厦门大学管理会计习题

管理会计选择练习题与答案

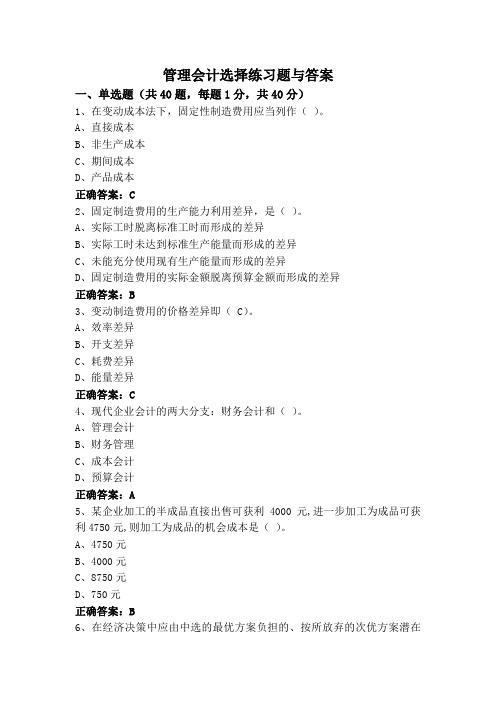

管理会计选择练习题与答案一、单选题(共40题,每题1分,共40分)1、在变动成本法下,固定性制造费用应当列作()。

A、直接成本B、非生产成本C、期间成本D、产品成本正确答案:C2、固定制造费用的生产能力利用差异,是()。

A、实际工时脱离标准工时而形成的差异B、实际工时未达到标准生产能量而形成的差异C、未能充分使用现有生产能量而形成的差异D、固定制造费用的实际金额脱离预算金额而形成的差异正确答案:B3、变动制造费用的价格差异即( C)。

A、效率差异B、开支差异C、耗费差异D、能量差异正确答案:C4、现代企业会计的两大分支:财务会计和()。

A、管理会计B、财务管理C、成本会计D、预算会计正确答案:A5、某企业加工的半成品直接出售可获利4000元,进一步加工为成品可获利4750元,则加工为成品的机会成本是()。

A、4750元B、4000元C、8750元D、750元正确答案:B6、在经济决策中应由中选的最优方案负担的、按所放弃的次优方案潜在受益计算的那部分资源损失,就是所谓()。

A、沉没成本B、机会成本C、专属成本D、增量成本正确答案:B7、设某企业有固定搬运工10名,工资总额5000元;当产量超过3000件时,就需雇佣临时工。

临时工采用计件工资制,单位工资为每件1元,则该企业搬运工工资属于()。

A、阶梯式成本B、曲线成本C、延期变动成本D、半变动成本正确答案:C8、下列各项中,与传统的财务会计相对立概念而存在的是()。

A、现代会计B、成本会计学C、企业会计D、管理会计正确答案:D9、在关于变动成本法的应用上,下列说法中唯一正确的是()A、变动成本法可以与制造成本法同时使用,以提供两套平行的核算资料B、变动成本法的积极作用决定了它可以取代制造成本法C、变动成本法和制造成本法根本无法结合D、变动成本法和制造成本法的有机结合是最理想的做法。

正确答案:D10、已知企业某产品的单价为2 000元,目标销售量为3 500件,固定成本总额为100 000元,目标利润为600 000元,则企业应将单位变动成本的水平控制在( )。

厦门大学管理会计习题

管理会计作业一、课堂讨论题1.举例说明管理会计信息在以下决策中如何起作用?1)出租汽车公司经理正考虑是否增加车队中的豪华轿车的数量?2)汽车厂生产经理正考虑是按周或按月对机器进行日常维修?3)市政工程正考虑是否要扩建当地图书馆?4)商店经理考虑要聘请几名保安以减少店内偷窃损失?2.公共责任和道德两难唐力是新城公司的助理会计师,他刚收到公司1999年年报的副本,并为此感到烦恼。

原来,几星期前,他把准备好的年报和附注交给了总会计师、公司总裁和董事会,在附注中他指出公司1999年度的净收益比上一年度降低了6.3%。

但是,现在他发现在公司总裁给股东的对外年报中净收益被宣布为比去年增长了4.3%。

这是因为年报把1450万的预收款计为1999年度的销售收入,而这些本应属于2000年度的销售收入。

唐力的上司告诉他,这是董事会的决定。

董事会不希望令股东失望和不安,而且2000年度对公司来说会是一个好年景。

总会计师告诉唐力不要担心,因为明年的预期收入会补上差额,股东们不会失去任何东西。

请问:唐力应该怎么办?3.成本性态分析1)以下问题取自某公司的生产成本预算,生产量420 515生产成本82200 90275(1)该期的成本公式可以表现为:A TC=46500+85VB TC=42000+95VC TC=46500-85VD TC=51500-95V(2)当生产量为450单位时,预算成本额应为:A 84750B 80250C 42750D 82750在分析中采用的是什么方法,该方法有什么优点和不足?2) 在办公室举行的元旦晚会的一片喧闹之中,你不小心打翻了桌上的墨水瓶,弄脏了一些文件。

其中一份文件是对半变动成本进行分析的报告,老板要求你在新年度假前完成。

(1)ΣXY=aΣX+bΣ?(2)ΣY=?a +bΣX(1)126000=?a+ ?b(2)? =?a+?b(1)126000=?a+ ?b(2)×6 ? =?a+?b(1)-(2)?=??b? =b所以,单位变动成本为???。

厦门大学财务管理专在线练习标准答案图文稿

C、应收账款占用资金=应收账款平均余额×资金成本率

D、应收账款平均余额=日销售额×平均收现期

标准答案:D

题号:19?题型:单选题(请在以下几个选项中选择唯一正确答案)

本题分数:1

内容:

国际投资主要采取国际直接投资和()。

A、国际资产投资

B、国际间接投资

C、国际现金投资

本题分数:1

内容:

最佳资本结构是指企业在一定时期最适宜其有关条件下()。

A、企业价值最大的资本结构

B、企业目标资本结构

C、加权平均的资本成本最低的目标资本结构

D、 加权平均资本成本最低,企业价值最大的资本结构

标准答案:D

本题分数:1

内容:

对于流动比率来讲,下列结论正确的是()。

A、流动比率越大越好

B、营运资金越多企业的偿债能力就越强

C、速动比率比流动比率更反映企业的偿债能力

D、如果流动比率小于2,则说明企业的偿债能力较差

标准答案:C

题号:9?题型:单选题(请在以下几个选项中选择唯一正确答案)

本题分数:1

内容:

企业的筹资活动按其是否是以金融机构为媒介,可分为()。

厦门大学财务管理专在线练习标准答案

题号:1?题型:单选题(请在以下几个选项中选择唯一正确答案)

本题分数:1

内容:

国际银行信贷的信贷条件有()。

A、日期

B、期限

C、空间

D、条件

标准答案:C

题号:2?题型:单选题(请在以下几个选项中选择唯一正确答案)

本题分数:1

内容:

