亨格瑞管理会计英文第15版练习答案07解析

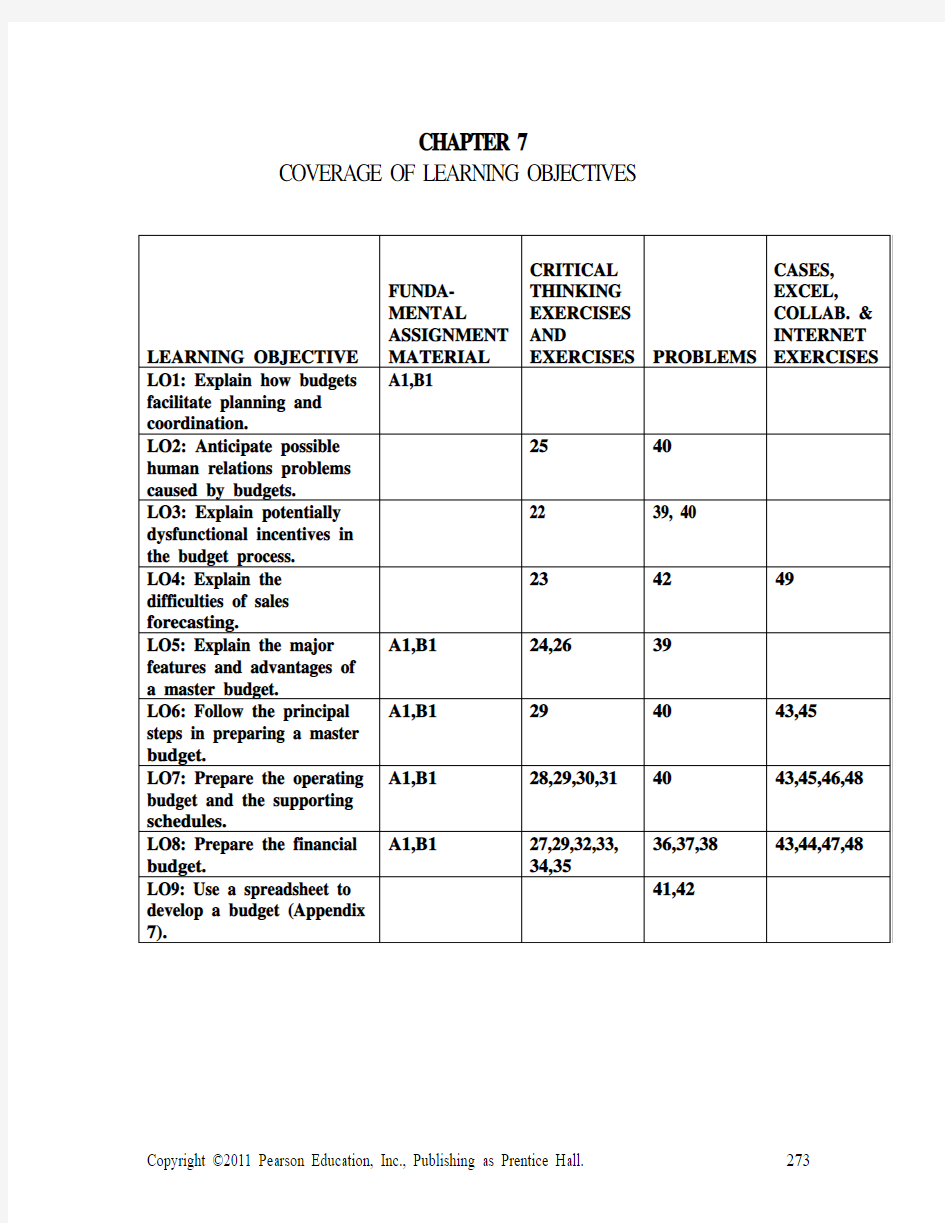

CHAPTER 7 COVERAGE OF LEARNING OBJECTIVES

Introduction to Budgets and Preparing the Master Budget

7-A1 (60-90 min.)

