高鸿业(宏观经济学)第6版 第十三章

西方经济学高鸿业主编第13章课后...

西方经济学高鸿业主编第13章课后习题答案(Western economics, Gao Hongye, editor, thirteenth chapters, after-schoolExercises answer)1. in the two sector of the economy, equilibrium occurs when(C).A. actual savings equals actual investment;B. actual consumption plus actual investment equals output value;C. plans to save is equal to planned investment;D. total investment equals the income of the enterprise sector.2. when the consumption function is C = Aby (a>0,0<b<1), which showed that the average propensity to consume (A).A. is greater than marginal propensity to consume;B. is less than marginal propensity to consume;C. equals marginal propensity to consume; three cases aboveD. are possible.3., if the marginal propensity to save is 0.3, the investment expenditure will increase by 6 billion yuan, which will lead to an increase in the balanced income GDP (D).A. 2 billion yuan;B. 6 billion yuan;C. 18 billion yuan;D.20 billion yuan.4., in the balanced output level, whether the planned inventory investment and unplanned inventory investment must be zero?Answer: when a balanced production level is reached, the planned inventory investment is generally not zero, rather than the planned inventory investment must be zero. This is because the planned inventory investment is part of the planned investment, and the balanced output equals the output of the consumption plus planned investment, so the planned inventory is not necessarily zero. When the planned inventory increases, the inventory investment is greater than zero; when the planned inventory decreases, the inventory investment is less than zero. It should be pointed out that the stock is the stock, the stock investment is the flow, and the stock investment refers to the stock change. At the equilibrium level of output and inventory investment plan is part of a plan to invest, it is not zero, but the non planned inventory investment must be zero, if unplanned inventory investment is not zero, then it is not a balanced output. For example, enterprises wrongly estimated the situation, exceeded the market demand and produced more products, resulting in unplanned inventory investment.5. can the marginal propensity to consume and the average propensity to consume be always greater than zero and less than 1?Answer: consumption tendency is the relation between consumption expenditure and income, also called consumption function. The relationship between consumption expenditure and income can be studied from two aspects, one is the relationship between consumption expenditure and income variables, this is the marginal propensity to consume (can use the formula MPC = y or MPC = delta C delta dcdy), two is to investigate certainincome level of consumer spending in the relationship between the quantity and the this is the amount of income, the average propensity to consume (can use the formula APC = CY). The marginal propensity to consume is greater than zero and less than 1 of the total, because generally, increased consumer income, not only does not increase consumption is MPC = delta C delta y = 0, also won't increase revenue to increase consumption, the general situation is a part for increasing consumption, the other part is used to increase savings, i.e. y = C + delta delta delta s, therefore, delta C delta y + delta s delta y = 1, so, delta C delta y = 1 delta s delta y. As long as Delta s, delta y is not equal to 1 or 0, there are 0 < C, delta y < 1. However, the average propensity to consume is not always greater than zero, but less than 1. When people earn very little or even zero, they have to consume, even if they borrow money. Then the average propensity to consume will be greater than 1.6. what is Keynes's law and what is the social and economic background put forward by Keynes's law?Answer: the so-called Keynes Law refers to, no matter how much for the demand, economic system can provide the supply amount corresponding to the same price, that is to say the total social demand changes, will only cause the yield and income changes, until the supply and demand are equal, without causing a price change. This law is the background of Keynes's writing, "employment, interest and money" a book, the 1929 and 1933 in the western world economic depression, a large number of unemployed workers, a large number of idle resources. In this case, the increase in aggregate social demand will only makeuse of idle resources and increase production, rather than raise resource prices, so that product costs and prices can remain largely the same. The Keynes's law is thought to be suitable for short-term analysis. In the short run, prices are volatile and when social demand changes, firms first consider adjusting output rather than variable prices.7. the government purchase and government transfer payment belong to government spending, why the calculation of total demand of national income is only in government purchases excluding government transfer payments, which is why Cig (y = Xm) rather than Cigtr (y = Xm)?Answer: the government has increased transfer payments, although it has an impact on aggregate demand, but this effect is achieved by increasing disposable income and increasing consumer spending. If the transfer payment is included in the aggregate demand, the repeated calculation in the aggregate demand calculation will be formed. For example, the government increases the transfer payment by 1 billion