公共部门经济学(双语)教案

《公共部门经济学(双语)》(07115020)课程教案

甘行琼、胡洪曙

一、授课对象

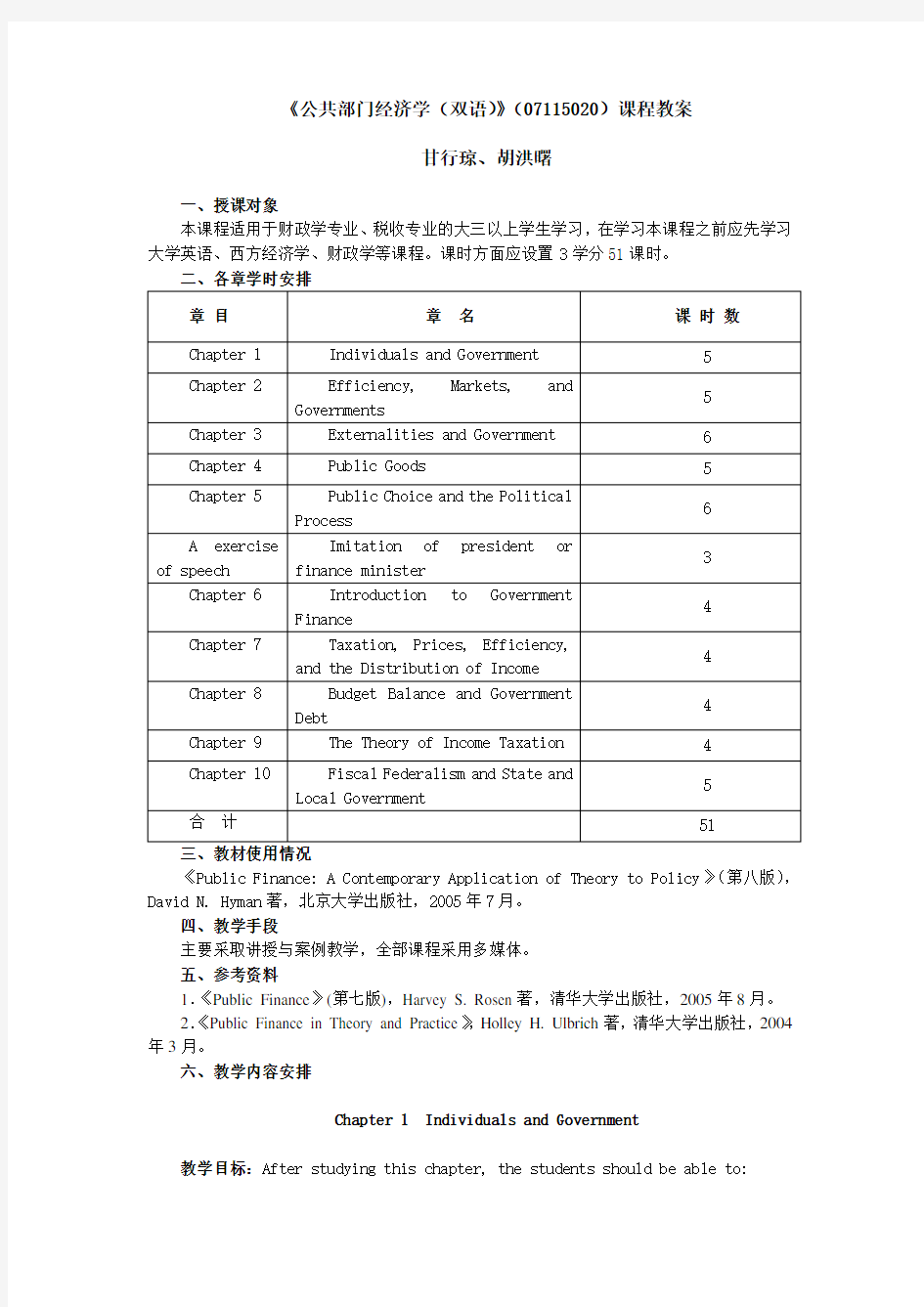

本课程适用于财政学专业、税收专业的大三以上学生学习,在学习本课程之前应先学习大学英语、西方经济学、财政学等课程。课时方面应设置3学分51课时。

三、教材使用情况

《Public Finance: A Contemporary Application of Theory to Policy》(第八版),David N. Hyman著,北京大学出版社,2005年7月。

四、教学手段

主要采取讲授与案例教学,全部课程采用多媒体。

五、参考资料

1.《Public Finance》(第七版),Harvey S. Rosen著,清华大学出版社,2005年8月。

2.《Public Finance in Theory and Practice》,Holley H. Ulbrich著,清华大学出版社,2004年3月。

六、教学内容安排

Chapter 1 Individuals and Government

教学目标:After studying this chapter, the students should be able to:

1. Use a production-possibility curve to explain the trade- off between private goods and services and government goods and services.

2. Describe how the provision of government goods and services through political institutions differs from market provision of goods and services and how government affects the circular flow of income and expenditure in a mixed economy.

3. Discuss the various categories of federal, state, and local government expenditures in the United States and the way those expenditures are financed.

内容提要:Public finance is the field of economics that studies government activities and alternative means of financing government expenditures. Modern public finance emphasizes the relationships between citizens and governments. Government goods and services are supplied through political institutions, which employ rules and procedures that have evolved in different societies for arriving at collective choices. Government goods and services are usually made available without charge for their use, and they are financed by compulsory payments (mainly taxes) levied on citizens and their activities. A major goal in the study of public finance is to analyze the economic role of government and the costs and benefits of allocating resources to government use as opposed to allowing private enterprise and households to use those resources.

重点难点:The allocation of resources between government and private use; The structure of state and local government expenditure; Market failure and the functions of government: how much government is enough? Government transfer payments; Nonmarket rationing.

有关提示:这一部分是公共部门经济学的引言部分,应让学生明白公共部门和私人部门的区别,以及他们各自是如何配置资源的,另外也要熟悉美国政府支出的增长情况。在这部分内容中主要应使学生对公共部门经济学有一个感性的认识。

课堂设计:首先和学生讲明本章的教学目的和重点、难点。结合教材相关内容提问学生如下问题:

1. Give four examples of government goods or services and discuss how they are

distributed to citizens.

2. What is the difference between government purchases and government transfer

payments?

讲稿内容:

1. Individuals, Society and Government

a. Public finance is the field of economics that studies government activities and the alternative means of financing government expenditures.

b. Governments are organizations formed to exercise authority over the actions of persons who live together in a society and to provide and finance essential services.

c. Political Institutions are rules and generally accepted procedures that evolve for determining what government does and how government outlays are financed

d. Examples of Political Institutions:

Majority rule; Representative government

2. The Allocation between Private and Government Resources

a.Private:

Food; Housing; Cars; Clothing

b. Government:

National Defense; Public Schools; Police

c. A Production-Possibility Frontier

d. Distribution of Government Goods and Services

Nonmarket rationing: Prices and willingness to pay those prices are not applicable to goods like national defense.

3. The Mixed Economy: Markets and Politics

a. Pure Market Economy

Virtually all goods and services are supplied by for-profit private firms.

Supply and demand determine price.

b. Mixed Economy

A mixed economy is one in which government supplies a considerable amount of goods and services and regulates private economic activity.

4. Government Expenditures in the United States

a. Government purchases of

labor; land; capital

b. Government Transfer Payments

Welfare; Social Security

c. Structure of Federal Government Expenditures

Purchases of Goods and Services; Transfer Payments; Grants in Aid to State and Local Governments; Net Interest Paid

d. The Structure of State and Local Government Expenditures in the United States

Education; Civilian Safety; Transportation; Executive, Legislative, and Judicial; Income Security; Health and Hospitals; Recreational and Cultural Activities

5. Financing Government Expenditures in the US

a. Taxes:

Income (Corporate and Personal); Payroll; Excise; Customs

b. State Budget Crunch of 2002

37 states were forced to reduce their budgets.

Revenues were typically 10% less than anticipated.

States with the most severe deficits: AK, AZ, CA, NY, NC, OK, OR, VA, and WA

c. Causes

a)Cuts in taxes on business and individuals in the 1990s

b)No sales tax collections on services

c)Growth in costs of Medicaid

d. Implications of a Graying America

Social Security

a) In 2008 baby-boomers start to retire and collect

b)The ratio of workers to retiree falls

e. Medicare

Health care inflation is substantially higher than overall inflation

f.Medicaid

Increased use of long-term care for baby-boomers

6. How Much Government is Enough?

The question of how much government is enough is an important one in any society.

It is the tradeoff between public and private goods. When government gets bigger, its increased involvement comes at the expense of less private consumption.

课后思考题:

1. How does the mechanism for distributing and rationing most government services differ from that for distributing goods through markets?

2. What is a production-possibility curve? Show how such a curve can be used to explain how private goods and services must be sacrificed to obtain government goods and services.

3. Discuss the trends in government expenditures and outlays as a percentage of GDP.

Chapter 2 Efficiency, Markets, and Governments

教学目标:After studying this chapter, the students should be able to:

1. Discuss the difference between positive and normative economics.

2. Define the efficiency criterion and show the marginal conditions for efficiency can be used to identify the efficient output of a goods or service.

3. Demonstrate how taxes and subsidies affect incentives and how they can prevent competitive markets from achieving efficient outcomes.

内容提要:Resources are efficiently allocated when the well-being of any one person cannot be increased without harming another. This condition is attained when all goods are consumed over any period up to the point at which the marginal social benefit of each good equals its marginal social cost.

When prices in competitive markets reflect marginal social costs and benefits, market exchange achieves efficiency. Individuals opposing actions that improve efficiency act rationally. They are simply better of with a larger share of a smaller pie. To predict outcomes any political process, it is necessary to know the benefits of any changes proposed, to whom they accrue, and what changes in the distribution of income result.

重点难点:Normative evaluation of resource use: the efficiency criterion; Markets, prices, and efficiency conditions; Market failure: a preview of the basis for government activity; compensation criteria; Utility-possibility curve.

有关提示:这一部分是公共部门经济学的基础理论部分,应着重培养学生对相关概念的辨别能力和记忆能力,要提示学生帕累托最优只存在于理论当中,在现实当中是很难达到的。

课堂设计:这部分应结合课件中的大量图示来给学生讲明本章中出现的大量重要概念和基本理论,以老师讲解为主。结合教材相关内容提问学生如下问题:

1. Under what circumstances will a resource allocation be efficient?

2. What are the marginal conditions for efficiency?

3. Describe how taxes can affect incentives and cause losses in net benefits.

讲稿内容:

1. Positive and Normative Economics

a.Positive Economics explains “what is,” without making judgments about the

appropriateness of “what is.”

b.Normative Economics: designed to formulate recommendations about what

“should be.”