在计算速动比率时,要从流动资产中扣除存货部分,再除以流动负债。这样做的原因在于在流动资产中____。

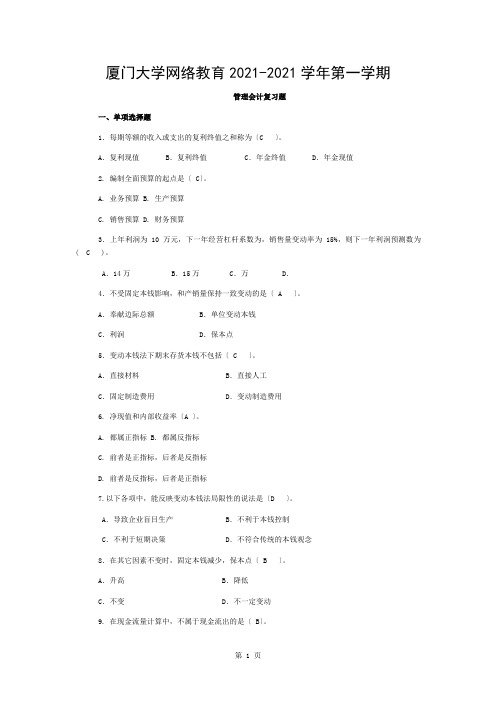

管理会计-复习题

厦门大学网络教育2021-2021学年第一学期管理会计复习题一、单项选择题1.每期等额的收入或支出的复利终值之和称为〔C 〕。

A.复利现值 B.复利终值 C.年金终值 D.年金现值2. 编制全面预算的起点是〔 C〕。

A. 业务预算B. 生产预算C. 销售预算D. 财务预算3.上年利润为10万元,下一年经营杠杆系数为,销售量变动率为15%,则下一年利润预测数为( C )。

A.14万 B.15万 C.万 D.4.不受固定本钱影响,和产销量保持一致变动的是〔 A 〕。

A.奉献边际总额 B.单位变动本钱C.利润 D.保本点5.变动本钱法下期末存货本钱不包括〔 C 〕。

A.直接材料 B.直接人工C.固定制造费用 D.变动制造费用6. 净现值和内部收益率〔A 〕。

A. 都属正指标B. 都属反指标C. 前者是正指标,后者是反指标D. 前者是反指标,后者是正指标7.以下各项中,能反映变动本钱法局限性的说法是〔D 〕。

A.导致企业盲目生产 B.不利于本钱控制C.不利于短期决策 D.不符合传统的本钱观念8.在其它因素不变时,固定本钱减少,保本点〔 B 〕。

A.升高 B.降低C.不变 D.不一定变动9. 在现金流量计算中,不属于现金流出的是〔 B〕。

A. 所得税B. 折旧C. 付现本钱D. 初始投资额10.以下各项中,属于非折现指标的是〔 A 〕。

A.投资回收期法 B.净现值法C.内含报酬率法 D.现值指数法11.如果本期销售量比上期增加,其它条件不变,则可断定变动本钱法计算的本期营业利润〔B 〕。

A.一定等于上期 B.一定大于上期C.应当小于上期 D.可能等于上期12. 以下指标中,〔D 〕属于考核投资中心的最正确指标。

A. 责任本钱B. 奉献边际C. 投资利润率D. 剩余收益二、多项选择题1.与决策相关的本钱是〔 ABDE 〕。

A.时机本钱 B.增量本钱 C.漂浮本钱D.专属本钱 E.可延缓本钱2.管理会计的根本原则中,决策有用性原则包括〔BC〕。

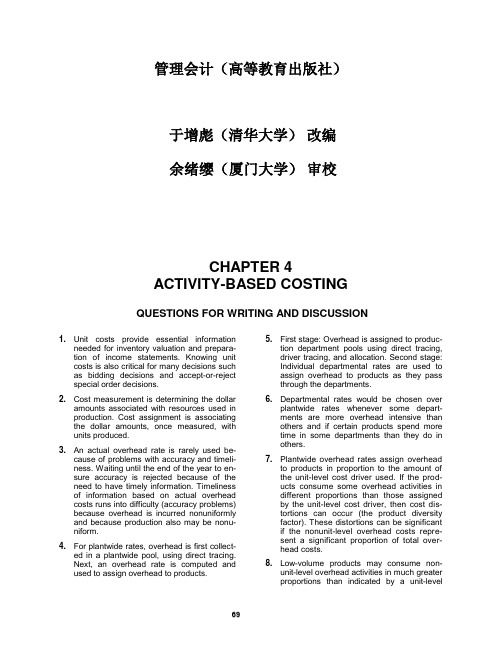

管理会计(英文版)课后习题答案(高等教育出版社)chapter 4

管理会计(高等教育出版社)于增彪(清华大学)改编余绪缨(厦门大学)审校CHAPTER 4ACTIVITY-BASED COSTINGQUESTIONS FOR WRITING AND DISCUSSION1.Unit costs provide essential informationneeded for inventory valuation and prepara-tion of income statements. Knowing unit costs is also critical for many decisions such as bidding decisions and accept-or-reject special order decisions.2.Cost measurement is determining the dollaramounts associated with resources used in production. Cost assignment is associating the dollar amounts, once measured, with units produced.3.An actual overhead rate is rarely used be-cause of problems with accuracy and timeli-ness. Waiting until the end of the year to en-sure accuracy is rejected because of the need to have timely information. Timeliness of information based on actual overhead costs runs into difficulty (accuracy problems) because overhead is incurred nonuniformly and because production also may be non-uniform.4.For plantwide rates, overhead is first col-lected in a plantwide pool, using direct trac-ing. Next, an overhead rate is computed and used to assign overhead to products. 5.First stage: Overhead is assigned to produc-tion department pools using direct tracing, driver tracing, and allocation. Second stage: Individual departmental rates are used to assign overhead to products as they pass through the departments.6.Departmental rates would be chosen overplantwide rates whenever some depart-ments are more overhead intensive than others and if certain products spend more time in some departments than they do in others.7.Plantwide overhead rates assign overheadto products in proportion to the amount of the unit-level cost driver used. If the prod-ucts consume some overhead activities in different proportions than those assigned by the unit-level cost driver, then cost dis-tortions can occur (the product diversity factor). These distortions can be significant if the nonunit-level overhead costs represent a significant proportion of total overhead costs.8.Low-volume products may consume non-unit-level overhead activities in much greater proportions than indicated by a unit-levelcost driver and vice versa for high-volumeproducts. If so, then the low-volume prod-ucts will receive too little overhead and thehigh-volume products too much.9.If some products are undercosted and oth-ers are overcosted, a firm can make a num-ber of competitively bad decisions. For ex-ample, the firm might select the wrongproduct mix or submit distorted bids.10.Nonunit-level overhead activities are thoseoverhead activities that are not highly corre-lated with production volume measures. Ex-amples include setups, material handling,and inspection. Nonunit-level cost driversare causal factors—factors that explain theconsumption of nonunit-level overhead. Ex-amples include setup hours, number ofmoves, and hours of inspection.11.Product diversity is present whenever prod-ucts have different consumption ratios fordifferent overhead activities.12.An overhead consumption ratio measuresthe proportion of an overhead activity con-sumed by a product.13.Departmental rates typically use unit-levelcost drivers. If products consume nonunit-level overhead activities in different propor-tions than those of unit-level measures, thenit is possible for departmental rates to moveeven further away from the true consumptionratios, since the departmental unit-level ra-tios usually differ from the one used at theplant level.14.Agree. Prime costs can be assigned usingdirect tracing and so do not cause cost dis-tortions. Overhead costs, however, are notdirectly attributable and can cause distor-tions. For example, using unit-level activitydrivers to trace nonunit-level overhead costswould cause distortions.15.Activity-based product costing is an over-head costing approach that first assignscosts to activities and then to products. Theassignment is made possible through theidentification of activities, their costs, and theuse of cost drivers.16.An activity dictionary is a list of activitiesaccompanied by information that describeseach activity (called attributes)17. A primary activity is consumed by the finalcost objects such as products and custom-ers, whereas secondary activities are con-sumed by other activities (ultimately con-sumed by primary activities).18.Costs are assigned using direct tracing andresource drivers.19.Homogeneous sets of activities are pro-duced by associating activities that have thesame level and that can use the same driverto assign costs to products. Homogeneoussets of activities reduce the number of over-head rates to a reasonable level.20. A homogeneous cost pool is a collection ofoverhead costs that are logically related tothe tasks being performed and for whichcost variations can be explained by a singleactivity driver. Thus, a homogeneous pool ismade up of activities with the same process,the same activity level, and the same driver.21.Unit-level activities are those that occur eachtime a product is produced. Batch-level activi-ties are those that are performed each time abatch of products is produced. Product-levelor sustaining activities are those that areperformed as needed to support the variousproducts produced by a company. Facility-level activities are those that sustain a facto-ry’s general man ufacturing process.22.ABC improves costing accuracy wheneverthere is diversity of cost objects. There arevarious kinds of cost objects, with productsbeing only one type. Thus, ABC can be use-ful for improving cost assignments to costobjects like customers and suppliers. Cus-tomer and supplier diversity can occur for asingle product firm or for a JIT manufactur-ing firm.23.Activity-based customer costing can identifywhat it is costing to service different custom-ers. Once known, a firm can then devise astrategy to increase