yuan, assuming that the marginal propensity to consume is 0.8, which will increase consumption by 800 million yuan. Here, the first round of aggregate demand increased by 800 million yuan, not 1 billion 800 million yuan. But if the 1 billion yuan transfer payment is also regarded as an increase in aggregate demand, then it is repeated calculation, that is, 1 billion yuan at a time,It's 800 million yuan at a time.8. why some western economists believe that a portion of national income from the rich to the poor will increase thetotal income level? Answer: their reason is that the rich consumption tendency and lower propensity to save is higher, while the poor and high consumption propensity (because of the poor low income, in order to maintain the basic living standards, the proportion of their spending in income must be greater than the rich, so) will be part of the national income from the rich to the poor that can improve the whole society consumption tendency, so as to improve the whole society's total consumption expenditure level, so the total output or total income will increase.9., why is the absolute value of the government expenditure multiplier larger than the absolute value of the government tax multiplier and the government transfer payment multiplier?Answer: the government (purchase) expenditure directly affects total expenditure, the change of both is the same direction. Changes in total expenditure are several times the amount of government purchases. This multiple is the government's purchase multiplier. But taxation does not directly affect total expenditure, which affects consumer spending by changing people's disposable income, and then affects total expenditure. Tax changes are in reverse direction with changes in total expenditure. When taxes increase (tax rates rise or tax base increases), people's disposable income decreases, consumption decreases, and total expenditure decreases. Total expenditure reductions are several times greater than taxes, and vice versa. This multiple is the tax multiplier. Since tax revenue does not directly affect total expenditure, it will affect consumer spending by changing people's disposable income, and then affect total expenditure. Therefore, the absolute value of thetax multiplier is less than the absolute value of the government purchase expenditure. For example, an increase of 1 billion yuan to buy a government, to increase 1 billion yuan of total demand, but the tax 1 billion yuan, will make people more disposable income of 1 billion yuan, if the marginal propensity to consume is 0.8, one begins to increase consumer demand is only 800 million yuan, so the government spending multiplier of the absolute values of it must be greater than the tax multiplier.Government transfer payment impact on total expenditure is similar to tax, also indirectly affect the total expenditure, but also by changing people's disposable income to affect consumer spending and spending; the absolute value and the government transfer payment multiplier and the tax multiplier is as large as the. But unlike taxes, the government transfers payments in the same direction as the government purchases, but the government transfer payment multiplier is smaller than the government purchase multiplier.10. what is the mechanism of the balanced budget multiplier?Answer: a balanced budget multiplier is the ratio of changes in national revenues to changes in government revenues and expenditures when the amount of government revenue and expenditure increases or decreases in the same amount. In theory, the balanced budget multiplier equals 1. That is to say, if the government increases the expenditure of one yuan and increases the tax on one yuan of money, it will increase the national income by one yuan, because the government's expenditure multiplier is larger than the tax multiplier. Ifyou use the formula that is t = delta delta G (assuming that the transfer payment, and income tr constant) change is determined by the total expenditure changes, that is y = C + I + delta delta delta G, delta I assumes that the investment is unchanged, namely = 0, y = C +, delta delta delta G. The delta C = YD = beta (beta delta delta y delta T), therefore, there is y = P (Y - t) + delta G = P (Y - G) + delta (delta T = g for a g), the authors obtainedY (1 - beta) = delta G (1 - beta)Visible, delta y = g = 1 - beta 1 - beta = 1, i.e. balanced budget multiplier (expressed in KB), KB = g, delta y = 1.This conclusion can also be obtained by directly adding the government purchase expenditure multiplier and the tax multiplierKgkt = 11 - beta (1t) + - beta (1t) beta 1 (1t) = 111., why have some of the multipliers in the closed economy become smaller after foreign trade?Answer: in the closed economy, investment and government expenditures increase multiples of the national income increase is 11 - and beta have foreign trade after the multiple became M (11 - beta beta here and M denote the marginal propensity to consume and the marginal propensity to import), obviously the multiplier becomes small, this is mainly due to a part of the increase the income now used to buy imported goods.12. what is the difference between the three ways in which taxes, government purchases and transfer payments affect aggregate demand?Answer: aggregate demand consists of four components: consumer spending, investment spending, government purchases, and net exports.Taxation does not directly affect