2. Normative Evaluation of Resource Use:The Efficiency Criterion

a. Pareto Optimality

The efficiency criterion is satisfied when resources are used over any given period of time in such a way as to make it impossible to increase any one person’s well-being without reducing any other person’s well-being.

b. Marginal Conditions for Efficiency

Total Social Benefit; Total Social Cost

Net Benefit = TSB–TSC

Maximum Net Benefit occurs where MSB = MSC

3. Conditions under which the Market is Pareto Optimal

a. A perfectly competitive market system exists if:

a) All productive resources are privately owned.

b) All transactions take place in markets, and in each separate market many competing sellers offer a standardized product to many competing buyers.

c) Economic power is dispersed in the sense that no buyers or sellers alone can influence prices.

d) All relevant information is freely available to buyers and sellers.

e) Resources are mobile and may be freely employed in any enterprise.

b. If These Conditions are Met

P = MPB = MSB and P = MPC = MSC

So P = MSB = MSC

c. When Does Market Interaction Fail to Achieve Efficiency?

Monopoly; Taxes; Subsidies

4. Market Failure: A Preview of the Basis for Government Activity

a. Government intervention may be warranted if a market exhibits:

a)Monopoly power by one supplier

b)Effects of market transactions on third parties

c)Lack of a market for a good where MSB>MSC (i.e. a public good)

d)Incomplete information about goods being sold

e)An unstable market

b. The Tax System and the Birth Rate

a)Families with children pay less tax than families without children: personal

exemption; child tax credit.

b)Historical data shows that an increase in the real value of the personal

exemption is associated with increases in the birth rate.

5. Equity vs. Efficiency

Equity: perceived fairness of an outcome.

Horizontal equity is achieved when equal people are treated equally.

Vertical equity is achieved when people are treated fairly along the socio-economic continuum.

6. Positive Analysis Trade-off Between Equity and Efficiency

a. When making choices about public policy issues, we are usually faced with the inevitable situation that you make one person worse off while making another better off. (Taxes must be paid by some in order that public goods can be purchased; these benefits accrue to people other than taxpayers.) Some economists attempt to overcome this with the Compensation Criteria.

b. Compensation Criteria

a)An attempt is made to compare the dollar value of the gain to the gainers

and the dollar value of the loss to the losers.

b)If the gainers gain more than the losers lose, then the gainers can pay the

losers enough to compensate the losers for their loss.

c)Everyone can be made at least as well off as they were without the change

as long as compensation is paid.

c.International View: Agricultural Subsidies, International Trade Restrictions and Global Efficiency

a)Many nations subsidize farmers with: Production subsidies; Export subsidies;

Import constraints.

b)This results in reduced agricultural efficiency.

c)Since WTO agreements, such subsidies and import constraints have been

reduced.

课后思考题:

1. How does trading improve efficiency? Why are trades that apparently provide mutual gains to those involved not undertaken?

2. Show how equating the total social benefit of a good with its total social cost will result in more than the efficient output of the good.

3. Efficiency can correspond to more than one distribution of well-being. Can the efficiency criterion be used to rank one distribution over another?

Chapter 3 Externalities and Government Policy

教学目标:After studying this chapter, the students should be able to:

1. Define an externality and explain how positive and negative externalities can prevent efficiency from being achieved even when markets are perfectly competitive.

2.Describe how corrective taxes and subsidies can be used to internalize externalities.

3.Explain the Coase theorem and its significance.

内容提要:Externality are costs or benefits of market transactions not reflected in prices. They are a dominant form of market failure to achieve efficiency in industrial economies. When the marginal external cost or benefit is priced so that buyers and sellers consider it in their decisions, an externality is internalized. To internalize an externality, the parties involved must be identified and the marginal external cost or benefit must be measured.

The Coase theorem shows that, government assignment of rights to resource use,

along with facilitation of free exchange of those rights, achieves efficiency, independent of which party is granted the right. When larger numbers of individuals are involved, a solution will require collective action to internalize the externality. Among the techniques used for this are corrective taxes and subsidies, regulations, and the establishment of standards.

重点难点:Internalization of externalities; Property rights to resource use and internalization of externalities: the Coase theorem; Corrective tax; Transactions costs

有关提示:这一部分涉及到公共部门经济学的一个重要概念――外部性,以及对这一问题的解决办法之一科斯定理。外部性是政府介入的理由之一,但很多外部性靠明晰产权也能解决,这就是科斯定理介绍的方法。应着重培养学生对解决问题的发散性思维。

课堂设计:这部分内容以案例讲解为主,通过周围的大量事件介绍,告诉学生哪些造成了负的外部性,哪些具有正的外部性,以及分别采取哪些办法来解决,在课堂中应引导学生进行积极的思考。结合教材相关内容提问学生如下问题:

1. What does it mean to internalize an externality?

2. What is the Coase theorem? How is it significant to the understanding of social conflicts caused by externalities?

3. Explain why the efficient level of pollution abatement is unlikely to be 100 percent.

讲稿内容:

1. Externalities

a. Externalities are costs or benefits of market transactions not reflected in prices.

Negative externalities are costs to third parties.

Positive externalities are benefits to third parties .

b. Externalities and Efficiency

The marginal external cost is the dollar value of the cost to third parties from the production or consumption of an additional unit of a good. These occur when market transactions for a good produce negative externalities.

Social Costs

MSC = MPC + MEC

Market equilibrium occurs where

MPC = MSB

Efficiency Requires that

MSC = MPC + MEC = MSB

c. Positive externalities

The marginal external benefit is the dollar value of the benefit to third parties from an additional unit of production or consumption of a good. These occur when the market for a good creates positive externalities.

Social Benefit

MSB = MPB + MEB

2. Internalization of Externalities

An externality can be internalized under policies that force market participants to account for the costs of benefits of their actions.

a. Corrective Taxes to Negative Externalities

Setting a tax equal to the MEC will internalize a negative externality.

Results of a Corrective Tax:

Price rises.

The tax revenue is sufficient to pay costs to third parties.

Socially optimal levels of production are achieved.

b. Using a Corrective Tax

The greenhouse effect and a “Carbon Tax”

The greenhouse effect is caused by burning carbon-based fuels. A carbon tax can be imposed to limit greenhouse gasses to their socially optimal levels.

It is called a carbon tax because the amount of the tax would depend on the amount of carbon in the fuel.

c. Theory of the Second Best

When one condition for an optimum is violated, then maintaining the others will not guarantee a second-best solution.

d. A Polluting Monopolist

Chapter 2 showed that monopoly creates a loss to society. This chapter shows that a negative externality causes a loss as well.

The losses do not necessarily add to one another. In fact, they can cancel each other out.

e. Corrective Subsidies

Setting a subsidy equal to MEB will internalize a positive externality.

Property Rights and Internalization of Externalities

Externalities arise because some resource users’ property rights are not considered in the marketplace by buyers or sellers of products.

Governments can give businesses the right to emit wastes in the air and water or it can give individuals the right to clean air and water.

3. Coase's Theorem

By establishing rights to use resources, government can internalize externalities when transactions or bargaining costs are zero.

a. The Significance of Coase’s Theorem

a)The efficient mix of output will result simply as a consequence of the

establishment of exchangeable property rights.

b)It makes no difference which party is assigned the right to use a resource.

c)If the transactions costs of exchanging the rights are zero, the efficient

mix of outputs among competing uses of the resource will emerge.

b. Limitations of Coase’s Theorem

a)Transactions costs are not zero in many situations.

b)However you allocate the property rights, the distribution of income is

affected.

c. Applying Coase's Theorem

a)The Clean Air Act of 1990 allows for the sale of the "right to pollute." Firms

face a tradeoff when they pollute. If they pollute, they forgo the right to sell their emission permits to others.

b)In markets for electricity, Clean Air Act has motivated firms to shift to

natural gas and away from coal as a means of producing electricity.

4. Recycling

Recycling may be a less efficient and more polluting use of labor, land and capital than simple land fill disposal because:

a) Collecting waste for recycling costs three times as much as collecting it for disposal.

b) Rural land is inexpensive.

c. Recycling paper creates more water pollution and does not “save” trees; it simply reduces the number that are plante

d.

5. Regulatory Solutions

Instead of using market forces to force firms to internalize externalities, we can use emission standards and apply these to all market players.

a. Markets for Pollution Rights

The Clean Air Act of 1990 allowed firms the right to trade Sulfur Dioxide emissions allowances.

The market for the allowances began in 1991.

Firms must have the allowances to emit Sulfur Dioxide.

Firms increasing production can buy permits or use pollution controls to keep their total emissions constant.

Firms that reduce their emissions can sell their allowances to others.

b. Global Externalities:

CFC’s; Deforestation; Global Warming

c. Costs and Benefits to the EPA

The EPA estimates that annual compliance costs could be in the range of $225 billion per year.

The EPA estimated in 1990 that the benefits of the Clean Air Act were nearly 50 times the costs.

Ninety percent of the benefits are estimated to come from laws pertaining to power plants and factories.

课后思考题:

1. Explain why externalities prevent the attainment of efficiency when goods

are traded in competitive markets.

2. How can a corrective tax adjust costs to reflect externalities? What effects

will a corrective tax have on prices, output, and pollution?

3. Under what conditions are externalities likely to be internalized without

the necessity of government intervention?

Chapter 4 Public Goods

教学目标:After studying this chapter, the students should be able to:

1. Define public goods and discuss their characteristics.

2. Explain the difference between pure public goods and pure private goods.

3. Discuss cooperative methods of supplying pure public goods and the

characteristics of the Lindahl equilibrium.

4. Analyze the free-rider problem.

内容提要:A pure public good is one that is consumed by all members of a community as soon as it is produced for any one member. Its benefits are nonrival and nonexcludable to consumers. Efficiency requires that the production of pure public goods be undertaken to the point where the sum of marginal private benefits is exactly equal to the marginal social cost of production.

Ideally, an efficient output of a pure public good could be achieved if each person contributed an amount equal to the marginal benefits received per unit of a public good. This is known as the Lindahl equilibrium. However, problems in inducing households to reveal their true preferences for public goods resulting from free-rider effects make this solution difficult to implement.

重点难点:Characteristics of public goods; Efficient output of a pure public good; The free-rider problem; Lindahl Equilibrium.

有关提示:这一部分是公共部门经济学的核心理论之一,应着重教授学生对公共产品概念的理解,及公共产品有效率的供给方法。要提示学生解决公共产品的效率供给是一个很复杂的问题,其主要原因之一是存在消费者的搭便车心理。

课堂设计:这部分应结合大量实例来给学生说明公共产品和私人产品所具有的不同特点,以及与此相对应的不同的供应方法。。结合教材相关内容提问学生如下问题:

1. What are the characteristics of public goods?

2. Under what conditions is the output level of a pure public good efficient?

3. How does the free-rider problem affect the effectiveness of voluntary

cooperative methods in achieving efficient levels of output for pure public goods?

讲稿内容:

1. Public Goods

a. Public Goods are goods for which exclusion is impossible.

One example is National Defense: A military that defends one citizen from invasion does so for the entire public.

b. Characteristics of Public Goods

a)Nonexclusion: The inability of a seller to prevent people from consuming a

good if they do not pay for it.

b)Nonrivalry: The characteristic that if one person “consumes” a good,

another person’s pleasure is not diminished, nor is another person prevented from consuming it.

c. Pure Public Goods and Pure Private Goods

Pure Public Good: No ability to exclude and no rivalry for benefits.

