人,其目的就是赢钱,任何与赢钱无关的都是废话。

而市场中的行为,就如同一个修炼上乘武功的过程,最终能否成功,还是要落实到每个人的智慧、秉性、天赋、勤奋上来!教你炒股票4:什么是理性?今早买N中工就是理性!理性来自高水平操作,只有多操作,多总结才能出真知,其余都是假的,所以理性是干出来的,今天,你干了吗?教你炒股票5:市场无须分析,只要看和干!猎手只关心猎物,猎物不是分析而得的。

猎物不是你所想到的,而是你看到的。

相信你的眼睛,不要相信你的脑筋,更不要让你的脑筋动了你的眼睛。

被脑筋所动的眼睛充满了成见,而所有的成见都不过对应着把你引向那最终陷阱的诱饵。

猎手并不畏惧陷阱,猎手只是看着猎物不断地、以不同方式却共同结果地掉入各类陷阱,这里无所谓分析,只是看和干!如果觉得这有点残忍,那就到市场中来,这里有无数的虎豹豺狼,用你的眼睛去看,用你的心去感受,而不是用你的耳朵去听流言蜚语,用你的脑筋去抽筋!”作为散户,我们总喜欢追追小道消息,也很容易迷失在一些社会人士写的文章分析上,回头想想,有很多是很浪费时间的,也容易充满成见,忽然想起那天联通重组利好的跌停,好消息也要看是什么时候啊。