投资学精要英语(essenfial of investment )计算分析题

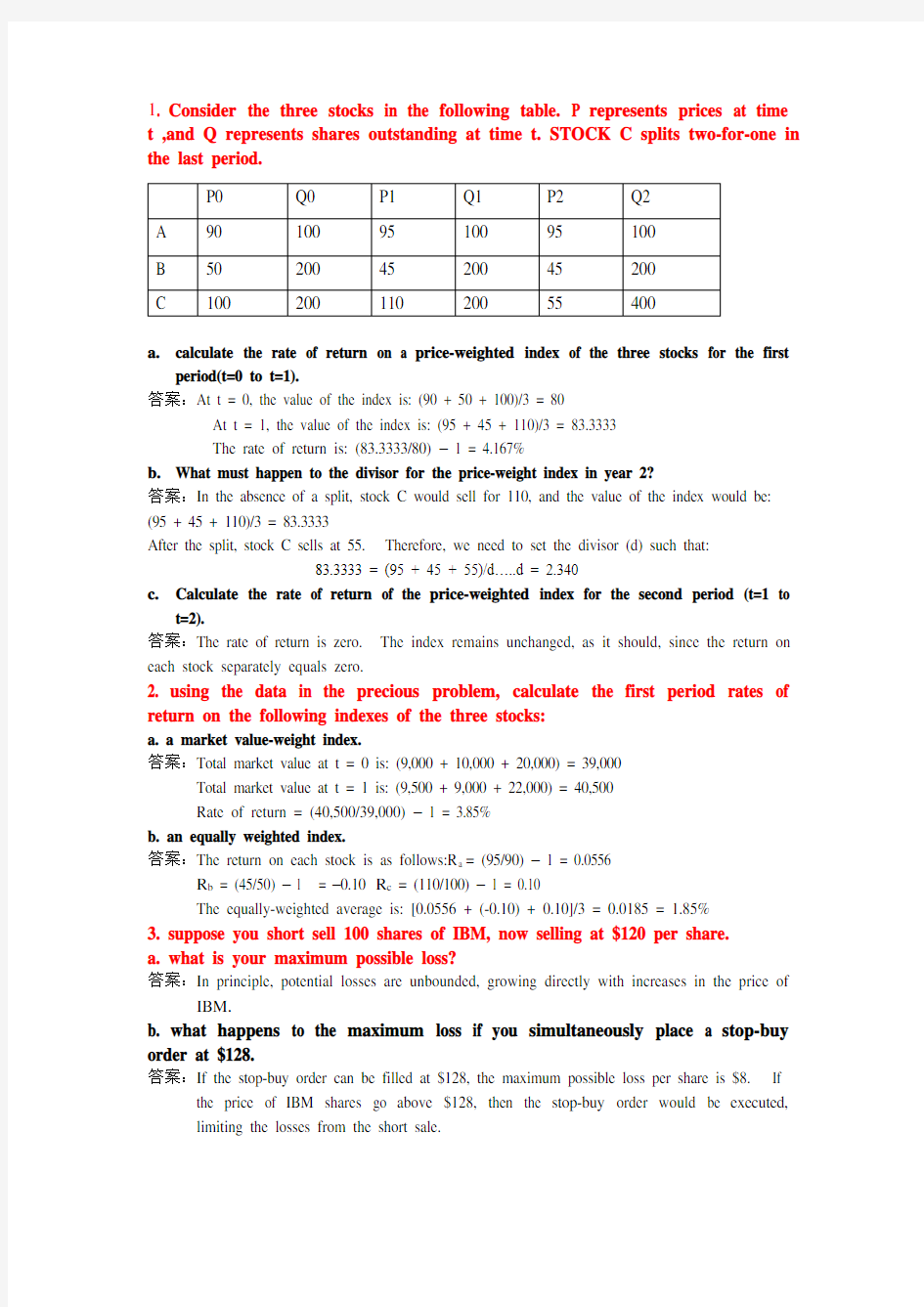

1. Consider the three stocks in the following table. P represents prices at time t ,and Q represents shares outstanding at time t. STOCK C splits two-for-one in the last period.

P0 Q0 P1 Q1 P2 Q2

A 90 100 95 100 95 100

B 50 200 45 200 45 200

C 100 200 110 200 55 400

a.calculate the rate of return on a price-weighted index of the three stocks for the first

period(t=0 to t=1).

答案:At t = 0, the value of the index is: (90 + 50 + 100)/3 = 80

At t = 1, the value of the index is: (95 + 45 + 110)/3 = 83.3333

The rate of return is: (83.3333/80) – 1 = 4.167%

b.What must happen to the divisor for the price-weight index in year 2?

答案:In the absence of a split, stock C would sell for 110, and the value of the index would be: (95 + 45 + 110)/3 = 83.3333

After the split, stock C sells at 55. Therefore, we need to set the divisor (d) such that:

83.3333 = (95 + 45 + 55)/d…..d = 2.340

c.Calculate the rate of return of the price-weighted index for the second period (t=1 to

t=2).

答案:The rate of return is zero. The index remains unchanged, as it should, since the return on each stock separately equals zero.

2. using the data in the precious problem, calculate the first period rates of return on the following indexes of the three stocks:

a. a market value-weight index.

答案:Total market value at t = 0 is: (9,000 + 10,000 + 20,000) = 39,000

Total market value at t = 1 is: (9,500 + 9,000 + 22,000) = 40,500

Rate of return = (40,500/39,000) – 1 = 3.85%

b. an equally weighted index.

答案:The return on each stock is as follows:R a = (95/90) – 1 = 0.0556

R b = (45/50) – 1 = –0.10 R c = (110/100) – 1 = 0.10

The equally-weighted average is: [0.0556 + (-0.10) + 0.10]/3 = 0.0185 = 1.85%

3. suppose you short sell 100 shares of IBM, now selling at $120 per share.

a. what is your maximum possible loss?

答案:In principle, potential losses are unbounded, growing directly with increases in the price of IBM.

b. what happens to the maximum loss if you simultaneously place a stop-buy order at $128.

答案:If the stop-buy order can be filled at $128, the maximum possible loss per share is $8. If the price of IBM shares go above $128, then the stop-buy order would be executed, limiting the losses from the short sale.