Pure Private Good: Clear ability to exclude and rivalry for benefits.

d. Marginal Costs for Provision of Public Goods

The marginal cost of allowing another person to benefit from a pure public good is zero, while the marginal cost of providing a greater level of public good is positive.

Example: Bread versus Heat

Bread – Clearly a pure private good because there is the ability to exclude

and there is rivalry to consume.

Heat – Clearly a pure public good because there is no ability to exclude and there is no rivalry to consume.

2. Provision of Private Good and Public Goods: Markets and Government

a. Price Excludable Public Goods vs Congestible Public Goods

a) Price Excludable Public Goods (Excludability, but no rivalry)

Another type of good is a price-excludable public good: no rivalry but exclusion is easy.

Examples: Country Clubs, Cable TV

b) Congestible Public Goods (Rivalry but no excludability)

There are public goods where, after a point, the enjoyment received by the consumer is diminished by crowding or congestion. These are called Congestible Public Goods.

Examples: roads and parks

b. Education as a Public Good

Education is a service that has some characteristics of a public good and some characteristics of a private good.

a) External benefits:

It helps us live in a civil society.

It has a “socializing ” function.

It teaches the importance of following rules, obeying orders, and working together.

It provides students with basic skills like punctuality and the ability to follow directions that increase their productivity as workers.

It helps students identify their abilities and choose appropriate occupations, thereby increasing productivity levels for a nation.

b) Education as a Private Good

Education has characteristics of a private good:

Wide disparities exist in the quantity and quality of education provided among school districts.

The level of support that parents can give students at home increases with income and home support is an important factor in learning for children.

There is no way to prevent parents who want more than a standardized quantity and quality of education for their children from buying it in the marketplace.

3. Demand For a Pure Public Good

Market demand for a Pure Private Good is derived by adding quantities demanded at each price.

Demand for a Pure Public Good is derived by adding how much people will be willing to pay at each quantity.

Efficient Output of a Pure Public Good

The socially optimal level of the public good requires that we set the Marginal Social Benefit of that good equal to its Marginal Social Cost. MSB = MSC Lindahl Pricing: Everyone in a group cooperates and participants each pay their marginal benefit.

We can demonstrate this issue mathematically, numerically (using a table), and graphically.

Mathematically: Lindahl Pricing

Recall from Figure 4.5 that the marginal social benefit for a pure public good is the sum of the individual marginal benefits.

That is: MSB =ΣMB

Efficient output is therefore:

MSB =ΣMB = MSC.

Numerically: Lindahl Pricing

Suppose we have three people who are discussing the issue of hiring security guards. Note that each person places a different value on the levels of security.

A Numerical Example

If the cost of security guards is $450 per week, then no individual will hire even one guard, even though to the group one guard is worth $750. The group should hire three.

If they each pay their marginal benefit, then three guards are hired. Person A pays $600 ($200 per guard), person B pays $450 ($150 per guard) and person C pay $300 ($100 per guard).

Lindahl Equilibrium

The amount each person contributes, ti, depends on individual desires for the public good.

The sum of the contributions equals the total cost of the public good.

?S tiQ* = MC(Q*) = AC(Q*)

?S ti = MC = AC

All individuals agree to pay their shares.

4. Freeriding

Freeriding occurs when people are not honest in stating their Marginal Benefit, because if they understate it, they can get a slightly reduced level of the public good while paying nothing for it.

Freeriding is easier with:

Anonymity: If everyone knows who contributes, there can be powerful social stigmas applied to shirkers.

Large numbers of people: It’s easier to determine the shirkers in a small group

and the punishment is more profound when people close to you shun you for not paying your share.

5. Illustrating Voluntary Contributions to a Public Good: The Gulf War

Under the premise that defeating Iraq in the Gulf War in 1990 was a public good to be consumed by the industrialized economies and Arab nations, each nation was expected to contribute.

The U.S. and UK contributed the bulk of the fighting forces.

Saudi Arabia, Kuwait, the UAE, Japan, and Germany voluntarily paid $54 billion of the estimated $61 billion cost.

6. National Defense and Homeland Security

National defense is a classic example of a public good.

a. Defense

From 1968 to 1978, defense spending fell from 9% of GDP to 5%.

Between 1978 and 1986, it increased to 6.3%.

By 1999, it had fallen to less than 4%.

In 2002, it was 4.5%.

b. Homeland Security

The new department merged several agencies from the departments of Justice, Transportation, Treasury, Agriculture, Energy, Health and Human Services, and Commerce.

The Homeland Security Department could ultimately have 170,000 employees working in border and transportation security, emergency preparedness and response, biological warfare defense, and computer security. It will also house the Secret Service and Coast Guard.

课后思考题:

1. What are the essential differences between pure public goods and pure private goods?

2. Although the marginal cost of producing a pure public good is always positive, some consumers can enjoy the benefits of pure public goods at zero marginal costs. Explain the apparent paradox, if there is one!

3. How will shares in the finance of public goods vary among contributors in

a model of voluntary cooperative supply of such goods?

Chapter 5 Public Choice and the Political Process

教学目标:After studying this chapter, the students should be able to:

1. Define a public choice and the concept of political equilibrium.

2. Discuss the characteristics of political equilibrium for a single public good under majority rule, the importance of the median voter, and how cycling of outcomes can result when all voters do not have single-peaked preferences.

3. Describe the role of political parties and special-interest groups in the political process.

内容提要:A political equilibrium is an agreement on the level of production of one or more public goods, given a specified rule for making the public choice

and the distribution of tax shares among individuals. Collective, or public, choices are agreements resulting in political equilibria on issues of common concern. Political equilibria are influenced by politicians and bureaucrats. When all voters have single-peaked preferences, parties will tend to move to the median position to win elections.

When all voters do not vote, the median most-preferred outcome of all citizens could differ from the median most-preferred outcome of all voters. Logrolling is the explicit trading of votes on issues of great interest to voters. When two or more issues are voted on simultaneously, implicit logrolling can occur. Models of bureaucratic behavior presume that bureaucrats attempt to maximize the size of their budgets.

重点难点:A Model of political equilibrium under majority rule; Uniqueness and cycling of outcomes under majority rule; Voting on more than one issue at a time: logrolling; Arrow’s impossibility theorem; rational ignorance.

有关提示:公共选择是公共部门经济学在理论上的一个较新的发展,逻辑性较强,有的地方学生难以理解,应把这一理论的基本规则给学生阐明。在这一部分中,应着重培养学生的逻辑推理能力和学科创新能力,并提示学生民主投票并不一定能产生唯一结果。

课堂设计:这部分应结合课件中的案例图示来给学生讲明不同投票规则将容易产生不同的结果,以老师讲解为主。结合教材相关内容提问学生如下问题:

1. Under what circumstances does a rational voter choose to vote in favor of

a proposal to increase the output of a public good? Why do some voters choose not to vote?

2. What are the major determinants of a political equilibrium?

3. Who is the median voter?

4. What can cause cycling of outcomes under majority rule?

讲稿内容:

1. The Supply of Public Goods Through Political Institutions

Public Choice involves decisions being made through political interaction of many persons according to pre-established rules.

2. Political Equilibrium

A political equilibrium is an agreement on the level of production of one or more public goods, given the specified rule for making the collective choice and the distribution of tax shares among individuals.

a. Tax Shares or Tax Prices

Tax shares, sometimes called tax prices, are pre-announced levies assigned to citizens.

They are a portion of the unit cost of a good proposed to be provided by government.

ti = tax share to individual i

Σti = average cost of good

b. Individual's Choice

Individuals make choices given their most preferred political outcomes.

Each person will favor the quantity of the government-supplied good corresponding to the point at which the person’s tax share is exactly equal to the

marginal benefit of the good to that person.

c. The Choice to Vote or Not

Rational Ignorance is the idea that, to many voters, the marginal cost of obtaining information concerning an issue is greater than the marginal benefit of gaining that information. This leads the voter to fail to gather the information and then not to vote.

d. Determinants of Political Equilibrium

The public choice rule

Average and marginal costs of the public good

Information available on the cost and benefit

The distribution of the tax shares

Distribution of benefits among voters

3. Median Voter Model

The median voter model assumes that the voter whose most-preferred outcome is the median of the most-preferred political outcomes of all those voting will become the political equilibrium.

Implications of Median Voter Model

Only the median voter gets his most-preferred outcome.

Others get either too little or too much.

4. Political Externalities

Political Externalities are the losses in well-being that occur when voters do not obtain their most-preferred outcomes, given their tax shares.

Political Transactions Costs

Political Transactions Costs are the measures of the value of time, effort, or other resources expended to reach or enforce a collective agreement.

5. Preferences

a) Single-peaked preferences

A unique optimal outcome exists

b) Multi-peaked preferences

As people move away from their most preferred outcome, they become worse off until a certain point. After that point, as they move further away from their most-preferred outcome they become better off.

6. Pairwise Cycling

Pairwise cycling is a phenomenon in which each outcome can win a majority, depending on how it is paired on a ballot.

a. Arrow's Impossibility Theorem

It is impossible to devise a voting rule that meets a set of conditions that can guarantee a unique political equilibrium for a public choice.

b. Conditions of Arrow’s Impossibility Theorem

All voters have free choice; no dictator.

We cannot rule out multi-peaked preferences.

If all voters change their rankings of a particular alternative, the public choice that emerges must not move in the opposite direction.

Public choices are not influenced by the order in which they are presented.

Public choices must not be affected by the elimination or addition of alternatives to the ballot.

Public choice, like all economic choices, should be transitive.

7. Political Processes

Constitutions; Minority Rule; Majority Rule

a. Costs and Benefits of Collective Action

Benefit: decrease in political externalities

Cost: increase in political transaction costs

b. Possible Alternatives Methods

Unanimity

Relative unanimity (2/3, 7/8 etc.)

Plurality rule (more than 3 outcomes possible)

Point-count voting (enables voters to register the intensity of their preference)

Instant Runoffs

8. Political Institutions in U.S. Cities

a. In the United States, municipal government takes two basic forms.

City Manager Form: The city manager makes day-to-day decisions, and advises elected officials. The mayoral and council elections are typically nonpartisan.

Mayor –City Council Form: The mayor makes day-to-day decisions and elections are typically partisan.

b. Researchers have found that relative to cities run by managers, those run by elected mayors:

a) Have greater capital stock (roads, parks, police and fire stations),

b) Use relatively less labor in providing public services,

c) Spend the same amount of money.

c. Forms of City Government and their Effects on Spending

a)Manager/Council Government

Unelected city manager makes most executive decisions, with policy recommendations by elected city council.

b)Mayoral Government

Elected mayor makes most executive decisions.

c)Results:

Similar total expenditures

Mayoral systems utilize more capital intensive public goods production.

9. Logrolling or Vote Trading

Logrolling is the act of voting for something you would ordinarily vote against so that someone else will vote for something that they would ordinarily vote against.