its profitability by focus-ing more on profitable customers, convertingunprofitable customers to profitable oneswhere possible, and “firing” customers thatcannot be made profitable.24.Activity-based supplier costing traces allsupplier-caused activity costs to suppliers.This new total cost may prove to be lowerthan what is signaled simply by purchaseprice.EXERCISES4–11.Quarter 1 Quarter 2 Q uarter 3 Quarter 4 Total Units produced 400,000 160,000 80,000 560,000 1,200,000 Prime costs $8,000,000 $3,200,000 $1,600,000 $11,200,000 $24,000,000 Overhead costs $3,200,000 $2,400,000 $3,600,000 $2,800,000 $12,000,000 Unit cost:Prime $20 $20 $20 $20 $20Overhead 8 15 45 5 10Total $28 $35 $65 $25 $30 2. Actual costing can produce wide swings in the overhead cost per unit. Thecause appears to be nonuniform incurrence of overhead and nonuniform production (seasonal production is a possibility).3. First, calculate a predetermined rate:OH rate = $11,640,000/1,200,000= $9.70 per unitThis rate is used to assign overhead to the product throughout the year.Since the driver is units produced, $9.70 would be assigned to each unit.Adding this to the actual prime costs produces a unit cost under normal cost-ing:Unit cost = $9.70 + $20.00 = $29.70This cost is close to the actual annual cost of $30.00.1. $13,500,000/3,600,000 = $3.75 per direct labor hour (DLH)2. $3.75 ⨯ 3,456,000 = $12,960,0003. Applied overhead $ 12,960,000A ctual overhead 13,600,000U nderapplied overhead $ 640,0004. Predetermined rates allow the calculation of unit costs and avoid the prob-lems of nonuniform overhead incurrence and nonuniform production asso-ciated with actual overhead rates. Unit cost information is needed throughout the year for a variety of managerial purposes.4–31. Predetermined overhead rate = $4,500,000/600,000 = $7.50 per DLH2. Applied overhead = $7.50 ⨯ 585,000 = $4,387,5003. Applied overhead $ 4,387,500Actual overhead 4,466,250Underapplied overhead $ (78,750)4. Unit cost:Prime costs $ 6,750,000Overhead costs 4,387,500Total $ 11,137,500Units ÷750,000Unit cost $ 14.851. Predetermined overhead rate = $4,500,000/187,500 = $24 per machine hour(MHr)2. Applied overhead = $24 187,875 = $4,509,0003. Applied overhead $ 4,509,000Actual overhead 4,466,250Overapplied overhead $ 42,7504. Unit cost:Prime costs $ 6,750,000Overhead costs 4,509,000Total $ 11,259,000Units ÷750,000Unit cost $ 15.01**Rounded5. Gandars needs to determine what causes its overhead. Is it primarily labordriven (e.g., composed predominantly of fringe benefits, indirect labor, and personnel costs), or is it machine oriented (e.g., composed of depreciation on machinery, utilities, and maintenance)? It is impossible for a decision to be made on the basis of the information given in this exercise.1. Predetermined rates:Drilling Department: Rate = $600,000/280,000 = $2.14* per MHrAssembly Department: Rate = $392,000/200,000= $1.96 per DLH*Rounded2. Applied overhead:Drilling Department: $2.14 ⨯ 288,000 = $616,320Assembly Department: $1.96 ⨯ 196,000 = $384,160Overhead variances:Drilling Assembly Total Actual overhead $602,000 $ 412,000 $ 1,014,000 Applied overhead 616,320 384,160 1,000,480 Overhead variance $ (14,320) over $ 27,840 under $ 13,520 3. Unit overhead cost = [($2.14 ⨯ 4,000) + ($1.96 ⨯ 1,600)]/8,000= $11,696/8,000= $1.46**Rounded1. Activity rates:Machining = $632,000/300,000= $2.11* per MHrInspection = $360,000/12,000= $30 per inspection hour*Rounded2. Unit overhead cost = [($2.11 ⨯ 8,000) + ($30 ⨯ 800)]/8,000= $40,880/8,000= $5.114–71. Yes. Since direct materials and direct labor are directly traceable to eachproduct, their cost assignment should be accurate.2. Elegant: (1.75 ⨯ $9,000)/3,000 = $5.25 per briefcaseFina: (1.75 ⨯ $3,000)/3,000 = $1.75 per briefcaseNote: Overhead rate = $21,000/$12,000 = $1.75 per direct labor dollar (or 175 percent of direct labor cost).There are more machine and setup costs assigned to Elegant than Fina. This is clearly a distortion because the production of Fina is automated and uses the machine resources much more than the handcrafted Elegant. In fact, the consumption ratio for machining is 0.10 and 0.90 (using machine hours as the measure of usage). Thus, Fina uses nine times the machining resources as Elegant. Setup costs are similarly distorted. The products use an equal number of setups hours. Yet, if direct labor dollars are used, then the Elegant briefcase receives three times more machining costs than the Fina briefcase.4–7 Concluded3. Overhead rate = $21,000/5,000= $4.20 per MHrElegant: ($4.20 ⨯ 500)/3,000 = $0.70 per briefcaseFina: ($4.20 ⨯ 4,500)/3,000 = $6.30 per briefcaseThis cost assignment appears more reasonable given the relative demands each product places on machine resources. However, once a firm moves to a multiproduct setting, using only one activity driver to assign costs will likely produce product cost distortions. Products tend to make different demands on overhead activities, and this should be reflected in overhead cost assign-ments. Usually, this means the use of both unit- and nonunit-level activity drivers. In this example, there is a unit-level activity (machining) and a non-unit-level activity (setting up equipment). The consumption ratios for each (using machine hours and setup hours as the activity drivers) are as follows:Elegant FinaMachining 0.10 0.90 (500/5,000 and 4,500/5,000)Setups 0.50 0.50 (100/200 and 100/200)Setup costs are not assigned accurately. Two activity rates are needed—one based on machine hours and the other on setup hours:Machine rate: $18,000/5,000 = $3.60 per MHrSetup rate: $3,000/200 = $15 per setup hourCosts assigned to each product:Machining: Elegant Fina$3.60 ⨯ 500 $ 1,800$3.60 ⨯ 4,500 $ 16,200Setups:$15 ⨯ 100 1,500 1,500Total $ 3,300 $ 17,700Units ÷3,000 ÷3,000Unit overhead cost $ 1.10 $ 5.90Activity dictionary:Activity Activity Primary/ ActivityName Description Secondary Driver Providing nursing Satisfying patient Primary Nursing hours care needsSupervising Coordinating Secondary Number of nurses nurses nursing activitiesFeeding patients Providing meals Primary Number of mealsto patientsLaundering Cleaning and Primary Pounds of laundry bedding and delivering clothesclothes and beddingProviding Therapy treatments Primary Hours of therapy physical directed bytherapy physicianMonitoring Using equipment to Primary Monitoring hours patients monitor patientconditions1. dCost of labor (0.75 ⨯ $40,000) $30,000Forklift (direct tracing) 6,000 Total cost of receiving $36,000 2. b3. a4. c5. dActivity rates (Questions 2–5):Receiving: $36,000/50,000 = $0.72 per partSetup: $60,000/300 = $200 per setupGrinding: $90,000/18,000 = $5 per MHrInspecting: $45,000/4,500 = $10 per inspection hour6. aOverhead rate = $231,000/20,000 = $11.55 per DLH Direct materials $ 850Direct labor 600Overhead ($11.55 ⨯ 