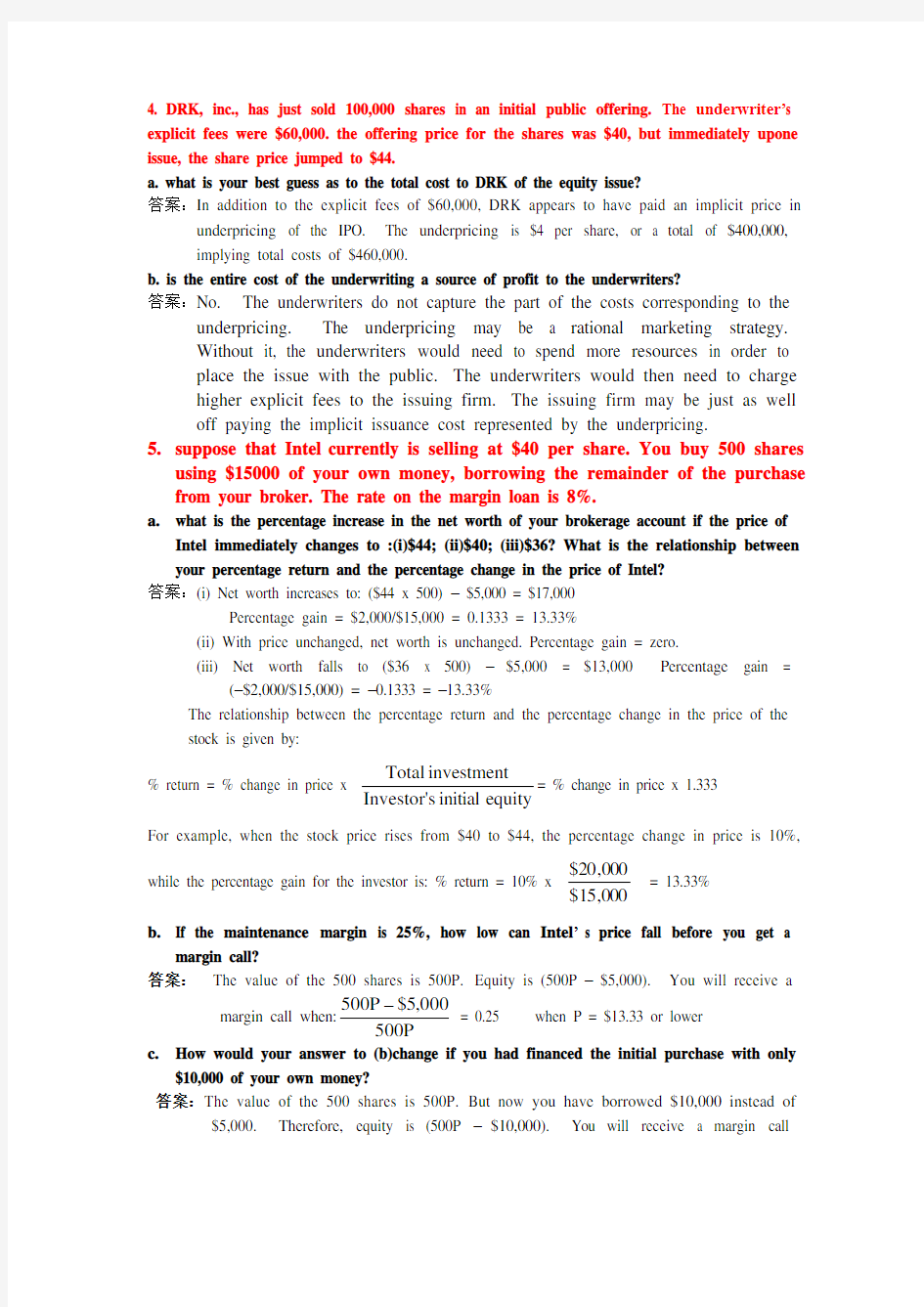

4. DRK, inc., has just sold 100,000 shares in an initial public offering. The underwriter’s explicit fees were $60,000. the offering price for the shares was $40, but immediately upone issue, the share price jumped to $44.

a. what is your best guess as to the total cost to DRK of the equity issue?

答案:In addition to the explicit fees of $60,000, DRK appears to have paid an implicit price in

underpricing of the IPO. The underpricing is $4 per share, or a total of $400,000, implying total costs of $460,000.

b. is the entire cost of the underwriting a source of profit to the underwriters?

答案:No. The underwriters do not capture the part of the costs corresponding to the

underpricing. The underpricing may be a rational marketing strategy. Without it, the underwriters would need to spend more resources in order to place the issue with the public. The underwriters would then need to charge higher explicit fees to the issuing firm. The issuing firm may be just as well off paying the implicit issuance cost represented by the underpricing.

5. suppose that Intel currently is selling at $40 per share. You buy 500 shares

using $15000 of your own money, borrowing the remainder of the purchase from your broker. The rate on the margin loan is 8%.

a. what is the percentage increase in the net worth of your brokerage account if the price of

Intel immediately changes to :(i)$44; (ii)$40; (iii)$36? What is the relationship between your percentage return and the percentage change in the price of Intel?

答案:(i) Net worth increases to: ($44 x 500) – $5,000 = $17,000

Percentage gain = $2,000/$15,000 = 0.1333 = 13.33%

(ii) With price unchanged, net worth is unchanged. Percentage gain = zero.

(iii) Net worth falls to ($36 x 500) – $5,000 = $13,000 Percentage gain =

(–$2,000/$15,000) = –0.1333 = –13.33%

The relationship between the percentage return and the percentage change in the price of the stock is given by: % return = % change in price x equity

initial s Investor'investment T otal = % change in price x 1.333 For example, when the stock price rises from $40 to $44, the percentage change in price is 10%, while the percentage gain for the investor is: % return = 10% x 000

,15$000,20$ = 13.33% b. If the maintenance margin is 25%, how low can Intel ’ s price fall before you get a

margin call?

答案: The value of the 500 shares is 500P. Equity is (500P – $5,000). You will receive a margin call when:P

500000,5$P 500 = 0.25 when P = $13.33 or lower c. How would your answer to (b)change if you had financed the initial purchase with only

$10,000 of your own money?

答案:The value of the 500 shares is 500P. But now you have borrowed $10,000 instead of

$5,000. Therefore, equity is (500P – $10,000). You will receive a margin call

when:P

500000,10$P 500- = 0.25 when P = $26.67 With less equity in the account, you are far more vulnerable to a margin call.

d. What is the rate of return on your margined position (assuming again that you invest

$15,000 of your own money) if Intel is selling after on year at : (i) $44.; (ii) $40; (iii) $36? What is the relationship between your percentage return and the percentage change in the price of Intel? Assume that Intel pays no dividends.

答案: By the end of the year, the amount of the loan owed to the broker grows to:$5,000 x

1.08 = $5,400

The equity in your account is (500P – $5,400). Initial equity was $15,000. Therefore, your rate of return after one year is as follows:

(i )000

,15$000,15$400,5$)44$500(--?= 0.1067 = 10.67% (ii) 000

,15$000,15$400,5$)40$500(--?= –0.0267 = –2.67% (iii)

000,15$000,15$400,5$)36$500(--?= –0.1600 = –16.00% The relationship between the percentage return and the percentage change in the price of Intel is given by:

% return = ???? ???equity init ial s Investor'investment T otal price in change %???

? ???-equity initial s Investor'borrowed Funds %8 For example, when the stock price rises from $40 to $44, the percentage change in price is 10%, while the percentage gain for the investor is:??? ??

?000,15$000,20$%10??

? ???-000,15$000,5$%8=10.67% e. Continue to assume that a year has passed. How low can Intel ’s price fall before you get

a margin call?

答案:The value of the 500 shares is 500P. Equity is (500P – $5,400). You will receive a margin call when:

P

500400,5$P 500- = 0.25 when P = $14.40 or lower . 6. suppose that you sell short 500 shares of intel , currently selling for $40 per

share, and give your broker $ 15,000 to establish your margin account. a. if you earn no interest on the funds in your margin account , what will be your rate of

return after one year if Intel stock is selling at: (i) $44.; (ii) $40; (iii) $36? Assume that Intel pays no dividends.

答案:The gain or loss on the short position is: (–500 P)Invested funds = $15,000

Therefore: rate of return = (–500 P)/15,000

The rate of return in each of the three scenarios is:

(i) rate of return = (–500 $)/$15,000 = –0.1333 = –13.33%

(ii) rate of return = (–500$)/$15,000 = 0%

(iii) rate of return = [–500 (–$4)]/$15,000 = +0.1333 = +13.33%

Total assets in the margin account are $20,000 (from the sale of the stock) + $15,000 (the initial margin) = $35,000. Liabilities are 500P. A margin call will be issued when:= 0.25 when P = $56 or higher

b.If the maintenance margin is 25%, how high can Intel’s price rise before you get a

margin call?