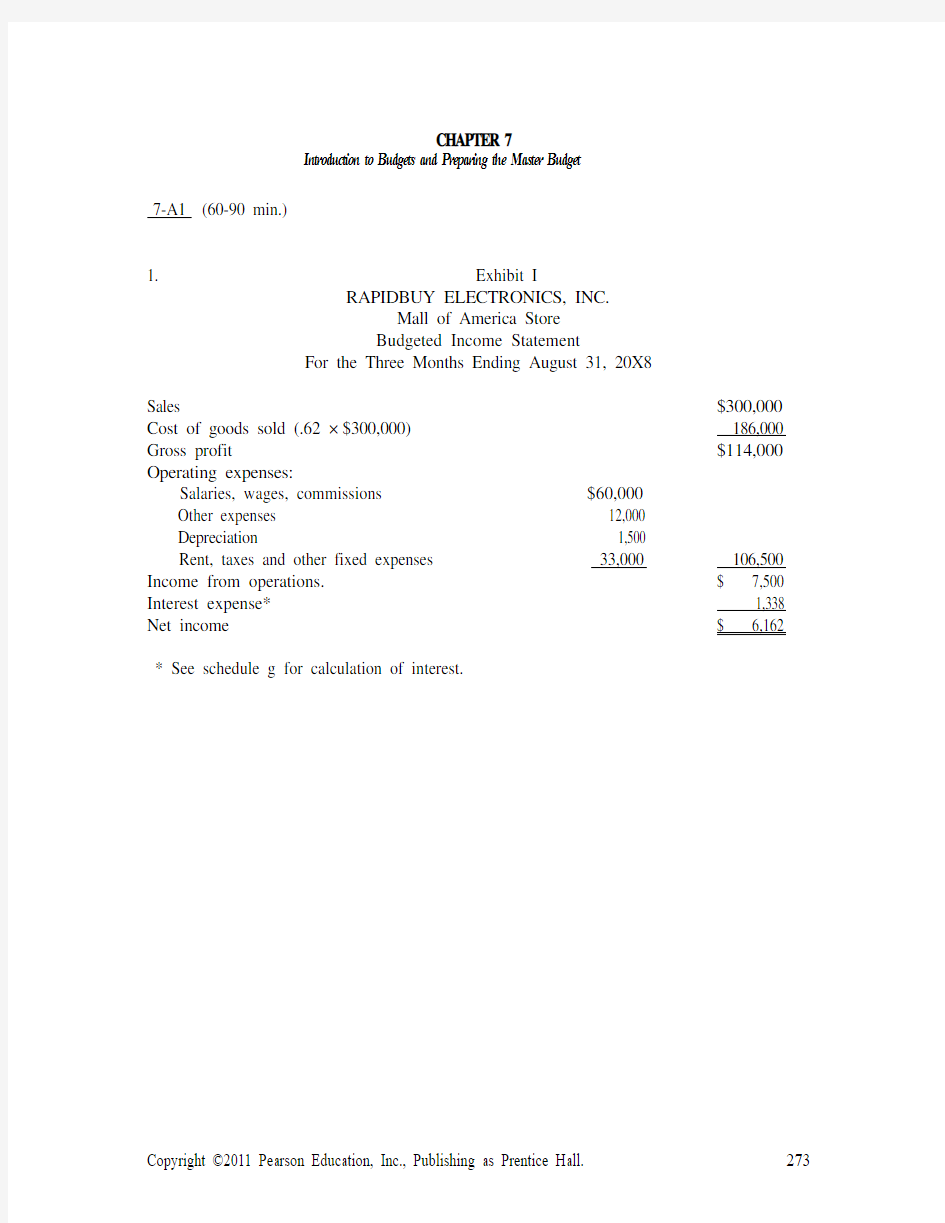

1. Exhibit I

RAPIDBUY ELECTRONICS, INC.

Mall of America Store

Budgeted Income Statement

For the Three Months Ending August 31, 20X8

Sales $300,000 Cost of goods sold (.62 × $300,000) 186,000 Gross profit $114,000 Operating expenses:

Salaries, wages, commissions $60,000

Other expenses 12,000

Depreciation 1,500

Rent, taxes and other fixed expenses 33,000 106,500 Income from operations. $ 7,500 Interest expense* 1,338 Net income $ 6,162 * See schedule g for calculation of interest.

RAPIDBUY ELECTRONICS, INC.