aggregate demand. It affects consumer spending by changing people's disposable income, and then affects aggregate demand. The change in taxation is in reverse direction with the change in aggregate demand. As taxes increase (tax rates rise or tax base increases), people's disposable income decreases, consumption decreases, and aggregate demand decreases. The decrease in aggregate demand is several times the increase in taxes, and vice versa. This multiple is the tax multiplier.Government purchase expenditure directly affects aggregate demand, and both change in the same direction. Changes in aggregate demand are also several times the amount of government purchases,This multiple is the government's buying multiplier.The impact of government transfer payments on aggregate demand is similar to taxation, which indirectly affects aggregate demand, as well as changes in people's disposable income, thereby affecting consumer spending and aggregate demand. Moreover, the absolute value of the government transfer payment multiplier and the tax multiplier is the same. But unlike taxes,the government transfer payments change in the same way as the government purchases, but the government transfer payment multiplier is smaller than the government purchase multiplier.These three variables (taxes, government purchases and government transfer payments) are variables that the government can control, and policies that control these variables are called fiscal policies. The government can regulate the economic operation through fiscal policy.For example, an increase of $1 in government spending initially increased aggregate demand by $1, as government purchases were directly related to the demand for end products. But increase the transfer payment of 1 dollars and 1 dollars to reduce taxes, just make people disposable income increased by $1, if the marginal propensity to consume is 0.8, while consumer spending increased only $0.8, the $0.8 is $1 increase transfer payments and tax cuts of $1 in the first round of the final product demand increases, the the difference between the government transfer payment and tax multipliers are equal and opposite, the absolute value of the government purchase multiplier is greater than the government transfer payment multiplier and the absolute value of the tax multiplier.The 13. assumption of an economy's consumption function is C = 1000.8yd investment, I = 50, g = 200 government purchase expenditure, government transfer payment tr = 62.5, t = 250 (tax unit for $1 billion).(1) seeking balanced income.(2) try to find the investment multiplier, the government expenditure multiplier, the tax multiplier, the transfer payment multiplier and the balanced budget multiplier.Answer: (1) by equationsSolvable y = 1000 ($100 million), so the balanced income level is $100 billion.(2) we can obtain the multiplier value directly according to the formula of the multiplier in the three sector economyInvestment Multiplier: ki = 11 - beta = 110.8 = 5Government spending multiplier: kg = 5 (equal to the investment multiplier)Tax Multiplier: KT = - 1 - beta beta = 0.810.8 = 4Transfer Payment Multiplier: KTR = 1 beta beta = 0.810.8 = 4The balanced budget multiplier is equal to the sum of government spending (purchase) multiplier and tax multiplierKB = Kgkt = 5 (4) = 1In the 14. part, assuming that the society to achieve the needs of full employment, national income is 1200, ask: (1) increase in government purchases; (2) to reduce taxes; (3) with the same amount of increase in government purchases and taxes (in order to balance the budget) to achieve full employment, the amountof how much?Answer: the question clearly uses a variety of multipliers. Originally balanced income is 1000, now need to reach 1200, then the gap = y = 200.(1) increase the government purchase of delta G = ykG = 2005 = 40.(2) decrease of tax = t = 200|kt| = 2004 = 50.(3) from the balanced budget multiplier equals 1, we can see that 200 of the government purchases and 200 of the tax revenue can achieve full employment.15. assume that the consumption function of economy and society in a C = 300.8yd, net tax total tax minus government transfer payment amount after TN = 50, investment I = 60, g = 50 government purchase expenditure and net export balance that exports minus imports after NX = 500.05y, for: (1) balance of income; (2) in the equilibrium level of income on the net export balance; (3) investment multiplier; (4) investment from 60 to 70 when the balance of income and net export balance; (5) when the equilibrium income net exports from NX = 50 to NX = 40 0.05y - 0.05y and net export balance.Answer: (1) disposable income: YD = Ytn = Y50Consumption: C = 300.8 (Y50)= 300.8y40= 0.8y10Equilibrium income: y = Cignx= 0.8y106050500.05y= 0.75y150The solution is y = 1500.25 = 600, i.e., the equilibrium income is 600.(2) net export balance:Nx = 500.05y = 500.05 x 600 = 20(3) investment multiplier ki = 110.80.05 = 4.(4) when the investment increased from 60 to 70, there wereY = Cignx= 0.8y107050500.05y= 0.75y160The solution is y = 1600.25 = 640, i.e., the equilibrium income is 640.Net export balance:Nx = 500.05y = 500.05 x 640 = 5032 = 18(5) the equilibrium income of the net export function changed from NX = 50 - 0.05y to NX = 40 - 0.05y:Y = Cignx= 0.8y106050400.05y= 0.75y140The solution is y = 1400.25 = 560, i.e., the equilibrium income is 560.Net export balance:Nx = 400.05y = 400.05 560 40 28×=-=12。