This is typically done when people care deeply about passage of their issue and less about other issues.

a. Implicit Logrolling

Implicit logrolling occurs when political interests succeed in pairing two (or more) issues of strong interest to divergent groups on the same ballot or the same bill.

The willingness of each special-interest group to vote for the combined package is a function of the relative intensity of preference on the two issues.

b. State Government Spending and the size of the Legislature

The theory of logrolling suggests that, as more districts are available to distribute the costs of public spending, there will be more incentives for individual legislators to engage in vote trading to expand state government spending.

Researchers found a positive relationship between the size of the state Senate and spending.

Spending on highways and education were most affected by the size of the legislature.

10. Special Interests

Special Interests are groups that lobby on particular issues.

An example of a special interest is unions and/or steel companies lobbying for Tariffs and Import Quotas to protect their jobs or profits.

Efficiency losses per job saved almost always exceed the pay of the retained worker.

Estimates of the net effect run between –$9000 and –$38,000

11. Bureaucracy and the Supply of Public Output

Officials measure their power in terms of the size of their budgets, not the efficiency of the outcomes they generate. This causes bureaucrats to have a self-interest in inefficiently high levels of government spending.

课后思考题:

1. How does a person decide to vote on any issue that proposes to change the amount of public goods supplied by the government?

2. Given tax shares, explain why only the median voter consumes his most-preferred quantity of a public good under majority rule.

3. Under what conditions will the median peak correspond to an extreme outcome, such as no output of a good?

4. What is logrolling? Under what conditions is logrolling likely to emerge? How can logrolling prevent the attainment of efficiency?

A exercise of speech:

Imitation of president or finance minister

Chapter 6 Introduction to Government Finance

教学目标:After studying this chapter, the students should be able to:

1. Discuss alternative means of financing government expenditures, the effects they have on the economy, and issues relating to the distribution of the burden of government finance.

2. Understand the basic terminology used to analyze the impact of taxes on the economy, including the tax base and the tax rate structure.

3. List the criteria used to evaluate alternative means of financing government expenditures.

内容提要:Government finance transfers use of productive resources from individuals and business firms to the government. Taxes are the major method of government finance. The method of government finance used can have an impact on political and market equilibria and on the efficiency with which resources are employed in the private sector.

A basic problem in government finance is the distribution of the costs of financing public goods among citizens. No one best way of accomplishing this exists that will satisfy all citizens. In addition to affecting the political equilibrium, the method of government finance chosen often has significant and complicated effects on the private choices made by citizens.

重点难点:Principles of taxation; How should the burden of government finance be distributed? Criteria for evaluating alternative methods of government finance; Earmarked taxes; Government-induced inflation;

有关提示:这一部分着重阐述了政府财政支出的来源,尤其是重点论述了作为主要来源的税收的基本理论,如税率、税基及各种税的形态。应着重培养学生对费和税等概念的辨别能力,并提示学生要满足政府支出在现实中很难找到一个最优的方法。

课堂设计:这部分应结合现实中的大量实例来给学生讲明费和税的区别,在政府筹资中它们各有何优缺点。另外,也要给学生阐明按能纳税和按受益原则纳税的不同,以及它们在现实中的具体实践。教学设计以老师讲解为主,学生讨论为辅。结合教材相关内容提问学生如下问题:

1. What is a tax base? List three major classes of tax bases, and give an example of a particular type of tax levied on each of the three major bases.

2. How does the relationship between the marginal tax rate(MTR) and the average tax rate(ATR) vary, depending on whether a tax rate structure is proportional, progressive, or regressive?

3. What are the two major “philosophies” of taxation used to guide the way the burden of government finance is distributed?

讲稿内容:

1. Federal, State, and Local Revenue

a. $3 trillion annually

b. Sources:

a) Taxes:

Payroll; Income (Corporate and Personal); Property; Sales and Excise; Estate; Tariffs

b) Fees

c) Tuition

d) Licenses

2. Purpose and Consequences of Government Finance

a. Political Equilibrium

b. Market Equilibrium and Its Efficiency

c. The Distribution of Income

3. Taxes

Taxes are compulsory payments to government

a. Tax Base

The item or activity that is to be taxed

A general tax is one that taxes all of the components of the economic base, with no exclusions, exemptions, or deductions from the tax base.

A selective tax is one that taxes only certain portions of the tax base, or it might allow exemptions and deductions from the general tax base.

An excise tax is a selective tax on the manufacture or sale of a particular good or service.

b. Tax Rate Structure

The relationship between the amount that is to be paid in tax and the tax base for a given accounting period

a) Marginal Tax Rate

The amount by which the tax increases when the tax base increases

b) Average Tax Rate

The total amount of tax divided by the total amount of the tax base

c) Tax bracket

The range of the tax base in which the marginal rate is constant

d) Descriptors of the Tax Rate Structure

A Progressive Tax has a structure where the marginal tax rate is increasing and greater than the average tax rate.

A Proportional Tax has a structure where the marginal tax rate is constant and equal to the average tax rate. (Sometimes called a Flat Tax)

A Regressive Tax has a structure where the marginal tax rate is decreasing and less than the average tax rate.

e) Average Tax Rates in the US

4. How Should the Burden of Government Be Financed?

a. Benefit Principle

Those who benefit the most from a particular program should pay the most for that program (Lindahl Tax principle at work).

b. Ability-to-Pay Principle

Those who have the greatest ability to pay should be required to pay the most.

5. Criteria for Evaluating Methods of Government Finance

a. The Criteria are:

a) Equity

The distribution of the government finance burden should coincide with commonly held notions of fairness and ability-to-pay.

b) Efficiency

The system of government finance should raise revenues with the least loss in efficiency in the private sector.

c) Administrative ease

A government finance system should be relatively easy to administer consistently, without excessive costs to collect, enforce, and comply with taxes and tax laws.

b. Horizontal and Vertical Equity

Horizontal equity is achieved when individuals of the same economic capacity (measured, for example, by income) pay the same amount of taxes per year (or over

their lifetimes).

Vertical equity is accomplished when individuals of differing economic ability pay annual tax bills that differ according to some collectively chosen notion of fairness.

c. Both concepts are subjective.

a) “Economic capacity” is difficult to measure and administer.

b) “Ability to pay” requires value judgments on the proper income distribution.

d. Tax Compliance, Avoidance and Evasion

Tax Evasion is the term for illegal ways to avoid paying taxes. It is typically the result of not declaring income or overstating otherwise legal deductions.

Tax Avoidance is the term for legal ways to avoid paying taxes, typically the result of avoiding activities that are taxed, delaying the time at which taxes are owed, or taking an action designed to lower a tax burden.

6. Alternatives to Taxation

a. Debt Finance is the means of financing expenditures by issuing bonds.

b. Inflationary Finance is the means of financing expenditures through the printing of money.

c. More alternatives to Taxation

a) Donations

Money (but more usually time) is voluntarily given to government. Military service or work in the Peace Corps can be considered a donation when the compensation is less than the market value of the time.

b) User Charges

Users of a government service can expect to pay for that service. Examples include tuition, fees paid to enter state parks, greens fees at publicly owned golf courses.

c) Earmarked Taxes

Taxes can be implemented to fund specific public goods. Examples include gasoline taxes and tolls designed to fund road and bridge repair.

d. User Charges and the Transportation Infrastructure

Economists argue that voters demand better roads and airports in part because the price to use them (usually zero) is less than the true marginal cost (which should include congestion costs.)

e. User Charges and Efficiency

Roads and Bridges wear out when too much weight is concentrated on too few axles.

Tolls motivate the wrong behavior in that they tax per axle rather than on pounds per axle.

Estimates suggest that taxing pounds per axle and using the revenue to create stronger roads would pay for itself more than eight-fold.

7. Government Enterprise

Local Utilities

8. Lotteries

State Lotteries

公共部门经济学几个重要知识点

公共部门经济学几个重要知识点 一、公共部门经济学的分析工具 1、实证分析—企图描述世界是什么的观点。是描述性的。不涉及价值问题(事实领域,价值领域区分,最早是英国休谟提出的,称之休谟的铡刀)“公共选择理论”属于对政府的实证分析。 2、规范分析—企图描述世界应该如何运行的观点。规范表述是命令性的。规范分析涉及价值判断。“政府应该做什么”是个规范问题,从“市场失灵”推出政府职能,属于规范分析; 例题:实证分析涉及“是什么”的问题,规范分析涉及“应该是什么”的问题。例如,“谋杀是一种罪”是实证性命题,而“根据经验观察,政府官员的行为应该是追求个人效用最大化的,而不是传统假定的公共利益”是规范性命题。 答:错误。“谋杀是一种罪”不是实证性命题,因为它属于价值判断,应该是规范性命题。而对政府官员的表述是在描述社会现象,不涉及价值判断,所以是实证性命题。 二、福利经济学(研究各种经济状态的社会可取性的经济理论分支)两大定理 第一定理是亚当斯密的“看不见的手”之原理的现代版本,--竞争的均衡是帕累托有效的。假定:(1)所有生产者和消费者的行为都是完全竞争的,没有人拥有任何垄断权力。(2)每一种商品都有市场。在这些假设条件下,所谓福利经济学第一基本定理是说帕累托效率的资源配臵就会出现。竞争的经济会“自动地”实现有效的资源配臵,无需任何集权性指导。帕累托效率要求,价格之比等于边际成本之比,而竞争保证了该条件得到足。帕累托效率是指一种资源配臵状态,在该状态下,如果不使一个人的境况变差就不可能使另一个人的境况变好。帕累托效率—现实生活中不存在。 例题1:福利经济学第一定理所阐述的内容实际上就是亚当斯密“看不见手”原理。 正确。福利经济学第一定理为:竞争的均衡是帕雷托有效的。任何均衡都是帕雷托最优状态。看不见手的原理是指,在完全竞争市场条件下,市场配臵资源是最有效的。此时,竞争性价格机制能够保证效率,价格具有配臵资源和分配的作用。因此,两者实质上是一回事。即竞争的经济会“自动地”实现有效的资源配臵。 例题2:在经济学上,效率常被分为“生产效率”与“配臵效率”两种。帕雷托效率包括三个方面:交换方面的效率、生产方面的效率和总体效率。虽然帕雷托效率指的是“配臵效率”,但其中生产方面的效率是指“生产效率”。 错误。生产效率是指在所有产品的供给是固定的情况下,经济沿生产可能性曲线上的点运行。而在研究帕雷托效率即配臵效率时,我们已假设生产效率已实现,内在地包含了生产效率,也可以说是在生产效率既定的情况下研究配臵效率。帕雷托效率包括的生产方面的效率却是指重新在使用者中间配臵生产要素导致提高一种物品产出的同时,不减少其他物品的产出是不可能的,这是研究生产要素边际技术替代率。因此两者是不同的。生产效率不都有效,企业追求利润最大化,其生产效率不是帕雷托有效。 第二定理:每一个帕累托有效,都可以通过竞争性价格机制达到。 社会通过作出初始资源禀赋的适当安排,然后让人们在埃奇沃斯框图模型内彼此自由地交易,就能获得帕累托效率资源配臵。即政府适当地对收入进行再分配,然后让市场发挥作用,就能得到效用可能性边界上的任何一点。 --只要偏好成凸状,每一个帕累托有效配臵均可证明为竞争性的均衡。 该定理强调效率和公平可以分开考虑。通过改变禀赋来实现最优。尽量不要通过价格。如所得税是对禀赋征税。 无差异曲线-曲线上任意两点效用相等。 艾奇渥斯方框图。二个无差异曲线的切点是帕累托最优点。切点连线即契约线,线上每一点都是帕累托有效点。 1