Mall of America Store

Cash Budget

For the Three Months Ending August 31, 20X8

June July August Beginning cash balance $ 5,800 $ 5,600 $ 5,079 Minimum cash balance desired 5,000 5,000 5,000 (a) Available cash balance $ 800 $ 600 $ 79

Cash receipts & disbursements:

Collections from customers

(schedule b) $ 75,200 $121,400 $ 90,800 Payments for merchandise

(schedule d) (86,800) (49,600) (49,600) Fixtures (purchased in May) (11,000) - - Payments for operating

expenses (schedule f) (44,600) (30,200) (30,200) (b) Net cash receipts & disbursements $(67,200) $ 41,600 $ 11,000

Excess (deficiency) of cash before

financing (a + b) (66,400) 42,200 11,079 Financing:

Borrowing, at beginning of period $ 67,000 $ - $ - Repayment, at end of period - (41,000) (10,000) Interest, 10% per annum - (1,121)* (217)* (c) Total cash increase (decrease)

from financing $ 67,000 $(42,121) $(10,217) (d) Ending cash balance (beginning

balance + b + c) $ 5,600 $ 5,079 $ 5,862 * See schedule g

RAPIDBUY ELECTRONICS, INC.

Mall of America Store

Budgeted Balance Sheet

August 31, 20X8

Assets Liabilities and Owners’ Equity

Cash (Exhibit II) $ 5,862 Accounts payable $ 37,200 Accounts receivable* 86,400 Notes payable 16,000** Merchandise inventory 37,200 Total current liabilities $ 53,200 Total current assets $129,462

Net fixed assets: Owners' equity:

$33,600 less $102,200 plus net

depreciation of $1,500 32,100 income of $6,162 108,362 Total assets $161,562 Total equities $161,562 *July sales, 20% × 90% × $80,000 $ 14,400

August sales, 100% × 90% × $80,000 72,000

Accounts receivable $86,400

** See schedule g

June July August Total Schedule a: Sales Budget

Credit sales (90%) $126,000 $72,000 $72,000 $270,000

Cash sales (10%) 14,000 8,000 8,000 30,000

Total sales (to Exhibit I) $140,000 $80,000 $80,000 $300,000 Schedule b: Cash Collections

June July August

Cash sales $ 14,000 $ 8,000 $ 8,000

On accounts receivable from:

April sales 10,800 - -

May sales 50,400 12,600 -

June sales - 100,800 25,200

July sales - - 57,600

Total collections (to Exhibit II) $75,200 $121,400 $90,800 Schedule c: Purchases Budget May June July August Desired purchases:

62% × next month's sales $86,800 $49,600 $49,600 $37,200 Schedule d: Disbursements for PurchasesJune July August

Last month's purchases (to Exhibit II) $86,800 $49,600 $49,600

Other required items related to purchases

Accounts payable, August 31, 2008

(62% × September sales - to Exhibit III) $37,200

Cost of goods sold (to Exhibit I) $86,800 $49,600 $49,600 Schedule e: Operating Expense Budget

June July August Total Salaries, wages, commissions $28,000 $16,000 $16,000 $60,000 Other Variable expenses 5,600 3,200 3,200 12,000 Fixed expenses 11,000 11,000 11,000 33,000 Depreciation 500 500 500 1,500 Total operating expenses $45,100 $30,700 $30,700 $106,500 Schedule f: Payments for Operating Expenses

June July August Variable expenses $33,600 $19,200 $19,200 Fixed expenses 11,000 11,000 11,000 Total payments for operating expenses $44,600 $30,200 $30,200 Schedule g: Interest calculations

June July August Beginning balance $67,000 $67,558 $26,000 Monthly interest expense @ 10% 558 563 217 Ending balance before repayment $67,558 68,121 26,217 Principal repayment (from

statement of receipts and disbursements) (41,000) (10,000) Interest payment (1,121) (217) Ending balance $26,000 $16,000

2. This is an example of the classic short-term, self-liquidating loan. The need for such

a loan often arises because of the seasonal nature of a business. The basic source of

cash is proceeds from sales to customers. In times of peak sales, there is a lag

between the sale and the collection of the cash, yet the payroll and suppliers must be

paid in cash right away. When the cash is collected, it in turn may be used to repay

the loan. The amount of the loan and the timing of the repayment are heavily

dependent on the credit terms that pertain to both the purchasing and selling functions

of the business.

7-B1 (60-120 min.) $ refers to Australian dollars.