高鸿业版《西方经济学》(宏观部分)第十三章:简单国民收入决定.

用E代表支出,用Y代表收入。若支出<收入(需求<供给),则企业非意 愿存货投资IU>0 企业就要削减生产,若支出>收入(需求>供给),则企 业非意愿存货投资IU<0 企业就要扩大生产

E

直线上任意一点均为E=y

E

150

Y=c+s E=c+i

收入=100 100

利率变动对储蓄会产生替代效应与收入效应。得率引起的用 未来消费代替现期消费称为替代效应,利率引起的未来收入 的增加称为收入效应。

2、价格水平

这里指的是整体价格水平对消费的影响,而不是指个别商品 价格对消费的影响。如果消费者只注意到货币收入增加,而 忽弱了物价的上升,则会误以为实际收入增加,从而平均消 费倾向也会上升,这种现象称之为消费者的“货币幻觉” (Monetary illusion)。

5、流动资产

随着一个家庭拥有流动资产的增加,它增加流动资产的迫切 性递减,这样,拥有流动资产多的家庭其消费倾向要高于拥 有流动资产少的家庭。

6、减税政策

R·巴罗认为减税对消费并没有影响,因为减税并不会影响持 久收入,也就不会影响消费,人们只是把减税引起的收入增 加储蓄起来以支付以后的增税,只是增加了储蓄。但实证研 究表明:人们一般不重视未来增税,认为那是以后几代人的 事。

第十三章 简单国民收入决定理论

学习目的与要求 通过本章的学习,了解和掌握简单的国民收入决定的

基本概念、基本原理,为了解和掌握整个宏观经济学 的核心理论——国民收入决定论打下基础。 重点与难点 均衡产出、消费函数与国民收入、乘数理论

宏观经济学的内容体系 国民收入水平的决定分析 凯恩斯主义的全部理论涉及四个市场:产品、货币、

西方经济学 高鸿业第十三章 简单国民收入决定理论

生命周期假说的基本观点

依据的是微观经济学中消费者行为理论,使用边际分 析方法这一完善的工具。 1 消费者是具有理性的,能以合乎理性的方式使用自己 的收入。 2 唯一目标是实现效用最大化。 消费函数的基本形式: C=a· WR+c· YL WR是财产收入,是财产收入的边际消费倾向,是劳动收 入,是劳动收入中的编辑消费倾向。 消费取决于财产收入和劳动收入组成的总收入,不是现 期收入,而是一生的收入。

1 长期平均消费倾向是稳定的,而不是下降的。 2 边际消费倾向不是下降,而是上升了。

并非凯恩斯的专利——消费函数拓展 1 相对收入消费理论(J.S. Duesenberry)

美国经济学家J.杜森贝利在《收入、储蓄和消费者行为理 论》(哈佛大学出版社,1949年)中提出来的。

这种理论包括两个方面的含义:

APC=c/y

我国居民的收入与消费

年份 1978 1980 1985 1990 1991 收入 消费 APC 0.98 0.92 0.89 0.80 0.796 0.80 0.85 0.73 0.757 MPC

1544.0 1515.4 2246.6 2077.8 4674.8 4141.8

10176.9 11590.1

储蓄曲线

B点是储蓄曲线和横轴的 交点,表示这时的消费 与收入相等即收支平衡, B点往右有正储蓄,B点 往左有负储蓄,随着储 蓄曲线向右延伸它与横 轴的距离越来越大,表 示储蓄随收入而增加, 而且增加的幅度越来越 大。如图所示。

储蓄曲线

s B A 储蓄曲线 C y

o

线性储蓄函数

如果储蓄和收入的关系 呈线性关系即消费曲线 和储蓄曲线为一直线的 话,则,由于s=y-c 且c=α +β y,因此: s =y-c=y-( α + β y )=-α +(1- β )y。如图所示

高鸿业的宏观经济学学习讲义

试求:(1)、用定义法计算GDP; (2)、用生产法计算GDP; (3)、用支出法计算GDP; (4)、用收入法计算GDP。

第13章

国民收入核算习题课

1.设在一个经济中,新创造产品和劳务销售价格NDP=1000,政府税收T= 100,政府开支G=90,个人消费支出C=810;个人储蓄S=90,投资I=100。 试计算政府财政盈余,并表示出财政盈余与储蓄及投资的关系。 2.一个棉农一年生产1000元籽棉,他售给轧棉厂加工成1400元棉花,轧棉厂又 将这些棉花售给纺纱厂加工成棉纱… … 。根据下表分别计算总产值和总增加 值。并分析为什么不易用总产值来衡量一国的财富。

第六节

名义GDP和实际GDP

一、名义GDP和实际GDP的概念 名义GDP是指,用生产物品和劳务的当年价格计算的全部最终 产品的市场价值; 实际GDP是指,用从前某一年作为基期的价格计算出来的全部 最终产品的市场价值。 二、例题(参见教材P425) 三、若干常用字母的记号含义

典型习题

教材P429第9题:从下表资料中找出: ①国民收入;②国内生产净值;③国 内生产总值;④个人收入;⑤个人可支配收入;⑥个人储蓄。 求解提示: 此题中,政府和企业的转移支付是指政府 和企业都针对居民的转移支付,任何其它形式 的理解将不利于求解本问题。 注意,本题的求解和尹伯成的《宏观习题 指南》提供的解略有不同。 ①国民收入=雇员薪金+企业利息支付+ 个人租金收入+公司利润+非公司企业主收 入+社会保险税; ②国内生产净值=国民收入+间接税; ③国内生产总值=国内生产净值+折旧; ④个人收入=国民收入−(公司利润+社会 保险税)+政府支付利息+政府转移支付+红 利; ⑤个人可支配收入=个人收入−个人所得 税 ⑥个人储蓄=个人可支配收入−消费者支 付利息−个人消费支出。