国际贸易实务名词中英文对译

合同的标的至货物的交付 商品的名称name of commodity 凭买方样品买卖sale by seller’s sample 凭买方样品买卖sale by buyer’s sample 代表性样品representative sample=原样original sample =标准样品type sample 复样duplicate sample=留样keep sample 对等样品counter sample=回样return sample 色彩样品color sample 花样款式样品pattern sample 参考样品reference sample 免费样品free sample 推销样品selling sample 装运样品shipping sample ,shipment sample 到货样品outturn sample 检验用样品sample for test

凭文字说明买卖sale by description 凭规格买卖sale by specification 凭等级买卖sale by grade 凭标准买卖sale by standard 良好平均品质Fair Average Quality 或F.A.Q 凭产地名称或凭地理标志买卖sale by name of origin , or sale by geographical indication 凭说明书和图样买卖sale by description and illustration Quality and technical data to be strictly in conformity with the description submitted by the seller 仅供参考For Reference Only 质量公差quality tolerance 毛重gross weight 以毛作净gross for net 净重net weight 按实际皮重real tare , or actual tare 按平均皮重average tare 按习惯皮重customary tare 按约定皮重computed tare 按公量计重conditioned weight 按理论重量计重theoretical weight 法定重量legal weight

土木工程材料课程作业

土木工程材料课程作业_B 一、单选题 1. (4分)下列有关混凝土强度及强度等级的叙述,哪一条是错误的 ? A. 混凝土抗拉强度只有抗压强度的1/10~1/20,且随着混凝土强度等级的提高,比值有所降低 ? B. 按《混凝土结构设计规范(GB50010-2002)》规定,混凝土强度等级从C15~C80,划分为14个等级混凝土 ? C. 混凝土强度检测的标准养护条件是30±2℃ ? D. 混凝土强度检测的标准龄期为28天 得分:4 知识点:混凝土强度 答案C 解析2. (4分)在下列材料与水有关的性质中,哪一种说法是错误的 ? A. 湿润角θ≤90°的材料称为亲水性材料 ? B. 石蜡、沥青均为憎水性材料 ? C. 材料吸水后,将使强度和保温性降低 ? D. 软化系数越小,表明材料的耐水性越好

得分:4 知识点:材料与水的关系 答案D 解析3. (4分)下列有关外加剂的叙述中,哪一条不正确 ? A. 氯盐、三乙醇胺及硫酸钠均属早强剂 ? B. 膨胀剂使水泥经水化反应生成钙矾石、氢氧化钙,从而使混凝土产生体积膨胀 ? C. 加气剂可使混凝土产生微小、封闭的气泡,故用于制造加气混凝土 ? D. 强电解质无机盐类外加剂严禁用于使用直流电的结构以及距高压直流电源100m以内的结构 得分:4 知识点:外加剂 答案C 解析4. (4分)混凝土承受持续荷载时,随时间的延长而增加的变形称为() ? A. 弹性变形变 ? B. 徐变 ? C. 应变 ? D. 残余变形

得分:4 知识点:混凝土 答案B 解析5. (4分)当材料的孔隙率增大的时候,以下哪些性质一定下降 ? A. 密度、表观密度 ? B. 表观密度、抗渗性 ? C. 强度、抗冻性 ? D. 表观密度、强度 得分:4 知识点:孔隙率 答案D 解析6. (4分)加气砼所采用的加气剂多为()。 ? A. 松香胶泡沫剂 ? B. 磨细铝粉 ? C. 氯化胺 ? D. 动物血加苛性钠 得分:4

《国际贸易实务》教案设计

《国际贸易实务》教案设计 一、授课题目:《第一节支付工具》 二、课程类型:理论课 三、教学内容:教科书133页—137页的内容,明确国际贸易的支付方式 四、教学目标: 1、通过本节课程内容的学习,使学生了解广告公司创意部门的工作流程,熟悉创意部门各个环节的工作内容。 2、培养学生沟通和独立思考的能力,能够根据客户要求撰写广告创意纲要。 3、让学生在课堂上进行思维导图的训练,锻炼学生发散思维的能力,使学生真正掌握形成创意构思的方法。 4、设置广告创意部门的教学情境,通过实际的广告案例分析,激发学习兴趣,培养学生合作、探究和创新意识。 五、教学重、难点: 1、能够在实际工作中根据客户提供的客户纲要完成创意纲要的填写。 2、掌握创意构思的方法—思维导图,并且能够运用思维导图进行广告文案的创作。 六、教学方法: 1、问题探究式教学法; 2、启发式教学法; 3、案例分析法; 4、

练习法;5、讲授法 七、教学过程: 1)复习上节课的内容。 2)案例导入:例举两则学生印象深刻的创意广告案例导入新课程的内容。 例一:三星绚丽屏手机广告;例二:快干指甲油街头雕塑—环境广告。 新课程内容:广告创意程序流程图。 3)举例导入创意过程的第一步:形成创意战略,并运用问题探究式教学方法和启发式教学法完成创意纲要的填写。第一步是教学的重难点,培养学生运用实际案例进行分析问题的能力。 a、举例:小和尚“回头是岸”—形成创意战略是基于广告公司与客户的沟通,沟通的主要方式是形成创意纲要; b、讲授创意纲要的主要内容和制定的一般工作流程; c、设置问题情境:学生为创意部门的成员,需要共同完成一个广告创意。 d、确定问题:台湾统一企业关于杯装咖啡的客户纲要。 客户纲要的内容:台湾统一企业研制一种杯装咖啡。当时的市场竞争相当激烈,从高档的咖啡到低档的豆奶,市场售价在10元至15元新台币,最贵的灌装饮料也只卖到20元。统一企业新产品的售价定为25元/杯。 有两个问题需要解决:1、如何使消费者多花10元购买统一的杯

公共部门经济学概论

公共部门经济学概论

第一章公共部门经济学概论 一、什么是公共部门经济学 (一)公共部门经济学的概念 公共部门经济学,是从英文 Public Sector Economics翻译过来的,有时人们也称之为政府经济学。因此,公共部门经济学和政府经济学是指同一个概念。公共经济学是研究政府经济行为的科学。 在市场经济条件下,政府也是一个独立的经济主体。西方经济学把所有经济主体分为公共部门(Public Sector)和私人部门(Public Sector)两大类。公共部门是指政府及其附属物,私人部门是指企业和居民。政府、企业

和居民都以各自的方式参与国民经济运行,影响着国民经济的发展方向和速度。在西方宏观经济学的核心理论,即关于国民收人决定的一般理论中,这三者之间的关系表述如图所示。 在公共部门经济学中,政府是指国民经济中惟一通过政治程序建立的在特定区域行使立法、司法和行政权的实体。政府除对辖区内居民负有政治责任外,还参与辖区内非市场性社会生产活动,从事非市场性财富分配。 政府的含义有四个层次: 第一个层次是指狭义政府,也就是核心政府。即中央政府的各部、委、办、厅、局及其附属物。 第二个层次是指广义政府,即中央政府十地方政府。

第三个层次是指公共部门,即中央政府十地方政府十非金融性公共企业。 第四个层次是指广义公共部门,即中央政府十地方政府十非金融公共企业十政策性官方金融机构。 (二)公共部门经济学的研究对象 公共部门经济学的研究对象,就是以上各级政府的经济行为。一般来说,政府的经济行为有两大块: 一是非市场性社会生产活动。指政府为满足居民的公共消费需要,通过向社会成员征税或强制转移财富的办法来筹措资金,不以盈利为目的,从事生产和提供诸如国防、治安、义务教育、公共卫生等公共产品和服务。 二是非市场性社会财富分配。指政府为了保证辖区内全体社会成员的公平与公正,维护社会稳定,采取税收制度和其他强制性手段对社会成员的财富进行重新分配。 在公共部门经济学中,对政府经济行为的研究范围包括:(l)公共部门经济活动的深度和广度;(2)公共部门经济活动的后果及影响;(3)对

土木工程材料课程作业3

土木工程材料课程作业_C 一、单选题 1.(4分)合理砂率是指在用水量和水泥用量一定的情况下,能使用混凝土拌和物获得( )流动性,同时保持良好粘聚性和保水性的砂率值。 A. 最大 B. 最小 C. 一般 D. 不变 得分:4 知识点:砂率 答案A 2.(4分)下列哪一种玻璃的保温节能效果最差? A. 毛玻璃 B. 热反射玻璃 C. 光致变色玻璃 D. 吸热玻璃 得分:4 知识点:玻璃 答案A 3.(4分)《建设部推广应用和限制禁止使用技术》限制使用下列哪一类混凝土材料或工艺? A. 混凝土高效减水剂 B. 超细矿物掺合料C. 混凝土现场拌制 D. 预拌混凝土技术 得分:0 知识点:国家规范 答案D 4.(4分)下列绝热材料的热阻,在相同条件下,哪一个最大? A. 加气混凝土 B. 粘土空心砖 C. 泡沫塑料 D. 岩棉 得分:4

知识点:绝热材料 答案C 5.(4分)材料按微观结构可分为 A. 金属材料、非金属材料、复合材料 B. 有机材料、无机材料、复合材料 C. 承重材料、非承重材料D. 晶体、玻璃体、胶体 得分:4 知识点:材料的结构 答案D 6.(4分)试分析下列哪些工程不适于选用石膏制品。( ) A. 吊顶材料 B. 影剧院的穿孔贴面板 C. 冷库内的墙贴面 D. 非承重隔墙板 得分:4 知识点:石膏 答案C 7.(4分)下列哪一项关于大体积混凝土的定义最合适? A. 现场浇筑的混凝土,尺寸大到需要采取措施降低水化热引起的体积变化的构件 B. 建筑物的基础、大坝等体积达到几十立方米以上的工程 C. 大型建筑物的基础、大坝等尺寸达到几十米以上的工程 D. 可以采取增加水泥用量的方法减少大体积混凝土的裂缝 得分:4 知识点:大体积混凝土 答案A 8.(4分)下面关于材料硬度与强度的内容,哪一项是错误的?