50) 578*Total cost $ 2,028Units ÷100Unit cost $ 20.28*Rounded4–9 Concluded7. bDirect materials $ 850.00Direct labor 600.00Overhead:Setup 200.00 ($200 ⨯ 1)Inspecting 40.00 ($10 ⨯ 4)Grinding 100.00 ($5 ⨯ 20)Receiving 14.40 ($0.72 ⨯ 20) Total costs $ 1,804.40Units ÷100Unit cost $ 18.04**Rounded4–101. Unit-level: Testing products, inserting dies2. Batch-level: Setting up batches, handling wafer lots, purchasingmaterials, receiving materials3. Product-level: Developing test programs, making probe cards,engineering design, paying suppliers4. Facility-level: Providing utilities, providing space4–111. Unit-level activities: MachiningBatch-level activities: Setups and packing Product-level activities: ReceivingFacility-level activities: None2. Pools and drivers:Unit-levelPool 1:Machining $80,000Activity driver: Machine hoursBatch-levelPool 2:Setups $24,000Packing 30,000Total cost $54,000Product-levelPool 3:Receiving $18,000Activity driver: Receiving orders4–11 Concluded3. Pool rates:Pool 1: $80,000/40,000 = $2 per MHrPool 2: $54,000/300 = $180 per setupPool 3: $18,000/600 = $30 per receiving order 4. Overhead assignment:InfantryPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 200 = 36,000Pool 3: $30 ⨯ 200 = 6,000Total $ 82,000Special forcesPool 1: $2 ⨯ 20,000 = $ 40,000Pool 2: $180 ⨯ 100 = 18,000Pool 3: $30 ⨯ 400 = 12,000Total $ 70,0004–121. Deluxe Percent Regular PercentPrice $900 100% $750 100% Cost 576 64 600 80 Unit gross profit $324 36% $150 20% Total gross profit:($324 ⨯ 100,000) $32,400,000($150 ⨯ 800,000) $120,000,0002. Calculation of unit overhead costs:Deluxe Regular Unit-level:Machining:$200 ⨯ 100,000 $20,000,000$200 ⨯ 300,000 $60,000,000 Batch-level:Setups:$3,000 ⨯ 300 900,000$3,000 ⨯ 200 600,000 Packing:$20 ⨯ 100,000 2,000,000$20 ⨯ 400,000 8,000,000 Product-level:Engineering:$40 ⨯ 50,000 2,000,000$40 ⨯ 100,000 4,000,000 Facility-level:Providing space:$1 ⨯ 200,000 200,000$1 ⨯ 800,000 800,000 Total overhead $ 25,100,000 $ 73,400,000 Units ÷100,000 ÷800,000 Overhead per unit $ 251 $ 91.75Deluxe Percent Regular Percent Price $900 100% $750.00 100%Cost 780* 87*** 574.50** 77***Unit gross profit $120 13%*** $175.50 23%***Total gross profit:($120 ⨯ 100,000) $12,000,000($175.50 ⨯ 800,000) $140,400,000*$529 + $251**$482.75 + $91.75***Rounded3. Using activity-based costing, a much different picture of the deluxe and regu-lar products emerges. The regular model appears to be more profitable. Per-haps it should be emphasized.4–131. JIT Non-JITSales a$12,500,000 $12,500,000Allocation b750,000 750,000a$125 ⨯ 100,000, where $125 = $100 + ($100 ⨯ 0.25), and 100,000 is the average order size times the number of ordersb0.50 ⨯ $1,500,0002. Activity rates:Ordering rate = $880,000/220 = $4,000 per sales orderSelling rate = $320,000/40 = $8,000 per sales callService rate = $300,000/150 = $2,000 per service callJIT Non-JITOrdering costs:$4,000 ⨯ 200 $ 800,000$4,000 ⨯ 20 $ 80,000Selling costs:$8,000 ⨯ 20 160,000$8,000 ⨯ 20 160,000Service costs:$2,000 ⨯ 100 200,000$2,000 ⨯ 50 100,000T otal $ 1,160,000 $ 340,000For the non-JIT customers, the customer costs amount to $750,000/20 = $37,500 per order under the original allocation. Using activity assignments, this drops to $340,000/20 = $17,000 per order, a difference of $20,500 per or-der. For an order of 5,000 units, the order price can be decreased by $4.10 per unit without affecting customer profitability. Overall profitability will decrease, however, unless the price for orders is increased to JIT customers.3. It sounds like the JIT buyers are switching their inventory carrying costs toEmery without any significant benefit to Emery. Emery needs to increase prices to reflect the additional demands on customer-support activities. Fur-thermore, additional price increases may be needed to reflect the increased number of setups, purchases, and so on, that are likely occurring inside the plant. Emery should also immediately initiate discussions with its JIT cus-tomers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities.4–141. Supplier cost:First, calculate the activity rates for assigning costs to suppliers: Inspecting components: $240,000/2,000 = $120 per sampling hourReworking products: $760,500/1,500 = $507 per rework hourWarranty work: $4,800/8,000 = $600 per warranty hourNext, calculate the cost per component by supplier:Supplier cost:Vance Foy Purchase cost:$23.50 ⨯ 400,000 $ 9,400,000$21.50 ⨯ 1,600,000 $ 34,400,000 Inspecting components:$120 ⨯ 40 4,800$120 ⨯ 1,960 235,200 Reworking products:$507 ⨯ 90 45,630$507 ⨯ 1,410 714,870 Warranty work:$600 ⨯ 400 240,000$600 ⨯ 7,600 4,560,000 Total supplier cost $ 9,690,430 $ 39,910,070Units supplied ÷400,000 ÷1,600,000Unit cost $ 24.23* $ 24.94**RoundedThe difference is in favor of Vance; however, when the price concession is con sidered, the cost of Vance is $23.23, which is less than Foy’s component.Lumus should accept the contractual offer made by Vance.4–14 Concluded2. Warranty hours would act as the best driver of the three choices. Using thisdriver, the rate is $1,000,000/8,000 = $125 per warranty hour. The cost as-signed to each component would be:Vance Foy Lost sales:$125 ⨯ 400 $ 50,000$125 ⨯ 7,600 $ 950,000$ 50,000 $ 950,000 U nits supplied ÷ 400,000 ÷1,600,000I ncrease in unit cost $ 0.13* $ 0.59**RoundedPROBLEMS4–151. Product cost assignment:Overhead rates:Patterns: $30,000/15,000 = $2.00 per DLHFinishing: $90,000/30,000 = $3.00 per DLHUnit cost computation:Duffel BagsPatterns:$2.00 ⨯ 0.1 $0.20$2.00 ⨯ 0.2 $0.40Finishing:$3.00 ⨯ 0.2 0.60$3.00 ⨯ 0.4 1.20Total per unit $0.80 $1.602. Cost before addition of duffel bags:$60,000/100,000 = $0.60 per unitThe assignment is accurate because all costs belong to the one product.4–15 Concluded3. Activity-based cost assignment:Stage 1:Pool rate = $120,000/80,000 = $1.50 per transactionStage 2:Overhead applied:Backpacks: $1.50 ⨯ 40,000* = $60,000Duffel bags: $1.50 ⨯ 40,000 = $60,000*80,000 transactions/2 = 40,000 (number of transactions had doubled)Unit cost:Backpacks: $60,000/100,000 = $0.60 per unitDuffel bags: $60,000/25,000 = $2.40 per unit4. This problem allows the student to see what the accounting cost per unitshould be by providing the ability to calculate the cost with and without the duffel bags. With this perspective, it becomes easy to see the benefits of the activity-based approach over those of the functional-based approach. The activity-based approach provides the same cost per unit as the single-product setting. The functional-based approach used transactions to allocate accounting costs to each producing department, and this allocation probably reflects quite well the consumption of accounting costs by each producing department. The problem is the second-stage allocation. Direct labor hours do not capture the consumption pattern of the individual products as they