1. See Exhibits I, II, and III and supporting schedules a, b, c, d.

2. The cash budget and balance sheet clearly show the benefits of moving to just-in-

time purchasing (though the transition would rarely be accomplished as easily as

this example suggests). However, the company would be no better off if it left

much of its capital tied up in cash -- it has merely substituted one asset for

another. At a minimum, the excess cash should be in an interest bearing account

-- the interest earned or forgone is one of the costs of inventory.

Schedule a: Sales Budget January February March

Total sales (100% on credit) $248,000 $280,000 $152,000 Schedule b: Cash Collections

60% of current month's sales $148,800 $168,000 $91,200

30% of previous month's sales 30,000 74,400 84,000

10% of second previous month's sales 10,000 10,000 24,800

Total collections $188,800 $252,400 $200,000

December January February March Schedule c: Purchases Budget

Desired ending inventory $156,200 $ 24,000* $ 24,000 $ 24,000 Cost of goods sold 50,000 124,000 140,000 76,000 Total needed $206,200 $148,000 $164,000 $100,000 Beginning inventory 64,000 156,200 32,200 24,000 Purchases $142,200 $ - $131,800 $ 76,000 * Actual ending January (and beginning February) inventory level is $32,200, as

inventory levels are drawn down toward desired level of $24,000.

Schedule d: Disbursements for Purchases

100% of previous month's purchases $142,200 $ - $131,800 March 31 accounts payable $76,000

WALLABY KITE

Cash Budget

For the Three Months Ending March 31, 20X2

January February March Cash balance, beginning $ 20,000 $ 20,400 $138,767 Minimum cash balance desired 20,000 20,000 20,000 (a) Available cash balance 0 400 118,767 Cash receipts and disbursements:

Collections from customers

(Schedule b) 188,800 252,400 200,000 Payments for merchandise

(Schedule d) (142,200) - (131,800) Rent (32,200) (1,000) (1,000) Wages and salaries (60,000) (60,000) (60,000) Miscellaneous expenses (10,000) (10,000) (10,000) Dividends (6,000) -

Purchase of fixtures - - (12,000) (b) Net cash receipts & disbursements $ (61,600) $181,400 $ (14,800)

Excess (deficiency) of cash

before financing (a + b) $ (61,600) $181,800 $103,967 Financing:

Borrowing, at beginning of period $ 62,000 $ - $ - Repayment, at end of period - (62,000)

Simple interest, 10% monthly - (1,033)

(c) Total cash increase (decrease)

from financing $ 62,000 $ (63,033) $ - (d) Cash balance, end (beginning

balance + c + b) $ 20,400 $138,767 $123,967

WALLABY KITE

Budgeted Income Statement

For the Three Months Ending March 31, 20X2

Sales (Schedule a) $680,000 Cost of goods sold (Schedule c) 340,000 Gross margin $340,000 Operating expenses:

Rent* $ 67,000

Wages and salaries 180,000

Depreciation. 3,000

Insurance 1,500

Miscellaneous 30,000 281,500 Net income from operations $ 58,500 Interest expense 1,033 Net income $ 57,467 *(January-March sales less $40,000) × .10 plus 3 × $1,000

亨格瑞管理会计英文第15版练习答案07

CHAPTER 7 COVERAGE OF LEARNING OBJECTIVES

Introduction to Budgets and Preparing the Master Budget 7-A1 (60-90 min.) 1. Exhibit I RAPIDBUY ELECTRONICS, INC. Mall of America Store Budgeted Income Statement For the Three Months Ending August 31, 20X8 Sales $300,000 Cost of goods sold (.62 × $300,000) 186,000 Gross profit $114,000 Operating expenses: Salaries, wages, commissions $60,000 Other expenses 12,000 Depreciation 1,500 Rent, taxes and other fixed expenses 33,000 106,500 Income from operations. $ 7,500 Interest expense* 1,338 Net income $ 6,162 * See schedule g for calculation of interest.