答案:With a $1 dividend, the short position must now pay on the borrowed shares: ($1/share 500 shares) = $500. Rate of return is now:

[(–500P) – 500]/15,000

(i) rate of return =[(–500 $4) – $500]/$15,000 = –0.1667 = –16.67%

(ii) rate of return = [(–500 $0) – $500]/$15,000 = –0.0333 = –3.33%

(iii) rate of return = [(–500) (–$4) – $500]/$15,000 = +0.1000 = +10.00%

Total assets are $35,000, and liabilities are (500P + 500). A margin call will be issued when: = 0.25 when P = $55.20 or higher

7.waht are some differences between hedge funds and mutual funds?

答案:Hedge funds have much less regulation since they are part of private partnerships and free from mist SEC regulation. They permit investors to take on many risks unavailable to mutual funds. Hedge funds, however, may require higher fees and provide less transparency to investors. This offers significant counter party risk and hedge fund investors need to be more careful about the firm the invest with.

8.city street fund has a portfolio of $ 450 million , and liabilities of $ 10 millon.

a.if there are 44 million shares outstanding, what is net asset value?

答案:(450,000,000 – 10,000,000) / 44,000,000 = $10 per share

b.If a large investor redeems 1 million shares, what happens to the portfolio value, to

shares outstanding, and to NA V?

答案:(440,000,000 – 10,000,000) / 43,000,000 = $10 per share

9. a. Impressive fund had excellent investment performance last year, with portfolio returns that placed it in the top 10% of all funds with the same investment policy. Do you expect it to be a top performer next year? Why or why not?

答案:Empirical research indicates that past performance of mutual funds is not highly predictive of future performance, especially for better-performing funds. While there

may be some tendency for the fund to be an above average performer next year, it is

unlikely to once again be a top 10% performer.

b. Suppose instead that the fund was among the poorest performers in its comparison group. Would you be more or less likely to believe its relative performance will persist into the following year? Why ?

答案:On the other hand, the evidence is more suggestive of a tendency for poor performance to persist. This tendency is probably related to fund costs and turnover rates. Thus

if the fund is among the poorest performers, investors would be concerned that the

poor performance will persist.

10. Unlike other investors, you believe the Fed is going to dramatically loosen

monetary policy. What would be your recommendations about investments in the following industries ? a. gold mining b. construction

答案:a. Gold Mining. Gold is traditionally viewed as a hedge against inflation.

Expansionary monetary policy may lead to increased inflation, and could thus

enhance the value of gold mining stocks.

b. Construction. Expansionary monetary policy will lead to lower interest rates which

ought to stimulate housing demand. The construction industry should benefit. 11. here are four industries and four forecasts for the macroeconomy. Choose

the industry that you would expect to perform best in each scenario.

Industries: housing construction , health care , gold mining,, steel production.

Economic Forecasts: Deep recession: Falling inflation, falling interest rates, falling GDP. Superheated economy: Rapidly rising GDP, increasing inflation and interest rates.

Healthy expansion: Rising GDP, mild inflation, low unemployment. Stagflation: Falling GDP, high inflation.

答案:

Deep recession Health care (non-cyclical)

Superheated economy Steel production (cyclical)

Healthy expansion Housing construction (cyclical, but interest rate sensitive) Stagflation Gold mining (counter cyclical)

最后那两个大题的大表格什么的我就不打了,这个答案直接复制上来了,那么明显的大表格一下就能知道哪道题了哈!

第十二章课后CFA Problems中的2。

a. The concept of an industrial life cycle refers to the tendency of most industries to go

through various stages of growth. The rate of growth, the competitive environment,

profit margins and pricing strategies tend to shift as an industry moves from one stage

to the next, although it is usually difficult to pinpoint exactly when one stage has

ended and the next begun.

The start-up stage is characterized by perceptions of a large potential market and by high optimism for potential profits. In this stage, however, there is

usually a high failure rate. In the second stage, often called rapid growth

or consolidation, growth is high and accelerating, markets broaden, unit

costs decline and quality improves. In this stage, industry leaders begin

to emerge. The third stage, usually called the maturity stage, is

characterized by decelerating growth caused by such things as maturing

markets and/or competitive inroads by other products. Finally, an

industry reaches a stage of relative decline, in which sales slow or even

decline.

Product pricing, profitability and industry competitive structure often vary by phase.

Thus, for example, the first phase usually encompasses high product prices, high costs (R&D, marketing, etc.) and a (temporary) monopolistic industry structure. In phase two (consolidation stage), new entrants begin to appear and costs fall rapidly due to the learning curve. Prices generally do not fall as rapidly, however, allowing profit margins to increase. In phase three (maturity stage), growth begins to slow as the product or service begins to saturate the market, and margins are eroded by significant price

reductions. In the final stage, cumulative industry production is so high that production

costs have stopped declining, profit margins are thin (assuming competition exists), and

the fate of the industry depends on the extent of replacement demand and the existence of

substitute products/services.

b. The passenger car business in the United States has probably entered the final stage in the

industrial life cycle because normalized growth is quite low. The information

processing business, on the other hand, is undoubtedly earlier in the cycle.

Depending on whether or not growth is still accelerating, it is either in the second or

third stage.

c. Cars: In the final phases of the life cycle, demand tends to be price sensitive. Thus,

Universal can not raise prices without losing volume. Moreover, given the industry’s

maturity, cost structures are likely to be similar for all competitors, and any price cuts can

be match ed immediately. Thus, Universal’s car business is boxed in: Product pricing is

determined by the market, and the company is a “price-taker.”

Idata: Idata should have much more pricing flexibility given that it is in an earlier phase

of the industrial life cycle. Demand is growing faster than supply, and, depending on the

presence and/or actions of an industry leader, Idata may price high in order to maximize

current profits and generate cash for product development, or price low in an effort to

gain market share.

第十二章课后CFA Problems中的4。

a. ?The industry-wide ROE is leveling off, indicating that the industry

may be approaching a later stage of the life cycle.

?Average P/E ratios are declining, suggesting that investors are

becoming less optimistic about growth prospects.

?Dividend payout is increasing, suggesting that the firm sees less reason to reinvest earnings in the firm. There may be fewer growth opportunities in the

industry.

?Industry dividend yield is also increasing, even though market dividend yield is decreasing.

b. ?Industry growth rate is still forecast at 10 - 15%, higher than would be true of a

mature industry.

?Non-U.S. markets are still untapped, and some firms are now entering these markets.

?Mail order sale segment is growing at 40% a year.

?Niche markets are continuing to develop.

?New manufacturers continue to enter the market.