pass through the departments. The distortion occurs, not in using transac-tions to assign accounting costs to departments, but in using direct labor hours to assign these costs to the two products.In a single-product environment, ABC offers no improvement in product cost-ing accuracy. However, even in a single-product environment, it may be poss-ible to increase the accuracy of cost assignments to other cost objects such as customers.4–161. Plantwide rate = $660,000/440,000 = $1.50 per DLHOverhead cost per unit:Model A: $1.50 ⨯ 140,000/30,000 = $7.00Model B: $1.50 ⨯ 300,000/300,000 = $1.502. Departmental rates:Department 1: $420,000/180,000 = $2.33 per MHr*Department 2: $240,000/400,000 = $0.60 per DLHDepartment 1: $420,000/40,000 = $10.50 DLHDepartment 2: $240,000/40,000 = $6.00 per MHrOverhead cost per unit:Model A: [($2.33 ⨯ 10,000) + ($0.60 ⨯ 130,000)]/30,000 = $3.38Model B: [($2.33 ⨯ 170,000) + ($0.60 ⨯ 270,000)]/300,000 = $1.86Overhead cost per unit:Model A: [($10.50 ⨯ 10,000) + ($6.00 ⨯ 10,000)]/30,000 = $5.50Model B: [($10.50 ⨯ 30,000) + ($6.00 ⨯ 30,000)]/300,000 = $1.65*Rounded numbers throughoutA common justification is that of using machine hours for machine-intensivedepartments and labor hours for labor-intensive departments. Using this rea-soning, the first set of departmental rates would be selected (machine hours for Department 1 and direct labor hours for Department 2).3. Calculation of pool rates:Driver Pool RateBatch-level pool:Setup and inspection Product runs $320,000/100 = $3,200 per runUnit-level pool:Machine andmaintenance Machine hours $340,000/220,000 = $1.545 per MHr Note: Inspection hours could have been used as an activity driver instead of production runs.Overhead assignment:Model BBatch-level:Setups and inspection$3,200 ⨯ 40 $ 128,000$3,200 ⨯ 60 $ 192,000Unit-level:Power and maintenance$1.545 ⨯ 20,000 30,900$1.545 ⨯ 200,000 309,000Total overhead $ 158,900 $ 501,000Units produced ÷30,000 ÷ 300,000Overhead per unit $ 5.30 $ 1.674. Using activity-based costs as the standard, we can say that the first set ofdepartmental rates decreased the accuracy of the overhead cost assignment (over the plantwide rate) for both products. The opposite is true for the second set of departmental rates. In fact, the second set is very close to the activity assignments. Apparently, departmental rates can either improve or worsen plantwide assignments. In the first case, D epartment 1’s costs are assigned at a 17:1 ratio which overcosts B and undercosts A in a big way.Yet, this is the most likely set of rates at the departmental level! This raises some doubt about the conventional wisdom regarding departmental rates.4–171. Labor and gasoline are driver tracing.Labor (0.75 ⨯ $120,000) $ 90,000 Time = Resource driverGasoline ($3 ⨯ 6,000 moves) 18,000 Moves = Resource driverDepreciation (2 ⨯ $6,000) 12,000 Direct tracingTotal cost $ 120,0002. Plantwide rate = $600,000/20,000= $30 per DLHUnit cost:DeluxePrime costs $80.00 $160Overhead:$30 ⨯ 10,000/40,000 7.50$30 ⨯ 10,000/20,000 15$87.50 $1753. Pool 1: Maintenance $ 114,000Engineering 120,000Total $ 234,000Maintenance hours ÷4,000Pool rate $ 58.50Note:Engineering hours could also be used as a driver. The activities are grouped together because they have the same process, are both product lev-el, and have the same consumption ratios (0.25, 0.75).Pool 2: Material handling $ 120,000Number of moves ÷6,000Pool rate $ 20Pool 3: Setting up $ 96,000Number of setups ÷80Pool rate $ 1,200Note: Material handling and setups are both batch-level activities but have dif-ferent consumption ratios.Pool 4: Purchasing $ 60,000Receiving 40,000Paying suppliersTotal $ 130,000Orders processed ÷750Pool rate $ 173.33Note:The three activities are all product-level activities and have the same consumption ratios.Pool 5: Providing space $ 20,000Machine hours ÷10,000Pool rate $ 2Note: This is the only facility-level activity.4. Unit cost:Basic Deluxe Prime costs $ 3,200,000 $ 3,200,000Overhead:Pool 1:$58.50 ⨯ 1,000 58,500$58.50 ⨯ 3,000 175,500 Pool 2:$20 ⨯ 2,000 40,000$20 ⨯ 4,000 80,000 Pool 3:$1,200 ⨯ 20 24,000$1,200 ⨯ 60 72,000 Pool 4:$173.33 ⨯ 250 43,333$173.33 ⨯ 500 86,665 Pool 5:$2 ⨯ 5,000 10,000$2 ⨯ 5,000 10,000 Total $ 3,375,833 $ 3,624,165Units produced ÷40,000 ÷20,000Unit cost (ABC) $ 84.40 $ 181.21Unit cost (traditional) $ 87.50 $ 175.00The ABC costs are more accurate (better tracing—closer representation of actual resource consumption). This shows that the basic model was over-costed and the deluxe model undercosted when the plantwide overhead rate was used.1. Unit-level costs ($120 ⨯ 20,000) $ 2,400,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level ($20 ⨯ 20,000) 400,000Total cost $ 5,200,0002. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 20) 1,600,000Product-level costs ($80,000 ⨯ 10) 800,000Facility-level costs 400,000Total cost $ 6,400,000The unit-based costs increase because these costs vary with the number of units produced. Because the batches and engineering orders did not change, the batch-level costs and product-level costs remain the same, behaving as fixed costs with respect to the unit-based driver. The facility-level costs are fixed costs and do not vary with any driver.3. Unit-level costs ($120 ⨯ 30,000) $ 3,600,000Batch-level costs ($80,000 ⨯ 30) 2,400,000Product-level costs ($80,000 ⨯ 12) 960,000Facility-level costs 400,000Total cost $ 7,360,000Batch-level costs increase as the number of batches changes, and the costs of engineering support change as the number of orders change. Thus, batches and orders increased, increasing the total cost of the model.4. Classifying costs by category allows their behavior to be better understood.This, in turn, creates the ability to better manage costs and make decisions.1. The total cost of care is $1,950,000 plus a $50,000 share of the cost of super-vision [(25/150) ⨯ $300,000]. The cost of supervision is computed as follows: Salary of supervisor (direct) $ 70,000Salary of secretary (direct) 22,000Capital costs (direct) 100,000Assistants (3 ⨯ 0.75 ⨯ $48,000) 108,000Total $ 300,000Thus, the cost per patient day is computed as follows:$2,000,000/10,000 = $200 per patient day(The total cost of care divided by patient days.) Notice that every maternity patient—regardless of type—would pay the daily rate of $200.2. First, the cost of the secondary activity (supervision) must be assigned to theprimary activities (various nursing care activities) that consume it (the driver is the number of nurses):Maternity nursing care assignment:(25/150) ⨯ $300,000 = $50,000Thus, the total cost of nursing care is $950,000 + $50,000 = $1,000,000.Next, calculate the activity rates for the two primary activities:Occupancy and feeding: $1,000,000/10,000 = $100 per patient dayNursing care: $1,000,000/50,000 = $20 per nursing hour。