2019年国际贸易实务课程教案范文

2019 年国际贸易实务课程教案范文 第七章国际贸易争议的处理 教学要求与目的: 了解商品检验的作用、检验权及商品检验机构,了解仲裁、不 可抗力的含义、相关规则、实务操作等基本内容。 教学重点:检验权、仲裁、不可抗力 教学难点:仲裁的法律后果不可抗力的判断及法律后果 第一节商品检验 一、商品检验的含义和意义 商品检验是指由国家设立的检验机构或向政府注册的独立机构,对进出口货物的质量、规格、卫生、安全性能、卫生方面的指标及装 运技术和装运条件等项目实施检验和鉴定。

检验的目的是经过第三者证明,以确定其是否与贸易合同、有关标准规定一致,是否符合进出口国有关法律和行政法规的规定,保障对外贸易各方的合法权益。 二、商品检验机构 1.国际商品检验机构 (1)官方:如美国食品药物管理局(FDA) (2)半官方:如美国担保人实验室(UL) (3)民间(非官方):如瑞士日内瓦通用鉴定公司(SOCIETEGENERALEDESURVEILLANCES.A.SGS) 2.我国的商品检验机构 机构全称:中华人民共和国国家出入境检验检疫局 三大职能:法定检验、监督管理、鉴定工作 三、检验的时间和地点

(一)在出口国检验: (1)产地或工厂检验; (2)装船前或装船时检验:离岸品质或重量 否定买方的复验权,对买方不利 (二)在进口国检验: (1)目的港(地)卸货后检验; (2)目的港(地)买方营业处所或最终用户所在地检验 (三)在出口国检验,在进口国复验 (1)复验:是指买方收到货物后有复验权。复验期限的长短,应视商品的性质和港口情况而定。 (2)复验机构、复验地点均应在合同中规定。

公共部门经济学(本)

(一) 单选题 1. 当消费者认为某一社区供给的公共产品符合自己的偏好时就迁入该社区,否则就迁出,这种情形称为( )。 (A) 反叛表达 (B) 投票表达 (C) 发言表达 (D) 进退表达 参考答案: (D) 没有详解信息! 2. 矫正性税收着眼于( )。 (A) 私人边际成本与社会边际成本相一致 (B) 私人边际成本大于社会边际成本 (C) 私人边际收益与社会边际收益相一致 (D) 私人边际收益大于社会边际收益 参考答案: (A) 没有详解信息! 3. 下面哪一项经济活动可能引起负外部效应( )。 (A) 汽车排放的尾气 (B) 一项科学发明 (C) 购买一件衣服 (D) 修复历史建筑 参考答案: (A) 没有详解信息! 4. 公共部门的收入分配职能解决的是( )。 (A) “生产什么”的问题 (B) “为谁生产”的问题 (C) “如何生产”的问题

(D) 以上都是 参考答案: (B) 没有详解信息! 5. 当有正外部效应时,市场失灵之所以存在的原因是( )。 (A) 社会边际成本大于私人边际成本 (B) 社会边际成本小于私人边际成本 (C) 社会边际收益大于私人边际收益 (D) 社会边际收益小于私人边际收益 参考答案: (C) 没有详解信息! 6. 政治市场上需求方与供给方分别是( )。 (A) 私人企业与政府 (B) 投票者与政治家 (C) 私人企业与政治家 (D) 投票者与政府 参考答案: (B) 没有详解信息! 7. 用“社会机会成本”来衡量公共支出的最优规模是( )。 (A) 实证分析方法 (B) 规范分析方法 (C) 局部均衡分析方法 (D) 一般均衡分析方法 参考答案: (C) 没有详解信息! 8. 下面哪一项经济活动会产生“公共地的悲剧”( )。

最新《国际贸易实务》课程标准

《国际贸易实务》课程标准 适用专业:电子商务、商务管理、 会计、金融证券 编制人:方铮炀 编制单位:财经系 审核人: 系部主任:杨新颖 编制日期:2014 年12 月30 日 郑州信息工程职业学院教务处制

目录 一、课程基本情况 二、课程概述 (一)课程的性质与定位 (二)课程基本理念 (三)课程设计思路 三、课程目标 (一)知识目标 (二)能力目标 (三)素质目标 四、与前后课程的联系 五、课程内容标准 (一)课程总体设计 (二)项目(单元)设计 六、课程实施建议 (一)教学组织实施 (二)师资条件要求 (三)教学条件基本要求 七、教学资源基本要求 (一)教材的选用与编写 (二)网络资源建设 (三)信息化教学资源建设 (四)其它教学资源的开发与利用 八、考核方式与标准 九、其它 《国际贸易实务》课程标准一、课程基本情况

二、课程概述 (一)课程的性质与定位 《国际贸易实务》课程是国际商务、报关与国际货运、国际经济与贸易专业 学生必修的专业主干课,是专业英语、涉外会计等其他涉外经济类专业学生学习的专业必修课。本课程是一门主要研究国际商品交换的基本知识、基本规则和具体操作技术的学科,也是一门具有涉外经济活动特点的实践性很强的综合性、应用性科学。 (二)课程基本理念 《国际贸易实务》课程是物流专业及其相关专业课程体系中的一门专业基 础理论课程。本课程的目的是使学生懂得国际贸易发生的基本原因,熟悉基本的国际贸易政策和措施,具备一定的国际贸易政策环境分析能力,能够判断、解决现实中的国际贸易问题,为从事国际贸易以及相关专业的工作准备必要的理论基础。 本课程对学生从事国际贸易职业能力的培养和职业素养养成起着重要支撑 作用,任何具体的微观国际贸易业务,总是在一定的宏观政策环境中进行的,通过学习,学生具备了宏观的国际贸易理论政策知识,便于今后学习具体的国际贸易职业课程,也为学生职业生涯的可持续发展提供了思维能力的锻炼。 (三)课程设计思路 本课程总体设计思路是以外贸业务员的工作内容为教学内容,按进出口业务流程组织教学过程,将校内实训室和校外实习基地作为第二课堂,采用教、学、做三位一体的教学模式,突出对学生职业能力的培养。 (一)内容设计 按照对外经贸企业或岗位的业务工作内容和相关职业资格考试对从业人员基础知识、操作技能、职业素养等的要求,进行教学内容的选取和重、难点确定。在课程内容安排上,按照选用教材的章节顺序,以国际货物买卖合同的订立与履行为主线,将进出口业务各个环节串联起来,具体讲授国际货物买卖的基本知识与流程、进出口业务的主要操作技能与方法、国际贸易惯例的相关案例与规定。(二)教学设计 在教学过程设计上,既强调学生理解并掌握国际贸易操作的基础知识,又注重学生动手实践能力的培养,并将职业素养教育融入到教学活动中。采用讲授法、讨论法、分组教学法、案例分析教学法、任务式教学法、角色模拟教学法等形式多样的教学方法,综合运用多媒体、实训软件等教学手段,以期实现教学目标、达到预期的教学效果。大力开发课程资源,完善精品课程建设,将课堂讲授与网络教学相结合,促进学生自主学习。 三、课程目标 通过学习本课程,学生应具备从事国际贸易相关工作的职业能力,熟知 国际贸易惯例、熟悉国际贸易流程、具备独立开展进出口业务的技能,既能胜任外贸一线岗位,又具备可持续发展能力。 (一)知识目标 使学生熟知外贸业务的专业术语和专业知识,通晓外贸业务操作的程序步骤 和外贸合同的各项条件,理解国际法律法规及贸易惯例对外贸操作的主要规定。

土木工程材料课程作业_C

1. 下列有关石油沥青改性的叙述,哪一项是错误的? 常用橡胶、树脂和矿物填料来改善沥青的某些性质 橡胶是沥青的重要改性材料,它和沥青有较好的混溶性,并使沥青具有橡胶的很多优点,如高温变形小、低温柔性好等 在沥青中掺入矿物掺和料能改善沥青的粘结力和耐热性,减少沥青的温度敏感性 树脂也是沥青的重要改性材料,它与沥青相容性好,大部分品种树脂可以用来做改性材料 本题分值: 4.0 用户未作答 标准答案:树脂也是沥青的重要改性材料,它与沥青相容性好,大部分品种树脂可以用来做改性材料 2. 中砂的细度模数MX为()。 3.7~3.1 3.0~2.3 2.2~1.6 1.4 本题分值: 4.0 用户未作答 标准答案: 3.0~2.3 3. 胶体是由具有物质三态(固、液、气)中某种状态的高分散度的粒子作为散相,分散于另一相(分散介质)中所形成的系统.它具有_______特点。 高度分散性和多相性 高度分散性和二相性 高度絮凝性和多相性 高度絮凝性和二相性 本题分值: 4.0

用户未作答 标准答案:高度分散性和多相性 4. 能反映集料中各粒径颗粒的搭配比例或分布情况的是() 密度 细度 级配 颗粒形状 本题分值: 4.0 用户未作答 标准答案:级配 5. ()树脂属于热塑性树脂。 聚氯乙烯 聚丙烯 酚醛 (A+B) 本题分值: 4.0 用户未作答 标准答案: (A+B) 6. 预拌砂浆中表示预拌抹灰砂浆的符号是()。 RM RP RS RR 本题分值: 4.0 用户未作答 标准答案: RP

7. 为使室内温度保持稳定,应选用()的材料。 导热系数大 比热大 导热系数小,比热大 比热小 本题分值: 4.0 用户未作答 标准答案:导热系数小,比热大 8. 硅酸盐水泥石由于长期在含较低浓度硫酸盐水的作用下,引起水泥石开裂,是由于形成了() 二水硫酸钙 钙矾石 硫酸钠 硫酸镁 本题分值: 4.0 用户未作答 标准答案:钙矾石 9. 水泥胶砂强度试验三条试体28天抗折强度分别为7.0MPa,9.0MPa,7.0MPa,则抗折强度试验结果为() 7.0MPa 7.7MPa 9.0MPa 8.0MPa 本题分值: 4.0 用户未作答 标准答案: 7.0MPa