RAPIDBUY ELECTRONICS, INC. Mall of America Store Cash Budget For the Three Months Ending August 31, 20X8 June July August Beginning cash balance $ 5,800 $ 5,600 $ 5,079 Minimum cash balance desired 5,000 5,000 5,000 (a) Available cash balance $ 800 $ 600 $ 79 Cash receipts & disbursements: Collections from customers (schedule b) $ 75,200 $121,400 $ 90,800 Payments for merchandise (schedule d) (86,800) (49,600) (49,600) Fixtures (purchased in May) (11,000) - - Payments for operating expenses (schedule f) (44,600) (30,200) (30,200) (b) Net cash receipts & disbursements $(67,200) $ 41,600 $ 11,000 Excess (deficiency) of cash before financing (a + b) (66,400) 42,200 11,079 Financing: Borrowing, at beginning of period $ 67,000$ - $ - Repayment, at end of period - (41,000) (10,000) Interest, 10% per annum - (1,121)* (217)* (c) Total cash increase (decrease) from financing $ 67,000 $(42,121) $(10,217) (d) Ending cash balance (beginning balance + b + c) $ 5,600 $ 5,079 $ 5,862 * See schedule g

亨格瑞管理会计英文第15版练习答案04

CHAPTER 4 COVERAGE OF LEARNING OBJECTIVES

CHAPTER 4 Cost Management Systems and Activity-Based Costing 4-A1 (20-30 min.) See Table 4-A1 on the following page. 4-A2 (25-30 min.) 1. Merchandise Inventories, 1,000 devices @ $97 $97,000 2. Direct materials inventory $ 40,000 Work-in-process inventory 0 Finished goods inventory 97,000 Total inventories $137,000 3. NILE ELECTRONICS PRODUCTS Statement of Operating Income For the Year Ended December 31, 20X9 Sales (9,000 units at $170) $1,530,000 Cost of goods sold: Beginning inventory $ 0 Purchases 970,000 Cost of goods available for sale $ 970,000 Less ending inventory 97,000 Cost of goods sold (an expense) 873,000

Gross margin or gross profit $ 657,000 Less other expenses: selling & administrative costs 185,000 Operating income (also income before taxes in this example) $ 472,000

亨格瑞管理会计英文第15版练习答案05解析.

CHAPTER 5 COVERAGE OF LEARNING OBJECTIVES

CHAPTER 5 Relevant Information for Decision Making with a Focus on Pricing Decisions 5-A1 (40-50 min.) 1. INDEPENDENCE COMPANY Contribution Income Statement For the Year Ended December 31, 2009 (in thousands of dollars) Sales $2,200 Less variable expenses Direct material $400 Direct labor 330 Variable manufacturing overhead (Schedule 1) 150 Total variable manufacturing cost of goods sold $880 Variable selling expenses 80 Variable administrative expenses 25 Total variable expenses 985 Contribution margin $ 1,215 Less fixed expenses: Fixed manufacturing overhead (Schedule 2) $345 Selling expenses 220 Administrative expenses 119 Total fixed expenses 684 Operating income $ 531

亨格瑞管理会计英文第15版练习答案07

亨格瑞管理会计英文第15版练习答案07 CHAPTER 7 COVERAGE OF LEARNING OBJECTIVES CRITICAL CASES, FUNDA- THINKING EXCEL, MENTAL EXERCISES COLLAB. & ASSIGNMENT AND INTERNET LEARNING OBJECTIVE MATERIAL EXERCISES PROBLEMS EXERCISES LO1: Explain how budgets A1,B1 facilitate planning and coordination. LO2: Anticipate possible 25 40 human relations problems caused by budgets. LO3: Explain potentially 22 39, 40 dysfunctional incentives in the budget process. LO4: Explain the difficulties 23 42 49 of sales forecasting. LO5: Explain the major A1,B1 24,26 39 features and advantages of a master budget. LO6: Follow the principal A1,B1 29 40 43,45 steps in preparing a master budget. LO7: Prepare the operating A1,B1 28,29,30,31 40 43,45,46,48 budget and the supporting schedules.