管理会计试题库及答案

管理会计试题库及答案一、单选题(共47题,每题1分,共47分)1.现代企业会计的两大分支:财务会计和()。

A、预算会计B、管理会计C、财务管理D、成本会计正确答案:B2.在Y=a+( )X中,Y表示总成本,a表示固定成本,X表示销售额,则X的系数应是()。

A、单位边际贡献B、变动成本率C、边际贡献率D、单位变动成本正确答案:B3.某公司生产的产品,其保本量为20万件,单价2元,贡献边际率为40%,其固定成本为()。

A、16万元B、50万元C、100万元D、8万元正确答案:A4.在半成品立即出售或加工决策中,出现()时,应立即出售。

A、进一步加工增加的收入超过进一步加工所追加的成本B、进一步加工增加的收入等于进一步加工所追加的成本C、进一步加工增加的收入小于进一步加工所追加的成本D、以上均错正确答案:C5.在变动成本法下,固定性制造费用应当列作()。

A、期间成本B、直接成本C、非生产成本D、产品成本正确答案:A6.已知企业某产品的单价为2 000元,目标销售量为3 500件,固定成本总额为100 000元,目标利润为600 000元,则企业应将单位变动成本的水平控制在( )。

A、1500元/件B、1667元/件C、1000元/件D、1800元/件正确答案:D7.当企业的剩余生产能力无法转移时,应继续生产某亏损产品的条件之一是()A、该产品的单位贡献边际大于零B、该产品的单价等于单位变动成本C、该产品的单价小于单位变动成本D、该产品的变动成本率大于100正确答案:A8.下列关于安全边际和边际贡献的表述中,错误的是()。

A、边际贡献的大小,与固定成本支出的多少无关B、提高安全边际或提高边际贡献率,可以提高利润C、边际贡献率反映产品给企业做出贡献的能力D、降低安全边际率或提高边际贡献率,可以提高销售利润率正确答案:D9.某投资中心本年度的投资额为20000元,预期最低投资收益率为15%。

剩余收益为2000元,则本年度的利润为( )元。

K201709《管理会计》课程复习题

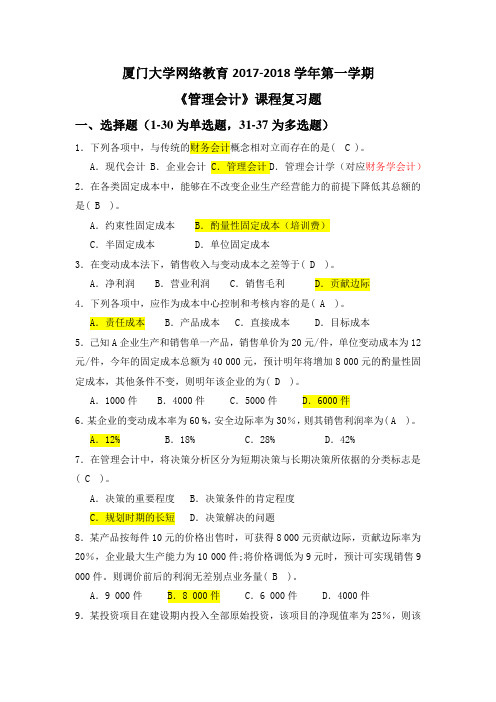

厦门大学网络教育2017-2018学年第一学期《管理会计》课程复习题一、选择题(1-30为单选题,31-37为多选题)1.下列各项中,与传统的财务会计概念相对立而存在的是( C )。

A.现代会计 B.企业会计 C.管理会计D.管理会计学(对应财务学会计)2.在各类固定成本中,能够在不改变企业生产经营能力的前提下降低其总额的是( B )。

A.约束性固定成本 B.酌量性固定成本(培训费)C.半固定成本 D.单位固定成本3.在变动成本法下,销售收入与变动成本之差等于( D )。

A.净利润 B.营业利润 C.销售毛利 D.贡献边际4.下列各项中,应作为成本中心控制和考核内容的是( A )。

A.责任成本 B.产品成本 C.直接成本 D.目标成本5.己知A企业生产和销售单一产品,销售单价为20元/件,单位变动成本为12元/件,今年的固定成本总额为40 000元,预计明年将增加8 000元的酌量性固定成本,其他条件不变,则明年该企业的为( D )。