国际贸易实务计算题及答案

班轮运费的构成=基本运费+附加运费即F=Fb+S 15.某企业出口柴油机一批,共15箱,总毛重为5.65公吨,总体积为10.676立方米。由青岛装船,经香港转船至苏丹港,试计算该企业应付船公司运费多少? 1.查阅货物分级表:Diesel Engine:10级W/M; 2.查阅中国--香港航线费率表:10级货从青岛运至香港费率为22美元,中转费13美元; 3.查阅香港--红海航线费率表:10级货从香港到苏丹港费率为95美元, 4.查阅附加费率表:苏丹港要收港口拥挤附加费,费率为基本运费的10%。 计算10.676×(22+13+95+95×10%)=10.676×139.5 = 1489.302美元 16.我国大连运往某港口一批货物,计收运费标准W/M,共200箱,每箱毛重25公斤,每箱体积长49厘米,宽32厘米,高19厘米,基本运费率每运费吨60美元,特殊燃油附加费5%,港口拥挤费为10%,试计算200箱应付多少运费? 解:W = 0.025MT M =0 .49 x0.32 x0.19 = 0.03 M>W 因此尺码吨是运费吨 每箱运费=运费吨X基本费率(1+附加费率) = 0.03 X USD60 (1+15%) = USD2.07 总运费= 200箱X USD2.07 = USD414 18.出口某商品10公吨,箱装,每箱毛重25公斤,体积20厘米*30厘米*40厘米,查表知该货为8级,记费标准为W/M,每运费吨运费80美元,另征收转船附加费20%,燃油附加费10%,计算该批商品的运费。 解:M(0.3x0.2x0.4 = 0.024) < W(0.025) 因此,重量吨是运费吨. 每箱运费=运费吨X基本费率(1+附加费率) = 0.025 X USD80(1+20%+10%) = USD2.6 箱数=总重量/每箱重量

国际贸易理论与实务_计算题

国际贸易理论与实务计算题 一、佣金与折扣的计算 1.我出口某商品,报价为CFR新加坡每公吨1800美元,现客户要求报价中含3%的佣金,为使净收入不减少,应改报多少? 2.以每箱25美元CIF汉堡价出口某商品1500箱,含3%的佣金。我方应向中间商支付多少佣金?如果中间商要求增加2%的佣金,试问我方在不影响净收入的前提下给佣5%的报价应为多少? 1.解:含佣价= 净价/(1 –佣金率) CFRC3%=1800/(1–3%) =1855.67(美元) 答:为使净收入不减少,我方改报价应为CFRC3%新加坡每公吨1855.67美元。 2.解:佣金=含佣价×佣金率 =25×3%×1500 =1125(美元) CIFC5%=CIFC3%×(1–3%)/(1–5%) =25×(1–3%)/(1–5%) =25.53(美元) 答:我方应向中间商支付1125美元佣金。在不影响净收入的前提下,我方给佣5%的报价应为每箱25.53美元。 3.一出口公司与国外某中间商达成一笔交易,约定我方以每公吨260

美元CFRC2%汉堡价出口某商品70公吨。海运运费为每公吨12美元。收汇后出口公司向国外中间商汇付佣金。 计算:(1)该出口公司向中国银行购买支付佣金的美元共需多少人民币? 3.(1)解:佣金=含佣价×佣金率 =260×2%×70×8.2685 =3009.73(元人民币) 答:该出口公司向中国银行购买支付佣金的美元共需3009.73元人民币。 4.我向国外某客户发盘,报价为每千克150美元CFR鹿特丹,对方回电要求我改报FOB中国口岸价,并含5%佣金。经查:自中国口岸至鹿特丹的运费为每千克1.05美元,我方如要保持外汇净收入不变,按买方要求应报何价? 5.我向外报价某商品每公吨1800美元FOB大连,对方要求改报CFRC5纽约价,已知大连至纽约的运费为每公吨17美元,应改报何价才能保证净收入不变?(佣金按FOB净价计支) 6.我方向外商的报价为每公吨600美元CFR新加坡,含2%的折扣,成交数量为300公吨,计算我方扣除折扣后的总收入是多少?4.解:FOB净价=CFR–运费=150–1. 05=148.95(美元)FOBC5%=FOB净价/(1–5%)=148.95/(1–5%)=156.79(美元) 答:按买方要求我方报价应为FOBC5%中国口岸每千克156.79

国际贸易实务计算题及答案

35道国际贸易实务计算题及答案 (1)公量计重 主要用于少数经济价值较高而水分含量极不稳定的商品,如羊毛、生丝、棉花等。 公量= 干量+ 标准水分量 =实际重量×(1+ 标准回潮率)/(1 + 实际回潮率) 公量的计算公式: 公量=商品干净重×(1+公定回潮率)=商品净重×(1+公定回潮率) /(1+实际回潮率) 实际回潮率=实际含水量/干重 注:干量=商品干净重=干重商品净重=实际重量公定回潮率=标准回潮率 公量的计算 1.例题:内蒙古某出口公司向韩国出口10公吨羊毛,标准回潮率为11%,经抽样证明10公斤纯羊毛用科学方法抽干水后净重8公斤干羊毛,求用公量计算的交货重量为多少? 实际回潮率=水分/干量=(10-8)/8*100%=25% 公量=实际重量×(1+ 标准回潮率)/(1 + 实际回潮率)=10(1+11%)/(1+25%)=8.88(公吨) 答:该批生丝的公量为8.88公吨。净剩的8公吨为干量, 公量=干量×(1+公定回潮率)=8 ×(1+11%) =8.88(公吨) 答:该批生丝的公量为8.88公吨。 2.、一批出口货物做CFR价为250000美元,现客户要求改报CIF价加20%投保海运一切险,我方同意照办,如保险费率为0.6%时,我方应向客户报价多少? 解:CIF=CFR+保险费 保险费=保险金额×保险费率=CIF×(1+20%)×0.6% CIF=CFR+CIF×(1+20%)×0.6% CIF=CFR÷(1-120%×0.6%)=250000÷0.9928=251813.05美元 答:我方应报价251813.05美元 3.、一批出口货CFR价为1980美元,现客户来电要求按CIF价加20%投保海上一切险,我方照办,如保险费率为2%时,我方应向客户补收保险费若干? 解:CIF价=CFR价/[1-(1+投保加成率)×保险费率] 保险费=保险金额×保险费率=CIF价×(1+投保加成率)×保险费率,所以 保险费=CFR价×(1+投保加成率)×保险费率/[1-(1+投保加成率)×保险费率] =1980×(1+20%)×2%/(1-120%×2%)=48.69(美元) 取整保险费应为49美元。 4、某公司出口商品1000箱,每箱人民币收购价100元,国内费用为收购价的15%,出口后每箱可退税7元人民币,外销价每箱19美元CFR曼谷,每箱货应付海运费1.2美元,计算该商品的换汇成本。(保留两位小数) 解:每箱货物出口总成本=100×(1+15%)-7=108元人民币 每箱货物出口销售外汇净收入=19-1.2=17.8美元 换汇成本=108/17.80=6.07元人民币/美元 5. 例1:出口健身椅(Sit-up Bench)1000只,出口价:每只1 6.57美元CIF纽约,CIF总价16570美元,其中运费2160美元、保险费112美元。进价每只人民币117元,共计人民币117000元(含增值税17%),

计算机专业英语作文

计算机专业英语 系别:数学系 班级:11级计算机二班姓名:徐小凤学号:110312248

Robot Competition From 11th to 13th October 2013, these three days are special for my teammates and me. I took part in the fifth Robot Competition of Anhui province. After continuous efforts, we got the third prize in the end. In April 2013, this competition was announced in our class by Mr He. In that moment, many students registered for the competition. After hardly training, there were only fifteen students remaining. We were divided into five teams. Each included three people. There were three teams taking part in wheel type robot competition (or named intelligent car). And the other two majored in dancing robot. My two roommates and I engaged in the designing of robot dance. We controlled the robots by program. But the program was programmed in BASIC, which is a high level programming language. The problem was that we had never touched to that language besides C or C++. So, we must learn the language before designing the action. It seemed difficult but we had never lost our courage. After seeking enough data from the Internet and the library, we spent about a few weeks to learn it. When we felt the fundamental grammar was easy, we began to design the dancing action. That was the most important and most difficult part. We spent much time on