亨格瑞管理会计英文第15版 答案 10-12章

CHAPTER 11 Capital Budgeting 11-A1 (15-25 min.) Answers are printed in the text at the end of the assignment material. 11-29 (10-15 min.) 1. The present value is $480,000 and the annual payments are an annuity, requiring use of Table 2: (a)$480,000 = annual payment × 11.2578 annual payment = $480,000 ÷ 11.2578 = $42,637 (b)$480,000 = annual payment × 9.4269 annual payment = $480,000 ÷ 9.4269 = $50,918 (c)$480,000 = annual payment × 8.0552 annual payment = $480,000 ÷ 8.0552 =$59,589 2. (a)$480,000 = annual payment × 8.5595 annual payment = $480,000 ÷ 8.5595 = $56,078 (b)$480,000 = annual payment × 7.6061 annual payment = $480,000 ÷ 7.6061 = $63,107 (c)$480,000 = annual payment × 6.8109 annual payment = $480,000 ÷ 6.8109 =$70,475 3. (a) Total payments= 30 × $50,918 = $1,527,540 Total interest paid= $1,527,540- $480,000 = $1,047,540 (b) Total payments= 15 × $63,107= $946,605 Total interest paid = $946,605 - $480,000 = $466,605 11-36 (10 min.) Buy. The net present value is positive. Initial outlay * $(21,000) Present value of cash operating savings, from 12-year, 12% column of Table 2, 6.1944 × $5,000 30,972 Net present value $ 9,972 * The trade-in allowance really consists of a $5,000 adjustment of the selling price and a bona fide $10,000 cash allowance for the old equipment. The relevant amount is the incremental cash outlay, $21,000. The book value is irrelevant. 11-39 (10-15 min.) Copyright ?2011 Pearson Education 1

亨格瑞管理会计英文第15版练习答案06

CHAPTER 6 COVERAGE OF LEARNING OBJECTIVES

LO6: Decide A4,B5 40 57,59 whether to keep or replace equipment. 26,39,41 52,58,64 71 LO7: Identify irrelevant and misspecified costs. B6 43 60 LO8: Discuss how performance measures can affect decision making. CHAPTER 6 Relevant Information and Decision Making With a Focus on Operational Decisions 6-A1 (20 min) 1. The key to this question is what will happen to the fixed overhead costs if production of the boxes is discontinued. Assume that all $60,000 of fixed costs will continue. Then, Sunshine State will lose $20,000 by purchasing the boxes from Weyerhaeuser: Payment to Weyerhaeuser, 80,000 × $2.10$168,000 Costs saved, variable costs 148,000 Additional costs $ 20,000 2. Some subjective factors are: Might Weyerhaeuser raise prices if Sunshine State closed down its box-making facility? Will sub-contracting the box production affect the quality of the boxes? Is a timely supply of boxes assured, even if the number needed changes? Does Sunshine State sacrifice proprietary information when disclosing the box specifications to Weyerhaeuser? 3. In this case the fixed costs are relevant. However, it is not the depreciation on the old equipment that is relevant. It is

亨格瑞管理会计英文第15版练习答案07

CHAPTER 7 COVERAGE OF LEARNING OBJECTIVES CHAPTER 7 Introduction to Budgets and Preparing the Master Budget 7-A1 (60-90 min.)

1. Exhibit I RAPIDBUY ELECTRONICS, INC. Mall of America Store Budgeted Income Statement For the Three Months Ending August 31, 20X8 Sales $300,000 Cost of goods sold (.62 × $300,000) 186,000 Gross profit $114,000 Operating expenses: Salaries, wages, commissions $60,000 Other expenses 12,000 Depreciation 1,500 Rent, taxes and other fixed expenses 33,000 106,500 Income from operations. $ 7,500 Interest expense* 1,338 Net income $ 6,162 * See schedule g for calculation of interest. Exhibit II RAPIDBUY ELECTRONICS, INC. Mall of America Store Cash Budget For the Three Months Ending August 31, 20X8 JuneJulyAugust Beginning cash balance $ 5,800 $ 5,600 $ 5,079 Minimum cash balance desired 5,000 5,000 5,000 (a) Available cash balance $ 800$ 600$ 79 Cash receipts & disbursements: Collections from customers (schedule b) $ 75,200 $121,400 $ 90,800 Payments for merchandise (schedule d) (86,800) (49,600) (49,600) Fixtures (purchased in May) (11,000) - - Payments for operating expenses (schedule f) (44,600) (30,200) (30,200) (b) Net cash receipts & disbursements $(67,200) $ 41,600 $ 11,000 Excess (deficiency) of cash before financing (a + b) (66,400) 42,200 11,079 Financing: Borrowing, at beginning of period $ 67,000 $ - $ - Repayment, at end of period - (41,000) (10,000) Interest, 10% per annum - (1,121)* (217)*