A.1000件 B.4000件 C.5000件 D.6000件6.某企业的变动成本率为60 %,安全边际率为30%,则其销售利润率为( A )。

A.12% B.18% C.28% D.42%7.在管理会计中,将决策分析区分为短期决策与长期决策所依据的分类标志是( C )。

A.决策的重要程度 B.决策条件的肯定程度C.规划时期的长短 D.决策解决的问题8.某产品按每件10元的价格出售时,可获得8 000元贡献边际,贡献边际率为20%,企业最大生产能力为10 000件;将价格调低为9元时,预计可实现销售9 000件。

则调价前后的利润无差别点业务量( B )。

A.9 000件 B.8 000件 C.6 000件 D.4000件9.某投资项目在建设期内投入全部原始投资,该项目的净现值率为25%,则该项目的获利指数为( B )。

A.0.75 B.1.25 C.4 D.2510.下列项目中,能够克服固定预算方法缺点的是( B )。

管理会计习题库(附参考答案)

管理会计习题库(附参考答案)一、单选题(共53题,每题1分,共53分)1.将全部成本分为固定成本、变动成本和混合成本所采用的分类标志是A、成本的可辨认性B、成本的性态C、成本的经济用途D、成本的目标正确答案:B2.销售收入与变动成本之差等于A、边际贡献B、净利润C、营业利润D、销售毛利正确答案:A3.下列选项中,不能列入变动成本法产品成本中的有A、变动制造费用B、直接材料C、直接人工D、固定制造费用正确答案:D4.变动生产成本不包括以下哪个选项A、制造费用B、直接人工C、直接材料D、变动制造费用正确答案:A5.在经济决策中应由中选的最优方案负担的、按所放弃的次优方案潜在收益计算的资源损失,即A、专属成本B、加工成本C、增量成本D、机会成本正确答案:D6.下列哪种成本为相关成本A、沉没成本B、联合成本C、共同成本D、可避免成正确答案:D7.管理费用预算的编制主要由()负责A、销售部门B、财务部门C、行政管理部门D、生产部门正确答案:C8.企业当期发生的广告费按照成本性态划分,属于A、半固定成本B、约束性固定成本C、半变动成本D、酌量性固定成本正确答案:D9.历史资料分析法的具体方法不包括A、高低法B、散布图法C、回归直线法D、会计分析法正确答案:D10.( )是衡量企业经济效益的重要指标,是指产品的销售收入扣减变动成本后的余额。

A、安全边际率B、边际贡献率C、边际贡献D、安全边际正确答案:C11.全面预算按其涉及的业务活动领域分为财务预算和A、销售预算B、现金预算C、经营预算D、生产预算正确答案:C12.下列各项中,能够揭示滚动预算基本特点的表述是A、预算期不可随意变动B、预算期与会计年度一致C、预算期是连续不断的D、预算期相对固定的正确答案:C13.散布图法是将一定时期的()的数据,逐一在坐标上标明以形成散布图。

A、混合成本B、变动成本C、固定成本D、生产成本正确答案:A14.将全部成本分为固定成本、变动成本和混合成本所采用的分类标志是A、成本的性态B、成本的可辨认性C、成本核算目标D、成本的经济用途正确答案:A15.在全部成本法下,产品成本则包括全部生产成本,只有()作为期间成本处理。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

管理会计作业一、课堂讨论题1.举例说明管理会计信息在以下决策中如何起作用?1)出租汽车公司经理正考虑是否增加车队中的豪华轿车的数量?2)汽车厂生产经理正考虑是按周或按月对机器进行日常维修?3)市政工程正考虑是否要扩建当地图书馆?4)商店经理考虑要聘请几名保安以减少店内偷窃损失?2.公共责任和道德两难唐力是新城公司的助理会计师,他刚收到公司1999年年报的副本,并为此感到烦恼。

原来,几星期前,他把准备好的年报和附注交给了总会计师、公司总裁和董事会,在附注中他指出公司1999年度的净收益比上一年度降低了6.3%。

但是,现在他发现在公司总裁给股东的对外年报中净收益被宣布为比去年增长了4.3%。

这是因为年报把1450万的预收款计为1999年度的销售收入,而这些本应属于2000年度的销售收入。

唐力的上司告诉他,这是董事会的决定。

董事会不希望令股东失望和不安,而且2000年度对公司来说会是一个好年景。

总会计师告诉唐力不要担心,因为明年的预期收入会补上差额,股东们不会失去任何东西。

请问:唐力应该怎么办?3.成本性态分析1)以下问题取自某公司的生产成本预算,生产量420 515生产成本82200 90275(1)该期的成本公式可以表现为:A TC=46500+85VB TC=42000+95VC TC=46500-85VD TC=51500-95V(2)当生产量为450单位时,预算成本额应为:A 84750B 80250C 42750D 82750在分析中采用的是什么方法,该方法有什么优点和不足?2) 在办公室举行的元旦晚会的一片喧闹之中,你不小心打翻了桌上的墨水瓶,弄脏了一些文件。

其中一份文件是对半变动成本进行分析的报告,老板要求你在新年度假前完成。

(1)ΣXY=aΣX+bΣ?(2)ΣY=?a +bΣX(1)126000=?a+ ?b(2)? =?a+?b(1)126000=?a+ ?b(2)×6 ? =?a+?b(1)-(2)?=??b? =b所以,单位变动成本为???。

将其代入算式(2)得到月固定成本如下:? =?a+?b? =?a+12600?=?a1000=a所以,固定成本为每月1000元。

度假班车在90分钟后要出发,你意识到,必须在出发前把数字补上。

要在周围一片欢乐的环境中静下心来可真不容易,可是你不得不做。

因为老板绝对不会通融的。

在开始恢复数据之前,你回忆起来,五月份的总成本的数字刚好可以用成本公式(按最小二乘法计算)乘以当月产量计算求得。

(即:固定成本+单位变动成本×销量)要求:(1)将上述分析资料誊到一张干净的纸张上,补上所有遗失的数据。

(2)由于(1)的工作只花了45分钟,离出发还有45分钟,所以你决定用高低点法来检查一下。

要求采用高低点法,列出成本公式。

(3)用高低点法得出的公式与用最小二乘法得出的公式存在很大差异,你不禁有些吃惊。

看看表,还有30分钟,你决定画出散布图,再最后检查一次。

要求用散布图法求解成本公式。

(4)对照(3)中的散布图,解释为什么高低点法的公式和最小二乘法的公式存在较大差异?4.完全成本法与变动成本法今天是19*5年9月30日,A公司D分部的F经理,正在准备编制当年最后一个季度的生产计算。