国际贸易理论与实务计算题

国际贸易理论与实务计算题一、佣金与折扣的计算 1.我出口某商品,报价为 CFR 新加坡每公吨 1800 美元,现客户要求报价中含 3%的佣金,为使净收入不减少,应改报多少? 2.以每箱 25美元 CIF汉堡价出口某商品 1500箱,含3%的佣金。我方应向中间商支付多少佣金?如果中间商要求增加2%的佣金,试问我方在不影响净收入的前提下给佣 5%的报价应为多少?1.解:含佣价 = 净价/(1 –佣金率) CFRC3%=1800/(1–3%) =1855.67(美元)答:为使净收入不减少,我方改报价应为 CFRC3%新加坡每公吨 1855.67 美元。2.解:佣金 =含佣价×佣金率 =25×3%×1500 =1125(美元) CIFC5%=CIFC3%×(1–3%)/(1–5%) =25×( 1–3%) /(1–5%) =25.53(美元) 答:我方应向中间商支付 1125美元佣金。在不影响净收入的前提下,我方给佣 5%的报价应为每箱 25.53 美元。3.一出口公司与国外某中间商达成一笔交易,约定我方以每公吨 260 美元 CFRC2%汉堡价出口某商品 70 公吨。海运运费为每公吨 12 美元。收汇后出口公司向国外中间商汇付佣金。

计算:(1)该出口公司向中国银行购买支付佣金的美元共需多少人民币? 3.(1)解:佣金 =含佣价×佣金率 =260×2%×70×8.2685 =3009.73(元人民币)答:该出口公司向中国银行购买支付佣金的美元共需 3009.73 元人民币。 4.我向国外某客户发盘,报价为每千克 150美元 CFR鹿特丹,对方回电要求我改报 FOB 中国口岸价,并含 5%佣金。经查:自中国口岸至鹿特丹的运费为每千克 1.05 美元,我方如要保持外汇净收入不变,按买方要求应报何价? 5.我向外报价某商品每公吨 1800 美元 FOB 大连,对方要求改报 CFRC5纽约价,已知大连至纽约的运费为每公吨 17 美元,应改报何价才能保证净收入不变?(佣金按 FOB 净价计支) 6.我方向外商的报价为每公吨 600美元 CFR新加坡,含2%的折扣,成交数量为 300 公吨,计算我方扣除折扣后的总收入是多少? 4.解: FOB净价=CFR–运费=150–1. 05=148. 95(美元) FOBC5%=FOB 净价/( 1–5%)=148. 95/( 1–5%)=156. 79(美元) 答:按买方要求我方报价应为 FOBC5%中国口岸每千克 156. 79

国际贸易实务计算题及答案

35道国际贸易实务计算题及答案(1) 公量计重 主要用于少数经济价值较高而水分含量极不稳定的商品,如羊毛、生丝、棉花等。 公量=干量+标准水分量 =实际重量×(1+标准回潮率)/(1 +实际回潮率) 公量的计算公式: 公量=商品干净重×(1+公定回潮率)=商品净重×(1+公定回潮率) /(1+实际回潮率) 实际回潮率=实际含水量/干重 注:干量=商品干净重=干重商品净重=实际重量公定回潮率=标准回潮率 公量的计算 1.例题:内蒙古某出口公司向韩国出口10公吨羊毛,标准回潮率为11%,经抽样证明10公斤纯羊毛用科学方法抽干水后净重8公斤干羊毛,求用公量计算的交货重量为多少 <解答1 > 实际回潮率=水分/干量=(10-8)/8*100%=25% 公量=实际重量×(1+标准回潮率)/(1 +实际回潮率)=10(1+11%)/(1+25%)=(公吨) 答:该批生丝的公量为公吨。 <解答2 > 净剩的8公吨为干量, 公量=干量×(1+公定回潮率) =8×(1+11%) =(公吨) 答:该批生丝的公量为公吨。

2.、一批出口货物做CFR价为250000美元,现客户要求改报CIF价加20%投保海运一切险,我方同意照办,如保险费率为%时,我方应向客户报价多少解:CIF=CFR+保险费 保险费=保险金额×保险费率 =CIF×(1+20%)×% CIF=CFR+CIF×(1+20%)×% CIF=CFR÷(1-120%×%) =250000÷ =美元 答:我方应报价美元 3.、一批出口货CFR价为1980美元,现客户来电要求按CIF价加20%投保海上一切险,我方照办,如保险费率为2%时,我方应向客户补收保险费若干 解:CIF价=CFR价/[1-(1+投保加成率)×保险费率] 保险费=保险金额×保险费率=CIF价×(1+投保加成率)×保险费率,所以 保险费=CFR价×(1+投保加成率)×保险费率/[1-(1+投保加成率)×保险费率]=1980×(1+20%)×2%/(1-120%×2%)=(美元) 取整保险费应为49美元。 4、某公司出口商品1000箱,每箱人民币收购价100元,国内费用为收购价的15%,出口后每箱可退税7元人民币,外销价每箱19美元CFR曼谷,每箱货应付海运费美元,计算该商品的换汇成本。(保留两位小数) 解:每箱货物出口总成本=100×(1+15%)-7=108元人民币 每箱货物出口销售外汇净收入 ==美元 换汇成本 =108/=元人民币/美元 5. 例1:出口健身椅(Sit-up Bench)1000只,出口价:每只美元CIF纽约,CIF总价16570美元,其中运费2160美元、保险费112美元。进价每只人民币117元,共计人民币117000元(含增值税17%),费用定额率10%,出口退税率14%。当时银行外汇(美元)买入价为元。

计算机专业英语报告

1.英语学术论文的语言风格特点就(知人方能论世) 为什么我们会读不懂SCI上面的文章呢? 第一,由于SCI里面出现的专业词汇一般都是出现在特定领域,一类是一词对应于一意,另外一类则是一词多义。 其次,名词化结构则是另外另外一个普遍出现的现象,可以看到,复合名词,加前缀和后缀,以及省略现象可谓是漫山遍野,因为文体要求行文简洁、表达客观、内容确切、信息量大、强调存在的事实,一般文章不会夹杂着太多主观看法。 最后,大量使用长句和定语从句SCI论文发表中大量使用长句和定语从句,在论证上起到连接信息和强调信息的作用。广泛使用被动语态SCI论文发表中侧重叙事推理,强调客观准确,第一、二人称使用过多,会造成主观臆断的印象。因此尽量使用第三人称叙述,采用被动语态。名词作定语和缩写词使用频繁SCI论文发表中要求结构紧凑、行文简炼,缩写词和名词作定语的频繁使用,增大了信息密度,简化了句型。 如果我们能逆向思维,转换个角度去看文章,如果你要发表一篇SCI论文,你会怎么去构造你的行为,你如何组织你文章的逻辑,特别是用词方面,口语和一些狸语在一般