土木工程材料教案讲义10混凝土的组成材料.doc

第5章混凝土 5.1混凝土的概述 5.1.1混凝土的定义 以胶凝材料、颗粒状集料(必要时加入的化学外加剂、掺合料、纤维等材料)为原材料, 按比例配料、拌合、成型,经硬化而形成的具有堆聚结构的人造石材,统称为混凝土, 5.1.2混凝土的发展历史 5.1.3混凝土的分类 从结构及表观密度方面进行分类 (1)按混凝土结构分 1)普通结构混凝土 2)细粒混凝土 3)大孔混凝土 4)多孔混凝土 (2 )按照表观密度分 1)重混凝土 2)普通混凝土 3)轻混凝土 4)特轻混凝土 5. 1.4混凝土材料的特点 (1 )优点 1)成木低 2)可塑性好 3)配制灵活,适应性好 4)抗压强度高 5)复合性能好 6)耐久性好 7)耐火性好 8)生产能耗低。 (2 )混凝土的缺点 1)自重大、比强度小混凝土比强度比木材、钢材小。 2)抗拉强度低、变形能力小呈脆性、易开裂,抗拉强度约为抗压强度的1/10?1/20。5.2混凝土的组成材料 普通混凝土的组成材料主要有水泥、水、粗骨料(碎石、卵石)、细骨料(砂)。有时,

loo-A 为了改善某方面的性能,需加入外加剂或掺合料。普通混凝土硬化后的宏观组织构造如图 5.1所示。 5.2.1水泥 (1 )水泥品种的选择 水泥品种的选择,需在分析工程特点、环境特点、施工条件的基础上,结合水泥的性能 特点来选择, (2 )水泥强度等级的选择 水泥强度等级要与混凝土强度等级相适应。 (3) 水泥的技术性质 对于所选水泥品种,应检验技术性质,需满足相关要求。 5. 2. 2细骨料 公称粒径在0. 15-4. 75mm 之间的骨料称为细骨料,也叫砂。砂按来源分为天然砂、人 工砂两类。砂的技术要求主要有: (1 )砂的颗粒级配和粗细程度 砂的颗粒级配是指砂了大小不同的颗粒搭配的比例情况。 砂的粗细程度是指砂了总体的粗细程度 砂子的颗粒级配和粗细程度,可通过筛分析的方法来确定。 砂的粗细程度可通过计算细度模数确定。细度模数根据(5.1)式计算(精确至O.ODo A + 旗 + &)-5卜 M _ (& + A + (5.1) 式中:细度模数。A 、盅、人3、人4、&、&一分别为4.751顶、2.36mm. 1.18mm 、 600 /Am 、300 /Jin 、150 /.un 筛的累计筛余百分率。 砂按细度模数分为粗、中、细三种规格,其细度模数分别为: 粗砂:3. 7?3.1 中砂:3.0?2. 3 细砂:2. 2?1.6 (2 )含泥量(石粉含量和泥块含量) 天然砂的含泥量和泥块含量应符合表5. 3规定。 (3) 有害物质 砂中云母、轻物质、有机物、硫化物及硫酸盐、藐盐等的含量应符合表5. 3的规定。 (4) 坚固性 坚固性是砂在自然风化和其他外界物理化学因素作用下,抵抗破裂的能力。根据 GB/T1464-2001规定,天然砂采用硫酸钠溶液进行试验,砂样经5次循环后其质量损失应符 合表5. 4规定。 (5) 表观密度、堆积密度、空隙率 砂的表观密度大于2500 kg ? m ;,松散堆积密度大于1350 kg ?m 3,空隙率小于47%。 (6 )碱集料反应 指水泥、外加剂等混凝土组成物及环境中的碱与集料中活性矿物在潮湿环境下缓慢发生 并导致混凝土开裂破坏的膨胀反应。 (7 )砂的含水状态 砂有四种含水状态(如图5. 4所示): 1) 绝干状态

国际贸易实务实验教案

第一篇出口贸易流程 实验一建立客户联系与交易磋商 一.实验目的 1、掌握与客户建立业务联系的主要程序,并掌握对外联系函的一般内容及书写 2、掌握交易磋商的基本程序:发盘、还盘与接受 3、掌握出口商品的成本核算与报价方法 4、掌握发盘函的一般内容 二.实验内容 1、选择实习公司,查看公司基本情况 2、以本公司员工的身份寻找贸易伙伴,了解进口方的需求状况 3、书写对外联系函与客户建立业务联系 4、出口报价及发盘:计算成本、费用和利润,按外方要求贸易术语报价,写发盘函 5、出口还价核算及还盘:确认外方来函,调整我方的利润率,进行还价核算,强调原价的合理性,并列明理由,提出我方条件,并催对方行动 6、出口成交核算:计算出口总价和总利润 三.实验步骤 1、进入国际贸易实验室:打开IE浏览器,在地址栏输入:HTTP://192.168.0.105/ITRADE 2、点击“出口流程”,在本页输入学号,密码与学号相同 3、点击“选择实习公司”,从提供的公司中任选一家,查看此公司的信息资料 4、点击“与客户建立联系”,进入操作一,查看客户需求信息及相关资料,并从背景信息中下载交易商品资料 5、写联系函 (1)先将本页最小化,然后打开WORD文档,在WORD文档中写好对外联系函。 (2)将写好的联系函保存在“我的文档”或“桌面” 6、文档递交 (1)先将上一步缩小的页面还原,点击文档递交下的浏览 (2)页面出现如下情况,先从“我的文档”中或“桌面”找到保存的联系函,点击“打开”,然后,点击“确认”,写好的函件便传递到了教师批阅处 7.修改文档:如果要修改上传文档,点击文档递交时间栏内“下载”,对文档进行修改后,重复第6步递交文档 8、阅读外方反馈函:在操作一发出联系函后,外方有一回复资料,从回复资料中下载外方反馈函,并打开 9、出口报价及还盘 (1)点击“出口报价及还盘”进入操作二,浏览出口报价核算资料 (2)从背景信息中下载报价公式:按出口报价核算资料及外方反馈函的要求计算价格 (3)写发盘函:根据以上报价计算,按发盘函的一般书写要求,拟写发盘函,发盘函的书写操作和递交程序同操作一的联系函 (4)阅读外方的反馈函 10、出口还价核算及还盘 (1)点击“出口还价核算及还盘”进入操作四,阅读出口还价核算资料 (2)还价核算:根据我方还价资料中提供的利润率要求,及外方反馈的信息核算出对应的价

公共部门经济学论文

电子商务带来的税收问题 摘要:电子商务的迅猛发展给我国的税收部门带来了严峻的挑战,如何在保证我国税收利益不受大损失的前提下,保护我国电子商务产业持续发展,成为一个很重要的问题。本文结合电子商务课程和公共部门经济学课程税收方面的相关知识,尝试探讨我国是否应该对电子商务收税,如何对电子商务收税以及相应的优化措施等问题。 2009年12月3日,中国互联网络信息中心(CNNIC)发布了《2009年中国网络购物市场研究报告》(以下简称《报告》)。数据显示,截至2009年6月,我国网购用户规模已达8788万,同比增加2459万人,年增长率为38.9%,上半年网购消费金额超过千亿。 报告显示,今年上半年,全国网络购物消费金额总计1195.2亿元,预计到年底,这个数字将达到2500亿元左右。其中在C2C平台上完成的交易占据了总额的89%。报告同时显示,上半年有85.7%的网民在网上查询过商品价格,但只有26%的网民完成了最终交易,在完成交易的网民中,80%的人对网购经历很满意。 从这篇报告中,我们不难看出以下几点: 第一,中国的电子商务产业正在以近10%的年增长速率迅猛发展,略大于中国8%左右的GDP增长率。而且作为一个正在迅猛发展的新兴产业,政府至少不会在政策上作出对行业发展不利的决定。因此我们可以说,电子商务在未来的发展前景非常值得看好。 第二,中国电子商务产业拥有规模庞大的潜在客户群。从数据中可以看出,上半年1195亿的消费额只是由26%的网民完成的,还有近60%的网民只是上网查过价格,但未进行过交易。这其中的原因可能是对价格不满意,也可能是对购物流程不熟悉,或者是消费能力不足,但不管如何,只要加以正确的引导和到位的宣传,这60%的网民中的很大一部分在未来都会参与到网络购物之中。如果我们将60%乘上中国3.6亿的网民人数(2009年底的预计数字),那将会是2.16亿,一个非常庞大的数字,一个值得憧憬的数字。因此我们可以说这个市场的前景也是非常广阔的。 尽管行业前景一片大好,但是从政府的角度来看,仍有一个问题非常值得我们注意:在1195亿元的消费总额中,C2C类的占到了89%,而B2C类的只占到10%左右。但是由于迄今还没有实现对从C2C类网络交易行之有效的税收管理,所以这个数据的背后可能隐藏着巨大的税收流失问题。为了更好地管理我国的税收,我们有必要借鉴一下其他国家在电子商务税收问题上的处理方法。 国际上的电子商务税收制度 现在国际上对电子商务税收制度主要分为三个阵营,即美国、欧盟和广大发展中国家。下面我们来具体看看他们各自的主张。 美国一直想在全球范围内实现电子商务零税收的愿望。从1996年开始,美国就不遗余力地在国内和国际两条战线推行他的电子商务交易零税收方案,并希望尽快确定全球范围内的电子商务征税原则。尽管收效并没有他们自己预期的那样显著,但是这些政策在国内和国际上都产生了一定影响,尤其是在国内,电子商务零税收的贯彻力度尤为彻底。 欧盟则认为税收系统应具备法律确立性,应使纳税义务公开、明确、可预见和纳税中立性,即新兴贸易方式同传统贸易方式相比不应承担额外税收。但同传统的贸易方式一样,商品和服务的电子商务显然属于增值税征收范畴。因此大多数欧洲国家都把Intemet经营活动看作是新的潜在的税源,认为电子商务活动必须履行纳税义务,否则将导致不公平竞争。

《国际贸易实务》教学大纲.doc

《国际贸易实务》教学大纲 第一讲导论、国际贸易术语(1) 【教学目的和要求】 1、掌握国际贸易的特点 2、了解国际货物买卖使用的法律与惯例 3、了解本课程的研究的对象 4、了解国际货物买卖合同的主要条款 5、认真阅读本课程的学习方法 6、认真阅读贸易术语的产生与发展。 7、认真阅读并知晓有关贸易术语的国际贸易惯例。 8、掌握国际贸易惯例的性质与作用。 【课程知识点】 1、国际货物买卖适用的法律与惯例 2、国际货物买卖合同及其特点 3、国际贸易术语及其含义和作用 4、有关贸易术语的国际贸易惯例:《1932年华沙-牛津规则》、《1941年美国对外贸易定义修订本》、《2000年国际贸易术语解释通则》 5、国际贸易惯例的性质与作用 【复习思考题】 1、在我国进出口贸易中为什么要遵循《联合国国际货物销售合同公约》的有关规定? 2、根据我国合同法规定,合同应包括哪些主要内容? 3、进口贸易和出口贸易的一般业务程序各包括哪些环节和内容? 4、国际贸易惯例与法律有何联系与区别?如合同内容与惯例有冲突以什么为准? 5、当事人可否在合同中作出与惯例不符的规定? 6、有关贸易术语的国际惯例都有哪些?各有何不同? 7、学习和掌握国际贸易惯例的意义何在? 第二讲国际贸易术语(2) 【教学目的和要求】 1、了解E组贸易术语的主要特点 2、掌握F组贸易术语的特点 3、重点掌握FCA和FOB贸易术语的特点及其注意的问题。

4、重点掌握C组贸易术语中有关CIF贸易术语的特点及其注意的问题 5、重点掌握CIP贸易术语的有关特点 【课程知识点】 1、EXW贸易术语的特点 2、FAS贸易术语的特点 3、FOB、CFR和CIF贸易术语的买卖双方基本责任义务的划分、特点和使用的注意问题 4、FCA、CPT和CIP贸易术语的买卖双方基本责任义务的划分、特点和使用的注意问题 【复习思考题】 1、简述EXW术语的含义及卖方完成交货的条件。 2、《2000通则》对FCA条件下卖方交货的地点、风险划分的界限及买卖双方各自承担的责任和费用问题是如何规定的? 3、FAS术语与FCA术语有何共同点和区别? 4、如何理解按FOB术语成交时以船舷为界划分风险的问题? 5、CFR与FOB术语的异同点是什么? 6、请指出CPT、CIP和FCA三种术语之间的联系与区别。 第三讲国际贸易术语(3) 【教学目的和要求】 1、掌握D组贸易术语的特点 2、重点掌握DES贸易术语及其注意的问题。 3、重点掌握常用贸易术语的变形及其涵义 4、重点掌握贸易术语与合同的关系。 5、重点掌握选用贸易术语时应该注意的问题。 【课程知识点】 1、DAF贸易术语的含义及其使用中的注意问题 2、DES贸易术语的含义及其使用中的注意问题 3、DEQ贸易术语的含义及其使用中的注意问题 4、DDU贸易术语的含义及其使用中的注意问题 5、DDP贸易术语的含义及其使用中的注意问题 6、E、F、C、D三组不同的贸易术语的特点 7、FOB、CFR和CIF三种不同贸易术语的变形及其含义 8、贸易术语与合同的关系 9、风险转移问题 10、包装和检验问题 11、选用贸易术语应注意的问题 【复习思考题】 1、请比较DES与CIF术语的区别。 2、《2000通则》对DEQ术语作了什么新的规定?