宏观经济学,高鸿业第十三章ppt精选课件

ppt精选版

9

一、消费函数

凯恩斯的绝对收入假说 影响消费的因素很多,如收入、消费品价格、 消费者偏好、消费者预期、消费信贷、利率水 平等等。 其中最重要的是个人收入。 宏观经济学假定消费与收入水平存在着稳定函 数关系。

ppt精选版

10

一、消费函数

凯恩斯认为存在基本的心理规律:随着收入的 增加,消费也会增加,但消费的增加不如收入 的增加多。

Δy = Δc + Δs;

Δy/Δy = Δc/Δy +Δs/Δy

即: MPC + MPS = 1

ppt精选版

25

储蓄曲线

S4

3

2

10 12 14

Y

-1

ppt精选版

26

线形储蓄曲线

S4

3

2

S=-α+(1-β )y

1

0

6 8 10 12 14

Y

-1

线形储蓄曲线图

APS和MPS都随收入增加而递增,但APS<MPS

例越高,社会消费曲线向下移动。

ppt精选版

30

分析

据估算,美国的消费倾向大于中国的消费 倾向。请解释这一经济现象。

ppt精选版

31

主题内容

第一节 均衡产出 第二节 凯恩斯的消费理论 第三节 其他消费函数理论 第四节 两部门国民收入的决定 第五节 乘数论 第六节 三部门的收入决定及其乘数

ppt精选版

(3) MPC

0 .8 9 0 .8 5 0 .7 5 0 .6 4 0 .5 9 0 .5 3

(4) APC

1 .0 1 1 .0 0 0 .9 9 0 .9 7 0 .9 4 0 .9 2 0 .8 9

高鸿业《西方经济学(宏观部分)》第6版名校考研真题详解(国民收入的决定 收入—支出模型)【圣才出品】

高鸿业《西方经济学(宏观部分)》第6版名校考研真题详解第十三章国民收入的决定:收入—支出模型一、名词解释1.均衡产出(武汉大学2001研;中国政法大学2005研)答:均衡产出是指和总需求相一致的产出,也就是经济社会的收入正好等于全体居民和企业想要有的支出。

在两部门经济中,总需求由居民消费和企业投资构成,于是均衡产出可用公式表示为:y c i=+。

c、i分别代表计划消费、计划投资数量,而不是国民收入构成公式中实际发生的消费和投资。

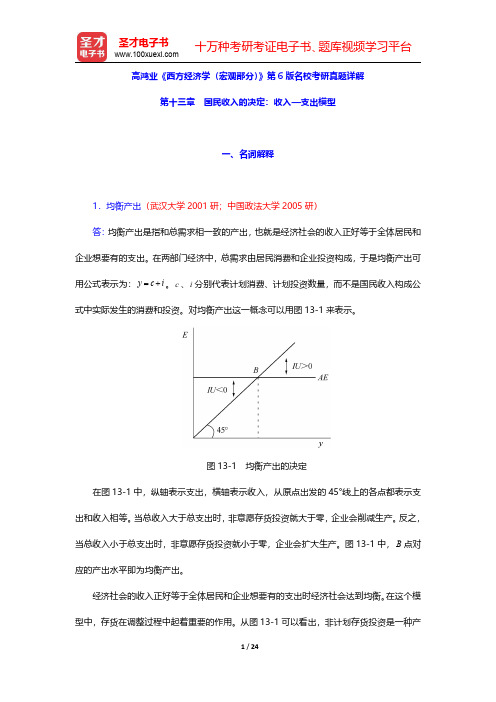

对均衡产出这一概念可以用图13-1来表示。

图13-1均衡产出的决定在图13-1中,纵轴表示支出,横轴表示收入,从原点出发的45°线上的各点都表示支出和收入相等。

当总收入大于总支出时,非意愿存货投资就大于零,企业会削减生产。

反之,当总收入小于总支出时,非意愿存货投资就小于零,企业会扩大生产。

图13-1中,B点对应的产出水平即为均衡产出。

经济社会的收入正好等于全体居民和企业想要有的支出时经济社会达到均衡。

在这个模型中,存货在调整过程中起着重要的作用。

从图13-1可以看出,非计划存货投资是一种产量调节机制,不是价格调节机制。

2.边际消费倾向(山东大学2001研;辽宁大学2002研;武汉大学2002研;中南财经政法大学2001、2010研;中南大学2004研;北京化工大学2006研;东北财经大学2006、2011研;财政部财政科学研究所2015研)答:边际消费倾向(marginal propensity to consume,简称为MPC )指增加1单位收入中用于增加消费部分的比率,其公式为:CMPC Y∆=∆式中,C ∆表示增加的消费,Y ∆表示增加的收入。