情况不应该出现在文章中。还有些中式英语也会极大地影响我们的阅读,例如说足球比赛,可不是我们想象中的football match (之前有次演讲说,英语里面不能有2个名词的情况,在此就举了个例子bicycle man),而应该做football play亦作soccer play。 2.翻译是一门艺术,从某种意义上来讲是没有标准答案的。 这里本人想要想要阐述这样一种观点,翻译是一个不断精进的过程,翻译最初的目的即是为了实现语言之间的一个互相沟通,然而不同的人对一句话,应该会有着不同的理解。这也就有了译者极大的自由发挥性,但是译者必须准确理解原文的基础之上的。 有三个字可以高度概括翻译的精髓“信,达,雅”,想必大家都应该听过。”“信”指意义不背原文,即是译文要准确,不歪曲,不遗漏,也不要随意增减意思;同样可以举个例子?This is a pan in my hand (请问如何翻译呢?) “达”指不拘泥于原文形式,译文通顺明白;这里就涉及到一个直译和意译的关系啦,否则就会出现像bicycle

《国际贸易理论与实务》计算题精选

《国际贸易理论与实务》计算题精选 一、计算对外贸易依存度 1、某国2007年的外贸出口总额为120亿美元,进口总额为100亿美元,该国GDP总额为400亿美元。试计算2007年该国的对外贸易依存度。(计算结果保留两位小数) 2、某国某年的国内生产总值(GDP)为26416亿美元,贸易出口额为9689亿美元,贸易进口额为7915亿美元。计算该国该年的对外贸易依存度。(计算结果保留到百分数的整数位) 3、2006年,中国的出口额是1万亿美元,进口额是8千亿美元,中国的GDP是21万亿元人民币,全年的平均汇率是7.6人民币元/美元,试计算2006年中国的对外贸易系数(对外贸易依存度)。(计算结果保留整数) 二、计算贸易结构 1、2006年,中国的外贸货物贸易额是1.82万亿美元,中国的外贸服务贸易额是0.18万亿美元,试计算2006年在中国对外贸易中,货物贸易与服务贸易的结构(百分比重)。 2、2006年,中国进出口商品总额为1.8万亿美元,其中农产品、矿产品等初级产品为3.6千亿美元,零部件、工业原材料等中间产品为6.4千亿美元,最终制成品为8.0千亿美元,试计算2006年在中国对外贸易中,初级产品、中间产品、最终制成品的结构(各自的百分比重)。(计算结果保留到整数) 三、计算贸易条件 1、假定某国以2000年为基期,2006年的出口商品价格指数为103%,进口商品价格指数为124%,出口商品的数量指数为200%,计算该国2006年的净贸易条件,并说明其含义。(计算结果保留到整数) 2、以2000年为基期,中国2005年的出口价格指数为115%,进口价格指数为120%,试计算2005年中国的净贸易条件,并说明它是改善还是恶化。(计算结果保留到整数位) 3、以2005年为基期,某国2007年的出口价格指数为85%,进口价格指数为120%,出口商品数量指数为150%。试计算2007年该国的收入贸易条件,并说

计算机常用英语词汇大全

、 计算机常用英语词汇大全 CPU(Center Processor Unit)中央处理单元 mainboard主板 RAM(random access memory)随机存储器(内存) ROM(Read Only Memory)只读存储器 Floppy Disk软盘 Hard Disk硬盘 CD-ROM光盘驱动器(光驱) , monitor监视器 keyboard键盘 mouse鼠标 chip芯片 CD-R光盘刻录机 HUB集线器 Modem= MOdulator-DEModulator,调制解调器 P-P(Plug and Play)即插即用 , UPS(Uninterruptable Power Supply)不间断电源 BIOS(Basic-input-Output System)基本输入输出系统 CMOS(Complementary Metal-Oxide-Semiconductor)互补金属氧化物半导体

setup安装 uninstall卸载 wizzard向导 OS(Operation Systrem)操作系统OA(Office AutoMation)办公自动化、 exit退出 edit编辑 copy复制 cut剪切 paste粘贴 delete删除 select选择 find查找 · select all全选 replace替换 undo撤消 redo重做 program程序 license许可(证) back前一步 next下一步

] finish结束 folder文件夹 Destination Folder目的文件夹 user用户 click点击 double click双击 right click右击 settings设置 … update更新 release发布 data数据 data base数据库 DBMS(Data Base Manege System)数据库管理系统view视图 insert插入 object对象 ; configuration配置 command命令 document文档 POST(power-on-self-test)电源自检程序 cursor光标

国际贸易实务计算题

1、老三种贸易术语的价格换算(计算题) 1、主要贸易术语的价格构成(FOB、CFR、CIF贸易术语) FOB=进货成本价+国内费用+净利润 CFR=进货成本价+国内费用+国外运费+净利润 CIF=进货成本价+国内费用+国外运费+国外保险费+净利润 2、主要贸易术语的价格换算: (一)FOB价换算为其它价 1、CFR=FOB价+运费 2、CIF=(FOB+运费)/(1-投保加成×保险费率) (二)CFR价换算为其它价 1、FOB价=CFR价-运费 2、CIF价=CFR价/(1-投保加成×保险费率) (三)CIF价换算为其它价 1、FOB=CIF价×(1-投保加成×保险费率)-运费 2、CFR价=CIF价×(1-投保加成×保险费率) Eg: 1、某出口公司对外报价牛肉罐头2.20美元/听CIF古晋,按发票金额加成10%投保一切险,保险费率0.3%,客户要求改报CFR价格,请问改报多少? 解:CFR= CIF - I = CIFX(1-投保加成X保险费率) =2.2X[1-(1+10%)X0.3%] =2.193 2、某公司对外报价CIF纽约50美元每袋,后进口商要求我方改报FOB价,若运费是 每袋3美元,保险费率是0.2%,按惯例加一成,在不影响外汇收入的情况下,试计算该货物的FOB价。 解:FOB价=CIF价*[1-保险费率*(1+加成率)]-运费 = 50*(1-0.2%*1.1) - 3 = 46.89(美元) 3、我出口公司对外报价某产品每公吨350美元FOB青岛(大宗散装货物),后外国商 人要求报CIF横滨价,假设运费每公吨35美元,保险费率为5%0,按惯例加一成,在不影响外汇收入的情况下,试计算我方应报的CIF横滨价。 解:CIF =(FOB价+国外运费)/(1-投保加成*保险费率) =(350+35)/(1-0.5%*1.1) = 387.13(美元) 2、含佣价和净价的计算 净价=含佣价×(1–佣金率) 含佣价=净价/ (1 –佣金率) 3、盈亏率的计算(计算题) 出口商品盈亏率=(出口人民币净收入-出口总成本)×100% 出口总成本 出口总成本=出口商品进货成本+国内费用-出口退税 出口外汇净收入= FOB价格

计算机专业英语翻译

国家计算机教育认证 计算机英语 计算机英语词汇对译 蒙阴高新电脑学校 资料整理:孙波 IT CFAC gaoxindiannaoxuexiao

2010年9月1日

?PC personal computer 个人计算机 ?IBM International Business Machine 美国国际商用机器公司的公司简称,是最早推出的个人 计算机品牌。 ?Intel 美国英特尔公司,以生产CPU芯片著称。 ?Pentium Intel公司生产的586 CPU芯片,中文译名为“奔腾”。 ?Address地址 ?Agents代理 ?Analog signals模拟信号 ?Applets程序 ?Asynchronous communications port异步通信端口 ?Attachment附件 ?Access time存取时间 ?access存取 ?accuracy准确性 ?ad network cookies广告网络信息记录软件 ?Add-ons 插件 ?Active-matrix主动矩阵 ?Adapter cards适配卡 ?Advanced application高级应用 ?Analytical graph分析图表 ?Analyze分析 ?Animations动画 ?Application software 应用软件 ?Arithmetic operations算术运算 ?Audio-output device音频输出设备 ?Basic application基础程序 ?Binary coding schemes二进制译码方案 ?Binary system二进制系统 ?Bit比特 ?Browser浏览器 ?Bus line总线 ?Backup tape cartridge units备份磁带盒单元 ?Business-to-consumer企业对消费者 ?Bar code条形码 ?Bar code reader条形码读卡器 ?Bus总线 ?Bandwidth带宽 ?Bluetooth蓝牙 ?Broadband宽带 ?Business-to-business企业对企业电子商务 ?cookies-cutter programs信息记录截取程序 ?cookies信息记录程序