E分部原计划在投产的第一年,19*5年销售3600件产品,但是,到9月30E分部可租到的仓库最多能储存1000件产品。

要求的最低存货存储量为50件。

F经理知道,要留住核心员工,每季度的生产量至少必须达到200件。

每季度的最大生产量为1500件。

19*5年的市场很不景气,预计最后一个季度的销售量只有600件。

由于E分部生产经营的特点,固定性制造费用在产品成本中占了很大比重。

要求:(1)假设该部门采用变动成本计算法。

最后一季度的生产计划中的产量应是多少?(公式:预计的销售量+预计的期末存货-期初存货=预计产量)列示计算过程并做解释。

生产量是否影响该部门当年的损益?为什么?(2)假设该部门采用的是完全成本计算法,F经理的年度奖金是根据E分部的经营利润而定的。

如果F经理希望能使其分部19*5年的经营利润最大,在最后一个季度应安排生产多少件产品?计算并做解释。

(3)指出F经理所做的决策中涉及到的道德问题。

5.本量利分析(1)Juarez公司生产的某产品的信息如下:单价50美元,单位变动成本35美元,每月的固定成本是27,000美元。

请填空:a.产品的单位贡献毛益是____________美元b.每月的保本销售量是____________ 单位c.每月净利润达9,000美元的销售量是____________单位d.每月净利润率达20%的销售量是____________单位e.如果每月销售2,500单位产品,则净利润为____________美元f.如果变动成本下降3%,每月的固定成本增加9,000美元,那么每月的保本销售量是____________单位g.如果单位变动成本35美元,每月固定成本27,000美元保持不变,公司希望销售5,000单位产品就可以获得15,000美元的净利润,那么产品的单价应该定位____________美元。

(2)公司总经理有一部手机,其收费有两种模式:(1)A方式:月基本费用400元加每分钟0.20元(2)B方式:月基本费用250元加每分钟0.35元如果两种方式的电话费相同,总经理可以每月可以打多长时间电话?应选择哪一种方式?6.定价决策除非另行说明,以下各题相互独立。

列出计算过程:1)J假设公司采用完全成本加成法定价,加成率为40%。

计算目标售价。

2)延用1)中数据。

假设公司采用变动成本加成法,加成率为110%,计算销售价格。

3)延用1)中数据。

即便是在存在剩余生产能力的情况下,公司的定价的下限是多少?4)公司采用完全成本加成法,期望的ROI为18%,则加成率应是多少?定价应是多少?如果采用变动成本加成法,期望的ROI不变,则加成率应是多少?定价应是多少?7.成本概念1)D公司的某顾客希望D公司为其加工一项特殊产品,并为此支付22000元。

做该工作需要以下一些材料:存货单位价值材料需要量存货中已有的数量帐面价值可变现价值重置成本A 1000 0 -- 6B 1000 600 2 2.5 5C 1000 700 3 2.5 4D 200 200 4 6 9企业定期使用B材料,如果将B材料用于此工作,需重新购置材料B,以满足企业的其他生产要求。

材料C和D是以前过度购买存货的结果,而且使用受到很大限制。

.材料C没有其他用途,但是材料D可用于另外一项工作。

如果在另外一项工作中使用材料D,就会节约300个单位的材料E的消耗。

材料E的单位成本是5元,企业现在没有库存材料E。

要求:计算分析各材料的相关成本。

8.长期投资决策(1)老王年已58,再过12年退休。

他计划在退休后去旅游。

旅游费用估计至少要4000美元。

为此他打算现在开始攒钱。

预计投资收益率为12%,则从现在起,他每年得拿出多少钱进行投资?(2)某机器买价为14000元,采纳后,可替代手工操作系统,从而使年成本下降4000元。

该机器的使用年限为5年,预计无残值。

请:(1)计算投资回收期。

(2)计算会计投资报酬率。

(3)计算贴现投资回收期。

(4)计算贴现投资报酬率为12%的项目年成本节约额。

(5)计算当资本成本为10%时的净现值。

9.财务业绩填空10.转移定价某公司有两个分部,其资料如下:假设分部A的固定性制造费用为400000,预计年产量为100000件。

每件的完全成本为:假设分部A有剩余生产能力,分部B正在考虑是否向分部A购买10000件的部件继续加工,然后以17元的价格出售给外部客户。

要求:(3)假设分部A对这10000件部件要求的转移价格为完全成本价格,分部B的经理是否愿意向其购买?(4)假设分部B的经理决定购买,从公司整体看是否有利?(5)如果现有某厂愿意以每件9元的价格向A分部购买这剩余的100000件产品,但需要分部A追加运费1元,则是对外销售还是对内销售对公司最有利?(6)为使公司利益最大,分部A的这10000件产品的转移价格应如何确定?二、作业题1.成本性态某企业的历史成本数据表明,维修成本在相关范围内的变动情况如下:要求:1)分别用散布图法、高低点法和回归分析法进行成本分解2)假设下月预计工时为400小时,请预测其维修成本应是多少?2.完全成本计算与变动成本计算(1)某企业产销A产品,最近几年的有关资料如下要求:(1)分别采用完全成本法和变动成本法编制该公司1995年的损益表。

(2)分别采用完全成本法和变动成本法计算该公司各年的税前利润。

(3)说明1994和1995年度分别采用完全成本计算法和变动成本计算法的税前利润的差异。

(4)说明完全成本法下1995年和1996A税前收益的差异。

(5)说明变动成本法下1995年和1996B税前收益的差异。

2.完全成本法与变动成本法(2)F公司是一家制造各种新奇玩具以及服装、娱乐用品的公司,公司历史上的盈利记录一直很好。

然而,从1993年开始,公司的销售量与利润开始下降,并且一直没有好转的迹象。

1005年初,董事会限令公司总裁威利在6个月内扭转局面。

但是,尽管威利想尽了各种改进管理的措施,却没有收到很好的成效。

生产能力利用了50%,成本已降到了最低限度,但是销售量和利润仍没有显示出增加的迹象。

想到董事会的限令,威利似乎看到自己的暗淡前途,几近绝望。

一天夜里,从恶梦醒来,威利忽然有了主意。

他想起公司是采用完全成本法计算存货成本的,那么他或许可以通过增加产量的方式来增加公司利润。

第二天,威利来到公司后,下达的一个道命令是扩大一倍产量,使生产能力得到完全利用。

在剩下的期限内,威利一直采取这个措施。

结果奇迹出现了。

尽管公司的销售情况在1995年前6个月内并无改善甚至持续恶化,但这一时期内期净收益却显著增加。

威利成了拯救公司的英雄,董事会也对他大家赞赏。

作为奖励,董事会给了威利一大笔奖金,并给了他一次去巴哈马度假的机会。

讨论问题:1)为什么威利采取的措施使F公司的净收益大幅增加?2)威利的措施会给F公司带来怎样的负面影响?本案例中涉及了哪些职业道德问题?3.本量利分析(1)A.设某企业1998年生产单一产品A产品,本月份有关数据如下:预计销售量60000件,单位售价10 单位变动成本 4 全月固定成本120 000要求,(1)根据上述资料,绘制盈亏临界图,计算盈亏临界点。

(2)如果将单位售价增加到12,请在(1)上画出新的销售收入线,标出新盈亏临界点。

经理希望将销售单价提高到12元,但同时可能会导致销售量下降。

请确定支持涨价措施的最低销售数量。

要求:(1)绘制盈亏临界图(2)计算A和B产品盈亏临界点的销售量和销售额(3)计算安全边际(4)如果广告费增加19400元,可以使B产品销售量增加到90000件,A产品销售量减少10000件,说明该方案是否可行?(5)计算(4)中的盈亏临界点的销售额。