按照凯恩斯的观点,收入和消费之间存在着一条心理规律:随着收入的增加,消费也会增加,但消费的增加不及收入增加多。

因此,一般而言,边际消费倾向在0和1之间波动。

当消费函数为线性函数时,MPC β=。

可以看出,一般情况下,1MPC 0<<,即存在边际消费倾向递减规律。

(完整版)高鸿业《宏观经济学》课后习题答案第十三章习题答案

第十三章 简单国民收入决定理论1.在两部门经济中,均衡发生于( )之时。

A.实际储蓄等于实际投资; B.实际消费加实际投资等于产出值;C.计划储蓄等于计划投资;D.总投资等于企业部门的收入。

解答:C2.当消费函数为c =a +by(a>0,0<b<1),这表明,平均消费倾向( )。

A .大于边际消费倾向;B .小于边际消费倾向;C .等于边际消费倾向;D .以上三种情况都可能。

解答:A3.如果边际储蓄倾向为0.3,投资支出增加60亿元,这将导致均衡收入GDP 增加 ( )。

A . 20亿元;B . 60亿元;C . 180亿元;D . 200亿元。

解答:D4.在均衡产出水平上,是否计划存货投资和非计划存货投资都必然为零?解答:当处于均衡产出水平时,计划存货投资一般不为零,而非计划存货投资必然为零。

这是因为计划存货投资是计划投资的一部分,而均衡产出就是等于消费加计划投资的产出,因此计划存货不一定是零。

计划存货增加时,存货投资就大于零;计划存货减少时,存货投资就小于零。

需要指出的是,存货是存量,存货投资是流量,存货投资是指存货的变动。

在均衡产出水平上,计划存货投资是计划投资的一部分,它不一定是零,但是非计划存货投资一定是零,如果非计划存货投资不是零,那就不是均衡产出了。

比方说,企业错误估计了形势,超出市场需要而多生产了产品,就造成了非计划存货投资。

5.能否说边际消费倾向和平均消费倾向总是大于零而小于1?解答:消费倾向就是消费支出和收入的关系,又称消费函数。

消费支出和收入的关系可以从两个方面加以考察,一是考察消费支出变动量和收入变动量的关系,这就是边际消费倾向(可以用公式MPC =Δc Δy 或MPC =d c d y表示),二是考察一定收入水平上消费支出量和该收入量的关系,这就是平均消费倾向(可以用公式APC =c y表示)。

边际消费倾向总大于零而小于1,因为一般说来,消费者增加收入后,既不会不增加消费即MPC =Δc Δy=0,也不会把增加的收入全用于增加消费,一般情况是一部分用于增加消费,另一部分用于增加储蓄,即Δy=Δc +Δs ,因此,Δc Δy +Δs Δy =1,所以,Δc Δy =1-Δs Δy 。

高鸿业《西方经济学(宏观部分)》笔记和课后习题(含考研真题)详解(国民收入的决定:收入-支出模型)

第13章国民收入的决定:收入-支出模型13.1 复习笔记现代宏观经济学的奠基人凯恩斯的学说的中心内容就是国民收入决定理论。

凯恩斯主义的全部理论涉及四个市场:产品市场、货币市场、劳动市场和国际市场。

仅包括产品市场的理论称为简单国民收入决定理论。

一、均衡产出社会产出水平究竟由社会总需求还是由社会总供给能力决定,这实际上是从凯恩斯开始的现代宏观经济学与凯恩斯以前的古典和新古典传统经济学的分水岭。

在20世纪30年代经济大萧条的背景下(编者注:建议读者结合大萧条的背景来理解凯恩斯学说的理论体系),凯恩斯在名著《就业、利息和货币通论》一书中提出了生产和收入取决于总需求的理论。

1.短期分析假设前提(1)经济中存在着生产能力的闲置生产能力的闲置包括两层含义:①劳动力资源没有得到充分利用,即存在着失业;②厂房、机器等资本品没有得到充分利用,即存在着开工率不足。

(2)价格水平固定不变凯恩斯认为,在短期内,价格机制是一种僵化的、不易变动的机制,即存在价格刚性。

价格刚性表现为两个方面:①在劳动力市场,即使存在失业,工资也不会下降;②在产品市场,即使存在生产过剩,物价也不会下降。

(3)在既定的价格水平上,总供给是无限的在既定的价格水平上,总供给是无限的。

反映在图表上,体现为总供给曲线平行于横轴。

其经济含义为:由于存在资源闲置,在固定的价格水平下,要什么有什么,要多少有多少。

(4)由于总供给无限,所以均衡的国民收入由总需求单方面决定(总需求分析)在短期中,国民收入决定于总需求,这是凯恩斯经济学的一个基本原理。

产量由总需求决定,是就非充分就业状态而言的,而非充分就业是一种通常的状态。

2.均衡产出与非计划存货投资均衡产出是指和总需求相等的产出。

在两部门经济中,即经济中只有居民户和厂商(暂时不考虑政府部门和国外部门,在后面的章节会引入政府部门和国外部门),总需求由居民消费和企业投资构成,于是均衡产出可用公式表示为:y=c+i。

c、i分别代表计划消费、计划投资,而不是国民收入构成公式中实际发生的消费和投资。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