国际贸易与实务计算题与案例分析题

国际贸易与实务计算题与案例分析题 计算练习题 1、某国的国民生产总值为10000亿美元,商品进口贸易额为600亿美元,出口贸易额为400 亿美元,问: ①该国的对外贸易依存度是多少? ②该国的出口依存度是多少? ③该国的进口依存度是多少? 2、甲乙两国的国民生产总值分别为1000亿美元和2000亿美元,对外贸易额分别为200亿美元和400亿美元。问哪一国的对外贸易依存度高? 3、假定某国以1980年为基期是100%,1990年出口价格指数下降5%,进口价格指数上升10%,计算净贸易条件为多少?并对结果进行说明? 4、假定某国以1980年为基期是100%,1990年出口价格指数下降5%,进口价格指数上升10%,且该国的出口数量指数从1980年的100%提高到1990年的120%,在该情况下,计算该国1990年的收入贸易条件,并对结果进行说明? 5、假定某国以1980年为基期是100%,1990年出口价格指数下降5%,进口价格指数上升10%。该国出口商品的劳动生产率由1980年的100%提高到1990年的130%,计算单项因素贸易条件,并对结果进行说明? 6、假定某国以1980年为基期是100%,1990年出口价格指数下降5%,进口价格指数上升10%,1990年该国的出口商品劳动生产率指数由1980年的100%提高到130%,进口商品劳动生产率指数由1980年的100%提高到1990年的105%,计算双项因素贸易条件,并对结果进行说明? 7、我向美商出口蘑菇罐头一批,价值50万美元,美进口关税普通税率为45%,最惠国税率为12.5%,普惠税率为3%,美进口商应支付多少关税? 8、受惠国向给惠国出口机织地毯每平方米350美元,现普惠制优惠差幅15%,受惠国拟将优惠好处60%拿过来,受惠国外销员应报价多少? 9、我向美出口男式开司米绒衫500打,每件重1磅,单价为20美元,对此羊绒衫美国每磅从量税征收37.5美分加征从价税15.5%,则这批羊绒衫美进口商要支付多少关税? 10、我公司向美某公司出口功夫鞋25000双,每双售价FOB 上海:2.75美元,美进口关税最惠国税率为15%,但美按其国内售价5.25%美元计税,则该批功夫鞋比原先多征税多少? 11、瑞典某进口商拟从我国进口长毛绒玩具一批,价值20万美元,同样从日本进口只需19.5万美元,瑞典长毛绒玩具普通税率30%,最惠国税率15%,普惠制生产率为零。它最终从中国进口,因此它的进口成本减少了多少? 12、皮革名义关税税率是18%,而皮箱最终产品“增值”部分为45%,有效保护税率为多少?

最完整的计算机中的常用英语单词大全

A Active-matrix主动距陈 Adapter cards适配卡 Advanced application高级应用Analytical graph分析图表 Analyze分析 Animations动画 Application software 应用软件Arithmetic operations算术运算 Audio-output device音频输出设备Access time存取时间 access存取 accuracy准确性 ad network cookies广告网络信息记录软件 Add-ons附软件 Address地址 Agents代理 Analog signals模拟信号 Applets程序 Asynchronous communications port异步通信端口 Attachment附件 B Bar code条形码 Bar code reader条形码读卡器 Basic application基础程序 Binary coding schemes二进制译码方案Binary system二进制系统 Bit比特 Browser浏览器 Bus line总线 Backup tape cartridge units备份磁带盒单元 Bandwidth带宽 Bluetooth蓝牙 Broadband宽带 Browser浏览器 Business-to-business企业对企业电子商务 Business-to-consumer企业对消费者Bus总线C Cables连线 Cell单元箱 Chain printer链式打印机 Character and recognition device字符标识识别设备 Chart图表 Chassis支架 Chip芯片 Clarity清晰度 Closed architecture封闭式体系结构Column列 Combination key结合键 computer competency计算机能力connectivity连接,结点 Continuous-speech recognition system 连续语言识别系统 Control unit操纵单元 Cordless or wireless mouse无线鼠标Cable modems有线调制解调器 carpal tunnel syndrome腕骨神经综合症CD-ROM可记录光盘 CD-RW可重写光盘 CD-R可记录压缩光盘 Channel信道 Chat group谈话群组chlorofluorocarbons(CFCs) ]氯氟甲烷Client客户端 Coaxial cable同轴电缆 cold site冷战 Commerce servers商业服务器Communication channel信道Communication systems信息系统Compact disc rewritable Compact disc光盘 computer abuse amendments act of 19941994计算机滥用法案 computer crime计算机犯罪 computer ethics计算机道德 computer fraud and abuse act of 1986计算机欺诈和滥用法案 computer matching and privacy protection act of 1988计算机查找和隐

计算机专业英语

计算机专业英语

?PC (Personal Computer) 个人计算机 ?CPU (Central Processing Unit) 中央处理器 ?RAM (Random-Access memory) 随机存储器 ?ROM (Read-Only Memory) 只读存储器 ?BIOS (Basic Input/Output System) 基本输入输出系统 ?IDE (Integrated Drive Electronics) 智能磁盘设备 ?PCI (Peripheral Component Interconnect) 外部设备接口 ?SCSI (Small Computer System Interface) 小型计算机系统接口 ?CD-ROM (Compact Disc, Read-Only Memory) 只读光盘 ?EEPROM (Electrically Erasable Programmable Read-Only Memory) ?电可擦除只读存储器 ?DVD-ROM (Digital Versatile Disc, Read-Only Memory) ?只读数字化视频光盘 ?USB (Universal Serial Bus) 通用串行总线 ?LAN (Local Area Network) 局域网 ?DSL (Digital Subscriber Line) 数字线用户 ?VDSL (Very high bit-rate DSL) 甚高位率数字线用户 ?POST (Power-On Self-Test) 开机自检 ?TFT(Thin-Film Transistro) 薄膜晶体管 ?LCD(Liquid Crystal Display) 液晶显示屏 ?CRT(Cathode Ray Tube) 阴极射线管 ?DLP(Digital Light Processing) 数字光处理技术 ?LCoS(Liquid Crystal On Silicon) 硅基液晶(也缩写为LCOS) ?SED(Surface-conduction Electron-emitter Display) 表面传导电子发射显示?OLED(Organic Light-Emitting Diode) 有机发光二极管 ?PDP(Plasma Display Panel) 等离子显示器