兰大网院17春土木工程材料课程作业_C

2017秋春兰大课程作业答案---单选题 下列哪种绝热材料的导热系数最小? A: 矿棉 B: 加气混凝土 C: 泡沫塑料 D: 膨胀珍珠岩 单选题 石灰使用时需要“陈伏”两星期以上,其目的是: A: 有利于Ca(OH)结晶 B: 使石灰浆变稠 C: 减少熟化产生的热量 D: 消除过火石灰的危害 单选题 钢筋在高应力作用下,随时间增长其应变继续增加的现象为蠕变,钢筋受力后若保持长度不变,则其应力随时间增长而()的现象称为松弛。 A: 升高 B: 降低 C: 加快 D: 放慢 单选题 工程中一般采用抗渗等级来表示结构物的抗渗性,是按材料在标准抗渗试验时能承受的最大水压力确定的,如某种材料试验时在0.7MPa水压力作用下开始渗水,那么该材料的抗渗等级为下列哪一个? A: s6 B: s0.6 C: s7 D: s0.7 单选题 能反映集料中各粒径颗粒的搭配比例或分布情况的是() A: 密度 B: 细度 C: 级配 D: 颗粒形状

单选题 玻璃体结构的材料具有的特征是() A: 各向异性,强度较高,化学稳定性好 B: 各向同性,强度较低,化学稳定性差点 C: 各向同性,强度较高,受外力作用时有弹塑性变形 D: 各向异性,强度较低,受外力作用具有触变性 单选题 材料抗渗性的指标为()。 A: 软化系数 B: 渗透系数 C: 抗渗指标 D: 吸水率 单选题 建筑石油沥青的黏性是用()表示的。 A: 针入度 B: 黏滞度 C: 软化点 D: 延伸度 单选题 石油沥青的牍号由低到高,则沥青的()由小到大 A: 粘性 B: 塑性 C: 温度敏感性 D: (A+B) 单选题 下列有关石油沥青改性的叙述,哪一项是错误的? A: 常用橡胶、树脂和矿物填料来改善沥青的某些性质 B: 橡胶是沥青的重要改性材料,它和沥青有较好的混溶性,并使沥青具有橡胶的很多优点,如高温变形小、低温柔性好等 C: 在沥青中掺入矿物掺和料能改善沥青的粘结力和耐热性,减少沥青的温度敏感性 D: 树脂也是沥青的重要改性材料,它与沥青相容性好,大部分品种树脂可以用来做改性材料

《土木工程材料》教案第1-6章.docx

绪论 本章主要了解土木工程材料的分类和土木工程材料技术标准、建筑材料特点。 一、 目的要求:让学生掌握土木工程材料的概念、轮点、组成;熟练掌握建材的国家标准 二、 重点、难点:建材的国家标准 讲授 2016.2.29 2课时 导入新课-新课内容-课后小结-作业 导入新课:小时候玩的—身边的—房屋 一、 土木工程材料的定义和分类 人类赖以生存的总环境中,所有构筑物或建筑物所用材料及制品统称为建筑材料。本课程的建筑材料是指用于建 筑物地基、基础、地面、墙体、梁、板、柱、屋顶和建筑装饰的所有材料。 建筑材料的分类: 1、 按材料的化学成分分类,可分为无机材料、有机材料和复合材料三大类: 无机材料又分为金属材料(钢、铁、铝、铜、各类合金等)、非金属材料(天然石材、水泥、混凝土、玻璃、烧土 制品等)、金属一非金属复合材料(钢筋混凝土等); 有机材料有木材、塑料、合成橡胶、石油沥青等; 复合材料又分为无机非金属一有机复合材料(聚合物混凝土、玻璃纤维增强塑料等)、金属一有机复合材料(轻质 金属夹芯板等)。 2、 按材料的使用功能,可分为结构材料和功能材料两大类: 结构材料一一用作承重构件的材料,如梁、板、柱所用材料; 功能材料一一所用材料在建筑上具有某些特殊功能,如防水、装饰、隔热等功能。 二、 土木工程材料的特点 土木工程材料在工程中的使用必须有以下特点:具有工程要求的使用功能;具有与使用环境条件相适应的耐久性; 具有丰富的资源,满足建筑工程对材料量的需求;材料价廉。 建筑环境中,理想的建筑材料应具有轻质、高强、美观、保温、吸声、防水、防震、防火、无毒和高效节能等特 点。 三、 技术材料的类型 我国常用的标准有如下三大类: 1、 国家标准 国家标准有强制性标准(代号GB )、推荐性标准(代号GB/T )O 2、 行业标准 如建筑工程行业标准(代号JGJ )、建筑材料行业标准(代号JC )等。 3、 地方标准(代号DBJ )和企业标准(代号QB )。 标准的表示方法为:标准名称、部门代号、编号和批准年份。 小结:1、建筑材料的分类:按材料的化学成分分类,可分为无机材料、有机材料和复合材料三大类;按材料的使 用功能,可分为结构材料和功能材料两大类 2、我国常用的标准有如下三大类:国家标准、行业标准、地方标准(代号DBJ )和企业标准(代号QB ) 作业:土木工程材料的怎么分类? (P4. 1) 三、教学准备 教案、课件、视频 四、 教学方法 五、 教学时间 六、 教学时数 七、 教学步骤 八、 教学内容

《国际贸易实务》教案

《国际贸易实务》教案 教案说明 第一章国际贸易术语 第二章合同的标的物 第三章国际货物运输 第四章国际货物运输保险 第五章进出口商品的价格 第六章国际货款的收付 第七章检验、索赔、不可抗力与仲裁第八章出口合同的商订与履行 第九章进口合同的商订与履行 第十章国际贸易方式(自学) 参考资料

教案说明 本教案根据国际贸易实务教学大纲、教材和课程管理规程制定,适用于经济管理类相关专业。专业不同则课程地位不同(如专业骨干课、学科基础课或专业选修课),导致课时量不同,本教案以54课时设计。 课程以国际贸易买卖合同内容为基础,以进出口合同签订履行的业务操作程序为轴心,形成二元主体结构体系。此体系主要反映三个方面的知识与技术能力模块:一是对国际买卖条件的把握与运用,讲授34学时,辅助训练4学时;二是整个贸易过程的操作方法与技术,讲授6学时,辅助训练4学时;三是防范贸易风险与处理贸易纠纷的能力,包含在以上两模块当中,讲授4学时以上,辅助训练2小时以上。此外还有模拟实验课及毕业实习等。 三大知识模块构成了本课程的三个方面的重点,即国际买卖业务内容,也即合同条款;进出口贸易程序;以及含于前两项之中的风险防范。难点为贸易惯例和价格术语解读,以及对贸易内容的动手操作能力与过程。 重点难点的解决途径是三种教学方法的组合:一是课堂精讲,辅以讨论和答疑,目的是使学生准确掌握知识点;二是案例教学,培养进出口业务中分析问题和解决问题的能力;四是模拟仿真教学,通过传统的业务填单方式或微机模拟环境,使学生足不出户即对进出口业务进行操作,目的是培养学生的实际动手能力。这套方法组合可有效实现知识向动手能力的转化,为理论与实际相结合、知识与应用相结合、思考与操作相结合,提供了完整的教学模式。 教材、教学大纲及电子教案在内容的结构(宽度、深度、重点)上相对接;依电子教案在多媒体教室讲授实务知识和操作要领,同时分三个阶段进行知识点考核;学生不少于2周的实验室模拟操作,并进行操作考核;在电子题库中抽取综合试卷进行综合考核,评定总成绩。该教学内容的组织方式,能有效地实现教学内容向业务操作能力的转化,达到培养动手能力强的应用型人才的目的。 教案采用纵横结构,纵向以10章内容顺序展开;横向依九项要素展开,即采用教材、教学目标、计划学时、重点难点、教学方法、教学工具与手段、教学内容与学时分配以及作业训练等。这样根据每章的特点,通过立体化教学,使本教案形成了不同的教学内容、教促方法、教学工具和教学手段的组合。

国际贸易实务课程教学与改革方案

国际贸易实务课程教学与改革方案 国际经济贸易系 指导思想:以增强职业能力为核心进行课程建设与改革 改革的具体目标是:突出专业课程的职业定向性,以职业岗位能力作为配置课程的基础,使学生获得的知识、技能真正满足职业岗位(群)的需求,注重知识和技能的结合。 具体做法: (一)、调整教学计划,整合课程结构,深化课程容改革。 1、以就业为课程主要目标,重点突出职业能力培养,不再追求学科知识体系的逻辑严密性,强调教学容的“实际、实用、实践”,理论要以实际应用为目的,以“必需、够用”为度。同时,把职业资格标准引入课程体系,促进学校课程与职业书在教学涵上的统一,学完课程后,学生可以考取相关的职业书。 2、在保证理论知识够用的同时,加大实践性教学容的分量。(目前案例教学、实训教学环节等实践性教学容所占比例达60%)。 本课程教学总学时为126课时(含实训周24学时),每周6学时,具体学时分配如下表:

(二)、建立较为完善的实践教学体系。 实践教学体系由基本技能训练(课程章节配套实训练习)、专业技能训练(以业务过程为导向的模拟实训—实训周)、综合应用技能训练(以职业能力为导向的职业资格培训---单证员、跟单员和外贸业务员培训)、顶岗实习四个部分构成,纵向上形成体系,横向上与理论课程有机结合。 (三)、积极探索教学方法的改革。 进行案例教学和双语教学两种教学方法的尝试,取得较好效果。 (四)、教材使用与建设。 《国际贸易实务》课程建设在教材使用上,我们把握的原则是:1.应有利于应用型人才培养模式及课程目标的实现;2.适应高职教育教学需要;3.教师必须根据上述要求,处理教材容、通过改造教材,形成最佳教学容组合。 目前已基本完成《国际贸易实务》《国贸实务实训指导书》以及《国际贸易实务习题册》等三本教材的编写工作,在2008年二月底能作为校本教材投入使用,待使用一轮并逐步修改完善后争取在今年暑期正式出版。 (五)、大力推进校企合作,加强实训实习基地建设