和 MPS 随收入增加而递增,但

APS MPS 。

(3) APC APS 1 , MPC MPS 1 。

图13-4

消费曲线和储蓄曲线的关系

4.家户消费函数和社会消费函数

社会消费函数并不是家户消费函数的简单加 总。从家户消费函数求取社会消费函数时,还要 考虑以下一系列限制条件: (1)国民收入的分配; (2)政府税收政策; (3)公司未分配利润在利润中所占比例。

图13-5 入

消费加投资曲线和45°线相交决定收

2.两部门经济中收入的决定——使用储蓄函

数决定收入

图13-6

储蓄曲线和投资曲线决定收入

第四节 乘数论

1.乘数的含义 乘数(Multiplier)是指每单位外生变量的 变化所带来的引致变量的变化情况。乘数的数学定 义为: 乘数=边际量= 因变量

自变量

m m0 y

将消费函数 c y t t 和进口函数 m m0 y

r

代入收入恒等式 y c i g x m 可得四部门经济 中的均衡收入为:

y 1 1

i g t tr +x m0

表13-1 某家庭消费函数

( 1) 收入

A 9000

( 2) 消费

9110

( 3) 边际消费倾向 (MPC)

0.89 0.85 0.75

( 4) 平均消费倾向 (APC) 1.01 1.00

0.99 0.97 0.94 0.92 0.89

B

C D E F G

10000

11000 12000 13000 14000 15000

税收乘数为负值,这表示收入随税收增加而 减少,随税收减少而增加。

3.政府转移支付乘数

政府转移支付乘数是指收入变动与引起这种 变动的政府转移支付变动的比率。 当税收为定量税时,政府转移支付乘数为:

ktr

1

政府转移支付乘数绝对值和税收乘数相同, 但符号相反。

4.平衡预算乘数

平衡预算乘数指政府收入和支出同时以相等 数量增加或减少时国民收入变动对政府收支变动 的比率。 假设政府购买支出和税收各增加同一数量即

图13-3

线性储蓄函数

边际储蓄倾向(MPS)指增加一单位收入中用

于增加储蓄部分的比率,即 MPS s 。当储蓄函数

y

为线性函数时,MPS 1 。 平均储蓄倾向( APS )指任一收入水平上储蓄 在收入中的比率,即

y

APS

y

函数时, APS 1 y 1 。

1.三部门经济宏观均衡的条件

加入政府部门后的均衡收入是计划的消费、 投资和政府购买之总和,同计划的消费、储蓄和 净税收之总和相等的收入,即:

ci g c st

整理得:

i g st

图13-8

三部门经济收入的决定

2.定量税变动的影响

图13-9

定量税变动改变s+t的截距

第六节 三部门经济中各种乘数

称为乘数。可以看出,边际

3.乘数的图解

图13-7

乘数的图形推导

第五节 三部门经济中国民收入的决定

三部门经济,即在两部门经济的基础上加入 政府部门,需考虑政府购买、税收和转移支付等 政府行为因素。 政府的收入主要来自税收,税收包括两种: 一种是定量税,税收量不随收入而变动;另一种 是比例所得税,税收量随收入的增加而增加。

g t 时,有:

y kg g kt t

k 所以, y 1。 g

1 g t g 1 1

b

第七节 四部门经济中国民收入的决定

1.四部门经济中的收入决定 四部门经济即在三部门的基础上加入净出口 一项。出口由外国的购买力和购买要求决定。进 口函数为:

c 于增加消费部分的比率,其公式为: 。当 MPC y

消费函数为线性函数时,MPC 。

图13-2

消费曲线

(2)平均消费倾向

平均消费倾向( APC )指任一收入水平上消 费支出在收入中的比率,其公式为 费函数为线性函数时,APC

y

APC

c y

。当消

,即平均消费倾

向总是大于边际消费倾向。

入是多少?