国际贸易实务计算题及答案

公量计重主要用于少数经济价值较高而水分含量极不稳定的商品,如羊毛、生丝、棉花等。 公量=干量+标准水分量=实际重量x(1+标准回潮率)/ (1 +实际回潮率)公量的计算公式: 公量二商品干净重X (1 +公定回潮率)二商品净重X (1 +公定回潮率)心+实际回潮率) 实际回潮率二实际含水量/干重 注:干量=商品干净重=干重商品净重=实际重量公定回潮率=标准回潮率 公量的计算 1 .例题:内蒙古某出口公司向韩国出口10公吨羊毛,标准回潮率为11%,经抽样证明10 公斤纯羊毛用科学方法抽干水后净重8 公斤干羊毛,求用公量计算的交货重量为多少?<解答 1 > 实际回潮率=水分/干量=(10-8)/8*100%=25% 公量二实际重量X(1+标准回潮率)/ (1 +实际回潮率)=10 (1+11% / (1+25% =8.88 (公吨)答:该批生丝的公量为8.88 公吨。 <解答2 > 净剩的8 公吨为干量, 公量二干量X (1 +公定回潮率)=8 X (1 + 11%)=8.88 (公吨) 答:该批生丝的公量为8.88 公吨。 2.、一批出口货物做CFR价为250000美元,现客户要求改报CIF价加20液保海运一切险,我方同意照办,如保险费率为0.6%时,我方应向客户报价多少? 解:CIF=CFR保险费 保险费=保险金额X保险费率=CIF X (1+20%)X 0.6% CIF=CFR+CIF X(1+20%)X0.6% CIF=CFR H(1 -120%< 0.6%) =250000 - 0.9928 =251813.05 美元答:我方应报价251813.05 美元 3.、一批出口货CFR价为1980美元,现客户来电要求按CIF价加20%^保海上一切险,我方照办,如保险费率为2%时,我方应向客户补收保险费若干? 解:CIF价二CFF价/[1 - (1 +投保加成率)X保险费率] 保险费二保险金额X保险费率=CIF价X (1 +投保加成率)X保险费率,所以 保险费=CFR价X (1 +投保加成率)X保险费率/[1 - (1 +投保加成率)X保险费率] =1980X(1+20% X 2%/ (1- 120%X 2% = 48.69 (美元) 取整保险费应为49美元。 4.某公司出口商品1000 箱,每箱人民币收购价100 元,国内费用为收购价的15%,出口后每箱可退税7元人民币,外销价每箱19美元CFR曼谷,每箱货应付海运费1.2美元,计算该商品的换汇成本。(保留两位小数) 解:每箱货物出口总成本=100X (1+15%)-7=108元人民币 每箱货物出口销售外汇净收入=19-1.2=17.8 美元 换汇成本=108/17.80=6.07 元人民币/美元 5.例1:出口健身椅(Sit-up Bench)1000只,出口价:每只1 6.57美元CIF纽约,CIF 总价16570美元,其中运费2160美元、保险费112美元。进价每只人民币117元,共计人民币117000元(含增值税17% ,费用定额率10%,出口退税率14%。当时银行外汇(美元买入价为8.32 元。

计算机专业术语大全(中-英文版)

******************************* <计算机专业术语大全(中~英文版)> ******************************* #include } AGP(Accelerated Graphics Port) -图形加速接口 Access Time-存取时间 Address-地址 ANSI (American National Standards Institute) 美国国家标准协会ASCII (American Standard Code for Information Interchange)Async SRAM-异步静态内存 BSB (Backside Bus) Bandwidth-带宽 Bank -内存库 Bank Schema -存储体规划 Base Rambus -初级的Rambus内存 Baud -波特 BGA (Ball Grid Array)-球状引脚栅格阵列封装技术 Binary -二进制 BIOS (Basic Input-Output System) -基本输入/输出系统 Bit-位、比特 BLP-底部引出塑封技术 Buffer-缓冲区 Buffered Memory-带缓冲的内存 BEDO (Burst EDO RAM) -突发模式EDO随机存储器 Burst Mode-突发模式 Bus-总线 Bus Cycle-总线周期 (一)保险费的计算 1、一批出口货物做CFR价为250000美元,现客户要求改报CIF价加20%投保海运一切险,我方同意照办,如保险费率为0.6%时,我方应向客户报价多少? 解:CIF=CFR+保险费 保险费=保险金额×保险费率=CIF×(1+20%)×0.6% CIF=CFR+CIF×(1+20%)×0.6% CIF=CFR÷(1-120%×0.6%) =250000÷0.9928 =251813.05美元 答:我方应报价251813.05美元 2、一批出口货CFR价为1980美元,现客户来电要求按CIF价加20%投保海上一切险,我方照办,如保险费率为2%时,我方应向客户补收保险费若干? 解:CIF价=CFR价/[1-(1+投保加成率)×保险费率] 保险费=保险金额×保险费率=CIF价×(1+投保加成率)×保险费率,所以 保险费=CFR价×(1+投保加成率)×保险费率/[1-(1+投保加成率)×保险费率] =1980×(1+20%)×2%/(1-120%×2%)=48.69(美元)取整保险费应为49美元。 3、进出口货物运输保险实务计算: FOB、CFR和CIF在量上的关系 CFR=FOB+F(运费) CIF=CFR+I(保险费)=FOB+F+I FOB是基础 保险金额= CIF价×(1+投保加成率)=(FOB+F+I)×(1+投保加成率) 保险费I = 保险金额×保险费率= CIF ×(1+投保加成率)×保险费率 4、我国某商品对某国出口的CFR单价是110美元,如外商要求我们改报CIF价,在不影响我外汇净收入的前提下,我应报何价?(注:按发票金额的110%投保,保险费率为0.5%) 解:CIF =110/(1-0.5%×110%)=110.61(美元) 5、一批货物由上海出口至某国某港口CIF总金额为30000美元,投保一切险(保险费率为0.6%)及战争险(保险费率0.03%),保险金额按CIF总金额,客户要求加保一成。 解:应付的保险费= 30000×(1+10%)×(0.6%+0.03% )= 207.90(美元) 6、某商品出口报价CFR1200美元,保险费率0.63%,客户要求加一成保险,求:CIF价、保险金额、保险费。 解:CIF价= CFR价/[1 - 保险费率×(1+投保加成率)] 附录 1 单词表国际贸易实务计算题(精选超全)

计算机专业英语常用单词表

单词 abnormal abridge absorb abstract abstraction accelerator access accessible accessory accident accommodate accompany accomplish accurate acquire actual adapter address addressing adherent adjacent adjust adjustability adjustable administrator adopt adopter advantage advantageous advent aerospace affix affordable agency agent agile agreed akin adj.反常的 v.删节, 削减, 精简 vt.吸收 adj.抽象的,深奥的,理论的 n.提取,抽象 n.加速者,加速器 vt.存取,访问 adj.易接近的,可到达的,易受影响的,可理解的 n.附件,零件 n.意外事件,事故 vt.供应,供给;使适应,调节 vi.适应 vt.伴随 vt.完成,达到,实现 adj.正确的,精确的 vt.获得 adj.实际的,真实的 n.适配器 n.地址 n.寻址 n.信徒,追随者,拥护者 adj.邻近的,接近的 vt.调整,调节,校准,使适合 n.适应性 adj.可调整的 n.管理员 vt.采用 n.采纳者; 接受器 n.优势, 有利条件, 利益 adj.有利的 n.出现,到来 n.航空与航天工业 vt.使附于,粘贴 adj.付得起的,不太昂贵的;便宜的;价格合理的 n.代理处,行销处,代理,中介 n.代理 adj.敏捷的,轻快的,灵活的 adj.已经过协议的,同意的 adj.类似的 中文意义

1