《管理会计》名词中英文对照key terms

管理会计key terms Chapter1 1、activity-based management 作业管理 2、certified internal auditor(CIA)注册内部审计师 3、Certified management accountant(CMA)注册管理会计师 4、certified public accountant(CPA)注册会计师 5、continuous improvement 持续改进 6、controller 管理员 7、controlling 控制 8、customer value 客户价值 9、decision making决策 10、electronic business(e-business)电子商务 11、electronic commerce(e-commerce)电子商务 12、employee empowerment 员工激励 13、ethical behavior 道德行为 14、external linkages 外部联系 15、feedback反馈 16、financial accounting information system 财务会计信息系统 17、industrial value chain 产业价值链 18、internal linkages外部联系 19、internal value chain内部价值链 20、line position 直接职能 21、management accounting information system管理会计信息系统 22、performance reports 业绩报告 23、planning计划 24、postpurchase costs 售后服务成本 25、staff positon间接职能 26、strategic cost management 战略成本管理 27、strategic decision making 战略决策 28、supply chain management 供应链管理 29、total product 总产量 30、total quality management 全面质量管理 31、treasurer 财务主管 Chapter2 1、absorption-costing(full-costing)income完全成本法收益 2、activity 作业 3、activity-based costing(ABC)作业成本法 4、activity-based management(ABM)作业成本管理 5、activity-based management(ABM)accounting systerms作业成本管理会计系统

亨格瑞管理会计英文第15版练习答案03

CHAPTER 3 COVERAGE OF LEARNING OBJECTIVES

CHAPTER 3 Measurement of Cost Behavior 3-A1 (20-25 min.) Some of these answers are controversial, and reasonable cases can be built for alternative classifications. Class discussion of these answers should lead to worthwhile disagreements about anticipated cost behavior with regard to alternative cost drivers. 1. (b) Discretionary fixed cost. 2. (e) Step cost. 3. (a) Purely variable cost with respect to revenue. 4. (a) Purely variable cost with respect to miles flown. 5. (d) Mixed cost with respect to miles driven. 6. (c) Committed fixed cost. 7. (b) Discretionary fixed cost. 8. (c) Committed fixed cost. 9. (a) Purely variable cost with respect to cases of 7-Up. 10. (b) Discretionary fixed cost. 11. (b) Discretionary fixed cost. 3-A2 (25-30 min.) 1. Support costs based on 60% of the cost of materials: Sign A Sign B Direct materials cost $400 $200 Support cost (60% of materials cost) $240 $120 Support costs based on $50 per power tool operation: Sign A Sign B Power tool operations 3 6 Support cost $150 $300 2. If the activity analysis is reliable, by using the current method, Evergreen Signs is predicting too much cost for signs that use few power tool operations and is predicting too little cost for signs that use many power tool operations. As a result the company could be losing jobs that require few power tool operations because its bids are too high -- it could afford to bid less on these jobs. Conversely, the company could be getting too many jobs that require many power tool operations, because its bids are too low -- given what the "true" costs will be, the company cannot afford these jobs at those prices. Either way, the sign business could be more profitable if the owner better understood and used activity analysis. Evergreen Signs would be advised to adopt the activity- analysis recommendation, but also to closely monitor costs to see if the activity- analysis predictions of support costs are accurate.

亨格瑞管理会计英文第15版练习答案03

CHAPTER 3 COVERAGE OF LEARNING OBJECTIVES

CHAPTER 3 Measurement of Cost Behavior 3-A1 (20-25 min.) Some of these answers are controversial, and reasonable cases can be built for alternative classifications. Class discussion of these answers should lead to worthwhile disagreements about anticipated cost behavior with regard to alternative cost drivers. 1. (b) Discretionary fixed cost. 2. (e) Step cost. 3. (a) Purely variable cost with respect to revenue. 4. (a) Purely variable cost with respect to miles flown. 5. (d) Mixed cost with respect to miles driven. 6. (c) Committed fixed cost. 7. (b) Discretionary fixed cost. 8. (c) Committed fixed cost. 9. (a) Purely variable cost with respect to cases of 7-Up. 10. (b) Discretionary fixed cost. 11. (b) Discretionary fixed cost. 3-A2 (25-30 min.) 1. Support costs based on 60% of the cost of materials: Sign A Sign B Direct materials cost $400 $200 Support cost (60% of materials cost) $240 $120 Support costs based on $50 per power tool operation: Sign A Sign B