(4)投资乘数是多少?[中央财大2005研;暨 南大学2012研]

解:(1)由两部门经济产品市场均衡条件

Y CI

得:

Y 1000 0.8Y 1000

解得:均衡收入 Y * 10000 。 (2)当实际收入为12000时,消费为

C 1000 0.812000 10600 ,总需求为 C I 10600 1000 11600 ,

10000

10850 11600 12240 12830 13360

0.64

0.59 0.53

2.储蓄函数

储蓄函数是描述储蓄随收入变化而变化的函 数,用公式表示为 s s y 。当消费函数为线性函 数时,s y c y y 1 y 。

(2)政府削减数量为X的税收

(3)政府增加数量为X的开支,同时增加数 量为X的税收,以保持财政平衡。

请说明你的理由。[南开大学2012研]

答:三种政策中,政策(1)对总产出(总支

出)产生刺激效果最大,政策(2)和(3)哪个 最小取决于边际消费倾向与0.5的大小比较。分析 如下: (1)如果政府增加数量为 X 的开支,考虑定 量税情况下,结合乘数效应可得产出增加 其中 表示边际消费倾向。

y ci

图13-1 均衡产出的决定

3.投资等于储蓄

计划支出等于计划消费加投资,即 E c i ; 收入等于计划消费加计划储蓄,即 y c s ; 而 E y ,于是可得 i s。 需要注意的是,这里的投资等于储蓄,是指 经济要达到均衡,计划投资必须等于计划储蓄, 与前面的储蓄—投资恒等式是两回事。

第二节 凯恩斯的消费理论

1.消费函数 凯恩斯认为,存在一条基本心理规律:随着 收入的增加,消费也会增加,但消费的增加不及 收入增加得多,用公式表示为 c c y 。若消费与 Y 收入间存在线性关系,则可表示为:

c y

(1)边际消费倾向

边际消费倾向(MPC)指增加1单位收入中用

社会非自愿存货为12000-11600=400。由于总产出 大于总需求,存在社会非自愿存货,理性的厂商

会减少生产,因此总产出或总收入减少。

(3)投资增加400时,由两部门经济产品市

场均衡条件得:

Y 1000 0.8Y 1400

解得:均衡收入 Y * 12000 。 因此,若投资增加400,相应增加的均衡收入 为2000。 (4)投资乘数 k

2.四部门经济中的乘数

对外贸易乘数为:

dy 1 dx 1

对外贸易乘数小于封闭经济时的乘数,这主 要是由于增加的收入的一部分现在要用到进口商 品上去了。

13.3

名校考研真题详解

【例13.1】以下三种方式中,哪种方式对总 产出(总收入)产生的刺激效果最大?哪种方式 最小? (1)政府增加数量为X的开支

2.乘数理论推导

假设投资增量为 i ,则产出的增加量为:

y i i 2 i ... n 1i i 1 2 ... n 1 1 i 1

其中,倍数 消费倾向越大,乘数就越大。

1 1

第一节 均衡产出

1.假设条件

(1)假设所分析的经济中不存在政府,也不 存在对外贸易,只有家户部门和企业部门。 (2)假设不论需求量为多少,经济社会均能 以不变的价格提供相应的供给量。凯恩斯定律 (3)假设折旧和公司未分配利润为零。

2.均衡产出的概念

均衡产出又称为均衡国民收入,是和总需求 相一致的产出,即经济社会的总产出或总收入正 好等于全体居民和企业想要有的支出。 二部门经济中,均衡产出可用公式表示为:

第三节 两部门经济中国民收入的决定及变

动 1.两部门经济中收入的决定——使用消费函 数决定收入 将消费函数 c y 代入收入恒等式 y c i 可得均衡收入: y a i

1

表13-3 均衡收入的决定

c 1000 0.8 y 消费函数为:

(1)收入 3000 4000 5000 6000 7000 8000 9000 10000 (2)消费 3400 4200 5000 5800 6600 7400 8200 9000 (3)储蓄 -400 -200 0 200 400 600 800 1000 (4)投资 600 600 600 600 600 600 600 600

1.政府购买支出乘数 政府购买支出乘数是指收入变动对引起这种 变动的政府购买支出变动的比率。 征收定量税时,政府购买支出乘数为:

kg y 1 g 1

2.税收乘数

税收乘数是指收入变动对引起这种变动的税 收变动的比率。 当税收为定量税时,税收乘数为:

kt y t 1

s y

。当储蓄函数为线性

表13-2 某家户储蓄表

( 1) 收入 ( y) 9000 10000 11000 12000 ( 2) 消费 (c) 9110 10000 10850 11600 ( 3) 储蓄 ( s) -110 0 ( 4) 边际储蓄倾向 (MPS) 0.11 B C D 0 ( 5) 平均储蓄倾向 (APS) -0.01

1

,此时政策(3) ,此时政策(2)

1 ,此时政策(2) 效果最小;当 0.5 时, 1

效果最小;当 0.5 时, 和(3)效果一样。

1

1

【例13.2】假设,在一个只有家庭和企业的两